Sign In to Avion Rewards

Sign in with:

If you have a personal credit card or deposit account, you need to enrol in RBC Online Banking to enjoy Avion Rewards. It’s easy and secure.

Sign in now to start shopping and saving

RBC client ? Sign in with: Eligible RBC clients enjoy bigger and better benefits from Avion Rewards. Check out the list of eligible products – if you have any of these, you’re in. Close

Don’t have Online Banking credentials?

Not an RBC client? Sign in with:

By Sandra MacGregor

Fact Checked: Scott Birke

Updated: August 13, 2024

- Best travel rewards programs

- Best loyalty rewards programs

- Best Aeroplan credit cards

- Aeroplan guide

- Best Air Miles credit cards

- Air Miles guide

- Scene+ guide

- Aeroplan vs. Air Miles vs. Avion

- Best RBC credit cards

- RBC Avion Visa Infinite review

- WestJet RBC World Elite Mastercard review

- RBC ION+ Visa review

- RBC Visa Platinum Card review

Avion Rewards guide 2024

Rbc rewards are now avion rewards.

RBC Avion Rewards, overseen by the Royal Bank of Canada, the biggest of the Big Five banks, is one of the most popular loyalty programs in Canada. Though it offers an impressive variety of redemption options overall, the program is particularly appealing to frequent fliers who covet the bank’s Avion credit cards. Whether you’re a more casual Avion Rewards earner or a seasoned jet setter, our RBC Avion Rewards guide will help you decide if Avion Rewards is the loyalty program you’ve been looking for, or if you should keep up the hunt for the perfect spending and travel companion.

How do you earn Avion Rewards points?

The best way to earn RBC Avion Rewards points is by making purchases with an RBC Avion credit card such as the RBC Avion Visa Infinite and RBC ION+ Visa. Our full list below and summary RBC Avion Rewards chart shows all the RBC credit cards you can use to rack up points and how much they earn.

- RBC Avion Visa Infinite

Sign up to receive the latest news, tips and offers by email

- Rates & Fees

Rewards program is highly flexible, transferable, and includes a slew of non-travel-related reward options

Partnerships with other retailers like HBC and Petro-Canada

Provides excellent travel insurance

New cardholders earn 35,000 welcome Avion points on approval*

Solid option for looking for a travel-centric points program

The points-to-dollars ratio is only average and there are few opportunities for accelerated earning.

The $120 annual fee isn’t cheap

High annual income requirement: Personal: $60,000 or Household: $100,000

Eligibility

Recommended Credit Score

Required Annual Personal Income

Earn 1 Avion point for every dollar you spend*.

extra Avion points on eligible travel purchases

mobile device insurance

savings on fuel at Petro-Canada and always earn 20% more Avion points

Be Well points for every $1 spent on eligible products at Rexall

off at Hertz and earn 3x the Avion points

delivery fees for 12 months from DoorDash

Purchase APR

Balance Transfer Rate

Cash Advance APR

Annual Fee $50 for each additional card

Foreign Transaction Fee 2.5% of the transaction in CDN

Foreign Transaction Fee

- RBC ION+ Visa

Decent rewards rate in everyday spending categories.

Low monthly fee, (rebated for students with the RBC AdvantageTM Banking Account for students).

Perks like mobile device insurance and fuel savings at Petro-Canada.

Complex rewards structure with less valuable Avion points in the ION tier.

Limited insurance benefits (but you can pay to add-on travel insurance).

Avion Ion points† per $1 on qualifying grocery, dining, food delivery, gas, rideshare, public transit, EV charging, streaming, digital gaming and online subscriptions

Avion Ion point per $1 on all other purchases

Cash Advance APR 21.99% for residents of Quebec

Annual Fee $4 per month

Full list of Avion Rewards credit cards that earn Avion points

The following RBC Royal Bank credit cards earn Avion points on net purchases and are points-earning credit cards:

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Privilege for Private Banking

- RBC Avion Visa Platinum

- RBC ION Visa

- RBC Rewards Visa Preferred

- RBC Visa Gold Preferred

- RBC Visa Platinum Preferred

- Signature RBC Rewards Visa

- RBC Rewards Visa Gold

- RBC Rewards+ Visa

- RBC U.S. Dollar Visa Gold

- RBC Visa Classic II

- RBC Visa Classic II Student

- RBC Mike Weir Visa

- RBC Avion Visa Business

- RBC Avion Visa Infinite Business

- RBC Royal Bank Visa CreditLine for Small Business

- RBC Commercial Avion Visa

Refer to RBC Page for up to date offer terms and conditions.

There's no distinction between the points earned from a standard RBC card vs. an Avion card, like the RBC Avion Visa Infinite . Both cards earn Avion Rewards points—though some Avion cardholders may mistakenly refer to their points as such. The difference between an Avion card and a standard RBC rewards card is that Avion cards are intended to appeal to those looking specifically for travel rewards cards. Avion cards have higher annual fees, better welcome offers, and feature additional travel-friendly perks (like good travel insurance packages and exclusive experiences). Finally, though both Avion and non-Avion cardholders use the same travel portal to redeem points, Avion cardholders get better value for their points when redeemed for travel.

If you don’t feel comfortable using credit, keep in mind that you can still earn RBC Rewards points with a debit card. If you enrol an eligible RBC bank account (such as the RBC Day to Day Banking or Advantage Banking accounts) in the Value Program you can earn RBC points every time you use your debit card.

What can Avion Rewards be used for?

Avion Points value varies substantially depending on how they are redeemed, and Avoon Rewards can be redeemed for a wide variety of purposes, including travel, merchandise, charitable donations, paying with points and gift cards. You can also use the Avion Rewards ShopPlus browser extension to earn money back when shopping online.

How to redeem travel points For Avion and Non-Avion cardholders

When you want to redeem your RBC Rewards for travel, you’ll notice that there’s a different redemption option based on whether you have an RBC Avion card or not.

If you don’t have an Avion card, then your redemption options for travel are very straightforward: 100 points = $1 travel value. To redeem your points for travel you simply sign in to the RBC Rewards Travel page and select a travel purchase. There is no minimum number of points required to redeem for travel, and if you don’t have enough points to cover a full travel redemption you can pay the remaining balance with your credit card.

If you are an Avion cardholder, you can select round-trip flights on any airline based on the Air Travel Redemption Schedule. The number of points you need to redeem depends on your destination, and each destination has a maximum ticket price (not including fees and taxes). If you exceed the maximum ticket price, RBC lets you charge the additional cost to your credit card or pay the difference at a rate of 100 points = $1.

It’s clear from the travel redemption schedule that Avioners get more value for their points when they redeem them for travel compared to non-Avioners. Whereas the value of one point for non-Avioners is locked in at 1 point = 1 cent, Avioner point values range from 2 cents to as high as 2.33 cents per point.

Note that while there are redemption differences between Avion and non-Avion cardholders, there are some important benefits that both cardholders share. Both can redeem their points for a number of different travel-related purchases, such as flights, cruises, vacation packages, hotels, and car rentals. Furthermore, both enjoy no blackouts or seat restrictions when they book their travel. Plus, both can use RBC Rewards points to cover air travel fees and taxes at a rate of 100 points per $1.

RBC Avion Rewards points conversion

Another appealing feature of the Avion Rewards program is that you can transfer your Avion points to a few other participating loyalty programs.

All Avion Rewards cardholders can convert their Avion Rewards points into WestJet dollars and Hudson’s Bay Rewards points. For every 100 RBC Rewards points converted, you receive 1 WestJet dollar (minimum 1,000 pts needed to convert). For every 500 RBC Rewards points converted, you receive 1,000 Hudson’s Bay Rewards points (minimum 500 pts needed).

RBC Avion cardholders have even more conversion options. They can transfer points to the aforementioned programs, but they can also convert RBC Rewards points to other participating travel rewards programs:

- American Airlines (10,000 RBC Rewards points = 7,000 AAdvantage miles)

- Cathay Pacific’s Asia Miles (10,000 RBC Rewards points = 10,000 Asia Miles)

- British Airways (10,000 RBC Rewards points = 10,000 Avios)

Note that all cardholders can also transfer RBC Rewards points to a second RBC Rewards account held in their name. You can also transfer RBC Rewards points to a family member or friend if they have an RBC Rewards account.

Other Avion Rewards redemption options

The Avion Rewards program is incredibly flexible and points can be redeemed for an impressive variety of pursuits outside travel, including merchandise, charitable donations, and gift cards. You can also put points toward an RBC Financial Reward, by transferring them to accounts like an RBC investment portfolio or RESP . Finally, you can take advantage of a relatively new feature called Pay With Points that lets you pay bills, pay down your credit card statement, or even make purchases in-store with an eligible digital wallet app like Google Pay.

Here’s a look at what your Avion Rewards points are worth:

- Merchandise : $0.006–$0.0085 per point. Point value varies because there’s a wide range of items you can redeem points for, including Bose stereos, Fitbit smartwatches, Cuisinart kitchen appliances, and more. RBC Rewards also has an impressive range of Apple products like MacBook Pro and iPhones.

- Gift Cards : $0.0071–$0.01 per point. When redeeming points for gift cards, points usually have a value of $0.0071 each. However, sometimes RBC Rewards will have special bonuses where the points needed for a redemption are reduced, which gives your points more value. For example, normally you need 1,400 points to redeem for a $10 Amazon.ca gift card but sometimes the same $10 Amazon.ca gift certificate is available for only 1,000 points, bringing your point value up to one cent per point. There is a good selection of gift cards aside from Amazon.ca, including Best Buy, Air Canada, A&W and more.

- Charitable Donations: $0.01 per point. Redemptions can be donated to Hope Air, Own The Podium, Ronald McDonald House Charities, and The David Foster Foundation.

- RBC Financial Reward: $0.0083 per point. You can contribute to your RBC investment portfolio, RBC personal loan, RBC mortgage, RBC line of credit, and more.

- Pay With Points: $0.0058 per point. If you use Pay with Points to pay down your statement credit you get the worst value for your points.

Redeeming points is a straightforward process: Head to the Rewards portal and sign in when you’re ready to redeem. There may be minimum redemption requirements depending on what redemption option you use. For example, there are set point minimums required when you convert points to other loyalty programs, as well as a minimum of 12,000 points needed to redeem points for RBC Financial Rewards.

Do Avion Rewards expire?

Avion Rewards points never expire as long as your account remains open and in good standing. However, you’ll have limited time periods to redeem your points after closing your account: 90 days for self-serve, online point redemption and 365 days to redeem by calling in to the RBC advice centre.

Other Avion Rewards program benefits

RBC has point-earning partnerships with both Rexall and Petro-Canada. With Petro-Canada, you earn 20% more RBC Rewards points when you use a linked eligible RBC Rewards credit card to make purchases. You also instantly save 3 cents per litre at Petro-Canada locations. With Rexall, RBC cardholders with a linked debit or credit card earn 50 Be Well points (Rexall’s rewards program) per $1 they spend at Rexall stores.

RBC also has a new partnership with DoorDash that gets eligible cardholders a free DashPass subscription for up to 12 months, as well as unlimited deliveries with no delivery fees on orders over $12.

Is RBC Avion Rewards the best travel program in Canada?

So how does RBC stack up? To get a sense of how competitive the RBC Avion Rewards program is, it’s helpful to compare it to the two other most popular travel rewards programs in Canada: Aeroplan and AIR MILES .

The new Aeroplan flight award chart features dynamic pricing, so the value you get for an Aeroplan point depends on numerous factors like flight distance, exact destination, and route popularity. Since Aeroplan recently revamped its program, point values now generally range anywhere from about 1.5 cents per point to as high as 2 cents, which is a lower range than the travel redemption values for Avion cardholders. Unlike Avion, Aeroplan points cannot be transferred to other loyalty programs, but you can transfer points from some other loyalty programs to Aeroplan. That said, there’s a larger selection of Aeroplan credit cards issued by multiple financial institutions (TD, CIBC, and Amex) and they tend to feature more travel perks than Avion cards, including the likes of free checked bags, NEXUS application rebates, and free airport lounge visits.

AIR MILES, while not strictly a travel reward program, gives you the best (if not the most consistent) value when you redeem them for travel. Value ranges anywhere between 8 to 25 cents a point, depending on when and where you fly. However, AIR MILES are slow to add up because AIR MILES credit cards typically only earn 1 MILE per $5–$25 you spend, depending on the card. It’s also worth noting that unlike with RBC, the values for Aeroplan points and AIR MILES don’t change based on which credit card they were earned with. So although an entry-level Aeroplan or AIR MILES card might earn points at a slower rate than a card with a high annual fee, the ‘class’ of the card doesn’t affect how much its points are worth when it’s time to redeem.

Pros and cons of RBC's Avion Rewards program

Flexible program with lots of redemption options

Points can be earned with your debit card if you have a qualifying bank account

You can convert points to several other participating loyalty programs

Non-Avion credit cards have weak to non-existent welcome bonuses and ho-hum earn rates

Must have an Avion credit card to get maximum point value when redeeming for travel

Relatively low value for points when redeeming for statement credits

All told, I recommend RBC Avion Rewards to those who meet the income and credit score requirements for an Avion card, and who are willing to pay an Avion card’s annual fee for access to its high-value point redemptions. Avion is particularly appealing for those who find themselves making a lot of short-haul flights within Canada or to nearby U.S. states, for which your points get exceptional value. It’s also a great option if you fly frequently with American Airlines, Cathay Pacific, or British Airways, and you like the flexibility of transferring your points to one of those loyalty programs in order to maximize value and get free flights.

On the other hand, if you only qualify for an entry-level, non-Avion card, there are other travel rewards programs or even cash back credit cards out there that might offer more sign-up bonus points, better regular earn rates, and better value for your points.

What are Avion Rewards for Taylor Swift?

As an Avion Rewards member, you can enjoy exclusive access to contests for Taylor Swift's The Eras Tour in Canada. Find the best RBC credit card today and join Avion Rewards.

Avion Rewards Guide , RBC Royal Bank, Dec 22, 2023

Sandra MacGregor has been writing about finance and travel for nearly a decade. Her work has appeared in a variety of publications like the New York Times, the UK Telegraph, the Washington Post, Forbes.com and the Toronto Star.

More rewards programs

Rbc credit cards, latest articles, joe rogan blasts 'demonizing' blue-collar work, what is purchase interest, canadians prioritize saving, what are digital money jars, suze orman: plan for financial emergencies, watch out for the bank ndas.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

15 good uses of RBC Avion Rewards points

- Post author: Andrew D'Amours

- Post published: April 27, 2023

- Post category: Travel rewards Canada / Using rewards

- Post comments: 0 Comments

RBC Avion Rewards points are pretty much the only ones among all of Canada’s travel rewards currencies that even try to compete with Amex points in terms of ways to use them for outsized value and transfer partner options (and ease of earning a lot of points). Let’s start with the basics, but we’ll have much more content about this currency!

We’ll look at 15 good uses for those RBC Avion Rewards points.

Basics of RBC Rewards points

The RBC Avion Visa Infinite Card is currently offering its regular welcome bonus. It’s already one of the most popular cards in Canada, as the main card for the country’s largest bank.

Basically, you’ll earn 35,000 RBC Avion Rewards points with no minimum spend requirement to reach, so it’s perfect as a 2 nd card to apply for on the same day as a 1 st one with a minimum spend requirement and a bigger bonus.

You can get this welcome bonus even if you’ve had this card before; that’s the beauty of all cards that aren’t issued by Amex (often there’s a minimum wait period; but not with RBC). And that’s why you can get a literally infinite amount of free rewards to travel more for less! Save your spot for our free webinar on travel rewards for beginners to learn more!

You can read all the details on our RBC Avion Visa Infinite Card page , and on our review (which includes a video presentation if you prefer that format).

We’ll also have a lot more content, tips, and guides on all the major programs (including RBC, Amex, Aeroplan, Avios, Marriott, etc.) very soon.

How to use RBC Avion Rewards points

With other RBC cards, the RBC Avion Rewards points you get work differently. So we’ll just focus on the RBC Avion Rewards “Elite” points that are relevant here, as the RBC Avion Visa Infinite Card ‘s welcome bonus is by far the most valuable among RBC cards.

RBC Avion Rewards points can be used as both of the 2 only types of rewards use options that exist: uses that are more valuable (less simple) or uses that are more simple (less valuable).

So we will divide the article into the 4 different ways that RBC Avion points can work:

- Transfer to Avios (12 good uses)

- Transfer to WestJet Rewards and others (1 good use)

- Reward flights with the RBC price chart (1 good use)

- Travel credit to erase almost any travel expense (1 good use)

1. Transfer to Avios (12 good uses)

The Avios program is far from being as simple as the ubiquitous airline rewards program in Canada (the Aeroplan program ), but depending on your travel preferences, it can be very valuable too.

We’ve put together an article that lists 12 good uses of Avios points .

Note that 60,000 RBC Avion points = 60,000 Avios points (1 to 1 transfer rate). The increased welcome bonus on the RBC Avion Visa Infinite Card that is offered regularly gives you those 60,000 points ( sign up to get an alert when it returns).

But usually, RBC has a transfer bonus promo with at least a 30% bonus every year. That means you get 30% more Avios points when transferring RBC points, giving you 30% more free travel! And 30% more value than our Flytrippers Valuation for the RBC Avion Visa Infinite Card ‘s welcome bonus. That’s even more amazing!

This option can give you up to 9 one-way short-distance flights in some countries, or 4 one-way flights to/from Miami from Toronto or Montreal for example.

But with Avios, you’ll have much fewer options compared to Aeroplan. So you’re better off choosing the cards with amazing offers that earn Aeroplan points or American Express points if you want airline rewards (the most valuable type of rewards) but prefer some that are simpler than Avios points.

2. Transfer to WestJet Rewards and others (1 good use)

Okay, there is more than 1 good use with the other airline partner programs, but it’s really a lot rarer that it’s a good value. So we’ll say 1 good use for now: for a sweet spot with other partners.

The 3 other RBC airline program partners are:

- WestJet Rewards (1 to 1 transfer rate)

- Cathay Pacific Asia Miles (1 to 1 transfer rate)

- American Airlines AAdvantage (1 to 0.7 transfer rate)

We’ll discuss it in more detail in our RBC Avion Rewards program guide soon , but the main appeal used to be for those who often fly WestJet. But now, their program is so bad that the RBC points option #4 below is probably more valuable even for WestJet flights.

(The WestJet RBC World Elite Mastercard also has an increased offer and the WestJet RBC Mastercard is a no-fee option, if you really like WestJet — we’ll cover those cards later since the welcome bonus is hundreds of dollars lower than the RBC Avion Visa Infinite Card and the other incredible offers right now !)

The Asia Miles program can be interesting, especially since it is also a transfer partner with the Amex Membership Rewards program and the HSBC Rewards program . So it’s easy to earn many Asia Miles. But it’s a program with sweet spots that are even more specific than Avios, which I’ll cover soon to keep this post shorter today.

Finally, the American AAdvantage program has a much less appealing transfer rate for starters. And the program is not great, as is the case with most US airline programs. That said, I did make my 1 st AAdvantage redemption in 15+ years in the world of travel rewards… and it was literally one of the most valuable redemptions I’ve ever made. I was glad to have RBC Avion points to transfer to AAdvantage!

3. Reward flights with the RBC price chart (1 good use)

We’re now at the first of the 2 uses of RBC points that don’t involve transferring to another program.

I’ll do a separate article for you soon, but basically, the RBC award chart has only one good use: when airline tickets are very expensive in cash .

The thing is the price chart will give you a ticket for a fixed number of points, regardless of the cash price (with a maximum price though).

It’s harder to maximize than airline partner programs, at least for those who don’t normally buy expensive flights. And it’s much more restrictive: you have to book flights only departing from Canada or the USA. However, RBC does allow you to book one-ways at least (compared to the Amex price chart that only allows roundtrips for example).

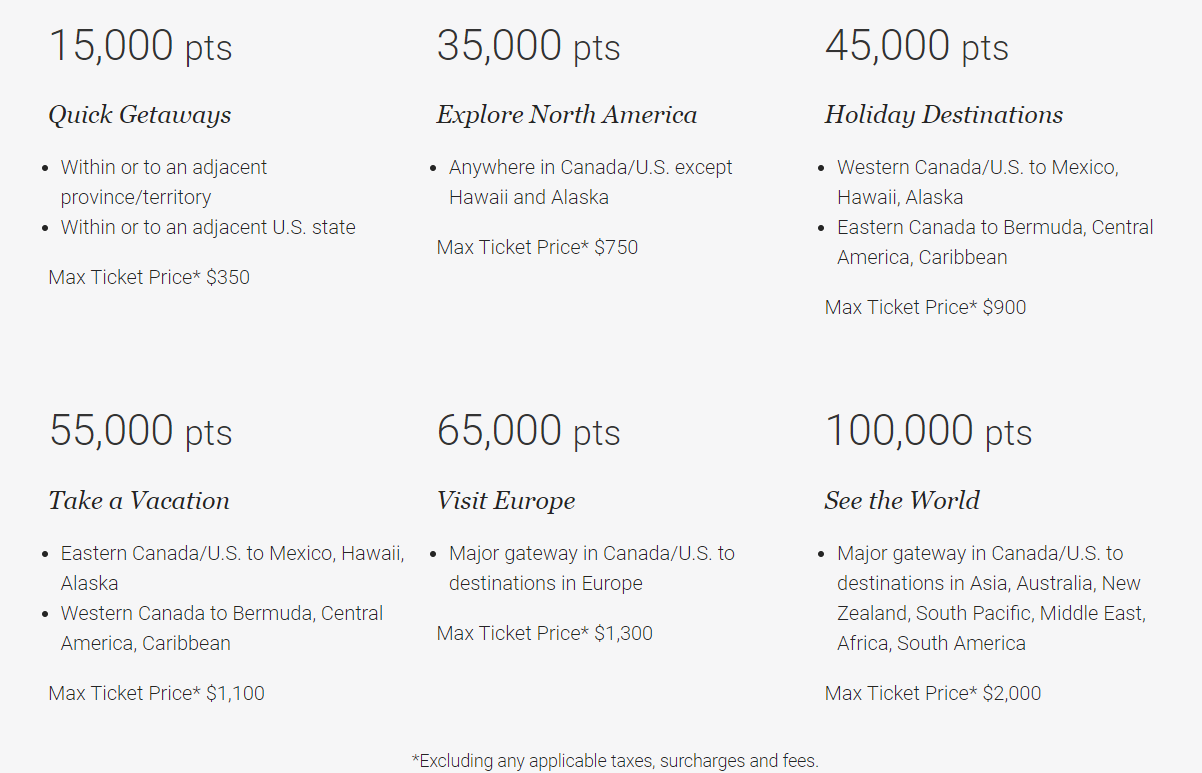

Here is the full RBC price chart for roundtrip reward flights (directly through the RBC program instead of having to transfer points).

(One-ways simply cost half the amount of points with half the maximum price too!)

So for example, let’s say you use your 60,000 RBC Avion points for 4 roundtrip flights that cost 15,000 points… you could “save” $1400 ($350 x 4)!

That would give a great value of 2.3 ¢ per point (and the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus would be worth $1280 instead of ≈ $780 at our always conservative Flytrippers Valuation).

However, that means you’d be paying for very, very expensive tickets. So it’s just a good use if you were really going to pay a lot of money for those flights (if you didn’t have any flexibility for example). And when the plane ticket’s base fare is as close as possible to the maximum ticket price in the RBC price chart.

When used this way, RBC points only cover the base fare, so not the taxes and some other fees. The maximum ticket price in the price chart is also only for the base fare (the same as the Amex price chart for reward flights ).

Remember that what’s important is not how much you pay out of pocket, but how much you SAVE in total, at least if you know how to do the math and if you want to get the most value with your rewards.

So the RBC price chart can still be interesting if you have to go somewhere and the flights are very expensive. For example, if you are going to a European destination that is very expensive for your dates, that can easily cost $1600, especially if you’re not in Toronto or Montreal (which is sad considering we often spot deals to Europe in the $400s roundtrip).

But then again, like all redemption option of the more lucrative type… certain redemptions are just not good. This time, it’s because of airline surcharges. For example, they’re often high to Europe, making that a bad redemption most of the time.

With 65,000 RBC Avion points (the 5,000 missing after the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus are pretty easy to earn), you could save $1300, a great use on paper. But it’s not a good use if the alternative is a flight to Europe paid with cash that has just a $300 base fare.

To give you an idea, I’ve used airline reward programs for dozens and dozens of flights in the past 10 years, and I have used the bank price charts only once (it was with RBC during the Christmas holidays this year because flights during the holidays are expensive).

I usually don’t buy expensive flights so it’s less beneficial for me. And when I do buy expensive flights, I’m flexible, so airline points are a lot more valuable.

In short, the value you can get with the RBC price chart really depends on your personal situation and how good you are at finding cheap flights. As is always the case in the world of travel, you have to compare!

4. Travel credit to erase any travel expense (1 good use)

Finally, the only option that has a fixed value… isn’t really a good use at all in fact.

It’s a “good” use only if you want to keep it simple and are willing to get a lot less value in return, as so many people are.

Instead of being worth ≈ $780, the RBC Avion Visa Infinite Card ‘s often-increased welcome bonus is worth a flat $480 net if you use it like this. Because as a travel credit, 60,000 RBC Avion points = a $600 credit.

But it’s much simpler: you can apply the points to any travel expense.

It’s always going to be worth 1¢ per point. Any travel use. Very simple.

That’s why the other options are about 50% more valuable… but even $480 for free is pretty good!

With this option, you don’t have to think anything through, you don’t have to maximize anything, you don’t have to take any specific flights… it’s really as simple as it gets.

Well, almost as simple as it gets. There is one restriction: you need to book on the RBC Avion website (you cannot book on other websites as you can with other rewards programs).

If you want to use points for any travel expense, you really shouldn’t “waste” valuable points like RBC Avion points anyway (unless you’re never going to use them for more valuable flight redemptions, in that case of course take the points instead of not taking them).

Instead, use points that cannot give you more value AND can be used by booking on any website! Like Scene+ points (the Scotiabank Gold American Express Card ), BMO Rewards points (the BMO eclipse Visa Infinite Card ), or AIR MILES miles (the BMO AIR MILES World Elite MasterCard ).

Or points that can be used by booking on any website without losing too much value. Like TD Rewards points (the TD First Class Travel Visa Infinite Card ) or HSBC Rewards points (if you already have some).

The RBC Avion Visa Infinite Card is a great option to get points of the more valuable type. These examples may give you a good idea of what you could do with the welcome bonus, while you wait for our more comprehensive guides.

Have any questions about RBC Avion Rewards points? Ask me in the comments below.

Want to be the first to get our free travel rewards course and all our content, sign up for our travel rewards newsletter.

See the deals we spot: Cheap flights

Explore awesome destinations : Travel inspiration

Learn pro tricks : Travel tips

Discover free travel: Travel rewards

Featured image: Beach (photo credit: Nico David)

Share this post to help us help more people travel more for less:

Andrew D'Amours

Leave a reply cancel reply.

Avion Rewards

Avion Rewards is a powerful points program offered by Royal Bank of Canada (RBC) and is easily one of the best loyalty programs among all financial institutions in Canada. These points can be redeemed for travel, gift cards, transferred to frequent flyer programs, and much more.

There are two types of Avion Rewards points that are earned from different families of credit cards:

- RBC Avion Elite points (higher tier)

- RBC Avion Premium points (lower tier)

RBC Avion Elite points can be redeemed for travel and also transferred to all airline partners, while RBC Avion Premium points have more restrictions.

RBC credit cards that earn Avion Elite points will have Avion in their name, such as the RBC Avion Visa Infinite credit card. On the other hand, there are RBC credit cards that earn Avion Premium points such as the RBC ION+ Visa credit card.

Throughout this page, we will use the term “Avion Rewards” to refer to both tiers of points to be consistent. However, we will note any differences between the two sets of points in the relevant sections below.

Earning Avion Rewards Points

There are two main ways in which you can earn points in the Avion Rewards program: credit card welcome bonuses and organic credit card spending.

Credit Card Bonuses

The most effective method to earn Avion Rewards points is through earning the welcome bonus on an Avion Rewards credit card.

The most popular Avion Rewards credit cards are the RBC Avion Visa Infinite card and the RBC Avion Visa Platinum card as they tend to offer the most bonus points and benefits for the lowest annual fee. Both of these cards also earn Avion Elite points, meaning they can easily be transferred to partner frequent flyer programs where you will receive the most value for your points.

The RBC Avion Visa Infinite card earns Avion Elite points and gives cardholders the opportunity to earn 1.25x Avion Elite points on all travel purchases. In 2024, we awarded this card as the Best Flexible Points Travel Credit Card.

Check out our RBC Avion Visa Infinite card review for more details.

Credit card bonuses may also be earned through product switching .

Credit Card Spending

The majority of RBC credit cards that earn Avion Rewards points have a standard earning structure in that a set amount of points are earned for every dollar spent on all everyday purchases with no extra points for spending in specific categories (such as groceries or transportation).

The table below captures all credit cards in Canada that earn Avion Rewards points.

There is one exception as some Avion Rewards credit cards, such as the RBC Avion Visa Infinite card, will earn 1.25 points for travel purchases. On the other hand, the RBC Avion Visa Infinite Business card and the RBC Avion Visa Infinite Privilege card earn 1.25 points on all purchases.

Converting Avion Premium Points to Avion Elite Points

The majority of Avion Rewards earning credit cards earn Avion Elite points, however, both the RBC ION+ Visa card and RBC ION Visa card earn Avion Premium points. These points are much more restrictive when it comes to transferring to frequent flyer programs, as they can only be transferred to WestJet Rewards.

However, cardholders can easily convert their Avion Premium points to Avion Elite points. All that is required is that a customer holds both an Avion Premium points earning credit card and an Avion Elite points earning credit card at the same time. Cardholders can then transfer their Avion Premium points to their Avion Elite points credit card, such as the RBC Avion Visa Infinite card, to effectively convert them to Avion Elite points.

Utilizing this trick is an easy way to get more out of your Avion Rewards points, as this will unlock the ability to transfer to any of the listed frequent flyer partners.

Redeeming Avion Rewards Points

Avion Rewards is a highly flexible points program and can be redeemed for travel in a variety of ways, as well as redeemed for other types of rewards including financial rewards, merchandise, and gift cards.

As with most bank point programs, travel provides the highest redemption value. Avion Rewards can be redeemed for travel in three ways:

- Air Travel Redemption Schedule (Fixed Travel)

- Flexible Travel Reward

- Transfer to Airline Partners

Air Travel Redemption Schedule (Fixed Travel)

The RBC Air Travel Redemption Schedule provides the greatest value for redeeming Avion Rewards points for flights. However, as the name suggests, there are a few more rules to follow when redeeming your points this way. First of all, you can redeem Avion Rewards for one-way, round trip, and multiple destinations flights.

How many points are required for redemption through the Air Travel Redemption Schedule is fixed and based on the particular destination, according to the chart below. For a given destination, there is a maximum ticket price that the points can be redeemed for – this does not include taxes and fees.

If you exceed the maximum ticket price, you can pay the difference in points at a rate of 100 points = $1 CAD (the flexible travel rate). You can also pay for flight taxes by redeeming your points at this same rate of 100 points = $1 CAD.

There is one other restriction with the Air Travel Redemption Schedule: you must make the booking a minimum of 14 days before the departing flight. Keep this in mind when considering whether to redeem RBC points for flights using this method.

How to Redeem Avion Rewards Points Using the Air Travel Redemption Schedule

To make a flight booking using the Avion Rewards fixed travel program, cardholders will need to access the Avion Rewards Travel portal , which is powered by Expedia.

In order to initiate a flexible travel rewards booking, log into Avion Rewards and click “Travel Home” on the top bar. From there, click on the “Book Travel” button.

This will take you to the Avion Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. In order to redeem through the fixed travel redemption program, you will need to click on flights.

From here, fill in your desired routing, dates, number of passengers, and ticket class, and click “Search” to generate a list of flights.

Once you can see the list of flights, you will see the total point cost using the fixed travel redemption in addition to the taxes and fees on the ticket. At the top of the screen, you can flip between fixed points pricing and flexible points pricing to determine which is the better deal.

In this case, fixed points pricing has all itineraries at 35,000 Avion Rewards points (as one would expect per the chart above).

On the other hand, if we were to make this booking with flexible rewards, we would be paying at a minimum an additional 21,000 Avion Rewards points. This is where the fixed rewards chart really shines.

Once we go through the portal and select our outbound and inbound flights, we are presented with a page summarizing the flights chosen and the total price. On the right-hand side, you can confirm that you are using the fixed travel redemption method by looking at the total point cost. Since this is an economy roundtrip fare within North America, 35,000 is the correct amount of points. From here, click “Check Out” to complete the rest of the booking process.

For this booking in particular, I was effectively able to redeem 35,000 Avion Rewards for $413 in base fare value (roughly 0.0118 cents per point). Since you can cover up to a $700 base fare with the 35,000 Avion Rewards fixed flight redemption, there is some additional value that could be extracted with the right flight. But if you were just looking to travel to Los Angeles, this is a great value for your points.

It is important to note that any flights that do not qualify for the Air Travel Redemption Schedule will automatically have flexible points pricing applied.

Flexible Travel Rewards

The other way to use Avion Rewards points for travel is through the flexible travel reward chart. This method allows you to redeem your Avion Rewards towards virtually any flight, hotel, car rental, and other travel expenses at a rate of 100 Avion Rewards points = $1 CAD (RBC sometimes refers to this as the “1% rate”).

So for example, 25,000 Avion Rewards points can be redeemed for $250 CAD worth of travel. What makes this method even more flexible is that you can pay for travel using any combination of points and payment via credit card.

In general, you would only want to redeem Avion Rewards points for flights using this method if your flights do not qualify for the Air Travel Rewards Redemption Schedule. Alternatively, you may already have lots of airline points from other programs like Aeroplan and prefer to use your RBC points for a hotel stay, car rental, cruise, or vacation package.

Also of note, holders of the following credit cards actually get a special 2x rate for flexible travel redemptions used towards Business (J) or First Class (F) airline tickets, meaning they can redeem 100 points for $2 CAD:

- RBC Avion Visa Infinite Privilege

- RBC Avion Visa Infinite Business

- RBC Commercial Avion Visa

How to Redeem Avion Rewards Points for Flexible Travel Rewards

Redeeming Avion Rewards for flexible travel rewards can be done entirely through the Avion Rewards Travel portal , which is a search engine powered by Expedia. In order to redeem points through this method, you do need to book through the portal and cannot apply points to a pre-existing booking made elsewhere.

This will take you to the Avion Rewards Travel portal page. From here, you will be able to search for flights, hotels, car rentals, and vacation packages. The process is the same no matter what you are redeeming your Avion Rewards for.

For our how-to, let’s take a look at booking a hotel in Las Vegas for August. Select “Stays” at the top, and select the desired destination, your dates, and the number of travelers. Click “Search”.

Once you search, a variety of hotels will be displayed that meet your travel criteria. You are able to filter or sort if desired to find the perfect hotel to suit your needs. Once you find the hotel you are interested in, click on it to be brought to the hotel-specific page with property details and room types that are available for this booking.

Scroll down and you will see the rooms that are bookable. Once you find the one that you like, click on Reserve to be taken to the payment page.

Once you are on the payment page, this is where you can elect to use your points to pay for the booking through the flexible travel rewards option. You are able to use a portion or all of your points when making a flexible travel booking, however, the default is to use all of your points (or the maximum number of points to pay the booking off completely).

As you update the points and cash payment split, the price summary on the right-hand side of the screen will update. This will give you insight into what you will be paying for this booking when you confirm in addition to any on-property fees (such as a resort fee in Las Vegas).

Once you are happy with the price summary, simply fill in the rest of the details and click “Complete Booking”. Any applicable points will be withdrawn from your account and you will receive an email confirmation of the booking.

Convert Avion Rewards to Airline Partners

If you are pursuing a flight redemption on another airline, you might find value in converting your Avion Rewards points to a specific airline loyalty program. Avion Rewards is partnered with American Airlines AAdvantage, British Airways Executive Club, Cathay Pacific Asia Miles, and WestJet Rewards.

Avion Premium points can only be transferred to WestJet Rewards, whereas Avion Elite points can be transferred to all of the below frequent flyer programs.

You can convert Avion Rewards points at the following rates:

The Avion Rewards program also offers transfer bonuses from time to time. For example, in recent years we have seen promotions that give cardholders an extra 30% British Airways Avios Miles when transferring. This can create some strong value propositions in making dream trips much more accessible, such as redeeming Avios for Qatar Airways Qsuites .

If you hold any of the RBC Avion credit cards, you will be able to transfer to any of the partners listed above. On the other hand, if you hold a card that earns Avion Premium points, you will only be able to transfer your points to WestJet Rewards. (However, you can fix this by either switching the card to an Avion card or by applying for another Avion card and transferring the Rewards+ points to the Avion card).

You can see the current transfer ratios, including any bonus promotions, by viewing our Miles & Points Transfer Partner Tool .

How to Convert Avion Rewards to Airline Partners

To convert your Avion Rewards points to airline partners, go to the ‘Shop Avion Rewards’ portal. You can access this from the account summary page of any of your RBC credit cards.

Then from the Avion Rewards portal home page, select ‘Manage Points’ from the main navigation menu and then ‘Convert Points’ from the submenu.

From the next screen, you’ll be prompted to select which loyalty program you would like to transfer to and then the number of points. You will also be prompted to input your membership number for whatever program you are transferring points to, as well as an email address for confirmation (optional).

RBC often offers promotions of 20-25% off on gift card costs for various retailers so there may be value there (which is atypical as for most points programs, redeeming points for gift cards offers terrible value).

The best value is consistently hotels.com or Fairmont as both can be purchased at 1 cent per point without any promotions required. However, there have been previous promotions for hotels.com and Fairmont, in which we have seen up to 25% off.

If you have a Rewards+ earning RBC credit card (not Avion), you can also redeem at 1 cent per point for Amazon.ca gift cards.

Other Redemption Options

Avion Rewards can also be redeemed for merchandise, a statement credit, or financial rewards. These methods are not viable from a value perspective and it is strongly recommended that you do not redeem Avion Rewards using any of these methods as you are effectively throwing money away.

The Avion Rewards merchandise catalog has various products to purchase with points. The value for redeeming points for merchandise varies widely but is generally underwhelming and not recommended. You would be better off redeeming points for a gift card and purchasing the merchandise outright on many occasions.

Points can be redeemed towards a statement credit for your Royal Bank of Canada credit card account. If you were to redeem points through this method, 10,000 Avion Rewards points would be worth a $58 statement credit. It doesn’t take a mathematician to understand the terrible value that this offers.

Finally, Avion Rewards can be redeemed towards RBC financial rewards. This means that if you hold a mortgage, personal loan, or registered account with RBC, you can redeem points to financially fund that account. If you were to use this option, 10,000 Avion Rewards points would be worth $83 in your financial account. Again, not a great value when you can easily redeem points for at least 1 cent per point.

Frequently Asked Questions

As long as you hold an active Avion Rewards or Avion credit card, the points tied to that card will not expire. If you cancel an RBC credit card that still has points remaining, you will have 90 days to either redeem those points or transfer them to another active RBC Rewards or Avion credit card that you hold.

RBC Avion Elite points are Avion Rewards points earned by Avion cardholders. They are a higher tier of points than the basic RBC Avion Premium points and can be redeemed for travel and also transferred to other airline partner programs.

You can redeem points to redeem for flights through two methods: via the fixed travel award chart or the flexible travel option. The fixed travel award chart allows you to redeem points for round-trip flights to destinations around the world for a set amount of points and up to a certain ticket value. For example, a round-trip economy flight anywhere in North America will always cost you 35,000 Avion Rewards points. The ticket can have a maximum value of $750 CAD. Flexible travel redemptions allow you to redeem points at a rate of 100 Avion Rewards = $1 towards any travel booked through the Avion Rewards travel portal.

Some select flights are not available to book on RBC’s Travel portal. If this is the case, you can instead opt to book the flight yourself and receive statement credit from RBC in exchange for your points. To do this: 1. Navigate to Support from the RBC Travel homepage 2. Select the popular topic “Book with a statement of credit on an Avion flight” 3. Go through the process outlined therein You must call and receive authorization from an RBC travel agent before making the booking. Then you must complete a manual form before you will be credited with statement credit and the appropriate amount of RBC points removed from your account. This method can be used to redeem using the Air Travel Redemption Schedule rates or the 1% flexible travel rate.

Yes, you are able to combine Avion Rewards points between any Avion Rewards credit cards that you hold. When you log into Avion Rewards, click “Transfer Points” and you will be able to choose the account you want to transfer points from and the destination account. You can also quickly combine points between all of your accounts using this feature.

Yes, you can combine Avion Rewards points between yourself and your significant other by adding them as a co-applicant to an ION or ION+ credit card. Note that a co-applicant is different than an authorized user.

The value of an Avion Reward point varies, depending on how you choose to redeem them. We recommend using a base value of 1 cent per Avion Rewards point when making your redemptions.

The Avion Rewards program team can be contacted via phone at 1-800-769-2512.

Posts about Avion Rewards

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Subscribe to our newsletter .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

5 comments on “ Avion Rewards ”

I just tried the RBC Rewards Travel Portal to see how much a fixed point redemption would cost and it was not as advertised. One person, return trip from Vancouver,BC to LHR leaving Dec 16th and returning Dec 23rd, 2023 would cost 65,000 fixed points (should be worth up to $1,300 excluding tax and fees) plus $935.66 out-of-pocket. I compared this against Expedia and the out-of-pocket trip cost would be $1,140.66 (breakdown is $805.00 in air transportation charges, plus $335.66 for taxes and fees). So, the 65,000 RBC Avion points only saves me $200 in travel costs – this is pathetic! It should have saved me the $805 flight cost! What is going on here; is RBC devaluing their own points? …I ‘m considering changing credit cards if this is the case. Thanks for your advice.

$1300 is the max ticket price, not the guaranteed value. Are you comparing the exact same flight on Expedia and on RBC? The $935 out of pocket seems strangely high but I wonder if its on an airline like BA which have notoriously high taxes and fees. You’d be better off booking a flexible travel redemption and taking $650 off instead.

Personally I find best use of RBC to be transfers to airline partners like BA Avios, Cathay, etc.

Hi Reed. Thanks for your reply. Maybe I’m not quite understanding the ticket price vs guaranteed value. To clarify, the comparison was for the exact same flights, carrier (Air Canada), and dates. Expedia “Air transportation charges” (I assume this is the ticket price portion?) showed as $805 so this was what I expected RBC to cover but they don’t. I did another comparison tonight with different dates (July 6-20, 2024 flying with Iceland Air) and the Expedia cost was $976 for “Air transportation charges” plus $277.96 for “taxes and fees” (total cost $1,253.96). RBC wants 65,000 points plus $621.96. So, out of the total cost of $1,253.96 RBC is only covering the difference of $632 with my 65,000 points (about a 1% points vale); still extremely terrible “value” from RBC. They should cover the $976 flight cost. What am I missing? Can I send you a screenshot? Thanks again.

Yes – I emailed you.

I was not allowed to choose Level of economy flight from basic to the next two levels of economy this is a situation on Air Canada site that allows me to increase my level of comfort

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities. For complete and current information, please consult the entity's website.

RBC Avion : How to Use Your RBC Avion Points for Travel Rewards

RBC Avion Rewards Credit Cards

There are several RBC Avion credit cards part of the Avion Rewards program . One of the best is the RBC Avion Visa Infinite Card .

It has excellent insurance, including one for mobile devices, which is rare. In addition, as a welcome offer, it offers a lot of points with little effort.

Other cards that earn Avion Points are:

- RBC Avion Visa Infinite Card

- RBC ION+ Visa Card

- RBC ION Visa Card

- RBC ® Avion ® Visa Infinite Privilege* Card

- RBC Avion Visa Platinum

- RBC Avion Visa Infinite Business Card

- RBC Avion Visa Business Card

With this offer for the RBC Avion Visa Infinite Card, you can earn 35,000 Avion points upon approval . No purchase necessary!

You can use your Avion Rewards points for travel or redeem them with other loyalty programs such as :

- American Airlines AAdvantage

- British Airways Executive Club (and Qatar Airways Privilege Club)

- Cathay Pacific Asia Miles

- WestJet Rewards

The current welcome offer, for example, gives you the equivalent of 35,000 British Airways Avios or 350 WestJet Dollars .

With the RBC Avion Visa Infinite Card, you earn 1 point per dollar and 1.25 points for travel purchases.

What’s more, you’ll benefit from a wide range of insurances: trip cancellation and interruption insurance, out-of-province or out-of-country emergency medical care insurance, collision and damage insurance for rental vehicles, and mobile device insurance.

How to Use Your Avion Points for Travel Rewards

Use the fixed fare chart for airline tickets.

One way to use your Avion points for travel is with the purchase of an airline ticket. This is the best way to get the most value out of the RBC Avion Rewards program . This is described in detail in this article .

Depending on the destination, 15,000 to 100,000 Avion points are required per ticket.

RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket. A one-way trip requires half as many Avion points. Here is the airfare table for a round-trip flight:

On average this equals about 2 cents per Avion point .

Use the Flexible Fare Chart for Airfare

The Flexible Fare Plan uses 100 Avion points for a $1 discount on your airfare. The transaction must be made directly on the Avion Rewards website, using the flight search tool.

For example, with the flat rate fare, 35,000 points will get you a round-trip ticket anywhere in Canada and the U.S., up to a value of $750.

If you choose to purchase that same $750 ticket with the flexible fare structure , you will need 75,000 points. So using the flexible fee schedule would be more of a disadvantage in this case. It’s up to you to make your calculations, depending on the number of points you have banked.

Redeem Avion Points for Any Trip

For even more flexibility, book your hotel, car rental, cruise or airline tickets as you wish on the Avion Rewards site to have your account credited.

Avion credit cardholders can redeem 100 Avion points to deduct $1 from this travel expense. For example, for a night at the hotel that cost $200, 20,000 points are required to bring the balance down to zero.

For ION and ION+ credit card holders, it’s different. They redeem their points using a conversion rate of 172 points = $1.

Buy Gift Cards

There are approximately 250 gift cards to purchase with Avion points. About ten of these geared towards travel. For example, buying a gift card for future stays at Fairmont or Best Western hotels. Or Tim Hortons, for roadtrips !

Generally, the cost is 1 cent per Avion point, so 5,000 points for a $50 gift card .

Uber is different, with 7,000 points for $50.

Transfer to Other Airline Loyalty Programs

Did you know that it is possible to transfer your Avion points to other airline loyalty programs? We explain how in our tutorial on this subject:

Another way of exchanging RBC points in the event of technical problems

Occasionally, the Avion Rewards site may experience technical difficulties or your flight may not appear in the search results.

During that time, call Avion Rewards Customer Service at 1-800-769-2512.

- Get an authorization number to book the flight you want;

- Book your own flight directly on the desired airline’s website;

- Send an e-mail to [email protected] with your authorization number obtained earlier from Customer Service, your name, the number of tickets reserved, proof of ticket purchase and itinerary details.

Avion Rewards will then deduct the required points from your RBC Rewards points account to credit the cost of your airline tickets, according to their fare structure.

Frequently asked questions about the Avion Rewards program

How many avion points are needed for a free airline ticket.

Depending on the destination, 15,000 to 100,000 Avion points are required.

Can I buy a ticket for another person?

Yes , make sure that the person’s personal information is written down perfectly at the time of booking.

What is the definition of a basic Avion Rewards account?

These are the people enrolled in the Value Program , who earn Avion Rewards points.

Where can I redeem my Avion Rewards points for travel?

Go to the site Avion Rewards or click on the Avion Rewards icon in your RBC Direct Banking session. Then go to the Travel section.

All posts by Caroline Tremblay

Suggested Reading

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Points Programs

Hotel programs, best credit cards, back to news, rbc’s upcoming transition of hsbc rewards to rbc avion rewards.

More details have been released about RBC’s upcoming transition of HSBC Rewards points to RBC Avion Rewards.

Written by T.J. Dunn

On February 21, 2024

Read time 20 mins

As first reported by Rewards Canada , there’s more information available about the upcoming transition from HSBC Rewards to RBC Avion Rewards . After publishing this article, we’ve received additional information from RBC, and have added it below.

While the exact conversion rates are still not known, we have more insight into what we might expect, which can help you decide what to do with your existing HSBC Rewards balance.

More Details Regarding the HSBC Rewards to RBC Avion Rewards Transition

RBC has provided more insight into what customers can expect in the upcoming transition from HSBC Rewards to RBC Avion Rewards .

As a reminder, your HSBC Rewards points will be converted to RBC Avion Rewards points as part of RBC’s acquisition of HSBC Canada . The acquisition is set to be completed by the end of March 2024.

Previously, RBC has stated that the transfer will be at a comparable ratio, but has remained mum on the exact transfer ratio. Without knowing the rate at which your HSBC Rewards will be converted to RBC Avion Rewards, it’s been difficult to make a decision whether to redeem them now or wait for the conversion.

However, we now have some more insight into what cardholders can expect, and if it turns out to be the case, it should be sufficient to guide your decisions on whether to redeem now or wait.

First off, HSBC Canada customers won’t receive confirmation of the conversion value until after it’s taken place.

Clients will receive a communication with more information about the conversion of their points within one week of migration.

We can infer that this is because some cardholders will be transitioned to products that earn RBC Avion points at the Elite tier, while others will be transitioned to products that earn RBC Avion points at the Premium tier. It seems that there won’t be blanket conversion rates that apply to everyone, and rather, it will be unique to each cardholder’s situation.

Despite not knowing exact conversion values, there’s now more information available that should help guide your decision on whether to redeem your HSBC Rewards points now or to wait for the conversion, which we’ll discuss in detail below.

RBC has shared that HSBC Canada clients will receive equal or greater value with their converted points based on flexible redemptions.

We can share that all HSBC Bank Canada clients migrated to RBC will receive an Avion points balance that will have equal or higher value in the flexible travel redemption category in the same way they book their travel today.

As a reminder, HSBC Rewards can be flexibly redeemed against travel at a rate of 0.5 cents per point, while RBC Avion points at the Elite tier can be flexibly redeemed against travel booked through the Avion Rewards platform at a rate of 1 cent per point.

Therefore, for those being transitioned from an HSBC product to an RBC Avion product, we project that the minimum conversion rate might be 2 HSBC Rewards points = 1 RBC Avion Elite point.

With HSBC Rewards earned on either the HSBC +Rewards Mastercard or the HSBC Travel Rewards Mastercard, you can also flexibly redeem points against travel at a rate of 0.5 cents per point.

Since you’ll be transitioned to the RBC ION Visa, which earns RBC Avion points at the Premium tier that can be flexibly redeemed against travel booked through the Avion Rewards platform at a rate of 0.58 cents per point, we project that the minimum conversion rate might be 1.16 HSBC Rewards = 1 RBC Avion Premium point.

It’s worth reiterating that the exact transfer ratios aren’t known, and won’t be known until after the conversion has taken place. However, if these ratios turn out to be true, or maybe even better, we have more guidance on whether it’s best to redeem now or wait.

There is no specified date for the conversion to take place; however, once it does, you’ll have full access to your new batch of RBC Avion Rewards points within a week.

Should You Redeem HSBC Rewards Points Now or Wait?

Assuming that the estimated minimum conversion rates are accurate, let’s take a look at whether it’s in your best interest to redeem now or wait until later.

However, keep in mind that the exact transfer ratio won’t be known until after the conversion, so if you’d rather lock in a redemption with 100% certainty, you’ll want to redeem your HSBC Rewards points now.

As a reminder, the last day to transfer HSBC Rewards to airline partners is February 29, 2024.

Customers being transitioned to the RBC® Avion Visa Infinite†

If you’re being transitioned from the HSBC World Elite Mastercard, your options for redeeming HSBC Rewards currently include the following:

- Redeem against travel purchases at a rate of 0.5 cents per point

- Transfer to British Airways Executive Club at a 25:10 ratio

- Transfer to Singapore Airlines KrisFlyer at a 25:9 ratio

- Transfer to Cathay Pacific Asia Miles at a 25:8 ratio

After the transition, you’ll earn RBC Avion points at the Elite tier, which can be redeemed as follows:

- Redeem against travel purchases at a rate of 1 cent per point

- Redeem for flights on the RBC Air Travel Redemption Schedule for up to 2.33 cents per point

- Transfer to British Airways Executive Club at a 1:1 ratio

- Transfer to Cathay Pacific Asia Miles at a 1:1 ratio

- Transfer to American Airlines AAdvantage at a 1:0.7 ratio

- Transfer to WestJet Rewards at a 100:1 ratio

Depending on how you’d like to redeem your points, it should result in the same or better value if you choose to wait for the conversion.

To illustrate this, we’ll use an example of someone with 105,000 HSBC Rewards points who’s transitioning from the HSBC World Elite Mastercard to the RBC® Avion Visa Infinite†. Plus, we’ll assume that their HSBC Rewards will be converted to RBC Avion points at the Elite tier at a 2:1 ratio.

If you tend to redeem points flexibly against travel purchases, then it makes no difference to redeem now or later.

105,000 HSBC Rewards points can be redeemed for $525 against travel purchases. If they’re converted at a 2:1 ratio, you’d be able to flexibly redeem 52,500 RBC Avion Elite points against $525 worth of travel.

However, it’s worth noting that with HSBC Rewards, you can book travel directly with any vendor, and then redeem points against charges posted to your statement. Booking this way ensures you’re eligible for earning points with airlines and hotels, and also makes you eligible for status qualifying activity.

On the other hand, to redeem RBC Avion points for travel, you must book through the Avion Rewards platform, which may limit your ability to earn points from airline and hotel programs, and could also make you ineligible for elite qualifying activity.

If you plan to make use of the RBC Air Travel Redemption Schedule for booking flights, it’s likely in your best interest to wait for the conversion, since you can unlock more value for your points by doing so.

That’s because you can redeem RBC Avion points at the Elite tier for up to 2.33 cents per point with the Air Travel Redemption Schedule.

If you planned on transferring your HSBC Rewards points to British Airways Executive Club or Cathay Pacific Asia Miles, it’s likely in your best interest to wait for the conversion.

105,000 HSBC Rewards points is equal to 42,000 British Airways Avios, or 33,600 Asia Miles.

Assuming that 105,000 HSBC Rewards will be converted to 52,500 RBC Avion points at the Elite tier, you could then convert them into 52,500 British Airways Avios or 52,500 Cathay Pacific Asia Miles.

However, if there’s a transfer bonus from RBC Avion to either program after the conversion has happened, you’d wind up with an even better rate.

It’s worth noting that 52,500 RBC Avion points at the Elite tier could also be transferred to 36,750 AAdvantage miles, or 525 WestJet dollars. AAdvantage is otherwise quite difficult to access, and there are some great redemption options available in the program, so be sure to consider it as an option, too.

If you have your eyes set on a Singapore Airlines KrisFlyer redemption, you’ll want to make your transfer before February 29, 2024. After that point, it will no longer be possible to transfer Canadian points currencies to KrisFlyer, aside from Marriott Bonvoy points, since RBC Avion Rewards doesn’t have it as a transfer partner.

Customers being transitioned to the RBC® ION Visa

If you’re being transitioned to an RBC® ION Visa , then your HSBC Rewards points will be converted to RBC Avion points at the Premium tier, which are less flexible than RBC Avion points at the Elite tier.

It shouldn’t make a difference whether you redeem your HSBC Rewards points against travel purchases now, or wait until later, since you’ll likely wind up with the same rate.

Plus, you can also choose to transfer your RBC Avion points at the Premium tier to WestJet Rewards, which could result in a higher redemption value.

However, keep in mind that if you eventually get an eligible RBC Avion credit card, such as the RBC® Avion Visa Platinum, RBC® Avion Visa Infinite†, or RBC® Avion Visa Infinite Privilege†, you can convert your RBC Avion points at the Premium tier into RBC Avion points at the Elite tier at a 1:1 ratio.

Therefore, if you find yourself in this position, it’s likely in your best interest to wait for the conversion, and then plan on adding an RBC Avion credit card product to your wallet in the future to unlock more value from your points.

Customers being transitioned to the RBC® Avion Visa Infinite Privilege†

Lastly, if you’re being transitioned to an RBC® Avion Visa Infinite Privilege† , you’ll also be moved to a card that earns RBC Avion points at the Elite tier.

However, one unique feature of the RBC® Avion Visa Infinite Privilege† is that you can redeem RBC Avion points for business class and First Class tickets at a rate of 2 cents per point.

If you plan on redeeming points this way, it’s in your best interest to wait for the conversion, since you’ll be able to unlock more value from your points by doing so.

For example, assuming 125,000 HSBC Rewards points are converted to 62,500 RBC Avion points at the Elite tier, you’d then be able to redeem them for up to $1,250 (CAD) worth of business class and First Class flights at 2 cents per point.

Perhaps one great example of this would be to book a round-trip Emirates A380 First Class flights between Bangkok and Hong Kong, which routinely price out at around $1,225 (CAD).

We now have more insight into how RBC will convert existing balances of HSBC Rewards into various tiers of RBC Avion Rewards points.

Assuming the conversion estimates are accurate, you should get either the same or better value by waiting for the conversion, rather than redeeming your HSBC Rewards points prior to the conversion.

However, it’s worth reiterating that the exact conversion rate will be unique to each individual, and it won’t be announced until after the conversion has taken place.

Therefore, if you’d rather be 100% certain of the value you can get from your points, you can choose to redeem your points now, knowing that it could be possible to get better value once the conversion takes place.

†Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

Share this post

Copied to clipboard!

Sign In to Avion Rewards

Sign in with:

If you have a personal credit card or deposit account, you need to enrol in RBC Online Banking to enjoy Avion Rewards. It’s easy and secure.

Avion Rewards members can have it all

You’ve got points 1 , cash back and savings – all in one program.

Points, cash back, and savings – all in one program.

Shop smarter with Avion Rewards

Enjoy more ways to shop, save and earn everywhere, every day.

Deals from over 2,000 brands

Get special prices AND earn points on your favourite brands.

Take that dream vacation

Flights, hotels, cars and more – they’re all yours 2 .

Pay with points

Use your points 2 to shop Apple, Best Buy, gift cards, home decor, sports gear and more.

Do more with points

From bills to investments to charitable giving, use your points 2 for what matters most.

Deals at over 2,400 retailers

Get up to 40% cash back 1

Earn money back in your pocket with the Avion Rewards ShopPlus browser extension.

Flights, hotels, cars and cruises – they’re all yours 2 .

Let ShopPlus find the savings for you

Shop more savvy with the ShopPlus browser extension. You do the shopping, we do the searching. Avion Rewards ShopPlus is available for desktop and mobile iOS users – and it’s free!

Get the app and you can get it all on the go

Savings, cash back, offers and points– all in your pocket. Get the Avion Rewards app and never miss a deal.

Download the app

Power up your rewards with our partners

and an RBC credit or debit card

Save 3¢/L instantly at the pump

Plus get 20% more Petro-Points & Avion points

Get 5x more Be Well points

Earn faster, save more every time

Get up to 10% back

Save on DIYs, renos and more

Enjoy $0 delivery fees

Get a free DashPass and save up to $120

5 stars for Avion Rewards

Don’t just take our word for it – let the rest of the Avion Rewards family do the talking!

“So easy to use. Works on Canadian stores. WHAT?! Amazing.”

“Amazed with the offers … lots of options to choose from”

“Absolutely fantastic… Great job RBC. As always, the best experience from the #1 Canadian bank.”

I just booked a weekend trip to Montreal through the app. I was able to find what I was looking for in the travel section!

I recently bought a pair of sneakers through the app's Shop the Web section. I found a good deal and earned some cashback!

Join the millions of people already shopping and saving with Avion Rewards

View Legal Disclaimers Hide Legal Disclaimers

Cash back percentage varies by brand and is subject to change.

Not all rewards are available for all members.

To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC Business Clients will only be able to link up to two (2) Business Credit Cards and one Business Debit Card to a Petro-Points card.

Any/every/your card means an RBC Card that is linked to a Petro-Points card. A linked RBC Member means you have an RBC debit or credit card issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”) that is linked to a Petro-Points card.

You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A Linked RBC Card means an RBC Card linked to a Petro-Points Account. Your Linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your Linked RBC card at Petro-Canada Locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your Linked RBC Card.

Each time you use your Linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada Location, you will save three cents ($0.03) per litre at the time of the transaction.

Each time you use your Linked RBC Card to pay for qualifying purchases at a Petro-Canada Location, you will earn a bonus of twenty percent (20%) more Petro-Points than you normally earn, in accordance with the Petro-Points terms and conditions available at https://www.petro-canada.ca/en/personal/terms-and-conditions#petropoints .

Petro-Points are not awarded on tobacco products, vaping products, gift cards, transit tickets and taxes on non-petroleum purchases.

To participate in this offer, you must have an eligible RBC Debit Card, Personal Credit Card or Business Credit Card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC Business Owners will only be able to link up to two (2) Business Credit Cards and one RBC Debit Card to a Be Well Card.

Eligible RBC Debit Cards are debit cards tied to a personal banking or savings account or a business banking or savings account in good standing that is set up to pay for goods and services at a store or merchant that has point of sale or other designated debit card terminals that accept debit card payments.

You must be enrolled in RBC Online Banking in order to link your RBC Card to your Be Well Card. Card linking may take up to 2 business days to process before Be Well points can be applied to purchases. Each time you scan your Be Well Card and pay with your Linked RBC Card, you will earn 50 Be Well points for every $1 spent on eligible purchases at Rexall Locations, in accordance with the Be Well Terms and Conditions available at https://www.letsbewell.ca/terms-conditions .

Be Well points are not awarded on taxes; tobacco products; products containing codeine; lottery tickets; alcohol; bottle deposits; gift cards; prepaid cards and wireless or long distance phone cards; event tickets; transit tickets and passes; post office transactions; stamps; passport photos; cash back; gifts with purchases; delivery charges; environmental levies; Home Health Care services/rentals and any other products or services that Rexall / McKesson Canada Corporation may specify from time to time or where prohibited by law.

To receive a complimentary DashPass subscription for $0 delivery fees on orders of $15 or more at eligible restaurants when you pay with your Eligible RBC Credit Card, you must subscribe to DashPass by adding an Eligible RBC Credit Card, accept the DoorDash terms and conditions, and activate your benefit by clicking “Activate Free DashPass” before July 5, 2023 (“Offer Period”). If you are an existing DashPass subscriber and have already added an Eligible RBC Credit Card to your account you must activate your benefit by clicking “Activate Free DashPass” during the Offer Period. If you have been charged for DashPass you will receive a refund to the method of original payment, in the amount of the monthly subscription fee for the month you activate your complimentary subscription. For all clients, by clicking on “Activate Free DashPass” you agree to the DoorDash terms and conditions which can be found at https://help.doordash.com/consumers/s/terms-and-conditions (opens in a new window)

Existing Cardholders: Get 10% in statement credits on your first $250 of qualifying purchases, and 5% in statement credits on your next $1,250 of qualifying purchases, after taxes and shipping, when you pay with your eligible RBC debit or credit card from now until July 31, 2023 (“Offer Period”) at participating RONA stores and online. No minimum spend required. Statement credits limited to the first $1,500 of total spend during the Offer Period. This offer is not transferable. To take advantage of this offer, you must activate the offer by clicking the “Load Offer” button in RBC Online Banking before you make your purchase.

Once the offer has been activated you will receive a Statement Credit, calculated on the final price of your Qualifying Purchases after taxes and shipping fees at participating RONA stores in Canada and https://www.rona.ca/ Qualifying Purchase made during the Offer Period with any RBC Royal Bank personal debit or credit card, other than an RBC US Dollar Visa card, (“Eligible RBC Card”) to receive:

- 10% in statement credits on the first $250 spent on Qualifying Purchases, and

- 5% in statement credits on the next $1250 spent on Qualifying Purchases (i.e., spend between $250.01 - $1,500)

(collectively, Statement Credits”).

There is no minimum spend required. Statement Credits are limited to the first $1,500 of total Qualifying Purchases during the Offer Period. Qualifying Purchases exclude payments made through PayPal for online orders, payments by Gift Cards and purchases of items that are out of stock and/or not ready for shipping within the Offer Period.