CRA Mileage Rate 2024: Guide to Tax-Free Vehicle Allowances For Business Travel

Cra mileage rate 2024.

Are you an employee, small business owner, or self-employed individual looking to understand the rules and regulations of CRA mileage rate this 2024 ? Canadian taxpayers need to be aware of what they can expense on their taxes as entertainment, such as meals or kilometres travelled in a car.

We will discuss all relevant to ensure you maximize your deductions for businesses travelling while remaining compliant.

Key Takeaways

- 70¢ per kilometre for the first 5,000km driven

- 64¢ per kilometre after that

- 74¢ per kilometre for the first 5,000km driven

- 68¢ per kilometre after that

Changes to the CRA mileage rate for 2024

When reimbursing employees for business travel, the Canada Revenue Agency (CRA) has set out a specific set of rules that employers must adhere to. Canadian taxpayers should be aware of these rules when managing their business expenses to avoid any penalties from the CRA.

The 2024 standard CRA mileage rate per kilometre is currently 70 cents with a 4-cent per kilometre reduction after the first 5,000 kilometres driven yearly.

Here’s the CRA’s Automobile Allowance Rates for the past five years:

You can report any tax-subjected automobile allowances paid to employees or officers on Form T2200 Declaration of Conditions of Employment .

Employers can claim input tax credits based on reimbursements made for these expense claims but must ensure they keep detailed records alongside invoices related to any incurred costs.

Businesses must recognize reimbursement requirements, as failure to comply could result in CRA-implemented fines and other financial penalties, which will financially affect both employers and their staff.

What is CRA mileage allowance and tax-free vehicle allowance in Canada?

The CRA mileage rates are a guide set by the Canada Revenue Agency to reimburse taxpayers for vehicle expenses incurred for business use. They calculate the deductible expenses related to operating a vehicle for business, medical, moving, or charitable purposes. Taxpayers can use these rates to calculate their deductible vehicle expenses when filing their income tax returns.

How to use the 2024 CRA mileage rate and automobile allowance: Salaried workers, Self-employed, and Employers

Mileage reimbursement rules for salaried workers.

Employees may be eligible to claim allowable motor vehicle expenses on their income tax return if they incurred these expenses under the terms of their employment contract. For instance, if an employer agrees to reimburse travel expenses for using one’s personal vehicle for work-related tasks.

However, it’s essential for employees to maintain accurate records and evidence to substantiate that the kilometers claimed were indeed for business purposes.

Mileage Reimbursement Rules for Self-employed

Self-employees can also deduct business-related vehicle expenses. This also applies to personal cars used for business purposes such as purchasing supplies for your businesses, meeting with clients, attending conferences, or visiting customers. Other expenses may also include:

- License and registration fees

- Fuel and oil expenses

- Insurance fees

- Maintenance and repairs expenses

- Leasing costs

- Capital cost allowance

The allowance will be deducted in the annual tax returns. But remember, self-employees must keep receipts and invoices in order to get deductions. Expenses incurred for personal use of their personal vehicle will not be eligible for coverage under the allowance.

Mileage Reimbursement Rules for Employers

There is no law mandating that employers must compensate employees for using their personal vehicles for business purposes – this depends on individual company policies or contracts.

Nevertheless, implementing a mileage allowance using Canada Revenue Agency (CRA) standards can make a job offer more attractive to potential employees, as it compensates for their personal vehicle usage.

With a CRA mileage allowance, employers are obliged to cover employees’ work-related vehicle expenses. This reimbursement also provides a tax benefit for the company. To qualify as legitimate and tax-deductible, the reimbursement should:

- Cover the yearly amount of kilometres driven solely for business purposes

- Be based on a reasonable per-kilometre rate or slightly lower than the official CRA vehicle allowance rates

- Be for the employee who hasn’t already been reimbursed for the same use of their vehicle.

If these conditions are met, the mileage reimbursement is considered a non-taxable benefit for employees.

Eligibility For CRA Mileage Rate 2024 And Tax-Free Vehicle Allowances

The CRA provides rules and regulations for claiming tax-free vehicle allowances and mileage rates when travelling for business purposes.

You are also eligible if you use your car to attend conventions, seminars or meetings, and other activities with work-related purposes away from home. But travelling from your home to your normal place of work is not considered business-related driving.

The type of transportation used is essential—employees using public transport, such as buses and subways, do not qualify for any reimbursements. At the same time, those who choose personal cars will receive a predetermined per-kilometre rate (according to the CRA standard mileage rate as shown above).

4 Types Of Business Travel Eligible For CRA Mileage Rates And Tax-Free Vehicle Allowances

- Regular Work Locations

- Temporary Work Locations

- Home Office as a Regular Work Location

- Commuting to Work

Whether travelling for regular work locations, temporary work locations, home office or commuting to work, you’ll find everything you need to know about the CRA mileage rates and tax-free vehicle allowances here.

Canada Revenue Agency (CRA) defines regular work location as any workplace that the employee visits at least once a week on a sustained basis for a purpose related to their employment.

It includes both long-term and short-term job positions or assignments. The employer must be able to provide sufficient proof of attendance; records such as timesheets should help demonstrate this.

In addition, travel expenses associated with these locations are only eligible for reimbursement if they are located more than 80 km (one way) from the primary place of business or residence of the employee.

For example, an accountant who works in Toronto but travels to Ottawa each weekend would likely qualify for CRA mileage rate reimbursements since it’s more than 160 km one way between cities—even if he has not been assigned there permanently yet.

Any work location other than an employee’s regular place of employment is considered a “temporary” work location and would be eligible for mileage rate and tax-free vehicle allowances.

According to CRA guidelines, temporary locations last up to four weeks or have been pre-approved by the employer in writing. Considering all surrounding circumstances, the employer must demonstrate why the travel was reasonable.

Any expenses related to this travel, such as lodging, meals, allowance and specific motor vehicle rates, can be deducted from income if proven to be necessary business or relocation expenses incurred during that journey.

- Home Office As A Regular Work Location

Home offices may qualify for either CRA mileage reimbursement or tax-free vehicle allowance when it is determined to be a regular work location.

To qualify as a regular work location, the home office must be used for working with clients or customers more than 50% of the time each month and must meet specific criteria, such as having private entrances, separate telephone lines and an exclusive portion of the residence dedicated solely for business activities.

- Commuting To Work

Commuting expenses incurred while travelling to and from work regularly are usually not eligible for mileage rate or tax-free vehicle allowance benefits under the CRA.

However, Canadian taxpayers can claim certain commuting expenses for business activities associated with their job or profession that require them to travel and attend industry events or other such engagements away from their workplace.

To be eligible, the primary purpose of this travel must be generating income by performing duties related to your job/profession rather than commuting between home and work.

LEARN MORE: How to Find the Best Tax Accountant Near Me

Mileage Reimbursement Implications

Tax implications.

In Canada, tax deductions are available to businesses for business travel expenses, including mileage and car allowances. Mileage allowance paid to employees or officers is treated as a taxable benefit subject to the employer’s income tax withholding at source.

If an employee is provided with the use of a company car, this will be presented as part of their salary, and taxes will be deducted accordingly. For employers, eligible expenditure on providing car allowances to employees may also qualify for input tax credits if applicable according to prevailing rules in each province or territory.

Accurate tracking and record-keeping are essential when claiming CRA mileage rates and tax-free vehicle allowances for business travel. Recent changes have been implemented regarding the supporting documentation that employers must keep to claim certain deductions from their business’s income taxes relating to these types of expenses (e.g., a detailed log that includes the date of travel, route taken, and distance travelled).

If you need clarification about the tax implications, you can always consult a tax accountant who can help you with personal and corporate tax matters.

External Influences

- Economic Conditions : Rates might be adjusted to align with prevailing economic conditions.

- Cost of Fuel: Fluctuations in fuel prices may cause the allowance rate to increase or decrease.

- Inflation Rates: General inflation can affect the cost of vehicle maintenance, repairs, insurance, and other related expenses. CRA might adjust the mileage allowance accordingly.

- Policy Changes: Any new regulations regarding business expenses and reimbursements might necessitate changes to the allowance.

- Technological Advancements: The increase in electric and hybrid vehicles can affect the per-kilometre cost calculation regarding vehicle expenses, which could potentially impact the CRA mileage allowance.

3 Tips For Managing Business Travel Expenses and Mileage Tracking

– Provide clear guidelines for employees to follow when tracking and recording business travel expenses, such as keeping detailed records and utilizing technology.

1. Keep Detailed Records

Keeping detailed records of business travel expenses is essential for Canadian taxpayers. It helps to accurately calculate CRA mileage rates and tax-free vehicle allowances and avoid potential issues during an audit from the Canada Revenue Agency (CRA). Taxpayers need to keep records such as:

• Gas receipts

• Oil changes

• Car maintenance & repair costs

• Insurance payments

• Any other related out-of-pocket expenses

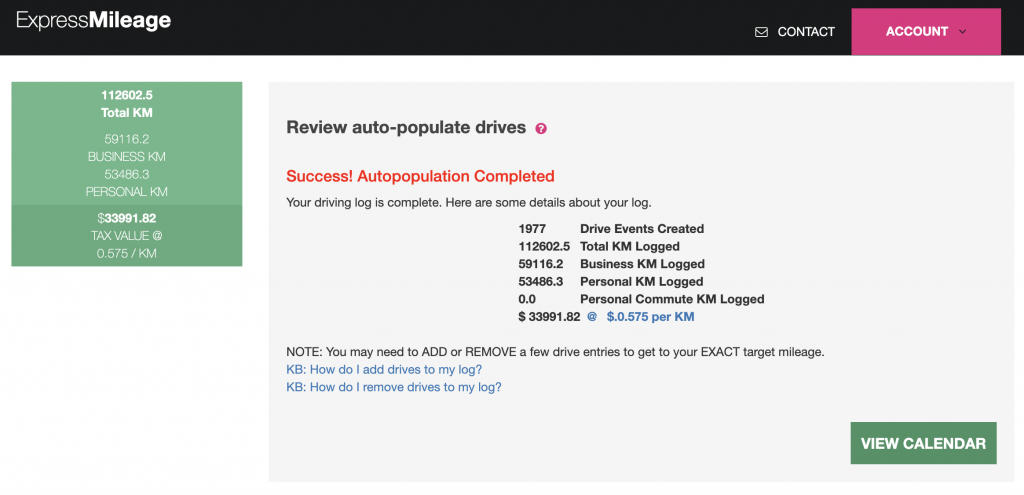

By keeping these mileage records, Canadian taxpayers can easily track their business travel expenses and ensure everything is accounted for correctly. Further, it provides evidence that any vehicle deductions are legitimate, so there are no problems or additional costs associated with CRA audits. Technology can also help Canadians monitor their spending by using various automatic mileage tracking tools, such as Driversnote’s expense reimbursement system and tracking tool – perfect for managing business trips abroad or just around town!

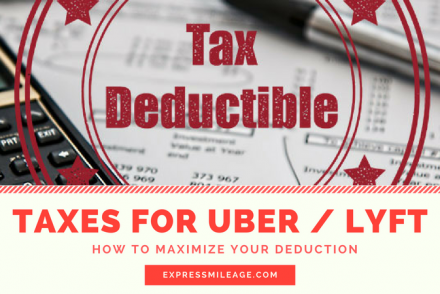

2. Use Technology To Track Vehicle Expenses

Technology can be a valuable tool for managing business travel expenses associated with CRA mileage rates and tax-free vehicle allowances. Mileage tracking apps and other tools can enable accurate record-keeping and precise calculations, which can help taxpayers claim total tax deductions. Keeping a detailed log of trips is still necessary, but using technology reduces the need for manual tracking of odometer readings while adding convenience.

Examples of mileage tracking apps include TripLog , MileIQ , QuickBooks Self Employed , etc. Additionally, businesses may install GPS units on employee vehicles to keep track of automobile-related expenses for various purposes, including deduction claims at year-end taxes or providing client billing information when required.

Using these apps or tools can make managing business travel expenses in different locations within Canada easier by automatically tracking all drives based on time spent driving as per kilometre rate set by the CRA standard mileage allowance (SMA). It saves time to manually enter odometer readings every time an individual travels between two points, ensuring that no detail remains unaccounted during tax filing or claiming expenditures from bosses/employers, respectively.

DISCOVER: Free Resources

3. Reimburse Employees Promptly

Employers must ensure that employees are reimbursed promptly and accurately for travel expenses on business trips to avoid any potential complications or legal ramifications.

Promptly reimbursing employees helps maintain employee morale and makes them feel empowered and valued, primarily if the employer guides them in navigating the expense system. Hence, they know exactly what to do when their reimbursements will be delivered and why it’s crucial.

According to Canadian tax laws, employers who provide an automobile allowance must maintain documents clearly outlining this arrangement and documenting all claims made by employees against it via an expense reimbursement form.

Furthermore, failure to automate the process in some way may lead to delays with repayment — another aspect that should be addressed in such arrangements.

- Understanding Provincial/Territorial Allowances and Mileage Rates in Canada

Canadian taxpayers are responsible for understanding the differences between federal and provincial/territorial allowances when claiming expenses related to business travel.

The CRA has a standard mileage rate of $0.70 per kilometre for the first 5,000 kilometres driven each year; however, some provinces or territories might have additional tax-free vehicle allowance amounts based on their accommodations, cost of living or other particular circumstances that could increase the amount an individual can claim up from CRA’s base rate.

CRA Mileage Rate 2024 Conclusion

As business travel can be complicated and expensive, understanding the CRA mileage rates and tax-free vehicle allowances is essential. Following the rules prescribed by the Canada Revenue Agency (CRA) can save time, money, and energy when preparing your taxes.

The key takeaway from this article is to keep records of all your travels—including destinations, distances travelled, and dates—and submit accurate expense reports for CRA mileage reimbursement or claim for a business vehicle allowance as per eligible criteria as soon as possible.

Common questions related to CRA Mileage Rates this 2024 And Tax-Free Vehicle Allowances For Business Travel relate to eligibility criteria for claiming deductions on taxes relating to business trips; applicability of different rates in various provinces/territories; use of technology tools for tracking expenses; etc., all of which have been addressed throughout this article.

It’s also essential to remember that expenses must adhere to guidelines set forth by the Canada Revenue Agency’s prescriptions for deductions to apply on personal income tax filings.

1. What are the CRA mileage rates for business travel?

The Canada Revenue Agency (CRA) sets a mileage rate for business travel for automobile and bicycle use. Currently, the kilometric rate is set at $0.70/km (2024)for taxis, cars or vans leased or owned by employees.

2. How do you calculate vehicle allowances provided by employers through CRA?

To calculate vehicle allowance amounts provided by employers using the CRA mileage rate, multiply an employee’s total business kilometres driven during a given tax year with the corresponding kilometric rate of ($0.70 per km 2024 for the first 5,000km and $0.64 thereafter). This amount should be included in Box 14 on their T4 slip from the employer to declare it as income when filing taxes every year unless the allowance meets certain criteria and is considered “reasonable.”

3 . Are car expenses covered under my prescribed mileage rates allowance?

Yes – once you met CRA’s conditions, reimbursed car expenses such as insurance costs and eligible lease payments are intended to be covered by your prescribed mileage rates allowance according to CRA guidelines.

Are you looking for assistance with your personal or corporate taxes? Look no further than CPA Guide. Our network of top accountants and accounting firms in Canada will help you find the best CPA to suit your needs. Get started today with CPA Guide .

Taxpayer finds himself on wrong side of CRA when claiming employee expenses

Jamie Golombek: Changes to how travel allowance was calculated and paid trip up B.C. boilermaker

You can save this article by registering for free here . Or sign-in if you have an account.

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

If you’re required to use your own vehicle for work, perhaps to visit clients or for other work reasons, most employers will reimburse you based on a per-kilometre basis and, provided the reimbursement is reasonable, it need not be included in your income for tax purposes.

Taxpayer finds himself on wrong side of CRA when claiming employee expenses Back to video

But a recent case shows what can happen when an employer provides its employees with an allowance that’s not entirely based on the actual kilometres the employee has driven.

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Sign In or Create an Account

Before delving into this latest employment expense case , let’s review the general rules for deducting automobile expenses. If you’re an employee who needs to use your car for work, you must meet certain conditions in order to deduct some of your automobile expenses on your tax return.

CRA conditions

First, you must normally be required to work away from your employer’s place of business or in different places. Second, under your contract of employment, you must be required to pay your own automobile expenses, and this must be certified by your employer on a signed copy of CRA Form T2200, Declaration of Conditions of Employment.

Finally, you must not be the recipient of a “non-taxable” allowance for motor vehicle expenses. An allowance is considered to be non-taxable when it is solely based on a “reasonable” per-kilometre rate. For 2023, the Canada Revenue Agency considers a reasonable rate to be 68 cents per kilometre for the first 5,000 kilometres driven, and 62 cents/km after that. In the territories, the rate is four cents/km higher.

If your employer reimburses you, but you feel the amount was not reasonable to cover the actual operating costs of your vehicle, you can deduct the employment portion of your vehicle operating expenses provided you include the employer vehicle allowance you received in your income.

Get the latest headlines, breaking news and columns.

- There was an error, please provide a valid email address.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Travel expenses taxable?

This most recent case involved a Kelowna, B.C. taxpayer who has worked as a boilermaker for more than 30 years. The terms of his employment are governed by a collective agreement between his union and the Boilermaker Contractors’ Association of British Columbia, an umbrella association of member companies who together are the taxpayer’s “employer.”

The taxpayer said his union hall typically calls him at his home to let him know what and where his next job is, and most of his jobs require him to drive from Kelowna to other locations. In the years under review, the taxpayer travelled to jobs in various parts of B.C., such as Port Alice, Fort Nelson, Trail, Kamloops, Castlegar, Quesnel and Crofton, as well as Edmonton, among other locations.

The issue in the case was whether the travel allowances received by the taxpayer of $4,006 in 2014 and $6,590 in 2015 were taxable, and whether any amount of his motor vehicle expenses was deductible from his employment income in those years.

The issue arose because in 2014 and 2015, the collective agreement changed the way travel allowances were calculated and paid to employees. The process for reimbursing employees for travel was streamlined by eliminating the need for receipts and using a single location as a common starting point for calculating the per-kilometre reimbursement for all work-related trips. The changes also ended up affecting the employees’ tax treatment.

In the previous collective agreement, the taxpayer’s employer paid him his hourly rate for travel time, plus full airfare and transportation costs to his hotel. Under the new collective agreement, which governed the tax years under review, the employer reimbursed the taxpayer for use of his motor vehicle by paying a travel allowance calculated using the CRA’s annual per-kilometre vehicle rate , measured using Burnaby City Hall as a common starting place for all workers, regardless of whether a person actually set out from there (which the taxpayer typically did not). There was no additional payment or reimbursement for travel time or expenses incurred, subject to specific exceptions for expenses such as ferries, tolls, taxis and airfare.

The taxpayer testified he didn’t have to submit receipts for travel under this regime, and would automatically receive the allowance if he was dispatched to an out-of-town worksite. He said this new method of calculating the allowance sometimes paid him less than it actually cost him to travel, and sometimes it paid him more, so it “likely averaged out” at the end of the year. He also recalled that under the previous collective agreement, his travel reimbursements were never subject to tax.

During the CRA audit, the taxpayer provided copies of forms T2200 for 2014 and 2015, dutifully signed by one of the companies he did a significant amount of work for in those years. On the form, the employer confirmed the taxpayer was required to pay expenses for which he did not receive an allowance or reimbursement and confirmed it did pay the travel allowances under review by the CRA.

The judge reviewed the facts and the legislation. Put simply, the legislation states that an allowance for motor vehicle expenses must be “wholly reasonable” in order to be excluded from employment income. Allowances that are unreasonable must be included in income in their entirety, as the taxpayer has no discretion to carve out a reasonable portion from the rest. As a result, if a car allowance is considered unreasonable and must therefore be included in the taxpayer’s income, the taxpayer can deduct their actual motor vehicle expenses from their income.

The judge ruled that since Burnaby City Hall is “an arbitrary starting point,” the allowance was not solely based on the number of kilometres driven by the taxpayer, and was therefore not reasonable and needed to be included in income.

As for the possible deduction of the taxpayer’s actual motor vehicle expenses, this matter was left unclear. Since the collective agreement allows the taxpayer (and other boilermakers) to live and base themselves in or outside B.C.’s Lower Mainland, the judge queried whether travel from one’s home to the out-of-town locations is personal versus work-related.

Nevertheless, without the taxpayer providing his actual expenses, the judge was not willing to allow the taxpayer to simply deduct expenses equivalent to the amount of the taxable allowances.

A most unfortunate result for the taxpayer.

Jamie Golombek, CPA, CA, CFP, CLU, TEP, is the managing director, Tax & Estate Planning with CIBC Private Wealth in Toronto. [email protected] .

_____________________________________________________________

If you liked this story, sign up for more in the FP Investor newsletter.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.

Posthaste: Canadian dollar could throw wrench into Bank of Canada rate cuts

Why canadian mortgage rates may be stealthily heading higher, opinion: want a truly fairer income tax system tax families, canadian dollar could sink to 50 cents a decade from now, says analyst, 'mark my words': canadian tech investor warns trudeau of capital flight after tax hike.

This website uses cookies to personalize your content (including ads), and allows us to analyze our traffic. Read more about cookies here . By continuing to use our site, you agree to our Terms of Service and Privacy Policy .

You've reached the 20 article limit.

You can manage saved articles in your account.

and save up to 100 articles!

Looks like you've reached your saved article limit!

You can manage your saved articles in your account and clicking the X located at the bottom right of the article.

- @achenhenderson >

- /AchenHenderson >

What is the 2024 CRA per-kilometer Allowance Rates?

2024 cra per-kilometer allowance rates.

The Canada Revenue Agency (CRA) has adjusted the per-kilometer rates for vehicle allowances, varying by year and location. Here’s a breakdown of the recent revisions:

2024 Automobile Allowance Rates:

– $0.70 per kilometer for the initial 5,000 kilometers.

– $0.64 per kilometer beyond the first 5,000 kilometers.

– In the Northwest Territories, Yukon, and Nunavut, an additional 4 cents per kilometer is permitted for travel.

2023 Automobile Allowance Rates:

– $0.68 per kilometer for the first 5,000 kilometers.

– $0.62 per kilometer after the initial 5,000 kilometers.

– Additional allowance of 4 cents per kilometer for travel in the Northwest Territories, Yukon, and Nunavut.

2022 Automobile Allowance Rates:

– $0.61 per kilometer for the initial 5,000 kilometers.

– $0.55 per kilometer beyond the first 5,000 kilometers.

– An extra 4 cents per kilometer was allowed for travel in the Northwest Territories, Yukon, and Nunavut.

How to Manage Automobile Interest and Operating Costs?

Aside from capital or leasing expenses, vehicles entail additional costs that can be expensed within the company. These include fuel or electricity, insurance, repairs, maintenance, interest (subject to CRA limits), and license and registration fees. Such expenses are typically fully expensed in the corporation where the vehicle is owned or leased, with proper record-keeping required to support the claims.

How to Maintain Records?

To substantiate deductions, individuals or companies must maintain records of total kilometers driven and those driven for business purposes. This can be achieved through a logbook for each business-used vehicle, documenting the date, destination, purpose, and kilometers driven for each trip. Additionally, odometer readings at the fiscal period’s start and end, or upon vehicle changes, must be recorded. Employees and owners may be eligible for a simplified logbook method .

How to Utilize Technology?

Various apps are available to assist with logbook maintenance, such as MileIQ and MileBug , which can export data for accounting purposes. For automobile allowance recipients, maintaining a logbook is sufficient. However, companies or vehicle owners must retain all receipts and invoices for vehicle-related expenses, ensuring they detail the date, amount, expense type, and vendor name.

If you want to discover more insights about How to Claim Motor Vehicle Expenses for Your Business in Canada , click here.

At Achen Henderson , we help entrepreneurs and business leaders build great companies. Do you have questions about how we can help you pay less tax in your corporation? Get in touch today!

Share this article

Join our community today.

Sign up for the “Your Business Unleashed” newsletter.

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

The complete guide to corporate mileage reimbursement

An employer’s guide to car allowance, what is a car allowance and how does it work.

?)

Start writing your own corporate travel policy with our comprehensive template

What does car allowance cover, wear and tear, other maintenance, insurances, taxes, and depreciation costs, what is the average car allowance amount, how to calculate car allowance for employees, 1. use a tool like the cra’s car allowance rate calculator to calculate fuel costs., 2. caa for car repair estimates., 3. use a comparison site for car insurance., 4. calculate depreciation and other fees., understanding mileage rates for car allowance, mileage rates in canada, the differences for a company car vs car allowance, pros and cons of car allowance, the pros of a car allowance, the cons of a car allowance, learn how to write a comprehensive business travel policy with our ebook., car allowance: frequently asked questions, is car allowance taxable, does company car allowance count as income, as an employer, can i take away my employee’s car allowance.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Corporate Travel Resources

- Thoughts from TravelPerk

- User Reviews

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

Discover how TripLog can drive time and cost savings for your company.

TripLog is the market’s premier mileage and expense tracking solution. We cater to businesses of all sizes and industries. Find out how much your company can save:

Learn about new features, tips & tricks, and how people have used TripLog to save thousands of dollars and man-hours.

- What’s new

2024 CRA Mileage Rate Explained – How To Claim CRA-Approved Mileage Deductions in Canada

Sehela Simin

Whether you are a self-employed or salaried worker in Canada, using your personal vehicles for work means that any car-related expenses incurred when conducting business are tax-deductible. The CRA allows you to claim these deductions if you have accurate records that show how you used your personal vehicle for business purposes.

Today, we will explain the CRA’s regulations for both self-employed and salaried workers in detail, as well as how TripLog’s mileage/kilometer tracking solutions can help you save thousands every tax season.

CRA Rules: Mileage/Kilometer Tracking For Self-Employed

Self-employed individuals can find the general guidelines for motor vehicle expense deductions in Canada here . It’s worth noting that business-related travel expenses are only deductible if the vehicle is used for both personal and business purposes.

Related: Are You an Independent Contractor or an Employee?

Below is a synopsis of all the deductible vehicle expenses that you should monitor and record in order to be eligible for deductions come tax time.

Total Operating Expenses

Individuals can claim any expenses incurred for operating their vehicles for business purposes to the CRA. These expenses can include fuel costs, maintenance, repairs, licenses, insurance, and certain leasing costs (additional details here ).

As stated above, you will need accurate records to prove that you incurred these costs when conducting business using your personal vehicle. Using pen-and-paper mileage logs can be time-consuming and inaccurate, costing you thousands. Try TripLog free for 15 days and see your savings immediately with our intuitive in-app expense reports !

Capital Cost Allowance

Capital cost allowance (CCA) refers to either the fair market value or the cost of the vehicle used for business purposes; whichever is lower if it’s a passenger vehicle that fits no more than eight passengers, including the driver, and is valued under $20,000.

For any passenger vehicle costing more than $20,00 and/or motor vehicles such as vans and pickup trucks, you can find the details here .

You can deduct up to $250 every 30 days on any interest you pay on loans used to buy your vehicle.

Personal vs. Business Segment

As mentioned above, the portion of your total expenses, capital cost, and interest that you can claim will be the proportion of the total kilometers driven for business vs. personal use of the passenger vehicle.

For example, let’s say you accrued $8000 in business expenses when using your personal vehicle, and you drove for 32,000 kilometers, with 24,000 representing business use. Using the below equation, we find that the deductible amount of $6,000.

(24,000 ÷ 32,000) × $8,000 = $6,000

CRA Rules: Mileage/Kilometer Tracking For Salaried Workers

Salaried employee’s allowable motor vehicle expenses.

As a salaried employee, you may be able to claim certain employment expenses on your income taxes and receive a return if you had to pay for those expenses under the contract of your employment. This employment contract does not have to be in writing, but you and your employer must agree to the terms and understand what is expected.

Related: 3 Ways SMBs Can Save Money (And 3 Ways They Lose Money)

The types of deductible and allowable expenses are very similar to those for self-employed individuals . As previously mentioned, a portion of your total expenses incurred when conducting business using your personal vehicle that you may claim will be proportional to the total kilometers driven for business vs. personal use of the passenger vehicle.

Company Reimbursement Using AAR (Automobile Allowance Rate)

As a salaried individual, your employer may reimburse you for any expenses incurred when using your personal car for work. When you do get your reimbursements, make sure they are included in your employment contract and follow the CRA automobile allowance (AKA mileage) rates for 2024 .

What Is the 2024 CRA Automobile Allowance (Mileage) Rate?

From the CRA’s official website , the 2024 automobile allowance rates are:

- $0.70 per kilometer for the first 5,000 kilometers driven

- $0.64 per kilometer driven after that

Keep in mind, if you’re driving in the Northwest Territories, Yukon, and Nunavut, there is an additional $0.04 per kilometer allowed for travel (starting at $0.74 per kilometer, then $0.68 after 5,000 kilometers driven).

Do You Need a CRA-Compliant Mileage/Kilometer Log?

Whether you’re self-employed or an employee, no matter what deductibles you’re eligible to claim back, you are required to keep and provide factual support to prove that the kilometers you listed were driven for business reasons. The CRA requires you to document your business kilometers in detail to qualify for motor vehicle deductions.

According to the CRA website , the best way to support the use of a vehicle is an accurate digital logbook of business travel maintained for the entire year showing each business trip, the destination, the reason for the trip, and the distance covered.

As mentioned above, to make a claim, you must keep a log containing both the total kilometers driven and the kilometers driven solely for business purposes. In addition, the deductible expenses must be reasonable and backed by receipts.

Furthermore, you must record the dates of the changes and the odometer readings for the corresponding transactions for any motor vehicle changes.

Manual Mileage/Kilometer Tracking

Although a pen-and-paper CRA log is a good way to keep all your records straight for the year, it can become a very tedious and time-consuming process that can bog you down. This is especially so if you’re a busy self-employed individual or a large company tracking your employee’s business kilometers. Manual kilometer tracking and monitoring through logbooks can get tiresome, be prone to errors , and is simply not scalable.

Related: How To Prevent Fraud In Business

Automatic Mileage/Kilometer Tracking

Automatic mileage/kilometer tracking is very popular thanks to recent advancements in technology, and the benefits over manual tracking are numerous. Most automated tracking solutions are smartphone apps like TripLog, often with cloud backup and web dashboard access.

Here are some of the top reasons to use an automatic mileage tracker instead of outdated manual methods:

Automatic Mileage/Kilometer Tracking App Benefits For Self-employed & Enterprise-scale Companies

Accuracy & cra compliance.

Bluetooth tracking, iBeacons , GPS, and other technologies have enabled fast and accurate tracking that a manual log cannot beat. Humans are prone to errors in tracking logs using logbooks and hoarding expense receipts, especially for small business owners, freelancers, and gig economy leaders.

Savings: Time & Money

Smartphone apps can get you so much more savings, whether through money or time. Simplified and automatic tracking saves you time, and accurate and complete CRA-compliant records of all your business kilometers ensure you maximize your tax deductions and savings.

Related: 3 Reasons Why Your Small Business Needs An Accountant

In addition, some advanced mileage/kilometer tracking apps have integrations with accounting software that can save you even more time. No need to keep separate records for your car and your accounting software.

These integrations save time and money, as well as provide better communication between you and your accountant. TripLog, for instance, integrates with

Mileage Tracking App Benefits Just For Enterprise-scale Companies

Transparency – inflated employee estimates.

Many smartphone mileage/kilometer tracking apps have enterprise solutions for mileage reimbursement purposes. These apps take the guesswork and verification process out and bring more transparency to the process through automatic tracking technologies and map-verified locations. This saves the company from potential fraud, leading to more savings in terms of time and money.

Schedule and Time Management

Dispatching a team on the road and scheduling pickup/deliveries for many businesses can be a logistical and scheduling nightmare. But automated tracking with smartphones and monitoring on the web can save the day and vastly improve the schedule and time management capabilities of small to medium organizations .

How Can TripLog Help?

TripLog is a smartphone app with a powerful web dashboard designed to provide company mileage tracking to businesses and their mobile employees. Our solution offers CRA-compliant tax deductions, travel and expense management, and replaces time-consuming manual solutions.

Related: Why TripLog Is The Best Mileage Tracker App (2024 Comparison)

Our integrations to QuickBooks , Xero , and ADP make mileage/kilometer tracking and claiming expenses from the CRA at tax time a breeze.

Whether you are a self-employed or a salaried individual, and whether you do it manually or by using an automated system, keeping track of all your kilometers is a must if you want to claim back some of your business-related expenses from the CRA. Get started with TripLog today with a complimentary web demo , or visit our pricing page to learn more !

- Mileage Tracking , Small business , Tax , TripLog , TripLog Canada

Like what you read?

Show that you found the article interesting by liking and sharing.

Ditch manual mileage and expense reports and save thousands with TripLog!

Free Uber/Lyft Vehicle Inspections Explained (2024 update)

Best Times to Deliver For Uber Eats (2024 Guide)

Uber Pro Explained: Everything Drivers Need to Know (2024 Update)

Switch to the #1 mileage tracking & reimbursement solution.

(4.8 rating score)

Mileage Tracking For Companies

Mileage Tracking For Self-Employed

Feature Videos

TripLog Drive™

TripLog Beacon ™

ACH Reimbursement

Company Debit Cards

Bank/Credit Cards

Google & Outlook Calendar

Emburse (Certify & Chrome River)

Sage Intacct

Construction

Public Sector & Nonprofits

Sales Representatives

Accountants

Login with Intuit

Terms of Service

Privacy Policy

© 2011 – 2024 Copyright TripLog, Inc. All Rights Reserved.

Let's chat!

Number of anticipated TripLog users:

Need support?

Mileage Reimbursement Savings Calculator

Using outdated manual mileage logs can cost businesses thousands of dollars per year in lost time and incorrect reimbursements . See how much TripLog can help you save!

Number of drivers

Average miles daily per person

Number of trips daily

Cents-per-mile

Annual mileage reimbursement costs based on the numbers you provided.

Annual Mileage Reimbursement

50 mi/day x 100 drivers x $0.54 (5 days x 50 wks)

This is the inline help tip! You can explain to your users what this section of your web app is about.

According to research, on average employees inflate the mileage by 25% when self reported.

Estimated Reimbursement Savings

People on average spend 2 minutes on manually recording trips.

Manual Entry Hours

2 mins x 10 trips/day x 100 drivers (5 days x 50 wks)

Taking national average $25 hourly rate.

Estimated Labor Savings

Avg. $25/hr x Manual Entry Hours

Your Company

(Labor Savings + Reimbursement Savings) / Number of Drivers

Before you go, schedule a complimentary demo

See how TripLog works, ask questions, and explore your potential savings!

Get TripLog

Start automatically tracking your mileage today to never miss another deductible mile. Try the #1 mileage tracker for free!

(4.8 out of 5)

Schedule a call with a TripLog agent in as little as 15 minutes!

In your introductory meeting with one of our mileage experts, you will:

- Get a demo of the TripLog admin dashboard.

- Have the opportunity to ask questions.

- Learn more about how TripLog can benefit your team.

- Get insight into which pricing plan will best suit your team’s needs.

Torben Robertson

2023 CRA Per-Kilometre Rate

The 2023 CRA per kilometre rates are set at $0.68/km for the first 5,000 kilometres driven in a year, and $0.62/km after that.

Update: 2024 CRA per kilometre rate is here!

Introduction, what is the cra mileage rate in 2023, mileage reimbursement rates in the northwest territories, the yukon, and nunavut, business owners need to know about cra rules for reimbursing vehicle expenses, historical mileage rates in canada, follow us on linkedin.

The 2024 CRA mileage rate has been announced. To see the new rate, check out this blog post:

Canada 2024 Mileage Rates, Automobile Deduction Limits

The CRA per-kilometre rate is the rate paid per kilometre driven for work related expenses. The 2023 CRA per kilometre rates are set at $0.68/km for the first 5,000 kilometres driven in a year, and $0.62/km after that. This reimbursement rate covers things like gas, vehicle maintenance, and insurance. The CRA per kilometre rate is a mileage reimbursement rate .

If you’re a Canadian who drives for work or a business owner in Canada, it’s important to know what the CRA per kilometre rates are so that you can plan accordingly. Keep reading to learn more about the 2023 CRA per kilometre rates and how they may affect you!

The Canadian Revenue Agency (CRA) Mileage Rate for the year 2023 has been set at 68 cents per kilometre for business travel, with a 4-cents-per-kilometre rate for charitable and medical purposes. It is important to keep these rates in mind when claiming expenses related to operating a vehicle such as fuel and repairs, as it can be used against income sourced from employment or business activities. Additionally, it is necessary to maintain records that indicate the date of each trip, the purpose of the trip, and the kilometres travelled so that any claims are verified upon audit.

“The limit on the deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes in the provinces will increase by seven cents to 68 cents per kilometre for the first 5,000 kilometres driven, and to 62 cents for each additional kilometre. For the territories, the limit will also increase by seven cents to 72 cents per kilometre for the first 5,000 kilometres driven, and to 66 cents for each additional kilometre,” per Canada’s Department of Finance .

The rate applies from British Columbia to the Maritimes, including Quebec , but it is different in the North.

What is the Canada Revenue Agency?

The Canada Revenue Agency (CRA) is an independent agency and part of the Federal Government of Canada. Its mission is to help Canadians benefit from available tax and other credits and deductions, as well as to comply with administrative requirements. The CRA makes sure that everyone meets their obligations under Canadian taxation law by administering tax laws for all levels of government, enforcing payment, collecting taxes, and overseeing refunds and credits. They also administer government programs, including the Canada Pension Plan (CPP); Old Age Security (OAS), Registered Retirement Savings Plans (RRSPs); GST/HST credit; Universal Child Care Benefit; Working Income Tax Benefit; and more. By offering Canadians comprehensive services in a cost-effective manner, the CRA ensures fairness, integrity, and service excellence.

The CRA mileage rate is a reasonable per kilometre allowance and can be paid to drivers tax-free

The CRA mileage rate is an excellent option for businesses or individuals who require reimbursement for using their vehicle on the job or during work-related travel. The reimbursement rate of $0.68 per kilometre incurred can be paid without taxes. A number of requirements must be met in order to receive the CRA mileage rate; however, overall, it’s a convenient and reasonable way to invoice driving expenses without worrying about tax implications down the line.

The requirements that you have to meet in order for a rate to be considered reasonable are the following:

- This allowance is calculated solely based on the amount of company-related kilometres driven in a year.

- The rate per-kilometre is “reasonable,” i.e. is the same as the rate stated in section 7306 of the Income Tax Regulations

- You did not pay any other kind of allowance for the vehicle in question. If you decide on the allowance without including any reimbursements for tolls, ferry fees, and supplementary business insurance premiums then this does not apply to your situation.

For those who live and work in the Northwest Territories, Yukon, and Nunavut, mileage reimbursement rates are a critical part of their job. For the first 5000 kilometres driven in any given year they are reimbursed at 72¢ per kilometre; however, they receive 66¢ per kilometre driven after that. Understanding rate changes can help ensure that professionals living and working in these Northern territories maximise their journey claims and receive what they are rightfully entitled to.

As a business owner, complying with the CRA rules for vehicle expenses is incredibly important in safeguarding your company’s financial position. Gone are the days when mileage reimbursement was fuzzy at best; the CRA has released detailed guidelines regarding claims that business owners need to be aware of in order to stay compliant. By understanding and following these rules, businesses can ensure they are not wasting money on over-inflated expense reimbursements and audit risk is minimised. Ignoring or taking a lax approach to reimbursing vehicle expenses could put your company’s finances at risk – make sure you understand the CRA regulations before submitting any claims.

What the CRA considers business-related driving

For employees who drive for work in Canada, the Canada Revenue Agency (CRA) considers only business-related travel as eligible for reimbursement. Business owners need to be aware that they need to reimburse employees properly and should not include commuting costs in reimbursements. The amount eligible is determined by the CRA’s per kilometre rate, which factors in vehicle expenses such as fuel, repairs and insurance. It is important for employers to understand when travel is considered ‘business-related’ so employees can be reimbursed correctly.

How the CRA treats a Combination of flat-rate and reasonable per-kilometre allowances

When an individual receives flat-rate and per-kilometre allowances from his or her employer in combination, the Canada Revenue Agency (CRA) treats this as a taxable benefit. Therefore, it is up to the individual to be accountable for these amounts of money and to claim them on their tax returns. Employers must comply with the CRA regulations by deducting CPP, EI, and income tax from flat-rate and per-kilometre allowances. Individuals should ensure that the agency has been made aware of all flat-rate and per-kilometre allowances that they might have received over the course of a year in order to comply with its regulations.

You can read more about the CRA’s treatment of these allowances here.

How the CRA treats flat rate automobile allowances

The Canadian Revenue Agency (CRA) considers flat rate automobile allowances as taxable income for employees. As such, these allowances must be deducted from an employee’s paycheque by the employer, who is also required to deduct CPP, EI and income tax. To get a tax deduction when claiming these allowances, it is important that employees do the accounting themselves when filing their taxes. This way they can ensure that these amounts are properly filed and used to their own benefit when paying taxes.

Canadian automobile allowance rates have changed significantly over the past several years. For 2023, the rate is 68¢ per kilometre for the first 5,000 kilometres driven and 62¢ per kilometre driven after that. In the Northwest Territories, Yukon, and Nunavut, there is an additional 4¢ per kilometre allowed for travel. Automobile allowance rates for earlier years may vary widely; for 2020, 2021 and 2022 are 61¢, 59¢ and 59¢ per kilometres respectively for the first 5,000 kilometres driven each year. For 2016 – 2018 these rates were 54-55 cents respectively whereas in 2015 it was 55 cents per mile for the first 5,000 kilometres driven. These differing rates are essential to consider before planning business driving in Canada.

As a business owner, it’s important to know about the CRA rules for reimbursing vehicle expenses. The mileage rate for 2023 has been set by the CRA and is a reasonable per kilometre allowance that can be paid to drivers tax-free. However, there are some exceptions in the Northwest Territories and Nunavut where the rates are different. It’s also important to note that when you drive your personal vehicle for work, this is considered a taxable benefit. You can claim driving allowances that have been taxed as a deduction on your personal income tax return. If you want to run a mileage reimbursement program today, contact Cardata. We would be happy to help you get started.

Disclaimer: nothing contained in this blog post is legal or accounting advice. Consult your lawyer or accountant and do not rely on the information contained herein for any business or personal financial or legal decision making. While we strive to be as reliable as possible, we are neither lawyers nor accountants. For several citations of IRS publications, on which we base our blog content ideas, please always consult this article: https://www.cardata.co/blog/irs-rules-for-mileage-reimbursements. For Cardata’s terms of service, go here: https://www.cardata.co/terms.

Come along for the ride

Latest blog posts.

Jan 22, 2024 | Blog

By Torben Robertson

What are Vehicle Reimbursement Programs?

Jan 03, 2024 | Blog

The Power Of Vehicle Reimbursement For Sales Teams

Dec 20, 2023 | Blog

Professional Guide to Distance Allowance and Deductions in Canada (CRA)

Welcome to ExpressMileage, your comprehensive resource for navigating distance allowance and deductions in Canada. Here, you’ll find a curated collection of articles and resources that will guide you through the regulations on how to claim your distance allowance as an employee or as a self-employed individual. This is your one-stop source for understanding the CRA’s guidelines on motor vehicle logbooks.

With ExpressMileage, effortlessly sharing your motor vehicle logbook with the CRA or your employer is just a click away. To streamline your experience, sign up for ExpressMileage .

CRA Automobile Allowance

Automobile allowance refers to the financial compensation for expenses incurred from using personal vehicles for business activities. Typically, this allowance is provided by employers to cover the cost of business use of a personal vehicle and is given in addition to the employee’s salary. For self-employed individuals, business owners, or independent contractors, vehicle-related expenses can be deducted from your annual tax return.

In Canada, the distance allowance is generally calculated based on a per-kilometre rate, designed to reimburse the costs associated with the ownership and operation of a personal vehicle for business reasons.

Annually, the CRA issues a standard per-kilometre allowance rate that organizations adopt to compensate employees for business travel.

Defining Business-Related Travel

The CRA defines business-related travel as any use of a vehicle directly connected to the fulfillment of one’s work responsibilities. This encompasses:

- Travel between multiple work locations.

- Attendance at business meetings and professional conferences.

- Client visits and customer service calls.

- Conducting work-related errands, such as supply runs.

Please note, commuting from home to your primary place of employment does not qualify as business travel.

CRA Distance Allowance Parameters

The CRA sets a specific per-kilometre rate annually for business-related travel. For the latest rates and detailed analysis, refer to our specialized article on the CRA’s distance rates for 2023 and previous years.

Tax Implications of the CRA Distance Allowance

An allowance is deemed non-taxable when it does not exceed the CRA’s prescribed per-kilometre rate. Should the allowance surpass this threshold, it becomes taxable income.

CRA Motor Vehicle Logbook Reimbursement Guidelines

For Employees: Employers may reimburse you for the business use of your personal vehicle. While not mandated by law, it is customary in Canada to provide this type of compensation. The most prevalent form of reimbursement is based on the official CRA automobile allowance rates, though some employers may opt to cover the actual operational costs of the vehicle for business travel.

Employers typically specify the records required for reimbursement. These records, which form the basis of your motor vehicle logbook, should detail business trips, parking fees, tolls, and other incidental costs incurred during business travel.

For Employers: The CRA regards any payment to employees for business travel as an allowance. Such allowances are taxable unless they align with the CRA’s reasonable per-kilometre rates for the tax year in question.

To qualify as non-taxable, the allowance must:

- Only compensate for the number of business kilometres driven by the employee.

- Utilize a per-kilometre rate consistent with the CRA’s published rates.

- Exclude any other form of employee reimbursement for the same vehicle use.

For Self-Employed Individuals: As a self-employed professional using your vehicle for business, you are entitled to claim CRA distance deductions on your tax return. This includes a comprehensive list of vehicle expenses, from fuel and maintenance to insurance and interest on vehicle loans.

You can choose between two methods for logging business travel:

- Full Logbook Method : Requires meticulous record-keeping for every business trip within the fiscal year.

- Simplified Logbook Method : Involves maintaining a detailed logbook for one base year, after which a three-month sample can be used to estimate business use for subsequent years.

It’s important to retain your motor vehicle logbook records for six years following your tax submission.

By adhering to these guidelines, you can ensure your distance claims and reimbursements are accurately reflected and compliant with CRA regulations.

ExpressMileage

You might also like.

Clear, Unbiased Facts about How Rideshare Drivers Pay Taxes: Uber, Lyft

Learn to Log Business Mileage for Taxes

Top 10 Mileage Log Mistakes

Cra logbook rules simplified, i recently got audited . do you need to show proof of odometer to irs.

ExpressMileage Do you need a mileage log for reimbursement or IRS tax purposes? Our online mileage log generator helps you make mileage logs in a matter of minutes.

- How it Works

High Contrast

- Asia Pacific

- Latin America

- North America

- Afghanistan

- Bosnia and Herzegovina

- Cayman Islands

- Channel Islands

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Hong Kong SAR, China

- Ireland (Republic of)

- Ivory Coast

- Macedonia (Republic of North)

- Netherlands

- New Zealand

- Philippines

- Puerto Rico

- Sao Tome & Principe

- Saudi Arabia

- South Africa

- Switzerland

- United Kingdom

- AI, analytics and cloud services

- Audit and assurance

- Business strategy and operations

- Business tax

- Family office

- Financial management

- Global business services

- Managed services and outsourcing

- Mergers and acquisitions

- Private client services

- Restructuring and recovery

- Risk, fraud and cybersecurity

- See all services and capabilities

Strategic technology alliances

- Sage Intacct

- Budget commentary

- Middle market economics

- Supply chain

- The Real Economy

- The Real Economy Blog

- Construction

- Consumer goods

- Financial services

- Food and beverage

- Government and public sector

- Life sciences

- Manufacturing

- Private equity

- Professional services

- Real estate

- Restaurants

- Technology companies

- Financial reporting resources

- Tax regulatory resources

Featured technologies

Platform user insights and resources.

- RSM Technology Blog

- Diversity and inclusion

- Environmental, social, and governance

- Middle market focus

- Our global approach

- RSM alumni connection

- RSM Canada Alliance

- RSM Classic experience

Experience RSM

- Your career at RSM

- Student opportunities

- Experienced professionals

- Executive careers

- Life at RSM

- Rewards and benefits

Spotlight on culture

Work with us.

- Careers in assurance

- Careers in consulting

- Careers in operations

- Careers in tax

- Apply for open roles

Popular Searches

Asset Management

Health Care

Partnersite

Your Recently Viewed Pages

Lorem ipsum

Dolor sit amet

Consectetur adipising

Reimbursements and allowances for remote workers’ travel expenses

This content was originally published in the Canadian Tax Foundations newsletter: Canadian Tax Focus. Republished with permission.

Travel between an employee’s residence and a regular place of employment (RPE) has long been considered by the Canada Revenue Agency (CRA) to be personal travel and not part of the employee’s office or employment duties; therefore, any reimbursement or allowance relating to this travel is a taxable benefit. Conversely, where travel relating to a location other than an RPE is involved, such payments are non-taxable.

But what is an RPE in this era of remote work? A recent technical interpretation provides that a location used for a one-time, multi-day training session for remote workers is not an RPE for those workers (CRA document no. 2022-0936671I7, June 30, 2022); the CRA therefore concludes that the reimbursements and allowances for travelling there are generally non-taxable. However, the CRA notes one exception: allowances for meals (and presumably lodging) are non-taxable only if the rules for a special work site apply.

The CRA generally comments that whether a location is an RPE is a question of fact. CRA document no. 2012-0432671E5 (August 13, 2012) observes that a location could be an RPE even if the employee works there only once or twice a month, but the location might not be an RPE if the employee works there only once or for a few days during the year. In contrast, CRA document no. 2016-0643631E5 (August 17, 2020) declines to offer an opinion on a situation where an employee works at two different locations on alternating weeks. The 2022 technical interpretation takes more definitive positions, which are favourable to the employee.

The 2022 technical interpretation concerns an employer’s plans to hire new employees who reside far from the employer’s offices. The employees may work from home or designate one of the employer’s offices as their place of work, without requiring regular attendance or reserving an onsite workspace. The employer will also provide the necessary equipment for remote work. In addition, the employees will be required to attend a single three-day event during their employment contract for training and team-building activities. For employees who are required to attend, the employer will reimburse reasonable accommodation and transportation costs (bus, train) or provide a per-kilometre motor vehicle allowance. A meal allowance will also be provided.

The CRA concludes that the work location designated in the employment contract is not considered to be an RPE for the new employees. Therefore, reimbursements of travel expenses do not need to be included in their income under paragraph 6(1)(a). Also, reasonable per-kilometre allowances received by employees for the use of their motor vehicle for travel in the course of performing their duties will not be included in their income by virtue of subparagraph 6(1)(b)(vii.1).

The CRA notes that the situation for meal allowances is different. The exemption in subparagraph 6(1)(b)(vii) for reasonable allowances for travel expenses that are not for the use of a motor vehicle requires that the employee be travelling away from the municipality where the employer’s establishment is located. Since the employee’s home is not such an establishment, this condition is not satisfied. However, the CRA notes that the meal allowance could be non-taxable by virtue of subsection 6(6)—special work site. The CRA agrees that the work to be performed (that is, training and team-building activities) is considered temporary in nature and required as part of the employee’s duties. As such, the amounts paid for travel will not be required to be included in their income if all other conditions of the subsection are met. In particular, the employee must be away from home or at the special work site for at least 36 hours and cannot be expected to return home daily from the special work site because of the distance involved.

Similar reasoning would presumably apply to allowances for lodging expenses, although this issue was not discussed.

RSM contributors

Get our tax insights in your inbox

Rsm tax professionals stay on top of changing legislation and provide perspective to help you keep your business running smoothly..

THE POWER OF BEING UNDERSTOOD

ASSURANCE | TAX | CONSULTING

- Accessibility plan

- RSM Canada client portals

- Cybersecurity

RSM Canada LLP is a limited liability partnership that provides public accounting services and is the Canadian member firm of RSM International, a global network of independent assurance, tax and consulting firms. RSM Canada Consulting LP is a limited partnership that provides consulting services and is an affiliate of RSM US LLP, a member firm of RSM International. The member firms of RSM International collaborate to provide services to global clients but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmcanada.com/about for more information regarding RSM Canada and RSM International.

©2024 RSM CANADA LLP. All rights reserved.

- Terms of Use

- Credits & Deductions

- Income & Investments

- CRA Tax Updates

- Getting Organized

- Family & Children

- Homes & Rental Properties

- Medical & Disability

- Expats & Non-Residents

- Employment & Employees

- Foreign Income & Property

- Self-Employed & Freelance

- Small Business

- Unemployment

- After you File

Claiming Medical Expense Travel Credits

Canada is vast and some of the most beautiful places in our great country to live are quite remote. One of the drawbacks of living outside a major city center can be that if you need medical care, you may need to travel a long way to get it. Thankfully, depending upon how far you have to go for your care, the government of Canada may allow you to claim medical expense travel credits.

Many of the expenses that you may incur to travel for medical treatment or expenses that you incur on behalf of your spouse or dependants are tax-deductible. Eligible expenses may include transportation costs, meals, and accommodation for both the patient and an attendant if required. Let’s explore the allowed eligible expenses and how to claim them .

How Far Do I Need to Have Travelled to be Eligible for Claiming Medical Expense Travel Credits?

Anyone who has had to pay for parking at a hospital knows how expensive it can get. While it would be nice to be able to deduct those expenses , unless you traveled more than 80 km for medical care, your parking expenses aren’t deductible.

To claim transportation and travel expenses with the CRA, the following conditions must be met:

- There were no equivalent medical services near your home

- You took a direct route

- It was reasonable for you, under the circumstances, to travel to the place you did for those medical services

If you traveled at least 40 km (one way) to get medical services, you can claim the cost of public transportation (ex. bus, train, or taxi fare). If public transportation isn’t available, you may be able to claim vehicle expenses.

If you traveled more than 80 km (one way), you can claim vehicle expenses, accommodation, meals, and parking expenses.

Whether you traveled more than 40km or 80 km, if a medical practitioner has certified that you can’t travel without help, you may also claim the travel expenses you pay for an attendant.

File your taxes with confidence

Get your maximum refund, guaranteed*.

How are Vehicle Costs Calculated by the CRA?

If driving to get medical care is necessary, you can claim the cost of fuel, oil, license fees, insurance, maintenance, and repairs, including parts . Depreciation, provincial tax, and finance charges are all eligible.

There are two methods to calculate vehicle expenses — the detailed and the simplified method . If you use the detailed method, keep track of the number of kilometers driven in the 12-month period you choose for medical expenses. Then, calculate the percentage of your total vehicle expenses that relate to the kilometers driven for medical treatment.

For example; if you drove 10,000 km during the year and 5000 of those kilometers were related to medical treatment (more than 40 km away), you can claim half of your total vehicle expenses on your tax return.

If you chose the simplified method, you only need to determine how many km you traveled for medical treatment in the 12-month period. Multiply the km by the rate for your province . The rates are different for each province or territory, are updated annually, and can be found at the Canada Revenue Agency’s website.

Whether you choose the detailed method or the simplified method, be sure to save all your receipts in case the Canada Revenue Agency (CRA) asks to see them later.

How do I Claim Meals?

- You need to have traveled more than 80 km for care to claim meals with the CRA. Just like vehicle costs, you can choose the use the detailed method or the simplified method.

- To use the detailed method, you tally the actual cost of each meal .

- If you choose the simplified method, you may claim up to $17 per meal, up to a maximum of $51 per day , including sales tax.

- Whether you choose the detailed method or the simplified method, be sure to keep those receipts.

What are the Rules for Accommodations?

- To claim accommodations, like meals, you need to have traveled more than 80 km for medical services.

- Accommodation claims are based on your receipts, and only the cost — with taxes — of the stay is eligible . Extra costs like room service, movies, and phone calls are not included.

Travel outside of Canada

Outside of Canada medical expenses may also be eligible. You have to meet all the following conditions:

- practitioners must be authorized in their country of service by law. In the case of hospital stays, the institution must be public or a licensed private hospital.

- the health care services you receive must not be available in your area, and you must be required to travel to access them .

Travel Companions

If your spouse, your common-law partner, or another individual travels with you, you may be able to include that person’s expenses as part of your medical expense tax credit. To include these expenses, you need to have a note from your physician or another authorized medical practitioner that certifies that you were unable to travel alone .

If you qualify, you can write off the cost of your travel companion’s transit tickets, accommodation, and meals, depending on how far you have traveled for your medical care.

Related articles

Medical expenses you can claim on your tax return, medical expenses checklist, facts every canadian needs to know about filing coupled tax returns.

Track mileage automatically

Medical travel in canada, in this article, cra rules on medical travel, medical travel if you travel more than 40 kilometres, medical travel over 80 kilometres in canada and abroad, cra medical travel rates 2023, medical travel rates 2022.

If you need to receive medical care, you may be able to deduct medical travel expenses for your medical mileage. The deductions can represent a big chunk of savings that you can claim at tax time. Here’s an overview of the rules for claiming medical travel from the CRA.

Firstly, you will need proof that you attended the medical service you needed. You can provide receipts for the services you’ve received or a document or letter signed by the provider of the medical service.

You cannot claim medical travel expenses if you travelled less than 40 kilometres in one direction to receive medical attention.

If you travelled more than 40, but less than 80 kilometres one way, you will be able to claim medical travel, and if you travelled more than 80 kilometres, you will be able to claim mileage, as well as accommodation, meal and parking costs.

You will also be able to claim travel expenses if you had to receive medical care outside of Canada.

If a medical practitioner certifies that you needed to be accompanied to receive medical attention, you will be able to claim the expenses of the attendant.

You will only be able to claim medical expenses for which you have not, and will not be reimbursed. If medical reimbursement has been included in your income (ergo, it will be taxed) you will be able to claim your medical travel expenses.

Track business driving with ease

Trusted by millions of drivers

You will be able to claim medical travel from the CRA such as bus, train and taxi fares, and vehicle mileage (if public transportation is not readily available) if you meet the following conditions:

- You were not able to receive the needed medical care near your home

- You took a reasonable and direct route

- It was reasonable for you to travel to a farther destination in order to receive medical attention.

You can claim medical mileage from the CRA by the detailed or simplified method.

If you use the detailed method, you need to keep all receipts of your medical travel expenses in order to claim them. You are able to deduct all qualified public transport fares, and if you travel with your vehicle - all costs of operating and owning it. These include fuel, oil, insurance, maintenance, depreciation and more.

With the simplified method, you will be able to claim a flat medical mileage rate and you won’t need to keep detailed records. However, the CRA may still ask you to provide documentation to support your medical mileage claim, so we recommend keeping a logbook of your medical travel.

If you need to travel more than 80 kilometres in order to receive medical care, you will be able to claim medical expenses such as bus, train and taxi fares, vehicle mileage (if public transportation is not readily available), meals, parking and accommodation if you meet the following conditions:

Again, you can claim medical travel and other expenses by the detailed or simplified method.

The detailed method of claiming medical travel and other expenses requires you to keep all receipts of your accrued expenses, such as for travel, parking (if applicable), meals and accommodation.

The simplified method lets you use a medical mileage rate and a per-meal rate for your expenses. Keep receipts of your accommodation costs, as there are no flat rates. While you don’t need to keep detailed receipts for medical travel and meals, the CRA may ask for documentation to support your mileage expenses claim.

If you claim medical travel with the flat per-kilometre medical rate, note that there are different rates for each Canadian territory.

Use the medical travel rates above to claim your medical travel expenses for 2023.

Are you claiming work-related mileage besides medical travel expenses? See our CRA mileage guide for all the rules on mileage reimbursement and deductions in Canada.

How to automate your mileage logbook

Latest posts

Izev rebates in canada.

- Mileage Calculator Canada

- CRA Mileage Rate 2023

Automate your logbook

Related posts, per diem allowance.

In Canada, Per diem often refers to a meal or travel allowance. The CRA doesn’t set fixed rates, so what is a fair rate, and what about tax?

CRA Mileage Rate 2024

The CRA announces 2024 rates for vehicle allowance: From January 1st, 2024, per kilometre rates will increase 2 cents over 2023.

You can benefit from federal and provincial iZEV rebates when buying or leasing electric vehicles. See how much you can get per province.

Choose your Country or region

Language selection

- Français fr

Medical Expenses 2023

From: Canada Revenue Agency

RC4065(E) 23

The CRA's publications and personalized correspondence are available in braille, large print, etext, or MP3. For more information, go to About multiple formats or call 1-800-959-8281 .

Find out if this guide is for you

This guide is for persons with medical expenses and their supporting family members. The guide gives information on eligible medical expenses you can claim on your tax return.