- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

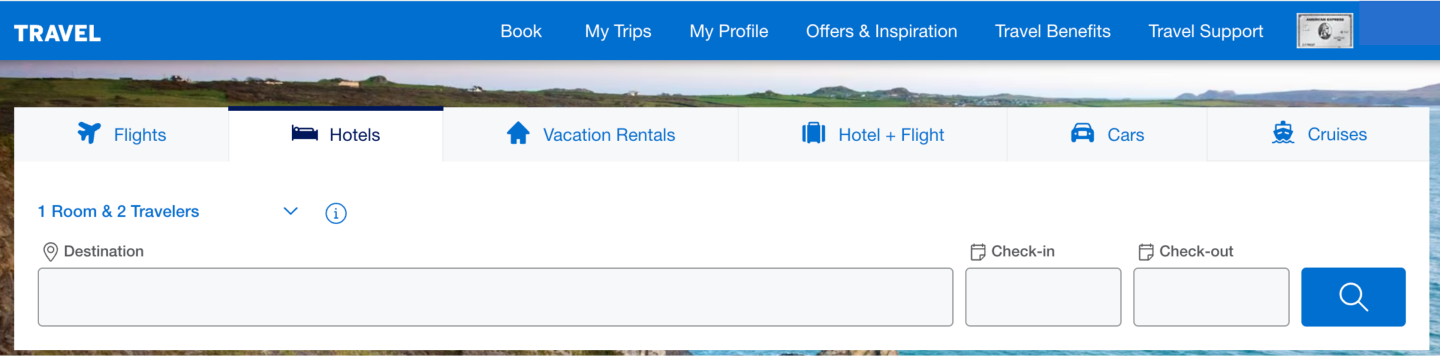

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel using your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

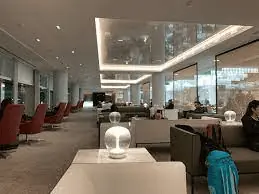

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $199 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.¤

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

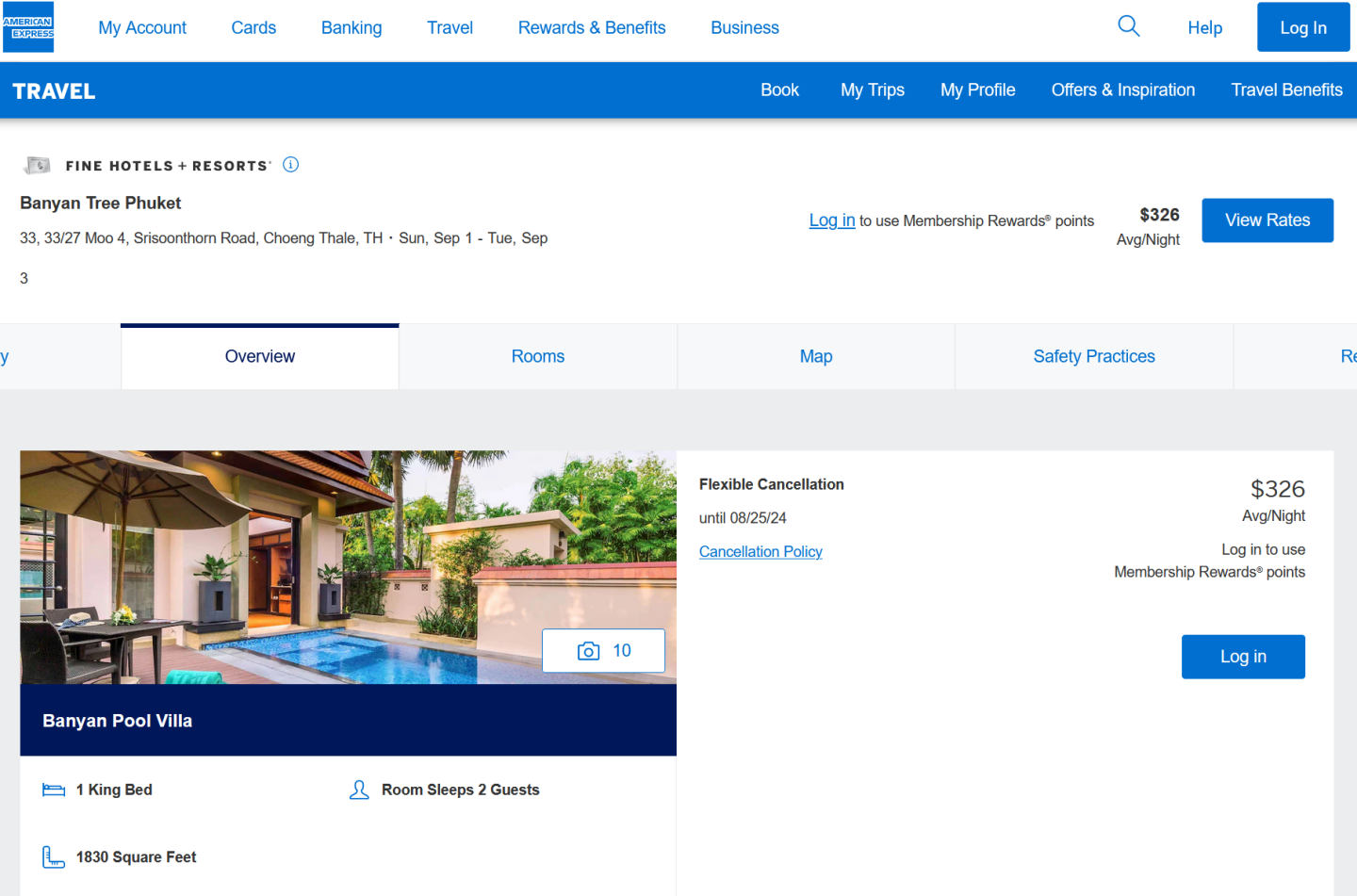

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards® points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 on eligible purchases at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

How to redeem points for boutique luxury hotels

Credit cards Harrison Pierce

Why I chose the Wells Fargo Active Cash® Card over other cash-back cards

Credit cards Jason Steele

Big Changes to the American Express Gold Card

Credit cards Carissa Rawson

Chase Freedom Flex vs Freedom Unlimited

Credit cards Sarah Brady

Study: Over two-thirds of Americans are stressed by everyday expenses – these are the most frustrating ones

Credit cards Stella Shon

Chase trifecta: What it is and how to maximize it

Credit cards Ryan Smith

Best credit cards for families of August 2024

Credit cards Dawn Papandrea

Citi Strata vs. Chase Sapphire Preferred

Citi Merchant offers: Everything you need to know

Credit cards Louis DeNicola

Best credit cards for young adults of August 2024

How to redeem Citi Double Cash credit card rewards

Credit cards Rebecca Safier

Chase Ink Business Preferred welcome offer reaches new heights with 120k points for big spenders

Guide to Citi ThankYou transfer partners

Credit cards Lee Huffman

Blink and you’ll miss it, new elevated offers on IHG credit cards

Credit cards Sarah Sharkey

Best credit cards for lounge access of August 2024

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Platinum Card

Full List of Travel Insurance Benefits for the Amex Platinum Card [2024]

Christine Krzyszton

Senior Finance Contributor

323 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Senior Editor & Content Contributor

153 Published Articles 768 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Keri Stooksbury

Editor-in-Chief

41 Published Articles 3375 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

![amex travel phone number platinum Full List of Travel Insurance Benefits for the Amex Platinum Card [2024]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Platinum-Upgraded-Points-LLC-09-Large.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Amex platinum card overview, car rental loss and damage insurance, trip cancellation and trip interruption insurance, trip delay reimbursement, baggage insurance, premium global assist hotline, filing a claim, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Frequent travelers who are interested in premium travel benefits and solid reward-earning opportunities gravitate to The Platinum Card ® from American Express . The card, as well as The Business Platinum Card ® from American Express , has been the go-to card for meeting travelers’ earning, redemption, and benefits needs.

We frequently cover Membership Rewards points-earning opportunities , as well as a multitude of ways to maximize the redemption options . We’ve even done a deep dive into getting the most from statement credits offered by Amex cards.

Next up in our collection of articles focusing on the valuable perks that come with the Amex Platinum card is the card’s travel insurance benefits. Insurance can be inherently confusing in general and the insurance coverages that come with credit cards can be equally so.

Fortunately, even a quick overview will give you some insight as to the insurance coverages you can expect on the Amex Platinum card. So, right here and now, we’re stepping up to deliver just that.

Let’s take a look at exactly which insurances come with the card, how these benefits can provide a level of peace of mind, and find out what situations might trigger the coverage to provide economic value.

It’s important to have a little background on the card to put its coverage into context. Here are important card details, including the current welcome bonus and annual fee.

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings through American Express Travel using your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $199 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.¤

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

The Amex Platinum card comes with complimentary standard car rental insurance that provides secondary coverage when using your card to reserve and pay for your entire rental car contract. You also have the option to purchase premium primary car rental coverage .

For either coverage to be valid, you must decline the rental car agency’s LDW (loss damage waiver) or CDW (collision damage waiver) coverage when renting the vehicle.

Here’s an overview of how both of these coverages work:

Standard Car Rental Coverage

Secondary (standard) coverage means that you must first file a claim with any other applicable insurance you might have before the card coverage applies.

You can expect to receive excess secondary coverage for these losses:

- Damage to and theft of the vehicle

- Personal property up to $1,000 per person/$2,000 per accident

- Accidental injury up to $5,000 per claimant

- Accidental death/dismemberment up to $300,000

This is just a snapshot of the standard secondary car rental coverage; several terms and conditions apply. You should access the official guide to benefits or call your benefits administrator for specific information.

Premium Car Rental Protection Coverage

One of the real car rental insurance perks of holding the Amex Platinum card is having access to Premium Car Rental Protection coverage for just 1 low fee that covers the entire rental period, not a per-day charge like the rental agency charges.

Although there are some credit cards with primary rental car insurance , the American Express Premium Car Rental Protection coverage, in some circumstances, can provide equal or better coverage and elevated peace of mind. Terms and conditions apply.

Bottom Line: Consider Amex Premium Car Rental Protection if you don’t have a credit card that provides primary car rental insurance. Additionally, if you are renting an expensive vehicle that exceeds your card’s limit of coverage or the maximum length of the rental period on your other card is limited to less than 42 days, the Amex Premium Car Rental Protection could also be a prudent choice.

Trip cancellation and trip interruption insurance are designed to cover unexpected, unforeseen events that may cause you to have to cancel your trip or that cause a disruption in a trip you’re already started.

To be eligible for coverage, purchase your entire round-trip common carrier ticket with your Amex Platinum card.

American Express has a broad definition of who is covered under this benefit. Eligible travelers can include the cardholder, traveling companion, family member of the eligible traveler, or family member of the traveling companion.

Examples of events that could be covered include the following:

- Bodily Injury or Illness — If you, a traveling companion, or a family member of either, experience an accidental injury or become ill, causing you to cancel your trip, you may have coverage

- Bad Weather — If extreme weather causes your trip to be canceled or disrupted, there could be coverage

- Change in Military Orders —Applies to cardmember and/or spouse (spouse definition includes domestic partner)

- Terrorist action or hijacking

- Jury duty or other qualifying legal obligation

- Uninhabitable dwelling of either the cardmember or traveling companion

- Quarantine imposed by a physician for health reasons

You can expect coverage of up to $10,000 per trip , and a maximum limit of $20,000 per card per 12-month period.

Terms and conditions apply.

Bottom Line: While the trip cancellation/trip interruption benefit covers specifically stated reasons for trip cancellation/interruption, there is no coverage for voluntary cancellations, disruptions due to known events, or for preexisting conditions. Additional terms and conditions can be found in your guide to benefits or call the benefits administrator prior to your trip.

Experiencing a trip delay is inevitable so having coverage for added expenses as a result of that delay could be a welcome economic benefit. To qualify for trip delay coverage, just pay for the full amount of your common carrier round-trip transportation ticket with your Amex Platinum card.

The delay must be for more than 6 hours for you to be eligible for reimbursement for necessary incidentals, meals, and lodging.

Coverage limits are $500 per covered trip and a maximum of up to 2 covered trips in each consecutive 12-month period. Coverage is secondary to other coverage that applies and does not include expenses that are reimbursed by the airline or other entities. Additional terms and conditions also apply.

Losing a checked bag used to be a very common occurrence. With new technology and tracking mechanisms, however, incidents have declined, but they still happen. If you do happen to experience lost bags, however, you can count on the baggage insurance found on the Amex Platinum card.

To activate the coverage , simply pay for your common-carrier fare with your card and/or Membership Rewards points.

Here’s the coverage you can expect for lost luggage:

- Checked Bags — Up to $2,000 per covered person, per trip

- Carry-on Bags — Up to $3,000 per covered person, per trip

- Specialty High-value Items — Up to $1,000 per person, per covered trip ($2,000 for New York residents, maximum $10,000 per trip)

- Combined Limit — The limit for all baggage, including high-risk items, is $3,000 per covered person, per single trip

Checked baggage is covered only while traveling on a common carrier . Carry-on baggage is additionally covered while traveling to , from , and when waiting at the carrier terminal.

Note that the coverage on the card is secondary to any other insurance or reimbursement you might receive from the airline. There is no coverage for delayed baggage , but several other credit cards do offer this coverage .

While technically not insurance coverage, having access to help when you’re traveling, 24/7, is sure to provide additional peace of mind. The Amex Platinum card offers a premium version of a dedicated helpline that serves as a welcome resource should things go wrong during your travels.

Here are the types of assistance you can expect from the service:

Emergency Medical Transport and Evacuation — Complimentary Coverages

One of the premium services offered on the card is complimentary emergency medical transport or evacuation . If you or a covered family member becomes injured or ill during your travels, you could receive emergency medical transportation or evacuation , if necessary.

You can expect to receive the following services without charge when arranged via the hotline:

- Emergency Transport or Evacuation — Transport to the nearest medical facility or transport from an inadequate medical facility

- Transport of Family Member — Transport may be covered for an adult member to be by the bedside of the cardmember or for the cardmember’s minor child (who had been traveling alone with the cardmember) to be transported back to the U.S.

- Transport of Remains — Amex will pay for the transport of remains back to the U.S.

- Post-Evacuation Assistance — If you’re evacuated and your return ticket back to the U.S. has become invalid, Amex will arrange and pay for transportation back to the U.S.

Please note that the Premium Global Assist Hotline does not cover any medical expenses or emergency transportation services arranged outside of the hotline. Several terms and conditions apply to these coverages.

Additional Medical Assistance

In addition to the complimentary coverages offered by the hotline, you’ll find these additional medical services:

- Medical Referrals — Receive help finding an English-speaking doctor, a hospital, or other needed medical services

- Prescription Replacement Assistance — Get help with replacing lost or forgotten medications

There is no charge for the referral service but cardmembers are responsible for actual services received from the provider.

Other Hotline Services

- Passport/Visa Assistance — Whether you need help replacing a passport or have a need to contact the U.S. consulate, the hotline can assist

- Emergency Translation Services — Receive over-the-phone services or written language translation assistance

- Legal Referrals — Should you need legal services during your trip, the hotline can help you find local bail bond services that accept Amex or refer you to other legal personnel

- Financial Assistance — The hotline can help you arrange cash wire services, help you check out of your hotel remotely, or assist with lost card situations

- Emergency Message Relay — In the event of an emergency, the hotline can send a message to a family member, friend, or another recipient on your behalf

- Lost Items — Should you lose an item, your baggage gets lost, or other missing possession, the hotline can help track it down

- Trip Planning Services — Access information such as weather, currency exchange rates, passport/visa requirements, customs information, travel warnings, and more

Bottom Line: The Amex Platinum card comes with complimentary emergency transportation and evacuation services with no stated limit. Additional medical, legal, and travel service referrals are also complimentary, but other than the emergency medical transportation and evacuation, services rendered must be paid for by the cardholder.

As with any insurance claim, you’ll need to report any event as soon as possible, provide supporting documentation, and follow up after the claim has been filed.

You could be expected to submit any, or all, of the following:

- Copies of your common carrier ticket

- Copies of your credit card statement showing the expenses

- Proof of the loss (i.e. a copy of physician’s quarantine order, military orders, etc.)

- Copy of the travel supplier’s cancellation policy

- Any other supporting documentation requested by the claims administrator

Claims must be reported within 60 days but it is best to do it as soon as possible. Once you report the claim, you’ll receive instructions for completing the next steps in the process.

Hot Tip: Be sure to take photos and videos, keep receipts, secure any applicable police report, and hold on to other documentation that might be needed to support your claim. Keep in mind that supporting information can be difficult to obtain after the fact but may be readily secured at the time of the claim.

While the insurance that comes with the Amex Platinum card won’t take the place of a comprehensive travel insurance policy , you’ll find value in several of the benefits.

Utilizing Premium Car Rental Protection, trip cancellation/interruption, trip delay, and complimentary emergency medical transport or evacuation could save you more than you could imagine in certain circumstances.

Additionally, knowing the coverages you have in advance has tremendous value. You’ll be armed with information to make educated decisions that can protect each aspect of your trip and be better prepared for how you might handle a covered incident during your travels. If you’re looking for other card options, see our article on the best credit cards for travel insurance .

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For the car rental collision damage coverage benefit of The Platinum Card ® from American Express, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc. For the trip cancellation and interruption insurance coverage benefit of The Platinum Card ® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the trip delay insurance benefits of The Platinum Card ® from American Express, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company. For the baggage insurance plan benefit of The Platinum Card ® from American Express, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the entire fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. For the Premium Global Assist Hotline benefit of The Platinum Card ® from American Express, you can rely on the Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card members may be responsible for the costs charged by third-party service providers.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here .

Related Posts

![amex travel phone number platinum The Amex Platinum Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2019/01/American-Express-Platinum-2.4.2021.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Maximize the AmEx Platinum Hotel Credit

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Platinum Card® from American Express offers cardholders benefits that can cover its $695 annual fee, and many users can come out ahead in value. From lounge access via The American Express Global Lounge Collection to hotel elite status and Membership Rewards points , the perks are solid.

Easy to overlook are the numerous benefits that come with the card for airlines, shopping and entertainment, as well as the card’s travel credits. Those include both a $200 airline fee credit (enrollment required) and a $200 hotel credit when booked through the AmEx portal at participating hotels.

Don’t let the valuable hotel perk go to waste if you have the card (or are considering getting it). Here’s what you need to know about the The Platinum Card® from American Express $200 hotel credit and its Fine Hotels and Resorts (FHR) program. Terms apply.

» Learn more: Benefits of The Platinum Card® from American Express

What is the $200 American Express Platinum hotel credit?

The $200 The Platinum Card® from American Express hotel credit is received in the form of a statement credit. Terms apply.

To use it, cardholders must make an eligible, prepaid (you must pay immediately rather than at the hotel) Fine Hotels and Resorts or The Hotel Collection reservation via the American Express travel portal . Reservations can also be made by contacting the phone number on the back of the credit card.

When booking accommodations from The Hotel Collection, a two-night minimum stay is required. It is available to use once each calendar year, and no enrollment is required.

Once booked, the credit will be refunded to your card within 90 days — although travelers who use it report that it appears much faster.

The $200 FHR American Express credit will still apply if you choose to Pay With Points for your hotel reservation.

Even better, valuable benefits (similar to what hotel elite status members generally receive) for booking Fine Hotels and Resorts hotels are still part of the deal when using the credit. They include:

Noon check-in (based on availability).

4 p.m. late checkout.

Room upgrade (based on availability).

Daily breakfast for two.

Complimentary Wi-Fi.

$100 property credit (varies by hotel for dining, spa and beverages).

This $200 hotel credit benefit is available for U.S. cardholders of The Platinum Card® from American Express , but it is not available to The Business Platinum Card® from American Express cardholders.

How do you book a hotel stay through the AmEx Travel portal?

Cardholders can access the AmEx travel portal by logging in to their credit card account or visiting AmexTravel.com directly.

Members can pay with cash or Membership Rewards points to take advantage of the $200 hotel credit and the associated benefits. Paying with points is a convenient feature, but members can often secure more value for their points by transferring to AmEx’s travel partners to redeem for outsized value.

Aer Lingus (1:1 ratio).

AeroMexico (1:1.6 ratio).

Air Canada. (1:1 ratio).

Air France/KLM (1:1 ratio).

ANA (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio)

Delta Air Lines (1:1 ratio).

Emirates (1:1 ratio).

Etihad Airways (1:1 ratio).

Hawaiian Airlines (1:1 ratio).

Iberia Plus (1:1 ratio).

JetBlue Airways (2.5:2 ratio).

Qantas (1:1 ratio).

Qatar Airways (1:1 ratio).

Singapore Airlines (1:1 ratio).

Virgin Atlantic Airways (1:1 ratio).

Choice Hotels (1:1 ratio).

Hilton Hotels & Resorts (1:2 ratio).

Marriott Hotels & Resorts (1:1 ratio).

For details on transfer ratios, see AmEx's website .

While the AmEx travel site has a variety of hotels, you can check the Fine Hotels and Resorts and The Hotel Collection boxes in the sidebar under 'Hotel Programs' to filter for hotels that are eligible for this credit.

When using The Platinum Card® from American Express or The Business Platinum Card® from American Express , members earn 5 points per dollar spent on up to $500,000 when booking prepaid travel through this site (although you won’t earn points on the $200 statement credit). A reminder that The Business Platinum Card® from American Express is not eligible for the FHR hotel credit. Terms apply.

How to get the most value

Stay at unique properties.

It may be wise to use this credit at expensive hotels that are not affiliated with a hotel loyalty program and where you cannot use miles or points to stay. You can shave off some of the cost of the stay while adding value from the perks that come with this card.

» Learn more: 9 awesome FHR options to book

Pay attention to how it affects your elite status

If you do choose to use the credit at a hotel that has a loyalty program , some, but not all, hotels still award points, elite benefits and status-counting nights for a stay booked through the FHR program.

This trade-off might not matter if you aren’t actively pursuing your chosen program's next elite status tier.

» Learn more: The best hotel elite status programs this year

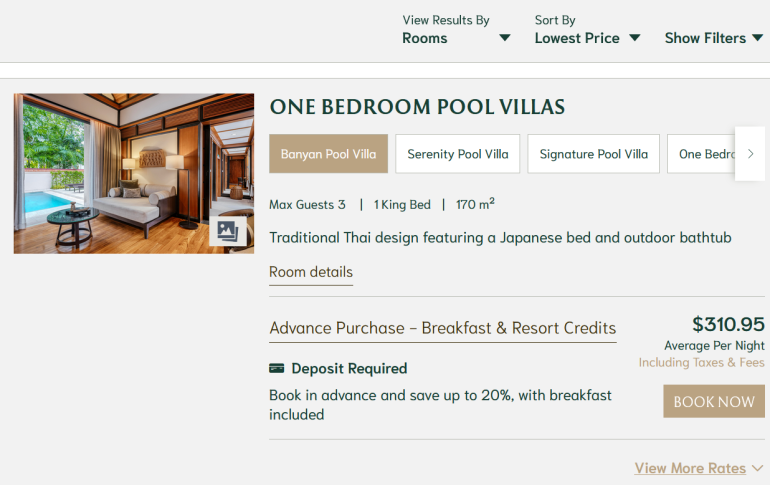

Consider the costs — it may be more expensive, but still worth it

The AmEx Travel portal may not always be the cheapest, so it is wise to compare the cost to book through the portal versus directly with the hotel. The added perks (and $200 hotel credit) can sometimes make an upcharge worth it.

For example, AmEx is charging $326 per night plus eligible perks for a stay at Banyan Tree Phuket booked through the portal.

Meanwhile, the hotel’s website is charging slightly less if booked directly, for $310.95. This rate also includes meaningful perks like breakfast and resort credits.

When booking through the AmEx travel portal is more expensive than the hotel’s website, you should consider whether the $200 hotel credit and any built-in FHR benefits (such as breakfast, early check-in and late checkout) will make up for the extra cost. If not, save the $200 FHR credit for another time.

» Learn more: Best American Express credit cards

Use the entire credit

If the hotel stay is less than the $200 credit, any remaining value can be applied to another reservation within the calendar year. You can track your status for how much has been used after logging into the benefits section of your account. Additional cardholders on the account can also use the credit, but a maximum of $200 per account is available as a credit each year.

If you have not used the benefit before the end of the year, consider booking a reservation for the next year (as long as it posts to your account by Dec. 31 of the current year). The expiration date is for using the credit as payment, not for the actual hotel stay.

If you have to cancel a booking after having received the $200 credit, expect that American Express will reverse the credit.

Maximize The Platinum Card® from American Express ’s $200 hotel credit

The Platinum Card® from American Express is packed with benefits, including a $200 statement credit on eligible hotels booked through its travel portal.

While it is always worth comparing the benefits and rates that the hotel is offering directly, in many scenarios, this FHR hotel credit can net you a lot of value. Terms apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

The Platinum Card from American Express benefits guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

- • Personal finance

- • Credit cards

- Connect with Margaret Wack on LinkedIn LinkedIn

- • Building credit

- • Credit card debt

- Get in contact with Liza Carrasquillo via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- While The Platinum Card® from American Express comes with a hefty annual fee, the right cardholders can take advantage of the card’s big travel perks to make up for the cost.

- The Amex Platinum offers both airline and hotel benefits, including up to $200 in hotel credits and Global Lounge Collection access.

- Other travel benefits, like additional protections, premium car rental status and access to a Platinum Card Concierge, only add to the allure of this card.

If you’re looking for a luxury rewards credit card with plenty of perks, The Platinum Card® from American Express could be the right fit. While this card comes with a hefty annual fee , savvy cardholders can more than make up for the cost through a combination of rewards, hotel and airline credits and more.

Best suited for high spenders and frequent travelers, this travel credit card comes with plenty of additional perks and benefits for users, like access to airport lounges around the world and automatic Gold Elite status from Marriott Bonvoy and Hilton Honors.

Amex Platinum airline benefits

Here’s a breakdown of the Amex Platinum’s airline benefits:

Up to $200 in airline fee credits

In order to qualify for this perk, you’ll need to pre-select one qualifying airline. You’ll then receive up to $200 in statement credits per calendar year for airline incidentals like checked bags and in-flight refreshments. Keep in mind that this credit can’t be applied to the cost of a plane ticket itself or any seat upgrades.

Up to $189 in Clear Plus membership statement credits

You can get up to $189 in statement credits annually if you purchase a Clear Plus membership with your card, which helps you expedite the process of airport security.

Global Entry or TSA PreCheck application credit

Cardholders can receive a statement credit of up to $100 for Global Entry or $85 for TSA PreCheck . The statement credit comes every four years for Global Entry and every four and a half years for TSA PreCheck.

Bankrate’s take: Global Entry, which is best for those who want to expedite their reentry into the U.S., includes free TSA PreCheck membership. If you often travel internationally, getting Global Entry would be a better deal.

Global Lounge Collection access

American Express provides unparalleled network lounge access when compared to other issuers. For a premium airport experience, cardholders get access to airport lounges across the world, including:

- Amex Centurion Lounges

- Delta Sky Clubs (when you fly with Delta; access limitations apply)

- Priority Pass Select lounges

- International American Express Lounges

Trip delay insurance

The Platinum card also comes with trip delay insurance if you purchase a round-trip entirely with the card and your trip is delayed more than six hours. Amex Platinum cardholders can receive up to $500 per trip (up to two claims every 12 months) to cover the cost of expenses if their flight is delayed for a qualifying reason.

Trip cancellation and interruption insurance

If your trip is canceled, Amex will reimburse you up to $10,000 per trip or $20,000 per card (each year) in trip cancellation and interruption insurance .

Baggage insurance plan

If your baggage is damaged, lost or stolen, this perk will cover you for up to $2,000 for checked luggage and up to a combined maximum of $3,000 for checked and carry-on luggage.

Amex Platinum hotel benefits

While the Amex Platinum is more well-known for its flight perks, it also has a lot to offer when it comes to hotel perks. Here are some benefits:

Up to $200 in hotel credits

Cardholders can earn up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts or The Hotel Collection bookings with American Express Travel . This requires a minimum two-night stay.

$100 credit on qualifying hotel purchases

Book at least a consecutive two-night stay with The Hotel Collection via Amex Travel and enjoy a $100 credit to use toward experiences like spa treatments or snorkeling at your resort, for example.

Marriott Bonvoy Gold Elite status

Cardholders get automatic Marriott Bonvoy Gold Elite status, which includes benefits like room upgrades and late checkouts.

Hilton Honors Gold status

The card also comes with Hilton Honors Gold status. Perks of this status include room upgrades, food and beverage credits and more.

Additional Amex Platinum travel benefits

Other reasons to love this top travel credit card include:

No foreign transaction fees

The Amex Platinum charges no foreign transaction fees , meaning you can use the card when traveling abroad without incurring any additional expenses.

Platinum Card Concierge

Need help planning your travels? Amex provides complimentary travel services through American Express Platinum Concierge, including helping cardholders with itineraries and customized recommendations. But you can also use this service for things like dinner reservations and securing tickets for events.

Premium car rental status

Cardholders can enjoy Amex Platinum rental car benefits like premium status at a number of major rental car companies, including Avis, Hertz and National Car Rental.

Car rental loss and damage insurance

With this card, you don’t need to pay extra for rental car insurance . Through this secondary coverage, you’re automatically protected against damage or theft of your rental vehicle.

Global Assist Hotline

When traveling more than 100 miles from home, cardholders have 24/7 access to medical, legal, financial or other select emergency coordination and assistance services.

Amex Platinum entertainment benefits

In addition to its travel benefits, the Amex Platinum also offers a range of shopping and entertainment perks.

Up to $240 in digital entertainment credits

With enrollment, cardholders can get up to $240 in statement credits (up to $20 each month) for entertainment-related purchases. These can include subscriptions to:

- The Wall Street Journal

- The New York Times

Up to $300 in eligible Equinox membership credits

Another Amex Platinum card benefit is an up to $300 statement credit annually for Equinox in-club or digital membership fees, including fees for:

- Equinox All Access

- Equinox Destination membership

- E by Equinox gyms

$300 SoulCycle credit

Enjoy a $300 credit for a single, eligible SoulCycle At-Home bike purchase. In order to qualify for this credit, you must make the purchase with your Platinum card through Amex’s provided link.

Up to $100 in Saks Fifth Avenue credits

Cardholders can get up to $100 in statement credits ($50 semi-annually) when they shop at Saks Fifth Avenue.

Up to $155 in Walmart+ credits

This credit covers the cost of a monthly Walmart+ membership when you pay with your Platinum card, meaning you’d get up to $12.95 plus applicable taxes per month.

Up to $200 in Uber Cash

Amex Platinum cardholders receive $15 in Uber Cash for rides and deliveries every month (plus an extra $20 in December) (Terms Apply).

Complimentary ShopRunner access

Cardholders get a complimentary membership to the online shopping platform ShopRunner. This platform provides free 2-day shipping on eligible items and has a network of over 100 online stores with ShopRunner.

Additional Amex Platinum protection benefits

Your Amex Platinum can keep your purchases safe with the following benefits:

Cellphone protection

When you pay for your cellphone bill with your Amex Platinum, you can get reimbursed up to $800 (up to two claims per year) for damage or theft to your device. A $50 deductible applies to each claim.

Return protection

If you try to return an eligible item within 90 days from the date of purchase and the merchant won’t take it back, American Express may refund you up to $300 per item (excluding shipping and handling), with a maximum of $1,000 per calendar year for each account.

Purchase protection

New purchases are protected for up to 90 days if they’re lost, damaged or stolen. American Express purchase protection covers up to $10,000 per occurrence and $50,000 per year.

Extended warranty protection

The Amex Platinum allows you to extend your warranty protection for longer, matching the original warranty for up to an additional year. The warranty protection covers up to $10,000 per item and $50,000 per year.

Amex Platinum authorized user benefits

Amex Platinum cardholders can add an authorized user to their account for an annual fee of $195 per additional user.

While authorized users don’t get as many benefits as primary cardholders, some Amex Platinum authorized user benefits include airport lounge access, elite statuses with Marriott Bonvoy and Hilton Honors, various shopping, travel and entertainment credits and more. Our guide to Amex Platinum authorized user benefits covers this more in depth.

Maximizing the perks and benefits offered by the Amex Platinum

To get the most out of your Amex Platinum, follow these tips:

Take advantage of credits

The most important thing to keep in mind when maximizing Amex Platinum benefits is that you should take advantage of as many of the annual credits as you can in order to help offset the hefty annual fee.

Amex Platinum travel benefits, like the hotel and airline fee credits, are especially valuable since they’re relatively easy to qualify for if you travel often. Use as many of these credits as possible to make the most of the card — potential credits are worth up to $1,709, which more than covers the $695 annual fee.

Steer clear of unnecessary purchases

Cardholders shouldn’t feel obligated to sign up for pricey services like Equinox just because it comes with the card. If you find yourself spending more money than you otherwise would for a product that you don’t feel strongly about, it’s a good sign that the purchase isn’t worth the cost. That said, there are many credits (like those for digital entertainment services, Walmart+ and Uber) that make certain purchases essentially free.

Maximize rewards earnings

To maximize your rewards earnings, it’s a good idea to book all flights and hotels using this card. American Express Membership Rewards points are about 2.0 cents when transferred to a high-value travel partner, each according to Bankrate valuations .

In addition to redeeming them with a travel partner you can redeem them for statement credits, gift cards, loyalty programs and more — though we recommend trying to redeem them for options with the highest points value.

Claim freebies

The number of perks and benefits that come with this card can be overwhelming, but it’s worth spending time reviewing everything to make sure you take advantage of all the free stuff offered. Taking advantage of complimentary perks like airport lounge access, premium status at hotels and more can make your travel experience a little more luxurious, while shopping and entertainment credits can give you money back for purchases that you already make each month.

The bottom line

The Platinum Card from American Express comes with a hefty annual fee, but it’s relatively easy for frequent travelers to recover that fee thanks to the card’s generous welcome bonus, impressive array of annual credits and various travel and purchase protections.

While there are a few extraneous benefits that the average cardholder may not end up taking advantage of, this card offers an impressive value and can certainly be worth it. If you’re looking for a luxury rewards credit card with great travel perks , the Amex Platinum won’t disappoint.

Capital One Venture X vs. Amex Platinum Card

Is the Amex Platinum worth the yearly fee?

The Platinum Card from American Express review: Unparalleled potential value, but at a premium

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

Welcome to the

Help center, explore the help center to read answers to some of the most frequently asked questions.

Forgot Login

Create an Account

Replace a Card

Confirm My Card

Update Personal Details

Open a Dispute

Free Credit Score

Traveling Soon

Hi, How we can help?

Getting Started

Find tools and information to help you get started with your American Express account

Account Management

Activate and manage your account online. Update information to stay up to date with American Express

Payments

View statements and understand American Express fees and balances. Get help making a payment

Benefits & Rewards

Browse Membership Rewards® categories, insurance offers, credit card benefits, military benefits and more

Explore Banking support and services for opening and managing your Loan, Savings or Checking account

Learn more about how American Express helps keep you safe and secure, at home and abroad

Learn more about how American Express protects your privacy and the choices available to you

American Express Merchant Services account help for payments, supplies and disputes

Business Blueprint Help Center

Discover more about managing cash flow and covering your funding and checking needs in one place

@Work Resource Center

Learn more about managing your employee spending onboarding, expense reconciliation, purchasing authority, and more

Travel Center

Find travel help resources to book a trip, discover benefits, manage bookings, and more

Useful Links

Our digital tools.

Discover our digital tools that are here to help you get it done

Places to Use Your Card