A single card from public transport to payment!

Korea travel card.

Top 6 Benefits

Korea's representative bank card, Transit Cards

Easy Deposit (Charge)

Unlimited cashback & benefits

Google reservation service

Hassle-free Withdrawals (refunds)

Stay safe with a card from korea's leading bank, pay at 5 million stores nationwide.

T-money, EZL Transportation Card

Nationwide buses, subways, and taxis.

National buses, Seoul/Jeju City Tour Bus, Airport Limousine

National Subway

National Taxi

KTX•Saemaeul• Mugunghwa•ITX Cheongchun•Nuriro, etc

National Express Bus terminal

National Expressway Corporation toll booths, private toll booths

*You can charge your transit balance at subway transit card charging terminals, convenience stores(CU, GS25, 7-11), and kiosks.

Anywhere, as much as you want

Airport banks, convenience stores, currency exchange, kiosks,, online recharge via app.

.png)

Online Recharge via App Mobile Payments, Visa, Master, Amex, Union Pay

At a bank at the airport Exchange and deposit money upon arrival in Korea

At a MONEY BOX Exchange and recharge at the best exchange rates

Charge at over 14,000 CU convenience stores nationwide

charge at kiosks in major tourist spots

No deposit fees, no payment fees

When depositing at woori bank, up to 50% cash back, at partner stores, 0.2% unlimited cash back, on every purchase.

.png)

10,000 partner stores

Nationwide provision of, reservation services.

Find an ATM or convenience store near you

Hassle-free refunds.

.png)

REDTABLE Gaeyang Building 7F, Myeongdong 3-gil 6, Jung-gu, Seoul, Republic of Korea Tel : +82-2-6964-7955 Corporate Registration Number : 206-86-50534 Mail-order Registration Number : 2022-Seoul Jung-gu-1568 Tourist Business Operator Registration Number : 2022-000073 @Copyright KOREA TRAVEL CARD. All Rights Reserved.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

5 Best Travel Cards for South Korea

Getting an international travel card before you travel to South Korea can make it cheaper and more convenient when you spend in South Korean Won. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to KRW for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to South Korea, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for South Korea:

Let's kick off our roundup of the best travel cards for South Korea with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to South Korea.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in South Korea. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to South Korea or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in KRW, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in KRW when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

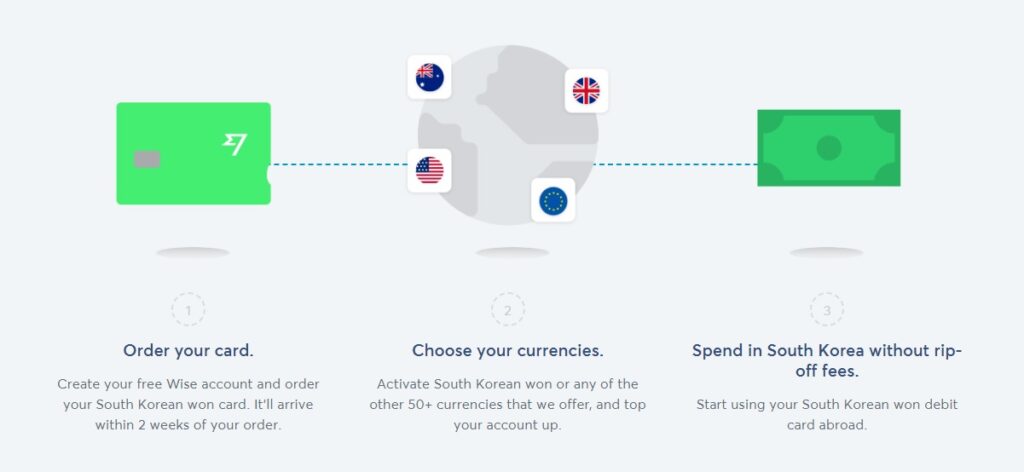

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in South Korea, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in South Korea with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to KRW instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in South Korea and globally. Monzo accounts are designed for holding USD only - but you can spend in KRW and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in South Korea. While these cards don’t usually let you hold a balance in KRW, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

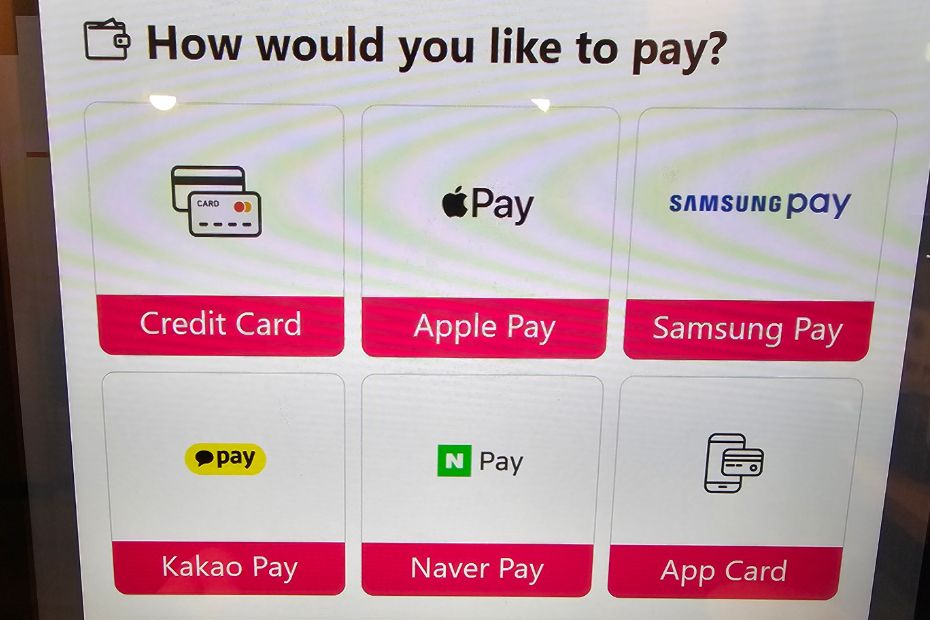

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to South Korea or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to South Korea. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for South Korea

We've picked out 5 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for South Korea include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in KRW can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for South Korea

The best travel debit card for South Korea really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in KRW.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for South Korea. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For South Korea in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in South Korea - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in South Korea

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In South Korea card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use KRW?

You’ll find that KRW can only be used in South Korea. If you don’t travel to South Korea frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or Revolut which lets you leave your money in USD and convert at the point of payment with no penalty.

What should you be aware of when travelling to South Korea

You’re sure to have a great time in South Korea - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to South Korea before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to KRW before you travel to South Korea if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to KRW in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach South Korea to make an ATM withdrawal in KRW if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for South Korea

Ultimately the best travel card for your trip to South Korea will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

How does a South Korean Won card work?

Getting a South Korean Won card can make managing your money easier when you travel to South Korea.

Your South Korean Won card will be linked to a digital account you can manage from your phone, so you'll always be able to see your balance, get transaction notifications and manage your card no matter where you are. Just add money to your account in pounds, and - depending on your preferences and the specific card you pick - you can either convert your balance to South Korean Won instantly, or just let the card do the conversion when you spend or make a withdrawal.

If your card gives you the option to hold a South Korean Won balance, there's not normally any extra fee to spend the South Korean Won you have in your account when you're in South Korea.

Can I withdraw South Korean Won currency with my card in South Korea?

With some cards, you'll be able to add money to your card in United States Dollar, and then convert to South Korean Won instantly online or in your card's app.

Once you have a balance in South Korean Won you can spend with your card with no extra fees - just tap and pay as you would at home. You'll also be able to make cash withdrawals whenever you need to, with no extra conversion fee to pay. Your card - or the ATM operator - may charge a withdrawal fee, but this can still be a cheap, secure and convenient option for getting cash when you need it.

With other cards, you can't hold a balance in South Korean Won on your card - but you can leave your money in United States Dollar and let the card convert your money for you when you spend and withdraw.

Some fees may apply here - including currency conversion or foreign transaction charges - so do compare a few different cards before you sign up, to make sure you're picking the one which best suits your specific spending needs.

Bear in mind though, that not all cards support all currencies - and the range of currencies available with any given card can change from time to time. If your card doesn't let you hold a balance in South Korean Won you might find that fees apply when you spend in South Korea, so it's well worth double checking your card's terms and conditions - and comparing the options available from other providers - before you travel, just in case.

Why should I get a South Korean Won card?

Getting a South Korean Won card means you can spend like a local when you're in South Korea. You'll be able to check your South Korean Won balance at a glance, add and convert money on the move, and use your card for secure spending and withdrawals whenever you need to. Best of all, South Korean Won cards from popular providers often offer good exchange rates and low, transparent fees, which can mean your money goes further when you're on a trip abroad.

FAQ - best travel cards for South Korea

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in South Korea.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / KRW rate to calculate how much South Korean Won you would receive when exchanging / spending $4,000 USD. The card provider offering the most KRW is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Travel money guide: South Korea

Traveling to south korea don't forget your plastic..

In this guide

Travel card, debit card or credit card?

These are your options for spending money in south korea, compare travel credit cards, south korean currency, buying currency in the us, atms in south korea, what should i budget for my trip to south korea, exchange rate history.

Travel money type

Compare more cards

Top picks of 2024

South Korea is a modern and cosmopolitan country, with exciting culture and food. Credit cards, debit cards, and cash are all accepted without issue in South Korea, with cash becoming less common.

According to the Bank of Korea, only about 20% of financial transactions in Korea are made with cash. Between credit card, debit cards and the popular T-money cards, South Korea is quickly becoming a cashless society. The best way to make payments in South Korea is to use credit, particularly a card that reimburses or waives foreign transaction fees.

South Korean T-money

South Korea uses the T-money card to streamline payments for buses, taxis and the subway. They recently extended those payments for select retail and restaurants, making it a popular way to pay your way in South Korea.

Like a debit card, it’s connected to your bank and makes automatic withdrawals each time you make a payment. Use the T-money card on your smartphone, making payments as easy as a tap of your phone.

Our picks for traveling to South Korea

40+ currencies supported

Wise Multi-currency

- 4.85% APY on USD balances

- $0 monthly fees

- Up to $100 free ATMs withdrawals worldwide

- Hold and convert 40+ currencies

Up to $300 cash bonus

SoFi Checking and Savings

- 0.50% APY on checking balance

- Up to 4.60% APY on savings

- $0 account or overdraft fees

- Get a $300 bonus with direct deposits of $5,000 or more

Free ATM transactions

HSBC Premier Checking

- $50 waivable monthly fee

- 0% foreign transaction fee

- Securely move money domestically and globally

- 5 monthly out-of-network ATM reimbursements

- Free international HSBC ATM transactions

You can use your Visa or Mastercard and travel money card almost everywhere in South Korea. While you can use debit cards to make purchases, not all ATMs accept foreign cards. Always look for the word Global on ATMs before you use it.

Mobile payments are wildly popular with youth in South Korea. So, load your credit cards onto your smartphones and leave your credit cards back at the hotel when you go out in big cities. That said, always carry a bit of cash on you for tips or smaller restaurants and street food.

Using a credit card

Visa, Mastercard and American Express credit cards are accepted throughout much of South Korea. You want to find a card that will waive the foreign transaction fee and offer travel benefits to get the most from your spending, like the Capital One VentureOne Rewards Credit Card (Terms apply, see rates & fees ). You’ll find that Visa and Mastercard use their own exchange rates that are close to the market rate, and better than the rate offered on most prepaid travel cards.

Travel credit cards also offer opportunities for rewards and other ways of saving during your travels. Before making your trip, review your travel card options to find one that can best support your travels and your wallet.

- Tip: Some South Korean merchants won’t accept a credit card payment for transactions under 10,000 won (about $10 USD).

- Major credit cards widely accepted

- Protected by PIN & chip

- Accepted worldwide

- Interest-free days when you pay your account in full

- Some cards offer travel benefits

- Emergency card replacement

- Fees and interest for cash withdrawal

- Many cards charge 3% currency conversion fees

- ATM machines are out of service after 11:00 p.m.

- Some merchants do not accept payments for transactions under 10,000 won

Explore top debit cards with no foreign transaction fees and travel credit cards by using the tabs to narrow down your options. Select Compare for up to four products to see their benefits side by side.

- Credit cards

Using a debit card

A debit card is a good way to access your cash while in South Korea, though be aware that not all ATMs accept foreign debit cards. Look for the “Global” sign on machines that will take your cards. Also, many ATM machines shut down after 11 p.m.

A debit card is a good choice if you want to avoid racking up debt and carrying a balance on your credit cards. It’s best if you can find a card that waives international ATM fees or foreign transaction fees. Not all providers offer this luxury, so look for banks that do, such as Betterment Checking , if you’re opening a new account.

- Tip: A debit card can be used to shop over the counter, online and for ATM withdrawals in South Korea.

- Use at stores and hotels, online and ATMs

- Protected by PIN and chip

- Spending your own money means avoiding interest charges

- No access to cash advances

- Only ATMs with the Global sign accept foreign cards

Using a prepaid travel card

Though many of the travel cards you find on the market will carry South Korean won, South Korea has its own travel card. Buy the Korean travel card for less than $4 and get discounts on museums and shopping, covered by travel insurance and pay for food, travel and entertainment.

It’s sold at convenience stores and can be bought in denominations of 100,000, 200,000, 300,000 and 500,000. You pay the value of the card (4000 won) and reload it with any amount you specify at a subway machine or convenience store. Although when you reload, you’ll have to use cash rather than your credit card.

- Tip : Travelers can purchase prepaid travel card online before their trip and use the mobile app version of the card on their phone.

- Can hold multiple currencies.

- Emergency card replacement and backup cards

- Reloadable online

- Korea offers the Korea Travel Card

- Come with lots of fees for loading and reloading, inactivity and ATM withdrawals.

- Your name isn’t printed on the front

- Many won’t load South Korean won

Paying with cash in South Korea

Although card payments are the norm in South Korea, street food, small restaurants and some public transport only accept cash — some merchants also won’t take cards for purchases under 10,000 won: about $10.

You can make withdrawals at Cash Dispenser Machines or visit an exchange office or bank to get foreign currency changed when you arrive in South Korea. Banks are open from 9 a.m. to 4 p.m. weekdays.

- Greater payment flexibility

- Convenience

- More difficult to manage expenses

- Higher risk of theft

The main banks in South Korea are:

- Shinhan Financial Group

- NongHyup Financial Group

- KB Financial Group

- Hana Financial Group

- Korea Development Bank

- Woori Financial Group

- Industrial Bank of Korea

- BNK Financial Group

- DGB Financial Group

The import and export of local currency is allowed up to KRW 8,000,000, or about $7,000 USD. Be sure to declare any incoming money greater than $10,000, including traveler’s checks. And you can’t take out more than you bring in.

You can always send cash to South Korea ahead of time with a money transfer service and have it waiting for pickup when you arrive.

Refreshing in: 60s | Sun, Jul 14, 11:26PM GMT

There are two types of ATMs in South Korea: those that accept foreign cards and those that don’t. Cash dispenser (CD) machines generally accept international cards. If you insert your card into an ATM and it gives you an error message, you’ll need to search for another machine.

Look for the Global logo on the front of the ATM and select the English option before you insert your credit, debit or travel card. These types of ATMs are common in public places such as bus and train stations, and are out of service after 11 p.m.

Local ATM operator fees will apply. However, you’ll save on each withdrawal if you find a debit card that waives foreign transaction fees, like the card offered by Betterment Checking .

South Korea can be considered expensive compared to budget destinations like Thailand , Cambodia and Vietnam. But you’ll find it less pricey than other developed countries like Japan .

Expect to spend up to $50 daily if you’re traveling on a tight budget. If you loosen those purse straps, you can find yourself spending up to $100 to $300 a day.

Average cost of travel in South Korea

Travel money options for South Korea at a glance

*Prices are indicative and subject to change

South Korea is one of the fastest-growing global economies and the fourth-largest economy in Asia. Remarkably it was able to rise from one of the world’s poorest countries to a highly developed nation in only one generation.

Historically, the US dollar has been stronger against the won. Over the past decade, the USD has generally been worth between 1,000 and 1,200 KRW.

Case study: Peter’s trip to Seoul

On his last trip to South Korea, Peter visited Seoul for one week before heading to Hong Kong. While in Seoul, he took a flight from Gimpo International Airport (Western Seoul) to Jeju Island so he could see the Seongsan Sunrise Peak, one of the New Seven Wonders of Nature.

What travel money tips do you have for South Korea? Peter purchased a Korean travel or T-money card to make payments easier. It can be used to pay for goods and services at most Korean merchants. What’s more, Peter says you can get a discount when you use the T-money Card to pay for public transport.

Kyle Morgan

Kyle Morgan is SEO manager at Forbes Advisor and a former editor and content strategist at Finder. He has written for the USA Today network and Relix magazine, among other publications. He holds a BA in journalism and media from Rutgers University. See full bio

More guides on Finder

How to pay, how much to bring and travel money suggestions for your trip to USA.

How to pay, how much to bring and travel money suggestions for your trip to South Africa.

How to pay, how much to bring and travel money suggestions for your trip to Sri Lanka.

How to pay, how much to bring and travel money suggestions for your trip to Mexico.

How to pay, how much to bring and travel money suggestions for your trip to Portugal.

How to pay, how much to bring and travel money suggestions for your trip to Hungary.

How to pay, how much to bring and travel money suggestions for your trip to Ecuador.

How to pay, how much to bring and travel money suggestions for your trip to Fiji.

How to pay, how much to bring and travel money suggestions for your trip to Japan.

How to pay, how much to bring and travel money suggestions for your trip to South America.

Ask a Question

Click here to cancel reply.

8 Responses

Hi, we are traveling to Hong Kong, South Korea, Beijing, and Shanghai. Is it best to take a travel credit card? Where can we purchase a travel card?

Many thanks, Trisha

Thanks for getting in touch with Finder. It’s nice to hear about your travel plans, Trisha. :)

Regarding your question, aside from travel credit cards, you can also use prepaid travel money cards. Whether travel credit card is best for you or not would depend on your needs, preference, budget. It would be good to know the advantages of using travel credit cards. You can know more how travel credit cards compare with other travel money options using our table above under the subheading, “Travel money options for South Korea at a glance.”

Regarding your second question, you don’t “purchase” a travel card, but instead, you apply for them. You can use our comparison table above and compare your options based on currency conversion rate, annual fee, and APR. Once you’re done comparing, you can then click on the “Go to site” green button to be redirected to your chosen provider’s website. From there, you can know more about the card and initiate your application.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers, Joshua

Hello! We are planning to visit in mid of March. We don’t have credit cards. We have a forex card. Does it work in South Korea?

Thanks for getting in touch with finder. I hope all is well with you. :)

If you are referring to the forex card, a prepaid travel card, then it should work just fine in South Korea. Depending on which forex card you are using, you need to take a look if it has the Visa, Mastercard or Amex logo on it. Once you have determined this, you can then use your forex card in stores or ATMs with your logo displayed.

How to open a saving account in the bank in South Korea?

Thank you for your comment.

To open a bank account in Korea, please refer to the steps below: 1. Visit the nearest bank branch of your choice. 2. Take a ticket from the queue ticket machine at the Foreign Exchange section, and wait for your turn. 3. Proceed to the desk that displays your number. 4. Present your passport and alien registration card in order to open a bank account. 5. Apply for a check card with ATM deposit/withdrawal functions.

Generally, the bank will require you to fill out a short application, verify your documents, and assuming there are no problems, you will walk out with a new bank account. Please note that when applying for a local bank account, you may be required to present some or all of the following documents:

– Passport – Certificate of Alien registration – Visa

Should you wish to have real-time answers to your questions, try our chat box on the lower right corner of our page.

Regards, Jhezelyn

Hi, my friend is leaving to Korea today and I was wondering if I get her gift cards here if they will work there? Specifically McDonalds and Baskin Robbins? Please answer as soon as possible. Thank you.

Thanks for reaching out to finder.

Generally, retailers’ gift cards are limited to use within the country they are issued in.

Upon checking, Baskin-Robbins gift cards can be used to pay for any purchase at select Baskin-Robbins or Dunkin’ Donuts locations in the United States only. The same goes for McDonald’s gift card, it is valid only at participating McDonald’s restaurants in the US.

Please feel free to contact us if any other questions arise.

Cheers, Charisse

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

2024 Korea Tourist Card Guide: Transport, Shopping & More!

We regret not preparing our Korea tourist cards including the T-Money Card as well as other travel essentials such as the SIM card , eSIM , and pocket WiFi on our previous Korea trips. We just winged it and thought we could easily buy them upon arrival anyway.

Don’t be like us – it pays to have these Korea travel essentials ready before your trip. This will save you the hassle of having to look for stores offering them in Korea. And, you may actually save on costs since you can strategically plan your Korea itinerary with all the benefits in mind.

Best Korea tourist cards for transportation, shopping, and e-money

1. t-money card.

It’s a no-brainer. A T-Money Card should be the first thing that you should prepare before your Korea trip. It is the most popular Korea transport card with the largest number of affiliated partners. You can mainly use your T-Money Card to pay for public transportation like trains, buses, and taxis. Aside from that, you may also use it to pay at convenience stores, vending machines, and retail brands.

Read our T-Money Card guide for more information on the costs, where to buy, and benefits.

BUY T-MONEY CARD

Cashless payments are a thing in South Korea. In fact, many stores no longer accept cash payments. With the WOWPASS , you can use it as a prepaid debit card to pay for your purchases in Korea. Aside from that, it also serves as a Korea transport card so you can pay for public transportation including trains, buses, and taxis. You can top-up, withdraw, or exchange currencies at machines found in airports, subways, and even hotels.

This special Korea tourist card offers better exchange rates than banks, airports, or money changers, and accepts 16 currencies including USD, EUR, SGD, HKD, and even PHP. What’s even better is that it also offers brand cashback benefits, which is really great for tourists who love shopping and dining in Korea. You can check your balance, history, and benefits by downloading the WOWPASS mobile app .

BUY WOWPASS

3. NAMANE Card

A NAMANE Card is a prepaid travel card in Korea you can use as payment for transport and offline purchases. But what sets this card apart from the rest is that it is customizable. This means you can design your own card, making it a cute souvenir item from Korea .

Another advantage of this Korea tourist card is that there is no authentication needed and no limit to who can use the card, so even minors can use it. You may download the NAMANE Card app to check your balance and transactions.

BUY NAMANE CARD

Best Korea tourist cards and passes for attractions

4. discover seoul pass.

If you are mainly exploring the capital city of Seoul and nearby places, we highly recommend that you get a Discover Seoul Pass . With this Korea tourist card, you get FREE or discounted access to over 100 tourist attractions in Seoul and beyond like Lotte World , N Seoul Tower , Nami Island , and so much more!

Choose from 24-hour, 48-hour, or 72-hour validity, depending on your trip duration. The card itself also serves as your Korea transport card where you can top-up to pay for public transport.

Check out our Discover Seoul Pass guide where we discussed the benefits, costs, and sample itinerary in greater detail.

BUY DISCOVER SEOUL PASS

5. Klook Seoul Pass

If you are staying longer in Korea, we recommend the Klook Seoul Pass as it is valid for 30 days. You can handpick the top attractions you want to visit without squeezing them into a number of days like the Discover Seoul Pass, which will force you to use it within 24 hours to 72 hours, depending on what you avail.

With the Klook Seoul Pass, you have the freedom to pick the attractions you want to visit and when to visit them. Choose from 2, 3, or 4-attraction passes and get up to 52% discount. Some of the top attractions include Everland, Nami Island, N Seoul Tower, Lotte World, and COEX Aquarium to name a few.

BUY KLOOK SEOUL PASS

Korea travel essentials for communication and connectivity

6. korea sim card.

South Korea is one of the countries with the fastest internet speed so you are assured that the data from their SIM cards are of top quality. If you are traveling solo or as a couple, we recommend that you get a SIM card since it’s handy and more efficient than getting another device like a pocket WiFi. You can even get an eSIM if you don’t want to insert another SIM card into your mobile phone.

There are various Korea SIM card options to choose from. You may read our Korea SIM card guide so you can compare the prices and advantages.

BUY KOREA eSIM

7. Korea Pocket WiFi

If you are traveling in groups, we suggest that you get a pocket WiFi instead since it can be shared with up to 5 devices. A pocket WiFi actually costs less than a SIM card, but there are also disadvantages to it like the battery life may only last for 7 to 9 hours, and you need to physically return the device before you fly back home.

You may read our Korea pocket WiFi guide so you can see the costs and benefits before making a decision.

RENT POCKET WIFI

These are some of the best Korea tourist cards, transportation cards, and travel items we wished we paid more attention to and actually bought when we went to Korea. So, if we were you, secure your Korea tourist card ahead and you’ll thank us later!

Before you go, you may be interested to read our 5-day Korea winter itinerary , 5-day Korea spring itinerary , Incheon Airport to Seoul guide , and Korean street food guide .

South Korea Travel Requirements: Complete Guide

Last Updated: Jun 16, 2024 by Max · This post may contain affiliate links · Leave a Comment

Whether planning a trip to South Korea or getting ready for a layover in Incheon Airport , it's important to understand the travel requirements for visiting Korea.

Before you book your ticket, make sure all of the necessary documents are in check, including a K-ETA or visa for Korea. In this post I discuss the important travel requirements for South Korea to make your trip planning a lot smoother.

✈️ Basics of Travel in South Korea

📝 south korea entry requirements, ✍️ how to apply for k-eta: step-by-step, 🚌 public transportation and safety, ✅ travel advisory and checklist , 🙋 frequently asked questions.

Visa: Most travelers will need a K-ETA ( Korean Electronic Travel Authorization ), applied for at least 72 hours before departure. If you needed a visa before, you'll need a K-ETA now. Note that from April 1, 2023, to December 31, 2024, passport holders from 22 countries, including the US, UK, Canada, and several EU nations, can visit visa-free – no K-ETA required!

Currency: South Korean won ( KRW or ₩ )

Arrival in Korea: all international flights arrive at Incheon Airport (ICN), one of the best-rated airports in the world. It usually takes about 1 hour to get through security & pick up checked bags.

Getting Around: Korea has an extensive & reliable public transport system. A refillable T-Money card is your ticket to buses and trains across the country; you can buy and refill yout TMoney card at any subways station or convenience store in Korea.

Internet & SIM Cards: Rent a Wi-Fi egg or purchase a prepaid Korean SIM card at the airport, available for up to one month of connection.

Travel Insurance: always recommended, though some credit card companies offers limited coverage when booking.

Visa Categories and Conditions

When you plan a trip to South Korea, you must be aware of the various Korean visa categories and conditions . Each South Korean visa category differs depending on the purpose and duration of one’s stay, but the most common categories are for tourist, business, and student visas.

Most foreigners I encountered when living in Korea happened to be citizens of a primarily English-speaking country (like Australia, Canada, England, Ireland, New Zealand, South Africa, and the U.S.A.) who have an E-2 visa.

This visa lets you stay in the country to teach English for 13 months - if you’re curious about teaching English in Korea and want to know more, please visit the English Program in Korea (EPIK) website.

Korean Electronic Travel Authorization (K-ETA)

A Korean Electronic Travel Authorization (K-ETA) may be required for some nationalities, and a visa is needed for others. To check your eligibility and find out how long you can stay in South Korea, please use the official K-ETA Application Eligibility Guide .

Make sure to apply for a K-ETA at least 72 hours (or even earlier) before travel. Most travelers recommend acquiring this as soon as possible because it may take a while to process, or you may need to reapply, though one month in advance is generally enough time.

Visa-Free Travel and Visa Waiver Countries

For some nationalities, visa-free travel to South Korea is possible under specific conditions. If you come from a designated visa-free or visa-waiver country, you may enter South Korea without a visa for short-term tourism or business purposes .

Still - this benefit doesn’t exempt you from the K-ETA requirement, so be sure to secure one before you arrive in South Korea.

Note: Always check the current visa policies for your specific nationality before making your travel arrangements . For a list of South Korea’s visa-free countries, please refer to this site .

Documents and Passport Validity

Depending on your nationality and the type of visa you have, you may still need to provide other supporting documents, such as a return or onward ticket or proof of sufficient funds for your stay (and you may also need an itinerary if you are planning to venture Korea as a tourist).

Also, it's important that you check if your passport is valid at the time of entry and that it has at least one blank page for a stamp. Besides the passport, you can refer to HandyVisas to learn what requirements you need to enter South Korea.

Culture enthusiasts will love the idea that most of the tourist sites in Korea can also be visited for a small fee or free if they meet certain conditions (like wearing a hanbok in any of the five Seoul palaces ).

Before starting the process, you have to make sure that you have the following: a valid passport, an ID photo following the K-ETA conditions, dual nationality information (if applicable), travel agency information (optional), and an address in Korea .

There’s also a ₩10,000 fee (~$8USD) for the application process, and additional fees depending on your online payment method may apply. Be sure to check everything carefully before you hit send because once you pay this amount, you can never get it back.

You must also be willing to disclose a history of disease-related information and state past criminal records. For more information regarding this process, please visit the Application Requirements page of the K-ETA website.

Applying for a K-ETA is very simple. First, you must apply for K-ETA through the K-ETA official website or download the mobile app (in Google Play or Apple App Store ) at least 24 hours before boarding an airplane or ship bound for Korea.

Once you have chosen your mode of application, here’s a step-by-step guide to the whole process:

1. Choose your preferred language and service type on the upper left corner of the site. The website offers multiple language options.

2. Click the two bars in the upper right corner, and press “ K-ETA Apply .”

3. Answer the Terms and Conditions Agreement. Select your continent/region, and then select the country/region listed on your passport. Read the following agreements on the collection and use of personal information, and make sure you agree to everything before moving forward.

4. Fill in your passport number and submit your email address. Provide a valid and active email address, as you will receive confirmation and updates regarding your K-ETA application through this email.

5. Enter your personal and travel details. In this step, you are asked to upload a passport bio page image file. Fill in your personal and passport information, including your full name, date of birth, passport number, and passport expiry date.

6. If you are a dual citizen, kindly indicate “YES” once you see this option.

7. Upload your phone number. If you don’t have a personal phone number, make sure that it is a contactable and reachable line.

8. Indicate if you have ever visited Korea before, select your purpose of entry, and enter the address where you will be staying in Korea. Toggle between the Korean or English option depending on the address given to you.

You can search using the postal code search or the address search. Hit the find button on the search engine and choose the address generated by the search results. Then, you provide the full address in the space below to include specifics like the floor and room number.

9. Provide your contact number in Korea. If you don’t have a mobile phone number yet, you can input the number of your hotel, guesthouse, company, or acquaintance. Afterward, choose your occupation type.

10. Please declare if you are currently sick with an infectious disease and if you have faced any criminal charges in the past.

11. Upload your photo. You must upload a recent passport-sized photo of yourself with a plain white background. It should be in color, saved as an image file (preferably in .jpg format), and its size should be under 100 KB with a pixel density of less than 600x600.

Avoid wearing accessories like hats, scarves, or sunglasses in the picture, and opt for simple clothing. Remember that Korean identification rules require a full face, facing forward, eyes open, and looking directly at the camera.

12. Review and confirm your information. Before submitting your application, double-check all the information you entered to ensure everything is correct. If everything is accurate, proceed with submitting your application.

13. Pay the K-ETA fee. You will be prompted to pay the K-ETA application fee online using the provided payment options. Complete the payment process to finalize your application.

After completing these steps, you'll receive a confirmation email with your K-ETA application number. Once approved, the K-ETA will be sent to your email. Remember to print it out and carry it with you when traveling to South Korea.

Take note that your K-ETA is valid for 3 years (or 2 years if you applied before July 3, 2023) from the approval date. But, if the passport you used for the K-ETA application expires in less than 2 years, then the K-ETA approval will only be good until your passport’s expiration date.

Using Public Transportation

Public transportation in South Korea is known for being efficient, reliable, and relatively easy for foreigners to navigate, especially the Seoul Subway . When visiting for tourism or business purposes, you'll find that most transportation systems have English signage, albeit sometimes intermittently, making it simpler to find your way around.

Keep in mind that it's always a good idea to plan your routes in advance to avoid any confusion. To plan routes, download applications like Kakao Map ( Android | Apple ) or Naver Map ( Android | Apple ) to help you with your travel planning.

Medical Care and Emergency Assistance

In case you need medical care or emergency assistance during your time in South Korea, it's important to be aware of the available resources. You can dial 1339, which is the Medical Assistance Call Center, if you need help finding medical facilities or understanding the local healthcare system.

Additionally, make sure to visit your doctor at least a month prior to your trip to get any vaccines or medicines you might need.

Alcohol and Drug Regulations

It's essential to be aware of and adhere to the country's alcohol and drug regulations. South Korea has strict laws when it comes to drug possession and usage, with severe penalties for violations.

For alcohol consumption the rules aren’t as strict, considering that they only have stipulated the legal drinking age (19 years old) and the regulation of online alcohol sales.

This doesn’t mean that you should go crazy on your drinking. Keep in mind that despite the cultural drinking expectations , you must know your limits to keep yourself safe in a different country.

Covid-19 Advisory

Before traveling to South Korea, it's important to stay updated with the latest travel advisories. Read the Department of State's COVID-19 page and the Embassy's COVID-19 page for country-specific information.

Currently, the Republic of Korea doesn’t require incoming visitors to undergo COVID-19 testing, show proof of vaccination, or fulfill quarantine requirements for entry to Korea.

However, they still need you to present a QR code from the Quarantine Information Advance Input System . If you haven’t accomplished this, then upon arrival, airport staff will have you fill out a yellow form.

The rules and regulations are always subject to change, and you should always visit the Korea Disease and Control Prevention Agency for updates regarding this matter.

If you’re required to do a PCR test upon arrival, please refer to this list of COVID-19 Screening Clinics . Even though the restrictions on COVID-19 have been lifted, it’s still essential that you abide by the local COVID-19 guidelines and protocols to ensure your safety and the safety of those around you.

Q-Code System

When traveling to South Korea, you should be aware of the Q-Code system , which handles the management of incoming travelers. The Q-Code system is an electronic health declaration that helps Korean authorities monitor the health condition of travelers entering the country.

Upon arrival, you must download and install a mobile app on your device and register your personal information, including your vaccination status and PCR test certificate, if applicable.

The Q-Code system will assign you a unique code to track your health while you’re in Korea. You should carry your phone with you at all times during your stay in the country, as you may be required to present your Q-Code at any public health center or facility for monitoring purposes.

Last-Minute Checklist

To help prepare for your trip, create a checklist to ensure you have everything you need. Consider including the following items on your checklist:

- Valid passport with at least 6 months of validity remaining

- Travel insurance that covers your entire duration in South Korea (try WorldNomads and Visitors Coverage if you don’t have one yet)

- Copies of important documents, such as your passport and travel insurance policy

- Adequate local currency for your trip

In addition to these essentials, preparing for your health and safety while visiting South Korea is important. If you need assistance locating a facility that provides specific vaccines or medicines, visit the CDC's Find a Clinic page .

Furthermore, Americans may enroll in the Smart Traveler Enrollment Program (STEP ) to receive alerts and help the embassy locate you in case of an emergency. Lastly, familiarize yourself with local customs, etiquette , laws, and norms to ensure a smooth and enjoyable trip.

Currently, pre-departure negative PCR test certificates are no longer required to enter South Korea since September 3, 2022. However, upon arrival, travelers exhibiting symptoms like fever or cough need to undergo COVID-19 testing at their own expense.

There are no specific COVID-19 vaccination requirements for travel to South Korea. But, vaccinated visitors do benefit from not having to quarantine upon arrival. Remember that the situation can change in the future, so it is essential to stay updated on any new regulations regarding vaccination and entry.

US citizens traveling to South Korea for short-term business or tourism purposes don’t need a tourist visa from April 1, 2023, to December 31, 2024. The Korean Electronic Travel Authorization (K-ETA) is also not required during this period. However, your passport must be valid at the time of entry, and you need at least one blank page for entry stamps.

Foreign nationals entering South Korea won’t be required to undergo a 7-day mandatory quarantine. However, travelers must still obtain a valid visa or K-ETA before their trip. Moreover, I advise you register your travel and health information through the Quarantine COVID-19 Defense (Q-Code) system before traveling to streamline the airport arrival process.

More South Korea Travel

Sharing is caring!

Reader Interactions

No Comments

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

KoreaTechDesk | Korean Startup and Technology News

Mon, July 15, 2024

Travel Wallet attracts Series C investment, plans to launch cloud-based B2B payment solution

Travel Wallet is a global payment service

Korean FinTech startup Travel Wallet, a global payment service, has secured 19.7 billion won ($15 million) in Series C investment from investors including SK Securities, Golden Oak Investment, Smilegate Investment, CJ Investment, and BNK Investment & Securities. This investment brings the cumulative amount of investment in Travel Wallet to 50 billion won ($38 million).

With this latest funding, Travel Wallet’s financial stability is expected to be further enhanced. The company now has 37.5 billion won in equity capital and 70 billion won in cash assets, a scale more than 10 times that of its customer prepaid charges.

Travel Wallet provides a global payment service that eliminates payment and exchange fees when traveling abroad or making purchases overseas. Users can exchange currencies of 38 countries through the Travel Wallet app and pay at over 100 million VISA online and offline stores worldwide, without any payment fees. The payment service is available in 38 currencies, including the US dollar, euro, yen, and various Asian currencies. Travel Wallet only charges the lowest level of fees in the country for other currencies.

By simplifying the complex international settlement and payment process, Travel Wallet has built its own modern foreign exchange trading system, drastically lowering the costs of existing international transactions. The company also offers Travel Pay, a service that provides the lowest level of overseas payment fees.

This year, Travel Wallet plans to launch a cloud-based B2B payment solution after three years of development. This solution aims to help domestic and foreign companies enter the payment business without initial cost investment by providing the necessary infrastructure for domestic and international payment business on a cloud basis.

- On Vacation, a Chat-Based Personalized Travel Platform, Secures Pre-A Investment from Fast Ventures

- Korean startup, Travelai will enter Thailand and Malaysia by early 2023

- PaymentInApp wants to provide better service than ‘Uber’ for Smart City public transit systems

- Korean Fintech startup Paywatch’s EWA service garners attention as a financial welfare service for employees

WeBudding partners with the most popular free app Goodnotes 5 to provide Korean digital stationery content to users globally

Korean space startup innospace successfully launches suborbital test rocket hanbit-tlv from brazil.

POPULAR POSTS

MOST READ ARTICLE OF THE WEEK

List article, similar articles.

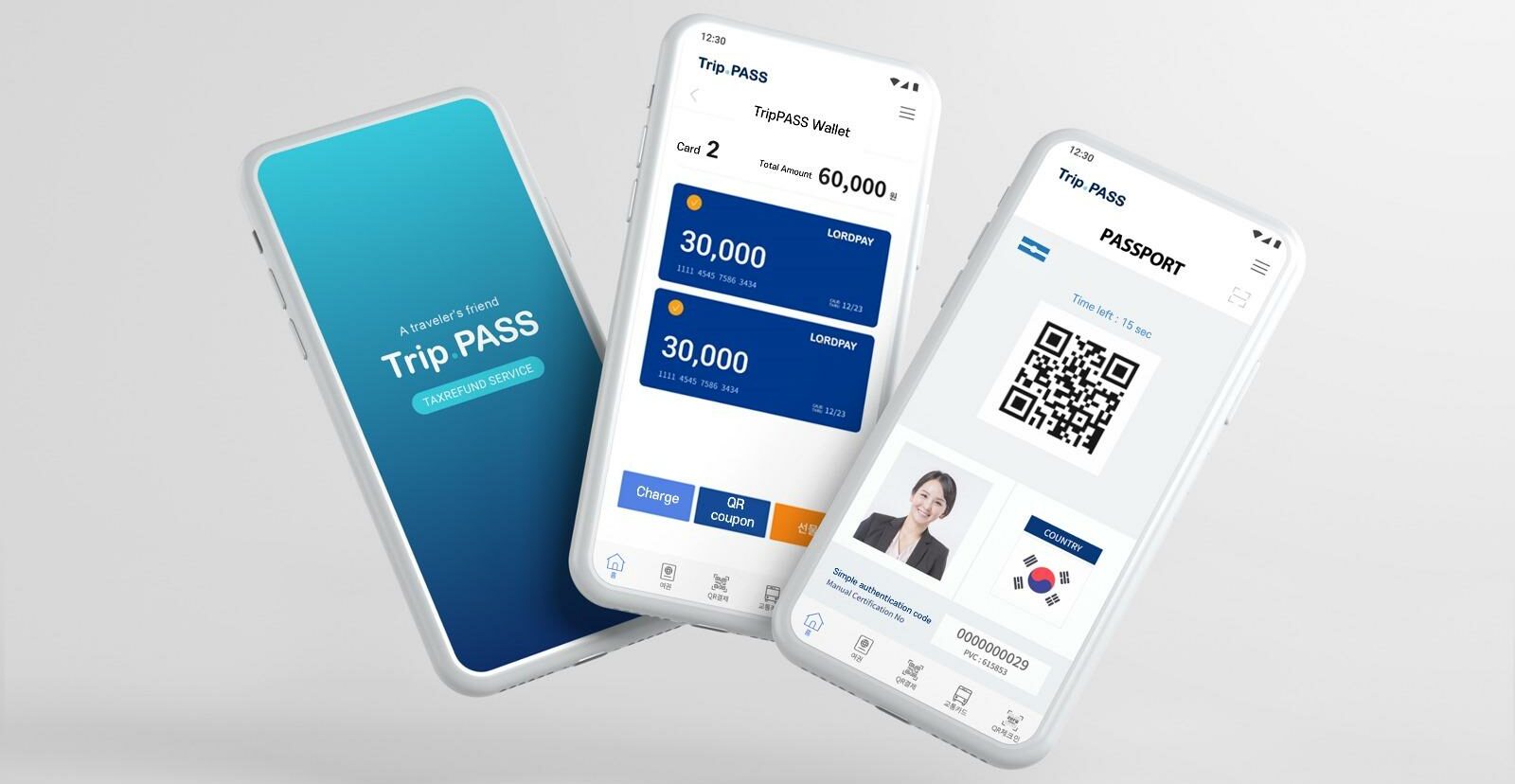

Lord System’s ‘Mobile Passport’ Simplifies Identification Authentication & Elevates Duty-Free Shopping

‘Unicorn’ Korea Credit Data Secures $75.7 Million Funding from Morgan Stanley Tactical Value

Fintech Startup Finda Attracts $ 36 million Series C Investment from JB Financial Group & 500 Global

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

We hope you enjoy our content, May you please give us Feedback regarding our website!

Single post feedback, what you think about koreatechdesk, share your idea with us, feedback popup.

- Rate your experience * Very Good Good Normal Poor Very Poor

- Describe your experience

Invitation submission has been closed

Insert/edit link.

Enter the destination URL

Or link to existing content

In My Korea

How To Pay In Korea: Cash, Card And Other Payment Methods

Planning to travel to South Korea soon but not sure what’s the best way to pay for goods and services in Seoul and beyond? Want to avoid expensive money exchange costs when you arrive in Korea? The issue of how to pay in Korea, whether you should use cash, card, or some other payment means, is a common problem for travellers and one I hope to resolve in this article.

This article will cover the most popular methods of payment, like cash and credit cards, as well as other methods, such as mobile payment apps, Korean debit cards, and transportation cards. From street food to shopping, sightseeing, and singing rooms, spending money in Korea doesn’t need to be difficult.

I’ve lived and travelled in Korea since 2015 and helped hundreds of people plan their trip to Korea through this website and social media groups. I want to share all of my best tips to help you save money, avoid problems, shop, and spend in Korea more easily and to help you plan your Korean adventure.

Table of Contents

Affiliate Disclaimer : This site contains affiliate links and I may earn commission for purchases made after clicking these links.

Cash Or Card: What’s The Best Way To Pay In Korea?

Which is better, cash or card when you want to pay in Korea? Well, it depends on a number of factors, such as what you’re buying, where you’re buying it from, and which country you’re visiting from. You might use cash to pay for small purchases in stores, traditional markets, or for street food, but as all merchants in Korea are required to accept credit cards by law, the need for cash is shrinking.

Using a credit card is the best payment method in Korea and will allow you to pay safely and conveniently for tours, hotels, meals, coffee, and more. Visa and Mastercard are accepted widely for payments in Korea from small purchases in shops to large payments like hotels and tours. However, using a foreign credit card isn’t 100% reliable for payments, so taking cash is a good backup.

Korea is fast becoming a cash-free society with a strong push for digital payments through apps, as well as the use of credit cards and mobile payments. Public transport has long rewarded travellers who don’t use cash with discounted fares available through transportation cards . These days, many buses are cash-free and won’t accept cash in cities like Seoul (20% of buses) and Daejeon (all buses).

If you don’t want to pay with your credit card when travelling in Korea, an alternative is a multi-currency travel card , such as those offered by Wise and Revolut, as well as payment apps such as Apple Pay and Samsung Pay . These are becoming more common as a means to spend money when visiting Korea and a way to possibly save money vs. exchanging cash.

Recommended Money Mix For Visiting Korea

What payment options would I recommend for Korea? From my own experience of travelling abroad for over 20 years, I recommend a mixture of cash and card , as well as paying for as much as you can before travelling so you can pay in your home currency. Booking hotels, tours, and attractions through sites like Klook.com can potentially save you money and avoid exchange fees.

Here’s a suggested money mix for visiting Korea:

- You can withdraw extra cash using a credit card or multi-currency card if you need to.

- Alternatively, get a WOWPASS when you arrive in Korea and bring more cash to top it up.

- Online prices for attractions are generally much cheaper than the gate prices.

Despite Korea being card-friendly, there are still times when you need cash, so definitely bring some with you or withdraw it from a Global ATM in Korea. I suggest using a card for most of your spending as it’s quick, convenient, and increasingly the only option due to Korea’s move away from using cash .

Which card you bring depends on what you’re comfortable using. I travel using a Wise multi-currency card to make payments and receive money in Korea from my own account and other sources. When I travel to other countries in Asia, such as Thailand, I don’t use my UK credit card as my bank charges me an exchange fee. It’s much cheaper for me to transfer money to my Wise card instead.

Another option that I would recommend to travellers, especially those from other parts of Asia, is bringing cash and loading it onto a WOWPASS , which is a Korean debit card. The WOWPASS allows you to exchange money from 15 foreign currencies into Korean won and load it onto the debit card, which you can use to pay across Korea.

I’ll cover each of the payment methods discussed above in the following sections so you can get a better idea of the pros and cons of each and whether it’s the right way for you or not.

Disclaimer : This guide is intended to provide you information about payment options in Korea and the practicality of using each. I don’t think there is one payment option that is suitable for all travellers and I recommend you look at your own situation and determine what’s best for you based on exchange fees from your country, fees charged by your bank, and whether your credit card works overseas.

Paying By Debit And Credit Card In Korea

Credit cards from Visa and Mastercard are widely accepted in Korea and will work in most locations, including tourist attractions, hotels, shops, department stores, and restaurants. American Express is also accepted, but not as widely. Using your credit card in Korea can be a great way to build up points / miles and your card may have other benefits, such as travel insurance.

While larger businesses are likely to accept foreign credit cards, you might find that smaller ones refuse to accept them or are unable to process them, which is why I recommend bringing some cash or getting a Korean debit card just in case. However, in most places, especially in tourist-friendly places like Seoul, Busan, and Gyeongju, international credit cards should be accepted without any problems.

Here are some considerations when deciding whether you should pay by credit card in Korea:

Foreign Exchange Fees : Your bank may charge you a fee when you use your credit card overseas. Be sure to check with your bank before travelling so you don’t find unexpected costs when you return.

ATMs : Foreign credit cards should work at ‘Global ATMs’ in popular tourist areas like Myeongdong, Hongdae, and Gangnam, as well as at Incheon Airport. However, other ATMs in Korea may not accept non-Korean credit cards. There is usually a fee to use a Korean ATM of around ₩3,600 (about $3). Also, Korean ATMs don’t operate 24 hours a day and close around 11pm at night.

Chip & Pin Use : Card payments in Korea are done by touching the card to a card reader or inserting the card and signing for the payment if it’s over ₩50,000. Chip & Pin isn’t commonly used in Korea.

Blocked Cards : Your bank may block your credit card when travelling as a security measure. It might be necessary to tell your bank that you plan to travel to Korea so they don’t block it later on.

Fraud & Card Security : Credit card fraud against tourists in Korea isn’t a serious issue, although it can still happen. Phishing is a growing problem in Korea, but usually against Koreans instead of tourists.

Pay Before You Travel : You can book tours, hotels, attractions, and lots more online before you travel and pay with your credit card. These will charge you in your own currency, so there’s no exchange rate fees and you also have peace of mind that everything is booked before you arrive in Korea.

Debit Cards : If your debit card is from Visa, Mastercard, or American Express, you should be fine using it to pay in Korea in the same way you can a credit card, as long as your bank allows it. However, the same issues will apply when trying to withdraw money from an ATM – you’ll need to go to a ‘Global ATM’ to withdraw cash. Also, you’ll need to check if your bank allows you to use it internationally.

Multi-Currency Cards: Wise And Revolut

I know many travellers feel comfortable using their own credit card due to the various benefits their credit card might offer, but there is another way to pay in Korea that could lower the fees you pay. This alternative is a multi-currency travel card, which allows you to convert money from your home currency to Korean won online and then use that balance to pay by card in Korea.

There are many companies that offer multi-currency travel cards, including Wise and Revolut , which are available to residents of the USA, Canada, UK, Europe, Australia, New Zealand, Singapore, and many other countries. Starling Bank (UK), YouTrip (Singapore), Chime (US), N26 (Eurozone), and KOHO (Canada) also provide multiple-currency travel cards.

The main benefits of these cards can include:

- Top-up from your home bank account.

- Only spend what you need.

- No transaction fees when you pay by card.*

- You get the mid-market exchange rate.*

- Withdraw cash from ATMs.

- Track your spending with the app.

- Instantly freeze and replace your card.

- Digital payments through Google / Apple Pay*

- Can be used in dozens of countries.*

*depending on the card and the terms and conditions of that card

What’s good about these cards? Multi-currency cards offer a lot of flexibility and cost savings when travelling as you can get the mid-market exchange rate on currency exchanges, which is typically better than the rates offered by money exchanges. It’s easy to control your spending in the connected app and you can transfer more money to the card when you need it. Any leftover money can be refunded, saved for later, or converted into another currency. You can also use them in other countries.

How do these cards let you pay in Korea? The process is really simple. First, apply for the card before you travel and download the relevant app that goes with it. Transfer money from your bank to top-up the card balance in your home currency and then convert that into Korean won (or other currencies you might need). When you arrive in Korea, use the card as you would a regular credit card.

My experience using Wise in Korea : I’ve tested out both the Wise card and Revolut card in Korea and they both worked with no real problems. I tested them in restaurants, shops, cafes, attractions, and other places tourists are likely to visit. The only time they didn’t work was at an automated kiosk for train tickets in Seoul Station. I use the Wise card to spend my UK money in Korea or when I travel.

Learn more : This article about using Wise in Korea shows you how to get a Wise card, how it can save you money as you travel (in many countries), how to activate the card in Korea, and lots more.

WOWPASS Korean Debit Card

An alternative to using your own credit card to pay in Korea is to get a local Korean debit card called the WOWPASS . The WOWPASS has two great functions that make it a practical solution for travellers to Korea, especially those from countries such as the Philippines, Indonesia, Malaysia, and Thailand.

Debit Card Function : The main feature of the WOWPASS is the ability to pay like a local in Korea with a debit card issued by a Korean company, which is accepted in most locations. You can exchange 15 currencies, including PHP, IDR, MYR, THB, into Korean won to top-up the debit card (up to a value of 1 million won) at the WOWPASS terminals found across Korea. This helps you to avoid exchanging cash elsewhere and you can withdraw cash from the card in Korean won, too.

T-Money Function : The WOWPASS comes with a built in T-Money transportation card, which means you can use it to travel on Korea’s buses and subways. This makes it really easy to travel around Korea and you can simply touch in and out of buses and subways as you travel and the fee will be automatically deducted.

My experience using WOWPASS in Korea : I wrote an article about the WOWPASS and tried using the card in loads of locations in Seoul, Incheon Airport, and Daejeon. It’s very easy to use and the app helps you find the WOWPASS machines where you can recharge the card and exchange money. I still use the card now and I would definitely recommend it as an option for people visiting Korea.

Learn more : Read my guide to the WOWPASS to see how to get one, where it works, how to top it up, ways it can save you money, and my experience using the WOWPASS in Korea.

Planning to visit Korea? These travel essentials will help you plan your trip, get the best deals, and save you time and money before and during your Korean adventure.

Visas & K-ETA: Some travellers to Korea need a Tourist Visa , but most can travel with a Korean Electronic Travel Authorisation (K-ETA). Currently 22 Countries don’t need either one.

How To Stay Connected : Pre-order a Korean Sim Card or a WiFi Router to collect on-arrival at Incheon Airport (desks open 24-hours). Alternatively, download a Korean eSIM for you travels.

Where To Stay : For Seoul, I recommend Myeongdong (convenient), Hongdae (cool culture) or Gangnam (shopping). For Busan, Haeundae (Beach) or Seomyeon (Downtown).