The Industry’s New Standard of Success

CoStar is the only market share product that provides owners, operators and brands with a comprehensive view into the entire hotel lifecycle from acquisition through operations to divestment. Benchmark your performance, generate new corporate leads, and expand your growth corridors.

Property- and portfolio-level functionality

The transformative Benchmark solution within CoStar equips hoteliers with the insights needed to make smart, real-time decisions and strategically optimize operations across entire enterprises.

Enhanced STAR Report experience

The STAR Report remains a foundational piece of the industry’s leading benchmarking solution. Within the more secure environment of CoStar, the STAR Report now includes more data, new visualizations and intuitive report download capabilities.

Powerful hospitality market data

CoStar’s data analytics help destination organizations, consultants, developers and other industry stakeholders connect with their markets, identify new opportunities and inform their decision-making.

Why STR and CoStar set the industry standard for success

Benchmarking that gives you the edge..

Bring together all the data you need in one place. With a Benchmarking license, you gain access to the expansive CoStar product suite, where you will unlock unmatched insight into commercial real estate property values, market conditions, and availabilities.

Latest Insights

Summer olympics drove paris room rates to all..., u.s. hotel performance for july 2024, less global markets show revpar growth, but o..., u.s. hotel construction activity highest sinc..., hotel industry analysis: impact of inflation,..., the role of total revenue management in a hot..., costar group upgrades product access for str’..., what is hotel revenue management a foundatio..., strategic success unveiled: how competitive s....

Sourav Ghosh, Chief Financial Officer , Host Hotels & Resorts

Andrew rubinacci, chief advisory officer , flyr hospitality (formerly with aimbridge hospitality), dana cariss, vp of revenue strategy and distribution , coral tree hospitality, caroline thissen, sr. area director of sales & revenue optimization , radisson hotel group, request a demo.

- Partner Portal

- STR Reports

- You are here:

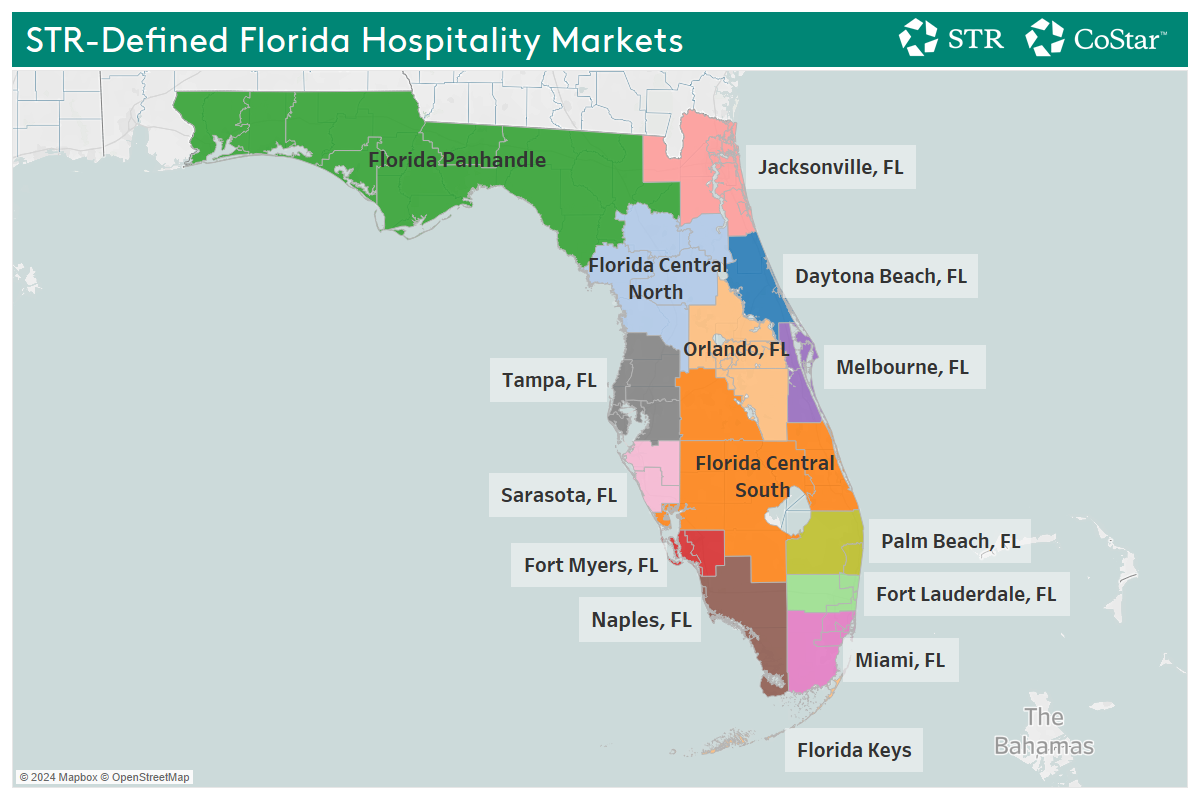

VISIT FLORIDA provides monthly reporting from STR for up to 200 partners each month. The STR reports include data on hotel occupancy, average daily rate, revenue per available room, and other hotel-related metrics. The data are broken down by market, with every area in the state being covered by at least 1 market. A map of the markets may be found below. You will receive a report that covers each of these regions. If you are unsure as to which region applies specifically to your destination, contact our research team at [email protected] for assistance. To request access to an STR report, please fill out the request form by clicking here . You must be a VISIT FLORIDA Marketing Partner to access the request form.

You may not share these reports or the data contained in the reports with anyone outside of your organization.

Please note that in recent reports, the Florida Central market has been split into Florida Central North and Florida Central South. The dividing line is in the narrow section near Orlando. We are working to obtain an updated map.

Travel Oregon

- Programs & Initiatives

- Marketing Co-Ops & Toolkits

- Industry News

- Virtual Training, Engagement and Assistance

- Tourism in Oregon

- Central Oregon

- Eastern Oregon

- Mt. Hood & Gorge

- Oregon Coast

- Portland Region

- Southern Oregon

- Willamette Valley

- Message from the CEO

- Oregon Tourism Commission

- Equity Statement

- Vision, Mission & Values

- Conferences

You Might Be Looking For...

- Strategic Plan

Weekly Lodging Report

This report shows a weekly summary of statewide and regional lodging statistics provided by STR, including the year-over-year (YOY) change in Average Daily Rate (ADR), Revenue Per Available Room (RevPAR), and Occupancy. The date at the top of the chart refers to the beginning of the presented week.

*Please note that STR reports include self-reported survey data. On a daily, weekly and monthly basis, STR processes performance data from hotels all around the world. This data is submitted straight from the source: chain headquarters, management companies, owners and directly from independent hotels. The data is checked for accuracy and for adherence to their reporting guidelines.

Read the Plan

Sign Up Now

- Attribution Solutions

- Global City & International State Travel

- Global Travel Service

- Air Passenger Forecasts

- Custom Forecasts

- Cruise Forecasts

- Visitor Economy

- Travel Industries

- Marketing Investment

- Events & Projects

- Testimonials

- Budget Analysis

- Policy Analysis

- Marketing Allocation Platform

- Project Feasibility

- In the News

- Client Login

- Oxford Economics

Bullseye Forecast: STR, Tourism Economics Nail Hotel Room Demand and Occupancy Recovery Predictions

Recovery forecast issued in 2020 proves spot on three years following the pandemic.

Issue Date - 1/23/2024

WAYNE, PENNSYLVANIA—A joint U.S. hotel recovery forecast issued in 2020 by Tourism Economics and STR has proven spot on in demand and occupancy despite the unprecedented forecasting challenges posed by the pandemic.

Tourism Economics, an Oxford Economics company, is a recognized leader in economic forecasting for the travel and tourism industry. STR, a CoStar Group company, is the global hotel industry’s leader in data benchmarking, analytics and marketplace insights. Tourism Economics and STR have partnered on industry forecasts since 2011, consistently ranking among the most accurate industry prognosticators.

The U.S. hotel performance benchmark forecast was released during the virtual NYU Hospitality Investment conference in November 2020. At the time, U.S. hotel occupancy rates were hovering around 40%, as COVID-19 cases surged and vaccines and at-home tests were not yet available. Amid these challenges, STR and Tourism Economics projected the following:

- 2020 Projection: Daily demand to return to 2019 levels (3.5 million room nights) in early-2023.

- 2023 Result: Three years later, actualized full-year results from 2023 showed exactly 3.5 million room nights on average, just 1.7% below 2019 performance.

- 2020 Projection: Hotel occupancy rate to reach 63.0%* in 2023.

- 2023 Result: The U.S. Hotel occupancy rate landed at an exact match of 63.0%.

Adam Sacks, President of Tourism Economics, reflected on the November 2020 forecast sharing, “Our predictions acknowledged the bleak conditions of travel in the early days of COVID-19. However, we were convinced that the innate human desire to travel would drive a full recovery in time. While certain segments and destinations remain below pre-pandemic levels, the overall market has recovered as expected.”

Higher than anticipated inflation and historically strong revenue management have driven healthy gains in average daily rate (ADR), resulting in a more robust recovery in revenue per available room (RevPAR) than expected. However, the November 2020 demand and occupancy forecasts presented an accurate view of the volume of travel over a future three-year horizon. “Travel forecasting serves an essential role in informing critical short- and long-term goals and strategies for businesses worldwide,” said Amanda Hite, STR president. “We are pleased that our forecasts continue to be a beacon for our industry.”

Aran Ryan, Director of Industry Studies with Tourism Economics further highlighted the forecast’s significance stating, “The travel sector maintained strong interest in our quarterly hotel sector outlook and accompanying narrative throughout recovery. It’s heartening to see the forecast accuracy prove out and guide the industry through uncertain times.”

*The 2020 estimate utilized the standard calculation of occupancy, rather than the total-room-inventory occupancy that was temporarily implemented at the time to account for closures.

Geena Bevenour, US Marketing Manager, Tourism Economics | Email: [email protected]

Haley Luther, Communications Manager, STR | Email: [email protected]

Media Inquiries:

Shreena Patel, PR & Communications Officer, Oxford Economics | Email: [email protected] | Tel: +44 7999 379025 (London)

About Tourism Economics

Tourism Economics, an Oxford Economics company, focuses on the intersection of the economy and travel sector, providing actionable insights to our clients. We provide our worldwide client base of over 300 leading companies, associations, and destinations with direct access to the most comprehensive set of historic and forecast travel data available. Our team of specialist economists develops custom economic impact studies, policy analysis, and forecast models to help drive better marketing, investment and policy decisions.

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.

See here for a printable version of this press release.

- Hi, My Account Subscriptions --> My KT Trading Contact Us Privacy Notice Sign Out

Thu, Sep 05, 2024 | Rabi al-Awwal 2, 1446

Dubai 20°C

- Expo City Dubai

- Emergencies

- Ras Al Khaimah

- Umm Al Quwain

Life and Living

- Visa & Immigration in UAE

- Banking in UAE

- Schooling in UAE

- Housing in UAE

- Ramadan 2024

- Saudi Arabia

- Philippines

- Cryptocurrency

- Infrastructure

- Currency Exchange

- Horse Racing

- Local Sports

Entertainment

- Local Events

Dubai World Cup

- Track Notes

- Big Numbers

- Daily Updates

- Arts & Culture

- Mental Health

- Relationships

- Staycations

- UAE Attractions

- Tech Reviews

- Motoring Reviews

- Movie Reviews

- Book reviews

- Restaurant Reviews

- Young Times

Supplements

- Back To School

- Eid-Al-Adha

- It’s Summer Time

- Leading Universities

- Higher Education

- India Real Estate Show

- Future Of Insurance

- KT Desert Drive

- New Age Finance & Accounting Summit

- Digital Health Forum

- Subscriptions

- UAE Holidays

- Latest News

- Prayer Timings

- Cinema Listings

- Inspired Living

- Advertise With Us

- Privacy Notice

KT APPDOWNLOAD

UAE leads in GCC tourist numbers in H1

Hotel occupancy rates at 80% were the highest in the region.

Somshankar Bandyopadhyay

- Follow us on

Top Stories

UAE announces 2-month grace period for residence visa violators

UAE announces fee refund for tax service charges from August 1

Paid parking in Dubai: Residents face up to Dh4,000 extra yearly costs when new rates kick in

Published: Wed 4 Sep 2024, 9:40 PM

Dubai’s tourism sector retained its global appeal in the first half of this year, with a 9.3 million tourists arriving in the city, representing an increase of 9 per cent on H1 2023, data showed on Wednesday.

Citing STR data, Knight Frank says that between January and May 2024, the UAE emerged as a standout performer, with an average hotel occupancy rate of 80 per cent - the highest level in the region. This figure was matched by revenue per available room (RevPAR) levels of $155. As of the end of H1 2024, the UAE remains the largest hospitality market in the GCC, with current hotel stock standing at 212,000 quality hotel rooms, 154,000 of which are in Dubai alone. Assuming the planned completion of ongoing construction, Knight Frank expects this supply to increase by 10 per cent to 232,000 keys by 2026.

According to Knight Frank data, Dubai was the third most visited city in the world during 2023, with 17.2 million visitors to the city’s 154,000 hotel rooms.

Not to be outdone, Saudi Arabia emerged as the world’s 13th most visited country during 2023, with 27.4 million visitors, just behind the UAE (28.2 million visitors).

Overall, the travel & tourism sector injected a $223.4 billion to the GCC’s GDP, underpinned by the 76.2 million tourist arrivals to the region, who together spent $135.5 billion, up 45.3 per cent on 2022.

The hospitality sector across the GCC has experienced impressive growth in occupancy levels and average daily room rates (ADR) over the last few years, supported in big part by strategic government initiatives and substantial investments in tourism, leisure, hospitality and aviation infrastructure. The sector plays a pivotal role in many of the GCC’s transformation and vision programs such as Vision 2030 in Saudi Arabia, which is forecasting 150 million visitors to the Kingdom by 2030 and Dubai Economic Agenda (D33) in the UAE.

Faisal Durrani, partner – head of research, Mena at Knight Frank, said: “The synergy between a robust economy and a dynamic, vibrant hospitality and tourism sector is evident across the region as the GCC states collectively pursue an economic future that is far less reliant on oil than it is today. The UAE and Dubai, in particular, has blazed a trail in this regard with the travel and tourism sector now accounting for around 11.7 per cent of UAE’s economy, proving not only that it can be done, but creating a blueprint for other markets in the region to build on and adapt”.

Saudi Arabia recorded an average daily rate (ADR) of $198 and a RevPAR of $127, despite a more modest average occupancy rate of 64 per cent. As of the end of June, the Kingdom’s current hotel stock stood at 159,790 quality hotel rooms. With ongoing construction, Knight Frank is forecasting this supply to rise by 29 per cent to 205,500 by 2026, assuming projects are completed as planned. Riyadh alone is poised to experience a 46 per cent increase in quality hotel rooms to 32,500 by 2026.

lsewhere, the tourism sector in Qatar continues to show promising growth, following the successful hosting of the world’s largest soccer event and witnessing a remarkable 58 per cent surge in visitor numbers to 4 million in 2023, compared 2.6 million in 2022 (PSA). Notably, 28 per cent of these visitor’s hail from other GCC countries, Knight Frank points out.

As a result of the increased influx of tourists, the hotel performance indicators in Qatar have improved steadily between January and May this year. The ADR increased by 8.3 per cent to $127, while average occupancy levels increased by 33 per cent to 70 per cent. As a result, RevPAR grew by 44 per cent to $90 (STR).

Turab Saleem, partner and head of hospitality, tourism & leisure advisory, MEA, says: “Tourism and hospitality has emerged as a pivotal sector in the region, contributing to job creation, fostering international collaboration, and enhancing the global profile of the GCC. Notably, in 2023, the travel and tourism sector supported over 2.6 million jobs across the region, underpinned by a total of 464,465 hotel rooms.”

Kuwait, Knight Frank says, faces challenges with the GCC’s lowest occupancy rate (42 per cent), despite having the second highest ADR of $197 in the region. Around 200+ hotel keys were added to Kuwait’s total quality stock of around 10,300 rooms, with no additional rooms due to be completed this year. The quality room supply in Kuwait is expected to reach 10,770 keys by the end of 2026.

In Bahrain the hospitality sector has shown resilience and growth. From January to May this year the ADR increased by 7.1 per cent to $181, while average occupancy levels rose by 2 per cent to 54 per cent. Consequently, the RevPAR grew by 11.3 per cent to $98 (STR), signalling a robust recovery and promising future for Bahrain’s tourism sector. The overall hotel room supply has continued to expand, with current figures showing approximately 19,000 quality room keys available, a slight increase over previous years. By the end of 2026, the quality room supply in Bahrain is expected to reach 20,600 keys.

Supporting the growth of the hospitality sector across the GCC has been the rapid rise of the cruise industry as the Middle East establishes itself as a burgeoning tourism hub, marked by the inauguration of new cruise ship terminals across UAE, Oman, Qatar, and Saudi Arabia. Having hit a total revenue of $200 million last year, the projected cruise industry growth in the GCC is forecast grow by 9.9 per cent per year for the next five years.

According to Knight Frank, GCC’s current hotel stock stood at 464,465 quality rooms as of the end of June 2024, of which 46 per cent (212,000 keys) are in the UAE and 34 per cent (159,800 keys) are in Saudi Arabia. With ongoing construction, this supply is expected to increase by 17 per cent to 544,250 by 2026, assuming projects are completed as planned.

Future outlook

The large promotion of world-class cultural and entertainment offerings planned across the region is expected to play a critical role in attracting international and domestic tourists to the GCC, helping to reshape the regions hospitality landscape.

Amar Hussain - associate partner, research, ME, concluded: “The scale of the GCC region’s tourism ambitions is further amplified when we consider the mega events set to be held across the Gulf. Riyadh, for instance, winning the bid to host the 2030 World Expo is expected to inject an economic boost of $94.6 billion into the nation’s capital, with an estimated 40 million visitors expected during the six-month exhibition. In addition, Saudi Arabia is the sole bidder for the 2034 FIFA World Cup, while also being the host nation for the 2029 Asian Winter Games”.

More news from Business

African leaders in beijing eyeing big loans and investment.

China has expanded ties with African nations in the past decade

business 3 days ago -->

Event bridges MENA and Chinese luxury travel markets

Connect. China underscores the shift in Chinese luxury travel preferences

Ambani says India's Reliance to more than double in size before end of decade

To double sales, profit in telecoms, retail in 3-4 years

business 6 days ago -->

Chinese regional banks investment revenues surge even as lending falters

Chinese lenders are still facing challenges such as narrow margins and low loan rates

Emirates Global Aluminium posts net profit of Dh1.84 billion in H1 2024

Isr leadership global summit and awards in london announced in dubai.

Event aims to serve as a platform for fostering collaboration and knowledge-sharing

UAE poised to lead AI revolution in the Middle East

Sharjah Investment Forum 2024 contributes to the UAE’s ongoing momentum in developing a tech-driven economy

Dubai, Abu Dhabi are top global spots for executive nomads

Both Dubai and Abu Dhabi rank highly in several categories

business 1 week ago -->

Type your keywords

$7.5 million grant to guard against AI-driven misinformation

IU researchers to lead multidisciplinary team studying the psychological influence of online communications developed with artificial intelligence

BLOOMINGTON, Ind. — Indiana University researchers will lead a multi-institutional team of experts in areas such as informatics, psychology, communications and folklore to assess the role that artificial intelligence may play in strengthening the influence of online communications — including misinformation and radicalizing messages — under a $7.5 million grant from the U.S. Department of Defense.

The project is one of 30 recently funded by the department’s Multidisciplinary University Research Initiative, which supports basic defense-related research projects.

“The deluge of misinformation and radicalizing messages poses significant societal threat,” said lead investigator Yong-Yeol Ahn , a professor in the IU Luddy School of Informatics, Computing and Engineering in Bloomington. “Now, with AI, you’re introducing the potential ability to mine data about individual people and quickly generate targeted messages that appeal to them — applying big data to individuals — which could cause even greater disruptions than we’ve already experienced.”

The insights from the research — on the interplay between AI, social media and online misinformation — could potentially equip the government to counter foreign influence on campaigns and radicalization, he said.

The five-year effort will unite experts across a wide range of disciplines, including psychology and cognitive science; communications; folklore and storytelling; artificial intelligence and natural language processing; complex systems and network science; and neurophysiology. The six IU researchers on the project, all from the Luddy School, are also affiliated with IU’s Observatory on Social Media . Other collaborators include a media expert at Boston University, a psychologist at Stanford University and a computational folklorist at the University of California at Berkeley.

Specifically, Ahn said, the project will investigate the role of a sociological concept called “resonance” on people’s receptiveness to certain messages. This refers to the idea that people’s opinions are influenced more strongly by material that resonates with them through emotional content or narrative framing that appeals to existing beliefs or cognitive biases, such as political ideology, religious convictions or cultural norms.

Resonance can be used to create messages that bridge gaps between groups, as well as fuel greater polarization, Ahn added. However, AI’s ability to rapidly generate text-, image- or video-based content has the potential to escalate the power of these messages — for good or ill — by tailoring content to people on the individual level.

“This is a basic science project; everything we’re doing is completely open to the public,” Ahn said. “But it’s also got a lot of potential applications, not only to understanding the role of AI on misinformation and disinformation campaigns, such as foreign influence on elections, but also topics such as how can you foster trust in AI, similar to a pilot’s faith in the reliability of AI navigation systems. There are a lot of important questions about AI that hinge on our understanding of its intersection with fundamental psychological theories.”

The team will also be applying AI technology to support its research, he added. The use of AI to create “model agents” — or virtual people who share information and react to messages inside a simulation — will help the researchers more accurately model the way information flows between groups, as well as the effect that information has on the “people” inside the model, he said.

The team also plans to study real-life humans’ physical response to online information, both AI- and non-AI generated, with tools such as heart rate monitors to better understand the influence of their “resonance,” he said.

“There have been a lot of major developments in the area of model agents in the past few years,” Ahn said.

Other researcher have been able to create model agents who “debate” each other in a virtual space, then measure the effect of this debate on their simulated opinions, for example.

The IU-led team’s work will represent a “major departure” from other attempts to model belief systems through the simulation of people’s opinions, Ahn added. The project will apply “a complex network of interacting beliefs and concepts, integrated with social contagion theory” to produce “a holistic, dynamic model of multi-level belief resonance.” This approach was has been outlined in a paper published in the journal Science Advances.

The result would be a system that more closely resembles real-life complexities, where people’s opinions aren’t simply based upon political party but rather a complex intersection of belief systems, or social dynamics. For instance, Ahn said an individual’s social group or attitudes toward the medical industry may predict their opinions about vaccine safety more accurately than political ideology.

IU co-principal investigators on the project are assistant professor Jisun An , professor Alessandro Flammini , assistant professor Gregory Lewis and Luddy Distinguished Professor Filippo Menczer , all of the Luddy School in Bloomington. Lewis is also an assistant research scientist at the Kinsey Institute. Haewoon Kwak , associate professor at the Luddy School, will serve as senior personnel.

Other co-principal investigators on the grant are Betsi Grabe of Boston University, Madalina Vlasceanu of Stanford and Timothy Tangherlini of UC Berkeley. The research project will also involve several Ph.D. and undergraduate students at IU.

Media Contact

Kevin fryling, filed under:, more stories.

New consortia to advance sustainability and health economics research

2024 Presidential Arts and Humanities Fellows selected to advance research, creative projects

Social media.

- Facebook for IU

- Linkedin for IU

- Twitter for IU

- Instagram for IU

- Youtube for IU

Additional resources

Indiana university.

- About Email at IU

- People Directory

- Non-discrimination Notice

- Email Newsletters & Press Releases

Maui remains top hotel market despite slow recovery after fires

Analysis by Emmy Hise

A year after a series of tragic fires in Maui, the island’s hotels and Hawaii's governor want visitors to return to the destination to help support the local economy and regain a sense of normalcy.

Topline hotel performance across the island remains below 2023 levels. While most of the hotel performance decline was due to the devastating fire, performance was already starting to slow before the fire, similar to many U.S. leisure destinations. Nationally, domestic leisure demand has slowed due to Americans traveling abroad or travelers being more budget-conscious, causing them to take fewer trips or pick less expensive destinations. The lagging international visitor recovery, mainly from Japan and China, also hinders hotel performance.

While hotel performance declined year over year, there is a bright side. Maui maintains the nation's highest 12-month average daily rate (ADR) at $551. The market was among the list of leisure destinations that experienced significant ADR growth over pre-pandemic levels, despite a lack of occupancy recovery. Maui's 12-month ADR is approximately $120 higher than the second-highest destination, the Hawaii/Kauai Islands, with the Florida Keys achieving the highest 12-month ADR outside of Hawaii, at $357.

There have been more occupied hotel room nights outside of the Kaanapali area, which was the most impacted by the fire. Outside of the impacted area, the 12-month average occupancy increased year over year, while the decline in ADR was not as much as in the Kaanapali/Lahaina/Kapalua area.

The Hawaii/Kaui Islands experienced similar results with less hotel room night demand, resulting in a decline in occupancy. However, Maui was the only Hawaii area to experience an ADR decline. Some of that room rate decline could be attributed to more reasonable prices for housing displaced residents and area recovery support workers.

Oahu was the only market in Hawaii that achieved hotel performance growth. Home to the state capitol and the Hawaii Convention Center, the destination also attracts the group and corporate travel segments, which continue to grow nationally. The diversified demand segments cause Oahu to have the second-highest 12-month occupancy in the nation at nearly 81%, only trailing New York.

Hotels in Hawaii have the highest topline performance metrics, with Maui, Hawaii/Kaui, and Oahu achieving the first, second, and fifth-highest 12-month average revenue per available room (RevPAR), respectively, in the U.S.

While travel demand contributes to higher ADR, it is also expensive to operate a hotel due to the high cost of living on the islands, which increases labor and supply operating expenses. Hawaii is a highly-desired destination due to its year-round temperate weather, sought-after beaches, and plentiful excursion options. As such, continued recovery in Maui is expected, with annual RevPAR expected to reach peak levels again in 2025.

Related Content

U.s. hotel performance for july 2024, str weekly insights: 18-24 august 2024, the role of total revenue management in a hotel profitability strategy.

IMAGES

VIDEO

COMMENTS

STR data is frankly the industry's standard in the lodging space. And there is a lot of trust that STR has garnered over the years, not only in terms of the data they put out there, but also the analysis and research work that they do. Sourav Ghosh, Chief Financial Officer, Host Hotels & Resorts. We use STR every day, and it is extremely ...

As the hospitality data benchmarking leader, ... Tourism. Industry Basics. STR Weekly Insights: 18-24 August 2024. 30 August 2024 ... STR's global "bubble chart" update through late-August showed fewer RevPAR growth markets but a handful of event-driven standouts. Tags. Global.

As the industry's trusted provider of past, present, and future data solutions, STR empowers businesses to identify opportunity from every angle and make more informed decisions at the hotel and above-property levels. Comparing your performance against the competition adds a necessary layer of context when measuring your success.

NASHVILLE - STR and Tourism Economics made slight adjustments to the 2024-25 U.S. hotel forecast just released at the 16 th Annual Hotel Data Conference. For 2024, projected gains in average daily rate (ADR) were downgraded 0.1 percentage points, while revenue per available room (RevPAR) was held steady at +2.0% year over year.

STR and Tourism Economics released the latest U.S. hotel forecast for 2024 and 2025 at the Hotel Data Conference in Nashville, Tennessee. Pictured is the Nashville skyline overlooking Cumberland Park.

August 12, 2021 | 2:46 P.M. NASHVILLE — Just released at the 13th Annual Hotel Data Conference, STR and Tourism Economics have upgraded the U.S. hotel forecast for 2021 as a whole and lessened ...

The STR report uses a variety of metrics to show performance data. Here are a few of the main terms that you'll see throughout the report: Occupancy = Rooms Occupied / Total Number of Rooms. Occupancy is expressed as a percentage, like 78%. ADR (Average Daily Rate) = Total Revenue / Number of Rooms Sold. ADR is the average room rate sold for ...

By HNN Newswire. January 23, 2024 | 6:16 AM. STR and Tourism Economics made minimal adjustments to growth projections in the first U.S. hotel forecast of 2024 just released at the Americas Lodging ...

STR, Inc. is a subsidiary of CoStar Group that provides market data on the hotel industry worldwide, including supply and demand and market share data. The company has a corporate headquarters in Hendersonville, Tennessee, an international headquarters in London, England and offices in Italy, Dubai, Brazil, Singapore, Tokyo, Jakarta, Sydney, and Beijing.

STR also offers Trend Analysis reports for a one-time fee of $600. The Trend Analysis provides valuable data to hotels that don't want to pay for a monthly plan. The downside is that it's an overview of the hotel industry rather than a detailed report that displays your individual hotel data vs. your comp set.

Trend Reports display historical monthly, year-to-date and total-year performance metrics as well as census and sample information for a market, submarket, city, county, specified set of hotels, etc. Trend reports are the ideal resource for a thorough analysis of the hotel industry. Years' worth of monthly, YTD and total-year performance metrics.

Research. STR Reports. VISIT FLORIDA provides monthly reporting from STR for up to 200 partners each month. The STR reports include data on hotel occupancy, average daily rate, revenue per available room, and other hotel-related metrics. The data are broken down by market, with every area in the state being covered by at least 1 market.

STR and Tourism Economics made slight adjustments to the 2024-25 U.S. hotel forecast just released at the 16th annual Hotel Data Conference. For 2024, the analysts downgraded projected gains in average daily rate 0.1 percentage points while holding revenue per available room steady at +2 percent year over year. Occupancy for the year was ...

July 8, 2024. ACCESS THE WEEKLY REPORT. This report shows a weekly summary of statewide and regional lodging statistics provided by STR, including the year-over-year (YOY) change in Average Daily Rate (ADR), Revenue Per Available Room (RevPAR), and Occupancy. The date at the top of the chart refers to the beginning of the presented week.

STR and Tourism Economics lifted year-over-year growth projections for average daily rate and revenue per available room in the final U.S. hotel forecast revision of 2023. For 2023, growth in RevPAR was raised by 0.3 percentage points, due to a 0.6 percentage point lift in ADR growth.

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North ...

For example, STR data reveals that the average occupancy rate across US hotels in August 2022 was 66.5%, and the average daily rate was US$151.49. ... Perhaps a tourist campaign brought more guests to your hotel last year, or maybe there has been an overall downturn in discretionary spending. If you can't attribute the downturn to any broader ...

Media members stay up to date on the latest hospitality data and trends through STR press releases. ... STR and Tourism Economics made slight adjustments to the 2024-25 U.S. hotel forecast just released at the 16th Annual Hotel Data Conference. U.S. hotel results for week ending 27 July.

NASHVILLE — As the Hotel Data Conference began, STR and Tourism Economics released their latest U.S. hotel forecast, with improved predictions for 2021 as a whole and lessened growth projections for 2022. Additionally, full recovery of demand remains on the same timeline for 2023, while revenue per available room is projected to surpass 2019 ...

STR, a CoStar Group company, is the global hotel industry's leader in data benchmarking, analytics and marketplace insights. Tourism Economics and STR have partnered on industry forecasts since 2011, consistently ranking among the most accurate industry prognosticators.

Dubai's tourism sector retained its global appeal in the first half of this year, with a 9.3 million tourists arriving in the city, representing an increase of 9 per cent on H1 2023, data showed ...

By HNN Newswire. June 3, 2024 | 6:43 AM. STR and Tourism Economics made significant downward adjustments to the 2024-25 U.S. hotel forecast just released at the 46th Annual NYU International ...

Global travel and tourism trends. International travel recovery is off to a strong start in 2022, with travel restrictions easing at a swift pace following the wave of Omicron infections earlier in the year. High frequency data points to a strong desire to return to travel across many destinations.

BLOOMINGTON, Ind. — Indiana University researchers will lead a multi-institutional team of experts in areas such as informatics, psychology, communications and folklore to assess the role that artificial intelligence may play in strengthening the influence of online communications — including misinformation and radicalizing messages — under a $7.5 million grant from the U.S. Department ...

Keep up with the latest news online at STR. Browse press releases and media as well as our online data insights blog. ... Revised Market Forecasts from STR and Tourism Economics are now available. View the full global travel and macroeconomic assumptions that went into this quarter's reports.

Analysis by Emmy Hise. A year after a series of tragic fires in Maui, the island's hotels and Hawaii's governor want visitors to return to the destination to help support the local economy and regain a sense of normalcy. Topline hotel performance across the island remains below 2023 levels. While most of the hotel performance decline was due to the devastating fire, performance was already ...