Reference.com

What's Your Question?

- History & Geography

- Science & Technology

- Business & Finance

- Pets & Animals

What Is the Difference Between Inbound and Outbound Tourism?

In the simplest terms, inbound tourism occurs when a foreigner or non-resident visits a particular country, and outbound tourism occurs when a resident of a particular country leaves it in order to visit another one.

As an example from an American perspective, if an American visits Germany, that is considered to be outbound tourism. However, if a German visits the United States, that is considered to be inbound tourism. Inbound and outbound tourism have an important impact on a country’s financial health.

The Benefits of Inbound Tourism

When a country attracts a lot of inbound tourism, the tourists spend money on hotels, dining, attractions, souvenirs and other amenities. This creates jobs, and through consumption taxes, it adds additional money to that country’s coffers. As the inbound tourism increases, so does the job market in that country in order to cope with the increased traffic. New hotels are needed to accommodate the influx of tourists, new attractions spring up to offer something enticing for visitors, the need for taxis and hired cars increases and so on.

Inbound Tourism in the United States

Tourists flock to the United States to see natural wonders, such as the Grand Canyon and Niagara Falls, and historic landmarks like the Statue of Liberty, the White House and Mount Rushmore. Theme parks attract millions of tourists each year, including Walt Disney World and Universal Studios Hollywood. There are famous annual events, such as Mardi Gras in New Orleans and Comic-Con International in San Diego. Generally speaking, foreign tourists are known to spend a considerably higher amount of money in the United States than domestic tourists. This investment helps the economy thrive.

Outbound Tourism

Outbound tourism also generates some money in the country of origin even though the residents are leaving to visit elsewhere. Outbound tourists make purchases that include plane tickets, travel insurance and new travel clothing from their home country. As travel trends change and people look for specialized vacations, such as adventure tourism or wellness tourism, tourism companies benefit from sourcing and booking customized packages. Ultimately, however, outbound tourism takes financial resources out of the home country and gives them to the destination country. As an example, travel exports (inbound tourism) for the United States in 2016 reached $246 billion, while its travel imports (outbound tourism) reached $159 billion.

Travel Trade Surplus

If a country has more inbound than outbound tourism, as in the above example, it has a travel trade surplus. A country with a travel trade surplus can consider tourism to be a very lucrative export. For the United States, international travel as a whole continually enhances American job growth and helps balance the country’s trade, being its largest service export. In 2016, over a million U.S. jobs were supported by international travel and the country’s travel trade surplus ran into tens of billions of dollars. Benefiting from a high level of inbound tourism doesn’t mean that a country shouldn’t encourage outbound tourism, however. There are intangible effects of both inbound and outbound tourism, and these include learning about the surrounding world and fostering positive relationships between countries. Outbound tourism includes business trips as well as vacations, enhancing ties between other nations and boosting the economies of each participating country.

MORE FROM REFERENCE.COM

What Is Inbound and Outbound Tourism With Example?

By Robert Palmer

Inbound and outbound tourism are two terms that are commonly used in the travel industry. Both of these terms refer to the movement of people from one place to another for the purpose of tourism. In this article, we will take a closer look at what inbound and outbound tourism means, along with examples.

What is Inbound Tourism?

Inbound tourism refers to when tourists visit a country that is not their own. In other words, it refers to the arrival of visitors from overseas into a country.

This type of tourism is also known as international tourism. The visitors could be traveling for various reasons such as leisure, business or visiting friends and family.

Inbound tourism can have a significant impact on a country’s economy by generating revenue through spending on accommodation, food, transport, and other tourist activities. For example, when tourists visit India to see the Taj Mahal or Singapore to experience its unique culture, they contribute significantly towards the local economy.

Examples of Inbound Tourism

- A family from Germany visiting Disneyland in California

- A group of backpackers from Australia traveling across Southeast Asia

- A businessman from Japan attending a conference in New York City

What is Outbound Tourism?

Outbound tourism refers to when tourists leave their home country to visit another country. It’s also known as domestic tourism when people travel within their own country for leisure or business purposes.

Outbound tourism can have an impact on both the traveler’s home country and the destination they are visiting. When people travel abroad from their home countries, they spend money on flights, accommodation and other tourist activities which can contribute significantly towards the local economy of the visited country.

Examples of Outbound Tourism

- A family from Canada taking a vacation to Hawaii

- A group of friends from the United States traveling to Europe for a backpacking trip

- A couple from Australia taking a romantic getaway to Bali, Indonesia

Inbound and outbound tourism are two important aspects of the travel industry. While inbound tourism refers to tourists visiting a country that is not their own, outbound tourism refers to people leaving their home country for leisure or business purposes.

10 Related Question Answers Found

What is meant by inbound and outbound tourism, what are the types of outbound tourism, what is the meaning of outbound tourism, what is meant by outbound tourism, what is an example of outbound tourism, what is the significance of outbound tourism, what is outbound tourism, what does outbound tourism mean, what is an example of inbound tourism, what is outbound tourism in simple words, backpacking - budget travel - business travel - cruise ship - vacation - tourism - resort - cruise - road trip - destination wedding - tourist destination - best places, london - madrid - paris - prague - dubai - barcelona - rome.

© 2024 LuxuryTraveldiva

The differences between outbound and inbound tour operator agents

By Rezdy — 25 Mar 2018

distribution inbound tour operator inbound travel outbound tour operator outbound travel

Updated September 2024 – Are you a tour operator trying to find which option is best for you? Or alternatively, are you a tourism professional trying to set up your distribution system? Trying to make your mark and stand out in a highly competitive tourism industry? Let’s start at the beginning to help you understand the types of travel agents available to partner with, including inbound tour operators, outbound tour operators, and domestic tour operators.

The role of a tour operator is to brainstorm ideas and conduct research to design holiday packages for travelers. In essence, they curate and compile various travel elements into a package that people will find appealing — creating a tailored and individual experience based on the interests and needs of various travelers. Holiday packages usually combine accommodation, cuisine, sightseeing, and transport. Different types of tour operators, such as ground operators, receptive tour operators, and destination management companies, cater to specific destinations and travel experiences.

Inbound vs. outbound travel

An inbound tourist is someone who visits a country but is not a resident of it. In outbound tourism, residents of a country visit another country. Does this sound like two sides of the same coin? That’s because it is.

Let’s look at an example:

Kevin, an Australian citizen, is traveling to Argentina for a holiday.

Kevin is an inbound tourist to Argentina. In contrast, Kevin is an outbound tourist from Australia.

Depending on where Kevin chooses to organize his holiday packages will depend on if he makes use of inbound tourism or outbound tourism.

An inbound tour operator will sell to people soon to be arriving in their countries, whereas an outbound tour operator will sell to people before they arrive at their destination.

Inbound tour operator agents

An inbound tourist is someone who visits a country but is not a resident of it. In outbound tourism, residents of a country visit another country. Does this sound like two sides of the same coin? That’s because it is. Inbound tourism involves welcoming international travelers, while outbound tourism focuses on residents of one country visiting others.

Let’s look at an example:

Kevin is an inbound tourist to Argentina. In contrast, Kevin is an outbound tourist from Australia. Depending on where Kevin chooses to organize his holiday packages, he might work with an inbound operator or an outbound operator. Outbound travel options offer opportunities for residents to explore international destinations, while inbound travel allows international travelers to experience local travel within their host country.

An inbound tour operator will sell to people soon to be arriving in their countries, whereas an outbound tour operator will sell to people before they arrive at their destination. Outbound tour operators also provide valuable services to international travelers, helping them navigate different countries and ensuring seamless travel experiences.

An inbound tour operator, also known as a destination management company, is a locally-based business or individual that provides holiday planning. This includes itinerary planning and arrangement of payment for their overseas clients. Inbound operators work closely with transportation companies, local service providers, and tour guides to create memorable experiences for inbound tourists.

Inbound tour operators deal with both individuals and groups of international travelers. They make arrangements that are specifically catered to international guests, ensuring their clients have a comfortable and enjoyable stay.

An inbound operator can work with the convenience of being able to operate at the same location in which they are organizing the holiday packages. Compared to outbound tour operators, an inbound operator would better understand the local area and its culture. This is especially true when receiving any inquiries or questions about tour information from a potential client. Additionally, an inbound tour operator is usually encouraged to develop strategic partnerships with other local companies and tour and activity operators . Building these relationships is a lot easier due to geographical location.

Inbound tour operators are locally based

The purpose of inbound tour operators is to promote the entire destination to potential visitors from their local viewpoint. The operational advantage of being locally based is having easy access to work with other companies to promote the location as a whole to interested overseas travelers. Additionally, inbound tour operators can offer a more personalized service to their customers by having direct contact with them in their chosen destinations.

Inbound tour operators often work with other travel agents and distribution partners

Tour packages are often created and promoted by inbound tour operators in partnership with other travel agents and travel distribution channels . Inbound tour operators work under the assumption that travelers are often motivated by package tours and promotions, and take advantage of this when marketing their destination. This means it’s beneficial for inbound tour operators to create packages that include local tourism businesses such as hotels, transportation, and tours and activities. Following that, these same packages are promoted to segments of the target market that are most likely to visit the region in the near future.

Choose an inbound tour operator if:

Working with an inbound tour operator is a good idea if you want to increase your visibility in a chosen destination. This will be increasingly beneficial if your target market shows interest in package deals. Inbound operators are particularly useful for companies targeting inbound tourism and specific country markets.

Outbound tour operator agents

A typical outbound tour operator works with international tourists. In contrast to inbound tour operators, outbound tour operators take travelers overseas from their home country. They offer a variety of tour packages that enable tourists across borders to travel abroad easily. Outbound tour operators provide tailored travel packages to cater to the specific needs and preferences of outbound travelers.

Outbound tour operators contribute significantly to the destination country’s economic growth. The majority of outbound tour operators choose to focus on a specific destination. This may be a destination that is currently popular or a destination in which they have special expertise and distribution partners. This approach allows outbound tour operators to develop in-depth knowledge of the local culture, sightseeing opportunities, and the best service providers in the market.

Most outbound tour operators cater to international travelers.

Outbound tour operators offer travelers the convenience of visiting another country of their choice through tour packages. When travelers book a tour with an outbound tour operator, they can get everything they need under one roof — simplifying the travel experience. Outbound operators are skilled at designing travel experiences that appeal to specific traveler segments, whether they are domestic travelers seeking new experiences abroad or international travelers exploring Europe, Southeast Asia, or other specific destinations.

A particular region of the world is often their specialty

Outbound tour operators have the benefit of being experts in the destinations they serve. European destinations are a very popular choice with outbound tour operators; however, other destinations, such as Southeast Asia and the Middle East, are growing in popularity. A successful outbound tour operator will often be very tuned-in to trends, one step ahead of the crowds, so they know which destinations to specialize in next. Outbound operators are adept at curating experiences that resonate with the interests and expectations of their target market.

Choose an outbound tour operator if:

If your business strategy includes targeting international travelers, partnering with an outbound tour operator is likely to be a good fit. Additionally, an outbound tour operator will be a good fit if you understand overseas offerings and have the ability to promote them to domestic customers.

Advantages and Disadvantages

Just like running any form of travel company, there will always be some advantages and disadvantages. Before working with either an inbound or outbound tour operator, here are a few pros and cons you should consider.

Inbound tour operators

As an inbound tour operator, you’ll have the advantage of convenience. This is due to being able to operate in the same location or home country as the tours you offer. This is extremely beneficial when receiving any inquiries or questions about the tours as you’d have a greater understanding of the local area and its culture compared to outbound tour operators. Furthermore, as an inbound tour operator, developing strategic partnerships and forming great relationships with other local companies and tour and activity operators will be a lot easier and is usually encouraged.

Another major advantage an inbound tour operator has is that most of the interactions with their customers will be direct. Meaning, it will allow them to offer a more personalized experience based on their customer’s needs. Inbound tour operators can collaborate with providers to offer exclusive travel options that highlight local culture and unique experiences.

Outbound tour operators

Just like the inbound operators, outbound tour operators deal with customers from their own countries. This makes designing and creating tour packages a whole lot simpler as they can customize the tours based on the customer’s interests. However, a disadvantage outbound tour operators have is not being based on the travel destination itself. This could create problems and can be more difficult to resolve any issues that may arise.

Fortunately, outbound tour operators have the flexibility to update their products and packages based on the latest travel trends and demands. As we all know, the travel industry is highly competitive and constantly evolving. Offering outbound tours gives you the freedom to adapt to changes in the travel and tourism market swiftly. Outbound operators are well-positioned to offer curated travel packages that appeal to a wide range of traveler types, from luxury seekers to budget-conscious explorers.

———-

Which one should you choose?

The key difference between inbound and outbound tour operators comes down to whether they provide tours in their home country or abroad. You should consider both types of tour operator agents when developing your distribution strategy. Partnering with these two agents will maximize your reach to both international and domestic travelers. Inbound and outbound operators each offer unique benefits, making them valuable partners for any tour operator business.

Now, it’s time to think about ways to make your distribution and marketing strategies more effective. You can identify your key partners via your research or by connecting with a tour wholesaler . By establishing partnerships with a large tour operator network, you can advance your business — both inbound and outbound. Read our previous blog if you are looking for tips and tricks for partnering with travel agencies or download our online distribution ebook today.

In general, both types of tour operator agents play an important role in the overall success of your distribution strategy. By partnering with both of these agents, you’ll be able to maximize your reach to both international and domestic travelers.

When bookings start to come through, you’d want to ensure that you’re providing your customers with a simple booking journey. By utilizing an online booking software , you’re not only simplifying the customer’s booking journey, you’re streamlining your processes as well. This is due to advanced features that automate your processes that allow your customers to make a booking on the spot. These features include a real-time availability viewer, that allows your customers to book based on your exact availabilities. Payment gateway integrations that provide your customers with the convenience of secure online payments. And Automatic communication, which sends your customers confirmation and updates regarding their bookings.

To top this all off, you can easily manage your partnership with both outbound and inbound tour operators via an online tour operator marketplace like Rezdy Channel Manager . Rezdy’s marketplace broadens your reach to over 25,000 active resellers in the industry.

Using Rezdy Channel Manager is as simple as:

- Naming your price

- Setting your rates

- Letting resellers sell and promote your products

On top of that, you don’t have to worry about collecting payments and paying commissions as Rezdy automatically organizes payments for both parties. This reduces the need to chase your agents for payments.

Ready to capture more inbound and outbound bookings with Rezdy? Book a free demo today.

If you enjoyed this article, then make sure to sign up for our newsletter where you’ll receive the latest marketing tools and tour operator tips designed with businesses like yours in mind.

Start free trial

Enjoy 21 days to take a look around and see if we are a good fit for your business.

No obligations, no catches, no limits, nada

Distribution

eBook: Guide to growing your tourism business through distribution & channel management tools

How to navigate API connections with resellers

Case Study: Wendella Tours & Cruises

UN Tourism | Bringing the world closer

The first global dashboard for tourism insights.

- UN Tourism Tourism Dashboard

- Language Services

- Publications

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

UN Tourism Data Dashboard

The UN Tourism Data Dashboard – provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism share of exports and contribution to GDP, source markets, seasonality and accommodation (data on number of rooms, guest and nights)

Two special modules present data on the impact of COVID 19 on tourism as well as a Policy Tracker on Measures to Support Tourism

The UN Tourism/IATA Destination Tracker

Un tourism tracker.

- International tourist arrivals and receipts and export revenues

- International tourism expenditure and departures

- Seasonality

- Tourism Flows

- Accommodation

- Tourism GDP and Employment

- Domestic Tourism

International Tourism and COVID-19

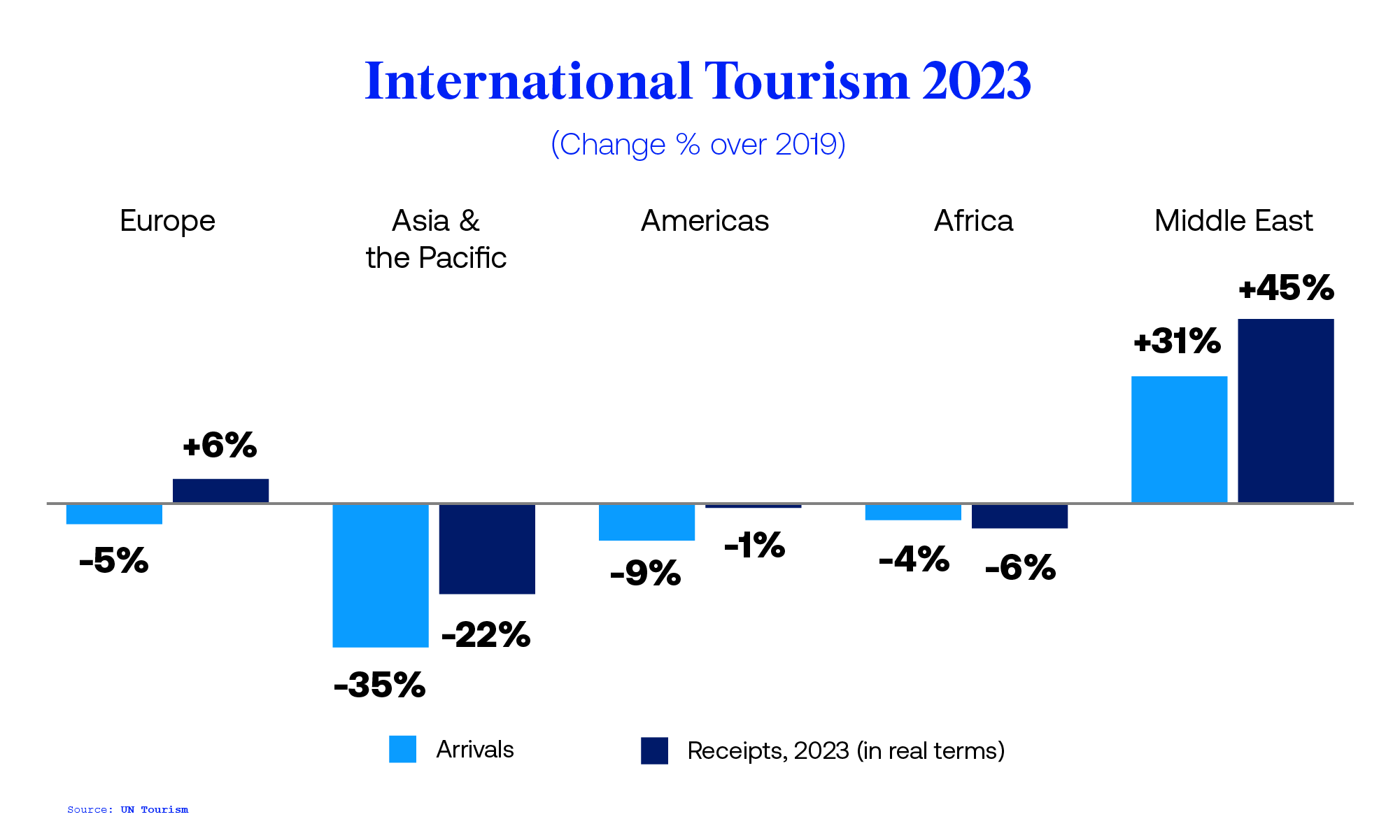

- The pandemic generated a loss of 2.6 billion international arrivals in 2020, 2021 and 2022 combined

- Export revenues from international tourism dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 34% below pre-pandemic levels.

- The total loss in export revenues from tourism amounts to USD 2.6 trillion for that three-year period.

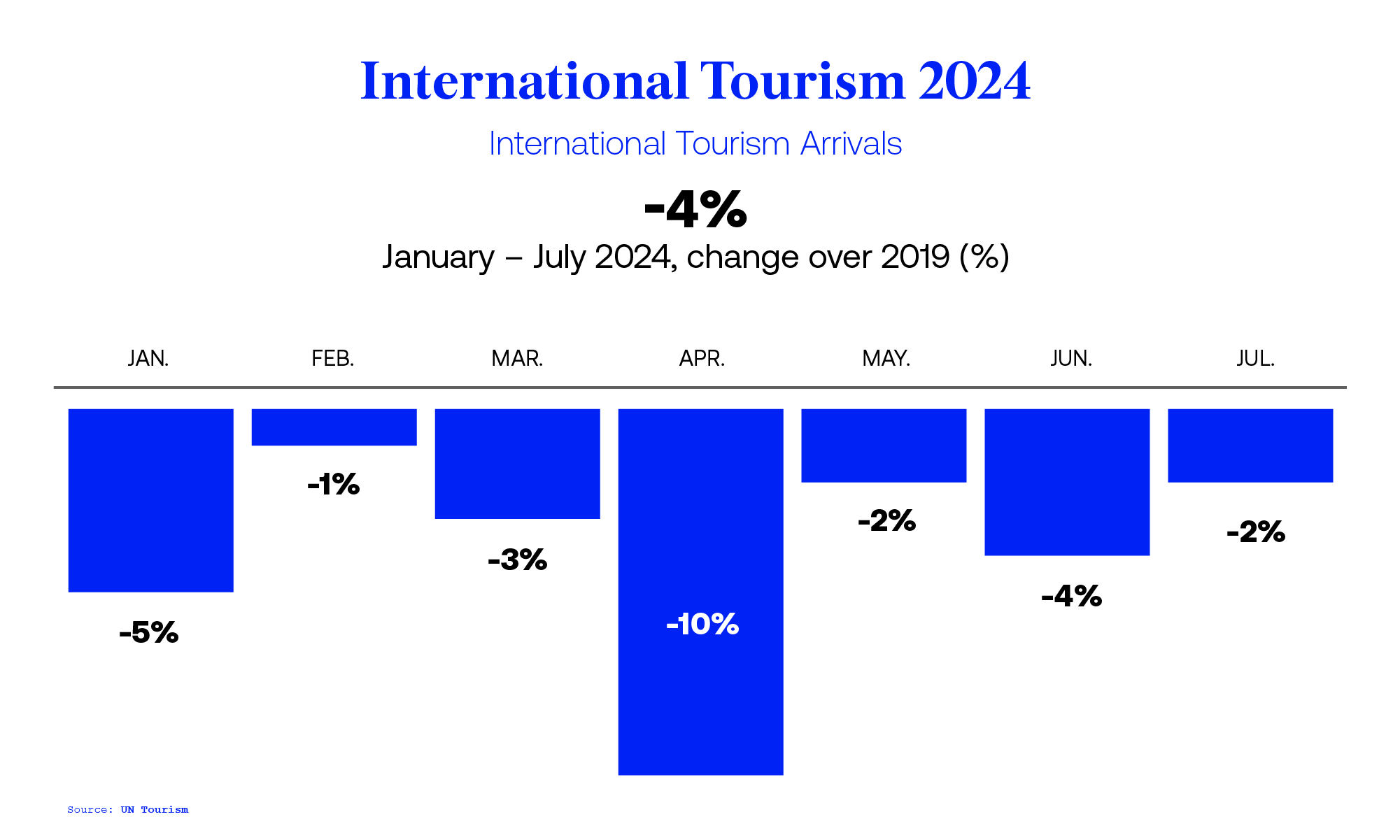

- International tourist arrivals reached 89% of pre-pandemic levels in 2023 and 97% in Q1 2024

COVID-19: Measures to Support Travel and Tourism

- Hospitality Industry

- Institutions

- Vocational Courses

- Master’s Courses (International)

- Order our Book

- Search for: Search Button

What is Tourism and explain in brief factors that promote tourism?

Ans: Travelling outside from their usual environment/places for the purpose of Leisure, Business, Pilgrimage, Education, Treatment, etc. There are Outbound tourism, Inbound Tourism, Domestic Tourism which has explained in detail below.

This Industry is a dynamic and competitive industry, very important for the country’s economy.

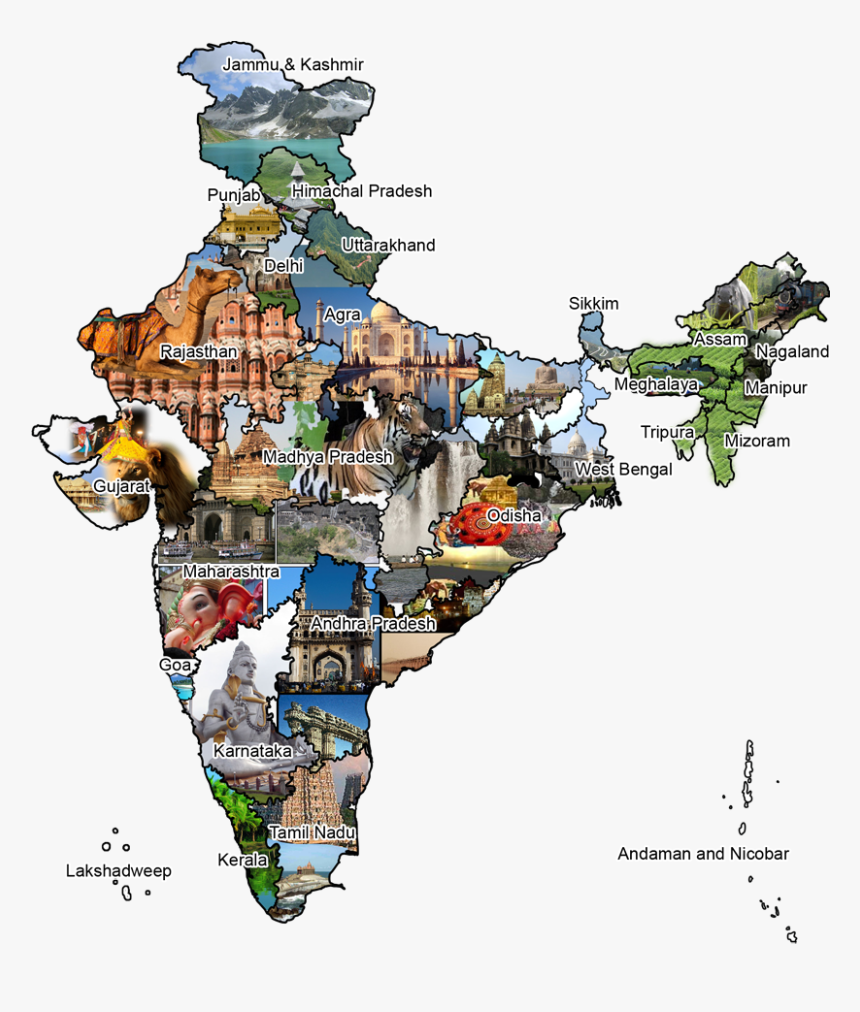

India is growing rapidly.

It has been calculated by the World Travel and Tourism Council of World that Indian tourism generated ₹16.91 lakh crores (US$240 billion) or 9.2% of Indian GDP and created 43 Million Jobs in 2018 and expected to grow ₹32.05 lakh crores (US$450 billion) by 2028.

It enhances the economy of the countries and boosts in a range of many sectors of the countries.

Many Countries rely on Tourism.

Outbound Tourism

Outbound tourism is the act of traveling “out” of your home country for the purpose of tourism, it comprises the activities to travel out their country of residence and outside their usual environment for not more than 12 consecutive months for the purpose of Leisure, Business, Pilgrimage, Education, Treatment, etc. It involves the people going from India to other provinces, territories, or countries. For example, going to Hawaii for a holiday is considered outbound tourism. The three biggest factors contributing to the growth of outbound tourism are the advent of low cost, an increase in disposable income, and leisure time in globalization. There are tourists who visit places with the objective of studies and exploration. The need for research promotes tourism. Archeologists, Geologists, Oceanographers, Biologists and Zoologists, Architects, and People researching Arts and Cultures seek places that have great significance in the field of research.

The recent growth in outbound tourism industries in the world market is from China. It has an estimate in 2018 is approx $300 billion only in outbound tourism. Whilst, Chinese tourism travel all over the world. This means that the Chinese outbound tourism market is particularly welcoming in many destinations around the world.

Inbound Tourism

The tourists coming from other places are called inbound tourists. Tourism can bring in a lot of money to a country through the foreign exchange from a global market. It is for this reason that many countries will target their advertising towards certain nationalities and will try to attract tourists, mainly from the United States, China, Japan, Germany, and many other countries. To attract the tourist the government explores the cultures, Places, Monuments & Heritage, Food, Lifestyles, etc. The best example is people mostly travel to see the “Wonder of the World” or a place like Las Vegas due to the biggest Casino or to a place like Dubai to watch” Burj Khalifa”. The Industry also implements marketing campaigns, aimed to attract travelers from other parts of the country.

The problems occur when there are pandemic, terrorism, natural calamities, etc. this kind of uncertainties our intentional problem creates a major problem in economics.

India is said to be the largest market for travel and tourism. India is a diverse product like eco-tourism, film, rural and religious, spiritual tourism.

Domestic Tourism

It comprises the activities of residents, traveling within the countries. It is also a big business to bring the economy of the local area. India is one of the popular domestic tourism. It is surrounded by Sea, Hills, Sand dune, Jungles, Different cultures, religion, food, temples (the state with the highest domestic tourists was Tamil Nadu, with over 385 million tourist visits), monuments, and heritage, etc.

No Responses

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

© 2024 The Hotel Skills. Created with ❤️ using WordPress and Vertice theme.

By: Bastian Herre and Veronika Samborska

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000.

Tourism can be important for both the travelers and the people in the countries they visit.

For visitors, traveling can increase their understanding of and appreciation for people in other countries and their cultures.

And in many countries, many people rely on tourism for their income. In some, it is one of the largest industries.

But tourism also has externalities: it contributes to global carbon emissions and can encroach on local environments and cultures.

On this page, you can find data and visualizations on the history and current state of tourism across the world.

Interactive Charts on Tourism

Cite this work.

Our articles and data visualizations rely on work from many different people and organizations. When citing this topic page, please also cite the underlying data sources. This topic page can be cited as:

BibTeX citation

Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license . You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.

Our World in Data is free and accessible for everyone.

Help us do this work by making a donation.

Travel and tourism in Russia

Statistics report on the travel and tourism sector in Russia

This report provides statistics and facts about travel and tourism in Russia. It gives an overview of the Russian travel market, including figures on outbound, inbound, and domestic tourism. Furthermore, it contains data on the most popular destinations as well as travel behavior of Russians.

Download your Report

Table of contents.

- Premium Statistic Countries with the highest outbound tourism expenditure worldwide 2019-2023

- Premium Statistic Inbound visitor growth in CEE 2020-2024

- Premium Statistic Travel industry revenue distribution in Russia 2022, by segment

- Premium Statistic Tourism spending share in Russia 2019-2023, by purpose

- Basic Statistic Travel and tourism's total contribution to GDP in Russia 2019-2034

- Basic Statistic Travel and tourism's total contribution to employment in Russia 2019-2034

- Premium Statistic Travel transportation consumer price in Russia 2022, by type

Outbound tourism

- Basic Statistic Outbound travel expenditure in Russia 2011-2023

- Premium Statistic Number of outbound tourism trips from Russia 2014-2023

- Premium Statistic Leading outbound travel destinations in Russia 2022-2023

- Premium Statistic Number of outbound tourists from Russia 2023, by territory

- Premium Statistic Outbound tourist flow growth in Russia 2022, by destination

- Premium Statistic European Union (EU) Schengen visas issued in Russia 2010-2023

Inbound and domestic tourism

- Basic Statistic International tourism spending in Russia 2011-2023

- Basic Statistic Domestic travel spending in Russia 2019-2034

- Premium Statistic Number of inbound tourist arrivals in Russia 2014-2023

- Premium Statistic Leading source markets for travel to Russia 2021-2023, by arrivals

- Basic Statistic Number of nature protected areas in Russia 2015-2023, by type

- Premium Statistic Estimated demand for inbound tourism in Russia Q1 2014-Q2 2024

- Premium Statistic Inbound tourist flow growth in Russia 2020-2023

- Premium Statistic Tourist flow in Moscow 2019-2023

- Premium Statistic Tourist count in Saint Petersburg, Russia 2016-2023, by origin

Travel industry

- Premium Statistic Travel industry organizations distribution in Russia 2022, by segment

- Premium Statistic Number of tourism companies in Russia 2010-2022

- Premium Statistic Average monthly travel industry salary in Russia 2014-2022

- Premium Statistic Most popular travel websites in Russia 2023, by traffic

Package tours

- Premium Statistic Number of package tours sold in Russia 2014-2022, by type

- Premium Statistic Value of package tours sold in Russia 2014-2022, by type

- Premium Statistic Package tour cost in Russia 2014-2022, by type

- Premium Statistic Most popular travel destinations on package tours in Russia 2022

Accommodation

- Basic Statistic Paid travel accommodation services value in Russia 2015-2022

- Premium Statistic Travel accommodation establishments in Russia 2023, by federal district

- Basic Statistic Total room area in travel accommodation in Russia 2013-2022

- Premium Statistic Number of visitors in hotels in Russia 2010-2023

- Basic Statistic Number of hotel visitors in Russia 2023, by travel purpose

- Premium Statistic Overnight accommodation cost in Moscow monthly 2020-2023

- Premium Statistic Hotel occupancy rate in Moscow 2023, by segment

- Premium Statistic Average daily hotel rate in Moscow 2023, by segment

- Premium Statistic Glamping sites share in Russia 2023, by seasonality

Travel behavior

- Premium Statistic Household expenditure on travel & recreation per capita in Russia 2014-2022

- Premium Statistic Reasons to not travel long-haul in Russia 2022

- Premium Statistic Intention to travel long-haul from Russia 2019-2022

- Premium Statistic Intention to travel to Europe in Russia 2019-2022

- Basic Statistic Summer vacation plans of Russians 2012-2023

- Premium Forecast Travel frequency for private purposes in Russia 2023

- Basic Statistic Average holiday spend per person in Russia 2011-2023

- Premium Forecast Attitudes towards traveling in Russia 2023

- Premium Forecast Travel product online bookings in Russia 2023

- Premium Statistic Internet use for travel booking in Russia 2014-2022

If this report contains a copyright violation , please let us know. Note that you will leave this page when you click the link.

Recommended and recent reports

Recommended statistics.

- Premium Statistic Brand value of leading global QSR brands 2024

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Premium Statistic Countries with the highest number of inbound tourist arrivals worldwide 2019-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Premium Statistic Destinations with the highest inbound tourism receipts worldwide 2019-2023

Statista report shop

We provide information on industries, companies, consumers, trends, countries, and politics, covering the latest and most important issues in a condensed format.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Get instant access to all reports & Premium Statistics

- Download reports & statistics for further analysis

- Share the exported formats inside your company

- Hi, My Account Subscriptions --> My KT Trading Contact Us Privacy Notice Sign Out

Wed, Sep 18, 2024 | Rabi al-Awwal 15, 1446

Dubai 20°C

- Expo City Dubai

- Emergencies

- Ras Al Khaimah

- Umm Al Quwain

Life and Living

- Visa & Immigration in UAE

- Banking in UAE

- Schooling in UAE

- Housing in UAE

- Ramadan 2024

- Saudi Arabia

- Philippines

- Cryptocurrency

- Infrastructure

- Currency Exchange

- Horse Racing

- Local Sports

Entertainment

- Local Events

Dubai World Cup

- Track Notes

- Big Numbers

- Daily Updates

- Arts & Culture

- Mental Health

- Relationships

- Staycations

- UAE Attractions

- Tech Reviews

- Motoring Reviews

- Movie Reviews

- Book reviews

- Restaurant Reviews

- Young Times

Supplements

- Back To School

- Eid-Al-Adha

- It’s Summer Time

- Leading Universities

- Higher Education

- India Real Estate Show

- Future Of Insurance

- KT Desert Drive

- New Age Finance & Accounting Summit

- Digital Health Forum

- Subscriptions

- UAE Holidays

- Latest News

- Prayer Timings

- Cinema Listings

- Inspired Living

- Advertise With Us

- Privacy Notice

KT APPDOWNLOAD

UAE residents likely to spend over Dh140 billion on outbound travel and tourism this year

Emirates' inbound and outbound have grown exceptionally in the post-pandemic period as countries reopened their borders.

Waheed Abbas

- Follow us on

Top Stories

UAE announces 2-month grace period for residence visa violators

UAE announces fee refund for tax service charges from August 1

Paid parking in Dubai: Residents face up to Dh4,000 extra yearly costs when new rates kick in

Published: Wed 4 Sep 2024, 3:38 PM

Last updated: Wed 4 Sep 2024, 7:11 PM

Outbound spending by the UAE residents on travel and tourism will see a massive increase in 2024, according to a new report released on Wednesday.

The latest figures released by the World Travel and Tourism Council, outbound spending by UAE travellers is projected to grow 21.6 per cent to $38.31 billion (Dh140.6 billion) this year compared to $31.51 billion (Dh115.64 billion) in 2023. In 2019, UAE travellers' outbound travel and tourism spending was $28.7 billion.

The UAE's inbound and outbound travel and tourism have grown exceptionally in the post-pandemic period as countries reopened their borders for travel and tourism.

Stay up to date with the latest news. Follow KT on WhatsApp Channels.

Ranked 15th, UAE residents will be the largest spenders among Arab and Middle Eastern countries this year. UAE travellers will spend more than those from Taiwan (China), Switzerland, Hong Kong, Indonesia, and Brazil.

Seeing a massive opportunity in this segment, the UAE launched a domestic tourism strategy in 2023 to capitalise on residents' growing outbound spending and focus more on staycations, especially during the summer. This would help expand the local economy and create a large number of jobs in the travel and tourism industry.

According to the World Travel and Tourism Council's 2024 Economic Impact Trends Report released on Wednesday, international visitors' spending in UAE is projected to grow 9.4 per cent to $52.2 billion (Dh191.57 billion) in 2024 compared to $47.7 billion (Dh175 billion) last year. The UAE will be the 10th largest recipient globally and second in the region after Saudi Arabia (ranked 6th) in 2024.

Driven by Dubai, inbound tourism bounced back strongly in the UAE after the pandemic. In fact, the UAE was one of the first countries where the travel and tourism sector recovered to the pre-pandemic level.

"As we look forward to a record-breaking 2024, it's clear that travel and tourism are not only back on track but also set to achieve unprecedented growth. We will continue to prioritise sustainability and inclusivity, ensuring that this growth benefits everyone and protects our planet for future generations. The sector's resilience and potential for innovation continue to drive us forward," said Julia Simpson, president and CEO of WTTC.

Regional & global

The Middle East's travel and tourism sector expanded by 25.3 per cent in 2023, bringing the sector's economic contribution back to its 2019 level. This amounted to $460 billion, or 6.7 per cent of the region's economy. Similarly, employment supported by the sector increased by 11.8 per cent to reach 7.7 million jobs. This represents a growth of 3.3 per cent over the 2019 level.

Saudi Arabia, representing around a quarter of the region's sector, has quickly recovered. Its sector's contribution to national GDP in 2023 was 29.1 per cent above the 2019 level. Similarly, the UAE's travel sector – the third largest in the region – experienced robust growth, with its contribution to GDP increasing by 14.3 per cent over the 2019 level.

Globally, the 2024 Economic Impact Trends Report revealed the US as the world's most influential travel and tourism market, contributing a record-breaking $2.36 trillion to the nation's economy last year.

The latest report from the global tourism body revealed China as the world's second most powerful market, with a GDP contribution of $1.3 trillion in 2023, underscoring its impressive rebound despite the late reopening of its borders.

Germany secured the third spot with a $487.6 billion economic contribution, while Japan, which was in fifth place in 2022, jumped to fourth position, contributing $297 billion.

The United Kingdom is among the top five countries, contributing $295.2 billion.

- UAE: Need a holiday to recover from vacation? How residents can prolong relaxation period

- Travelling to UAE? Avoid visa fraud; 5 important questions to ask

- Dubai among top 10 most popular destinations for British travellers in 2025

- [email protected]

More news from Travel

Uae: airfares for visa-free countries surge 300% ahead of next public holiday.

Round-trip tickets that usually cost around Dh800 have spiked to over Dh2,800 for some destinations

travel 1 month ago -->

Air India suspends flights to Tel Aviv 'until further notice' due to regional tensions

Passengers will be given a one-time waiver on rescheduling and cancellation charges, it said

In France for the Olympics? Check out Lyon

It may only be two hours from Paris, but Lyon is like a whole different world

UAE: Work by the beach? Some residents take laptops to holiday on 'workcations'

Mental well-being is one of the biggest reasons why many employees opt to travel and balance it with work

UAE-India travel: New route to Bengaluru introduced by budget carrier

With over 200 weekly flights, this is the largest station for Air India Express

Summer in Maldives: Top things to do on holiday

From water activities to land-based gems, there’s a lot to do in this archipelago

UAE: Why many expats do not visit home countries for longer vacations now

Budget carriers have added several long-haul popular tourist routes across Southeast Asia and Western Europe, going beyond a five-hour flight radius

From ‘secret’ cave to Chocolate Hills: Why Filipinos in UAE should be proud of Bohol

The destination has become more accessible to both local and international explorers, with the rise of budget carriers like Cebu Pacific

travel 2 months ago -->

Type your keywords

The evolving role of experiences in travel

The Evolving Role of Experiences in Travel

Since the dawn of leisure travel, people have journeyed in search of new experiences. They long to meet friendly locals, eat new foods, stroll through unfamiliar landscapes, and witness (or maybe even join) cultural traditions that remind them that they’ve left home.

More and more, experiences have become powerful decision drivers for travelers: the possibility of a life-changing travel moment motivates people to book a trip. The quest for the right type of moment even influences which destinations people will choose. But despite the enduring excitement about experiences and the large pool of value they represent, the travel industry has yet to crack the code on an approach that can simultaneously please travelers, make sense for experience providers, and produce profit at scale for distributors and larger stakeholders.

Today’s travelers often find the breadth of available experiences overwhelming, and they crave easy-to-navigate platforms that can sort through experiences and offer seamless, real-time booking anywhere in the world. Experience providers (often small, passionate outfits, sometimes run by a single tour guide) want to create broad awareness of their offerings. But operators can become frustrated when a booking platform’s thumbnail descriptions fail to capture the appeal of a quirky activity—or when an intermediating player fumbles customer relations. Distribution platforms want to become comprehensive sites for one-stop experience shopping but face challenges as they try to scale profitably while cobbling together a fragmented array of experiential offerings. Meanwhile, legacy travel institutions, such as airlines and hotel chains, are still searching for ideal ways to fit magical travel moments into the machinery of complex corporate enterprises.

The global marketplace for travel experiences offers a more than $1 trillion opportunity. Younger generations, in particular, demonstrate an eagerness to splurge on experiences, suggesting the sector will continue to expand. Yet nearly half of the business of experiences is still transacted offline. As experience booking goes digital, a considerable share could be claimed by organizations that can anticipate and eliminate pain points at every stage of the process, up and down the value chain.

How can operators quench travelers’ thirst for magical experiences while finding new customer streams from around the world? How can distribution platforms simplify and scale the discovery and booking process while creating an attractive proposition for operators? How can airlines and hotels learn from the awe and wonder that a terrific tour guide can conjure, becoming distributors for experiences and also injecting the essence of that magic into their core businesses?

A new report, The evolving role of experiences in travel , produced by McKinsey and Skift, examines the world of travel experiences 1 In this research, we defined “travel experiences” as activities, attractions, and tours, excluding multiday tours, available to visitors at a destination. —ranging from stadium rock concerts to guided nature hikes to in-home culinary gatherings and everything in between. The report offers an assessment of the experience industry as it stands today, presents ideas that could help address current dissatisfactions, and looks at opportunities for various players to capitalize on growing interest.

Desire for experiences is reshaping travel demand

Once upon a time, travelers might have picked a destination first and only later started choosing what to do upon arrival. But today’s travelers don’t treat experiences as afterthoughts. Their travel decisions are increasingly based on specific activity interests. This can invert the trip-planning funnel, placing experiences at the top and destination choices further down the cone.

A recent McKinsey survey asked about the factors most important to travelers when selecting a destination . 2 “ The way we travel now ,” McKinsey, May 29, 2024. Survey respondents cited the range and quality of local activities on offer at a rate that trailed only the rates of their citations of essential needs, such as safety, navigability, cost, and accommodation range and quality (Exhibit 1). Respondents were nearly as likely to cite, as a decision factor, the ability to experience authentic local customs and culture.

Interest in experiences is unlikely to dissipate soon, as evidenced by the preferences of younger travelers. According to McKinsey survey data, 52 percent of Gen Zers say they splurge on experiences , compared with only 29 percent of baby boomers. 3 “ The way we travel now ,” McKinsey, May 29, 2024. And Gen Z travelers say they try to save money on flights, local transportation, shopping, and food before trimming their spending on experiences.

Travel experiences could compose a market worth more than $1 trillion

The travel experience market is large and, by some estimates, rapidly growing. To size it, we began by examining the value represented by the entirety of the world’s tours, attractions, and activities. Our analysis indicates that this global market could be more than $3 trillion.

Many local residents participate in the experiences offered at a given destination. But per our research, destination visitors—both domestic and international—account for roughly 30 percent of the experience market, spending about $1.1 trillion to $1.3 trillion on experiences. This is how we defined the total addressable market for travel experiences.

Next, we quantified the serviceable available market by assessing the proportion of travel experiences that are in some way structured (for example, a professionally guided tour or a live ticketed event) versus those that are independently undertaken (for example, a tourist strolling up to an art museum’s ticket window and then perusing its galleries). The segment involving paid, structured activities represents a large part of the market that’s in play for experience providers (such as tour operators), intermediaries (such as online-booking platforms), and stakeholders from other parts of the travel industry (such as hotels and airlines).

We estimate that paid, structured tourist activities account for roughly 25 percent of global experience spending, totaling about $250 billion to $310 billion per year (Exhibit 2). This number comprises tourist spending on rock concerts, baseball games, history walks, nature hikes, theme park visits, spa treatments, museum tours, and a host of other activities. And it continues to expand: experts estimate growth in this segment of more than 14 percent per year by 2025. 4 “TUI Musement special—part of FY22 results,” TUI, December 14, 2022.

There’s an emerging recipe for creating magical experiences

A top-notch experience can be the cornerstone of a trip, lingering in a traveler’s memory for years to come. In our conversations with 19 experience providers, several crucial components for creating great experiences became apparent:

- Entertainment comes first. Experience operators observe that, no matter the type of experience, what travelers want above all is to have a good time and be entertained.

- Well-trained guides set the tone. Because creating a magical, guided experience depends so much on the guide, experience operators focus on molding high-quality frontline employees.

- Authenticity and local engagement matter. Visitors appreciate thoughtfully crafted itineraries that bring a specific locale to life.

- Expectations should be managed—and then exceeded. Overcommunicating and overdelivering are crucial.

- Guests need to feel they’re in sure, safe hands. Travelers like to feel that a tour guide is in control every step of the way.

Booking platforms might consider these components when deciding which experiences to give prominent visibility. Larger travel players, such as hotel chains and airlines, might also keep these ingredients in mind—both when thinking about add-on experiences to offer through their own platforms and when exploring how to scale magical experiences across a chain of hotel lobbies or a schedule of transoceanic flights.

Finding and booking experiences remains a frustrating process—offering opportunities for improvement

Many travelers enjoy the process of planning a vacation. They have fun searching for the individual elements that will add up to a perfect trip. But the discovery and booking process for travel experiences can be alternately thorny and exhausting. It can present travelers with an overwhelming menu of options but doesn’t always surface the best ones. It sometimes fails to accurately describe an activity, which can create expectation mismatches.

Meanwhile, the experience industry’s move to digital is still in progress. According to 2023 data, 47 percent of experience booking still happens offline—either via walk-ups or telephone calls or through offline conduits, such as hotel concierges and traditional travel agents. 5 Euromonitor, accessed July 2024. Only 22 percent of booking occurs through online intermediaries, such as booking platforms.

Many experience providers have faced difficulties as they shift their booking operations toward online distribution platforms. And for the platforms, scaling while maintaining or expanding margins has been a challenge.

Travelers aren’t always getting what they want or need from online booking

Booking platforms that offer experiences sometimes serve up a large database presented as a list, which might not have been carefully curated. These lists can be overwhelming for a customer who isn’t sure what to look for. And they might fail to surface hidden gems. What’s more, the tours and activities that appear on platforms aren’t always especially well vetted. They might not meet travelers’ expectations for quality or value—or might not align with the thumbnail descriptions travelers see on the platforms.

There’s an opportunity here to create a discovery and booking process that features more fun and fewer hiccups. Travelers could benefit from simplified and more enjoyable discovery systems (including ones linked with social media), a streamlined booking process in which platforms become seamless (or even invisible), and a detangled customer service approach (in which it’s always clear who to contact, even on short notice).

Experience operators can benefit from the transition to digital—but may also encounter challenges

Of the 19 operators we interviewed in June 2024, 78 percent already receive at least half of their bookings through platforms. Platforms can help attract online eyeballs and raise product awareness in ways an experience provider couldn’t on its own. One reason is that platforms tend to perform better in search engine results than an individual operator’s website does on its own—in part, because platforms can afford to pay more for local language translation, search engine optimization, and search keyword marketing than a typical experience operator could.

Despite all the advantages that online platforming can offer operators, it also presents some structural challenges. For instance, the variety of experience offerings—ranging from strenuous outdoor adventures to quiet cooking classes and from giant group tours to intimate gatherings—is difficult to fit into the one-size-fits-all listing approach that platforms sometimes take. Unlike, for example, air travel, where the ticket offerings tend to be fundamentally similar and easily compared, distinctively crafted activities and tours can often benefit more from a bespoke framing of offers.

The intermediary role of the booking platform can also create frustration for experience providers. When service issues arise or customers wish to cancel or reschedule a booking, execution isn’t always smooth. For instance, the customer might attempt to interact with the platform when it would be more effective to interact directly with the operator. The operator might become aware too late of a service issue or booking change request—or might not become aware at all.

Online booking platforms are hoping to scale a fragmented industry

Online-booking platforms enjoy natural advantages when it comes to selling experiences to travelers. Because the experience space is so fragmented—full of countless smaller operators—travelers look to save time and effort by turning to a platform that can aggregate and sort through an overwhelming number of options. Platforms can also lower payment and communication hurdles for a traveler, particularly when experience operators speak foreign languages or transact in foreign currencies.

Many booking platforms have thus far focused on prioritizing top-line growth instead of maximizing profitability. Building a large platform can incur significant expenses related to both acquiring a large supply of inventory and ensuring that the platform’s tools and algorithms can handle it. A central question for platforms will be how effectively they’ll be able to expand revenue while also growing margins.

Other players are seeking profitable ways to get involved with experiences

Experiences are gaining enough traction in the travel ecosystem that other players are now eyeing the market. The margins for sales of experiences can be high: operators told us they typically achieve up to 60 percent margins, even after deducting a booking platform’s commission (with labor constituting the bulk of the operator’s cost). That can make this an appealing space for businesses to enter.

Which strategies might help stakeholders find success in the experience marketplace?

The evolving role of experiences in travel could create favorable circumstances for stakeholders across the value chain. Industry players in various sectors should consider how best to capitalize on emerging opportunities.

Experience operators should generate the magic that will enable industry growth

For experience providers, it begins with delivering the distinctive, authentic moments that travelers crave. Once this crucial prerequisite is met, other success factors can be considered:

- Meeting consumer demand. This requires monitoring changing trends, catering to evolving traveler tastes, and making guests feel they’re in safe hands from start to finish.

- Savvy marketing. Using the right words and images can communicate an experience’s value proposition.

- Discovery systems. For experiences, discovery systems are still in flux, so it’s important to find customers where they are—including on social media.

- Booking strategy. Different operators can benefit from different booking strategies. It’s important for operators to consider how their needs could evolve over time when evaluating the trade-offs that come with various booking approaches.

Booking platforms could profit from making sense of a large and growing market

Distributors might find themselves in a sweet spot, as demand for travel experiences grows and the corresponding rise in supply creates an ever-more-confusing marketplace. Platforms might consider how to effectively gather, intelligently curate, artfully display, and smoothly broker the sale of experiences in ways that will appeal to overwhelmed travelers who want one-stop activity shopping:

- Building supply might involve building relationships with operators. Experience providers want to list on platforms that offer visibility and value.

- Curation can make a traveler’s discovery phase relatively easy and fun. Most travelers don’t have the time, ability, or desire to conduct a long, difficult search for a hard-to-find experience.

- A seamless booking process is likely to draw customers in and keep them coming back. Customers shouldn’t need to wade through multiple pages and filtering tools to find what they’re looking for.

- Platforms might advise—or even become—experience providers. Booking platforms have a high-level vantage point and an ability to access large amounts of data, so they are in a good position to spot unmet demand in the marketplace and help generate supply that’s likely to be appealing to travelers.

As demand for experiences grows, travel industry players could look for new ways to get involved

Stakeholders across all travel sectors could benefit from viewing their roles through the lens of serving up memorable, positive experiences to travelers. This might involve reframing services a company already provides, or it might mean looking for new opportunities to integrate experiences into a traveler’s journey:

- Hotel stays. Hotels might use experiences as incentives for travelers to book stays. Strong brand recognition and existing digital infrastructure can help hotel chains act as distribution channels for experiences. There might also be an opportunity to improve on-premises experiences that a hotel more closely controls—for instance, at the hotel’s spa or through a pop-up event in the hotel’s lobby.

- Short-term rentals. Short-term-rental platforms might offer experiences alongside accommodation bookings. Given that many short-term-rental bookings already happen online, it might make sense for short-term-rental platforms to claim a share of experience booking. These platforms have established online relationships with many customers, and they have already integrated online payments and scheduling into their operations.

- Flight packages. Many airlines already generate significant revenue from package holidays, which could be supplemented with add-on experiences. Airlines might take advantage of customer data and contexts to surface attractive experience options at the time of flight booking, which tends to happen early in the trip-planning process.

- Reframed core products. Travel stakeholders can view their core products through the lens of experiences. Hotels might consider how to turn lobbies into experiential opportunities. Airlines might examine what travelers want from experiences and then apply the insights to create in-flight presentations and improve cabin atmospheres. Spaces might be revamped in ways that make them social media worthy.

Destinations could offer support for the experience ecosystem

Visitor bureaus and destination management organizations have roles to play in helping meet traveler demand for great experiences. The distinctive capabilities and resources of these groups could aid them in shaping the experience landscape.

Magical experiences are what leisure travel is all about. They bring people joy. They shape people’s identities. They can be the chapters of people’s lives that they’re most eager to tell the world about.

The business of travel experiences is quickly growing and evolving. Today’s marketplace could be at an inflection point, poised to transform in ways that will better connect travelers, providers, platforms, and other players. The travel industry should look for opportunities to collaborate and innovate to improve the commercial elements of travel experiences while never losing sight of the essential magic that turns a travel experience into a life-changing event.

Download the full report: The evolving role of experiences in travel

Jules Seeley is a senior partner in McKinsey’s Boston office, Ryan Mann is a partner in the Chicago office, Vik Krishnan is a senior partner in the Bay Area office, and Alex Gersovitz is an associate partner in the Southern California office.

The authors wish to thank Alessandra Powell, Carol Flaksberg, Cedric Tsai, Lily Miller, Nadya Snezhkova, Nick Meronyk, and Sharon Yao of McKinsey, as well as Pranavi Agarwal, Robin Gilbert-Jones, Seth Borko, and Varsha Arora of Skift, for their contributions to this article.

This article was edited by Seth Stevenson, a senior editor in the New York office.

Explore a career with us

Related articles.

The way we travel now

Now boarding: Faces, places, and trends shaping tourism in 2024

The promise of travel in the age of AI

IMAGES

VIDEO

COMMENTS

In the simplest terms, inbound tourism occurs when a foreigner or non-resident visits a particular country, and outbound tourism occurs when a resident of a particular country leaves it in order to visit another one. As an example from an American perspective, if an American visits Germany, that is considered to be outbound tourism. However, if ...

Inbound tourism refers to when tourists visit a country that is not their own. In other words, it refers to the arrival of visitors from overseas into a country. This type of tourism is also known as international tourism. The visitors could be traveling for various reasons such as leisure, business or visiting friends and family.

based on the destination and country of departure, according to the UNWTO: domestic tourism, inbound tourism, and outbound tourism. Domestic tourism It's usually much easier to organize than international travel, since you don't need additional paperwork, health checks, and you can simply take a domestic flight, bus, or train ride to your ...

Here are a few tourism markets that have a high number of inbound tourists each year-Spain . According to Statistica, Spain ranked second on the World Tourism Organisation's list of most visited countries in the world, with its number of international visitors amounting to nearly 89.4 million in 2018.. Most travellers to Spain come from Europe, with the largest amount of tourists being British.

International tourism: International tourism comprises inbound tourism and outbound tourism, that is to say, the activities of resident visitors outside the country of reference, either as part of domestic or outbound tourism trips and the activities of non-resident visitors within the country of reference on inbound tourism trips (IRTS 2008, 2 ...

Tourism Statistics. Get the latest and most up-to-date tourism statistics for all the countries and regions around the world. Data on inbound, domestic and outbound tourism is available, as well as on tourism industries, employment and complementary indicators. All statistical tables available are displayed and can be accessed individually.

The terms outbound tourism and inbound tourism are often used interchangeably. This is because a tourist who is travelling internationally is both an outbound tourist (because they travel OUT of their home country) and an inbound tourist (because they travel IN to another country).. The only exception to this would be if a person was travelling on a multi-centre trip, for example a backpacker.

That's because it is. Inbound tourism involves welcoming international travelers, while outbound tourism focuses on residents of one country visiting others. Let's look at an example: ... Partnering with these two agents will maximize your reach to both international and domestic travelers. Inbound and outbound operators each offer unique ...

Compendium of Tourism Statistics. provides statistical data and indicators on inbound, outbound and domestic tourism, as well as on the number and types of tourism industries, the number of employees by tourism industries, and macroeconomic indicators related to international tourism. to see the Index of indicators and basic data that form the ...

UN Tourism Data Dashboard. The UN Tourism Data Dashboard - provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism share of exports and contribution to GDP, source markets, seasonality and accommodation (data on number of rooms ...

It has an estimate in 2018 is approx $300 billion only in outbound tourism. Whilst, Chinese tourism travel all over the world. This means that the Chinese outbound tourism market is particularly welcoming in many destinations around the world. Inbound Tourism. The tourists coming from other places are called inbound tourists.

Evidence on the significance of the tourism economy is presented, with data covering domestic, inbound and outbound tourism, enterprises and employment, and internal tourism consumption. Tourism policy priorities, reforms and developments are analysed and examples of country practices highlighted. Thematic chapters provide insights on building ...

The data covers various aspects of tourism, such as inbound tourism (including arrivals by region, main purpose, and mode of transport, as well as accommodation and tourism expenditure in the country), domestic Tourism (including trips and accommodation), outbound tourism (including departures and tourism expenditure in other countries ...

Inbound tourism, outbound tourism and international tourism are the three major types of tourism. Learn more about the tourism industry with lots of examples...

Tourism has massively increased in recent decades. Aviation has opened up travel from domestic to international. Before the COVID-19 pandemic, the number of international visits had more than doubled since 2000. Tourism can be important for both the travelers and the people in the countries they visit. For visitors, traveling can increase their ...

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2023, with a forecast for 2024 and 2034 (in trillion U.S. dollars) ... Inbound tourism visitor growth ...

Deriving from the most comprehensive statistical database available on the tourism sector, the Compendium of Tourism Statistics provides statistical data and indicators on inbound, outbound and domestic tourism, as well as on the number and types of tourism industries, the number of employees by tourism industries, and macroeconomic indicators ...

ABSTRACT. Despite globalisation and its effects, it is clear that there are still significant differences between countries in terms of their patterns of domestic, inbound and outbound tourism. This is due to a large number of factors, including geography, cultural traditions, demographics, history, government policy in relation to tourism and ...

Deriving from the most comprehensive statistical database available on the tourism sector, the Compendium of Tourism Statistics provides statistical data and indicators on inbound, outbound and domestic tourism, as well as on the number and types of tourism industries, the number of employees by tourism industries, and macroeconomic indicators ...

It gives an overview of the Russian travel market, including figures on outbound, inbound, and domestic tourism. Furthermore, it contains data on the most popular destinations as well as travel ...

The latest figures released by the World Travel and Tourism Council, outbound spending by UAE travellers is projected to grow 21.6 per cent to $38.31 billion (Dh140.6 billion) this year compared ...

The "Compendium of Tourism Statistics" provides statistical data and indicators on inbound, outbound and domestic tourism, as well as on the number and types of tourism industries, the number of employees by tourism industries, and macroeconomic indicators related to international tourism.

Interest in experiences is unlikely to dissipate soon, as evidenced by the preferences of younger travelers. According to McKinsey survey data, 52 percent of Gen Zers say they splurge on experiences, compared with only 29 percent of baby boomers. 3 "The way we travel now," McKinsey, May 29, 2024. And Gen Z travelers say they try to save money on flights, local transportation, shopping, and ...