- Explore Properties

- Agents & Brokers

- Sell Your Property

- Track with Stessa

- Screen with RentPrep

- Investor Services

- Investment Solutions

- News & Press

- Free Property Valuation

How to (Legally) Deduct Rental Property Travel Expenses

Tax law in the U.S. can be extremely friendly to real estate investors. Rental property owners can deduct normal operating expenses, and use depreciation to reduce taxable net income. Another benefit of owning rental real estate is deducting travel expenses.

However, there’s a right way and a wrong way to claim travel expenses on your tax return. In this article, we’ll explain how rental property travel expenses work, along with some of the most common travel expense deductions for real estate investors. After all, tax deductions are often seen as one of the biggest benefits of owning real estate.

Note: this is not tax advice and we recommend you speak with your CPA to understand your specific situation.

Can Landlords Deduct Travel Expenses?

Landlords can deduct travel expenses when traveling to visit a remote real estate investment in another market and for going to a property you own locally.

However, the IRS knows that travel expenses are one of the most abused deductions for business people, so it’s important to play by the rules before claiming a deduction for rental property travel expenses.

IRS and Travel Expense Deductions

According to IRS Publication 527 , Residential Rental Property:

“You can deduct the ordinary and necessary expenses of traveling away from home if the primary purpose of the trip is to collect rental income or to manage, conserve, or maintain your rental property. You must properly allocate your expenses between rental and nonrental activities. You can’t deduct the cost of traveling away from home if the primary purpose of the trip is to improve the property. The cost of improvements is recovered by taking depreciation.”

The IRS also provides additional guidance for travel expense deductions in Publication 463 .

Travel Expense Rules of Thumb

If you’re ever in doubt about whether a specific travel expense is deductible, it’s always a good idea to get professional advice from your accountant or CPA. With that in mind, here are some rules of thumb to follow to help understand if an expense incurred when traveling can be deducted on your tax return:

- Purpose of travel must be mainly for business and have a clear business purpose.

- Majority of the travel time must be spent on your rental business rather than leisure.

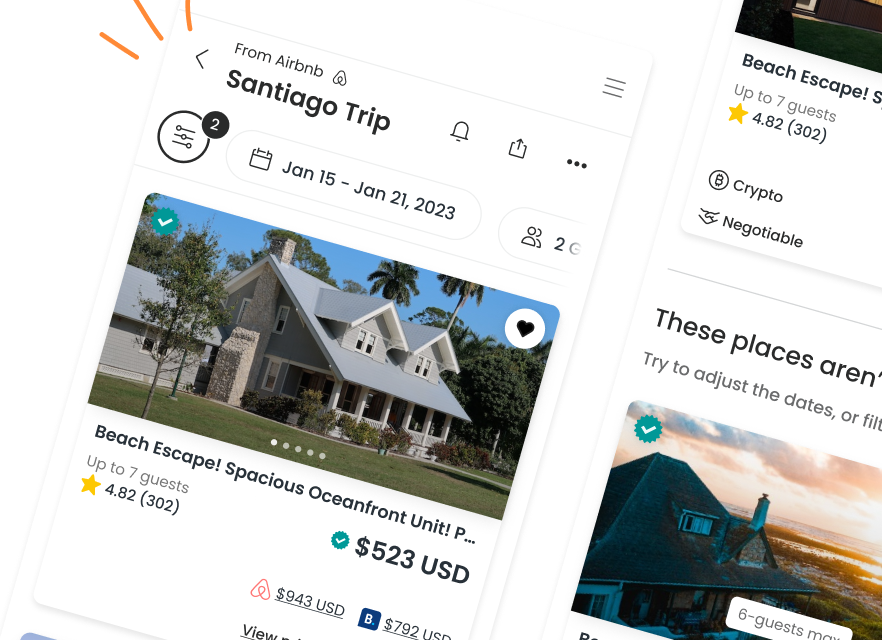

- Travel expenses must be “ordinary and necessary” for your real estate business but not overdone, such as staying in a 5-star resort versus an Airbnb or VRBO when going out of town.

- Rental activity like showing the property to prospective tenants or doing an inspection is also a deductible travel expense, provided that was the main reason for traveling.

- Traveling to conduct repairs and maintenance is deductible, but traveling to the property to make a capital improvement such as replacing the HVAC or installing a new roof is not a deductible expense.

Common Rental Property Travel Expense Deductions

Your travel expenses and the reason for taking a trip must have a logical connection to your rental property business.

A good way to decide whether or not a travel expense is legitimate is to use common sense. For example, if your wife or partner says something along the lines of, “Wow, I didn’t know this was deductible!” you may want to think twice before claiming the travel expense.

Now, let’s take a look at some of the common rental property travel expense deductions real estate investors can claim:

- Expenses traveling to and from the airport, such as a taxi or Uber.

- Airfare, train, or bus fare.

- Car rental expenses and associated costs such as parking fees or tolls.

- Travel to a Home Depot or Lowes to shop for materials and supplies to be used for your rental property.

- Traveling to the property to show it to prospective tenants.

- Travel expenses incurred to interview or meet with members of your local real estate team, such as an accountant, attorney, leasing agent, property manager, lender, or general contractor.

- Costs of traveling to an event or meeting for continuing education purposes, such as a seminar, trade show, or convention.

- Shipping costs for luggage or items required for your rental property business.

- Lodging expenses and 50% of meal and beverage expenses incurred while you are traveling outside of your home market.

- Tips paid for service in conjunction with travel to your rental property.

- Miscellaneous expenses such as laundry and dry cleaning, groceries, computer rental fees, or internet charges.

Travel Expenses to a New Rental Market

A recent post on the Stessa blog explains how travel expenses are treated differently when going to a new market to investigate potential rental property to invest in.

For example, let’s say you’ve been researching the Austin real estate market on the internet and know it’s one of the best cities to invest in real estate this year.

If you travel to Austin, incur $2,000 in travel expenses, and eventually buy your first rental property in the market, those travel expenses are not immediately deductible. Instead, they must be capitalized by adding them to your property basis and depreciated over 27.5 years rather than being expensed the year they are incurred.

Now, assume your first rental property in Austin performs beyond your wildest expectations and you want to buy another. This time your travel expenses can be fully deducted (instead of capitalized) because you already own a property in the market, assuming the travel expenses are ordinary and necessary for your rental property business in the market.

So what happens if you travel to a different city to research potential rental properties, but decide not to invest?

In a situation like this, the travel costs are considered a business start-up expense and can only be deducted after you buy your first rental property in that market. If you’re a remote real estate investor, it may be a good idea to research as much as possible online. Then, wait to travel to the market once you have a property under contract and the home has passed its preliminary inspections.

How Auto Deductions Work

Real estate investors who own rental property in their home market can claim the auto expense deduction provided by the IRS.

As a side note, your home market – also known as your “tax home” – is your regular place of business. For most real estate investors, the home market is also the city that they live in. Even if you own rental property remotely, or in an area of the country outside of your home market, you still do the majority of your work on your rental property business from your home office.

There are two ways rental property owners can claim an auto expense deduction:

Standard Mileage Deduction

The standard mileage deduction is the easiest way to claim an auto deduction when traveling to a rental property in your own market. To calculate the mileage deduction, simply keep track of your miles driven for your rental property business and multiply by the standard mileage rate.

The standard mileage rate issued by the IRS for 2021 for a car, van, pickup, or panel truck is 56 cents per mile. For example, if you drove a total of 500 miles this month for rental property-related purposes, the standard mileage deduction would be $280 (500 miles x 56 cents).

Actual Expense Deduction

The second way that rental property investors can claim an auto expense is by keeping track of all auto expenses and business-related miles, then claiming proportional share used for business as the actual auto expense deduction.

For example, assume your auto expenses – items such as car payments, gas and oil, insurance, repairs and maintenance, car washes, registration and license fees, and tolls and parking costs – were $975 this month. If you drove a total of 2,100 miles and 500 of those miles were related to your rental property business, your actual auto expense deduction would be $232:

- $975 total auto expenses / 2,100 total miles driven = 46.4 cents per mile

- 500 miles related to rental property business x 46.4 cents = $232

Keeping Track of Your Miles

Both the standard mileage deduction method and the actual expense deduction method require you to keep track of the miles driven for your rental property business:

- Odometer reading at the beginning of the period (usually the month or year).

- Odometer reading at the end of the period.

- For each business trip, the date and purpose of each trip, the number of miles driven, and the location of the tip.

How to Track Rental Property Travel Expenses

You can keep track of your mileage using a logbook or digitally. Smartphone apps for tracking mileage include MileIQ , SherpaShare , and TripLog .

If you’re using the actual expense deduction you’ll also need to keep track of your auto expenses.

One of the easiest ways to do this is with Stessa’s mobile app . Each time you incur an auto expense, scan the receipt or invoice. Stessa’s machine learning and OCR technologies will parse all of the details and automatically organize the information for you.

Mixing Business with Pleasure

Sometimes it’s possible to mix personal and business travel provided that you do it strategically. Generally speaking, as long as at least 50% of your travel days were spent on your rental property business, your trip may still be tax-deductible

Of course, any lodging and meal expenses incurred on non-business days are not tax-deductible as a travel expense, nor are the travel expenses for a spouse, partner, or child unless they accompanied you on the trip for a legitimate business purpose.

Final Thoughts on Deducting Travel Expenses

There are a variety of reasons people invest in real estate – recurring rental income, appreciation in property value over the long term – and of course, rental property travel expenses.

Whether you’re traveling outside of your home market as a remote real estate investor or going to rental property you own in-town, travel expenses are typically deductible as long as they’re ordinary and necessary for your rental property business.

Jeff has over 25 years of experience in all segments of the real estate industry including investing, brokerage, residential, commercial, and property management. While his real estate business runs on autopilot, he writes articles to help other investors grow and manage their real estate portfolios.

Roofstock makes it easy to get started in real estate investing.

Join 100,000+ Fellow Investors.

Subscribe to get our top real estate investing content., subscribe here, recommended articles.

Notice of intent to sell rental property: Your obligations

What happens to depreciation when selling a rental property?

How to create an S corporation for your rental properties

- Sell Properties

- Manage with Stessa

- Institutions

- General Inquiries

- (800) 466-4116

- [email protected]

Still need to file? An expert can help or do taxes for you with 100% accuracy. Get started

Rental Property Deductions You Can Take at Tax Time

Landlords can deduct most ordinary and necessary expenses related to the renting of residential property. This includes rental property tax deductions for use of a car, cleaning costs, mortgage interest payments, repairs, property taxes, utilities, and more. The deductions offset rental property income and are generally reported on Schedule E (Form 1040). However, the passive activity loss rules can limit your rental property deductions in certain cases.

Importance of tax deductions for rental property

Types of rental property income and how they’re taxed, rental property tax deductions, what’s not a deductible rental property expense, how to claim rental property deductions, effect of passive activities losses.

Key Takeaways

- In addition to regular rent payments, landlords renting residential real estate must include advance rent payments, expenses paid by your tenant on your behalf, property or services provided by the tenant, lease payments with an option to buy, lease cancellation payments, and certain security deposits as taxable rental income.

- Rental property tax deductions are available for a wide range of expenses related to the renting of residential property, including the cost of advertising, cleaning, insuring, managing, and repairing the property.

- No rental property deductions are available for personal expenses, even if they’re related to the renting of property you own. You can only claim your share of deductions if you only own part of the rented property.

- Passive activity loss rules can limit the impact of rental property deductions. However, exceptions apply for certain real estate professionals, and for people who actively participate in rental activities (that is, make management decisions about the rental property and own at least 10% of it).

Renting a house or other residential property can provide a steady source of income. But being a landlord also comes with its own set of financial responsibilities – including paying taxes on your rental income.

The good news is that there are several federal tax deductions available for people who own and rent residential properties. These tax breaks can help reduce your tax burden and increase your cash flow.

Whether you’re a long-time landlord or just starting out, claiming these deductions can make a significant difference in your bottom line. That’s why it’s important to be aware of and understand the tax deductions that apply to you.

Before diving into the tax deductions for rental real estate , let’s take a look at some of the common types of income you might receive when you rent residential property and how they’re taxed.

TurboTax Tip: If you rent out your home for fewer than 15 days during the year, you don’t have to include the rent payments in your taxable income for the year. However, you can’t deduct related expenses, either.

If you only own part of the property, you only have to report a proportional amount of the taxable rental income from the property.

Regular rent payments

Of course, you’ll receive periodic rent payments from your tenants. Rent is often paid monthly, but rent can be collected at other intervals. Regardless of how frequently it’s paid, periodic rent payments are considered taxable income.

Advance rent payments

Rent can be paid in advance, too. If you receive an advance payment, it’s included in your taxable income for the tax year you receive it. For example, if you sign a five-year lease and you immediately receive rent for the next tax year, you need to include the advance payment in your taxable income for the current tax year.

Security deposits

Tenants often must pay a security deposit when signing a lease. As the landlord, don’t include that payment as taxable income for that tax year if you might have to return the deposit to the tenant when the lease expires. However, if you end up keeping all or part of the deposit at any point because the tenant breaks the lease, include the amount you keep in your taxable income for that year.

If you keep all or part of the security deposit because the tenant damaged the rental property, include the amount you keep in your taxable income for that year if you deduct the cost of repairing the damage as an expense (see below). On the other hand, if you use the deposit to cover any repair costs, but don’t deduct the cost of repairs, don't include the amount you keep in your taxable income.

Also, if a payment is called a “security deposit,” but if it's really going to be used as a final rent payment, it’s really just an advance rent payment and is included in your taxable income for the tax year you receive it.

Expenses paid by the tenant

If your tenant pays any of your expenses – such as a utility or repair bill—and deducts the amount from the regular rent payment, the amount paid is treated as taxable income to you.

However, you can deduct an equal amount if the underlying expenses qualify as deductible rental expenses (see below).

Property or services provided by the tenant

What if your tenant pays you with property or services, instead of money? For example, the tenant is a carpenter who builds a deck on your rental property instead of paying rent for two months.

In that case, include the fair market value of the property or services provided in your taxable income. If you and the tenant agree upon a price for the property or services, use that price as the fair market value unless there’s evidence to the contrary.

Lease payments with an option to buy

If a rental agreement gives the tenant the right to buy your rental property, rent payments made under the agreement are generally taxable income for the tax year you receive them. However, if the tenant exercises his or her right to buy the property, payments received after the sale are treated as part of the selling price, not as rental income.

Lease cancellation payments

Sometimes tenants need to break a lease early. If a lease cancellation payment is required, you must include it in taxable income for the year you receive it.

Now that you have a better sense of what counts as taxable rental income, let’s review some of the more common tax deductions available for residential rental property expenses.

Generally speaking, you can deduct all ordinary and necessary expenses related to your rental property. You might also be able to write off up to 20% of your business income if you qualify for a special deduction available to small business owners.

Advertising costs

When your rental property is vacant, you need to get the word out about its availability. For example, you might place an ad online or in a local newspaper. Money you spend on advertising your rental property is deductible.

Auto expenses

If you use a car, truck, or van for activities related to your rental property, you can generally deduct your auto expenses. This includes expenses related to a vehicle you rent, not just for vehicles you own.

You can use either the standard mileage rate or your actual expenses to calculate this deduction.

For the 2024 tax year, the standard mileage rate is 67¢ per mile driven for rental property-related or other business purposes (65.5¢ per mile for 2023).

Actual expenses include gas, oil, repairs, insurance, and other ordinary costs associated with owning and operating a motor vehicle. However, you can only deduct the expenses for the miles that you drive for rental property activities as a rental property expense. If you also use your vehicle for personal driving, you can only deduct expenses for the miles you drive for rental property as a rental property expense.

Cleaning costs

Your rental property likely needs a good cleaning between tenants. Whether you hire a cleaning service or do it yourself, cleaning costs can add up quickly. However, you can deduct the ordinary and necessary costs of keeping your rental property clean.

Depreciation

Rental property depreciation deductions let you recover the cost of purchasing your rental property over time. For example, if you buy a house that you rent out to tenants, you can generally deduct a portion of the purchase price allocated to the building (but not the land) each year until your combined deductions equal the cost of the property.

If you build an addition, replace the roof, or make other improvements to the property, you can also claim depreciation deductions to recover those costs, too.

How much you can deduct each year for depreciation depends on your cost basis in the property, the property’s recovery period, and when the property is placed in service.

Disaster and theft losses

You may be able to deduct the damage, destruction, or loss of your rental property from a storm, fire, earthquake, or similar disaster. You might also be able to deduct losses from the theft of items you own that are in the rental property, such as a television or furniture that you provide for your tenants.

You’ll likely need to insure your rental property to protect yourself from damage, liability claims, and other potential risks. Premium payments for insurance coverage are generally deductible.

However, you can only deduct premiums that apply to that tax year. So, if you pay an insurance premium for a future year in advance, you can’t deduct that payment in the year you pay it.

Interest payments

Suppose you take out a loan to cover the cost of new appliances, furniture, or other necessary expenses for your residential rental property. As you pay back the loan, part of your payments will be for interest. The portion of your payments allocated to interest – as opposed to principal – are generally deductible.

However, you can’t deduct prepaid interest in the tax year you pay it. Instead, if you pay interest that’s allocated to next year or sometime after that, you have to wait to deduct the payment until the tax year to which the interest applies.

You may have also heard that business interest deductions are sometimes limited. Fortunately, you probably don’t have to worry about the limits. For the 2024 tax year, they only apply to businesses with average annual gross receipts over $30 million for the previous three years (average of over $29 million for 2023).

Legal and other professional fees

You might need to hire a lawyer, accountant, or other professional to handle issues related to your rental property. If so, their fees are generally deductible.

This includes fees for tax advice and preparation of tax forms related to your rental property. You can also deduct the cost to resolve a tax underpayment related to your rental activities.

However, you can’t deduct legal fees paid to protect title rights or to recover, develop, or improve rental property. Instead, these fees should be added to the property's basis and depreciated (see above).

Management fees

You might hire someone to manage your rental property. Property managers can handle tenant applications, rent collection, maintenance requests, and more. If you go that route, you can generally deduct the property management fees.

Mortgage interest payments

If you have a mortgage on your residential rental property, you can generally deduct interest paid on the loan. However, payments for principal are not deductible.

Points paid to take out a mortgage – sometimes called loan origination fees, maximum loan charges, or premium charges – are also deductible. But you have to deduct them gradually over the life of the mortgage.

Certain other costs of obtaining a mortgage on your rental property aren’t deductible, such as mortgage commissions, abstract fees, and recording fees. Instead, they’re added to the property's basis and depreciated (see above).

If you rent a second home or part of your primary residence, there are two different ways that mortgage interest for the property can be deducted – but you first have to divide the interest payments into rental use expenses and personal use expenses. Once the expenses are separated, you can write off the interest attributed to rental use as a rental property deduction. Then, the amount attributed to personal use might be deductible as an itemized deduction .

Qualified Business Income Deduction

While not a deduction of particular expenses, you might be able to claim the Qualified Business Income (QBI) Deduction if you meet the deduction’s many requirements.

Landlords can claim this deduction if their property rental activities are treated as a trade or business, or if they satisfy the requirements for a “safe harbor” exception under the QBI deduction rules.

If you qualify, you can deduct up to 20% of the net amount of qualified items of income, gain, deduction, and loss from your business.

Repairs and maintenance

The costs of repairing and maintaining residential rental property are generally deductible for the tax year you pay for it. This includes expenses required to keep the property in good condition, such as fixing a leaking faucet or painting a room.

Improvements, which add to the value of the property, aren’t immediately deductible. Instead, their costs are subject to depreciation and deducted gradually over a period of years (see above).

You’ll likely have to pay property taxes on your rental property. If so, those tax payments are deductible.

Other tax payments related to your rental property might be deductible, too. For instance, you might owe local occupancy taxes, which are deductible. If you have employees, Social Security and Medicare taxes withheld from their wages and paid to the IRS are also deductible.

Travel expenses

Landlords can generally deduct the cost of traveling away from home if the main reason for taking the trip is to collect rental income or manage, conserve, or maintain rental property. You can generally deduct 50% of meal expenses while traveling away from home, too.

Travel costs aren’t deductible if the main purpose for the trip is to improve rental property (as opposed to repairing or maintaining it). Instead, those costs can only be recovered through depreciation deductions (see above).

Electric, gas, water, and other utility bills you pay for your rental property are generally deductible. If your tenant pays for utilities, you can’t deduct them on your tax return.

You can also deduct the cost of telephone calls related to your rental activities, such as calls to your tenant or property manager.

While the rules for deducting ordinary and necessary expenses are relatively broad and allow for a wide variety of write-offs for landlords, not every expense (or 100% of every expense) related to residential rental property is deductible.

Here are a few situations where you can’t deduct certain expenses.

Personal expenses

Any personal expenses you pay generally aren’t deductible, even if they’re somehow related to your rental property. So, for example, if you take a trip away from home to collect rent, but end up staying an extra day or two for personal reasons, you can’t deduct any expenses related to the additional two days.

This type of situation also arises with utilities, insurance, maintenance costs, and the like if you rent part of your primary home, use your rental home for more than 14 days, or sometimes rent a second home. In that case, you need to divide your expenses between rental use and personal use, and only deduct those expenses related to renting the property (although the portion of your mortgage interest deemed a personal expense might also be deductible, as noted above).

Partial ownership of rental property

If you only own part of a rented property, you can only deduct expenses you paid multiplied by your percentage of ownership. You can’t deduct the remaining portion, but you can seek reimbursement of it from the other owners.

For example, if you own 50% of a rental property and pay $1,000 for repairs during the year, you can only deduct $500 for the repairs on your tax return ($1,000 x .50 = $500).

Local benefit taxes

You generally can’t deduct taxes for local benefits that increase the value of your rental property, such as taxes and fees for putting in streets, sidewalks, or water and sewer lines. Instead, these taxes are added to the property’s basis and depreciated (see above).

Commuting costs

Auto expenses for traveling between your home and a rental property are generally nondeductible commuting costs unless you use your home as the place from which you manage your rental property.

Rental property that’s for sale

If you're selling a rental property, you can generally deduct the cost of managing, maintaining, or preserving the property until it's sold. But if the property isn't held out and available for rent while it's listed for sale, the expenses aren’t deductible as rental expenses.

Rental income and expenses are generally reported on Schedule E (Form 1040). The total income (or loss) is copied to Schedule 1 (Form 1040), where it’s combined with other forms of income and then reported on the main 1040 form.

Use Schedule C instead of Schedule E to report rental activities if you provided significant services to the tenant, such as regular cleaning, changing linens, or housekeeping services. Furnishing utilities, cleaning public areas, collecting trash, and similar services don’t count.

Also use Schedule C instead of Schedule E to report income and expenses from rental property you held for sale to customers as a real estate dealer.

You have to file Form 4562 if you’re depreciating property placed in service during the tax year.

If you’re claiming a disaster or theft loss for your rental property, use Form 4684 to calculate your loss.

Use either Form 8995 or Form 8995-A to calculate the QBI deduction.

The impact your rental property deductions have on your overall tax bill could be limited by the passive activity loss rules . That’s because the IRS generally treats rental property activities as passive activities.

However, there are a couple of exceptions to the passive activity loss rules that are designed for landlords. First, if you “actively participate” in a rental property activity, you might be able to deduct up to $25,000 of passive activity loss from nonpassive income, such as wages. However, the $25,000 amount is gradually phased out if your modified adjusted gross income is more than $100,000 ($50,000 if you’re married and filing a separate tax return ).

You can be treated as actively participating in rental property activities if you make management decisions, such as approving new tenants, deciding on rental terms, and approving expenditures. You must also own at least a 10% interest in the rental property to qualify for this exception.

Second, renting property isn’t treated as a passive activity if you materially participate in the activity as a real estate professional (material participation is a higher level of activity than active participation). Basically, to qualify for this exception, more than half your work time must be spent in real property-related trades or businesses, and these activities must total more than 750 hours per year.

File Form 8582 if you have passive activity losses that are subject to loss limitation rules.

Let a local tax expert matched to your unique situation get your taxes done 100% right with TurboTax Live Full Service . Your expert will uncover industry-specific deductions for more tax breaks and file your taxes for you. Backed by our Full Service Guarantee . You can also file taxes on your own with TurboTax Premium . We’ll search over 500 deductions and credits so you don’t miss a thing.

Investment and Self-employment taxes done right

A local expert matched to your unique situation will get your taxes done 100% right, guaranteed with TurboTax Live Full Service . Your expert will find every tax deduction you deserve & file for you as soon as today.*

Taxes done right for investors and self-employed

TurboTax Premium searches 500 tax deductions to get you every dollar you deserve. Your taxes done 100% right, guaranteed .

Looking for more information?

Related articles, more in rental property.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

TaxCaster Tax Calculator

Estimate your tax refund and where you stand

I’m a TurboTax customer

I’m a new user

Tax Bracket Calculator

Easily calculate your tax rate to make smart financial decisions

Get started

W-4 Withholding Calculator

Know how much to withhold from your paycheck to get a bigger refund

Self-Employed Tax Calculator

Estimate your self-employment tax and eliminate any surprises

Crypto Calculator

Estimate capital gains, losses, and taxes for cryptocurrency sales

Self-Employed Tax Deductions Calculator

Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

ItsDeductible™

See how much your charitable donations are worth

Read why our customers love Intuit TurboTax

Rated 4.6 out of 5 stars by our customers.

(678,307 reviews of TurboTax Online)

Star ratings are from 2023

Your security. Built into everything we do.

File faster and easier with the free turbotax app.

TurboTax Online: Important Details about Filing Form 1040 Returns with Limited Credits

A Form 1040 return with limited credits is one that's filed using IRS Form 1040 only (with the exception of the specific covered situations described below). Roughly 37% of taxpayers are eligible. If you have a Form 1040 return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Full Service at the listed price.

Situations covered (assuming no added tax complexity):

- Interest or dividends (1099-INT/1099-DIV) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

Situations not covered:

- Itemized deductions claimed on Schedule A

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income

- Stock sales (including crypto investments)

- Rental property income

- Credits, deductions and income reported on other forms or schedules

* More important offer details and disclosures

Turbotax online guarantees.

TurboTax Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited individual returns filed with TurboTax for the current 2023 tax year and for individual, non-business returns for the past two tax years (2022, 2021). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Excludes TurboTax Business returns. Additional terms and limitations apply. See Terms of Service for details.

- Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

- 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest. Limitations apply. See Terms of Service for details.

TurboTax Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See Terms of Service for details.

- TurboTax Audit Support Guarantee – Business Returns. If you receive an audit letter from the IRS or State Department of Revenue on your 2023 TurboTax business return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited business returns filed with TurboTax for the current 2023 tax year. Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals for this question-and-answer support, we will refund the applicable TurboTax Live Business or TurboTax Live Full Service Business federal and/or state purchase price paid. Additional terms and limitations apply. See Terms of Service for details.

TURBOTAX ONLINE/MOBILE PRICING

- Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. Special discount offers may not be valid for mobile in-app purchases. Strikethrough prices reflect anticipated final prices for tax year 2023.

- TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form 1040 and limited credits only, as detailed in the TurboTax Free Edition disclosures. Roughly 37% of taxpayers qualify. Offer may change or end at any time without notice.

- TurboTax Live Assisted Basic Offer: Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only. Roughly 37% of taxpayers qualify. Must file between November 29, 2023 and March 31, 2024 to be eligible for the offer. Includes state(s) and one (1) federal tax filing. Intuit reserves the right to modify or terminate this TurboTax Live Assisted Basic Offer at any time for any reason in its sole and absolute discretion. If you add services, your service fees will be adjusted accordingly. If you file after 11:59pm EST, March 31, 2024, you will be charged the then-current list price for TurboTax Live Assisted Basic and state tax filing is an additional fee. See current prices here.

- Full Service $100 Back Offer: Credit applies only to federal filing fees for TurboTax Full Service and not returns filed using other TurboTax products or returns filed by Intuit TurboTax Verified Pros. Excludes TurboTax Live Full Service Business and TurboTax Canada products . Credit does not apply to state tax filing fees or other additional services. If federal filing fees are less than $100, the remaining credit will be provided via electronic gift card. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. Must file by April 15, 2024 11:59 PM ET.

- TurboTax Full Service - Forms-Based Pricing: “Starting at” pricing represents the base price for one federal return (includes one W-2 and one Form 1040). Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you’ll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them.

- Pays for itself (TurboTax Premium, formerly Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2022. Actual results will vary based on your tax situation.

TURBOTAX ONLINE/MOBILE

- Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

- Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Get your tax refund up to 5 days early: Individual taxes only. When it’s time to file, have your tax refund direct deposited with Credit Karma Money™, and you could receive your funds up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early. 5-day early program may change or discontinue at any time. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

- For Credit Karma Money (checking account): Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account.

- Fees: Third-party fees may apply. Please see Credit Karma Money Account Terms & Disclosures for more information.

- Pay for TurboTax out of your federal refund or state refund (if applicable): Individual taxes only. Subject to eligibility requirements. Additional terms apply. A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition (but is available as an upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply See Terms of Service for details.

- Tax Advice, Expert Review and TurboTax Live: Access to tax advice and Expert Review (the ability to have a Tax Expert review and/or sign your tax return) is included with TurboTax Live Assisted or as an upgrade from another version, and available through December 31, 2024. Intuit will assign you a tax expert based on availability. Tax expert and CPA availability may be limited. Some tax topics or situations may not be included as part of this service, which shall be determined in the tax expert’s sole discretion. For the TurboTax Live Assisted product, if your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the TurboTax Live Full Service product: Handoff tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer. The ability to retain the same expert preparer in subsequent years will be based on an expert’s choice to continue employment with Intuit. Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

- TurboTax Live Full Service – Qualification for Offer: Depending on your tax situation, you may be asked to answer additional questions to determine your qualification for the Full Service offer. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. These situations may include but are not limited to multiple sources of business income, large amounts of cryptocurrency transactions, taxable foreign assets and/or significant foreign investment income. Offer details subject to change at any time without notice. Intuit, in its sole discretion and at any time, may determine that certain tax topics, forms and/or situations are not included as part of TurboTax Live Full Service. Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Additional limitations apply. See Terms of Service for details.

- TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service Experts are available to prepare 2023 tax returns starting January 8, 2024. Based on completion time for the majority of customers and may vary based on expert availability. The tax preparation assistant will validate the customer’s tax situation during the welcome call and review uploaded documents to assess readiness. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation.

- TurboTax Live Full Service -- Verified Pro -- “Local” and “In-Person”: Not all feature combinations are available for all locations. "Local" experts are defined as being located within the same state as the consumer’s zip code for virtual meetings. "Local" Pros for the purpose of in-person meetings are defined as being located within 50 miles of the consumer's zip code. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. Not all pros provide in-person services.

- Smart Insights: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits, and is available through 11/1/2024. Terms and conditions may vary and are subject to change without notice.

- My Docs features: Included with TurboTax Deluxe, Premium TurboTax Live, TurboTax Live Full Service, or with PLUS benefits and is available through 12/31/2025 . Terms and conditions may vary and are subject to change without notice.

- Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12/31/2025 . Terms and conditions may vary and are subject to change without notice.

- Easy Online Amend: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits. Make changes to your 2023 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10/31/2026. Terms and conditions may vary and are subject to change without notice. For TurboTax Live Full Service, your tax expert will amend your 2023 tax return for you through 11/15/2024. After 11/15/2024, TurboTax Live Full Service customers will be able to amend their 2023 tax return themselves using the Easy Online Amend process described above.

- #1 best-selling tax software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2023, tax year 2022. Self-Employed defined as a return with a Schedule C tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA prepared returns, 2022.

- CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees . Limitations apply. See Terms of Service for details.

- TurboTax Premium Pricing Comparison: Cost savings based on a comparison of TurboTax product prices to average prices set forth in the 2020-2021 NSA Fees-Acct-Tax Practices Survey Report.

- 1099-K Snap and Autofill: Available in mobile app and mobile web only.

- 1099-NEC Snap and Autofill: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). Available in mobile app only. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

- Year-Round Tax Estimator: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). This product feature is only available after you finish and file in a self-employed TurboTax product.

- **Refer a Friend: Rewards good for up to 20 friends, or $500 - see official terms and conditions for more details.

- Refer your Expert (Intuit’s own experts): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details.

- Refer your Expert (TurboTax Verified Independent Pro): Rewards good for up to 20 referrals, or $500 - see official terms and conditions for more details.

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 2/17/23 and may not reflect actual refund amount received.

- Average Deduction Amount: Based on the average amount of deductions/expenses found by TurboTax Self Employed customers who filed expenses on Schedule C in Tax Year 2022 and may not reflect actual deductions found.

- More self-employed deductions based on the median amount of expenses found by TurboTax Premium (formerly Self Employed) customers who synced accounts, imported and categorized transactions compared to manual entry. Individual results may vary.

- TurboTax Online Business Products: For TurboTax Live Assisted Business and TurboTax Full Service Business, we currently don’t support the following tax situations: C-Corps (Form 1120-C), Trust/Estates (Form 1041), Multiple state filings, Tax Exempt Entities/Non-Profits, Entities electing to be treated as a C-Corp, Schedule C Sole proprietorship, Payroll, Sales tax, Quarterly filings, and Foreign Income. TurboTax Live Assisted Business is currently available only in AK, AZ, CA, CO, FL, GA, IL, KS, MA, MD, ME, MI, MN, MO, NC, NJ, NV, NY, OH, PA, RI, SD, TN, TX, UT, VA, WA, WV and WY.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

TURBOTAX DESKTOP GUARANTEES

TurboTax Desktop Individual Returns:

- 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back – Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state software license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2023 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited individual returns filed with TurboTax Desktop for the current 2023 tax year and, for individual, non-business returns, for the past two tax years (2021, 2022). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Satisfaction Guarantee/ 60-Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop, go to refundrequest.intuit.com within 60 days of purchase and follow the process listed to submit a refund request. You must return this product using your license code or order number and dated receipt.

TurboTax Desktop Business Returns:

- 100% Accurate Calculations Guarantee – Business Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we’ll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See License Agreement for details.

- Maximum Tax Savings Guarantee – Business Returns: If you get a smaller tax due (or larger business tax refund) from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Desktop Business license purchase price you paid. Additional terms and limitations apply. See License Agreement for details.

TURBOTAX DESKTOP

- Installation Requirements: Product download, installation and activation requires an Intuit Account and internet connection. Product limited to one account per license code. You must accept the TurboTax License Agreement to use this product. Not for use by paid preparers.

- TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees may apply for e-filing state returns. E-file fees may not apply in certain states, check here for details . Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet connectivity.

- Fastest Refund Possible: Fastest federal tax refund with e-file and direct deposit; tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Average Refund Amount: Sum of $3140 is the average refund American taxpayers received based upon IRS data date ending 02/17/23 and may not reflect actual refund amount received.

- TurboTax Product Support: Customer service and product support hours and options vary by time of year.

- #1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2022 TurboTax products.

- Deduct From Your Federal Refund: A $40 Refund Processing Service fee may apply to this payment method. Prices are subject to change without notice.

- Data Import: Imports financial data from participating companies; Requires Intuit Account. Quicken and QuickBooks import not available with TurboTax installed on a Mac. Imports from Quicken (2021 and higher) and QuickBooks Desktop (2021 and higher); both Windows only. Quicken import not available for TurboTax Desktop Business. Quicken products provided by Quicken Inc., Quicken import subject to change.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Compare TurboTax products

All online tax preparation software

TurboTax online guarantees

TurboTax security and fraud protection

Tax forms included with TurboTax

TurboTax en español

TurboTax Live en español

Self-employed tax center

Tax law and stimulus updates

Tax Refund Advance

Unemployment benefits and taxes

File your own taxes

TurboTax crypto taxes

Credit Karma Money

Investment tax tips

Online software products

TurboTax login

Free Edition tax filing

Deluxe to maximize tax deductions

TurboTax self-employed & investor taxes

Free military tax filing discount

TurboTax Live tax expert products

TurboTax Live Premium

TurboTax Live Full Service Pricing

TurboTax Verified Pro

TurboTax Live Full Service Business Taxes

TurboTax Live Assisted Business Taxes

TurboTax Business Tax Online

Desktop products

TurboTax Desktop login

All Desktop products

Install TurboTax Desktop

Check order status

TurboTax Advantage

TurboTax Desktop Business for corps

Products for previous tax years

Tax tips and video homepage

Browse all tax tips

Married filing jointly vs separately

Guide to head of household

Rules for claiming dependents

File taxes with no income

About form 1099-NEC

Crypto taxes

About form 1099-K

Small business taxes

Amended tax return

Capital gains tax rate

File back taxes

Find your AGI

Help and support

TurboTax support

Where's my refund

File an IRS tax extension

Tax calculators and tools

TaxCaster tax calculator

Tax bracket calculator

Check e-file status refund tracker

W-4 tax withholding calculator

ItsDeductible donation tracker

Self-employed tax calculator

Crypto tax calculator

Capital gains tax calculator

Bonus tax calculator

Tax documents checklist

Social and customer reviews

TurboTax customer reviews

TurboTax blog

TurboTax Super Bowl commercial

TurboTax vs H&R Block reviews

TurboTax vs TaxSlayer reviews

TurboTax vs TaxAct reviews

TurboTax vs Jackson Hewitt reviews

More products from Intuit

TurboTax Canada

Accounting software

QuickBooks Payments

Professional tax software

Professional accounting software

Credit Karma credit score

More from Intuit

©1997-2024 Intuit, Inc. All rights reserved. Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

Security Certification of the TurboTax Online application has been performed by C-Level Security.

By accessing and using this page you agree to the Terms of Use .

Welcome! Where would you like to log in today?

Sign up and get pro free for 14 days.

Once your PRO trial is over you can continue using Landlord Studio GO completely free.

By continuing you agree to our Terms & Conditions .

Already have an account? Log in

Visiting from the United Kingdom?

Please visit our United Kingdom site for a better experience

Tracking Travel and Mileage Deductions for Rental Properties

Travel and mileage make up a significant tax deduction for landlords. Keep detailed records using software like Landlord Studio.

PUBLISHED ON

Updated for the 2023 tax year

Travel and mileage form a significant tax deduction for landlords. Unless you live next door to your property you are going to spend time and money traveling to and from, whether this is traveling to pick up supplies, managing viewings, or doing property inspections. Instead of paying for the associated costs out of pocket, these travel expenses can be deducted against taxable income at the end of the tax year.

This will allow you to reduce your taxable income and maximize profits. To ensure you remain tax compliant, you need to know what travel expenses are deductible and how to calculate your mileage tax deduction.

About the travel and mileage tax deduction

For landlords, mileage, as well as other car-related and travel expenses, are deductible in the year incurred.

This means that come tax season, you can claim your expenses for gas, car maintenance, and more against your taxes. The IRS has set guidelines as to what constitutes a deductible travel expense, and these should be followed to avoid being penalized.

However, it’s important to note that if you do intend to claim your mileage allowance you will need to keep a detailed and accurate mileage log. The easiest way to keep a mileage log for taxes is with specifically designed software. Thankfully, if you’re using Landlord Studio you can easily log the distance, purpose and details of all of your travel and easily run a mileage report at the end of the tax year.

The Travel Expenses Must Be “Ordinary And Necessary”

In order for your travel expenses to be deemed legitimate, they need to be both ordinary and necessary.

For landlords, this might look like traveling to one of your rental properties to perform a routine inspection or traveling to meet accountants. It would not include, taking a longer route to work every day so you can drive past your rental properties or meeting another landlord friend for coffee.

Mileage expense examples that can be claimed for rental business purposes include:

- Traveling to your property to deal with tenants, maintenance, repairs

- Traveling to your property to show prospective tenants

- Traveling to collect supplies, such as building supplies for maintenance or renovations

- Traveling to meet with contractors, attorneys, accountants, etc.

- Traveling to landlord-specific classes or trade shows

Non-business related travel that cannot be claimed includes:

- Traveling to and from your house and your workplace (every day commuting)

- Making a detour to the grocery store on the way home from visiting your rental

Although what constitutes a travel expense can sometimes be ambiguous, it’s best to abide by the guidelines to avoid being penalized by the IRS . If you’re audited by the IRS and they determine that you have claimed unnecessary expenses (extra miles, for example), you could face penalties for overstating deductions, such as fines or even federal prison time. Negligence and not keeping relevant records can also lead to penalties.

What Are The 2021/2022 Mileage Tax Deduction Rates?

The easiest way to calculate mileage tax deductions is by using the standard mileage rate set by the IRS.

- For the 2021 tax year, the rate was 56 cents per mile

- For the first 6 months of the 2022 tax year, it’s 58.5 cents per mile .

- In recognition of significant gasoline price increases during 2022, the IRD adjusted the rate for the last 6 months of the 2022 tax year to 62.5 cents per mile.

What Is The 2023 Mileage Tax Deduction Rate?

The IRS increased the standard mileage rate for tax purposes by 3c per mile for the 2023 tax year.

For the 2023 tax year, the standard mileage rate is 65.5 cents per mile.

These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

Using The Standard Mileage Rate To Calculate Your Deduction

To calculate your deduction, simply multiply your business miles by the standard mileage rate. For example, if you drove 10,000 business miles in 2023, you would multiply this by 0.0655 to give you a mileage tax deduction of $655.

In order to claim this deduction, you need to keep an exact record of the miles traveled, the dates and time of the travel, and the purpose of the travel. The easiest way to do this is to use an automated mileage tracker like the one built into the Landlord Studio app.

Other vehicle expenses you can claim in addition to mileage include business-related parking fees and tolls, interest on a car loan, and registration or license fees. You must use the standard mileage rate in the first year you use a car for your rental activity to be qualified to use this rate going forward. The bottom line is that unless your vehicle has high operating costs, the standard mileage rate should give you a significant deduction.

Claiming Actual Expenses Instead Of The Mileage Deduction

Another way to claim a mileage tax deduction is to deduct your actual expenses. This is a little more complex than using the standard mileage rate as you also have to track how much you spend on gas, oil, repairs, tires, insurance, and other car operating costs. Vehicle depreciation is also included here.

The downside of using this method to claim expenses is that it requires more record-keeping, so may not be worth it if you don’t drive much for work purposes. If done properly and/or your car has higher than normal operating costs, it can lead to healthy tax savings.

An easy way to help you track actual expenses is to use an income and expense tracking software (like Landlord Studio) which will allow you to record and categorize your travel expenses as they happen so you don’t miss any, and easily digitize receipts and recording the purpose of the travel in the notes section.

Whether you claim actual expenses or the standard mileage rate, the IRS stipulates that you must complete part V of Form 4562 and attach it to your tax return.

Other Travel Expense Deductions

Depending on how geographically widespread your rental property portfolio is, or if you’ve invested in out-of-state property , you may not always be able to travel for work by car. If this is the case, and you have to leave your city or state in which your business or work is located in order to manage your rental properties, you can deduct other expenses such as:

- Transportation : fares for airplanes, trains, buses, or if you rent a car .

- Meal and beverage: 50% of food and drink expenses.

- Lodging : 100% lodging expenses (hotel, motel, etc.) for days you work at your rental.

The Primary Purpose Of The Trip Must Be Work

For an overnight trip to be deducted, the primary purpose of the trip must be work. Although this sounds obvious, the IRS pays close attention to overnight business trips, so operating within the guidelines is a must.

Travel within the United States is subject to a hard-line rule whereby you can deduct 100% of your expenses for a business trip, but only if you spend more than half of your time on rental activities.

For example, if you go away for 6 days and work for 4 of those days and relax for 2 days, that can be expensed as a business trip. If, however, you’re only planning to work for 1 day but decided to extend the trip by 5 days to have a personal vacation while you’re already away, this cannot be counted as a work-related trip.

What To Include In Your Mileage Log For Taxes

Maintain a driving log (if claiming the standard deduction).

You must keep a log of the total miles driven if you choose to take the standard mileage deduction. The IRS specifically requires that you record the following:

- the odometer reading at the beginning and end of the trip

- the purpose of the travel,

- the start and end locations,

- and date of the trip.

The IRS does not care for ballpark figures, which means your mileage log must be maintained on a regular and consistent basis.

Tip: You can use the Landlord Studio's in-built GPS mileage tracker to easily keep an accurate and up to date mileage log.

Keep a Record of Receipts (If claiming the actual expense)

If you choose the actual expense deduction, you don’t need to maintain or record your mileage . Instead, keep copies of relevant receipts and documentation.

Each document must include:

- dollar amount of the service or service purchased,

- and description of the product or service needed.

The travel expense must be incurred within the tax year for which you’re making the claim.

How To Track Your Rental Mileage Tax Deduction

Your accounting software should have a built-in mileage tracking tool. Landlord Studio for exmple, has an automatic GPS mileage tracker that will save you time and simplify the process of tracking your travel and mileage expenses. Claim the maximum allowable deduction at tax time.

What’s more is that at the end of the tax year, you can instantly generate a mileage report to calculate your overall deduction for the year. This report can be generated on any device whenever you need it and all data is securely stored in the cloud for posterity.

If you choose to track your actual expenses or have other travel expenses such as airfares Landlord Studio can be used to easily record and categorize these and reports run at the end of the year.

All reports can be downloaded or shared directly from the software with your accountant or business partners.

Tracking your mileage tax deduction for rental property accurately is key to maximizing your tax deductions and avoiding being penalized by the IRS.

Landlord Studio has an in built GPS mileage tracker that makes it easier to stay compliant by allowing you to track your travel expenses and then create relevant reports at the tap of a button.

About Landlord Studio

Landlord Studio is an easy to use property management and accounting software designed for landlords. Find and screen tenants, collect rent online, track income and expenses, run reports, and more - all for free.

Featured articles

- 15 Free Rental Listings Sites To Advertise Your Property

- 9 Best Tenant Background Check And Screening Services

- The Best Way to Collect Rent Payments From Your Tenants

- Should You Use QuickBooks For Rental Properties?

- Tax On Rental Income: How Much Tax Do You Owe?

Webinar: Finding Tenants With Landlord Studio

We take a look at everything new with Landlord Studio from syndication to tenant screening. Find great tenants fast, without the stress.

Hosted by: Logan Ransley, Co-Founder of Landlord Studio

Where: Online

When: 21st August 3pm ET

Create your FREE account with Landlord Studio today.

From finding tenants to filing taxes. Reduce vacancies and maximize your portfolio ROI with software designed for you.

Get started with Landlord Studio now.

- Credits and deductions

- Homeownership

What kinds of rental property expenses can I deduct?

By turbotax • updated 1 week ago.

The IRS lets you deduct ordinary and necessary expenses required to manage, conserve, or maintain property that you rent to others. You're allowed to deduct these expenses if your property is vacant, as long as you're trying to rent it .

Expenses are generally deducted in the year you pay them (if you use the accrual method, go here for more info). For example, if a pest-control company serviced your rental in 2023 but you didn't pay them until early 2024, you'd deduct that expense on your 2024 tax return.

Deductible expenses include, but aren't limited to:

- Cleaning and cleaning supplies

- Maintenance and related supplies

- Travel to and from the property

- Management fees

- Legal and professional fees

- Commissions

- Taxes and tax return preparation

- Lease cancelation costs

- Advertising

- Real estate taxes

- Refinance fees and mortgage points are entered in the Assets/Depreciation section instead of the Expenses section. The IRS considers these "amortizable intangibles," which means they must be expenses over the projected life of the asset (or amortized). These don't get expensed or depreciated like tangible assets

- Entered in the Assets/Depreciation section instead of the Expenses section

You must sign in to vote.

Found what you need?

Already have an account? Sign In

More like this

- What can I deduct when refinancing rental property? by TurboTax • 1463 • Updated December 09, 2023

- Can I deduct rent? by TurboTax • 8790 • Updated June 28, 2024

- Can I deduct property (real estate) taxes on my rental? by TurboTax • 302 • Updated December 10, 2023

- Where do I enter income and expenses from a rental property? by TurboTax • 5133 • Updated 4 weeks ago

- What self-employed expenses can I deduct? by TurboTax • 4709 • Updated March 14, 2024

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Rental properties and travel expenses

If you have a residential rental property, you may not be able to claim a deduction for related travel expenses.

Last updated 16 June 2024

Deductions for travel expenses

Travel expenses include the costs you incur on car expenses, airfare, taxi, hire car, public transport, accommodation and meals to:

- inspect, maintain or collect rent for a rental property you own or have an ownership interest in

- travel to any other place as long as it is associated with earning rental income from your existing rental property (for example, visiting your real estate agent to discuss your current rental property).

Prior to 1 July 2017:

- you could claim your travel expenses relating to your residential rental property, and

- you didn’t include the travel expenses in the cost base or reduced cost base when calculating any capital gain or capital loss when you sold the property.

From 1 July 2017 you can't claim any deductions for the cost of travel you incur relating to your residential rental property unless you are either:

- in the business of letting rental properties

- an excluded entity .

A residential premises (property) is land or a building that is:

- occupied as a residence or for residential accommodation

- intended to be occupied, and is capable of being occupied, as a residence or for residential accommodation.

To be residential premises, the premises must be fit for human habitation.

For example, a house or a unit used as residential accommodation to produce rental income is residential rental property.

A caravan or a houseboat is generally not residential rental property.

Example: individual with residential rental property

Sarah owned and rented out her residential rental property in the 2023–24 income year. She travelled to the property to repair damages caused by tenants during the year.

As the investment is a residential property and Sarah is not in the business of letting rental properties or an excluded entity, she can't claim a deduction for her travel expenses.

Commercial rental properties, for example factories or office blocks, are not residential rental properties. If you own or have an ownership interest in a commercial rental property, you can claim a deduction for travel expenses incurred in earning your rental income from the property.

Example: ownership interest in commercial property

Kei is the sole owner of a commercial rental property. Her husband, Bert, occasionally drives to the rental property in his own car to undertake maintenance. As he has no ownership interest in the property, Bert can't claim travel expenses. Similarly, since Kei didn't travel to the property to undertake the maintenance, she can't claim a deduction.