- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Fintech Cards

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

- American Express

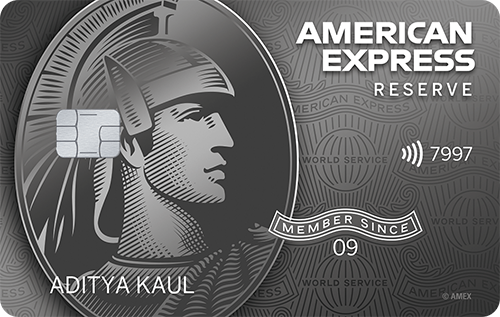

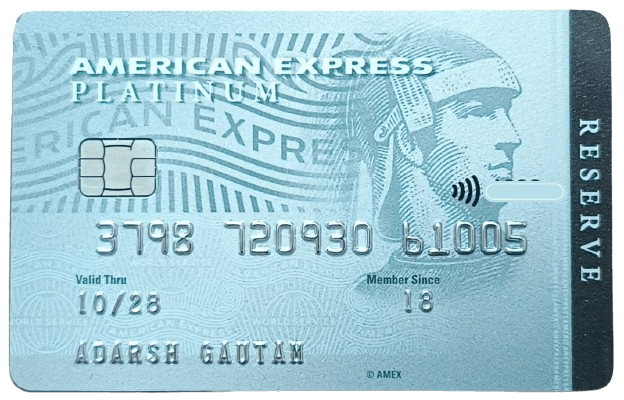

American Express Platinum Reserve Credit Card

The Platinum Reserve credit card is the second most premium credit card that American Express offers, only next to the Platinum card, which is a Charge Card (Charge cards have a variable credit limit). Looking at the benefits that it offers, from Taj Epicure membership to the Hotel Collection program, one might consider it a travel credit card. However, it offers many other benefits, including exclusive dining benefits, complimentary golf, and movie vouchers.

Apart from all these benefits, AmEx cards are known for their brand value. Many prefer AmEx cards over Visa and MasterCard just for that reason. Here, we’ve covered in detail all the features and benefits this card offers. Read on to find out whether it fits your needs.

Joining Fee

Renewal fee, best suited for.

Travel | Dining | Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & dining.

BookMyShow Vouchers Worth Rs. 1,000 on Achieving Monthly Spends and Complimentary Membership of EazyDiner Prime

Rewards Rate

1 Membership Reward Point for every Rs. 50 spent with the card except for spends on fuel, utilities, insurance, cash transactions, and EMI conversion at Point of Sale.

Reward Redemption

Membership Rewards Points redeemable for online shopping vouchers, INSTA rewards for offline purchases, transfer to various flight and hotels loyalty programs and for making credit card bill payments under the Cash + Points scheme.

Complimentary Priority Pass, Accor Traveller, Taj Epicure Membership

Domestic Lounge Access

12 complimentary domestic lounge visits (limited to 3 per quarter)

International Lounge Access

Two Free Visits Via Priority Pass

2 complimentary rounds of golf per month at 32 premium golf destinations in India with a 100% waiver on the green fee.

Insurance Benefits

Air accident cover worth Rs. 1 crore, purchase protection against loss, damage, or burglary of any item purchased using the card

Spend-Based Waiver

Annual Fee Waiver on Spends of Rs. 10 Lakh in a Year

Rewards Redemption Fee

Foreign currency markup.

3.5% of the transaction amount

Interest Rates

3.5% per month

Fuel Surcharge

Waived at HPCL fuel stations for transactions up to Rs. 5,000, 1% surcharge on BPCL and IOCL stations and 2.5% surcharge at all other fuel stations.

Cash Advance Charges

3.5% of the advanced amount, subject to a minimum amount of Rs. 250.

- 11,000 bonus Membership Rewards Points as a welcome gift.

- 1 Membership Rewards Point for every Rs. 50 spent with the card (except fuel, insurance, utility, EMI conversions).

- Monthly Flipkart/BookMyShow or other brands vouchers as milestone benefits.

- Complimentary (limited) visits to domestic airport lounges and a complimentary Priority Pass membership.

- Complimentary membership of Taj Epicure.

- 2 complimentary rounds of golf every month at 32 premium golf courses across India.

- Dining offers with complimentary membership of EazyDiner Prime.

- 24×7 American Express concierge service.

- Air accident insurance cover worth Rs. 1 crore.

- For frequent flyers, this card offers 12 domestic lounge visits and a Priority Pass membership.

- You would get 11,000 Membership Reward Points on the realization of card joining fees.

- Although the joining fee is Rs. 5,000, the annual fee chargeable from the second year is Rs. 10,000.

American Express Platinum Reserve Credit Card Rewards

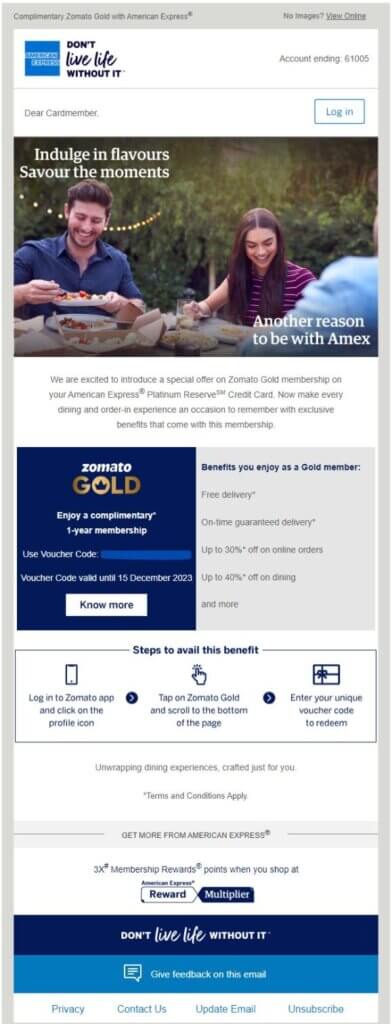

You earn 1 Membership Rewards Point for every Rs. 50 spent with this card with the exception of spends on fuel, insurance, utilities, cash transactions and EMI conversion at Point of Sale. 3X Reward Points while shopping through the AmEx Rewards Multiplier .

Reward Redemption:

- The Membership Rewards Points earned on the American Express Platinum Reserve Credit card can be redeemed for purchasing e-vouchers from American Express’s online shopping portal, INSTA purchases at offline stores, and also to make credit card bill payments under the card issuer’s Cash + Points scheme.

- Membership Reward Points can also be transferred to airlines and hotel loyalty programs like Asia Miles, British Airways Executive Club, Club Vistara, Emirates, Skywards, Etihad Guest, Finnair Plus, InterMiles, Qatar Privilege Club, Singapore KrisFlyer, Virgin Points, Marriott Bonovoy and Hilton Honors.

- The monetary value of the Membership Reward Points varies for different modes of redemption.

Welcome Benefit

You get 11,000 bonus Membership Rewards Points as a welcome benefit on the expenditure of Rs. 30,000 within 90 days of the card issuance, subject to the realization of the joining fee.

Milestone Benefits

- You can choose between Flipkart, BookMyShow, or other brand vouchers worth Rs. 1,000 on the expenditure of Rs. 50,000 in a calendar month.

- Taj stays voucher worth Rs. 10,000 on the expenditure of a minimum of Rs. 5 lakhs in a membership year (subject to realization of the annual membership fee).

Travel Benefits

- 12 complimentary domestic airport lounge visits (limited to 3 per quarter) to partner airport lounges across India.

- Complimentary Priority Pass Membership for international lounge access at 1200+ VIP lounges across 120+ countries around the world. Two visits to the international lounge are complimentary via Priority Pass, while additional visits are chargeable.

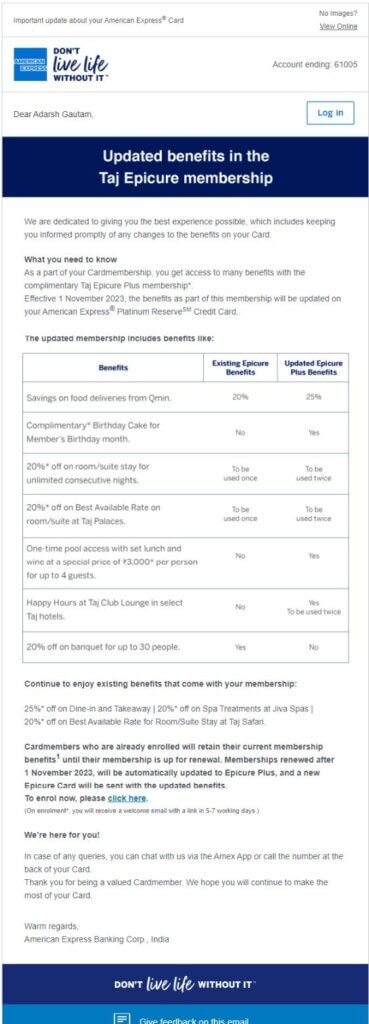

- Complimentary Taj Epicure Membership that gives you special privileges, including a 10% discount on stays, late check-outs, and unlimited validity of Taj InnerCircle Points.

- Complimentary Accor Plus Traveller Membership which offers up to 50% off on dining at over 1,400 participating Accor hotel restaurants, early access to Accor hotel sales, access to exclusive member events, and more.

- USD 100 hotel credit and a complimentary room upgrade at luxurious hotel chains, including Hyatt & Hilton Hotels, under the Hotel Collection program.

Movie Benefits

You can choose between a movie or shopping voucher worth Rs. 1,000 on a minimum monthly expenditure of Rs. 50,000. The following shopping brands are included for redemption Flipkart, Shoppers Stop, Myntra, Big Basket, PVR, and MakeMyTrip.

Dining Experiences

- Complimentary Taj Epicure Program with exclusive benefits on dine-outs at bars, restaurants, and spas across Taj, SeleQtions, and Vivanta Hotels, including 50% discount on first three dining transactions, 2 room upgrade vouchers, and happy hours from 6 PM to 8 PM at participating bars.

- Complimentary membership of EazyDiner Prime , which entitles you to benefits like a minimum of 25% off on Prime restaurants, and complimentary drinks with every booking.

Golf Privileges

- Two complimentary rounds of golf every month at 30+ of the top golf destinations in India with a 100% waiver on the green fee. This benefit is unlocked on making spends of Rs. 50,000 and above in the prior two months.

- Primary and add-on card members can also get golf lessons at a discounted price.

Concierge Service

You get a global 24×7 Platinum concierge service with this credit card. You’ll get assistance regarding-

- Delivery of flowers and gifts

- Booking movie tickets,

- Arranging a round of golf,

- Booking a spa session with participating partners,

- Dining reservations

- You can avail of the American Express concierge service by dialing 1800-180-1030 or 1800-419-1030.

- Personal air accident cover worth Rs. 1 crore (applicable only in case of loss of life).

- Purchase protection in case an item (purchased via the credit card) is stolen due to burglary or damages or breaks due to fire, earthquake, flood, storm, cyclone, etc., within 60 days of purchase. In such a case, the amount paid may be refunded.

- Both these insurance benefits are provided in partnership with ICICI Lombard General Insurance Company Limited.

- No fuel surcharge is applicable at HPCL fuel stations for transactions of up to Rs. 5,000 (1% surcharge applicable thereafter).

- 1% fuel surcharge applicable at BPCL and IOCL filling stations (subject to a minimum surcharge of Rs. 10).

- 2.5% fuel surcharge at all other filling stations (subject to a minimum surcharge of Rs. 10).

Zero Liability Protection

The cardholder is not liable for any fraudulent transaction made with the card if the loss of the card is reported within three days. Otherwise, the liability of the cardholder is limited to a maximum of Rs. 1,000.

American Express Platinum Reserve Credit Card Eligibility

Eligibility for this credit card as per the table below-

American Express Customer Care

American Express has a dedicated helpline for their Platinum Reserve credit card customers. You may dial 1800 180 1030 (toll-free), 1800 419 1030 (toll-free), or 0124-280 1030 to report the loss of your card or in case you need assistance. These numbers are operational 24×7.

American Express Platinum Reserve Credit Card Review

Look at the travel-related benefits that this card offers. You might find a resemblance between the Platinum Travel card and this one, with the former offering similar benefits at half the annual membership fee. The reward rate for both cards is also similar. So, if travel benefits are all you need from your credit card, you might consider the Platinum Travel card instead.

If you’re looking for a premium credit card packed with all kinds of benefits, including some exclusive travel privileges , this card is worth looking at. If we leave behind the extra travel benefits that this card offers, it is in direct competition with HDFC’s Infinia and ICICI’s Emerald credit cards. If you’re one of those people for whom the AmEx logo increases the worth of their wallet, you can pick this one without a second thought. It’s not a bad deal, at least as far as premium cards are concerned specifically with the additional dining benefits and complimentary memberships. Let us know in the comments what you think of American Express’s premium offering and what benefits you seek in a high-end credit card.

Dont purchase. It’s a complete waste of money. There are many better cards than this.

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Discover incredible deals and find the perfect credit card for yourself by comparing the most rewarding options on our platform.

Quick Links

- Privacy Policy

- Terms & Conditions

How Can You Reach Us?

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Add cards to start comparing

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Delta Reserve vs. AmEx Platinum: Platinum is Tops for Most Air Travelers

Anisha is a former personal finance writer for NerdWallet. She has worked for Silicon Valley startups as well as in the public sector and has contributed to publications including Technorati and Women Grow Business. She studied applied mathematics and economics at Brown University.

Erin is a credit card and travel rewards expert at NerdWallet, based in Baltimore, Maryland. She has spent nearly two decades showing readers unique ways to maximize their investments and personal finances. Prior to joining NerdWallet, Erin worked on dozens of newsletters and magazines in the areas of investing, health, business and travel with Agora Publishing. Her love of travel led to a passion for credit card and loyalty rewards to subsidize trips, and she thrives on teaching others how to harness the power of credit card rewards. When she's not writing or editing, Erin is planning her next adventure for her family of four using points and miles. Erin recommends this card as the cornerstone for all travelers looking to build up their rewards portfolio - see it here.

Jae Bratton is a writer for the credit cards team at NerdWallet. She has a bachelor’s degree in English from Wake Forest University and a master’s in English from University of North Carolina at Greensboro. Before writing for NerdWallet, Jae spent 13 years teaching English and journalism. Her writing has been published in newspapers, blogs and an academic journal. Jae is based in North Carolina.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Frequent flyers who want to travel in comfort and style — and who aren’t dissuaded by high annual fees — will likely find their needs satisfied by a premium travel card . And two of the best on the market right now are the Delta SkyMiles® Reserve American Express Card and The Platinum Card® from American Express .

Both options come with hefty annual fees, but cardholders can make up the cost by taking advantage of the cards' generous perks. It may be easier to do so with The Platinum Card® from American Express , though, and its $1,500 in annual credits.

Redemption choices are also more varied and valuable with the AmEx Platinum, which allows Membership Points to be transferred to 20 travel loyalty partners. By contrast, miles earned with the Delta Reserve are only good for flights on Delta and its partners.

You’ll also gain access to more airport lounges with AmEx Platinum, a feature that looks even more enticing in light of Delta’s recent restrictions on its Sky Clubs: As of Feb. 1, 2025, Delta Reserve cardholders will receive 15 lounge visits per year rather than unlimited access — unless they can spend $75,000 a year on the card.

» SEE: Delta overhauling SkyMiles program, Sky Club Access in 2024

on American Express' website

$650 . Terms apply

$695 . Terms apply.

Earn 95,000 Bonus Miles after you spend $6,000 in purchases on your new Card in your first 6 months of Card Membership. Terms Apply.

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Terms Apply.

Earn 3 miles per dollar on eligible purchases made directly with Delta.

Earn 1 mile on all other eligible purchases.

Terms apply.

5 Membership Rewards points per dollar spent on flights booked directly with airlines or with American Express Travel.

5 points per dollar on prepaid hotels booked with American Express Travel.

2 points per dollar on other eligible travel expenses booked with American Express Travel.

1 point per dollar on all other purchases.

$240 Resy credit, doled out in $20 monthly credits. Enrollment required.

$120 rideshare credit, doled out in $10 monthly credits. Enrollment required.

$200 annual Delta Stays credit for prepaid hotel and vacation rentals booked through delta.com.

Either a $100 Global Entry credit every 4 years, or an $85 TSA PreCheck credit every 4.5 years.

First checked bag free.

$200 hotel credit.

$240 digital entertainment credit, doled out in $20 monthly credits. Enrollment required.

$155 Walmart+ membership credit.

$200 airline fee credit.

$200 Uber Cash.

$300 Equinox credit, enrollment required..

$189 CLEAR Plus credit.

Up to $100 in statement credits for Saks Fifth Avenue purchases, up to $50 twice per year, enrollment required.

$300 SoulCycle at-home bike credit.

Delta SkyMiles® Reserve American Express Card is a traditional credit card, unlike The Platinum Card® from American Express , which was originally introduced as a charge card. However, they function in the same way since American Express launched its Pay Over Time feature that charges users interest to maintain a balance on the card.

Why The Platinum Card® from American Express is better for most people

Most of the annual credits that come with The Platinum Card® from American Express are meant to accommodate the frequent traveler. For instance, cardholders receive $200 a year for hotel bookings, $200 a year for airline fees like checked-bag fees and a fee credit for TSA PreCheck or Global Entry. Cardholders may or may not get much use out of some of the other perks, such as an annual $300 toward an Equinox gym membership. Overall, though, the menu of credits is broad enough to satisfy many people.

» MORE: Making the most of American Express Platinum’s credits

Redemption options

Purchases made with The Platinum Card® from American Express earn highly versatile Membership Rewards points. These points can be transferred to 17 airline and 3 hotel partners . Better still, they are worth more than the 1:1 transfer rate with a few airlines and hotels.

American Express's website has calculators that allow you to see how much your Membership Rewards points are worth when transferred to each of the loyalty partners.

» MORE: AmEx Membership Rewards: How to earn and use them

Lounge access

If you’re paying the three-figure annual fee for The Platinum Card® from American Express , it’s reasonable to expect a luxurious travel experience. You’ll likely find it in one of the more than 1,400 airport lounges that you’ll have access to when you carry the card. Delta SkyMiles® Reserve American Express Card cardholders do get unlimited access to American Express Centurion Lounges when flying Delta, in addition to Delta SkyClub visits.

Why you might want the Delta SkyMiles® Reserve American Express Card

Companion certificate.

The Delta Reserve will be most rewarding for those who prefer to fly with Delta. Perhaps the biggest draw is the annual companion certificate that’s good for a round-trip flight within the U.S. (including Alaska and Hawaii), Mexico, the Caribbean and Central America. To redeem the companion ticket, you and your guest must travel in the same fare class — so if you choose to travel in first class, you get one first-class ticket free.

Your plus-one can also accompany you into the Delta Sky Clubs. Delta Reserve cardholders get four one-time guest passes every year.

Effective 2/1/25, Reserve Card Members will receive 15 visits per year to the Delta Sky Club. To earn an unlimited number of visits each year, the total eligible purchases on the Card must equal $75,000 or more the previous year. To earn unlimited visits in 2025, you’ll need to spend this amount between 1/1/24 and 12/31/24.

Discount on flights

Delta Reserve cardholders get a benefit dubbed TakeOff 15 , a 15% discount on Delta flights booked with Delta SkyMiles. This discount will be shown and applied automatically at booking. That means a 50,000-mile flight would only cost you 42,500 miles at checkout. You don't need a Delta SkyMiles® Reserve American Express Card in order to get that 15% discount, though: Any Delta co-branded card that charges an annual fee also gives 15% off on award flights.

Elite status

If you care about earning elite status on Delta, the Delta SkyMiles® Reserve American Express Card is the only card of the two that helps you toward that goal. Cardholders earn $2,500 in Medallion Qualifying Dollars (MQD), giving a head start toward status each qualifying year. The spending you do on your card gives a status boost, too: You'll earn 1 MQD for every $10 spent.

» MORE: The complete guide to Delta Air Lines SkyMiles program

Which card should you get?

For Delta lovers, Delta SkyMiles® Reserve American Express Card is the clear choice over The Platinum Card® from American Express . The Delta companion pass is a rare commodity offered with only one other card: the Delta SkyMiles® Platinum American Express Card .

However, travelers who aren’t wedded to Delta and who enjoy the best amenities should opt for The Platinum Card® from American Express . It beats the Delta SkyMiles® Reserve American Express Card in terms of lounge access by, well, a mile. And the annual credits such as a $240 digital entertainment credit toward popular streaming services make The Platinum Card® from American Express even more appealing.

» MORE: How to pick a premium travel card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Manage My Account

Help With My Account

Manage My Card

Help With My Card

Travel Services

Travel Benefits

Help With Travel

Insure Myself

Insure My Possessions

Help With Insurance

Benefits And Offers

Manage Membership

Corporate Payment Solutions

Accept Our Cards

Help With Business

Frequently Asked Questions

Top Actions

Top Questions

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience all the features in the website.

DISTINCTLY YOURS EVERY DAY

With the american express ® platinum reserve sm credit card, enter an enhanced realm of privileges with the american express ® platinum reserve sm credit card., a card made distinctly for you, where every experience is tailored to your lifestyle choices., enjoy benefits worth ₹80,000 * on shopping, dining, travel and more. calculate now.

GETTING STARTED,

TAP INTO POSSIBILITIES

Scan the QR code to download American Express® App.

Scan the QR code to download the Amex Experiences App.

Click here to activate your Card.

Discover the power of your Card, set it up now

Activate your Card and select a PIN via any the following ways:

The American Express ® Mobile App

Download the American Express® App.

- Enter Card Details.

- Create User ID and Password.

- Set a PIN of your choice and Activate your Card.

If you already have the Amex App, log in and go to Account’ tab and select ‘Activate and Add Card to your Account’ option.

American Express ® Online Account

- Register for online services at americanexpress.co.in/activate

- Set a PIN of your choice and activate your Card.

Register and enjoy the ease of managing your account anytime, anywhere.

- View your Account balance and pay your bill online

- Set up SMS and email alerts to help keep up to date

- Register for special offers and updates

- View, change or unlock your PIN. Know more.

- Track your Membership Rewards ® points balance

In case of any query, call the helpline number printed on the back of your Card.

Manage your Card, your way

Your Card statement

Once you register for Online Account Services, you can easily access your Card Statement. To ensure your payment due date is set to one convenient for you, please contact Customer Services to discuss changing the date your statement is sent each month. If your Account is currently overdue for payment, please make the payment before requesting any change.

You can pay your Card bill through any of the following ways:

- Online Funds Transfer: NEFT

- Online Payment : Debit card powered by Rupay; UPI/BHIM-UPI; UPI QR Code/BHIM-UPI QR Code

- Recurring Direct Debit/NACH

Account Alerts

Stay on top of your Account with our wide range of alerts – from balance updates, real-time transaction alerts to payment due date reminders .

You can do this by logging into your account and setting up the alerts of your choice.

You can also set up push notifications through the Amex App.

Card replacement

If your Card is lost, stolen, damaged or not received you can order a replacement Card for yourself or your additional Cardmembers on your Account by calling up Customer Care. Know more

A world of privileges at your fingertips

Download Amex Experiences App

Explore your Card's exclusive benefits and offers effortlessly with the Amex Experiences App.

Book golf sessions with the App

You can also unlock Golf benefits through the App. Here's how:

- Visit 'Golf' and click on "First time registration" to create your profile on Golftripz.

- You will receive your login credentials via email.

- If you have registered already, you can begin to make bookings using the Amex Experiences App.

- You can also view the status of your bookings or cancel a booking via the App.

Back to top

JOURNEYS UNLOCKED,

UNWIND IN STYLE

Every departure with world class lounges.

12 complimentary domestic lounge visits

Enjoy 12 complimentary visits in a year (limited to 3 visits per quarter) to domestic airport lounges across India.

2 complimentary international lounge visits

Avail 2 complimentary visits in a year to international airport lounges using your Priority Pass TM .

Click below to enrol your Basic American Express® Platinum Reserve Credit Card into the Priority Pass program.

1,400+ lounges with complimentary Priority Pass

Enjoy the Priority Pass TM Membership worth US$99 complimentary with your American Express® Platinum Reserve Credit Card and access 1,400+ VIP lounges across 100+ countries.

Click below to enrol your Basic Platinum Reserve Credit Card into the Priority Pass program.

Find participating lounges here .

Experience more with luxurious stays

Complimentary Accor Plus Traveller Membership

Enhance every experience around the world at 1,000+ hotels like Fairmont, Sofitel, Pullman and more across 20 countries in Asia Pacific.

Get Accor Plus Traveller Membership worth ₹10,000 + GST complimentary with your Credit Card.

- Up to 50% off on dining at over 1,400 participating Accor hotel restaurants across Asia Pacific, plus 15% off on drinks in Asia.

- Up to 50% savings with exclusive member offers and hotel packages at more than 1,000 participating Accor hotels in Asia Pacific.

- Members' Rate at minimum 10% off the best available public room rate Elite membership status with a bonus of 20 Status Nights in ALL - Accor Live Limitless, Accor's global lifestyle loyalty programme.

- Early access to Accor hotel sales.

- Access to exclusive member events such as celebrity masterclasses, unique wine and dine experiences and more.

For detailed Terms and Conditions refer here

Please note that Cardmembers already enrolled for Taj Epicure Plus till 30 April 2024 will automatically be enrolled for Accor Plus Traveller, the membership details will be shared on the registered email address within 30 business days.

$100 hotel credit & more with the hotel collection.

With a $100 hotel credit and a room upgrade, The Hotel Collection offers a world of luxurious comfort from trusted brands like Hyatt & Hilton Hotels.

(A minimum of two consecutive nights booking is required to avail the credit.)

Complimentary Taj Epicure Plus Membership

Get Taj Epicure Plus Membership worth ₹10,000 + GST complimentary with your Credit Card. Unlock a fine life and exciting discounts across Taj properties.

- 20% off on Best Available Rate for Room/Suite stay at Taj Palaces. Applicable on direct bookings, for stays lasting up to five consecutive nights, twice a year.

- 20% off on Best Available Rate for Room/Suite stay. Applicable on direct bookings on room/suite stay for unlimited consecutive nights, twice a year.

- 20% off on Best Available Rate for Room/Suite stay at Taj Safaris. Applicable on direct bookings, for stays lasting up to five consecutive nights, once a year.

- 25% off on food & beverage. Applicable on dine-in & takeaway at participating restaurants across hotels for up to 10 persons.

- 25% off on Qmin food deliveries ordered via the Qmin mobile application.

- 20% off on Spa Treatments at Jiva Spas across participating hotels.

- 20% off on Salon Experiences at participating salons across hotels.

- Complimentary celebration cake in member’s Birthday month 1/2kg.

- One-time access to the pool, with set Lunch & Wine at a special price of 3,000 3 + taxes.

- Happy hours (1:1) at Taj Club at Taj Hotels (at select Taj Hotels).

Effective 1 November 2023, Cardmembers enrolling into Taj Epicure Plus will receive the updated Epicure Plus benefits. Already enrolled Cardmembers will retain their current membership benefits* until their membership is up for renewal.

ELEVATED LIFESTYLE,

EXCLUSIVE ACCESS

Unfold grandeur with a choice of benefits.

Complimentary EazyDiner Prime Membership

Savour the finest at select premium restaurants with the EazyDiner Prime Membership worth ₹3,000 + GST, complimentary with your Card.

- Assured 25% to 50% off at premium restaurants and bars

- Joining Bonus of 2,000 EazyPoints

- Earn 2X EazyPoints and redeem them for free meals faster

- Preferential reservations for Prime members dedicated 24hour VIP line for Prime members

- Dedicated 24-hour VIP line for Prime members, accessible at 7861004400 .

For detailed Terms and Conditions refer here .

On clicking 'Enrol Now', you will redirected to a third party website.

Unlock access twice a month to 30+ golf courses

As an avid golfer, gear up for an exclusive golfing experience at iconic golf courses across the country.

- Enjoy complimentary access twice a month to 30+ lush green courses in India on spending ₹50,000 3 on your Card two months prior. This access comes without a green fee, so you can perfect your swing and learn from the best!

- Golf lessons are available to you and your Supplementary Cardmembers at discounted rates.

- Your Cardmembership makes it easy for you to book your next trip to the greens with an online portal. Share your details to help us create your profile and start booking. You will receive your login credentials via email. Once your profile is ready, you can log in to your account anytime you want to make a golf booking.

If you have registered already, you can begin to make bookings using the Amex Experiences App . You can also view the status of your bookings or cancel a booking via the App.

MAXIMISE MOMENTS,

MULTIPLY REWARDS

Unlock points at every step of the way.

11,000 bonus points as Welcome Gift

- Use your points for Gift vouchers from leading brands like Amazon, ITC and more.

- Transfer points to airline and hotel loyalty programmes like Marriott Bonvoy, Hilton Honors and more.

- Pay with points at your favourite brands online and in-store.

- Redeem your points to pay eligible Card charges.

Up to ₹12,000 vouchers on spends of ₹50,000

Spend ₹50,000 or more in a calendar month and earn ₹1,000 5 voucher every month.

You can redeem across a host of India’s most popular brands like Flipkart, BookMyShow, MakeMyTrip & more.

100% fee waiver on spending ₹10,00,000

Get 100% * annual fee waiver on spending ₹10,00,000 6 in a membership year.

Your world, redefined with bonus rewards

1 Membership Rewards® point for every ₹50 spent

- With no expiry and no cap on how many points you can earn, your Membership Rewards ® points are all yours to indulge. It's easy to earn and flexible to use, so you never have to compromise!

- Earn 1 Membership Rewards® point for every ₹50 7 spent.

3X points on 50+ brands via Reward Multiplier

Travel with your points.

Take off in some of the world's best airlines like British Airways, Air India, Singapore Airlines, and more without having to transfer your rewards points to any frequent flyer programme.

Pay Card charges with points

Use your Membership Rewards ® points to pay your Card charges with Select and Pay.

Shop with your points

Insta vouchers from 100+ brands.

Choose from a wide selection of shopping categories and redeem your points for e-vouchers from Amazon, Myntra and more.

EVERY BENEFIT,

WITH POWERFUL BACKING OF AMEX

Reserved for the select few.

100+ offers across categories

Explore an exclusive selection of offers on brands you like to shop across categories like retail, travel, dining and more with your American Express® Card.

Terms and conditions apply

Places to use your Card

Your Cardmembership opens up the world to you with your Card being accepted online, on your street and all over the world. You can use your Card for practically anything and everything, across purchases such as:

- Entertainment

Saving your new American Express Card details at your favourite online retailers is the most convenient way to quickly make purchases online. Check out faster whenever you shop online at places like Amazon, Flipkart, Myntra, Uber, Swiggy, Paytm, Big Basket, BookMyShow and many more

Use your Credit Card for your next big buy. Discover special EMI offers on home appliances, electronics, travel and more.

Invite your friends on a rewarding journey

Nominate a loved one to get an add on Card

Add a loved one to your account by giving up to 4 Supplementary Cards at no additional cost.

Nominate your parents, siblings, spouse, or any other companion and enjoy the below benefits of your membership together.

- Earn points faster * with spend made on Supplementary Cards.

- Achieve your spend milestones quicker with Supplementary Cards.

Apply for a Supplementary Card online:

- Log in and click on ‘Account Management’ to apply

- Nominate for a Supplementary Card by filling the form

- Inform the applicant about the link sent on their email ID

Refer a friend & earn up to 1,50,000* bonus points

Invite your friends to the rewarding world of American Express ® by referring them for a Card of their own.

On every approved referral, you earn 8,000 * bonus Membership Rewards ® points, up to 1,50,000 * bonus points in a calendar year.

Here’s how it works:

- Refer friends by sharing the unique referral link

- Let your friends apply for the Card that suits them best

- Get rewarded when your friend’s Card application gets approved

Peace of mind with Platinum Care

Platinum Concierge Services

Platinum Concierge brings you the world on a platter and at your doorstep. You can call the Platinum Concierge for:

- Delivery of flowers and gifts to someone special

- Booking movie tickets

- Arranging a round of golf or even booking a rejuvenating spa session at participating partners

- Dining reservations Please call Platinum Concierge Services on 0124-6736660/ 1800-419-1030 (Toll free from MTNL, BSNL landlines) - press option 1 for Card Assistance or 3 for Concierge.

Purchase Protection

If an item is stolen due to burglary or damages or breaks due to fire, earthquake, flood, storm, cyclone, etc. within 60 days of purchase, it can be refunded*.

- Claim to be intimated within 30 days of date of loss to ICICI Lombard by customer.

- Cover is valid for 60 days from the date of purchase. ICICI Lombard Toll Free No :- 1800 2666 *Exclusions : Loss or damage to Gold or Silver articles, watches or jewelry or precious stones or medals or coins or curios, sculptures, manuscripts, rare books, plans, models, designs, deeds, bonds, bills of exchange, bank, treasury or promissory notes, cheques, money, securities, stamps, collection of stamps, business books or papers due to burglary is not covered.

Platinum Assist

Enjoy 24x7 services for all Card related assistance.

When calling from a mobile or from overseas, call any of the following numbers:

- Toll free number : 1800-180-1030 / 1800-419-1030 (From MTNL, BSNL landlines) - press option 1 for Card Assistance or 3 for Concierge.

- Gurgaon : 0124-6736660

Emergency Card Replacement

In case your Card is lost, stolen or damaged, just notify Platinum Assist while in India or the American Express Travel Service Offices or Network Locations if you are travelling overseas. You will receive a Replacement Card within 2 business days, free of charge, anywhere in the world.

Air Accident Insurance of ₹1 Crore

You, as the Basic Cardmember, are automatically insured against loss of life in an air accident for up to ₹1 crore when you purchase your air ticket with your Platinum Reserve SM Credit Card. This benefit is brought to you by ICICI Lombard General Insurance Company. Terms, conditions, limits and exclusions apply.

Please do send your Insurance Nomination Form if not sent already.

Download Insurance form

We’ve got your back

Fuel Waiver

0% surcharge 8 for HPCL transactions less than ₹5,000.

Zero Lost Card Liability

Provided that the Cardmember has acted in good faith, his liability to American Express arising out of any unauthorised use of the Credit Card shall be nil if American Express receives the report within 3 working days of the fraud. If the fraud is reported beyond 3 working days then the maximum liability of the customer will be limited to ₹1,000.

American Express Insurance Services

Together with our partner, ICICI Lombard, we have developed a value for money proposition for you. ‘Comprehensive Protection Plan Plus’* - a plan that covers you from all aspects of your insurance protection needs. For more information e-mail us at [email protected].

*Insurance underwritten by ICICI Lombard General Insurance Company Limited. Insurance is the subject matter of solicitation. The premium paid is tax deductible under Section 80(D) of the Indian Income Tax Act.

Interest Rates and Other Charges

Interest rates may vary from time to time. At any given point, the current rates will be displayed in your Statement of Account/Most Important Terms and Conditions.

Contactless Payment

Your American Express Card may be enabled for contactless payments. To see if your Card is contactless, look for the contactless symbol network on the front and back of your Card. To make a Contactless purchase, touch your Card on the front of the specially marked American Express Contactless reader. For purchases of less than ₹5,000*, you will not need to enter your Personal Identification Number (PIN) or sign. To know more visit here .

*Please be advised that few of our merchant terminals are still undergoing the upgrade process, to support Contactless Transactions upto ₹5,000, without PIN authentication. We regret inconvenience, caused, if any, during this transition period.

If you don't have the American Express® Platinum Reserve SM Credit Card

Terms and conditions.

- Authorization for an amount of Rs. 2 will be taken for Card Validation purpose. The Cardmember will enjoy 12 complimentary visits every year (limited to 3 times per quarter). The 12 months period is defined as January 1 to December 31 of every year.

- Cardmember exceeding the 2 complimentary visits would be charges as per the prevailing rates; currently US$35 per person per visit. This is an enrollment based benefit.

- Effective 1 May’24, Cardmembers can avail up to two (2) complimentary access to Golf courses every month for every Rs. 50,000 spends made using your Platinum Reserve Credit Card in the previous to previous calendar month. Eg. Spend at least Rs. 50,000 in a May’24 using your Platinum Reserve Credit Card, Onwards the First calendar date of next to next month i.e. Jul’24 book your Golf Round as per the applicable process.

- Welcome Gift is available only in the 1st year on payment of the annual fee and on spending Rs. 30,000 within 90 days of Cardmembership.

- Effective 1 May 2024, upon reaching spend milestone of Rs. 50,000 respectively in a Calendar month you can avail a voucher worth Rs.1,000 of any of the available brands. If you are already enrolled in the Monthly Voucher benefit, you will not be required to re-enroll. For details click here . Starting 11/10/2022, instead of receiving a Voucher for BookMyShow or Flipkart, we’ll send you a unique gift code you can redeem for a Voucher of your choice when you reach the spend milestone in a calendar month.

- Eligible spends do not include cash advances, express cash transaction, draft made from the account, balance transfer, fees and is net of any returns.

- Please note that your expenses made on fuel*, insurance, utility^ payments and cash transactions will not earn you Membership Rewards points.

*Fuel includes petrol, diesel, CNG from Oil Marketing Companies (OMCs)

^Utility services include providers of household/domestic electricity, gas and water. These providers can be government departments and agencies including local, state, municipal organisations; public housing societies and apartment associations.

8. 1% fee per transaction is applicable for all HPCL transactions on and above Rs. 5,000, 1% of the transaction value subject to a minimum of Rs.10 + applicable taxes, will be charged as convenience fee at fuel stations operated by the Public Sector Oil Marketing Companies BPCL and IOCL, 2.5% of the transaction value subject to a minimum of Rs.10 + applicable taxes, will be charged as convenience fee at fuel stations of all other Oil Marketing Companies (except HPCL, BPCL and IOCL).

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Chase Sapphire Reserve Card vs. Amex Platinum Card [Detailed Comparison]

Christine Krzyszton

Senior Finance Contributor

315 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Editor & Content Contributor

163 Published Articles 797 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Director of Operations & Compliance

6 Published Articles 1182 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![platinum reserve travel credit Chase Sapphire Reserve Card vs. Amex Platinum Card [Detailed Comparison]](https://upgradedpoints.com/wp-content/uploads/2019/03/Chase-Sapphire-Resrve-Amex-Platinum-Upgraded-Points-LLC-28-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Chase sapphire reserve card vs. amex platinum card — overview, welcome offers, lounge access, hotel and rental car program elite benefits, earning power, redeeming points, annual fees and adding additional users, statement and shopping credits, rideshare benefits, travel protection and insurance, shopping protections, food delivery benefits, additional benefits offered by both cards, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Upgraded Points: Expertise You Can Trust

Our seasoned and experienced team brings years of expertise in the credit card and travel sectors. Committed to integrity, we offer data-driven guides to help you find the card(s) that best fit your requirements. See details on our intensive editorial policies and card rating methodologies .

- Content by Leading Industry Experts

- Routine Updates and Fact-Checks

- First-Hand Credit Card Experience

- Shared Across 200+ Top Outlets

The U.P. Rating System

- 1048+ Expert Credit Card Guides

Most frequent travelers appreciate the value of a premium travel rewards credit card. Having the ability to relax in an airport lounge, receiving an upgraded hotel room, and earning travel rewards make the value of having such a card clear.

Two of the best premium travel rewards credit cards available are The Platinum Card ® from American Express and the Chase Sapphire Reserve ® . Both cards are loaded with travel benefits and earn flexible points that, when redeemed for travel, deliver good value.

If you do some research, you’ll likely find that one of these cards is a better fit for your travel preferences and spending patterns. Both cards are equally impressive premium travel rewards cards, so how do you decide?

Let’s take a look at both cards, comparing benefits and earning power. These comparisons will help paint a clearer picture of which card may be a better fit for you.

Before diving into each card’s attributes, let’s start with a high-level overview comparison of the Chase Sapphire Reserve card and the Amex Platinum card .

While welcome offers change periodically, they can be a large factor when selecting which card to apply for.

Here’s a snapshot of current offers and pricing for the Chase Sapphire Reserve card and the Amex Platinum card:

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority PassTM Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

- APR: 22.49%-29.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

While welcome bonuses are only 1 element in the cards’ offerings, looking at the long-term value, in addition to the welcome bonus, allows you to pick a card that’s going to work best for you beyond the first year.

One of the benefits of a premium travel rewards credit card is complimentary airport lounge access to lounges worldwide .

Without this benefit, it’s not unheard of to see rates of $50 per person for a day pass or $700 for an annual membership. Given that paid access to these lounges can be expensive, the value of complimentary lounge access can be quite substantial.

Here’s a comparison of lounge access between the 2 cards :

Amex Platinum Card

The American Express Global Lounge Collection includes:

- Centurion Lounges (both in the U.S. and international locations)

- Delta Sky Club (when flying Delta the same day)

- Escape Lounges — The Centurion Studio Partner

- Plaza Premium Lounges

- Priority Pass lounges (upon enrollment)

- Select Lufthansa Lounges (when flying with Lufthansa Group on the same day)

- Select Virgin Clubhouses

Chase Sapphire Reserve Card

- Chase Sapphire Lounge by The Club (via Priority Pass)

- Priority Pass lounges

- Chase Sapphire Terrace

Both cards provide complimentary access for the cardholder to all of the card’s associated lounges. Additionally, both cards also allow 2 additional guests, at no charge, to most lounges.

The Priority Pass lounge network consists of over 1,400 locations worldwide. However, a drawback is that Priority Pass can limit access for guests, and even for cardholders, at certain peak times.

When it comes to complimentary lounge access, the Amex Platinum card not only offers access to more than 1,400 lounges worldwide with Priority Pass but also to several additional lounge networks, including the prestigious Centurion Lounges .

Bottom Line: With access to over 1,400 airport lounges worldwide across several lounge networks, including the exclusive Centurion Lounges, the Amex Platinum card provides greater lounge access benefits than the Chase Sapphire Reserve card.

Hotel Program Elite Status

If you frequently stay at hotels, you know the value of an upgraded hotel room, late checkout, complimentary breakfast, and many of the other perks that come with having hotel elite status. Having complimentary hotel elite status as a credit card benefit can significantly boost your experience if you stay often at the participating hotels.

- Hilton Honors Gold status upon enrollment

- Marriott Bonvoy Gold Elite status upon enrollment

In addition to elite status with Hilton Honors or Marriott Bonvoy, the Amex Platinum card also offers special benefits with American Express Fine Hotels and Resorts that include:

- Room upgrades

- Daily breakfast for 2 guests

- Early check-in and late checkout (when available)

- Complimentary Wi-Fi

- A unique property amenity (such as a spa, or food and beverage credit) worth a minimum of $100

Additional hotel benefits are available when booking a least a 2-night stay at The Hotel Collection :

- Up to $100 room credit to spend on dining, spa, and resort activities

- Upgraded room (when available)

Chase partners with the Luxury Hotel and Resort Collection to offer these benefits when booking directly through the Luxury Hotel and Resort Collection at one of over 900 properties worldwide.

- Breakfast for 2

- Upgraded room when available

- Property amenity

Chase Sapphire Reserve cardholders receive similar benefits at Relais & Chateaux and Ennismore properties as well.

Rental Car Program Benefits

- National Emerald Club Executive Club status

- Avis Preferred Plus status

- Hertz President’s Circle status

- Audi on demand benefits and discounts

- Avis Preferred benefits and discounts

Bottom Line: The Amex Platinum card comes out ahead by offering complimentary elite status with hotel and rental car partners . Cardholders receive Hilton Honors Gold status and Marriott Bonvoy Gold Elite status. Rental car benefits and elite status are similar on both credit cards.

The Amex Platinum card clearly excels in providing airport lounge access and hotel program elite status. However, the Amex Platinum card is challenged in earning power by the Chase Sapphire Reserve card given you can earn more points in more ways with the Chase Sapphire Reserve card .

The first difference that stands out is that you can only earn big on the Amex Platinum card if you purchase flights directly through an airline or if you purchase flights and prepaid hotels through AmexTravel.com.

With the Chase Sapphire Reserve card, you’re going to earn 3 points per dollar spent on all travel regardless of how you purchase.

Here’s a sample annual spending scenario:

- $5,000 in flights purchased from an airline

- $3,000 in non-prepaid hotels purchased directly through a hotel’s website

- $2,000 in dining

- $2,000 in other travel expenses

Based on this spending mix, you will have earned 32,000 Membership Rewards points with the Amex Platinum card and 36,000 Ultimate Rewards points with the Chase Sapphire Reserve card. This calculation is based on the assumption that flights were qualifying purchases earning 5x points per dollar with the Amex Platinum card.

If all hotel purchases were qualifying bookings (prepaid hotel purchases made through AmexTravel.com), you would earn 44,000 Membership Rewards points versus 36,000 Ultimate Rewards points .

A downside to note when booking hotels through AmexTravel.com is that hotel elite status benefits typically do not apply.

With the Chase Sapphire Reserve card, however, you’ll have the flexibility to make travel purchases from any provider . Plus, the broad definition of travel puts more of your purchases into the 3x bonus earning category. For example, purchases such as train tickets, car rentals, parking, tolls, ferries, and much more are included in the travel definition for the Chase Sapphire Reserve card.

Both cards offer the option to earn rewards points on affiliated Amex and Chase no-annual-fee cards, then transfer and redeem with travel partners for potentially greater redemption value.

Bottom Line: While both cards have good earning potential, the Chase Sapphire Reserve card has the edge as more categories earn 3 points per dollar spent. Only prepaid hotels and flights purchased from AmexTravel.com and flights purchased from the airline receive elevated 5x earnings on the Amex Platinum card.

Fortunately, both cards offer good value when redeeming for travel, transferring points to travel partners, and offering additional redemption choices.

The Chase Sapphire Reserve card’s redemption rate of 1.5 cents per point results in great value when redeeming for inexpensive flights via the Chase Travel , for Pay Yourself Back qualifying purchases, and also when transferring to select airline partners for premium flights.

With 17 airline transfer partners, there are more options for premium-cabin award redemptions with the Amex Platinum card versus the 11 airline transfer partners with the Chase Sapphire Reserve card.

When we look at hotel redemptions, transferring Ultimate Rewards points earned on the Chase Sapphire Reserve card to hotel partner World of Hyatt shines as a sweet spot. Free nights at Hyatt start at 3,500 World of Hyatt points, and with a 1:1 transfer ratio, you would need just 3,500 Ultimate Rewards points for a free Hyatt hotel night.

Bottom Line: With the wide variety of airline transfer partners, Membership Rewards points edge out Ultimate Rewards points for premium flight award redemptions. However, Ultimate Rewards can result in good value for inexpensive fares via Chase Travel.

While the Amex Platinum card’s annual fee is higher at $695 , you can add authorized users at $195 per card ( rates & fees ). The Chase Sapphire Reserve card has an annual fee of $550 , and authorized users can be added for $75 each.

Regardless of which card you select, if you can utilize the offered benefits, you’ll receive value far beyond the cost of either annual fee.

One of the card benefits that can directly offset the cost of a credit card’s annual fee is the credits you receive after making specific purchases.

- Up to $200 airline incidental fee credits

- Up to $200 in Uber Cash

- Global Entry or TSA PreCheck application fee credits

- Up to $100 Saks Fifth Avenue credit

- Up to $189 annual CLEAR Plus credit

- Up to $300 annual Equinox credit

- Up to $240 digital entertainment credit

- Up to $200 prepaid hotel credit on eligible stays

- Up to $155 Walmart+ credit

- $300 SoulCycle bike credit

- Up to $300 statement credit for travel purchases each cardmember year

- Global Entry, NEXUS , or TSA PreCheck reimbursement

- Complimentary Instacart+ membership (activate by July 31, 2024), plus up to $15 per month in Instacart statement credits after activating your Instacart+ membership

If you spend money on checked baggage and other airline incidental fees, use streaming services, or shop at Saks, you’ll find value with the Amex Platinum card.

The Chase Sapphire Reserve card’s up to $300 travel credit, however, is much easier to utilize because airline tickets, hotels, taxis, and more are considered travel purchases.

Bottom Line: When we compare statement/shopping credits, the Amex Platinum card offers more total value. However, you must use all of the benefits to maximize the value. The $300 credit on travel purchases offered by the Chase Sapphire Reserve card may be much easier to utilize given Chase’s definition of travel is quite broad.

The Amex Platinum card includes up to $200 Uber Cash , split up into up to $15 increments each month (except December which gets up to $35 in credit). This is added to your Uber account as Uber Cash and can be used towards any Uber ride or Uber Eats delivery in the U.S.

Likewise, you’re automatically enrolled in Uber VIP (available only in select cities) when you add your Amex Platinum card to your Uber account. This gives you access to exclusive discounts and UberX VIP and Uber Black VIP rides. When you select this option, you’re only paired with the highest-rated drivers in your city at no additional cost.

These benefits only apply to the card’s primary cardholder and not any authorized users.

Lyft purchases earn 10 points per dollar spent (through March 31, 2025) when they’re charged to your Chase Sapphire Reserve card — this means that a $10 ride would earn 100 Ultimate Rewards points!

Cardholders also receive complimentary Lyft Pink All Access for 2 years as well as 50% off the price of membership for the third year.

Hot Tip: Are you considering both of these credit cards? Be sure to consider the reasons you may (or may not) want 2 premium credit cards before deciding.

It’s nice to experience luxury travel benefits, but occasionally, things do go wrong. When they do, you may turn to your premium travel rewards credit card for coverage and assistance.

Bottom Line: The Chase Sapphire Reserve card is known for its comprehensive travel benefits , including primary rental car insurance and limited medical/dental coverage. The Amex Platinum card offers cardholders travel insurance benefits like complimentary emergency transportation and evacuation with no stated limit but does not offer roadside assistance or baggage delay.

When comparing shopping protections and benefits, both cards offer similar coverage:

- Purchase Protection — Qualifying items are covered on both cards for damage up to $10,000, with a maximum of $50,000 per year (up to 90 days from the purchase date for the Amex Platinum card and up to 120 days from the date of purchase for the Chase Sapphire Reserve card.)

- Extended Warranty — Both cards offer an additional year of manufacturer’s warranty protection; the Amex Platinum card offers an additional year on warranties of 5 years or less, whereas the Chase Sapphire Reserve card offers an additional year on warranties 3 years or less

- Return Protection — Coverage provided on both cards for up to 90 days from the purchase date; $300 per item on the Amex Platinum card and $500 per item on the Chase Sapphire Reserve card

Bottom Line: While one does not select a premium travel rewards credit card based solely on shopping-related protections, it is good to know that both cards offer similar shopping coverage .

As previously mentioned, the Amex Platinum card receives up to $200 in Uber Cash that can be used towards any Uber Eats delivery or Uber ride in the U.S.

The card offers a free DoorDash DashPass subscription so long as it’s activated by December 31, 2024. This subscription is usually $9.99 monthly and includes free delivery and discounted service fees on select DoorDash orders over $12. There’s also a $5 monthly DoorDash credit available.

You will find the following benefits offered on both the Amex Platinum card and the Chase Sapphire Reserve card:

- No Foreign Transaction Fees — Neither card charges a foreign transaction fee

- VIP Access to Events — The Chase Sapphire Reserve card’s “Reserve Experiences” and the Amex Platinum card’s “By Invitation Only” benefits offer unique experiences available exclusively to cardholders

- Member Concierge Services — Each card has its own concierge service to assist with travel planning, booking event/dining reservations, and arranging VIP access to special events

Both cards are designed for the frequent traveler, but which card is best for you depends on which benefits you deem most important.

The Chase Sapphire Reserve card focuses more on overall earnings, significant redemption values, and travel-related protections and insurance.

The Amex Platinum card has strengths that center on luxury travel benefits with elevated earnings narrowed to specific travel purchases. The card provides valuable no-stated-limit emergency transportation or evacuation benefits that can provide peace of mind when traveling.

Both cards offer the flexible option of transferring points to travel partners for the potential of even greater value for your points. There is no clear winner or loser here as both cards offer tremendous value for the right frequent traveler. The card that fits your spending patterns and benefit preferences and has protections/insurance you can use will be the best choice.

*No Preset Spending Limit on an American Express card means your spending limit is flexible. Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

For the Trip Cancellation and Interruption Insurance benefit of The Platinum Card ® from American Express, the maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the Car Rental Loss & Damage Insurance benefit of The Platinum Card ® from American Express, Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the Baggage Insurance Plan benefit of The Platinum Card ® from American Express, Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the Trip Delay Insurance benefit of The Platinum Card ® from American Express, up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the Premium Global Assist Hotline benefit of The Platinum Card ® from American Express, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the Purchase Protection benefit of The Platinum Card ® from American Express, Purchase Protection is an embedded benefit of your Card Membership and requires no enrollment. It can help protect Covered Purchases made on your Eligible Card when they’re accidentally damaged, stolen, or lost, for up to 90 days from the Covered Purchase date. The coverage is limited up to $10,000 per occurrence, up to $50,000 per Card Member account per calendar year. Coverage Limits Apply. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the Extended Warranty benefit of The Platinum Card ® from American Express, when an American Express ® Card Member charges a Covered Purchase to an Eligible Card, Extended Warranty§ can provide up to one extra year added to the Original Manufacturer’s Warranty. Applies to warranties of five (5) years or less. Coverage is up to the actual amount charged to your Card for the item up to a maximum of $10,000; not to exceed $50,000 per Card Member account per calendar year. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the Return Protection benefit of The Platinum Card ® from American Express, with Return Protection, you may return eligible purchases to American Express if the seller won’t take them back up to 90 days from the date of purchase. American Express may refund the full purchase price excluding shipping and handling, up to $300 per item, up to a maximum of $1,000 per calendar year per Card account, if you purchased it entirely with your eligible American Express ® Card. Purchases must be made in the U.S. or its territories. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Which credit card is better, the amex platinum card or the chase sapphire reserve card.

The best card for you will depend on your spending mix and your travel benefit preferences.

If you enjoy luxury travel benefits and spend a lot on flights and prepaid hotels you will realize the most value with the Amex Platinum card.

If you spend more on overall travel in general, in addition to hotels and flights, you may earn more rewards overall with the Chase Sapphire Reserve card. This is because travel, such as tours, cruises, train travel, taxis, and more are included in the broad travel definition of the Chase Sapphire Reserve card. Dining purchases also receive 3x earnings.

The Chase Sapphire Reserve card also offers lounge access (but to a drastically lesser extent than the Amex Platinum card) and a very strong collection of travel protections and insurance.

Each card offers tremendous value for the right frequent traveler.

Which points are worth more for travel, Membership Rewards points or Ultimate Rewards points?

The value of your rewards points, when redeemed for travel, will depend on how the points are redeemed.

One option is to transfer your points to airline or hotel programs; both programs allow you to do this.

Value will vary based on the airline or hotel program. American Express has more transfer partners but Chase has partners like World of Hyatt that also provide excellent redemption value.

Membership Rewards points can be redeemed for up to 1 cent per point towards travel with Amex Travel and Chase Ultimate Rewards points can be redeemed at 1.5 cents per point for travel through the Chase Travel portal.

Chase Ultimate Rewards can be worth more when redeemed through Chase Travel. Membership Rewards may be worth more when redeemed with the right airline transfer partner.

Which credit card has the best airport lounge access?

The Amex Platinum card offers access to more properties and to higher-end lounges than the Chase Sapphire Reserve card.

The Amex Platinum card’s complimentary lounge access is valid for several lounge networks including Centurion Lounges, Priority Pass lounges, Delta Sky Clubs, Plaza Premium Lounges, and more.

The Chase Sapphire Reserve card offers lounge access to Priority Pass lounges and Chase Sapphire Lounges by The Club only.

Which credit card has the best car rental insurance?

The Chase Sapphire Reserve card provides primary car rental coverage while the Amex Platinum card offers secondary coverage.

Secondary coverage means that you must first file a claim with your own auto insurance before coverage kicks in.

Additional terms and conditions apply but the Chase Sapphire Reserve card offers better coverage.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!) .

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts