Travel Insurance

An illness, an accident or an unexpected situation can arise before or during any type of vacation. Such an event might cause you to cut short your cruise or cause your trip to be canceled altogether. Unfortunately, most cruise lines impose penalties for canceling a cruise, up to and including loss of the entire cruise price.

Because a cruise is a significant investment, most cruise lines offer some form of insurance to protect their passengers from financial loss in the event of an emergency. Details and prices vary from cruise line to cruise line, as do coverage limits and exclusions.

If you decide to purchase insurance, you will have two options, to go with the cruise line's plan or to use our independent insurance provider, Generali Global Assistance. Use the summaries below to compare policies and prices.

Generali can provide insurance coverage to all customers, regardless of their country of citizenship, except residents of the province of Quebec, Canada.

For more information or a complete copy of a policy, ask your Vacations To Go cruise counselor.

Independent Insurance Coverage

Generali Global Assistance

Cruise Line Coverage

You are using an outdated browser. Please upgrade your browser to improve your experience.

Welcome to P&O Cruises. This website presents a main menu on the left hand side from where you can browse our cruises, and a toolbar menu at the top page with search, live chat, support, and profile settings.

- Skip to side menu (Press enter)

- Skip to toolbar menu (Press enter)

- Skip to content (Press enter)

- Plan a Cruise Trip

- Know Before You Go

Travel Insurance

There’s nothing like a cruise to feed the soul and broaden the mind. And nothing like the unexpected to put a dampener on your plans.

With nearly thirty years of experience and more than 2.2 million journeys every year, Cover-More knows what travellers need. That’s why P&O Cruises recommends Cover-More Travel Insurance.

Ensure you are covered for general medical expenses overseas, existing medical conditions, hospitalisation and medical evacuations.

If you plan on participating in sports such as scuba diving or parasailing, ensure your policy covers these activities.

International travel insurance is recommended on Australian coastal cruises, as your cruise is outside the scope of the New Zealand Health system.

If your cruise includes a call to New Caledonia, please note the New Caledonia government requires that all guests hold comprehensive international travel insurance. Guests will be required to bring printed proof of travel insurance and this will be checked at embarkation. Guests may also be requested to present it during the cruise. Any guest who is unable to provide proof of travel insurance will be denied boarding.

Be aware when organising your insurance that uninsured travellers (or their families) are held personally liable for cancellation, medical and associated costs incurred at any time whether before the cruise, on board or overseas. Hospitalisation costs on board or outside of the country and medical evacuation costs are very expensive and are not covered by Medicare or private health insurance. Daily hospital bills can cost as much as AUD 5,000 per day. All consultations, treatments and medications are charged at private rates.

If something goes wrong, you want expert help fast so you can keep travelling.

For more information, please see the Ministry of Foreign Affairs and Trade website at safetravel.govt.nz .

For more information about this travel insurance product, contact us on 0800 550 125.

Disclosure: P&O Cruises Australia has a referral arrangement with Cover-More and may receive a fee or commission if you choose to purchase an insurance product from Cover-More.

Limits, sub-limits, conditions and exclusions apply. Insurance administered by Cover-More (NZ) Ltd, underwritten and issued by Zurich Australian Insurance Limited (ZAIL) incorporated in Australia, ABN 13 000 296 640, trading as Zurich New Zealand. Consider the Policy Brochure and wording therein before deciding to buy this product. For further information see Zurich New Zealand’s financial strength rating.

As Australian Medicare, New Zealand ACC and private health insurance won’t cover you for medical costs onboard, all cruises (even domestic cruises) require international travel insurance.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

All medical conditions considered

Includes Medical Assistance Plus

Kids go free on family policies (1)

A choice of travel insurance to suit you

We have different types of cover for whatever you have planned. And we consider all medical conditions.

Single-trip cover

Offering cover for anything from a short UK break to a year of travelling around the world

- Covers you for a one-off trip up to 365 days (2)

- Perfect for short or long trips for anywhere in the UK or abroad

- No age limit

Annual multi-trip cover

Travelling more than once this year? An annual multi-trip policy could save you time and money

- Cover for multiple-trips for a 12-month period

- 31-day trip limit, with extensions available up to 45 and 60 days

- Available for everyone aged up to 75 years

Backpacker cover

Looking for a gap year, career break or to travel the world? We could have the cover you're after

- Cover for a one-off trip up to 18 months

- Option to return home for up to 7 days on 3 occasions

- Available for those aged 18 – 60

Medical Assistance Plus: 24/7 holiday health support

Have peace of mind when you travel knowing that health professionals are just one click away.

Medical Assistance Plus (3), powered by Air Doctor, comes free with all our travel insurance policies. It gives you access to outpatient medical support while you’re abroad.

Through the service you can book an in-person or video consultation with a doctor. You can also get prescriptions delivered to your nearest pharmacy.

We’ll send you an SMS reminder about the service the day before you travel (for single-trip and backpacker cover) or the day before your policy begins (for annual multi-trip cover).

Living with a medical condition shouldn’t stop you seeing the world. And, with the right travel insurance in place, you can enjoy peace of mind on your adventures – just in case something unfortunate happens.

At Post Office, we cover most pre-existing conditions. Contact us for a quote to see if we can cover you. It’s important to declare upfront all your medical conditions and any medication you're taking.

If we can’t help and yours is a serious pre-existing medical condition, check the Money and Pensions Scheme (MaPS) directory. It lists companies that may be able to help you. Or call 0800 138 7777.

Choose a travel insurance cover level

We can offer you a choice of economy, standard and premier cover levels.

Policy wording

Upgrade your cover with ease

Need cover for your policy that's not included as standard? Just pay a little more to add these upgrades – optional or mandatory depending on the trip type.

This optional extra helps protect you from the impact of airspace disruption, natural catastrophes, terrorist acts or Covid-19 (5)

If you’re happy with the cover offered, but worried about excess fees, you can opt for an excess waiver. For an additional premium, you can add it to any Post Office level of cover for zero excess fees (5)

Insure all your devices with our easy-to-add gadget cover. It’s perfect to protect all your smartphones, tablets, laptops and consoles (5)

Specialist cover is mandatory for winter sports like skiing and snowboarding. There’s greater risk of emergency costs. Make sure you’re protected on the pistes (5)

If you're going on a cruise, specialist cover is both important and mandatory. It covers missed departure due to breakdown, falling ill on board, being confined to your cabin, lost baggage and more (5)

Trip extensions are available up to 45 or 60 days, increasing from the standard 31 days (5)

Ready to get a quote?

Let’s find the protection that’s right for your travels. Get a quote for Post Office Travel Insurance

What is travel insurance?

Travel insurance may be able to protect you against a range of unexpected events. From losing valuables to medical emergencies, and anything else that could spoil your holiday. Take a look at our policy documents to make sure that you’re getting the cover that meets your needs.

Cancellation and cutting short your trip

- Emergency medical expenses

- Missed departure

- Delayed departure

Personal liability and legal costs

We'll repay you for any non-refundable, unused travel and accommodation costs if you have to cancel or cut short a trip due to reasons set out in the policy. This includes pre-booked activities and excursions, car hire, cattery and kennel fees, up to the limits shown

We may be able to help if you need emergency medical treatment, return to the UK (getting you back home) and more while you’re abroad

Missed departure (6)

We’ll also cover any extra travel and accommodation costs you're charged if you arrive too late to travel on your booked transport. As long as they match the reasons set out in the policy

Delayed departure (6)

You’re covered if your first outbound or final inbound international departure is delayed by 4 or more hours. As long as it matches certain reasons set out in the policy wording

Items that are usually carried or worn during a trip are covered if they get lost, stolen or damaged

You'll also get protection for any unexpected legal costs you might be charged while you're away

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

An award-winning provider

Best travel insurance provider.

Post Office won a ‘Best Travel Insurance Provider’ award at the Your Money Awards in 2021, 2022 and 2023

Post Office won a “Best Travel Insurance Provider” award at the British Travel Awards in 2023

Defaqto 5-star rated cover

Our travel insurance policies with premier level cover are Defaqto 5-star rated

Cover you can count on. We’ve paid out over £177 million in travel insurance claims since 2007

Common travel insurance questions, what does travel insurance cover.

Post Office Travel Insurance can cover you for a single trip of up to 365 days(2), or multiple trips in a single year. This applies to trips taken anywhere in the UK and abroad too. We also offer backpacker cover(7) for a single trip of up to 18 months.

The type and level of cover provided depends on the insurance policy type and options you choose. It can include cover for:

- Cancellation

- Cutting your trip short and abandonment of your trip

- Lost, stolen or damaged baggage

- Lost, stolen or damaged passports

- Lost, stolen or damaged personal money

- Personal accidents and liability

- Legal protection

You can add additional cover to your policy. Options include:

- Gadget cover

- Excess waiver

- Trip disruption

- 45- or 60-day trip extensions (on annual multi-trip only)

Winter sports cover is compulsory for winter sports trips and cruise cover is mandatory if you’re going on a cruise. It’s important to check the different travel insurances available, and their various options and add-ons you can buy. This way, you’re sure to be fully covered for your trip and all you’ll do on it.

Why is it important to have travel insurance?

Having travel insurance is a worthwhile purchase for anyone going abroad for their holidays. Even in relatively safe locations such as central Europe, a number of things can go wrong.

Flights can be delayed. Airlines can lose your luggage. Tourist areas may be prone to opportunist thieves who may target your belongings. And you could fall ill anywhere in the world, to the detriment of your holiday plans.

We hope that none of these events happen to you. But, if they do, you could be out of pocket. And with emergency medical problems it could be by tens or even hundreds of thousands of pounds.

Holiday insurance may be able to help avoid some of this risk. It’s a way to insure for travel you, those travelling with you and your belongings.

If your luggage is lost, holiday insurance may not be able to replace it, but the payout from a claim can help recover any costs that you have had to pay to get replacements.

In particular, the medical cover outside of the EU offered by insurance is a necessity.

Within the EU, you may think that an European Health Insurance Card (Ehic) or its replacement, the UK Global Health Insurance Card (Ghic), can cover all your medical needs. This isn’t true. Some of the most expensive medical services, such as repatriation, aren’t covered by the Ehic or Ghic. They're limited to health cover and won’t help at all with things like cancellation, loss or theft. And the Ehic no longer provides access to healthcare for UK nationals travelling to Iceland, Liechtenstein, Norway or Switzerland.

Even if you’re staying in the UK for your break , having holiday insurance will provide cover for lost, damaged or stolen possessions such as baggage, and cancellation, cutting your trip short or delay to your trip in some circumstances.

To qualify for cover on our annual multi-trip policies, UK trips must consist of:

- At least one night's pre-booked and paid-for accommodation, or

- A stay at least 100 miles from your home, or

- At least one sea crossing

Why choose Post Office?

You’re in safe hands with Post Office. We won Best Travel Insurance Provider at the Your Money Awards in 2021, 2022 and 2023. We also won bronze for Best Travel Insurance Provider at the British Travel Awards 2023, voted for by the UK public.

Our premier cover is 5 Star Defaqto Rated. Defaqto is a financial information business, helping financial institutions and consumers make better informed decisions.

We have a range of cover options available to suit lots of different holidays, so you can choose the cover that suits you best. We’re there for our customers when they need us the most; since we launched travel insurance in 2007, we’ve paid out over £177 million in claims.

What cover is there for Covid-19 as standard?

Policies purchased from the 31 March 2022 onwards provide cover if:

- you test positive for Covid-19 within 14 days of your trip and are required to self-isolate by a medical practitioner, the NHS or any UK government body

- a medical practitioner certifies you as too ill to travel due to Covid-19

- you, someone you’re travelling with, or someone you’re staying with is required to self-isolate by a medical practitioner, UK government body or health authority

- you, an immediate relative (8) or someone you plan to travel or stay with dies or is hospitalised due to Covid-19

If an insured trip has to be cut short, the unused portion of it can be claimed for if:

- you test positive for Covid-19 after you’ve left the UK and have to self-isolate

- you test positive on arrival in your destination and are not allowed to continue your trip

- you, an immediate relative (8) or someone you’re travelling or staying with dies or is hospitalised due to Covid-19

There’s also cover for medical and repatriation costs if you fall ill with Covid-19 while away. Call our emergency assistance line and we’ll help you seek treatment or, if needed, arrange to bring you back to the UK.

There’s no other coronavirus cover on our policies, but for extra reassurance you can add our trip disruption cover upgrade option. This gives you added protection against missed departures and expenses incurred due to change of testing or quarantine requirements. Add it to your preferred policy for an extra premium.

For policies sold on or after the 31 March 2022

Should the FCDO advise against all travel to your destination, there's no cover under any section of the policy if you decide to travel.

If the FCDO have advised to only undertake essential travel to a destination and your trip's not essential and you choose to travel, we'll only cover a claim if the cause is not linked to the reason for the FCDO advice. This limitation applies even if you've purchased an optional trip disruption cover upgrade. You may be able to travel with full cover if we authorise in writing that your trip's essential before you depart. Should you like to request this, please email [email protected]

Please make sure you’re clear what’s covered and what’s not. Check the answers to common questions about coronavirus cover and the full policy wording for more details.

Does Post Office Travel Insurance cover medical expenses?

Yes, our travel insurance covers you for unexpected medical expenses. This includes emergency treatment and hospitalisation, plus repatriation if you need it. Cover's provided up to the limit specified in the policy wording for the specific cover level you choose.

Emergency medical assistance

If you need emergency medical assistance, you can call our dedicated team. They're here 24 hours a day, 7 days a week to get you the help you need. Check the correct contact details for your policy on our travel insurance help and support page .

Non-emergency medical support

If it’s not an emergency but you still need to see a medical professional, you can use our Medical Assistance Plus (3) service. This outpatient service is included free with all new Post Office Travel Insurance policies.

Get easy access to medical experts such as doctors, dentists and gastroenterologists. The single online platform can be used wherever you are abroad.

Choose whether you’re seen at a clinic, in your hotel or via an online video consultation. All sessions are in your own language. They even have prescriptions delivered to your nearest pharmacy.

This takes away the stress of finding medical help, so you can kick back and enjoy your holiday to the full.

Do I need travel insurance for UK trips?

We provide cover whether you’re taking a break in the UK or going on holiday overseas. You’re covered if your luggage or personal belongings are lost, stolen or damaged while you’re staying away from home in Britain. And if you have to cancel or cut short your trip in some circumstances, we can cover that too. As long as it matches the reasons set out in your policy.

Our annual multi-trip travel insurance can cover you for UK trips too. The minimum requirements are one night’s pre-booked and paid accommodation. Or your stay must be at least 100 miles from your home. Or you must have at least one sea crossing.

Where can I go on holiday in the UK or overseas?

The UK Government provides guidance on travel 24 hours a day, 7 days a week. Visit the Foreign, Commonwealth & Development Office website for the latest travel information. It lists if it's safe to visit your chosen country. This information can change at short notice. So it's a good idea to check the FCDO page regularly.

Remember, your cover won’t be valid if you travel against the FDCO advice of all travel, and local government advice. Check the latest on the FCDO site or read our where can I go on holiday guide .

Does travel insurance include gadget cover?

Our standard travel insurance policies will only provide limited cover for electronic items such as mobile/smart phones, camcorders and their accessories, all photographic/ digital/ optical/ audio/ video media and equipment, iPods, MP3/4 players or similar and/or accessories, E-book readers, and satellite navigation systems up to the single article limit. The single article limit depends on the cover you’ve taken out. For economy it’s £150, for standard it’s £250, and for premier it’s £400.

Gadget cover is an optional add on you can buy at any time to add protection for your devices. Check the policy wording for full terms.

Do you offer a student discount?

Yes, we do. We’ve partnered with Student Beans to offer a discount to students. To claim it, you’ll need to either register for a Student Beans account (to verify your student status) or log in with your existing account . You’ll be given a unique code, which you’ll need to enter in the promotion code box that appears when getting your travel insurance quote. The discount will be taken off your quote total.

Do you offer a discount for graduates?

Yes, we do. We’ve partnered with Grad Beans to offer a discount to graduates. To claim it, you’ll need to either register for a Grad Beans account (to verify your graduate status) or log in with your existing account . You’ll be given a unique code, which you’ll need to enter in the promotion code box that appears when getting your travel insurance quote. The discount will be taken off your quote total.

- Read more travel insurance FAQs

Need some help?

Travel insurance help and support.

For emergency medical assistance, to make a claim, find answers to common questions about our cover or get in touch:

Visit our travel insurance support page

We’re here to help on your travels

Access your travel insurance policy anywhere.

You can buy travel insurance and view your policy all in our free Post Office travel app. Plus you can order and top-up our Travel Money Card wherever you are too

Travel money made easy

Buy your travel money online. You can click and collect from a branch near you or choose next-day delivery to your home

Related travel guides and services

We all know the feeling – getting to the airport, then a wave of panic comes ...

It's a proud feeling when children turn eighteen and start holidaying on their ...

If you're travelling abroad as a family, it makes sense to take out insurance ...

Fancy trekking in a remote Asian rainforest? A wild time in New York? Flying ...

Learn the difference between embassies and consulates, and why you might need ...

With festivals overseas becoming the new norm, festivalgoers need to do a bit ...

Perched on the northern tip of Africa, Morocco’s long been a popular ...

It may be a short hop away, but a trip to France is not without its travel ...

Canada is a vast country of diverse delights – everything from bustling cities ...

For many UK holidaymakers, India is an intriguing and diverse culture with ...

Thailand’s idyllic beaches, azure-blue sea, buzzing cities and exciting ...

The white stuff is alluring, so make sure you can enjoy it safely, are ready ...

The status of Schengen visas for international students resident in the UK is ...

Every year, millions of holidaymakers from the UK head to Spain for its ...

The famous cliché of America is that it's big. And it is. Across its six time ...

Heading down under for a trip to or around Australia? Make sure you’ve got the ...

Today, Cuba is more accessible than it has been for many decades, and those who ...

Do UK residents need travel insurance for Ireland? And what healthcare is ...

Planning on living the high life with a trip to the UAE’s iconic mega-city, ...

Booking a last-minute holiday can get the blood pumping with the sudden thrill ...

Find out about medical care available to Brits in Mexico, as well as travel ...

Find out about the safety of travelling to Italy as well as the medical care ...

Make sure you’re travelling safely in Egypt with the latest advice and risks, ...

Taking your best friend on holiday with you is everyone's ideal situation, but ...

If you’re jetting off to Japan soon make sure you have good travel insurance to ...

How safe is South Africa to visit and why is having travel insurance important ...

Find out what medical care Brits can access in New Zealand and travel risks to ...

There’s nothing worse than falling ill while away from home. Along with the ...

Travel’s a great way to unwind, see the world, open the mind and expand ...

People flock to the Canary Islands from all over Europe. No wonder, with such ...

Greece and the Greek islands have long been a popular travel destination for us ...

A trip to Turkey offers toasty beaches and tourist treats aplenty. No wonder ...

Learn about the different types of travel insurance available from Post Office, ...

There’s no better feeling than planning an amazing trip to an exotic ...

It’s your holiday too, and good preparation can take some of the worry out of ...

The opportunities to combine business and leisure have never been greater. You ...

Ready to jet off on a much-needed break but worrying about what you can take ...

Having your son or daughter go on holiday without you for the first time can be ...

ATOL stands for Air Travel Organisers' Licensing, a scheme that helps make sure ...

The arrival of Airbnb has helped to transform the travel industry in recent ...

Whether you’re travelling solo because of business, you’re hoping to meet ...

Travelling with high blood pressure is fine – but it’s important to make sure ...

The whole idea of lounging around on the beach is to switch off and enjoy the ...

Over 60 million people travel from the UK most years for holidays or business. ...

Enjoy that precious time away with your grandchildren, and take some of the ...

There are several ways to get to the top of the class on your flight – whether ...

If you're travelling to an EU country from the UK, make sure you take a Global ...

The last thing you want to happen on holiday is standing the luggage carousel ...

Lots of people who need assisted travel at airports are missing out simply ...

If you're living with cancer but love to travel, can you get travel insurance ...

Going backpacking is one of life’s great adventures. But before you set off ...

It’s one of the most popular holiday hotspots for UK holidaymakers. But what ...

You should be able to get the right cover to travel abroad if you’re diabetic, ...

Most of the time, getting a flight is a hassle-free event. If you only take ...

Exploring the globe can be scary, but there’s so much to find at the edge of ...

Finding out that your airline or holiday company has gone bust is a shock – ...

Holidays for teenagers can take some imagination to make sure they’ve got the ...

Do you need travel insurance for your trip? Is travel insurance worth it? And, ...

So, you’ve booked your flights, accommodation and activities. What next?

Satisfy your travel craving while making your holiday budget go further. We’ve ...

Whether you’re heading to the beach for a much-needed break or boarding a boat ...

Travel insurance for a holiday in the UK isn't something you must have, but it ...

If you're the type of sunchaser who looks forward to that sizzling summer ...

In an average year, millions of Britons go abroad without the right travel ...

Some vaccinations for Thailand are recommended and some are mandatory in ...

As you get older, being able to go where you want when you want is all part of ...

Adventurous holidays can take many forms, from action-packed itineraries in ...

Travelling solo means freedom and independence, making new connections and ...

With the winter sports season upon us, we conducted a Winter Sports Survey for ...

Dark mornings, cold hands, heating bills and chapped lips are among the most ...

Before your little bundle of joy arrives, you may be considering taking a ...

About our travel insurance

Post Office® Travel Insurance is arranged by Post Office Limited and Post Office Management Services Limited.

Post Office Limited is an appointed representative of Post Office Management Services Limited which is authorised and regulated by the Financial Conduct Authority, FRN 630318. Post Office Limited and Post Office Management Services Limited are registered in England and Wales. Registered numbers 2154540 and 08459718 respectively. Registered Office: 100 Wood Street, London, EC2V 7ER. Post Office and the Post Office logo are registered trademarks of Post Office Limited.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

(1) Kids (under 18s) can be covered at no extra cost on our single-trip and annual multi-trip policies provided they have no medical conditions.

(2) For economy, standard and premier policies, the single-trip policy will cover you for one trip up to: 365 days for those aged up to and including 70 years 90 days for those aged between 71 and 75 31 days for those aged 76 years and above.

(3) Medical Assistance Plus is not available for trips taken in the UK, only for international travel. The service allows up to 3 separate medical events per person, per policy and for each medical event up to 3 appointments per person listed on the policy. All appointment charges are covered by your travel insurance policy. You will not need to pay any excess fees for this service.

For any online appointments or where the appointment was held at your accommodation, where a prescription is issued, you will need to pay for any medication and claim upon your return home. No excess will be applied for any prescription charges. If your appointment takes place at a clinic and they have a dispensing chemist, you will not need to pay for your prescription and all charges will be covered by your policy at the point of appointment. If there is no dispensing chemist at the clinic, you will either be given a prescription, or the prescription will be sent to a chemist by the treating doctor, and you will need to pay for any medication and claim upon your return home.

If your medical situation needs to be handed over from an outpatient case to an inpatient case and requires hospital admission, you will be handed over to our emergency medical assistance team in the UK. For any inpatient cases, no excess will be applicable.

(4) Increased to £750 if you bought your foreign currency from Post Office.

(5) Terms and conditions apply.

(6) Delayed and missed departure are only available with our standard and premier cover levels.

(7) Backpacker policies only available on the economy level of cover.

(8) Immediate relative: your mother, father, sister, brother, spouse, civil partner, fiancé/e, your children (including adopted and fostered), grandparent, grandchild, parent-in-law, daughter-in-law; sister-in-law, son-in-law, brother-in-law, aunt, uncle, cousin, nephew, niece, step-parent, step-child, step-brother, step-sister or legal guardian.

Travel Insurance. Stay worry-free at sea.

There’s nothing like a cruise to feed the soul and broaden the mind. And nothing like the unexpected to put a dampener on your plans.

With over 30 years’ experience in travel insurance, covering more than 3.8 million journeys every year, cover-more is the perfect travel (and cruising) companion. cover-more helps you explore the world with confidence by ensuring you are covered for general medical expenses overseas, existing medical conditions, hospitalisation and medical evacuations~., if something goes wrong, you want expert help fast so you can keep travelling., travel insurance for all your cruising needs, budget plan.

- Our most affordable insurance especially for cruises

- On-trip cover if you’re diagnosed with COVID-19*

- Up to $5 million of emergency overseas medical expenses~*

- Missed cruise departure cover

- Amendment or cancellation costs*

Comprehensive Plan

- On-trip cover if you’re diagnosed with COVID-19 (including cabin confinement)*

- Up to $10 million of overseas emergency medical expenses~*

- Missed cruise departure, port and connections cover*

- Up to $8,000 luggage cover⬩

- Amendment or cancellation costs^

- Existing medical conditions cover available.

(To ensure your Existing Medical Condition is covered, read page 21 of the PDS )

Premium Plan

- Pre-trip cover if you’re diagnosed with COVID-19#*

- $Unlimited overseas emergency medical expenses~*

- Up to $15,000 luggage cover⬩

- Amendment or cancellation costs^*

~Cover will not exceed 12 months from onset of the illness, condition or injury. To ensure your Existing Medical Condition is covered, read page 21 of the PDS . ^Cover chosen applies per policy. Read page 14 of the PDS for more information. *Sub-limits apply. Read the PDS for more information. #If you bought the policy within the 21 days before your scheduled trip departure date, we will only cover the travel costs that you paid for in the 48 hour period before buying your policy and after buying this policy. ⬩ Sub-limits and item limits apply. You may wish to increase these items limits, read the PDS for more information.

Doing more than relaxing?

If you plan on participating in sports such as scuba diving or parasailing, a premium may apply..

Special Note For New Caledonia

Guests traveling on a South Pacific cruise that calls on New Caledonia must hold a valid international travel insurance policy and present printed proof of this travel insurance at time of check-in. Guests may also be requested to present it during the cruise. Any guest who is unable to provide proof of holding suitable travel insurance will be denied boarding.

Frequently Asked Questions

Not all domestic cruise ships have access to a Medicare accessible doctor on board. If you need to see a GP while on a domestic cruise, the cost won’t be covered by Medicare in these cases and – you may have to pay for it yourself in full.

At Cover-More, we can provide cover for these expenses when you tell us you are travelling on a cruise for two or more nights (except for river cruises within Australia). An additional premium will need to be paid and cruise cover benefits will then be available on your policy.

When generating a Cover-More travel insurance quote – the first step in buying our cover – you will be asked if you are travelling on a cruise for two or more nights (except for river cruises in Australia). An additional premium will be applied to your policy and the cruise cover benefits will be available once the premium is paid and the Certificate of Insurance issued.

To buy cover for a domestic cruise in Australia, select “Domestic Cruise” as the destination in the quote box, and answer the cruise question when prompted. To buy cover for an international cruise, select the country or region or “Anywhere in the World” as your destination, and answer the cruise question when prompted. Before protecting your trip with our Cover-More cruise insurance benefits, please read the PDS to ensure our product is right for you.

No. For cruise cover to apply, your travel insurance policy must include our Cruise Cover and must be purchased before you leave home. This also includes before you catch any flights or transportation required to get to your departing port.

Our Cruise Cover benefit includes cover for onboard emergency medical and dental expenses and ship-to-shore medical expenses incurred by travellers on multi-night cruises. If you fall ill with COVID-19 while on board a cruise, we can help you financially and provide emergency assistance support if required.

For more information on what is and isn’t covered regarding COVID-19 while you’re on a multi-night cruise, please read the PDS . For Cover-More’s COVID-19 FAQs you can read here .

If for some reason you change your mind about your insurance purchase, Cover-More policies give you peace of mind by offering a ‘cooling off period’ of 21 days. During this time, you can obtain a full refund if you haven’t made a claim and your departure date has not passed. If you need to cancel your policy, please phone 1300 72 88 22

Your claim will be managed by Cover-More. You can make a claim online or call Cover-More, 8am-5pm Mon – Fri and 9am-4pm Sat (Sydney/Melbourne time)

Within Australia: Call Cover-More on 1300 467 951

From overseas: Call Cover-More on +612 8907 5060 (call charges may apply)

For more information, please see the Department of Foreign Affairs website at smartraveller.gov.au.

Disclosure: Carnival Cruise Line has a referral arrangement with Cover-More and may receive a fee or commission if you choose to purchase an insurance product from Cover-More. Limits, sub-limits, conditions and exclusions apply. Insurance administered by Cover-More Insurance Services Pty Ltd (ABN 95 003 114 145, AFSL 241713) on behalf of the product issuer, Zurich Australian Insurance Limited [ABN 13 000 296 640, AFSL 232507). Any advice is general advice only. Please consider your financial situation, needs and objectives and read the Combined FSG/PDS before deciding to buy this insurance. For information on the Target Market and Target Market Determination for these products, contact Cover-More on 1300 77 88 22

With over 30 years’ experience in travel insurance, covering more than 3.8 million journeys every year, Cover-More is the perfect travel (and cruising) companion.

- P&O Cruises ( UK )

Insurance requirements for P&O?

By james95 , April 12, 2022 in P&O Cruises ( UK )

Recommended Posts

I am new to cruising, and have just paid for a Baltic cruise in August with P&O for me and my partner (for their 30th birthday present).

I am a little confused by P&O's travel insurance requirements - maybe because I'm new to cruising, but there's lots of specific terminology and it just seems to confuse me and I want to make sure I'm doing it correctly.

I have done some research on insurance comparison sites and found a policy by coverforyou.com. I've attached the policy documents that came with the quote. Does anyone know if this meets all of P&O's specific requirements? Namely:

- cover for emergency evacuations and medical expenses related to COVID-19

- cover for repatriation, cancellation and curtailment including in the event of you contracting COVID-19 as certified by a Medical Practitioner and possibly, if deemed medically necessary, have to leave the ship due to a medical emergency

policywording-cfu-msm-AXA-XM24.pdf important-information-coronavirus-cover-latest (1).pdf ipid-cfu-msm-standard-st-safi-v13.pdf

Link to comment

Share on other sites, teamstewart.

2 hours ago, james95 said: Hi all, I am new to cruising, and have just paid for a Baltic cruise in August with P&O for me and my partner (for their 30th birthday present). I am a little confused by P&O's travel insurance requirements - maybe because I'm new to cruising, but there's lots of specific terminology and it just seems to confuse me and I want to make sure I'm doing it correctly. I have done some research on insurance comparison sites and found a policy by coverforyou.com. I've attached the policy documents that came with the quote. Does anyone know if this meets all of P&O's specific requirements? Namely: cover for emergency evacuations and medical expenses related to COVID-19 cover for repatriation, cancellation and curtailment including in the event of you contracting COVID-19 as certified by a Medical Practitioner and possibly, if deemed medically necessary, have to leave the ship due to a medical emergency Thank you! policywording-cfu-msm-AXA-XM24.pdf 1.02 MB · 3 downloads important-information-coronavirus-cover-latest (1).pdf 45.24 kB · 0 downloads ipid-cfu-msm-standard-st-safi-v13.pdf 137.38 kB · 1 download

My in laws are just back off Iona. I helped them arrange a new annual policy before they left and it’s with cover for you. Was absolutely fine they seemed to make it there with no issues! It’s underwritten by Axa, so big insurance firm, which made me feel confident using it. So I reckon you should be fine

Hi eveyone! Could someone clarify the insurance requirements for P&O for me?

I know there needs to be Covid-19 cover (medical expenses/repatriation/curtailment etc), but what about pre-existing medical conditions?

My dad has a condition being investigated, and some insurance providers are refusing to cover him altogether. Some specifically will cover covid-19 or "new" conditions or accidents etc but not any pre-existing medical conditions. Im not sure of this is enough for p&o?

https://www.pocruises.com/travel-insurance

This suggests its enough but im sure I read another page on p&o a few days ago (I can no longer find it!) that mentioned you must also have cover for pre-existing medical conditions

Grateful if anyone could shed some light?

terrierjohn

42 minutes ago, CamillaJia said: Hi eveyone! Could someone clarify the insurance requirements for P&O for me? I know there needs to be Covid-19 cover (medical expenses/repatriation/curtailment etc), but what about pre-existing medical conditions? My dad has a condition being investigated, and some insurance providers are refusing to cover him altogether. Some specifically will cover covid-19 or "new" conditions or accidents etc but not any pre-existing medical conditions. Im not sure of this is enough for p&o? https://www.pocruises.com/travel-insurance This suggests its enough but im sure I read another page on p&o a few days ago (I can no longer find it!) that mentioned you must also have cover for pre-existing medical conditions Grateful if anyone could shed some light?

All travel insurance requires you to provide pre-existing conditions if you have any, otherwise your claim will be rejected and could leave you with a big bill.

Should be ok as long as cruise cover is included.

3 minutes ago, terrierjohn said: All travel insurance requires you to provide pre-existing conditions if you have any, otherwise your claim will be rejected and could leave you with a big bill.

They will be declared but not covered by the insurance, that's why I'm asking about what P&O need. This was with staysure. Holiday Extras refused to provide cover at all.

2 minutes ago, CamillaJia said: They will be declared but not covered by the insurance, that's why I'm asking about what P&O need. This was with staysure. Holiday Extras refused to provide cover at all.

If your insurer wont cover your existing conditions, then I would think carefully about whether you want to cruise, or go on any holiday. Of course if you are happy enough to cover your own risks then that's your decision.

Just now, terrierjohn said: If your insurer wont cover your existing conditions, then I would think carefully about whether you want to cruise, or go on any holiday. Of course if you are happy enough to cover your own risks then that's your decision.

But what is P&Os position? Do they require insurance cover for pre-existing conditions? (Im leaning towards probably) In which case I need to find a different insurer to staysure.

The reason they don't provide cover is because its an undiagnosed condition (being investigated) so they can't cover something they don't know the risks for.

My second question is.. has anyone found an insurer that will provide insurance if you're still awaiting a diagnosis (if not for the undiagnosed condition itself, for other pre existing medical conditions) or is this unlikely?

15 minutes ago, terrierjohn said: If your insurer wont cover your existing conditions, then I would think carefully about whether you want to cruise, or go on any holiday. Of course if you are happy enough to cover your own risks then that's your decision.

To answer the question, this is the first time we've ever got/needed insurance for a trip so willing to risk it (depending on what his condition is like closer to the time!) But our accepted risk vs what P&O require might be different.

I used Cover for You on my last cruise and no problem i also have cover for my Cruise next month

16 minutes ago, CamillaJia said: But what is P&Os position? Do they require insurance cover for pre-existing conditions? (Im leaning towards probably) In which case I need to find a different insurer to staysure. The reason they don't provide cover is because its an undiagnosed condition (being investigated) so they can't cover something they don't know the risks for. My second question is.. has anyone found an insurer that will provide insurance if you're still awaiting a diagnosis (if not for the undiagnosed condition itself, for other pre existing medical conditions) or is this unlikely?

I dont think you will find any insurance to cover undiagnosed conditions, unfortunately.

8 hours ago, CamillaJia said: To answer the question, this is the first time we've ever got/needed insurance for a trip so willing to risk it (depending on what his condition is like closer to the time!) But our accepted risk vs what P&O require might be different.

Whilst this is an extremely negative comment, the worst case scenario you are risking is the cost of a helicopter to evacuate someone should they become seriously unwell. That risk could be tens of thousands of pounds.

All highly unlikely, but it does happen fairly regularly.

Hi Camilla

Unfortunately even saga won’t cover until diagnosis.-it is in questions and answers on their website— if they won’t cover then I don’t think anyone will.

as said already it is approx £25k to evacuate someone from ship then medical bills on top.

Really not cheap and it does happen.

On 4/12/2022 at 11:07 PM, CamillaJia said: They will be declared but not covered by the insurance, that's why I'm asking about what P&O need. This was with staysure. Holiday Extras refused to provide cover at all.

There was a long thread on this a few months ago. Megabear did sterling work. We used goodtogo as DW was awaiting a procedure. As you say, many just said no.

yorkshirephil

I used Staysure for my annual policy this year, I was undergoing investigation for undiagnosed illness, I explained to Staysure and they were fine, of course my policy went up 60% to £302 which to be fair didn't seem too bad.

https://www.staysure.co.uk/medical-travel-insurance/awaiting-surgery/

My bank wanted an extra £300+ a few years back to insure me after I had a brain tumour removed as it was less than a year after the operation, so I shopped around and used Staysure who were very reasonable.

On 4/12/2022 at 10:17 PM, CamillaJia said: Hi eveyone! Could someone clarify the insurance requirements for P&O for me? I know there needs to be Covid-19 cover (medical expenses/repatriation/curtailment etc), but what about pre-existing medical conditions? My dad has a condition being investigated, and some insurance providers are refusing to cover him altogether. Some specifically will cover covid-19 or "new" conditions or accidents etc but not any pre-existing medical conditions. Im not sure of this is enough for p&o? https://www.pocruises.com/travel-insurance This suggests its enough but im sure I read another page on p&o a few days ago (I can no longer find it!) that mentioned you must also have cover for pre-existing medical conditions Grateful if anyone could shed some light?

CamillaJia,

re your dad being investigated, I personally was under medical investigation and could not get travel insurance cover. Once I had the surgery paid inflated premiums for 3 years and now accepted with normal age and inflation related premiums. Seriously consider your dad not cruising as medical costs abroad are horrendous. Disappointing I know and sorry to say this to you.

On 4/12/2022 at 11:32 PM, CamillaJia said: To answer the question, this is the first time we've ever got/needed insurance for a trip so willing to risk it (depending on what his condition is like closer to the time!) But our accepted risk vs what P&O require might be different.

Presume you live in UK and use NHS. People have no idea about the price of health care, many £k, and somebody mentioned helo evacuation saw one from QM2 in English channel sailing from Le Havre to New York (2019) 1 x out of 11 cruises, and I am sure people on Cruise Critic boards will tell stories re helo evacuations. Not worth the risk that you want to take.

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- Special Event: Q&A with John Waggoner, Founder & CEO Victory Cruise Lines

- Hurricane Zone 2024

- Cruise Insurance Q&A w/ Steve Dasseos of Tripinsurancestore.com Summer 2024

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Ask Me Anything About

Victory Cruise Lines!

Ask Your Questions Today;

See answers beginning August 12th

Write Your Own Amazing Review !

Click this photo by member XFrancophileX to share your review w/ photos too!

Parliament, Budapest

Features & News

LauraS · Started 8 hours ago

LauraS · Started 13 hours ago

LauraS · Started Tuesday at 08:45 PM

LauraS · Started Tuesday at 04:21 PM

LauraS · Started Tuesday at 01:39 PM

Cruise Planning

Find a cruise, popular ports, member reviews.

© 1995— 2024 , The Independent Traveler, Inc.

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

Cruise travel insurance: What it covers and why you need it

What does cruise travel insurance cover? And does it pay to buy cruise travel insurance?

The answer is not always clear-cut, as we'll discuss in this guide. But consider this: It's not always smooth seas when it comes to cruising. Even the best-laid plans for a cruise vacation can sometimes be thrown off course by an unexpected event.

You might need to cancel a cruise in advance due to the sudden onset of an illness, such as COVID-19 or the flu. Or, maybe you fall ill during the cruise and need emergency medical attention. Maybe your flight to your ship gets canceled, and you miss the vessel's departure. Or your ship is late arriving in port at the end of a voyage, and you miss your flight home.

In all of these situations, you might benefit from having cruise travel insurance — keyword "might."

Cruise insurance policies vary widely, and not every policy covers every type of mishap. That's why it always pays to read the fine print in a travel insurance policy before you purchase it to know what you're getting in advance.

It's also why you should read this introduction to everything you need to know about cruise insurance. It has many details, but the next time something unexpected happens on your cruise vacation, you'll be glad to be educated and covered by a comprehensive travel insurance policy.

What does travel insurance cover when you cruise?

The typical cruise insurance policy covers a wide range of circumstances that can go wrong in conjunction with a vacation at sea — both before and during the sailing.

For starters, policies often will reimburse you for the cost of canceling a cruise due to a last-minute crisis. They will also often cover costs related to an interruption of a cruise (maybe your ship breaks down, requiring you to fly home mid-voyage ). These two elements are known as trip-cancellation and trip-interruption insurance, and they are bundled into a typical travel insurance policy.

Some policies will also cover out-of-pocket costs related to a flight delay or cancellation that results in you missing your cruise departure (for instance, the cost of catching up to the ship at its next port). Expenses related to baggage delays and loss are often covered as well.

But perhaps most importantly, many travel insurance policies will cover medical expenses you incur while on a cruise. Some will even cover the cost of evacuating from a foreign destination if you are in the midst of a medical crisis.

Travel insurance giant Allianz Global Assistance reports that 53% of all cruise-related "billing reasons" for claims are because of illness for the insured person, while 14% are for an injury. Another 8% are for the illness of a family member, 4% for the death of a family member and 4% for the illness of a traveling companion, among other reasons.

Those percentages include illness and accidents that happen to cruisers just before a trip, making travel impossible. But, in many cases, such claims result from illness and injuries that occur during voyages.

"People often take risks during vacation that they might not take back home, whether riding a jet ski, zipping around on a motorized scooter in a city they don't know well or hiking unfamiliar terrain," James Page, senior vice president and chief administration officer of AIG Travel, told TPG .

Some policies also cover the financial default of a travel provider. In such cases, if your cruise line goes out of business before you sail, you could get all — or at least some — of your money back.

Cruise travel insurance policies don't cover everything. For instance, standard travel insurers generally will not reimburse you for the cost of a cruise you cancel due to worries about an outbreak of an illness. That's true even if a U.S. government agency such as the U.S. Centers for Disease Control and Prevention issues a recommendation that you don't cruise due to an illness outbreak, as it did during the COVID-19 pandemic .

If you want the ultimate flexibility to cancel for such a reason or any other, you'll want to look into a more expensive cancel for any reason travel insurance upgrade.

Related: Avoiding outbreaks isn't covered by most travel insurance policies

Where to find a cruise travel insurance policy

You can buy a travel insurance policy directly from your cruise line when booking your trip or through your travel agent (if you're using one, which often is a good idea when booking a cruise). You also can go directly to a third-party travel insurance provider or a travel-insurance aggregator site, such as InsureMyTrip or TravelInsurance . Your credit card might even give you some travel protections.

Here's what you need to know about each type of cruise travel insurance.

Third-party insurance companies

Third-party insurance companies that specialize in writing travel insurance include AIG Travel, Allianz Travel Insurance, Travelex Insurance and American Express Travel Insurance.

One reason to use a travel agent or a travel aggregator: They can help you find a policy that offers added coverage specific to cruising.

Related: The Points Guy's guide to the best travel insurance companies

"Many plans now offer benefits that will specifically appeal to cruise travelers, such as missed connection, missed port-of-call and cruise disablement coverage," Stan Sandberg, cofounder of TravelInsurance.com, said.

Missed connection coverage reimburses cruisers for a set dollar amount if they need to rebook travel to catch up with their cruise at the next port. Missed port-of-call coverage pays a benefit if the cruise ship misses a scheduled port of call due to weather, a natural disaster or a mechanical breakdown.

Cruise disablement coverage pays a benefit if the traveler is confined on a ship for more than five hours without power, food, water or restrooms.

As noted, policies vary widely. It's a good idea to compare plans and make sure the one you buy has the elements that are most important to you. One size doesn't fit all.

Credit cards with travel benefits

Some premium credit cards offer valuable travel protections comparable to what you might get from a standard travel insurance plan. For example, the travel insurance provided when you pay for travel with select cards can reimburse you for expenses if your baggage is damaged, you're stranded overnight due to a flight delay or cancellation, or you have to return home to handle a family medical emergency.

The Chase Sapphire Reserve card, for example, offers trip delay reimbursement, trip cancellation and interruption insurance, emergency medical coverage and even medical evacuation coverage , among other benefits. And yes, cruise lines are considered common carriers just like airlines.

If you're planning to rely on a card like the Chase Sapphire Reserve or The Platinum Card® from American Express * (among others) for travel insurance, just be sure to recheck your card's benefits and limits carefully against regular travel insurance. You must pay for at least part — and sometimes all — of the trip with that credit card to take advantage of its protections.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Related: The best credit cards for booking cruises

Find out if your credit card protection includes travel accident insurance or covers preexisting medical conditions, and figure out when it will pay you back. Other questions to ask: What are the coverage limits? Will you have to pay for a foreign hospital bill upfront and then seek reimbursement later?

Cruise lines

Cruise lines often ask consumers booking a cruise to buy the line's own protection at the time of purchase. If specifics about the coverage are lacking, always ask the line for details in advance, review coverage perks and limits; then, compare those to one or two independent travel insurance policies or your credit card's insurance benefits.

Related: A beginners guide to picking a cruise line

Cruise line travel insurance policies sometimes have quirks. Many cruise companies will only offer a travel voucher or credit for future use in the event of a covered cancellation, not an outright refund.

Also, financial default may not be a covered event in a cruise line-sold policy, but it's typically covered with plans from third-party travel insurance companies.

Cruise line policies also can be more restrictive.

"Cruise line insurance seems to have become better and has more widespread coverage than in the past, but it typically won't cover air or pre- and post-travel [arrangements] unless those elements are purchased through [the line]," said Debra Kerper, a Cruise Planners travel adviser from Carrollton, Texas, who books travel and sells private insurance. "This is when private insurance coverage becomes so very important."

How much does cruise insurance cost?

Expect to pay anywhere from 4% to 8% of your total prepaid, nonrefundable trip expenses for a travel insurance policy. That's a wide range, we know, but it reflects the wide range of products out there.

You'll also find some basic plans that cost even less than 4% of your trip expenses, while some super-premium plans that cover just about any conceivable issue can cost as much as 12% of your trip expenses.

Related: What's included in your cruise fare?

All reputable insurance companies will offer a "free-look period" during which you can receive a 100% refund on your premium. This allows you to review the policy you've selected and return it for any reason within the period allotted — usually for a small administration fee of less than $10.

Under normal circumstances, you don't need to purchase a so-called "cancel for any reason" add-on to your cruise travel insurance policy unless you really need the flexibility. The upgrades are significantly more expensive.

You can receive a quote and purchase a policy online in minutes with any credit card. Although you may think travel insurance should code as "travel" when paid on a credit card and thus be eligible for bonus points on certain cards, that isn't always the case. Your points earnings will depend on the individual underwriter's merchant code. When in doubt, expect the purchase to fall under the insurance category for earnings.

Should I buy travel insurance for a cruise?

Whether you buy travel insurance is a personal decision that will depend on many factors. Would you be willing to absorb the loss of canceling a cruise on short notice due to an illness or accident? Could you afford an evacuation flight from a far-off port if you suddenly became seriously ill? Only you can answer those sorts of questions.

Here are some things to consider as you make that decision.

You might not be covered by regular medical insurance while cruising

If you're a U.S. citizen traveling internationally (which will be the case for most cruises), you may find that most private medical insurance plans in the U.S. won't cover you.

Additionally, Original Medicare only covers people traveling outside U.S. borders in limited circumstances.

While certain Medicare Supplement Plans do have some foreign emergency medical benefits, not all do. Be sure to talk to your Medical Supplemental Plan provider to see if you're covered, what's covered, what the limits are and how the bill is paid.

Also note that, in some countries (particularly those in Central and South America), travelers may not be discharged from a hospital until their bill is paid in full.

Related: Trip wrecked: 7 ways to prepare for any kind of travel disaster

Plus, if you have a medical incident overseas, you could find yourself stuck in a shared hospital room without air conditioning or a private bathroom. The level of care may not be what you expect.

"For people traveling internationally, it's crucial to know beforehand where to go for any treatment … and how they're going to pay for that treatment," Page said.

Getting evacuated for a medical condition is expensive

Most airlines won't accept seriously ill passengers, those carrying bulky medical equipment or those requiring a full medical team.

Even a low-cost weekend getaway on a cruise to the Bahamas out of Miami can turn costly if you suffer a serious accident or illness requiring medical treatment or an emergency medical evacuation.

Related: Do cruise ships have doctors, nurses, medical centers or hospitals?

Being flown back to the U.S. from a far-flung overseas location in a private, medically equipped aircraft, with a professional medical team on board, can run between $70,000 and $180,000, according to Mike Hallman, president and CEO of Medjet, a medical transport membership company.

"Domestic transports, which we cover as well, can cost upwards of $30,000," Hallman said.

Without proof of medical evacuation coverage, foreign providers will also want that money upfront. Hallman said that regular travel insurance will typically get you to an acceptable overseas hospital and even to a higher-level care facility if "medically necessary." Alternatively, medical evacuation coverage means you can fly home to your own hospital, doctors and family — without claim forms, cost caps on transports or surprise bills.

The tandem approach — buying both travel insurance and a separate medevac transport membership — is a good option, Hallman said.

"We always recommend travel insurance, as it covers trip interruption, which is important, as well as medical coverage for the hospital and treatment costs," he said. "We pick up where they leave off."

You can't predict the weather

Cruising is a great way to explore multiple destinations in one trip. But it's good to remember that unexpected delays, interruptions or cancellations due to weather can happen during cruises, particularly during hurricane seasons in places such as the Caribbean and Asia (where hurricanes are called typhoons).

During a typical hurricane season (June 1 to Nov. 30), Allianz pays about 6,000 claims from customers whose travel plans in the Caribbean, Gulf of Mexico and southeastern U.S. are affected by the storms, according to a spokesperson for Allianz Global Assistance USA.

If you're hoping to insure against a storm-related disaster, it's good to buy travel insurance as early as possible. Once a storm or hurricane is named, it's too late to buy travel insurance to cover it.

Of course, cruise lines will move ships away from a weather threat. When the port lineup is adjusted or the cruise shortened, the company will offer the guest an onboard credit, onboard gift or future cruise credit rather than any refund. It depends on the circumstances of that specific voyage. You won't be able to make a claim on your cruise travel insurance policy just for a minor itinerary change .

Related: Everything you need to know about cruising during hurricane season

Costs can mount quickly when things go wrong

Even if the cruise line does provide a full or partial refund or cruise credit for an itinerary change or some other interruption, travelers could have to swallow the cost of other travel elements not purchased through the line. That could include nonrefundable flights , prepaid resort or hotel nights, nonrefundable tour fees and more.

Travel insurance can cover those, plus help with flight delays or cancellations, baggage loss or theft.

If a winter storm causes you to miss your flight to where the ship is boarding , "travel insurance could help you get to the next port to join the cruise, so you don't miss your entire trip," Page said.

In fact, 13% of "billing reasons" for claims to Allianz are for common carrier delays (such as a flight delay), while weather and natural disaster-related claims account for about 3%.

The government probably won't bail you out

While cruise ships have medical facilities, they're usually not equipped to treat serious illnesses. If you experience a serious medical problem on a vessel, you may have to get off the ship in a foreign port to seek treatment at a hospital. In such a case, if you don't have medical evacuation insurance, you may then find yourself stranded in that port awaiting a medical evacuation.

Don't expect Uncle Sam to step in and help foot the bill.

The U.S. Department of State's Bureau of Consular Affairs clearly states the importance of buying travel insurance.

"The U.S. government does not provide medical insurance for U.S. citizens overseas," the bureau says on the website. "We do not pay medical bills. You should purchase insurance before you travel."

You may need more assistance than you think

If you're injured or become severely ill during a cruise, especially in a foreign country, it may be difficult to access help without the assistance of trained professionals that comes with many insurance plans.

Many travel insurance companies provide around-the-clock assistance with locating overseas clinics and pharmacies, getting to a doctor or hospital, refilling lost or depleted prescriptions, assisting with up-front payments to hospitals, and arranging flight changes so you can get home.

Travel insurance companies also can arrange for an air ambulance, a nurse escort, oxygen and a lie-flat seat on a flight home if your medical condition warrants it.

You want to be careful if you have preexisting conditions

When you cruise, it's important to be fully covered, which means having comprehensive medical coverage that includes any preexisting conditions. Otherwise, if you head into a doctor's office overseas, have any tests completed, or visit an urgent care center or emergency room, you might not be covered.

Here, timing is extremely important. Cruisers seeking coverage of preexisting conditions, as well as cancel for any reason insurance, generally must book within seven to 21 days of the first payment they make for a trip. The timing varies by insurer.

Bottom line

Cruise insurance isn't for every traveler — or even for every sailing. It's not inexpensive. However, it can bring a lot of peace of mind if you're about to head out to sea. Do your homework, compare plans and always assess the risks.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- The 8 worst cabin locations on any cruise ship

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- Top ways cruisers waste money

- 12 best cruises for people who never want to grow up

- The ultimate guide to what to pack for a cruise

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

P&O Cruises Travel Insurance - 2024 Review

P&o cruises travel insurance.

- Insurance Not Provided to US Citizens – Travelers Can Shop The Open Marketplace

- Insurance Suggestions Not Offered

Sharing is caring!

P&o cruises - background.

P&O Cruises is the oldest cruise line in the world, having operated the world's first passenger cruise ship in 1837. P&O began life as " The Peninsular Steam Navigation Company ", but in 1840 the word “ Oriental " was added to reflect the company's expanding services eastwards beyond the Iberian Peninsula to Egypt and the Orient.

P&O Cruises – Carnival Corporation

P&O Cruises was demerged from the P&O Group (which operates container and channel ferry services) in 2000 and became a subsidiary of P&O Princess Cruises. Just three years later, in 2003, P&O Princess Cruises merged with Carnival Cruises to form the current company.

P&O Cruises – The Passenger Experience

P&O strives to give its passenger a memorable and stress-free holiday. From the moment you drive into either the Ocean Cruise Terminal or the original Mayflower Cruise Terminal in Southampton, your cases and car are whipped away by smiling, cheerful staff. The entire P&O ethos centers on the passenger experience, and it is something P&O is very good at. However, before you arrive in Southampton to take your cruise, you need to have booked the cruise itself and your cruise travel insurance.

P&O Cruises Website

The P&O Cruises website is extremely easy to navigate. Simply select a destination, months to travel, cruise duration and ship. The system will eliminate any dates that are unavailable for that destination which makes selection easy.

Once you have the trip details selected, the system will show you the pricing per travelers. However, you’ll need to call P&O to book the cruise – you cannot book online.

P&O Cruises does not sell their own insurance. They have partnered with Holiday Extras to provide travel insurance to their Non-US guests. Once you go to the Holiday Extras website and put in general information on your trip, you’re presented with several options for insurance (again in British pounds):

When you select one of the three available options, you then answer a series of questions about pre-existing conditions. Finally, you arrive at the declaration page (see below) prior to paying for the insurance. It’s here that the insurance spells out that it is only available to UK residents, and you must have a UK General Practitioner and the trip must start and end in the UK.

To be eligible for cover under this Policy, you confirm and agree that:

- You are a resident and must have an address in the United Kingdom, the Channel Islands or the Isle of Man and lived here for at least 6 months in the last 12 months.

- You are 18 years of age or older at the date of buying this policy.

- You are registered with a General Practitioner in the United Kingdom, the Channel Islands or the Isle of Man.

- Your trip must start and end in the UK and not have already started your trip.

Since US residents cannot purchase travel insurance from Holiday Extras, we’ll need to look elsewhere for travel insurance.

Let’s book a cruise on P&O and then shop for insurance on the open marketplace.

Our Cruise – Northern Europe

Our sample couple, both aged 62, chose a 8-night cruise from April 1 – April 8 to several northern European countries. The cruise starts in Southampton and travels through Germany, Netherlands, and Belgium before returning to Southampton.

Total cost for both travelers after converting to US dollars is $1413.94.

Alternatives to Holiday Extras Travel Insurance

As US residents, we’ll have to find alternate insurance. We used the same trip information to create a quote at CruiseInsurance101 and our system provided 25 results for a variety of plans and insurers.

CruiseInsurance101 consistently recommends carrying at least $100k Medical Insurance, $250k Medical Evacuation, and a Pre-Existing Medical Condition Waiver when traveling outside the US.

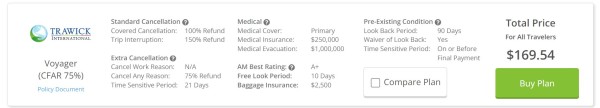

For this trip, the Trawick Voyager plan is the least expensive policy that meets the recommended coverage amounts, at a total of $99.74 for both travelers combined. It provides $250,000 of medical coverage and $1 million of medical evacuation coverage. Pre-existing medical conditions will be waived if the policy is purchased on or before the final trip payment date.

Next, we looked for the least expensive Cancel For Any Reason (CFAR) plan that meets our minimum recommended coverage, which is the Trawick Voyager (CFAR 75%) for $169.64. This is the same plan as the standard Trawick Voyager but includes the added benefit of allowing you to cancel your trip for any reason not otherwise covered by the policy and receive a 75% reimbursement of your trip cost.

Price and Value

CruiseInsurance101 recommends carrying at least $100k in Medical Insurance when traveling outside the country. Both Trawick Voyager policies provide $250k in medical coverage, so you can feel assured you will have sufficient medical coverage should you need it.

We recommend at least $250k of Medical Evacuation coverage when traveling to Europe. For trips farther afield, we recommend at least $500k of Medical Evacuation coverage. The Trawick Voyager provides $1 million of Medical Evacuation coverage so you’ll be well covered in a medical emergency that requires evacuation to a hospital and back to the US.

If needed, CruiseInsurance101 also recommends getting a policy that provides a waiver for Pre-Existing Medical Conditions. The Trawick Voyager policies provides coverage for Pre-Existing Conditions, if purchased on or before the final trip payment date.

Next, we’ll discuss other important benefits in travel insurance.

Trip Cancellation

Sometimes unexpected events interfere with your travel plans, forcing you to cancel your trip. Trip Cancellation reimburses you for your pre-paid and non-refundable trip costs if you must cancel your trip for a covered reason.

Most plans available from CruiseInsurance101 cover cancellation for:

- Unforeseen illness, accidental injury, or death (traveler, traveling companion, family member, or host)

- Inclement weather, strike, or mechanical delay of a common carrier

- Financial default of a common carrier

- Traffic accident en route to the destination

- Hijacking, quarantine, jury duty, subpoena

- Fire, flood, burglary, or natural disaster

- Documented theft of passport or visas

- Mandatory evacuation

- Called to military duty or revocation of leave

- Involuntary job termination or lay off

Hopefully, none of these things happen, and you can leave for your vacation without a hitch.

Cancel For Any Reason (CFAR)

Cancel For Any Reason policies provide peace of mind against any uncertainty about traveling. This coverage helps you recover 50% - 75% (depending on policy) of your trip cost if you must cancel your travel plans for any reason not covered by the policy. Without it, you would lose all your pre-paid and non-refundable trip costs for a non-covered cancellation.

Suppose your main concern for cancellation is uncertainty about Covid rates at your destination. You may worry that you shouldn’t travel on your scheduled trip if your destination country sees a large spike in Covid rates. Even if your doctor advises against traveling, Trip Cancellation does not cover cancellation due to fear of traveling because of Covid concerns.

Travel insurance with a Cancel For Any Reason benefit is the only option. CruiseInsurance101 offers a variety of Cancel For Any Reason options for residents in most states.

There are some rules to keep in mind when purchasing a Cancel For Any Reason plan:

- You must insure 100% of your pre-paid and non-refundable trip costs

- You must purchase the policy within the Time Sensitive Period (10-21 days of the date you placed your initial payment or deposit towards the trip) and insure subsequent payments

- You must cancel your trip no later than 48 hours prior to departure

The Trawick Voyager (CFAR 75%) will reimburse 75% of your trip cost should you cancel for a reason not listed in the policy.

Trip Interruption