Capital One VentureOne Card benefits guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

- • Credit cards

- • Rewards credit cards

- Connect with Jason Steele on Twitter Twitter

- Connect with Jason Steele on LinkedIn LinkedIn

- Connect with Greg Johnson on LinkedIn LinkedIn

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- With the Capital One VentureOne Rewards Credit Card, accessing major travel benefits doesn’t have to mean being charged a high annual fee.

- The VentureOne Rewards card offers 5X miles per dollar on hotels and rental cars (when booked through Capital One Travel), 1.25X miles on all other purchases as well as a suite of additional travel-specific perks.

- These miles can be especially valuable when transferred to Capital One travel partners.

- The VentureOne Rewards card is also a good option for travelers who want the opportunity to earn travel rewards in addition to receiving a 0 percent intro APR offer on new purchases and balances transfers — a benefit that isn’t available with many travel cards (19.99 percent to 29.99% variable APR applies thereafter).

The Capital One VentureOne Rewards Credit Card is one of the best travel credit cards available with no annual fee. While it might seem as if a no-annual-fee card would offer fewer worthwhile benefits than an annual-fee card, Capital One VentureOne cardholders aren’t missing out — the card includes many valuable benefits of note.

Main Capital One VentureOne Card benefits

The Capital One VentureOne Card includes impressive rewards rates for a card with no annual fee:

- 5X miles per dollar on hotels and rental cars booked through Capital One Travel

- 1.25X miles per dollar spent on all purchases

As for the welcome bonus, new cardholders earn 20,000 bonus miles after using their card to spend $500 within three months of account opening. Additionally, new cardholders enjoy a 0 percent intro APR on purchases and balance transfers for 15 months (19.99 percent to 29.99 percent variable APR after that), making this card a solid choice to consider if you’re looking to finance a large purchase or transfer a balance.

Capital One VentureOne Card travel benefits

Auto rental insurance.

When traveling, Capital One VentureOne cardholders have access to several travel insurance perks. One of the most valuable is auto rental insurance coverage, which allows you to decline the expensive optional insurance offered by rental car companies when you use your VentureOne card to pay for the rental.

Travel accident insurance

Another benefit is travel accident insurance. When you use your card to pay for your ticket, you will be covered for up to $250,000 in the event of accidental loss of life, limb, sight, speech or hearing while riding as a passenger.

Travel assistance services

You also can receive up to $3,000 worth of lost luggage reimbursement compensation when traveling, as well as access to a travel and emergency services hotline and roadside assistance.

No foreign transaction fees

There are no foreign transaction fees on purchases made outside of the U.S., making this card a great choice for traveling abroad or making online purchases in foreign currency right from your sofa.

Capital One Travel

Capital One Travel uses technology to help improve the travel booking experience. Specific features you’ll enjoy include:

- AI-powered price prediction, price watch and price match guarantee

- More flexible booking options

- More earning potential: Earn 5X miles per dollar on hotels and rental cars booked through Capital One Travel

Capital One Lounges

Capital One Lounges include restaurant-quality dining, exercise facilities and family-friendly features. Current Capital One Lounge offerings can be found at Dallas Fort Worth International Airport, Denver International Airport and Dulles International Airport outside of Washington, D.C.

Only select Capital One customers enjoy complimentary access to Capital One Lounges; VentureOne cardholders will need to pay $65 for every visit to Capital One Lounges. If lounge access is important to you, you may want to consider one of Capital One’s other cards .

Lounge access and pricing are as follows:

- Capital One Venture X Rewards Credit Card : Complimentary access; additional terms apply

- Capital One Venture X Business : Complimentary access; additional terms apply

- Capital One Venture Rewards Credit Card : Two free visits per year (through December 31, 2024), then $45; additional terms apply

- Capital One Spark Miles for Business : Two free visits per year (through December 31, 2024), then $45; additional terms apply

- All other cardholders and non-customers : $65 per visit; kids under two are free

Other VentureOne Card benefits

Beyond the card’s travel rewards program and benefits, VentureOne cardholders have access to numerous other cardholder benefits.

Eno, a virtual assistant

Capital One offers a virtual assistant, Eno, in its mobile app. Eno can create a virtual card number for when you shop online, enabling you to conceal your actual card number and minimize the risk of fraud. Eno can also be configured to offer account alerts that can notify you of potential mistakes, duplicate purchases or recurring bill increases.

CreditWise credit monitoring

Capital One also offers its CreditWise service for credit monitoring , which provides alerts when there’s a change to your TransUnion or Experian credit report, among other services.

Capital One Dining and Entertainment

Capital One has also partnered with some leading brands to offer VentureOne cardholders special access to dining, entertainment and sports experiences. For example, Capital One Dining may include access to Michelin-rated restaurants and special culinary experiences. Capital One Entertainment may provide first access to major concerts, exclusive ticket packages for sporting events and cardholder-only events.

Capital One Shopping

Capital One offers a shopping portal with a free browser extension that will automatically apply the best coupon codes at checkout, in addition to letting you know when prices drop on products you’ve viewed and purchased.

Purchase protections

- Extended warranties: When you make a purchase with your Capital One VentureOne Card, you’ll get additional warranty protection on eligible items.

- Fraud protection: You’ll receive $0 fraud liability to protect you from being held responsible for unauthorized charges.

- Purchase security: Eligible items will be replaced, repaired or reimbursed up to $500 per claim and within 90 days of purchase.

See your card’s guide to benefits for complete terms and restrictions.

Maximizing the Capital One VentureOne Card’s benefits

You can maximize the VentureOne Card’s benefits in several ways. First, if you plan on taking advantage of the 15 months of interest-free financing, make sure you avoid interest charges by paying off your balance before the promotional period ends at which point the 19.99 percent to 29.99 percent variable APR will apply. And when traveling outside the U.S. or making a charge to a foreign company, use your Capital One card to avoid the 3 percent foreign transaction fee that many other credit cards charge.

Additionally, while you can redeem your Capital One miles at Amazon.com and PayPal, doing so may offer less value than you’d receive by redeeming your miles for statement credits toward travel purchases. It’s also potentially much less than your miles could be worth when strategically transferred to travel partners and redeemed for high-value airline or hotel reservations. According to Bankrate’s latest valuations , Capital One miles are worth an average of 1.7 cents per mile when transferred to the right travel partner — giving you the greatest value for your miles.

The bottom line

The Capital One VentureOne Rewards card has no annual fee , but that doesn’t stop it from offering many of the same features found on premium travel rewards cards with high annual fees. The most important feature is its robust rewards program that allows you to either redeem your reward miles for statement credits toward travel purchases or transfer your rewards to an expanded list of airline and hotel partners.

Beyond rewards, important Capital One VentureOne benefits include numerous shopping, security, travel and purchase protection features. If you’re looking for a travel card with no annual fee and numerous benefits, the Capital One VentureOne card is certainly worth consideration .

Article sources

We use primary sources to support our work. Bankrate’s authors, reporters and editors are subject-matter experts who thoroughly fact-check editorial content to ensure the information you’re reading is accurate, timely and relevant.

“ Visa and Mastercard Benefits Guides | Capital One .” Accessed on July 5, 2024.

7 reasons to get the Capital One VentureOne Rewards Card

Capital One VentureOne vs. Quicksilver

Is the Capital One VentureOne Card worth it?

Capital One VentureOne Rewards Credit Card review

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Capital One Ventureone Rewards Card

26 Benefits of the Capital One VentureOne Credit Card

Christine Krzyszton

Senior Finance Contributor

322 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

6 Published Articles 1199 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Initial benefits, earning capital one miles, redeeming capital one miles, 0% introductory apr period for purchases, transfer miles to other accounts, finding your capital one offers, travel protection and benefits, shopping protections and benefits, account management and security features, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Capital One likes to keep things simple. As a result, their collection of credit card offerings tend to fall short of being exciting.

Sure, if you have bad credit or no credit, you’ll find cards that can help you build or rebuild your credit history. And if you’re a foodie, you’ll find they have a card that caters perfectly to your tastes.

But what you won’t find with Capital One credit cards are luxury travel benefits or a long list of bonus earning categories. Simplicity has always been a priority for Capital One. That is, until now.

Capital One has recently improved earning and redemption options on their miles-earning credit cards.

With sweetened earnings on hotel purchases and the added ability to transfer miles to airline partners, Capital One has now created some modest excitement for their travel rewards cards.

Today we’re going to focus on the Capital One VentureOne Rewards Credit Card and how it treads water respectively in a crowded sea of rewards-earning credit cards.

Welcome Bonus

Welcome bonus offers vary depending on when you’re approved, but one thing you can count on is a jump start in earnings that will contribute nicely to your travel fund!

Once you’ve been approved for the card, you’ll need to complete the minimum spending requirement within the specified time period from the date of card approval to qualify for the bonus.

The card offers unlimited miles at 1.25x per $1 and no annual fee. When you consider the flexible rewards, frequent travelers come out on top.

Interested in a travel rewards credit card without one of those pesky annual fees? Then say hello to the Capital One VentureOne Rewards Credit Card.

In addition to no annual fee, the Capital One VentureOne card offers no foreign transaction fees.

But is this card worth its salt, or is it merely a shell of the more popular Capital One Venture card?

- No annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- Ability to use transfer partners

- Weak earn rate at 1.25x miles per $1 spent on all purchases

- No luxury travel or elite benefits

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

- APR: 19.99% - 29.99% (Variable),0% intro on purchases for 15 months

- Foreign Transaction Fees: None

Capital One Miles

No Annual Fee

The VentureOne Card doesn’t charge an annual fee ( rates & fees ).

Earn Miles on Every Purchase

Every purchase you make on the VentureOne Card is going to earn 1.25 miles for every dollar spent. You’ll want to keep the card in your wallet for those everyday expenses so the earnings can add up quickly.

Miles Don’t Expire

As long as you have an open, active account, your miles will not expire. Should your account be closed, any miles that have not been redeemed will be forfeited.

No Limit on Earning

There’s no limit to the amount of Capital One miles you can earn with the card.

Capital One has several flexible options for redeeming your miles.

The best value, in general, is to redeem your Capital One miles for travel, where you have several options. You can book travel with any hotel or airline you wish, book travel directly through Capital One, or utilize airline transfer partners.

You’ll never have to worry about redeeming your Capital One miles for good value.

Book Travel Directly with Capital One

You can book travel via the Capital One website by logging in to your account and selecting “book a trip” from the redemption options. Your miles will be worth 1 cent when used for travel.

Be sure to compare prices with other travel providers to receive the best deal and to utilize other travel rewards programs.

For example, you might be able to earn additional perks on your travel purchase with online travel agencies such as Expedia or Orbitz .

Transfer Your Miles to Airline Partners

Capital One miles can easily be turned into airline miles. Airline miles can then be used to purchase award flights.

This option offers the possibility of greater value for your Capital One miles than the standard 1 cent per mile.

Currently, there are more than a dozen airline transfer partners, but more are being added.

If you’re looking to book a trip with miles, be sure to read our guide: The Best Ways to Redeem Capital One Miles .

Redeem for Gift Cards

You can still receive 1 cent per mile in value (or better) when redeeming your Capital One miles for gift cards. Look for discounts and specials offered on the Capital One website.

Redeem for Cash

While transferring your Capital One miles to airline partners or redeeming for travel may give you the most value for your miles, there are other options.

You can redeem miles for previous purchases or a check. The value you receive will be poor, about one-half of a cent per mile.

No Minimum Redemption Amount

No need to accumulate a certain level of miles, you can redeem as few or as many as you want, anytime you want.

Have a large purchase or multiple purchases coming up that you’d like to pay for over time? How about without interest?

Taking advantage of a 0% APR period on purchases can really help ensure that you don’t overpay in fees and interest, and still allow you to buy those unexpected big purchases.

Here’s the current APR offer: 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that ( rates & fees ).

It’s important to pay off your balance before the end of the promotional period to avoid incurring interest charges .

There’s no cost to transfer Capital One miles from one Capital One account to another. Both accounts must be in good standing and be miles-earning accounts.

You can find out if you have Capital One credit card offers waiting for you by using these risk-free tools that don’t affect your credit score.

See if You’re Pre-Qualified

Capital One has a great tool for determining if you’re already pre-qualified or pre-approved for one of their credit cards.

They’ve established a special website for you to enter your basic information and find out if you have credit card offers available.

If you do have Capital One personalized offers, it doesn’t mean you are guaranteed to be approved for a credit card, but the tool does give you an idea of which cards are best suited for you. Applying for the cards that fit your lifestyle can raise your chances of being approved.

To learn more about pre-qualifying and getting pre-approved for credit cards, we’ve put together a complete pre-qualification guide to walk you through the process.

Capital One and the Card Match Tool

Capital One participates in the Card Match Tool .

The tool works similarly to the pre-qualification tool. Simply complete and submit some basic information to find if you have existing credit card offers.

Bottom Line: Neither the Card Match Tool nor Capital One pre-qualification can guarantee you’ll be approved for a particular credit card. You will, however, have a much better idea of which cards you’re likely to get approved for by using these no-risk tools.

The VentureOne Card provides you with certain travel protections and benefits, making travel not only affordable but also easy.

No Foreign Transaction Fees

This card also serves you well while traveling overseas as no fees are charged on your foreign purchases ( rates & fees ).

Auto Rental Collision Damage Waiver

Use your VentureOne Card to reserve and pay for your rental and refuse the rental car agency’s CDW coverage.

You will receive coverage for damage, theft, loss of use, and towing on your rental car for rentals 31 days or less outside your country of residence. Rentals of 15 days or less are covered within your country of residence.

Coverage is subject to terms and conditions found in your specific card’s benefits guide.

Hot Tip: If car rental insurance is an important factor for you, see our post on the best credit cards for car rental insurance.

Travel Assistance Services

Receive 24/7 referral assistance for services such as an English-speaking doctor, emergency transportation, and legal help.

The cardholder is responsible for the actual cost of the provided services.

Hot Tip: If you own a business, check out some of the business credit cards offered by Capital One.

Extended Warranty

Purchase an eligible item with your card and receive an extension on the term of the manufacturer’s warranty.

Easy Authorized User Management

Add an additional user to your credit card and track their spending with the VentureOne Card

Customized Alerts

Set up personalized payment reminders and alerts to be notified of specific activity on your account.

Manage Your Account on the Go

Manage transactions, make a payment, or view your balance with the convenient Capital One Mobile App.

CreditWise ®

Access and monitor your credit risk-free with the CreditWise ® tool from Capital One. The tool is available free to non-cardholders as well.

Eno ® Assistant

Eno ® is your virtual assistant who watches over your account, alerts you to unusual activity, and answers your questions 24/7.

As you can see, the Capital One VentureOne card is a solid card with many perks and benefits. Depending on what your main spending categories are, how much you travel, and what you’re looking to get out of a card, the VentureOne could be a nice option if it meets your needs.

For Capital One products listed on this page, some of the benefits may be provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply .

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Related Posts

![venture one travel protection Capital One Venture Rewards Credit Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2019/06/Capital-One-Venture-Card-Image.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Is the Capital One Venture Card worth it? For this traveler, yes

Ariana Arghandewal is a travel rewards expert and personal finance content strategist. Over the last decade and a half, she has written about personal finance and travel rewards for prominent publications, including Bankrate, Business Insider, CNN Underscored, Forbes Advisor and Lonely Planet. Ariana is passionate about helping people leverage credit cards to achieve their travel goals and optimize their finances.

Glen Luke Flanagan is a deputy editor at Fortune Recommends who focuses on mortgage and credit card content. His prior roles include deputy editor positions at USA TODAY Blueprint and Forbes Advisor, as well as senior writer at LendingTree—all focused on credit card rewards, credit scores, and related topics.

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

With 11 credit cards in my wallet, you may not think at first that I’m discerning, but I put a great deal of thought into the best cards for my credit card portfolio. A card must offer serious value for me to keep it long term, and the Capital One Venture Rewards Credit Card is one of the few continuously worth the annual fee.

The Venture easily provides more than enough value to justify its $95 annual fee, between its lucrative rewards structure, flexible redemption options, and practical travel perks. If you’re wondering whether the Capital One Venture Card is worth it, here are five key reasons I believe this travel card is a keeper.

Capital One Venture Rewards Credit Card

Intro bonus.

at Cardratings.com

Reward Rates

- 5x Earn 5x miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- 2x Earn 2x miles on every purchase

- The Venture offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment

2X rewards at a reasonable annual fee

I have multiple credit cards that earn bonus points on categories like dining, grocery spending and travel. While I earn up to 5X points per $1 spent with my other cards, the Venture Card comes in handy for purchases that fall outside of these categories.

The Capital One Venture Card earns a flat 2x miles on every purchase, allowing me to maximize every dollar I spend—even if it’s not in a specific rewards category like gas stations or grocery stores .

Plus, the Venture also earns 5x miles on hotels, vacation rentals and rental cars booked through Capital One Travel. While I prefer to book directly with airlines and hotels to ensure I earn frequent flyer miles and receive elite status benefits, I don’t mind using this card for rental car bookings if the rates are competitive. Furthermore, I’ve occasionally found lower rates booking through the Capital One Travel portal, letting me earn miles while saving money on travel.

A great selection of transfer partners

A competitive transfer partner selection is the main reason I think the Capital One Venture Card is worth it. Capital One has 15 airline and three hotel partners to which you can transfer your Capital One miles , most at a 1:1 rate. I get tons of value by transferring miles to programs including Air Canada Aeroplan and Turkish Airlines Miles&Smiles for business class tickets.

International business class tickets generally cost thousands of dollars, which I can’t afford out of pocket. Instead, I use these miles to reduce costs and stretch my travel budget.

Even if I wasn’t planning to spend money on business class seats, and would have just booked economy class, using miles saves me money I would have spent on that economy ticket. I get to keep my cash in the bank for a rainy day—and relax in a better seat too. It’s a win-win.

Flexible redemption options

While transferring miles is often the best way to maximize value from flexible rewards , sometimes it’s nice to zero out your credit card balance after a vacation.

I try to keep my travel expenses to a minimum at all times—it’s why I’ve feverishly collected points for the past decade.

But when the cost of hotels is relatively low or there’s a great flight deal, I’m often conflicted between wanting to save points vs. money. The Capital One Venture Card makes it so I don’t have to choose.

Capital One miles are worth 1 cent each to cover past travel purchases. Since I’m earning them at a 2X rate, I feel less conflicted about occasionally redeeming Capital One miles for travel expenses.

I love returning from a trip with an unseemly credit card balance and zeroing it out without spending an actual dime. Capital One makes that option viable.

I get my money’s worth

The Capital One Venture Card is well worth the $95 annual fee I pay every year. I earn thousands of miles that exceed the annual fee in redemption value—and I get value from award redemptions and benefits. I also use the card abroad for non-bonus purchases because it waives foreign transaction fees , so I easily save hundreds of dollars in fees every year.

Aside from these money-saving benefits, the Venture Card offers a very important perk that most other cards with an annual fee in the $95 range do not: an up to $100 application fee credit every four years to reimburse Global Entry or TSA PreCheck .

Global Entry is a trusted traveler program that allows you to go through an expedited security line when you return from a trip abroad. It also includes automatic enrollment in TSA PreCheck, which streamlines the security screening process when flying out from more than 200 airports across the United States. Between these two programs, I estimate that I save hundreds of hours transiting the airport over the four-year membership period.

I used the card’s $100 application fee credit this year to renew my Global Entry membership. It’s not a huge amount, and I would have gladly paid for it out of pocket. But it offset my Venture Card’s annual fee this year, making it a keeper.

Useful travel protections

Travel protection is one of the most important features I look for in a credit card. Sure, earning points is great, and having access to a strong list of transfer partners is crucial. But I need the peace of mind that comes with knowing my travel purchases are protected, no matter which card I use.

The Capital One Venture Card provides travel accident insurance (covering you and eligible family for loss of life, limb, sight, speech or hearing) plus extended warranty and secondary rental car insurance .

And, as a World Elite Mastercard, the Venture provides baggage delay and trip cancellation/interruption insurance, too.

I like knowing that I’m protected if I use this card during my travels (or for everyday purchases) and something goes wrong.

The takeaway

The Capital One Venture Card is worth the annual fee between the miles, high-value transfer partners, and recurring benefits. I don’t mind paying $95 per year in return for thousands of miles that I can use to top off my most prized mileage balances with my favorite loyalty programs. It’s fair to say I save thousands of dollars on travel and maximize every dollar I spend, thanks to the Venture. But, if you’re a hardcore traveler who spends so much time on the go that you want even more generous rewards and elevated perks such as airport lounge access, you may want the Venture’s big sibling—the Capital One Venture X Rewards Credit Card . Here’s why one Fortune Recommends writer keeps the Venture X in his wallet despite its $395 annual fee.

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers. Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

- Our ranking of the best credit cards makes it easy for you to choose the best card.

- We’ve done the hard work to find the best business credit card for your small business.

- Want to earn cash on all your card purchases? Check out the best cash back credit cards .

- Choosing one of the best secured credit cards can help you rebuild your credit score.

- Travelers who prefer Delta Airlines should see our ranking of the best Delta credit cards .

- The best credit cards for Marriott can help you earn points with every booking.

About the contributors

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

How to meet minimum spending on the Capital One Venture X

Update: Some offers mentioned below are no longer available. View the current offers here.

The Capital One Venture X Rewards Credit Card debuted in October 2021 and has already proved its worth as one of the top travel credit cards available for applicants today.

But as with most rewards cards , there's a six-figure sign-up bonus on the line that also requires a hefty amount of spend.

If you've been thinking about applying for the Venture X, here are some strategies to help you meet the minimum spending requirements .

Official application link: Capital One Venture X.

New to The Points Guy? Sign up for our daily newsletter .

Card details — and why it's worth getting

What makes the Venture X so special? Beyond the attractive 100,000-mile welcome bonus, the Venture X is a rewarding card for travelers. Here's a look at its impressive benefits:

- Rewards rate: Earn 10 miles per dollar on hotels and car rentals booked through the Capital One travel portal , 5 miles per dollar on flights booked through Capital One and 2 miles per dollar on all other eligible purchases.

- Access to transfer partners: Transfer your Capital One miles to 14 airline and three hotel partners .

- Redeem your miles for travel on your statement credit or through the Capital One portal: You can redeem miles for travel at a 1-cent-per-mile rate for travel purchases on your statement credit or for flights, hotels and rental cars through the Capital One travel portal.

- Unlimited lounge access: Get access to Capital One lounges for you and up to two guests for free (then $45 per guest), as well as a Priority Pass Select membership that allows you to visit 1,300-plus airport lounges worldwide along with up to two guests.

- Annual up-to-$300 travel statement credit: Bring down the net effective cost of the $395 annual fee to $95 per year with the up-to-$300 annual travel credit toward bookings made through Capital One Travel.

- Rental car elite status: Get complimentary Hertz's President Circle elite status when you activate through your Capital One account.

- Anniversary 10,000-mile bonus: Receive 10,000 bonus miles after you renew your card every year.

- Global Entry or TSA Precheck reimbursement: Receive up to $100 in statement credits for your Global Entry or TSA Precheck application .

- Primary rental car coverage: When renting a car, decline coverage at the counter and you'll get theft and damage protection of up to $75,000.*

- Trip cancellation and interruption insurance: If a covered trip is canceled or cut short due to eligible reasons, you could be eligible to receive up to $2,000 per eligible person for reasonable expenses.*

- Trip delay reimbursement: If your covered trip is delayed by 12 or more hours , you can receive up to $500 per covered ticket for reasonable expenses.*

- Purchase protection: If an item you purchased with your card is damaged or stolen within the first 120 days after the purchase, you're covered up to $10,000 per claim, with up to $50,000 per account.*

- Return protection: If a retailer does not accept a return, you can be reimbursed up to the purchase price within 90 days of purchase — up to $300 per item and up to $1,000 annually per account.*

- Extended warranty: This benefit extends a U.S. manufacturer's warranty of three years or less on an eligible item by an additional year.*

- Cellphone protection: Pay your monthly cellphone bill with this card and receive up to $800 per claim (with a maximum of two claims in a 12-month period and $1,600 per 12-month period. A $50 deductible applies).

- Authorized users: Add up to four authorized users for no additional cost and they'll get their own lounge benefits , too.

- No foreign transaction fees: You won't incur any foreign transaction fees on purchases made abroad.

*Benefits available on Visa Infinite accounts. Terms apply.

Even with these ongoing features on the card, you won't want to miss out on this six-figure sign-up bonus, worth $1,850 according to TPG's valuations .

Sign-up bonus

Currently, the sign-up bonus on the Venture X is twofold.

You'll earn 100,000 bonus miles after spending $10,000 in the first six months from account opening. For a limited time, you can also receive an up to a $200 vacation rental statement credit during the first year of account opening that is good for eligible merchants like Airbnb, Turnkey, Vacasa and Vrbo.

New applicants for the Venture X are eligible to earn this sign-up bonus. You might also consider upgrading to the Venture X from your Capital One VentureOne Rewards Credit Card or the Capital One Venture Rewards Credit Card. However, in that case, you're not eligible to receive this sign-up bonus, so it likely makes sense to fill out a separate application rather than requesting a product change.

Strategies for meeting minimum spend requirements

While the spending threshold for the Venture X is higher than other cards, the time you have to meet these requirements is also longer. As such, $10,000 spend in six months breaks down to roughly $1,667 per month.

When you break it down in this fashion, the minimum spend requirements feel a lot more reasonable. Here are some ways to get to the finish line quicker.

Holiday shopping

The holiday season is especially conducive to applying for a card like the Capital One Venture X since most households likely will face a lot of shopping expenses around this time of year. What's even better is that the Venture X awards 2 miles per dollar on all non-bonus purchases. Since many shopping purchases fall outside of traditional, everyday bonus categories on other credit cards, you'll be racking up double the miles while working toward that $10,000 threshold.

Book trips for the new year

The Venture X is also quite the beast when it comes to earning and redeeming miles for travel and getting premium travel benefits. With that in mind, it's a great time to start planning trips for the new year, which could be hundreds or potentially even thousands of dollars in spend. Just note that you won't earn miles if the travel credits are applied to your card.

Add authorized users

One of the major benefits that sets the Venture X apart from other premium credit cards on the market is the ability to add up to four authorized users for no additional cost . Not only will their spend count toward your sign-up bonus, but they'll also get their own access to Capital One and Priority Pass lounges and can bring in their own two guests for free. This makes the Venture X one of the best cards for families – and you can reap the benefits of their spending as the primary cardholder.

Considerations

Before you go all-in, there are a few reminders to go over before pursuing a lucrative sign-up bonus like the one on the Venture X.

Don't spend what you can't afford to pay back

No matter how great a sign-up bonus is, it's never worth it to go into debt or pay late or interest fees if you can't afford to pay off your statement balance on time and in full every month. $10,000 in spend is not something to take lightly, so be sure that you can afford to pay off this balance before the end of the six months. Likewise, you're responsible for any and all charges that your authorized users add to the card, so be sure that you can trust them with this responsibility.

Can't meet the spend threshold? Consider the Capital One Venture instead

The Venture X is a premium card. As such, the welcome bonus and benefits come at a premium — namely, a $395 one. If your budget is stretched thin this year you may want to consider some other, more affordable options instead. The classic Capital One Venture Rewards Credit Card is still a great pick. While the benefits aren't as extensive, you'll enjoy a similar earning rate (5x on hotels and rental cars booked through Capital One Travel), the Global Entry or TSA Precheck application credit and access to Capital One's suite of transfer partners for a fraction of the cost, at $95 per year.

The Venture's sign-up bonus is much more approachable and will still reward you with a ton of bonus miles. Currently, you can earn 75,000 miles after you spend $4,000 in the first three months of account opening.

Beware of timing

From the moment you're approved, the clock starts ticking for the spending needed to trigger the sign-up bonus. While you won't receive your physical card in the mail for a few business days, Capital One offers a unique feature that allows you to get a virtual card number by installing the Eno browser extension when shopping online. This not only allows you to start shopping with your new Venture X, but it also helps protect you from potential fraud by not providing your real card number online.

Bottom line

Among all of the reasons we think that the Venture X is one of the best premium cards we've seen in a while, that 100,000-mile welcome offer is hard to ignore. With the right strategies in mind, meeting the $10,000 spend threshold shouldn't be too difficult for those who are intentional about doing so within the six-month period.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Capital One Travel Price Drop Works

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is Capital One price drop protection?

How do you claim a capital one price drop protection refund, limitations of capital one price drop protection, which cards are eligible for capital one travel price drop protection, how i've (already) saved via capital one travel price drop, if you like the sound of automatic flight refunds.

Capital One has made a big push into the travel scene recently. It introduced the impressive new Capital One Venture X Rewards Credit Card , vastly improved its airline and hotel transfer partners and introduced a new Capital One Travel portal . And although it seems like every bank has a travel portal these days, this one offers features not found elsewhere.

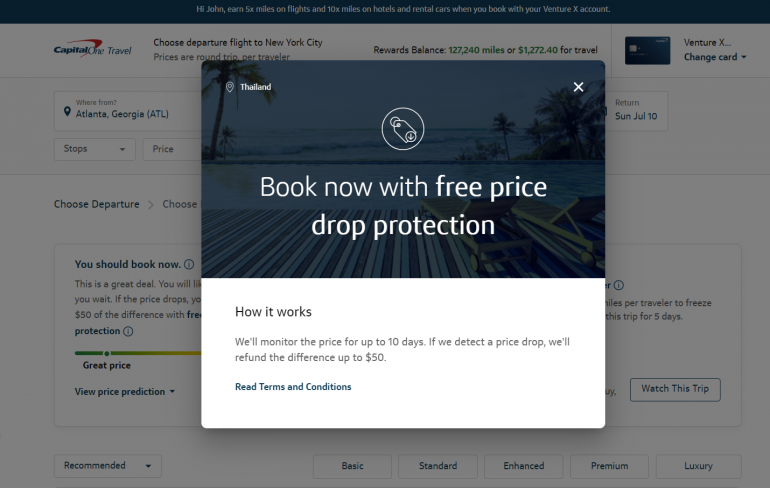

Some of these unique features include price watch and prediction tools, an airfare price freeze feature and the ability to cancel a flight for any reason for a refund of 70-90% of the ticket price. This article will focus on one of the portal’s biggest benefits: price drop protection.

Here's what you need to know about using Capital One Travel price drop protection to save money on flights.

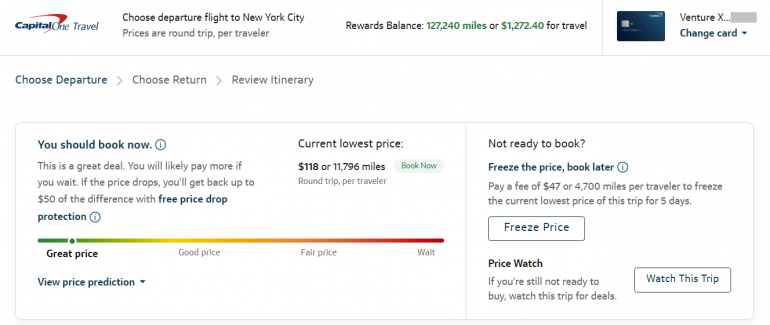

Capital One price drop protection is a free service that refunds you the price difference if the cost of a flight drops after you book it through Capital One Travel. The protection is automatically applied when Capital One's price prediction tool recommends that you buy a given flight because its price is likely to increase.

To get this free price protection, just look for the phrase "you should book now" at the top of your Capital One Travel search results. If you follow this advice and book your flight through the portal, you'll automatically receive price drop protection — subject to limitations covered below.

Besides being free, the best part of Capital One price drop protection is how easy it is to get automatic refunds when the price of your flight drops. Once the protection is applied to eligible bookings, Capital One automatically tracks prices on the flight you booked. Then, if it finds a cheaper price, you’ll receive a refund without needing to prompt the system.

There is no way to manually request a refund if you find a lower price elsewhere. However, you can use the Capital One Travel Price Match Guarantee to submit a claim if you find the same flight, hotel or rental car available at a lower price through another booking platform within 24 hours of booking through Capital One's portal.

After 24 hours, you don't have any incentive to manually check for lower prices. If you don't get a refund, you can feel confident that you got a good price on your flight.

» Learn more: How the Capital One Miles program works

Capital One price drop protection is great for automatically monitoring and refunding the price of a flight; however, there are limitations to this service.

Specificity. Capital One will monitor the price of the particular itinerary you booked only — which it specifies is the same flight, fare class and seat type. Unfortunately, this means that you won't get a refund if the price drops on another similar flight or on another airline.

Time limits. Capital One will monitor for price drops for a set amount of time only. Again, this isn't a limitation that's stated in the terms and conditions, so it may vary. However, in each of five recent eligible Capital One Travel bookings and searches, Capital One offered complimentary price drop protection for 10 days.

Refund allowance caps. Capital One limits how much you can get back through price drop protection. This isn't a limit that's stated in the terms and conditions and may be based on the particular flight results. However, it appears that the price drop protection cap is generally $50 per passenger.

For example, when searching for a flight from Atlanta to New York City in a few weeks, Capital One Travel recommended that I book now and offered free price drop protection of up to $50.

When it was first introduced, Capital One limited access to its travel portal to cardholders of the Capital One Venture X Rewards Credit Card and Capital One Venture Rewards Credit Card . However, in May 2022, access was expanded to all Capital One rewards cards.

That means holders of the following cards now have access to Capital One Travel:

Capital One SavorOne Cash Rewards Credit Card .

Capital One Quicksilver Cash Rewards Credit Card .

Capital One Spark Cash for Business .

Capital One Spark Miles for Business .

» Learn more: Who benefits the most from the Capital One Venture Card?

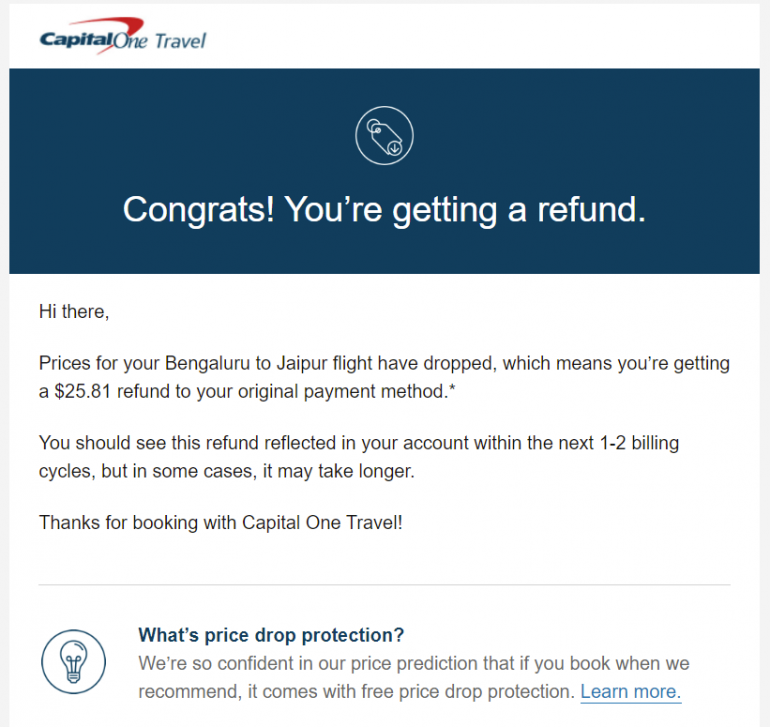

I recently got a chance to see how price drop protection works in practice. In April and May 2022, my wife and I visited India. As local airline websites wouldn't accept our international credit cards, we needed to book through a travel portal — giving us a perfect reason to try booking through Capital One Travel.

In total, we booked three intra-India flights through Capital One Travel. In each case, it was recommended that we book the flight, meaning we received complimentary price drop protection on all three flights. And booking through the portal paid off. The price ended up dropping on two of the three flights, netting us refunds of $25.81 and $12.92.

While a refund of $38.73 may not sound like a lot, these flights didn't cost very much. Plus, this is $38.73 more than we would have gotten if we had booked through another travel portal or website.

After this positive experience, I'm certainly more likely to book flights through Capital One Travel — even after I've used the $300 annual travel credit on my Capital One Venture X Rewards Credit Card .

» Learn more: The best Capital One transfer partners — and ones to avoid

Capital One Travel is making a compelling case for being the go-to place for booking flights. In addition to price watch and price freeze tools, the portal’s price prediction feature helps you figure out when it's the best time to book a flight. If you follow the recommendation to book your flight when prices are low, you may be able to get automatic refunds through Capital One price drop protection.

Plus, Capital One rewards cardholders earn bonus miles or cash back for booking through Capital One Travel. Capital One Venture X Rewards Credit Card holders get 10x miles on hotels and rental cars and 5x miles on flights booked through the portal. Meanwhile, Capital One Venture Rewards Credit Card and other rewards cardholders get 5x miles or 5% cash back on rental cars and hotel bookings.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

Capital One credit cards with travel insurance

July 16, 2024 | 3 min read

Whether you’re a frequent jet-setter or an occasional road-tripper, travel insurance can help protect you financially if something unexpected happens.

And if you’re a Capital One cardholder, you may already have travel insurance as part of your card’s benefits. Read on to find out more.

What you’ll learn:

- Capital One has several credit cards, including miles rewards cards, that come with travel insurance.

- Travel insurance could reimburse you for a canceled trip, pay for expenses during a delay or cover the costs of rental car damage.

- The coverage you receive depends on the credit card, the issuer and the network that provides the benefits.

- If you have a card with travel insurance, you’re typically covered as soon as you charge the cost to your card.

Earn 75,000 bonus miles

Potential benefits of travel insurance.

Travel insurance through your card could help protect you from unexpected expenses if something goes wrong when traveling. Every card is different, but you can check your card’s benefits guide for coverage details and to see which types of travel insurance you have access to. Here are a few of the most common types of coverage and how they can help:

- Trip cancellation and interruption insurance: If you can no longer go on a trip or have to cut a trip short for covered reasons, cancellation coverage may reimburse you up to a certain amount for some prepaid costs.

- Trip delay reimbursement: If you experience a delayed flight, inclement weather or some other type of delay, this insurance may cover expenses you might incur during the delay, like food and lodging.

- Auto rental insurance: Rental car insurance may help protect you from paying for things like collision damage, towing, repairs and theft.

- Baggage loss or delay insurance: Lost, delayed or stolen baggage can interrupt your trip. If you need to buy replacement items, you could be reimbursed.

- Travel accident insurance: In cases of death or dismemberment while traveling, you or your family could receive benefits.

- Travel assistance services: This could include referrals to a local, English-speaking doctor or lawyer if needed during a trip. It could also include pre-trip help, like guidance on what vaccinations are required for different countries.

Which Capital One cards have travel insurance?

These Capital One rewards credit cards offer travel insurance among their benefits:

- Quicksilver

Coverage can vary. You can check your card’s benefits guide to learn more.

The card may provide some travel insurance benefits. And card networks, such as Visa® and Mastercard®, may provide others. Here’s a look at what’s included with the credit card network programs available with Capital One cards:

How to access travel insurance

If you have an eligible Capital One credit card, you already have access to travel insurance benefits. Your coverage kicks in when you charge the relevant cost to your card. Because each card has its own terms and conditions, it’s worth checking what you’re covered for before setting off on a trip.

Filing a travel insurance claim

Here are some steps you could take when filing a travel insurance claim through your Capital One credit card:

- Read your card’s benefits guide to better understand your coverage.

- Be sure to save all relevant receipts and proofs of purchase.

- Check whether there’s a time limit for filing a claim after an incident.

- Contact the administrator listed in your benefits guide with the details of your claim.

- Answer any questions, complete a form and submit your receipts to complete the claim.*

Key takeaways: Capital One credit cards and travel insurance

Several Capital One credit cards include travel insurance among their benefits. The level of coverage varies between cards.

If you’re interested in a Capital One credit card that offers travel insurance, you can compare Capital One cards . If you find a good fit, you can find out whether you’re pre-approved before applying. It’s quick and won’t hurt your credit scores.

Related Content

Is travel insurance worth it?

Can you add travel insurance after booking a flight?

Capital One rewards credit card benefits

IMAGES

COMMENTS

Capital One. The Capital One Venture card's travel insurance benefits pale in comparison to the Capital One Venture X Rewards Credit Card. The Capital One Venture X card is a Visa Infinite card, so it offers a variety of other travel protections, such as: Primary auto rental collision damage waiver. Trip interruption and cancellation insurance.

Here are some things to know about Capital One travel rewards credit cards: Get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. (View important rates and disclosures.) Earn unlimited 2X miles per dollar on every purchase, every day and ...

The Capital One Venture X Rewards Credit Card has quickly built a reputation as one of the best travel rewards credit cards on the market since its launch last November. And for good reason. With an annual fee of just $395, it is drastically cheaper than its primary competitors, the Chase Sapphire Reserve® which has an annual fee of $550, and ...

With our Venture X, Venture and VentureOne miles rewards cards, transfer your miles to your choice of 15+ travel loyalty programs for more flexibility. Capital One Shopping** Capital One Shopping is an online shopping tool that automatically applies available coupon codes to your order.

Tour Operator or Travel Supplier. Additional Travel Accident benefit. As a cardholder, You, Your spouse (or Domestic Partner), and unmarried . Dependent Children will be automatically insured up to one thousand . dollars ($1,000) for Accidental Loss of life, limb, sight, speech, or hearing. This benefit applies while:

The Capital One Venture X card offers some of the best travel insurance a credit card can offer. This is in addition to the other benefits you get, such as unlimited Capital One Lounge access, up to $300 Capital One Travel credit every cardmember anniversary year, cell phone insurance, and so much more. In particular, the primary rental car ...

The Capital One Venture X Rewards Credit Card is a travel credit card offering a long list of benefits for travelers. For the card's $395 annual fee, you get a lot of perks — an annual $300 ...

What you'll learn: The Capital One Venture X card rewards travel with flexible benefits like a 75,000-mile early spend bonus, a $300 annual credit for bookings through Capital One Travel and a 10,000-mile anniversary bonus. Venture X cardholders who book through Capital One Travel earn unlimited 10X miles on hotels and rental cars and 5X miles ...

Bottom Line. Capital One offers complimentary travel insurance coverage on a handful of credit cards. This benefit protects travelers who value financial peace of mind for delayed and lost bags ...

With price drop protection, Capital One will monitor the price of a flight for 10 days after you buy it. The terms of the protection can change based on your exact itinerary and dates, but if the price drops during that time, you'll get a travel credit for the difference (up to $50). Related: Book now and then check for hotel and airline price ...

Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that's ...

The Capital One VentureOne Card includes impressive rewards rates for a card with no annual fee: 5X miles per dollar on hotels and rental cars booked through Capital One Travel. 1.25X miles per ...

The Capital One Venture X Card dishes out 75,000 Miles after you spend $4,000 in the first 3 months. Redeeming these for travel purchases would give you $750 in value on this bonus alone. That's ...

While useful, Capital One's coverage isn't as robust as what you'll find with other travel credit card providers. Published Sep 18, 2023 10:33 a.m. PDT Written by Aaron Hurd

Auto Rental Collision Damage Waiver. Use your VentureOne Card to reserve and pay for your rental and refuse the rental car agency's CDW coverage. You will receive coverage for damage, theft, loss of use, and towing on your rental car for rentals 31 days or less outside your country of residence.

The Venture offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment View offer at ...

Update: Some offers mentioned below are no longer available. View the current offers here.. The Capital One Venture X Rewards Credit Card debuted in October 2021 and has already proved its worth as one of the top travel credit cards available for applicants today.. But as with most rewards cards, there's a six-figure sign-up bonus on the line that also requires a hefty amount of spend.

The Moscow Summit of 1972 was a summit meeting between President Richard M. Nixon of the United States and General Secretary Leonid Brezhnev of the Communist Party of the Soviet Union.It was held May 22-30, 1972. It featured the signing of the Anti-Ballistic Missile (ABM) Treaty, the first Strategic Arms Limitation Treaty (SALT I), and the U.S.-Soviet Incidents at Sea agreement.

8. Eligible cardholders must enroll through the unique Benefits Tab link found within the Capital One website or mobile app after logging in. Cardholders can find the link to enroll by visiting their eligible card's Rewards tab or Capital One Travel Benefits tab and by clicking on the Hertz benefit tile. Upon doing so, a new webpage will open ...

When it was first introduced, Capital One limited access to its travel portal to cardholders of the Capital One Venture X Rewards Credit Card and Capital One Venture Rewards Credit Card. However ...

You will earn 10,000 bonus miles after your anniversary each year, starting with your first anniversary. Once you qualify for this bonus, we will apply it to your rewards balance. 3. Annually, eligible Venture X primary account holders will receive a $300 Capital One Travel credit ("Credit") to use toward purchases made through Capital One ...

President Nixon returned to the United States on May 30. Nixon's visit to Moscow on this day in 1972 was a step toward conciliation (in the form of space cooperation and the signing of the SALT arms control treaty) in the depths of the Cold War. Today, the United States and Russia may be over two decades removed from the Cold War, but there ...

50th Anniversary of Moscow Summit. On the heels of a historic visit to China in February, President Nixon made another historic first in May 1972 by becoming the first U.S. President to visit Moscow. This was part of Nixon's grand strategy of foreign policy centered on Triangular Diplomacy—seizing on division within the Communist bloc to ...

An SSSS code on a boarding pass stands for "Secondary Security Screening Selection." While somewhat of an annoyance, this code only means you have been flagged to undergo additional security ...

Plus get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. ... 5 Capital One Travel's price drop protection is available when Capital One Travel recommends that a customer buys a given flight and the customer books the flight. Capital One ...

These Capital One rewards credit cards offer travel insurance among their benefits: Coverage can vary. You can check your card's benefits guide to learn more. The card may provide some travel insurance benefits. And card networks, such as Visa® and Mastercard®, may provide others. Here's a look at what's included with the credit card ...