You are using an outdated browser. Please upgrade your browser to improve your experience.

How to visit Singapore using Apple Pay, Apple Wallet, and zero cash

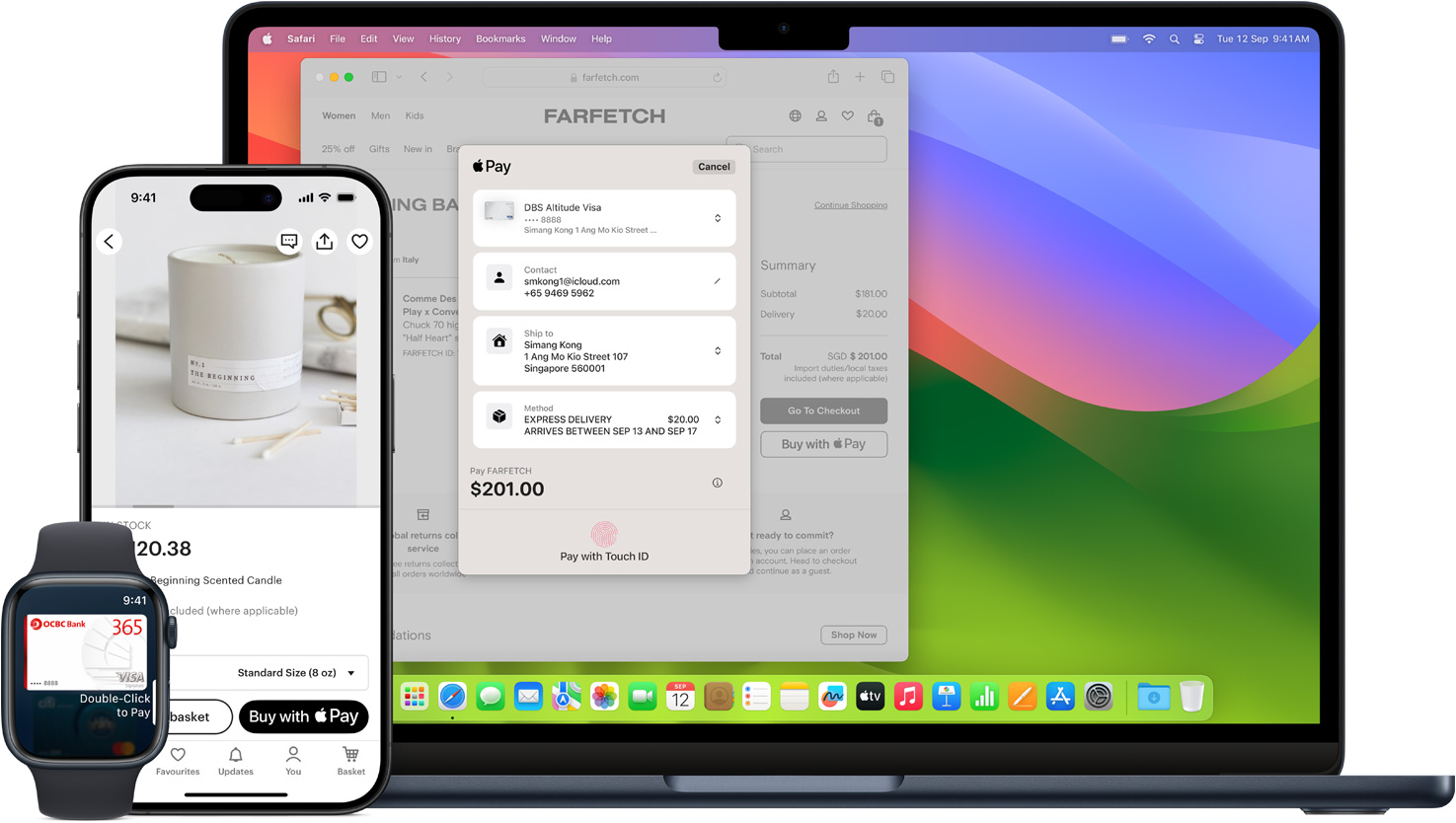

Using Apple Pay in Singapore is safe and convenient.

On a recent visit to Singapore, both my husband and I were able to go sightseeing around Singapore without any cash. We used Apple Pay to do things like buy hawker street food and ride the Mass Rapid Transport (MRT) system.

The benefits of cashless travel are numerous, such as removing the worries of pickpocketing or losing your wad of cash. As a bonus, you can skip shady currency exchange places.

Prepare before your trip

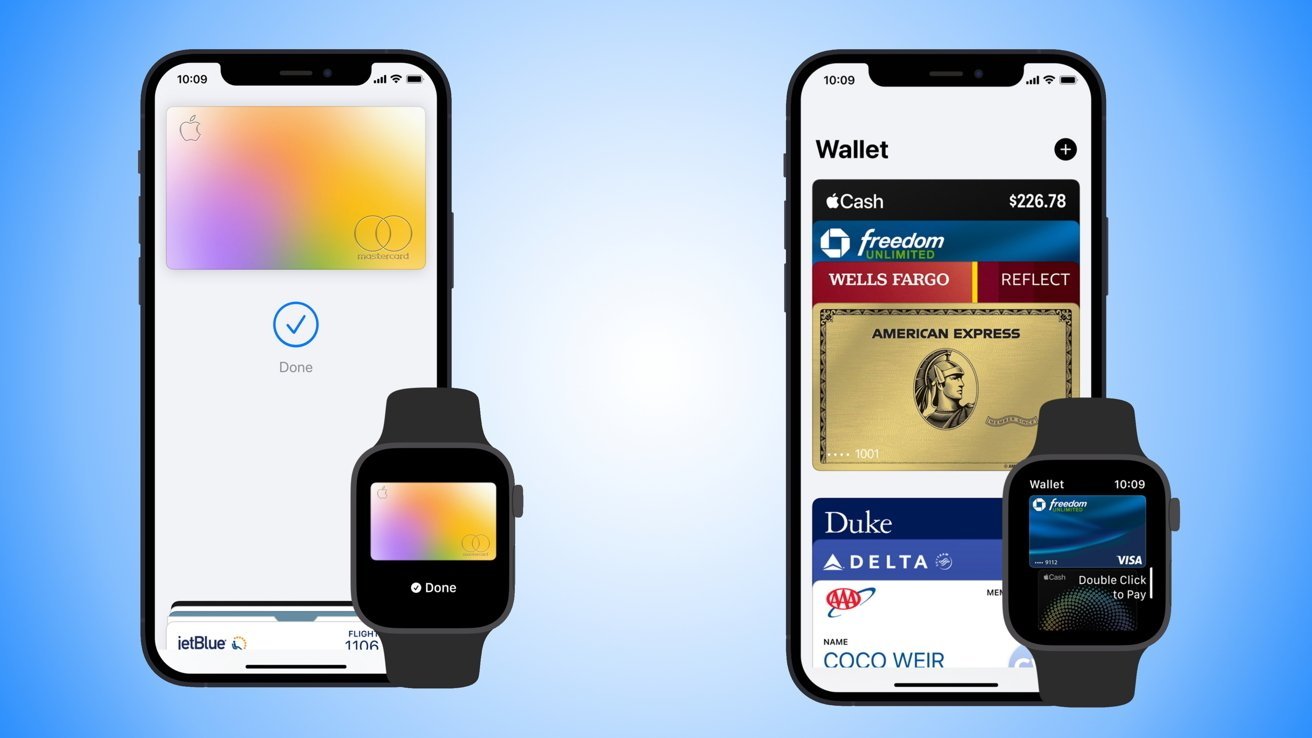

Before your flight to Singapore, make sure to load your Apple Wallet with the cards you want to use.

Singapore's MRT, accepts cards including MasterCard or Visa credit and debit cards and NETS contactless ATM cards. Check Singapore's Land Transport Authority SimplyGo for the latest accepted card payment list.

If you choose to purchase a rechargeable EZ-Link card to ride the MRT, add this to your Apple Wallet before your trip.

You could use any of the above cards for contactless payments by tapping the card at the train station, but loading them up on your Apple Wallet before your trip will save you from having to carry a physical card around town.

Before using Apple Pay abroad, confirm with your bank about any possible fees they may charge.

If possible, when adding a card to your Apple wallet or Apple Pay, use a card with zero foreign transaction fees. It's even better if this is a card that gives you extra points for travel and food transactions, as well as offering travel insurance.

Apple Pay for transportation

Singapore's MRT system is built to handle cashless payments with the tap of a card. However, having your card preloaded onto your Apple Watch or iPhone makes it easier as it's one less thing to worry about.

Before entering the train platform, simply scan your Apple Watch or iPhone with Apple Wallet enabled. Once the card payment has been verified, you can go right through.

Besides the MRT, a popular way to get around Singapore is by Grab or Gojek , on-demand taxi services much like Uber or Lyft in the States.

To use this transportation option, simply enter your card information into the Grab or Gojek app. Your card will be deducted for the cost of the taxi ride, and once again you can do all of this without using any physical cash.

Apple Pay for top attractions

Many top attractions in Singapore accept Apple Pay. Before visiting, research the specific landmarks you want to visit and look for their accepted payments.

Here is a list from Apple of the current participating banks and card issuers in Singapore.

- American Express (Bank-issued American Express cards aren't supported.)

- Citibank (Mastercard and Visa credit cards, Mastercard debit cards)

- DBS (Mastercard and Visa credit and debit cards)

- HSBC (Mastercard and Visa credit cards, Visa debit cards)

- Maybank (Mastercard and Visa credit and debit cards)

- OCBC (Mastercard and Visa credit and debit cards)

- POSB (Mastercard credit and debit cards)

- Singtel (Visa Prepaid Card)

- Standard Chartered Bank (Mastercard credit and debit cards, Visa credit cards)

- United Overseas Bank (Mastercard and Visa credit and debit cards)

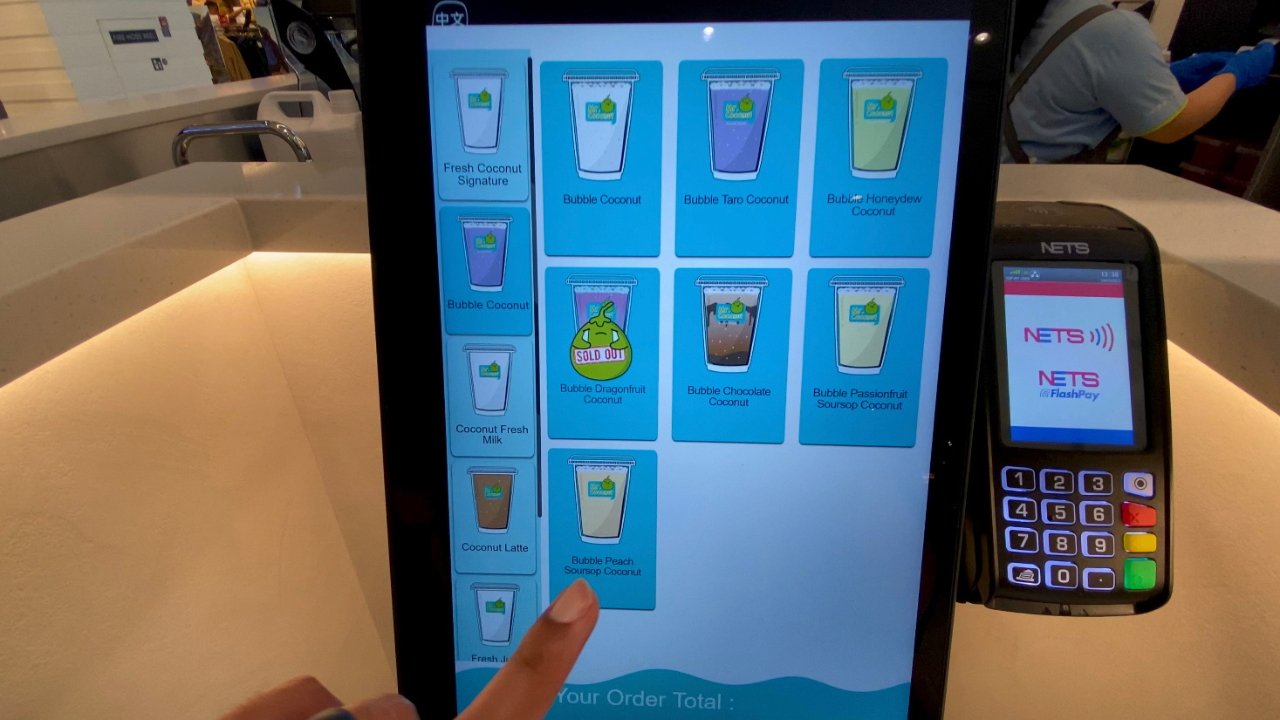

Apple Pay for Singapore street food

Visitors will be pleasantly surprised to find that even modest food vendors accept Apple Pay. For example, we used an Apple Watch to buy curry, naan, claypot rice, and iced Milo from three different vendors at the Marina Bay Sands food court.

You can use Apple Pay at places like BreadTalk, a popular bakery chain, or Uniqlo, a favorite clothing brand. When ordering at a food court, each stall will have its own payment options, so double-check before ordering.

Using Apple Pay in Singapore

At the cashier, look for the Apple Pay logo on the card terminal, or simply ask the vendor if they accept Apple Pay. These vendors are comfortable with tourists and are happy to confirm payment options.

This was our experience in Singapore, but your mileage may vary in other countries.

We loved using Apple Pay while exploring Singapore's top sights. We didn't have to hunt down currency exchange stalls or fumble with foreign currency, and we highly recommend going cashless when in Singapore.

Sponsored Content

Buckle and Band offers a new take on designer Apple Watch bands for sophisticated owners

Top stories.

New iPad Air & iPad Pro models are coming soon - what to expect

The long nightmare may be over — iPad could finally get a Calculator app

The best of WWDC — the developer conference that shapes technology for the rest of us

Apple Silicon might get used for AI chips in server farms

The history — and triumph — of Arm and Apple Silicon

Featured deals.

Best Buy kicks off new M3 MacBook Air sale, blowout M2 deals up to $400 off still available

Latest comparisons.

M3 15-inch MacBook Air vs M3 14-inch MacBook Pro — Ultimate buyer's guide

M3 MacBook Air vs M1 MacBook Air — Compared

M3 MacBook Air vs M2 MacBook Air — Compared

Latest news.

The Calculator app could finally make its way to the iPad with iPadOS 18, and we could see the debut of some exciting new features and powerful upgrades in the process.

More evidence surfaces that Beats Solo 4 are coming soon

New animations discovered within the most recent beta of Apple Vision Pro software strongly suggest that Apple is gearing up to release the fourth version of its Beats Solo headphones.

Deals: save up to $450 on Microsoft 365, Office, Adobe Creative Cloud & more

This week's top software sales offer discounts of up to $450 off standalone licenses and subscriptions for popular tools, including Microsoft 365, Office, Adobe Creative Cloud and more.

Third visionOS 1.2 developer beta arrives, with few changes

Developers equipped with the Apple Vision Pro can now try out the third developer build of visionOS 1.2.

Apple Vision Pro shipments reportedly cut as US demand for headset wanes

Ming-Chi Kuo says Apple has reduced its orders for Apple Vision Pro parts and assemblies, with the cut in shipments said to indicate lower demand for Apple's headset than previously thought.

Apple rolls out the third developer beta round for testing

Apple's third round of developer betas for the current generation has arrived, including iOS 17.5 and macOS Sonoma 14.5.

A new rumor claims that Apple will use TSMC's 3nm technology for an AI server processor that it is designing alongside its iPhone and Mac chips.

Apple is holding a special event on May 7 that will most likely focus on new models of the iPad Air and iPad Pro. Here's what to expect from the "Let Loose" event.

iPhone isn't secureable enough for the South Korea military - but Android is

An iPhone ban in the South Korean military that has less to do with security and more to do with a poorly crafted mobile device management suite coupled with nationalism may be expanding to the rank-and-file.

Apple's iPhone skid in China continues, with another big hit to start 2024

Apple is having a tough quarter in China, with new research claiming that Apple's iPhone sales are down 19.1% year-over-year.

Apple's FineWoven cases rumored to get one final release

Apple has probably stopped production of its poorly-received FineWoven cases for the iPhone, but a new report from the same herald of its death says there is one last set of seasonal colorways coming.

Latest Videos

All of the specs of the iPhone SE 4 may have just been leaked

When to expect every Mac to get the AI-based M4 processor

Latest reviews.

Ugreen DXP8800 Plus network attached storage review: Good hardware, beta software

Espresso 17 Pro review: Magnetic & modular portable Mac monitor

Journey Loc8 MagSafe Finder Wallet review: an all-in-one Find My wallet

{{ title }}

{{ summary }}

Apple Wallet 4+

Tickets, passes and more.

- 2.6 • 133 Ratings

Screenshots

Description.

The Wallet app lives on your iPhone. It’s where you securely keep your credit and debit cards, travel cards, boarding passes, tickets, car keys and more — all in one place. And it all works with iPhone or Apple Watch, so you can take less with you but always bring more. APPLE PAY Apple Pay is the one way to pay. It replaces your physical cards and cash with an easier, safer, more secure and private payment method — whether you’re in a shop or online. It’s money, made modern. PUBLIC TRANSPORT* Easiest way to get around town. Apple Pay makes it simple to catch buses and trains in your favourite city. Breeze through the turnstiles just by holding your iPhone or Apple Watch up to the reader. CAR KEY* An iPhone and Apple Watch feature that lets you unlock and start your car with a digital car key stored in the Wallet app. STUDENT ID* Add your student ID card to Wallet, and use it to access places like your halls, the library and campus events. Or pay for washing, snacks and dinners around campus at participating universities. HOME KEY* Add home keys to Wallet on iPhone and Apple Watch, then simply tap to unlock a compatible door lock for seamless access to your home or flat. HOTEL KEY* Add your hotel key in Wallet after making your reservation, use it to check in so you can skip the lobby, and use your iPhone and Apple Watch to tap to unlock and access your room. OFFICE KEY* Add your employee badge/ID to Wallet and then use your iPhone and Apple Watch to unlock doors and other access locations where your corporate badge is accepted. REWARDS & LOYALTY CARDS* Add your favourite coffee shop or chemist’s rewards cards to Wallet, so you never miss out on all the rewards and benefits. BOARDING PASSES & EVENT TICKETS* Simply add your boarding pass or tickets to Wallet to board flights or enter the stadium with just your iPhone or Apple Watch. *Only available with selected partners and locations, and requires an eligible device and OS version. See apple.com/uk/wallet for details. Features are subject to change. Some features, applications and services may not be available in all regions or languages, and may require specific hardware and software. See apple.com/uk/ios/feature-availability for more information.

Ratings and Reviews

133 Ratings

Add a section/category for loyalty card

Dear Apple, there other app on the app store that allow us to add our loyalty. But it is still a 3rd party app. Could you please add this function? So that in future we will not need to bring so many cards with us. Thanks.

Disappointed

From Singapore:- Was so excited when I saw that you had added the new features- express travel card. When I on it and try to use it, I’m unable to. There was so many embarrassing moments whereby I’m happily scanning without using the password but unable to. It wanted me to key in the password again. There was so many passengers waiting for me behind. I have no choice, every time I have to set 2-3 mins before I alight. The duration is also very short. If I set the password too early, when it’s finally my turn to scan, it required the passcode again. This is really stressful and I super not enjoying it. Please update to Singapore user. It’s really a hassle…rightfully it should be fuss free as it’s only a $1-3 bus journey. If we are talking about buying things, yes, then passwords is definitely required.

Constant issues with using Tap feature

Recently i encountered issues when using the tap feature. First i tried to remove all my credit cards, restart the phone and add them back. It worked intermittently. Initially, i only had issue when paying at the MRT station. Now I also have the same issue when making contactless payment at other retail stores. I had to kill the app and tried again a few times. Sometimes it worked, other times it didnt. Apple, pls do look into this issue seriously as contactless payment is a feature that a phone cannnot afford to not have these days. Soon you will lose share market to other samsung phone because of this.

App Privacy

The developer, Apple , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Financial Info

- User Content

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

English, Arabic, Catalan, Croatian, Czech, Danish, Dutch, Finnish, French, German, Greek, Hebrew, Hindi, Hungarian, Indonesian, Italian, Japanese, Korean, Malay, Norwegian Bokmål, Polish, Portuguese, Romanian, Russian, Simplified Chinese, Slovak, Spanish, Swedish, Thai, Traditional Chinese, Turkish, Ukrainian, Vietnamese

- Developer Website

- App Support

- Privacy Policy

More By This Developer

Apple Books

Apple Podcasts

Find My Friends

You Might Also Like

Visa Commercial Pay

Wallet: Budget & Money Manager

Skrill - Wallet App

Bitcoin.com: Buy BTC, BCH, ETH

Pay the Apple way.

Faster and easier than using cards or cash.

Privacy and security built in., accepted on millions of websites and apps., checkout is easier online with apple pay., it’s ready and set. just go..

Set up in seconds. Directly on your iPhone. Apple Pay is built into iPhone, Apple Watch, Mac and iPad. Start by adding your credit or debit card to the Wallet app on your iPhone, and you’ll have the option to add it to your other devices in one easy step. When you want to pay, just double-click, tap and you’re set. You still get all your card’s rewards and benefits — so you won’t miss out on any hard-earned points or miles.

Apple Pay is already on your device. Apple Pay is built into iPhone, Apple Watch, Mac and iPad. No separate app to download. No complicated processes to complete. No hassles.

Easy. Does it all.

Grab from the corner café. Pay for your instantly. Order a new online. Have delivered. Subscribe to . Get from a vending machine. And from the supermarket. Just look for or when you check out.

At stores and more. Apple Pay is widely accepted, so you can likely use it wherever and however you want. If you’re not sure, just ask. Apple Pay works anywhere that takes contactless payments — from vending machines and grocery stores to taxis and train stations.

In apps and online. Use Apple Pay for purchases in Safari on your iPhone, iPad or Mac. You can skip the lengthy checkout forms and pay with just a touch or a glance. Or use Apple Pay to subscribe to services like Apple Music and Apple TV+, buy apps and games on the App Store, and upgrade your iCloud storage.

Safe and sound. And secure.

Personal data. Protected. When you make a purchase, Apple Pay uses a device-specific number and unique transaction code. So your card number is never stored on your device or on Apple servers. And when you pay, your card numbers are never shared by Apple with merchants. If you prefer not to share your email address with merchants when paying online, you can use Hide My Email to generate unique, random email addresses that automatically forward to your personal inbox.

Your purchases stay private. When you pay with a debit or credit card, Apple Pay doesn’t keep transaction information that can be tied back to you.

Tap more. Touch less. Apple Pay works straight from your device, helping you avoid touching buttons and terminals, handling cards and exchanging cash. Every purchase requires Face ID, Touch ID or a passcode — helping to keep your security in your hands.

Use it how you like.

Add your cards and keep earning loyalty points., use apple pay in these locations. and so many more., use apple pay on many apps and websites like these., questions answers., how do i use apple pay.

You can use Apple Pay to make purchases in stores, on websites and in apps. It’s widely accepted, simple, safe, secure and private.

- Learn how to use Apple Pay in stores

- How to make a purchase with Touch ID

- Learn how to use Apple Pay on websites

- Learn how to use Apple Pay in apps

How secure is Apple Pay?

Apple Pay is safer than using a physical credit, debit or prepaid card. Face ID, Touch ID or your passcode are required for purchases on your iPhone, Apple Watch, Mac or iPad. Your card number and identity aren’t shared with merchants, and your actual card numbers aren’t stored on your device or on Apple servers.

When you pay in stores, neither Apple nor your device will send your actual card number to merchants. When you pay online in Safari or in apps, the merchant will only receive information you authorise to fulfill your order — such as your name, email address, and billing and shipping addresses.

When you pay with a debit or credit card, Apple doesn’t keep transaction information that can be tied back to you.

- Learn more about Apple Pay security and privacy

How do I set up Apple Pay?

It’s simple. Just add a credit, debit or prepaid card to the Wallet app on your iPhone. And remember to add your cards to any other Apple devices you want to use with Apple Pay. It works on iPhone, Apple Watch, Mac and iPad.

Which banks support Apple Pay?

Apple Pay works with major credit and debit cards from banks around the world, with more added all the time. You can see all the banks that support Apple Pay here . If your card does not yet support Apple Pay, contact your bank for more information.

Does it cost extra to use Apple Pay?

No. Apple does not charge any fees when you use Apple Pay — in stores, online or in apps.

Can I use Apple Pay abroad?

Apple Pay works in countries and regions that support contactless payments. Confirm with your bank, and ask about any fees they may charge for overseas usage.

How can my business accept Apple Pay?

If your business already accepts credit and debit cards, simply contact your payment provider to start accepting Apple Pay. Contact merchant support for more information. If you want to accept Apple Pay on your website or in your app, visit Apple Pay for developers .

How do I let my customers know I accept Apple Pay?

Download the Apple Pay mark to use within email, on your terminal screen, on your website and in your app. You can also order Apple Pay decals to put on your storefront window and at the cashier.

- Download the decal and guidelines

- View online marketing guidelines

- Order Apple Pay decals for your store

- Add Apple Pay to your Maps listing

Carry one thing. Everything.

Set up Apple Pay on your Apple device.

Open the Wallet app and tap to add a card.

Apple Watch

Open the Apple Watch app on your iPhone, tap Wallet & Apple Pay, and then tap Add Card.

Go to Settings Wallet & Apple Pay and tap Add Card.

On models with Touch ID, go to System Preferences Wallet & Apple Pay and tap Add Card.

For more information, visit the Apple Pay setup support page .

Sep 25th, 2019

How to Use iPhone as EZ-Link in Singapore

For a country so advanced, I was surprised that there isn't more information telling us how to use our iPhone as an EZ-link. I hate fumbling with transit cards, so I want to use my iPhone to tap MRT gantries. It's not an unreasonable thing to ask for.

Why do it in the first place?

Well, several reasons.

- You save space in your wallet since you need one card less. Boom. Minimalism. You can graduate from a bifold, like the Bellroy Note Sleeve , to a minimalist wallet like this one from TOM BIHN.

- Never fumble at the gantry. Nothing worse than reaching an MRT gantry to have your card have too low a value and have the auntie behind you go “tsk.” Using a credit card means more or less no limit.

- Manage your transactions digitally. Track each transaction and never have to queue up at a machine to top up your card.

- Get points. I would recommend you use a credit card that would give you air miles.

I'm all set up with almost every mobile payment provider in Japan, and of course, with Suica integrated with Apple Pay, I can tap my iPhone XS Max and waltz through the gates at the busiest of stations.

I managed to get the same flow set up when I was traveling in Beijing , and being able to ride the trains and buses without having to get cards is awesome.

So, I wanted to do the same in Singapore. Searching for “iPhone EZ-link”, I'm taken to the NFC EZ-Link website, where iPhone isn't in the list of supported devices despite NFC technology being included since iPhone 6. In fact, the iPhone XS Max that I'm currently using has both NFC and Felica, which is the Japanese version of NFC.

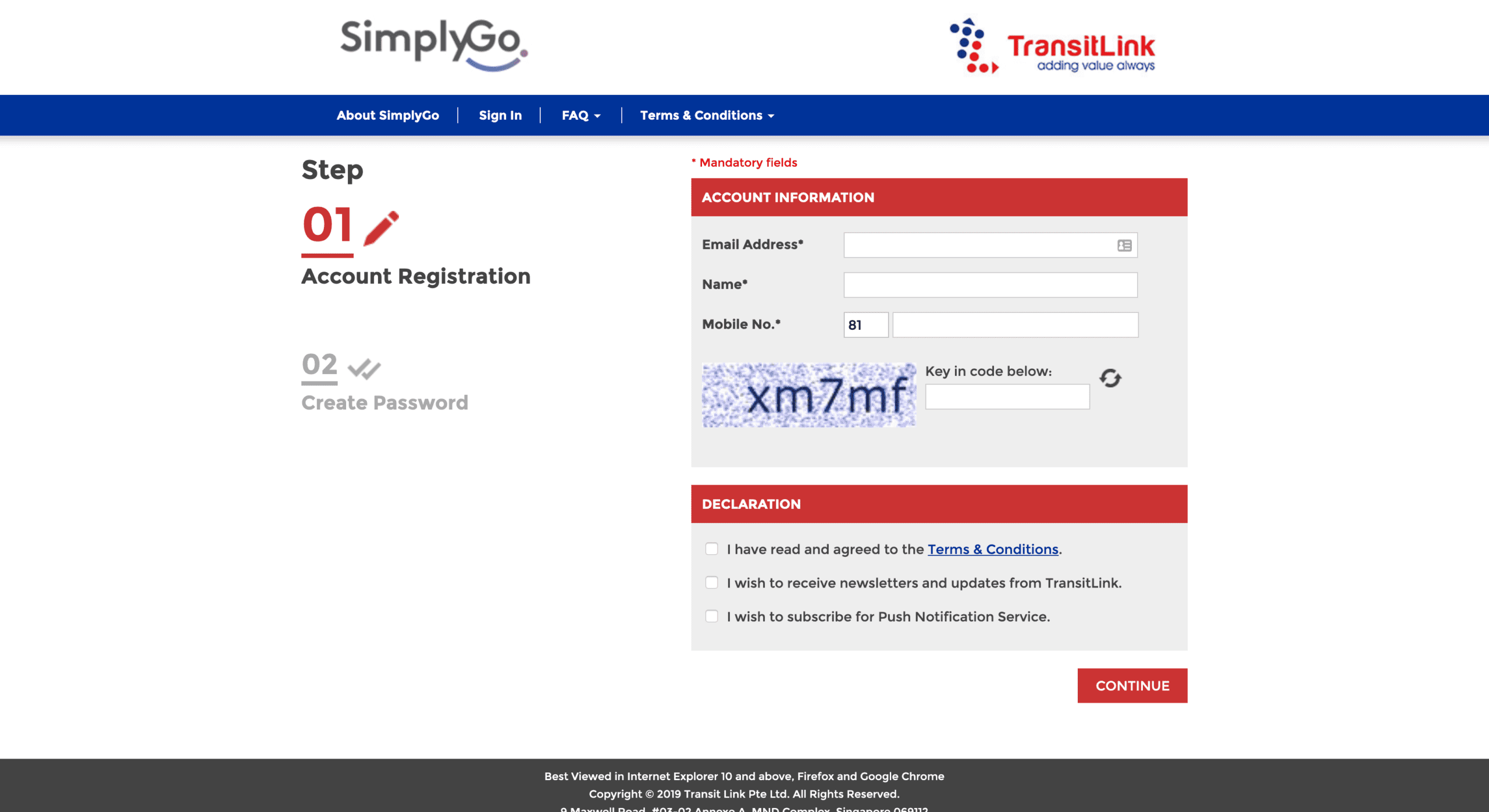

Then, after some furious interrogation of Google sensei, I stumbled onto the SimplyGo program . It seems promising, so I continued digging. After more enhanced interrogation of Google sensei, and finally, I found out how.

And I'm gonna tell you how to. Before I do, make sure you have the following

- Update to the latest iOS version if you haven't already.

- Make sure you have an iPhone 6 or 6 Plus or later device that has NFC.

- Have a contactless/CePAS enabled credit or debit card on hand. It basically needs to have this sideways WIFI icon on it.

To use your iPhone in place of a EZ-link card, all you have to do is…

Simply set up card in Apple Wallet. No more EZ-link cards!

Open your Wallet app, which comes preinstalled and is not removable. Add your credit card. That's it.

What's the SimplyGo thing about then, you ask? I'm sure every time you read about using iPhone as an EZ-link card, you'll be made to believe you have to sign up for a SimplyGo account.

This used to be an ad.

But no one likes ads, so I got rid of them. If my articles helped you, I ask for your support so I can continue to provide unbiased reviews and recommendations. Every cent donated through Patreon will go into improving the quality of this site.

or buy me coffee

Actually, you don't have to. All signing up for an account does is let you track your transaction history in the portal. You can use your credit or debit card as an EZ-link card without signing up.

How to use it like an EZ-link card

Added your credit card and ready to tap away? Here are some ways you can use it as smooth as possible.

- Turn on the Double-Click Side Button option under Settings > Wallet & Apple Pay. Doing so will make your cards appear by double-clicking the side button. You can set the card as your Express Transit card, and the card will appear when you tap the sensor with your phone, but you might already be holding up the queue.

- Set the registered card to your Default Card in Settings > Wallet & Apple Pay. Doing so will allow the specific card to appear as the first option when you double click, so you can go straight into authentication. You can also do this on the screen where the list of cards are shown by long-pressing and dragging the card to the bottom.

- Authenticate via passcode, Touch ID, or Face ID before you tap. You don't want to hold up the queue, so be sure to get it ready before reaching the sensor. As far as I can tell, even if the option is available in the settings, there are no Singapore credit or debit cards that support Express Transit yet, which lets you tap your iPhone without authentication, even in lock mode.

- If you have an iPhone 12 or later, you want to enable Face ID while wearing a mask since you are still required to wear a mask on public transport at this time.

You might also want to know that the EZ-link reader won't show the fare or remaining balance like it does with regular EZ-link cards. It will just show “SimplyGo Bank Card Usage”, so you can also check the actual usage in your credit card bill or SimplyGo account.

If you still want to sign up for a SimplyGo account

Doing so will let you track your transaction history in the portal, although it takes 3 whole days for transactions to show up. You'll be able to see the transactions in your card's account statements anyway, so this isn't really necessary and gives the government another way to monitor you. But if you insist…

Go here and sign up for an account. I was pleasantly surprised that they accepted international numbers, which was awesome since I gave up my local number after moving to Tokyo.

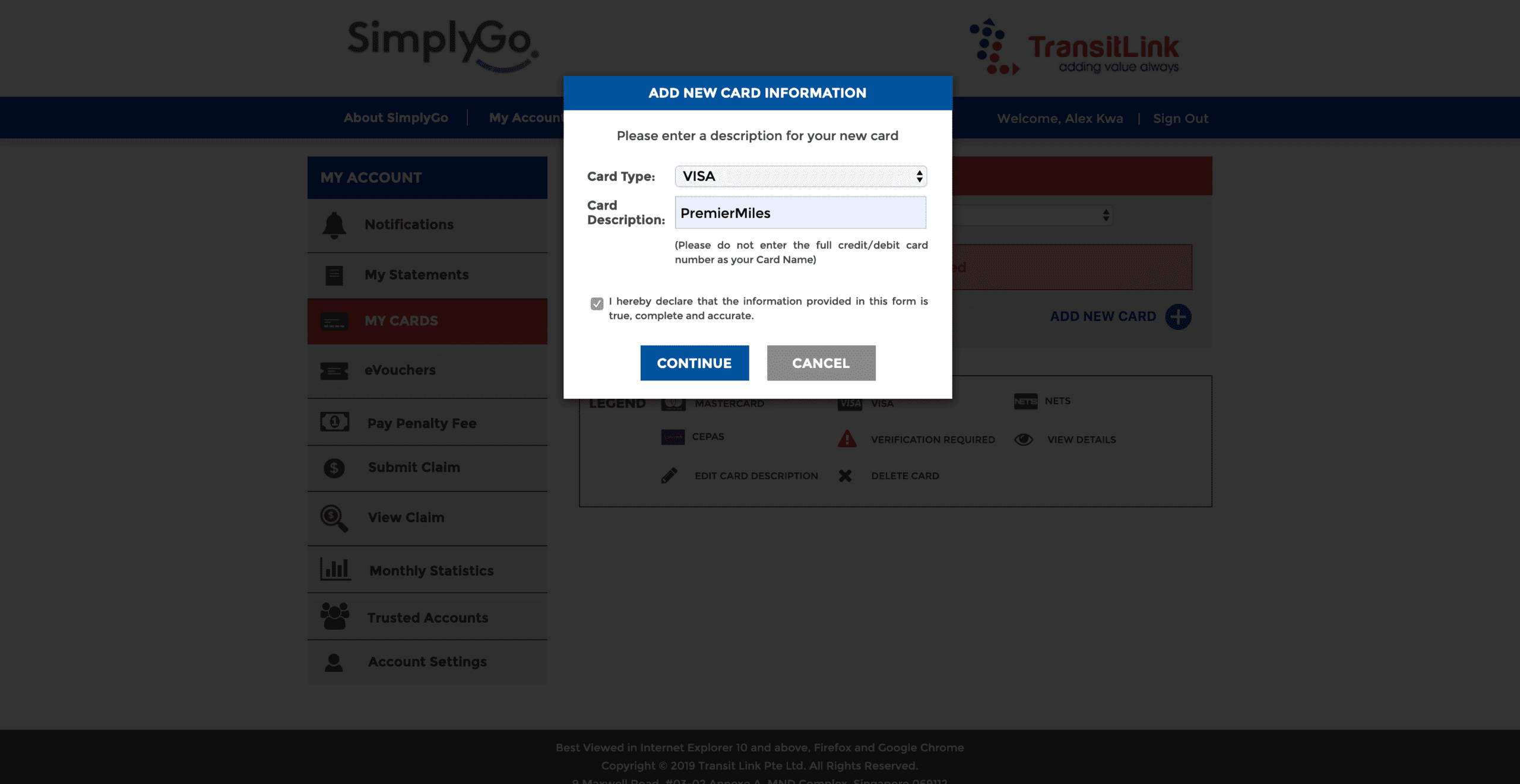

Once you signed up and is logged in, click on MY CARDS in the menu on the right and click on ADD NEW CARD

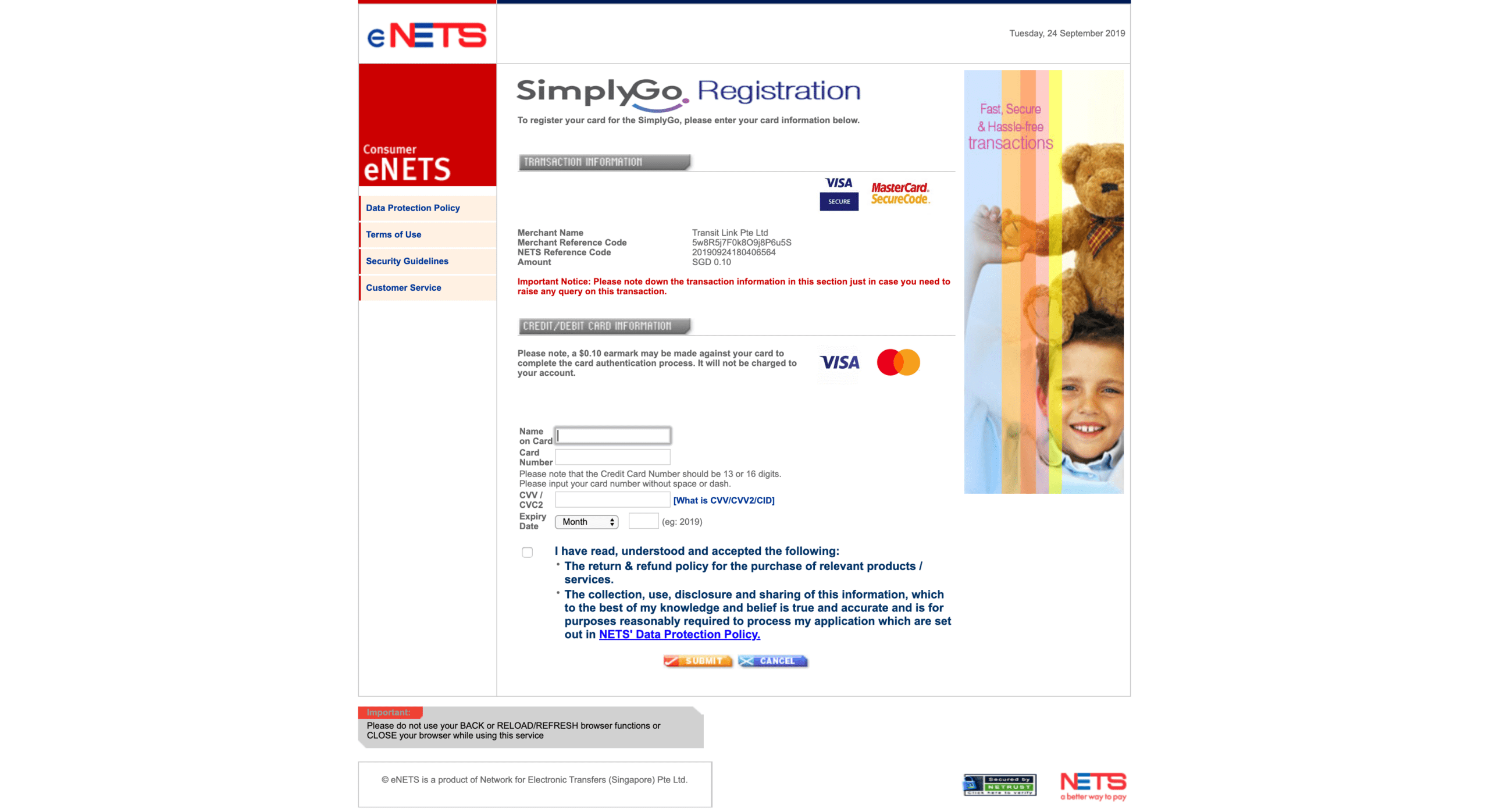

Enter your credit card details and submit the form. Once you complete the authentication, you should get an email confirming that your card has been registered successfully.

I'm pretty impressed that the bus and trains can accept every credit card now. But being used to how Suica works in Japan, it's a bummer that you would have to authenticate each time.

I designed a thing.

I found a 100 year old company that would create these heirloom quality canisters for me. They are handmade and will keep your tea leaves, coffee beans or anything that you need dry for years to come.

or read review

Tagged cashless payment mobile

You may also like

What did park saeroyi wear on itaewon class.

Dress like the legendary Park Saeroyi.

The Art Of Ikizukuri

Food that moves.

5 comments. I would love to hear from you!

XHTML: You can use these tags: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>

Post Comment

Dear, you! Many thanks for sharing. I have set up just as you said in this article that adding my DBS(credit card) card into my Wallet with iphone8. That’s all? Can I use my iPhone to tap in and out? Anything else should I do or just that? Many thanks for your kindness.

Hello Lien,

That’s all you need! Let me know if you encounter any difficulties. Remember that you need to authenticate each time you want to use it.

Hi, wanted to know if it’s possible to use the NFC function on the phone for ezlink cards with concession, I can’t seem to find a solution for this.

I haven’t tried it but I know how concession is set up in Japan. So I would say that you can’t since it requires special integration on SMRT side.

Was just about to set up a SimplyGo acccount before I read your article! Not that I care too much about govt surveillance (I mean if the govt really wants to track your movements they’ll defo find a way to do it), but good to know that’s one less thing I have to sign up for.

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Travel Cards: What are the best options in Singapore? 2024

Whenever you’re planning to spend internationally - in person or online - you’ll want to avoid excessive bank fees, and get the very best available exchange rate. If you’ve heard of international debit cards - also known as travel debit cards - you might be wondering if it’s worth getting one to use instead of your normal card when you travel.

International debit cards can offer some great benefits to anyone living an international lifestyle, allowing you to cut the overall costs of spending in a foreign currency, and access a better exchange rate. This guide walks through the key advantages of international debit cards, how they work, and which cards are the best on offer for customers in Singapore.

Our Top 4 Travel Debit Cards in SG:

Wise Travel Card

HSBC Everyday Global Travel Card

Sainsbury Travel Card

Travel cards: the best options in Singapore

How do travel cards work.

Travel cards work much like your normal bank debit card, but with a focus on overseas transactions. You can use your card to spend while you travel, when you shop online with international retailers, and to make overseas ATM withdrawals. Depending on how you want to use your card, you may also find that a travel debit card lets you cut the costs of international transactions and manage your money across currencies more conveniently.

Types of travel card

Travel cards break down into 3 key categories:

Prepaid travel cards

Travel debit cards

Travel focused credit cards

Each option has its own advantages, but depending on how you want to use it, you’ll probably find that one suits you better than the others. Here are some pointers to consider:

Prepaid travel card

A prepaid travel card - also called a travel money card - may be issued by a bank or a specialist provider. It’s not linked to your normal bank account which makes it pretty secure, but can also make it inconvenient to add money. Prepaid cards may have a broad range of fees, and terms and conditions can vary a lot between providers. Not all merchants and websites accept prepaid cards, so you’d need to have a secondary source of funds when you travel, just in case.

International card with traditional banks

Singaporeans love to travel - and of course Singapore is a popular expat destination too. So it’s no surprise that many banks here offer their own international cards which are linked to accounts with multi-currency capability. We’ll look at one of them - the HSBC Everyday Global account and card in more detail later. DBS also offers the popular My Account which has foreign currency options and a linked card.

Using your own bank’s card when you travel can be convenient - but banks may not offer the best fees and exchange rates. There’s also an inherent risk of using your regular bank card when you’re abroad or spending with an international retailer online - if it’s stolen or cloned your full balance could be at risk.

Travel card with neobanks

Online specialist providers and neobanks also offer a strong range of travel cards which can provide a good balance of cost, security and convenience. They can often be the cheapest option out there, with easy to use online and in-app services, industry level security, and some of the lowest fees available.

Cards are easy to order, with a fully online application and verification process in many cases.

Best travel debit cards: a comparison

There are a few money transfer providers which offer cheaper and more flexible alternatives to the international debit cards commonly issued by traditional banks, like the Wise account and card, which is available for Singapore customers.

We’ll dive into a few strong contenders in a moment - first let’s take a look at some highlights from our 4 top Singapore travel debit cards:

Open a free Wise personal multi-currency account and order the Wise card for a one time fee. You’ll get your card details instantly, and your physical card will be with you in around 3 days. You can hold, convert, send and spend in 50+ currencies from your Wise account - and make payments in 200+ countries and in 150+ currencies with your card.

Pros of the Wise card

Personal accounts are free to open with no monthly fees

Hold and exchange 50+ currencies in your Wise account

Auto convert feature so you always get the cheapest available currency conversion

Freeze and unfreeze your card in the Wise app and get instant transaction notifications

Cons of the Wise card

10 SGD fee for your first card

ATM fees apply if you make more than 2 withdrawals a month

Spending limits apply

No option to top up account in cash or with a cheque

HSBC travel card

HSBC offers its Everyday Global Account which allows customers to hold and manage 11 currencies in their account, and spend on a linked debit card. HSBC doesn’t charge a fee when you spend or withdraw currencies you hold from an in-network ATM - but there may be an exchange fee applied when you switch from one currency to another. These fees can be tricky to spot, as they may be wrapped up in the exchange rates used.

Pros of the HSBC travel card

Hold and manage 11 currencies in your account

Earn cashback on spending and interest on your SGD balance

No HSBC fee for withdrawing currencies you own at an HSBC ATM

Access Global Transfers when you want to send funds overseas

Cons of the HSBC travel card

Minimum balance requirements apply - 2,000 SGD for a standard account

In branch international payments cost 55 SGD

Receiving an inward payments cost 10 SGD

Early close fees apply

Revolut Money Travel Card

Revolut offers several different account plans which can be opened and operated online or in the Revolut app. Get a free standard account, or upgrade to a paid plan to unlock more benefits. All accounts come with a linked debit card, and can hold and handle 28 currencies. You’ll also be able to make withdrawals at ATMs internationally, fee free to 350 SGD for the standard plan, or more for fee paid plans.

Pros of the Revolut travel card

Pick the plan that suits your needs

Covers 28 currencies and lets you spend in 150 currencies with your card

Even free standard accounts come with some impressive perks

Some free currency exchange is offered, depending on your account plan

Cons of the Revolut travel card

Fee paid plans cost up to 19.99 SGD/month

Once you’ve hit your ATM withdrawal limits you pay 2% fees for each withdrawal

Out of hours and exotic currency exchange fees apply

YouTrip travel money card

YouTrip cards can be used to hold 10 currencies, spend and make cash withdrawals. There’s no fee to exchange currencies within the account, but there may be a charge rolled up into the exchange rate applied so it’s worth comparing the rates offered against the Google rate so you know exactly what you’re paying.

Pros of the YouTrip travel money card

Popular and recognized local brand

10 supported currencies

Co-branded with EZLink

Manage your account and card from the YouTrip app

Cons of the YouTrip travel money card

5 SGD cash withdrawal fee

Exchange rate markups may apply when you convert from one currency to another

Fees apply when you top up with a credit card

10 SGD fee for replacement cards

How does the travel card work?

Whenever you spend or make a cash withdrawal with your travel card, the money will be deducted from your account balance, which means there’s no interest cost to worry about, and no chance you can accidentally blow your travel budget. However, by choosing a travel card instead of a normal bank card, you’ll often be able to hold your account balance in different currencies, like US dollars or British pounds.

Top up your account in Singapore dollars and switch to the currency you need when you need it - or look out for a great rate and convert in advance so you’re making the most of your money. Holding foreign currency on your travel card makes it convenient to spend internationally, and means you’ll know in advance exactly how much foreign currency you have to enjoy when you travel.

It’s normally easy to get a travel card through an app, website or by calling a provider. Travel cards are also secure as they’re not usually linked to your primary bank account, and mean there’s no need to tell your normal bank you’re heading off overseas.

How can I use a travel debit card abroad?

Use your travel debit card internationally just as you would use your normal card here in Singapore. Travel cards often come with handy contactless and mobile functionality to tap and pay wherever you are.

You’ll need to make sure your card’s network is accepted by the merchant or ATM - look out for the network symbol, like Visa or Mastercard, which will be displayed. You’ll also want to double check all costs of using your card in advance, as these can vary somewhat by provider. And finally, remember to pay in the local currency when you’re abroad. That’s important to avoid dynamic currency conversion (DCC) which is where you’re charged overseas in Singapore dollars, which sounds convenient, but actually means extra fees and a bad exchange rate.

How to request a travel debit card

You may choose to get a specialist international debit card from your normal bank, or through an online and digital provider like Wise or Revolut . Providers like these allow you to open an account easily with a 100% online onboarding process.

To give an example, here’s how to get a Wise card in a few simple steps:

Download the Wise app or head to the Wise desktop site

Sign up for a Wise account with just an email address, Google, Facebook or Apple ID

Get verified using your Singpass and Myinfo - or by manually uploading a photo of your ID documents

Order your card online or in the Wise app for a one off 10 SGD fee

Your physical card will arrive within a few days - or you can access your card details in the Wise app right away for mobile payments

What are the transaction fees applied to a travel card?

There are a few different common types of travel card - which we’ll run through in just a moment. Each has its own fees, but there are a couple of common charges it’s worth looking out for, no matter which card you choose:

Exchange fee

An exchange fee - which can be called a currency conversion charge, a margin or a spread, among other things - covers the costs of exchanging currency for international spending. In some cases this fee is split out so you can clearly see it - but often it’s a cost added into the exchange rate, which is less transparent and means you’ll have to double check the rates applied against the Google rate to see how much it’s costing you.

Withdrawal fee

Even if you hold the currency you need in your account, you might still need to pay a withdrawal fee when you get cash from an ATM. Your bank might add a charge for this service, and there may also be an extra cost added by the ATM operator itself. Keep an eye on the ATM to see any extra charges, as these are usually disclosed during the transaction, or in a notice displayed on the ATM terminal.

Advantages of the travel debit cards

An international debit card can be a good alternative to traditional bank cards to spend money abroad. Here are some of the benefits you can expect:

Depending on the card you pick you may get lower fees and a better exchange rate

It’s easier to set and plan your budget ahead of time by converting currency in advance

Travel cards aren’t usually linked to your normal bank, making them relatively secure

Manage your money on the go through handy mobile apps

Are there any limitations on the travel debit card?

Of course, travel debit cards also have some drawbacks, which may not make them the best choice for everyone. Here are a few things to consider:

You often can’t use a debit card to pay a security deposit or hire a car

Travel cards do come with their own fees - you’ll need to review these before selecting one

Deposits to your account may not apply instantly

Many travel cards don’t offer cash back or interest on funds held

Conclusion: is the travel debit card worth it?

Travel debit cards are a useful tool for many people who travel or spend internationally . They can offer a more flexible and convenient way to manage money across several different foreign currencies, compared to using a normal bank account. Different travel debit cards are available for different customer preferences - use this guide to kickstart your research to find the perfect travel card for your needs.

An international debit card lets you spend and make cash withdrawals in a range of foreign currencies - often with lower fees than using your normal bank card.

Many online and specialist providers allow you to apply for a card easily through a desktop site, app or call centre.

Use your travel debit card just like you would your regular card, to spend and make cash withdrawals around the world.

Travel debit card fees do vary based on the provider, and can include ATM charges, early closure fees and exchange rate markups. Compare a few providers to get the best available deal for your needs.

Personal | Business

Source: Average exchange rate including transaction and additional fees.

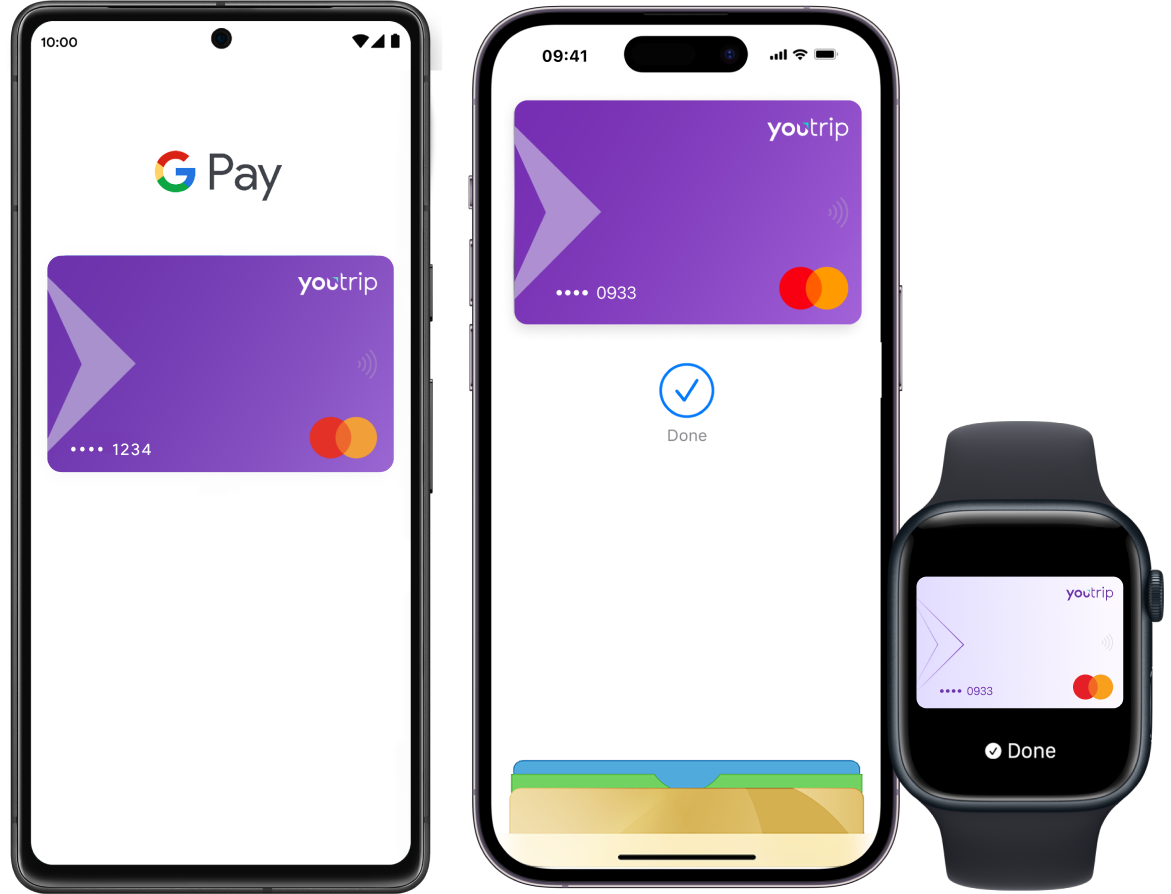

Seamless payments, now upgraded with Apple Pay and Google Pay, be it online or in-store.

Who says no to more cashback and offers?

Get more out of your YouTrip experience with great deals and savings on your favourite brands with YouTrip Perks!

Stay up to date with the latest news, announcements and articles.

Download Youtrip

© 2023 You Technologies Group Limited. All Rights Reserved.

Up to 10% tax free + 5% additional discount

- Valid till 01 Oct 2024

- Flash this at the payment counter & pay with YouTrip during checkout in store

- Enjoy additional 5% discount with min 10,000 yen (JPY) spent excluding tax

- We want to help you get your discount! 1. Ensure that you follow through with your purchase once you click on “Redeem Deal” on YouTrip Perks. 2. If you jump out of the check-out process (even if to check on a message or just happen to close your browser), click through YouTrip Perks again to re-purchase to get your discount.

- Valid until 01 October 2024.

- [Japanese temporary returnees] who purchased tax-free goods are eligible for the coupon.

- Foreign diplomat(s) are not eligible for tax exemption.

- Eligible Stores: Don Quijote, APITA, and PIAGO Stores in Japan (Excluding some stores)

- Tap the coupon banner below to go to the barcode screen.

- Present the coupon screen to the cashier staff at the time of payment.

- Last, tap the “Use Coupon” button.

- This coupon is valid only once for tax-free transactions of 10,000 yen (excluding tax) or more.

- Please note that the following items are not included & eligible for the discount: Alcohol, cigarettes, POSA cards, game consoles, products costing more than 100,000 yen (excluding tax), and products with price restrictions, etc.

- Please be sure to present the coupon at the time of payment.

- Please note that the discount cannot be applied if the coupon is presented after payment has been completed.

- Please note that the coupon is unaccessible from mobile screenshots.

- This coupon cannot be used with other discounts, services, or majica cards.

- Any outstanding balance after deducting the face value of the coupon must be paid in full using YouTrip Card.

- The offer is subject to terms and conditions of Don Quijote. In case of dispute, the decision of Don Quijote and YouTrip shall be final.

Up to 9% cashback at Charles & Keith!

9% cashback (New Charles & Keith users)

- Valid till 31 December 2023

- Pay with YouTrip during checkout

- Receive cashback within 45 days after checkout

3% cashback (Existing Charles & Keith users)

- Valid from 31 December 2023

- We want to help you get your cashback! 1. Ensure that you follow through with your purchase once you click on “Redeem Deal” on YouTrip Perks. 2. If you jump out of the check-out process (even if to check on a message or just happen to close your browser), click through YouTrip Perks again to re-purchase to get your cashback.

- Only purchases made through the Charles & Keith affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Charles & Keith whenever you are making a new transaction.

- Purchase must be made within the same window.

- Cookies must be enabled on your browser for cashback to be tracked.

- Cashback will not be awarded for cancelled or refunded orders.

- Cashback will be awarded after 45 days from the date of purchase.

- Cashback rate will be subjected to the merchant’s discretion and the eligibility of selected products.

- Cashback rate for Charles & Keith varies for each item and the exact cashback rates would only be known when the item is successfully tracked.

- Purchases made via the Charles & Keith mobile app will not be eligible for cashback.

8% off at SGPomades!

$8 off min S$50 spend

- Valid till 31 December 2021

- Pay with YouTrip and apply code 'YOUTRIP8' during checkout

- Enjoy 8% off min S$50 spend upon checkout

- Promo code only applicable when using your YouTrip Mastercard upon checkout.

- 1 redemption per customer only

- Promo codes are not exchangeable for cash.

- Valid only for original price items.

- Not stackable with existing promotions.

- Exclusions Apply.

3% cashback at Dyson!

3% cashback

- Only purchases made through the Dyson affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Dyson whenever you are making a new transaction.

- Dyson accessories will not be eligible for cashback.

4% cashback at UNIQLO!

4% cashback

- Only purchases made through the UNIQLO affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to UNIQLO whenever you are making a new transaction.

Up to 6% cashback at Trip.com!

Up to 6% cashback

- Receive cashback 45 days after checkout

- Only purchases made through the Trip.com affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Trip.com whenever you are making a new transaction.

- Cashback rate will be subjected to the merchant’s discretion and the eligibility of selected activities.

- Cashback rate for Trip.com varies for each item and the exact cashback rates would only be known when the item is successfully tracked.

- Please refer to the table below for full cashback rates.

25% off at HOUZE!

25% off min $60 spend

- Pay with YouTrip and apply code 'YOUTRIP25' during checkout

- Enjoy 25% off min $60 spend upon checkout

- Only 1 promo code may be used at a time.

25% off at Table Matters!

Up to $260 cashback and KrisShop e-Vouchers at Singapore Airlines!

$20 cashback with min $500 spend

- Valid till 26 November 2021

- Pay using YouTrip at checkout

- Register through YouTrip's campaign registration form

- Enjoy up to 4x cashback rewards per booking

- Receive cashback by 31 December 2021

- Limited to the first 1,000 redemptions

- Only bookings made via the SIA website, Mobile App or selected list of SIA appointed travel agents within the campaign period and redemption limit will be eligible for cashback.

- For full T&Cs, please visit https://www.you.co/sg/youtrip-singapore-airlines-cashback-tnc/

$30 KrisShop e-Voucher with min $500 spend

- Enjoy up to 6x KrisShop e-Vouchers per booking

- Limited to the first 4,000 redemptions

- Only bookings made via the SIA website, Mobile App or selected list of SIA appointed travel agents within the campaign period and redemption limit will be eligible for KrisShop e-Voucher rewards

- Offer is strictly applicable to flights to and from the following destinations only: Frankfurt, Munich, Amsterdam, Barcelona, Copenhagen, London, Los Angeles, Milan, New York, PAris, Rome, San Francisco, Seattle or Vancouver

- For full T&Cs, please visit https://www.you.co/sg/youtrip-singapore-airlines-krisshop-tnc/

Up to 10% off at Expedia!

Up to 10% off

- Valid till 30 Jun 2023

- Pay with YouTrip and apply code 'MASTER10' during checkout

- Enjoy 10% off (Capped at S$70) upon checkout

- Booking period Now till 30 Jun 2023

- Stay period: Now till 31 September 2023

- Participating “Expedia Rate” hotels refer to hotels labelled “Expedia Rate” and are not on the exclusion list available at the booking page.

- Up to 10% discount coupon on hotel bookings at thousands of participating properties globally. 10% savings with promo code MASTER10 – Singapore: Discount value capped at SGD70 per transaction

- No minimum stay requirement.

- Coupon only applies to first room in the booking.

Up to 6% cashback at JD Sports!

6% cashback (Regular-priced items)

2% cashback (Sale Items)

- Only purchases made through the JD Sports affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to JD Sports whenever you are making a new transaction.

- Cashback rate for JD Sports varies for each item and the exact cashback rates would only be known when the item is successfully tracked.

Up to 5% cashback at ASOS

Up to 5% cashback (New ASOS users)

3% cashback (Existing ASOS users purchases via Web)

2% cashback (Existing ASOS users purchases via App)

- Only purchases made through the ASOS affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to ASOS whenever you are making a new transaction.

10% off at SweatSpot!

10% off all packages

- Valid till 12 April 2022

- Pay with YouTrip and apply code 'YOUTRIP' upon checkout

- Enjoy 10% off upon checkout

10% cashback at Taobao!

10% cashback with min S$50 spend

- Valid till 31 January 2022

- Register and spend a minimum of $50 and pay with YouTrip during checkout

- Register for promotion here

- For first 750 users only

- 10% cashback with minimum spend of $50.

- Limited to the first 750 users on a first come, first served basis.

- Payment must be charged to a YouTrip Mastercard.

- The required minimum spend must be in a single transaction before any other promo codes, vouchers or coupons. Minimum spend excludes all taxes and fees, including but not limited to shipping and handling, unless otherwise stated.

- All purchases made in conjunction with the Offer are subject to prevailing taxes and service charges where applicable.

- YouTrip makes no warranty or representation as to the quality, merchantability or fitness for purpose of any goods or services purchased from the merchant. Any dispute about the same must be resolved directly with the merchant.

- YouTrip shall not be responsible for any loss, injury, claim, damage or expense arising from the redemption of the Offer or the use of the goods and services purchased from a merchant.

- YouTrip is not an agent of Taobao or any merchant, or vice versa.

- All information is correct at time of print. YouTrip will not be responsible for any changes which occur after print.

- YouTrip reserves the right to vary the terms and conditions of the Offer or withdraw or discontinue the Offer by providing written notice to the other party at least 7 days in advance and indemnify the direct economic loss of the other party caused by YouTrip’s behavior under the clause.

Up to 10% cashback at Shopee!

Up to 10% cashback (New Shopee users)

3% cashback (Existing Shopee users)

- All cashback will be capped at S$5.00

- Only purchases made through the Shopee affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Shopee whenever you are making a new transaction.

- Cashback rate for Shopee varies for each item and the exact cashback rates would only be known when the item is successfully tracked.

- Please refer to the table below for product cashback rates

Up to 7% cashback at Sephora!

7% cashback (New Sephora users)

2.5% cashback (Existing Sephora users)

- Only purchases made through the Sephora affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Sephora whenever you are making a new transaction.

$20 cashback at Circles.Life!

$20 cashback (For new Circles.Life customers)

- Only purchases made through the Circles.Life affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Circles.Life whenever you are making a new transaction.

- Not applicable for purchases made via the Circles.Life mobile application

Up to 12% cashback at AirAsia Food

12% cashback (New AirAsia Food Customers)

- Valid till 31 December 2022

6% cashback (Existing AirAsia Food Customers)

- Only purchases made through the AirAsia Food affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to AirAsia Food whenever you are making a new transaction.

10% cashback (New Lazada users)

- Valid till 31 December 2024

3% cashback (Existing Lazada users)

- Pay with YouTrip on Lazada (LazMall excluded) during checkout

- Only purchases made through the Lazada affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Lazada whenever you are making a new transaction.

- Cashback rate for Lazada varies for each item and the exact cashback rates would only be known when the item is successfully tracked.

- Products not eligible for cashback: Sports shoes and clothing, Electronics Accessories, Groceries.

- Cashback capped at $10

10% cashback at Puma!

10% cashback

- Valid till 30 Dec 2023

- Only purchases made through the Puma affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Puma whenever you are making a new transaction.

15% off at iShopChangi

15% off with no min. spend (For traveller purchases only)

- Pay with YouTrip and apply code 'YOUTRIP15' during checkout

- Enjoy 15% off with no min. spend

- Valid for traveller purchases only.

- Payment must be made with YOUTRIP Mastercard.

- Only one Promo Code may be used at a time.

- Promotion is valid until 31 December 2023.

- Promotion is not exchangeable for cash, prizes, products or other vouchers.

- Promotion is not valid in conjunction with privilege holder discounts.

- Chanel and Dior are excluded from this promotion.

- The Shilla Duty Free reserves the right to amend or withdraw any terms & conditions without any prior notice.

S$15 off at The Shilla!

S$15 off min S$150 spend in store

- Flash this at the counter and pay with YouTrip during checkout in store

- Enjoy S$15 off min S$150 nett spend

- Valid until 31 December 2022.

- Limited to one redemption per customer.

- Any outstanding balance after deducting the face value of the voucher must be paid in full using YouTrip Card

- The promotion must be fully utilised and any unutilised amount will be forfeited.

- Not exchangeable for cash, prizes, products or other vouchers.

- Not valid in conjunction with privilege holder discounts.

5% cashback at Chemist Warehouse!

5% cashback

- Only purchases made through the Chemist Warehouse affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Chemist Warehouse whenever you are making a new transaction.

Up to 10% off at Qatar Airways!

Up to 10% off

- Click through to Qatar via YouTrip Perks, apply code 'YTQR23' & Pay with YouTrip during checkout

- Enjoy up to 10% off upon checkout

- Sales period: 8 May 2023 – 31 December 2023

- Travel period: 8 May 2023 – 31 March 2024

- Booking must be made using promo code YTQR23 to avail of the discount

- Full payment must be made with a YouTrip Card

- Save 10% on Business Class Comfort fares

- Save 10% on Economy Class Convenience fares

- Save 7% on Economy Class and Business Class Classic fares

- Valid only on Qatar Airways flights from Singapore

- Valid to the following destinations: Abu Dhabi, Almaty, Amsterdam, Ankara, Athens, Atlanta, Baku, Barcelona, Belgrade, Berlin, Boston, Brussels, Bucharest, Budapest, Cape Town, Casablanca, Chennai, Chicago, Copenhagen, Dallas, Dar Es Salaam, Doha, Dubai, Dublin, Durban, Edinburgh, Frankfurt, Geneva, Harare, Helsinki, Houston, Islamabad, Johannesburg, Kilimanjaro, Larnaca, London, Los Angeles, Lusaka, Luxor, Madrid, Malabo, Manchester, Medina, Miami, Milan, Mombasa, Montreal, Moscow, Mumbai, Munich, Nairobi, New York City, Oslo, Paris, Philadelphia, Pisa, Prague, Rome, San Francisco, Sao Paulo, Seattle, Seychelles, Sharjah, Sofia, St Petersburg, Stockholm, Tbilisi, Venice, Vienna, Warsaw, Washington, Windhoek, Yerevan, Zagreb, Zanzibar, Zurich

- All-in fares include all taxes, fees, and surcharges which are subject to currency fluctuation

- Blackout dates and surcharges may apply. Please refer to the fare rules for details at the time of booking.

- Blackout Periods: 18 Nov – 20 Dec 2022 (Doha and Middle Eastern Countries), 1 Jan – 10 Jan 2023 (All destinations)

- Peak period surcharges may apply

- Fares are subject to change without prior notice

- Discount applies to return base fare only of selected fare classes

- Discount does not apply to taxes and all other surcharges

- Seats are limited and are subject to availability of the relevant booking class

- Minimum and maximum stay as well as advance purchase rules apply dependent on the booking class

- Please refer to the fare rules at the time of booking for changes, cancellations and no-show conditions

- Any change or cancellation less than 3 hours prior to the stated time of departure will be considered as no-show

- For travel involving multiple booking classes, the most restrictive fare rules apply to the entire itinerary

- Standard child/infant discount apply

- Please note that market-specific promotional fares may be available for selected dates and destinations, and may not be eligible for the discounts under this offer. All available options, together with the applicable terms & conditions for each fare will be displayed at time of booking for you to make your selection

- Qatar Airway’s terms and conditions will also apply to your booking, please review these at the time of booking

- Other terms and conditions apply. Please review at the time of booking

2.1% cashback at Watsons!

2.1% cashback

- Only purchases made through the Watsons affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Watsons whenever you are making a new transaction.

- Cashback rate for Watsons varies for each item and the exact cashback rates would only be known when the item is successfully tracked.

3% cashback at 24S!

- Only purchases made through the 24S affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to 24S whenever you are making a new transaction.

- Celine, Louis Vuitton and Dior products are not eligible for cashback.

8% cashback at On The List!

8% cashback

- Only purchases made through the On The List affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to On The List whenever you are making a new transaction.

- Purchases made via the On The List mobile site or app are not eligible for cashback.

5% cashback at AirAsia Grocer!

- Only purchases made through the AirAsia affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to AirAsia whenever you are making a new transaction.

Up to $12 off at FairPrice Online!

$10 off min $135 spend

- Valid till 22 December 2021

- Pay with YouTrip and apply code 'MCXMAS21' during checkout

- Enjoy $10 off min $135 spend

- First 2,500 redemptions only

$12 off min $150 spend

- Enjoy $12 off min $150 spend

- Redemption of promo code is applicable only for purchases made on FairPrice online at www.fairprice.com.sg and FairPrice Mobile App upon login, and for home delivery only.

- Only one promo code can be used for each transaction. FairPrice reserves the right to reject any order that has violated this.

- Promo code is to be used for one-time redemption only.

- Promo code cannot be used for the purchase of certain restricted products, for example, certain infant milk formulas. Please visit FairPrice online for more details.

- Qualifying spend refers to a nett spend of at least S$135.00 (excluding delivery fee, service fee, and any other surcharge) in a single transaction at NTUC FairPrice online during the promotional period.

- Using a promo code in conjunction with other free gift promotions, may alter the minimum amount for delivery.

- Additional charges, service fees and minimum nett purchase amount for free home delivery may be required and may differ for promotional periods and will be in accordance to that stated on FairPrice online.

- It is advisable to have at least S$5 nett purchase amount in cart after application of promo code in order to be able to checkout.

- Promo codes are not exchangeable or refundable for cash or other goods and services.

- FairPrice reserves the rights to vary/amend the privileges or terms and conditions of this promotion without prior notice.

- Other terms and conditions on FairPrice online (https://help.fairprice.com.sg/hc/en us/categories/360001184571-FairPrice-Online) apply.

- Mastercard does not assume any responsibility for the products and services offered under this promotion. The products are sold and services are provided solely by the relevant vendors, under such terms and conditions as determined by such vendors, and Mastercard accepts no liability whatsoever in connection with such products and services. The products and services have not been certified by Mastercard and under no circumstances shall the inclusion of any product or service in this promotion be construed as an endorsement or recommendation of such product or service by Mastercard

2% cashback at Razer!

2% cashback

- Only purchases made through the Razer affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Razer whenever you are making a new transaction.

- Cashback rate for Razer varies for each item and the exact cashback rates would only be known when the item is successfully tracked.

20% off at Zoey!

20% off supplements

- Pay with YouTrip and apply code 'ZOEYYT' during checkout

- Enjoy 20% off supplements upon checkout

20% off at noah!

- Pay with YouTrip and apply code 'NOAHYT' during checkout

$19 cashback at Starhub!

$19 cashback (For new broadband signups)

- Only purchases made through the Starhub affiliate link provided by YouTrip will be eligible for cashback.

- Return to YouTrip Perks and clickthrough to Starhub whenever you are making a new transaction.

- Only new broadband sign-ups are eligible for cashback

$10 off at Beauty Emporium!

$10 off (No min spend)

- Valid till 30 November 2021

- Pay with YouTrip and apply code 'YOUBF10' during checkout

- Enjoy $10 off upon checkout

- Limited to one time use per transaction.

- Discount will be given to total bill spend. Discounted products and services are eligible for this redemption.

- Discount cannot be used in Strip Merchandise and Clean Beauty Brands.

- Shipping fees apply if the minimum spend for free shipping is not met.

- Cannot be used in-conjunction with any other voucher, codes or redemption of Beauty Rewards points.

- Promotion ends on 30 Nov 2021 2359 hrs.

Tell us more about your business

*By clicking ‘Submit’, you hereby agree and acknowledge that your information will be stored and managed in accordance to YouTrip’s Privacy Policy .

If a payment card that you use with Apple Pay is declined

If a payment card that you use with Apple Pay is declined or doesn't work when you try to make a purchase, check to see whether your card can be used with Apple Pay.

On your device, go to the Wallet app or Wallet & Apple Pay settings:

On your iPhone, open the Wallet app.

On your iPad or Apple Vision Pro, go to Settings > Wallet & Apple Pay.

On your Mac with Touch ID, choose Apple menu > System Settings (or System Preferences), then click Wallet & Apple Pay.

Select your payment card.

If you see the message "This card cannot be used", check whether your bank or card issuer currently supports Apple Pay:

Apple Pay-participating banks in Canada, Latin America and the United States

Apple Payparticipating banks in Africa, Europe and the Middle East

Apple Pay-participating banks and card issuers in Asia-Pacific

If you have any other questions, please contact your bank or card issuer.

Related topics

Contact Apple Support

Need more help? Save time by starting your support request online and we'll connect you to an expert.

Adding Transit Card to Apple wallet

I'm trying to add a transit Suica card to my Apple wallet, but it's not letting me pay for it using either Face ID or passcode for my Credit Card stored on my Apple Wallet. Can someone help.

Posted on Apr 22, 2024 11:00 AM

Loading page content

Page content loaded

There are no replies.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Apple Card Review: Extra Rewarding for Apple Fans

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

It's not a game-changer, but the card does offer some intriguing features, including the ability to finance expensive Apple products with an interest-free payment plan.

Rewards rate

Bonus offer

Ongoing APR

APR: 19.24%-29.49%, Variable

Foreign transaction fee

- *Variable APRs for Apple Card range from 19.24% to 29.49% based on creditworthiness. Rates as of February 1, 2024. Existing customers can view their variable APR in the Wallet app or card.apple.com.

- Approval Odds are statements and determinations by NerdWallet and not those of Goldman Sachs Bank USA.

- See if you’re approved for Apple Card with no impact to your credit score.¹

- Created by Apple and built for iPhone. Designed to be private and secure.

- No fees.² No annual fees, foreign transaction fees, late fees, or any other fees.³

- Unlimited Daily Cash back on every purchase, every day. It’s real cash⁴ that never expires or loses value.

- Now, you can automatically grow your Daily Cash when you open a high-yield Savings account.⁵ Savings provided by Goldman Sachs Bank USA. Member FDIC.

- Apple Card Family allows you to share the benefits with anyone you call family.⁶

- Apple-designed, laser-etched titanium card that is accepted all over the world with the Mastercard payment network.

- 3% back on anything you buy from Apple, and at select merchants like Uber, Nike, Walgreens and more when you use Apple Card with Apple Pay.⁷

- 2% back when you use Apple Card with Apple Pay. Apple Pay is accepted at over 85% of retail locations in the U.S.

- Apply in minutes and use it right away.⁸

- ¹²³⁴⁵⁶⁷⁸Select “View Rates and Fees” to see offer, benefit terms, and important disclosures.

No annual fee

High rewards rate

Cash rewards

No bonus offer

Restricted 0% intro APR offer

When Apple announced in 2019 that it was launching a new Apple-branded credit card , some fans may have hoped it would reinvent how we pay for things. But the product's features make it the credit card equivalent of a Red Delicious: bright, shiny and appealing, if somewhat bland once you take a bite.

The $ 0 -annual-fee Apple Card earns 3% cash back on Apple purchases, as well as at a handful of eligible merchants and through select apps, and 2% back on everything else — but only if you make your purchases via Apple Pay on your iPhone. If you use the physical version of the card, which is an option at retailers that don’t accept Apple Pay, you’ll earn only 1% cash back.

As far as rewards rates go, what the Apple Card offers is pretty standard. Still, despite a crowded market of cash-back cards , consumers may be able to find room in their digital wallets for this one, especially for pricey Apple purchases.

The Apple Card is issued by Goldman Sachs and is different from the credit card formerly known as the Barclaycard Visa with Apple Rewards , which stopped accepting applications in late 2020.

» MORE: Apple Card: What's helpful and what's hype

Apple Card : Basics

Card type: Cash back .

Annual fee: $ 0 .

Sign-up bonus: None .

3% cash back on Apple purchases and at select merchants including Nike, Uber, Walgreens and more, when you use the Apple Card with Apple Pay.

2% cash back on all other purchases when you use the Apple Card with Apple Pay.

1% cash back on purchases made with the physical Apple Card .

Redemption options: Rewards are earned in the form of Daily Cash , which can be:

Redeemed for a statement credit.

Sent to Apple Cash for spending or sending to others through the iPhone's Wallet app.

Deposited into Apple Savings , an interest-earning account in Apple Wallet.

Interest rate: The ongoing APR is 19.24%-29.49%, Variable . (However, the card allows you to pay for Apple purchases over time, interest-free, with Apple Card Monthly Installments .)

Foreign transaction fee: None.

Other benefits:

Share an account with others in your household with Apple Card Family .

Higher cash-back rates for Apple Pay purchases

The Apple Card earns a respectable 2% back on purchases made through Apple Pay, and 3% back at participating merchants through Apple Pay.

Here's a quick look at the Apple Card 's rewards categories:

Get preapproved without affecting your credit score

You can see whether you qualify for the Apple Card — and what terms you qualify for, like credit limit and interest rate — without a hard credit pull . If you’re happy with the offer, you can accept it and continue with your card application. At that point, you will be subject to a hard pull, which can temporarily affect your credit scores.

» MORE: Credit cards that offer preapproval without a hard pull

Instant access to rewards

Cash-back rewards, called Daily Cash, are credited daily as the name implies. Daily Cash can be used more or less immediately . Unlike many other rewards cards, you don't need to wait until your billing cycle closes.

You can choose a few ways to redeem your Daily Cash. The default is a statement credit toward your Apple Card balance. You can also opt to spend your rewards by sending them to Apple Cash in your Wallet app. From there, you can pay your Apple Card bill, shop with Apple Pay or send money to someone else. If you’d prefer to stash away your Daily Cash, you can set up an interest-earning Apple Savings account, which is provided by Goldman Sachs, and park your rewards there.

» MORE: Apple Daily Cash: What it is and how it works

Ability to share card account

With Apple Card Family , you share one card account with up to five other people. You can designate a co-owner, who is equally responsible for paying the bills, and authorized users (called "participants"). Account activity is reported to all three major credit bureaus for co-owners, as well as for participants who are 18 or older and opt in to credit reporting. Each member of an Apple Card Family group earns Daily Cash through their purchases and gets to keep the cash back they earn. This is unlike many other authorized user arrangements, where earned rewards go to the primary cardholder.

Pay for Apple purchases over time

When you use your Apple Card in Apple stores, on the Apple website or in the Apple Store app, you can choose to pay over time with Apple Card Monthly Installments . This is an interest-free payment plan, and you’ll still earn 3% Daily Cash back on the total purchase upfront. The monthly installment is added to the minimum payment due on your card.

No late fees

Apple says you won't be charged a penalty rate or a late fee should you miss a payment. The company does, however, note that "late or missed payments will result in additional interest accumulating toward the customer’s balance." Regardless, NerdWallet recommends making payments in full and on time because late payments can hurt your credit scores .

Lower cash-back rate with physical card

The 2% cash back on most purchases matches many of the highest flat-rate cash-back cards on the market. But it comes with a big asterisk, because you must use Apple Pay to get elevated rates. Some major retailers, including Walmart, don’t accept Apple Pay. This is to say nothing of the much smaller merchants where you may run into issues: food trucks, mom-and-pop stores, bodegas and others simply may not be equipped to handle Apple Pay.

That leaves the physical card as your only option. As nicely designed as it is, it earns only 1% back on purchases. That's just not competitive when the industry standard is at least 1.5% .

Limited 3% Daily Cash categories

You may pony up for a new MacBook Pro once every few years, but if your everyday spending doesn’t happen at one of the participating merchants that earn 3% Daily Cash, other cash-back cards may make more sense. Maybe the bulk of your spending is on groceries and gas, but you don’t frequent Exxon stations. The Blue Cash Preferred® Card from American Express earns 6% cash back at U.S. supermarkets, on up to $6,000 a year in spending (then 1%); 6% cash back on select U.S. streaming subscriptions; 3% cash back at U.S. gas stations and on transit (including such things as taxis, rideshares, parking, tolls, trains and buses); and 1% cash back on all other purchases. Terms apply (see rates and fees ). Or perhaps you hit the town regularly? The Capital One SavorOne Cash Rewards Credit Card earns 3% cash back on dining, grocery stores and entertainment, including streaming services, and 1% elsewhere.

Read through Nerdwallet's full list of best credit cards for more options.

Few upfront incentives

Unlike many other cash-back credit cards, the Apple Card doesn't offer a rich sign-up bonus worth hundreds of dollars. Occasionally, the card will feature modest welcome offers, but they're infrequent and unpredictable. Compare that to what you'd get with a competitor like the Wells Fargo Active Cash® Card . It earns 2% back on every purchase, everywhere, no Apple Pay necessary — and it comes with a sign-up bonus: Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

Also, while the card does feature interest-free financing options for multiple Apple-branded devices and accessories, there’s no 0% introductory APR offer on other kinds of purchases. The ongoing APR is 19.24%-29.49%, Variable . This is not an ideal card if you need to carry a balance. A card with a lengthy 0% intro APR offer on all purchases would be a better option.

» MORE: Can I do a balance transfer with an Apple Card?

If you have some Apple product purchases in mind and use Apple Pay frequently at checkout, the Apple Card 's instant access to earned Daily Cash is appealing. But other cash-back cards may be more rewarding, depending on where you shop the most, especially if you don’t use Apple Pay often.

Earn 2% cash back on all purchases without the requirement to use Apple Pay. The card also offers a sign-up bonus and 0% APR promotion for purchases and balance transfers.

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

Frequently asked questions

You can apply for the Apple Card through the Wallet app in minutes. If approved, you’ll be shown the card terms you qualify for, including credit limit and APR. If you accept those terms, you can continue with the application process.

Your credit limit is determined by the information you provide in your application. Goldman Sachs, the issuer of the Apple Card, uses your credit score, income, debt obligations and other information when deciding whether to accept your application.

The Apple Card offers a preapproval, meaning you can see if you’d qualify for the card without affecting your credit score. If you accept the offer and proceed with the application, you’ll be subject to a hard credit inquiry, which can temporarily lower your score.

Apple Pay is a payment service you can use to make contactless purchases. You can use Apple Cash, the Apple Card, or any other credit or debit cards with Apple Pay. You must add cards to your Wallet app to use them with Apple Pay.

The Apple Card is a credit card. It can be used with Apple Pay from the Wallet app. You can also use the physical version of the card if a merchant doesn’t accept Apple Pay.