- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, use our currency converter, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans. You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important, as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions, so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

- Money Transfer

- Rate Alerts

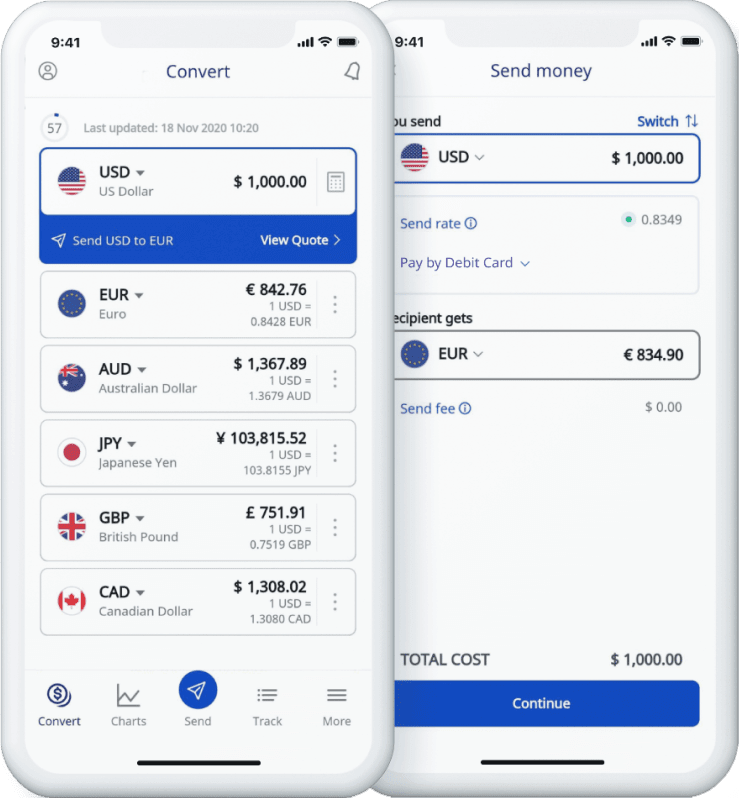

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 113 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

Travel money guide

Compare fees, convenience, rewards and more between three key payment methods..

- Online shopping

Traveling overseas involves a lot of planning — and that includes your money.

What is travel money?

Travel money, for lack of a better term, essentially means the options of credit cards, debit cards, prepaid cards and foreign currency — all designed for travel and foreign transactions. Each form of travel money has different pros and cons, so you’ll want to compare and contrast before choosing which’ll be best for you and your itinerary.

Compare travel money options

Compare the fees, convenience, rewards and more between prepaid travel cards, credit cards, debit cards and foreign currency while planning how you’re going to pay for food, souvenirs and other goods on your next trip.

How to decide which type of travel money is best for you?

Prepaid travel cards, credit cards and debit cards can all be effective ways to pay while you’re traveling. In fact, a combination of the three might be the safest and most convenient way to have all your bases covered. But the travel money you should embrace as your primary payment method depends on your situation:

Pick a credit card if…

- You travel frequently and want to earn rewards. Whether you’re a hotel fiend, a frequent flyer or just love earning cash back, a travel credit card can be the gift that keeps on giving — as long as you keep spending. Just make sure you have a plan for paying your balance in time.

- You want a safety net in case of emergencies. Even if it isn’t your primary payment method, keeping a travel credit card in your back pocket can help cover any unexpected expenses.

Pick a prepaid travel card if…

- You’re on a strict budget. A prepaid travel card can help ensure you don’t overspend, since you can only spend what you’ve already loaded onto the card.

- You want to lock in an exchange rate. Avoid unpleasant surprises by knowing exactly how much your US dollars are worth from the get-go.

Pick a debit card if…

- You plan on frequenting ATMs. If you like the feeling of cold, hard cash in your hands — or will be shopping at markets that only accept cash — you should consider a travel debit card that comes with zero ATM fees.

- You want direct access to your checking account. A travel debit card can be more convenient than a prepaid travel card, since you don’t need to preload money. It’s also ideal if you want to avoid racking up a credit card bill.

Travel credit cards

Browse travel credit cards to find an option with perks that match your travel style — just make sure you have a plan to pay it off.

- Access to credit. Credit access comes in handy for emergencies.

- Rewards. Earning cash back lets you have something to look forward to when you come home.

- Extras. Some cards come with complimentary travel insurance, purchase protection and concierge services.

- Availability. Some travel credit cards are banned in countries like Cuba, Iran, Myanmar, North Korea, Sudan and Syria due to economic sanctions.

- Lack of access to cash. You could be charged with hefty fees for using a travel credit card when you withdraw cash at an ATM.

- Inactivity fee. Some card issuers will charge you a monthly fee if you don’t use the prepaid card frequently enough.

40+ currencies supported

- 4.85% APY on USD balances

- $0 monthly fees

- Up to $100 free ATMs withdrawals worldwide

- Hold and convert 40+ currencies

Up to $300 cash bonus

- 0.50% APY on checking balance

- Up to 4.60% APY on savings

- $0 account or overdraft fees

- Get a $300 bonus with direct deposits of $5,000 or more

Free ATM transactions

- $50 waivable monthly fee

- 0% foreign transaction fee

- Securely move money domestically and globally

- 5 monthly out-of-network ATM reimbursements

- Free international HSBC ATM transactions

Prepaid travel money cards

Prepaid travel money cards are great for budgeting, since you can only spend what’s already on the card — but that could actually be a drawback in the event of an emergency.

- Lock in exchange rates. These cares allow you to lock in rates so you won’t be surprised by the fluctuating value of your US dollars.

- Earn cashback. Select cards like the Prepaid Travel Card by Mastercard can earn you some rewards.

- Use it worldwide. Most prepaid travel cards are either Visa or Mastercard, which are widely accepted.

- Fees. you may have to pay for loading, reloading, currency conversion, withdrawing cash and more.

- ATM withdrawal limits . you may have to pay extra for withdrawing larger amounts of money.

- Not great for emergencies. since you only have a finite amount of cash you may need another source of money in case you run out.

Compare prepaid travel money cards

If you’re leaning toward a prepaid travel money card, compare some of our favorites before signing up.

Travel debit cards

Many travel debit cards waive foreign transaction fees and ATM withdrawal fees, setting you up for an easy breeze experience — as long as you don’t overdraw your checking account.

- Fewer fees. Withdraw cash and buy all the souvenirs you want without getting dinged for it.

- ATM availability worldwide. Choose a travel debit card that’s compatible with the highest number of ATMs.

- Fraud protection. Your bank can help with damage control if your card is lost or stolen.

- No cushion for emergencies. If you make large purchases, they could drain your account, which may lead to overdraft fees.

- Long card replacement wait. If you lose your card it may take up to two weeks to get a new one.

Traveler’s checks

Traveler’s checks were once a widely used form of travel money, but they’re going the way of the dinosaur. You can weigh up whether they’re worth your time below — but we’d advise looking elsewhere.

- Secure. Traveler’s checks are an extremely secure method to spend money overseas.

- Safe. They can be easily replaced if lost or stolen.

- Initial cost. You might be charged a purchasing fee when you first pick up your traveler’s check.

- Acceptance. Traveler’s checks aren’t accepted as widely as other payment methods.

- Can be bulky and awkward to carry. Plus, you’ll have to go to the effort of getting them cashed rather than having immediate access to your cash like you would with a card.

Comprehensive guide to using debit cards overseas

Foreign cash

Holding a certain amount of foreign cash provides you with convenience and payment flexibility. Some stops on your destination may be cash-only and having extra on you can provide a smooth transition to wherever your destination may be.

Knowing how the dollar has performed against foreign currency in the past few years and months will enable you to get the best exchange rate for your foreign exchange transaction. Our travel money guides will inform you on some of the ways to access cash and ATMs worldwide.

Is it safe to travel with cash?

Yes! In fact, it’s usually safer to travel with some cash than none at all — though you don’t need to take large sums along with you. To keep your cash safe while traveling, avoid keeping it all in one place. Instead, divide it between your suitcase, purse and other safe places so that if some gets stolen you still have backup cash.

Keep in mind that carrying more than $10,000 at a time could actually be a headache, since you’ll need to declare it on your customs form to explain why you’re traveling with so much money.

5 places to do a foreign currency exchange

The best place to exchange your foreign currency is at your bank or credit union BEFORE you travel.

- Bank. Call your local branch beforehand to see if their services line up with what you need. Most nationwide banks, like PNC, offer competitive rates and no transaction fees.

- Credit unions. Similar to banks, credit unions generally offer competitive exchange rates and limited or no transaction fees.

But if you’re already in a foreign destination, your best bet is to use a travel debit card to withdraw funds at an ATM.

- Debit card. You should be able to withdraw cash from an international ATM with decent exchange rates and fees ranging from 1% to 3%.

Airport kiosks and currency exchange stores should only be used as a last resort.

- Airport kiosk. After disembarking from the plane, you can exchange your currency at the airport. But fees are high and exchange rates will be less-than-favorable.

- Currency exchange store. You can find exchange stories in most international cities, but again, the fees will be working against you.

Destination money guides

For your next international trip, plan ahead by knowing how much to bring, and which travel money option is best for you. Choose your destination to get the full guide:

- Czech Republic

- Hong Kong, China

- Netherlands

- New Zealand

- South Africa

- South America

- South Korea

- Switzerland

Amy Stoltenberg

Amy Stoltenberg managed newsletters at Finder, gathering the best articles each week to help subscribers save money and stretch their hard-earned dollars. She also handles the Twitter account, dabbling in Instagram and Facebook too. When she's not on the computer, you can find her exploring Los Angeles with a good book in tow. She studied writing at Savannah College of Art and Design and has been featured on the Zoe Report. See full bio

Kyle Morgan

Kyle Morgan is SEO manager at Forbes Advisor and a former editor and content strategist at Finder. He has written for the USA Today network and Relix magazine, among other publications. He holds a BA in journalism and media from Rutgers University. See full bio

Read more on this topic

How to pay, how much to bring and travel money suggestions for your trip to USA.

How to pay, how much to bring and travel money suggestions for your trip to South Africa.

How to pay, how much to bring and travel money suggestions for your trip to Sri Lanka.

How to pay, how much to bring and travel money suggestions for your trip to Mexico.

How to pay, how much to bring and travel money suggestions for your trip to Portugal.

How to pay, how much to bring and travel money suggestions for your trip to Hungary.

How to pay, how much to bring and travel money suggestions for your trip to Ecuador.

How to pay, how much to bring and travel money suggestions for your trip to Fiji.

How to pay, how much to bring and travel money suggestions for your trip to Japan.

How to pay, how much to bring and travel money suggestions for your trip to South America.

Ask a Question

Click here to cancel reply.

4 Responses

My son did some work overseas and was paid in Macedonian Denars. He’s having a terrible time getting this exchanged to US money. Where can he do this?

Hi Foxtrotrn,

Thank you for reaching out to finder.

Macedonian Denar is a closed currency which is a currency that you can only get in the country of origin and that is the reason why it is quite difficult to have it exchanged to US dollars.

The options that you have for foreign currency exchange are:

– International exchange kiosks which can be found in airports – Banks – Online foreign exchange companies such as World First, XE and other similar companies which offer exchange services online

I hope this helps.

Cheers, Charisse

Can I get dirhams–Moroccan currency–from any Chase branches?

Thanks for your inquiry. Please note that we are not affiliated with Chase or any company we feature on our site and so we can only offer you general advice.

Yes, Chase offers international money transfers including dirhams. Aside from using your bank, you can also compare currency exchange companies that you can use to save on your next exchange.

Best regards, Rench

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Travel Money

- Clubcard Prices Clubcard Prices

Clubcard Prices are available for all currencies, just enter your Clubcard number on the next page. Full T&Cs below.

- Click & Collect Click & Collect

Collect for free from more than 350 Tesco stores with a Bureau de change.

- Home Delivery Home Delivery

Free delivery on orders worth £500 or more.

Exchange rates may vary during the day and will vary whether buying in store, online or via phone.

Select currency

Error: Please select if you have a Clubcard to continue

Do you have a Tesco Clubcard?

How much would you like?

Error: Please enter an amount between £75 and £2,500

British Travel Awards 2024

.jpg)

Tesco Bank has been entered into the British Travel Awards 2024 for Best Retailer for Forex/Travel Money.

Votes are cast by our valued customers like you, so every vote is important to us.

If you're happy with our Travel Money service, please take time to vote for us.

Voting closes at 11:59pm on 29 September 2024.

Find a Store to get your Travel Money

With Click & Collect you can order your travel money online and pick it up from selected Tesco stores near you, or you can buy instantly from an in-store travel money bureau.

Enter a postcode or location

Search results

3 easy ways to purchase Travel Money

Click & collect.

- Order online and choose to collect from over 500 Tesco store locations Order online and choose to collect from over 500 Tesco store locations

- Pick a collection day that works for you Pick a collection day that works for you

- Order euro or US Dollars before 2pm and you can pick up from most stores the next day. Order Euros or US Dollars before 2pm and you can pick up from most stores the next day.

About Click & Collect

Home delivery

- Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK Order online by 2pm Mon-Thurs for next day delivery (excludes bank and public holidays), to most parts of the UK

- Free delivery for orders of £500 or more Free delivery for orders of £500 or more

- Secure delivery via Royal Mail Special Delivery Secure delivery via Royal Mail Special Delivery

About Home Delivery

Buy in-store

- Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK Buy your foreign currency instantly in our travel money bureaux in selected Tesco stores across the UK

- Turn unspent travel money back into Pounds with our Buy Back service Turn unspent travel money back into Pounds with our Buy Back service

About Buy Back

Best Travel Money Provider 2023/24

Now in it’s 26th year and voted for by the public, the Personal Finance Awards celebrate the best business and products in the UK personal finance market. We’re delighted that you voted us as Best Travel Money Provider 2023/24.

Additional Information

Ordering and collection.

You can pick a collection date when you're ordering your money. Order before 2pm and you can pick up Euros or US Dollars from most Tesco Travel Money bureaux the next day. Other currencies can take up to five days. Alternatively, you can order any currency for next weekday delivery to most of the selected customer service desks.

Please make sure you collect your money within four days of your chosen date. If you don't, your order will be returned and your purchase will be refunded, minus a £10 administration charge.

Will I be charged if I cancel my order?

Collection fees

Click and collect from stores with a Bureaux de change:

- Free for all orders

For non-bureaux stores with a click and collect function:

- £2.50 for orders of £100.00 - £499.99

- Free for orders of £500 or more

What to bring

For security, travel money will need to be picked up by the person who placed the order.

- a valid photo ID – either a passport, EU ID card, or full UK driving license (we do not accept provisional driving licenses)

- your order reference number

- the card you used to place the order (you’ll also need to know the card’s PIN)

Home Delivery

We can send your travel money directly to you via secure Royal Mail Special Delivery. You can even pick the delivery date that suits you best.

We also offer next-day home delivery on all currencies to most parts of the UK if ordered before 2pm Monday-Thursday.

Check the Royal Mail site to find out if your postcode is eligible for next day delivery

Delivery costs

£4.99 for orders of £100 - £499.99 Free for orders of £500 or more

- You’ll need to make sure there’s someone at home to sign for your delivery.

- Bank holidays and public holidays will affect delivery times.

- We are unable to cancel or amend home delivery orders after they have been placed.

Clubcard Prices

Clubcard Prices are available on the sell rate only for currencies in stock online, on your date of purchase. The Clubcard Price will be better than the standard rate advertised online on the date of purchase. When purchasing online you must enter a valid Clubcard number to obtain the Clubcard Price rate. Exchange rates may vary whether buying in store, online or by phone.

Clubcard Prices apply to foreign currency notes in stock on your date of online purchase. Due to constant market and currency fluctuations, rates on the date of purchase cannot be compared to another day’s rates. The actual rate you receive may vary depending on market fluctuations. Clubcard data is captured by Travelex on behalf of Tesco Bank.

Check out the Tesco Bank privacy policy to find out more.

Buying foreign currency using a credit or debit card

No matter how you purchase your travel money, whether it be in store, online or over the phone, you will not be charged any card handling fee by us. However, regardless of your card type, your card provider may apply fees, e.g. cash advance fees or other fees, so please check with them before you purchase your travel money.

Click & Collect cancellations

You can cancel a Click & Collect order any time prior to collection. We'll refund you with the full Sterling amount that you paid for your order, unless you cancel less than 24 hours before your collection date, in which case we'll charge a £10 late cancellation fee.

We are unable to refund any fees charged by your card issuer, so please contact them if you have any further queries.

When you get home, we'll buy your travel money back

Let us turn your unspent holiday money into Pounds. It couldn't be simpler.

Just pop into one of our in-store Travel Money Bureaux when you get home. We buy back all the currencies we sell in most banknote values and also the Multi-currency Cash Passport™. Buy back rates may vary during the day.

It doesn't matter where you bought your travel money, even if it wasn't from a Tesco Travel Money Bureau, we'll still buy it back.

More about currency buy back

How our Price Match works

If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three mile distance (using an appropriate route planning tool).

See full terms and conditions below.

Tesco Travel Money is provided by Travelex

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Multi-currency Cash Passport is issued by PrePay Technologies Limited pursuant to license by Mastercard® International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

How much travel money will I need?

Whether it’s a burger in Brisbane or a taxi in Toronto, get a feel for how far your travel money might go with our foreign currency guides. We’ll help you manage your travel budget like a pro.

Insurance servicing

- Life insurance (opens in a new window)

- Home insurance (opens in a new window)

- Travel insurance (opens in a new window)

- Car insurance (opens in a new window)

Internet Banking

- Sign in to internet banking (opens in a new window)

- Register for internet banking (opens in a new window)

- M&S Travel Money

Buy Travel Money

Currency calculator.

Our currency calculator is a quick and easy way to check our latest foreign currency exchange rates.

What do I need to bring to collect my foreign currency?

The benefits of exchanging your holiday money with M&S Bank

Wide range of foreign currencies.

We offer a wide range of foreign currencies in our Bureaux, with more available to order online. It is easy to compare travel money with M&S Bank. See footnote * *

As well as the euro and US dollar , our range includes currencies such as the UAE dirham, Bulgarian lev , Turkish lira , Thai baht and Mexican peso .

Travel money sale now on!

Click & Collect sale on euro and US dollar available until 11 April 2023.

£150 minimum order. Exchange rates will still fluctuate daily during the sale period, but you’ll receive the best rate applicable on the date your order is placed. Rates shown when placing your order are sale rates. Offer subject to availability, buy back not included. Cancellation fee and full T&Cs apply.

SameDay Click & Collect

- Order between £150 and £2,500

- Euro and US dollars available to order and collect in over 450 stores *

- Order and collect euro , US dollars , Turkish lira , New Zealand dollar , Australian dollar , Thai baht , Canadian dollar , South African rand and UAE dirham, from our Bureau the same day

Find my nearest Click and Collect store

Click & Collect † See footnote †

- A wide range of currencies available to collect from our in store Bureaux See footnote * *

- Order and collect from the next day

Our best rates on euro and US dollar when you Click & Collect

To get an even better exchange rate on euro and US dollar , use our Click & Collect service. Pay now and lock in today's rate, then collect from a store at a time convenient for you.

CHANGE4CHANGE

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureaux, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a Bureau

Travel money buy-back service

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the Bureau de Change. That's all unused notes in any denomination we sell.

Find out more about M&S Travel Money Buy Back service

If you would like to donate your unused foreign currency to charity we have Change4Change collection boxes in our Bureau stores, with all the money we collect going to Breast Cancer Now. Since 2007, we have raised over £630,000 for the charity via your Change4Change donations.

Find a bureau

When your holiday is over, we'll buy back your leftover holiday money at the buy-back rate on the day you return it to the bureau de change. That's all unused notes in any denomination we sell. Proof of purchase may be required so please retain your receipt, just in case.

Up to 55 days' interest-free credit when purchasing with an M&S Credit Card See footnote ** **

Representative example: based on an assumed credit limit of £1,200, our 24.9% rate per annum (variable) for purchases gives a representative rate of 24.9% APR (variable). Credit is subject to status.

No cash advance fee when M&S Travel Money is purchased using an M&S Credit Card.

What you'll need to bring

To collect foreign currency you've purchased online, you will need:

- A valid UK photographic driving licence, passport or EU national identity card (Romanian & Greek National ID Cards are not accepted)

- Your card you used to place your order - both ID and payment card must have the same name

- Your order number (this can be found on your confirmation email)

To purchase foreign currency in one of our Bureaux, you will need:

- A valid UK photographic driving licence, passport or EU national identity card - both ID and payment card must have the same name

Find my nearest M&S Bureau de Change

Use the M&S Bank Bureau Finder to find your nearest M&S Bureau de Change and opening hours.

Find a Bureau de Change

Manage your existing travel insurance policy

Want to renew, change or cancel your policy or need to make a claim?

Find out more - about managing your travel insurance policy

Need some winter sun?

Planning a winter sunshine break? Use our handy guide to help with your planning.

Ready to hit the slopes?

Thinking about a skiing holiday in Europe, North America or Asia? Use our guide to help you with your trip.

Planning to travel with cash?

Our guide explains how much money you can take abroad.

Learn more about the euro

How many countries use the euro? When was the euro first introduced? Find out more.

Using your credit card abroad

Going on holiday? Get to grips with how you can use a credit card outside of the UK.

What is RFID blocking technology?

If you are concerned about having your passport or credit card skimmed whilst abroad learn more about RFID technology.

What influences exchange rates?

Discover what factors contribute to the exchange rates that you see today.

How to budget for long term travel

Going on a long-term trip? Read our guide on how to budget successfully to ensure you have the most memorable time possible.

Visiting a Christmas market?

Learn more about the many Christmas markets across Europe.

Frequently asked questions

Can i use a credit card to purchase travel money.

Yes, you can use a credit card to purchase travel money. However, please check with your card provider as they may apply fees or charges e.g. cash advance fees or other fees.

Our Bureaux accept the majority of UK issued major credit cards.

How much cash can I travel with?

You can learn more about taking cash in and out of Great Britain and declaring cash by visiting gov.uk .

Should I get foreign currency before I travel?

Buying your travel money before you travel can be an important part of pre-holiday preparation. You can use our Currency Converter to get the latest exchange rates across worldwide holiday destinations.

Where can I collect M&S Travel Money from?

You can collect M&S Travel Money from over 100 bureaux de change or from over 350 stores nationwide. You can find your nearest M&S Bureau de Change using our Bureau Finder .

Where can I get the best exchange rate?

Exchange rates change on a regular basis and vary depending on the currency you order. At M&S Bank, we offer our best rates for euro and US dollar via the Click & Collect service, where you can order your currency and collect from the next day in an M&S location local to you. If you order online before 4pm, you can collect the same day. For all other currencies, check our website for more information.

How much travel money can I order?

For orders placed via Click & Collect, there is a minimum £150 order and maximum of £2,500. For Bureau de Change walk-ups, there is no minimum order.

How do I confirm my Travel Money purchase using my M&S Credit Card?

There are three ways to verify your payments - you can use our M&S Banking App, a one-time passcode via text message or by using a card reader to verify your payment. Use our how-to videos or step-by-step guides to find out more.

Have a question about travel money or other travel products?

Ask our Virtual Assistant

Useful information

View exchange rates

Find out more about euro rates

Find out more about US dollar rates

Find out more about Australian dollar rates

Find out more about Canadian dollar rates

Find out more about New Zealand dollar rates

Find out about M&S Travel Insurance

Important documents

M&S Travel Money Terms and Conditions

You may require Adobe PDF reader to view these documents. Download Adobe Reader

* Subject to availability

** With the M&S Credit Card, you'll receive up to 55 days' interest-free credit when you pay your balance in full and on time each month.

† Next Day collection is subject to availability. Please confirm your collection date and location at the checkout.

- Home ›

- Travel Money ›

Get the best euro exchange rate

Compare the latest euro exchange rates from the UK's top currency providers

How to get the best euro exchange rate

If you're travelling to Europe, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best euro exchange rate by comparing a wide range of UK travel money suppliers who have euros in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Are you looking to get the best euro exchange rate for your next trip abroad? At Compare Holiday Money, we compare the euro rates from dozens of top UK foreign exchange providers to help you find the most competitive currency deals online and on the high street.

We continuously scan and track the latest euro rates from a wide range of currency providers to help you find the companies offering the best deals. Our clever currency comparisons automatically factor in all costs and charges like delivery fees and commission, so all you need to do is tell us how much you want to spend and we'll show you the best euro rates available to buy online right now.

Compare deals

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Some of the best travel money deals are only available from specialist online currency providers who offer better euro rates than high street bureaux de change.

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Most supermarkets and currency suppliers offer better rates if you buy or reserve your currency online. If you're planning to buy euros in store, place your order online beforehand to guarantee the online rate.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

You'll often get better rates the more you order. If you're travelling with a group, consider placing one large currency order instead of everyone buying euros individually.

Remember, exchange rates aren't the only important factor when finding the best euro deal. Delivery costs, commission and payment surcharges can all affect the amount of money you'll receive. See our comprehensive euro travel money comparisons to find the absolute best deal with all costs and charges factored in.

Online foreign exchange providers who specialise in travel money usually offer the best euro exchange rates, and you'll get the best deals when you buy online for home delivery. If waiting isn't an option, or if you'd rather buy your euros in person, supermarkets typically offer the best euro rates on the high street - but don't just walk in off the street unannounced. Reserve your euros online (ideally the day before you want to collect them) as most supermarkets offer enhanced exchange rates on their website compared to the rates they advertise in store. By ordering online you'll lock-in the better online rate and can collect your euros in person at a time that's convenient for you.

Euro rate trend

Over the past 30 days, the Euro rate is up 0.32% from 1.171 on 15 Jun to 1.1747 today. This means one pound will buy more Euros today than it would have a month ago. Right now, £750 is worth approximately €881.03 which is €2.78 more than you'd have got on 15 Jun.

These are the average Euro rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Euro currency chart .

We found 16 foreign exchange providers offering euros today. The table below shows the results ordered by best euro rate, assuming you wanted to buy £750 worth of euros for home delivery.

Remember, exchange rates aren't the only important factor when it comes to getting a good currency deal. Delivery fees, payment surcharges and other hidden costs can all affect the amount of money you'll receive. See our euro travel money comparisons to help you find the best euro rate today.

Timing is key if you want to maximise your euros, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the euro rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the euro rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their euros as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your euros sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better euro rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your euros first before you collect them from the store so you benefit from the supplier's better online rate.

Euro banknotes and coins

Over 340 million people use the euro every day according to the European Central Bank, making it the second most-traded currency in the world after US dollars. Twenty out of 27 EU Member States have adopted the euro as their official currency, and euros are used officially and unofficially in many non-EU countries and territories throughout Europe such as Monaco, San Marino, and Vatican City.

Euros are governed and issued by the European Central Bank which is based in Frankfurt, but the actual production of euro banknotes and coins is handled by various national banks throughout the Eurozone. Spain and Greece are responsible for printing €5 and €10 banknotes, Germany prints €100 notes, and the other EU member states are responsible for printing €20 and €50 notes.

One euro (€) can be subdivided into 100 cents (c). There are seven denominations of euro banknotes in circulation: €5, €10, €20, €50 and €100 which are frequently used, plus €200 and €500 notes which are no longer printed but are still in circulation and remain legal tender. The designs printed on each banknote are intended to be symbolic of the European Union's identity and unity, as well as highlighting the diversity and richness of different European cultures. The front of each banknote features architectural styles from different periods in Europe's history, including Classical, Gothic, Renaissance and modern, while the reverse side features bridges that represent communication and cooperation between the different countries within the European Union.

Euro coins are available in eight denominations: 1c, 2c, 5c, 10c, 20c, 50c, €1 and €2. Each EU member state is responsible for minting its own coins, and can choose their own design for the 'tails' side. For example, German coins feature the 'Bundesadler' or Federal Eagle which has been the German coat of arms since 1950, while French coins depict Marianne; an important symbol of French national identity. Next time you've got a handful of euro coins, take a look at the tails side and see if you can guess which EU country they came from!

There's no evidence to suggest that you'll get a better deal if you buy your euros in Europe. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your euros in Europe:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy euros when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in Europe

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Twenty out of 27 EU member states have adopted the euro as their official currency. These are: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The following European countries and territories who are not part of the EU also use the euro as their official currency: Andorra, Kosovo, Monaco, Montenegro, San Marino and Vatican City, French Guiana and Martinique, the Azores, Canary Islands, and Madeira.

Tips for saving money while visiting Europe

The most budget-friendly destinations in Europe are generally those located in the east such as Latvia, Lithuania and Estonia. In contrast: Luxembourg, Ireland and France usually top the list as some of the most expensive holiday destinations. Regardless of where you're planning to visit, you can save money during your trip by following some simple tips:

- Research your accommodation: Hotels can be expensive, so one way of saving money is to look for more budget-friendly accommodation such as hostels, holiday rentals, or even campsites. AirBnB can be an affordable option too, especially if you rent a room instead of an entire apartment; and you'll get to experience what it's like to live like a local. Salud!

- Use public transport: Make the most of any metro systems, buses, or trams to get around instead of relying on private taxis or rental cars. Many European countries also offer national and regional travel passes for public transport which can work out significantly cheaper than buying individual tickets.

- Eat like a local: Opt for local restaurants or street food vendors that offer authentic cuisine at lower prices. Avoid dining at expensive tourist restaurants, and try cooking your own meals if your accommodation has a kitchen. Not only is this a great way to save money, but it can also be a fun cultural experience to shop around in European supermarkets and cook with local ingredients.

- Plan your itinerary: Look out for free attractions such as museums, parks, churches and historical sites, and plan your itinerary around these. Many cities in Europe also offer free walking tours which can be a great way to get an overview of a new location while learning about its culture and history.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or euros - always choose euros. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

^Please speak to one of our Hays Travel colleagues for the full Terms & Conditions of the Hays Travel Buy Back Guarantee. ^^In-branch rates will differ from our online rates. The rates displayed online are for currency banknotes pre-order only, and guaranteed if currency is collected before close of business on Sunday 14th July 2024. ^^^Not all notes presented for buy back may be able to be exchanged, please ask our staff for more details. ^^^^Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC. ^^^^^Hays Travel Prepaid Currency Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

Exchange Rates

Always great value and no minimum spend*

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 22 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Trinidad Tobago Dollar TTD

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Euros and US dollars in 2 hours

Click and collect euros and US dollars in 2 hours. Terms and conditions apply

Today’s online rates

Rate correct as of 15/07/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

The nation needs a holiday. And, with the summer season already underway, new ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Our annual survey of European ski resorts compares local prices for adults and ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

One of the joys of summer are the many music festivals playing across the ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

From European hotspots to far-flung destinations, UK travellers are making ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

We all look forward to our holidays. Unfortunately, though, more and more ...

Travelling abroad? These tips will help you get sorted with your foreign ...

Please upgrade your browser

To have the best experience using our site, please upgrade to one of the latest browsers.

- Tips for travel

Foreign currency

Bureau de change

If you need foreign currency, you can order it online and we’ll deliver it for free to your home address in the UK, or you can collect it from one of our branches.

How it works

- You can order up to £5,000 per person within a 90-day period. A maximum of £2,500 from that amount can be sent for home delivery to a single residential address 1

- You’ll need to order at least £50

- You’ll need a Barclays debit card or Barclaycard to place your order 2

- To help keep your money safe, home delivery orders will be delivered to your Barclays debit card or Barclaycard billing address

Missed the online deadline?

Just call 0345 072 2222 before 3pm and you can still get your currency delivered on the next business day, as above. To maintain a quality service, we may monitor or record phone calls. Call charges

You can only collect a currency order from a branch when the counter is open. The counter might have different opening hours to the rest of the branch, so please check the opening times using our branch finder before you order.

Buy foreign currency

Loading currency tool...

Today's online sell rates *

- [leftCurrencyCode] [leftRate] [rightCurrencyCode] [rightRate]

* Rates are indicative. Use our currency converter to get the latest rates.

Things to consider

Travel wallet

Buy foreign currency in the Barclays app and use your debit card as a travel money card

Our travel wallet lets you buy foreign currency to spend on your debit card, so you don’t have to carry travel money around. It’s a great way to travel light and gives you security, convenience and control while you recharge your batteries.

Using your debit card abroad

A secure and convenient way to pay when you’re away

If you’re currently abroad and need to use your debit card, here’s what it’ll cost you to withdraw cash and make purchases.

Barclays travel and breakdown insurance

- Important information

£2,500 is the maximum amount that can be ordered and delivered to an individual residential address in a 90-day period. Please note, you cannot exceed £5,000 per person within a 90-day period. Return to reference

If you pay with your Barclaycard, you may be charged a Cash Fee – please check your Barclaycard terms and conditions for details. Return to reference

Working day means Monday to Friday excluding bank and public holidays. There are no deliveries on Sundays or public holidays. Return to reference

Our products

- Current accounts

- Credit cards

- Help & FAQs

- Money worries

- Report fraud or a scam

- Report card lost or stolen

Site information

- Accessibility

- Privacy policy

- Cookies policy

- Find Barclays

- Service status

Barclays Bank UK PLC and Barclays Bank PLC are each authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Barclays Insurance Services Company Limited and Barclays Investment Solutions Limited are each authorised and regulated by the Financial Conduct Authority.

Registered office for all: 1 Churchill Place, London E14 5HP

Cards, Loans & Savings