- Personal Finance

The TD First Class Travel Visa Infinite Card and its travel insurance benefits

Insurance Coverage

First, it is very important to read the most recent version of the TD First Class Travel Visa Infinite Card Benefits Coverage Guide .

They can change at any time and it is your responsibility to be aware of these insurance benefits .

If you have any questions, please contact TD Customer Service at 1-866-374-1129 . It is strongly recommended that you call them before booking travel with your card and before you leave on your trip.

Eligibility

Travel insurance coverage is only available to :

- Primary cardholder

- Spouse and dependent children of the primary cardholder

- Additional cardholder

- Spouse and dependent children of the additional holder

In addition, the card account must be in good standing . This means:

- The Primary Cardholder has not asked TD to close the Account

- TD has not suspended and revoked credit privileges or closed the account

Eligibility Tool

To make it easier to understand the insurance coverage of its credit cards, TD has put together an interactive tool on travel insurance . In 6 questions, you can quickly find out if you qualify or not, when you pay in full for the trip in cash.

TD First Class Travel Visa Infinite Card Description

Travel medical insurance.

The maximum benefit for emergency medical care is $2,000,000. To be eligible, you only need to have the card, as per the Eligibility section above. This includes the following inclusions:

- Hospitalization

- Physician’s fees

- Private nursing

- Diagnostic services

- Ambulance and air ambulance services

- Prescription drugs

- Accidental dental and emergency relief of dental pain

- Medical Appliances

- Emergency return home

- Transportation to the bedside and compensation for the bedside companion

- Compensation for the travel companion

- Meals and accommodation

- Incidental hospital expenses

- Vehicle return

- Repatriation of deceased

- Baggage return

Trip cancellation and trip interruption insurance

To receive the benefits of this insurance coverage, the full cost of your trip must be paid with your ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card and/or TD Rewards points.

A trip cancellation occurs before departure .

A trip interruption occurs on or after the departure date when the trip has begun .

Eligible reasons may be:

- The death of an insured person or an immediate family member

- A sudden, unexpected illness or accidental injury to a person or a member of his or her immediate family

- A natural disaster at the insured person’s principal residence

- Weather conditions during the trip

Common Carrier Travel Accident Insurance

To be eligible for this insurance, you must:

- Privileges under your account have not ceased or been suspended

- The account is not more than 90 days past due

- And the TD credit card must be in good standing

A common carrier is a land, air or water conveyance that is authorized to carry passengers for compensation. This can be a :

- Ferry or Cruise ship

- Bus or Train

- Cab or Limousine

If there is an accidental death or dismemberment, the maximum benefit is $500,000 .

Delayed and Lost Baggage Insurance

In order to benefit from this insurance, the credit card must have been used to pay 100% of the airfare .

Flight and travel delay insurance

To benefit from this insurance, at least 75% of the cost of your trip must be charged to the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card .

The reason for the delay may be due to weather, an outage or a strike for example.

This flight or travel delay insurance can be up to $500 , for a delay of 4 hours or more .

Hotel/Motel Burglary Insurance

This is for hotel and motel reservations in Canada and the United States only. At least 75% of the total cost of the stay must be charged to the card. The use of TD Rewards points is also valid under certain conditions.

The maximum amount is $2,500 .

Collision and damage insurance for rental vehicles

- Pay for the car rental at the rental agency with the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card MD (payment with TD Rewards points is accepted, under certain conditions).

- Refuse to purchase the Collision Damage Waiver (CDW ) or an equivalent coverage from the rental agency and have it written into the contract

The car rental covers up to 48 consecutive days and the manufacturer’s suggested retail price (MSRP) of the car must be under $65,000 . Some types of vehicles are not insured.

Purchase Assurance and Extended Warranty Protection

Purchase insurance covers items purchased with the ® Visa Infinite* Card" href="https://milesopedia.com/en/credit-cards/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card for 90 days from the date of purchase . If the item is lost, stolen or damaged, it will be replaced or repaired with this insurance.

Extended warranty protection extends the manufacturer’s warranty up to one year . It begins after the manufacturer’s warranty expires and the item must be purchased with the Card.

Mobile Device Insurance

Did your new smartphone or tablet have a major accident and stop working? Mobile device insurance can come to the rescue, up to a maximum of $1,000 in reimbursement!

To qualify, at least 75% of the total cost of the device must be charged to the TD First Class Travel Visa Infinite Card. Under certain conditions, insurance is also eligible if the total cost of the device is financed through a plan with monthly payments .

Emergency travel assistance services

It is not really an insurance, but rather a help to solve a problem during a trip in unknown land. They do not offer payment or refunds. They are more of a medical second opinion or will tell you what to do if you don’t know what to do when you are in total panic.

The phone number is 1-800-871-8334 for Canada or the United States. Or if you are in another country: 1-416-977-8297 (collect).

This phone line can be useful for the following situations:

- Medical consultation and follow-up

- Medical emergency travel and medical referrals

- Payment to medical service providers

- Assistance in case of lost luggage

- Legal assistance

- Replacement of lost tickets and documents

- Translation Services

- Emergency transfer of funds

What to do if you have an insurance claim with the TD First Class Travel Visa Infinite Card

You must call 1-866-374-1129 , within the time frame following the date the event occurred.

In summary, here are the various insurance coverages of the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card :

Bottom Line

In addition to all this insurance to prevent inconvenience, the ® Visa Infinite* Card" href="https://milesopedia.com/en/go/td-first-class-travel-visa-infinite-card-qc/" rel="noindex">TD First Class Travel ® Visa Infinite* Card has a very profitable welcome offer from TD Bank .

With all these points, you can afford to get a stay that will not cost much. This is in addition to his annual TD Travel Credit of $100 for Expedia for TD bookings of $500 or more.

To save on travel and insurance, this is a secret card to have in your wallet!

All posts by Caroline Tremblay

Suggested Reading

This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Best credit cards

- Best rewards cards

- Best travel cards

- Best cash back cards

- Best low interest cards

- Best balance transfer cards

- Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih and Courtney Reilly-Larke on March 31, 2022 Estimated reading time: 6 minutes

TD First Class Travel Visa Infinite Card review

This premium TD card lets travellers redeem flexible rewards through a partnership with Expedia.

With a plethora of travel-focused credit cards on the market, the TD First Class Travel Visa Infinite Card may not be the obvious choice—especially considering how many Aeroplan cards TD currently has on its roster. That said, the TD First Class Travel Visa Infinite Card is worth considering. Why? It boasts a flexible redemption program and a partnership with Expedia. Cardholders get access to Expedia For TD online portal to redeem rewards for flights, hotels and car rentals on expediafortd.com.

Add to that comprehensive insurance coverage and generous earn rates and the TD First Class Travel Visa Infinite Card becomes a solid choice for avid travellers.

TD First Class Visa Infinite Card

Annual fee: $139

- Up to 8 TD Rewards points per $1 on travel

- 6 points per $1 on groceries and restaurants

- 4 points per $1 on recurring bills

- 2 points per $1 on all other purchases

Welcome offer: earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

Card details

The TD First Class Travel Visa Infinite Card

- Three things you need to know about the TD First Class Travel Visa Infinite Card

- How to redeem your TD Rewards

- What are the best ways to benefit from this card?

Are there any drawbacks to the TD First Class Travel Visa Infinite Card?

4 things to know about the td first class travel visa infinite card, 1. the you earn points under the td rewards program.

T he TD points system is easier to understand than the point system for the bank ’ s Aeroplan credit cards. Your Point values stay the same no matter where you ’ re flying, so it ’ s easy to work out how much they ’ re worth. Plus, TD Points can be redeemed on any airline, not just Air Canada or Star Alliance Partners. While Aeroplan Miles are valuable, if you prefer simplicity the TD First Class Travel Visa Infinite Card might be more up your alley.

2. Your points go farther when you book with ExpediaForTD.com

If you already use Expedia to book your travel, this card is a savvy choice. When you book travel online through Expedia For TD, you earn 8 TD points per $1.

3. The card comes with a generous welcome bonus

You can earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.. Plus, earn a birthday bonus of up to 10,000 rewards points (conditions apply). You can also receive a $100 TD travel credit when you spend at least $500 at Expedia for TD.

4. You’ll get great travel insurance

The TD First Class Travel Visa Infinite Card comes with up to $2 million of travel medical insurance coverage for the first 21 days of a trip. Trip cancellation, trip interruption, common carrier travel accident insurance, travel assistance services, flight delay insurance, auto rental collision insurance, and delayed and lost baggage insurance round out the card’s benefits. For a premium rewards card, The TD First Class ’ s insurance is fairly standard, however; so, if you ’ re looking for more comprehensive credit card insurance , you could consider a card like the National Bank World Elite Mastercard, * which comes with up to $5 million in out-of-province-of-residence medical/hospital insurance for trips up to 60 days (if you ’ re under 54).

How to redeem your TD Points:

You can redeem your TD Points for travel in two ways. The best—and most valuable—way is through the Expedia For TD online portal, where you can redeem 200 TD points per $1 in travel credit (0.5%) and pay the balance of the cost (if any) using your credit card (you’ll also earn Points on this spend).

Your other redemption choice is the “Book Any Way” option, which lets you book via other travel websites; however, your bookings can cost up to 25% more if you go this route. When using “Book Any Way” you’ll redeem at 250 TD points per $1 (0.4%) applied as a statement credit on your first $1,200 in travel purchases and 200 TD points per $1 (0.5%) for your travel purchases over $1,200. In comparison, with Expedia For TD, you’ll get a better and more consistent return of 0.5% on all your travel spending.

In both cases, the TD First Class Travel Visa Infinite Card allows you to redeem for any seat on any airline. Additionally, you can redeem points for rewards in small increments (minimum 200), so this means you don’t need to build up a large pool of points before you’re able to apply them towards travel.

Finally, through the TD Rewards site, you can shop for items such as a Vitamix blender, a Dyson vacuum or gift cards. However, you won’t get the same value as you would booking travel. For example, a $50 gift card at Best Buy will cost you 20,000 TD points, whereas you can use the same amount of points for $100 in travel on the Expedia For TD portal.

How to optimize the TD First Class Travel Visa Infinite Card

Ultimately, your best bet is to redeem points for travel from ExpediaForTD.com . Generally, prices on the website are similar to those on the main Expedia website, and you’ll be able to redeem at the rate of 200 points per $1. If you redeem points for travel outside of the TD portal, your points can lose up to 25% in value; however this could be a smarter route if you find a really good deal on another travel portal.

If you do find a better hotel or flight deal elsewhere, you have the option to price match, but there are some restrictions: you must have booked within the last 24 hours; your travel plans must be at least 48 hours away; and travel dates, and flight and hotel classes must all be the same to submit a claim.

Does the TD First Class Travel Visa Infinite Card have travel insurance?

With this card you’ll get an extensive suite of travel insurance coverage, for big and small emergencies. For frequent travellers and those who cross the border often, this is a must. The card includes travel medical insurance of up to $2 million of coverage for the first 21 days. (If you or your spouse are over 65 or older, you’re only covered for the first four days of your trip.) You’ll also get up to $1,500 of trip cancellation insurance with this card up to a maximum of $5,000 for all insured persons. For trip interruption insurance, you get $5,000 per insured person, up to $25,000 for all the insured people on the same trip.

You’ll also get common carrier travel accident insurance, emergency travel assistant services and delayed/lost baggage insurance (up to $1,000 per insured person if your baggage is delayed for more than six hours or gets lost ultimately).

There is a minimum personal income requirement of $60,000 or a household income of $100,000. However, this is a common requirement for many cards in the same category.

Other cards offer more incentive to spend in categories like groceries, dining and entertainment. The TD First Class Travel Visa Infinite Card only offers three times the Points earn on travel booked through the Expedia For TD portal (4.5%)—everything else is at the base three TD points per $1 (1.5%) rate. To compare, the Scotiabank Gold American Express has a five-times Points accelerator on restaurants and groceries (5% per dollar).

Finally, the TD First Class Travel Visa Infinite Card doesn’t offer airport lounge access , and you’ll be charged foreign transaction fees . So, if you like to use airport lounges, or you often find yourself shopping in a foreign currency, you may want to consider a card that offers those perks.

Bottom line

TD’s unique partnership with Expedia, accelerated earn rates and incremental points redemption structure make the TD First Class Travel Visa Infinite Card a worthwhile consideration as a travel credit card . However, the biggest boost in earning points you’ll get with this card is by booking with ExpediaForTD.com. If you don’t want to be locked into booking that way, you may want to explore other travel card options.

More on credit cards :

- Canada’s best travel cards 2022

- Canada’s best credit cards for gas

- Canada’s best credit cards for grocery purchases 2022

- Best cash back credit cards

What does the * mean?

Affiliate (monetized) links can sometimes result in a payment to MoneySense (owned by Ratehub Inc.), which helps our website stay free to our users. If a link has an asterisk (*) or is labelled as “Featured,” it is an affiliate link. If a link is labelled as “Sponsored,” it is a paid placement, which may or may not have an affiliate link. Our editorial content will never be influenced by these links. We are committed to looking at all available products in the market. Where a product ranks in our article, and whether or not it’s included in the first place, is never driven by compensation. For more details, read our MoneySense Monetization policy .

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Comments Cancel reply

Your email address will not be published. Required fields are marked *

One of the TD First Class Infinite VISA Benefits List include : “ Earn 3 points per $1 on everything spent “ Could you clarify why on my recent Bill Statement, showed $5 earned for 1,178 points Wouldn’t 1,178 points translate into 1178 divided by 3 ?

I have this card, but rarely use except for buying something on a trip to get the insurance coverage. The issue I have is I like to book my travel through web sites like tripcentral.ca (better for packages), VRBO (for condo rentals) and booking.com (much better selection), so only end up rarely using Expedia for TD and end up getting 1.2% back on my purchases, unless I want to wait until I have over $1,200 of points and then buy a major trip, getting 1.5% on the part over $1,200.

So, its pretty good and the insurance is good, but its not as great for travel as they like to claim.

I have had this card for about 2 years now and I am so dessapointed with it. I will stop using it from now on and I will tell everybody I know NOT to get this card or anything related to TD Bank. I changed to this card because they assured me I have full trip coverage with it so I booked my last vacation with it and considering that I did not get what I wanted on my trip they will take some responsibilities and give me some refund after my claim was with them for 8 months. They kept asking me for documents that I provided every time they asked and at the end they kept asking for documents I already submitted three times before. TD is a disgrace for Canadians. I wish the government take actions and do a deep audit on these guys. I will slowly withdraw everything I have with TD to go to another bank. Anything is better than this. Please people, do not do anything with this bank and definitely nothing with this credit card. I am been having issues with this bank since 2008 and it’s time to move on to a better service.

This is the all lying I have issues with that I lost my luggage on my way back home and my flight cut and delayed for 5 months they don’t cover anything’s this massage is for the Visa highly in-charge manager if you guys don’t find me solution I have to take legal step and say bye to TD my whole family since they denied my claim it’s really really broke my heart. I was really trust them never ever again.

I want to redeem my points from my business travel which I have accumulated as I switched to the rewards cash card now .How do I do this June 15,2022

This card is excellent and works well if you are looking to use it for travel specifically. I find it comes in handy when even needing a car rental or a hotel stay on the fly.

We have this card and use it often, we had enough points to use it for 5 hotels on our roadtrip last spring (booked them through expedia). I guess it all depends on what you plan to do. We often go on little roadtrips to Canmore, Banff or Jasper and use it to stay there as well so it really saves us for accommodations. Also not having to get separate car insurance for rental cars is a big plus.

I just got back from Cuba. Unfortunately my flight from Ottawa to Cuba was delayed by 4 hours. And from Cuba to Ottawa for 14 hours. I want to be reimbursed because I bought a ride on my The TD First Class Travel Visa Infinite. Please give me the contact information to whom to apply for compensation. Thank you,

I have First Travel Visa card. My trip is more than 21 days. How can I get travel insurance for the days after first 21 days?

This is incorrect. the $100 travel credit is only for hotels and vacation rentals ALONG with flights. Not if your travel consists only of flights. It is a Hotel credit and NOT a travel flight credit. Beware! This credit card is absolutely useless.

Related Articles

Making sense of the markets this week: August 25, 2024

Canada’s railway-bound economy screeches to halt, inflation is down, Target shares rebound and TD to pay $4-billion penalty.

The best no-fee credit cards in Canada for 2024

These cards have no annual fee and still boast perks like cash back, travel insurance and more.

The best credit cards for airport lounge access in Canada for 2024

If you want to make your travels a little more comfortable, airport lounge access is key. Here are the...

The best Aeroplan credit cards in Canada for 2024

Interested in earning versatile travel points at a faster rate? Here’s what you need to know to get started.

Why a reverse mortgage should be a last resort for most Canadian retirees

Reverse mortgages do the job of freeing up income for house-rich, cash-poor Canadian seniors. But their terms are often...

Real Estate

Open bidding in Ontario: Game-changer or business as usual?

An Ontario law came into effect last year, designed to add transparency to the home-bidding process. Has it changed...

PC Optimum points: How it works and best ways to earn

If you frequently shop at Loblaw-affiliated stores, the right PC Financial Mastercard or a PC Money Account can help...

Visa vs. Mastercard: What are the differences—and do they matter?

Some people care about which of the two logos appears on their credit card. Here’s why it shouldn’t make...

Canada’s inflation rate falls to 2.5%, paving way for another interest rate cut

The inflation reading gives some economists more confidence that the Bank of Canada will cut its benchmark interest rate...

A parents’ guide to home down payment gifts and loans

Many parents loan or gift money to their adult children for real estate purchases. Here are the legal and...

TD First Class Travel® Visa Infinite* Card review

Welcome Offer Ends Sep 3, 2024

Earn up to $700 in value†, including up to 75,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by September 3, 2024.

- Rates & Fees

- Eligibility

8 Points Earn 8 TD Rewards Points for every $1 you spend through ExpediaForTD†

6 Points Earn 6 TD Rewards Points for every $1 you spend on groceries and restaurants.†

4 Points Earn 4 TD Rewards Points for every $1 you spend on recurring bill payments.†

2 Points Earn 2 TD Rewards points for every $1 you spend using your card.†

10% Bonus Points Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

$100 Get an annual TD Travel Credit when you book at Expedia For TD†

USD The annual fee is in USD

20.99% Purchase APR APR for purchases 20.99%†

22.99% Balance Transfer Rate APR for balance transfers 22.99%†

22.99% Cash Advance APR APR for cash advances 22.99%†

$139 Annual Fee First year fee is rebated. First additional cardholder is $50, subsequent cardholders are $0.

2.50% Foreign Transaction Fee 2.5% of the transaction in CND

Good Recommended Credit Score

$60,000 Required Annual Personal Income

$100,000 Required Annual Household Income

By Tyler Wade & Scott Birke

Updated: August 20, 2024

- Compare credit cards in Canada

- Best Canadian credit cards

- Best cash back credit cards

- Best travel credit cards

- Best rewards credit cards

- Best no annual fee credit cards

- Best credit card offers

- Best credit cards for rental car insurance

- Best student credit cards

This offer is not available for residents of Quebec.

The TD First Class Travel® Visa Infinite* Card stands out among travel credit cards for its nice welcome bonus, strong rewards rate on all purchases, and particularly massive earn rate for purchases via through Expedia® For TD†. It also offers substantial long-term value for those who have a TD All-Inclusive Banking Plan, as that membership rebates the card’s annual fees for the primary cardholder and an Authorized User.

This could underwhelm some travelers but may be forgivable for those who are just focused on getting as many free flights and hotel nights as possible.

Who's the TD First Class Travel® Visa Infinite* Card for?

A travel lover who wants to accumulate points fast on everyday spending without any loyalty to a particular brand of store, but ideally can be loyal to TD Bank and their booking portal Expedia For TD to find the best travels deals.

TD First Class Travel® Visa Infinite* Card Welcome bonus

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card † .

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening † .

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year † .

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

Pros and Cons of the TD First Class Travel® Visa Infinite*

Major combined value for the welcome bonus (up to $700 in value)†

Good base earn rate on all purchases

Huge earn rate when you book travel through Expedia® For TD†

Very flexible redemption options

$100 TD Travel Credit†

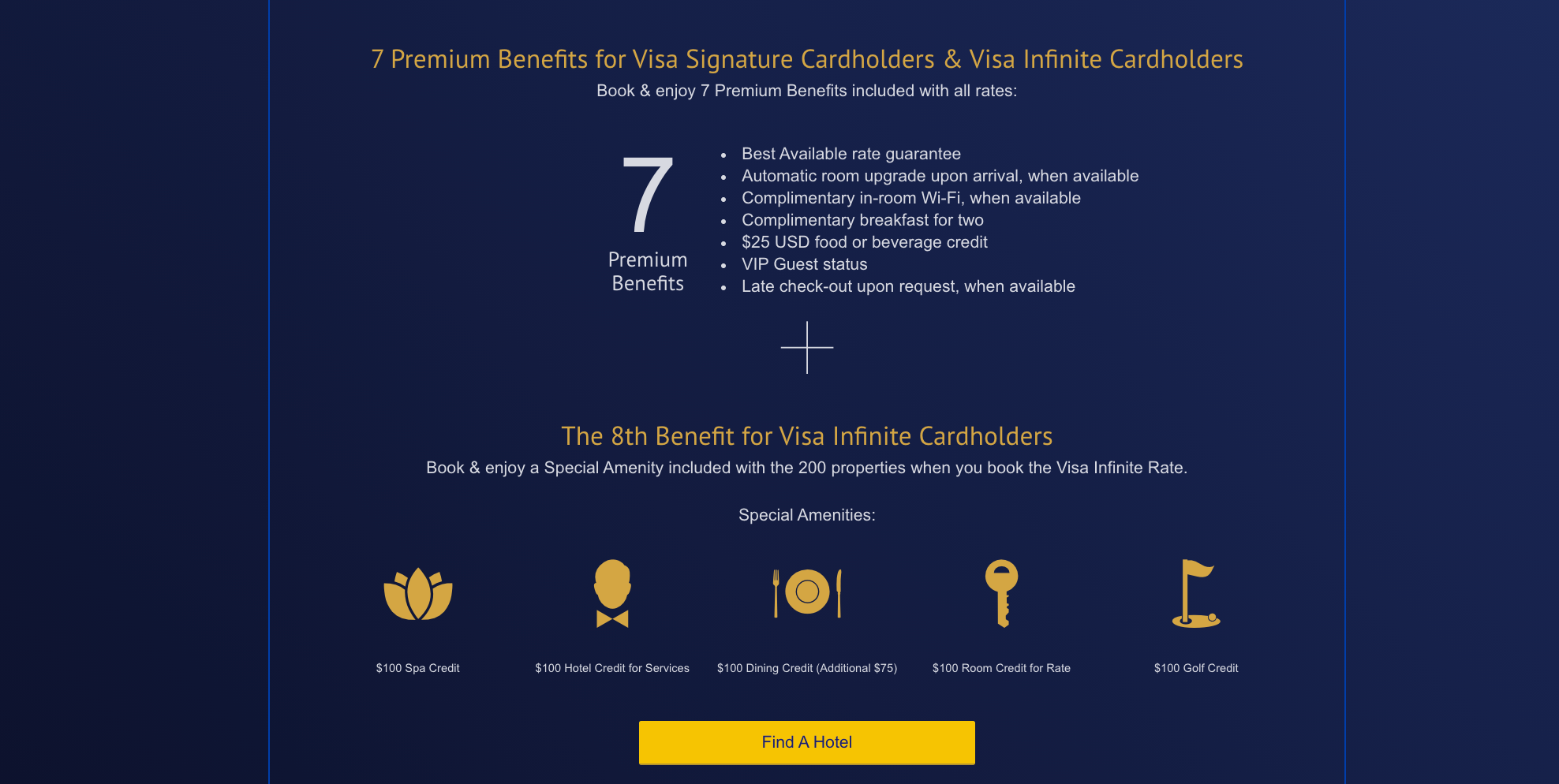

Visa Infinite Benefits

Great savings on annual fees for accountholders of TD’s All-Inclusive Banking Plan

Does not provide free lounge access

Charges foreign transaction fees

How to earn TD Points with the TD First Class Travel Visa Infinite

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†

- Earn 2 TD Rewards Points For every $1 you spend on other purchases made using your card†

Points don’t expire as long as your account is active, and the card has no caps on the total amount of TD Points that can be earned.

How to redeem your TD Points

Though there are a number of redemption options with TD Points, you get the best value when redeeming for travel via one of two methods:

1. Book Any Way†

The Book Any Way† redemption path allows you to charge eligible travel expenses to your credit card and then retroactively redeem your points for those expenses within 90 days of the expense date. Travel expenses may include but are not limited to:

- Air travel taxes

- Baggage fees

- Airport parking and shuttles

- Car rentals

- Local commuter transport, like trains, buses or subways

- Travel attractions and entertainment

Each point redeemed via Book Any Way† is worth $0.004 for the first $1,200 of any redemption and $0.005 for the remainder of any redemption above $1,200.

Expedia® For TD

Points can alternatively be redeemed for flights, hotels, vacation packages and rental cars via ExpediaForTD.com. Redeeming with this method yields a flat value of $0.005 per point. The site will indicate the dollar value of the TD points you have on hand, and then you apply those points to your travel purchase when checking out.

Aside from the high value in earning and redeeming rewards via ExpediaForTD.com, the platform also provides a nice price guarantee feature: If you find a cheaper Flight + Hotel package within 24 hours of booking or a cheaper hotel rate up to 48 hours before check-in, Expedia will refund the difference between what you paid and the lower rate you found.

2. Other redemption paths

TD Points can also be redeemed for the following, though the value you get per point tends to be lower than what you get for the above two travel redemption methods.

- Amazon’s Shop with Points † : Select your TD card as your method of payment at Amazon.ca checkout , then automatically apply points toward your purchase. 10K TD Points can be redeemed for $33 (value of $0.0033 per point) and can be redeemed for Amazon.ca purchases either in part or in full.

- TD’s Shop the Mall † : Redeem points for clothing, electronics and computers from retailers like Roots, Zara, and the Body Shop.

- TD’s Shop the Catalogue † : Redeem points for merchandise including clothing, games, furniture, and appliances.

- Gift cards † at retailers like Bed Bath & Beyond, Best Buy, Canadian Tire, and more.

- Cash statement credit † for your TD card account. This requires a minimum 10K points to redeem. The first 10,000-point minimum is worth $0.005 per point and then each additional 400 points is worth $1 (0.0025 per point).

- Education credit † via HigherEdPoints.com . Credits must be purchased in minimum 62,500 points/$250 credit increments, for a redemption value of $0.004 per point.

TD First Class Travel Visa Infinite key benefits

- Excellent welcome bonus of up to $700 in value, including up to 75,000 TD Rewards Points and no annual fee for the first year † and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- High earn rate on travel, groceries and restaurants, and recurring bills without loyalty to a particular store

- Comprehensive travel insurance

TD First Class Travel Visa Infinite travel insurance and other protections

You can check out our guide to credit card travel insurance to learn more about the different types of coverage listed above, and to review other Canadian travel credit cards that might have stronger travel insurance benefits.

TD First Class Travel Visa Infinite extra benefits

- $100 annual travel bonus

- Mobile device insurance

- Earn more at Starbucks when you link your card

- Save a minimum of 10% with Avis and Budget in Canada and the U.S. (5% savings elsewhere)

- Apple pay, Google Pay, or Samsung Pay to instantly use your credit card.

- Complimentary Visa Infinite Concierge 24/7 for any cardholder request

- Visa Infinite Luxury hotel collection, dining series, wine country, and entertainment access.

What people have to say about the TD First Class Visa Infinite

Redditor, alwaysdetermined points out that yes, the annual fee can be waived with TD's All Inclusive but notes "the All-Inclusive costs $29.95, but that account fee can be waived if you keep $5,000 in the account at all times."

Reddit user, SensitiveAward , has the card, says they travel multiple times a year and is please with the insurance coverage saying "TD [credit card] comes out cheaper" when comparing it to third-party travel insurance products.

However, some users say the Expedia For TD prices are higher than regular Expedia rates, so be sure to cross reference the two portals before booking (and clear your internet cache or browse in incognito to prevent tracking)

TD First Class Visa Infinite eligibility requirements, fees, and rates

- Minimum income: $60,000 individual and $100,000 household annual income

- Foreign transaction fee: 2.5%

- Annual fee: $139, $50 for each additional cardholder (fees can be waived with TD's All inclusive banking plan)

How does TD First Class Visa Infinite compare?

¹ Conditions Apply. Visit here for the Scotiabank Gold American Express® Card to learn more. *See Card Provider's website and Card Application for complete card details, terms and current offers. Reasonable efforts are made to maintain accuracy of information.

When comparing travel credit cards with similar annual fees, the TD First Class Travel® Visa Infinite* Card strengths and weaknesses are clear:

Its sign-up bonus eclipses the competition, which gives it an immediate punch of value. It’s also something of a no-brainer card for those who have TD’s All-Inclusive Banking Plan, as the annual fee rebate† effectively makes the card free to use year after year.

It’s less ideal for those who are unlikely to spend a significant amount at through Expedia® For TD, want to avoid the foreign transaction fees and want free airport lounge access.

TD First Class Travel Visa Infinite vs. Scotiabank Gold American Express® card

No foreign transaction fees, earns 6X Scene points for each $1 CAD on all eligible purchases at Sobeys and eligible grocers¹, 5X Scene+ points for every $1 CAD spent on other eligible groceries and 3X Scene+ points for every $1 CAD spent on gas, and has an all-encompassing travel insurance package.

Conditions Apply. Visit here for the Scotiabank Gold American Express® Card to learn more. *See Card Provider's website and Card Application for complete card details, terms and current offers. Reasonable efforts are made to maintain accuracy of information.

TD First Class Travel Visa Infinite vs. BMO Ascend™ World Elite®* Mastercard®*

Includes complimentary membership in Mastercard Travel Pass provided by DragonPass,* with four annual complimentary passes. That’s a ~$128 USD value that renews every year*. Plus the up to 60,000-point sign-up bonus* and first year annual fee waiver* is still competitive with the TD card’s sign-up bonus.

*Terms and conditions apply

Drawback: There are increased earn rates but you earn only 1 point for every $1 spent everywhere else where they do not apply.*

Is the TD First Class Travel Visa Infinite worth it?

Yes, for its welcome bonus alone it's a great card. You'll also get a first year annual fee rebate, high earn rate in everyday spending, 10% annual birthday bonus, a $100 annual travel credit, and comprehensive travel coverage.

Is TD First Class Travel good?

Yes, especially if you're a TD client. You can't lose with its awesome welcome bonus, high earn rate in everyday spending, special perks like its birthday bonus and $100 annual travel credit (nearly negating its annual fee), and full suite of insurance coverage.

Does TD First Class Travel have lounge access?

No, there is no airport lounge access with the TD FIrst Class Travel Visa Infinite. Check out the BMO Ascend or Scotiabank passport for cards with similar annual fees that include airport lounge access .

What does TD First Class Travel Cover?

It's the full suite of travel insurance as well as purchase protection and rental car. Check out all the details in the TD First Class Travel review insurance section.

†Terms and conditions apply.

Sponsored Content

The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

This offer is not available to residents of Quebec.

Tyler Wade has worked in personal finance for over 5 years writing for brands like Ratehub, Forbes, KOHO, and now Money.ca.

Scott Birke is a finance editor at Money.ca.

More great credit card content

Latest articles, student loan vs line of credit, detached home prices increases in 2024, 8 smart strategies to navigate market volatility, equitable bank launches new construction loan, student discounts in canada, lower credit card fees for small businesses coming.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

TD First Class Travel Visa Infinite Card Review

By Stefani Balinsky | Published on 20 Jul 2023

Is it me or is TD throwing benefits at you with this card? The TD First Class Travel ® Visa Infinite * credit card has an aggressive offer of up to 135,000 points and an easy earn rate that includes Starbucks. Yes, I invoked the name of that coffee chain and I meant it. Want to know something else? TD First Class Travel ® Visa Infinite * earns TD points that you can redeem on Amazon.ca. So, is this credit card a hot-cup-of-goodness or just lukewarm at best? Let’s find out.

Welcome Offer

- Up to 135,000 bonus TD Rewards Points

- Annual fee rebated for the first year

The TD First Class Travel ® Visa Infinite * Welcome Offer is really good. You can earn up to $1,100 worth of welcome offers in the first year, including 135,000 bonus points, the annual fee rebated and travel benefits. Here’s how:

TD gives you 20,000 points when you make your first purchase on the card in the first 3 months of opening the account. Next, you can earn another 115,000 points if you spend $5,000 on the card within the first 180 days of opening the account. Then, you could earn a birthday bonus of up to 10,000 TD Rewards Points. You also get an annual TD Travel Credit of $100 when you book at Expedia for TD. Finally, you get a free 12 month† Uber One membership worth $120. As always, terms and conditions apply. To get the annual fee rebated for the first year, you must make a purchase on the card within the first 3 months of opening the account.

The annual fee is usually $139 for the primary cardholder, $50 for the first additional cardholder and $0 for subsequent cardholders. You have to have a minimum personal annual income of $60,000 or an annual household income of at least $100,000 to qualify.

TD First Class Travel ® Visa Infinite * interest rates

Actually, these rates are pretty standard. You need to remember that this is a travel perks card and not a low-interest credit card. Nearly all credit card interest rates are in the 19.99% to 23.99% range. Plus, most cards have different interest rates for cash advances. If you live in Quebec, you may be subject to different rates. Of course, the best choice is to pay off your credit card balance each month and to pay back any cash advance even faster.

The TD First Class Travel ® Visa Infinite* points calculator

Inflation is not your friend, but it can help you make better spending decisions. In that same vein, the TD First Class Travel ® Visa Infinite* has a points calculator to help you decide if your spending and this credit card are good for your situation.

Let’s set the scene. You are an average Canadian family who might spend $14,000 on groceries this year, or $1,166.66 a month. You might also fill up at least one car once a week. According to StatsCan, the Canadian average fuel price for unleaded gas at a self-service station was $1.616 at the beginning of Summer 2023. If you fill up your car once a week, you spend $419.84 a month on gas for a 60 L fuel tank. How many points would you earn with the TD First Class Travel ® Visa Infinite* ?

With the average spending on gas and groceries alone, you could earn 194,245 points in the first year including the welcome offer. That is $971 in travel dollars. Plus, you only ate and gassed up the car. If you have other expenses on the card, your first-year points total can be higher.

Remember, the spending amounts and points earned are for demonstration purposes only. Actual points accrual depends on your individual shopping habits. Use the TD points calculator to estimate how many points you could earn in the first year.

Earn points on the little things

- 8 TD points/$1 Expedia for TD bookings

- 6 TD points/$1 on groceries & restaurants

- 4 TD ponts/$1 on recurring bill payments

- 2 TD points/$1 on all other card purchases

The TD First Class Travel Visa Infinite * lets you earn 2 TD points for every $1 spent. It’s a nice ratio. If you book travel with your card through Expedia for TD , you earn 8 TD points for every dollar spent. Then, you earn 6 TD points per $1 spent on groceries and restaurants and 4 TD points on recurring bill payments on your account.

If you use your card at Starbucks, you earn 50% more TD points and 50% more Stars at Starbucks. This feature is about lifestyle. Even if you don’t want to travel yet and don’t always get Starbucks, the card lives up to its slogan of ‘Earn points on the little things.’ Plus, your points do not expire so you can save them for all things big and small.

Redeeming your TD points

Thankfully, your TD points are redeemable in really extensive ways. You can use the points to buy gift cards or merchandise off of TD Rewards. They have weekly deals where you can get merchandise for less points. If you want a financial reward, you can use your points to pay off some or all of your TD credit credit card balance. Also, you can use your points to book travel with Expedia for TD.

TD First Class Travel ® Visa Infinite* is your Canadian Amazon credit card

- Redeem TD Points on Amazon.ca with Amazon Shop with Points

You don’t need to get the Amazon credit card, because you can use your TD First Class Travel Visa Infinite* card on Amazon and redeem your TD points for merchandise. That is right, the Amazon points you’ve always wanted are TD points. Of course, there are more details, but you can exchange your points on Amazon for free stuff.

What is Expedia for TD?

- Earn & redeem TD Points on Expedia for TD

- No blackout dates

Finally! Expedia for TD is a travel booking site that allows travellers to use their TD Rewards points with an Expedia-like experience. It is exclusive to TD credit card holders and the site often has exclusive deals. Plus, it is a great way to spend and earn TD points simultaneously. You earn 8 TD Points/$1 when you book travel through Expedia for TD. There are no blackout dates and you can modify your plans easily.

TD First Class Travel ® Visa Infinite* insurances

If you read Hardbacon credit card reviews, you know that we take a deep look at the insurances you get with your card. The TD First Class Travel ® Visa Infinite * is a travel affinity card, so it should stand out for all-things travel-related. In terms of insurance, it has the requisite ones. Let’s take a look:

- Travel medical insurance

- Trip cancellation/interruption

- Flight/trip delay

- Delayed or lost baggage

- Common carrier accident

- Auto Rental Collision/Loss Damage Insurance

And that is on top of their Emergency Travel Assistance Services and a $100 Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

First, a word about TD’s online travel insurance tool

TD and its online tools are outmaneuvering the competition. This is the first time I’ve found an online tool that shows me my credit card insurance coverage based on the card I use, the number of people I am travelling with, and the duration of the trip. It makes it easier for me to decide if I need extra travel insurance or if I should split my trip costs over different TD credit cards.

Travel emergency medical insurance

TD offers a solid but average emergency medical insurance policy. If I travel with my spouse or dependents, each one of us is eligible for $2,000,000 per trip. Of course, not every procedure is guaranteed a payout. As with every medical insurance plan, it covers eligible procedures and services. You have to check what is accepted before agreeing to the treatment. Your coverage is good for 21 days as long as you or any of the other travellers is under age 65. If you travel with someone over age 65 and they are a spouse, child, or the primary cardholder, they are only covered with TD’s emergency medical insurance for only the first 4 days.

Trip cancellation/interruption insurance and flight/trip delay

That handy online tool shows that you can have up to 5 travellers in your party and that your trip cancellation insurance is a maximum of $5,000. Per person, there is a $1,500 coverage. However, your maximum trip coverage is $5,000. If you are more than 5 people travelling and you are paying with one card, you might want to buy extra cancellation insurance.

Trip interruption insurance is slightly more generous. Each person has a $5,000 interruption policy. Again, the maximum for the trip for all persons combined is $25,000. Yet another instance of checking what is best for you and maybe buying extra travel interruption coverage.

Your flight/trip delay insurance covers up to $500 per insured person if your flight/trip is delayed for over 4 hours.

Delayed or lost baggage insurance

It’s true that not every credit card offers this type of coverage. TD First Class Travel ® Visa Infinite* cardholders have $1,000 in insurance coverage per person if their baggage is delayed more than 6 hours or if it is lost. Again, this is OK coverage.

Common carrier accident insurance

This is a terrible what-if scenario. If you are or one of your dependents is on a common carrier like a bus, train, ferry, rented car, cruise ship, limousine, or plane and it is involved in an accident, you are covered. You are eligible for up to $500,000 of coverage for covered losses. The amount depends on your injuries.

TD First Class Travel ® Visa Infinite* and auto rentals

If you book your auto rental with your TD First Class Travel ® Visa Infinite* credit card, you are covered for 48 consecutive days. If you are in an accident, the driver must not be legally intoxicated and there must have been no violation of the rental agreement by the primary cardholder.

You also benefit from a great rate through Avis auto rentals. When you use your TD First Class Travel ® Visa Infinite* credit card, you save a minimum of 10% off the lowest available base rates in Canada and the U.S. If you rent a car outside of Canada and the US, the minimum is 5% off the lowest base rate available at participating Avis or Budget locations.

TD First Class Travel ® Visa Infinite* ’s other benefits

Other than everything listed already, having a TD First Class Travel Visa Infinite* credit card means that you can do the following as well:

- Sign up for TD Auto Club membership, where you get 24-hour road assistance

- Purchase security and extended warranty protections

- Instant fraud alerts

- Mobile device insurance up to $1,000

- Hotel/Motel Burglary Insurance up to $2,500

- Access to the TD app

- Click to pay

- Optional balance protection insurance

- The choice to set up structured payment plans

The most interesting thing to me is the click-to-pay feature and instant fraud alerts. It keeps pace with how customers expect banks to use technology to enable easy transactions but also immediate contact if fraud is suspected. Basically, it is a sign of good service.

Who is the TD First Class Travel ® Visa Infinite* credit card good for?

The base earn rate of the TD First Class Travel Visa Infinite is a decent 2 points per $1 spent, with more aggressive points for grocers, restaurants, travel and recurring bills. The insurance is decent, too.

OK, but the real advantages kick in if you use the card to book travel. You redeem fewer points for travel if you do it through Expedia for TD, a site exclusive to TD credit card customers. Plus, if you book travel with your TD card, you have access to excellent online tools to calculate how much insurance you have from your card.

Furthermore, using your card for everyday purchases stretches your dollar on two key sites: Amazon.ca and Starbucks. Hear me out: Amazon is a retail behemoth in Canada, and Starbucks is also a near-daily retail destination.

Amazon lets you use TD points for Amazon purchases. The same goes for Starbucks, but in reverse. You earn 50% more points when you buy Starbucks with your credit card.

This card makes good in its promise to earn points on the little things. If you want to travel and don’t want to use Aeroplan, this travel card is a good choice. If you are interested in Amazon purchases and love your Starbucks, this is the only card for you.

TD First Class Travel ® Visa Infinite* Rating

Benefits and perks of the td first class travel ® visa infinite*.

- Redeem TD points on Amazon.ca

- Earn 50% more TD points when you use your card at Starbucks

- Accelerate points earning for travel with Expedia for TD, food, and recurring bills

- 2 points for every $1 spent on everyday purchases

- Points never expire

- No travel blackout dates

- Welcome Offer up to 135,000 TD Rewards points

- Annual fee for the primary card rebated for the first year

- Decent purchase interest rate and cash advance interest rates

- Comprehensive travel insurances including emergency medical, trip interruption, and trip cancellation

- Fantastic online tools to estimate points calculation as well as travel insurance coverage

For complete and current information about any product, please visit the provider’s website. Terms and conditions apply.

Stefani Balinsky

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Points Programs

Hotel programs, best credit cards.

TD First Class Travel® Visa Infinite* Card

Updated on: June 4, 2024

{post.custom_fields.card_benefits_0_b_title}

{post.custom_fields.card_benefits_1_b_title}, {post.custom_fields.card_benefits_2_b_title}, application must be approved by september 3, 2024 to receive this offer, signup bonus:.

20,000 TD Rewards Points upon first purchase† 55,000 TD Rewards Points upon spending $5,000 within 180 days of account opening† Total of up to 75,000 TD Rewards Points†

Interest rates:

20.99% purchase 22.99% cash advance (20.99% in Quebec) 22.99% balance transfer (20.99% in Quebec)

Earning rate:

8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD† 6 TD Rewards Points† per dollar spent on eligible groceries and restaurant purchases† 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account† 2 TD Rewards Points† per dollar spent on all other eligible purchases†

The TD First Class Travel ® Visa Infinite * Card is one of the most popular credit cards that allows you to earn points in the bank's proprietary TD Rewards program. With regular high-volume welcome bonuses, a strong return on travel purchases booked through Expedia, and a competitive insurance package, the TD First Class Travel ® Visa Infinite * Card is a solid choice to incorporate into your TD credit card strategy.

Bonuses & Fees

- 20,000 TD Rewards Points upon first purchase †

- 55,000 TD Rewards Points upon spending $5,000 within 180 days of account opening †

Earning Rewards

- 8 TD Rewards Points † per dollar spent on travel booked through Expedia ® for TD †

- 6 TD Rewards Points † per dollar spent on groceries and restaurants †

- 4 TD Rewards Points † per dollar spent on recurring bills and purchases †

- 2 TD Rewards Points † per dollar spent on all other purchases †

Redeeming Rewards

The best way to redeem TD Rewards Points is by booking travel through Expedia ® for TD, an online travel portal operated in partnership with Expedia ® . You can book flights, hotels, car rentals, vacation packages, and anything else that you would normally be able to book via Expedia ® . You'd apply your TD Rewards Points to the purchase at a rate of 200 points = $1, or 0.5 cents per point. If you'd rather not book through Expedia ® for TD, you can also redeem TD Rewards Points directly against any travel purchase that you purchase with your TD First Class Travel ® Visa Infinite * Card. However, the rate isn't quite as competitive at 250 points = $1, or 0.4 cents per point. Redeeming for statement credits or gift cards is also possible, although the rate is even less appealing at 400 points = $1, or 0.25 cents per point. Generally speaking, you should always strive to redeem your TD Rewards Points for travel through Expedia ® for TD whenever possible, in order to maximize their value. TD Rewards Points never expire as long as you're a cardholder. † If you cancel or switch your card to a different product, you'll have 90 days' time to redeem your TD Rewards Points before they go away. However, you'll lose the ability to book through Expedia ® for TD for 0.5 cents per point, and you'll be limited to redeeming against any travel purchase for only 0.4 cents per point.

Perks & Benefits

TD First Class Travel ® Visa Infinite * cardholders are eligible to earn a $100 credit † on accommodations and vacation packages booked through Expedia ® for TD. † This benefit is available annually to cardholders, and notably does not include flights. However, it certainly helps to offset the $139 annual fee that the card commands, beginning in the second year. Cardholders can also get car rental discounts at Avis and Budget: 10% in Canada or the US, and 5% internationally. †

Insurance Coverage

As one of TD's flagship travel rewards credit cards, the TD First Class Travel ® Visa Infinite * Card offers a strong set of insurance provisions. The card comes with 21 days of travel medical insurance of up to $2,000,000 for travellers aged under 65, and four days of coverage for travellers aged 65+. † There's also trip cancellation and trip interruption insurance of up to $1,500 and $5,000 per person, up to a maximum of $5,000 and $25,000 per trip, respectively. † While flying, cardholders are covered for up to $500 in flight delay insurance and an aggregate amount of $1,000 for lost, stolen, or delayed baggage. † And when making purchases, the card offers extended warranty of up to one additional year, as well as purchase protection that insures you against damage or theft of an item for up to 90 days after your purchase. † Lastly, it also comes with Mobile Device Insurance. By paying for your smartphone, tablet, or smartwatch using your TD First Class Travel Visa Infinite Card, you’ll get coverage of up to $1,000 in the event your mobile device is lost, stolen, or accidentally damaged, for up to 24 months! †

† Terms and conditions apply.

† The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Share this post

Copied to clipboard!

Prince of Travel is a non-traditional, full service travel concierge designed exclusively for companies and individuals who require exclusive travel arrangements. We handle the nuances of travel ensuring a seamless and extraordinary journey from start to finish.

Join the Prince Collection newsletter to get weekly updates delivered straight to your inbox.

Book your travel

Let Prince Collection’s Travel Concierge handle your exclusive travel arrangements. Get started by filling out some basic info about your trip.

- Credit Cards

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel Vs. TD Aeroplan: Which Is Better?

Updated: Jun 25, 2024, 7:41am

Table of Contents

What is td first class travel, earning rewards, what is td aeroplan, td first class travel vs td aeroplan: which to choose, td first class travel and td aeroplan cards comparison, td first class travel vs. td aeroplan.

One bank, two rewards programs. If you’re looking for a travel rewards card with TD Bank, you’ll have the choice between one of the many TD Aeroplan cards they offer and a TD First Class Travel Visa Infinite. But how do you know which one will benefit you the most? We break down the differences between these two types of travel cards.

Featured Partner Offer

TD® Aeroplan® Visa Infinite Privilege* Card

On TD’s Website

Welcome Bonus

Up to $2,700 in value† including up to 75,000 Aeroplan points†

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

American Express® Aeroplan®* Card

On American Express’s Secure Website

Up to 50,000 Aeroplan points

Regular APR

30% (charge card)

- TD® Aeroplan® Visa Infinite* Card

Up to $1,000 in value† including up to 40,000 Aeroplan points†

TD First Class Travel isn’t really the name of a rewards program with TD. Rather, it refers to a specific credit card TD issues: the TD First Class Travel Visa Infinite . This card and several others from TD earn TD Reward points.

TD Reward points are exclusive to TD and are specifically linked to TD credit cards , meaning you won’t find them anywhere else. TD Reward points use a fixed-value points system, ensuring they can be redeemed consistently across various redemption options. This feature makes them good for covering incidental travel expenses like boutique hotel bookings, vacation rentals and other travel-related expenses.

How Many TD First Class Travel cards does TD offer?

TD only offers one TD First Class Travel card: the TD First Class Travel Visa Infinite Card.

It does offer a few other credit cards that earn TD Rewards points, including:

- TD Platinum Travel Visa

- TD Travel Rewards Visa

- TD Business Travel Visa

TD First Class Travel Rewards

Pros of td first class travel.

- Earn up to 8 points per dollar on select spending

- Points can be redeemed through multiple travel booking sites, including Expedia for TD

- Includes travel insurance

Cons of TD First Class Travel

- TD Rewards points are exclusive to TD Bank

- Must earn either $60,000 in annual personal income or $100,000 in annual household income to be eligible for this card

Redemption Options for TD First Class Travel

TD Rewards points can be redeemed for Amazon.ca purchases, Starbucks Rewards Stars and gift cards. You can also redeem TD Rewards points for travel bookings, like flights , hotels and car rentals, on any site through the TD Book Any Way option on any travel booking website or on Expedia For TD. You can also use your TD Reward points for a statement credit or for continuing education credits.

TD Aeroplan refers to credit cards issued by TD Bank that earn Aeroplan points. Aeroplan was originally designed as a loyalty program for Air Canada customers but changed hands several times over the years. 2018 Air Canada repurchased the program and reintroduced it in 2020.

Following its relaunch, Aeroplan focused on flexible rewards and expanded, adding a wide range of airline and retail partners to its network and removing fuel surcharges. Aeroplan credit cards are issued by TD Bank but are also issued by CIBC and American Express .

How Many TD Aeroplan cards does TD offer?

TD currently offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite

- TD Aeroplan Visa Platinum

- TD Aeroplan Visa Infinite Privilege

- TD Aeroplan Visa Business

TD Aeroplan Rewards

Pros of td aeroplan.

- Generous welcome bonus

- Points can be used for various items, including travel, merchandise, gift cards, and statement credit.

- Many partner retailers earn more points

- Business card option

- Cards include other travel perks, like travel insurance

Cons of TD Aeroplan

- The most benefits for redemption are with Air Canada

- All TD Aeroplan cards have an annual fee

- Lower earn rates than the TD First Class Travel card.

- Some Aeroplan cards have income eligibility requirements.

- You must fly Air Canada when redeeming Aeroplan Points.

Redemption Options for TD Aeroplan Credit Cards

Aeroplan points can be used for everything from booking flights and vacations with Air Canada to flights on partner airlines, hotel rooms, and car rentals. You can also redeem your Aeroplan points for merchandise, gift cards, and statement credit.

In order to take a closer look and help us choose between choose a TD First Class Travel Visa and a TD Aeroplan card, let’s review some of the facts.

Best for frequent flyers

Td first class travel® visa infinite* card.

Up to $700 in value†, including up to 75,000 TD Rewards Points†

$139 (fee rebated in the first year)

Think of the TD First Class Travel Visa Infinite Card as a cheaper step down from its higher-flying cousins on this list. Packed with travel benefits, but lacking a heavyweight rewards program, this card is really aimed at frequent fliers rather than high spenders who also like to travel.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

- Earn up to $700 in value†, including up to 75,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year†.

- To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

Best for earn rates

Thanks to the TD Aeroplan Visa Infinite Card ’s robust Aeroplan rewards program, cardholders can earn roughly twice what they’d net through any of the other cards on this list, although its travel insurance coverage leaves something to be desired.

- Great rewards program earnings

- Plenty of perks, including comprehensive travel insurance and a NEXUS rebate

- High annual fee

- Earn up to $1,000 in value†, including up to 40,000 Aeroplan points† and additional travel benefits. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†.

- Enroll for NEXUS and once every 48 months get an application fee rebate†.

- Plus, share free first checked bags with up to 8 travel companions†.

- This offer is not available to residents of Quebec.

Best For Aeroplan Points with Low Annual Fee

Td® aeroplan® visa platinum* card.

Up to $500 in value†

$89 (first year of annual fee rebated)

The TD Aeroplan Visa Platinum Card shares many lots of the same features seen in premium cards that cost five times the annual fee. However, it does lack a bit in the insurance department.

- Decent travel and consumer protection benefits

- Allows cardholders to earn Aeroplan Points twice

- Low annual fee that’s rebated the first year

- Lower insurance coverage than other Aeroplan cards

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

- Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†.

- Get an annual fee rebate for the first year†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

Best For Exclusivity

True to its name, the TD Aeroplan Visa Infinite Privilege Card is exclusive and expensive, but brings to bear a broad array of perks and benefits, along with a surprisingly accessible credit score threshold.

- Extensive travel perks, insurance and consumer protections

- Low credit score threshold for such a powerful card

- The most expensive annual fee on the list

- Requires minimum personal income of $150,000 a year or $200,000 in annual household income

- Earn up to $2,700 in value† including up to 75,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†

- Earn an additional 25,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†

- Share first free checked bags with up to 8 travel companions† and get unlimited access to Maple Leaf Lounges†, including complementary access for one guest.

- Plus, primary card holders get 6 complimentary worldwide select airport lounge visits annually through the Visa Airport Companion Program†.

- †Terms and conditions apply.

Best Aeroplan Card for Business Owners

Td® aeroplan® visa* business card.

Up to 65,000 Aeroplan points

This card is a must for business owners , especially those who travel. With exclusive perks and benefits starting at the airport, insuring you at take-off and at your destination with a robust travel insurance package and even providing discounts when you rent a car, you’ll feel like someone’s rolling out the red carpet for you on every business trip.

- High earn rate, especially on essential categories for business

- Travel perks like travel insurance and priority check-in and boarding

- $149 annual fee

- Limited travel benefits compared to other premium cards

- Limited acceptance outside of Aeroplan and Air Canada partners

- Earn up to $1,850 in value† including up to 65,000 Aeroplan points, no annual fee for the first year, and additional travel benefits†. Accounts must be opened by January 3, 2024.

- Get an annual fee rebate for the first year for the primary cardholder and two additional cardholders†.

- Share free first checked bags and get access to Maple Leaf Lounges†.

- Earn 2 points for every dollar spent on eligible purchases made directly with Air Canada® including Air Canada Vacations®.

- Earn 1.5 points for every dollar you spend on eligible purchases for travel, dining and select business categories such as shipping, internet, cable and phone services made on your Card.

- Earn 1 point for every dollar you spend on all other eligible purchases on your Card.

- Earn 50% more points at Starbucks when you link your TD card with your Starbucks® Rewards account.

With this in mind, the decision comes down to how you want to book travel, what you’re using the card for, what the decision comes down to is how you want to book travel, what you’re using the card for and how you like to redeem your points.

If you prefer to book travel through Expedia or other platforms, you’re better off choosing the TD First Class Travel card. If you prefer to book through Air Canada, you’ll likely get more value from an Aeroplan card.

The TD First Class Travel Visa Infinite Card is better if you prefer to redeem points for Amazon purchases or at Starbucks. However, if you’d rather redeem points for merchandise, an Aeroplan card might be worth considering.

That said, if you plan to use this card for business purposes, the TD Aeroplan card is best since the TD First Class Travel Visa Infinite is a single card you’re planning to use this card for business purposes, the TD Aeroplan card is best since the TD First Class Travel Visa Infinite is a single card and is meant for individuals, not businesses.

- Best Travel Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Aeroplan Credit Cards

- Best Air Miles Credit Cards

- Best Hotel Credit Cards

- Best No Annual Fee Credit Cards For Travel

- Best Credit Cards for Travel Insurance

- Best Credit Cards for Roadside Assistance

- Best Credit Cards For International Travel

- Best Credit Cards for Road Trips

- American Express Cobalt Review

- American Express Centurion Black Card Review

- TD Aeroplan Visa Infinite Privilege Review

- TD First Class Travel Visa Infinite Card

- RBC Avion Visa Infinite Review

- MBNA Rewards World Elite Mastercard

- Scotiabank Passport Visa Infinite Review

- TD Aeroplan Visa Platinum Card Review

- Cathay World Elite Mastercard Review

- BMO Air Miles World Elite Mastercard Review

- Platinum Card From American Express Review

- TD Platinum Travel Visa Card Review

- American Express Aeroplan Card Review

- American Express Green Card Review

- Scotiabank Gold American Express Card

- Scotiabank Platinum American Express Card

- American Express Gold Rewards Card Review

- Scotia Momentum Visa Infinite Review

- Marriott Bonvoy American Express Card Review

- National Bank World Elite Mastercard Review

- Brim World Elite Mastercard Review

- RBC Avion Visa Infinite Business Review

- National Bank Platinum Mastercard

Air Canada Aeroplan: The Ultimate Guide

- How To Redeem Aeroplan Points

- Foreign Transaction Fees: How To Avoid Them

- How Much Is The Amex Platinum Foreign Transaction Fee?

- How To Use Google Flights To Find Cheaper Flights

- Credit Card Travel Insurance Vs. Separate Travel Insurance

- The Amex Platinum Travel Insurance Guide

- American Express Fine Hotels + Resorts: Everything You Need To Know

- All You Need To Know About The New Air Miles

- Expedia For TD: Is It Worth It?

- Are Travel Credit Cards Worth It For Non-Aspirational Travellers?

- How To Pick A Hotel Credit Card

- Credit Cards With A Free Hotel Night

- Transfer Holiday Debt to Credit Card

More from

A guide to the air miles reward program in canada, everything you need to know about the new air miles, 5 ways to save money on your next airfare purchase, what’s the best day & time to book flights, what is premium economy (and is it worth it).

Courtney Reilly-Larke is the deputy editor of Forbes Advisor Canada. Previously, she was the associate editor of personal finance at MoneySense. She was also managing editor of Best Health Magazine and has contributed to publications such as Cottage Life and Blog TO. She currently lives in Toronto.

TD Aeroplan Visa Infinite Travel Insurance

Natasha Macmillan, Business Unit Director - Everyday Banking

Insurance summary

Select an insurance type.

- Travel Accident Insurance

Car Rental Insurance

Purchase security, extended warranty, trip cancellation, trip interruption & delay, flight delay, travel medical emergency, lost baggage insurance.

- Delayed Baggage Insurance

View Other Insurance Pages

- BMO World Elite MasterCard Travel Insurance • BMO Rewards Credit Cards • Value of a BMO Rewards Point

- BMO Air Miles World Elite Travel Insurance • Air Miles Credit Cards • Value of an Air Mile

- TD First Class Travel Visa Infinite Travel Insurance • TD Points Credit Cards • Value of a TD Point

- Starwood Preferred Guest Travel Insurance • American Express Credit Cards • Value of a Starpoint

- American Express Gold Rewards Travel Insurance • American Express Credit Cards • Value of a Membership Rewards Point

- American Express AeroplanPlus Gold Insurance • American Express Credit Cards • Value of a Membership Rewards Point

- Scotiabank Gold American Express Travel Insurance • Scotiabank Rewards Credit Cards • Value of a Scotia Reward Point

- CIBC Aerogold Visa Infinite Travel Insurance • Aeroplan Miles Credit Cards • Value of an Aeroplan Mile

- CIBC Aventura Visa Infinite Travel Insurance • Aventura Credit Cards • Value of an Aventura Point

- RBC Visa Infinite Avion Travel Insurance • RBC Rewards Credit Cards • Value of an RBC Reward Point

- WestJet RBC World Elite MasterCard Travel Insurance • WestJet Dollars Credit Cards

- National Bank World Elite Mastercard Travel Insurance • National Bank Credit Cards

The knowledge bank

A wealth of knowledge delivered right to your inbox., making dollars make sense, other card types.

- No foreign transaction fee

Travel programs

- Aeroplan Miles

- American Express Rewards

- Aventura Points

- Marriott Bonvoy Points

- Scotia Rewards

- WestJet Dollars

- American Express

- Canadian Tire

- National Bank

- Neo Financial

- Refresh Financial

Calculators

- Aeroplan Miles Calculator

- Air Miles Calculator

- TD Points Calculator

- MBNA Reward Points Calculator

- BMO Rewards Points Calculator

Credit Card Basics

- How Credit Cards Work

- Credit Card Interest Fees

- Credit Card Fees

- Credit Card Applications

- Credit Card Companies

- Credit Card Alternatives

Types of Rewards Credit Cards