Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

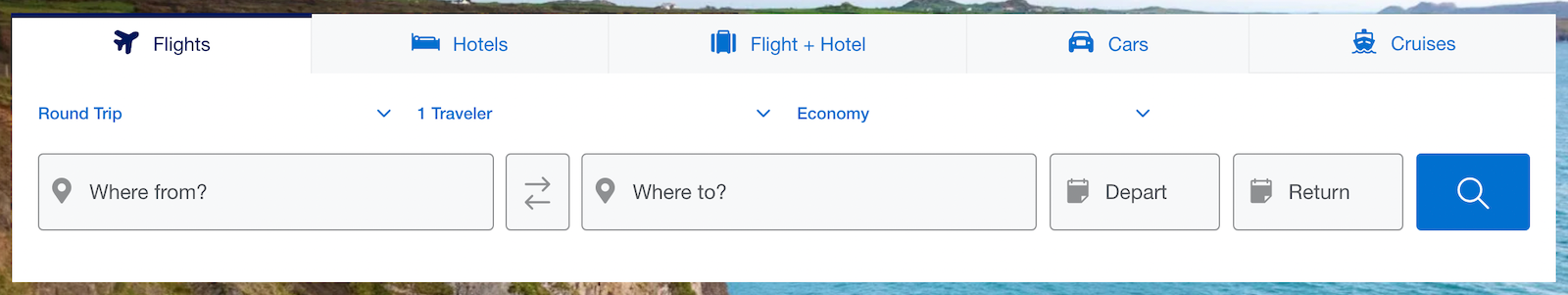

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

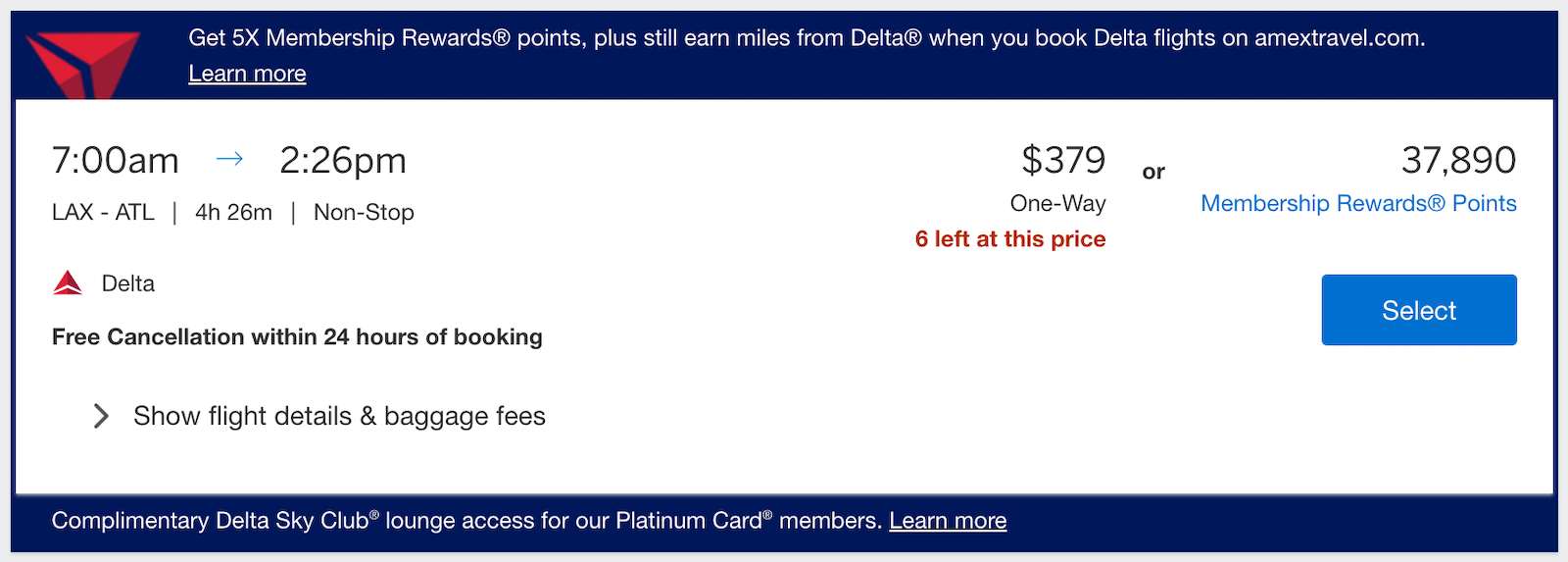

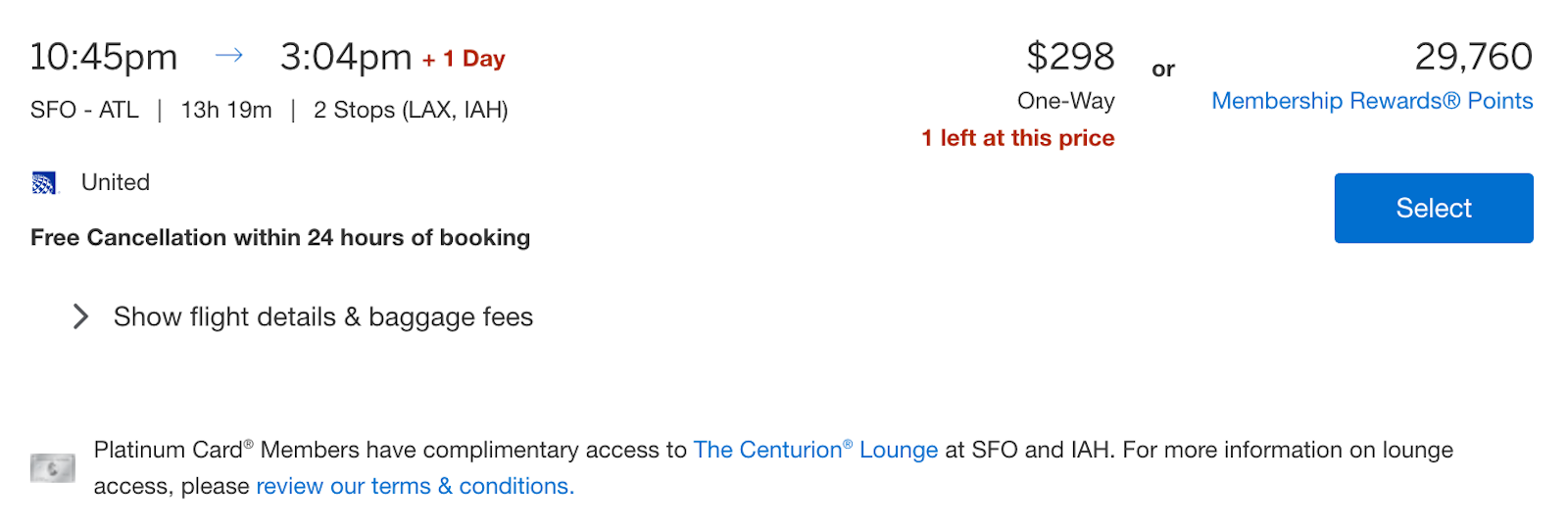

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

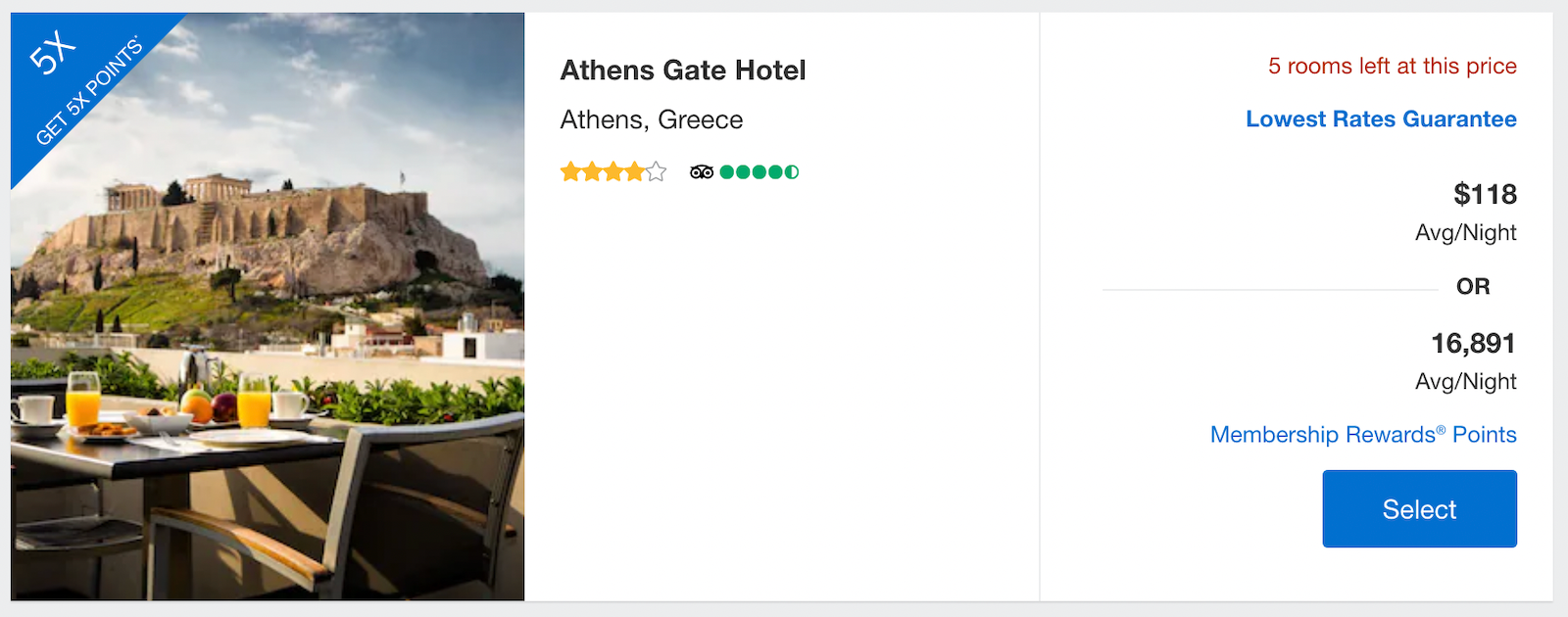

How to book hotels on the Amex Travel portal

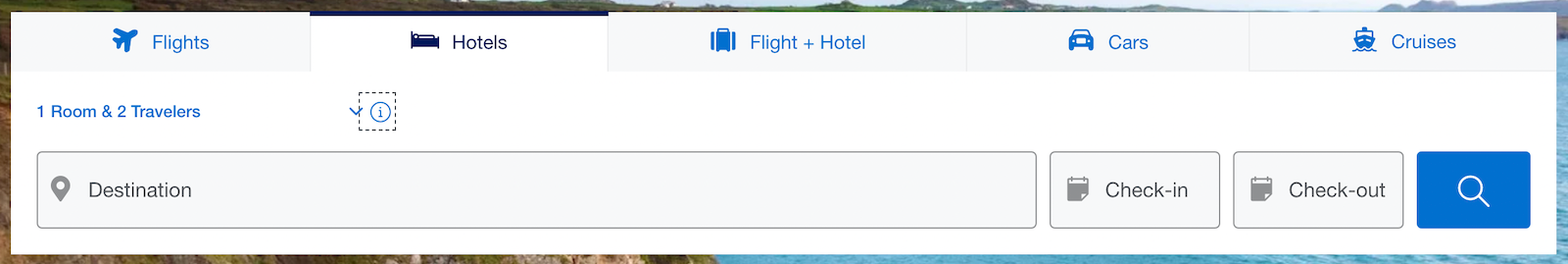

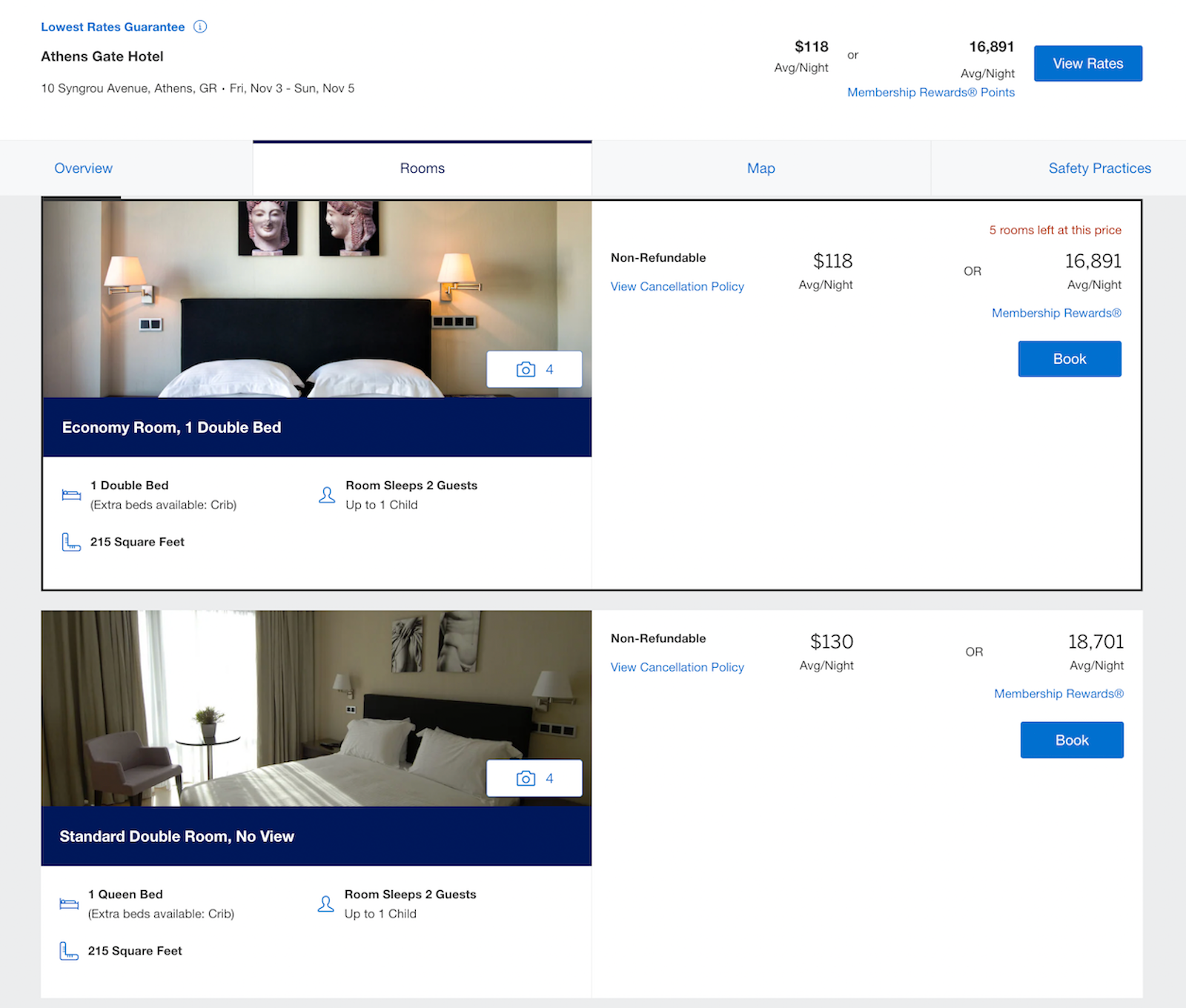

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

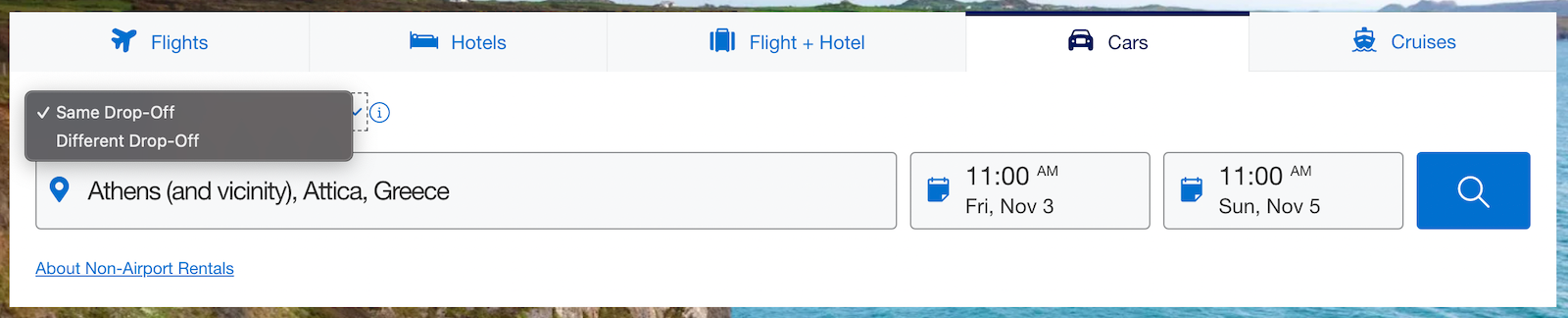

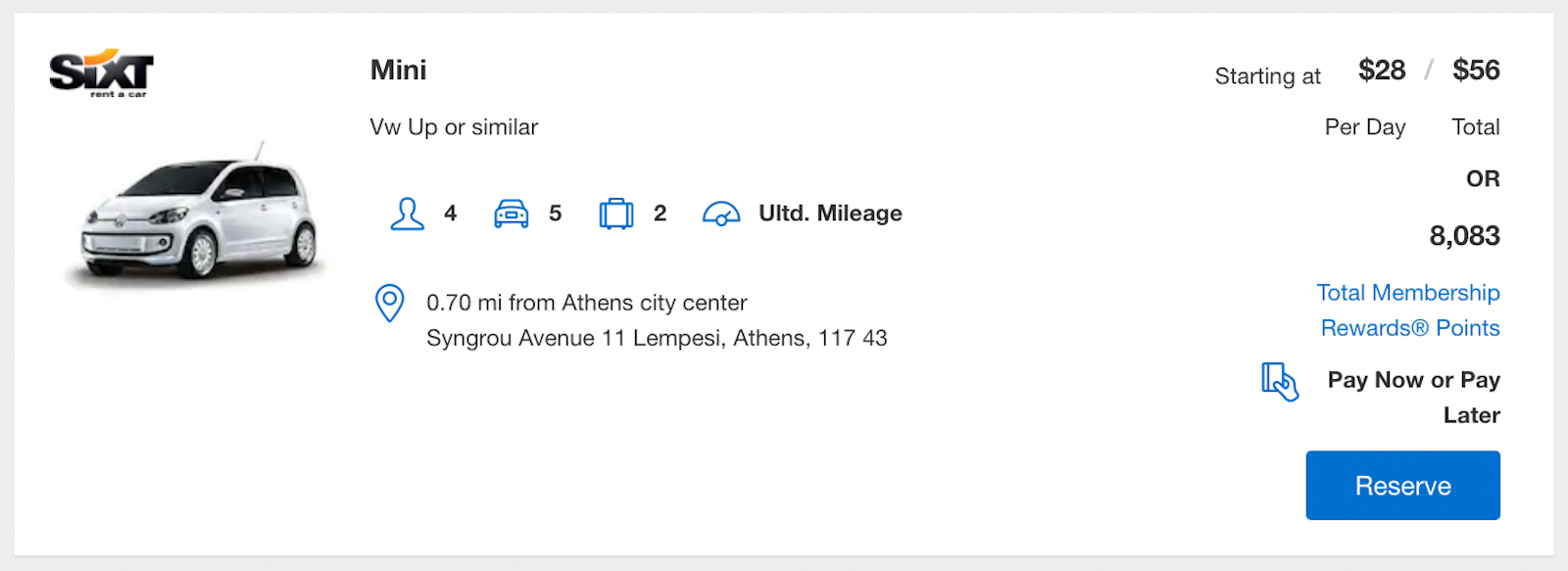

How to book rental cars and cruises on the Amex Travel portal

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

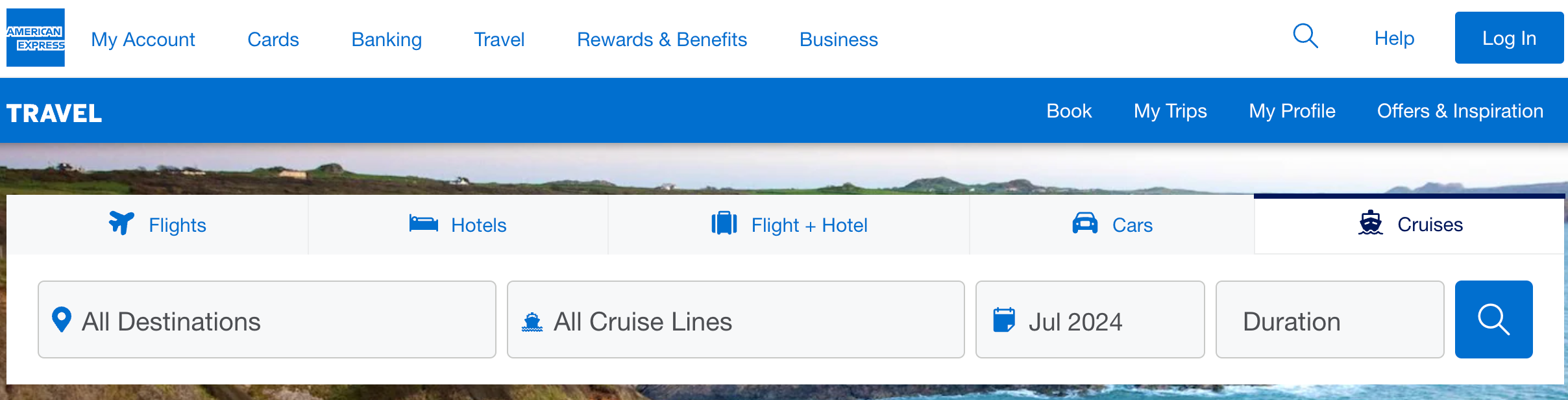

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

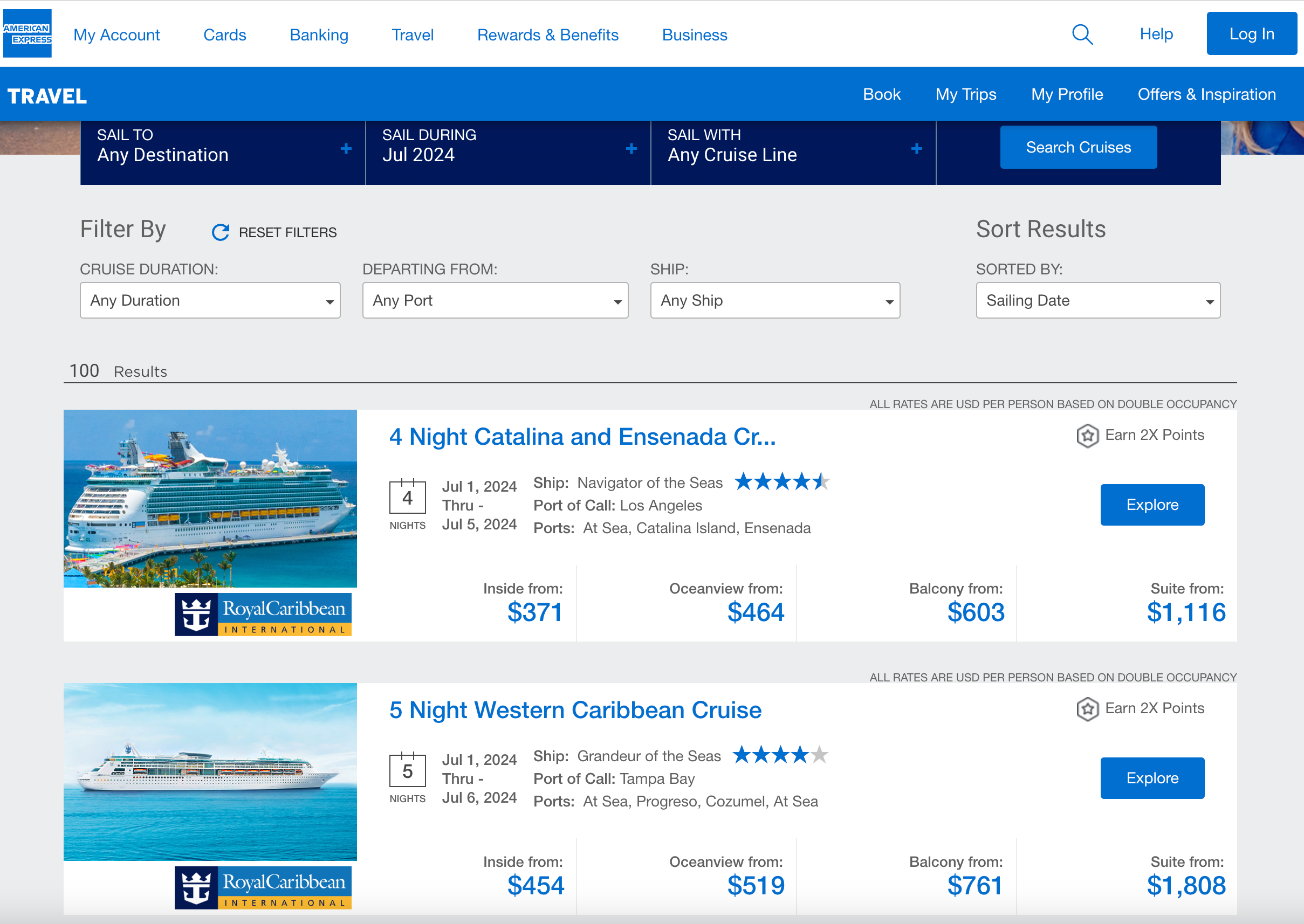

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.

First, using Amex Membership Rewards points on Amex Travel may not provide the best value compared to transferring points to airline or hotel loyalty programs. The Pay with Points feature typically values points at 0.7 to 1 cent per point, which is far lower than our 2-cent valuation .

Additionally, the prices on Amex Travel may not always be the most competitive, so we recommend checking other platforms like Google Flights before booking your travel. Also, booking directly with hotels is advised for those seeking to utilize elite status benefits.

When you need to change your upcoming trips booked through Amex Travel, it can get complicated. You may encounter change and cancellation fees, often around $75, and making a change requires a phone call. Flight credit vouchers from cancellations can only be used for rebooking through Amex Travel via phone.

On the positive side, Amex Travel allows a 24-hour cancellation window for most reservations, and booking flights through the site generally still qualifies for earning miles and status with airline loyalty programs.

Related: Redeeming American Express Membership Rewards for maximum value

Bottom line

American Express Travel offers an array of booking options, including the ability to earn bonus Membership Rewards points on select purchases. Although you can use your points to book hotels, flights, rental cars and cruises through Amex Travel, you can get more from your points when you transfer them to Amex's airline and hotel partners .

However, there are exceptions, such as when there is no award availability for last-minute travel. In addition, Amex Travel offers perks like discounted premium flights, added benefits with Amex Fine Hotels + Resorts and a user-friendly interface. And with a simple redemption scheme that doesn't involve complicated loyalty programs and transfer partners, many Amex cardholders prefer it when planning their trips.

Additional reporting by Ryan Patterson and Kyle Olsen.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

American Express Travel: Your Guide to Booking Flights, Hotels, Car Rentals, & Cruises

Jarrod West

Senior Content Contributor

440 Published Articles 1 Edited Article

Countries Visited: 21 U.S. States Visited: 24

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3109 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

What Is AmexTravel.com?

Fees for using the portal, searching for flights, insider fares, the hotel collection, american express fine hotels and resorts, standard hotel booking, searching for packages, compare flights+hotel to booking separately, searching for cruises, special offers, cruise privileges program, amextravel.com insiders, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

American Express is best known as a credit card issuer, but the company also offers other products and services, including travel booking and planning using AmexTravel.com.

While AmexTravel.com is available for anyone (not just cardmembers), holding an Amex card can definitely help you get extra value when using the program.

Here’s a look at what AmexTravel.com is, what services it provides, what the cost to use, the best ways to use it, and when it’s worth using!

At its most basic, AmexTravel.com is an online travel booking portal (or “online travel agency”) just like Expedia , Kayak , and Orbitz .

You can use it to book a whole trip or just a flight, hotel (or flight + hotel packages), rental cars, or even cruises. If you’d like extra assistance from a customer service agent, you can book by phone as well.

Flights booked through the portal can be subject to small fees. However, sometimes the benefits can make these fees worth it, and they’re waived for holders of the Platinum Card ® from American Express .

There are also a few “sub-categories” that fall under the AmexTravel.com umbrella, including the Hotel Collection and Fine Hotels and Resorts .

Why Should You Use AmexTravel.com?

The main reason to book with AmexTravel.com is the incredible customer service . If you run into any problems during your trip (like delays, cancellations, over-bookings, etc.), you can connect with a live travel agent by phone 24/7 who will work with you to find a solution.

Additionally, if you hold an Amex credit card that earns Membership Rewards points, you can often earn 2x points or more by using it to pay for travel services booked through AmexTravel.com.

Hot Tip: If you use your Amex Platinum card , you can earn 5x Membership Rewards points on flights booked directly with airlines or with AmexTravel.com.

Anytime you book a flight through AmexTravel.com (either on its own or as part of a package), you’ll pay a fee of $6.99 for domestic flights and $10.99 for international flights .

These fees are waived if you have the Amex Platinum card and are logged into your account.

If you choose to book a flight by phone rather than online, there’s an added $39 phone service fee .

If you make changes to your flight, there’s a $39 reissue fee in addition to whatever fee the airline charges. This only applies to advance changes, not changes due to problems like canceled flights .

Below, we’ll take a look at how to use AmexTravel.com to book flights, hotels, vacation packages, rental cars, and cruises.

Booking Flights With AmexTravel.com

Searching for flights with AmexTravel.com is similar to other online travel agencies. You can search by city or by specific airport, select your departure and return dates, and click whether you want to search for lower fares within 3 days of your chosen dates.

On the results page, American Express lists the most relevant Delta result at the top highlighted as a “featured airline.” The featured airline is followed by the lowest available fares.

When you scroll down, you can use the controls on the left sidebar to filter the results by the number of stops, departure/arrival times, airline, or even specific flight number.

By default, flights are displayed in price order starting with the lowest, except for a featured Delta flight at the top (when available). At the top of the search window above the results, all available airlines are shown, as well as the lowest available price with each airline.

Depending on your search, you may see a blue tab labeled “Insider Fares Available” above some of the airlines listed at the top of the search window.

These are discounted fares, and they only apply if you pay for the entire flight with Membership Rewards rather than cash. Note that cash prices are rounded to the nearest dollar.

If you’re logged in and have enough Membership Rewards points to cover the entire flight, you will be able to see these discounted fares.

For example, in the below search, you’ll see an example of an Insider Fare available for purchase. The Insider Fare offered a slight discount rather than just matching the cash price in points with each point worth 1 cent (more on that below).

The difference can be fairly minimal. In the JFK-ATL example above, the discount was from 25,259 Membership Rewards points to 24,120 — changing the value from 1 cent per point to about 1.05 cents per point .

Amextravel.com charges a fee to book, but they bundle this into the displayed price. The fee is $6.99 per domestic ticket or $10.99 per international ticket. These fees are waived as a benefit of the Amex Platinum card , just make sure you’re logged into your Amex account when booking.

Hot Tip: AmexTravel.com now offers Trip Cancel Guard coverage that you can add when purchasing flights via AmexTravel.com whether paying with an American Express card, with Membership Rewards points using the Pay With Points option, or a combination of both. It provides for reimbursement of up to 75% of the cost of the non-refundable prepaid flight expense, penalty and change fees caused by the cancellation, or the amount of any expired vouchers/flight credits received for the canceled flight. Coverage is applicable when your flight is canceled for any reason and is valid until 2 full calendar days prior to your trip’s originally scheduled departure date.

When searching several different flights across different online travel agents, we found similar results to the below example each time.

To compare prices, we searched multiple online travel agents and portals using the same search parameters: departing John F. Kennedy-New York (JFK), arriving at London-Heathrow International (LHR), round-trip, 1 traveler, economy, and nonstop on specific dates.

We selected the lowest-priced nonstop flight available through AmexTravel.com: a Finnair flight operated by Oneworld partner , American Airlines.

When searching on AmexTravel.com, the flight was $595.86. This breaks down to $133 in base fare and $462.86 of government, airline, and American Express-imposed fees.

We received the same search results when we replicated this search on Finnair’s U.S. website, Kayak, and Orbitz.

In a second search, we looked for a domestic round-trip from Phoenix Sky Harbor (PHX) to Los Angeles International (LAX) on the same dates. This flight was priced at $199.40. Keep in mind, you would usually see this rate plus the $6.99 Amex booking fee, but again, this is waived for Amex Platinum cardholders.

When cross-referencing this itinerary on Delta’s website, we found the same price listed for a regular economy fare of $199.40. However, there was a basic economy option that was a bit cheaper, which was not available through AmexTravel.com.

Other online travel portals, including Orbitz and Kayak , listed the same price.

This means, if you’re already set on the specific itinerary you want to fly, booking through AmexTravel.com can often cost the same as booking directly with the airline, or through a third party . This assumes you receive waived booking fees for being an Amex Platinum cardholder.

However, what if you’re just looking for the cheapest flight on a particular day? If you do a general search for a route on set dates, will AmexTravel.com find the same rates as other portals? In our experience, the answer is no.

In our example search, here are the lowest available regular economy non-stop flights we could find between New York (any airport) and London (any airport) when searching the same set of dates on a few different websites (sorted by price ascending):

*Including a $10.99 AmexTravel.com booking fee.

The reason for these results is likely due to the fact that the Amex portal doesn’t include some low-cost carriers like Norwegian, so travel portals that do will often win on price.

Even excluding the low-cost carriers, though, other portals like Expedia and Orbitz were able to offer lower fares by about $15.

That said, AmexTravel.com was able to find about the same fares you would find when booking directly with an airline.

Hot Tip: If you hold The Business Platinum Card ® from American Express you can get a 35% rebate on select flights when you pay with points through AmexTravel.com.

AmexTravel.com Hotel Programs

There are actually 3 programs offered for booking hotels:

- Fine Hotels and Resorts

- AmexTravel.com booking (standard)

What Is The Hotel Collection?

The Hotel Collection is a program through AmexTravel.com only available to holders of certain cards:

- The American Express ® Gold Card and the American Express ® Business Gold Card

The Amex Platinum card and the Business Platinum Card ® from American Express

The Centurion card

Perks of The Hotel Collection

When you book a hotel through The Hotel Collection, you get certain perks including:

- Room upgrade at check-in (if available)

- Up to a $100 hotel credit for on-site amenities like the restaurant, bar, room service, or spa

- Ability to use Pay With Points on prepaid reservations

- 3x Membership Rewards points for Amex Gold cardholders on prepaid bookings

- 5x Membership Rewards points for Amex Platinum cardholders on prepaid reservations

- Up to $200 credit each year towards prepaid hotel reservations with either The Hotel Collection (2-night stay) or Fine Hotels and Resorts with select credit cards

Usually, American Express guarantees that any hotel booked through AmexTravel.com will have the lowest publicly-available rates (prepaid rates only), but this rule does not apply to bookings through The Hotel Collection per the terms & conditions . Be certain to check multiple booking options to ensure you’re getting the best deal.

Rooms have to be booked through AmexTravel.com. That means that if you book directly through the hotel or another service, you won’t get the perks, even if the hotel is a part of The Hotel Collection and you pay for the stay with your American Express card.

Further, you must stay a minimum of 2 nights , and you cannot book consecutive stays within 24 hours of each other.

The good news is that these benefits are available for up to 3 rooms per stay . So if you book 3 rooms for family members, you’ll get a total hotel service credit of up to $300.

Hotel Points and Elite Benefits

Typically, you won’t earn points through a hotel loyalty program if you book through a third party, and this includes the AmexTravel.com portal.

Further, you won’t get any elite benefits that you might otherwise be entitled to if you have status with that hotel chain.

Bottom Line: The Hotel Collection is potentially useful if you’re planning to pay with your eligible Membership Rewards-earning card. This comes at the expense of hotel-specific elite benefits, including points and elite credits in any hotel loyalty program.

What Is the Fine Hotels and Resorts Program?

AmexTravel.com runs a second hotel program called Fine Hotels and Resorts (FHR). It can be a little bit confusing since it sounds like it would overlap with the Hotel Collection, but that’s not the case.

The Fine Hotels and Resorts program is exclusive to Amex Platinum cardholders (personal or business) , as well as those with the invitation-only Centurion Card .

FHR includes different hotels and resorts than The Hotel Collection, with minimal overlap. The FHR collection tends to be more geared toward leisure travelers who wish to book stays at higher-end properties.

Perks of Fine Hotels and Resorts

Booking hotels through the Fine Hotels and Resorts collection entitles you to a handful of potentially valuable perks, including:

- Early noon check-in (when available)

- Room upgrade on arrival (when available)

- Daily breakfast for 2 people

- Guaranteed 4 p.m. late checkout

- Complimentary Wi-Fi

- A unique amenity valued at $100 or more; examples include a property credit, dining credit, spa credit, or similar amenity

Unlike The Hotel Collection, rooms booked through Fine Hotels and Resorts are not all prepaid. In fact, most are standard rates that you’ll pay for at the end of your stay when you check out. In comparing several properties, including the Park Hyatt in Chicago, we found rates identical to the non-prepaid rates when booking directly through the hotel.

However, keep in mind that the hotel may directly offer prepaid and early-purchase options which may be much cheaper, though you won’t benefit from the Fine Hotels and Resorts perks.

There are fewer terms with Fine Hotels and Resorts than with The Hotel Collection. You must book through AmexTravel.com/FHR to receive the benefits .

As with The Hotel Collection, if you book directly with the hotel or through a different travel agency or portal, you won’t be able to claim FHR benefits even if it’s a participating hotel. Other terms vary by property.

Good news here! Unlike stays booked through The Hotel Collection, stays through American Express Fine Hotels and Resorts count as “qualifying rates” for hotel loyalty programs. That means if you’re staying at a hotel that’s part of a loyalty program, you’ll be able to earn points and receive the relevant benefits if you hold elite status.

Hot Tip: Want to know about the differences between these programs? Dig into our dedicated guide on the differences between the Hotel Collection and Fine Hotels & Resorts .

Searching Hotels

Searching for hotels at AmexTravel.com works more or less the same as with flights. You enter your city, dates, number of rooms, and guests. You can check a box to have properties from The Hotel Collection and Fine Hotels and Resorts displayed at the top.

Of course, if you’re interested in booking through either of those programs, you could also just book on their dedicated pages.

By default, search results are ranked by “recommended,” which seems to be decided by an algorithm factoring in price, location, and reviews.

Terms vary by the specific hotel and rate you book, so make sure to read the fine print.

The site can be a bit confusing when trying to compare prices since American Express doesn’t include all taxes and fees in the price displayed (while some hotel websites do).

For example, we searched for a 4-night stay at the Hyatt Regency London – The Churchill. American Express quoted an average of $337/night, which should make the total stay around $1,348. When you go to book, though, the total with fees is $1,625.

While it initially looks more expensive to book directly with Hyatt (where the cost is quoted at $404/night), that price includes all taxes and fees , so you’ll actually pay $1,611, or $14 less.

Our search for the Marriott Regent Park yielded similar results. It’s listed at $233/night in the search function, which implies the total to be $932.

In reality, once you click through, the total is $1,120. Booking directly with Marriott, rates are listed at $261/night, but that includes taxes and fees — for a total prepaid rate of $1,080.

For the 2 hotels in question, here’s how total prices compared through different portals (sorted by price ascending):

In both tickets, AmexTravel.com was within a few dollars of the other online travel agencies, which were all more expensive than booking directly through the hotel’s website.

Similar to The Hotel Collection, rates booked through AmexTravel.com aren’t eligible for elite benefits or hotel loyalty points.

Bottom Line: Like most other online travel portals and agencies, prices can vary between AmexTravel.com and the hotel’s direct booking channel. You won’t get elite benefits or hotel points, so it might be worth booking directly if those are valuable to you.

Flights+Hotel Packages

Like with many online travel portals and even airline websites, you can book packages that include flights and hotels through AmexTravel.com. Usually, the point of booking these packages is to get a discount, special perks, or promotions.

The search window for Flights+Hotels is simple: input airports (or cities), dates, number of travelers, and rooms. Results are listed in a recommended order by default just like when searching for a standard hotel.

Terms vary by the specific package you book, so make sure to read the fine print !

As with standalone flight reservations, AmexTravel.com charges a fee to book Flights+Hotel packages: $6.99 per domestic ticket or $10.99 per international ticket .

Again, these fees are waived for holders of the Amex Platinum card or the Centurion card.

In the results field, a total starting price per person is listed, including all taxes and fees with the cheapest flight option. American Express also lists how much you’re saving with the package, although this is missing for some hotels.

Once you select the hotel, you can customize your flight. The total price changes based on which flight you select.

In a sample search, we chose the Hyatt Regency London – The Churchill, and picked the cheapest nonstop flight: British Airways flight, which was Newark Liberty International (EWR) to LHR and London-Gatwick (LGW) to JFK. The package came to $1,446 per person, or $2,892 total.

Annoyingly, AmexTravel.com doesn’t show a breakdown of hotel and airfare costs and fees; instead, it just displays a total per person.

For comparison, you can search the flight and hotels separately. We tried searching for the flight first on the same day.

We found Finnair flights operated by American Airlines for $660 per person — an option that wasn’t offered as part of the package (although with the booking fee, the flights should have been $671). When we filtered the search to British Airways only, it showed a ton of options for $671.

Searching hotels next, we again chose the Hyatt Regency London – The Churchill’s lowest prepaid rate. It was listed as $337 per night for 1 room (plus taxes and fees), for a total of $2,031. For the 2 flights and the hotel, that comes to a total of $3,351, or $1,675.50 per person.

In this case, booking the trip as a package saves almost $460, even though the search results page didn’t highlight any savings specifically.

The main downside to booking a package is that you have less flexibility. Say you want to change hotels for part of the trip or maybe stay with a friend for the last few days. This isn’t an option because you must book a single hotel for the entire time between your flights. It can also make solutions harder to find if there are any problems — although the AmexTravel.com customer support should make up for that.

Bottom Line: If you’re using AmexTravel.com and your plans allow for the lack of flexibility, you might be able to save a lot of money with a package. Just make sure to compare the listed price to booking everything separately. Note that you can’t book a package retroactively: you have to book the flights and hotel at the same time.

Rental Cars

AmexTravel.com also offers a rental car booking service. You can make reservations from rental stations at airports and elsewhere.

To search for rental cars, simply enter an airport or city . You can also click a button to search near a specific address.

Results are shown in a handy grid format, with each column showing a different rental company, and each row displaying the pricing for a different category of car (economy, compact, midsize, and so on).

Bookings of up to 4 days are charged a daily rate, while bookings 5-7 days are charged on a weekly basis. There are specific rates for weekends and weekdays, as well as monthly options, with specific details varying by the rental agency.

In several sample searches, prices were generally consistent with other online travel agencies — though sometimes lower by $1-$2/day. Prices were identical to booking with the rental company directly.

Bottom Line: Renting a car through AmexTravel.com doesn’t get you any benefits above what you’d receive for paying with your credit card, such as the collision damage waiver for paying with your Amex Platinum card. However, the convenient search page makes it a great option for comparing multiple prices at once.

AmexTravel.com also offers tools to book cruises . In addition to letting you search for cruises all over the world, AmexTravel.com periodically highlights special offers on cruises, usually in the form of credits to use onboard.

To search for cruises, you need to enter the region you want to travel in, the cruise line(s) you want to travel with (or search all available lines), the month you’re planning the trip for, and the approximate length of the cruise you want.

Results are shown in order, from the lowest-priced option to the highest . Note that this is based on the lowest available rate; hovering over any result will show all available cabin types and the corresponding prices.

Under each result, the information shown includes the port of departure/return, date of departure, and ports visited.

Hot Tip: Wondering what to pack for your time at sea? Check out our ultimate cruise-based packing list — it’s printable and complete with tons of tips and advice!

Cruise rates booked through AmexTravel.com were within $1-2 of rates found on other online travel agents and websites . We found identical prices on the various cruise company websites — though each online travel portal and cruise line offers different promotions, so it might be worth comparing them.

For example, during a sample search for a weeklong Caribbean cruise in December, we found that Royal Caribbean was offering a $50 onboard credit if you booked directly.

On the search results page, you might notice a tab labeled “Special Offers.” Those offers are generally onboard credits, but can also include discounts or other special features. If you aren’t committed to a specific cruise line, these are often worth exploring.

Those with the Amex Platinum card have special access to the Cruise Privileges Program . Like the Fine Hotels and Resorts program, this is only available on specific cruises, although it’s more limited than FHR.

It includes onboard credit (often higher than otherwise offered) and a special onboard amenity, like complimentary dinner for 2 or a bottle of premium champagne.

Bottom Line: It can be worth booking a cruise through AmexTravel.com, especially if there are special offers. Make sure to compare different booking sites , though, as some may have better or exclusive promotions.

AmexTravel.com offers a feature called Travel Insiders. When you use the program, American Express connects you with a travel expert who can help you plan an itinerary based around your desired destination. Fees vary based on location, length of the trip, and details of the itinerary.

AmexTravel.com can be a very useful tool when booking flights, hotels, vacation packages, cruises, or rental cars. In many cases, it may not offer the best rate options , but it’s worth comparing to other booking sites and airlines or hotels directly.

If you have an American Express card that offers access to the Hotel Collection or Fine Hotels and Resorts, the perks can be very worthwhile.

Additionally, the extra Membership Rewards points you earn by booking through AmexTravel.com can be valuable, as long as the price is right.

Aside from the Hotel Collection and Fine Hotels and Resorts, the real value of AmexTravel.com is in the customer service provided. Booking a trip on your own is easy — dealing with problems when they arise can be less so!

If you book through AmexTravel.com, you’ll have easy access to someone who can help you get on a new flight, find a new hotel, or manage whatever other issues come up day or night. So if you’re looking to have that extra support, then AmexTravel.com might be a great choice for you!

The information regarding the Centurion ® Card from American Express was independently collected by Upgraded Points and was not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the American Express ® Business Gold Card, click here .

Frequently Asked Questions

What is american express travel.

AmexTravel.com is an O nline T ravel A gency (OTA), just like Orbitz , Kayak , or Expedia . You can book flights, hotels, rental cars, or cruises through AmexTravel.com.

Do I need an American Express card to use Amex Travel services?

Whether or not you have an American Express card, you can book flights, hotels, rental cars, or cruises through AmexTravel.com. If you do have an Amex card, you might be eligible for certain perks or rewards.

Does American Express Travel cost anything?

If you book a flight through AmexTravel.com, there’s a small fee ($6.99 for domestic flights, $10.99 for international) that fee is waived for Amex Platinum, Amex Business Platinum, and Centurion cardmembers. Other services, like hotels and cruises, do not have fees.

Why should I book with American Express Travel?

AmexTravel.com has very helpful customer service resources. If you have any problems with your trip (like a canceled flight), you can call an agent who can help solve the issue.

Was this page helpful?

About Jarrod West

Boasting a portfolio of over 20 cards, Jarrod has been an expert in the points and miles space for over 6 years. He earns and redeems over 1 million points per year and his work has been featured in outlets like The New York Times.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![american express uk travel American Express Cash Magnet Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/07/American-Express-Cash-Magnet-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome Bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s Take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card Details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Can you pay off one credit card with another?

Credit Cards Louis DeNicola

Amex Gold vs. Platinum

Credit Cards Harrison Pierce

Why I chose the Chase Sapphire Preferred as my first ever rewards card

Credit Cards Sarah Li Cain

How to use Alaska Airlines Companion Fare

Credit Cards Ariana Arghandewal

How I maximize my Chase Ink Business Unlimited Card

Credit Cards Lee Huffman

How to do a balance transfer with Discover

9 ways to maximize the Citi Custom Cash card’s 5% cash-back categories

American Express Business Platinum benefits guide 2024

Credit Cards Chris Dong

Why I applied for the new Wells Fargo Autograph Journey℠ Visa® Card

Credit Cards Jason Steele

Which Citi balance transfer card should I get?

Credit Cards Julie Sherrier

5 reasons why the Citi Diamond Preferred is great for paying down debt

Credit Cards Michelle Lambright Black

Welcome offer on Chase’s IHG One Rewards Premier Business card soars to 175K points

Credit Cards Carissa Rawson

You might be a small business owner and not even know it

Chase Freedom Flex benefits guide 2024

6 ways to maximize the Citi Double Cash Card

Credit Cards Ben Luthi

- 0808 274 5111

- Live Chat (Online) Live Chat (Offline)

- My Wishlist

- Find a Trip

Your browser 'Internet Explorer' is out of date. Update your browser for more security, comfort and the best experience on this site.

Mexico Real Food Adventure

9 days from 1481.

Take a 9-day culinary journey through Mexico, tasting the flavours of Oaxaca, Puebla,...

Vietnam Real Food Adventure

12 days from 1523.

Travel the breadth of Vietnam, from Hanoi to Ho Chi Minh City, experiencing Halong Bay,...

Sri Lanka Real Food Adventure

12 days from 1644.

Take a food-filled journey through Sri Lanka, spending 12 days cooking and eating in...

Italy Real Food Adventure

8 days from 2311.

From Venice to Rome, you’ll indulge in the best things to eat in Italy, with stops in...

Japan Real Food Adventure

11 days from 3008.

Take a foodie’s adventure to Japan, starting in Tokyo and hitting the streets of...

Greece Real Food Adventure

9 days from 2390.

Meet passionate cooks and producers on a food adventure in Greece, via amazing ancient...

Cambodia Real Food Adventure

8 days from 896.

Munch your way through Cambodia on this mouth-watering food adventure from Phnom Penh...

Jordan Real Food Adventure

6 days from 1183.

Discover diverse heritage and delicious dishes on a 6-day food-focused journey through...

Thailand Real Food Adventure

8 days from 942.

Take an 8-day Intrepid tour to Thailand, full of adventure, fun and flavour. Explore...

18 to 35s Adventures

Essential vietnam, 11 days from 480.

Take an awesome trip through Vietnam. Head from old-world Hanoi to ancient Hue, Hoi An,...

Real Central America

16 days from 991.

Explore Mexico, Belize and Guatemala on this Central American adventure. Experience...

Essential Japan

10 days from 1305.

Shop in Tokyo, see Samurais in Kanazawa, soak up history in Hiroshima, wander the...

Essential Morocco

12 days from 515.

Check out the best bits of Morocco, in Casablanca, Fes, Chefchaouen and Marrakech on a...

Real Mexico

14 days from 884.

Explore the best of Mexico with an adventure through Mexico City, Oaxaca, Palenque,...

Real Peru to Bolivia

15 days from 1970.

From Lima to La Paz this Peru and Bolivia trip takes you deep into the Amazon Jungle,...

Essential Bali & Gili Islands

10 days from 447.

Discover Bali from laidback Ubud to the Mt Batur volcano. Explore Gili Trawangan and...

Essential Southern Balkans

9 days from 870.

From Dubrovnik, head on a Southern Balkans adventure to Stari Bar, Tirana, Dhermi Beach...

Essential South Korea

9 days from 1274.

Take a journey through South Korea, starting in Seoul and heading to Jeonju, Wanju,...

Real Turkey

15 days from 1071.

Immerse yourself in Turkish culture on this adventure through Istanbul, Canakkale,...

12 Days From 734

You’ll see the Terracotta Warriors, Chengdu pandas, Yangshuo’s beauty, the Great Wall...

One Week In Costa Rica

8 days from 518.

Head to the Caribbean coasts of Costa Rica with a fun-filled adventure to San Jose,...

Our travellers' favourite trips

Vietnam express southbound, 10 days from 829.

Take a tour of Vietnam from Hanoi to Ho Chi Minh City, with stops to cruise the Mekong...

Classic Costa Rica

15 days from 1356.

Travel to Costa Rica and discover a tropical playground of immense natural beauty....

Best of Sri Lanka

15 days from 1556.

Discover the must-sees, must-eats, and must-meets of gorgeous Sri Lanka on this 15-day...

Best of Vietnam & Cambodia

18 days from 1467.

Travel into the heart and soul of South East Asia on this tour of Vietnam and Cambodia....

Best of Morocco

15 days from 872.

Discover the best of Morocco on an action-packed trip exploring Marrakech, Fes, the...

Egypt Adventure

8 days from 820.

Visit Egypt and adventure along the River Nile through the land of the pharaohs, from...

Explore Jordan

8 days from 816.

Travel to Jordan and tour Amman, Madaba and the inspiring desert landscape of Wadi Rum....

Classic Rajasthan

15 days from 893.

Travel to India and visit the Rajasthan region. Tour from Delhi to Pushkar through...

Okavango Experience

10 days from 1179.

Tour through Johannesburg, Maun, Chobe, the Okavango Delta and Victoria Falls on a ten...

Beautiful Cuba

8 days from 889.

Escape to Cuba on an adventure to this exotic Caribbean island and explore the sultry...

Mexico Unplugged

15 days from 1269.

The incredible cultures and colours of Mexico await on this 15-day adventure through...

Ready to start your own Intrepid Adventure?

Officially certified as the world’s largest travel B Corp, we’ve been helping to change the way people see the world for over 30 years – so we know what makes travellers tick. Read our story to learn more about our origins and the founding principles that still guide everything we do today.

The safety and wellbeing of our travellers, leaders, crew, staff and suppliers remains our priority and our return to operations will be done in a safe and responsible way. If you’re ready to go, explore what we offer in the destination that’s calling you . Once you’ve found the trip for you, simply follow the steps below.

Note: The prices on this website are for tours only. We can always add flights so just give us a call and we'll give you a full quote.

The Intrepid Foundation

The Intrepid Foundation is a not-for-profit that supports non-government organisations around the world. We base our work on the UN’s Sustainable Development Goals in the areas of People, Peace, Prosperity, Partnership and Planet. We support 53 projects in 25 countries, and match all donations pound for pound. Below are a couple of projects which we’re proud to support around the world.

Support to Life (Hayata Destek)

Support to Life, Hayata Destek in Turkish, is an independent humanitarian agency working in the field of disaster risk reduction, disaster preparedness and emergency response by promoting community participation in Turkey and the surrounding region.

The Himalayan Rescue Association Nepal (HRA)

The Himalayan Rescue Association Nepal (HRA) provides much needed medical and emergency evacuation assistance and treats many cases of severe mountain sickness. The HRA operates high altitude aid-posts at Manang (3500m) on the Annapurna route, and at Pheriche (4200m) on the Everest Base Camp trek.

KOTO Training Centre

The KOTO Training Centre provides a two-year program in hospitality, English and life skills training, to groups of 16-22 year olds from disadvantaged backgrounds. Trainees also receive accommodation, food, medical check-ups and treatment if required.

TravelAsker

Is American Express widely accepted in the UK?

Travel Destinations

April 13, 2023

By Kristy Tolley

American Express in the UK

American Express, also known as Amex, is a multinational financial services corporation based in the United States. It is one of the most popular credit card providers in the world. American Express has been operating in the UK since 1856 and is widely accepted in the country. However, its acceptance rate varies depending on the merchant and location.

American Express Acceptance in the UK: Overview

American Express is widely accepted in the UK, but not as widely as other credit cards such as Visa and Mastercard. According to a survey conducted by Consumer Intelligence, in 2021, American Express was accepted by 54% of UK merchants. This is a significant increase from 2017, where only 36% of UK merchants accepted American Express. However, the acceptance rate is still lower than other credit cards. Visa, for example, is accepted by 97% of UK merchants, while Mastercard is accepted by 95%.

Major UK Merchants That Accept American Express

Major UK merchants such as Tesco, Sainsbury’s, Morrisons, Boots, and John Lewis accept American Express. These merchants also offer rewards and cashback on American Express purchases. Other major merchants that accept American Express include Amazon, Apple, and Uber.

Popular Places That Do Not Accept American Express

Some popular places that do not accept American Express include petrol stations, small independent retailers, and some restaurants. This is because American Express charges higher merchant fees compared to other credit cards. However, the acceptance rate is increasing, and more merchants are now accepting American Express.

Regional Differences in Acceptance of Amex

The acceptance rate of American Express varies depending on the region in the UK. In London, for example, American Express is more widely accepted compared to other regions. This is because there are more high-end merchants in London that cater to American Express cardholders.

How to Check if a Merchant Accepts American Express

Customers can check if a merchant accepts American Express by looking for the American Express logo or by asking the merchant directly. Customers can also check the American Express app or website to find merchants that accept American Express.

Tips for Using American Express in the UK

Customers can maximize their American Express rewards and cashback by using their card at major merchants that accept American Express. Customers should also use their card for purchases that offer rewards and cashback, such as travel and dining. It is also advisable to inform the merchant that you are using an American Express card to avoid any payment issues.

Benefits of Using American Express in the UK

American Express offers a range of benefits to its cardholders in the UK, such as rewards and cashback on purchases, travel insurance, and airport lounge access. American Express also offers excellent customer service and fraud protection to its cardholders.

Alternatives to American Express in the UK

Some alternatives to American Express in the UK include Visa, Mastercard, and Discover. These credit cards offer similar rewards and cashback programs to American Express.

American Express Card Options for UK Residents

American Express offers a range of card options to UK residents, including the American Express Platinum Card, the American Express Gold Card, and the American Express British Airways Card. These cards offer different rewards and benefits to cater to different needs.

Comparison of American Express Acceptance in the UK vs US

American Express is more widely accepted in the US compared to the UK. According to the same Consumer Intelligence survey, American Express is accepted by 77% of US merchants. This is because American Express has a higher market share in the US compared to the UK.

Conclusion: Using American Express in the UK

American Express is widely accepted in the UK, but not as widely as other credit cards such as Visa and Mastercard. Customers can maximize their rewards and cashback by using their card at major merchants that accept American Express. American Express also offers a range of benefits to its cardholders in the UK, such as rewards and cashback on purchases, travel insurance, and airport lounge access. However, customers should also consider other credit card options in the UK that offer similar rewards and benefits.

Related Posts

- Is it permitted to use an American driving license for driving in the UK?

- Would your laptop from the US be compatible in the UK?

- Would you consider American Airlines to be a reputable airline?

- Would it be beneficial to invest in energy in the UK?

- Would Brazil be a desirable destination to explore with friends from the UK?

Kristy Tolley

Leave a comment cancel reply.

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

Card Accounts

- Account Home

- Register for Online Services

- Activate a new Card

- Support 24/7

- Download the Amex App

Business Accounts

- American Express @Work

- Online Merchant Services

- FX International Payments

Help & Support

- Forgot your User ID or Password?

- Security Centre

- Where can I use my Card?

Personal Cards

- View Personal Cards

- View Dollar and Euro Cards

- Credit Cards

- Why American Express?

- Invite friends. Get rewarded.

- Add someone to your Account

Business Cards

- View All Business Cards

- Compare Business Cards

- Business Platinum Card

- Business Gold Card

- Why American Express for Your Business

- Add an employee to your Account

Corporate Solutions

- View All Corporate Cards

- Compare Corporate Cards

Online Travel

- Book Travel Online