Powerd By SAG INFOTECH

We Would Like To Send You Push Notifications.

Notifications can be turned of anytime from browser settings

- 0141-4072000 (90 line)

- [email protected]

- Budget 2024 GST Income Tax TDS MCA Payroll

Section 194J Under TDS for Technical/Professional Services Fees

TDS Section 194J is getting attention again after Finance Bill 2020, which brings some revisions to Section 194J. The same will come into effect from 1/04/2020. TDS Section 194J of the Income Tax Act 1961 includes provisions regarding the TDS deduction of fees for technical as well as professional services.

We prepared this article to keep you up to date about the changes and to provide a complete overview of Section 194J under TDS. Here you will also get information about the applicability, rate of TDS under section 194J and a lot more.

Free Demo for TDS Software

Amendments in TDS Section 194J Due to Finance Bill 2020

As per the Finance Bill 2020, some amendments have been made to Section 194J under TDS , the same will take effect from 1/04/2020. Now let’s take a look at amendments to Finance Bill 2020

- TDS will be deducted under Section 194J at a rate of 2% in case of fees for technical services (not being professional services) and the rate reaches up to 10% of such sum in any other case.

- Individual or HUF having a total sales, gross receipts or turnover from the business or profession carried on by him exceeding 1 crore rupee in case of business or Rs 50 lacs in case of the profession during the Financial year immediately preceding the FY in which such interest is credited or paid, shall be liable to deduct TDS. Monetary limits shall be substituted wherever Section 44AB has

Read Also: Section 194I, 194IB & 194IC for TDS Under Income Tax Act

After talking about the changes due to the Finance Bill 2020 let’s back to the basic structure of Section 194J Under TDS

Who is Liable to Deduct TDS Under Section 194J?

Everyone except an individual/HUF who is liable to make the following payments to any resident is liable to deduct TDS Under Section 194J:

- Fees for professional services and for technical services or

- Any remuneration/ fees/ commission whatever name called to a director of a company other than the payment on which tax is deductible u/s 192 or Royalty or

- Non-compete fees u/s 28(VA)

Note: It includes Individual/HUF falling under the scope of section 44AB .

Meaning of Professional Services Under Section 194J

- Engineering

- Architectural profession

- Accountancy

- Technical consultancy, or

- Interior decoration

- The profession of film artist

- The profession of the authorized representative

- The profession of Company Secretary

- Commentators

- Event Managers

- Physiotherapists

- Referees and Umpires

- Sports Persons

- Sports Columnists

- Trainers and Coaches

Read Also: A Brief Study of Newly Added TDS Section 194M

Meaning of Fees for Technical Services Under Section 194J:

Payment for the following services comes under the fees for technical services under section 194J:

- Technical services

- Managerial services

- Consultancy Services

- Provision of services of technical or other personnel

Get a Free Demo of Gen TDS Software for e-filing

Rate of TDS Deduction Under Section 194J

The rates of TDS deduction under TDS Section 194J are given below in the table:

Time of TDS Deduction Under Section 194J

Tax Deducted at Source (TDS) under Section 194J of the Income Tax will be deducted at the time of:

- The credit of the amount to the payee’s account

- Payment of such amount to the payee in cash/ cheque/ draft or any other medium, whichever is earlier

It is to be noted that the term credit here has an interesting meaning where such amount is transferred to the Payee’s account (called suspense account or any other name) in the books of account of the person liable to make such payment shall be deemed to have been credited to the payee’s account and TDS shall be deducted accordingly.

The Threshold Section 194J Under TDS

Section 194J under TDS (Tax Deducted at Source) will be not deducted where the prescribed payment or credit does not exceed the prescribed threshold limit.

We would like to mention here that the limit is applied and varies for each of the above services in section 194J under TDS (Tax Deducted at Source). To understand it better we can take an example that if the payment amount to a person towards each of the above categories is less than Rs 30000 but exceeds Rs 30000 in aggregate then TDS is not to be deducted.

Download TDS e-filing Software

Conditions for Non-Applicability of TDS Section 194J

There are some cases where TDS Section 194J is not applicable, listed below:

- If the payment is made by an individual or HUF. But if the individual/ HUF falls under *44AB(a)/ 44AB(b)then the payment is liable to deduct TDS following Section 194J

- Further, an individual/HUF is not liable to pay TDS under section 194J if the payment is made or credited exclusively for personal purposes.

Notes: Section 44AB(a) is related to those Businesses whose Total turnover or gross receipts for an FY exceeds Rs. 1 crore, whereas Section 44AB(b) is related to those Professionals whose Total Gross Receipts for an FY surpasses Rs. 50 Lakhs.

Recommended: How New Income Tax Rules Will Affect the TDS You Pay on Services

General Queries on Section 194J Under TDS

Q.1 – Who will deduct TDS for services listed under Section 194J?

The Tax Deducted at Source or TDS liabilities arising from services under Section 194J for professional technical experts or consultants will be paid by the payer at the time of making payment for the respective services used. For example, if the payer has hired an engineer to avail his services, then, the payer is required to make the respective payments after deducting the TDS liability arising from it.

Q.2 – Should I deduct TDS if the consultancy services of a professional are availed for the personal use of payer before paying his fees?

No, the taxpayer is not obliged to deduct TDS for the services availed for personal use

Q.3 – Are there any tax exemptions for TDS under Section 194J?

The exemption under Section 194J can be availed by a payer if he pays the tax according to the TDS rate, regardless of the total amount payable. The maximum exemptions under such cases id INR 30,000

Q.4 – I do not have the PAN details of the payee. Should I still deduct TDS u/s 194J?

Absolutely. Moreover, you should do that without any hesitation as the rate of TDS for those individuals who have submitted their PAN is 10% but for those who have not, it is 20%. You should ask the professional to give the PAN details and if he refuses to do so just deduct the TDS at the rate of 20%

Q.5 – Will I be penalized for not paying TDS to the government?

Yes, after the collection of required TDS, the payer is required to submit the respective TDS to the government. If he fails to do so, he will have to face the consequences. The interest at the rate of 1.5% is applicable per month from the date of collection to the date of payment

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

Was this page helpful to you?

Join the Conversation

71 thoughts on "Section 194J Under TDS for Technical/Professional Services Fees"

i wanted to know at what rate tds to be deducted on amc for e lock intelligent lock management for guest room door lock

If I work as a lecturer with a direct contract to institute. I do not belong to any third-party contract. Monthly income credited to my bank account. Is the income will come in the category of 194jb or it will be as salaried income?

Dear Sir, I am working as a Freelance corporate Trainer. In FY 2021-2022 my gross receipts from my clients / vendors exceeded 20 Lakhs. Every month my vendors deducting 10% TDS and depositing the same with my TDS account.

When I am going for ITR-3 Filling, My regular auditor is saying as TDS amounts are getting deposited in my account under section 194JB (professional or technical services). So GST filling is applicable for me. But another tax consultant is saying it is not required to Get GST Number and I can proceed with IRT-3.

I am totally confused, Please guide me. Do I need to register for GST or not?

Thanks in advance

Dear sir, You need to get Registered under GST if your gross receipts (Turnover) exceeds Rs.20 lakhs (For other than North -Eastern States) and Rs.10 lakhs (For North -Eastern States)

Can you please let me know the TDS deduction rate for Google cloud service and Amazon web services

Our company uses these services for developing our apps. So we pay monthly subscription charges for Google and Amazon. Now i’m not sure how much TDS should be deducted. Please let me know the tds rate and section.

TDS is required to be deducted at the rate of 10% U/s 194J

HI… we run an consultancy firm where we provide medical staff for our clients. Once we generate the invoice every month, there is tax deduction under 194J 10%. We too have to deduct 10% TDS tax on the salaries paid to our employees. Can’t my services be considered as contract as i supply doctors and nurses, and hence be deducted under 194C… instead of being deducted at 194F

Hi 1. I am a software engineer in a company, which pays me monthly after deducting tax. 2. I am also giving professional services to an institution as part time job which have deducted TDS@10%. In form 26AS, TDS deducted from both are mentioned. I tried to file ITR and uploaded my company’s(1) form-16 and added income from profession(2) also, but now it shows tax liability. Why tax is being calculated on salary mentioned in second part when TDS is already calculated on it?

Hi Preeti, Usually, there won’t be any Tax liability on your salary income as TDS would have been deducted by your employer. However when you consider your professional income there are chances that you will get a tax liability. the reason is very simple. TDS on Professional Charges are deducted at 10%. But when you club this income with your salary, Your personal tax rate will be more than 10 %

eg: Suppose your Salary is 10 Lakhs and your employer has deducted salary and there is no liability. But If You have a professional income of 1 lakh on which Rs 10,000 TDS deducted the you will have a liability of Rs 20,000. The reason being once your Income crosses Rs 10 Lakhs your personal tax rate will be 30%. TDS is deducted only at 10%. therefore the difference 20% (30%-10%) you will have to pay.

Note: Example is based on old Tax regime

I work for a company supplying a teaching service across via the internet. I do not live in India and Invoice them for my services – but they have deducted TDS @ 30% as if I was an employee. This cannot be correct can it? Your comments would be useful as I have to speak to their finance manager thanks

Fees-tech services, call center, royalty for sale etc.2%TDS Deducted Under Section 194J(a)

tell me tds rate & u/s of laboratory technical service bill

I am a consultant to govt getting payment u/S 194 JB. Which IT form should i file for tax returns?

remuneration u/s194jb which ITR form be used to file the I T Return

1. Whether the fee paid(according to the fourth schedule of the Arbitration act) to the sole arbitrator is taxable under 194J and TDS is to be deducted while paying the fee? 2. The arbitrator has claimed Secretarial expenses and other misc. expenses too, whether they are taxable?

I am working as a White Label ATM Cash recycling Agency. in a month based on the number of transactions done from my ATM, I am paid commission from the WLA operator. here is below payment I have received from the WLA operator till now.

September 1485, (TDS@5%->56) Remaining 1429 deposited in the bank October 5458, ([email protected]%->205) Remaining 5253 deposited in the bank November 10,475 ([email protected]%->393) Remaining 10,082 deposited in bank December 14,917, ([email protected]% ->559). remaining 14,358 deposited in bank

kindly help me how to claim the TDS. Can I get this money back after filing income tax?

Once you file your ITR of the Financial Year in which TDS has been deducted then you will get the Refund amount of TDS deducted in excess of Tax Payable.

I provide website designing & consulting services to my customers. Can you please let me know the current TDS rate whether its 7.5 or 1.5 that my vendor has to deduct while making payment?

Hi Soil testing will come under technical service?

Sir, I have been engaged by the Govt Insurance as a Specialist after my retirement from the Insurance Company. I am not an engineer/Doctor, It is on a contract basis for one year which may be extended. Am I eligible for 194J?

Dear Sir Have you received your clarification on the subject? Kindly tell me as I am also sailing in the same boat, a retired Govt employee, on one year contract as consultant. The remuneration (which is not same as FEE a consultant charges) being paid is Basic Pension minus Last Basic Pay. I am of the opinion that it is not covered under Sec 194J.

sir, my auditor put the nature of payment as 194JA instead of 194J in Q2 of this year. kindly clarify the section 194J and 194JA.

I am a salaried person and come in 30% slab of income tax. I also receive remuneration as a professional fee under 194J. how much tax I have to pay on the amount that I received in 194J slab money.

hi sir/mam, I have a doubt against TDS on section 194 j – i.e ..TDS on technical services, section-194j is applicable on internet monthly charges …or monthly charges amount is more than 10,000 per month kindly resolve my doubts as soon as possible plz

PLEASE REFER SECTION 194J OF INCOME TAX ACT 1961

I’m working as a graphics designer consultant and my salary is ₹15000 for the month. The TDS deduction was 7.5%. The transaction between me and the Co hasn’t been to ₹30000 yet, as it has just been a month. Am I liable to pay TDS?

AS PER SECTION 194J IF AMOUNT PAID OR CREDITED IS MORE THEN RS 30000, TDS REQUIRED TO BE DEDUCTED

payment of professional fees is as under Q1 10000 Q2 15000 Q3 20000 Up to Quarter 2 payment of professional fees was less than Rs 30000 so no TDS is deducted but in Q3 cumulative payment has exceeded Rs 30000 so liability for payment of TDS arises on entire payment including Q1 and Q2. Our query is that while filing TDS returns for Q3, details of Q1 and Q2 can not be included. If we now go back to Q1 and Q2 and include these details then the interest amount will have to be paid. So we want to know the correct procedure.

TDS on payment of professional fees is required to be deducted on an amount exceeding Rs 30,000. Your payment of the amount of Rs 30,000 exceeds in the 3rd quarter hence your liability arises in the 3rd quarter on an amount exceeding Rs 30,000 i.e. on Rs 15,000. There is no need to go back to Q1 and Q2.

I am a cricketer and tds was made under section 194JB…Which ITR form will be chosen for filing ITR…Please suggest me…

While I am preparing 26Q – Q2 for the financial year 2020-21, strangely I cannot able to find the 94J option in the deductee details (Annexure I part). is there any changes in the 194J deductions. Kindly share the correct section.

I have rendered my services at an engineering college as a Guest Faculty and got payment in 194J and got tax deducted at the source. Which ITR form should I fill? How much amount is exempted from tax? I got only 400000 as payment in FY 2019-20

ITR form depends on your other income.

Hi Sir what if this the only income can we take 44ADA or we can show income under 44AD and claim an income of near about 60-70% or we have to file as per normal provisions ITR 3?

We avail GSUITE services for Google email, drives etc, and till now we were paying 10% TDS on their invoice. Now with 194JA and JB, I understand that GSUITE SAC is defined as OTHER IT i.e. it should fall under technical service and hence a TDS rate of 2%.

Is my understanding correct?

Select Sub-section 194JA applicable rate will be 2% and select sub-section 194JB applicable rate will be 10%.

I rendered a professional service in March 2020. However, the payment is made on 22nd July 2020 and “date of payment” and “date of booking” have been entered in Form 26AS for FY20-21. Will this be counted for income in FY19-20 or FY20-21?

It counted as income of FY 2020-21

Am I hiring a dental doctor for salary is he come under 194 j or 192

I provide COVID19 related technical Consultancy services from lab development to training and guidance and also clinical trials Consulting services with scientific research guidance through my startup company. Last year’s gross revenue is less than 1 crore.

Also, all my services are directly related to COVID19 testing. So, shall I need to pay any TDS?

Yes, you have to pay TDS.

In FY_2020-21_Q1, I have deducted TDS on technical service 2% & 1.5% accordingly as per latest govt notification, but in traces, I have received default notice for the short deduction? Shall I submit a correction statement by selecting the section as 194JA? Or shall I contact the department?

Yes you can File Correction statement.

As in FY_2020-21_Q1 i have deducted technical service 2% & 1.5% accordingly as per latest govt notification 25% reduce TDS rate. but in traces, I have received default notice for short deduction?. any subsection needs to show in traces under 194J_Technical service. pls, suggest on this!

Yes, kindly refer the latest utility

Please select section 4JA for TDS on technical services @ 2% (1.5% till March 21) and 4JB for TDS on professional services to avoid default in TRACES in case of 194J.

Yes Correct

What is the TDS rate deduction for hospital staff eg doctors/ staff nurse/ ward boy and pc/ lab technician or x-ray technician?

No specific TDS Rate deduction for hospital staff eg doctors/ staff nurse/ ward boy and pc/ lab technician or x-ray technician

As in FY_2020-21_Q1 i have deducted technical service 2% & 1.5% accordingly as per latest govt notification 25% reduce TDS rate. but in traces, i have received default notice for short deduction?. any subsection need to show in traces under 194J_Technical service. pls, suggest on this!

“Please contact to department”

Now department was updated in new version 3.3, in that version use section code 4JA

I have deducted 2% on technical services under 194J for Q1 F.Y.19-20. but the same is not processed and it shows 10% category only for processing. Why is that?

What is the flag need to be selected in Return for lower deduction of 2% for 194J

Department has not yet notify any flag for tecnical services u/s 194J

Lab testing charges are included in professional services or technical services.

There is a subsection under 194J for Technical services TDS @ 2%. Like 194Ia and 194Ib.

As per latest amendment in section 194J via Finance Act 2020, In case of fees for technical services TDS will be deducted at rate 2%.

We are engaged in the solar power plant installation and receive technical services from our consultants in terms of solar designs and drawings. It would attract TDS u/s 194J. But would it be treated as fees for professional services (10%) or fees for technical services (2%)?

Please refer to TDS chart notified by the department

We are into providing G suite services that are covered under ‘Other information Technology Service’ SAC 998319. Please confirm 2% TDS is applicable or 10% TDS?

TDS @ of 10% is applicable.

I am an accounts manager in a software company that is into the business of recruiting software employees and putting them on its payroll but will send them to work at client places through another contractor A. Billing will be sent to A and he will pay us by deducting 10% TDS. My question is whether our services come under professional services or technical services which attract only 2% TDS please clarify. Thanks in Advance

Hi, Please help me by clarifying my doubt with Section 194j and Audit 44AB liability, I work as a Technical consultant, The company pays me 10,000 rupees per month and this is the only source of income I have, in which 2% TDS is being deducted so as I don’t have liability with 44AB can company deduct the TDS, If yes can I file form 15G self-declaration for non-deduction of TDS.

As per section 194J if payment made to the resident for fees for professional and technical services exceeding 30000, TDS should be deducted @ 10%

What are the TDS rate on Data Centre Charges & Software License fee

We process our company payroll through one software called paybooks, So please clarify for me, whether this service is technical service, then TDS @ 2% is applicable or 10% applicable.

Yes, this is technical service and TDS will be deducted at 2%. please refer to 194J for more clarification.

Cancel reply

Your email address will not be published. Required fields are marked *

Follow Us on Google News

Latest posts.

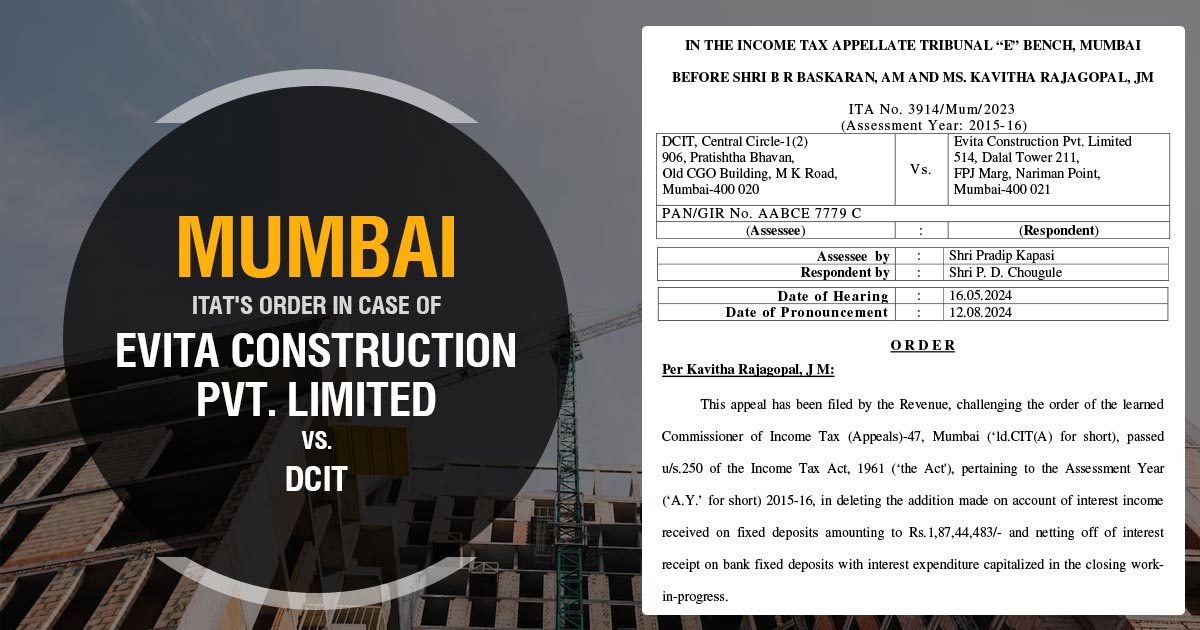

Mumbai ITAT Quashes Addition on Interest Income from FD Due to Lack of Evidence

Quick Guide to Income Tax Section 148A with New Changes

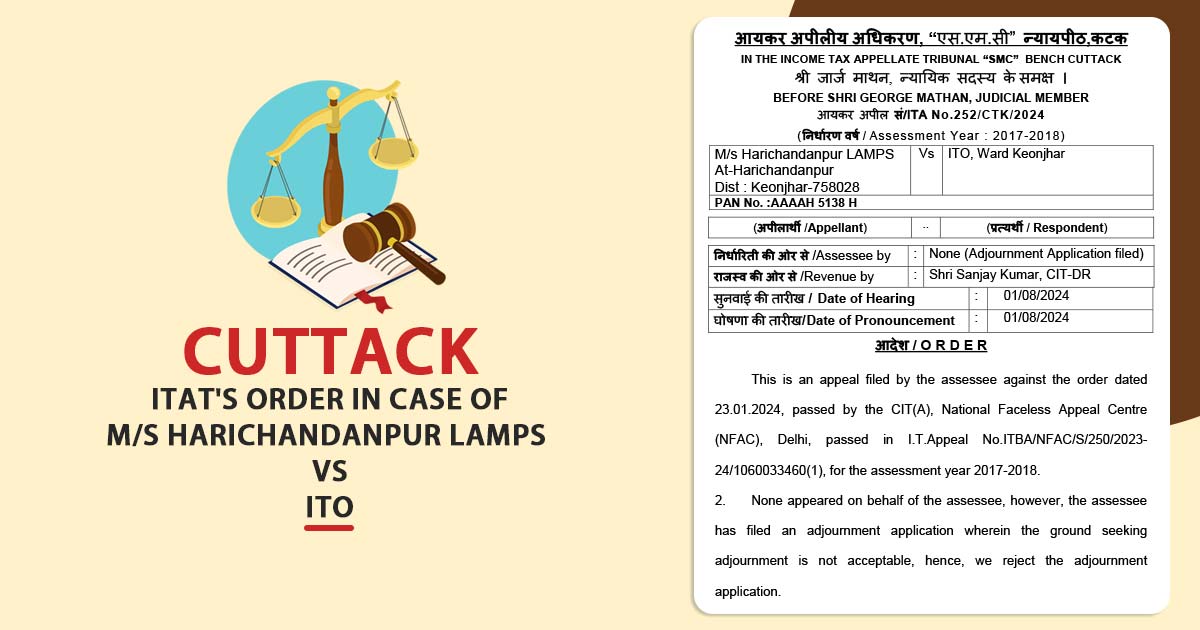

Cuttack ITAT Remands Case to CIT(A) for Reassessment of Non-Compliance and Evaluation of Evidence

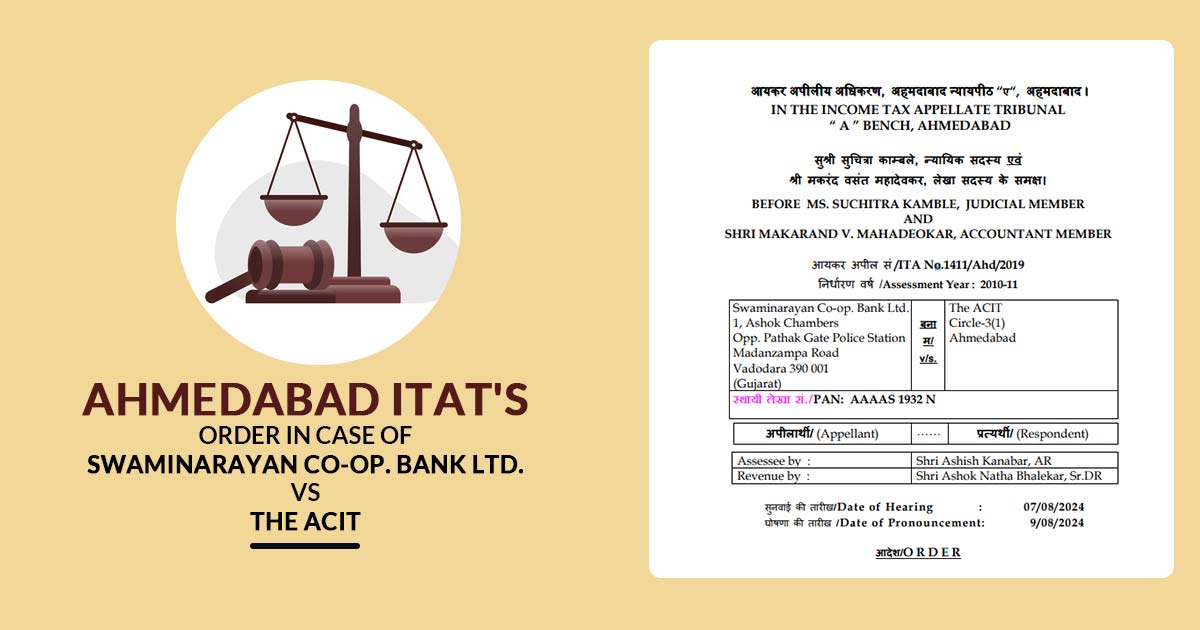

Ahmedabad ITAT: AO Failed to Specify Tax Penalty u/s 274 and 271(1)(c)

New offer for professionals, huge discount on tax software.

Promo code: FEB15 -->

Best Offer for Tax Professionals

Upto 20% discount on tax software.

Select Product *

Mega Offer - Upto 20% Off On Genius, ROC/XBRL, Payroll, CA Portal

Fill form for a demo.

- Consultants

- Be a Member

- SIGN IN Become a Member

TDS on Visit Charges

Whether TDS needs to be deducted on visit charges say, Representative has been called from the company from where the machinery had been purchased.

Such a company has billed towards visiting its representatives.

Acording to section 194J of the income tax act 1961 if such company has billed towards visiting charg for its representatives which called technical services so paid money is not more then Rs 30000 whether TDS not to be deducted.

Suggested GST Resources

Inspiring consultants.

Latest Resources

Supreme court judgment on retrospective application of mining taxation ruling: balancing legal precedent and practical implications.

Aug 14, 2024

by CA Shafaly Girdharwal

Guidelines for the Second Special All-India Drive Against Fake GST Registrations - 2024

Aug 13, 2024

Key Changes to ISD Rules in Finance Bill 2024: What Businesses Need to Know

Aug 12, 2024

Interim Relief Granted Against GST Notification No. 56/2023

Aug 05, 2024

Section 128A of CGST Act : Waiver of interest or penalty or both relating to demands raised under section 73, for certain tax periods

Aug 03, 2024

Stay informed...

Recieve the most important tips and updates

Absolutely Free! Unsubscribe anytime.

We adhere 100% to the no-spam policy.

export of exempted goods

Get updates in your mailbox

Need a consultation? Start your search...

Are you a consultant join the evergrowing family of consultants.

Comprehensive

Season #2 / 24 hours, by shaifaly girdharwal.

Get your GST Queries answered by Shaifaly Girdharwal via one on one phone or email consulting.

Starting 3,000

Home » TDS » TDS on repair and maintenance – Section 194C

TDS on repair and maintenance – Section 194C

Tds on repair and maintenance – section 194c – introduction.

Section 194C provides for TDS to be deducted on payment made on repair and maintenance. TDS on repair and maintenance is required to be deducted under Section 194C of the Income Tax Act, 1961 (hereinafter referred to as the “Act”). When a person makes a payment to the contractor on a contract for repair or maintenance, such person is liable to deduct TDS on payment made for repair and maintenance. Let’s understand this concept in depth.

What is ‘repair and maintenance’ for the purposes of Section 194C of the Income Tax Act, 1961?

In essence, the work which is of routine, normal and repetitive nature relating to repairing and maintenance but not of technical nature is to be considered under Section 194C.

Applicability of TDS provisions on Repair and Maintenance under Section 194C of the Income Tax Act, 1961

When there is a contract for repair and/or maintenance between a contractor and ‘specified persons’ and a payment is made to the contractor for undertaking any work in the nature of repair or maintenance in furtherance to the contract signed, TDS is to be deducted on such payment as per the specified rate in Section 194C of the Act.

Note: A contract between a sub-contractor and specified persons will also be liable to TDS under Section 194C, Income Tax Act, 1961.

Who are considered as “ specified persons” for the purpose of deduction of TDS on repair and maintenance?

A specified person, as per Section 194C includes:

- The Central Government;

- Any of the State Governments;

- Any Local Authority;

- A cooperative society;

- Any State authority responsible for providing housing accommodation or planning or development of cities, towns, etc.

- A society registered under the Societies Registration Act, of 1860;

- A university established or incorporated under the respective Central, State or Provincial legislation;

- A Government of a foreign country or a non-resident corporate entity or any other association or body of such foreign State;

- An individual, BOI, AOP or HUF has total sales, turnover or gross receipts of more than Rs. 1 crore (in case of business) or Rs. 50 Lakh (in case of profession).

Rate of deduction of TDS on Repairs and Maintenance under Section 194C of the Income Tax Act, 1961

The rate of TDS to be deducted is as under: –

- Credit is given/ Payment is made to an Individual/ HUF – 1%

- Credit is given/Payment is made to a person other than an Individual/ HUF – 2%

- Moreover, no Surcharge and Higher Education Cess (“HEC”) shall be added to the above-mentioned rates .

Furthermore, as per Section 206AB of the Act, TDS at the rate of 20% shall be deducted where the payee does not provide the PAN number to the deductor.

Time of deducting TDS on repair and maintenance under Section 194C of the Income Tax Act, 1961

TDS is required to be deducted in case of payment made to the contractor when –

- Such sum is credited to the account of the payee; or

- Payment is made to the payee in cash or by way of issue of cheque/ draft/ any other mode than the ones mentioned

whichever event takes place earlier.

Deemed application of provisions of TDS on Repair and Maintenance

When the amount is credited to the Suspense Account or any other account in the books of the person who is liable to make payment to the payee, it will be deemed to be credited to the account of the payee and the provisions for TDS on repair and maintenance will apply.

Threshold Limit for deduction of TDS on Repair and Maintenance under Section 194C of the Income Tax Act, 1961

- The threshold for deduction of TDS on Repair and Maintenance is currently set at Rs. 30,000 in a single transaction and the aggregate amounts do not exceed Rs. 1,00,000.

- If it exceeds the threshold limit, then the rate of deduction as provided under Section 194C of the Act will be applicable, i.e., 1% or 2%.

Exemption from Income Tax deduction under Section 194C

- The sum doesn’t exceed Rs. 30,000 : When the amount credited/ paid is not more than Rs. 30,000 in a single transaction, then no TDS shall be deducted.

- The sum doesn’t exceed the aggregate of Rs. 1,00,000 : Furthermore, no TDS shall be deducted, when the amount or aggregate of amounts credited/ paid during the FY is not more than Rs. 1,00,000.

- Personal purpose: When consideration paid by an individual or HUF is on account of personal purpose, no TDS will be deducted.

- Non-Resident Contractor: Payment made to a Non-Resident contractor shall not attract TDS under section 194C of the Income Tax Act. However, it shall be governed by provisions of Section 195.

Clarification by CBDT

- TDS on payment made for repair and maintenance shall be deducted on invoice value, excluding the value of GST (if such value is mentioned separately in the invoice) – Circular No. 23/ 2017.

- However, TDS shall be deducted from the entire invoice value (if the value of GST is not mentioned separately in the invoice) – Circular No. 23/ 2017.

- Routine and normal contracts of maintenance including supply of spares will be covered under Section 194C – Circular No.: 715/1995

Landmark Judgements for Section 194C (TDS on Repair and Maintenance), Income Tax Act, 1961

- In the case of Vide Eastern Typewriter Service v. State of Andhra Pradesh (1978) , the Court held that the repair of typewriters and other machines of government offices will be covered under the definition of work under Section 194C.

- Furthermore, the Bombay High Court in Commissioner of Income Tax v Saifee Hospital, 2019 , held that where the service provided was of maintenance of the medical equipment, it will not be considered as Technical Services under Section 194J but a work contract under Section 194C.

Commissioner of Income Tax v. Mumbai Metropolitan Regional Development Authority, [2018]: In this case, the Bombay High Court held that repair and maintenance of spare parts like greasing does not require technical expertise. So, Section 194C will be applicable and TDS will be deducted on such payments.

Illustration: –

Mr Y has employed the services of Mr Z for repairing the spare parts of his house and outhouse. So, at what rate the TDS will be applied [Assuming the payment is of Rs. 35,000]?

The payment is made to the individual for its services. Additionally, the repairing of spare parts did not require technical expertise and thus, it will not constitute technical services. It will be covered under Section 194C.

Therefore, the applicable rate and amount of TDS will be 1% and Rs. 350 respectively on such payment.

Illustration:

Mr A employed the services of Mr B for repairing the car tyres of his car for Rs. 10,000. So, at what rate, TDS will be deductible?

The payment is made for the services provided to an individual and it is covered under Section 194C but it is not more than the threshold limit of Rs. 30,000.

Thus, the TDS rate for repair and maintenance will be Nil, i.e., no TDS will be deducted on such payment.

For the Full text of Section 194C of the Income Tax Act, 1961 please refer to this link.

So, TDS on repair and maintenance is required to be deducted under Section 194C of the Income Tax Act, 1961 at the rate of 1% or 2% (as the case may be) for payments to residents.

Want to know more about TDS on repair and maintenance? Get enrolled on our ‘ TDS Course ’ today.

Related Articles

- TDS on maintenance charges

- TDS on repair and maintenance

- TDS on transport contractors – Section 194C

- TDS on car hire charges

- TDS on AMCs (Annual Maintenance Charges)

- TDS on Advertisement Agencies

- TDS on catering services

- TDS on courier charges

- TDS on job work

- TDS on security services

- TDS on labour charges

- TDS on payment to a transporter

- TDS on courier service

- +919667714335

- [email protected]

Contact Us For Tax Consultancy

CA Arinjay Jain

Have query and need a consultation with tax expert?

We provide consultation to resolve your queries in the Area of International Tax, Merger, Demerger and Foreign Investment, though call with our Tax Expert Mr. Arinjay Jain.

RELATED BLOGS

Key proposals relating to union budget 2024-25 – prepared by sorting tax advisory services private limited , advisory- direct tax | cross border tax | m&a tax, filing form 10f | pan| no pe declaration| dsc, 2 thoughts on “tds on repair and maintenance – section 194c”.

Please tds applicable on own company car used for business. tds liabilities on repair & Maintenace charges above limit.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Quick Links

- Our Courses

Our Services

- Income Tax Consultant

- International Tax Consultant

- M&A Tax Services

Sorting Tax Advisory Services Private Limited Unit 319 Vipul Trade Centre, Badshahpur Sohna Road, Gurugram, Haryana, 122018

- +91-9667714335

Get 10% discount on our International Tax Course - USE COUPON RA10PEROFF

- Submit Post

- Budget 2024

TDS on fee for Professional and Technical Services

Section 194J of The Income Tax Act 1961, pertains to deduction of tax at source in case of fees for professional or technical services. It applies to TDS on payment of any sum by way of –

a) fees for Professional services

b) fees for Technical services

c) Remuneration or fees or commission paid to directors (excluding salary)

e) Non-compete fee

Threshold Limit for each of the above payments except for payment to directors is Rs. 30,000 i.e. no TDS shall be required to deduct at source if the amount paid or payable during the year do not exceed Rs. 30,000.

Non Applicability of Threshold Limit

However, in case of payment made to directors, TDS has to be deducted irrespective of quantum.

Rate of TDS

The rate of TDS is 10%, however this rate is taken to be 2% in following cases:

i. Fees for technical services

ii. royalty where such royalty is in the nature of consideration for sale, distribution or exhibition of cinematographic films

iii. in case of a payee engaged only in the business of operation of a call centre

This implies that the rate of TDS is 10% in case of fees paid for professional services while it is 2% in case of fees for technical services. As the rate of TDS is different for professional services and technical services, looking into the difference between the two is the need of the hour.

Let us go into the definitions of both as provided in the Act for the purpose of this very section –

Meaning of “Professional services”

“Professional services” means carrying on

a) Legal profession

b) Medical Profession

c) engineering Profession

d) architectural profession

e) profession of accountancy

f) technical consultancy

g) interior decoration

h) advertising

i) Profession of “authorised representatives”

j) Profession of “film artist”

k) Profession of “company secretary”

l) Profession of “information technology”

Meaning of “authorised representatives” and “film artist” has also been provided in the Act.

The CBDT has notified the services of following persons in relation to sports activities as “Professional Services”, namely –

a) Sports Persons,

b) Umpires and Referees,

c) Coaches and Trainers,

d) Team Physicians and Physiotherapists,

e) Event Managers,

f) Commentators,

g) Anchors and

h) Sports Columnists

However, the term “profession”, as such, is a very wide import but the term is defined exhaustively for the purpose of this section.

Meaning of “fees for technical services”

“fees for technical services” means any consideration (including any lump sum consideration) for rendering of any of the following services:

i. Managerial services

ii. Technical services

iii. Consultancy services

iv. Provision of services of technical or other personnel

i. Consideration for any construction, assembly, mining or like project or

ii. Consideration which is chargeable under the head ‘Salaries’

So, a broad kind of definition is provided of “fees for technical services” with a very wider ambit.

If the services specified in the definition of “Professional services” are carried out by a professional (an individual) or by partnership firms including LLP, as they in their capacity can pursue a profession, then it shall be considered to be a professional service and TDS rate applicable would be 10%. However, if the same services are provided not in the course of profession i.e. by Corporate, Trust, Society, Artificial Juridical person and similar organizations then it will fall under the ambit of “fees for technical services” and beneficial TDS rate of just 2% shall be applicable.

Whereas the law is not that much clear on establishing the distinction between the two, thus the same may be interpreted differently depending upon the circumstances or situation in hand. For example, services of a Chartered Accountant, Doctors, Lawyer, Architectures, Engineer etc. are considered to be professional services and liable to higher TDS i.e. 10%. While, setting up an ERP system within an organization by an IT company shall be considered as technical services and thus liable for 2% of TDS.

The intention of lawmaker behind introducing differential TDS rates is quite justifiable. Since, in case of profession, the role of intellect and professional skills are more than that of infrastructure and other overheads. Therefore, the profit is on a higher side. Also, whole of the responsibility of the service provided lies on a person only. Hence, they earn a good margin of profit. Consequently, higher rate of TDS is imposed. On the other hand, in provision of technical services, profit is much less owing to huge expenditure of business overheads and infrastructure and accordingly, a lower rate of TDS is thus imposed.

About the Author

- section 194J

- « Previous Article

- Next Article »

Name: Neeraj Bhagat & Co.

Qualification: ca in practice, company: neeraj bhagat & co., location: new delhi, new delhi, in, member since: 28 feb 2019 | total posts: 161, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Group

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Subscribe to Our Daily Newsletter

Latest posts, live course on grow your idt practice & preparation for gstat (gst tribunal), voter id cannot be sole evidence for determining age in insurance claims: orissa high court, section 153a addition valid only if based on material seized during search: itat kolkata, avoidance application timelines under ibc regulation 35a is not mandatory: delhi hc, settlement consideration to be treated as taxable under the head ‘capital gains’: delhi hc, passing of order u/s. 148a(d) on the basis of fresh ground untenable: delhi hc, addition u/s. 68 justified as genuineness of transaction and creditworthiness of creditors not proved: itat ahmedabad, advance tax payment provisions doesn’t apply in reassessment proceedings: itat indore, notice u/s. 148 to nri without following mandatory faceless procedure unsustainable: telangana hc, comparison of secured loan and unsecured loan interest rate not justified: itat indore, bogus purchase addition cannot be based on superficial inquiry: bombay hc, featured posts, taxability of loans granted between related persons or between group companies, income tax calculator financial year 2024-25, 18% gst on samosa & kachori: hc dismisses petition & directs to approach appellate authority, sc upholds state governments’ tax levy on mining activities wef april 1, 2005, recent gst portal advisories: july-august 2024 updates, analysis on guidelines for second all-india drive against fake gst registrations, empanelment with bank of maharashtra for concurrent/revenue audit (last date 14.08.2024), live course: handling faceless income tax assessment with ai tools like chatgpt, join 5-day live & online income tax audit course with practical examples, popular posts, due date compliance calendar august 2024, list of resolution required to be filed with roc in form mgt-14, empanelment for concurrent and stock audit with indian bank, form gstr 1 & gstr-1a- monthly statement of outward supplies | faqs, everything about directors report under companies act, 2013, statutory registers under companies act 2013, august, 2024 tax compliance tracker: income tax & gst deadlines, conversion of public limited company into private limited company, section 44ab vs 44ad – presumptive taxation (with examples).

Selling a House in California? Get to Know the Rigorous Transfer Disclosure Statement

- Contracts, Disclosures, and Paperwork

- Published on December 27th, 2018

Allison Landa began her real-estate writing career at Inman News Features, a wire service and syndicate based in the San Francisco Bay Area. She has worked for many industry entities including Commercial Property Executive, SalesTeamLive, NAREIT, and Paragon Real Estate.

- Share on LinkedIn

- Share on Twitter

- Share on Facebook

- Share by Email

- Save to Pinterest

Californians like their sushi rolled, their ocean waves big, and their real estate disclosures rigorous and handwritten.

That’s why during the process of selling your house in the Golden State you’ll come across the Transfer Disclosure Statement (TDS) , California’s official form for disclosing any known issues that could negatively impact a home’s value or pose an unreasonable risk to the buyers’ safety or health.

Most states, in some shape or form, require sellers and their agents to disclose any of these “material defects” about a home upfront in writing (we even put together a list of all 50 states’ mandated disclosure paperwork for super easy access.)

But per Civil Code Section 1102, California has some unique and particularly thorough rules for home sellers, all laid out in the Transfer Disclosure, that we’ll go through point by point to make completion as easy as possible.

Filling out the California Transfer Disclosure Statement: All…by…yourself, sellers!

Generally, sellers complete real estate disclosure paperwork after the buyers sign the purchase offer agreement or may even have it filled out prior to listing their home. There’s no official deadline for delivering the form but it’s expected to be provided to the buyers in a “timely fashion.”

Then, the buyers of your house do have a deadline to either move forward or terminate the contract based on any discoveries in the disclosure: they get three days to cancel the deal if you delivered the document in person, and five days if it came by mail.

By law, you must fill out the disclosure form by yourself, in your own handwriting. While your agent is allowed to assist you in understanding what is being asked of you, he or she cannot legally complete the form on your behalf.

“I don’t fill it out for them,” Bakersfield, California -based agent Bart Tipton , founder and team leader for Prestige Properties, said.

“Nor can I give them advice. If they have questions, it’s recommended that they talk to a real estate attorney.”

Indeed, your agent should be familiar with your state’s disclosure requirements and statutes but may be limited in what they can legally advise. When in doubt, always consult a real estate attorney for their advice on whether you should disclose something about your property’s history to cover all your bases and navigate any gray areas with care.

Filling out the forms accurately is essential, Tipton said, since the threat of failing to properly disclose issues can pose a legal problem. “What’s pertinent information to a seller may not be to a buyer and vice versa; that becomes an issue of ‘under-disclosure’ and that’s going to lead to issues down the road,” he said.

Gerard Launay of Berkeley and Sebastopol, California, based Law Office of Gerard D. Launay called the TDS “a pretty complete disclosure,” noting that the onus is on the seller to provide any information he or she has with regard to their property.

“Pretty much the rule is that if you have any notice or knowledge that you have a problem with your house, you have to disclose it,” he said. “Homeowners have the experience of being in their home and they know when things don’t work. The Realtor wouldn’t know that. There are certain things the buyer should know.”

What does California’s Transfer Disclosure Statement require sellers to disclose?

Both Tipton and Launay agree that one of the more significant disclosures is whether or not anyone has died in the home . “That’s probably the one that people get the creepiest about,” Tipton said.

California’s law is unique in that any deaths—including natural ones—in the past three years must be disclosed . That’s according to California Civil Code Section 1710.2, which also states that a seller need not disclose a death that occurred on the property if it occurred outside the three-year time frame.

However, there is one exception: death disclosure due to AIDS is considered discriminatory and cannot be done even if it occurred within the three-year time frame. This is true in every state per the Department of Housing and Urban Development’s fair housing laws .

Other items that the TDS requires California sellers to disclose include:

- Any chemicals on the property—for example, if marijuana or methamphetamine was grown there: “That’s a pretty important one,” Tipton said.

- Major neighborhood disturbances such as rush-hour traffic or adjacency to an airport.

- Any encroachments, easements, or other issues affecting a seller’s interest in the property.

- Flooding, drainage, or grading problems.

- Any common area—such as a pool or walkway—co-owned in undivided interest with others.

Tipton warns sellers to prepare themselves: “There’s a lot of questions,” he said. “If they answer yes, they want (you) to give a short explanation as to why.”

For example:

- If you as the seller know of any possible zoning changes that are coming up.

- If there are any legal claims against the property.

- If there have been any insurance claims against the property in the last five years.

No extra documentation is required up front with these disclosures. However, if after a buyer looks over the disclosure and wants more information, he or she can request it at that time.

“The buyers can dive as deep as they want and ask as many questions (as they need),” Tipton said. “I’m sure in the past I’ve had a sale fall through because of transfer disclosure issues. It’s pretty easy to get out if someone gets cold feet.”

Breaking down the contents of the California Transfer Disclosure Statement

Now that you’re ready to fill out the TDS, let’s break it down into manageable chunks. It consists of:

Section A of the Transfer Disclosure Statement: Property Characteristics

Here a seller must indicate whether he or she is occupying the property, along with the specific appliances being sold along with the home.

This list is fairly exhaustive and includes kitchen range, dishwasher, central heating/air conditioning, sprinklers, and hot tub.

It also comes with the proviso that the form is not a warranty, but it is a reliable source of information for the buyer to trust that the seller has disclosed any items not in operating condition. It goes on to clarify that the representations are that of the seller, not of the agent(s), if any, and is not part of the buyer-seller contract.

Section B of the Transfer Disclosure Statement: Malfunctions and Defects

Here the seller must answer whether he or she is aware of any significant malfunctions or defects in various structural components including:

- Walls/fences

- Electrical systems

- Interior walls

- Exterior walls

- Plumbing/sewers/septics

This is intended to cut down on a seller attempting to cover up the home’s defects.

“Many homeowners really either don’t know, or they go into denial and they figure, I can function in my house (as it is) but what the buyers want to know is … there a big scratch on the window, is there something you did to the deck to make it look bigger than it is?” Launay said. “(These are) cosmetic repairs as opposed to substantive repairs so that the house looks better than it really is. It’s to make the house look good for a sale and is less focused on the inherent problems.”

Section C of the Transfer Disclosure Statement: Special Questions

This is a lengthy list of 16 yes-or-no questions designed as somewhat of a catch-all to cover what may not already have been addressed in Sections A and B. The seller is requested to indicate whether he or she is aware of elements such as:

- Room additions or modifications to the property

- Major damage to the property from fire, earthquakes, floods or landslides

- A homeowner’s association that has any authority over the property

- Any notices of abatement or citations against the property

- Fill, compacted or otherwise, on the property or any portion thereof

What other notable disclosures are required in the transfer of California real estate?

The California Transfer Disclosure Form has a section detailing “coordination with other disclosure forms.”

Specifically, it states: “This Real Estate Transfer Disclosure Statement is made pursuant to Section 1102 of the Civil Code . Other statutes require disclosures, depending upon the details of the particular real estate transaction.”

Other legally required disclosures include the Natural Hazard Disclosure Report/Statement that, according to the TDS, “may include airport annoyances, earthquake, fire, flood, or special assessment information, have or will be made in connection with this real estate transfer, and are intended to satisfy the disclosure obligations on this form, where the subject matter is the same.”

Other disclosure forms that are frequently listed here include:

- Agent’s Inspection Disclosure Form , which is based on “a reasonably competent and diligent visual inspection of the accessible areas of the property.”

- Local Option Real Estate Transfer Disclosure Statement, which provides specific information about the neighborhood or community in which the property is located.

- Notice Regarding the Advisability of Title Insurance , in which both buyer and seller acknowledge a transaction in which no title insurance is to be issued.

Be sure to check out HomeLight’s article on required disclosures when selling one’s home in any state. Addressed here are:

- The seller’s disclosure form

- Why document disclosures matter

- What must be disclosed when selling a home

Anything else sellers should know about the TDS?

While California’s TDS is particularly rigorous, “It’s a very litigious state,” says Tipton. “If someone could be sued for something, I’m sure they have a question about it on the disclosure statement.”

While your agent may not be legally allowed to fill out these forms for you, they can advise you on what must be submitted in line with your individual sale. This is one of many reasons that selling your home with agent representation is preferable.

At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying. Therefore, we promote strict editorial integrity in each of our posts.

Allison Landa

Contributing Author

- Popular Courses

- CCI Pro @20% OFF

- More classes

- More Courses

Tds on survey fees

Trinadharao Adigarla

Similar Resolved Queries

- Whether Tax Audit Required or not.

- Defective Return ITR-4

- Taxability of Premium & Survival Benefit

- Gift Deed for Gift from Husband to Wife

- 26QB information for 2 buyers and 1 seller on resale property

- Switching to Form 2 from Form3

- NCD and Land rent income split to categories

- Income Tax 123

- Depreciation in Personal Balance Sheet

- TDS Receivable Journal Entry

- Penalty for for reposting sales for which All advance received are not shown at GST paid for.

- Regarding form 112- second course

- Explanation to Sec 11(1) determining the Amount of Application Under Clause (a) and (b)

- PFA notice AY2024-2025

- In which group income tax should go

- Movement of goods using back dated invoice

- Draft notes on accounts and accounting policies

- STCOK IN TRADE AND FIXED ASSETS TRANSFER TO PARTNERS

- Incometax notice

- Companies name requirements

Trending Online Classes

LIVE Course on Foreign Exchange Management Act (FEMA)(with recording)

5 days Certification Course on GST Practical Return Filing Process

Mastering Power BI for Financial Analysis - Data-Driven Finance

Quick Links

- Experts Home

- Apply As Expert

- Daily Digest

- Show all queries

- Today's Posts

- Ask a Query

- Answer a Query

- Hall of Fame

- Settings (Only for experts)

- Settings (experts)

- Resolved Queries

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

TDS Calculator

Enter your payment details to calculate tds, enter the following details.

TDS Details

Payment Breakdown

Rule of tds.

If payment made to the individual/ HUF during the F.Y. exceeds ₹ 5,000 then TDS will be applicable @ 10%, no threshold limit for other deductees

Save, Pay, File taxes

How does this tool work?

TDS calculator is an online tool developed by Quicko that helps users estimate the tax amount to be deducted on any payments such as interest, rent, etc. It considers factors like deductee type, nature of payment, date of payment, etc. to determine the TDS deduction, assisting taxpayers in accurate TDS calculation.

Save, Pay, File Taxes

File in minutes with easy-to-follow steps on your computer or phone.

Frequently Asked Questions (FAQs)

What is the due date for filing tds returns.

TDS returns need to be filed quarterly. The due dates are generally the 31st of July, October, January, and May for the respective quarters.

How can I check my TDS deducted?

Form 26AS, available on the Income Tax Department website, provides a consolidated view of TDS deducted against your PAN.

Can I get a refund if excess TDS is deducted?

Yes, if your total tax liability is less than the TDS deducted, you can claim a refund while filing your income tax return.

How do I avoid TDS deduction?

Submitting Form 15G/15H (for certain individuals) or obtaining a certificate of lower TDS can help reduce or eliminate TDS on their income.

Is PAN mandatory for TDS deduction?

Yes, PAN is generally mandatory for TDS deduction. If PAN is not provided, TDS may be deducted at a higher rate.

What are the consequences of non-compliance with TDS regulations?

Non-compliance with TDS regulations may result in interest, penalties, disallowance of expenses, and potential legal action.

Other Tools

Rated 4.8/5 by customers like you

Getting started with Quicko is easy

Sign Up, Prefill Incomes, Review and E-File your Taxes in minutes.

Home sale commissions are getting a shake-up this weekend

Changes to realtor commissions taking effect this weekend could give home sellers a lot more negotiating power — and for buyers, potentially some more paperwork.

Starting Saturday, realtors will be barred from offering compensation on multiple listing services (MLS), making it harder for buyers’ agents and sellers’ agents to negotiate fees on their own, as they’ve done for decades.

Until now, home sellers traditionally had to pay commissions, commonly in the range of 5% to 6%, to their agents, who then split that fee with the buyer’s agent upon making a sale. The new rules, which follow a historic $418 million settlement with the National Association of Realtors in March, leave more room for sellers to negotiate those fees down and make it more appealing for buyers to forgo agents entirely.

“It’s the biggest change probably in the history of real estate,” said Mike McCann, a realtor in Philadelphia. “It has created a lot of fear, a lot of anxiety” within the industry, he said.

With the MLS no longer serving as a forum for negotiation, it remains to be seen how agents, buyers and sellers will choose to cover commission costs. While sellers could pass on any savings on the commission to the buyer in the form of a lower home price, it’s also possible that sellers could increasingly choose to ask the buyer to cover some or even all of the costs.

To ensure buyers know the compensation that they may be on the hook for, the NAR is implementing a change, also effective Saturday, requiring agents to enter into written agreements with buyers before showing a home.

Jan Jaeger is a client of McCann’s and says the new rules add more work to the experience of homebuying, which she’s going through now in Philadelphia after selling her house there earlier this month.

“It’s just another step in already a very difficult process, and I only say that because I have bought and sold many homes in the past, and what’s happening today is very different. It used to be fairly simple,” Jaeger said.

The settlement that triggered the shake-up stemmed from a class-action antitrust lawsuit that alleged brokers were steering clients to listings on the MLS offering better commissions. The NAR denied wrongdoing and reaffirmed its “commitment to requiring that MLS Participants must not limit the listings their client sees because of broker compensation.”

The NAR has also clarified that even though offers of compensation are prohibited on the MLS, offers “could continue to be an option consumers can pursue off-MLS through negotiation and consultation with real estate professionals.”

The changes come in the midst of a cooling housing market, where high home prices and high mortgage rates have caused sales of existing homes to slide since the pandemic-era homebuying frenzy.

For first-time homebuyers already concerned about affordability, the possibility of being on the hook for commissions adds more potential costs.

“People are saving, they’re paying rent, they don’t have the money,” McCann said of younger buyers looking for their first homes. “How are they going to pay the commission? That’s my biggest concern.”

Still, experts say the big takeaway is that fees could decline further. Real estate listing site Redfin noted in a report earlier this month that commissions for buyers’ agents have already been on a yearslong decline.

“It’s also possible that news of the settlement made consumers more aware they can offer any commission to a buyer’s agent or none at all, contributing to the decline since March,” the report said.

In the end, the new changes should at least give homebuyers and sellers more transparency into how they compensate brokers.

Brian Cheung is a business and data correspondent for NBC News.

- Site Search Search Posts Find A Forum Thread Number Threads by Name Search FAQs

- ENGINEERING.com

- Eng-Tips Forums

- Tek-Tips Forums

Join Eng-Tips ® Today!

Join your peers on the Internet's largest technical engineering professional community. It's easy to join and it's free.

Here's Why Members Love Eng-Tips Forums:

- Notification Of Responses To Questions

- Favorite Forums One Click Access

- Keyword Search Of All Posts, And More...

Register now while it's still free!

Already a member? Close this window and log in.

Join Us Close

India’s #1 GST software

1 click auto-fill GSTR-3B with G1 & 2B data

Download 2B data for multiple months in < 2 mins

GSTR-2B vs purchase matching in under 1 min

Start your free trial now!

Browse by Topics

- Construction services - gst rates & sac code 9954

- Services wholesale trade - gst rates & sac code 9961

- Services retail trade - gst rates & sac code 9962

- Accommodation services - gst rates & sac code 9963

- Passengers transport services - gst rates & sac code 9964

- Goods transport services - gst rates & sac code 9965

- Vehicle rental services - gst rates & sac code 9966

- Supporting services transport - gst rates & sac code 9967

- Postal courier services - gst rates & sac code 9968

- Electricity distribution services - gst rates & sac code 9969

- Financial services - gst rates & sac code 9971

- Real estate services - gst rates & sac code 9972

- Leasing rental services - gst rates & sac code 9973

- Research services - gst rates & sac code 9981

- Legal services - gst rates & sac code 9982

- Engineering advisory services - gst rates & sac code 9983

- Telecommunication services - gst rates & sac code 9984

- Support services - gst rates & sac code 9985

- Agriculture support services - gst rates & sac code 9986

- Maintenance services - gst rates & sac code 9987

- Manufacturing services - gst rates & sac code 9988

- Other manufacturing services - gst rates & sac code 9989

- Public administration services - gst rates & sac code 9991

- Education services - gst rates & sac code 9992

- Healthcare services - gst rates & sac code 9993

- Sewage collection - gst rates & sac code 9994

- Membership organization services - gst rates & sac code 9995

- Recreational services - gst rates & sac code 9996

- Other services - gst rates & sac code 9997

- Domestic services - gst rates & sac code 9998

- Services extraterritorial organizations bodies - gst rates & sac code 9999

- MAINTENANCE SERVICES - GST RATES & SAC CODE 9987 >> -->

Maintenance Services.

Origin Chapter: Chapter 99

Disclaimer: Rates given above are updated up to the GST (Rate) notification no. 05/2020 dated 16th October 2020 to the best of our information. We have sourced the HSN code information from the master codes published on the NIC's GST e-Invoice system. There may be variations due to updates by the government. Kindly note that we are not responsible for any wrong information. If you need information about the "Effective Date" for every GST or cess rates, then please visit the CBIC website. Do much more than verifying HSN/SAC codes with ClearTax GST , India's most trusted billing and GST solution where reconciliation is made easy through intelligent inbuilt validations and tools.

Calculate monthly Pension & Tax Benefits through Cleartax NPS Calculator

- Media & Press

- User reviews

- Engineering blog

- Clear Library

- FinTech glossary

- ClearTax Chronicles

- GST Product Guides

- Trust & Safety

- Cleartax(Saudi Arabia)

- Income Tax e Filing

- ClearInvestment

- ClearServices

- Mutual Funds & ITR e-filing App

- Mutual Funds

- e-filing app Download

- Income Tax App android

- Secion 80 Deductions

- Income tax for NRI

- GST software

- New GST returns

- e-invoicing

- Input tax credit

- ClearE-Waybill

- e-Invoicing Software

- eWay Bill Registration

- CA partner program

- ClearTaxCloud

- ClearPro App

- Billing Software

- Invoicing Software

- Services for Businesses

- ClearOne App

- Tax filing for professionals

- Tax filing for traders

- Clear Launchpad

- Trademark Registration

- Company Registration

- TDS returns

- MSME Registration

- HSN Code Finder

- Cement HSN Code

- Transport HSN Code

- Plastic HSN Code

- Cloth GST Rate

- Books GST Rate

RESOURCES & GUIDES

- GST Registration

- GST Returns

- GST Procedure

- GST News & Announcement

- GSTR 9 Annual Returns

- GST Payments and Refunds

- Invoicing Under GST

- Income Tax Slab

- What is Form 16

- Salary Income

- How to File TDS Returns

- New Income Tax Portal

- Incometax.gov.in

- Income From Selling Shares

- Income Tax Due Dates

- How to Invest in Mutual Funds

- Mutual fund Types

- SIP Mutual Funds

- Hedge Funds

- What is AMFI

- What is NAV

- Memorandum of Understanding ( MoU )

- Mudra Yojana

- Inflation & Deflation

- Loan Agreement

- Succession Certificate

- Solvency Certificate

- Debt Settlement Agreement

- Rental Agreement

- Letters Of Credit

- Income tax calculator

- EMI Calculator

- Mutual fund calculator

- SIP calculator

- GST calculator

- PPF Calculator

- GST number search

- IFSC Code Search

- Generate rent receipts

- Home Loan EMI Calculator

- NPS Calculator

- HRA calculator

- RD Calculator

- FD Calculator

- Gold Rates Today

- Currency Converter

- Compound Interest Calculator

- Find HSN code

- Tax Saving Calculator

- Get IT refund status

- Salary Calculator

- EPF Calculator

- GST Number Search by Name

TRENDING MUTUAL FUNDS

- ICICI Prudential Technology Fund Direct Plan Growth

- Tata Digital India Fund Direct Growth

- Axis Bluechip Fund Growth

- ICICI Prudential Technology Fund Growth

- Aditya Birla Sun Life Tax Relief 96 Growth

- Aditya Birla Sun Life Digital India Fund Direct Plan Growth

- Quant Tax Plan Growth Option Direct Plan

- SBI Technology Opportunities Fund Direct Growth

- Axis Long Term Equity Fund Growth

- SBI Mutual Fund

- Nippon India mutual fund

- HDFC Mutual Fund

- UTI mutual fund

- Kotak Mahindra Mutual Fund

- ICICI Prudential Mutual Fund

- Aditya Birla Mutual Fund

- Axis mutual fund

STOCK MARKETS

- Stock Market Live

- Yes Bank Share Price

- SBI Share Price

- IRCTC Share Price

- ITC Share Price

- TCS Share Price

- Tata Motors Share Price

- Infosys Share Price

- Idea Share Price

- HDFC Bank Share Price

- Best Mutual Funds

- Best Tax Savings Mutual Funds

- Best Index Funds

- Best Equity Mutual Funds

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law. Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

CLEARTAX IS A PRODUCT BY DEFMACRO SOFTWARE PVT. LTD.

Privacy Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

Looking for a business loan

Thank you for your interest, our team will get back to you shortly

IMAGES

COMMENTS

As per the Finance Bill 2020, some amendments have been made to Section 194J under TDS, the same will take effect from 1/04/2020. Now let's take a look at amendments to Finance Bill 2020. TDS will be deducted under Section 194J at a rate of 2% in case of fees for technical services (not being professional services) and the rate reaches up to ...

Examples Of TDS On Professional And Technical Services. Example 1: Mr Jay has availed professional service from Mr Veer in F.Y. 2023-24. The first payment was in April month of Rs 55,000, and the second payment was in December month of Rs 22,000. Let us check the TDS liability for both the payments for the F.Y. 2023-24 in three scenarios:

Ans: As per provisions of section 194J of the Income Tax Act, 1961 requires every person to deduct TDS @ 10% or 2% depending on case to case basis on the following payment made to a resident person -. Fees for professional services; Fees for technical services; Royalty;

The TDS on transportation charges limit is Rs. 30,000 for a single payment and Rs. 1,00,000 in aggregate during a financial year. TDS Rate on Transportation Charges. The TDS rate on transportation charges under Section 194C is generally 1% for payments to individual or HUF contractors and 2% for other entities. However, there is a specific ...

Section 194J requires deduction of tax at source @10% from the amount credited or paid by way of fees for professional services, where such amount or aggregate of such amounts credited or paid to a person exceeds Rs. 30,000 in the F.Y. 2021-22. As per Explanation (a) to section 194J, professional services include services rendered by a person ...

The tax deduction rates under Section 194J are mentioned in the table below: Nature of Payment. Tax Deduction Rate. Fee payments for technical services. 2%. Fee payments made to call centres. 2%. Royalty paid for the sale, distribution, or screening of a film. 2%.

Views expressed are the author's own. Introduction In the case of fees for technical services, tax deducted at source ("TDS") under Section 194J of the Income Tax Act, 1961 ("IT Act") has ...

The Department conducted a TDS inspection u/s 133A of the Act, at the business premises of the assessee appellant on 28.09.2011. During the course of such inspection and assessment proceedings u/s 201(1)/201(1A) of the Act, it was noticed by the ACIT (TDS) that the hospital is running different OPDs, apart from indoor patients' treatment.

TDS or Tax Deducted at Source is income tax reduced from the money paid at the time of making specified payments such as rent, commission, professional fees, salary, interest etc. by the persons making such payments. Usually, the person receiving income is liable to pay income tax. But the government with the help of Tax Deducted at Source ...

Payments that are Protected by Section 194J. When making the following payments to a citizen in a fiscal year (over Rs.30,000), a person can subtract TDS at a rate of 10%: The sum is paid as a premium for professional services. Amount paid as a business fee for technical assistance. Non-compete charge under Section 28 (VA) of the Income Tax Act ...

Here firm XYZ is not liable to deduct TDS from payments made to Mr. Red as ₹ 30,000/- limit is separate for each item, namely fees for technical services and professional charges. ... Hence, Tax was to be deducted at source under section 194J as professional charges. (AYS.2009-10, 2010-11) Dy. CIT (TDS) .v. Ivy Health Life Sciences (P.) Ltd ...

Whether TDS needs to be deducted on visit charges say, Representative has been called from the company from where the machinery had been purchased. Such a company has billed towards visiting its representatives. Answer the question. Question Tags: TDS on Visit Charges. 1 Answers.

A Missouri woman with a long history of small-time scams and fraud was arrested Friday morning on federal charges in connection with a scheme to extort Elvis Presley's family out of millions and ...

The threshold for deduction of TDS on Repair and Maintenance is currently set at Rs. 30,000 in a single transaction and the aggregate amounts do not exceed Rs. 1,00,000. If it exceeds the threshold limit, then the rate of deduction as provided under Section 194C of the Act will be applicable, i.e., 1% or 2%.

Jaime Mesa, 20, and Anthony Morales, 22, are accused of racing sports cars and causing the deadly crash Saturday night in Grand Prairie, a suburb of Dallas.

At least one individual was arrested in Southern California in connection with "Friends" actor Matthew Perry's death last year, which was attributed to the acute effects of ketamine.

Thomson, GA (August 14, 2024) - On Wednesday, August 14, 2024, the GBI arrested and charged the Mayor of the City of Thomson, Benjamin Cary Cranford, age 52, of Thomson, Georgia, with Furnishing Prohibited Items to Inmates and Criminal Attempt to Commit a Felony.. On June 6, 2024, the Thomson Police Department requested that the GBI conduct an investigation into an allegation that Cranford ...

There will be a slight improvement (TDs on 63 percent of trips), but not nearly enough to punch a ticket to the Big 12 title game or end the 15-game losing skid to K-State.

This implies that the rate of TDS is 10% in case of fees paid for professional services while it is 2% in case of fees for technical services. As the rate of TDS is different for professional services and technical services, looking into the difference between the two is the need of the hour. Let us go into the definitions of both as provided ...

The California Transfer Disclosure Form has a section detailing "coordination with other disclosure forms.". Specifically, it states: "This Real Estate Transfer Disclosure Statement is made pursuant to Section 1102 of the Civil Code. Other statutes require disclosures, depending upon the details of the particular real estate transaction.".

TDS Secure Login User Name or Email Address Examples: [email protected] or [email protected] Continue Forgot user name? Retrieve it. Password. Show password Sign in Forgot Password. Don't have a TDS online account? Sign Up Return to Previous Page. Questions? Call 800-605-1962. If you ...

The United Auto Workers on Tuesday filed federal labor charges with the National Labor Relations Board against former President Donald Trump and billionaire Elon Musk for publicly applauding the ...

WHICH SECTION OF TDS WILL BE ATTRACTED AS IT CONTAINS FEES FOR SUPPLY OF MAN POWER AS WELL AS CENTER FEES FOR CONDUCTING SURVEY. Trinadharao Adigarla (Expert) Follow. 11 December 2015 Hi, Survey Fees is Treat as Professional Service Under Section 194J @ 10%. Manpower Supply as a nature of Sury work is treat Professional Service.

I. Notice and Disclosure to Buyer of State Withholding on. Disposition of California Real Property. In certain California real estate sale transactions, buyers must withhold 3 1/3% of the total sales prices as state income tax and deliver the sums withheld to the State Franchise Tax Board.

Alamo, Laurens County, Georgia (August 16, 2024) - At the request of the Laurens County Sheriff's Office, GBI agents are investigating an officer involved shooting in Alamo, Laurens County, Georgia. One man, later identified as Curtis "CJ" Glen Purvis Jr., age 31, of McRae-Helena, GA, died in the incident. No officers were injured in this incident.

TDS calculator is an online tool developed by Quicko that helps users estimate the tax amount to be deducted on any payments such as interest, rent, etc. It considers factors like deductee type, nature of payment, date of payment, etc. to determine the TDS deduction, assisting taxpayers in accurate TDS calculation.

Calhoun, GA (August 16, 2024) - At the request of the Gordon County Sheriff's Office, GBI agents are investigating an officer involved shooting in Calhoun, GA. Michelle Ralstons, age 55, of Calhoun, GA was shot and injured in the incident. No deputies were injured in this incident.

After the National Association of Realtors settlement, new rules around real estate fees are taking effect that boost buyers' and sellers' negotiating power.

-That first site visit with a new client is a funny dance. As others are mentioning, too much information renders you useless. ... What MotorCity said. I charge for my initial visit or meeting - existing or new client. If they have a problem with that, I don't want their business. RE: Charging for Meetings/Site Visits Prior to Being Engaged

01/04/2020 25/01/2018. 5% 5% 18%. 998719. Maintenance And Repair Services Of Other Machinery And Equipments. 5/18. Nil Provided that Director (Sports), Ministry of Youth Affairs and Sports certifies that the services are directly or indirectly related to any of the events under FIFA U-17 Women's World Cup 2020.