59000N The Traveller Business Size Portable Checks 8 5/8 x 3"

Personalization.

* denotes required field

Product Reviews

Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

We’ve signed you out of your account.

You’ve successfully signed out

We’ve enhanced our platform for chase.com. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

Checks FAQs

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Frequently Asked Questions

How do i order checks from chase.

If checks come with your account, you can order them online .

You may be able to make payments, pay bills and send money online on the Chase Mobile ® app and at chase.com instead of writing checks.

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

PRICE QUOTE REQUEST

1-800-492-1218.

Sales & Service Team:

8AM - 8PM ET

Frequently Ordered Products

- Custom Towing Invoice Form

- Restaurant Guest Checks

- Appliance Service Order Form

- Landlord Rent Receipt Books

- Custom Road Service Towing Invoice

- Road Service Register Form

- Business Receipt Book - Special Wording

- Towing Service Form

- Towing Company Invoice

- Mileage Fuel Trip Report

- Business Checks & Banking Products

- Business Forms

- Carbonless Forms

- Custom Envelope Printing

- Design Services

- Forms By Service

- Labels & Tags

- Marketing Products

- Office Supplies

- Packaging - Bags, Boxes & Bows

- Pressure Seal Documents

- Promotional Products

Home :: Business Checks & Banking Products :: Manual Business Checks With Logo :: The Traveller, Business Size Portable Checks

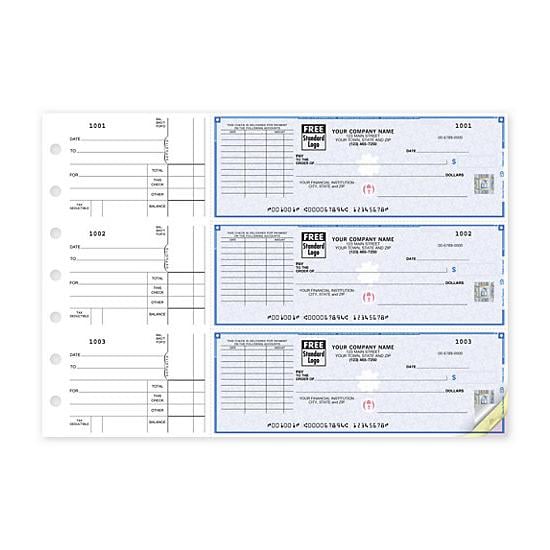

The traveller, business size portable checks.

Item # 59000N

- Size: 8" x 3"

- Parts: 2-Part Carbonless

- Min/QTY: 40

- Price: $79.80

ENTER INFORMATION TO CUSTOMIZE TEMPLATE

Enter your business information below then select print options on the right, bank information, transaction information, optional information, select print options.

100% satisfaction guaranteed

- Benefits And Features

A great compliment to computer checks when you are on the go. An ideal full-size business check for organizations that only need small quantities. Our Traveller business checks are full-sized, yet easily carried in your purse, briefcase, or pocket! Conveniently fits in a purse, briefcase, or coat pocket for easy portability. Includes: 40 full-sized checks with 15 1-part deposit tickets, or 160 checks with 60 deposit tickets, and register(s).

- Choose 40 checks with 15 deposit slips, or 160 checks with 60 deposit slips.

- All orders go through proprietary screening to prevent unauthorized orders.

- Compatible with Premier Leather Cover (59001) and Leather Zippered Portfolio (59002), sold separately.

- Additional customization options include imprinting your custom logo.

- Free personalization includes your business imprint plus a choice of standard typeface & business logo.

- Built-in check security trusted by 7,000 financial institutions nationwide, with features such as chemically sensitive paper, microprint border, invisible fluorescent fibers, erasure protection, security screen & warning box.

- Checks are available in 1-part or 2-part duplicate format.

- Blue vinyl cover & check register included.

Similar Products...

Manual Business Check With Voucher

Hourly Payroll Master Check

Voucher Stub Check

1820 Highway 20 SE

Suite 114, PMB 1094

Conyers, GA 30013

Join our Email List for Exclusive Offers and Updates.

Be the first to know about special offers, new product launches, features, events and more.

- Best Sellers

- Cheapest Checks

- Classic Checks

- Photo Checks

- Bird Checks

- Horse Checks

- Wildlife Checks

- Designer Checks

- Animal Prints Checks

- Licensed Artists Checks

- Funny Checks

- Cartoon Checks

- Disney Checks

- Fantasy Checks

- Flower Checks

- Motorcycle Checks

- Career Checks

- Girly Checks

- Military Checks

- Religious Checks

- Support Causes

- America Checks

- Beach Checks

- International Checks

- Sports Checks

- Baseball Checks

- Collegiate Checks

- Football Checks

- Hunting Checks

- View All Categories

- Top Stub Checks

- Side Tear Checks

- 3 To A Page Checks

- Check Binders

- Desk Set Checks

- High Security Checks

- Manual Checks

Travel Size Checks

- Deposit Slips

- Business Deposits

- Deposit Bags

- Address Labels

- Business Accessories

- Business Forms

- Christmas Cards

- Debit Wallets

- Office Supplies

- Return Address Stamps

- Checkbook Covers

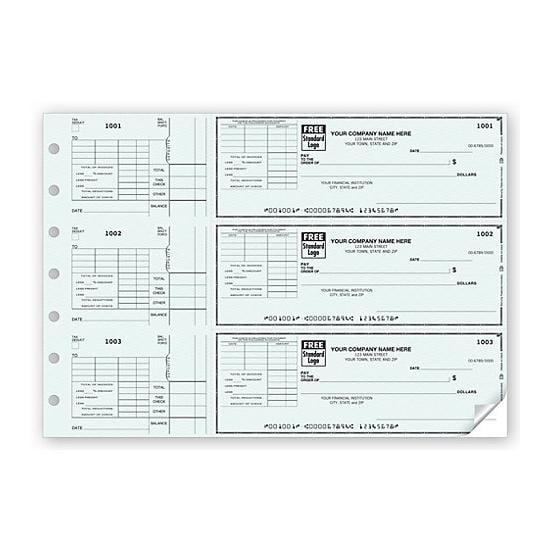

We are pleased to offer you great prices on travel size business checks by Deluxe, Carousel Checks and Checks Unlimited. Our line of business pocket checks are one of the most popular lines of business checks.

Don't leave home without putting travel checks in your pocket, briefcase, backpack or purse. They are a portable solution for doing business on the go. Ordering cheap business travel size checks will allow you the convenience of manual business checks. Small and compact is the perfect size for travelers.

Check formats include duplicate checks or single checks with the standard top tear style. These are designed to fit in a business size checkbook cover or a zippered check book cover. Pocket checks contain 3 books of 50 checks and 4 deposit tickets.

Checks Unlimited Business Partner Checks come in blue safety, parchment and executive gray. They come in duplicate checks or one-part checks. Quantities come in 100, 200, 400 and up from that point to 4800. Security features include Chemical Protection, Erasure Protection and Microprint Signature Line. Checks measure 8-1/4" x 3".

Compact Business Travel Checks by Deluxe corporation are printed in 6" x 2 3/4" sizes and quantities of 150, 300, 600, 900, 1200. They are available in a bi-fold style or a tri-fold style. Deluxe also offers a side-tear business check - The Traveler that measures 8 5/8" X 3."

One of the added benefits of owning small business travel checks is that you will also be doing some advertising for your company since your company name will be very visible as well as your company logo. Business travelers should not forget to buy a zippered travel pack cover too. Durable zippered covers for your business travel checks help you to make sure that your checking account supplies are protected from the elements. Order today.

- New Checks Designs

- 3 Per Page Business Checks

- Accounts Payable

- Blank Checks

- Business Safety Checks

- Business Travel Checks

- Check Starter Kits

- Checks In The Middle

- Checks On The Bottom

- Checks On The Top

- Continuous Computer Checks

- Entrepreneur Checks

- High Security Laser Checks

- Laser Checks

- Microsoft Money Checks

- Multi Purpose Business Checks

- One Write Checks

- Payroll Checks

- Quickbook Checks

- 7 Ring Check Binder

- Endorsement Stamps

- Security Deposit Bags

- Self Inking Stamps

- Zippered Covers

- Personal Checks

- Personal Checks Sitemap

- Personal Check Accessories

- Business Sitemap

Cheap Personal Checks | Personal Checks | Personal Checks Sitemap | Business Checks Sitemap | Top Stub Checks Business Checks | Address Labels Contact Us | FAQ | Privacy Policy, Terms & Conditions | About Us © 2007 - 2024 | Cool Checks

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase’s Travel Portal

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

Who can use Chase's travel portal?

How to use chase's travel portal, other things you can do in chase's portal, chase travel contact options, chase's travel portal can be lucrative.

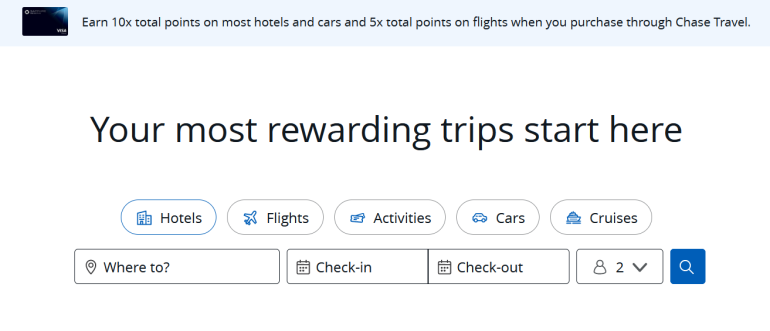

Chase Ultimate Rewards® points are among the most useful rewards you can earn. When it comes time to redeem them, you will be directed to Chase's travel portal. This is where you can book flights, hotels and rental cars with points, redeem them for merchandise and gift cards, or transfer points to other programs.

Should you redeem points to pay for a trip instead of using cash or transfer them to a loyalty program partner to get better value? You'll need to do a little homework to find the right answer as each situation is different.

Chase points are the currency you earn when using cards like Chase Sapphire Preferred® Card or Chase Sapphire Reserve® . They are superior in many ways to other point currencies because you earn more than one penny in value per point with these two cards. For example, when redeeming through Chase's travel portal, the Chase Sapphire Reserve® will net you 1.5 cents in value per point and the Chase Sapphire Preferred® Card will net you 1.25 cents in value per point. When you transfer to a partner, your per-point-value may be even greater.

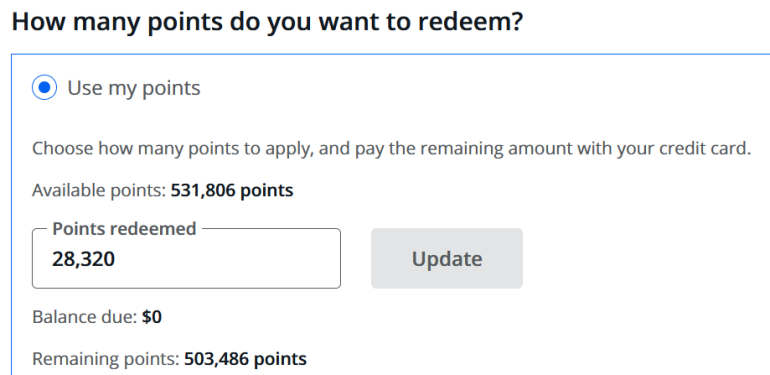

With the travel portal, you can redeem points to pay for an entire trip or you can use a mix of points and cash to cover a travel booking. You can also pay all in cash, earning 5 to 10 points per $1 spent, depending on the card you have. Using points for travel is the most valuable way to extract value from Chase Ultimate Rewards® for most people.

It's an efficient website, but some irritants snag even savvy travelers. Let's dig into Chase's travel portal's good and bad. You'll find that it is mostly good, if not great.

Chase cards vary in earning and redemption benefits so you will want to pay attention to which one you use, especially if you have more than one card. The most valuable cards earn Ultimate Rewards® points, but some Chase cards, like the United℠ Explorer Card , earn miles or points in that co-branded program (in this example, United MileagePlus miles ).

Let’s review the cards that earn Chase Ultimate Rewards®, with the most rewarding cards first. Keep in mind that if you have more than one of these cards, you can move points between Chase Ultimate Rewards® accounts to redeem them from an account that delivers more cents per point in value.

These cards earn Chase Ultimate Rewards® and provide access to Chase's travel portal:

Chase Sapphire Reserve® .

Chase Sapphire Preferred® Card .

Ink Business Preferred® Credit Card .

Chase Freedom Unlimited® .

Chase Freedom Flex® .

Ink Business Cash® Credit Card .

Ink Business Unlimited® Credit Card .

Chase Freedom Rise Credit Card.

★ LIMITED TIME OFFER

Heads up! For a limited time, the Chase Sapphire Preferred® Card is offering a two-part sign-up bonus worth more than $1,000 . The issuer spells it out like this: Get up to $1,050 in Chase Travel℠ value. Earn 60,000 bonus points after $4,000 in purchases in your first 3 months from account opening. That’s worth $750 when redeemed through Chase Travel. Plus, get up to $300 in statement credits on Chase Travel purchases within your first year. Learn more and apply here.

There is an important perk to remember if you have multiple cards. Since the Chase Sapphire Reserve® card offers 1.5 cents in value per point and the Ink Business Preferred® Credit Card and the Chase Sapphire Preferred® Card offer 1.25 cents in value, it is best to redeem points from these accounts rather than any other Chase card.

If you have one of those two premium cards and another Chase card (like Chase Freedom Unlimited® , for example), you can move your Ultimate Rewards® points from the Chase Freedom Unlimited® account to a premium card’s account (like the Chase Sapphire Reserve® card).

This strategy allows you to unlock half a cent more in value in seconds. It’s one of the best benefits of Ultimate Rewards® when you have a premium card and one of its no-fee cards.

Want to earn a bunch of points quickly to make a redemption? The sign-up bonuses on these cards can rake in extra points if you meet the terms and conditions.

Chase Ultimate Rewards® are easily my favorite rewards currency. I've transferred almost 3 million points to transfer partners in 10 years, mostly to cover nicer flights and hotels than I'd typically pay for in cash. I've received great value from my points by transferring to Hyatt for stays at swanky properties like the Park Hyatt Tokyo and the Nimb Hotel in Copenhagen, and to United Airlines and Air Canada for international flight redemptions on partner airlines.

I love Chase Ultimate Rewards® points because they’re so easy to use. Hyatt is definitely the most valuable transfer partner, but since I rarely stay at Hyatt hotels, I tend to use my points for flights. United is a great domestic option to have, but I have also found great deals on domestic flights by transferring my points to Air Canada and British Airways and booking codeshare flights on United and American Airlines, respectively.

I save all of my Chase Ultimate Rewards® points to use on Hyatt redemptions. World of Hyatt has the highest value points among all of Chase Ultimate Rewards' transfer partners by far, so instead of booking through the Chase Travel portal or transferring to low-value partners, I transfer my Chase Ultimate Rewards points to Hyatt to stay at beautiful, luxury properties like the Park Hyatt Kyoto.

on Chase's website

• 5 points per $1 on travel booked through Chase.

• 3 points per $1 on dining (including eligible delivery services and takeout), select streaming services and online grocery purchases (not including Target, Walmart and wholesale clubs).

• 2 points per $1 on other travel.

• 1 point per $1 on other purchases.

Point value in Chase's travel portal: 1.25 cents apiece.

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

Point value in Chase's travel portal: 1.5 cents apiece.

• In the first year, 6.5% cash back on travel purchased through Chase, 4.5% cash back on drugstores and restaurants, and 3% on all other purchases on up to $20,000 in spending.

• After that, 5% cash back on travel purchased through Chase, 3% cash back at drugstores and restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Point value in Chase's travel portal: 1 cent apiece.

Get up to $1,050 in Chase Travel℠ value. Earn 60,000 bonus points after $4,000 in purchases in your first 3 months from account opening. That’s worth $750 when redeemed through Chase Travel. Plus, get up to $300 in statement credits on Chase Travel purchases within your first year.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

» Learn more: The best travel credit cards right now

Here’s a primer on what you can and cannot do with Ultimate Rewards® points.

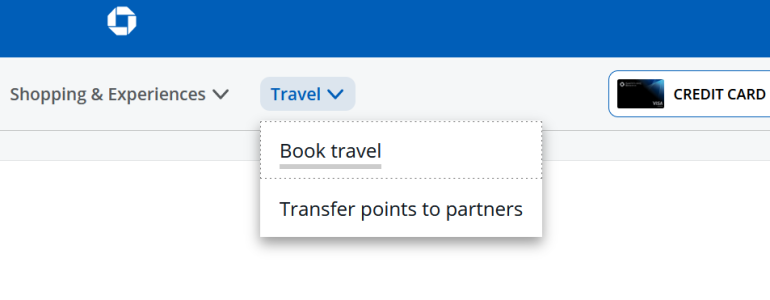

Log in to your account, then navigate to the Chase Ultimate Rewards® tab on the right of the screen. If you have more than one card that earns this currency, you can see each balance and select the account from which you want to redeem points.

Once you select the card, you’ll be taken to a homepage that shows the points you have earned and how you can redeem them. We recommend sticking to travel redemptions rather than using points for merchandise as the value diminishes significantly with the latter.

Select the "Travel" tab at the top of the screen. From here, you can decide whether to transfer points to a partner or redeem them as cash for a trip.

One of the best perks of using this travel portal to make a points redemption is that you still earn frequent flyer miles on most airline tickets since these are booked as a revenue ticket (not as an award redemption like when using airline miles to book a flight).

How to book award flights in Chase's travel portal

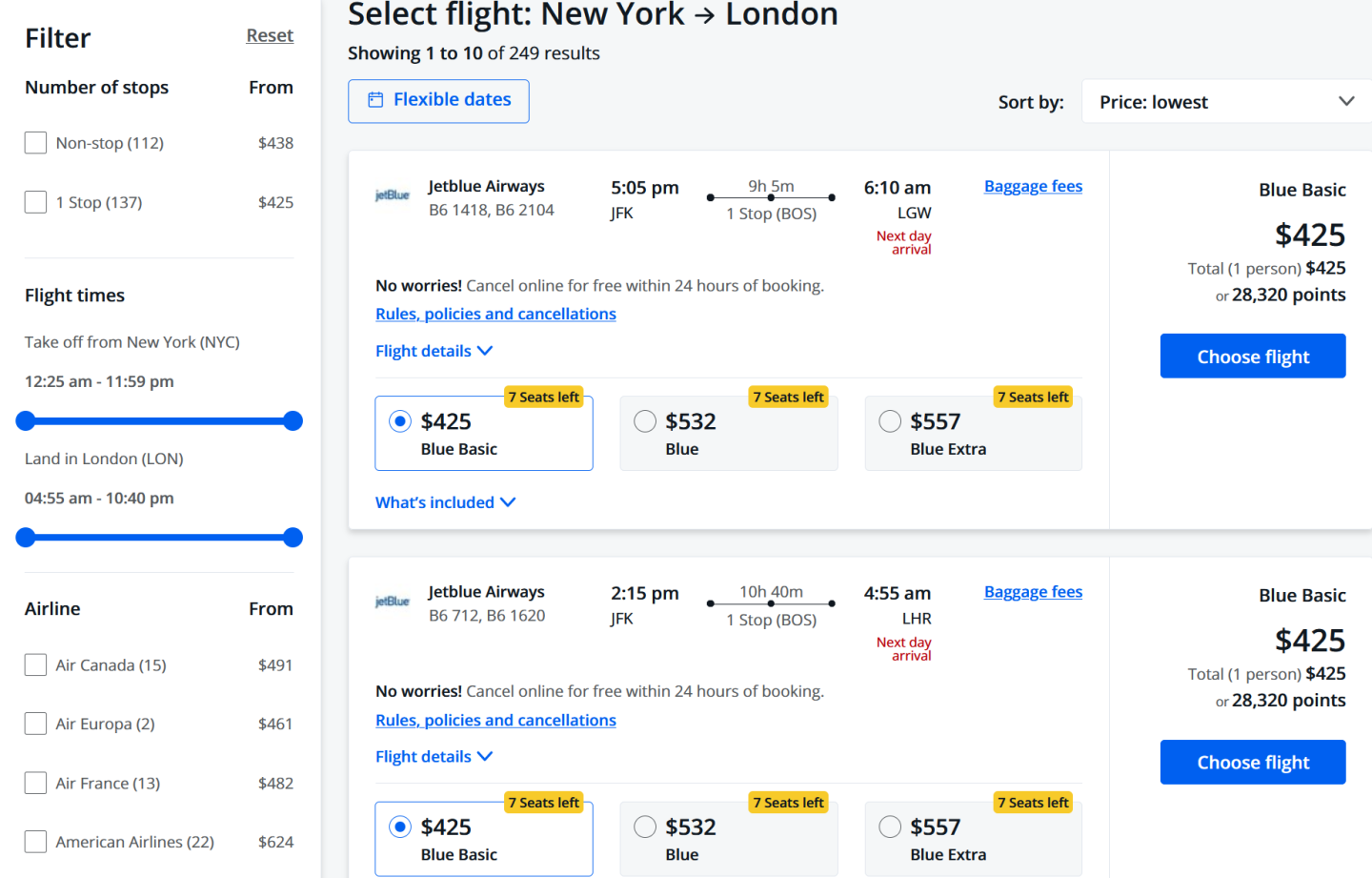

This is one of the more popular features of using points, but keep in mind it doesn't feature all airlines, which can be frustrating. Even if you find a flight on an airline's website or third-party booking site, it doesn't mean it will be available at Chase.

Enter the relevant details in the search bar to find a flight. Results can be filtered by stops, airline or price. Another benefit of this portal is that you aren't subject to award seat availability in the same way you might be when redeeming miles through an airline's program.

If there is a seat that could be bought with cash, you can usually redeem points for it. Plain and simple.

Compare how many miles you would need if booking directly with the airline with what Chase is charging.

If it would cost fewer points to book directly with the airline, you’ll want to use miles instead. For example, Delta co-branded American Express cardholders can often redeem their miles like cash on Delta’s website (at 1 cent per mile’s value). That’s just average, but if it is cheaper than what Chase is charging, consider that the better option. But don’t forget that airlines will add on taxes and fees when redeeming miles . Airfare booked with Chase Ultimate Rewards® points don't have additional costs tacked on — these are already bundled into the fare.

Another important note is that some low-cost airlines like Allegiant don't appear in search results. If you want to travel on a budget airline, then you'll need to visit those websites to compare fares.

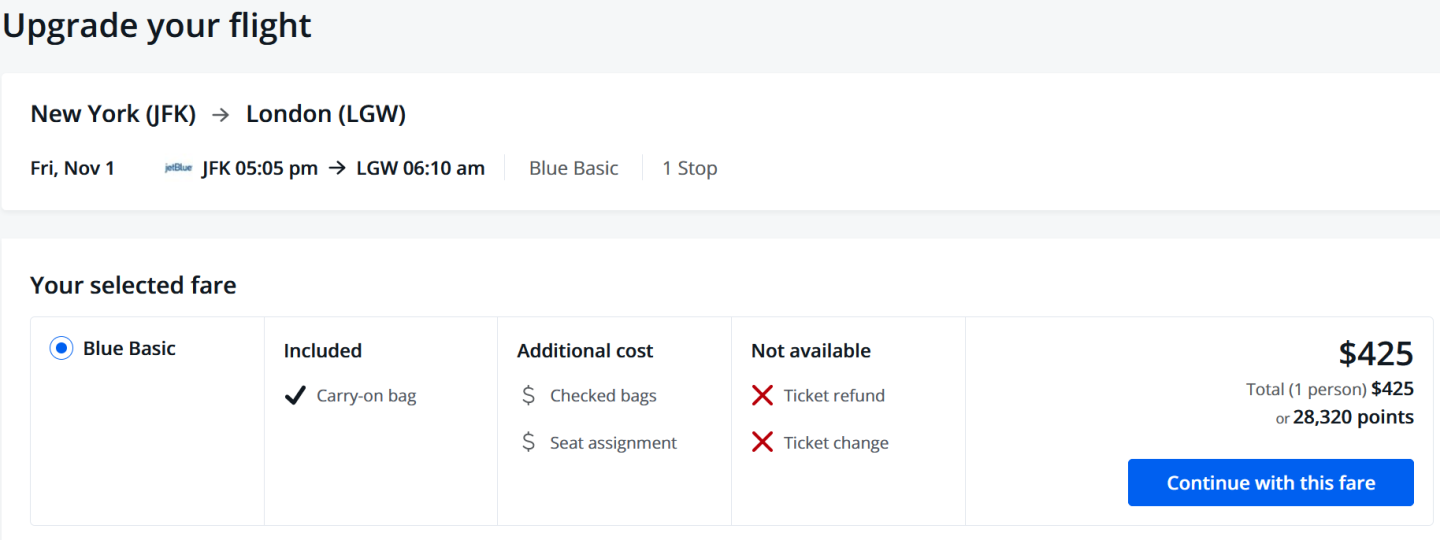

You can pay in cash, points or a combination. Chase will display particular details about your fare, like whether assigned seats or checked bags are included. This may not take into account any elite status perks you hold.

How to book hotels in Chase's travel portal

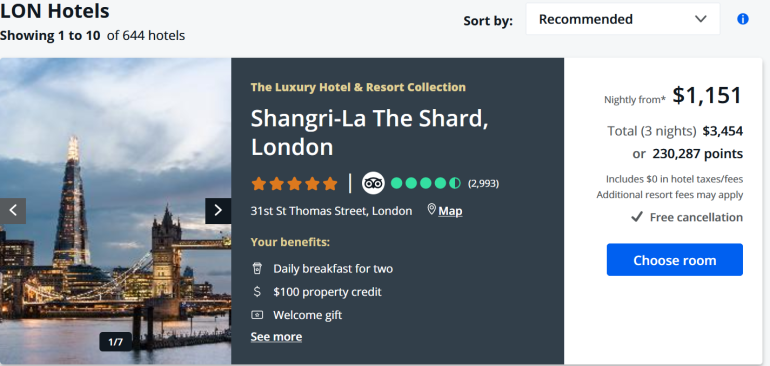

You can also redeem points for hotel stays using Ultimate Rewards® points. This is great news, especially when staying at hotels where you may not have elite status or don't care about elite perks or points earned.

Keep in mind that when making a reservation outside a hotel’s official reservation channels, you won’t earn points in its program or be able to take advantage of elite status benefits. So if you have status with a hotel chain, this isn't the best value unless you are willing to forgo those benefits.

Making a reservation is straightforward. Enter the city and travel dates to see a list of hotels available for redemption. Then, you can redeem points or pay in cash for your trip.

Like with flights, compare the cost of Chase Ultimate Rewards® points with the number of points a hotel’s program is charging. A particular favorite is World of Hyatt, which still uses an award chart and, as a transfer partner of Chase Ultimate Rewards®, can often deliver more favorable deals when using Hyatt’s points rather than Chase points.

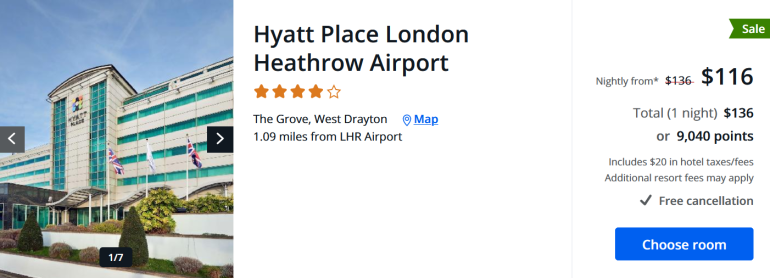

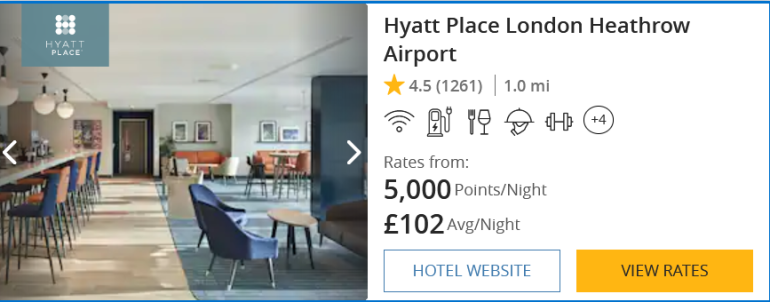

For example, it would cost about 9,000 Chase Ultimate Rewards® points to redeem a night at Hyatt Place London Heathrow Airport. But, if you transfer points to World of Hyatt, you would need 5,000 points for the same night’s stay.

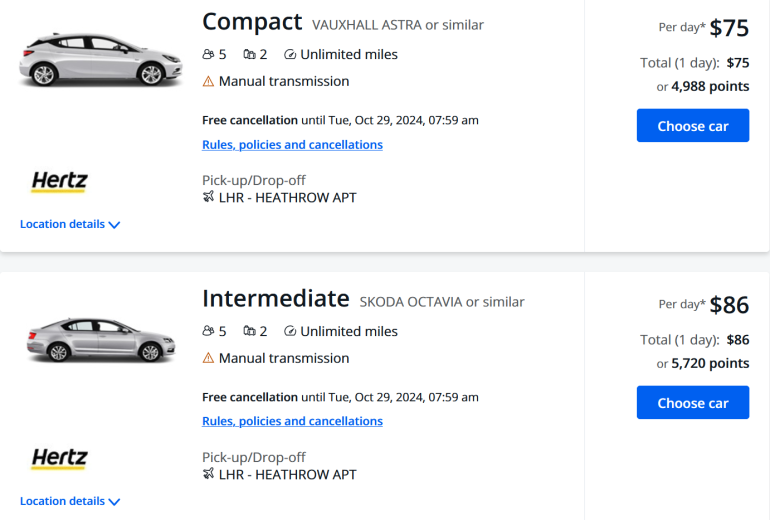

How to book car rentals in Chase's travel portal

This is a great place to reserve rental cars using points, and Chase rental car insurance benefits apply when using the card and paying with points. But, for that to be the case, you will want to pay for part of the rental in cash so the insurance benefits are activated. To do that, pay with a combination of cash and points, and decline the rental company's insurance first.

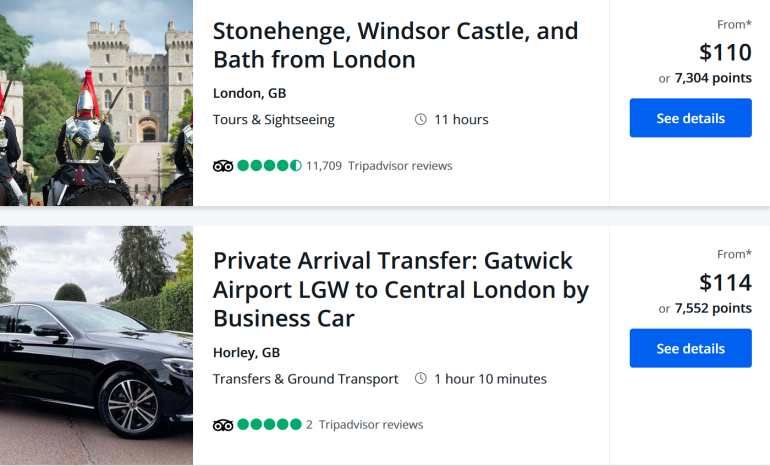

How to book activities in Chase's travel portal

Activities available for booking through Chase's travel portal include tours and experiences at home or when traveling and airport transfers. Price comparison plays a role here, too, since many hotel brands have their own platforms like Marriott Bonvoy Moments or FIND Experiences from World of Hyatt. These allow you to redeem points for experiences.

Check which program is cheaper before redeeming Chase points if you find similar options in either program.

How to book cruises in Chase's travel portal

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise that may be better than using Chase, but when redeeming points for a cruise , there can be a lot of value.

Using Chase's portal to make a travel reservation is also strategic, as depending on your card, you can earn a healthy stash of points this way. Just be sure to compare the benefits you can earn with the opportunity cost of booking elsewhere.

Benefits of booking travel in Chase's portal

Let’s say you have a premium card like Chase Sapphire Reserve® . It earns 5x points per $1 when booking flights through the portal. The sweet spot is when using this card for hotel stays and rental cars booked via the portal for 10x points per dollar spent. Consider what’s in your wallet, and decide which card will net the most points.

Another benefit is that you will earn miles from flights booked through the portal, even when redeeming Chase Ultimate Rewards® points since these are viewed as a revenue ticket.

Remember, you will want to compare if it is cheaper to redeem airline miles directly through a carrier’s redemption program or if you can use fewer points by redeeming Chase points via the portal.

Sometimes it might make more sense to transfer points from Chase to an airline partner when redeeming a flight (or a hotel program when making a hotel stay). Be as vigilant with price comparison when redeeming miles and points as you would when using cash.

Does Chase's travel portal price match?

No. You cannot submit a lower fare elsewhere for a price guarantee here since this isn't a publicly available site. It is only available to those who have a Chase card.

What else you need to know

When booking through this reservation site, keep in mind that most airlines and hotels cannot assist directly with a reservation. They see this as a third-party booking through Expedia and will direct you to Chase's agents.

Many travelers report the experience can be frustrating when travel disruptions or cancellations occur. Agents are friendly but can sometimes be limited in their abilities, often reading prompts on their screens in international call centers.

It can be a hazard booking a reservation with a third party, but the trade-off in redeeming points is worth it for some travelers.

If you do need to contact a Chase portal agent for support on a reservation made through the site — whether for a flight, hotel booking, car rental or activity — you've got one option: a good, old-fashioned telephone call.

Dial 866-331-0773 for assistance regarding changes or cancellations to your bookings.

You might have better luck dialing the support line for your specific Chase card. You might opt to give one of these a try:

Chase Sapphire Reserve® : 855-234-2542.

Chase Sapphire Preferred® Card : 866-331-0773.

All other cards: 866-951-6592.

If you compare prices and consider the opportunity cost of using the portal instead of booking elsewhere, you can almost always come out ahead.

You can save money, earn bonus points and travel better with transferable loyalty points like Chase Ultimate Rewards®. They have the flexibility and versatility necessary to deliver excellent value on travel (rather than being locked into one airline or hotel loyalty program). With the right card (or suite of cards), you’ll be able to accumulate points and benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

[Limited Time] New Cardholders Can Get up to $1,050 in Chase Travel℠ Value

Chase Sapphire Preferred® Card

✈️ Our Nerds say it's "nearly a must-have for travelers " because of its big sign-up bonus, high-value points and money-saving perks like hotel credit and rental car insurance.

🤑 Better yet, it's offering one of the best bonuses ever right now, only for a limited time...

- Office Products

- Office & School Supplies

- Forms, Recordkeeping & Money Handling

- Money Handling Products

- Check Writers

Image Unavailable

- To view this video download Flash Player

The Traveller Business Size Portable Business Checks (50)

Looking for specific info, product information, technical details, additional information, warranty & support, product description.

(50 count) Our Traveller business checks are full-sized, yet easily carried in your purse, briefcase or pocket! An ideal full-size business check for organizations that only need small quantities. Great compliment to computer checks when you are on the go. Blue vinyl cover & check register included. Checks available in 1-part or 2-part duplicate format. Built-in check security trusted by 7,000 financial institutions nationwide, with features such as chemically sensitive paper, microprint border, invisible fluorescent fibers, erasure protection, security screen & warning box.

Customer reviews

- 5 star 4 star 3 star 2 star 1 star 5 star 0% 0% 0% 0% 0% 0%

- 5 star 4 star 3 star 2 star 1 star 4 star 0% 0% 0% 0% 0% 0%

- 5 star 4 star 3 star 2 star 1 star 3 star 0% 0% 0% 0% 0% 0%

- 5 star 4 star 3 star 2 star 1 star 2 star 0% 0% 0% 0% 0% 0%

- 5 star 4 star 3 star 2 star 1 star 1 star 0% 0% 0% 0% 0% 0%

Customer Reviews, including Product Star Ratings help customers to learn more about the product and decide whether it is the right product for them.

To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness.

No customer reviews

- Amazon Newsletter

- About Amazon

- Accessibility

- Sustainability

- Press Center

- Investor Relations

- Amazon Devices

- Amazon Science

- Sell on Amazon

- Sell apps on Amazon

- Supply to Amazon

- Protect & Build Your Brand

- Become an Affiliate

- Become a Delivery Driver

- Start a Package Delivery Business

- Advertise Your Products

- Self-Publish with Us

- Become an Amazon Hub Partner

- › See More Ways to Make Money

- Amazon Visa

- Amazon Store Card

- Amazon Secured Card

- Amazon Business Card

- Shop with Points

- Credit Card Marketplace

- Reload Your Balance

- Amazon Currency Converter

- Your Account

- Your Orders

- Shipping Rates & Policies

- Amazon Prime

- Returns & Replacements

- Manage Your Content and Devices

- Recalls and Product Safety Alerts

- Registry & Gift List

- Conditions of Use

- Privacy Notice

- Consumer Health Data Privacy Disclosure

- Your Ads Privacy Choices

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

2024 Checked Luggage Size Chart and Allowances for 62 Airlines [Dimensions, Sizes and More]

Alex Miller

Founder & CEO

297 Published Articles

Countries Visited: 34 U.S. States Visited: 29

Keri Stooksbury

Editor-in-Chief

49 Published Articles 3419 Edited Articles

Countries Visited: 50 U.S. States Visited: 28

Michael Y. Park

Senior Editor & Content Contributor

27 Published Articles 430 Edited Articles

Countries Visited: 60+ U.S. States Visited: 50

![chase traveller biz size chec 2024 Checked Luggage Size Chart and Allowances for 62 Airlines [Dimensions, Sizes and More]](https://upgradedpoints.com/wp-content/uploads/2023/01/Luggage-Choice.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Key takeaways, checked luggage allowances by airline, can i prepay for baggage, recommended cards that reimburse your baggage fees, checked luggage options.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

- Airline policies for checked luggage sizes and weights vary, with most allowing bags up to 62 linear inches and 50 pounds, though these limits can differ by airline and route.

- Oversized or overweight bags incur additional fees, which can be substantial, making it important for travelers to check specific airline policies before packing.

- Understanding airline baggage rules helps avoid unexpected charges and issues during check-in boarding.

With no universal set of rules for checked luggage allowances, you need to review what you’re permitted to bring with you every time you travel in order to avoid excess charges.

Allowances can differ from airline to airline, with some allocating a total weight allowance and some restricting passengers to a specific number of pieces. Airline policies can also vary depending on the route and will nearly always vary based on the cabin you’re traveling in.

Your ticket will give you the most accurate information for your specific flight. If baggage details are not included on your ticket, you can check out our handy table below that details allowances for over 60 popular airlines. Where available, you can also click the airline name for a more detailed overview of the airline’s baggage policy, including excess charges and frequent flyer allowances.

When talking about baggage allowances, many airlines refer to “maximum linear dimensions” or something similar. This is merely the number you get when you add together the length, width (or height), and depth of a piece of luggage. For example, if you had a suitcase that’s 26 inches long, 20 inches wide, and 16 inches deep, then its linear dimensions are 62 inches, or right at the maximum for many airlines.

Traveling light? We’ve also covered carry-on luggage allowances with a similar size chart.

Your airline may allow passengers the ability to prepay luggage online for less than at the airport. Individual airlines’ baggage policies can be found by clicking the airline name in the preceding table or by visiting the airline’s website.

If you will be paying to check a bag on your next flight, or if your luggage is overweight or oversized, use one of the recommended Capital One cards below so that you can be reimbursed for the cost. Each card detailed allows you to redeem Capital One miles for 1 cent each as a statement credit against travel purchases made in the previous 90 days.

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights and vacation rentals purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights and vacation rentals booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- Receive up to a $120 credit for Global Entry or TSA PreCheck ®

- APR: 19.99% - 29.74% (Variable)

- Foreign Transaction Fees: None

Capital One Miles

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels, vacation rentals, and rental cars booked through Capital One Travel

- Up to a $120 Global Entry or TSA PreCheck application fee credit

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

The card offers unlimited miles at 1.25x per $1 and no annual fee. When you consider the flexible rewards, frequent travelers come out on top.

Interested in a travel rewards credit card without one of those pesky annual fees? Then say hello to the Capital One VentureOne Rewards Credit Card.

In addition to no annual fee, the Capital One VentureOne card offers no foreign transaction fees.

But is this card worth its salt, or is it merely a shell of the more popular Capital One Venture card?

- No annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- Ability to use transfer partners

- Weak earn rate at 1.25x miles per $1 spent on all purchases

- No luxury travel or elite benefits

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.74% - 29.74% variable APR after that; balance transfer fee applies

- APR: 19.74% - 29.74% (Variable),0% intro on purchases for 15 months

Hot Tip: To view more checked bags, check out our article on the best checked luggage bags for travelers .

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One VentureOne Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

IMAGES

COMMENTS

Our Traveller business checks are full-sized, yet easily carried in your purse, briefcase or pocket! An ideal full-size business check for organizations that only need small quantities. Great compliment to computer checks when you are on the go. Checks available in 1-part or 2-part duplicate format. WARNING: Cancer and Reproductive Harm - www ...

Full-featured business checks in the perfect size for travelers. Vinyl cover included for extra durability on the go. Search. Clear Search Start Search. Close. ... The Traveller, Business Size Portable Checks Item#: 59000N Size: 8 5/8 x 3" Turn Zoom On. View Price Chart. Quantity Price Breaks. 1-Part/Original

An ideal, full-size business check for organizations that only need small quantities. Checks available in 1-part or 2-part duplicate format. WARNING: Cancer and Reproductive Harm - www.P65Warnings.ca.gov. Size: 8 5/8 x 3". Chase Checks Marketplace, Custom Business Cheques, Deposit slips - Customize and order now.

You can order checks by signing in above and choosing your check design. For business accounts: Go to our check order page to sign in and order checks for your business accounts. Check pricing and discounts. Based on your product type, we'll tell you the price and any available discounts before you submit your check order. Changing your address

GTIN: 00810151600802. 59000N The Traveller Business Size Portable Checks. Size: 8 5/8 x 3". Great compliment to computer checks when you are on the go. An ideal full-size business check for organizations that only need small quantities. Our Traveller business checks are full-sized, yet easily carried in your purse, briefcase or pocket!

Enrollment in Zelle ® with a U.S. checking or savings account is required to use the service. Chase customers must use an eligible Chase consumer or business checking account, which may have its own account fees. Consult your account agreement. To send money to or receive money from a small business, both parties must be enrolled with Zelle ...

Check Size: 6 x 2 3/4". End-stubs preprinted on front & back. Trusted by 7,000 financial institutions nationwide. Order The Traveller, Business Size Portable Checks at DesignsnPrint.com. Conveniently fits in a purse, briefcase, or coat pocket for easy portability. Includes: 40 full-sized checks with 15 1-part deposit tickets, or 160 checks with ...

Get high-quality business check printing from Deluxe. Customize your business checks with a logo for added brand visibility. Most checks ship in 3 days. Order online. ... High Security 3/Page Business Size Checks, End Stubs Item# 53220HS; Laser High Security Mid Checks Work w/ Businessworks & more Item# SSLM102;

Specifications. Our 1-part compact business checks meet your needs affordably, complete with accessories in a handy trifold package! Separate register (51177N) & deposit ticket (51119N) refills let you buy only what you need! Built-in check security trusted by 7,000 financial institutions nationwide, with features such as chemically sensitive ...

4.5. NerdWallet rating. The bottom line: Chase Business Complete Checking℠ stands out with a $. 300. sign-up bonus and access to Chase QuickAccept℠, which can be used to accept credit card ...

Deluxe checks are high-quality, secure checks trusted by over 4,000 financial institutions. Deluxe offers customizable business and personal checks, featuring advanced security measures to help prevent fraud. Our business checks meet industry standards, are compatible with accounting software, and include branding elements including company ...

Checks measure 8-1/4" x 3". Compact Business Travel Checks by Deluxe corporation are printed in 6" x 2 3/4" sizes and quantities of 150, 300, 600, 900, 1200. They are available in a bi-fold style or a tri-fold style. Deluxe also offers a side-tear business check - The Traveler that measures 8 5/8" X 3."

An ideal full-size business check for organizations that only need small quantities. Great compliment to computer checks when you are on the go. Click here for pricing >> Size: 8 5/8 x 3. For business owners on the go, Deluxe.com has an ideal size business checks, it's known as the traveler. The blue vinyl cover and check register are included.

Since cruise bookings can be more complex, you will need to call Chase Ultimate Rewards® at 855-234-2542 to make a reservation. There are many ways to earn multiple points when booking a cruise ...

Amazon.com : CheckSimple Traveler Business Checks - Custom Manual Business Size Checks with Register (160 Checks) : Office Products. ... I had paid much more for last checks bought from online vendor linked to Chase bank. Read more. Helpful. Report. Horace B. 5.0 out of 5 stars Nice checks.

3-On-A-Page Business Size Checks with Deposit Tickets. 250 Starting at. $176.99. Item#: 54031HS. High Security 3/Page Business Size Manual Checks w/Register. 250 Starting at. $209.99. Item#: 51100HS. Deluxe High Security Entrepreneur Compact Checks & Register.

Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases ... To book a hotel through the Chase Travel portal, you'll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out ...

An ideal full-size business check for organizations that only need small quantities. Great compliment to computer checks when you are on the go. Blue vinyl cover & check register included. Checks available in 1-part or 2-part duplicate format. Built-in check security trusted by 7,000 financial institutions nationwide, with features such as ...

62 inches (158 cm) maximum linear dimensions. 1. 50 pounds (23 kg) Included. *For flights to Honolulu from Australia, the baggage allowance is 2 checked pieces. **The baggage allowance for flights to Shanghai, Singapore (from New Zealand & Australia), and Taipei (from New Zealand) is 2 checked bags. For flights departing Australia to Canada and ...