June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Buy Domestic Travel Insurance

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Domestic Travel

Domestic travel can be just as exciting — and as challenging — as overseas trips. We'll help you pack your bags, protect your travel arrangements and explore new U.S. destinations.

Featured Article

Share this page.

- {{errorMsgSendSocialEmail}}

Travel Insurance for Domestic Vacations

If you're planning a Caribbean honeymoon or an African safari, travel insurance is a no-brainer. You know you need medical coverage, and you can't risk losing your travel investment if something goes wrong. But what about trips within the United States? These trips are usually less expensive, and you're typically covered by your own medical insurance but what about trip cancellation and trip interruption coverage?...

{{articlePreview.snippet}} Read More

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Allianz Travel Insurance review: Is it a good option for your next trip?

With plenty of options to choose from, allianz likely has the right coverage for your trip..

Travel insurance can offer peace of mind — and financial protection — when you travel. Whether you want minimal coverage for emergencies or are looking for a more comprehensive plan, Allianz Travel Insurance probably has an option that will work for your situation.

CNBC Select breaks down the types of coverage Allianz includes in its policies, the features it offers and other providers you should consider.

Allianz Travel Insurance review

Other insurance offered, how it compares, bottom line, allianz travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

24/7 assistance available

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Allianz Travel Insurance is a global insurance provider. It partners with airlines, travel agencies, resorts, credit card issuers and other companies to offer worldwide travel coverage. The insurer currently offers 10 trip coverage plans, giving travelers plenty of options that range from single-trip plans to plans that cover all your travel for a year.

For example, OneTrip Prime provides trip cancellation/interruption, emergency transportation, baggage loss or delay and other key benefits for a single trip up to 180 days. AllTrips Executive, on the other hand, is a multi-trip plan designed for business travel with higher trip cancellation and interruption limits and coverage for business equipment. You can also opt for OneTrip Rental Car Protector if you need primary car rental coverage against collision, loss and damage.

These plans let you easily tailor your insurance to your situation. Here are the types of coverage that Allianz Travel can include in your plan:

- Trip cancellation

- Trip interruption

- Emergency medical (this covers medical and dental emergencies that happen during your trip)

- Emergency medical transportation

- Baggage loss/damage

- Baggage delay

- Travel delay

- Travel accident

- SmartBenefits℠ (this includes automatic and no-receipts payments for trip delays and no-receipts claims for baggage delays)

- Change fees (this coverage can reimburse you for the fees the airline charges when you have to change the dates of your flight)

- Loyalty program redeposit fee coverage (with this coverage, you can get reimbursement for frequent flyer mile redeposit fees if your trip is canceled or interrupted)

- 24/7 hotline assistance

- Concierge services

- Rental car collision damage waiver

- Existing medical condition (this benefit waives the pre-existing medical condition coverage exclusion)

The types and limits of coverage benefits you can get vary by plan.

Many travel cards provide travel insurance benefits . To avoid duplicate coverage, go through your card's terms and conditions and see what your issuer already offers.

One of the features that helped Allianz Travel land a spot on our list of the best travel insurance is the Cancel Anytime benefit. Included with OneTrip Prime and OneTrip Premier plans, Cancel Anytime can reimburse 80% of your unused, pre-paid, non-refundable trip costs if you have to cancel your trip for just about any unexpected reason.

Additionally, the insurer offers 24/7 global assistance to refer you to a prescreened hospital during your trip.

Policyholders can also use the TravelSmart TM app and check for flight status updates, the latest travel advisories and restrictions for their destination, local emergency services and hospitals and more. The app allows travelers to pull up their protection plan whenever they need and file a claim online.

As of writing, Allianz Travel doesn't advertise any discounts. That said, discounts aren't as common with this type of coverage, especially compared to home and auto insurance .

Allianz is a large global company offering a wide range of financial products and services. In the U.S., that includes travel insurance, life insurance and business insurance.

Allianz Travel can be a solid choice if you're looking to purchase travel insurance. However, it's always a wise idea to compare multiple options to ensure you're getting a good deal.

For instance, AXA Assistance USA travel insurance is also a good provider. You can pick from three plans with the most affordable one starting at just $16, according to the company's website. The most comprehensive option is the Platinum plan which comes with the option to cancel for any reason.

AXA Assistance USA Travel Insurance

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

Travel Guard® Travel Insurance also offers a selection of plans, ranging from last-minute options to an annual travel plan. Or you can request a specialty plan, but you'll need to speak to a representative to do so.

Travel Guard® Travel Insurance

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

With 10 available plans to choose from, Allianz Travel makes it easy to get the right travel insurance coverage for your upcoming trip. Multi-trip plans are also available for those who frequently travel, including for business. Still, we recommend gathering several quotes and comparing plans before you purchase travel insurance. Just like with any financial product, it pays to shop around for this type of coverage.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Citi Strata Premier Card replaces Citi Premier: Enjoy travel insurance and other new benefits Jason Stauffer

- These are the best homeowners insurance companies in Florida Liz Knueven

- First-time homebuyer grants: What you need to know Kelsey Neubauer

- Our history

- Allianz Advantage

- Global footprint

- Social responsibility

Travel protection

- Tuition protection

- Event ticket protection

- Bankcard services

- Assistance services

- Technology solutions

- Allianz Fusion

- Allianz TravelSmart

- Stories & insights

- In the news

- Press releases

- Vacation confidence index

- Internships

When the world calls, help your customers answer with confidence.

Looking for a travel insurance plan, get a quote at allianztravelinsurance.com ..

Benefits to help travelers explore reassured.

Expert assistance means travelers are never alone.

Industry-leading technology for the future of travel.

Travel safe. Travel simple. Allianz TravelSmart.

Our free Allianz TravelSmart TM app puts your customers’ travel protection plan at their fingertips, making it easy to check their coverage benefits, connect to our 24/7 assistance, or file a claim on the go.

What makes Allianz TravelSmart even smarter? We’ve loaded it with safety features to help customers explore more securely, including timely alerts about events that may impact their travels, a locator for nearby emergency assistance, medical translations, and more.

“I cannot even begin to tell you how wonderful my experience was with Allianz!! I had a terrible ski accident in France and every single Allianz person was unbelievably helpful. I now recommend Allianz to everyone I know and I will NEVER travel overseas without it. I am so very grateful for all the support I received.”

- Lindsay T., MN, 2021

“So often when you buy warranty or insurance it’s hard to actually get it to do what it’s supposed to do, but Allianz worked as it should. The cost for travel insurance is so negligible that it’s a no brainer to add to your trip.”

- Kyle Y., GA, 2021

“When I filed my claim your company made the process very easy. And you did not try to avoid your contract responsibilities like many other insurance companies with whom I have had to work with. I have recommended you to all of my travel friends.”

– Scott H., IL, 2021

Have questions about our products or services?

contact us — we’re here to help. .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

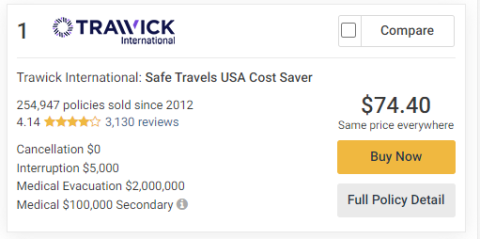

The search came up with nine results ranging in price from $74.40 to $179.18.

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

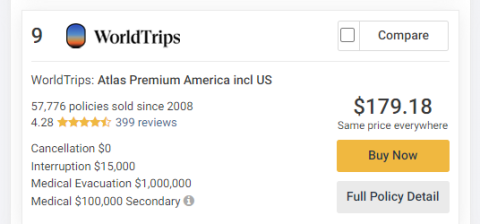

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

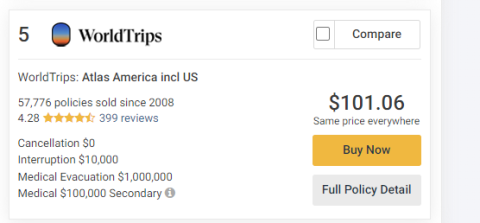

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

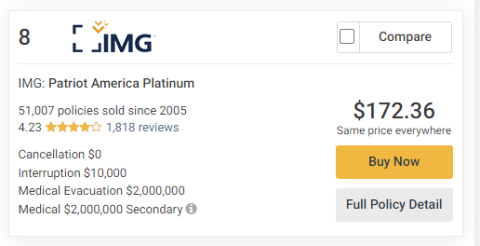

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Single Trip

- Annual Multi-Trip

- Winter Sports & Ski

- Collision Damage Waiver

- Sport & Leisure

- Medical Conditions

- Travel Insurance for Non-UK Residents

- Group Travel Insurance

- Travel Insurance for Couples

- Covid-19 travel insurance

- About Our Travel Insurance

- Holiday Cancellation Insurance

- Emergency Medical Assistance Cover

- Emergency Medical Cover for Travel Insurance

- Repatriation Insurance

- Baggage Cover

- Travel Insurance for Under 18s

- Comprehensive

- What's Covered

- Excluded Vehicles

- Range Rover

- Car Hire Excess Insurance

- Policy Information

- File a Claim

- Insurance Glossary

- Coronavirus - Annual Multi-trip Policy

Travel Insurance for the USA

Experience the American Dream with a holiday to the USA

From theme parks to National Parks, the USA is a destination that can suit almost every pace of holiday. You can experience the thrill of Las Vegas, witness the majestic beauty of the Grand Canyon or take a city tour of New York and snap photos with the Statue of Liberty.

You can also take in the iconic sights of Washington DC and brush shoulders with the president, or see some of America’s history in the Deep South. You can also enjoy an adventure in Texas, where you can get a real sense of the Wild West.

With so much to see and do, it’s no wonder that road trips across America are so popular. The Pacific Coast Highway takes in the very best of San Francisco and Los Angeles, while the Overseas Highway shows you some of America’s best scenery on the way to Miami. Road trips don’t get more iconic than Route 66 though. It takes you all the way from Chicago to Los Angeles and you’re close to Santa Fe, the Grand Canyon and Las Vegas if you’d like to take a few detours.

Don’t forget about the food, too. America’s culinary history is so great that the country’s towns, cities and states have a number of delicacies named after them, such as the Philly cheesesteak, Buffalo wings, New York cheesecake, California rolls, baked Alaska and even Mississippi mud pie. No matter what you’re craving, there’s a food for you in America.

Whatever you plan on doing in the USA, it’s important that you get travel insurance for the USA to help protect yourself against unforeseen eventualities.

Below is some more information about our insurance products, for which Terms and Conditions apply. Please visit the policy information hub for full details.

Healthcare for visitors to the USA

If you need any medical attention as a tourist in America, it can be incredibly expensive. An EHIC or GHIC card will not cover you in America because this is a reciprocal agreement the UK has only with other European countries.

In America, many residents have their own private medical insurance that covers them if they fall ill or get injured. For this reason, if you don’t have travel insurance for the USA, it can be very expensive for you to receive treatment, so even a minor fall or illness could end up costing you a significant sum of money if you’re not covered by USA travel insurance.

What does Allianz Assistance travel insurance for the USA cover?

- Cancelling or curtailing your trip

- Emergency medical and associated expenses

- Loss of passport*

- Delayed personal possessions

- Lost, stolen or damaged personal possessions*

- Loss of personal money*

- Personal accident cover

- Missed departures

- Delayed departures

- Personal liability

- Legal expenses

- End-supplier failure**

- *Not available with Bronze level cover

- **Only available with Gold level cover

- Terms and Conditions apply.

Plus, you can also purchase add-ons to ensure you have cover for any activities you’re taking part in. For example, if you’re hitting the slopes in the Rockies, our Ski and Winter Sports insurance could help protect you against avalanche closures and unused ski-pack costs.

Please note for Annual policies, if you’re travelling to America, you’ll need to select ‘Worldwide (including USA and Canada)’ as your area of cover.

Frequently Asked Questions

Although America’s healthcare is some of the most sophisticated in the world, it’s also one of the world’s most expensive healthcare systems. This makes travel insurance for the USA essential because, without it, you are unlikely to receive treatment and, even if you do, it may cost you tens of thousands of pounds.

Plus, even when heading somewhere relatively safe like the USA, you’ll still encounter other risks while you travel. For example, you’ll need to be vigilant against theft, pickpocketing, burglary and other street crimes in big cities. Thankfully, if you lose your possessions or you’re the victim of a theft, your USA travel insurance could protect you.

In addition, your travel insurance can also protect you for a number of other things that could go wrong while you’re away, including lost luggage, cancellations and travel delays.

If your stateside visit is the only trip you're planning to take this year, our Single Trip travel insurance for the USA will probably suit you best. If you're managing to get away more than once, then our Annual cover could work out to be a cheaper option.

Depending on how many countries you travel to, and whether you choose to buy any additional cover, costs for Backpacker insurance to the USA can vary. Get a quote online to find out how much it could cost to cover your stateside trip.

The exact price you’ll pay for your travel insurance for the USA will vary depending on:

- The type of policy you choose

- Your level of cover

- The duration of your trip

- Whether you need any pre-existing conditions to be covered

- Whether you require an add-on such as Ski and Winter Sports insurance

The price of your policy will also depend on how many people are travelling. For example, if you’re taking the family to Walt Disney World Resort in Florida, then you can place everyone on the same policy with our Family Travel Insurance for the USA. This is often a more cost-effective solution than buying multiple Single Trip policies for everyone.

Due to the improvements we are currently making to the booking engine of our website, we are currently unable to offer travel insurance to cover people’s pre-existing medical conditions. However, this is only a temporary measure and we plan to reintroduce this offer not only under our Single Trip or Backpacker policies, but also extending it to our Annual policies. Our Single Trip travel insurance policies for the USA can provide you with cover for up to 180 days, while our Backpacker cover can last for up to a full year, depending on how long you’re travelling for.

Once the website improvements have been made, it will be easy to declare your pre-existing medical conditions with our medical screening process. Simply click ‘Get a Quote’ and select your policy type. Then, provide us with some basic information about you and the trip you’re planning.

You’ll then be asked to declare your pre-existing medical conditions. All you need to do is type the first three letters of the condition into the box and then select your condition from the dropdown menu. Once you’ve declared all of your conditions, press ‘Finish’.

It won’t be long before we’ll be able to provide you with a quote again for travel insurance, to see if we’re able to cover you. You can read our policy documents online to see the full cover and exclusions. If there is anything you don’t fully understand, please get in touch.

America is home to some of the best winter sports resorts in the world. You can go skiing in the Rocky Mountains, snowboard in Lake Tahoe or even go sledging down the slopes of Alaska.

If you’re planning on trying any of these activities during your American holiday, then additional cover will be required. From lost ski equipment and piste closures to mountain rescues and repatriation, our Winter Sports and Ski add-on is designed to give you peace of mind and protect you if things don’t go to plan.

Cover options for your trip to the USA

Annual Multi-Trip Travel Insurance

Single Trip Travel Insurance

Backpacker Travel Insurance

Family Travel Insurance

Winter Sports & Ski Travel Insurance

Feel supported during your stateside visit, with travel insurance from allianz assistance.

Travel Insurance for Seniors

Travel Insurance for Medical Conditions

Need help? Call us on: 0371 200 0428

Make a claim, policy documents.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

GeoBlue »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Expat Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

Americans living abroad for all or even part of the year have a different set of considerations when it comes to finding a travel insurance plan. For example, expats may not need coverage for the same issues as people taking regular vacations, such as trip cancellations and interruptions, trip delays, and lost or delayed baggage. Instead, expats often primarily need health insurance or medical insurance for travel that works both at home and abroad, as well as coverage for emergency medical evacuation.

That said, not all travel insurance companies cover preexisting conditions within their trip insurance plans for expats. Further, some insurance providers limit coverage in a traveler's home country, especially for those who would normally reside in the United States. That's why, ultimately, U.S. citizens living abroad need to compare health plans that can work when they're away based on their coverage options, limitations and costs. Read on to find out which expat insurance plans U.S. News recommends and what each plan has to offer.

- Travelex Insurance Services: Best Premium Coverage for Expats

- Allianz Travel Insurance: Best for Comprehensive Coverage

- World Nomads Travel Insurance: Best for Adventure Travelers

- GeoBlue: Best for Medical-Only Coverage

- IMG Travel Insurance: Best Travel Health Insurance for Seniors

Best Expat Travel Insurance Options in Detail

Kids-included pricing

Preexisting conditions coverage available

Coverage can be expensive

- Trip cancellation coverage worth up to 100% of the trip cost (maximum of $50,000)

- Trip interruption coverage worth up to 150% of the trip cost (maximum of $75,000)

- Travel delay coverage worth up to $2,000

- Missed connection coverage worth up to $750

- Emergency medical coverage worth up to $50,000 (dental limit of $500)

- Emergency medical evacuation and repatriation coverage worth up to $500,000

- Baggage and personal effects coverage worth up to $1,000

- Baggage delay coverage worth up to $200 (12-hour delay required)

- Sporting equipment delay coverage worth up to $200 (24-hour delay required)

- Accidental death and dismemberment coverage worth up to $25,000

Includes a range of comprehensive travel insurance benefits

Coverage can be purchased on an annual basis

Annual plan coverage lasts for trips of up to 45 days at a time

- Trip cancellation coverage worth up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical transportation insurance up to $100,000

- Baggage loss and damage coverage up to $1,000

- Baggage delay coverage up to $200

- Travel delay coverage up to $600

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

150-plus adventure sports are covered

Choose the level of protection you need

Preexisting conditions typically not covered

- $10,000 in insurance for trip cancellations

- $100,000 in coverage for emergency medical expenses

- $500,000 in coverage for emergency medical evacuation

- $3,000 in protection for your bags and gear

Get comprehensive travel health insurance that works anywhere in the world

Customize your policy to suit your unique needs

Comes without coverage for trip cancellations, baggage and more

Travel medical coverage can be extended for up to 12 months

Limits can be high based on age and other factors

Deductibles of up to $2,500 can apply

No ongoing coverage for preexisting medical conditions

- Up to $250,000 in protection for emergency medical evacuations

- Prescription drug coverage

- Up to $50,000 in coverage for repatriation of remains

- Up to $50,000 in protection for political evacuations

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering personal finance, travel and insurance topics for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, which has led to her having personal experience navigating the claims and reimbursement process. Johnson works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

5 Best Travel Insurance Plans for Seniors (Medical & More)

Discover coverage options for peace of mind while traveling.

- Single Trip

- Annual Multi-Trip

- Winter Sports & Ski

- Travel Advice & News

- Policy Information

- File a Claim

- Insurance Glossary

We’re working really hard to keep you in the loop as much as possible in the fast-changing circumstances.

We want to help you wherever we can during these challenging times. If you’re struggling financially as a result of Coronavirus and are worried about the payments for your policy, or if you have a policy that you don’t think you’ll need now, such as an annual travel policy, please get in touch. We’ll discuss your options with you and work out how we can provide support.

Our call centres are very busy at the moment and we are trying to answer your questions as quickly as we can. If your query is non-urgent and you are not due to travel in the next two weeks, please don’t contact us yet, so we can prioritise people in need of urgent help or who are due to travel sooner.

In the meantime, we are regularly monitoring the situation and updating our Coronavirus single trip/backpacker and annual multi-trip FAQ pages. To find out more about the impact the outbreak is having on our travel insurance policies, please check the relevant FAQ before calling or emailing us.

We’d also like to highlight that travel insurance only protects against unforeseen circumstances getting in the way of your travel plans, so any policy you buy now will have very limited insurance coverage. While the Department of Foreign Affairs (DFA) has advised against all but essential travel indefinitely, you will not be covered under our travel insurance policies if you decide to go ahead with your trip.

Travel Insurance for America

From theme parks to National Parks, the USA can accommodate almost any type of holiday. You can experience the thrill of Las Vegas, witness the majestic beauty of the Grand Canyon or take a city tour of New York and snap photos with the Statue of Liberty.

You can also take in the historic sights of Washington DC or head to Texas, where you can get a real sense of the Wild West.

With so much to see and do, it’s no wonder that road trips across America are so popular. The Pacific Coast Highway takes in the very best of San Francisco and Los Angeles, while the Overseas Highway shows you some of America’s best scenery on the way to Miami. Road trips don’t get more iconic than Route 66, though. It takes you all the way from Chicago to Los Angeles and you’re close to Santa Fe, the Grand Canyon and Las Vegas if you’d like to take a few detours.

Don’t forget about the food, too. America’s culinary offering is so great that the country’s towns, cities and states have a number of delicacies named after them, such as the Philly cheesesteak, Buffalo wings, New York cheesecake, California rolls, baked Alaska and even Mississippi mud pie. No matter what you’re craving, there’s something to tickle everyone’s taste buds.

Whatever you plan on doing in the USA, you’ll need travel insurance to help protect you against any unforeseen eventualities.

Healthcare for visitors to the USA

What does our travel insurance for the usa cover .

At Allianz, our travel insurance for the USA from Ireland is suitable for most travellers, because we offer a range of different policies.

Our Single Trip , Annual and Backpacker policies are designed to protect you when your trip of a lifetime doesn’t quite go to plan. Across our Single Trip and Annual policies, we also offer three different levels of cover: Bronze, Silver and Gold. Depending on which level of cover you choose, you’ll be protected against:

- Cancelling or cutting your trip short

- Emergency medical and associated expenses

- Loss of passport*

- Delayed personal possessions

- Lost, stolen or damaged personal possessions*

- Loss of money*

- Personal accident cover

- Missed departures

- Delayed departures

- Personal liability

- *Not available with Bronze cover

- Terms and Conditions apply.

Please note that if you’re purchasing travel insurance for America, for Annual policies, you'll need to select ‘Worldwide (including USA and Canada)’ as your area of cover.

In addition, you can purchase add-ons to ensure you have cover for any activities you’re taking part in. For example, if you’re hitting the slopes in the Rockies, our Winter Sports and Ski insurance could help protect you against avalanche closures and unused ski-pack costs.

Below is some more information about our products, for which Terms and Conditions apply. Please visit the policy information hub for full details.

Frequently Asked Questions

Why do i need travel insurance to visit america.

Although America’s healthcare system is one of the most sophisticated in the world, it’s also one of the world’s most expensive. This makes travel insurance for America essential. Without it, you are unlikely to receive treatment and, even if you do, it may cost you tens of thousands of pounds.

Plus, even when heading somewhere relatively safe like the USA, you’ll still encounter other risks while you travel. You’ll need to be vigilant against pickpocketing and other street crimes in big cities, for example. Thankfully, if you lose your possessions or you’re the victim of a theft, holiday insurance for America can protect you.

In addition, travel insurance can protect you for a number of other things that could go wrong while you’re away, including lost luggage, cancellations and travel delays.

How much is travel insurance for the USA?

The exact price you’ll pay for your travel insurance for the USA will vary depending on:

- The number of people travelling

- The type of policy you choose

- The level of cover needed

Whether you require any add-ons, such as Business insurance or Winter Sports and Ski insurance

You can get a quote online today to see how much travel insurance for the USA from Ireland will cost you.

I'm planning to go skiing in the USA; do I need additional cover?

America is home to some of the best Alpine resorts in the world. You can go skiing in the Rocky Mountains, snowboard in Lake Tahoe or even go sledging down the slopes of Alaska.

If you plan on trying any of these activities during your American holiday, then additional cover will be required. From lost ski equipment and piste closures to mountain rescues and repatriation, our Winter Sports and Ski add-on is designed to give you peace of mind and protect you if things don’t go to plan.

Can I get travel insurance for backpacking in America?

America’s a vast country, so it’s great for a backpacking expedition. From the concrete jungle of New York to the glitzy lights of Las Vegas, there’s a lot to see as you cross this awe-inspiring country.

Our Backpacker insurance can cover you for up to 365 days. So, whether you’re trekking across America or visiting the States as part of a trip around the world, you’ll be covered. You’ll just need to make sure that you choose ‘Worldwide including USA and Canada’ as your area of cover when you book.

Insurance types for your trip to the USA

Backpacker Travel Insurance

Winter Sports & Ski Insurance

Annual Multi-Trip Travel Insurance

Family Travel Insurance

Single Trip Travel Insurance

Golf Insurance

Need help? Call us on: 0371 200 0428

Make a claim, policy documents.

- Our history

- Allianz Advantage

- Global footprint

- Social responsibility

- Travel protection

- Tuition protection

- Event ticket protection

- Bankcard services

- Assistance services

- Technology solutions

- Allianz Fusion

- Allianz TravelSmart

- Stories & insights

- In the news

- Press releases

- Vacation confidence index

- Internships

Allegiant Takes Off With Travel Protection From Allianz Partners

Las Vegas, NV and Richmond, VA, February 28, 2024 — Allegiant Travel Company (NASDAQ: ALGT), the parent company of Allegiant Air , today announces a partnership with Allianz Partners USA to offer travel protection products to Allegiant customers.

Vacationers who book air travel and vacation packages on Allegiant.com have the option to purchase travel insurance for covered unexpected trip cancellations and interruptions. Additionally, some protection plans provide coverage for significant travel delays and covered baggage issues. Allegiant customers are also encouraged to take advantage of Allianz Partners’ award-winning travel assistance services.

“Allegiant is committed to providing our customers with convenient travel options. We know sometimes plans change and a trip has to be unexpectedly cancelled, delayed or interrupted,” said Drew Wells, Allegiant’s chief revenue officer. “Our business model offers an unbundled product that allows travelers to customize their vacation. For customers who want to travel with additional peace of mind, we are proud to offer trip protection from Allianz Partners, the industry leader in travel insurance and assistance.”

Allianz Travel Insurance* will reimburse Allegiant customers up to 100% of their insured flight cost if they have to cancel or interrupt their trip for a reason covered by their plan. These reimbursements could also cover other lost, pre-paid trip expenses such as hotel rooms and rental cars. Customers can contact Allianz Partners directly to add additional coverage to their protection plan if needed. Some available products also include coverage for significant delays and reimbursement for lost, delayed or damaged baggage.