- Sign in

Alaska Airlines Visa Signature® Credit Card

We're sorry, this page is temporarily unavailable. We apologize for the inconvenience.

Unavailable

One or more of the cards you chose to compare are not serviced in English.

Continue in English Go back to Spanish

Limited Time Online Offer: Buy One Ticket, Get One for just the taxes and fees + 50,000 Bonus Miles

Card details, limited time online offer.

Buy one ticket, get one for just the taxes and fees ($0 fare plus taxes and fees from $23) and receive 50,000 bonus miles. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

Alaska's Famous Companion Fare™

Get a $99 Companion Fare (plus taxes and fees from $23) each account anniversary after you spend $6,000 or more in purchases within the prior anniversary year.

Free checked bag + priority boarding

Free checked bag for any cardholder who purchases airfare with their card, and up to 6 additional guests traveling on the same reservation. Plus you'll enjoy priority boarding when you pay for your flight with your card, so you can get to your seat quicker.

Earn miles with no mileage cap

Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases. Earn unlimited 2 miles for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit purchases. Earn unlimited 1 mile per $1 spent on all other purchases.

Flexibility with no blackout dates on Alaska Airlines flights and when booking with miles or a companion fare.

Get more out of your travels

Enjoy 20% back on Alaska Airlines inflight purchases when you pay with your new card.

Get $100 off an annual Alaska Lounge+ Membership purchased with your Alaska card.

10% rewards bonus

You can also earn a 10% rewards bonus on all miles earned from card purchases if you have an eligible Bank of America ® account.

For example, that means that for every 1,000 miles you earn on purchases, you'll receive 1,100 miles.

Interest Rates & Fees Summary †

Introductory apr, standard apr.

21.24% - 29.24%

Balance Transfer Fee

of each transaction †

† Please see Terms and Conditions for rate, fee and other cost information, as well as an explanation of payment allocation. All terms may be subject to change.

Note: minimum payments are applied to lower-interest balances first. Additional payments are applied to higher-interest balances first.

Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases. Earn unlimited 2 miles for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit purchases including rideshare, trains, even tolls and ferries! Earn unlimited 1 mile per $1 spent on all other purchases. And your miles don't expire on active accounts.

You can also earn a 10% rewards bonus on all miles earned from card purchases if you have an eligible Bank of America ® account. For example, that means that for every 1,000 miles you earn on purchases, you'll receive 1,100 miles.

Alaska's Famous Companion Fare™ – Get a $99 Companion Fare (plus taxes and fees from $23) each account anniversary after you spend $6,000 or more in purchases within the prior anniversary year. Valid on all Alaska Airline flights booked on alaskaair.com

With your Alaska Airlines Visa Signature ® credit card you earn unlimited miles and travel with no blackout dates on Alaska Airlines flights when booking with miles or a companion fare.

With one world ® Alliance member airlines and Alaska's Global Partners, Alaska has expanded their global reach to over 1,000 destinations worldwide bringing more airline partners and more ways to earn and redeem miles.

Security & Features

Stay protected, contactless chip technology, balance connect ® for overdraft protection, paperless statement option, digital wallet technology, online & mobile banking, account alerts, fico ® score.

Now, when you opt-in you can access your FICO ® Score updated monthly for free, within your Mobile Banking app or in Online Banking. FICO ® Score Program . The FICO ® Score Program is for educational purposes and for your non-commercial, personal use. This benefit is available only for primary cardholders with an open and active consumer credit card account who have a FICO ® Score available. The feature is accessible through Online Banking, the Mobile website, and the Mobile Banking app for iPhone and Android devices. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Data connection required. Wireless carrier fees may apply." data-footnote="ADDITIONAL_BENEFITS_FOOTNOTE_07" aria-label="Footnote 5"> Footnote [5] Learn More about Free FICO Credit Score opens in a new window

Priority code: VC01ZB

Schedule an appointment to apply in person

Connect one on one with a credit card specialist

Cardholders now enjoy new ways to earn double miles on everyday purchases, priority boarding, expanded free checked bag privileges; for a limited time, new cardholders can receive 70,000 bonus miles after making qualifying purchases

A new year reveals new reasons to celebrate what makes the Alaska Airlines Visa Signature® credit card , co-branded with Bank of America, better and more valuable than ever.

Our current and new cardholders can now take advantage of enhanced benefits when they use the card while traveling with us and while making everyday purchases – from earning more miles in new ways to boarding their flight earlier to continued savings with a free checked bag and Alaska’s Famous Companion Fare™.

Cardholders will enjoy these new benefits:

Earn Double Miles: Cardholders now earn 2 miles for every dollar spent on eligible purchases made every day – including gas, local transit including ride share, cable bill and select streaming services. Alaska miles don’t expire so they can be redeemed at any time.

Relationship Bonus: A 10% rewards bonus on all miles earned from card purchases with an open, eligible Bank of America checking, savings or investment account.

Priority Boarding : Early group boarding when tickets are purchased with an Alaska Visa Signature® card.

Expanded Privileges for Authorized Users: Authorized users added by primary cardholders will now receive additional savings and convenience when the Alaska Visa Signature® card is used to purchase a ticket. Authorized users can continue to book their own travel with the card but will now also gain access to a free checked bag and priority boarding even when they’re not traveling with the primary cardholder (previously, authorized users needed to travel with the cardholder on the same reservation to receive a free checked bag).

Alaska Lounge+ Membership Discount: Cardholders can enjoy $100 off the price of an Alaska Lounge+ membership every year when purchased with their Alaska Visa Signature® card.

With our newly enhanced Visa Signature® credit card, we strived to add benefits that mean the most to our cardholders – from adding value to their travel experience when using the card to earning more miles on things we buy all the time,” said Sangita Woerner, senior vice president of marketing and guest experience at Alaska Airlines. “All those earned miles with the card can be redeemed in our award-winning Mileage Plan program for flights on Alaska, our fellow one world member airlines and our additional global partners.”

Cardholders will also continue to enjoy the card’s additional benefits:

Alaska’s Famous Companion Fare™ Every Year : Current cardholders will continue to receive a companion fare that allows them to book a companion flight from just $122 ($99 fare plus taxes and fees from $23) when bought with their Alaska Visa Signature® card. The companion fare becomes available annually after their card anniversary and it’s valid on all flights booked on alaskaair.com . New cardholders must spend $6,000 or more on purchases within the prior anniversary year to receive the annual companion fare.

Continuing Ways to Earn Miles: Cardholders will still earn 3 miles for every dollar spent on eligible Alaska purchases and 1 mile for every dollar spent on all other things they buy.

20% Inflight Rebate: Cardholders get back 20% on onboard purchases such as food, beverages and Wi-Fi when they pay with their Alaska Visa Signature® card.

Low Annual Fee: Just $95 annually.

Now’s a great time to get the card. For a limited time, in addition to all the benefits above, new cardholders receive 70,000 bonus miles with this offer . Those bonus miles alone are more than enough for a roundtrip ticket anywhere Alaska flies. To qualify, cardholders need to make $3,000 or more in purchases within the first 90 days of opening their account.

“We are thrilled to work with Alaska Airlines in order to offer customers enhanced benefits on their Visa Signature® credit card,” said Jason Gaughan, Head of Consumer Credit Card Products at Bank of America. “With these new changes we’ve created more opportunities for customers to optimize their credit card rewards and get the most out of every dollar spent travelling or for everyday purchases. In addition, eligible Bank of America checking, savings or investment account holders can earn an additional rewards bonus.”

Alaska Airlines and Bank of America will launch similar enhanced benefits for the Alaska Airlines Visa Business card this spring.

Alaska and Bank of America announced last year an extension of our co-branded credit card agreement through 2030 to continue offering best-in-class benefits to our customers.

Mileage Plan miles earned by using the Alaska Airlines Visa Signature® credit card can be redeemed for free flights on Alaska and more than 20 of our fellow one world member airlines and additional global partners to more than 900 destinations around the world. Our guests can also use their miles to book hotel stays and upgrades on their flights.

For information about rates, fees, other costs and benefits associated with the use of this credit card, please see Terms and Conditions . This credit card program is issued and administered by Bank of America, N.A.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Ideal for flyers who travel frequently on Alaska Airlines

- • Rewards credit cards

- • Travel credit cards

- • Travel rewards credit cards

- • Loyalty programs

- • Credit card strategy

- • Credit card comparisons

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bottom line

Best for Alaska Airlines perks

Alaska Airlines Visa Signature® credit card

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Intro offer

50,000 bonus miles plus buy one ticket, get one for just the taxes and fees ($0 fare plus taxes and fees from $23) with this offer. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

Buy One, Get One + 50,000 Bonus Miles!

Rewards rate

Earn unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases. Earn unlimited 2 miles for every $1 spent on eligible gas, EV charging station, cable, streaming services and local transit (including ride share) purchases. Earn unlimited 1 mile per $1 spent on all other purchases.

1 mile - 3 miles

Regular APR

21.24% - 29.24% Variable APR on purchases and balance transfers

Bankrate Score

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

Rewards value

Rewards flexibility

Why you'll like this: Its annual companion fare perk is among the most valuable benefits you can get on a mid-tier airline card.

Remove a card to add another to compare

On This Page

- Current offer details

Alaska Airlines Visa Card pros and cons

- Reasons to get this card

- Reasons to skip this card

- Expert experience

- Alaska Airlines Visa vs. other travel cards

Best cards to pair with the Alaska Airlines Visa Card

- Is this card worth getting?

- Ratings methodology

What cardholders think

Alaska airlines visa signature® credit card overview.

The Alaska Airlines Visa Signature® credit card has valuable benefits for the airline’s frequent flyers and a solid sign-up bonus and rewards rate. Cardholders can also hit the ground running with Alaska’s Famous Companion Fare™ on Alaska Airlines — one of the best deals you can find on an airline rewards card. Get Alaska’s Famous Companion Fare™ from $122 ($99 fare plus taxes and fees from $23) each account anniversary after you spend $6,000 or more on purchases within the prior anniversary year. Valid on all Alaska Airlines flights booked on alaskaair.com.

This card can be worth the $95 annual fee, but mainly for those who fly with Alaska Airlines often since you can only redeem rewards and take advantage of benefits with the airline.

- 3 miles per dollar spent with Alaska Airlines

- 2 miles per dollar on eligible gas, EV charging stations, cable, streaming services and local transit purchases

- 1 mile per dollar on all other purchases

Expert Appraisal: Typical See our expert analysis

Limited-time online welcome offer

Limited time offer: Buy one ticket, get one for just the taxes and fees ($0 fare plus taxes and fees from $23) and get 50,000 bonus miles with this offer. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

Expert Appraisal: Good See our expert analysis

Rates and fees

- Annual fee: $95

- APR: 21.24% - 29.24% Variable APR on purchases and balance transfers

- Balance transfer fee: 4 percent of the amount of each transfer

- Cash advance fee: See Terms

- Foreign Transaction fee: None

- Late payment fee: Up to $40

Other cardholder perks

- Alaska’s Famous Companion Fare™

- Free checked bag for cardholder and up to six companions on the same reservation

- Priority boarding

- 20 percent back on Alaska Airlines inflight purchases

- $100 off an annual Alaska Lounge+ Membership

Earn Alaska’s Famous Companion Fare every year starting at $122 ($99 fare plus taxes and fees from $23).

Cardholders and up to six companions on the same reservation get a free checked bag on Alaska flights.

You can receive 20 percent back on inflight purchases when you use your card.

While Alaska Airlines is a oneworld Alliance partner, the airline has a limited route network.

The card's annual fee recently increased from $75 to $95, making it even less practical if you only fly Alaska Airlines occasionally.

You’ll need a good to excellent credit score for the best approval odds.

Why you might want the Alaska Airlines Visa Card

Like any branded airline card, the Alaska Airlines Visa card is excellent for frequent flyers of its respective airline, Alaska Airlines. It can be an ideal choice for customers of the airline who take annual or semi-annual trips because it includes generously boosted rewards rates and has some key perks that help you save.

Companion flights: For a friend or family member

You can earn a companion fare code when you spend $6,000 in one year with the Alaska Airlines Visa card ($99 fare plus taxes and fees from $23). This can be a great way to recoup your annual fee.

While spending $6,000 on your travel card is no easy task, it might help to look at this offer as an opportunity to save hundreds of dollars on a trip you’re sure to take each year. For instance, the average one-way Alaska Airlines fare hovers around $250 (before taxes). If you spend $6,000 in one year to earn this promotion and use the promotional code to cover companion airfare worth $250, then you’re looking at a return of roughly 4 percent, which rivals the cash back rate on some of the best cash back credit cards .

Rewards: Boosted rewards for flights and some recurring purchases

Cardholders can earn 3X miles on flights and 2X miles on eligible gas, EV charging stations, cable, streaming services and transit. In the right hands, these modestly boosted rewards categories can bring a healthy sum of miles. Regarding co-branded airline cards , 3X miles seems to be the standard among cards with comparable annual fees. You can also receive a 10 percent boost to your earned miles if you have an eligible Bank of America account.

Alaska Airlines also has a decent rewards program , with miles coming in at an estimated value of 1.1 cents, according to Bankrate’s latest valuations . This valuation isn’t exceptional, but it is more than you might expect on other cards and is far from the least valuable among airline miles. Plus, you’ll earn them at generously boosted rates, so your miles will stack quickly.

Welcome offer: Solid value with a little effort

While it may require some precise planning, the recent update to the Alaska Airlines Visa's limited-time online bonus has added significant value to the card. You can earn 50,000 bonus miles for spending $3,000 in your first 90 days with the card and snag a sweet "buy one, get one" deal on airfare (must pay taxes and fees).

Depending on how you use this flight can determine how valuable this welcome offer is. The miles with the welcome offer can be worth $550, based on the valuation of 1.1 cents, which is good value, but you can really boost the value of this offer by cashing in your buy one, get one offer on pricey airfare.

Perks: Free checked bags with priority boarding

Several credit cards include free checked bags , but not all have free checked bags for up to six people on the same reservation, something the Alaska Airlines Visa can boast. The only card that comes out ahead for this perk is the Delta SkyMiles® Gold American Express Card , which offers a free checked bag on Delta flights for up to eight additional people on the same reservation. But if you’re a loyal Alaska Airlines customer, there is no replacement for the value that this card carries for multi-person reservations.

Plus, this card has priority boarding for as long as you’re a cardholder. Although this perk isn’t a huge value play, it can help ease tension in the airport and get you onto your plane and into your seat before most of the overhead bag space is cluttered.

Why you might want a different travel card

If you don’t use Alaska Airlines you won’t be able to make the most of this card. However, even if you are a frequent flyer of the airline and live near Alaska Airlines hubs, this card might not provide you with the best value for your specific circumstances.

Limited network: Lacks wide-spread coverage

Alaska Airlines connects cities along the western coast of the United States with international routes to Belize, Mexico, Costa Rica, Guatemala, the Bahamas and Canada. As a oneworld Alliance member, the airline has several partners, opening its flight network to more destinations. However, if you’re hoping to stick with Alaska Airlines, you’ll be disappointed to learn that the airline does not fly to many destinations.

However, the airline has several partners as a oneworld Alliance member, opening its flight network to more destinations. Unfortunately, there are added fees and guidelines associated with transfers that can lower the value of your Alaska miles and make using them less convenient. The most viable way to redeem your airline miles is directly with Alaska Airlines on routes they serve. However, because the airline has fewer routes than most airlines, this might make the card a poor choice for travelers with plenty of variety in their travels — particularly regarding international travel via transatlantic routes.

Rates and fees: Increased annual fee eats into rewards

This card once carried a $75 annual fee but was increased to $95 not too long ago, making it more difficult to recoup the cost of the card with rewards earnings. Other general travel rewards cards might have the same annual fee as the Alaska Airlines Visa card fee, but they may have rewards programs that are far easier to maximize. If you don’t foresee yourself spending enough on the card to earn enough miles to offset it, then the card is most likely not a good choice for you. For reference, you’ll need to spend roughly $2,900 on Alaska Airlines flights in one year to earn the cost of your annual fee back with the value of your miles at 1.1 cents upon redemption.

You can also leverage rewards from other purchases to maximize your card’s value, but it will require substantial spending. If you spend $2,000 on purchases outside your boosted categories, $1,500 at eligible gas stations and $1,220 on Alaska Airlines flights, you’ll earn enough miles to offset the cost of your card’s annual fee at a redemption value of 1.1 cents per mile. Combined spending among these three categories is $4,700 at an average rewards rate of 1.8X miles just to earn back the cost of your card. If you opt for a general travel rewards card like the Chase Sapphire Preferred® card or the Capital One Venture Rewards Credit Card , you could offset the same $95 annual fee ( See Rates & Fees ) at faster rates with the same spending amount.

We tried it: Here’s what our experts say

Despite living in Florida, Nick Ewen , a credit card expert at The Points Guy , has kept the Alaska Visa in his wallet for a number of years.

I love the Alaska Visa card, mainly because of the annual companion fare benefit it offers. I’ve used it to fly to Hawaii (with a stopover in San Diego), Portland and Seattle in years past — saving well over $1,000 in the process. And Alaska Airlines MileagePlan remains an incredibly valuable loyalty program thanks to its Oneworld and non-alliance airline partners. — Nick Ewan, Director of Content, The Points Guy

How the Alaska Airlines Visa Card compares to other travel cards

If you’re considering the Alaska Airlines Visa Card, you should compare it to other travel credit cards and airline cards before applying. Here’s how the Alaska Airlines Visa Card stacks up against cards that offer similar perks and rewards.

Recommended Credit Score

Chase Sapphire Preferred® Card

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

5x on travel purchased through Chase Travel℠. 3x on dining, select streaming services and online groceries. 2x on all other travel purchases. 1x on all other purchases.

Capital One Venture Rewards Credit Card

75,000 miles once you spend $4,000 on purchases within 3 months from account opening

5 Miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. 2 Miles per dollar on every purchase, every day.

Some of the content regarding the Capital One Venture Rewards Credit Card is expired

Alaska Airlines Visa Card vs. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card lets you earn rewards for travel with more flexibility than a co-branded airline card and more miles for general purchases compared to the Alaska Airlines card, making it a better choice for cardholders who want to earn rewards on everyday spending. You can also redeem your miles to cover any recent travel purchase charged to your card. Capital One also has its own airline and hotel partners, which include some oneworld partners that offer the same routes you can book with Alaska Airlines. Plus, depending on the transfer partner and flight or hotel, we estimate that Capital One Miles can be worth around 1.7 cents, which is almost double the value of Alaska Airlines miles. And while you won’t get airline-specific benefits, you get a fee credit toward Global Entry or TSA Precheck membership.

Alaska Airlines Visa Card vs. Chase Sapphire Preferred

Along with ongoing rewards in a range of everyday spending categories, the Chase Sapphire Preferred offers one of the best available sign-up bonuses on a travel credit card in its price range.

You can redeem your points for travel through the Chase Travel portal, statement credits, gift cards or merchandise, or you can transfer points to one of Chase’s airline or hotel partners at a 1:1 ratio. If you redeem for Chase Travel, you also get a 25 percent increase to the value of your points.

Although the card doesn’t offer frequent flyer benefits with a specific airline, the Chase Sapphire Preferred card boasts a better overall rewards rate than most airline cards and points that are much more flexible.

Finding the right card to pair with the Alaska Airlines Visa can be difficult. It’s a branded airline credit card, so you won’t have many options if you’re hoping to combine points and bonus categories. However, it would pair excellently with a flat-rate travel rewards card or one that includes generous rewards with the option of transferring points to partnering airlines — particularly those in the oneworld Alliance.

Chase Sapphire Preferred® Card

Along with ongoing rewards in a range of everyday spending categories, the Chase Sapphire Preferred offers the best available welcome offer on a travel credit card in its price range.

You can redeem your points for travel through the Chase travel portal, statement credits, gift cards or merchandise, or you can transfer points to one of Chase’s airline or hotel partners at a 1:1 ratio. If you redeem for Chase Travel, you also get a 25 percent increase to the value of your points.

Although the card doesn’t offer frequent flyer benefits with a specific airline, the Chase Sapphire Preferred card boasts a better overall rewards rate and much more flexible points than most airline cards.

Capital One Venture Rewards Card

The Capital One Venture Rewards Card is one of our top picks for flat-rate travel cards. The earning rate on all purchases is reliable and greater than what you’d earn on the Alaska Airlines Visa Card.

The card also lets you transfer your earned miles to travel partners, many sporting a 1:1 transfer ratio. But like Alaska Airlines’ travel partners, many of these partners are international.

Who is the Alaska Airlines Visa Card right for?

Alaska airlines customers.

It’s difficult to recommend this card to anyone who isn’t a dedicated Alaska Airlines customer. If you fly with this airline regularly, you can benefit from its generous rewards rates. However, you’ll want to rack up at least $6,000 of card charges with the Alaska Airlines Visa to make the most of it.

Bankrate’s Take — Is the Alaska Airlines card worth it?

The Alaska Airlines Visa Card can be worth the $95 annual fee, but only if you can use Alaska miles and the card’s companion fare. If you live in an area not serviced by Alaska Airlines or frequently fly to destinations outside the airline’s service area, you may want to look at other card options.

Fortunately, there are many rewards and travel credit cards to choose from. No matter whether the Alaska Airlines Visa Card makes sense for your travel needs, you should consider all your options before you decide.

How we rated this card

We rate credit cards using a proprietary card scoring system that ranks each card’s estimated average rewards rate, estimated annual earnings, welcome bonus value, APR, fees, perks and more against those of other cards in its primary category.

Each card feature is assigned a weighting based on how important it is to people looking for a card in a given category. These features are then scored based on how they rank relative to the features on other cards in the category. Based on these calculations, each card receives an overall rating of 1-5 stars (with 5 being the highest possible score and 1 being the lowest).

We analyzed over 150 of the most popular rewards and cash back cards to determine where each stacked up based on their value, cost, benefits and more. Here are some of the key factors that influenced this card’s overall score and how the score influenced our review:

The primary criteria for a rewards or cash back card’s rating is its rewards value. This includes the card’s average rewards rate, estimated annual rewards earnings, sign-up bonus value and reward redemption value.

To estimate a card’s average annual rewards earnings, we first calculate its average rewards rate based on how much it earns in different bonus categories and how closely its categories align with the average person’s spending habits, according to data from the Bureau of Labor Statistics .

Based on this data, we determine a “chargeable” spend (which purchases are likely to be put on a credit card and earn rewards). This includes the following spending by category:

- Groceries: $5,200

- Dining out: $3,000

- Entertainment: $2,500

- Gas: $2,100

- Apparel and services: $1,700

Using this data, we assign a weighting to each of a card’s bonus categories. For example, a card’s grocery rewards rate receives a 23 percent weighting based on how much of the average person’s budget is spent on groceries. We also estimate the redemption value of points or miles from various issuer, airline and hotel rewards programs.

This weighting and rewards valuation allows us to estimate a card’s average annual rewards earnings — how many points or miles you’d earn with a given card if your spending was about average and you used the card for all of your purchases, as well as what those points are worth. We also use point valuations to determine a card’s sign-up bonus value

With these calculations complete, we assign each card a score based on how its average rewards earnings, sign-up bonus value, rewards rate and redemption value stack up against other rewards cards.

We also rate cards based on how much it costs to keep them in your wallet or carry a balance.

To start, each rewards or cash back card is scored based on whether it offers an intro APR and how its ongoing APR compares to the rates available on other rewards or cash back cards.

We also score each card based on how its annual fee influences its overall value.

We consider a card’s annual fee in two ways — how it ranks relative to the fees you’ll find on other cards in the category and how it impacts a card’s overall rewards value. Cards with an annual fee will always be at a slight disadvantage in our scoring system since annual fees inherently cut into your rewards value, but if a card offers terrific value via its ongoing rewards and perks, it can earn a high score even if it carries a high annual fee.

With this in mind, we rate a card based primarily on how its ongoing rewards value and ongoing perk value (such as annual credits or bonuses) stack up against other cards in the category when you subtract its annual fee.

Flexibility

We rate each card’s flexibility based on the restrictions it imposes on earning and redeeming rewards and factor this rating into a card’s overall score.

Flexibility factors include whether a card only allows you to earn a high rewards rate on a small amount of spending or requires you to meet a certain earning threshold before you can redeem rewards. We also examine whether your points are worth less when you redeem for some options versus others and whether a card gives you the flexibility to transfer rewards to airline and hotel partners.

We also score each card’s set of features – its perks and benefits — against five tiers of features to provide a rating.

We break down these tiers as follows:

- Tier 1 has less than standard card features (an ultra-streamlined card that offers basic utility and next to nothing in the way of ancillary benefits.

- Tier 2 includes the benefits you’d expect on standard Visa or Mastercard credit cards, such as free access to your credit score, car rental insurance and $0 liability for fraudulent charges.

- Tier 3 includes “prime card” or better-than-average card features like cellphone insurance, lost luggage insurance, concierge services and purchase protection.

- Tier 4 includes luxury features such as airport lounge access, elite status with an airline or hotel and credits for expedited security screening membership programs.

- Tier 5 includes the sort of exemplary benefits you’ll find on top-tier luxury cards, such as high-value travel credits, cardholder memberships and other unique and valuable perks.

Alaska Airlines Visa Signature® credit card

In May 2024, Bankrate collaborated with third-party SliceMR to survey 6160 cardholders nationwide. Bankrate and Slice MR collected, averaged and presented website analytics and cardholder responses to six questions on a 5-point scale. Responses are based on individual cardholder’s product details, and therefore cannot be verified for accuracy. User ratings are unedited and have not been reviewed or approved by credit card issuers, nor do these ratings reflect Bankrate’s own reviews of these cards.

Community Reviews

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Delta SkyMiles® Platinum American Express Card Review

Southwest® Rapid Rewards® Performance Business Credit Card Review

Southwest Rapid Rewards® Plus Credit Card Review

Delta SkyMiles® Gold American Express Card Review

Southwest Rapid Rewards® Priority Credit Card Review

Delta SkyMiles® Blue American Express Card Review

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Get the Most from the Alaska Airlines Visa Credit Card

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Alaska Airlines Visa Signature® credit card is popular among West Coast flyers and credit card maximizers alike for good reason: Its reasonable annual fee ( $95 ) can be easily offset by its solid combination of benefits.

But what if you want to do more than just "offset" the annual fee? Here are all the ways to get the most from your Alaska Airlines Visa Signature® credit card , including earning and redeeming miles and optimizing the useful-but-complex companion fare.

Taking advantage of this card requires a bit of homework, but the effort is well worth it.

Maximizing the companion fare

For many, the annual companion fare that comes with the card each anniversary (as long as you spend $6,000 on the card annually) is worth more than the other benefits combined. The trick is using it to maximum effect.

Here’s how the companion fare works: You can buy two main cabin round-trip airfares on the same Alaska-flown itinerary for the price of one ticket plus $99 plus taxes and fees.

Let’s say you’re buying a ticket that costs $500 total, $150 of which is taxes and fees. If you use the companion fare to add another traveler to this itinerary you would pay:

$500 for the full-priced regular ticket.

$99 for the companion fare.

$150 for the taxes and fees on the companion fare.

Which comes to $749 total for two tickets. In other words, it would cut the price of the second ticket in half.

As you may notice, the trick to getting the most value from this benefit is to use it for high-priced tickets, especially ones without high taxes and fees. Thankfully, Alaska is pretty generous with what it allows to qualify as a "round-trip" ticket, so you can include stopovers, "open jaws" (which don’t return from or to the same city) and other more complicated itineraries.

If you’d rather keep things simple, the Companion Fare is great to use for family travel during the holidays, when even normal domestic flights can be pricey .

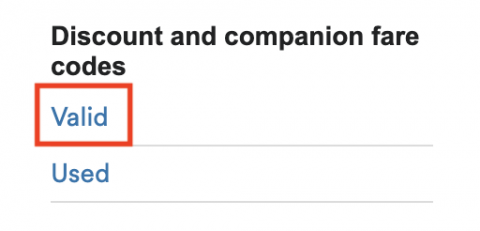

To use the companion fare, log into your Alaska Mileage Plan account on the website (not the app) and look for the "Discount and companion fare codes" section in the left column:

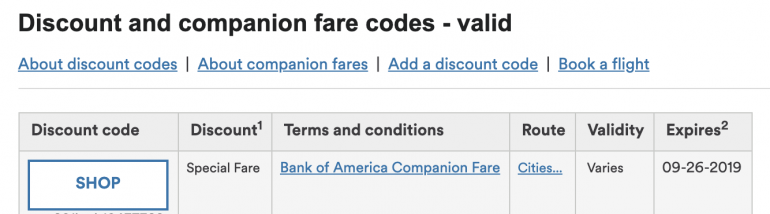

Look for the "shop" button to the left of your active code:

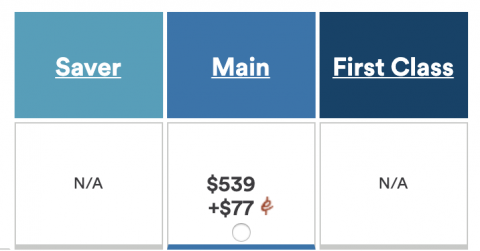

Then, do your flight search as normal. In the flight selection screen, you’ll see the companion fare price next to the weird red symbol:

Those are the basics of how to use this valuable fare. For an in-depth guide to squeezing the most value from it, check out our comprehensive guide to m a x i m i z i n g the Alaska companion fare .

Save on bag fees

When you book with the card, you and up to six companions on the same itinerary get one free checked bag each. This is one of the simplest benefits of the Alaska Airlines Visa Signature® credit card and one of the easiest ways to make the annual fee worth it.

The first bag usually costs $35 each way , so using this benefit on a single round-trip flight can nearly offset the annual fee. Doing so with a companion (or gaggle of companions) can save even more.

Keep in mind that this benefit is effectively nullified for Alaska elite status holders, who already get two free checked bags. That is, the free bag benefit of the credit card doesn't allow elite status holders to get an extra checked bag for a total of three.

» Learn more: Guide to Alaska Airlines Baggage and Other Fees

Earn miles through the card

This card offers two ways to earn Alaska miles: Through the sign-up bonus and through other spending.

Note: Miles earned through your card don't count toward earning Alaska’s MVP elite status. In other words, you can’t earn elite status by spending on the Alaska card.

Sign-up bonus

Here’s the current signup bonus: Buy one ticket, get one for just the taxes and fees ($0 fare plus taxes and fees from $23) and get 50,000 bonus miles with this offer. To qualify, make $3,000 or more in purchases within the first 90 days of opening your account.

Note that minimum spending requirement, and make sure to hit it within the timeframe. This bonus is all-or-nothing, meaning you won’t get any of it if you spend even $5 less than this threshold amount.

» Learn more: Who benefits the most from the Alaska Airlines Visa Signature® credit card ?

Spending on the card

The earning structure on the Alaska Airlines Visa Signature® credit card is straightforward. You’ll earn:

3 miles per dollar spent on eligible Alaska Airlines purchases.

2 miles per dollar spent on eligible gas, EV charging station, cable, streaming services and local transit including ride share purchases.

1 mile per dollar spent on all other purchases.

Since NerdWallet values Alaska miles at 1.3 cents apiece, this 3x multiplier on Alaska purchases is a decent return on spending. Other travel cards offer similar earning rates on travel spending, but none have points or miles that can be transferred to Alaska miles. So if you value Alaska miles, this is a good way to get them.

Also, if you have an eligible Bank of America account, you'll earn a 10% bonus on all miles earned from card purchases. That means if you spent enough to earn 1,000 miles on the card, you would actually receive 1,100 miles with the bonus.

Redeem miles

While earning miles through this card may be relatively straightforward, putting them to good use is the tricky part. Unlike some other airline loyalty programs like Delta (which offers a relatively narrow band of value), Alaska miles offer plenty of "sweet spots" and high-value redemptions. They just require a little work and patience to find.

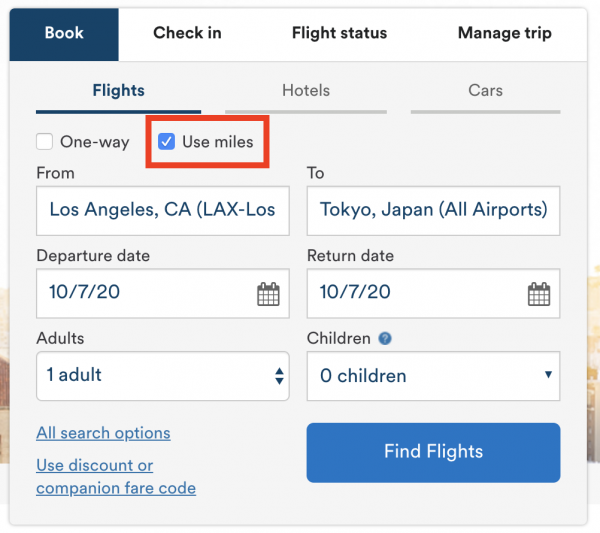

Although Alaska offers plenty of interesting ways to redeem miles, the best value almost always comes the old-fashioned way: using them to book flights. To search for these award fares, check the "use miles" box in the Alaska flight search tool:

The best value is often found in three types of fares (or combinations of all three, as described below:

Partner flights.

Premium cabin flights.

Free stopovers.

Partner flights

Alaska is a member of the OneWorld Alliance, bringing its total partner count to 23 global airlines. Using Alaska miles to book flights with these partners is one of the best ways to get the most bang for your award buck.

However, not all Alaska partners are created equal, and some have far better award charts than others. Here are some airlines to target for partner redemptions:

American Airlines.

Cathay Pacific.

Japan Airlines.

( Note: Cathay awards aren't searchable on the Alaska website. You’ll have to call an Alaska representative to book these awards.)

And here are some partners you can generally avoid:

British Airways.

Singapore Airlines.

Why? British Airways flights often carry outrageous fuel surcharges, and Singapore’s partnership with Alaska, while decent, doesn’t offer great overall value compared with Alaska’s other partnerships with Asian airlines.

» Learn more: Making sense of Alaska Airlines partners

Premium cabin flights

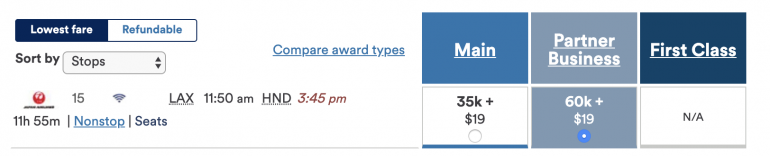

If you’re looking to get the absolute best return on your Alaska miles in terms of pure dollar value, you can’t beat first and business class redemptions, especially on partner flights. For example, you can get from North America to Japan in JAL business class for only 60k miles one way:

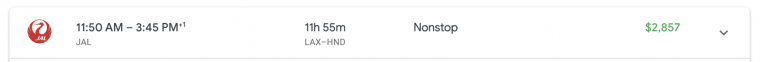

Compared with $2,857 for the same flight paying cash:

That works out to 4.7 cents per mile in value, well above our 1.3 cents baseline. That said, it’s important to ask yourself whether you would ever conceivably spend that much cash on a premium cabin ticket. If not, it might not make sense to book an equivalent award flight, even if the value is excellent.

Free stopovers

While other airlines devalue and restrict their award programs, Alaska has kept one of its most valuable policies: free stopovers on award flights.

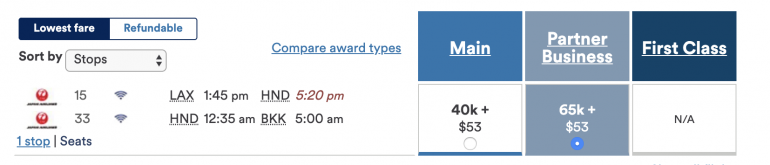

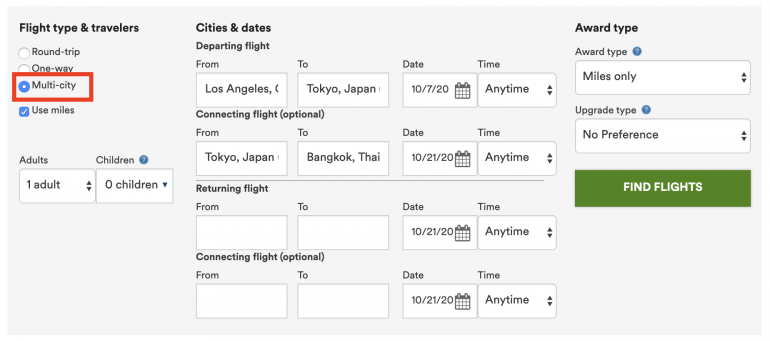

A "stopover" is a long layover in a connecting city — we’re talking up to weeks or months long, so you can effectively get two trips for the price of one. For example, a business class flight from Los Angeles to Bangkok with a two-week stop in Tokyo on JAL costs the same amount (65,000 miles) as a flight from Los Angeles to Bangkok.

To search for stopovers, use the “multi-city” search option on the Alaska flight tool.

Keep in mind that the stopover must be in a hub city for that airline. So if you’re looking to fly through Tokyo, you can only book a stopover award with JAL.

In-flight purchases

Finally, the Alaska Airlines Visa Signature® credit card offers 20% back on in-flight purchases made with the card. This is hardly a huge perk (unless you’re a cheese plate addict), but it offers a good reason to keep the card in your wallet while traveling.

Discount on lounge membership

If you're a frequent Alaska flyer and you usually purchase the Alaska Lounge+ membership anyway, this card will save you $100 on the membership fee. Membership is usually $550 for Alaska elite status members or $650 for non-elites. Alaska Lounge+ includes access to the nine Alaska lounges, plus 90 other partner lounges.

The bottom line

The Alaska Airlines Visa Signature® credit card often ranks as one of our favorite airline credit cards for good reason. It offers valuable perks like free bags and the companion fare without a budget-busting annual fee. That said, with a little research and dedication, you can get far more than average value from this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

British Airways Visa Signature credit card review: Combat high fuel surcharges and earn flexible Avios

Editors note: This is a recurring post, regularly updated with new information and offers.

British Airways Visa Signature Card overview

The British Airways Visa Signature® Card might not be your top choice for using one of your valuable 5/24 slots with Chase. However, its low annual fee, strong earning potential and credits to cover fuel surcharges make it a compelling option for many British Airways loyalists. Card Rating*: ⭐⭐⭐

* Card Rating is based on the opinion of TPG's editors and is not influenced by the card issuer.

Some lucrative credit card options from foreign airlines are often overlooked, and the British Airways Visa Signature® Card — the only cobranded credit card that British Airways offers in the U.S. — is among them.

It has a $95 annual fee that isn't waived the first year and a recommended credit score of 670 or higher.

It doesn't come with common airline benefits such as a free checked bag or priority boarding. Nevertheless, it's one of the more valuable airline cards on the market because of its big sign-up bonus and money-saving perks.

Let's examine whether the card deserves a spot in your wallet.

British Airways Visa pros and cons

British airways visa sign-up bonus.

The British Airways Visa is currently offering a sign-up bonus of 85,000 Avios after spending $5,000 on purchases within the first three months of account opening.

According to TPG's September 2024 valuation , Avios are worth 1.4 cents apiece, so earning 85,000 Avios is worth $1,190.

One important note: Like other Chase-issued cards, the British Airways Visa Signature Card falls under Chase's 5/24 rule . If you've opened more than five credit cards in the past 24 months (from all banks, not just Chase), your application will likely be automatically rejected — even if you have a nearly perfect credit score. Related: Cards currently offering sign-up bonuses of 100,000 points or more

British Airways Visa benefits

Although the British Airways Visa lacks many of the usual cobranded airline card perks, such as a free checked bag and priority boarding, the ones it does offer can still save British Airways flyers a significant amount on cash and award tickets.

- Reward flight statement credit: Receive a statement credit three times a year of $100 for Economy (World Traveller) and Premium Economy (World Traveller Plus) seats — or $200 for Business (Club World) and first-class seats — when you book a reward flight to London traveling on British Airways and pay taxes, fees and charges with your British Airways Visa Signature Card.

- Travel Together Ticket : Spend $30,000 on the card each calendar year and earn a Travel Together Ticket, which allows you to add a companion to a Reward Flight for no additional cost or save 50% on the Avios required if traveling solo. This is on any round-trip British Airways, Iberia or Aer Lingus redemption in any class.

- 10% flight discount: Get 10% off eligible British Airways flights when you book through the website provided in your welcome materials.

- Visa Signature perks: As a Visa Signature card, you'll get perks like lost/delayed baggage protection , purchase protection , secondary car rental insurance and access to the Visa Signature Luxury Hotel Collection .

- No foreign transaction fees : You won't be charged extra fees when you use your card abroad.

Again, these are different benefits than you'll find on many cobranded airline cards, but they can provide significant value to those who regularly book award flights using Avios.

Related: British Airways Executive Club: Guide to Avios, elite status and transfer partners

Earning Avios on the British Airways Visa

The British Airways Visa outdoes most other cobranded airline cards on the earnings side. With the British Airways card, you'll earn:

- 3 Avios per dollar spent on purchases with British Airways, Aer Lingus and Iberia

- 2 Avios per dollar spent on hotel bookings made directly with the hotel

- 1 Avios per dollar spent on all other purchases

While these aren't impressive earning rates, the bonus categories and the value cardholders can get from the card's additional benefits make this a good card option for many British Airways frequent flyers.

Related: The best ways to earn British Airways Avios

Redeeming Avios on the British Airways Visa

The most obvious way to redeem the Avios you earn with the British Airways Visa is to book award tickets with British Airways. Thanks to British Airways' distance-based award chart, one of the biggest sweet spots in the program is for short-haul awards. The program charges a mere 7,250 miles for award flights that are 651 miles to 1,151 miles long during off-peak season and 13,500 miles for business class during off-peak season.

Still, British Airways imposes hefty taxes and surcharges on some of its own international award tickets.

Therefore, the best uses for Avios are sometimes for partner awards. You could redeem your points on more than a dozen Oneworld alliance airlines , such as American Airlines, Alaska Airlines, Cathay Pacific and Iberia.

Related: How to maximize the British Airways distance-based award chart

Transferring Avios on the British Airways Visa

You can transfer Avios on the British Airways Visa to other Avios-earning airlines like Qatar Airways, Aer Lingus, Finnair and Iberia. This allows you to travel to many Oneworld destinations and book them with these Avios.

As the mileage currency of British Airways, Iberia and Aer Lingus, Qatar Airways, and Finnair, you can transfer Avios between the five airlines.

Iberia tends to charge significantly lower taxes and surcharges than British Airways and periodically offers discounted award redemption rates , including business class to Europe, from just 34,000 miles one-way. Additionally, Iberia charges based on total miles flown instead of per segment, making it the winner for some connecting itineraries.

I have gotten good value from my Avios by using them to book through Iberia to fly from O'Hare International Airport (ORD) and San Francisco International Airport (SFO) to Madrid in business class for under 34,000 Avios each time.

Related: How to book Iberia flights to Spain (and beyond) using Avios

Which cards compete with the British Airways Visa Card?

You may decide to go with a different card that earns Avios or a card that earns transferable points that you can transfer to Avios, like one of these:

- If you are not over the 5/24 rule: The Chase Sapphire Preferred® Card also comes with a $95 annual fee and earns 5 points per dollar spent on travel when booked through the Chase Travel℠ portal and 2 points per dollar on all other travel. It also earns bonus points on dining and select streaming services. For more information, read our full review of the Chase Sapphire Preferred .

- If you are over the 5/24 rule. The American Express® Gold Card has a higher annual fee of $325 (see rates and fees ) but also offers higher earning rates and comes with many valuable perks that offset the annual fee, including up to $424 in annual dining statement credits (enrollment required). The Membership Rewards points earned by this card can be transferred at a 1:1 ratio to British Airways. For more information, read our full review of the Amex Gold .

- If you want to earn Avios with a different card: The Iberia Visa Signature® Card has the same earning structure as the British Airways Visa. However, it has more Iberia-specific perks, like a 10% discount when booking select Iberia flights. For more information, read our full review of the Iberia Visa Signature .

For additional options, check out our full list of the best airline credit cards .

Related: 5 reasons you should care about Avios

Is the British Airways Visa worth it?

The British Airways Visa is well worth it if you want to earn valuable Avios. Its benefits, like the 10% flight discount and the up to $600 reward flight statement credit, can easily help you recoup the annual fee cost. However, you'll likely prefer a different card if you're over Chase 5/24 or don't travel on airlines that use Avios.

Bottom line

Diversifying your portfolio of loyalty currencies is critical in the world of travel rewards, and the British Airways Visa represents a fantastic way to do just that.

With a valuable welcome offer, a low annual fee and the opportunity to get some of your taxes and fees credited back, this card is a great choice for British Airways loyalists.

Apply here: British Airways Visa Signature Card

For rates and fees of the Amex Gold card, click here .

COMMENTS

The Alaska Airlines Visa Signature® credit card offers a few travel protections through Visa Signature, like lost luggage reimbursement, rental car insurance, and travel and emergency assistance ...

SEATTLE, WA — A new year reveals new reasons to celebrate what makes the Alaska Airlines Visa Signature® credit card, co-branded with Bank of America, better and more valuable than ever.. Our current and new cardholders can now take advantage of enhanced benefits when they use the card while traveling with us and while making everyday purchases - from earning more miles in new ways to ...

Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected]. For your next Alaska Airlines flight, get travel insurance to protect yourself, your valuables, and your travel experience if your trip is cancelled or interrupted by the unexpected.

New applicants for the Alaska Airlines Visa Signature® credit card can buy one ticket and get one ticket for just the cost of taxes and fees ($0 fare, plus taxes and fees from $23), plus get 50,000 bonus miles after spending $3,000 or more on purchases within the first 90 days from account opening. THE POINTS GUY.

With your Alaska Airlines Visa Signature ® credit card you earn unlimited miles and travel with no blackout dates on Alaska Airlines flights when booking with miles or a companion fare.. With oneworld ® Alliance member airlines and Alaska's Global Partners, Alaska has expanded their global reach to over 1,000 destinations worldwide bringing more airline partners and more ways to earn and ...

How to file a claim with Alaska travel insurance. Alaska gives you two options to file a claim through Allianz Travel: File a claim online. You can file a claim online by visiting https://www ...

Alaska Airlines credit card offer. For a limited time, get a $0 Companion Fare (plus taxes and fees from $23) and 50,000 bonus miles after qualifying purchases made with the Alaska Airlines Visa ® card. With the Alaska Airlines Visa Signature ® card, you'll enjoy plenty of exclusive benefits. Apply now.

Earn an annual companion fare starting at $122 ($99 fare plus taxes and fees from $23) after you spend $6,000 or more on purchases within the prior anniversary year. Free checked bag. Enjoy free ...

Check the number located under your name on your credit card. To combine or remove duplicate Mileage Plan™ account, please contact Alaska Airlines customer care at 1-800-654-5669. If you purchased items with your Alaska Airlines credit card and later returned them, the miles you earned on those purchases will be deducted from your Mileage ...

One of the biggest benefits of the Alaska Airlines Visa Signature® credit card is the Companion Fare. Buy one airline ticket and bring along a travel companion for as little as $99, plus taxes ...

Alaska Airlines Visa Signature® credit card. 3 miles per dollar spent. 4.5 cents. First checked bag free for you and up to six companions on the same reservation. 20% back on inflight purchases when paying with your card. $95. Alaska Airlines Visa® Business card. 3 miles per dollar spent. 4.5 cents.

Cardholders now enjoy new ways to earn double miles on everyday purchases, priority boarding, expanded free checked bag privileges; for a limited time, new cardholders can receive 70,000 bonus miles after making qualifying purchases A new year reveals new reasons to celebrate what makes the Alaska Airlines Visa Signature® credit card, co-branded with Bank of America, better and more valuable ...

1 mile - 3 miles. Annual fee. $95. Regular APR. 21.24% - 29.24% Variable APR on purchases and balance transfers. 4.5. Bankrate Score. Hover to learn more. Our writers, editors and industry experts ...

So, if you have a Bank of America account and the Alaska Airlines Visa Signature® credit card, and you spend $500 a month on gas, instead of only earning 1,000 Alaska miles, you will earn 1,100 ...

Visa Infinite cards offer trip cancellation and interruption protection covering the cardholder (you) and your immediate family when you purchase common carrier travel with your card. This benefit can reimburse up to $2,000 per trip for nonrefundable common carrier fares if you must cancel or interrupt your trip for a covered reason.

The Alaska Airlines Visa Signature® credit card, issued by Bank of America®, stands out from much of the airline-card competition for one major reason: It offers an annual Companion Fare, which ...

60,000. And each account anniversary year, you can earn another $99 (plus fees from $23) companion fare when you spend $6,000 or more in the previous year. The Alaska Airlines Visa Signature ...

Apply now for Alaska Airlines Visa Signature® credit card at Bank of America's secure site Buy One, Get One + 50,000 Bonus Miles! 50,000 bonus miles plus buy one ticket, get one for just the taxes and fees ($0 fare plus taxes and fees from $23) with this offer. To qualify, make $3,000 or more in ...

The earning structure on the Alaska Airlines Visa Signature® credit card is straightforward. You'll earn: 3 miles per dollar spent on eligible Alaska Airlines purchases. 2 miles per dollar ...

Earn a Travel Together Ticket (companion pass) every calendar year you make at least $30,000 in purchases; Save up to $600 annually in award taxes and fees on British Airways flights; No foreign transaction fees; Visa Signature card perks including trip and baggage protection; Miles redemption limited to British Airways and Oneworld alliance ...