High Contrast

- Asia Pacific

- Latin America

- North America

- Afghanistan

- Bosnia and Herzegovina

- Cayman Islands

- Channel Islands

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Hong Kong SAR, China

- Ireland (Republic of)

- Ivory Coast

- Macedonia (Republic of North)

- Netherlands

- New Zealand

- Philippines

- Puerto Rico

- Sao Tome & Principe

- Saudi Arabia

- South Africa

- Switzerland

- United Kingdom

- News releases

- RSM in the news

- AI, analytics and cloud services

- Audit and assurance

- Business operations and strategy

- Business tax

- Consulting services

- Family office services

- Financial management

- Global business services

- Managed services

- Mergers and acquisitions

- Private client

- Professional Services+

- Risk, fraud and cybersecurity

- See all services and capabilities

Strategic technology alliances

- Sage Intacct

- CorporateSight

- FamilySight

- PartnerSight

Featured topics

- 2024 economy and business opportunity

- Generative AI

- Middle market economics

- Environmental, social and governance

- Supply chain

Real Economy publications

- The Real Economy

- The Real Economy Industry Outlooks

- RSM US Middle Market Business Index

- The Real Economy Blog

- Construction

- Consumer goods

- Financial services

- Food and beverage

- Health care

- Life sciences

- Manufacturing

- Nonprofit and education

- Private equity

- Professional services

- Real estate

- Technology companies

- See all industry insights

- Business strategy and operations

- Family office

- Private client services

- Financial reporting resources

- Tax regulatory resources

Platform user insights and resources

- RSM Technology Blog

- Diversity and inclusion

- Middle market focus

- Our global approach

- Our strategy

- RSM alumni connection

- RSM Impact report

- RSM Classic experience

Experience RSM

- Your career at RSM

- Student opportunities

- Experienced professionals

- Executive careers

- Life at RSM

- Rewards and benefits

Spotlight on culture

Work with us.

- Careers in assurance

- Careers in consulting

- Careers in operations

- Careers in tax

- Our team in India

- Our team in El Salvador

- Apply for open roles

Popular Searches

Asset Management

Health Care

Partnersite

Your Recently Viewed Pages

Lorem ipsum

Dolor sit amet

Consectetur adipising

Tax issues arise when employers pay employee business travel expenses

Employers must determine proper tax treatment for employees.

Most employers pay or reimburse their employees’ expenses when traveling for business. Generally, expenses for transportation, meals, lodging and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip. However, the tax rules become more complex when the travel is of a longer duration. Sometimes the travel expenses paid or reimbursed by the employer must be treated as taxable compensation to the employee subject to Form W-2 reporting and payroll taxes.

The purpose of this article is to address some of the more common travel arrangements which can result in taxable income to employees for federal tax purposes. Although business travel can also raise state tax issues, those issues are beyond the scope of this article. This article is intended to be only a general overview as the tax consequences to an employee for a given travel arrangement depend on the facts and circumstances of that arrangement.

In the discussion below, it is assumed that all travel expenses are ordinary and necessary and incurred by an employee (or a partner in a partnership) while traveling away from home overnight for the employer’s business. In addition, it is assumed that the expenses are properly substantiated so that the employer knows (1) who incurred the expense; (2) where, when, why and for whom the expense was incurred, and (3) the dollar amount. Employers need to collect this information within a reasonable period of time after an expense is incurred, typically within 60 days.

Certain meal and lodging expenses can fall within a simplified substantiation process called the “per diem” rules (although even these expenses must still meet some of the substantiation requirements). The per diem rules are outside the scope of this article.

One of the key building blocks for the treatment of employee travel expenses is the location of the employee’s “tax home.” Under IRS and court holdings, an employee’s tax home is the employee’s regular place of work, not the employee’s personal residence or family home. Usually the tax home includes the entire city or area in which the regular workplace is located. Generally, only expenses paid or reimbursed by an employer for an employee’s travel away from an employee’s tax home are eligible for favorable tax treatment as business travel expenses.

Travel to a regular workplace

Usually expenses incurred for travel between the employee’s residence and the employee’s regular workplace (tax home) are personal commuting expenses, not business travel. If these expenses are paid or reimbursed by the employer, they are taxable compensation to the employee. This is the case even when an employee is traveling a long distance between the employee’s residence and workplace, such as when an employee takes a new job in a different city. According to the IRS, if it is the employee’s choice to live away from his or her regular workplace (tax home), then the travel expenses between the two locations which are paid or reimbursed by the employer are taxable income to the employee.

Example: Bob’s personal residence is in Chicago, but his regular workplace is in Atlanta. Bob’s employer reimburses him for an apartment in Atlanta plus his transportation expenses between the two cities. Since Atlanta is Bob’s tax home, these travel expenses are personal commuting expenses and the employer’s reimbursement of the expenses is taxable compensation to Bob.

Travel to two regular workplaces

Sometimes an employer requires an employee to consistently work in two business locations because of the needs of the employer’s business. Factors such as where the employee spends the most time, has the most business activity, and earns the highest income determine which is the primary location with the other being the secondary location. The employee’s residence may be in either the primary or the secondary location. In general, the IRS holds that transportation costs between the two locations can be paid or reimbursed by the employer tax-free. In addition, lodging and meals at the location which is away from the employee’s residence can generally be paid or reimbursed tax-free.

Example: Caroline lives in Location A and works at her company headquarters there. Her employer opens a new store in Location B and asks her to handle the day-to-day operations for two years while the store is getting up to speed. But Caroline is also needed at the headquarters so her employer asks her to spend two days a week at the headquarters in Location A and three days a week at the store in Location B. Because the work at each location is driven by a business need of Caroline’s employer, she is treated as having primary and secondary work locations and is not treated as commuting between the two locations. Caroline’s travel between the two locations and her meals and lodging at Location B can be reimbursed tax-free by her employer.

As a practical matter, the employer must carefully consider and be able to support the business need for the employee to routinely go back and forth between two business locations. In cases involving two business locations, the courts have looked at time spent, business conducted and income generated in each location. Merely having an employee “sign in” or “touch down” at a business location near his or her residence is unlikely to satisfy the requirements for having two regular workplaces. Instead, the IRS would likely consider the employee as having only one regular workplace with employer-paid travel between the employee’s residence and the regular workplace being taxable commuting expenses.

Travel when a residence is a regular workplace

In some cases an employer hires an employee to work generally, or only, from the employee’s home, as he or she is not physically needed at an employer location. If the employer requires the employee to work just from his or her residence on a regular basis, does not require or expect the employee to travel to another office on a regular basis, and does not provide office space for the employee elsewhere, then the residence can be the tax home since it is the regular workplace for the employee. When the employee does need to travel away from his or her residence (tax home), the temporary travel expenses can be paid or reimbursed by the employer on a tax-free basis.

Example: Jason is a computer programmer and works out of his home in Indianapolis for an employer in Seattle. He periodically travels to Seattle for meetings with his team. Since Jason has no assigned office space in Seattle and is expected by his employer to work from his home, Jason’s travel expenses to Seattle can be reimbursed by his employer on a tax-free basis.

Travel to a temporary workplace

Sometimes an employer temporarily assigns an employee to work in a location that is far from the employee’s regular workplace, with the expectation that the employee will return to his or her regular workplace at the end of the assignment. In this event, the key question is whether the employee’s tax home moves to the temporary workplace. If the tax home moves to the temporary workplace, the travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee because they are personal commuting expenses rather than business travel expenses. Whether or not the employee’s tax home moves to the temporary workplace depends on the duration of the assignment and the expecations of the parties.

- One year or less . If the assignment is expected to last (and actually does last) one year or less, the employee’s tax home generally does not move to the temporary workplace. Therefore, travel expenses between the employee’s residence and temporary workplace that are paid or reimbursed by the employer are typically tax-free to the employee as business travel.

Example: Janet lives and works in Denver but is assigned by her employer to work in San Francisco for 10 months. She returns to Denver after the 10-month assignment. Janet’s travel expenses associated with her assignment in San Francisco that are reimbursed by her employer are not taxable income to her as they are considered temporary business travel and not personal commuting expenses.

- More than one year or indefinite . If the assignment is expected to last more than one year or is for an indefinite period of time, the employee’s tax home generally moves to the temporary workplace. This is the case even if the assignment ends early and actually lasts one year or less. Consequently, travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee as personal commuting expenses.

Example: Chris lives and works in Dallas but is assigned by his employer to work in Oklahoma City for 15 months before returning to Dallas. Chris’s travel expenses associated with his assignment to Oklahoma City that are reimbursed by his employer are taxable income to him as personal commuting expenses.

- One year or less then extended to more than one year . Sometimes an assignment is intended to be for one year or less, but then is extended to more than one year. According to the IRS, the tax home moves from the regular workplace to the temporary workplace at the time of the extension. Therefore, travel expenses incurred between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are non-taxable business travel expenses until the time of the extension, but are taxable compensation as personal commuting expenses after the extension.

Example: Beth’s employer assigns her to a temporary workplace in January with a realistic expectation that she will return to her regular workplace in September. However, in August, it is clear that the project will take more time so Beth’s assignment is extended to the following March. Once Beth’s employer knows, or has a realistic expectation, that Beth’s work at the temporary location will be for more than one year, changes are needed to the tax treatment of Beth’s travel expenses. Only the travel expenses incurred prior to the extension in August can be reimbursed tax-free; travel expenses incurred and reimbursed after the extension are taxable compensation.

When an employee’s residence and regular workplace are in the same geographic location and the employee is away on a temporary assignment, the employee will often return to the residence for weekends, holidays, etc. Expenses associated with travel while enroute to and from the residence can be paid or reimbursed by an employer tax-free, but only up to the amount that the employee would have incurred if the employee had remained at the temporary workplace instead of traveling home.

Travel to a temporary workplace – Special situations

In order for an employer to treat its payment or reimbursement of travel expenses as tax-free rather than as taxable compensation, the employee’s ties to the regular workplace must be maintained. The employee must expect to return to the regular workplace after the assignment, and actually work in the regular workplace long enough or regularly enough that it remains the employee’s tax home. Special situations arise when an employee’s assignment includes recurring travel to a temporary workplace, continuous temporary workplaces, and breaks in assignments to temporary workplaces.

- Recurring travel to a temporary workplace . Although the IRS has not published formal guidance which can be relied on, it has addressed situations where an employee has a regular workplace and a temporary workplace to which the employee expects to travel over more than one year, but only on a sporadic and infrequent basis. Under the IRS guidance, if an employee’s travel to a temporary workplace is (1) sporadic and infrequent, and (2) does not exceed 35 business days for the year, the travel is temporary even though it occurs in more than one year. Consequently, the expenses can be paid or reimbursed by an employer on a tax-free basis as temporary business travel.

Example: Stephanie works in Location A but will travel on an as-needed basis to Location B over the next three years. If Stephanie’s travel to Location B is infrequent and sporadic and does not exceed 35 business days a year, her travel to Location B each year can be reimbursed by her employer on a tax-free basis as temporary business travel.

- Continuous temporary workplaces . Sometimes an employee does not have a regular workplace but instead has a series of temporary workplaces. If the employee’s residence cannot qualify as his or her tax home under a three-factor test developed by the IRS, the employee is considered to have no tax home and is “itinerant” for travel reimbursement purposes. In this case, travel expenses paid by the employer generally would be taxable income to the employee.

Example: Patrick originally worked in Location A, but his employer sends him to Location B for eleven months, then assigns Patrick to Location C for another eight months. Patrick will be sent to Location D after Location C with no expectation of returning to Location A. Patrick does not maintain a residence in Location A. Travel expenses paid to Patrick by his employer will likely be taxable income to him.

- Breaks between temporary workplaces . In an internal memorandum, the IRS addresses the outcome when an employee has a break in assignments to temporary workplaces. When applying the one-year rule, the IRS notes that a break of three weeks or less is not enough to prevent aggregation of the assignments, but a break of at least seven months would be. Some companies choose to not aggregate assignments when the breaks are shorter than seven months but are considerably longer than three weeks, given the lack of substantive guidance from the IRS on this issue.

Example: Don’s regular workplace is in Location A. Don’s employer sends him to Location B for ten months, back to Location A for eight months, and then to Location B again for four months. Although Don’s time in Location B totals 14 months, since the assignments there are separated by a break of at least seven months, they are not aggregated for purposes of applying the one-year rule. Consequently, the travel expenses associated with each separate assignment to Location B can be reimbursed by the employer on a tax-free basis as temporary business travel since each assignment lasted less than a year.

Conclusion

The tax rules regarding business travel are complex and the tax treatment can vary based on the facts of a situation. Employers must carefully analyze business travel arrangements to determine whether travel expenses that they pay or reimburse are taxable or nontaxable to employees.

RSM contributors

Subscribe to RSM tax newsletters

Tax news and insights that are important to you—delivered weekly to your inbox

THE POWER OF BEING UNDERSTOOD

ASSURANCE | TAX | CONSULTING

- Technologies

- RSM US client portals

- Cybersecurity

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

© 2024 RSM US LLP. All rights reserved.

- Terms of Use

- Do Not Sell or Share My Personal Information (California)

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

CoCounsel: The GenAI assistant for tax and accounting professionals

Save time and effort by reducing long research sessions into simple tasks with AI-assisted research on Checkpoint Edge.

Build a career without boundaries

Learn more about how Thomson Reuters informs the way forward in The Power of Purpose

Related posts

When Do COVID-19-Related Extended HIPAA Special Enrollment Periods End?

ACA Preventive Health Services Mandate to Remain in Effect During Braidwood Appeal

CMS Issues Guidance on Elimination of MHPAEA Opt-Out Elections by Self-Insured Non-Federal Governmental Health Plans

More answers.

Legal Insights on Forthcoming Federal Paid Family and Medical Leave Legislation

How tax professionals can add value by investing in advisory services

What are the different electric vehicle tax credits?

Travel and Expense

What is a travel allowance definitions and insights.

A travel allowance can be an effective way to manage employee travel expenses and manage costs for the employee.

When employees travel for business, there are myriad expenses, from hotels to taxis or ride-sharing services. Using a travel allowance can help give travelers flexibility and control while increasing compliance with tax regulations.

What Is a Travel Allowance?

A travel allowance is compensation paid by an employer to employees to cover expenses incurred when traveling for business. In addition to lodging and transportation, travel allowances are typically used for airfare, meals, and other expenses related to business travel. It is business travel compensation, provided either before or after travel is completed.

Managing business travel compensation can be complex and hard to manage. The way businesses handle travel compensation is changing, as leaders look to implement tools that aid travelers and companies alike.

Technology is transforming how companies manage all aspects of employee travel , including the creation and coordination of travel allowances.

Types of Travel Allowance

There are many types of travel allowances, which can be given upfront or based on a reimbursement schedule. Here is a look at some of the most common.

Fixed Travel Allowance

A fixed travel allowance is a flat rate that is offered to an employee, irrespective of the level of expenses incurred. Employees are responsible for managing their travel expenses and determining how to use the money best to accommodate their needs. It is commonly used with employees for short trips or who travel infrequently.

Typically, with a fixed allowance, if the employee spends less than the allocated amount, the employee can keep the difference. If the employee spends more, they are responsible for making up the difference. Businesses using fixed travel allowance should work with their tax professional to understand the implications of this practice.

Daily Travel Allowance

Also called a per diem, a daily travel allowance is an amount used for each day of travel and can be used for lodging, transportation, meals, and other travel expenses. Typically, a traveler will reconcile the per diem by submitting an expense report and receipts. The traveler will be reimbursed for any expenses they spent in excess and will return money that was unspent.

Travel Reimbursement

This travel allowance requires the traveler to submit receipts for actual expenses incurred, which are then reimbursed. This process can be cumbersome and time-consuming for the traveler. If reimbursement is not done in a timely manner, it can be burdensome for the employee, who is essentially lending money to the company. Fortunately, there are technologies available today to simplify this work.

Mileage Allowance

This type of allowance pays the employee for miles traveled on business. It is typically used when employees use their own car for business-related travel. Technologies can tracking and reimbursing for mileage simpler and more accurate.

Methods for Calculating Travel Allowances

When using travel allowances as part of a corporate travel program, one key consideration is how the travel allowances are calculated.

The process often has to consider the distance traveled and the time spent traveling. Here is one way to calculate a travel allowance.

Location and Days of Travel

Start by determining the location of the traveler at midnight on each day of travel. A day of travel is defined as a 24-hour period an employee is conducting business while traveling.

The day of travel ends when the next day starts or they return home from a business trip to their home or office. For example, if an employee leaves for a trip at 4 p.m., the first day of travel is from 4 p.m. that day until 4 p.m. the next.

Lodging allowances are provided based on whether an employee spends the night in accommodations other than their own home. Typically, lodging allowances are based on the location and the current price rates for various hotel categories, based on company preferences for the level of hotels allowed.

Unlike with other categories, usually lodging is an either/or determination. Employees are either allowed the lodging allowance or not based on the circumstances of the trip.

Like with lodging, meal allowances are usually based on the prevailing costs of meals in each location. It assumes that a traveler will have three meals a day.

Typically, a meal allowance covers both meals and incidentals, such as snacks. Often it is prorated based on the time in any given day a traveler is on the road.

The meal allowance may also be reduced if there are meals provided as part of the work travel, such as part of a conference registration fee or transportation ticket.

Managing Travel Allowances

Managing travel allowances is a complex task. Here are some tips on how to effectively implement and manage a program:

- Develop a Clear Policy. Travelers need to understand the specifics in your travel program and how allowances are used. The policy needs to spell out, for example, what expenses are allowed and not allowed and the ways in which allowances are calculated. Transparency is essential to ensure all employees understand how travel expenses are covered

- Consider Incidentals. Business travelers face many complexities and challenges. You want a policy that makes it easy for travelers to navigate while on the road. Be sure your policy covers costs that may arise, including parking, fuel, tips, laundry services, printing, internet fees, and luggage check fees

- Analyze Data. You need a system in place that collects and reports on travel data to allow you to better understand trends, shifts and challenges. With visibility into your travel program, you can make timely, well-informed decisions

Developing Travel Allowance Policies and Guidelines

If your company wants to develop a travel allowance policy, where should you begin?

The policy should be rooted in a broader travel policy which should consider the following:

- Scope. What aspects of business travel will your policy cover?

- Coverage. Determine which elements of travel the policy will cover, such as air travel, lodging, meals, incidentals, and ground transportation

- Reimbursement Types. Will your company use travel allowances and, if so, which types?

- Participation. How will policies be determined? Be sure to include staff from human resources, finance, and departments that frequently travel, in determining the policy

- Safety. Be sure your policy provides protection for employees while they are traveling

- Expense Reporting. Develop tools or adopt that will be used for the reporting of travel expenses, with an emphasis on scalability, technology integration, and ease of use

Technological Advancements in Travel Allowance Management

Technology is changing the way companies manage business travel . There are powerful platforms available today that integrate travel policies, allow for the booking of travel and itinerary management and provide robust data collection and travel.

Employees need access to easy-to-use tools that allow for the recording of receipts and other transactions, let them reconcile expenses and generate expense reports, and simplify approvals and routing.

SAP Concur solutions can provide companies with integrated business travel, expense, and invoice solutions. With SAP Concur solutions, companies can book travel, manage expenses, integrate with business systems, manage invoices, and more.

Learn more about how SAP Concur solutions can simplify your travel management .

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Travel allowances

Explains the PAYG withholding implications on travel allowances.

Last updated 24 August 2021

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties.

Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies.

You include the amount of the travel allowance in the allowance box on your employee's payment summary.

The exception applies if:

- you expect your employee to spend all of the travel allowance you pay them on accommodation, food, drink or incidental expenses

- you show the amount and nature of the travel allowance separately in your accounting records

- the travel allowance is not for overseas accommodation

- the amount of travel allowance you pay your employee is less than, or equal to the reasonable travel allowance rate.

If the exception applies, you:

- don't withhold tax from the travel allowance you pay your employee

- don't include the amount of the travel allowance in the allowance box on your employee's payment summary

- only include the allowance on their payslip.

If the first two exception conditions are met but you pay your employee a travel allowance over the reasonable travel allowance rate, you're required to withhold tax from the amount that exceeds the reasonable travel allowance rate. You also need to include the total amount of the travel allowance in the allowance box on your employee's payment summary.

You are always required to withhold tax from a travel allowance for overseas accommodation and include the amount of the travel allowance in the allowance box on your employee's payment summary.

Check the relevant Single Touch Payroll (STP) employer reporting guidelines to see how to report these payments through STP:

- STP Phase 1 employer reporting guidelines – allowances

- STP Phase 2 employer reporting guidelines – allowances

Reasonable travel allowance rate

Each year we publish the amounts we consider reasonable for claims for domestic and overseas travel allowance expenses.

- TD 2021/6 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2021–22 income year?

- TD 2020/5 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2020–21 income year?

- TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses

- Keeping travel expense records

- Tax return – allowances

- Tax return – work-related travel expenses

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Travel resources

Per diem look-up, 1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

City Pair airfares

Visit City Pair Program to learn about its competitive, federally-negotiated airline rates for 7,500+ domestic and international cities, equating to over 13,000 city pairs.

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

GSA lodging programs

Shop for lodging at competitive, often below-market hotel rates negotiated by the federal government.

FedRooms provides federal travelers on official business with FTR compliant hotel rooms for transient and extended stays (up to 29 days). The program uses FEMA and ADA-compliant rooms with flexible booking terms at or below per diem rates. Federal employees should make reservations, including FedRooms reservations, via their travel management service.

Visit GSALodging for more details on FedRooms and for additional programs offering meeting space, long term lodging, and emergency lodging.

Privately owned vehicle (POV) mileage reimbursement rates

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024.

* Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs).

For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

Plan a trip

Research and prepare for government travel.

Per diem, meals & incidental expenses (M&IE) Passenger transportation (airfare rates, POV rates, etc.) Lodging Conferences/meetings Travel charge card State tax exemption

Services for government agencies

Programs providing commercial travel services.

Travel Category Schedule (Schedule L) E-Gov Travel Service (ETS) Emergency Lodging Services (ELS) Employee relocation

Travel reporting

Federal Travel Regulation Table of contents Chapter 300—General Chapter 301—Temporary Duty (TDY) Travel allowances Chapter 302 - Relocation allowances

ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Office determination TD 2024/3 sets out reasonable allowances for the 2024-25 financial year. See details below .

2021, 2022, 2023 and 2024 rates and earlier years are also set out below.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

Allowances for 2024-25

The full document in PDF format: 2024-25 Determination TD 2024/3 (pdf).

The 2024-25 reasonable amount for overtime meal expenses is $37.65.

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $30.35

- lunch $34.65

- dinner $59.75

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document.

2024-25 Domestic Travel

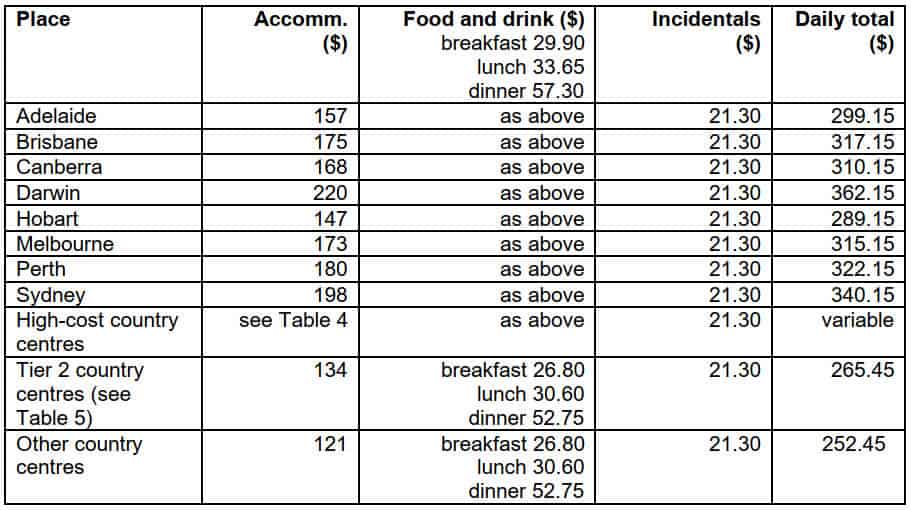

Table 1:Salary $143,650 or less

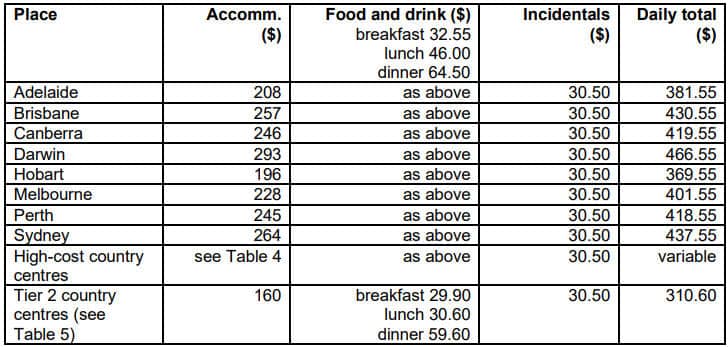

Table 2: Salary $143,651 to $255,670

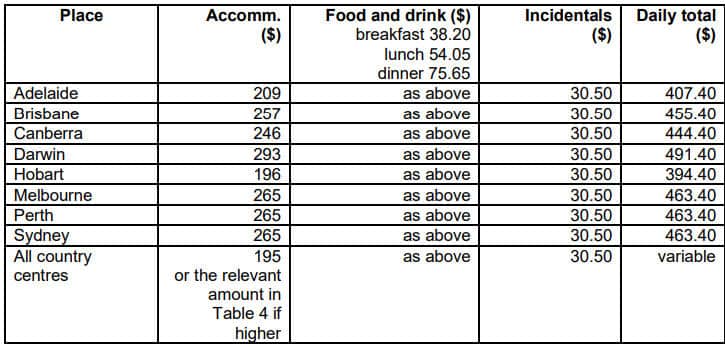

Table 3: Salary $255,671 or more

Table 4: High cost country centres accommodation expenses

Table 5: Tier 2 country centres

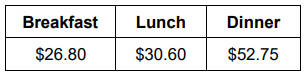

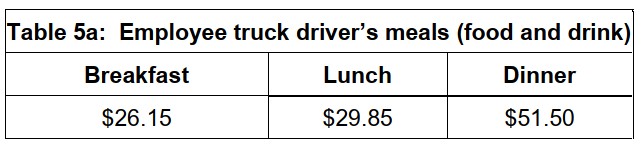

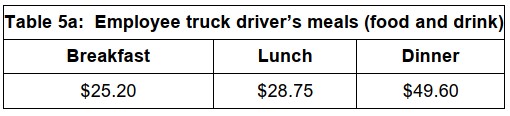

Table 5a: Employee truck driver’s meals (food and drink)

2024-25 Overseas Travel

Table 6: Salary $143,650 or less

Table 7: Salary $143,651 to $255,670

Table 8: Salary $255,671 or more

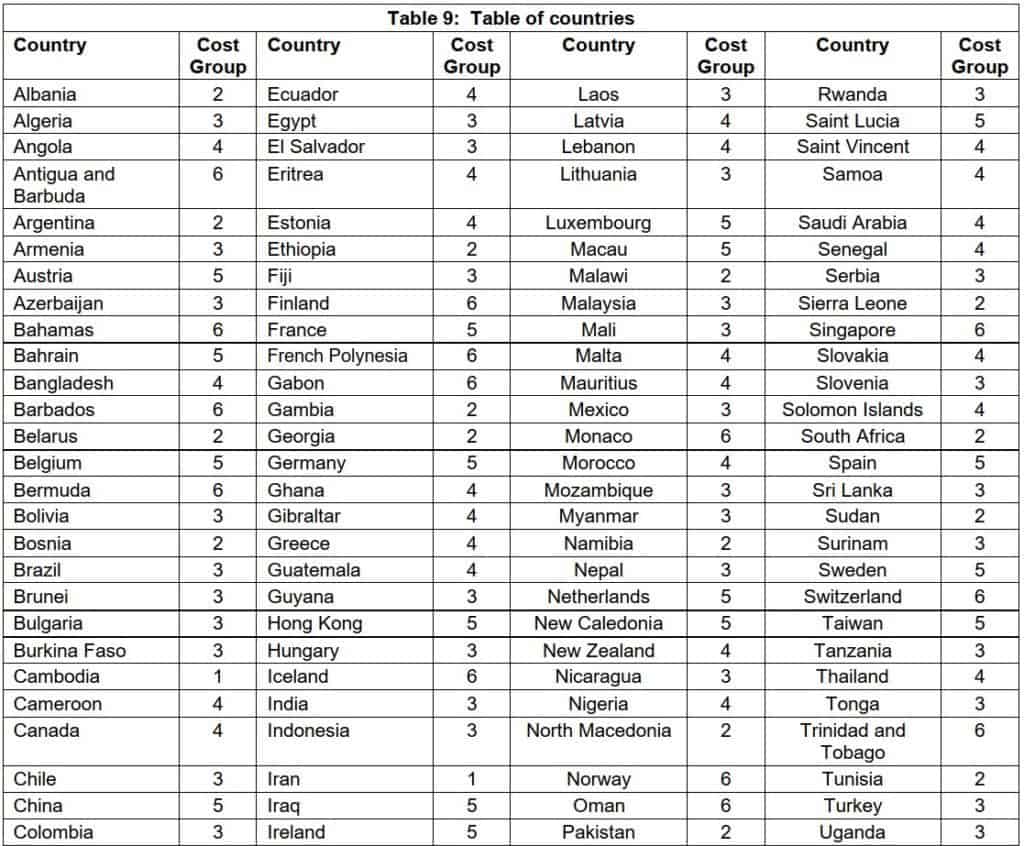

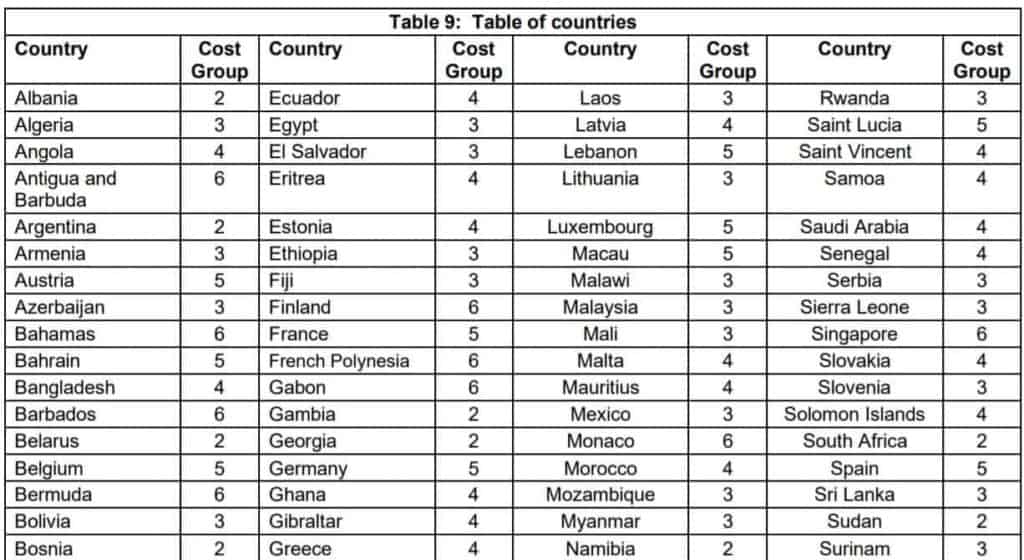

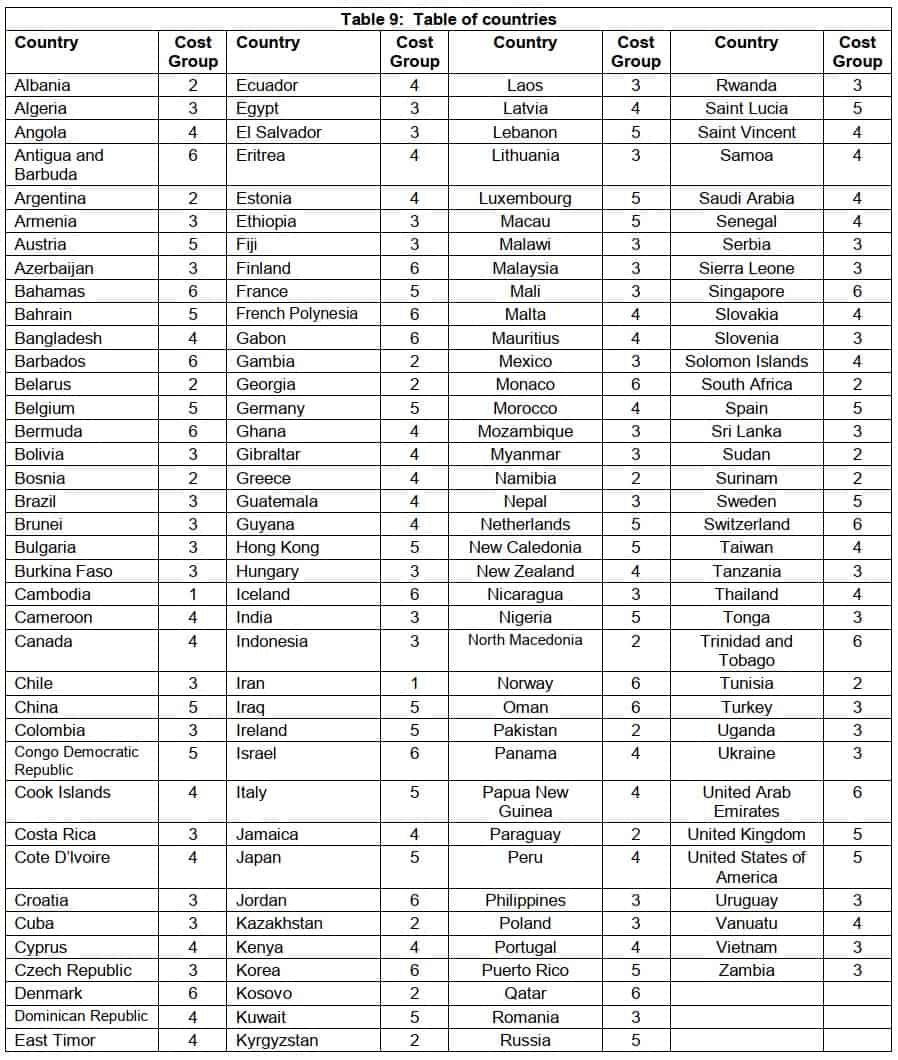

Table 9: Table of countries

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $143,650 or less

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $143,651 to $255,670

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $255,671 or more

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $143,650 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $143,651 to $255,670

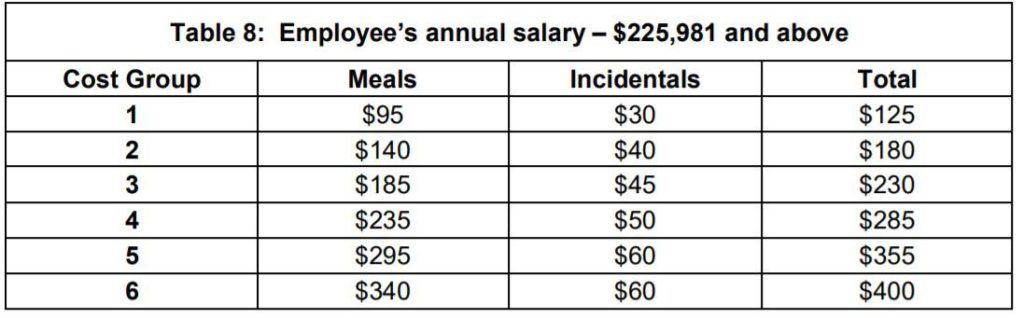

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $255,671 or more

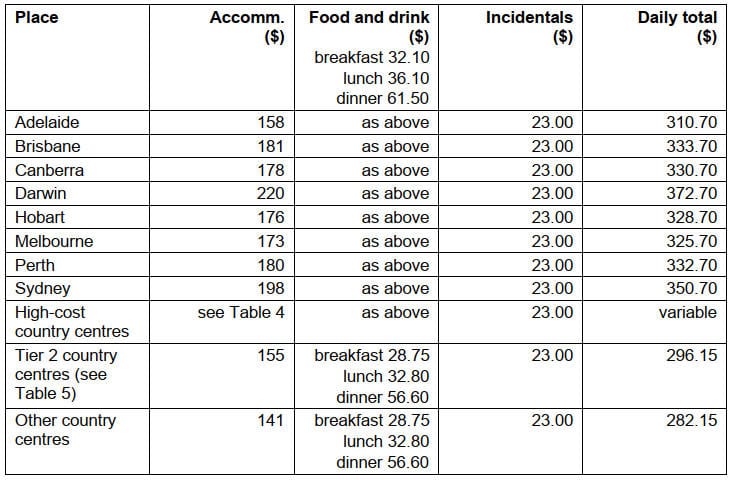

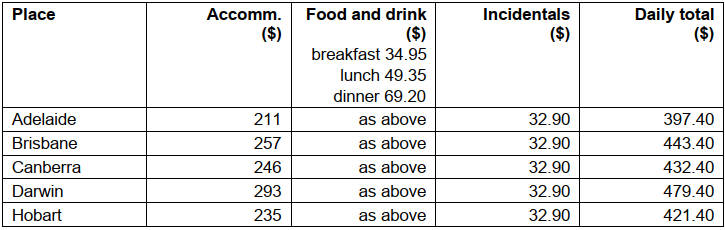

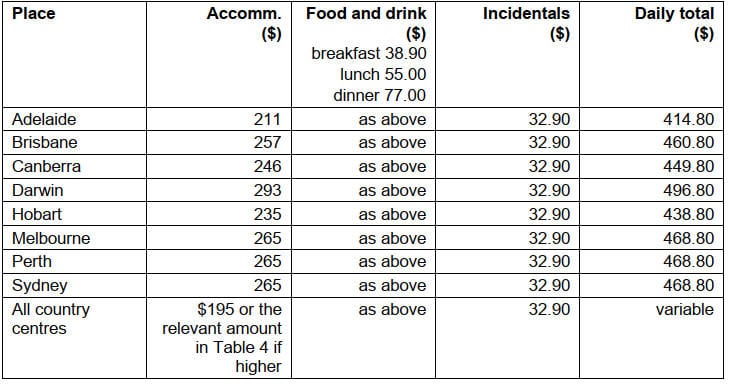

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

2023-24 Domestic Travel

Table 1:Salary $138,790 or less

Table 2: Salary $138,791 to $247,020

Table 3: Salary $247,021 or more

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

Table 7: Salary $138,791 to $247,020

Table 8: Salary $247,021 or more

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

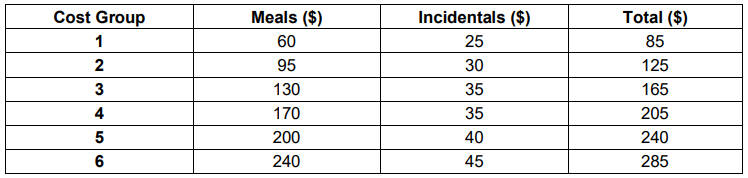

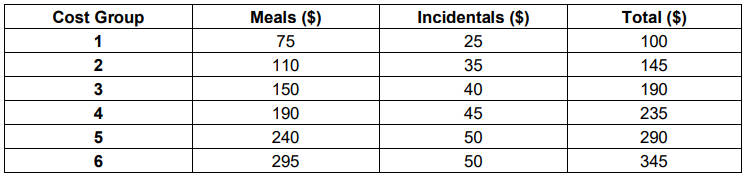

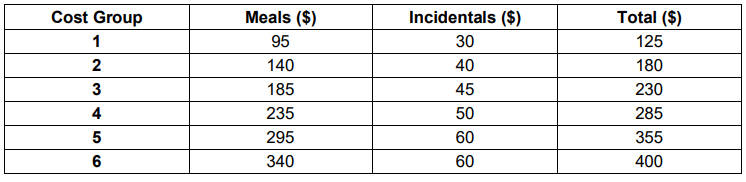

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

Table 6: Salary $133,450 and below

Table 7: Salary – $133,451 to $237,520

Table 8: Salary – $237,521 and above

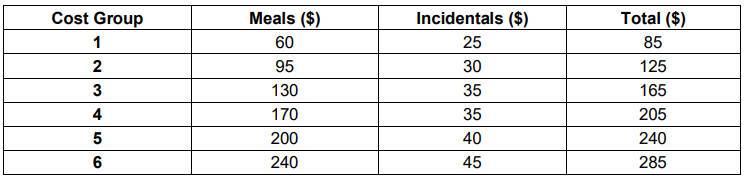

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

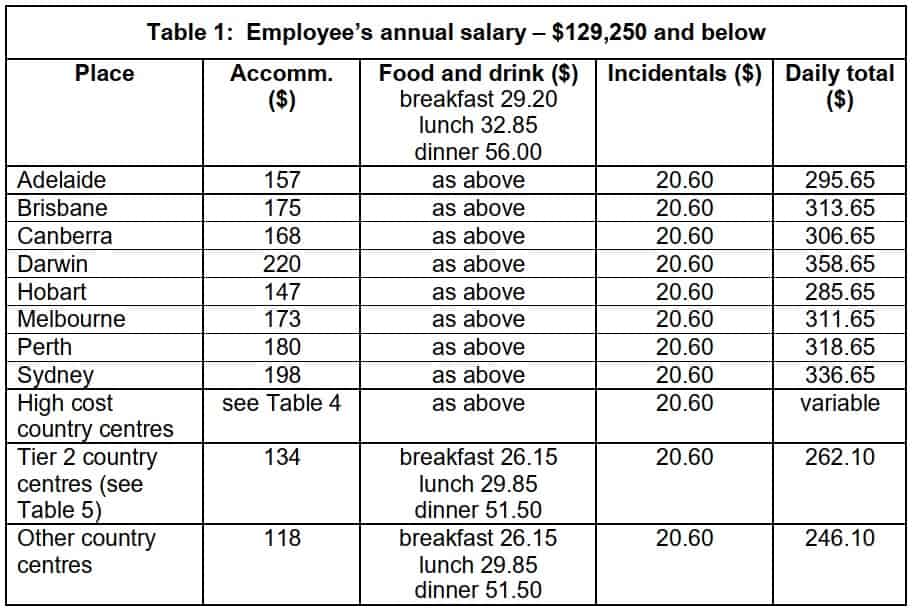

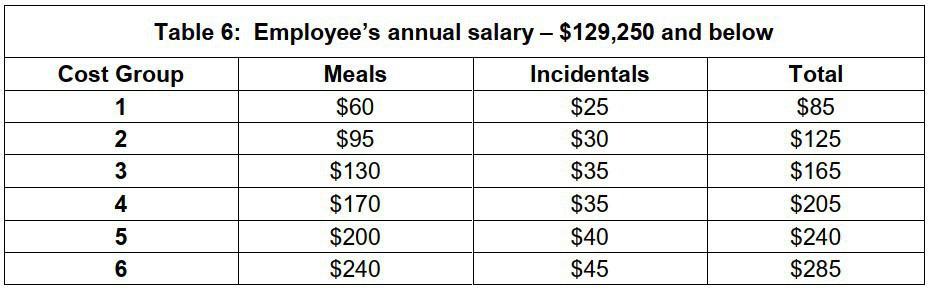

Table 1: Salary $129,250 and below

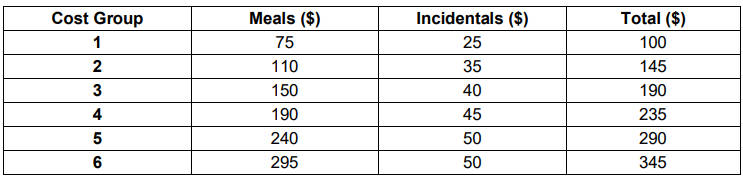

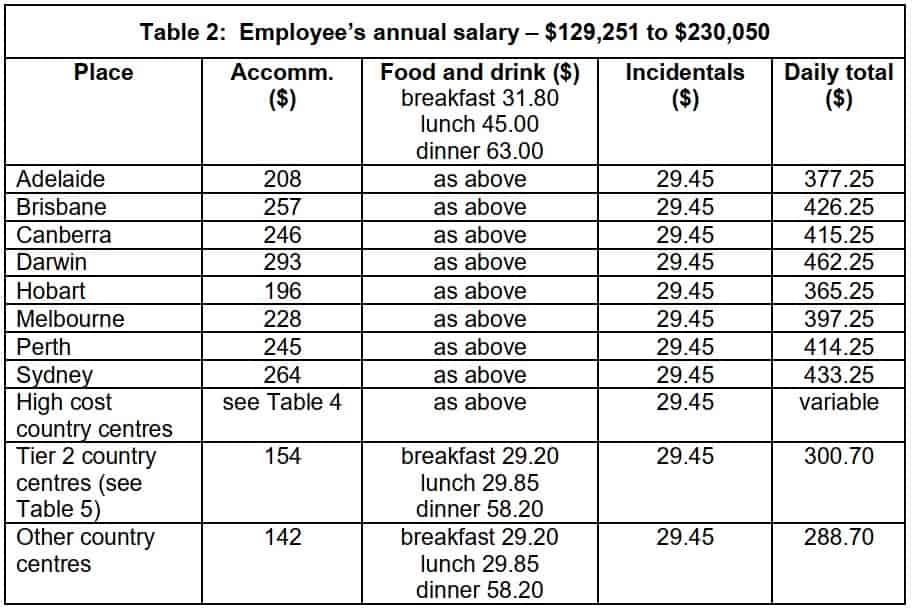

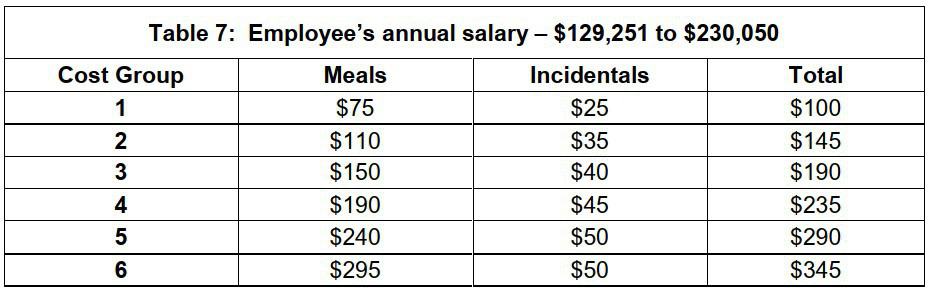

Table 2: Salary $129,251 to $230,050

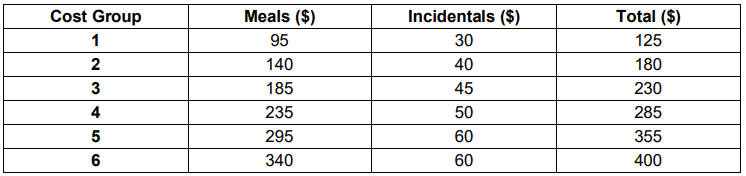

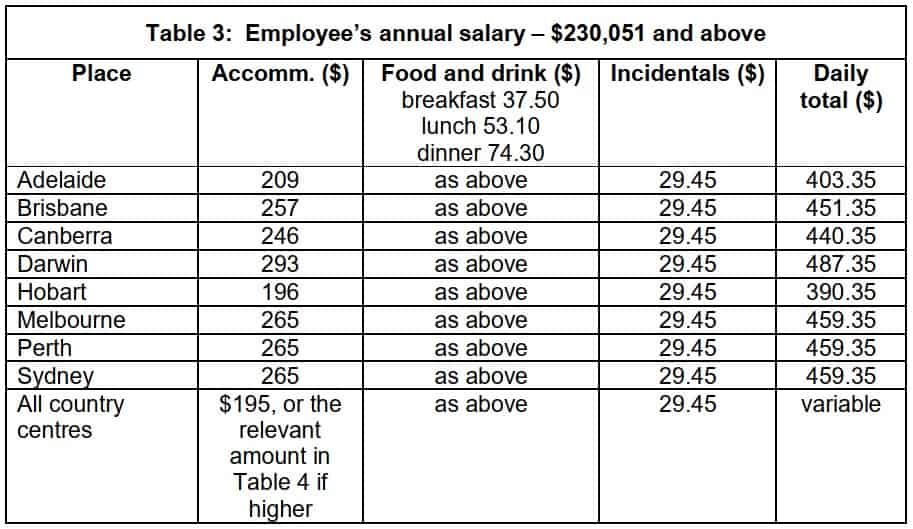

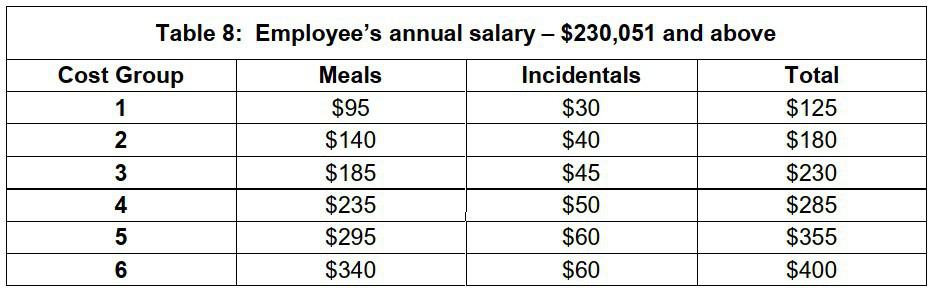

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

Table 7: Salary – $129,251 to $230,050

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

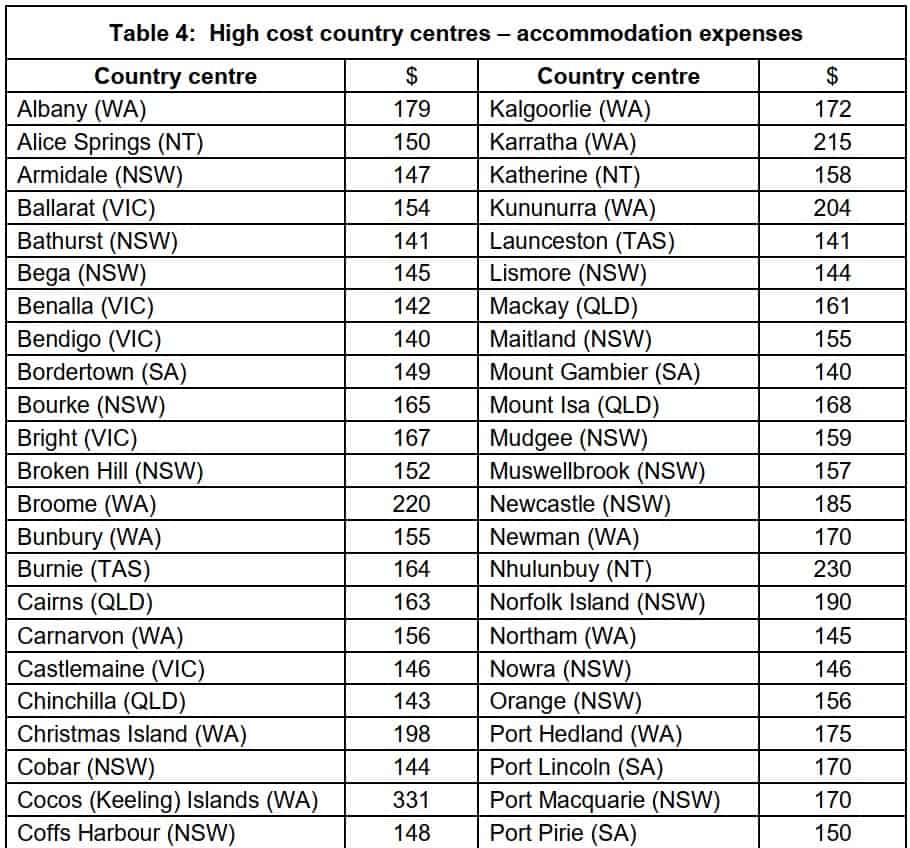

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

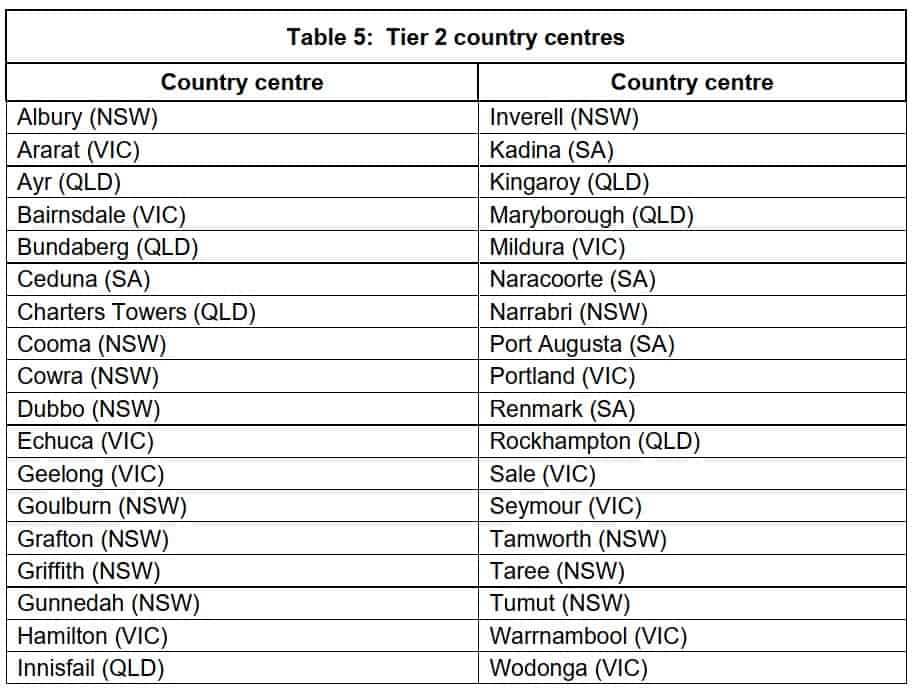

2021-22 Domestic Table 5: Tier 2 country centres

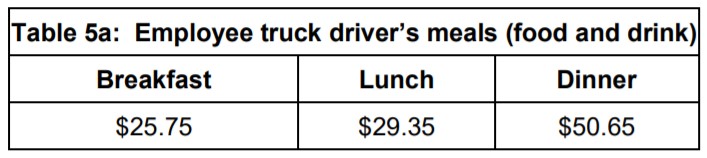

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

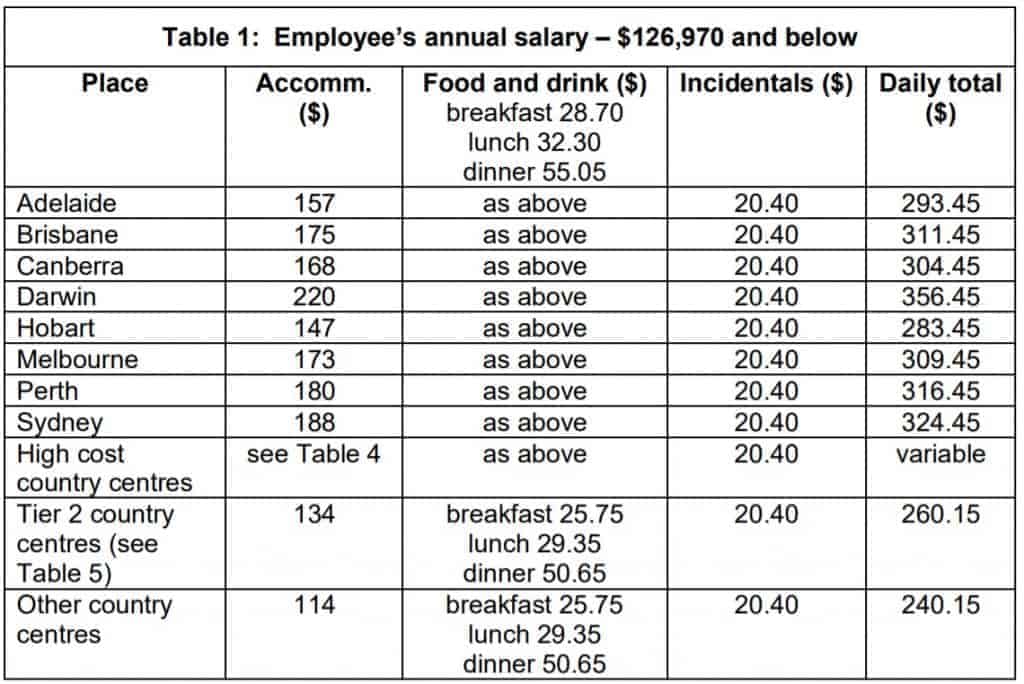

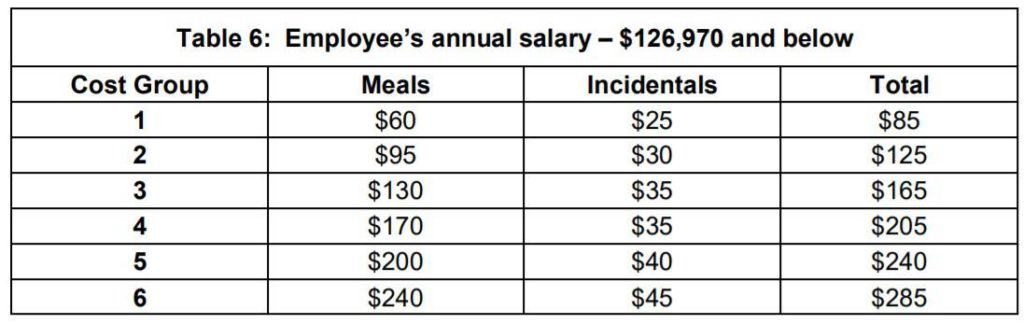

Table 1: Salary $126,970 and below

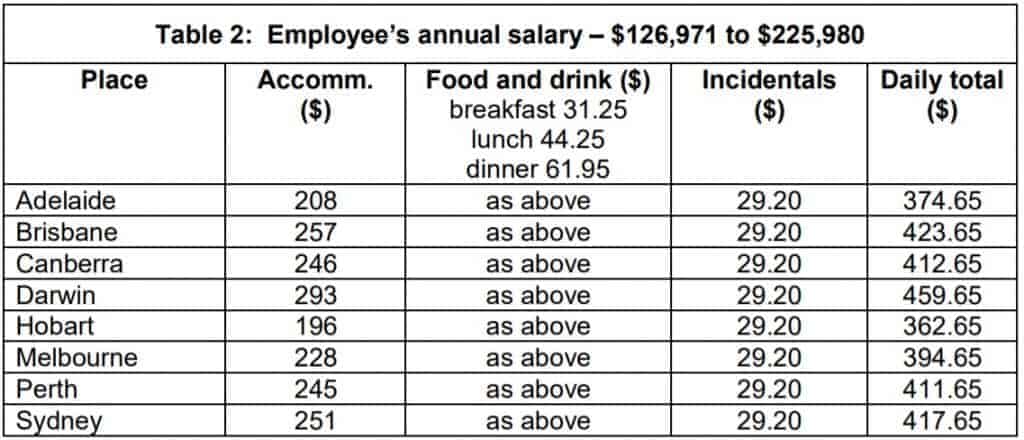

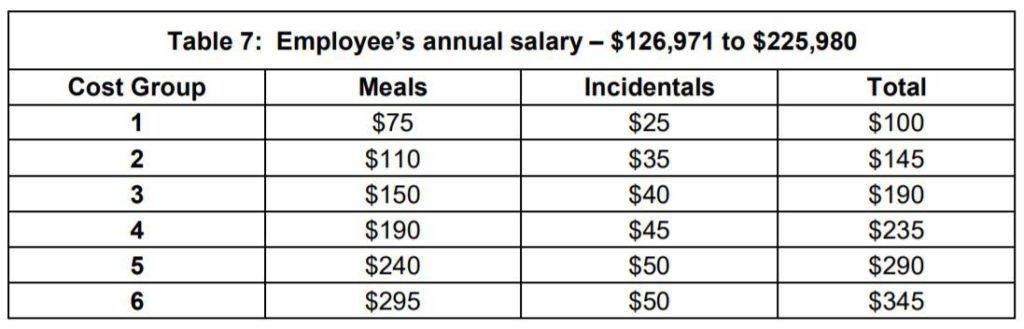

Table 2: Salary $126,971 to $225,980

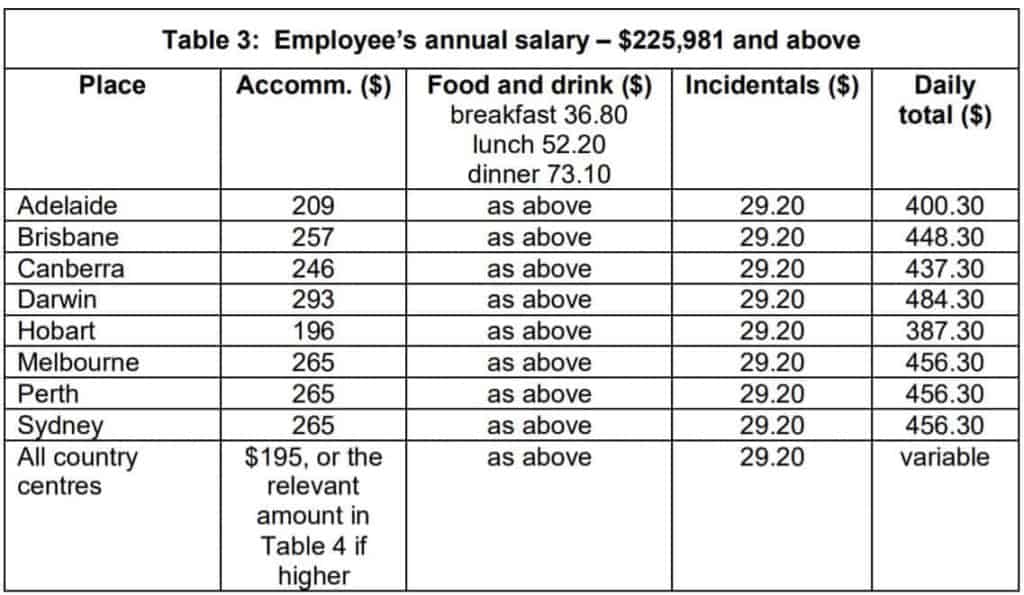

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

Table 6: Salary $126,970 and below

Table 7: Salary – $126,971 to $225,980

Table 8: Salary – $225,981 and above

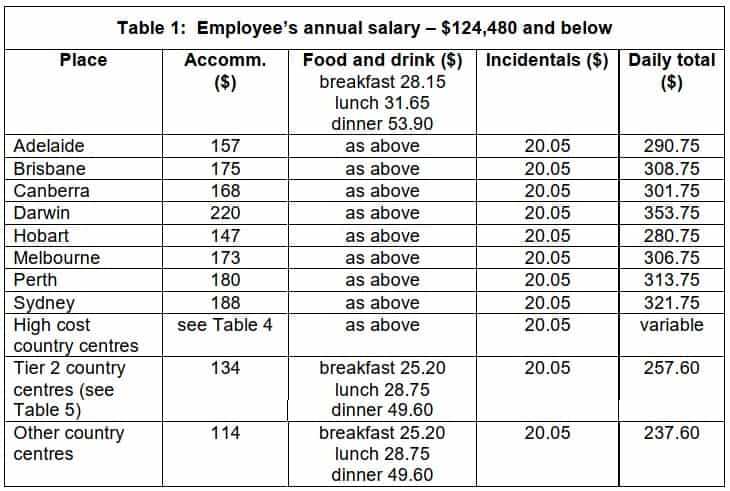

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

2020-21 Overseas Table 9: Table of countries

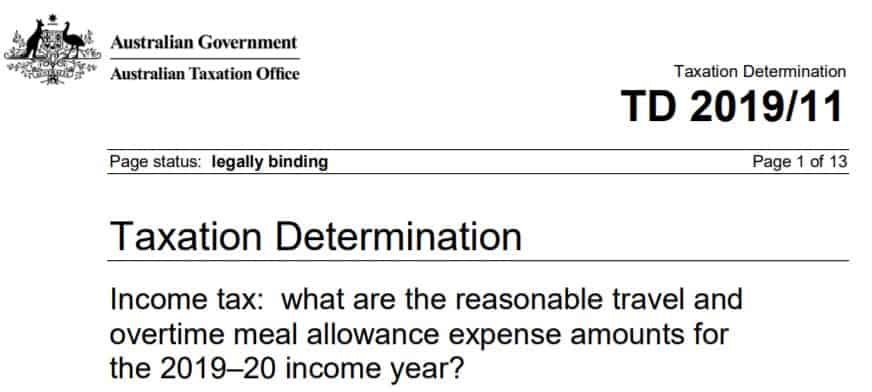

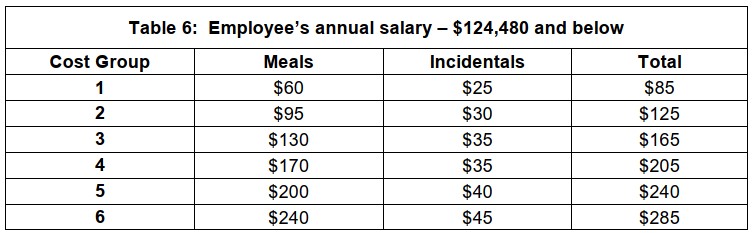

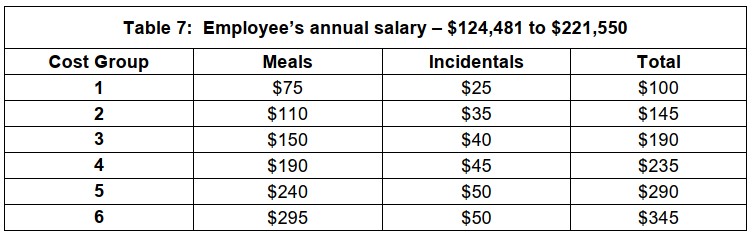

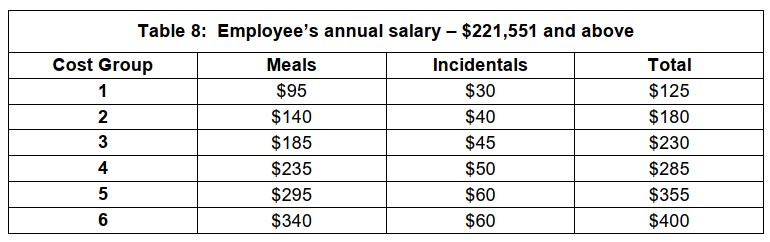

Allowances for 2019-20

The determination in sections:

Domestic Travel

Table 1: Employee’s annual salary – $124,480 and below

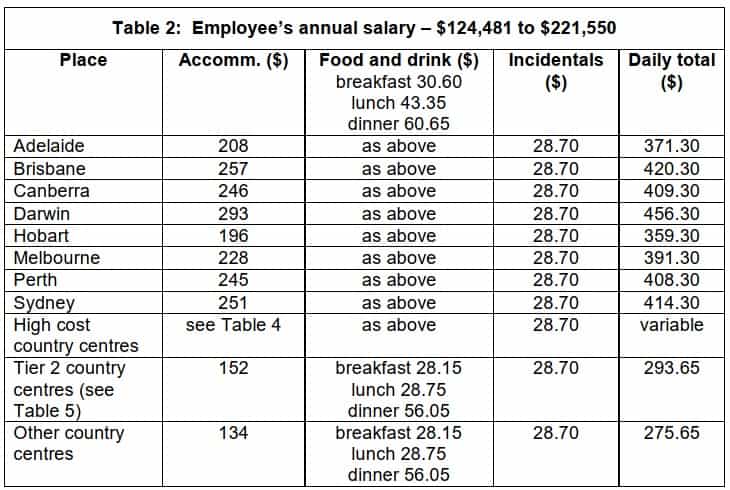

Table 2: Employee’s annual salary – $124,481 to $221,550

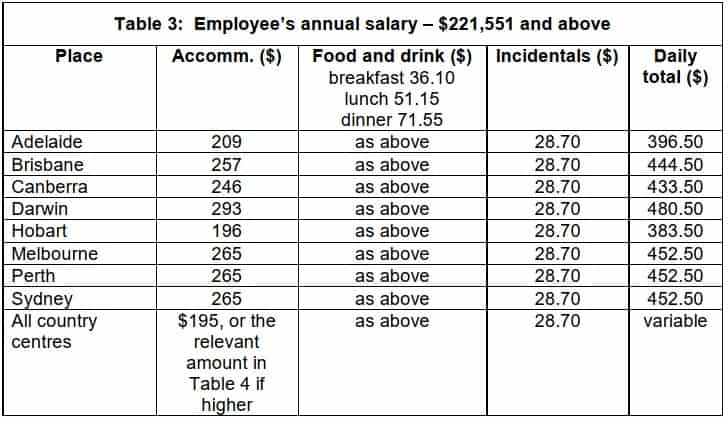

Table 3: Employee’s annual salary – $221,551 and above

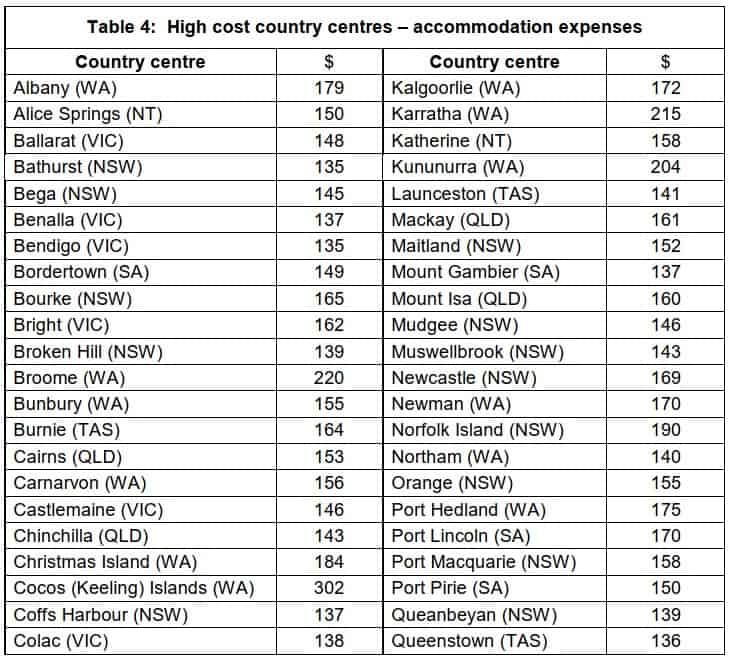

Table 4: High cost country centres – accommodation expenses

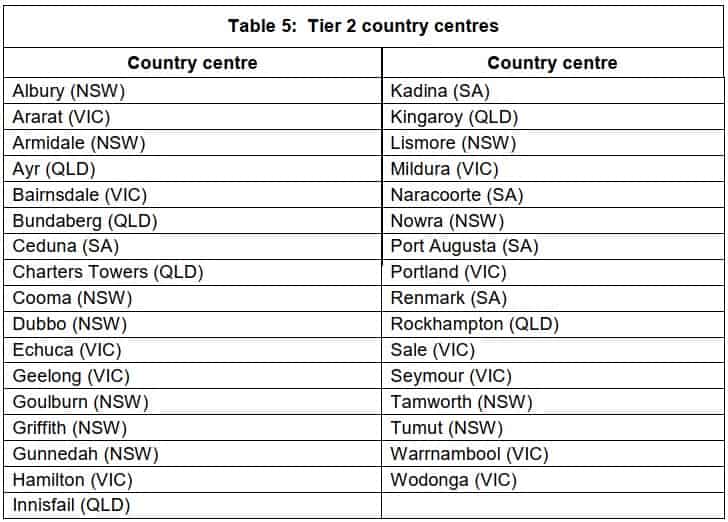

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

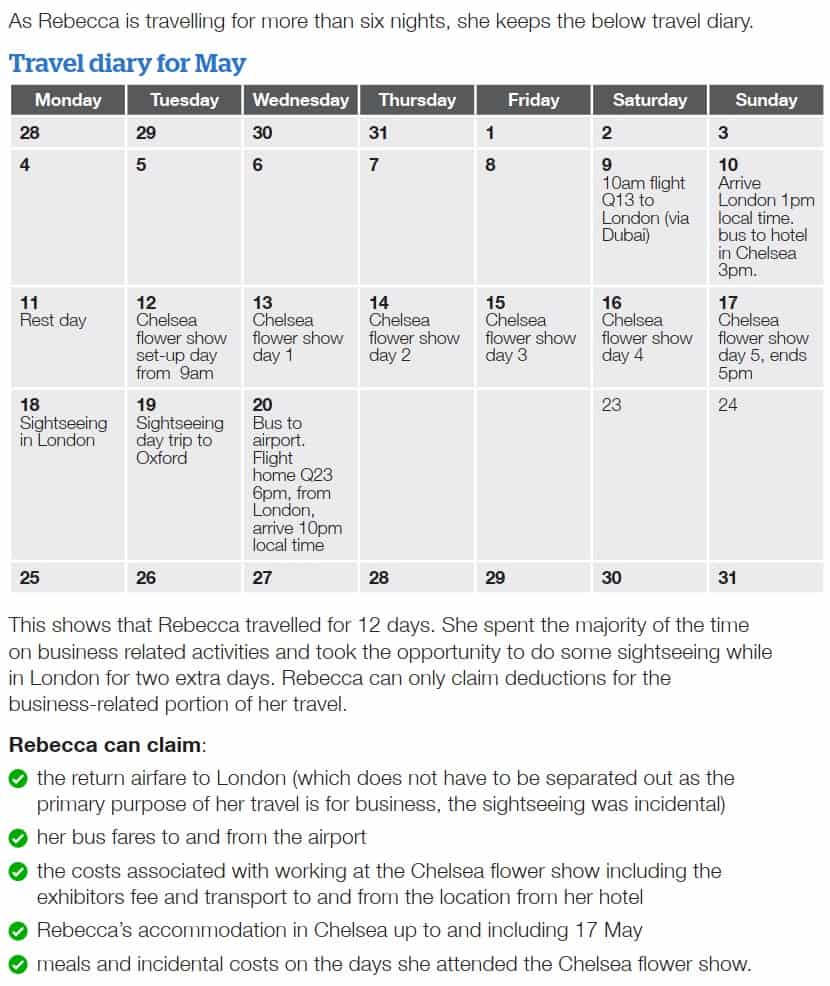

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2024-06-26

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Expenses and employee benefits

Expenses and benefits: travel and subsistence

As an employer paying your employees’ travel costs, you have certain tax, National Insurance and reporting obligations.

This includes costs for:

- providing travel

- reimbursing travel

- accommodation (if your employee needs to stay away overnight)

- meals and other ‘subsistence’ while travelling

Subsistence includes meals and any other necessary costs of travelling, for example parking charges, tolls, congestion charges or business phone calls.

There are different rules for reporting expenses relating to public transport .

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

Pay only when you file

AI Summary to Minimize your effort

Transport Allowance for Salaried Employees - Meaning, Exemption, Calculation, Rules

Updated on : Jun 6th, 2024

Transport Allowance is an allowance a company or employer provides to employees to compensate for their travel from their residence to the workplace. It is a type of special allowance. Like other allowances, transport allowance is a part of CTC and has fixed pay.

As the employee’s income tax computation is done by their employers for tax deduction purposes, salaried taxpayers may or may not be very concerned about their salary structuring and details of various kinds of allowances and exemptions available to them even before arriving at gross total income. However, understanding allowances and exemptions provided on such allowances is also significant for tax planning. This helps them choose the right CTC structure and lawfully claim the tax benefit to which they are entitled. Additionally the availability of the exemption depends on the tax regime chosen by the taxpayer.

This article will discuss one such allowance, i.e., transport allowance and its tax provisions.

What is Transport Allowance?

Transport allowance could mean allowance provided for the purpose of transport from residence to the place of work . However, transport allowance under Section 10(14) of Income-tax Act,1961 read with rule 2BB of Income-tax rules can be either of the following:

- Allowance granted to an employee to meet his expenditure for the purpose of commuting between his place of residence and office/place of duty

Transport allowance is taxable in the hands of the employee since it is added to their gross salaries. However, employees can claim tax exemption for transport allowance as per the exemption limit.

Quantum of Exemption

Section 10(14) read with Rule 2BB provides for transport allowance exemption. The amount of exemption is as follows:

Changes by Finance Act, 2018

From the financial year 2018-2019, the tax exemption for medical and transport allowances has been merged. The Income Tax Department introduced a standard deduction in place of transport and medical allowance. From the financial year 2019-2020, the standard deduction is Rs 50,000, which covers the transport and medical allowance.

Thus, employees can claim the deduction of Rs 50,000 while filing their ITR without producing any bills or documents. Employers will consider the standard deduction to compute the net taxable salary while calculating the TDS. This change shall take effect from the financial year 2018-19. Accordingly, no separate transport allowance of Rs 1,600 per month is available to employees other than physically challenged employees and employees of a transport business. The limit of Rs 40,000 has been increased to Rs 50,000 in the Interim Budget 2019. Know the highlights of the Interim Budget 2019 here.

Difference Between Transport Allowance and Conveyance Allowance

A transport allowance is an allowance given to meet commuting expenses between the place of residence and office or to meet the personal expenditure of an employee of a transport business.

A conveyance allowance is an allowance granted to meet the expenditure on conveyance in the performance of office duty.

Transport allowance is fully taxable for all employees in both regimes. However it is exempt under both tax regimes to the extent of 3,200 per month for the employees who are physically challenged such as blind/deaf/dumb or orthopedically handicapped with disability of lower extremities. C onveyance allowance is exempt from tax only to the extent of actual expenditure incurred.

Illustration

Let us derive the taxable income of an employee for the FY 2017-18, FY 2018-19, FY 2019-20 and onwards.

Let us look the same illustration for an employee who is specially abled.

Transport Allowance Under the New Tax Regime

From the FY 2020-21, the government introduced the new tax regime for individual and HUF taxpayers under section 115BAC. In the new tax regime, there are flat tax rates and no deductions or exemptions. For example, an individual opting for the new tax regime cannot claim exemptions for HRA and others. Also, the individual cannot claim deductions for any tax-saving investments. However, the new tax regime allows an individual to claim the following tax-exempt allowances:

- Allowance by the employer to meet the cost of travel on tour or transfer. It includes an allowance towards the cost of travel, such as airfare, rail fare and other transportation costs.

- Any allowance by the employer to meet the ordinary daily charges incurred by an employee on account of absence from the usual place of duty. The allowance should be in respect of the tour or for the period of the journey in connection with a transfer. The allowance includes expenses an employee incurs for food and other daily costs while travelling.

- Allowance to meet conveyance expense incurred while performing duties of an office or employment of profit. However, in this case, the employer should not provide a free conveyance to the employee. The allowance includes travelling expenses an employee incurs while performing official duties.

In the case of an employee who is blind, deaf and dumb, or orthopedically handicapped, with a disability of lower extremities can claim transport allowance to meet expenditure on commuting between residence and the place of duty. The benefit is up to Rs 3,200 per month. The same would be fully taxable in the case of an employee with no disabilities.

How to Claim Transport Allowance While Filing Income Tax Return for an employee who is specially abled ?

Usually, employers take care of the tax exemption on transport allowance while deducting TDS from the paycheck. In such cases, employees have to enter the amount mentioned in Form 16 part B in the ‘Income from Salary’ column of their ITR Form .

But when an employer has given a tax benefit on transport allowance or forgotten to give the tax benefit in Form 16 , you can claim tax exemption by following the below process:

- Check the CTC structure from the salary slip.

- Check whether the amount of transport allowance is part of the CTC.

- If the amount in the CTC structure is less than Rs 3,200 per month, the entire travel allowance would be tax-free.

- If the amount in the CTC structure is more than Rs 3,200 per month, the tax-free amount would only be Rs 3,200 per month.

Related Articles

Income tax allowances and deductions Special allowance taxation Allowances and deductions available to a salaried

Frequently Asked Questions

A normal employee (other than a handicapped employee) cannot claim transport allowance for commuting between residence and place of work or employment.

The standard deduction is a flat deduction available from the taxable salary or pension income. The deduction amount is Rs. 40,000 for FY 2018-19, whereas it is increased to Rs.50,000 from FY 2019-20 and onwards.

You can furnish the proof or invoices of relocation expenses to your employer and claim tax-free reimbursement.

The tax exemption for medical reimbursement is no longer applicable. From the FY 2018-19, the fixed medical reimbursement and transport allowance stand replaced by a standard deduction.

No, if there is a company-run transportation service facility, they will not pay you a conveyance allowance whether you use the service or not.

No, your employer can pay whatever amount they find appropriate. However, only specially abled employees can avail the exemption against such allowances.

An employee who is handicapped can get the exemption of transport allowance up to Rs. 3,200 per month.

Yes, a handicapped employee can get an exemption of up to 3,200 per month if he pays taxes in any of the regime.

No, transport allowance is fully taxable in the case of a normal employee if he pays taxes in any regime.

70% of such allowance up to a maximum of Rs.10,000 per month will be exempted if he has not received daily allowance. Suppose If he receives a daily allowance, then he would not be eligible for this exemption.

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

You are using an outdated browser. Please upgrade your browser to improve your experience.

[FAQ] What is the correct tax treatment of employee travel allowances?

Login to my account, quick registration.

- (1) Negotiating Tax Debt and Payment Arrangements with SARS

- (20) Accounting

- (2) Accounting for Income Tax

- (7) Administration of Estates

- (1) Application of tax rates, s6(2) rebates

- (1) Assessed losses

- (4) Audit, Reviews & Other Services

- (8) Capital Gains Tax

- (1) Capital Gains Tax - Individuals Tax

- (1) Capital Gains Tax Implications of Trusts

- (2) Case study: Home office expense

- (1) Case study: Travel allowances

- (1) Company Formations

- (119) Corporate Tax

- (9) Customs and Excise

- (2) Deceased Estate

- (1) Deductions Pre-trade and prepaid expenses

- (1) Deferred tax assets and deferred tax on equity

- (1) Deregistration

- (2) Employer and Employee (PAYE and UIF Specific)

- (1) Estate Duty

- (1) Events / Webinars

- (9) Faculty News

- (2) Farming

- (149) Individuals Tax

- (1) Input - Customs Duty

- (3) Interest

- (13) International Tax

- (17) Legislation

- (1) Low interest rate loans and loan subsidies

- (1) Nature of the rights of beneficiaries

- (1) Notional input tax

- (8) Payroll

- (2) Practical Payroll

- (2) Provisional tax (Link with other Taxes)

- (2) SARS Dispute Resolution

- (4) SARS Issues

- (1) Salaried Employees

- (127) Tax Administration

- (2) Tax Administration Part 2B: Resolving Problems with SARS using the Tax Ombud

- (1) Tax Administration Part 3B Dispute Resolution - Objection and appeal

- (3) Tax Update

- (2) Tax implications of loans to trusts

- (1) Tax residence

- (1) Tax returns and payments

- (1) Transfer-Pricing

- (1) Trust Income / Gain Allocations

- (1) Trust types and income allocations

- (3) VAT periods

- (1) Wear and tear allowances

- (1) Zero Rated

- (1) eFiling

- Recent Comments

- 28 August 2023

- Case study: Travel allowances

- The Tax Faculty Tax Specialist

This article is based on tax law for the year ending 29 February 2024.

In the 2021 tax year, my client received a non-taxable reimbursed travel allowance under code 3703, resulting in a nice refund. However, for the 2022 tax year, the payroll person changed the code to 3702, making it a taxable allowance, which has impacted the client negatively. Can a company change these codes without informing the recipient, giving them a chance to adjust and avoid owing money to SARS? Furthermore, the allowance for 2022 was unusually high at R 459,000.00 over six months, with a monthly amount of 3 times my client's basic salary of R 3601. I am concerned about my client's situation as they were not made aware of the code change and are now facing a significant amount owed to SARS. Is there any recourse available in this situation?

In the tax context, two specific codes are used to determine the nature of reimbursed travel allowances: code 3703 signifies a non-taxable reimbursed travel allowance, while code 3702 denotes a taxable reimbursed travel allowance. Allow me to elaborate on their distinctions:

- Code 3703 - Reimbursable Travel Allowance (Non-taxable):

This code is applicable when the allowance or advance is calculated based on the actual distance travelled for business purposes, excluding personal use. This code is used when the actual business kilometres travelled remain below 12,000 kilometres and the prescribed rate per kilometre is R4.64. It is important to note that no other forms of compensation are provided to the employee in this context.

- Code 3702 - Reimbursable Travel Allowance (Taxable):

Code 3702 comes into play when the employer's reimbursement rate surpasses the prescribed rate of R4.64, the business kilometres travelled exceed 12,000 kilometres, or the employee receives additional compensation for travel. This code is relevant only for the portion of the reimbursement that exceeds the amount calculated by multiplying the prescribed rate by the actual business kilometres travelled.

The company will select the appropriate code based on the conditions mentioned above for the reimbursed travel allowance. In your mentioned case, the value of R459,000.00 triggers an evaluation of the business kilometres travelled.

For the year 2021, where the prescribed rate was R3.82, it can be deduced that approximately 120,157 kilometres were travelled during that tax year. Considering the application of code 3703, the maximum kilometres must remain at 12,000, and the reimbursement must not exceed R45,840.00.

In 2022, code 3702 was used as the criteria for code 3703 were apparently no longer met. The value of R459,000.00 suggests either an exceptionally high distance travelled or an elevated rate per kilometre.

Payroll utilizes the following codes:

- Code 3702 = R amount (R4.64 x total business kilometres travelled) (not subject to employees’ tax)

- Code 3722 = R amount (Excess over prescribed rate x 1000 km) (subject to employees’ tax)

Please note that this explanation reflects the applicable codes and calculations for reimbursed travel allowances. If you require further assistance or clarification, feel free to ask.

Join Carmen Westermeyer for our September TaxCafé Discussion Forum, where she will focus on resolving current tax issues experienced in practice.

- Click here to intro snippet.

- Click here to for more information

LEAVE A COMMENT

Need help .

We couldn't found any email record. Please create new account Create an account

Ask a Technical Question is available to subscribers. Click here to find out more

STAY IN TOUCH

Subscribe to our mailing list and you will receive our best posts every week on our live CPD webinars , upcoming courses and webinars-on-demand

By subscribing to our mailing list you accept our Terms of Service and Privacy Policy

Verify Cell Number

Explore smarty.

- New 2 COLUMNS

USA Duty Free Allowances and Exemptions

Travelling to and from the US is easy, but only once you’re actually on the plane. The difficult bit has always been the slow trawl through Customs, Immigration and Security. Understanding the duty free and tax free allowances and exemptions rules in absolute detail also comes under “slow trawl” • So to help, here is our quick guide to the latest allowances ……….The duty-free exemption, also called the personal exemption, is the total value of merchandise you may bring back to the United States without having to pay duty. You may bring back more than your exemption, but you will have to pay duty on it. In most cases, the personal exemption is $800, but there are some exceptions to this rule.

Family members who live in the same home and return together to the United States may combine their personal exemptions. This is called a joint declaration.

Children and infants are allowed the same exemption as adults, except for alcoholic beverages and tobacco products.