Rest assured, you booked the best rate.

Important Update: The FedRooms Temporary Duty Travel (TDY) (1-29 nights) lodging program is available to Federal and DoD travelers on official business. In order to be compliant with policy and to reduce costs governmentwide, GSA will no longer require fedrooms.com as a contractor-provided website as of September 30, 2024. FedRooms rates will continue to be available for official duty travel via the government's booking tools (E2 Solutions, ConcurGov, Defense Travel System and by calling the agency Travel Management Company FedRooms is the official U.S. government hotel program. All existing reservations will be honored.

There’s a reason why thousands of travelers book FedRooms every day. As the only government-wide hotel program that can be used by all federal and military travelers on official business, we’ve been able to save Federal agencies over $51 million in 2023 alone — all while consistently providing a better night’s stay for less.

Who can use FedRooms?

Federal government employees on official travel

Federal government employees on leisure travel*

Government contractors and state and local employees on official travel through our FedRates and StateRates programs

* Select FedRooms properties choose to extend the rate for leisure travel - select "Book a Room" to go to our FedRooms.com booking tool and then click "Book Leisure"

Value, choice, amenities–It all adds up to a great stay

Superior Value

Rates are always at or below per diem

No add-on service, resort or early check out fees

More Choice

Access to thousands of properties around the world

59 hotel chains and thousands of independent properties

Receive loyalty points at your favorite brands

Guaranteed Amenities

Extra perks and benefits

Free Internet

Free Breakfast *

Free Parking *

* Offered by most, but not all, FedRooms properties

Look for the FedRooms rate every time you book through your authorized online booking tool

Stay on the pulse of government travel news with FedRooms Check-in

Sign-up for our newsletter

How do you gain access to government spend in your market? Find out if FedRooms could be a good fit for your property.

With plenty of choices, superior value and rates always at or below per diem, our program provides the value choice, amenities and loyalty points that you want.

Travel Counselors

We streamline the booking process by narrowing hotel selections for federal travelers and finding the hotel and rate your travelers are looking for..

FedRooms

News, Updates and Savings

The latest FedRooms travel news, tips and answers to your questions are just a click away.

Read the latest news

Stay on the pulse of travel news.

When booking the FedRooms rate, you're guaranteed certain standards, amenities, and more.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Frequently Asked Questions

State sales tax exemption applies primarily to hotels and car rentals and usually does not apply to meals and incidentals.

Aren’t government employees exempt from all hotel taxes?

No. In accordance with legal precedence , IBAs are subject to any tax that a state deems appropriate. There are states that choose to extend exemption for state sales tax only. For a list of states that provide state sales tax exemption for IBAs, please visit the State Tax Information page .

All states are required to honor state sales tax exemption for travel CBAs. In summary, for both CBA and IBA solutions, states have the sovereign authority to levy any tax other than sales tax for transactions using a GSA SmartPay program solution, unless specifically exempt in state law.

Applies to both CBAs and IBAs.

Am I still exempt from state sales tax if I choose to use a personal credit card instead of a GSA SmartPay Travel card/account for hotel stay?

No. State sales tax exemption is determined by method of payment, not by the federal entity that employs the card/account holder. Vendors are only required to honor state sales tax exemption (when applicable by state law) to users that present valid federal government forms of payment, and many states specify GSA SmartPay payment solutions.

Nearly all agencies require the use of a federal government method of payment on travel. If you have any questions regarding mandatory usage of the GSA SmartPay Travel card/account, please reach out to your agency’s charge card program directly.

How do I know which card/account type is exempt from taxes?

If the sixth digit in the bank identification number (BIN) is 0, 5, 6, 7, 8, or 9, then the charge card statement is paid directly by the federal government and should not be subject to state sales tax. If the sixth digit in the BIN is 1, 2, 3, or 4, then the charge card is not paid directly by the federal government and therefore may be subject to state sales tax. Each state may have different documentation requirements for exemption.

A hotel indicates that a card doesn’t look like the card images on the GSA SmartPay website or images that the state provided. The BIN prefix however, does match. Is the card still tax exempt?

Yes. The card artwork on the GSA SmartPay website and provided to hotels and state taxation offices is the default card art for the GSA SmartPay 3 program. Some agencies requested permission from the Center for Charge Card Management to deviate from the default card artwork, or to issue “generic” card artwork. The most reliable way to determine if a card is a GSA SmartPay charge card is to verify the prefix (first four digits of the card).

Why does every state have different forms and documentation requirements for state sales tax exemption?

States have the authority to assess state sales taxes on consumers, and hotels are responsible for collecting taxes on behalf of a state’s revenue authority. Once a hotel has determined that a card/account holder qualifies for state sales tax exemption under state law, the hotel must document the evidence for sales tax exemption eligibility.

Each state determines the level of information needed to constitute sufficient documented evidence, and that is usually collected through forms and documentation requirements.

Once information has been collected, the state has the right to review the evidence and determine if the exemption was appropriately applied. If the state deems that the hotel did not collect the proper documentation, the state has the authority to collect the state sales tax and penalties from the hotel.

The hotel is asking for a form and/or information that doesn’t seem to be required. Do I need to provide it?

As stated in the previous answer, if a state determines that a hotel did not collect sufficient information in accordance with state law, the state has the authority to collect the state sales tax and penalties from the hotel. To mitigate this risk, hotels may over-document or ask for information not required by state law (e.g., tax identification numbers or tax exemption numbers).

Card/account holders are not required to provide forms or information to hotels if the state does not require it. If the hotel is insistent, recommend the hotel contact the state taxation department directly for clarification.

Why isn’t there one form for all tax exemptions?

GSA and the broader federal government do not have the authority to dictate state sales tax exemption documentation requirements. Each state has the sovereign authority to determine individual state requirements.

I am in a state that should honor tax exemption for IBA travel cards/accounts, but the hotel is insistent on charging taxes. What should I do?

Recommend that the hotel reaches out to the state taxation department directly for clarification. If the hotel is not willing to, there may be an opportunity to reclaim the taxes assessed directly from the state after your trip.

Reclamation requirements vary by state, and card/account holders should contact states directly for more information about the process. As a best practice, travelers are encouraged to contact the hotel and confirm state sales tax exemption status and documentation requirements to avoid confusion.

Applies to IBAs only.

I am in a state that should not honor tax exemption for IBA travel cards/accounts, but the hotel has given me an exemption form to complete. Should I fill it out and get the tax exemption?

No. Due to complexity in state law as applied to federal government tax exemption, there is often confusion around tax exemption. In efforts to provide customer service to federal government employees, hotels in states that do not honor state sales tax exemption for IBA travel may provide incorrect forms for tax exemption. Card/account holders should not complete these forms and claim exemption.

A hotel exempted state sales tax, but I’m seeing all of these other taxes and fees on my bill. Are they allowed to do that?

Yes. Legal precedence only supports exemption for state sales tax, unless state law also extends tax exemption to other specific types of taxes

In addition to states, do counties and localities also exempt taxes?

Some municipalities may have separate tax exemption processes for federal government employees. As we are made aware of these, we add the information to the GSA SmartPay website.

All GSA SmartPay Purchase cards/accounts are CBAs.

Why won’t a merchant exempt me from taxes even though I am using a purchase card/account? Aren’t all CBAs exempt from taxes?

CBAs are exempt from state sales tax in all states. However, states have the authority to assess state sales taxes on consumers, and merchants are responsible for collecting taxes on behalf of a state’s revenue authority.

If a merchant determines a card/account holder qualifies for state sales tax exemption under state law, merchants must document the evidence for sales tax exemption eligibility.

Each individual state determines the level of information needed to constitute sufficient documented evidence, and that is usually collected through forms and documentation requirements.

Once information has been collected, the state has the right to review the documented evidence and determine if the exemption was appropriately applied. If the state deems that the merchant did not collect the proper documentation, the state has the authority to collect the state sales tax and penalties from the merchant. As such, if a state determines that a merchant did not collect sufficient information in accordance with state law, the state has the authority to collect the state sales tax and penalties from the merchant. To mitigate this risk, merchants may over-document or ask for information not required by state law (e.g., tax identification numbers or tax exemption numbers).

Card/account holders are not required to provide forms or information to hotels if the state does not require it. If the merchant is insistent, recommend the hotel reaches out to the state taxation department directly for clarification.

Are there states that don’t honor state sales tax exemption for purchase cards/accounts?

No. However, there are a few states that do not directly tax the user and instead choose to tax the merchant. This is an indirect or pass-along tax, as the merchant can choose to pass along the amount of the gross receipts tax to the purchase card/account user. Once the merchant passes along the tax it is no longer a state sales tax and it is allowable. Please also note that the merchant is not required to pass along the amount of the gross receipts tax to the card/account holder. For more information about specific states, visit the State Tax Information page .

For states that directly tax the merchant, are GSA SmartPay card/account holders exempt from these taxes?

Yes. There may be instances where the state will exempt the merchant from the gross receipts tax on federal government transactions, which may result in the merchant choosing to not pass the tax to the card/account holder. In these states, the merchant is not required to engage in this process.

What happens if a merchant refuses to honor state sales tax exemption and won’t contact the state for clarification?

As a best practice, card/account holders should clarify with merchants, prior to purchase, that the merchants will honor the state sales tax exemption. If the merchants do not, explore other options with merchants that will honor tax exemption.

The merchant refuses to honor state sales tax exemption and this is the only merchant I can use. What should I do?

Recommend that the merchant reaches out to the state taxation department directly for clarification. If the merchant is not willing to, please contact your agency’s charge card program for further information.

Can I use a purchase card/account for travel-related expenses?

The purchase card/account was not designed to be used for travel, especially for meals and incidental transactions. There may be agencies that allow limited use for specific types of travel-related expenses (e.g., booking room blocks). Prior to using a purchase card/account for travel-related expenses, card/account holders must confirm that agency policy allows for this type of use and follow applicable policies and procedures for documentation.

I’m using a GSA SmartPay Purchase card/account at a hotel for a transaction that has been approved by my agency. Am I still exempt from state sales tax?

Yes. State sales tax exemption is based on payment liability and not by how an agency uses the charge card. For CBAs such as the purchase card/account, the sixth digit identifier determining payment liability does not apply.

I am completing forms for the Amazon Tax Exemption Program. Do I have to complete all of these forms?

The Amazon Tax Exemption Program includes a process in which applicants must complete all tax exemption forms from each individual state. This occurs once during the application process to streamline future purchases as applicable tax exemption forms are saved and then applied for each individual transaction. Applicants should refer to agency policy to determine if participation in the Amazon Tax Exemption Program is allowable.

I am participating in the Amazon Tax Exemption Program. Why am I still being charged taxes?

For items sold by third party vendors, please contact the sellers directly with the proper documentation for more information.

If I am purchasing an item from a merchant not located in the same state, which taxes am I responsible for and where do I submit a claim for exemption?

It depends on the state. Some merchants are required by law to charge taxes based on where the business is based, but most are required by law to charge taxes based on where the card/account holder is based. Merchants are responsible for being familiar with this information.

A merchant insists that I provide a tax exemption number or tax identification number. What should I do?

If the state does not require this information, the card/account holder is not required to provide it. If a merchant is insistent or refuses to honor tax exemption, recommend that the merchant contact the state taxation department directly for clarification. If the state does require this information, please reach out to your agency’s budget or finance divisions to find out where this information may be housed within your agency/organization.

Am I exempt from taxes that are assessed by a federal authority (e.g., federal excise tax on telecommunications or fuel)?

Do i have to pay tariffs or any fees, surcharges, or pass-along taxes as a result of tariffs, may i claim tax exemption from foreign or tribal governments.

Foreign and tribal governments are sovereign entities that have the discretionary authority to tax any person belonging to any other sovereign nation or entity. There may be treaties or agreements between the United States Government and these entities that govern taxation or exemption circumstances. In the instances that there are no treaties or agreements, card/account holders are responsible for paying these taxes.

Card/Account Holders

Whom should i contact for help with my card/account.

Card/account holders should reach out to their Agency/Organization Program Coordinator (A/OPC), who will be able to answer most account-related questions.

Card/account holders can also contact the bank directly by calling the customer service phone number listed on the back of their card.

If the issue cannot be resolved by the A/OPC or bank, reach out to the GSA Center for Charge Card Management (CCCM) at [email protected] .

How do I obtain a GSA SmartPay card/account? What do I need to qualify?

To obtain a GSA SmartPay card/account, employees should reach out to their A/OPC and supervisor. Each agency has different criteria for issuing cards/accounts.

What may be purchased with my GSA SmartPay card/account?

Card/account holders should contact their A/OPC to learn more about their agency’s specific policies on purchases. In general:

- Purchase cards/accounts are used to pay for supplies or services.

- Travel and Tax Advantage Travel cards/accounts are used to pay for travel and travel-related expenses.

- Fleet cards/accounts are used to pay for fuel, maintenance and repair of government owned/operated motor equipment, aviation, small marine vessels and large marine vessels.

- Integrated cards/accounts involve two or more business lines (i.e. fleet, purchase and/or travel) on a single card/account.

What policies exist regarding the use of the GSA SmartPay payment solutions?

The Treasury Financial Manual is the Department of the Treasury’s official publication of policies, procedures and instructions concerning financial management in the federal government.

There are a number of policies that govern the use of government payment solutions, including:

- Federal Acquisition Regulations (FAR).

- Federal Travel Regulations (FTR).

- Federal Management Regulations (FMR).

- OMB Circular A-123, Appendix B.

- Public Law.

- American Recovery and Reinvestment Act.

For more information on the policies listed above, visit the Policies page .

Additionally, many agencies have regulations that are specific to their program and tailored to their agency’s mission and operating procedures. Contact your A/OPC to learn more information about your agency’s specific policies.

What are the training requirements? How will my A/OPC know that I have completed my online training?

Per OMB Circular A-123, Appendix B, all GSA SmartPay program participants must take the required training and receive a certificate of completion prior to their appointment. In addition, refresher training must be completed every three years (or more often as required by your agency’s training policy).

If permitted by your agency’s A/OPC:

- Card/account holders may complete the required training and obtain a certificate of completion via the GSA SmartPay Training website .

- Card/account holders may retake the course and quiz as refresher training. A passing score will enable the card/account holder to reprint the certificate with the new date of completion.

Note: If an card/account holder has previously taken the course and passed the quiz on the training website, a certificate can be reprinted by accessing past certificates through the training site.

What is my responsibility when it comes to paying taxes with my GSA SmartPay card/account?

In some cases, when using certain types of cards/accounts, card/account holders are exempt from taxes on their purchases. Please visit the State Tax Information page to learn more.

- Centrally Billed Accounts (CBA): Purchase, fleet and some travel accounts where payment is made directly to the bank by the government.

- Individually Billed Accounts (IBA): Travel accounts where payment is made directly to the bank by the individual. Each state determines the exemption status for IBAs.

- Integrated Accounts: Considered CBAs, but may involve both CBA and IBA transactions, which is determined at the agency’s task order level.

- Tax Advantage Travel Accounts: Combines CBA and IBA transactions to provide tax exemption at the point of sale for rental car and lodging expenses.

What is card/account misuse and what are the potential penalties?

Intentional use of government cards/accounts for other than official government business constitutes misuse, and depending on the situation, may constitute fraud. Each agency develops and implements policies related to employee misuse.

Examples of misuse include:

- Purchases that exceed the card/account holder’s limit.

- Purchases that are not authorized by the agency.

- Purchases for which there is no funding.

- Purchases for personal consumption.

- Purchases that do not comply with the policies.

Potential consequences for the card/account holder may include:

- Counseling.

- Cancellation of the card/account.

- Written warning.

- Notation in the employee’s performance evaluation.

- Suspension.

- Termination of employment.

In the case of purchase card/account or CBA travel card/account misuse, the employee may be held personally liable to the government for the amount of any unauthorized transactions. Depending on the agency and the circumstances, there are a number of applicable laws that can result in fines or imprisonment.

Is a merchant allowed to photocopy a GSA SmartPay card?

Both Visa and Mastercard state in their guidelines that a merchant is allowed to make/store a photocopy of a charge card provided they do NOT record or copy the PIN and/or Card Verification Code (CVC) data in any manner or for any purpose.

Note: According to U.S. Code Title 18, Part 1, Chapter 33, 701 , it is illegal for a merchant to photocopy your government ID.

Can card/account holders use their card/account to fund alternative payment mechanisms, such as PayPal?

Third Party Payment processors (such as PayPal) offer e-commerce/internet payment solutions for commercial transactions. The processors own merchant accounts that allow them to accept and process orders on behalf of other companies. Many vendors choose to utilize third party payment processors in order to accept online payments without having to establish a merchant account through a bank. Some vendors find that this is a more cost-effective option, especially if they do not process enough transactions to establish their own merchant account to accept charge cards. Vendors pay third-party processors a transaction fee for these services rather than processing transactions through a merchant bank.

Transactions that are made using third-party payment platforms are considered to be high-risk transactions. We recommend GSA SmartPay card/account holders consider alternative methods of payment.

Although there are not any existing governmentwide policies or procedures outlining the use of third-party payment processors, several agencies have developed internal policies related to this issue. These policies range from the complete restriction of third party payment processors to less restrictive policies which allow for transactions to be made when a workaround cannot be identified.

What is the liability for lost or stolen cards?

Agencies and/or individual card/account holders are not liable for charges made on a lost or stolen card after the card is reported as lost or stolen. A new card with a new card/account number will be issued to the card/account holder within 48 hours of the request. Any previous authorized activity will be transferred to the new card/account.

Why do I need to provide documentation to change my name on my IBA?

Since banks are required to conform to the Know Your Customer (KYC) requirements, they must confirm the identity of every applicant and card/account holder. KYC requirements are driven from the Bank Secrecy Act and Patriot Act . Documentation, such as a marriage certificate, is needed to support this requirement. This also allows the banks to maintain account accuracy throughout the life of the customer relationship. Supporting documentation also decreases the chance of fraud and assists the banks in ensuring they are in compliance with the Fair Credit Reporting Act in the event an account is reported to the credit bureaus.

How does the GSA SmartPay Tax Advantage Travel card/account work?

The Tax Advantage Travel card/account is issued to an employee designated by the agency/organization in the employee’s name. The agency will work directly with the contractor bank to:

- Establish the billing and payment procedures for Centrally Billed Account (CBA) transactions versus Individually Billed Account (IBA) transactions.

- Determine if credit checks or other creditworthiness assessments will apply.

- Identify Merchant Category Codes (MCCs) for rental cars and lodging, in order to exclude those transactions from taxes.

When the card/account is used, invoices will be sent to the agency and the card/account holder for payment. The agency is responsible for the CBA charges on the card/account, while the card/account holder is responsible for the IBA charges.

Is it mandatory to use a federal government travel card/account when traveling?

Yes. In accordance with the Federal Travel Regulations (FTR), Section 301-51, Paying Travel Expenses, agencies are required to pay for official travel expenses using a government authorized travel payment solution, unless granted an exemption in accordance with FTR policies.

For the Department of Defense, see DoD Instructions 5154.31 and the Joint Travel Regulations (JTR).

What is split disbursement in relation to travel vouchers?

The payment process called split disbursement as described in OMB Circular A-123, Appendix B divides a travel voucher reimbursement between the contractor bank and the traveler, sending the balance owed directly to the appropriate party.

Note: Although OMB Circular A-123, Appendix B in Chapter 2.5 requires all executive branch agencies to implement split disbursement, it may not yet be operational in your agency. Please contact your A/OPC for further details.

Program Coordinators

How do i connect with other a/opcs to share ideas and best practices.

There are several ways to actively participate within the community:

- Attend the Quarterly A/OPC meetings, monthly “Discussions with Dave” calls, and other special meetings and events: Level 1 A/OPCs receive email invites to these meetings.

- Attend the annual GSA SmartPay Training Forum: Learn about all aspects of how to successfully manage your agency’s charge card program. Network, collaborate and share best practices with other card managers, bank representatives and GSA personnel.

What can I do to improve my agency’s program performance?

The GSA SmartPay program office provides a number of tools and types of assistance to support effective charge card/account program management across the government. Tips include:

- Ensure policies are being followed: Most agencies have comprehensive policies regarding the administration of their payment programs. This includes policies for card/account use as well as for program management. A/OPCs should ensure that the policies are clearly communicated and easily accessible to card/account holders. It is also important for agencies to follow through with the implementation of their policies, including distribution and compliance monitoring.

- GSA offers free basic online training covering regulations and best practices for all agencies.

- A variety of free resources to support card/account management are available on the GSA SmartPay program’s website.

- Contact the bank to schedule an in-person or virtual Electronic Access System (EAS) training for your A/OPCs.

- Consider attending the annual GSA SmartPay Training Forum, which provides a large variety of training for all A/OPCs and charge card management staff.

- Initiate an Accounts Payable (A/P) File Review : An A/P File Review, performed by the contractor bank, is a no-cost tool to help agencies identify opportunities to leverage GSA SmartPay solutions as methods of payment to increase process efficiencies, cost savings and refunds.

- Participate in Workgroups: The GSA Center for Charge Card Management (CCCM) sponsors periodic workgroups to facilitate the sharing of information between agencies and to collect feedback on the performance of the GSA SmartPay program office and its contractor banks.

How do I go about incorporating a new payment solution into my program?

Under the GSA SmartPay program, there are many options available to assist your agency in meeting your mission critical needs. Products and related services under the GSA SmartPay program can offer customized payment solutions to help your agency achieve its goals. Under the GSA SmartPay Master Contract, each participating agency tags, joins a pool agreement, or awards its own task order to one of the contractor banks. Not all products and services offered under the GSA SmartPay program may be available to your agency, as each agency’s task order is different and unique. For this reason, it is important to review your agency’s task order. In addition, speak to those within your agency that are responsible for managing your agency’s task order, such as your Level 1 A/OPC and the task order’s Contracting Officer.

Additionally, many agencies have regulations that are specific to their program and tailored to their agency’s mission and operating procedures.

What training is available for A/OPCs?

There is a variety of free training offered to A/OPCs. All upcoming training opportunities for A/OPCs will be posted on the GSA SmartPay program website on the Events page .

- Online training for A/OPCs and card/account holders (Available 24/7).

- Annual GSA SmartPay Training Forum.

- Bank Electronic Access System (EAS) training.

- Other special training events offered throughout the year.

What can agencies/organizations do to help prevent misuse of cards/accounts? What tools are available to provide assistance to agencies in detecting fraud and misuse?

Mandating training that meets governmentwide standards for card/account holders and A/OPCs is the first step to preventing misuse. Currently, training varies widely among agencies, with many agencies relying on the training provided at the annual GSA SmartPay Training Forum and the online courses on the GSA SmartPay Training website. While these training courses review the necessary governmentwide rules and regulations, they do not reflect agency-specific requirements, which are important for card/account holders to know.

The GSA SmartPay Master Contract includes a number of tools that support agencies in controlling and monitoring card/account spend to prevent fraud, waste and abuse. Examples of these tools are:

- Credit limits: Restrict single purchase, daily, weekly or monthly expenditures by the card/account holders. In accordance with agency policy, limits are set to meet the agency needs.

- Merchant Category Code (MCC) Blocks: Established by the bankcard associations to classify different types of businesses. Merchants are assigned codes that describe their primary line of business. Agencies can limit the types of businesses where card/account holders are permitted to make purchases by limiting the MCCs available to card/account holders.

- Reports: Agencies have access to online management reports via their contractor bank’s Electronic Access System (EAS). Standard reports include Account Activity, Dispute, Unusual Spending Activity, Lost/Stolen Cards and Ad Hoc reports.

- Guidebooks: The banks are required to provide written A/OPC guides that serve as a stand-alone reference for A/OPCs to conduct program management for the GSA SmartPay Program. Topics include procedures for card/account setup and maintenance, card/account suspension/cancellation, transaction disputes and reconciliation. Agencies also have access to card/account holder, Designated Billing Office and Transaction Dispute Office guides from banks.

What action should I, as an A/OPC, take if an card/account holder does not pay their bill on time or it becomes delinquent?

Every effort should be made to assist the contractor in collecting the balance due. Ensure that your card/account holders are aware of their responsibilities.

Can A/OPCs suspend or cancel a card/account?

Yes. A reason must be documented for suspension or cancellation. Cards/accounts may be canceled through your bank’s EAS or through the bank’s customer service office.

How do I set up cards/accounts?

As the A/OPC, you are responsible for the establishment and maintenance of your program’s accounts. Refer to your contractor’s A/OPC guide and EAS manual for instructions on how to set up cards/accounts.

Do I have to accept GSA SmartPay cards/accounts?

Merchants that wish to obtain a GSA Multiple Award Schedule (MAS) contract to do business with the government are required to accept GSA SmartPay payment solutions as a method of payment for micro-purchases . The rules and requirements for accepting payment solutions are defined by the card associations.

How can I promote the use of the GSA SmartPay program at my business?

To promote the use of the GSA SmartPay payment solutions at their establishments, merchants can:

- Provide point-of-sale discounts: Offering a point of sale discount to government card/account holders is a great way to differentiate your business from others and to increase the amount of government purchases.

- Provide Level 3 transaction data: Merchants that provide Level 3 transaction data are more attractive to government agencies because the data enables agencies to keep track of their purchases more accurately. Merchants who wish to learn more about Level 3 data should contact their financial institution for more information.

How do I identify GSA SmartPay cards?

Most GSA SmartPay cards will use government-specific designs and will display the GSA SmartPay logo, including the phrase “United States Government” or “For Official Use Only.” The five standard card designs are displayed below:

How do I accept a GSA SmartPay card/account?

GSA SmartPay cards/accounts operate just like the commercial market. For example, if you already accept these forms of payment for non-government purchases, you can accept the GSA SmartPay payment solutions. The same previously negotiated transaction fees apply to GSA SmartPay transactions.

GSA SmartPay card/account holders may carry the following brands: Mastercard, Visa, Voyager and Wright Express (WEX).

If you do not currently accept a particular form of payment, contact any financial institution to learn more about establishing a merchant account and maximizing your ability to capture government sales.

Is a merchant allowed to photocopy a GSA SmartPay charge card?

Note: According to U.S. Code Title 18, Part 1, Chapter 33, 701 , it is illegal for a merchant to photocopy a government ID.

Is the GSA SmartPay card/account tax exempt?

In some cases, certain purchases made using a GSA SmartPay card/account are exempt from taxes. Please visit the State Tax Information page for more details.

What if I am unable to accept a GSA SmartPay card/account?

Businesses are required to label themselves by selecting a Merchant Category Code (MCC) that describes the products or services provided. Certain MCCs are blocked by agencies to prevent fraud and misuse. A business that has trouble accepting a GSA SmartPay card/account may be classified under a blocked MCC. To remedy this problem, merchants should talk to their financial institution to confirm that their MCC classification is accurate.

Where can I find the Mastercard and Visa rules and regulations?

Mastercard and Visa rules and operating regulations can be found here:

- Mastercard Operating Rules

- Visa Operating Regulations

Government Shutdown

Can i use my gsa smartpay card/account during a governmentwide shutdown.

It depends. Card/account holders are advised to check with your agency regarding the continued use of GSA SmartPay cards/accounts due to a lapse in funding during a shutdown. You may not be authorized to use your cards/accounts if your agency determines such use does not relate to excepted or exempted activities.

The Anti-Deficiency Act prohibits most agencies from incurring obligations in the absence of appropriations (unless otherwise allowed by law or for emergencies involving the safety of life or limb, the protection of property or other excepted/exempted services). Card/account holders should coordinate with the appropriate officials in their agency/organization to ensure only authorized travel and purchases are made during a lapse in funding.

Absent of any agency-specific action to limit card/account use, purchase, travel, fleet and integrated cards/accounts will continue to function normally.

Can I use my GSA SmartPay card/account for personal expenses?

No, it is never appropriate to use your GSA SmartPay card/account for expenses not related to official government business. Doing so may result in your agency taking disciplinary action.

Will the banks’ 1-800 customer service call centers continue to operate?

Yes. If you need to reach your contractor bank during the shutdown, please call the 1-800 number on the back of your GSA SmartPay card/account.

Do I still have to pay my individually billed travel card/account statement if I am unable to pay due to the shutdown?

Citibank: For agencies, organizations, and card/account holders unable to make payments in the event of a governmentwide shut down, Citibank will ensure that during such periods accounts will not age delinquent or be suspended or cancelled and finance charges will not be assessed. The bank will continue to generate Statements of Account.

U.S. Bank: Accounts could become past due until budgetary issues are resolved, and as such, no cards/accounts will be deactivated without authorization from the GSA Contracting Officer. U.S. Bank will work with the government to implement risk-mitigation measures to monitor fraud and unusual delinquencies, as well as to bring past due accounts up to date once the budget is approved.

If I am late paying due to the shutdown, will the delayed payment on my individually billed travel card/account be reported to the credit bureaus?

In general, the answer is “no.” Cards/accounts in good standing as of the start of the shutdown will not be reported by the contractor banks to credit bureaus for late payment. Additionally, “past due” notices will not be issued and collection activities will not occur. However, statements of account will continue to be issued and will likely show a balance due. This balance does not need to be paid until funding becomes available. These measures apply only to card/account holders affected by the shutdown with cards/accounts in good standing prior to the shutdown. For organizations (or components thereof) with funding, routine account management and payment rules apply. Generally, there is no need for individually billed GSA SmartPay Travel card/account holders to contact the contractor banks in order for these shutdown measures to be implemented, but card/account holders should comply with instructions issued by their agency. GSA SmartPay participating agency Headquarters (HQ) card/account managers (or other authorized HQ staff) are advised to coordinate with their servicing GSA SmartPay contractor bank(s) to ensure a clear understanding of how the individually billed travel cards/accounts impacted by the shutdown will be handled.

What if my card/account was already delinquent before the shutdown? Will I be given more time to pay?

No. Payment is due to the contractor bank per the statement due date. If your card/account was delinquent prior to the shutdown, it will continue to be considered delinquent until full payment is made to the contractor bank. The time elapsed after payment is due continues to accrue in the event of a government shutdown.

My card is about to expire. Will I receive my new card during a shutdown?

Yes. In accordance with the terms of the GSA SmartPay Master Contract, if your card is due to expire during a shutdown, your new card will still be mailed. If your agency elects to have the charge card sent directly to you (for example, an individually billed travel card), then you will receive the card at the address on file. Or, your agency may elect to have the card mailed to the government offices for dissemination by an Agency/Organization Program Coordinator (A/OPC) or other government employee. The card will most likely be held by the distributing government office until the shutdown is over. If you are deemed an exempt or excepted employee, your agency will most likely ensure card delivery to you, but we recommend that you confirm these procedures with the appropriate officials in your agency.

What if I am traveling for work during a shutdown?

Unless your agency takes action to limit or deactivate cards/accounts, your travel card/account will continue to work during a shutdown. For government travelers on official travel that are recalled to return home due to shutdown, GSA SmartPay contractor banks operate under a “no-strand” policy. This policy ensures that cards/accounts operate to support your return trip. But as policies vary, please be sure to check with your agency regarding travel during a shutdown.

What if I have recurring or automatic payments on my purchase card/account?

Please coordinate with your agency’s finance officials and A/OPCs to ensure that these payments are properly addressed in the event of a shutdown. Be advised that purchase card/account holders may need to contact merchants to stop any automatic payments which may be scheduled to occur during the shutdown period.

The Anti-Deficiency Act prohibits most agencies from incurring obligations in the absence of appropriations (unless otherwise allowed by law or for emergencies involving the safety of life or limb, the protection of property or other excepted/exempted activities). Card/account holders should therefore coordinate with the appropriate officials in their agency to ensure only authorized travel, purchases and payments are made in the event of a shutdown, as this issue can become especially complicated given the wide variety of agency missions, funding types, etc.

Will GSA SmartPay cards/accounts continue to operate normally during a shutdown to support authorized mission activities?

Yes. The program will continue to operate normally in that cards/accounts will function and GSA SmartPay contractor bank account management staff and systems, reporting, call centers, etc., will continue to operate.

Should agencies consider deactivating/reducing the spending limits for accounts not expected to be used during the shutdown?

A/OPCs should consult with their contractor bank to help ensure appropriate internal control measures are maintained during a shutdown.

Does the Prompt Payment Act (PPA) apply to payments to the contractor banks?

The PPA only applies to centrally billed accounts under the GSA SmartPay program. These account types include purchase, centrally billed travel, fleet and any centrally billed aspects of integrated accounts. PPA does not apply to individually billed accounts, as they do not constitute a federal government liability. GSA SmartPay cards/accounts will continue to function during a shutdown (except for those deactivated at agency direction) even though agencies may not be able to pay proper, official contractor bank invoices (which will continue to be generated) in a timely manner. Upon availability of funding, agencies must reconcile and pay these invoices as promptly as possible.

What if my agency wants to explore the temporary use of different GSA SmartPay card/account types during the shutdown (such as expanded use of centrally billed accounts)?

Agencies should first consult with the GSA Center for Charge Card Management at [email protected] . Changes in card/account types can lead to reconciliation challenges and affect dispute rights. All other potential implications should be fully explored and discussed prior to changes being made.

Even though individually billed account (IBA) travel cards/accounts are an individual liability, what if employees affected by a shutdown are unable to pay their account statements? Should the agency coordinate with its GSA SmartPay servicing bank regarding this matter?

In general, the answer is “no,” provided you are affected by the shutdown and therefore unable to pay. Payment would be required once funding is restored.

In the event of a shutdown, the contractor banks recognize that affected agencies and card/account holders may be unable to make timely payments and cards/accounts could therefore become past due until funding becomes available. For individually billed travel cards/accounts in good standing as of the start of the shutdown, the contractor banks will:

- Keep accounts open unless deactivation is requested by agency officials.

- Take appropriate action to prevent accounts from becoming delinquent, suspended or canceled.

- Ensure finance charges are not assessed.

- Waive all applicable late payment fees.

- Continue to generate account statements.

- Work with agencies to maintain risk mitigation measures.

- Coordinate with agencies and card/account holders to bring accounts up to date once funding becomes available. The banks use highly automated account management processes that may require manual intervention by bank staff during a shutdown. As a result, isolated instances of errant activities such as the issuance of late payment notices on a card/account affected by the shutdown can occur. Should this happen, please follow your agency procedures or contact your servicing contractor bank as appropriate.

For accounts that were past due prior to the start of the shutdown, routine account management and payment rules apply.

Agencies may issue supplemental card/account holder guidance regarding individually billed account management and payments during a shutdown, consistent with applicable GSA SmartPay contract and task order terms.

How can an agency contact the GSA Center for Charge Card Management during a shutdown?

Please contact us via email at [email protected] . We remain available to assist your agency during a government shutdown.

Emergency Use

Does use of the gsa smartpay purchase card/account automatically make an order for supplies a "rated order".

No, use of the purchase card does not automatically designate a purchase as a “rated order.”

Can the GSA SmartPay Purchase card/account be used to make payments on a "rated order"?

Yes, the purchase card may be used as a payment mechanism for “rated orders” so long as it is in accordance with the terms and conditions of the contract under which the order is placed.

Can the GSA SmartPay Purchase card/account be used to pay for GSA Fleet vehicle cleanings under emergency contracting conditions?

GSA Fleet does not have a policy precluding the use of the purchase card/account for services not covered by GSA Fleet leases, including interior vehicle cleanings. You must check with your agency’s policy on whether or not a purchase card/account can be used to pay for vehicle cleanings.

Can items be shipped to places other than departments or offices (ie. people's homes) during national emergencies?

This is an agency determination. Items must be for official use only (i.e., no personal use).

What are the ways to document receipt of a purchase when in a contingency/telework environment and the item is received at a different location than where the card/account holder is located?

Any method the agency determines acceptable can be used in a contingency or telework environment to verify receipt of goods or services for audit purposes.

Examples of verification/validation of receipt of orders are:

- Recipient can take pictures of items received for verification of receipt and provide those to the card/account holder for their log, or

- Sign off on the shipping receipt after verifying all items were delivered to “certify” all items were delivered/received and provide a copy to the card/account holder.

Both are acceptable when there is no third party available to verify receipt and/or the recipient is not at the same physical location as the purchase card/account holder.

Is there is anything in the GSA SmartPay regulations that stipulate that delivery must be made to a federal address? Or would it be acceptable for a federal employee using a valid purchase card/account to order supplies for delivery to their private residence? This would be in support of their official duties in light of the indefinite telework situation.

The appropriate agency decision-makers for each agency’s purchase card program will need to determine if a card/account holder can receive deliveries at their home, ship products to the home address of other employees, or if they must still be sent to a government address. This is usually the Level 1 A/OPC, Purchase Card Program Office, and/or Purchasing/Policy Office.

Considerations at the agency level may include, but are not limited to:

- Ability of card/account holders to access the Government building where shipments would be sent.

- Ability to verify/validate receipt of goods or services.

- Ability to maintain proper control of supplies/products.

- Ability to ensure supplies/products are only for official government use.

With the increase in the micro-purchase threshold (MPT) from $10,000 to $20,000 for emergency purchases related to COVID-19 buys, are the MPTs for services ($2,500) and construction ($2,000) increased as well?

No, the MPTs for services and construction remain at the lower thresholds:

- $2,500 for services subject to Service Contract Labor Standards (SCLS).

- $2,000 for construction.

Are interior vehicle cleanings permitted for GSA Fleet leased vehicles during the COVID-19 pandemic? Can the fleet card/account be used to pay for these cleanings?

Interior vehicle cleanings during the COVID-19 pandemic must be reviewed on a case-bycase basis to assess risk in accordance with CDC guidance. All environmental cleaning and disinfecting that occurs should follow CDC’s guidance. Drivers should consult their agency fleet manager for agency-specific policy.

How will washes be billed if they are in excess of the establish policy?

Washes charged to your GSA Fleet leased cards in excess of the established zonal policy will be billed to your agency by your Fleet Service Representative (FSR) through our Agency Incurred Expense (AIE) process.

smartpay.gsa.gov

An official website of the General Services Administration

Department of Defense Travel Card Benefits

Progress informed from the past, and inspired by the future, cardholder guide.

Official travel for the Department of Defense just became easier with the Citi Department of Defense Travel Card. When you are preparing to use your new card, please read What To Do When I First Receive My New Card . For more information regarding your new card, please read the Department of Defense Cardholder Guide .

Department of Defense Travel Insurance

As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card.

- Travel Accident Insurance Guide

- Lost Luggage Insurance Guide

MasterCard Guide to Benefits

Visa Guide to Benefits

In addition to the card benefits provided by Citi, Visa provides card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the Visa Guide to Benefits .

Travel Tips

For more information on your Citi Department of Defense Travel Card, please read What to do Before, During and After travel .

Online Tools

Citi's global online tool, CitiManager ® , enables you to manage business expenses from anywhere around the globe from your computer or mobile device; you can view statements online, confirm account balances, sign up for email and SMS alerts, and much more. If you have not already signed up for the CitiManager ® tool, please log on to www.citimanager.com/login and click on the 'Self registration for Cardholders' link. From there, follow the prompts to establish your account.

For more information on the CitiManager ® tool, view our CitiManager ® Cardholder Quick Reference Guide .

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Travel guide:

Frequently Asked Questions

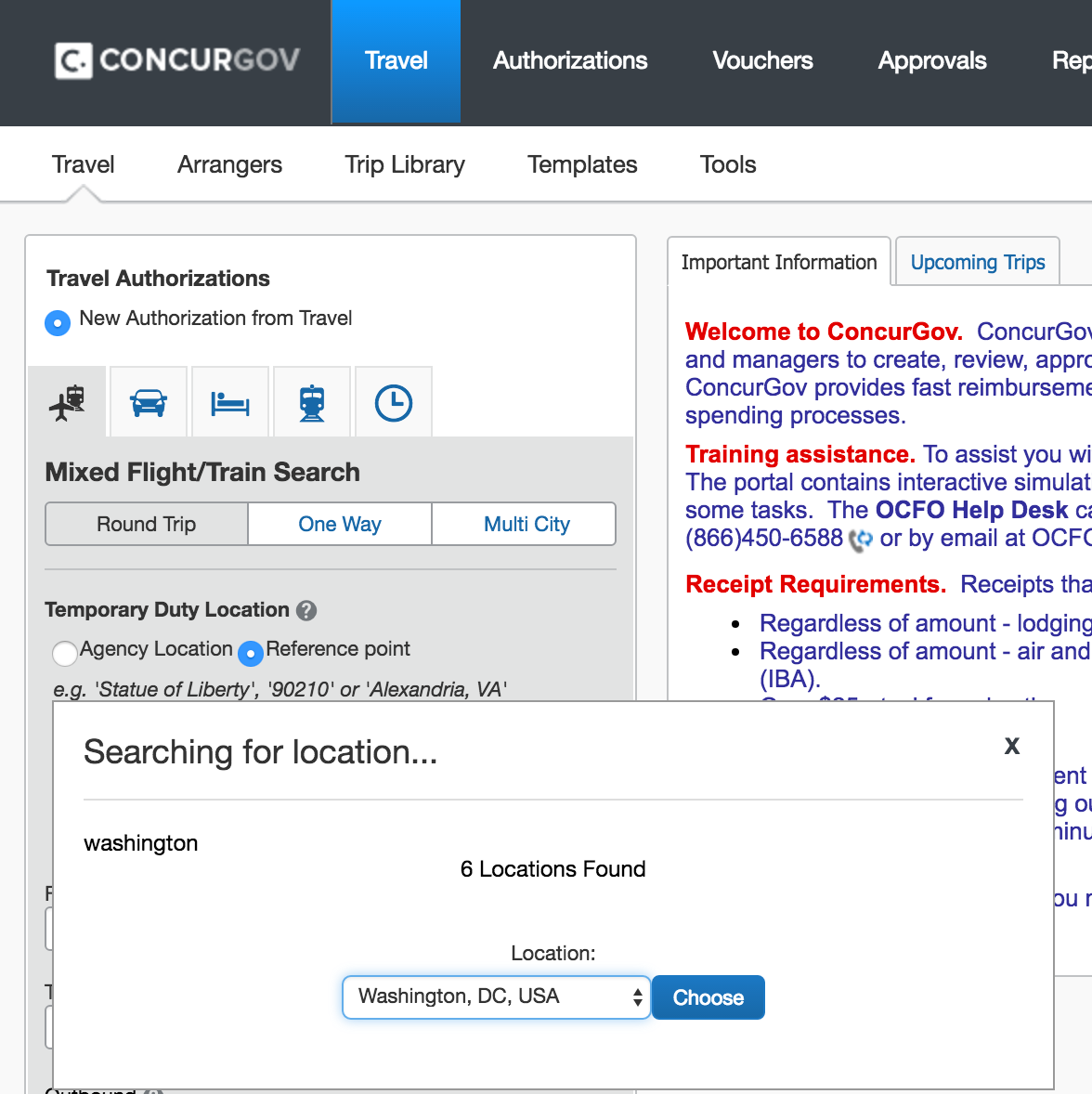

Questions about booking travel, how to book flights or rail, enter your destination, then origin.

- Go to Concur at travel.gsa.gov

- In the shortcuts menu on the upper left hand corner, select Travel - New Booking

- Click on the Air/Rail icon (this should be already selected). If you need to travel by train only, choose the Rail icon instead.

*Note: If you need to travel by both air and rail, call AdTrav at (877) 472-6716 and they will make your reservations for you. An hour after your call, skip ahead to this step to submit your AdTrav reservation for approval.

*Note: The destination city is entered before the departure city

- Click Search to move onto the next screen.

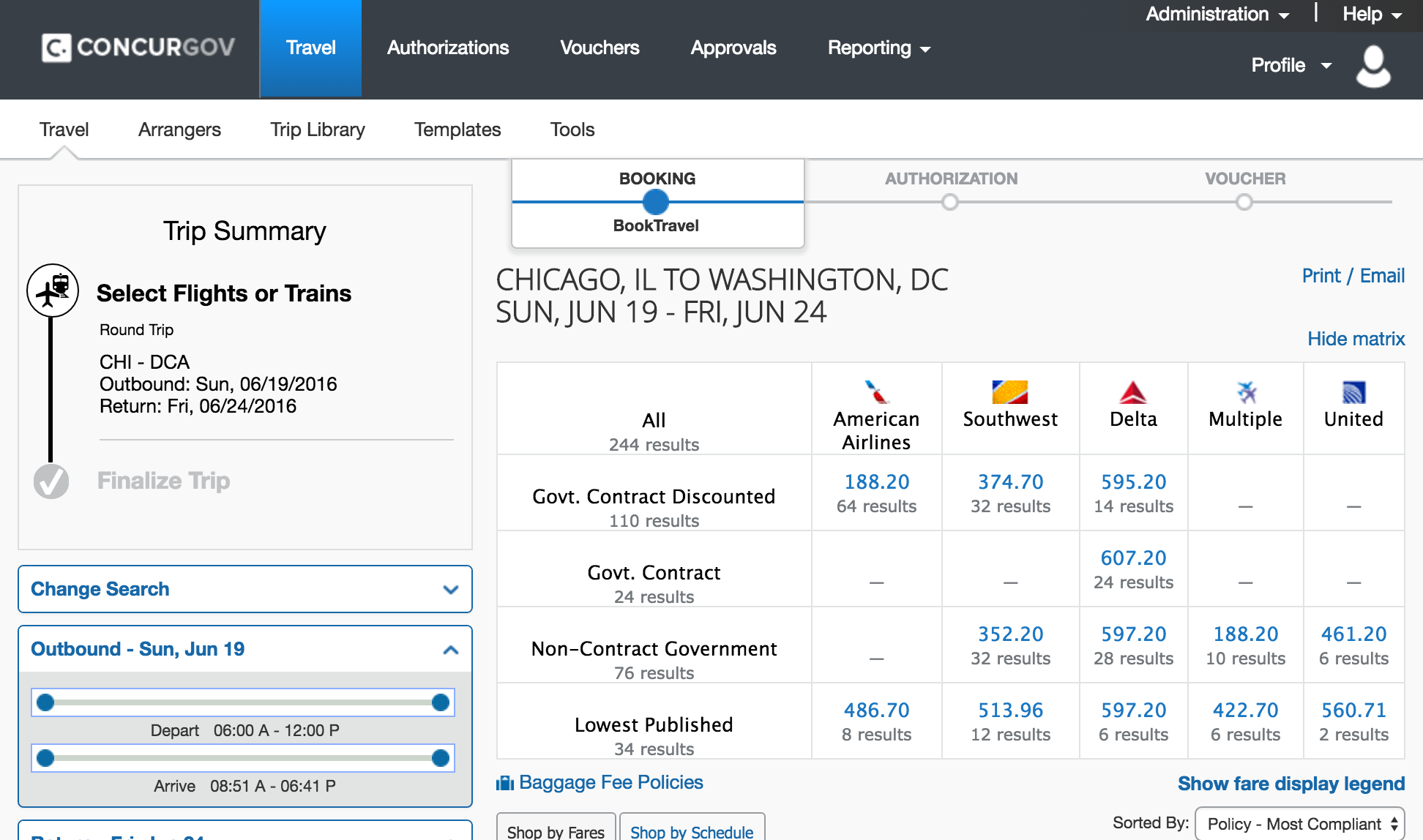

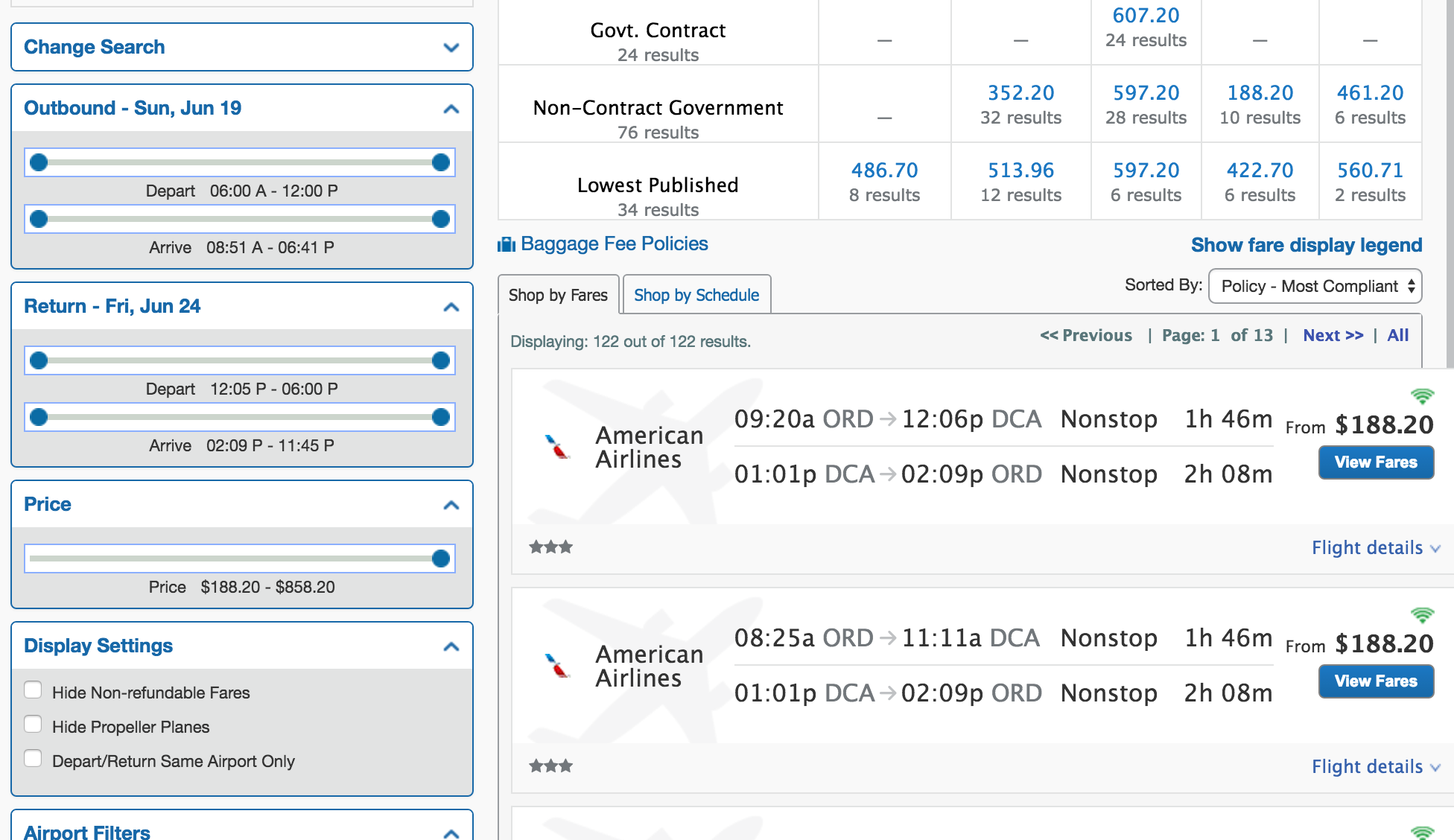

How to Choose a Flight

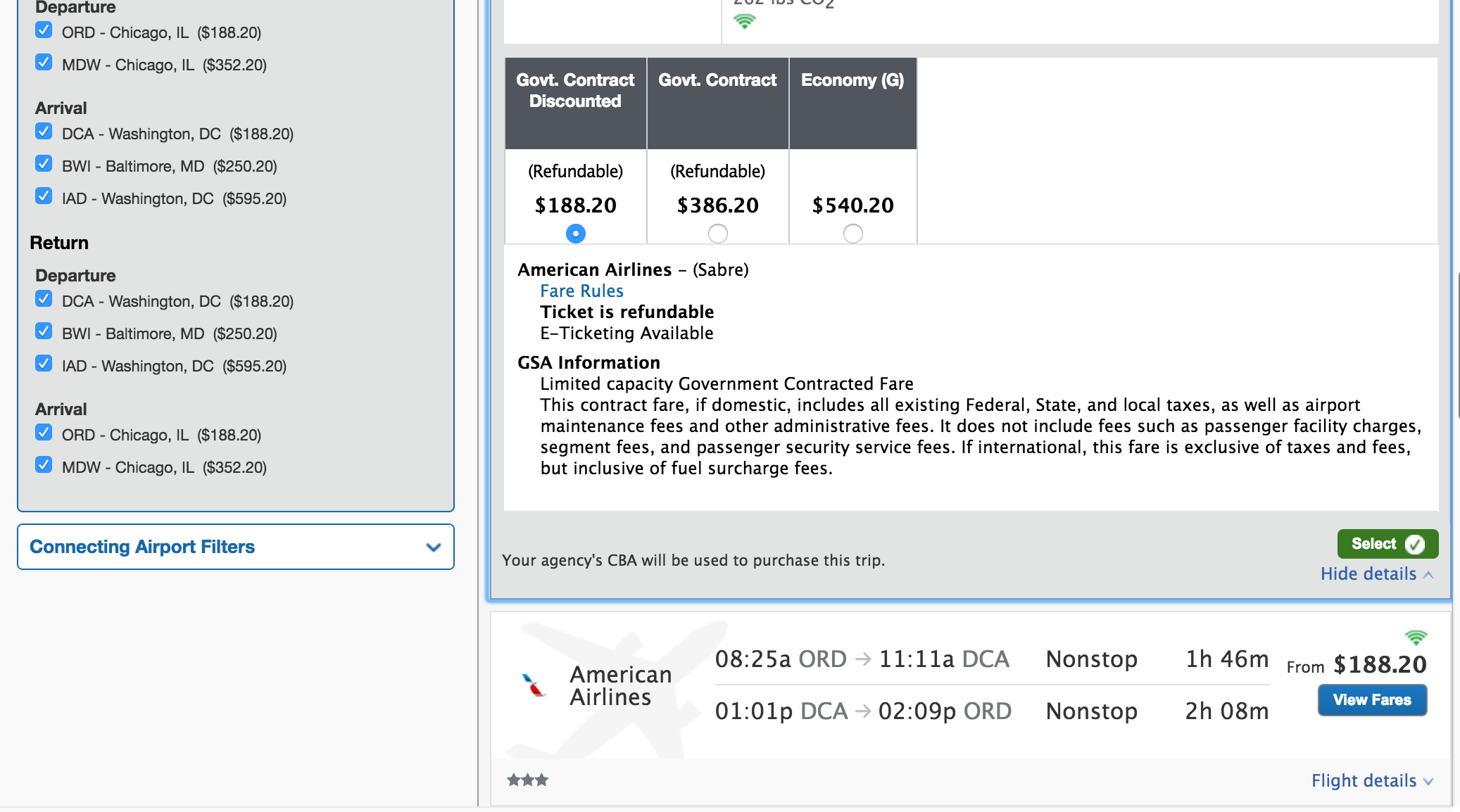

When choosing flights, you may notice they fall into four different categories:

- Govt. Contract Discounted: the preferred option. In general, these fares are only available 15 or more days in advance, so try to book your travel as early as possible.

- Govt. Contract: the standard option, based on the city pair rate , the agreed upon rate for government flights between two cities. These are preferred if no govt. contract discounted fares are available.

- Non-contract Government: these fares are also acceptable to book if the timing is more advantageous. All these fares are within the City Pair rate and are fully refundable. No additional approvals are required to book a non-contract government fare.

- Lowest published: while these fares may come at a lower cost than the contract options, they also come at increased risk to the government because many of these fares are nonrefundable. Any flight that is nonrefundable must be explicitly approved by the authorizing official before the TTS travel team can approve. If you think that choosing a "Lowest published" nonrefundable fare is your best option, skip ahead to securing your approval email now , and then come back to book later. You'll want to ensure you secure the approval before you book because these fares expire quickly, often before authorizing official and travel team approval can be reasonably obtained.

*Note about flights with policy violations:

If you need to take a flight which indicates a policy violation, the type of violation will inform what steps you need to take next. Click on "View Fares" to pull up additional details about your flight selection.

If any part of the fare that you chose is nonrefundable, or exceeds the City Pair rate (note that lookup values here are for one-way fares), you will need an additional email approving the risk of nonrefundable airfare and/or additional costs from your authorizing official sent to [email protected].

What justifies using a non-contract fare?

- Select the lowest cost, most compliant fare available by clicking on the blue button at right with the price. This will take you onto the confirmation page.

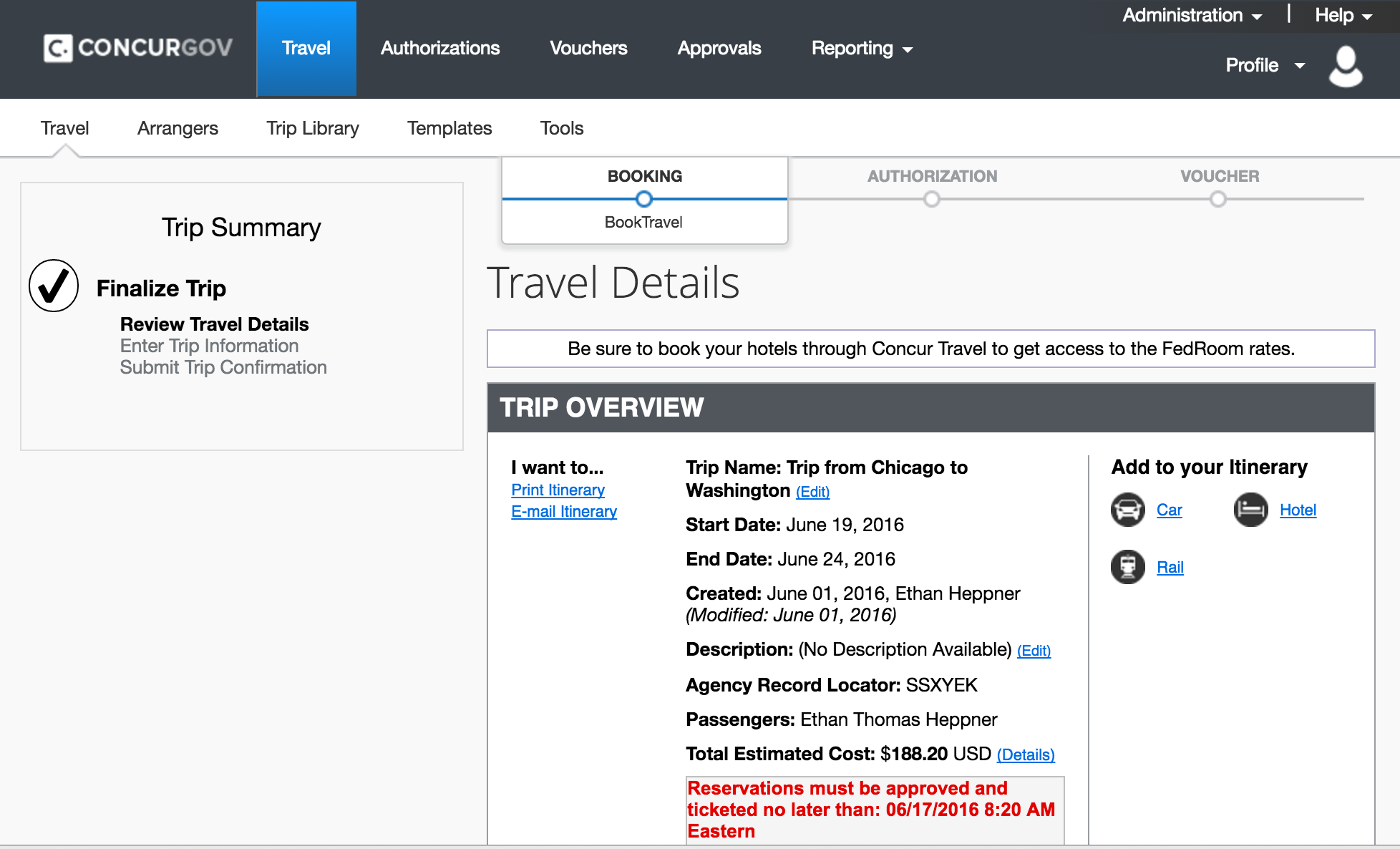

- This will take you to the Trip Overview . This page also lists your current reservations.

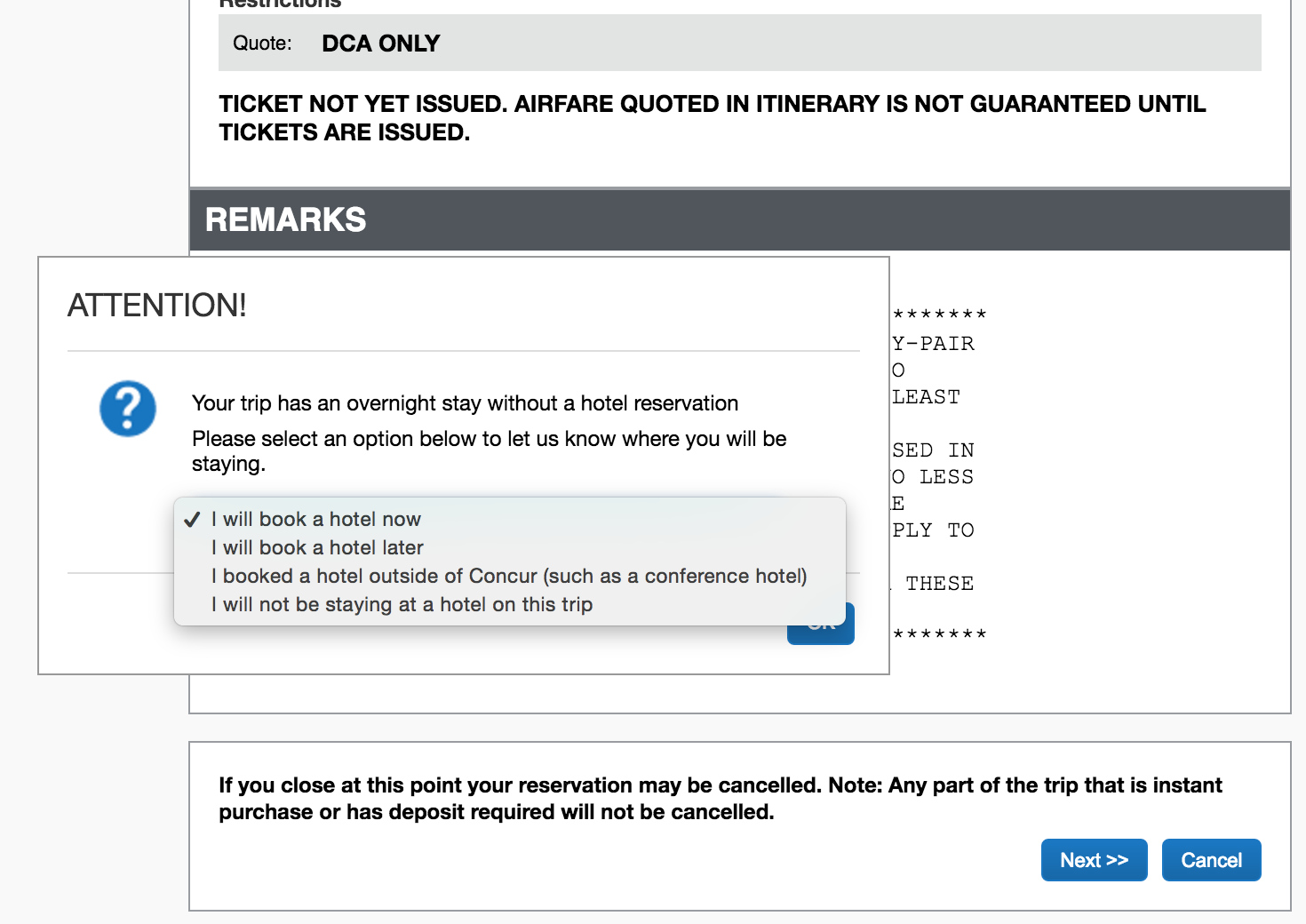

By choosing "I will book a hotel now." you will be allowed to book your hotel directly in Concur. Before doing so, please ensure that your travel card is saved in your Concur profile .

Book lodging

*Note : If you don't have a travel card yet, make sure that you've applied for one (it is required by GSA policy), then choose "I will book a hotel later". Call AdTrav at (877) 472-6716 to reserve your hotel (and rental car if needed) on your personal card in the meantime. Assuming you've already booked your flight or train in Concur, mention the authorization number associated with your itinerary so you don't get a second overlapping authorization for your hotel and/or rental car. You can verify your authorization number by going to the "Authorizations" tab in Concur and finding the number in blue on the left side associated with your travel dates. An hour after you call with AdTrav, proceed on to completing trip information .

How to Book a hotel in Concur

*Note: if you are coming back to this step after going back to the main menu of Concur, make sure your saved authorization is selected, go to Travel Home , reopen your itinerary, and then choose "Hotel" under "Add to your Itinerary".

*If you didn't need to book flights or rail, you can go to the Travel tab of Concur and make your reservations selecting the "hotel only" option.

Enter check-in and check-out dates, location, any preferred hotels, and then click next.

Confirm the per diem location and click next. The maximum lodging rate and M&IE allowance is indicated below.

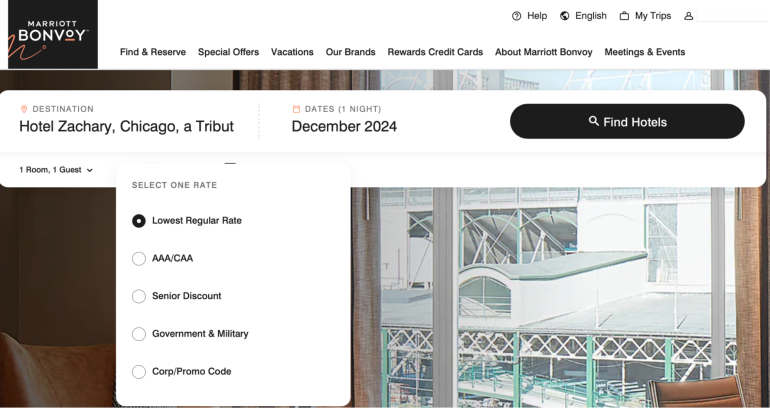

Choose a hotel from the list of search results. Unless you have approval otherwise, or intend to pay for the difference in price personally, sure that you pick a hotel with a nightly rate equal to or less than the government maximum for the area listed here . In the side bar you can filter your search results to only those under the Per diem rate by checking Hide hotels over Per Diem limit ($XXX.00) .

Click on View Rooms , to view a detailed list of rooms within the hotel and select the room by clicking on the listed price at right.

Review and Reserve Hotel On the review screen:

- Select your hotel room preferences

- Choose a credit card

- Agree to the hotel's rate policies.

- Click on Reserve Hotel and Continue

You will now be taken back to your trip itinerary. Note that the hotel has been added to the flight.

Scroll down and click Next and complete your trip information , or if needed, continue on to reserve a rental car .

Can I book outside of Concur?

Unless there are extenuating circumstances, you should use Concur for all reservations (flights, hotels, and rental cars). If you choose to book a hotel outside of Concur, include a justification that corresponds with one of the following (from the Federal Travel Regulation):

- When you are attending a conference where the conference sponsor has negotiated with one or more lodging facilities to set aside a specific number of rooms for conference attendees and to ensure that a set aside room is available to you, you are required to book lodging directly with the lodging facility.

- When your travel is to a remote location and it is not possible to book lodging accommodations through the TMS or ETS (Concur).

- When such travel arrangements are so complex and circumstance will not allow you to book your travel through an online self-service booking tool (Concur).

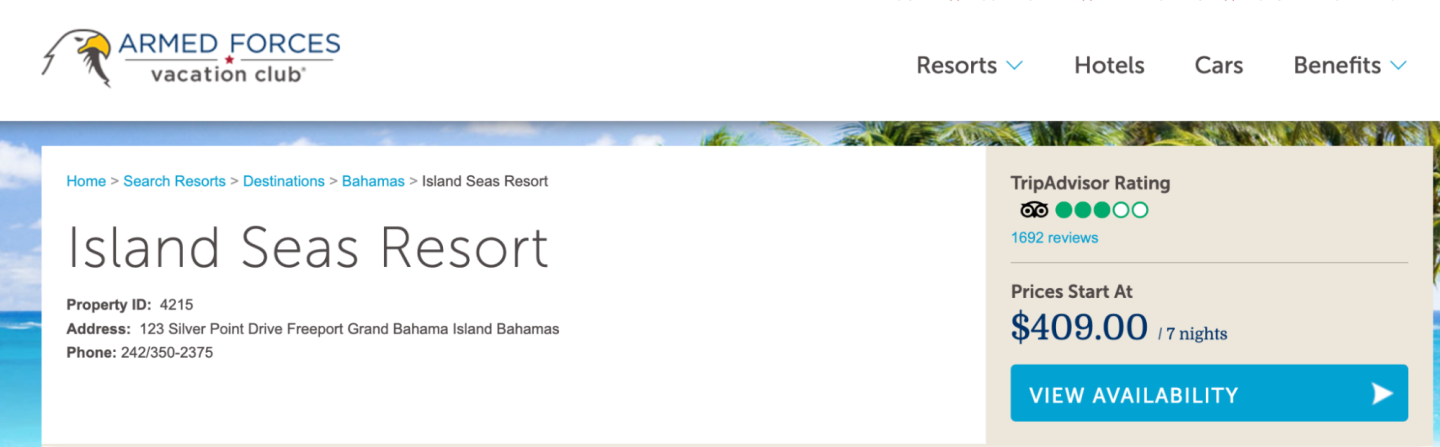

If you need to book a hotel outside of Concur, check if booking comes with any nonrefundable fees. If it does, make sure that you get your authorizing official to approve the approximate amount of what is nonrefundable and send the email to [email protected]. Nonrefundable hotel fees that are not pre-approved are the traveler’s liability. Should booking a hotel in Concur or via AdTrav not be possible, , external, Fedrooms offers hotels within government maximum rates that have flexible cancellation policies.

When you are finished booking your hotel, proceed on to complete trip information .

Booking a Rental Car

Before booking a rental car ensure that manager or client who approved your travel explicitly approved budget for a rental car-- in certain situations, rental cars and parking charges are not as advantageous to the government as common carriers such as taxis and/or public transit. Government vehicles may also be available-- check out the guide , external, TTS-only, here for more details.

*If you didn't need to book flights, rail, or hotel, you can go to the Travel tab of Concur and make your reservations selecting the "rental car only" option.

How to Book A Rental Car in Concur

- From the itinerary page, choose "Car" under "Add to your Itinerary" and then select the trip leg when prompted.

- Indicate pick-up and drop-off dates, location(s), car type, and preferred vendor(s).

*Note GSA employees are required to use the lowest cost compact car unless approved for a larger vehicle based on meeting one or more of the justifications listed in FTR §301-10.450(c) .

- Confirm your email address and travel card information, and then Reserve Car and Continue.

Important notes:

Be aware that the rental company you select must participate in the , external, Defense Travel Management Office's (DTMO) Rental Car Program . Rental car companies participating in the program established ceiling rates; unlimited mileage (except for one-way rentals); vehicle contract will be ready upon arrival; if size/class reserved is not available, the company will offer an upgrade at the same cost; no underage drivers’ fee for drivers between the ages of 18-25; no minimum rental period; no cost for additional drivers; and full coverage insurance for damages resulting from an accident while performing official travel.

The Government is self-insured and rental vehicles under the DTMO agreement include full coverage for damages resulting from an accident while performing official travel. Employees on TDY travel within CONUS will not be reimbursed for collision damage waiver (CDW) or theft insurance available on commercial rental contracts. Employees will be reimbursed for collision damage waiver or theft insurance while on TDY in non-foreign areas in accordance with FTR §301-10.451 . Personal liability insurance is considered a personal expense and will not be reimbursed.

Once you have reserved your rental car, continue on to complete trip information .

Questions about securing approvals

Completing trip information.

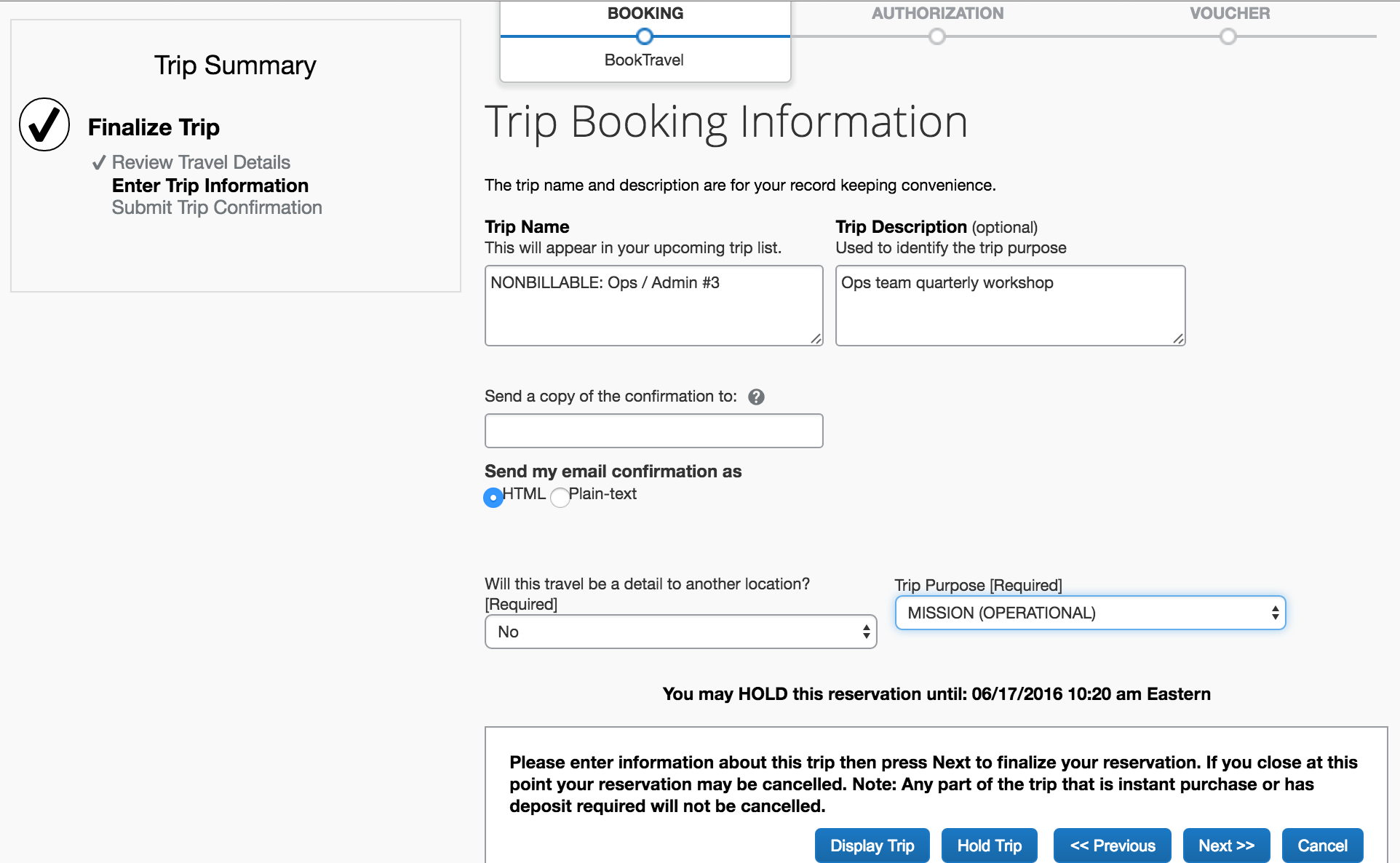

On the Trip Booking Information page you must enter some general information in order to ensure that your trip gets billed to the right client and/or budget.

*Note: If you called Ad Trav to book travel, you'll need to open Concur about an hour after your initial call to AdTrav, going to the Authorizations tab, clicking on your authorization, and selecting Edit Authorization . This will open up the document, where you can go to the General tab and see the fields that are presented below:

How to Complete Your Trip Information

Trip name: Identify the budget of your trip here, based on the type of project you are traveling for:

- Billable projects: for 18F and CoE, include the exact name and number of the project as it appears in , external, TTS-only, Tock . For PIF billable travel, simply indicate the project is billable.

- All other projects: include the name of the team budget that is paying for this travel (a list of options is in cell C5 of the , external, TTS-only, TTS Budget and Accounting Lookup

*Note: If you are traveling for multiple projects (whether billable or not), list all of the relevant Tock name and numbers and budget names as appropriate.

- BILLABLE: 18F / HHS / CMS FY19 #997

- BILLABLE: CoE / USDA Phase 2 / Cloud Adoption #980

- BILLABLE: PIF - DHS

- NONBILLABLE: OPP Smarter IT Solutions Division (QXD)

- NONBILLABLE: 18F Strategy Branch (QEAD)

- NONBILLABLE: Cloud Adoption CoE

Type Code: "SINGLE TRIP". Trip Purpose: “Mission (Operational)” in most cases, unless attending a conference or training. Document detail: Brief summary of the purpose of the trip. Will this travel be a detail to another location? No.

- Proceed by clicking Next to finalize the reservation.

Additional step if you booked your hotel outside of Concur or Ad Trav

*Note: If you did not book a hotel from Concur, a policy violation will be flagged. If this applies to you, briefly justify your hotel choice .

Additional step if you are extending travel for personal reasons

Deleting hotel expenses which auto-populate on your authorization is relatively straightforward, but an additional step is required to remove M&IE. In some cases, Concur may not allow you to do this on the authorization. If that's the case, proceed as normal and return to this step when creating your voucher after you get back.

How to Justify Rental Cars and Personal Vehicle Mileage

In most cases, you can proceed straight on to stamping and submitting for travel team approval at this point . However, since "common carrier" transit (e.g. public transit, flights, trains, buses, shuttles, taxis, etc) or a , external, TTS-only, government car are the preferred modes of transit for official GSA travel, additional justification is required if you intend to incur the following expenses:

- Rental Cars: You must add a comment on the "Expenses and Receipts" page justifying the use of a rental car as advantageous to the government (considering both cost and time) compared to common carrier transit or a government car.

- Mileage: You must add this in as an expense on the "Expenses and Receipts" page and then justify the mileage claim as advantageous to the government (considering both cost and time) compared to common carrier transit, government car, and rental car. Mileage from your home to the airport (plus associated parking fees or round-trip travel in case of a drop-off) need only be justified as advantageous compared to taxi and public transit, as it is understood that obtaining a government car or rental car is impractical over such a short distance.

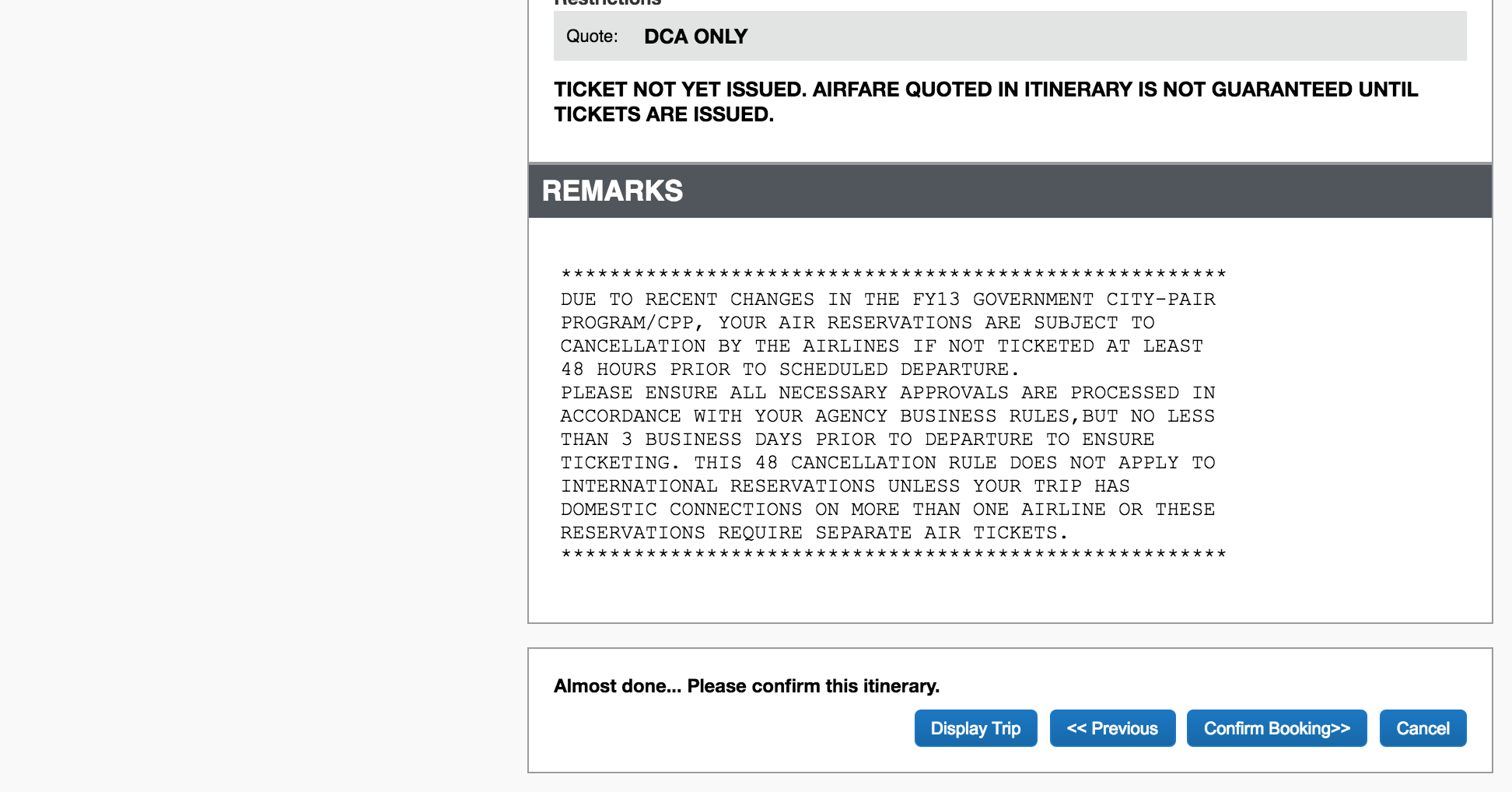

How to Stamp and Submit for Travel Team Approval

Following this step will ensure your authorization or voucher is in SUBMIT TO APPROVER status, which is required for your request to be reviewed, approved, and ticketed. Before you submit, you can review , external, this Checklist to ensure you've addressed all potential issues that can result in your request getting rejected or returned for correction.

- Click Document Actions -> Submit Document (in the upper right hand corner of your authorization)

- You will be taken to a document history page. If your “Status to Apply” is “Submit to Approver” , then click Stamp and Submit Document at either the top or the bottom of the page and continue. If not, please correct any other failures.

- The next page will show you your pre-audit results . These will let you know if anything might be awry, which is represented by either a FAIL or a HARDFAIL . Many of these are not a cause for concern as long as you secure approvals in the right way. For a more detailed guide on what to do for each FAIL or HARDFAIL , read on , external, TTS-only, here . As long as you don't have any hardfails, you are clear to Continue Stamping the Document

- If you successfully stamped the document, you be taken to a page with the button Close Post Stamping Document Closure Screen . It doesn’t look like it, but when you see that button, you are done! Your authorization has been submitted. You don’t even have to click the button again (but you can if you want).

- In the case of authorizations, your travel will be approved by the TTS travel team once you have secured approval from your authorizing official . Ensure this is complete by 3:30 PM Eastern, else your travel will not be approved until the next business day. If you require approval after business hours, see the guide for after-hours and emergency travel here .

*For vouchers, your travel will be approved within 3-5 business days.

- Once you have been approved by the TTS travel team, you should receive a notification from Concur. Please note that in most cases, government contract airfare does not ticket until 72 hours before departure , so you may not receive official confirmation of your itinerary until then. Don't worry about this, the TTS travel team is not aware of any situations where approved travelers have not been issued tickets :)

*For vouchers, reimbursement will be issued to your personal account and travel card 3-5 business days after travel team approval. For issues with reimbursement, read on more here

Once your authorization is approved and ticketed, you might want to take a look at what to expect while traveling !

How to secure authorizing official approval

You must formally request your authorizing official's approval* via email and forward it to [email protected], unless you are traveling to a training, conference, speaking event, or other "IRL" or large team gathering, in which case you must follow the event request process instead . Who is my authorizing official? The body of the email must include the following: See an individual template here and a group template here

- Names of individuals traveling What if this changes?

- Start and end dates of travel What if I am extending travel for personal reasons?

- A brief description of work to be done on the trip

- Identified budget that will be paying for the trip How do I identify my budget?

- Origin and destinations for each individual What if I am returning to or traveling from a location other than home?

- Estimated expenses for each individual, including a sufficient budget for local travel and miscellaneous expenses such baggage fees How should I estimate my expenses?

- Include the travel expenses estimator as an image in the body of the email to make the travel approver's life easier.

* Note that in many cases, your engagement manager or team lead may request approval on behalf of the group-- reach out to them before emailing your authorizing official.

Who is my authorizing official and what is my budget?

Your authorizing official must be a supervisor or director at GSA.

If your travel is non-billable , and coming from your team's budget, your authorizing official would be your supervisor or director. If expenses will be paid out of another team's budget (list of budgets available in cell C5 of , external, TTS-only, this sheet ), you will need a supervisor or director from that team to approve.

If your travel is billable , you will need to have the Account Manager of the project or Director of the team overseeing the project verify the budget prior to submitting the travel request. Please use the following process to document the verification:

- Project teams should send travel request(s) with estimated costs via email to the Account Manager

- The Account Manager will reply with either "Approve" or "Reject" and provide additional context if they deem necessary

- Once approved/rejected the Account Manager updates the comment session for the project in Airtable.

- Submit the travel request(s) to the appropriate approver as listed below

The following list provides Concur approvers for billable travel:

- 18F: 1st Line Supervisor (verify with the project's Account Manager first per instructions above)

- 10x: Nico Papafil

- cloud.gov: Ashley Mahan until a new cloud.gov director is selected

- login.gov: Dan Lopez

- Centers of Excellence: Jenny Rostami.

What if I am traveling for multiple projects?

Secure approval from each authorizing official as you would normally, but with an eye on which project will be covering each expense. When completing your trip information in Concur , ensure that either the Trip Name or Document Detail mentions that the travel will be split between multiple projects. If more than one authorizing official has approved expenses for a particular day or leg of the itinerary, clarify which project will be paying for each part of the trip, either via email to [email protected] or comment in the Trip Name or Document Detail sections of Concur. Splitting overall trip costs by a percentage is acceptable as well, as long as the split is agreed upon by all parties.

Another common situation which arises when splitting travel across multiple projects is having days in between, such as a weekend in between travel for two projects. Having official travel approved for the days in between, including weekends or leave is possible as long as the following conditions are met:

- It is not possible to reschedule one of the meetings or events to avoid having days in between.

- Considering both the travel time and overall cost, it is advantageous to the government to pay for the hotel and meals for the time in between rather than the round trip travel cost of having the employee return home.

- One or both authorizing officials agree to cover the costs of the time in between.

* Note that this same situation may arise when travel is required for one project on both sides of a weekend-- the same considerations apply.

How can I get my travel approved to attend a training, conference, speaking event, or other "IRL" or large team gathering*?

Instead of obtaining an email of approval, you must follow the event request process . You may book your travel in the meantime. However, if you will be extending your trip at your own expense , flying to or from points that are not either your duty station or location of the event , or combining your event travel with travel for some other reason, you must secure an email from your authorizing official approving of the revised itinerary.

*The threshold for a large team gathering is over 6 employees traveling for an internal management meeting (not day-to-day business) and/or more than $10,000 in estimated travel expenses for the group. Requests for approval of these events is typically handled by the organizer of the meeting.

What if who is traveling changes?

A follow-up to the original email from the authorizing official indicating who the new travel is, and if there is any change in dates or estimated cost is sufficient.

What if I am extending travel for personal reasons?

Include language that specifies which days will be at your own expense, and acknowledge that "I understand all other travel expenses including lodging and meals before or after the official travel dates specified above are my own responsibility." You may remove hotels and M&IE from your authorization in Concur if you haven't already.

Alternatively, you may book your official travel and have it approved as normal. Once your travel has been approved by the travel team in Concur, you may then call AdTrav at (877) 472-6716 and request to be re-booked on a different flight for personal travel. In the case of most government contract flights, there is no additional charge. However, if there is an additional cost compared to your original itinerary, AdTrav will request you provide a personal credit or debit card number to pay for the difference.

What if I am returning to or traveling from a location other than home?

If you were previously scheduled to be on leave or telework at the other location*, the full cost of travel from or to that location can be approved at the discretion of your authorizing official. Ensure that there is language in the email that reflects your itinerary.

If you'd like to schedule personal travel that's incidental to your work trip (i.e. planned after the work trip), after your official work itinerary has been approved in Concur, you can give AdTrav a call at (877) 472-6716 and request that your itinerary be changed for personal reasons, with you covering any difference in cost that may arise.

*Note that while GSA travel policy doesn't explicitly forbid being approved to travel from a foreign location, travel to or from foreign locations must be requested in Event Tracker for GSA Administrator approval at least 7 weeks in advance, making approval in these circumstances extremely unlikely.

International travel

All official international travel taken by GSA employees, regardless of funding source, requires Salesforce event approval. Please reach out to [email protected] at least 7 weeks in advance in order to coordinate this.

Teleworking from locations outside the U.S. while on personal travel is not allowed.

How should I estimate my expenses

In the case of individual or small group travel, you may estimate your expenses based on the total amount of your authorization in Concur, plus an reasonable allowance for any additional expenses such as taxis, parking, and baggage fees.

For larger group travel, it is recommended to use this , external, TTS-only, travel expenses estimator template which automatically calculates most airfare and per diems.

Questions about reimbursement

How do i create a "voucher from authorization".

Visit Concur at travel.gsa.gov . Click "Vouchers" in the top bar and then "New Voucher" in the next-to-top bar. In the field Document Type, select "Voucher From Authorization" and click Next. You will be led through creating a voucher from your authorization that you got approved prior to traveling.

- Under Document Search, you’ll see a list of your “open” authorizations (i.e. your authorizations that don’t have vouchers yet).