Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

Harmonized System (HS) Codes

Harmonized system (hs) codes .

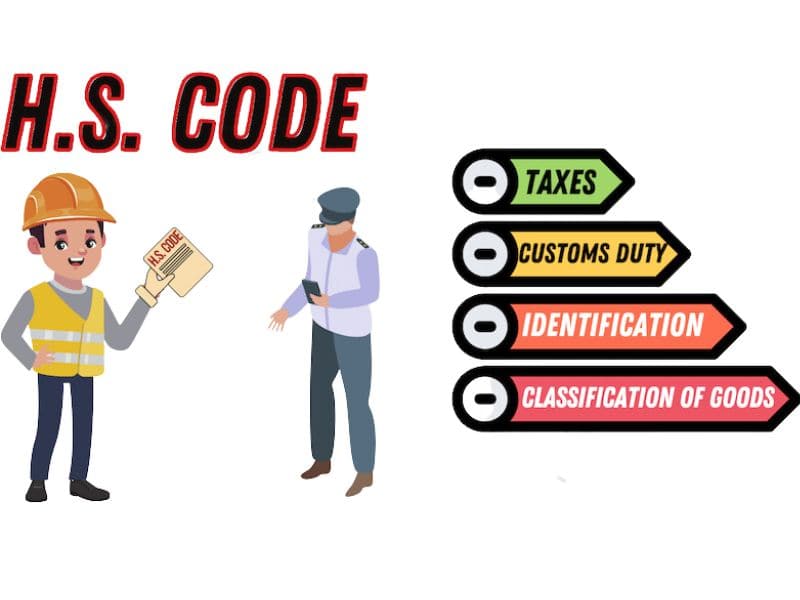

Among industry classification systems , Harmonized System (HS) Codes are commonly used throughout the export process for goods. The Harmonized System is a standardized numerical method of classifying traded products. It is used by customs authorities around the world to identify products when assessing duties and taxes and for gathering statistics.

The HS is administrated by the World Customs Organization (WCO) and is updated every five years. It serves as the foundation for the import and export classification systems used in the United States and by many trading partners.

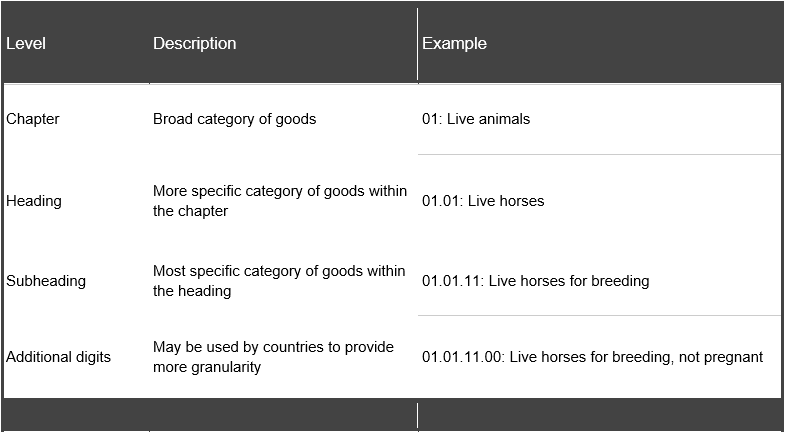

The HS assigns specific six-digit codes for varying classifications and commodities. Countries are allowed to add longer codes to the first six digits for further classification.

The United States uses a 10-digit code to classify products for export, known as a Schedule B number, with the first six digits being the HS number. There is a Schedule B number for every physical product, from paper clips to airplanes. The Schedule B is administered by the U.S. Census Bureau’s Foreign Trade Division .

How You Use the HS Code

You will need both the U.S. Schedule B number and the foreign country’s version of the HS code for your product during the export process. You use it to:

- Classify physical goods for shipment to a foreign country;

- Report shipments in the Automated Export System (AES) when the value is more than $2,500, or the item requires a license.

- Complete required shipping documentation such as shipper’s letter of instructions, commercial invoice or certificate of origin;

- Determine import tariff (duty) rates and figure out if a product qualifies for a preferential tariff under a free trade agreement;

- Conduct market research and obtain trade statistics;

- Comply with U.S. law, where applicable.

How to Identify Your Product’s (U.S.) Schedule B Code

The Census Bureau offers a free, widely used online Schedule B search tool that can help you classify your products. The Schedule B search tool is the most commonly used method for classifying products. The site provides training resources to help you better identify for your Schedule B number, as well as contact information for assistance.

If your product is difficult to classify, the Customs Rulings Online Search System (CROSS) database can help you find its Schedule B code. CROSS contains official, legally binding rulings from other exporters’ and importers’ requests for Schedule B codes. Use this database to determine whether other exporters or importers requested a ruling on the same or a similar product and, if so, what that ruling was.

Special situations:

- Shipping multiple items as a set : For the most part, determining a product’s Schedule B code is straightforward. For example, an unassembled bicycle that is sold in a box containing the bicycle frame, handlebars, pedals, and seat is classified as a bicycle (because the item is sold as one unit) and not as several different components. Some sets, however, are harder to classify. Rule 3 of the General Rules of Interpretation (GRI) of the Harmonized Tariff Schedule addresses composite goods, mixtures, and items that are sold in a set. The GRI has established a three-step process for determining the Schedule B code in such situations; the introduction to the official Schedule B publication contains the relevant passage.

- Textiles/Apparel shipped as a set: The rules that govern Schedule B codes for textiles and apparel sets are unique. Refer to GRI Chapter 50, Note 14 for more information.

How to Identify Your Product’s Foreign HS Code

To determine what the HS Code for your product is in another country, you can use a lookup tool in a foreign tariff database, such as the Customs Info Database .

Harmonized System

Here you can type a keyword, INN or CAS numbers.

You can find your search history by clicking on the button on the left side of the search bar.

You can use the Advanced search by clicking on the Advanced search button, or you can use the following shortcuts:

- @subheading

- @legalnotes

- @explanatorynotes

- @classificationopinion

- @hsnomenclature

LIVE ANIMALS; ANIMAL PRODUCTS

- Add to folder

- Send by e-mail

- Legal Notes

- Explanatory Notes

- Classification Opinions

1.- Any reference in this Section to a particular genus or species of an animal, except where the context otherwise requires, includes a reference to the young of that genus or species.

2.- Except where the context otherwise requires, throughout the Nomenclature any reference to “dried” products also covers products which have been dehydrated, evaporated or freeze‑dried.

You must log in to see this content and use many features.

No account yet? Learn more about our subscription offers.

- Add comment

VEGETABLE PRODUCTS

1.- In this Section the term “pellets” means products which have been agglomerated either directly by compression or by the addition of a binder in a proportion not exceeding 3 % by weight.

ANIMAL, VEGETABLE OR MICROBIAL FATS AND OILS AND THEIR CLEAVAGE PRODUCTS; PREPARED EDIBLE FATS; ANIMAL OR VEGETABLE WAXES

Prepared foodstuffs; beverages, spirits and vinegar; tobacco and manufactured tobacco substitutes; products, whether or not containing nicotine, intended for inhalation without combustion; other nicotine containing products intended for the intake of nicotine into the human body, mineral products, products of the chemical or allied industries.

1.- (A) Goods (other than radioactive ores) answering to a description in heading 28.44 or 28.45 are to be classified in those headings and in no other heading of the Nomenclature.

(B) Subject to paragraph (A) above, goods answering to a description in heading 28.43, 28.46 or 28.52 are to be classified in those headings and in no other heading of this Section.

2.- Subject to Note 1 above, goods classifiable in heading 30.04, 30.05, 30.06, 32.12, 33.03, 33.04, 33.05, 33.06, 33.07, 35.06, 37.07 or 38.08 by reason of being put up in measured doses or for retail sale are to be classified in those headings and in no other heading of the Nomenclature.

3.- Goods put up in sets consisting of two or more separate constituents, some or all of which fall in this Section and are intended to be mixed together to obtain a product of Section VI or VII, are to be classified in the heading appropriate to that product, provided that the constituents are :

(a) having regard to the manner in which they are put up, clearly identifiable as being intended to be used together without first being repacked;

(b) presented together; and

(c) identifiable, whether by their nature or by the relative proportions in which they are present, as being complementary one to another.

4.- Where a product answers to a description in one or more of the headings in Section VI by virtue of being described by name or function and also to heading 38.27, then it is classifiable in a heading that references the product by name or function and not under heading 38.27.

PLASTICS AND ARTICLES THEREOF; RUBBER AND ARTICLES THEREOF

1.- Goods put up in sets consisting of two or more separate constituents, some or all of which fall in this Section and are intended to be mixed together to obtain a product of Section VI or VII, are to be classified in the heading appropriate to that product, provided that the constituents are :

(a) having regard to the manner in which they are put up, clearly identifiable as being intended to be used together without first being repacked;

(b) presented together; and

(c) identifiable, whether by their nature or by the relative proportions in which they are present, as being complementary one to another.

2.‑ Except for the goods of heading 39.18 or 39.19, plastics, rubber, and articles thereof, printed with motifs, characters or pictorial representations, which are not merely subsidiary to the primary use of the goods, fall in Chapter 49.

RAW HIDES AND SKINS, LEATHER, FURSKINS AND ARTICLES THEREOF; SADDLERY AND HARNESS; TRAVEL GOODS, HANDBAGS AND SIMILAR CONTAINERS; ARTICLES OF ANIMAL GUT (OTHER THAN SILK-WORM GUT)

Wood and articles of wood; wood charcoal; cork and articles of cork; manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork, pulp of wood or of other fibrous cellulosic material; recovered (waste and scrap) paper or paperboard; paper and paperboard and articles thereof, textiles and textile articles.

1.‑ This Section does not cover :

(a) Animal brush‑making bristles or hair (heading 05.02); horsehair or horsehair waste (heading 05.11);

(b) Human hair or articles of human hair (heading 05.01, 67.03 or 67.04), except filtering or straining cloth of a kind commonly used in oil presses or the like (heading 59.11);

(c) Cotton linters or other vegetable materials of Chapter 14;

(d) Asbestos of heading 25.24 or articles of asbestos or other products of heading 68.12 or 68.13;

(e) Articles of heading 30.05 or 30.06; yarn used to clean between the teeth (dental floss), in individual retail packages, of heading 33.06;

(f) Sensitised textiles of headings 37.01 to 37.04;

(g) Monofilament of which any cross‑sectional dimension exceeds 1 mm or strip or the like (for example, artificial straw) of an apparent width exceeding 5 mm, of plastics (Chapter 39), or plaits or fabrics or other basketware or wickerwork of such monofilament or strip (Chapter 46);

(h) Woven, knitted or crocheted fabrics, felt or nonwovens, impregnated, coated, covered or laminated with plastics, or articles thereof, of Chapter 39;

(ij) Woven, knitted or crocheted fabrics, felt or nonwovens, impregnated, coated, covered or laminated with rubber, or articles thereof, of Chapter 40;

(k) Hides or skins with their hair or wool on (Chapter 41 or 43) or articles of furskin, artificial fur or articles thereof, of heading 43.03 or 43.04;

(l) Articles of textile materials of heading 42.01 or 42.02;

(m) Products or articles of Chapter 48 (for example, cellulose wadding);

(n) Footwear or parts of footwear, gaiters or leggings or similar articles of Chapter 64;

(o) Hair‑nets or other headgear or parts thereof of Chapter 65;

(p) Goods of Chapter 67;

(q) Abrasive‑coated textile material (heading 68.05) and also carbon fibres or articles of carbon fibres of heading 68.15;

(r) Glass fibres or articles of glass fibres, other than embroidery with glass thread on a visible ground of fabric (Chapter 70);

(s) Articles of Chapter 94 (for example, furniture, bedding, luminaires and lighting fittings);

(t) Articles of Chapter 95 (for example, toys, games, sports requisites and nets);

(u) Articles of Chapter 96 (for example, brushes, travel sets for sewing, slide fasteners, typewriter ribbons, sanitary towels (pads) and tampons, napkins (diapers) and napkin liners); or

(v) Articles of Chapter 97.

2.‑ (A) Goods classifiable in Chapters 50 to 55 or in heading 58.09 or 59.02 and of a mixture of two or more textile materials are to be classified as if consisting wholly of that one textile material which predominates by weight over any other single textile material.

When no one textile material predominates by weight, the goods are to be classified as if consisting wholly of that one textile material which is covered by the heading which occurs last in numerical order among those which equally merit consideration.

(B) For the purposes of the above rule :

(a) Gimped horsehair yarn (heading 51.10) and metallised yarn (heading 56.05) are to be treated as a single textile material the weight of which is to be taken as the aggregate of the weights of its components; for the classification of woven fabrics, metal thread is to be regarded as a textile material;

(b) The choice of appropriate heading shall be effected by determining first the Chapter and then the applicable heading within that Chapter, disregarding any materials not classified in that Chapter;

(c) When both Chapters 54 and 55 are involved with any other Chapter, Chapters 54 and 55 are to be treated as a single Chapter;

(d) Where a Chapter or a heading refers to goods of different textile materials, such materials are to be treated as a single textile material.

(C) The provisions of paragraphs (A) and (B) above apply also to the yarns referred to in Note 3, 4, 5 or 6 below.

3.‑ (A) For the purposes of this Section, and subject to the exceptions in paragraph (B) below, yarns (single, multiple (folded) or cabled) of the following descriptions are to be treated as “twine, cordage, ropes and cables” :

(a) Of silk or waste silk, measuring more than 20,000 decitex;

(b) Of man‑made fibres (including yarn of two or more monofilaments of Chapter 54), measuring more than 10,000 decitex;

(c) Of true hemp or flax :

(i) Polished or glazed, measuring 1,429 decitex or more; or

(ii) Not polished or glazed, measuring more than 20,000 decitex;

(d) Of coir, consisting of three or more plies;

(e) Of other vegetable fibres, measuring more than 20,000 decitex; or

(f) Reinforced with metal thread.

(B) Exceptions :

(a) Yarn of wool or other animal hair and paper yarn, other than yarn reinforced with metal thread;

(b) Man‑made filament tow of Chapter 55 and multifilament yarn without twist or with a twist of less than 5 turns per metre of Chapter 54;

(c) Silk worm gut of heading 50.06, and monofilaments of Chapter 54;

(d) Metallised yarn of heading 56.05; yarn reinforced with metal thread is subject to paragraph (A) (f) above; and

(e) Chenille yarn, gimped yarn and loop wale‑yarn of heading 56.06.

4.‑ (A) For the purposes of Chapters 50, 51, 52, 54 and 55, the expression “put up for retail sale” in relation to yarn means, subject to the exceptions in paragraph (B) below, yarn (single, multiple (folded) or cabled) put up :

(a) On cards, reels, tubes or similar supports, of a weight (including support) not exceeding :

(i) 85 g in the case of silk, waste silk or man‑made filaments; or

(ii) 125 g in other cases;

(b) In balls, hanks or skeins of a weight not exceeding :

(i) 85 g in the case of man‑made filament yarn of less than 3,000 decitex, silk or silk waste;

(ii) 125 g in the case of all other yarns of less than 2,000 decitex; or

(iii) 500 g in other cases.

(c) In hanks or skeins comprising several smaller hanks or skeins separated by dividing threads which render them independent one of the other, each of uniform weight not exceeding :

(i) 85 g in the case of silk, waste silk or man‑made filaments; or

(ii) 125 g in other cases.

(B) Exceptions :

(a) Single yarn of any textile material, except :

(i) Single yarn of wool or fine animal hair, unbleached; and

(ii) Single yarn of wool or fine animal hair, bleached, dyed or printed, measuring more than 5,000 decitex;

(b) Multiple (folded) or cabled yarn, unbleached :

(i) Of silk or waste silk, however put up; or

(ii) Of other textile material except wool or fine animal hair, in hanks or skeins;

(c) Multiple (folded) or cabled yarn of silk or waste silk, bleached, dyed or printed, measuring 133 decitex or less; and

(d) Single, multiple (folded) or cabled yarn of any textile material :

(i) In cross‑reeled hanks or skeins; or

(ii) Put up on supports or in some other manner indicating its use in the textile industry (for example, on cops, twisting mill tubes, pirns, conical bobbins or spindles, or reeled in the form of cocoons for embroidery looms).

5.‑ For the purposes of headings 52.04, 54.01 and 55.08, the expression “sewing thread” means multiple (folded) or cabled yarn :

(a) Put up on supports (for example, reels, tubes) of a weight (including support) not exceeding 1,000 g;

(b) Dressed for use as sewing thread; and

(c) With a final “Z” twist.

6.‑ For the purposes of this Section, the expression “high tenacity yarn” means yarn having a tenacity, expressed in cN/tex (centinewtons per tex), greater than the following :

Single yarn of nylon or other polyamides, or of polyesters ......................................................... 60 cN/tex

Multiple (folded) or cabled yarn of nylon or other polyamides, or of polyesters .................... 53 cN/tex

Single, multiple (folded) or cabled yarn of viscose rayon ........................................................... 27 cN/tex.

7.‑ For the purposes of this Section, the expression “made up” means :

(a) Cut otherwise than into squares or rectangles;

(b) Produced in the finished state, ready for use (or merely needing separation by cutting dividing threads) without sewing or other working (for example, certain dusters, towels, table cloths, scarf squares, blankets);

(c) Cut to size and with at least one heat-sealed edge with a visibly tapered or compressed border and the other edges treated as described in any other subparagraph of this Note, but excluding fabrics the cut edges of which have been prevented from unravelling by hot cutting or by other simple means;

(d) Hemmed or with rolled edges, or with a knotted fringe at any of the edges, but excluding fabrics the cut edges of which have been prevented from unravelling by whipping or by other simple means;

(e) Cut to size and having undergone a process of drawn thread work;

(f) Assembled by sewing, gumming or otherwise (other than piece goods consisting of two or more lengths of identical material joined end to end and piece goods composed of two or more textiles assembled in layers, whether or not padded);

(g) Knitted or crocheted to shape, whether presented as separate items or in the form of a number of items in the length.

8.‑ For the purposes of Chapters 50 to 60 :

(a) Chapters 50 to 55 and 60 and, except where the context otherwise requires, Chapters 56 to 59 do not apply to goods made up within the meaning of Note 7 above; and

(b) Chapters 50 to 55 and 60 do not apply to goods of Chapters 56 to 59.

9.‑ The woven fabrics of Chapters 50 to 55 include fabrics consisting of layers of parallel textile yarns superimposed on each other at acute or right angles. These layers are bonded at the intersections of the yarns by an adhesive or by thermal bonding.

10.‑ Elastic products consisting of textile materials combined with rubber threads are classified in this Section.

11.‑ For the purposes of this Section, the expression “impregnated” includes “dipped”.

12.‑ For the purposes of this Section, the expression “polyamides” includes “aramids”.

13.‑ For the purposes of this Section and, where applicable, throughout the Nomenclature, the expression “elastomeric yarn “means filament yarn, including monofilament, of synthetic textile material, other than textured yarn, which does not break on being extended to three times its original length and which returns, after being extended to twice its original length, within a period of five minutes, to a length not greater than one and a half times its original length.

14.‑ Unless the context otherwise requires, textile garments of different headings are to be classified in their own headings even if put up in sets for retail sale. For the purposes of this Note, the expression “textile garments” means garments of headings 61.01 to 61.14 and headings 62.01 to 62.11.

15.‑ Subject to Note 1 to Section XI, textiles, garments and other textile articles, incorporating chemical, mechanical or electronic components for additional functionality, whether incorporated as built-in components or within the fibre or fabric, are classified in their respective headings in Section XI provided that they retain the essential character of the goods of this Section.

Subheading Notes.

1.‑ In this Section and, where applicable, throughout the Nomenclature, the following expressions have the meanings hereby assigned to them :

(a) Unbleached yarn

Yarn which :

(i) has the natural colour of its constituent fibres and has not been bleached, dyed (whether or not in the mass) or printed; or

(ii) is of indeterminate colour (“grey yarn”), manufactured from garnetted stock.

Such yarn may have been treated with a colourless dressing or fugitive dye (which disappears after simple washing with soap) and, in the case of man‑made fibres, treated in the mass with delustring agents (for example, titanium dioxide).

(b) Bleached yarn

(i) has undergone a bleaching process, is made of bleached fibres or, unless the context otherwise requires, has been dyed white (whether or not in the mass) or treated with a white dressing;

(ii) consists of a mixture of unbleached and bleached fibres; or

(iii) is multiple (folded) or cabled and consists of unbleached and bleached yarns.

(c) Coloured (dyed or printed) yarn

(i) is dyed (whether or not in the mass) other than white or in a fugitive colour, or printed, or made from dyed or printed fibres;

(ii) consists of a mixture of dyed fibres of different colours or of a mixture of unbleached or bleached fibres with coloured fibres (marl or mixture yarns), or is printed in one or more colours at intervals to give the impression of dots;

(iii) is obtained from slivers or rovings which have been printed; or

(iv) is multiple (folded) or cabled and consists of unbleached or bleached yarn and coloured yarn.

The above definitions also apply, mutatis mutandis , to monofilament and to strip or the like of Chapter 54.

(d) Unbleached woven fabric

Woven fabric made from unbleached yarn and which has not been bleached, dyed or printed. Such fabric may have been treated with a colourless dressing or a fugitive dye.

(e) Bleached woven fabric

Woven fabric which :

(i) has been bleached or, unless the context otherwise requires, dyed white or treated with a white dressing, in the piece;

(ii) consists of bleached yarn; or

(iii) consists of unbleached and bleached yarn.

(f) Dyed woven fabric

(i) is dyed a single uniform colour other than white (unless the context otherwise requires) or has been treated with a coloured finish other than white (unless the context otherwise requires), in the piece; or

(ii) consists of coloured yarn of a single uniform colour.

(g) Woven fabric of yarns of different colours

Woven fabric (other than printed woven fabric) which :

(i) consists of yarns of different colours or yarns of different shades of the same colour (other than the natural colour of the constituent fibres);

(ii) consists of unbleached or bleached yarn and coloured yarn; or

(iii) consists of marl or mixture yarns.

(In all cases, the yarn used in selvedges and piece ends is not taken into consideration.)

(h) Printed woven fabric

Woven fabric which has been printed in the piece, whether or not made from yarns of different colours.

(The following are also regarded as printed woven fabrics : woven fabrics bearing designs made, for example, with a brush or spray gun, by means of transfer paper, by flocking or by the batik process.)

The process of mercerisation does not affect the classification of yarns or fabrics within the above categories.

The definitions at (d) to (h) above apply, mutatis mutandis, to knitted or crocheted fabrics.

(ij) Plain weave

A fabric construction in which each yarn of the weft passes alternately over and under successive yarns of the warp and each yarn of the warp passes alternately over and under successive yarns of the weft.

2.‑ (A) Products of Chapters 56 to 63 containing two or more textile materials are to be regarded as consisting wholly of that textile material which would be selected under Note 2 to this Section for the classification of a product of Chapters 50 to 55 or of heading 58.09 consisting of the same textile materials.

(B) For the application of this rule :

(a) where appropriate, only the part which determines the classification under Interpretative Rule 3 shall be taken into account;

(b) in the case of textile products consisting of a ground fabric and a pile or looped surface no account shall be taken of the ground fabric;

(c) in the case of embroidery of heading 58.10 and goods thereof, only the ground fabric shall be taken into account. However, embroidery without visible ground, and goods thereof, shall be classified with reference to the embroidering threads alone.

FOOTWEAR, HEADGEAR, UMBRELLAS, SUN UMBRELLAS, WALKING-STICKS, SEAT-STICKS, WHIPS, RIDING-CROPS AND PARTSTHEREOF; PREPARED FEATHERS AND ARTICLES MADE THEREWITH; ARTIFICIAL FLOWERS; ARTICLES OF HUMAN HAIR

Articles of stone, plaster, cement, asbestos, mica or similar materials; ceramic products; glass and glassware, natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin, base metals and articles of base metal.

1.‑ This Section does not cover :

(a) Prepared paints, inks or other products with a basis of metallic flakes or powder (headings 32.07 to 32.10, 32.12, 32.13 or 32.15);

(b) Ferro ‑cerium or other pyrophoric alloys (heading 36.06);

(c) Headgear or parts thereof of heading 65.06 or 65.07;

(d) Umbrella frames or other articles of heading 66.03;

(e) Goods of Chapter 71 (for example, precious metal alloys, base metal clad with precious metal, imitation jewellery);

(f) Articles of Section XVI (machinery, mechanical appliances and electrical goods);

(g) Assembled railway or tramway track (heading 86.08) or other articles of Section XVII (vehicles, ships and boats, aircraft);

(h) Instruments or apparatus of Section XVIII, including clock or watch springs;

(ij) Lead shot prepared for ammunition (heading 93.06) or other articles of Section XIX (arms and ammunition);

(k) Articles of Chapter 94 (for example, furniture, mattress supports, luminaires and lighting fittings, illuminated signs, prefabricated buildings);

(l) Articles of Chapter 95 (for example, toys, games, sports requisites);

(m) Hand sieves, buttons, pens, pencil-holders, pen nibs, monopods, bipods, tripods and similar articles or other articles of Chapter 96 (miscellaneous manufactured articles); or

(n) Articles of Chapter 97 (for example, works of art).

2.‑ Throughout the Nomenclature, the expression “parts of general use” means :

(a) Articles of heading 73.07, 73.12, 73.15, 73.17 or 73.18 and similar articles of other base metal, other than articles specially designed for use exclusively in implants in medical, surgical, dental or veterinary sciences (heading 90.21);

(b) Springs and leaves for springs, of base metal, other than clock or watch springs (heading 91.14); and

(c) Articles of headings 83.01, 83.02, 83.08, 83.10 and frames and mirrors, of base metal, of heading 83.06.

In Chapters 73 to 76 and 78 to 82 (but not in heading 73.15) references to parts of goods do not include references to parts of general use as defined above.

Subject to the preceding paragraph and to Note 1 to Chapter 83, the articles of Chapter 82 or 83 are excluded from Chapters 72 to 76 and 78 to 81.

3.- Throughout the Nomenclature, the expression “base metals” means : iron and steel, copper, nickel, aluminium, lead, zinc, tin, tungsten (wolfram), molybdenum, tantalum, magnesium, cobalt, bismuth, cadmium, titanium, zirconium, antimony, manganese, beryllium, chromium, germanium, vanadium, gallium, hafnium, indium, niobium (columbium), rhenium and thallium.

4.- Throughout the Nomenclature, the term “cermets” means products containing a microscopic heterogeneous combination of a metallic component and a ceramic component. The term “cermets” includes sintered metal carbides (metal carbides sintered with a metal).

5.‑ Classification of alloys (other than ferro‑alloys and master alloys as defined in Chapters 72 and 74) :

(a) An alloy of base metals is to be classified as an alloy of the metal which predominates by weight over each of the other metals;

(b) An alloy composed of base metals of this Section and of elements not falling within this Section is to be treated as an alloy of base metals of this Section if the total weight of such metals equals or exceeds the total weight of the other elements present;

(c) In this Section the term “alloys” includes sintered mixtures of metal powders, heterogeneous intimate mixtures obtained by melting (other than cermets) and intermetallic compounds.

6.‑ Unless the context otherwise requires, any reference in the Nomenclature to a base metal includes a reference to alloys which, by virtue of Note 5 above, are to be classified as alloys of that metal.

7.‑ Classification of composite articles :

Except where the headings otherwise require, articles of base metal (including articles of mixed materials treated as articles of base metal under the General Interpretative Rules) containing two or more base metals are to be treated as articles of the base metal predominating by weight over each of the other metals.

For this purpose :

(a) Iron and steel, or different kinds of iron or steel, are regarded as one and the same metal;

(b) An alloy is regarded as being entirely composed of that metal as an alloy of which, by virtue of Note 5, it is classified; and

(c) A cermet of heading 81.13 is regarded as a single base metal.

8.‑ In this Section, the following expressions have the meanings hereby assigned to them :

(a) Waste and scrap

(i) All metal waste and scrap;

(ii) Metal goods definitely not usable as such because of breakage, cutting up, wear or other reasons.

(b) Powders

Products of which 90 % or more by weight passes through a sieve having a mesh aperture of 1 mm.

9.- For the purposes of Chapters 74 to 76 and 78 to 81, the following expressions have the meanings hereby assigned to them :

(a) Bars and rods

Rolled, extruded, drawn or forged products, not in coils, which have a uniform solid cross-section along their whole length in the shape of circles, ovals, rectangles (including squares), equilateral triangles or regular convex polygons (including “flattened circles” and “modified rectangles”, of which two opposite sides are convex arcs, the other two sides being straight, of equal length and parallel). Products with a rectangular (including square), triangular or polygonal cross-section may have corners rounded along their whole length. The thickness of such products which have a rectangular (including “modified rectangular”) cross-section exceeds one-tenth of the width. The expression also covers cast or sintered products, of the same forms and dimensions, which have been subsequently worked after production (otherwise than by simple trimming or de-scaling), provided that they have not thereby assumed the character of articles or products of other headings. Wire-bars and billets of Chapter 74 with their ends tapered or otherwise worked simply to facilitate their entry into machines for converting them into, for example, drawing stock (wire-rod) or tubes, are however to be taken to be unwrought copper of heading 74.03. This provision applies mutatis mutandis to the products of Chapter 81.

(b) Profiles Rolled, extruded, drawn, forged or formed products, coiled or not, of a uniform cross-section along their whole length, which do not conform to any of the definitions of bars, rods, wire, plates, sheets, strip, foil, tubes or pipes. The expression also covers cast or sintered products, of the same forms, which have been subsequently worked after production (otherwise than by simple trimming or de-scaling), provided that they have not thereby assumed the character of articles or products of other headings.

(c) Wire Rolled, extruded or drawn products, in coils, which have a uniform solid cross-section along their whole length in the shape of circles, ovals, rectangles (including squares), equilateral triangles or regular convex polygons (including “flattened circles” and “modified rectangles”, of which two opposite sides are convex arcs, the other two sides being straight, of equal length and parallel). Products with a rectangular (including square), triangular or polygonal cross-section may have corners rounded along their whole length. The thickness of such products which have a rectangular (including “modified rectangular”) cross-section exceeds one-tenth of the width.

(d) Plates, sheets, strip and foil Flat-surfaced products (other than the unwrought products), coiled or not, of solid rectangular (other than square) cross-section with or without rounded corners (including “modified rectangles” of which two opposite sides are convex arcs, the other two sides being straight, of equal length and parallel) of a uniform thickness, which are : - of rectangular (including square) shape with a thickness not exceeding one-tenth of the width; - of a shape other than rectangular or square, of any size, provided that they do not assume the character of articles or products of other headings. Headings for plates, sheets, strip, and foil apply, inter alia , to plates, sheets, strip, and foil with patterns (for example, grooves, ribs, chequers, tears, buttons, lozenges) and to such products which have been perforated, corrugated, polished or coated, provided that they do not thereby assume the character of articles or products of other headings.

(e) Tubes and pipes Hollow products, coiled or not, which have a uniform cross-section with only one enclosed void along their whole length in the shape of circles, ovals, rectangles (including squares), equilateral triangles or regular convex polygons, and which have a uniform wall thickness. Products with a rectangular (including square), equilateral triangular or regular convex polygonal cross-section, which may have corners rounded along their whole length, are also to be considered as tubes and pipes provided the inner and outer cross-sections are concentric and have the same form and orientation. Tubes and pipes of the foregoing cross-sections may be polished, coated, bent, threaded, drilled, waisted, expanded, cone-shaped or fitted with flanges, collars or rings.

MACHINERY AND MECHANICAL APPLIANCES; ELECTRICAL EQUIPMENT; PARTS THEREOF; SOUND RECORDERS AND REPRODUCERS, TELEVISION IMAGE AND SOUND RECORDERS AND REPRODUCERS, AND PARTS AND ACCESSORIES OF SUCH ARTICLES

1. This Section does not cover :

(a) Transmission or conveyor belts or belting, of plastics of Chapter 39, or of vulcanised rubber (heading 40.10), or other articles of a kind used in machinery or mechanical or electrical appliances or for other technical uses, of vulcanised rubber other than hard rubber (heading 40.16);

(b) Articles of leather or of composition leather (heading 42.05) or of furskin (heading 43.03), of a kind used in machinery or mechanical appliances or for other technical uses;

(c) Bobbins, spools, cops, cones, cores, reels or similar supports, of any material (for example, Chapter 39, 40, 44 or 48 or Section XV);

(d) Perforated cards for Jacquard or similar machines (for example, Chapter 39 or 48 or Section XV);

(e) Transmission or conveyor belts or belting of textile material (heading 59.10) or other articles of textile material for technical uses (heading 59.11);

(f) Precious or semi‑precious stones (natural, synthetic or reconstructed) of headings 71.02 to 71.04, or articles wholly of such stones of heading 71.16, except unmounted worked sapphires and diamonds for styli (heading 85.22);

(g) Parts of general use, as defined in Note 2 to Section XV, of base metal (Section XV), or similar goods of plastics (Chapter 39);

(h) Drill pipe (heading 73.04);

(ij) Endless belts of metal wire or strip (Section XV);

(k) Articles of Chapter 82 or 83;

(l) Articles of Section XVII;

(m) Articles of Chapter 90;

(n) Clocks, watches or other articles of Chapter 91;

(o) Interchangeable tools of heading 82.07 or brushes of a kind used as parts of machines (heading 96.03); similar interchangeable tools are to be classified according to the constituent material of their working part (for example, in Chapter 40, 42, 43, 45 or 59 or heading 68.04 or 69.09);

(p) Articles of Chapter 95; or

(q) Typewriter or similar ribbons, whether or not on spools or in cartridges (classified according to their constituent material, or in heading 96.12 if inked or otherwise prepared for giving impressions), or monopods, bipods, tripods and similar articles, of heading 96.20.

2 .‑ Subject to Note 1 to this Section, Note 1 to Chapter 84 and Note 1 to Chapter 85, parts of machines (not being parts of the articles of heading 84.84, 85.44, 85.45, 85.46 or 85.47) are to be classified according to the following rules :

(a) Parts which are goods included in any of the headings of Chapter 84 or 85 (other than headings 84.09, 84.31, 84.48, 84.66, 84.73, 84.87, 85.03, 85.22, 85.29, 85.38 and 85.48) are in all cases to be classified in their respective headings;

(b) Other parts, if suitable for use solely or principally with a particular kind of machine, or with a number of machines of the same heading (including a machine of heading 84.79 or 85.43) are to be classified with the machines of that kind or in heading 84.09, 84.31, 84.48, 84.66, 84.73, 85.03, 85.22, 85.29 or 85.38 as appropriate. However, parts which are equally suitable for use principally with the goods of headings 85.17 and 85.25 to 85.28 are to be classified in heading 85.17, and parts which are suitable for use solely or principally with the goods of heading 85.24 are to be classified in heading 85.29;

(c) All other parts are to be classified in heading 84.09, 84.31, 84.48, 84.66, 84.73, 85.03, 85.22, 85.29 or 85.38 as appropriate or, failing that, in heading 84.87 or 85.48.

3.‑ Unless the context otherwise requires, composite machines consisting of two or more machines fitted together to form a whole and other machines designed for the purpose of performing two or more complementary or alternative functions are to be classified as if consisting only of that component or as being that machine which performs the principal function.

4.‑ Where a machine (including a combination of machines) consists of individual components (whether separate or interconnected by piping, by transmission devices, by electric cables or by other devices) intended to contribute together to a clearly defined function covered by one of the headings in Chapter 84 or Chapter 85, then the whole falls to be classified in the heading appropriate to that function.

5.‑ For the purposes of these Notes, the expression “machine” means any machine, machinery, plant, equipment, apparatus or appliance cited in the headings of Chapter 84 or 85.

6.- (A) Throughout the Nomenclature, the expression “electrical and electronic waste and scrap” means electrical and electronic assemblies, printed circuit boards, and electrical or electronic articles that :

(i) have been rendered unusable for their original purposes by breakage, cutting-up or other processes or are economically unsuitable for repair, refurbishment or renovation to render them fit for their original purposes; and

(ii) are packaged or shipped in a manner not intended to protect individual articles from damage during transportation, loading and unloading operations.

(B) Mixed consignments of “electrical and electronic waste and scrap” and other waste and scrap are to be classified in heading 85.49.

(C) This Section does not cover municipal waste, as defined in Note 4 to Chapter 38.

VEHICLES, AIRCRAFT, VESSELS AND ASSOCIATED TRANSPORT EQUIPMENT

1.‑ This Section does not cover articles of heading 95.03 or 95.08, or bobsleighs, toboggans or the like of heading 95.06.

2.‑ The expressions “parts” and “parts and accessories” do not apply to the following articles, whether or not they are identifiable as for the goods of this Section :

(a) Joints, washers or the like of any material (classified according to their constituent material or in heading 84.84) or other articles of vulcanised rubber other than hard rubber (heading 40.16);

(b) Parts of general use, as defined in Note 2 to Section XV, of base metal (Section XV), or similar goods of plastics (Chapter 39);

(c) Articles of Chapter 82 (tools);

(d) Articles of heading 83.06;

(e) Machines or apparatus of headings 84.01 to 84.79, or parts thereof, other than the radiators for the articles of this Section; articles of heading 84.81 or 84.82 or, provided they constitute integral parts of engines or motors, articles of heading 84.83;

(f) Electrical machinery or equipment (Chapter 85);

(g) Articles of Chapter 90;

(h) Articles of Chapter 91;

(ij) Arms (Chapter 93);

(k) Luminaires and lighting fittings and parts thereof of heading 94.05; or

(l) Brushes of a kind used as parts of vehicles (heading 96.03).

3.‑ References in Chapters 86 to 88 to “parts” or “accessories” do not apply to parts or accessories which are not suitable for use solely or principally with the articles of those Chapters. A part or accessory which answers to a description in two or more of the headings of those Chapters is to be classified under that heading which corresponds to the principal use of that part or accessory.

4.‑ For the purposes of this Section :

(a) Vehicles specially constructed to travel on both road and rail are classified under the appropriate heading of Chapter 87;

(b) Amphibious motor vehicles are classified under the appropriate heading of Chapter 87;

(c) Aircraft specially constructed so that they can also be used as road vehicles are classified under the appropriate heading of Chapter 88.

5.‑ Air‑cushion vehicles are to be classified within this Section with the vehicles to which they are most akin as follows :

(a) In Chapter 86 if designed to travel on a guide‑track (hovertrains);

(b) In Chapter 87 if designed to travel over land or over both land and water;

(c) In Chapter 89 if designed to travel over water, whether or not able to land on beaches or landing‑stages or also able to travel over ice.

Parts and accessories of air‑cushion vehicles are to be classified in the same way as those of vehicles of the heading in which the air‑cushion vehicles are classified under the above provisions.

Hovertrain track fixtures and fittings are to be classified as railway track fixtures and fittings, and signalling, safety or traffic control equipment for hovertrain transport systems as signalling, safety or traffic control equipment for railways.

OPTICAL, PHOTOGRAPHIC, CINEMATOGRAPHIC, MEASURING, CHECKING, PRECISION, MEDICAL OR SURGICAL INSTRUMENTS AND APPARATUS; CLOCKS AND WATCHES; MUSICAL INSTRUMENTS; PARTS AND ACCESSORIES THEREOF

Arms and ammunition; parts and accessories thereof, miscellaneous manufactured articles, works of art, collectors' pieces and antiques.

WCO Trade Tools provides essential information to support your trade activity.

Understanding HS codes (Harmonized System codes): what you need to know

The diversification of goods has grown increasingly complex over the years, leading to a need to classify all these categories in a uniform and standard manner recognized by governing bodies and businesses all over the world.

The Harmonized System code was designed to label all existing goods in elaborate detail so it would be easier to identify products internationally.

WHAT IS AN HS CODE?

Harmonized System (HS) codes are a unique identifier to classify the exact type of goods you’re shipping.

HS codes were created by the World Customs Organization, and are internationally recognized in almost every country. As customs and government bodies now have a common point of reference to instill regulations based on HS classes, they are able to create a standard to approach each HS category the same way. This in turn creates a more organized importing/exporting structure and a good guideline for countries wanting to implement new regulations.

Sign up to the Discover newsletter

- Fortnightly insights, tips and free assets

- We never share your data

- Shape a global audience for your business

- Unsubscribe any time

HOW TO FIND THE HS CODE

The responsibility of providing the HS code is always that of the shipper. You can find the HS code for your product via your country’s government website, or by using DHL Express’ dedicated MyGTS (Global Trade Services) tool .

HOW TO GET THE HS CODE FOR A PRODUCT

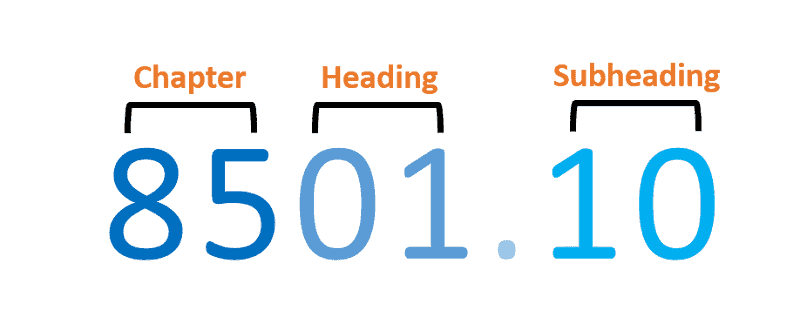

The structure of each Harmonized System comprises of six digits. The first two digits identify the chapter of which the HS code falls under. There are a total of 21 chapters; each chapter provides a description to generalize the category. The next four digits comprise of the heading and sub-heading within the chapter.

ASEAN countries follow the ASEAN Harmonized Tariff Nomenclature (AHTN) – where the first six digits still take reference from the international HS codes – but there are an additional two digits at the end that further break down the sub-headings. Commodities shipped within ASEAN normally use the eight digit AHTN classification, but the six digit HS codes are also considered valid.

HOW TO USE THE HS CODE

Businesses are encouraged to indicate the HS code in their shipping documents to ensure a uniform mode of clearance every time. There are thousands of different HS codes, but each commodity is further dissected into very specific descriptions.

In the example shown below, there are categories for men’s shirts made out of cotton, men’s shirts made of synthetic fibers, and men’s shirts made out of other textiles – the list goes on, totalling to about 10 different codes for the item ‘shirt’.

In some instances, certain commodities may contain overlapping codes, where two or more codes apply. In such cases, the shipper only needs to select one – usually the closest possible match to the actual item.

The customs department of almost every country would have already defined different regulations based on different classifications. When you include the incorrect code, there might be a risk of unintended duties and taxes , higher restrictions on importing, or in the worst-case scenario, rejection of entry into the destination country.

While it is not necessary to indicate your product’s HS code in any of the documents, it is always recommended to indicate it on your invoice to give a clear and accurate representation of the contents of your shipment, especially if the item you are shipping is very technical. Let’s use the example of “Television Parts” as a description on your invoice. Although the term to explain the product is straightforward, Television Parts can be further broken down into many different categories depending on the technicalities of the component. To truly define exactly which part you are shipping would require a HS code to clearly label the item.

HS Code FAQs

What does hs code mean.

HS code stands for Harmonized System code.

What is an HS code for shipping?

An HS code is a globally recognized classification of a traded product, via a system of names and numbers.

How do I find the HS code for my product?

The best route is to search on your country’s government website.

WHAT DOES DHL EXPRESS OFFER?

DHL Express handles thousands of documents, parcels, and cargoes every single day. Its global network of international specialists are well-versed in customs regulations and HS code variations so that every shipment moves on to its destination without delay. Whether you're importing or exporting, opening a DHL Business Express Account means all the hassle of customs will be taken care of for you, so that you can focus on the business of selling!

Similar Stories

- #project planning

- #tour guide

Finding the right tour guide system: We are providing an overview

Are systems only suitable for tours and guides 4 applications for tour guide systems which you have not thought of yet.

Museum tours, factory tours, tour guides and sightseeing tours: those are typical applications for a tour guide system. However, tour guide systems are always useful if a person has to maintain voice contact with one or more people - at least one-way. In other words, tour guide systems are basically suitable for far more scenarios than just museums and sightseeing. We have got four applications with a list of various devices and requirements. They can be included in your planning or be used for advice on planning PA systems.

- Communication between coach and athlete

- Translation at international conferences and lectures

- Support in case of hearing loss

- Wireless audio streaming

The fundamental question is simply which device for which requirement? This is how we are testing tour guide systems

Tour guide systems are suitable for versatile use: 4 applications scenarios

Customers often call us and roughly know for which scenario they need a solution. During the conversation it becomes clear that the customer does not really need a fixed installation or a traditional portable PA system . Instead, they need a tour guide system. Many installers and expert planners are often surprised because they have always underestimated the performance of a good tour guide system .

Many newcomers are surprised that some tour guide systems are capable of bidirectional communication.

It is also possible to use our tour guide systems for wireless communication with each other, instead of hand-held radios . Please find listed below 4 different application scenarios.

1. Tour guide systems for communication between coach and athlete

Trainers for equestrian sports are more frequently using tour guide systems. Trainers and students stay in contact via small wireless systems. This does not only work in equestrian sports but in all kinds of sports where the trainer has to observe and instruct the student from a distance. Another example would be track cycling. A trainer could also instruct an entire team with the transmitter of a tour guide system.

Please note the following:

If you are using a tour guide system in sports, you should be able to attach it to your belt or clothes or store it in your clothes. For this purpose, a lanyard is not practical because athletes move around a lot. You should also make sure that the athlete is able to operate the tour guide system almost blindfolded. Thus, the system should have large switches or potentiometers, i.e. it should be easy to operate, even with gloves on. Also pay attention to the operating range of the tour guide system. What is the maximum distance between athlete and coach?

2. Tour guide systems for translation at international conferences and lectures

At multilingual conferences, a tour guide system can transmit live translations to respective listeners.

The procedure will be as follows: the primary language at the conference will be German. The German speaker transmits his or her presentation in the normal way to the PA speakers in the hall using a microphone at the speaker's desk . International guests will become receivers of a tour guide system, the interpreter a transmitter .

Thus, translations can be done live and in a flexible way. This is because an interpreter can send the translation to any number of recipients via a tour guide system. The user is not linked to permanently installed PA technology and can pass on the transmitter and receiver as required. You can of course also use stationary transmitters as an alternative. The tour guide system attenuates the noise level in the room using headphones.

Please note: think about how many transmitters you need to use in parallel. Four transmitters and, therefore, four translators are often possible in the frequency range 863 MHz-865 MHz which is licence-free. However, it would be the maximum amount. If several speakers are using one tour guide system to transmit their speech during a discussion, a hand-held microphone may be useful. The presenter can pass this on to the next speaker more easily than a clip-on microphone or headset.

3. Support in case of hearing loss

A tour guide system supports people who need a different volume level during the PA application. In case some listeners have loss of hearing, a tour guide system can also help here. This can be in church or at lectures or conferences. You can use regular speakers for the main sound transmission and give a tour guide system to people with a hearing loss. People who need assistance can use the tour guide system to choose their own volume level, independent of the other listeners in the room.

If you need to implement a wireless PA system because the building is listed or cables are not an option, a tour guide system can be a useful alternative.

Please note the following: in case of hearing loss, a tour guide system can assist you in two ways. Firstly, through a louder speech transmission. Secondly, you could connect a portable induction loop to the tour guide system. This can simply be inserted into the jack connection of the tour guide's pocket receiver. The signal of the induction loop is transmitted directly to the T-coil of the hearing aid.

4. Tour guide systems for wireless audio streaming

The additional line input of some of the transmitters of our tour guide systems provides an additional option for application: wireless audio streaming and speech transmission to the PA system. One example is a mixer which is connected to active speakers. If cables have been forgotten or cabling is not possible, you can also use a tour guide system. The transmitter of the tour guide system is connected to the sound source, the receivers to the active speakers .

For this purpose, you should preferably use an analogue tour guide system due to the better sound. For a mono transmission, e.g. background music, one transmitter-receiver path is sufficient. For a stereo transmission, two transmitters and two receivers are required.

The fundamental question is simply which device for which requirement?

Analogue or digital tour guide systems, advantages of digital tour guide systems.

- Digital tour guide systems are tap-proof .

- Half-duplex or full-duplex: recipient can answer the guide and ask questions.

Advantages of analogue tour guide systems

- The sound quality is often better. This can particularly make a difference with audio streaming.

We are testing, documenting, sending the device back, are testing again - the same applies to a tour guide system

By no means do we want to cover certain adjoining sectors and reduce our technology accordingly. We simply cannot and will not do that. Experienced technicians test every tour guide system in detail, just like Frank Kuhl does in the PA section. For this purpose, we have our own workshop.

We take the whole series apart, test the operating range and sound quality. We are testing the devices in real application scenarios and not just under laboratory conditions.

If the device passes these tests, it will be included in our product range, otherwise it will not. In addition to various technical measurement checks, we are also testing the following:

- Is the operating range as specified by the manufacturer?

- How is the noise behaviour?

- How is the sound impression?

- Especially with integrated rechargeable batteries: how long does it take to charge?

- Do accessories meet their requirements?

- Is the running time of the battery sufficient?

- Is the device robust or will it break immediately if it falls down?

- Is the device easy to use or very complicated?

- How robust is the antenna?

- Is the device service-friendly, can it still be repaired? Or is it irreparable if there is a small defect?

If you have questions about tour guide systems, our technical project management will be happy to help you with the selection or planning.

Image source header graphic: stock.adobe.com - Anton Gvozdikov

You can send us your question or request here. Just enter your contact information to get started!

- Country * Germany Netherlands Belgium France Spain Austria Switzerland Italy Czech Republic Poland Sweden Norway Finland Denmark United Kingdom Ireland United States Australia China Japan Taiwan Andorra United Arab Emirates Afghanistan Antigua And Barbuda Anguilla Albania Armenia Netherlands Antilles Angola Antarctica Argentina American Samoa Aruba Aland Islands Azerbaijan Bosnia And Herzegovina Barbados Bangladesh Burkina Faso Bulgaria Bahrain Burundi Benin Saint Barthelemy Bermuda Brunei Darussalam Bolivia Brazil Bahamas Bhutan Bouvet Island Botswana Belarus Belize Canada Cocos (Keeling) Islands Congo, Democratic Republic Central African Republic Congo Cote D'Ivoire Cook Islands Chile Cameroon Colombia Costa Rica Cuba Cape Verde Christmas Island Cyprus Djibouti Dominica Dominican Republic Algeria Ecuador Estonia Egypt Western Sahara Eritrea Ethiopia Fiji Falkland Islands (Malvinas) Micronesia, Federated States Of Faroe Islands Gabon Grenada Georgia French Guiana Guernsey Ghana Gibraltar Greenland Gambia Guinea Guadeloupe Equatorial Guinea Greece South Georgia And Sandwich Isl. Guatemala Guam Guinea-Bissau Guyana Hong Kong Heard Island & Mcdonald Islands Honduras Croatia Haiti Hungary Indonesia Israel Isle Of Man India British Indian Ocean Territory Iraq Iran, Islamic Republic Of Iceland Jersey Jamaica Jordan Kenya Kyrgyzstan Cambodia Kiribati Comoros Saint Kitts And Nevis Democratic Peoples Republic of Korea Korea Kosovo Kuwait Cayman Islands Kazakhstan Lao Peoples Democratic Republic Lebanon Saint Lucia Liechtenstein Sri Lanka Liberia Lesotho Lithuania Luxembourg Latvia Libyan Arab Jamahiriya Morocco Monaco Moldova Montenegro Saint Martin Madagascar Marshall Islands Macedonia Mali Myanmar Mongolia Macao Northern Mariana Islands Martinique Mauritania Montserrat Malta Mauritius Maldives Malawi Mexico Malaysia Mozambique Namibia New Caledonia Niger Norfolk Island Nigeria Nicaragua Nepal Nauru Niue New Zealand Oman Panama Peru French Polynesia Papua New Guinea Philippines Pakistan Saint Pierre And Miquelon Pitcairn Puerto Rico Palestinian Territory, Occupied Portugal Palau Paraguay Qatar Reunion Romania Serbia Russian Federation Rwanda Saudi Arabia Solomon Islands Seychelles Sudan Singapore Saint Helena Slovenia Svalbard And Jan Mayen Slovakia Sierra Leone San Marino Senegal Somalia Suriname Sao Tome And Principe El Salvador Syrian Arab Republic Swaziland Turks And Caicos Islands Chad French Southern Territories Togo Thailand Tajikistan Tokelau Timor-Leste Turkmenistan Tunisia Tonga Turkey Trinidad And Tobago Tuvalu Tanzania Ukraine Uganda United States Outlying Islands Uruguay Uzbekistan Holy See (Vatican City State) Saint Vincent And Grenadines Venezuela Virgin Islands, British Virgin Islands, U.S. Viet Nam Vanuatu Wallis And Futuna Samoa Yemen Mayotte South Africa Zambia Zimbabwe

Please enter this Code into the field below:

You’ve not added any products to your Favorites. Simply click on the “Add to Favorites” button on the product page to add the corresponding item to your list.

Got questions? We are here for you!

April 8, 2024 Posted by Pat Tully

What is an HS (Harmonized System) Code?

Harmonized System codes, or HS codes, are an industry classification system used when exporting goods. Here we dive into exactly what the HS Code is, what separates it from other product codes, and a brief history of how the code came to exist.

Sr. Content Marketing Manager

What is the HS code?

- How it works: HS code?

HS code directory

Definition hs code, what is a harmonized system code.

- Harmonized systems code

Harmonized System code is an industry classification system used around the globe for the export process of goods. Used by customs, it identifies products when evaluating duties and taxes.

How are HS Codes Used?

To use the HS code, you need a U.S. Schedule B number and the foreign country’s version. You can then use the code for several purposes, including:

- Classifying goods when shipping them to foreign countries

- Reporting shipments valued over $2500 or requiring a license in the Automated Export System (AES)

- Completing required shipping documentation

- Determining import tariff (duty) rates, including preferential tariffs related to free trade agreements

- Conducting market research such as trade statistics

- Compliance where applicable.

How to Identify Schedule B Codes

There is a free Schedule B search tool provided by the Consensus board that comes in handy when classifying your products. Additionally, it offers training resources and assistance. For hard-to-classify products, the Customs Rulings Online Search System (CROSS) database is best as it provides official, legally binding rulings. They utilize other exporters’ and importers’ requests to support your own.

Although it is straightforward to determine a Schedule B code in most cases, it becomes more complicated for sets. For example, while an unassembled bike is still considered a bike, some products shipped as composite goods, mixtures, and items that are sold in a set are harder to find. For instance, tracking is difficult when products like textiles are shipped as a set.

How to Identify a Foreign HS Code

Luckily, you can also find HS codes in other countries. You can use custom info databases or foreign tariff databases when determining the HS Code for your product in another country.

How it works HS code

There are several uses for HS codes. They make it possible for customs officials to recognize the item and impose the relevant import tariff in addition to other levies and trade restrictions.

The HS classification is a crucial factor in identifying the country of origin of goods. The HS classification is also used to determine both the MFN duties and the preferential tariffs under free trade agreements.

Categorization

Additionally, to ascertain the proper rule of origin under any FTA, one must comprehend the product’s HS categorization. Any trade agreement’s rules of origin will vary depending on the commodity code that a thing is classed under. Furthermore, HS categorization plays a crucial role in determining whether the commodity is eligible for different kinds of origins.

The six-digit HS code is divided into three sections: Headings (the first four digits), Subheadings (the next two digits), and Chapters (the first two digits). Depending on the nation, the HS codes are further broken down into 7- to 12-digit items (sometimes referred to as commodities codes and national tariff lines).

Understanding every product code

What is a UNSPSC?

The HS designates distinct six-digit codes for different goods and classifications. For additional classification, nations are permitted to append lengthier codes to the first six digits. In turn, the HS number is the first six digits of a 10-digit code, known as a Schedule B number, that the US employs to categorize products for export. There are four parts to the US and global HS codes, explained below:

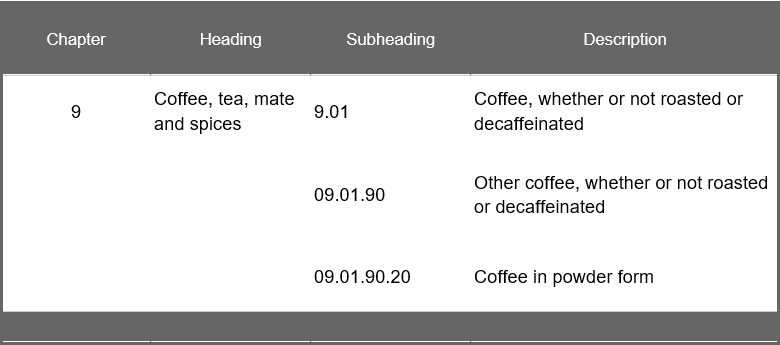

- There are 96 chapters divided into 21 different divisions. A few chapters are an exception: Chapter 77 is set aside for future use; Chapters 98 and 99 are restricted to usage within the country; and Chapter 99 is a special code that can only be temporarily altered. The chapter used here is 09, which is titled “Coffee, tea, maté, and spices.”

- The title denotes the exact category that each chapter falls under. The 01 in the previous example stands for coffee.

- The International Harmonized Code’s final two digits define product subdivisions and are more precise. Decaf coffee beans are 0901.22, while caffeinated coffee beans are 0901.21. As an aside, instant coffee would be classified as a miscellaneous food preparation under section 21.

- For classifications unique to their nation, countries may add two to four more numbers. For instance, Schedule B numbers, which are ten-digit codes, are used in the US HS code. In the example above, non-organic coffee is coded as 0050. Due to the uniqueness of these digits, non-organic caffeinated coffee from a different nation would likely have a different last four digits but the same first six.

The acronym for Harmonized System Code is HS Code. It is an international index for product classification that makes uniform taxation and classification possible. Shippers can explain their goods in tremendous detail using simple numbers thanks to the HS Code’s 21 parts and several subsections.

Updates and additions to the index are made by the World Customs Organization (WCO), and they occur every five years. Nations frequently add to or modify HS codes, such as the US with its HTS codes. Use the nation-specific HS Code to estimate tariffs when importing products into a country where different versions of the code exist.

The ASEAN Harmonized Tariff Nomenclature (AHTN), which is used by ASEAN countries, uses two extra digits at the end to further split down the sub-headings. The first six digits of the AHTN are still derived from the international HS codes. Although the six-digit HS codes are also accepted, the eight-digit AHTN classification is typically used for commodities shipping within the ASEAN region.

Internationally recognized codes called “harmonized codes” are used to categorize goods for taxation. Essentially, harmonized codes speed up international order shipment. They are also known as Tariff Codes, TARIC, Customs and Border Protection Tariffs, Harmonized Tariff Codes, and Harmonized System Codes. These codes are used by a nation’s customs agency to identify and determine the applicable taxes, tariffs, and fees for the goods you are sending once an order crosses international borders.

While a few nations require the description, the majority of destination countries utilize the Harmonized Code system. When exporting overseas, it is excellent practice to include a copy of the Harmonized Code and a thorough description.

Harmonized Systems Code

The Compendium of Classification Opinions, the Explanatory Notes, the Alphabetical Index, and the Brochure on Classification Decisions made by the Harmonized System Committee are among the other HS Tools that are available online as part of the HS Database (WCO Trade Tools), which compiles all of the available HS Tools.

A primary concern for the WCO is HS maintenance. This activity comprises steps to ensure consistent application of the HS and updates it regularly to reflect changes in trade patterns and technological advancements. The Harmonized System Committee (which symbolizes the Contracting Parties to the HS Convention) oversees this process on behalf of the WCO. It considers policy issues, decides on classification disputes, resolves disagreements, and drafts changes to the Explanatory Notes. Every five to six years, the HS Committee updates the HS by preparing modifications.

HS maintenance is one of the WCO’s top priorities. Consequently, this activity consists of actions to guarantee that the HS is used consistently. Also, it ensures that it is updated frequently to take into account modifications in trade patterns and developments in technology. On behalf of the WCO, this procedure is supervised by the Harmonized System Committee, which stands in for the Contracting Parties to the HS Convention. It evaluates matters of policy, renders decisions about disputes over classification, settles arguments, and writes modifications to the Explanatory Notes. The HS Committee prepares changes to the HS every five to six years.

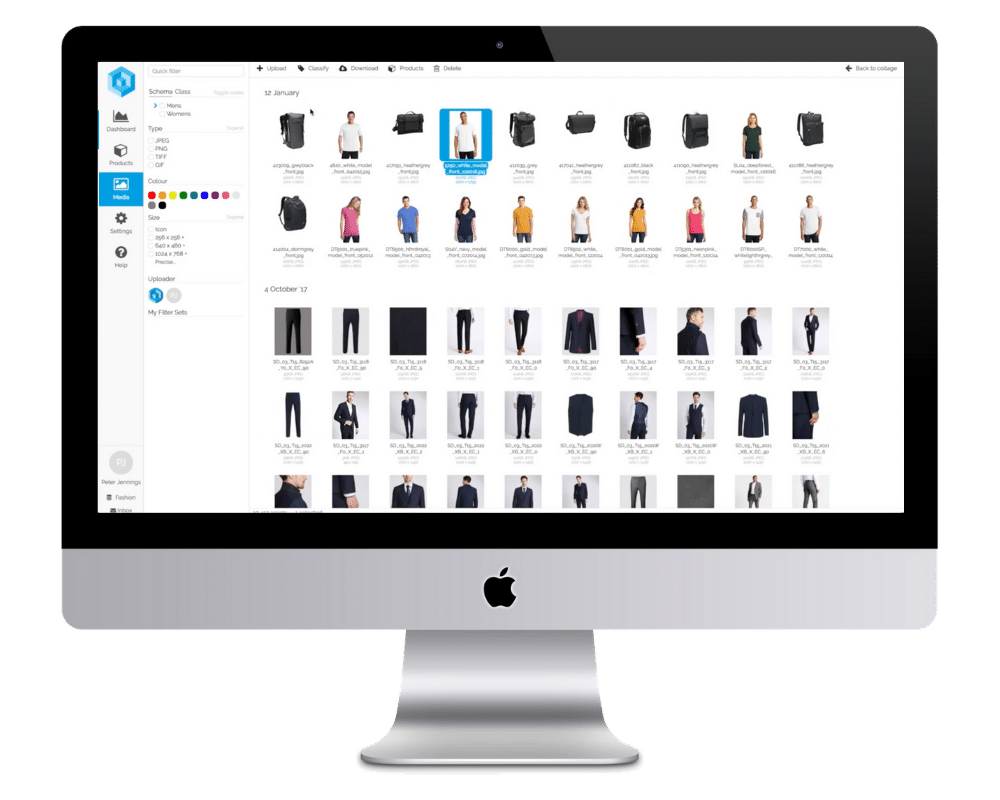

Bottom line

Harmonized system codes effectively help the placement and finding of products during imports and exports of any country. In addition to an HS code, using efficient management tools is also crucial for a smooth working database. If you require top-notch data management tools, contact us at Pimberly for the best services in town.

Take a deeper dive

In your personalized demo, you’ll learn how you can:

- Easily create, enrich, and automate product codes for all products you sell

- Increase revenue by reaching new channels and markets with confidence the accuracy of your data

- Give your teams a central hub to manage and update product data

Book a Demo

Connect with us

- @pimberlypim

1 Minute Intro to Pimberly

A super-quick run through of the key features of Pimberly’s key PIM, DAM and automation functionality.

View Product Tour

Boost eCommerce Performance

with Pimberly

"With Pimberly we are able to get rich data, right the first time." JD Sports

Book a Free Personalized demo

Find out how your business can create amazing product experiences.

Book a Free Demo

Want to stay ahead of the Curve?

Join thousands of eCommerce Specialists today

- What is PIM? Guide to Product Information Management

- What is DAM? Guide to Digital Asset Management

- Business Benefits of PIM

- Distributors

- Manufacturers

PRODUCT TOUR

- Product Information Management

- Digital Asset Management

- Implementation

- Integrations

- Whitepapers & Podcasts

- API Documentation

GET IN TOUCH

- Book A Demo

- Our Partners

- Become a Partner

- Terms and Conditions

Privacy Overview

- Find Warehouse Storage

- Find 3PL Companies

- Find Fulfillment Companies

- Find Ecommerce Fulfillment

- Find 3PL Warehousing

- Find Public Warehousing

- Find Pick & Pack Services

- How it Works

- Become a Vendor

A Definitive Guide to Understanding HS and HTS Codes

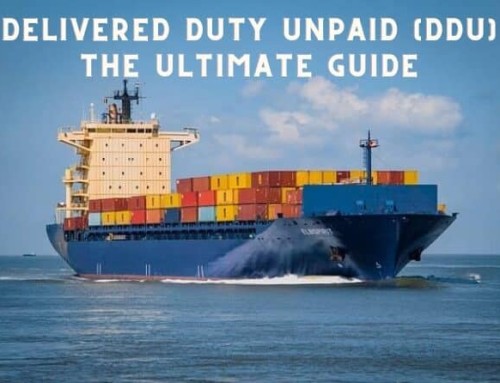

The Harmonized System (HS) and the Harmonized Tariff Schedule (HTS) are codes used to categorize goods for export. They assist in figuring out the sales taxes and levies that are applicable to imported or exported items. On the other hand, individuals unfamiliar with these codes may find it difficult to decode them. We will dissect the distinctions between HS and HTS codes, describe their applications, and offer advice for the success of your business.

What are HS and HTS Codes?

In international trade, products are identified and categorized using categorization methods called HS (Harmonized System) and HTS (Harmonized Tariff Schedule). A worldwide standard called the HS code categorizes products for shipping and customs. It comprises numbers linked to particular products and allows trade documents to be consistent across borders.

However, the HTS code is utilized in the US for tariff purposes. It’s an expanded form of the HS code offering more specificity for products entering the American market. Both codes are essential tools for companies involved in international shipments and trade as they assist in calculating appropriate tariffs, taxes, and trade restrictions. Accurate and compliant cross-border transactions depend on knowing and applying these codes correctly.

What is the Difference between HS and HTS Codes?

The HS (Harmonized System) code is a global classification system used universally to categorize products for international trade. In contrast, the HTS (Harmonized Tariff Schedule) code is specific to the United States and provides additional detail beyond the first six digits shared with the HS code.

How to Use HS and HTS Codes

Using HS (Harmonized System) and HTS (Harmonized Tariff Schedule) codes in your business involves a straightforward process. Correctly identify the product you’re shipping or receiving. The HS code is a standardized international system with a series of numbers assigned to specific goods. Once you’ve determined the appropriate HS code, you can use it for customs documentation and shipping labels.

The HTS code provides further detail beyond the HS code’s first six digits for businesses operating in the United States. It’s crucial to understand the product thoroughly to assign the correct code. These codes aid in determining applicable duties and taxes, ensuring compliance with trade regulations.

Regularly updating your knowledge of the HS and HTS codes for your specific products is essential if you want to conduct international trade smoothly. If you have uncertainties or need guidance, contacting customs authorities or trade experts can provide assistance in correctly using these codes.

What are the Pros and Cons of HS and HTS Codes?

When utilizing HS (Harmonized System) and HTS (Harmonized Tariff Schedule) codes in international trade, weighing the pros and cons for effective decision-making is essential.

Pros of HS and HTS Codes:

- Global Standardization : The HS code provides a globally recognized standard for product classification, facilitating consistency in trade documentation across different countries.

- Simplicity : HS codes offer a simple numerical classification system, making it relatively easy for businesses to identify and use them for customs purposes.

- Uniformity : Using HS codes promotes uniformity in trade practices and simplifies the process of categorizing products for customs clearance.

- Trade Facilitation : Accurate use of these codes streamlines customs processes, reducing the likelihood of delays and facilitating smoother cross-border transactions.

Cons of HS and HTS Codes:

- Complexity of HTS Codes : While HS codes are internationally recognized, HTS codes can be more complex, especially for those unfamiliar with the U.S. tariff system.

- Limited Detail in HS Codes : HS codes may lack the detail needed for certain countries or specific trade scenarios, requiring additional codes or documentation.

- Updates and Changes : Keeping up with changes or updates to the codes, which can occur over time, may pose a challenge for businesses.

- Potential for Misclassification : Misinterpreting or misclassifying products under these codes can lead to issues such as incorrect duties, taxes, or customs delays.

How to Choose the Right HS and HTS Codes

Choosing the right HS (Harmonized System) and HTS (Harmonized Tariff Schedule) codes can be complex, but using a reliable freight forwarder can greatly simplify the process. Here are effective ways to choose the right codes:

- Consult a Freight Forwarder : Engage with a reputable freight forwarder specializing in international shipping. Their expertise can guide you through the intricacies of HS and HTS codes, ensuring accurate classification for your specific products.

- Product Knowledge : Thoroughly understand the products you are shipping. Accurate code assignment requires clearly comprehending your goods, including materials, specifications, and intended use.

- Regular Updates : Stay informed about updates and changes to the HS and HTS codes. A proactive approach to code revisions helps prevent misclassifications and ensures compliance with evolving trade regulations.

- Industry Networking : Connect with industry peers or associations to discuss code assignments for similar products. Sharing insights with others in your industry can provide valuable perspectives and enhance your understanding of code applications.

- Continuous Learning : Invest time in learning about the principles and guidelines for HS and HTS code assignments. Resources provided by customs authorities and trade organizations can be valuable educational tools.

Empowering Your Business with HS and HTS Codes!

Empower your business by understanding and utilizing HS and HTS codes. These codes play a pivotal role in international trade, aiding in the classification of products and ensuring compliance with customs regulations.

Gaining proficiency with these codes will help you improve paperwork accuracy, expedite shipment , and facilitate easier cross-border transactions. Contact us if you need help figuring out HS and HTS codes for your company.

FAQs about HS and HTS Codes

Is hsn code mandatory.

The HSN (Harmonized System of Nomenclature) code is often mandatory for international trade, especially in customs documentation. It helps classify products for taxation and regulatory purposes, making it essential in many countries’ import and export procedures.

What Happens if You Enter the Wrong HSN Code?

Entering the wrong HSN code can lead to various issues, including delays in customs clearance, incorrect tax assessments, and potential fines. It is crucial to accurately identify and input the correct HSN code to ensure a smooth and compliant international trade process.

Do I Need an HS Code to Ship?

Yes, having an HS (Harmonized System) code, an international version of the HSN code, is often necessary for shipping internationally. The code helps authorities in customs identify and classify goods, facilitating proper documentation and ensuring adherence to trade regulations.

Leave a Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

What Our Customers Say About Us And Our Work

Jo-Ann Hill

I want to say thank you for your help in finding a warehouse so quickly. Your service was amazing. I received replies the same day and have selected a company that will work well for us. I definitely recommend your services.

I wanted to express my gratitude for your services and let you know that it was a very enjoyable experience! We have selected one of the companies and they are awesome!

You are doing such a great job and this service that you provide is a life saver for people especially startups like me....We cannot spend budgets on researching as much as the big firms can...and you provide us one stop solution which will answer all our questions.

Joyce Sloss