Our website doesn't support your browser so please upgrade .

Insurance Aspects

Existing HSBC Insurance Aspects customers

HSBC Insurance Aspects is currently not available for new customers to purchase. This information is for HSBC Advance customers who already hold an Insurance Aspects policy for:

- worldwide travel insurance (for eligible customers aged under 70)

24-hour motor breakdown assistance

- mobile phone insurance

If you already have an Insurance Aspects policy with us, find out how you can make a claim.

Worldwide travel insurance

Your worldwide travel insurance includes:

Baggage cover for loss, theft or damage to your personal belongings.

Up to £10 million of medical cover for emergency medical treatment and associated expenses.

Cover if you miss your pre-booked transport or your pre-booked transport is delayed for at least 12 hours.

- Up to £5,000 of cover for cancelling or coming home early - refund of unrecoverable travel and accommodation costs if you're forced to cancel or cut short your trip. Includes cover for if your transport or accommodation provider or booking agent becomes insolvent or you can't travel or continue your trip because of a terrorist attack.

Up to 31 days of winter sports cover for loss, theft or damage to winter sports equipment. Also includes additional benefits for delays due to avalanche, ski pack, piste closures or injury or illness which prevents you from taking part in winter sports activities.

Add optional upgrades for extended trip duration and increased cancellation cover.

You must be registered with a doctor in the UK in order to make any medical claims, or claims for cancellation or coming home early due to medical emergencies.

Worldwide travel insurance is provided by Aviva Insurance Limited. If you need to prove you have Travel Insurance, you can ask Aviva for confirmation of cover .

Coronavirus advice

For the latest coronavirus travel guidance, see what’s covered under HSBC Travel Insurance .

Declaring medical conditions before travelling

You'll need to call the HSBC Medical Risk Assessment helpline on 08000 517 142 before booking a trip if, in the 12 months before making the booking or opening your account (whichever is later), an insured person:

- has been prescribed medication, including newly-prescribed or repeat medication

- has received or is awaiting medical treatment

- has undergone or is awaiting tests or investigations

- has been referred to or is under the care of a specialist or consultant

- has been admitted to hospital or had surgery

You must also tell Aviva if:

- any of the above happens for a condition you've already declared

- there are any changes to prescribed medication

- any of the conditions deteriorate

You should also tell Aviva after booking a trip but before you travel if:

- an insured person is referred to a specialist or consultant or admitted to hospital because of a new condition or symptom, or a previously accepted condition

- there's been any deterioration in an accepted condition you've already told us about

- there's been a change in prescribed medication for an accepted condition you've already told us about

There's no cover where, at the time of opening your account or booking a trip (whichever is later), the insured person knew that their travel plans could reasonably be expected to be affected by the illness, injury or quarantine of:

- a travelling companion

- a person the insured was going to stay with

- a close relative

- a business colleague

Existing conditions are not covered at any time under this policy unless either of these applies:

- The insured person only has conditions included in the list of accepted conditions in the policy terms and conditions.

- You’ve told Aviva about them and they’ve agreed in writing to provide cover.

Travel policy documents

Your Travel Policy Document (PDF, 519KB)

Insurance Product Information Document for customers aged under 70 (PDF, 853.9KB)

Do I need to notify you to use my HSBC UK debit or credit card outside the UK?

No, you no longer need to notify us before you travel. To find out more about managing your money whilst you travel, see using your card abroad .

Mobile phone insurance

Your mobile phone insurance is for contract and pay-as-you-go phones you own. It includes:

- Worldwide cover for your mobile phone against loss, theft, breakdown (outside of warranty) or accidental damage.

- no upper claim value limit

- excess payable of £50 for repair, £75 for replacement.

- Up to 2 claims per HSBC Insurance Aspects holder per policy year.

- Claims are settled by repairing or replacing the phone. Replacement phones are refurbished models.

Mobile phone insurance is underwritten by Aviva Insurance Limited. While Aviva will be the insurer of this policy and will remain liable to you under the terms and conditions of this policy, it will use Likewize as its agent to help administer your policy and deal with claims.

Register your mobile phone

Your mobile phone is automatically covered. However we recommend you register your mobile phone in advance to make the process of making a claim easier.

You can register your phone online or call 0800 001 4278 .

Lines are open: Monday to Friday from 08:00 to 20:00

Saturday, Sunday and public holidays: 08:00 to 18:00

Mobile phone policy documents

Your Mobile Phone Insurance Policy Document (PDF, 166KB)

Insurance Product Information Document for customers aged under 70 (PDF, 853.9KB

Insurance Product Information Document for customers aged over 70 (PDF, 347.2KB)

Your motor breakdown assistance includes:

- Cover for you as a driver or passenger of any eligible vehicle for breakdowns which occur at your home address or on the road in the UK.

- Up to 5 call outs per year per account holder.

- In some circumstances you may need to pay for a service that is covered under your policy yourself, such as a taxi, and claim this back from the RAC as stated in your policy terms and conditions. To do so, please submit the RAC Reimbursement form within 90 days of your breakdown.

HSBC Insurance Aspects Motor Breakdown Assistance is provided by RAC Motoring Services and administered by Aviva Insurance Limited.

Motor breakdown policy documents

Your Motor Breakdown Policy Document (PDF, 898.9KB)

RAC Reimbursement form (PDF, 142KB)

How to make a claim

For details of how and when to make a claim, please visit our Insurance Aspects claim page.

Things to know

To remain eligible for Insurance Aspects you must:

- hold and pay the monthly fee from your HSBC Advance Account

- be a UK resident

- HSBC Insurance Aspects Terms and Conditions (PDF, 497.8KB) HSBC Insurance Aspects Terms and Conditions (PDF, 497.8KB) Download

HSBC Insurance Aspects fee

With effect from 31 May 2019 the HSBC Insurance Aspects fee is:

- £11.95 per month

- £5.95 per month if all policy holders are aged 70 or above (does not include travel insurance)

This fee will be taken from your HSBC Advance Bank Account.

Cancelling your policy

If you decide to cancel your HSBC Insurance Aspects policy it will not be possible to reinstate this in the future.

If you close your HSBC Advance Bank Account from which the monthly fee is paid, we will automatically close your HSBC Insurance Aspects policy at the same time.

If you tell us that you are moving outside of the UK, Channel Islands or Isle of Man, we will close your HSBC Insurance Aspects policy from your date of departure.

Frequently asked questions

Who's covered by this policy .

Cover is for you, the HSBC Insurance Aspects holder(s), your domestic partner (providing you are both under 70 years of age at the start date of your trip), and dependent children under 23 years of age, if they're travelling with you or to stay with a close relative. All insured persons must be residents of the UK, Channel Islands or Isle of Man.

Can I extend the trip duration?

You may be able to purchase a policy upgrade for an individual trip to extend the duration up to a maximum of 120 days. Please call Aviva on 0800 328 1563 at the point of booking your trip, and one of their advisers will be happy to assist you.

Are holidays in the UK covered?

Yes. Holidays in the UK, Channel Islands or Isle of Man that involve a stay of at least 2 consecutive nights are covered.

They must also have either of the following:

- pre-booked holiday accommodation in commercially-run premises

- pre-paid bookings on public transport, including flights and ferries

Please see our definition of ‘pre-booked holiday accommodation’ in your policy document.

Are business trips covered?

Yes, if you travel outside the UK to carry out non-manual work such as administrative tasks, meetings and conferences, you're covered.

Am I covered if I go on a cruise?

Although this is not a specific cruise policy, cruises are covered as standard as they're simply a type of holiday. However, there is no cover for some things that special cruise policies may cover, for example, missed port, unused excursion and change of itinerary cover.

What is covered by my mobile phone insurance policy?

Mobile phone insurance covers phones you own (including phone contracts where you will become the owner at the end of the contract, or where you are contractually responsible for any damage to the phone) for accidental damage, breakdown (outside of warranty), loss and theft.

Do I need to register my mobile phone?

Your mobile phone is automatically covered. However, we recommend you register your mobile phone in advance to make the process of making a claim easier.

Are accessories covered by my mobile phone insurance policy?

The battery and charger are covered if they are lost, damaged or stolen in the same incident but no other accessories are covered by this insurance.

How long am I covered for?

You're covered by mobile phone insurance from the date you became an HSBC Insurance Aspects holder, or 1 November 2018, whichever is later until the policy is cancelled/terminated or you stop paying the account fee.

Who is covered by my mobile phone insurance policy?

Your policy covers you (the policyholder), any joint account holder and anyone temporarily using the phone with your permission.

What if I'm abroad and my mobile phone is lost or stolen?

Cover applies worldwide, but we can only arrange a replacement phone when you're back in the UK (or the Channel Islands or the Isle of Man if you're resident there).

Motor breakdown insurance

Will you come out if i'm the passenger rather than the driver .

Yes, with HSBC motor breakdown assistance, cover is personal to the HSBC Insurance Aspects holder and so you're covered whether you're the driver or passenger of an eligible vehicle. However, please remember that the HSBC Insurance Aspects holder must be with the vehicle when the incident occurred and when assistance arrives otherwise assistance may not be provided.

How many times can I breakdown?

You can call us out up to 5 times per year per account holder.

How soon will I be covered once I take up HSBC Insurance Aspects?

Your cover starts as soon as you are an HSBC Insurance Aspects holder or 1 November 2018 whichever is later. However, breakdowns that occur before you take up HSBC Insurance Aspects are not covered.

Who's covered?

Anyone named as an HSBC Insurance Aspects holder is covered for Motor Breakdown Assistance.

Who provides the cover?

Cover is provided by RAC Motoring Services and administered by Aviva Insurance Limited.

What number do I call if I breakdown?

Contact the callout helpline number for assistance as soon as you can on 08000 014 279 or 01603 606 377 .

Why do I need identification?

Cover is restricted to HSBC Insurance Aspects holders, and so to ensure that you are able to have assistance, it may be necessary to confirm that you are the policyholder.

Explore more

See all insurance options, what to consider when buying insurance, how to make an insurance claim, customer support.

Our website doesn't support your browser so please upgrade .

- Premier Worldwide Travel Insurance

- What's covered

- What you should know before you travel

- Making a claim

As part of your HSBC Premier experience, you enjoy the benefit of Premier Worldwide Travel Insurance at no extra cost.

Our cover gives you, your partner, dependent children and grandchildren under 23 years of age worldwide protection.

Premier Worldwide Travel Insurance is underwritten by Aviva Insurance Limited. Policy terms and conditions apply.

Please note: holidays taken solely in the UK, Channel Islands or Isle of Man are covered if they include at least two consecutive nights away from home and either pre-booked accommodation or prepaid public transport.

- Guidance and FAQs on Novel Coronavirus (COVID-19)

- Guidance and FAQs on travel bookings with Flybe

Eligibility requirements

Please ensure you can answer YES to the following questions:

- do you hold an HSBC Premier account?

- are you under 70 years of age when you open your HSBC Premier account or when your trip starts? Note: When you reach 70, you will no longer be covered by HSBC Premier Travel Insurance.

- are you a resident of the Channel Islands or Isle of Man?

- are you going to start and finish your trip in the UK, the Channel Islands or the Isle of Man?

- are any dependent children* under 23 years of age at the start date of the trip?

- are any grandchildren* under 23 years of age at the start date of the trip?

*Children are only covered when travelling with you or your partner, or travelling with close relatives who are over 23 years of age, or travelling independently on a school/college trip with teachers/lecturers. Grandchildren are only covered when travelling with you or your partner.

Medical Conditions:

To make a medical claim you must be registered with a doctor in the UK, Channel Islands or Isle of Man.

You will need to call the HSBC Medical Risk Assessment Helpline on 0800 051 7457 before booking your trip if you or any insured person in the last 12 months has:

- been prescribed medication;

- received or are awaiting medical treatment, tests or investigations;

- been referred to a specialist, or admitted to hospital for any condition not listed on the accepted conditions list

All pre-existing medical conditions must be on the Accepted conditions list in your Policy Wording to be covered, otherwise they must be disclosed to and accepted in writing by the insurer.

1 Unexpected costs - significant or unusual exclusions

- any event, incident, or circumstance if, at the time you opened your account or booked a trip (whichever is later), you knew or could reasonably be expected to have known that travel disruption could impact travel plans

- any claim where the insured person hadn't allowed enough time, or done everything they reasonably could, to get to their departure point for the time shown on their itinerary

- any costs for running out of medication because the insured person hadn’t taken enough with them to cover their time away

2 Your belongings - significant or unusual exclusions

- belongings, valuables and money deliberately left somewhere that is not in the insured person's full view, with someone they know, or their travel provider

- valuables or money which is not kept in the insured person’s hand luggage while they're travelling

- theft from a vehicle or caravan unless it was broken into and the valuables or money were left in an enclosed storage compartment

- hired sports equipment

3 Winter sports - significant or unusual exclusions

- equipment deliberately left somewhere that is not in an insured person’s full view, with someone they know, or with their travel provider

- loss or theft from motor vehicles

Things you should know

Please take time to read the following:

- Privacy Notice

- HSBC Premier Worldwide Travel Insurance Policy Wording (PDF) HSBC Premier Worldwide Travel Insurance Policy Wording (PDF) HSBC Premier Worldwide Travel Insurance Policy Wording (PDF) Download

Should you need a letter to confirm you have Travel Insurance in place, you can request it online from Aviva here .

What's not covered

- all pre-existing medical conditions must be on the Accepted conditions list in your Policy Wording to be covered, otherwise they must be disclosed to and accepted in writing by the insurer

- any sports activities which are shown as excluded in the policy document

- if you are aged 70 or over

- any event, incident or circumstance which had already happened, or was going to happen, at the time you opened your account or booked your trip (whichever is later) – and could reasonably be expected to affect your travel plans

- winter sports beyond the 31 days per calendar year limit

- business trips in connection with an insured person's job where the trip involves manual or physical work of any kind, working with children, providing healthcare, policing, security or military service or an insured person's role as a politician, religious leader, professional entertainer or sportsperson

- claims for death, injury, illness or disability are not covered if they result from the misuse of alcohol or drugs

Please note, all trips must begin and end in the UK, the Channel Islands or the Isle of Man.

Contact the relevant helpline number for assistance as soon as you can, quoting your policy number if possible.

In case of medical emergency please call (+44) 1603 605 135 from abroad or 0800 051 7458 within UK, Channel Islands or Isle of Man.

Lines are open 24 hours a day, 365 days a year. Calls may be monitored or recorded.

Travel Claims

If your claim does not require urgent medical attention you can contact aviva and make a claim online or by calling:.

0800 051 7459 Lines open 24 hours a day Calls may be monitored or recorded

Customer services

03456 00 61 61 Lines open 24 hours a day Calls may be monitored or recorded

Medical assessment

0800 051 7457 Lines open 8am to 9pm Monday to Sunday (closed Christmas Day, Boxing Day and New Years Day) Calls may be monitored or recorded

Premier Worldwide Travel Insurance

What's covered , what you should know before you travel , making a claim , customer support.

Our website doesn't support your browser so please upgrade .

Travel insurance

Important reminder about travel insurance Please remember that your free travel insurance benefit only applies if you make part or full payment for your transportation and/or accommodation costs with your HSBC card. Remember to carefully check the limits and exclusions of your policy immediately before your date of travel to determine if the cover offered is adequate for you or your family’s purposes. More information about applicable benefits can be found in the insurer's documentation .

Free travel insurance for you and your loved ones

Travelling away from home without travel insurance puts you at risk of a number of situations. Needing medical treatment for illness, cancelled trips and other financial emergencies can turn your dream holiday into an overseas nightmare.

If you're a Premier or Advance customer, HSBC offers you free travel insurance. All you need to do is settle full or part payment of your flight, marine transport service and/or accommodation with a valid HSBC Premier/Advance debit or credit card.

Eligible accounts

What’s included.

Cover applies to you (the HSBC Premier or Advance customer) and your eligible family members* provided you are under 76 years of age for a maximum period of 90 days (HSBC Premier customer) or 60 days (HSBC Advance customer) per trip.

- free multi-trip worldwide cover

- personal accidents cover for unexpected injuries or fatal accidents

- medical expenses cover for medical treatment including hospital stays

- 24-hour emergency assistance for help when you need it most

- personal belongings cover for accidental loss, damage or theft of possessions

- travel cancellation and delay cover for when your holiday plans are disrupted

- personal liability cover for injury to someone else or damage to their property

- hire vehicle excess cover for Premier customers

A printable summary of the table of benefits highlighting your limits and excess can be found in our Important Documents page .

As with all insurance policies, terms and conditions, exclusions and limitations apply, so before each trip we recommend that you check carefully the policy documentation.

If you require additional cover, you are requested to contact Mediterranean Insurance Brokers (Malta) Ltd.

*Eligible members include partners living at the same address, as well as children living with you, under the age of 18 or under 25 if in full-time education.

Any questions

Policy queries.

Mediterranean Insurance Brokers

+356 2343 3234

Monday to Friday 08:30 - 17:00

Email Mediterranean Insurance Brokers

Premier customers

Premier Direct

+356 2148 9100

24 hours a day, 7 days a week

Advance customers

Advance dedicated line

+356 2148 9101

Monday to Saturday 08:00 - 18:00

In case of a medical emergency

In the event of a medical emergency during your trip, you must contact Global Response as soon as possible. Global Response is a world-wide organisation specialising in emergency assistance services. The service operates 24/7, 365 days a year for advice and assistance when making arrangements for hospital admission, repatriation and authorisation of medical expenses.

Over the phone: +44 (0) 292 066 2438

By email: [email protected]

Premier customers should quote Atlas Policy Certificate number - Travel: 167064 299 002

Advance customers should quote Atlas Policy Certificate number - Travel: 167064 299 001

How to make a claim

By phone.

+ 356 2343 3234

Monday to Friday from 08:30 to 17:00

Zentrum Business Centre

Level 2, Triq l-Imdina

Ħal Qormi, QRM 9010

This insurance is provided by Atlas Insurance PCC Limited and administered by Mediterranean Insurance Brokers (Malta) Ltd. A list of necessary information and documents required when making a claim can be found in our Important Documents page .

Important documents

You can download all the documents relating to our travel insurance, including terms and conditions, as well as information about what's covered and how to claim from our Important Documents page .

Frequently Asked Questions

Can i buy extra cover for a trip .

Yes, you can arrange additional cover for a trip at your own cost.

These optional extensions are available:

- Increased limit for rental vehicle excess (free up to €500 for Premier customers and can be bought separately by Advance customers)

- Winter sports extension

- Specified items extension

- Increase in baggage limit for cruises

- Cancellation of trip (extreme weather conditions)

- Maximum duration of trip extension

- Covid-19 extension

- Optional extension providing coverage for specific sailing trips

To discuss your needs and obtain a quotation, contact Mediterranean Insurance Brokers on +356 2343 3234 or email [email protected]

How long will I be covered for?

If you're a Premier customer you'll be covered for a single trip of up to 90 days; it's 60 days for Advance customers.

Am I covered for business trips?

Yes, the insurance covers both holidays and business travel.

Are eligible members travelling without being accompanied by the main cardholder still covered?

They are covered irrespective of whether travelling with the cardholder or not.

Eligible members include partners living at the same address, as well as children living with you, under the age of 18 or under 25 if in full-time education.

What information do I need when making a claim?

When making a claim it is important that you provide the necessary information and documents required, to enable Mediterranean Insurance Brokers to proceed with the handling of your claim. These may differ from one benefit to the other, however as a minimum the following documentation will be required:

- Completed claim form

- Passport Copy

- Copy of ID card of Main Card Holder

- Flight Tickets or e-tickets (departure and arrival)

- Luggage Tags

Depending on the claim being made, additional documentation may be required such as:

- Damage report by Airline/Cruise Line (Property Irregularity Report) if claiming for damaged luggage

- Police report for lost or stolen items, within 24 hours of discovery

- Medical Report/s (if claiming any medical expenses or cancellation of travel)

- Hotel Accommodation Vouchers

- Flight & Accommodation invoices & Receipts;

- Documentation to confirm reason/s for cancellation or curtailment;

- Cancellation confirmation from Airline / Agent indicating any refund due (if any);

- Evidence of money taken abroad – this may take the form of foreign exchange receipts or cash withdrawals in case of Euros.

For further guidance contact Mediterranean Insurance Brokers on +356 2343 3234 or email [email protected]

You might be interested in

Premier purchase protection.

Protect your purchases by using your Premier card.

HSBC Premier

Discover exclusive services and support for every aspect of your finances and lifestyle.

HSBC Advance

Enjoy rewards and preferential rates with the account that rewards you.

Connect with us

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

HSBC Travel Companion

Get ready to travel with hsbc.

- Protect yourself and enjoy travel insurance promotions

- Explore HSBC credit card promotion for hotels and flights bookings

- Earn cashback with one multicurrency account

Enjoy complimentary travel insurance promotion on selected HSBC credit cards

* Travel insurance coverage is underwritten by MSIG Insurance (Singapore) Pte. Ltd. HSBC Bank (Singapore) Limited is not the underwriter nor the distributor for this insurance plan. It is not an obligation of, deposit in or guaranteed by HSBC Bank (Singapore) Limited (Company Registration No. 201420624K).

1 HSBC Visa Infinite Credit Card Travel Insurance: Read the policy in detail .

2 HSBC Premier Mastercard Credit Card: Read the policy in detail

3 HSBC Advance Credit Card: Read the policy in detail

4 HSBC Revolution Credit Card: Read the policy in detail

5 HSBC TravelOne Credit Card: Read the policy in detail

Looking for a more comprehensive travel insurance plan? Check out our latest promotions for TravelSure .

Don't have an HSBC credit card?

Explore our exclusive promotions for hotel and flight bookings with your hsbc credit card.

From dining out to jetting off, find just what you're looking for. Get the latest travel deals and offers now!

Royal Caribbean

- Get 5% off on bookings & redeem a complimentary luggage Get 5% off on bookings & redeem a complimentary luggage click here to view more details This link will open in a new window

Expires 31 Dec 2024

- 8% off hotel bookings 8% off hotel bookings click here to view more details This link will open in a new window

Apply for one today and get a Samsonite luggage worth SGD670, or SGD150 cashback. T&Cs apply .

- extra 7% off hotel bookings extra 7% off hotel bookings extra 7% off hotel bookings This link will open in a new window

- 8% off worldwide hotel bookings 8% off worldwide hotel bookings click here to view more details about hotel bookings This link will open in a new window

Travel with your taste buds through global and sustainable dishes with One Planet Plate

Eating sustainably while on a holiday can be quite daunting, but it doesn’t mean that we have to stop paying attention to our environmental footprint while on the road.

One Planet Plate presented by HSBC aims to address the inherent problems in our food system, and has pulled together chefs from across the world to showcase dishes that celebrate local ingredients, produce zero waste and are low carbon footprint.

This opens up more opportunities for you to discover new sustainable restaurants and find out what delicious sustainable food actually looks, smells and tastes like in in Singapore and globally.

We've also partnered up with amazing restaurants so that you can explore a myriad of international cuisines right at your doorstep. View a range of exclusive credit card offers so you can shop and dine sustainably whilst in Singapore.

Travel and earn cashback with our multicurrency Everyday Global Account

Sign up now and receive preferential foreign exchange (FX) rates with our Everyday Global Account. Terms and conditions apply .

Sign up for an account with us and enjoy the following benefits

- $0 fee in 10 currencies for your retail purchases and cash withdrawals

- Free cash withdrawals at all HSBC ATMs worldwide

- Send money internationally faster with HSBC Global Money Transfers with no fees

Open an account today

New to hsbc.

You can apply faster with Myinfo via Singpass.

Already using online banking?

Unlock rewards easily with 1% cashback and enjoy up to sgd300 bonus cash rewards with everyday+, 1% cashback.

on all eligible spends on your HSBC Everyday Global Debit Card and GIRO bill payments .

1% p.a. Bonus Interest

on your incremental SGD average daily balances.

Receive a total of up to

in Cashback and Bonus Interest each month through HSBC Everyday+ Rewards Programme.

Plus, earn One-time Bonus Cash Reward

when you're new to the HSBC Everyday+ Rewards Programme.

Caps apply. For definition of the capitalized terms used here and further details on the HSBC Everyday+ Programme and applicable exclusions, please refer to the full terms and conditions here .

To qualify for HSBC Everyday+, simply:

Credit your salary or set up a regular deposit of at least SGD2,000/5,000 into your HSBC Everyday Global Account

Make 5 Eligible Transactions with your Everyday Global Debit Cards or any HSBC Credit Card

Deposit scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to SGD100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Protect yourself and enjoy travel insurance promotions

Explore hsbc credit card promotion for hotels and flights bookings , earn cashback with one multicurrency account .

Unlock instant travel rewards and elevated travel experiences with HSBC TravelOne

- Redeem travel rewards instantly with a wide range of airline and hotel partners.

- Earn up to 2.4 miles (6× Reward points) for your spending.

- Suite of travel privileges including 4 complimentary airport lounge visits, travel insurance coverage of up to USD100,000, and more

- Get 20,000 miles (in the form of 50,000 Reward points) for new HSBC TravelOne credit cardholders.

Terms and conditions apply.

Connect with us

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

TravelSurance

Travel confidently with comprehensive coverage

TravelSurance protects you, your family, friends and relatives from the moment you book a trip all the way until you return home. This all-in-one policy provides you with a hassle-free protection for a specific trip, including accidental injuries, medical and hospital expenses, personal liabilities, lost baggage and cash, delayed flights, stolen belongings, etc.

If you are a frequent traveller, you can be protected under our MultiTrip TravelSurance. It provides covers for all the trips you may take during the year so you don’t have to re-apply every time you travel. In addition to Worldwide coverage, if your destination is within the Greater Bay Area, then our MultiTrip TravelSurance - Greater Bay Area Plan is tailored for you, ensuring you have the right protection while exploring this exciting area all year round, at an even more affordable price.

Should you have any queries about TravelSurance cover under Coronavirus Disease 2019 , please see our FAQs

Key benefits

Covered for emergencies

Comprehensive cover, including personal accidents up to HKD2 million, and medical expenses up to HKD5 million

Designated loss coverage

Cover designated loss such as adverse weather conditions, strike, terrorism or natural disasters

Covers all ages with full benefits

All insured persons, including any children, will enjoy the full benefits

Coverage for your mobile

Get up to HKD6,000 coverage for your mobile phone

Limited time offer

Apply for TravelSurance between 23 June and 30 August 2024 (both days inclusive) to get:

- a chance to win HKD8,000 worth Klook Gift Card for annual MultiTrip TravelSurance. Enjoy 30% off on first-year’s premium and 20% renewal discount for Greater Bay Area plan, plus 30% off on first-year’s premium for MultiTrip Worldwide plan;

- 15% off for Single Trip TravelSurance and a chance to win HKD3,000 worth Klook Gift Card (which is only applicable to Asia Standard Plan or Worldwide Standard Plan)

T&Cs apply .

Compare HSBC TravelSurance Plans

Check out the full coverage details . Enjoy extra benefits if you choose the Annual MultiTrip TravelSurance Worldwide Plan:

- Year-round protection with one-off premium payment for unlimited number of trips per year, up to 100 days per trip.

- Experience the convenience with e-Policy servicing which provides you with 24-hour online access to your insurance policy details and allows you to submit policy service requests without hassle.

- If you travel to mainland China frequently, enjoy hospital admission deposit guarantee at designated hospitals in mainland China with a China Medical Card option under your Annual MultiTrip policy.

- MyDoc Health Passport provides you 6 free-of-charge virtual medical consultations per Period of Insurance. Additionally, enjoy prescribed medication and door-to-door medicine delivery service, where the expense could be reimbursed under the Medical Expenses benefit of your policy, when you are travelling to select cities in Japan, Singapore, Thailand and Vietnam.

The Annual Greater Bay Area Plan has the following features:

- Year-round protection with one-off premium payment for unlimited number of trips per year, up to 15 days per trip.

- Free China Medical Card offers you hospital admission deposit guarantee at designated hospitals in mainland China.

The coverage shown above is applicable to TravelSurance policies applied on or after 23 June 2024. For coverage of policies applied before 23 June 2024, please call our insurance service hotline (852) 2867 8678 .

What's included?

Our plans generally cover:

We'll reimburse the necessary medical expenses incurred during a trip and follow up medical expenses within 3 months after return to the Hong Kong SAR up to HKD5 million. For the Greater Bay Area Plan, medical expense benefit is applicable for in-patient only.

We'll also cover additional travel and accommodation costs for your children if they have to travel back to Hong Kong SAR while you stay in hospital (not applicable for Greater Bay Area Plan).

Sports and Activities [@sportsactivitiestravelsurance]

We provide cover for various sports and activities, including dune driving, sand boarding, safari adventures, whale tours, hot springs, horse riding, cable cars, iceberg climbing, watching auto racing, water sports, skiing, ice-skating, biking, thrill rides at amusement parks etc.

TravelSurance even covers certain hazardous sports activities such as hot air ballooning, bungee jumping, hang-gliding, parachuting, ziplining, rafting, speed-boating, jet-skiing, trekking, water skiing, wakeboarding, wake-surfing, sea kayaking, scuba diving (that is diving to a depth not greater than 40 metres), mountaineering, rock-climbing etc.

You'll receive cover for baggage loss or damage up to HKD20,000. We'll reimburse emergency purchases of essential items or clothing up to HKD2,000 if baggage is delayed for more than 6 hours after you've arrived at your destination abroad (not applicable for Greater Bay Area Plan).

Expand

Travel delays and cost of catch-up tickets.

We'll pay up to HKD2,500 if your scheduled transportation is delayed for 6 hours or more. For the Greater Bay Area Plan, we’ll pay up to HKD950 if your scheduled high-speed rail is delayed for more than 3 hours or more.

If you choose to buy Standard Plan, you have the option of buying another one-way travel ticket to catch up with the planned itinerary and may get reimbursed up to HKD4,000.

HSBC credit card protection

In the event of death of the insured person caused by an accident outside the Hong Kong SAR, any outstanding balance payable under the insured person’s HSBC credit cards up to HKD50,000 for items charged while outside the Hong Kong SAR during the trip will be covered.

Funeral expenses

In the unlikely event that a fatal incident occurs while you are travelling, we will pay the reasonable funeral expenses (other than the burial or cremation charges) outside Hong Kong SAR up to HKD100,000 (not applicable for Greater Bay Area Plan).

What's NOT included?

Our plans generally do not cover:

- riot, civil commotion, war, invasion, civil war and related perils

- suicide, self-inflicted injury, illegal acts, insanity, drugs-taking, alcoholism, venereal disease, AIDs

- any pre-existing conditions, including congenital conditions

- childbirth, pregnancy, miscarriage

- engaging in:

- any sports or activities which are played in professional capacity or in competition involving prize money or reward of any kind

- deep water diving (that is diving to a depth of greater than 40 metres)

- motor rallies

- aviation other than as a fare-paying passenger

- manual work or hazardous work (eg involving the use of mechanical and/or electrical equipment or handling of explosive or hazardous substances, etc.)

- property more specifically insured

- claims where no written notification is given to AXA General Insurance Hong Kong Limited within 31 days after end of the trip

For a full list of exclusions and terms and conditions, please refer to our policy wordings .

How to apply

Eligibility.

To be able to apply you must:

- be an HSBC bank account or credit card holder

- be an HKSAR resident and applying for this insurance policy in the HKSAR

- depart from and return to the HKSAR from your insured destination

- hold an HKID card for online applications

- for child under 18 years old, the parent or legal guardian[@legalguardiantravelsurance] information of the child must be provided during the application

- children aged under 12 years old must be accompanied by an adult during the trip

- provide information of any spouse/partner[@partnerdefinition], children, relatives and friends if you wish to insure them under the same policy

Important Information

- TravelSurance Declaration, Terms and Conditions TravelSurance Declaration, Terms and Conditions Modal

- Fees & Charges Fees & Charges Modal

- Forms and documents Forms and documents Modal

- Important Information Important Information Modal

- TravelSurance Product Factsheet TravelSurance Product Factsheet Download

- TravelSurance policy document TravelSurance policy document Download

- Frequently asked questions (FAQs) Frequently asked questions (FAQs) Modal

- Find a branch Find a branch Modal

HSBC customers can apply for a TravelSurance policy online

Or visit a branch

You can visit one of our branches to find out more

Find out more

Can non-hkid holders apply for travelsurance .

Yes, non-HKID holders can apply for TravelSurance via HSBC branches, as long as the trip starts from, and returns to, the Hong Kong SAR.

Can a child aged under 18 apply for TravelSurance if they are not travelling with adult?

If cover is required for children under 18 years old, parent’s or legal guardian’s[@legalguardiantravelsurance] information must be provided during the application process. For children aged under 12 years old, they must be accompanied by an adult during the trip.

Can I buy the TravelSurance for my friends or my friends' child(ren)?

Yes, you can buy TravelSurance for your friends and your friends’ child(ren) who is/are under 18 years old by providing your friend’s full name, HKID number and date of birth.

If cover is required for children under 18 years old, parent’s or legal guardian’s[@legalguardiantravelsurance] information must be provided during the application process. For children under 12 years old, they must be accompanied by an adult during the trip.

In case of emergency, how can I contact AXA for assistance?

You can call the Emergency Assistance Hotline on (852) 2528 9333 at any time for emergency medical and evacuation assistance, travel information, baggage assistance, medical referrals, legal referrals and emergency ticketing. The hotline operates in English, Cantonese and Mandarin.

How can I manage my policy in case I want to extend the covered period during my travel?

Should you have any queries about your policy, including request to extend the covered period, you can call our insurance service hotline at (852) 2867 8678 (during office hours) or manage your policy at ease by e-Policy servicing after logging on to HSBC Online Banking if you are an HSBC Online Banking customer. This online service provides you with 24-hour access to your policy details and allows you to submit policy service requests without hassle. Please note the covered period can be extended during travelling if you give us the notice of change before the start date of the extension while the policy is still in force. However, please note any extension is subject to AXA’s approval.

What if I’m being confined in an overseas hospital but not able to speak the local language, is the interpretation service fee covered under the policy?

In case you are confined in overseas hospital for over 24 hours due to accidental bodily injury or sickness during the trip and appoint a local translator referred by Emergency Assistance Service, a maximum of HKD500 per day subject to a HKD5,000 per trip is payable for the interpretation service.

What is the catch-up ticket benefit under in case of travel delay?

If you are insured under Asia or Worldwide Standard Plan, in the event the common carrier in your original travel itinerary is delayed during the trip for more than 6 hours due to covered conditions and you decide to buy another one-way travel ticket to catch up with the planned itinerary, the additional and reasonable cost of the ticket replacement will be reimbursed, up to HKD2,000 for Asia Standard Plan and HKD4,000 for Worldwide Standard Plan.

Please note that cash allowance and trip re-routing benefits will not be payable if catch-up ticket benefit is paid, and vice versa.

What kind of sports and activities are covered by TravelSurance?

TravelSurance covers various kinds of sports and activities provided that they are not played in professional capacity or in competition involving prize money or reward of any kind. For example, you are covered for dune driving, sand boarding, safari adventures, whale tours, hot springs, horse riding, cable cars, iceberg climbing, watching auto racing, water sports, skiing, ice-skating, biking, thrill rides at amusement parks etc.

TravelSurance also covers hazardous sports activities such as hot air ballooning, bungee jumping, hang-gliding, parachuting, zipline, rafting, speed-boating, jet-skiing, trekking, water skiing, wakeboarding, wakesurfing, sea kayaking, scuba-diving (that is diving to a depth not greater than 40 metres), mountaineering, rock-climbing etc.

To see what you’ll be covered for under TravelSurance, check the full list .

What extra protection can I receive if a Travel Alert is issued for the planned destination?

Except Greater Bay Area plan, you will be protected against the issuance of the Travel Alert in the following ways, provided that no claim has been paid. Before the trip, you may:

- upon any Travel Alert, cancel your Single Trip policy and receive a full premium and levy[@insurance-travelsurance-levyrefund] refund;

- upon Red Travel Alert (except for the reason of a pandemic), be reimbursed up to 50% of the irrecoverable deposits or charges paid in advance upon cancellation of trip up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

- upon Black Travel Alert (except for the reason of a pandemic), be reimbursed up to 100% of the irrecoverable deposits or charges paid in advance upon cancellation of trip up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

During the trip, you may:

- upon any Travel Alert, have your insurance automatically extended for 10 days free if your trip is unavoidably delayed;

- upon Red Travel Alert, be reimbursed up to 50% of the unused irrecoverable prepaid costs or additional travel-related costs upon curtailment of trip for up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

- upon Black Travel Alert, be reimbursed up to 100% of the unused irrecoverable prepaid or additional travel-related costs upon curtailment of trip for up to HKD50,000 for Standard Plan and HKD25,000 for Basic Plan.

- upon Black Travel Alert, obtain an additional HKD1,000 allowance to subsidise any unexpected cost due to curtailment of trip or unavoidable delay of the scheduled trip.

Can I claim for medical expenses incurred during my trip for any sickness or disease?

The policy covers medical expenses incurred provided that such sickness or disease is not in existence prior to the trip, and not caused by:

- an event of same nature mentioned in the black or red travel alert (except for the reason of COVID-19), unless the journey has been started before the issuance of such travel alerts.

- claims relating to the vaccine-preventable diseases if prior to the trip: (i) the insured person fails to obtain the related vaccine; and (ii) the vaccine is mandatorily required by the government(s) of Hong Kong SAR and/or the destination where the insured person has planned to travel.

For Greater Bay Area Plan, this benefit is only applicable for medical treatment requiring hospitalisation.

What is the virtual medical consultation service about and how can I use this?

If you have taken out the MultiTrip Worldwide Plan, you are entitled to 6 free virtual medical consultations per period of insurance by using MyDoc Health Passport. The consultations are usually available during local doctors’ office hours. Following a virtual medical consultation, you may choose to obtain the prescribed medication and have it delivered to your doorstep as needed during specific hours; however, this will incur charges which you will need to pay first and may then claim in accordance with your policy if eligible.

The virtual medical consultation is currently available in Tokyo, Osaka, Hokkaido and Fukuoka for Japan, and countrywide for Singapore, Thailand and Vietnam.

You will receive a confirmation email with a step-by-step guide on how to use the virtual medical consultation service.

Please note the above details are subject to change without prior notice.

Is an epidemic/ pandemic considered as a natural disaster?

Natural Disaster does not include epidemic or pandemic.

You may also be interested in

Home Contents Insurance

Our home contents insurance (ResidenceSurance) can meet your needs, leaving you free to enjoy your life without worrying about your most treasured possessions.

Personal Accident Insurance

A comprehensive insurance that protects you and your dependents against the financial strain that a personal accident can bring.

Medical and critical illness insurance

Safeguard yourself against unexpected medical expenses and critical illnesses.

Disclaimer

General Insurance products are applicable to HSBC Account holders and HSBC credit card holders only.

The above information is intended as a general summary. Please refer to the policy wording for exact terms and conditions and details of the exclusions.

The above policy is underwritten by AXA General Insurance Hong Kong Limited ("AXA"), which is authorised and regulated by the Insurance Authority of the Hong Kong SAR. AXA will be responsible for providing your insurance coverage and handling claims under your policy. The Hongkong and Shanghai Banking Corporation Limited is registered in accordance with the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) as an insurance agent of AXA for distribution of general insurance products in the Hong Kong SAR. General insurance plans are products of AXA but not HSBC.

For monetary disputes arising between HSBC and you out of the selling process or processing of the related transaction by HSBC, HSBC will enter into a Financial Dispute Resolution Scheme process with you. On the other hand, for any disputes over the terms and conditions of your policy, AXA will resolve with you directly.

Anti-fraud measures

A new safety measure is coming to the Android version of the HSBC Malaysia Mobile Banking app. To protect yourself, don't visit unknown links or download apps from unknown sources. Don't share your credentials, account details or authentication codes with unknown websites or apps either. Learn more

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

Travel Care

Go on a totally fuss-free, carefree holiday with travel care.

Not all who wander are lost, but your luggage certainly could go missing. That's just one of the unexpected events that could put a dampener on your travel plans - there might also be flight delays, accidents or lost passports to contend with.

Travel Care provides a comprehensive suite of coverage and Allianz's Authorised Representative's emergency hotline (+603-76283919 or +603-79653919) is available 24 hours a day to support you through any emergency you might face, so you and your loved ones can have a stress-free trip filled with beautiful memories.

Stand to receive a Touch 'n Go eWallet Reload PIN worth up to RM50

Be one of the first 200 customers to purchase travel care with the promo code 'hsbc23' and get a touch ‘n go ewallet reload pin worth up to rm50. promotion period 27 november 2023 - 31 july 2024., ¹allianz travel care ("this plan") is underwritten by allianz general insurance company (malaysia) berhad (company no. 200601015674 (735426-v)) ("allianz general") and hsbc bank malaysia berhad ("hsbc malaysia") is the intermediary in distributing this plan. travel care customer campaign promotion terms & conditions apply..

- Overseas and domestic travel coverage This includes coverage for luggage and travel delays, and for overseas travel, the coverage also includes loss or damage to your travel documents, personal luggage and valuables, and more

- Accidental death and permanent disability coverage

- Emergency medical evacuation and repatriation programme

- Reimbursement of medical expenses We'll reimburse the necessary and reasonable medical, surgical or hospital charges, and emergency dental treatment fees incurred as a result of accidental bodily injuries, illness or death during your trip

- Option to purchase rider plans to extend your coverage when you participate in certain sports or events during your travels

What your coverage includes

What you need to know, are you eligible.

You're eligible for a Travel Care plan if you belong to one of the following categories:

- Malaysian citizen or permanent resident

- valid work permit or student pass holder

- legally employed in Malaysia

You'll also be able to get coverage for your spouse and child if they legally reside in Malaysia.

Good to know

Emergency contact information .

If there's an emergency when you're travelling, you can call the Allianz 24-hour emergency hotline on +60 3 7628 3919. Toll fees may apply.

Cover for COVID-19

Travel Care covers medical expenses for COVID-19 treatment, subject to policy terms and conditions. Your diagnosis must be certified by a medical practitioner, and you'll also need to provide a supporting lab report or medical report that states your diagnosis.

Cover for high-altitude mountaineering

You can get cover for high altitude mountaineering by contacting Allianz via email on [email protected] , or by calling 1300 22 5542.

What options for Travel Care plans are available?

The following plans are available:

- Adult Plan/Adult Annual Plan: if you're aged 18-70 years old

- Child Plan/Child Annual Plan: if you're aged 30 days-17 years old

- Senior Citizen Plan: if you're aged 71-80 years old

- Family Plan: if the policyholder is aged 18-70 years old, the policyholder's 1 selected legal spouse is aged 18-70 years old and the policyholder's child/children is/are aged 30 days-24 years old

- Under family plan, the payment per individual will be based on the limit under an adult plan and/or child plan, as the case may be subject to the maximum limit as stated in the Schedule of Benefits in the brochure and policy document.

- Maximum period of coverage per journey/trip is 200 days for one way or return trip.

- Maximum period of coverage per journey/trip is 90 days for annual policy.

- Maximum period of coverage per journey/trip for High Altitude Mountaineering activities is 30 days.

- Each trip must begin and end in Malaysia except for one way trip.

- Maximum period of coverage per journey/trip is 30 days for one way/return trip or annual policy.

- Premium is subject to Service Tax.

- Customer may opt for Automatic Renewal (for annual policy only). This policy is deemed to be automatically renewed and the applicable premium will be charged upon expiry unless otherwise instructed.

For other key terms and conditions, please refer to the Product Disclosure Sheet in the link below.

Ready to apply for Travel Care?

Get a quote via mobile banking or online banking.

If you have an HSBC debit or credit card, you can apply via our mobile banking app or through online banking. Go to the homepage, select 'Products and services', and choose 'Travel Care'. We'll help you apply by filling in information from your records.

Get a quote without logging on

If you have an HSBC debit or credit card, you can also get a quote without logging on to mobile banking.

Scan the QR code to get the app

Download the HSBC Malaysia Mobile Banking app on your iOS or Android device.

- Learn more about mobile banking

Need help? Check out our step by step mobile guide .

Your insurance details in your hand

You can access your insurance policy details instantly via mobile banking. Simply go to 'Your insurance overview' in the HSBC Malaysia Mobile Banking app.

Important Information

- For after-sales service, you can contact Allianz by [email protected] or on 1300 22 5542 .

- You may find out more about our coverage by visiting your nearest Allianz branch.

The information provided on this page is not a contract of insurance. The descriptions of cover are a brief summary for quick and easy reference. The precise terms and conditions that apply are in the policy document. Allianz Travel Care ("this Plan") is underwritten by Allianz General Insurance Company (Malaysia) Berhad (Company No. 200601015674 (735426-V)) ("Allianz General") and HSBC Bank Malaysia Berhad ("HSBC Malaysia") is the intermediary in distributing this Plan. This Plan is exclusively for HSBC Malaysia Credit and Debit Cardholders only. Please read and understand the Product Disclosure Sheet (PDS), Brochure and Policy Wording before signing up.

The benefits payable from this insurance product are protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to certain limits. Please refer to PIDM's TIPS Brochure, the PIDM website , or contact Allianz General Insurance Company (Malaysia) Berhad to get more information about the Takaful and Insurance Benefits Protection System(TIPS).

- Product Disclosure Sheet (PDF) Product Disclosure Sheet (PDF) Download

- Brochure (PDF) Brochure (PDF) Download

- Policy Wording (Domestic) (PDF) Policy Wording (Domestic) (PDF) Download

- Policy Wording (Overseas) (PDF) Policy Wording (Overseas) (PDF) Download

- Allianz General Insurance Company - Privacy Notice (PDF) Allianz General Insurance Company - Privacy Notice (PDF) Download

Related products

HSBC UniversalLegacy plan

Leave a lasting legacy for the ones who matter.

HSBC UniversalIncome plan

Continue to pursue your passions even in your golden years.

HSBC HealthPlus plan

Make your health a priority by preparing for the unexpected.

Connect with us

- Share full article

Advertisement

Supported by

What’s in Store for the 2024 Hurricane Season?

Hurricane Beryl set records as the earliest Category 5 storm ever. What does that mean for the rest of hurricane season? Here’s what travelers need to know.

By Christopher Kuo

When Hurricane Beryl intensified into a Category 5 storm last week, it broke records and left a trail of damage across the Caribbean . The first named hurricane of the season, Beryl is the earliest Category 5 Atlantic hurricane ever recorded, and also the first Category 4 hurricane to form in the Atlantic in the month of June — a portent of what experts say is a hurricane season that will be much more intense than usual. It was also abnormal because of where it formed, farther south and east than is typical for storms of this magnitude.

After tearing through the Caribbean and the Yucatán Peninsula, the storm landed in southeast Texas, canceling more than a thousand flights and cutting power for more than two million residents. The storm killed at least 15 people.

Hurricane season usually runs from June 1 to Nov. 30, with most storms developing between mid-August and mid-October. A broad swath of the Caribbean, the Gulf of Mexico and the Atlantic seaboard of the United States is affected by the storms. If you’re planning to travel during this hurricane season, here’s what you should know.

How bad will hurricane season be this year?

The National Oceanic and Atmospheric Administration has predicted an 85 percent chance of a more active than normal season. An average season has about 14 named storms, but researchers at Colorado State University forecast that this year there will be 25, including six hurricanes that are Category 3 or higher.

More hurricanes are likely to occur because of the above-average water temperatures in the Caribbean and the tropical Atlantic. These warmer waters provide fuel for hurricanes and tend to be associated with lower pressure and a more unstable atmosphere, creating an environment conducive to storms, Phil Klotzbach, a senior research scientist in the department of atmospheric science at Colorado State , wrote in an email.

It seems as if the season is off to an early start. Why?

Warmer ocean temperatures are causing the hurricane season to start earlier than usual. Normally, storms would develop later in the season once the ocean has warmed , but this year parts of the Atlantic are already at 84 degrees, 2 to 3.6 degrees Fahrenheit above normal, according to Dr. Klotzbach. These kinds of temperatures are normally associated with the peak of hurricane season in September.

It’s particularly unusual for such an intense storm like Beryl to form this early in the season: The storm reached Category 4 a week earlier than any storm had since 2005. “Usually the June and July storms are relatively benign,” said Kerry Emanuel, professor emeritus of atmospheric science at the Massachusetts Institute of Technology. “They don’t get up to full strength, so it’s very rare to have this.”

What’s significant about the location of Beryl?

Beryl set another record, for the farthest east a hurricane has formed in the month of June, breaking a record set in 1933, Jennifer Collins, a professor in the School of Geosciences at the University of South Florida , wrote in an email. It also formed farther south than usual, affecting nations such as Grenada and St. Vincent and the Grenadines that tend to be outside the maximum activity range of hurricanes, according to Dr. Emanuel.

When a storm forms in the tropics and farther east than typical — especially if it’s a severe hurricane like Beryl — it tends to be a harbinger of a very busy season, Dr. Klotzbach said. “It’s one thing to get weak systems in the deep tropics like we did in 2013, while it’s a whole different ballgame when we’re getting Category 5 hurricanes,” he added. “Unfortunately, Beryl is breaking records that were set in 1933 and 2005 — two of the busiest Atlantic hurricane seasons on record.”

Historically, the so-called ABC islands (Aruba, Bonaire and Curaçao), plus Trinidad and Tobago, have been out of the hurricane zone. Has that changed?

It’s been years since a major hurricane has affected those islands.

Experts say that is unlikely to change. “We haven’t really observed any notable changes in terms of storms tracking over that region,” Dr. Klotzbach wrote.

Should I change my summer travel plans?

Many people choose to travel to hurricane-prone areas during the season, said Jackie Friedman, the president of Nexion Travel Group , a network of travel advisers, and most don’t face disruption from storms. “I don’t know of any advisers that would say, ‘I would not go to the Caribbean at all this summer,’” she said.

Dr. Klotzbach agreed that it’s not particularly risky to travel to the Caribbean. “The odds of any one spot getting hit by a hurricane during any short time span is going to be very small,” he said.

Ms. Friedman recommends purchasing travel insurance and considering taking a cruise instead of traveling to a single destination. “The benefit is the flexibility to avoid being in the eye of the storm,” she said. “They can modify their itineraries for a relatively pleasant vacation.”

Does travel insurance cover hurricanes?

Yes, but it’s important to purchase coverage early. Once a storm is named, newly purchased plans won’t cover claims tied to it. Travel insurance is meant to protect against unpredictable situations; once a storm is named, it’s considered a “foreseeable event.” So it’s best to purchase a plan before a storm develops.

Follow New York Times Travel on Instagram and sign up for our weekly Travel Dispatch newsletter to get expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places to Go in 2024 .

Christopher Kuo covers arts and culture as a member of the 2023-24 Times Fellowship class. More about Christopher Kuo

Explore Our Weather Coverage

Extreme Weather Maps: Track the possibility of extreme weather in the places that are important to you .

Heat Safety: Extreme heat is becoming increasingly common across the globe. We asked experts for guidance on how to stay cool .

Hurricane Preparation: When a storm is approaching, you may not have much time before you must head for safer ground. Here are some tips for getting ready .

Tornado Alerts: A tornado warning demands instant action. Here’s what to do if one comes your way .

Flash Flooding: Fast rising water can be deadly. Here’s what to do if you’re caught off guard , and how to prepare for a future flooding event.

Evacuating Pets: When disaster strikes, household pets’ lives are among the most vulnerable. You can avoid the worst by planning ahead .

- Find a Branch

- Call 1-800-769-2511

- Personal Banking Overview

Frequently Asked Questions

- Post Migration Checklist

- Client Card Activation

- Credit Card Activation

- Power of Attorney

- Mortgage Prepayment Charges

- Legal Disclosures Library

- Former Legal Disclosure Library

- About Your CDIC Coverage

- Product Migration Guide

- Private Banking & Wealth Overview

- Small Business Overview

- Migration Checklist

- Commercial & Corporate Overview

- Personal Banking

- Private Banking

- Small Business

- Commercial and Corporate

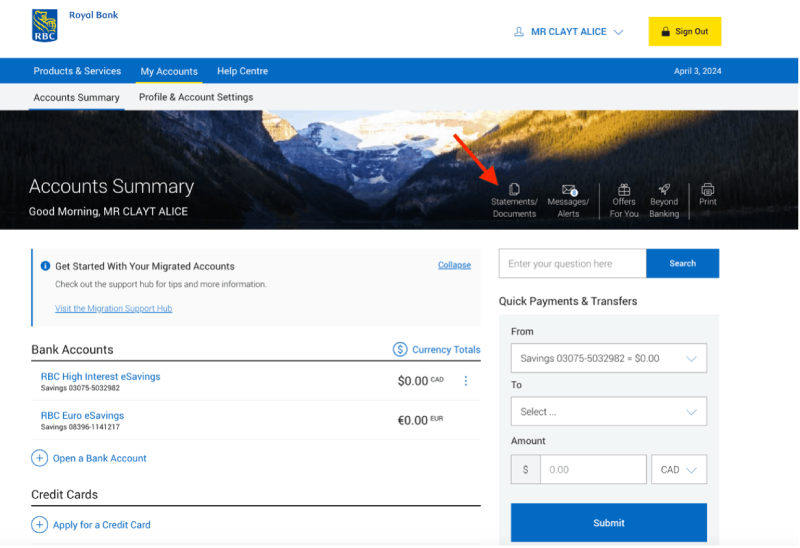

FAQs for Personal Banking Clients

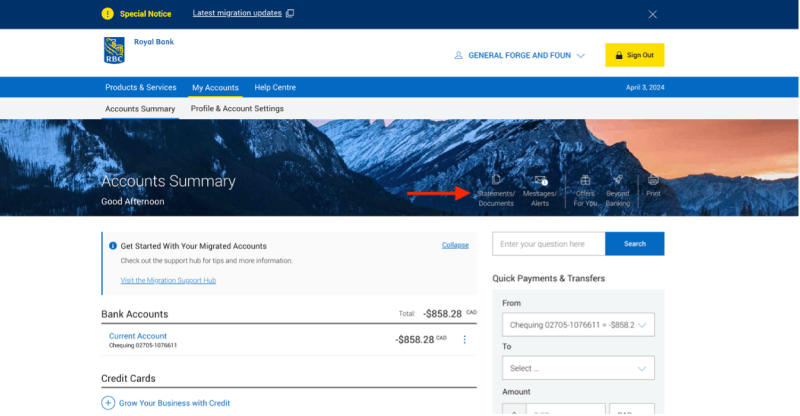

This page will continue to be updated with additional information regarding the migration of your products and services to RBC.

- Branches / ATMs

- Client Card

- Credit Cards

- Digital Banking

- Direct Investing

- GIC & Savings

- Global View & International Money Transfers (IMT)

- Group Advantage

- Mutual Funds

- Personal Financing Products

- 1) Through your existing HSBC Bank Canada Online credentials. If you are already enrolled in HSBC Bank Canada Online Banking, you will have access to enroll in RBC Online Banking via https://www.rbc.com/hsbc-canada/enrol

- 2) If you are not currently enrolled in HSBC Bank Canada Online Banking and would like to access your accounts through digital channels at RBC, you can enrol once you receive your RBC Client Card, or your RBC client number.

- China (Mainland, not Hong Kong)

- Philippines

- Accept the HSBC updated Terms and Conditions on HSBC Online Banking.

- Accept the RBC Terms and Conditions in the ‘External Accounts’ section on RBC Online Banking and RBC Mobile Banking.

- Transfer Money to your HSBC Global View Linked Accounts: Using RBC International Money Transfer (IMT), you will be able to transfer money from your eligible RBC CAD or USD chequing account to the globally linked HSBC Accounts (exception: CAD to CAD transfers are not available)

- Send Money to others Globally: Using RBC International Money Transfer, you can also choose to send money to anyone else globally. You will be able to transfer money from your eligible RBC CAD chequing account to third parties.

- You will NOT be able to view your non-Canadian HSBC accounts in RBC Online Banking or Mobile Banking and

- You will NOT be able to view your RBC Canada account information from other HSBC locations where you have Global View.

- Send money internationally to your own Global View Linked HSBC accounts around the world and/or

- Send money internationally to anyone around the world, where permitted, whether the recipient is a client of HSBC or a client of another financial institution.

RBC International Money Transfer (IMT) can be used to send money internationally. You can:

- Send money internationally to anyone around the world, where permitted, whether the recipient is a client of HSBC or a client of another financial institution

Currently, using IMT to send money to any person across the world can only be initiated from a RBC CAD account.

- Beneficiary Transit number (Routing #)

- Beneficiary Account number (International Bank Account Numbers are called IBANs)

- Beneficiary Name

- Amount of money being sent

- Beneficiary Address (where the statement is mailed to)

- Your RBC account number (this a 12-digit account number made up of the 5-digit branch transit code and your 7-digit account number).

- RBC Royal Bank institution number: 003

- RBC Royal Bank Routing/ABA number (if funds coming from U.S.): 021000021

- RBC Royal Bank SWIFT BIC (if funds coming from international location): ROYCCAT2

- Your RBC Royal Bank branch phone number, address and transit number

- Transfer funds to and from your foreign currency account to another one of your RBC CAD or U.S. dollar Personal Deposit Accounts through RBC Online Banking and the RBC Mobile App.

- Transfer funds to and from RBC Direct Investing Foreign Currently Accounts within the same currency

- Receive and send branch wires from your Foreign Currency Account.

- Visit a branch for any cash withdrawals and deposit needs. Please note that a limited supply of currency will be available in RBC branches and an order may have to be placed for you. It will take up to 5 business days for your foreign currency to arrive.

- Deposit or withdraw at the ATM (including cheques).

- Request the issuance of drafts or personalized cheques

- Execute the following transactions: Debit Point of Sale, Cross-Border debits, bill payments, e-Transfer, Third-Party Payment, and International Money Transfers

- Request RBC Virtual Visa Debit to make online purchases

- Transfer money between two FCA accounts that differ in currency.

- HSBC’s LOCs are attached to a chequing account that operates in a similar way to overdraft protection.

- RBC will maintain connection between an LOC and the designated chequing account for you to make credit draws.

- Your RBC LOC will appear separately from the designated chequing account on statements and online banking and will have a different account number. The line of credit will appear as a Royal Credit Line, but you will not have that product as the terms and conditions of the HSBC Bank Canada Line of Credit agreement will continue to apply, subject to the information in the RBC Product Migration Guide.

- Your monthly payments will only be taken from the designated chequing account linked to line of credit. If you wish to make principal payments, you can make a deposit directly into your designated chequing account.

- Your RBC LOC and designated chequing account may operate differently from the one you had at HSBC and it will be important to understand those differences upon migration as outlined in the "Loans, Line of Credit" section of the RBC Product Migration Guide.

- RBC Mortgage;

- RBC Royal Credit Line;

- RBC Homeline Plan (HLP)

- You will not have the ability to adjust your product mix and reallocate funds without having to re-qualify.

- As you pay down your mortgage(s), the limit of any Line of Credit you have under your EPM does not automatically increase.

- You may see references to an RBC Homeline Plan and a Royal Credit Line on your monthly statements and online banking (OLB). This is for migration purposes, ensuring you can continue using your products after migration as you do now. You have not signed an RBC Homeline Plan Agreement or a Royal Credit Line Agreement. The terms of your HSBC Bank Canada mortgage and/or line of credit agreement will apply, subject to the information in the RBC Product Migration Guide.

- Do not have the ability to adjust your product mix and reallocate funds without having to re-qualify with RBC.

- The credit limit of the Line of Credit does not automatically increase as you pay down your mortgage(s).

- Will receive monthly statements for an RBC Homeline Plan that disclose an RBC Homeline Credit Limit, and a Royal Credit Line and your RBC OLB will also show an RBC Homeline Plan including Royal Credit Line. You do not have either of those products and should disregard the RBC Homeline Plan Credit Limit disclosed.

- Your interest rate on the outstanding balance of your RBC personal overdraft account will increase from 18.5% or 21% per year to 22% per year.

- At HSBC Bank Canada you pay a $5 fee when you go into overdraft on a given month. At RBC we charge a monthly overdraft fee of $5 unless you have a personal banking package that waives this fee. If this fee applies to you, RBC will waive it for a minimum of your first 12 months after your account migrates to RBC.

- You may have been making monthly payments of interest only, or an amount that includes both principal and interest at HSBC Bank Canada. When your personal overdraft accounts migrates to RBC your monthly payments will be interest only and you should be aware that monthly payments will come out of the chequing account attached to the overdraft.

- For more information relating to personal overdraft, refer to the RBC Product Migration Guide, Section 3.

- Making additional payments

- Paying Principal only

- Missing a matched payment

- RBC Online banking will continue to display ‘Making additional payment’ and ‘Paying principal only’ options. Clients will be permitted to pay principal and additional payments through online banking to a maximum of 10% of initial mortgage amount and monthly payment, respectively. If your HSBC Bank Canada mortgage allows you to pay a greater amount, please contact an RBC Advisor.

- RBC Online banking displays an option for RBC Skip- a- Payment. As HSBC Bank Canada terms for missing a payment are different than terms of RBC skip-a-payment, if you wish to exercise the HSBC Bank Canada option to miss a payment, you should contact an RBC Advisor. You should not use the self-serve functionality on RBC Online banking.

- For Mortgage Life insurance only – a partial return of premium is going to be sent to you as an offset to this increase for the first year. Your premium is based on a combination of several factors including: i. If you have a mortgage, the life insurance premium will be based on the premium rate for your age,and mortgage balance, as of the migration date ii. If you have an LOC, the life insurance premium will be based on the premium rate for your age on the date your payment is due and your average daily debit balance during the statement period.

- Please refer to the RBC Product Migration Guide – Section 3 for detailed information on the calculation of insurance premiums

Creditor Insurance

Optional Travel Insurance

- Joint RESP (joint subscribers)

- Accounts Market Linked GIC(s)

- Registered accounts holding US Dollar Mutual Fund(s)

- Registered accounts with US Dollar cash balance(s)

- Your total account holdings are > $50,000 at any time between January 1 st and June 30 th , or;

- You have initiated activity on the account between January 1 st and June 30 th .

Important Information

- As of April 1 st , if you do not have a physical credit card on hand, you can set up Apple Pay through the Apple (iOS) version of the RBC Mobile App. Go to the credit card product page and select Manage card (top right) and under services select “Add to Apple Pay”. The credit card does not need to be activated to use the card through Apple Pay.

- You will be able to complete in-store purchases, where merchants accept Apple Pay, for transactions $250 and under. You will also make online/ecommerce purchases, if the merchant accepts Apple Pay, with no transaction limit.

Using Your RBC Credit Card

- After March 18 th , 2024, please call RBC at 1-800-769-2511 to request a new card to be mailed to you. Please note, you will need to be at the temporary address until April 15 th to receive the card.

- Consider Apple Pay as a temporary option, noting this is not accepted at all merchants, see below for details. Please note, the following example is only for Apple Pay when initiating enrollment from the RBC Mobile App. Enrollment into Samsung Pay or Google Pay will require your physical card on hand.

- As of April 1 st , despite not having your credit card on hand, please go into the Apple (iOS) version of the RBC Mobile App. Go to the credit card product page and select Manage card (top right) and under services select “Add to Apple Pay”. The credit card does not need to be activated to use the card through Apple Pay.

- You will be able to make in-store purchases with Apple Pay where merchants accept Apple Pay for transactions $250 and under. You will be able to make ecommerce purchases with your card through Apple Pay if the merchant accepts Apple Pay, with no transaction limit.

Managing Your RBC Credit Card

- To pay your credit card using funds from an RBC bank account, simply transfer the funds from your RBC bank account to your RBC credit card account. Visit rbc.com/hsbc-canada for detailed instructions and tutorials on how to enrol in RBC Online Banking.

- To pay your credit card using funds from a bank account at another financial institution, you must register the RBC credit card account as a “Bill Payment” to make a payment.

If you are the primary card holder, you can add authorized user(s) to your credit card(s) through Online Banking (OLB).

While logged into OLB Open the Account Details page of the credit card the authorized user is being added to. Unfortunately, co-applicants cannot be added to any migrated credit cards.

- Market-leading travel offerings