- Entertainment

5 best travel insurance plans in Singapore with Covid-19 coverage (2022)

As travel becomes possible again (woohoo!), travel insurance is now once again something that is relevant in our lives.

Remember the good old days when lost luggage was your biggest worry? These days, the most likely mishaps to happen are related to Covid-19, whether they be an infection or a trip cancellation.

Not all insurers cover Covid-19, but a handful do - to varying extents. Here's a comparison of the five best plans in Singapore.

Does travel insurance cover Covid-19?

When the Covid-19 pandemic started, most insurers did not extend their coverage to Covid-19-related mishaps.

The pandemic was quickly considered a "known event", which insurers usually do not offer compensation for. So, if your flight got cancelled because of Covid-19, you'd be out of luck.

Now. as travel restrictions get lifted, insurance companies are rushing for a slice of the pie. Since the virus looks like it's here to stay, insurers are starting to offer coverage specifically for Covid-19.

But Covid-19 coverage is such a new thing that it can vary quite a bit from insurer to insurer. Given a bit of time, insurers will start to understand what their competitors are offering and coverage across the board is likely to become more similar.

Do note that the plans still exclude travelling against a travel advisory put in place by the Singapore government or by the local authority at your trip destination. So be sure to check announcements on both ends before you depart.

Another common exclusion is failing to take precautions against Covid-19. This is broadly worded in the insurance policy but could include not following any Covid-19 regulations at your destination or on the plane. So make sure you wear your mask whenever it's required and don't go attending any illegal raves.

Best travel insurance with Covid-19 coverage

* For a one-week trip to Germany

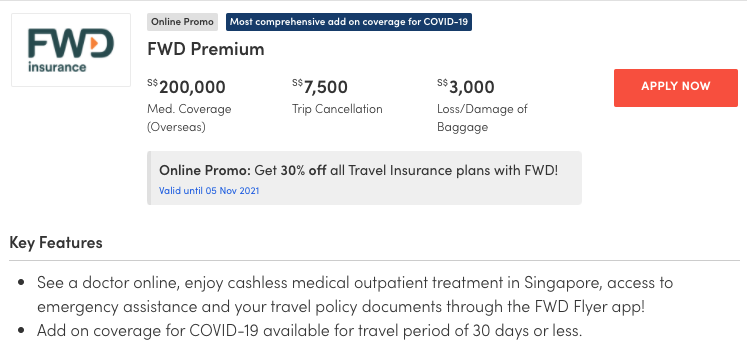

1. FWD travel insurance + Covid-19 coverage

FWD offers some of the cheapest travel insurance plans in Singapore, so this is a budget-friendly option if you're already baulking at the cost of all the antigen tests you'll have to take before and after your trip.

Here's a quick run-through of the Covid-19 coverage offered by this plan:

- Trip cancellation and loss of deposit

- Trip disruption

- Overseas hospital cash

- Hospital cash while in Singapore

- Medical expenses

- Emergency medical evacuation and repatriation

The plan reimburses some of your travel-related expenses if you are diagnosed with Covid-19 no more than 30 days before your scheduled departure date, or if you have to change your itinerary because of a Covid-19 diagnosis while overseas.

You also get to claim medical expenses and a hospital cash benefit if you get hospitalised overseas or for up to 14 days in Singapore upon your return.

The coverage is very bare bones but the plan is frickin cheap. Get this if you can't afford anything else.

2. AIG Travel Guard insurance

Here's a quick run-down of the plan's main offerings:

- Trip cancellation

- Early return home

- Overseas medical expenses

- Emergency medical evacuation

- Overseas quarantine allowance

This plan offers compensation if you catch Covid-19 in Singapore and have to postpone your trip, or if you or a family member catch the virus before your departure date and you have to cancel your trip because of that. You also get medical coverage and a quarantine allowance.

This is quite a decent list of benefits compared to what the other plans are offering, but there are a few perks missing from the list, including a daily hospital cash benefit, early return home and trip interruption due to quarantine or other government advisories.

Overall, the plan is on the cheap side but honestly quite bare bones. If you can afford this plan, you could also just spend a few more bucks to get a better one.

READ ALSO: Travel insurance claims guide - what to do, what receipts to keep and more

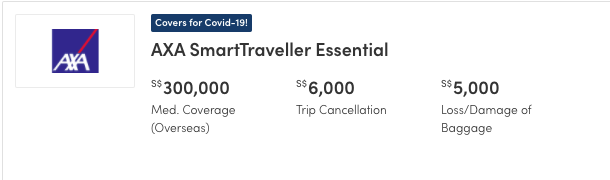

3. AXA SmartTraveller travel insurance

Here's what this plan gets you:

- Pre-departure trip cancellations and postponement

- Trip curtailment or rearrangement losses

- Overseas hospitalisation allowance

The medical expenses category is quite generous here. You can claim for costs incurred within 90 days of your trip.

One perk that not all insurers offer is overseas quarantine allowance if you're forced to hole up in a hotel or quarantine centre overseas due to a Covid-19 infection.

You can't claim for this if you're already claiming for hospitalisation, though you'd have to be really unlucky to get both quarantined AND hospitalised in one trip.

AXA also tends to be quite flexible when it comes to trip curtailment or rearrangement.

You can claim under this section not only if you yourself catch Covid-19 but if there is a death in your family due to Covid-19, public transport gets cancelled due to Covid-19 or there is a Covid-19 outbreak at your destination which prevents you from continuing on your trip.

In short, this plan has one of the most comprehensive benefits lists available, and it isn't even that expensive. This one gets a thumbs-up.

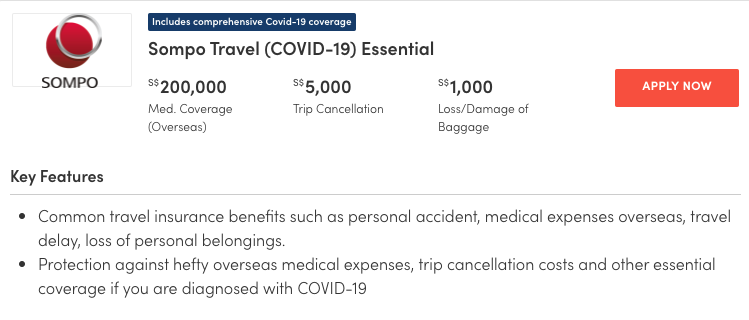

4. Sompo Travel (Covid-19) Essential travel Insurance

The key benefits are as follows:

- Trip postponement

- Trip curtailment

- Medical expenses overseas

- Overseas hospital income

Compensation for trip cancellation or postponement is offered if you, an immediate family member or a travelling companion also insured by Sompo, got diagnosed with Covid-19 not more than 30 days before your departure date.

If your travel partner gets infected you can choose to claim for your travel expenses rather than go alone.

The same goes for trip curtailment while overseas. While on your trip, you can make a claim for having to change your itinerary if your travelling companion or an immediate family member back in Singapore gets diagnosed with Covid-19 and you need to cut short your trip to return to Singapore.

Medical expenses can be claimed for a period of up to 45 days (the first day being the day you first seek treatment while overseas) or when the limit in your benefits table is first reached, whichever happens first.

Note that you might be left high and dry if you are ill for more than 45 days.

Overall, this plan is generous when it comes to changes to your travel plans, but not so much when it comes to medical treatment. It's probably best if you are young, have no existing health issues and have already been vaccinated.

5. NTUC Income travel insurance

Here's a run-down of the key benefits:

- Cancelling your trip due to Covid-19

- Postponing your trip due to Covid-19

- Shortening your trip due to Covid-19

- Trip disruption due to Covid-19

- Emergency medical evacuation due to Covid-19

- Sending you home due to Covid-19

NTUC Income offers up to $150,000 worth of overseas medical expenses and up to $150,000 worth of evacuation or repatriation expenses if you contract Covid-19 overseas. This coverage is valid for the first 90 days of your trip.

They have recently enhanced their Covid-19 cover to allow claims for trip cancellations and postponements due to you (or your travel companion) being diagnosed with Covid-19 or getting issued an isolation order by the government.

Covid-19 vaccine complications are now covered under medical expenses as well. For more details on what is covered, refer to the NTUC Income website and policy conditions.

There are no excluded countries due to Covid-19 except for Afghanistan, Iraq, Liberia, Sudan and Syria, which are normally excluded from the regular travel insurance plan as well.

In addition, NTUC Income has collaborated with Raffles Medical to offer Covid-19 (PCR) swab test at $124.2 along with a series of other types of pre-departure tests.

What to do if you get Covid-19 during/after travel?

First of all, when booking your trip, you should retain all receipts, tickets and itineraries in case your trip has to be cancelled or altered.

At the first sign of a Covid-19 infection or related travel disruption, you should call your insurer and ask for guidance. Many insurers maintain a 24-hour hotline for travel claims.

[[nid:549261]]

To make a claim you will usually have to submit your insurer's form with supporting documents within the deadline mentioned in your contract (usually 30 days). Don't wait until you're back in Singapore to check which documents you need.

If you catch Covid-19 while you're in Singapore, you will likely have to submit the results of a PCR Swab Test or Antigen Rapid Test conducted at a clinic or hospital.

It gets a bit more complicated if you're overseas. The insurer will likely require documentation from the hospital as well as a doctor's letter stating that you are unfit to travel and/or recommending treatment.

If you need to be quarantined overseas, you should make sure you have a quarantine order from the government, otherwise you may not be able to claim for quarantine allowance. Remember to ask for this as not all countries automatically issue such documentation.

This article was first published in MoneySmart .

- Car Insurance

- Corporate Employee Insurance

- Critical Illness Protect360

- Early Critical Illness Insurance

- Fire Insurance

- Home Protect360

- Home ProtectLite

- Hospital Income Insurance

- Maid Insurance

- Mobile Phone Insurance

- Accident Protect360

- Family Protect360

- Singapore Travel Pass

- Travel Insurance

- Business Packages

- Casualty Insurance

- Corporate Travel360

- Engineering Insurance

- Keyman Insurance

- Property Insurance

- Agent Recruitment

- Intermediary Login

- Our Corporate Profile

- Ethics Policy

- News and Media Releases

- HLAH Background and Regional Subsidiaries

- Check Claim Status

- Claim Forms

- Guide To Claims Process

- REGIONAL SERVICES

SAFE TRAVELS START WITH SINGAPORE'S BEST COVID-19 TRAVEL INSURANCE

Protect Yourself with Singapore’s Best COVID-19 Travel Insurance

Important Notice

The Ministry of Foreign Affairs has put up travel advisories against non-essential travel to Israel and Palestinian Territories, and to Iceland. Please click here if you intend to or have purchased a travel plan to these areas.

current promotion

Purchase your travel insurance policy with HL Assurance and you’ll have the chance to win a flight ticket of your choice to your dream destination. The more you purchase, the more points you earn and the more chances of winning! Terms apply.

How to participate.

Get your dream holiday!

Protect you and your family with our COVIDSafe Travel Protect360.

Stand a chance to WIN a flight ticket of your choice

Single Trip

Travel insurance promotion 45% discount, ncd th customer + 1 buddy + ncd-->.

Be protected from COVID-19 with the new travel insurance offer in Singapore – COVIDSafe Travel Protect360! Not only will you be covered for Overseas Medical Expenses and Trip Cancellation due to COVID-19 under our travel protection plan, but we are also now rewarding you with No Claim Discount. *Terms apply.

Please refer to below Single Trip Travel Insurance Promotion Terms and Conditions for more redemption details.

Annual Unlimited

Annual travel insurance promotion 50% discount, ncd.

Travelling more than twice in a year? Get our annual multi-trip insurance policy and additional travel perks at just $0.52 / day. This travel insurance annual promotion in Singapore could be better value than buying single trip insurance for each holiday! Take advantage of our best annual travel insurance promotion and discounts today!

Please refer to below Annual Multi Trip Travel Insurance Promotion Terms and Conditions for details.

COVIDSafe Travel Protect360.

Packed with all-inclusive enhanced benefits to give you peace of mind, COVIDSafe Travel Protect360 is the best travel insurance with COVID-19 coverage in Singapore. Choose from a variety of recommended plans that secure protection and peace of mind today: single trip, annual, long term, family, seniors and more. Buy your travel insurance online to ensure a hassle-free trip for you and your loved ones.

Enhanced Benefits with COVID-19 Cover

*NEW FEATURE* Making your vacation safe even during a pandemic

Get a peace of mind when you are travelling during the pandemic with our new COVID-19 benefits for Travel Protect360! Even if you require medical assistance or trip cancellation due to COVID-19, you can be assured that you are well covered!

Travel No Claims Discount

Get Rewarded for Safe Travels

We want to celebrate your safe travels with you! If you do not make any claims from your travel insurance, you get additional up to 10% off your next travel insurance purchase on top of our promotions.

Travel Inconvenience Protection

Be protected with comprehensive Travel Inconvenience cover

No traveller will wish for travel cancellations and travel interruptions and we are here to protect you from these inconveniences! No matter if it is the loss of baggage or insolvency of travel agencies, be assured that you are well protected!

Why You Should Choose Our COVID-19 Travel Insurance in Singapore?

Packed with all-inclusive enhanced benefits to give you peace of mind, COVIDSafe Travel Protect360 is the best travel insurance with COVID-19 coverage in Singapore. Choose from a variety of recommended plans that offer secure protection and peace of mind today: single trip, annual, long term, family, seniors and more. Buy your travel insurance online to ensure a hassle-free trip for you and your loved ones.

24/7 COVID-19 Travel Concierge

With regional alarm centres available 24/7, you can travel with peace of mind, knowing support is #OneClickAway. Connect with Global Teleconsultation via your communication method of choice. Click here to find out more.

Best COVID-19 Travel Insurance Coverage

Travelling during a pandemic can be stressful, not knowing if your insurance plans provide proper coverage. With our enhanced COVIDSafe Travel Protect360 Insurance, you can travel knowing that you are covered up to $200,000 in overseas medical expenses incurred due to COVID-19.

COVID-19 Quarantine Allowance

Be reimbursed with up to $1,500 even when you are quarantined overseas as part of our many COVID-19 travel insurance coverage benefits.

Enjoy No Claim Discount

If you do not make any claims from your travel insurance, you get up to 10% off your next travel insurance purchase with HL Assurance.

Greater Flexible Coverage

If you have to make changes to your trip due to the COVID-19 pandemic, COVIDSafe Travel Protect360 allows you to make adjustments to your policies. When your family is protected by COVIDSafe Travel Protect360 insurance, we are happy to make adjustments even when the trip needs to be cancelled because of one person in the family.

Stay Protected From Travel Inconvenience

Be it loss of baggage or insolvency of travel agencies, our comprehensive COVID-19 travel insurance cover ensures that you are well protected from travel cancellations, travel interruptions and other inconveniences! Buy your travel insurance online today.

Enhanced Benefits of our Travel Insurance

With our enhanced travel insurance, you can now be ready for all your adventures and travel with peace of mind. COVIDSafe Travel Protect360 insurance provides the comprehensive travel insurance coverage you need for your holiday.

COVID-19 Cover

Overseas Medical Expenses

Extensive Travel Inconvenience Benefits

What Our Customers Have To Say About Us

preferred travel insurance in singapore.

Customer Review by Lee Meng Tong

Thank you so much for your efforts in processing and finalising my travel claims. My wife and I are very appreciative of the care and excellent service provided by you and your staff. Rest assured that HL Assurance would be our preferred insurance for all our travels.

Hassle-Free Claims

Customer Review by Jack Wong

For my annual travel insurance, I always go with HLAS, their price is most reasonable with good enough coverage and the claim process is hassle-free. I always recommend my friends and colleagues to them.

Prompt And Excellent Service

Customer Review by H L

What professionalism! Prompt and excellent service for travel insurance as well as car insurance. I had immediate attention and was certainly impressed! 😀👌🏻

Seamlessly Easy And Convenient

Customer Review by Rasidah Maya

We get our travel insurance regularly from HL Assurance. Seamlessly easy and convenient online purchase. Thank you Jerry He for assisting me with the changes I needed and the advice given for my queries.

Good Choice For Travel Insurance

Customer Review by Choon Xiang

I am really inspired with HLAS travel NCD. You get rewarded for Safe Travels which everyone wishes. No doubt is your good choice for travel insurance.

No Claim Travel Insurance Discount Programme Terms and Conditions

Promotion terms and conditions.

- The promotion is held from now until 30 June 2024, customers who purchase any Travel Insurance policy (COVIDSafe Travel Protect360 Single Trip or Travel Protect360 Annual Trip) will automatically be enrolled into COVIDSafe Travel Protect360 No Claim Discount programme.

- For COVIDSafe Travel Protect360 Single Trip Policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be eligible for a 5% discount promotion code.

- For subsequent travel purchases with the utilising the 5% discount promotion code, where the policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be eligible for an additional 10% discount promotion code.

- Thereafter for subsequent travel purchases utilising the 10% discount promotion code, where the policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be capped at 10% discount promotion code.

- For COVIDSafe Travel Protect360 Annual Plan Policyholder(s) who has completed the policy period of one (1) year and has no claims during the policy period and within stipulated timeframe of 30 days from the policy end date, will be eligible for a 10% discount promotion code refund upon the next Travel Protect360 Annual Plan renewal.

- Promotional codes provided for the Single Trip can only be utilised for the next Single Trip purchase and can only be used once.

- The promotional codes are not transferable.

- Should there be any claims incurred, the No-claims discount promotion code will no longer be applicable.

- Each policy is only eligible for one promotion code.

Note: Swipe left or right to view the full table on your mobile screen.

- HL Assurance, at any time, at its sole discretion and without prior notice, can vary, modify, delete or add to these terms and conditions. Please refer to the policy wording for full details.

- In the event of any dispute, HL Assurance management’s decision is final.

- HL Assurance’s full disclaimers, terms, and conditions apply to individual products. © 2021 HL Assurance is a registered service mark of Hong Leong Group. HL Assurance Private Limited Co. Reg. No. 201229558W.

- “HL Assurance” means HL Assurance Private Limited.

- HL Assurance’s Travel Insurance is underwritten by HL Assurance Pte. Ltd. Co. Reg. No. 201229558W. This policy is protected under the Policy Owner’s Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites (www.gia.org.sg or www.sdic.org.sg). This is not a contract of insurance. Accordingly, the information should be read and construed in the light of, and subject to, all terms and conditions contained in the Policy. Full details are stated in the Policy.

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Promotion (Single Trip)

- The promotion is held from now until 30 June 2024.

- Eligible customers who successfully purchase any COVIDSafe Travel Protect360 Single Trip policies during the Promotion Period will be entitled to 45% discount.

- This promotion is only applicable for new purchases made via HL Assurance website at www.hlas.com.sg/personalinsurance/travelinsurance.

- New purchases refer to purchases via HL Assurance website (as per stated above), and are not applicable to any purchase from HL Assurance’s agency partner.

- This promotion is not valid with any ongoing travel discounts, schemes or privileges.

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Promotion (Annual Trip)

- Eligible customers who successfully purchase any COVIDSafe Travel Protect360 Annual Trip policies during the Promotion Period will be entitled to a 50% discount, provided that the policy is not subsequently cancelled.

- New purchases refer to purchases via HL Assurance website (as per stated above), and is not applicable to any purchase from HL Assurance’s agency partner.

What our Travel Insurance in Singapore Covers

Read the full terms and conditions

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites ( www.gia.org.sg or www.sdic.org.sg ).

Frequently Asked Questions for COVIDSafe Travel Protect360 Insurance

Q: can i continue my medical treatment for injury or sickness sustained overseas when i return to singapore.

A: Yes. We pay for the medical expenses, up to the Sub-limit, reasonably incurred by you in Singapore within 30 days after your return from the trip.

Q: If I was injured or sick overseas but did not seek medical treatment, can I do so upon my return to Singapore?

A: Yes. The Company will indemnify you up to the Benefits Payable under the Policy for the treatment sought within three (3) days after your return from the Journey where initial treatment for Bodily Injury or Sickness was not sought overseas, up to a maximum of thirty (30) days from the date of first treatment in Singapore.

Q: What is the time frame for submitting a travel claim when I return to Singapore?

A: You will need to submit a claim within thirty (30) days upon returning to Singapore.

Q: What should I do if I lose my money or travel documents during my trip?

A: If your loss arises out of robbery, burglary or theft, you should report the loss to the local police within 24 hours after the loss / incident and obtain a written statement from the police to substantiate your travel insurance claim.

Q: What should I do if I need assistance while overseas?

A: One of the benefits of our travel insurance is the 24 hours Travel, Emergency Medical and Evacuation Assistance which provides for loss of travel documents and baggage, air ticket arrangements, emergency medical evacuation, referral services for interpreters / translators, legal, embassy, hospital admission and other medical facilities etc. These services are available 24/7 by calling our Hotline at (65) 6922 6009.

Q: I am currently under medication for some medical conditions. Can I claim for medical expenses related to these medical conditions during the trip?

A: No. Our Travel Insurance Policy excludes all pre-existing medical conditions prior to the trip.

Q: If I am pregnant, am I covered for any medical treatment incurred overseas?

A: No. Our travel insurance policy does not cover any pregnancy-related issues.

Q: Is dental treatment covered while I am overseas?

A: Yes, dental treatment is covered (as a result of Bodily Injury only).

Q: Will I be covered if I am going overseas to receive medical treatment?

A: No. The travel insurance plan does not cover you if you are travelling contrary to the advice of any Qualified Medical Practitioner or for the purpose of obtaining medical treatment.

Q: Are adventure activities and indoor / outdoor sports covered by COVIDSafe Travel Protect360 insurance?

A: No. Our travel insurance does not cover adventure activities. You can find the list of exclusions in our policy wordings .

Q: Is there a waiting period for COVIDSafe Travel Protect360 Insurance coverage to take effect?

A: A 3-day waiting period applies only to trip cancellation, postponement, and curtailment due to COVID-19 in Enhanced Travel Inconvenience (for COVID-19).

Q: How to buy travel insurance from HL Assurance?

A: Buying your travel insurance from HL Assurance is a straightforward process. You can purchase your desired policy online. Simply visit our travel insurance section, select the plan that suits your needs, and follow the steps for a hassle-free purchase experience.

Q: Can I extend my travel insurance coverage if my trip is extended?

A: Yes. This is subject to our underwriter’s approval. You can call or email us before the policy expires. If you’re wondering where to buy travel insurance for extended trips, you can easily do so through our website or contact our customer support at 6702 0202 for assistance.

Q: Can I buy travel insurance after departure?

A: Generally, travel insurance should be purchased before your trip commences.

Q: Can I cancel my travel insurance policy if my plans change?

A: You may cancel the Policy before the start of your trip with administrative charges applicable.

Q: Annual Trip Insurance vs Single Trip Insurance - Which is better?

A: Single Trip Travel Insurance provides coverage for the destination you’ve indicated. Meanwhile, an Annual Trip Travel Insurance gives better value should you have already planned to go on more than two trips in the year.

Q: Does COVIDSafe Travel Protect360 Insurance cover me if I travel to multiple countries?

A: Please indicate the countries you will be travelling to when you buy your travel insurance online. If you’re wondering where to buy travel insurance online, simply visit our website’s travel insurance section for a seamless online purchase experience.

Q: What are the Terms and Conditions for COVIDSafe Travel Protect360 Insurance?

A: You can find out more about our Terms and Conditions for COVIDSafe Travel Protect360 here .

Q: What does COVIDSafe Travel Protect360 Insurance cover?

A: We provide comprehensive travel insurance coverage of four (4) levels with diverse limits: Basic, Enhanced, Superior and Premier. Though the limits vary, the coverage is broad and has everything you’re looking for in a travel insurance plan.

All plans cover the following travel benefits:

- Overseas Medical Expenses (Child, Adult, Senior / Elderly)

- Medical Expenses in Singapore

- Personal Accident: Accidental Death & Permanent Disablement

- Travel Inconvenience

- Travel Postponement

- Travel Misconnections

- Insolvency of Travel Agency (Excluding Basic Plan)

- Trip Disruption

- Flight Inconvenience and Diversion

- Hijack of Common Carrier

- Kidnap & Hostage (Excluding Basic Plan)

- Personal Liability

- Loss of Home Contents

- Credit Card Protections (Excluding Basic Plan)

- Rental Car Excess

- Enhanced Medical Benefits due to COVID-19 (Excluding Basic Plan)

- Enhanced Travel Inconvenience, Cancellation, Postponement or Curtailment due to COVID-19 (Excluding Basic Plan)

Chat with us if you have any questions via WhatsApp and we will be happy to answer your queries!

For 24-Hour Emergency Travel Assistance Service, please contact 6922 6009 .

File a travel insurance claim, claims procedure and documentation.

Please submit your claim to us with the original Claim form and supporting documents within 30 days upon returning from your trip.

Common documents required for all Travel Insurance Claims:

- Copy of flight itinerary

- Proof of travel, i.e. original boarding pass, air tickets, copy of passport, etc.

Supporting documents needed when making a claim for:

- Medical Report and Medical Certificate

- Original Medical bills / receipts

- Death Certificate, autopsy report, coroner’s findings, if applicable (for death claim)

- Documentary proof of relationship between deceased and claimant (for death claim)

- Motor accident report / police report (for injury / death resulting from a traffic accident)

- Baggage loss or damage report / Property irregularity report from the carrier / airline

- Baggage tag(s) issued from the carrier / airline during check-in

- Written confirmation of carrier / airline’s settlement / rejection of claim for damage / loss of property

- Photographs of damaged items

- Original purchase receipts of damaged/lost items

- Copy of police report lodged at place of loss within 24 hours

- Receipts for replacement of passport / visa

- Transportation and / or hotel bills / receipts incurred for replacement of document

- Baggage delay report

- Written confirmation from carrier / airline on reason and duration of delay

- Acknowledgement receipt of baggage received

- Medical Report and other medical documents / Death Certificate

- Proof of relationship (if due to sickness, injury or death of related person)

- Written advice or medical certificate from a Registered Medical Practitioner to cancel / curtail trip

- Original tour booking invoice / receipt

- Travel agent and / or airline’s confirmation of the refund amount

- Original invoice / receipt for charges incurred in amending or purchasing additional air ticket (for trip curtailment)

- Written confirmation from carrier / airline on reason and duration of delay, overbooked flight, travel misconnection, and / or diversion

- Air ticket and Boarding pass

- Copy of police report lodged within 24 hours upon discovery

- Invoice of damaged items / quotations

- Original photographs of damaged items

- Do not admit any liability or make any offer, promise or payment without our prior consent

- Forward all correspondence / documents from third parties concerning the accident to us immediately

- Copy of police report lodged (if applicable)

We will contact you for any additional documents that may be required.

You may submit your claims online . Kindly note that it may take longer to process a claim if we require additional information or documents from you. For any claims enquiry, amendment of details or submission of supporting or original documents, please email our friendly claims officers at [email protected] with our acknowledgement reference number – MTC/YYYY/000000.

We will keep you updated on your claim(s) by email. You can also call our Hotline at 6922 6003 to check on your claim(s).

Thank you for insuring with us.

Discover more about Travel Insurance in Singapore

Travel Essentials: Must-See Cities and Insurance Insights for Japan

Japan is an archipelago stretching along the eastern coast of Asia, made up of four main islands: Honshu, Hokkaido, Kyushu, and Shikoku. This geographic diversity brings a range of climates and landscapes, from the snowy mountains of Hokkaido to the tropical beaches of Okinawa. Whether you’re a first-time traveller or a yearly visitor, Japan continually…

Travel to Bali: Essential Insurance Tips for a Tropical Escape

Bali, Indonesia’s famed island paradise, beckons travellers with its enchanting blend of lush landscapes, friendly people, and serene beaches. Known for its majestic temples, vibrant arts scene, and world-renowned surf spots, Bali offers a myriad of experiences for every type of holiday-goer. As you plan to bask in the island’s natural beauty and dive into…

Travel Smart in Taiwan: Key Insurance Insights and Tips for Your Journey

Taiwan is a land of stunning contrasts, delightful food and friendly people. The island boasts a landscape as diverse as its cultural heritage, from the soaring peaks of the Central Mountain Range to the serene beaches of Kenting. Prefer food to scenery? Taiwanese cuisine, a delightful blend of local flavours and foreign influences, offers foodies…

SINGAPORE - With the Vaccinated Travel Lane (VTL) agreements paving the way for two-way quarantine-free travel, stir-crazy Singaporeans are dusting off their passports and making up for lost time.

But travel during a global pandemic is fraught with uncertainty, and if travel insurance was a good idea pre-Covid-19, it is practically essential now. In fact, it is literally essential for certain VTL countries such as Malaysia and South Korea, which require foreigners to purchase travel insurance with Covid-19 medical expense coverage as a condition of entry.

Fortunately, the majority of travel insurers now provide Covid-19 coverage, either integrated into the main policy or as an add-on rider.

It is not going to burn a hole in your pocket either. With the various ongoing promotions, coverage can be had for less than $10 a day (see chart on Sample Coverage Of Covid-19 Travel Insurance Policies).

What you need to be covered for

Medical expenses.

Assuming you are vaccinated and in good health, any Covid-19 infection should be fairly mild.

However, it is still important to have coverage for Covid-19 medical expenses, whether it is as simple as an outpatient consultation with a doctor or as serious as admission to hospital.

Moreover, some VTL countries require foreigners to buy travel insurance with a specified minimum coverage for Covid-19 medical treatment. You will usually need to present your insurance certificate before boarding the flight.

Emergency medical evacuation

In the event that you contract Covid-19 and your situation deteriorates, doctors may decide that evacuation to Singapore for further treatment is necessary.

This can be a very expensive process. According to examples from insurance company Chubb, medical evacuation via air ambulance can cost upwards of US$100,000 (S$136,700). You will want to ensure your travel policy has adequate coverage in this area.

When choosing your policy, make sure it provides separate coverage for medical expenses and emergency medical evacuation.

For example, MSIG TravelEasy (Standard) provides $65,000 of combined coverage for overseas medical expenses and emergency medical evacuation.

Allianz Travel Insurance (Bronze) provides $1 million of coverage for medical expenses and a separate $1 million of coverage for emergency medical evacuation.

If your situation is serious enough to warrant repatriation to Singapore, you may well have incurred significant overseas medical expenses already, so it is vital you have something left over to cover the evacuation.

Quarantine allowance

If you receive a positive Covid-19 result while overseas and are asymptomatic or mildly symptomatic, the standard procedure in most VTL countries is to self-isolate in a hotel.

The two situations where travellers are most likely to receive a positive Covid-19 result while overseas are:

- Upon arrival overseas: Assuming the country requires a further Covid-19 test on arrival (most European countries and the United States do not); and

- Pre-departure to Singapore: All VTL travellers to Singapore must take a Covid-19 antigen rapid test/polymerase chain reaction (PCR) test within two days of departure.

Getting a positive result on arrival is not a great way to start your vacation, but is unlikely to incur much incremental accommodation costs because you can use the hotel already booked for isolation. However, getting a positive result on your pre-departure test could be expensive because you need to book additional accommodation beyond your originally envisioned return date, as you wait for the all-clear.

A quarantine allowance helps defray some of the additional expenses involved. While most policies offer $50 a day, you are strongly advised to top up a little extra for a policy with $100 a day, to cover the cost of a decent hotel. Also, check how many days of quarantine are covered - some policies offer seven days, others 14 days.

Note that quarantine allowances do not cover situations where quarantine is a published requirement for travel. For example, Singapore residents travelling to Indonesia must undergo a 10-day quarantine on arrival . No claims will be allowed in this respect (travel insurance is meant to cover the possibilities, not the certainties).

There is one thing the quarantine allowance will not cover.

The Immigration & Checkpoints Authority has a policy that says travellers who have been diagnosed with Covid-19 in the last 14 days should not travel to Singapore.

Suppose your pre-departure test in Germany is positive and you are issued a seven-day self-isolation order. After seven days, you clear a Covid-19 PCR test and are released.

You can claim a quarantine allowance for the seven-day period indicated on the self-isolation order, but not the additional seven days you need to wait in Germany before returning to Singapore.

Trip cancellation

Many VTL countries require a pre-departure test before leaving Singapore. Should your result come back positive, you will almost certainly need to cancel your trip.

Trip cancellation protection offers reimbursement for forfeiture of deposits or charges that are unrecoverable - for example, flights, hotels and tickets to attractions.

The emphasis is on the word "unrecoverable". You will usually be required to submit proof that you contacted the merchant to request a refund and were denied. If the merchant agrees to refund you a portion of your costs, that portion is not recoverable from your travel insurer.

But trip cancellation does not cover situations where you get spooked out of travelling because of quarantine requirements or travel advisories.

Certain travel insurance policies may also provide coverage for trip postponement which, as the name suggests, covers the costs incurred in postponing your trip as opposed to cancelling it.

What you should know about Covid-19 coverage

Coverage applies to overseas expenses.

With the exception of trip cancellation or postponement, travel insurance is generally meant to cover you for things that happen outside of Singapore.

In other words, if you require overseas medical treatment for a Covid-19 infection diagnosed in Britain, you can file a claim with your travel insurer.

But if you are diagnosed with Covid-19 after returning to Singapore from Britain, you need to file a claim with your regular health insurance provider for medical treatment received in Singapore.

While the Singapore Government is currently picking up the tab for Covid-19 medical bills for fully vaccinated Singaporeans, permanent residents and long-term pass holders, an exception applies to those who test positive for Covid-19 within 14 days of their arrival in Singapore.

However, these individuals will still be able to tap government subsidies and insurance coverage where applicable. According to the Ministry of Health, the median acute hospital bill for patients who end up in the intensive care unit and require Covid-19 therapeutics is $25,000, although means-tested government subsidies and MediShield Life coverage can reduce the bill to about $2,000 to $4,000 for eligible Singaporeans in subsidised wards.

Covid-19 coverage will be less than general coverage

While travel insurance policies may offer very generous coverage of overseas medical expenses, Covid-19 treatment is usually a much smaller amount.

For example, AXA SmartTraveller offers up to $600,000 of overseas medical expenses, but only up to $150,000 for those specifically related to Covid-19.

I can only surmise that it is because Covid-19 is a relatively novel disease and underwriters prefer to err on the side of caution by limiting their liability.

Mandatory quarantine is not grounds for cancellation

If there is one thing the Omicron variant has done, it is remind people that border restrictions and quarantine requirements are liable to change at short notice.

In recent weeks, for example, Sydney and Melbourne have imposed 72-hour quarantine for all international arrivals, and India reinstated seven-day home quarantine for travellers from Singapore. While both these measures have since been lifted, they are reminders of how fast things can change.

As inconvenient as these things may be, changing regulations, government advisories against travel and border closures are generally not grounds to claim trip cancellation.

Most policies will cover only trip cancellation if you, a travelling companion or family member test positive for Covid-19 prior to departure.

To put it another way, while it is unfortunate you need to spend precious overseas time in quarantine, that is not really the insurer's concern.

If you want a policy that covers such situations, you might want to consider Aviva's travel insurance and its "cancel for any reason" clause.

This covers 50 per cent of your unrecoverable travel and entertainment costs (capped at $5,000) should you decide not to travel, claimable a maximum of once per period of insurance (that is, annual policy-holders can use it only once).

Travel insurance policies with Covid-19 coverage

Travel insurance policies have different tiers and coverage. The chart, Illustrative Pricing For Travel Insurance Policies, uses a seven-day trip to South Korea as the basis for comparison.

My advice would be to look for an insurer that provides coverage for all four areas discussed previously (some policies do not provide quarantine allowance).

Generally, there is no harm in purchasing travel insurance well in advance of your trip, since you are charged only for the days overseas.

For example, an insurance company charges the same for a seven-day trip to South Korea whether you buy it the day before departure or a month in advance. But buying it earlier means you will be covered for specified events that occur in the pre-departure period, such as a positive Covid-19 diagnosis.

Should you eventually decide not to travel, most Singapore-based insurers allow you to cancel and refund your policy, provided no claims have been made. Some may charge an administrative fee.

Other travel insurance options

From airlines.

Instead of purchasing travel insurance from a bank or underwriter directly, passengers flying on certain airlines can purchase or enjoy complimentary travel insurance with Covid-19 coverage.

For example, passengers flying with Singapore Airlines can purchase a policy underwritten by Allianz, which provides up to $1 million of overseas Covid-19 medical expense coverage and trip interruption coverage of up to $150 a day that would cover additional costs incurred due to quarantine.

Likewise, those flying with Scoot can buy a policy underwritten by AXA with $10,000 of overseas Covid-19 medical expense coverage and a daily quarantine allowance of $100. But do note that the relatively low medical coverage will make this unsuitable for certain VTL countries such as Malaysia or Thailand.

Passengers flying on Cathay Pacific, Emirates and Etihad will also enjoy complimentary Covid-19 medical insurance, with no action needed from them.

From overseas

Travellers can also consider purchasing insurance from overseas companies such as SafetyWing and World Nomads. These policies provide coverage for Singapore residents and may be more cost- effective in certain scenarios.

However, it is important to read up on both the seller and underwriter, since you will not have access to mediation bodies like FIDReC in the event of a dispute.

In a nutshell

Remember that travel insurance provides no coverage should your trip be impacted by new quarantine requirements and even border closures. Likewise, there is no coverage against a disinclination to travel, so if you are still on the fence, it is a good idea to hold your fire on any non-refundable bookings.

Venturing overseas without travel insurance was always a foolhardy endeavour prior to Covid-19 and to do so now is borderline insanity.

Do not pinch pennies when it comes to protection - no one ever enjoyed a mai tai on the beach while looking over his or her shoulder.

- Aaron Wong founded The MileLion (milelion.com) to help people travel better for less and impress relatives during Chinese New Year. He was 50 per cent successful.

- A version of this story was published in The MileLion .

What you need to know about S'pore's new Covid-19 vaccination strategy

Asia stepping up fight against more infectious Covid-19 variants

Hong Kong cements Covid-19 tests with centres just a 15-minute walk

Covid-19 wave looms in Europe amid vaccine fatigue and false sense of security

Long Covid remains a mystery, though theories are emerging

askST: What is excess death and what is Covid-19's true toll on the world?

Biden says pandemic is over; survivors and doctors disagree

No plans to include Covid-19 vaccinations in childhood immunisation schedule: Ong Ye Kung

Human development set back 5 years by Covid-19, other crises: UN report

Covid-19's harmful effects on the brain reverberate years later: Study

Join ST's Telegram channel and get the latest breaking news delivered to you.

- Travel and leisure

- Vaccinated Travel Lane/VTL

Read 3 articles and stand to win rewards

Spin the wheel now

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 27 March 2024, new safety measure in the Android version of the HSBC Singapore app will be launched to protect you from malware. Read more on malware scams .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

TravelSure makes travel safer with over 50 benefits and COVID-19 coverage to take care of you, even before take off.

Special offers

From now till 6 May 2024, enjoy 35% premium discount for Single-Trip plans and 15% premium discount for Annual plans.

- COVID-19 coverage COVID-19 coverage is automatically included for Single and Annual plans. Get up to SGD250,000 medical expense coverage when you travel overseas. Please refer to the COVID-19 section for more information.

- Overseas medical expenses Be covered up to SGD1,000,000 for overseas medical expenses.

- Replacement of traveller Pays for the charges incurred for change of traveller due to you or insured person not being able to travel as a result of serious injury, illness or death 30 days prior to the trip.

- Delayed departure Pays for additional administrative and travel expenses incurred to book alternative transport to the same destination should there be delays to the public transport.

Summary of benefits

The limits shown above are based on Individual sum insured. Learn more about the full coverage details .

How to buy TravelSure

Buy travelsure online now.

- Contact MSIG Singapore

- Submit your claims online

Important Notes

This product is underwritten by MSIG Insurance (Singapore) Private Limited ("MSIG") and distributed by HSBC Bank (Singapore) Limited ("HSBC"). It is not an obligation of, a deposit in or guaranteed by HSBC. Full details of the terms, conditions and exclusions of this insurance are provided in the policy and will be sent to you upon acceptance of your application by MSIG. This is not a contract of insurance. It does not constitute an offer to buy an insurance product or service. It is also not intended to provide any insurance or financial advice.

This policy is protected under the Policy Owner's Protection Scheme which is administered by the Singapore Deposit Insurance Corporation ("SDIC"). For more information on the scheme, please visit the General Insurance Association www.gia.org.sg or SDIC www.sdic.org.sg websites.

The information and opinions contained in this website are for information only, have been obtained from sources believed to be reliable, but HSBC makes no representation or warranty as to their adequacy, completeness, accuracy or timeliness for any particular purpose, are subject to change without notice, and are not intended for distribution to, or use by, any person or entity outside Singapore or in any jurisdiction or country where such distribution or use would be contrary to law, regulation or rule. HSBC does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time.

Where specific products are advertised and/or recommended, please note (a) the recommendation is intended for general circulation; (b) the recommendation does not take into account the specific investment objectives, financial situation or particular needs of any particular person; (c) advice should be sought from a financial adviser regarding the suitability of the products, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the recommendation, before the person makes a commitment to purchase the products; should the person choose not to do so, he should consider carefully whether the product is suitable for him; in particular, all relevant documentations pertaining to the product should be read to make an independent assessment of the appropriateness of the transaction; and (d) this advertisement has not been reviewed by the Monetary Authority of Singapore, or any regulatory authority elsewhere.

HSBC, its related companies, their directors and/ or employees may have positions or other interests in, and may effect transactions in, the product(s) mentioned here. HSBC may have alliances or other contractual agreements with the provider(s) of the product(s) to market or sell its product(s). In addition, HSBC, their directors and/or employees may also perform or seek to perform broking, investment banking and other banking or financial services for these product providers.

To the extent permitted by law, HSBC accepts no liability whatsoever for any direct indirect or consequential losses, claims or damages arising from or in connection with the use of or reliance on the information, opinions or contents herein.

You might also be interested in

Get ready to travel with HSBC

Plan your trip around the latest COVID-19 travel requirements and check out exciting travel related offers/benefits.

Overseas Study Insurance

Enjoy comprehensive protection for unexpected events such as accidents, study interruptions and holiday travel disruptions while studying overseas.

When it comes to the things that make your house a home, you can have peace of mind with our home insurance plans.

Car insurance

Protecting you and your passengers while you are on the road, with the flexibility of choosing your preferred car workshop and more

Connect with us

- Board Of Directors

- Organisation Chart

- Achieving Quality Tourism

- Legislation

- Corporate Governance

- Invest in Tourism

- ASEAN Economic Community

- Media Releases

- Corporate Publications

- Newsletters

- Statistics & Market Insights Overview

- Tourism Statistics

- Industries Overview

- Arts & Entertainment

- Attractions

- Dining & Retail

- Integrated Resorts

- Meetings, Incentives, Conventions & Exhibitions

- Tourist Guides

- Travel Agents

- Assistance and Licensing Overview

- Tourism Sustainability Programme (TSP)

- Singapore Visitor Centre (SVC) Network Partnership

- Grants Overview

- Licensing Overview

- Tax Incentives Overview

- Other Assistance & Resources Overview

- SG Stories Content Fund Season 2

- Marketing Partnership Programme

- SingapoReimagine Marketing Programme

- Singapore On-screen Fund

- Hotel Licensing Regulations

- Data College

- Trade Events and Activities

- Trade Events Overview

- SingapoReimagine Global Conversations

- SingapoRediscovers Vouchers

- Made With Passion

- Joint Promotion Opportunities

- Procurement Opportunities for STB's Overseas Regional Offices

- Product And Industry Updates

- Rental of F1 Pit Building

- Singapore Tourism Accelerator

- Sponsorship Opportunities

- STB Marketing College

- Tourism Innovation Challenge

- Harnessing Technology to Emerge Stronger Post COVID-19

- Tourism Transformation Index (TXI)

- New Tourism Development in Jurong Lake District

- International Trade Events

- Singapore Familiarization Trips

- EVA-Ready Programme

- Tourism Industry Conference

- Expo 2025 Sponsorship and Partnership Opportunities

- Students & Fresh Graduates

- Professionals

- Attractions Operator

- Business/Leisure Event Organiser

- Media Professional

- Tourist Guide

- Travel Agent

New insurance coverage for inbound travellers to cover Covid-19 related costs in Singapore

SINGAPORE 18 November 2020 – Changi Airport Group (CAG) and the Singapore Tourism Board (STB), on behalf of the Emerging Stronger Taskforce Alliance for Action (EST-AfA) on Enabling Safe and Innovative Visitor Experiences[1], announced today that foreign visitors will now be able to buy inbound travel insurance coverage for Covid-19 related costs incurred in Singapore.

Inbound insurance coverage has been identified as a key enabler to facilitate the resumption of travel to Singapore. In line with the EST-AfA’s focus on public-private partnerships, CAG, STB and the General Insurance Association of Singapore (GIA) led an Expression of Interest (EOI) exercise to reach out to interested private sector insurers to provide such coverage. In response to the EOI, three insurance companies, AIG Asia Pacific Insurance Pte. Ltd., Chubb Insurance Singapore Limited and HL Assurance Pte. Ltd., have developed travel insurance products which provide at least S$30,000 in coverage for Covid-19 related medical treatment and hospitalisation costs. A minimum of S$30,000 in coverage is recommended by the Ministry of Health based on Covid-19 bill sizes at private hospitals, which is where inbound travellers typically receive care for Covid-19. (Please see Annex for the list of insurers and their insurance plans).

Inbound foreign travellers entering Singapore via the various Safe Travel Lanes are required to bear the full cost of medical treatment, tests and isolation, should they be suspected of being infected with Covid-19, or require medical treatment for Covid-19 while in Singapore. With immediate effect[2], they will be able to purchase a travel insurance plan to help them cover some of these costs.

“We have been actively engaging the insurance community since August this year, through an Expression of Interest (EOI) exercise[3], to develop inbound travel insurance products as Singapore progressively reopens. We noticed such products were not available in the market, and wanted to encourage insurers to develop such products and offer them to travellers at a reasonable price.” said Mr Lee Seow Hiang, Changi Airport Group’s Chief Executive Officer and co-lead of the Alliance.

“With the gradual resumption of travel and the re-opening of borders, having robust travel insurance options in place is integral to ensuring a successful and sustainable revival of inbound travel to Singapore. The general insurance sector is committed to providing travellers visiting Singapore the protection they need to travel here with confidence.” said Mr Ho Kai Weng, General Insurance Association (GIA) of Singapore’s Chief Executive.

Earlier in September, the EST Alliance for Action on Enabling Safe and Innovative Visitor Experiences announced that it will be testing a prototype for safe tradeshows and exhibitions, as well as safe itineraries for event attendees. The new insurance products will complement this earlier work in resuming safe travel.

“As we gradually re-open for safe travel, Covid-19 insurance coverage is a key enabler to rebuild traveller confidence and provide peace of mind. We are heartened that the public and private sectors have come together to provide solutions, and we look forward to more collaborations that will help Singapore lead the way as a safe, trusted and innovative destination.” said Mr Keith Tan, Singapore Tourism Board’s Chief Executive.

Premiums for these inbound travel insurance plans start from S$5.35 (inclusive of GST) and can be purchased directly from the insurers through their respective websites.

[1] The Emerging Stronger Taskforce (EST), formed under the Future Economy Council (FEC) convened the Singapore Together Alliances for Action (“Alliances”), which are industry-led, government-supported coalitions that will act quickly by prototyping ideas on key areas for Singapore. The Alliance for Action on Enabling Safe and Innovative Visitor Experiences is one of them. Co-led by Mr Lee Seow Hiang of Changi Airport Group and Ms Kwee Wei-Lin of Singapore Hotel Association, the Alliance has worked closely with a diverse range of industry stakeholders and government agencies to explore and pioneer new ways to facilitate safe and innovative visitor experiences in a Covid-19 environment.

[2] Refer to Annex for each insurer’s expected sale date.

[3] CAG, on behalf of the Alliance, appointed Willis Towers Watson (WTW) as the consultant of the EOI exercise, where the objective was to invite licensed Singapore insurers to offer coverage to inbound foreign travellers’ Covid-19 related costs in Singapore.

About Changi Airport Group

Changi Airport Group (Singapore) Pte Ltd (CAG) (www.changiairportgroup.com) was formed on 16 June 2009 and the corporatisation of Singapore Changi Airport (IATA: SIN, ICAO: WSSS) followed on 1 July 2009. As the company managing Changi Airport, CAG undertakes key functions focusing on airport operations and management, air hub development, commercial activities and airport emergency services. CAG also manages Seletar Airport (IATA: XSP, ICAO: WSSL) and through its subsidiary Changi Airports International, invests in and manages foreign airports.

About Singapore Tourism Board

The Singapore Tourism Board (STB) is the lead development agency for tourism, one of Singapore’s key economic sectors. Together with industry partners and the community, we shape a dynamic Singapore tourism landscape. We bring the Passion Made Possible brand to life by differentiating Singapore as a vibrant destination that inspires people to share and deepen their passions.

More: www.stb.gov.sg or www.visitsingapore.com

About the Organisation

What industry does your organization fall within, what best describes the key intent of the project that your organisation is seeking funding for, is your organisation a singapore-registered legal entity, is your organisation an association, is the project able to achieve one or more of the following outcome.

- Increase no. of sailings to/from Singapore

- Increase no. of foreign cruise passengers to Singapore through sailings to/from Singapore

- Increase no. of pre/post nights for cruise passengers sailing to/from Singapore

- Increase capability of industry players via cruise-specific industry training programmes

- Strengthen the potential/ attractiveness of cruising in Singapore and/or Southeast Asia

Is the project able to achieve one or more of the following?

- Improve visitor satisfaction (especially foreign visitors)

- Increase footfall

- Increase revenue

- Significant branding and PR value

Is the project able to attract foreign visitors and contribute to foreign visitors' spend?

Who will be the main target audience of your project, is your project innovative and/or a new event in singapore with tourism potential, what best describes your project, does the event have proven track records in singapore or overseas, and/or growth in tourism value such as growing foreign visitorship, and/or enhancement of precinct vibrancy etc, does the project have a clear tourism focus (e.g. tourism-related trainings, tourism companies taking on capability development initiatives or technology companies creating technology products and services for the tourism businesses), what best describes your market feasibility study project.

Based on your selection, the following STB grant/s may be applicable for your project:

Please note that projects that have commenced prior to Singapore Tourism Board's offer may not be eligible for grant support. Examples where projects are deemed as having commenced include:

- Applicant has started work on the project e.g. tender has been called.

- Applicant has made payment(s) to any supplier, vendor or third party.

- Applicant has signed a contractual agreement with any supplier, vendor or third party.

Etiqa Travel Insurance Singapore Review: Pre-Ex, Covid-19, Claims (2022)

When you think travel insurance , you definitely don’t think of Etiqa. For the uninitiated, Etiqa is Malaysian bank Maybank’s insurance arm, and it’s a relatively new player in this field. Which explains why Etiqa travel insurance is one of the cheapest travel insurance options in Singapore. It’s cheap because it’s unknown.

But as much as everyone loves cheap travel insurance, nobody wants to end up with a lao hong plan that doesn’t cover anything, right? So let’s find out if Etiqa travel insurance is any good.

- Etiqa Travel Insurance: Summary

- Etiqa Travel Infinite – Covid Travel Insurance

- Etiqa Tiq Travel Insurance

- Etiqa Tiq Pre-Ex Travel Insurance

- Extreme Sports and Outdoor Adventure

- Etiqa Travel Insurance Terms and Conditions

- Etiqa Travel Insurance Claim Review

- Etiqa vs AXA Travel Insurance

- Etiqa Travel Insurance Promotion

- Etiqa Travel Insurance Review

1. Etiqa Travel Insurance Summary

There are two Etiqa travel insurance plans currently available, namely the Etiqa Tiq Travel Insurance which covers Covid-19 and pre-existing medical conditions, and the Etiqa Travel Infinite Covid travel insurance which offers higher overseas medical coverage.

How to choose which Etiqa travel insurance suits you better? If you don’t have any life threatening pre-existing medical conditions, you should get the Etiqa Tiq Travel Insurance (No Pre-Ex).

As with all travel insurance plans, Etiqa travel insurance plans’ premiums are based on the country you’re travelling to. They are split into three categories:

- Zone 1 (ASEAN) : Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Thailand, Philippines and Vietnam

- Zone 2 (Asia, Australia) : All of Zone 1, Armenia, Australia, Azerbaijan, Bahrain, Bangladesh, China (excluding Tibet), Cyprus, Georgia, Hong Kong, India, Israel, Japan, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Lebanon, Macau, Maldives, Mauritius, Mongolia, Nepal, New Zealand, Oman, Pakistan, Palestine, Qatar, Saudi Arabia, South Korea, Sri Lanka, Taiwan, Tajikistan, Timor-Leste, Turkey, Turkmenistan, United Arab Emirates and Uzbekistan

- Zone 3 (Worldwide) : All of Zone 1 and 2, Nepal, Tibet and Worldwide/the rest of the world excluding Democratic Republic of Congo, Iran, Libya, North Korea, Somalia, South Sudan, Sudan and Yemen

2. Etiqa Travel Infinite – Covid Travel Insurance

For most of us regular holiday-goers without outstanding pre-existing medical conditions, the Etiqa Travel Infinite would usually seem like the travel insurance plan we’ll likely go for. (Pre-existing conditions travel insurance usually cost more.) However, you need to buy this plan from one of Etiqa’s 18 partner tour agencies such as Chan Brothers. Ah, it’s one of those tour group type of travel insurance plans.

Anyway, here’s a summary of Etiqa Travel Infinite travel insurance plan’s key coverage, and benefits:

Since these Etiqa travel insurance plans are offered to tour agencies, you can see that the medical treatment and hospitalisation, emergency medical evacuation coverage are quite high. Likewise, other miscellaneous trip itinerary and logistics-related coverage are extremely high too. Trip cancellation, for example, starts from $5,000 – a whole lot more than Direct Asia travel insurance ‘s travel cancellation coverage of $3,000, and AIG travel insurance ‘s travel cancellation coverage of $2,500.

Etiqa Travel Infinite does not automatically include Covid-19 coverage. Instead, it comes as an add-on Covid-19 rider at an additional price.

Again, since this Etiqa Travel Infinite plan caters to tour groups, the Covid-19 rider’s coverage is pretty decent. You get a high $3,000 to $5,000 coverage for any Covid-19 related trip cancellations or disruptions, adequate $100,000 to $300,000 overseas Covid-19 medical expenses, and even a $100/day quarantine allowance. Etiqa Travel Infinite’s Covid-19 coverage is on par with reputable insurance providers such as Sompo travel insurance , but it’s considered pretty good compared to a budget travel insurance, e.g. Direct Asia.

3. Etiqa Tiq Travel Insurance

The other Etiqa travel insurance plan that you can buy directly online is called Tiq Travel Insurance. It comes in two variants:

- Pre-Existing Plan

- Normal Plan (no pre-existing medical conditions)

.png)

Total Premium

[MoneySmart Exclusive] • Enjoy 40% off your Single Trip policy premium and 60% off Covid-19 add-on for Annual Plans. T&Cs apply • Additionally, receive 2,400 My Millennium Points (worth S$16) with every policy purchased. T&Cs apply. [Etiqa's 10th Year 2024 Grand Draw] Stand a chance to win S$10,000 cash or a Singapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth S$173) with eligible Etiqa/Tiq by Etiqa plans purchased. T&Cs apply.

Key Features

Comprehensive Covid-19 add-on, protecting you before, during and after your trip

Covers Cruise to Nowhere

Instant claims encashment via PayNow

24-hour worldwide emergency travel support

Get paid upon a 3-hour flight delay, even without submitting a claim

Here, we first review the normal (non pre-ex) Tiq travel insurance plan.

Etiqa Tiq Travel Insurance (Normal)’s key coverage and benefits:

Compared to its competitors, Etiqa’s travel insurance coverage is adequate and comparable to what other travel insurance companies are providing. Take MSIG travel insurance for example, overseas medical expenses range from $250,000 to $1,000,000 while Etiqa Tiq’s coverage is $200,000 to $1,000,000.

However, very much like budget travel insurance provider Direct Asia , Etiqa’s Tiq travel insurance separates the main travel insurance plan from its Covid-19 rider. When you add the main travel insurance plan’s premiums and Covid-19 rider’s prices together, it’s as good as paying for a reliable insurance brand such as Sompo .

Again, Etiqa Tiq Travel Insurance’s Covid-19 rider is pretty good compared to other budget travel insurance providers such as Direct Asia. When compared against established insurance companies such as MSIG travel insurance, Tiq travel insurance’s Covid-19 coverage is adequate and on par.

4. Etiqa Pre-Ex Travel Insurance

The other variant of the Etiqa Tiq Travel Insurance is the pre-existing medical conditions plan.

There aren’t many travel insurance plans thats cover pre-existing medical conditions out there. Other than this Etiqa Tiq Pre-Ex Travel Insurance that you’re looking at, MSIG travel insurance and NTUC travel insurance offer pre-existing medical conditions and Covid travel insurance as well.

MSIG TravelEasy Pre-Ex Standard

Etiqa tiq pre-ex travel insurance’s key coverage and benefits:.

In terms of benefits and medical coverage, there really isn’t very much difference between the Tiq Travel Insurance non pre-ex and pre-ex versions. The only difference? Higher premiums and price. The pre-ex plans are twice more expensive than the non pre-ex plans for good reason – a price that I would honestly pay for if I were travelling with my mother, for example, who has a medical history.

Etiqa’s Tiq Pre-Ex Travel Insurance does not offer Covid-19 coverage .

5. Extreme Sports and Outdoor Adventure

Etiqa travel insurance is a good one for outdoorsy types and adventure junkies as quite a range of leisure outdoor activities are covered. (There’s nothing I hate more than seeing a long list of activity exclusions hidden in size 6 font in the policy wording.)

Most leisure and recreational type of holiday outdoor activities such as hot air balloon, skiing are explicitly stated as not excluded – aka covered by Etiqa.

If you’re in for rock climbing with ropes and equipment, you will need a more niche and specialised Extreme Sports travel insurance rider offered by Direct Asia travel insurance instead.

DirectAsia DA150

[ Win a Rolex, Dream Vacation & More! | MoneySmart Exclusive] • Enjoy 40% off your policy premium and 2,400 My Millennium Points (worth S$16) with every policy purchased. • Additionally, receive up to S$20 via PayNow with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, stand a chance to score over S$10,000 worth of prizes in our Grand Draw . • Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000) • All Expenses Paid Trip • 2D1N Staycation at any Millennium Hotels and Resorts and 15,000 My Millennium Points (worth up to S$550) Increase your chances of winning when you refer friends today. T&Cs apply.

Additional coverage for Travel Insurance - Sports equipment, Maid and COVID-19. Extreme Sports add-on only available for Annual Plans.

Kids go free – up to four kids travel for free with a Family policy only (2 adults)

Matching kids limits – children enjoy the same coverage limits as adults

Emergency Dental – Accidental Dental treatment can be costly, so it is covered under the main medical expenses coverage which is higher than a separate dental benefit

Optional COVID-19 coverage on trip cancellation, medical expense, and emergency evacuation. Only for Single Trip.

4. Etiqa Travel Insurance Terms and Conditions

Some terms and conditions found in Etiqa travel insurance’s policy wording that you should take note of:

- Air Miles and Hotel Reward Points : Tickets and bookings made with airline miles programmes, hotel membership reward points, and credit card points etc. will not be covered or claimable.

- Loss of Personal Belongings : If you’ve lost your personal baggage or belongings, you need to report the loss or theft to the local police, hotel, airlines, airport etc. wherever you were within 24 hours, and get printed reports for claims.

- Travel Postponement benefit: Will only be claimable if you bought your travel insurance more than 3 days before departure date (except for death reasons).

- Pre-Existing Medical Conditions : You must prove that you’ve been diligently following your doctor’s treatments, medications, and routine tests etc. You are not eligible if you were admitted to the hospital or A&E in the past year due to your pre-existing medical condition.

- Pet Hotel Add-On : Only covers dogs and cats.

5. Etiqa Travel Insurance Claim Review

Although Etiqa has been around in Singapore for reportedly over 55 years (says their website), you’ll be hard pressed to find reviews from actual customers who have successfully claimed from Etiqa travel insurance before. Instead, there are mixed reviews of Etiqa’s customer service team – some great, mostly negative.

Here are some emergency hotlines you should keep in handy if you’re buying Etiqa’s travel insurance plans:

Etiqa Overseas emergency hotline: Call Allianz Global Assistance emergency assistance hotline at +65 6327 2215 (Allianz is Etiqa’s emergency support provider)

Etiqa Travel insurance claims: WhatsApp Etiqa Customer Service at +65 6887 8777

Online claims: Sign in to your Etiqa Tiq Connect self-service portal to submit claims online

Mailed claims : Download claim forms from Etiqa website, mail with supporting documents to Etiqa’s office in Singapore

Etiqa Insurance Pte Ltd One Raffles Quay #22-01 North Tower Singapore 048583

Claims settlement time: According to Etiqa, their travel claims can be processed and paid as quickly as one day through this instant payment service, as opposed to a cheque which takes 2 to 4 weeks.

6. Etiqa vs AXA Travel Insurance

7. etiqa travel insurance promotion.

Etiqa has an ongoing promotions which gives you 40% off premiums with promo code TRAVEL40 .

Of course, Etiqa loses that competitive pricing edge once you take away the generous promotions… so let’s hope the promo code is here to stay.

8. Etiqa Travel Insurance Review

If you’re like me – a budget traveller who love the outdoors – Etiqa travel insurance is a great fit. It’s cheap, covers pretty much every adventure activity, and the emergency assistance and medical coverage benefits are solid.

As a bonus, you can skip the hotline and get in touch with the customer service via Whatsapp (although there are many bad reviews about that).

By the way, big families travelling together will appreciate the fact that Etiqa’s family plans cover up to 8(!) children. “Children” even encompasses young adults up to 25 years old as long as they are full-time tertiary students in Singapore. The Tiq Pre-Ex travel insurance also gives your elderly parents pretty comprehensive coverage – and peace of mind – while travelling.

Etiqa travel insurance is NOT for you if you’re more of a princess who just. cannot. deal. with flight delays and disappearing luggage. The benefits in this aspect are very poor. Maybe try fly carry-on only with this one.

Looking to buy Etiqa travel insurance? Compare all the best travel insurance plans in Singapore .

Related Articles

Travel Insurance Singapore Guide (2023): Must-Knows for Choosing the Best Travel Insurance

Airline Travel Insurance – What does SIA, Scoot, Jetstar travel insurance cover?

Best Travel Insurance Plans in Singapore [content outdated due to Covid]

- Chubb in Singapore

- Corporate News

- Singapore News

- Media Resources

- Submit an Enquiry

Inbound Travel Insurance

SG Travel Insured is a COVID-19 travel insurance plan specially designed for short-term foreign visitors arriving in Singapore, excluding Singapore Residents.

As part of the COVID-19 travel insurance and medical treatment guidelines for inbound travellers, all short-term visitors who are not vaccinated will need to have travel insurance for their COVID-19-related medical treatment and hospitalisation costs in Singapore, with a minimum coverage of S$30,000. From 1 April 2022, short-term visitors who are fully vaccinated are not required to have travel insurance for their COVID-19 related medical treatment and hospitalisation costs in Singapore for entry into Singapore 1 . As one of the appointed insurer by the Emerging Stronger Taskforce Alliance for Action (EST-AfA) on Enabling Safe and Innovative Visitor Experiences to provide inbound travel for foreign visitors, SG Travel Insured provides up to S$250,000 coverage for COVID-19 related costs. With 4 plan types with different levels of coverage to choose from and affordable premium from as low as S$19.15, SG Travel Insured helps defray the costs of COVID-19 medical treatment in Singapore and provides greater peace of mind in the event of other travel mishaps due to COVID-19.

COVID-19 Related Benefits

- Hospitalisation and Medical Expenses

- 24-hour Assistance Hotline

- Repatriation of Mortal Remains (optional add-on)

- Trip Cancellation (optional add-on)

- Trip Curtailment (optional add-on)

- Hospital Cash (optional add-on)

What is SG Travel Insured?

SG Travel Insured is an inbound travel insurance, with COVID-19 cover, specially designed for short-term visitors to Singapore.

Do all travellers entering Singapore require mandatory insurance coverage?

(Updated on 31 March 2022) In addition to pre-departure COVID-19 tests and entry visa (where applicable), foreign short-term visitors who are not fully vaccinated must also purchase travel insurance, with a minimum coverage of S$30,000, for COVID-19 related medical treatment and hospitalisation costs, prior to their travel to Singapore. From 1 April 2022, short-term visitors who are fully vaccinated are not required to have travel insurance for their COVID-19 related medical treatment and hospitalisation costs in Singapore, for entry into Singapore. For more information visit the ICA website here: https://safetravel.ica.gov.sg/health/insurance-and-treatment

I am fully vaccinated. Do I still require COVID-19 Travel Insurance?