- Vietcombank

- Thẻ ngân hàng Ngân hàng Agribank

Thẻ tín dụng quốc tế Agribank Visa/MasterCard

- 12553 VIEWS

Thẻ tín dụng quốc tế Agribank Visa/MasterCard do ngân hàng Nông nghiệp và phát triển nông thôn Agribank phát hành cho phép khách hàng sử dụng được nhiều tiện ích, thuận tiện cho khách hàng mọi lúc mọi nơi, thanh toán phạm vi trên toàn cầu hoặc giao dịch qua internet.

Thẻ tín dụng quốc tế Agribank Visa/MasterCard có 3 hạng thẻ:

- Hạng thẻ Chuẩn (Visa Credit Classic)

- Hạng thẻ Vàng (Visa/MasterCard Credit Gold)

- Hạng thẻ Bạch kim (MasterCard Credit Platinum)

Tiện ích khi sử dụng Thẻ tín dụng quốc tế Agribank Visa/MasterCard:

- Quý khách có thể rút/ ứng tiền tại quầy giao dịch, máy ATM, các điểm ứng tiền mặt

- Nộp tiền vào tài khoản, In sao kê với thẻ Visa Agribank .

- Mua thẻ trả trước, thanh toán hóa đơn

- Giao dịch thanh toán, vấn tin số dư, chuyển khoản một cách dễ dàng

- Sử dụng các tiện ích của Mobile Banking

- Khách hàng có thu nhập ổn định được cấp hạn mức thấu chi nên tới 30triệu thời hạn 12 tháng

- Miễn phí bảo hiểm tai nạn lên đến 15triệu khi đáp ứng đủ điều kiện Agribank

- Hưởng lãi suất không kỳ hạn với số dư trong thẻ

- Hạn mức ( tại ATM ):

- Rút tiền/thẻ/ngày: Thẻ chuẩn 25.000.000 VNĐ, thẻ vàng 50.000.000 VNĐ

- Chuyển khoản/thẻ/ngày: Thẻ chuẩn 20.000.000 VNĐ, thẻ vàng 50.000.000 VNĐ

- Rút tiền/giao dịch: Tối đa 5.000.000 VNĐ, tối thiểu 50.000 VNĐ

- Thấu chi: 30.000.000 VNĐ

- Biểu phí:

- Phát hành thẻ lần đầu: Thẻ chuẩn 50.000 VNĐ, thẻ Vàng 100.000 VNĐ

- Thường niên: Thẻ chuẩn 100.000 VNĐ, thẻ Vàng 150.000 VNĐ

- Rút tiền mặt: Tại cây ATM Agribank 1000 VNĐ/giao dịch, khác cây ATM Agribank 4%/số tiền giao dịch và tối thiểu 50.000 VNĐ

- Chuyển đổi ngoại tệ: 2%/số tiền giao dịch

- Thay đổi hạn mức thấu chi: 20.000 VNĐ/lần

Hạn mức thẻ:

- Thời hạn: 4 năm

- Hạn mức rút tiền/ngày/thẻ: 25 triệu(thẻ chuẩn), 50 triệu (thẻ vàng)

- Hạn mức chuyển khoản/ngày/thẻ: 20 triệu(thẻ chuẩn), 50 triệu (thẻ vàng)

- Hạn mức rút tiền/giao dịch: tối đa 5 triệu, tối thiệu 50 nghìn

- Số lần rút/ngày: không hạn chế

- Hạn mức thấu chi: tối đa 30 triệu

Điều kiện phát hành:

- Cá nhân là người Việt Nam có hành vi dân sự đầy đủ theo quy định hiện hành của pháp luật

- Có tài khoản tiền gửi thanh toán tại Agribank

- Khi phát hành thẻ đăng ký thấu chi phải có thu nhập ổn định

Thủ tục phát hành:

- Giấy đăng ký mở và sử dụng dịch vụ ngân hàng.

- Bản sao CMND hoặc hộ chiếu

- 01 ảnh 3x4 chụp trong phạm vi 6 tháng gần nhất

- Hợp đồng sử dụng thẻ

- Giấy xác nhận lương, trợ cấp xã hội do tổ chức, đơn vị quản lý lao động hoặc cơ quan có thẩm quyền cấp (Nếu đăng ký dịch vụ thấu chi tài khoản).

Phát hành bởi Ngân hàng Agribank

Các thẻ cùng loại:

- Thẻ tín dụng quốc tế Vietcombank Mastercard World với nhiều ưu đãi vượt trội

- Thẻ tín dụng quốc tế Vietcombank Unionpay

- ACB JCB tín dụng trong tay, thỏa sức bay

- Thẻ liên kết sinh viên Agribank

- Thẻ lập nghiệp Agribank

- Thẻ tín dụng Citi PremierMiles Visa Signature

- Thẻ tín dụng Citibank PremierMiles thẻ cao cấp cho những du khách bay thường xuyên

- Tiết kiệm chi tiêu cùng thẻ Citi Cash Back Visa platinum

- ACB Express

- Thẻ thanh toán quốc tế ACB MasterCard Gold

- ACB Visa Business

- ACB Visa Gold là gì ?

- Nhận nhiều ưu đãi với thẻ VIP ACB Visa Platinum

- Thẻ tín dụng ACB Visa Signature

- Thẻ Vietcombank Unionpay

Switch language:

- Company news

Vietnam’s Agribank to roll out co-branded credit and debit cards with JCB

- Share on Linkedin

- Share on Facebook

Vietnam Bank for Agriculture and Rural Development (Agribank) has joined forces with JCB International (JCBI) to launch new co-branded credit and debit cards.

Agribank is the only 100% state-owned commercial bank in Vietnam.

Go deeper with GlobalData

Innovation in Commercial Banking Market with focus on Neobanks for Business, ESG Financing, Digit...

Singapore retail banking consumer profiles, premium insights.

The gold standard of business intelligence.

Find out more

The Agribank JCB Ultimate credit and debit cards are said to be the highest line of payment cards from JCB.

Agribank JCB Ultimate credit cards have been launched for Vietnamese individuals with special promotions and premium privileges.

The credit cardholders receive a pool of benefits, including global travel insurance.

They get one special and complimentary dish at select Japanese restaurants in Vietnam, up to 100% off at 10 luxury golf courses, and a free stay at FLC Golf Resorts group.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

Cardholders can also enjoy free access to over 70 international airport lounges in Vietnam, Thailand, Singapore, Malaysia, Korea, Japan, Hong Kong, China, UK, and Hawaii.

The Agribank JCB debit card is printed with the lucky cat symbol from Japan.

The benefits offered by the debit card includes withdrawal insurance at ATM, special discounts at over 100 restaurants, and free access to JCB Plaza – oversea customer service centers.

Moreover, the cardholders of Agribank JCB Card can transact at about 34 million merchant locations worldwide as well as gain access to over a million ATMs.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

UAE card payments market to surpass $200bn in 2028, forecasts GlobalData

Visa, karta disrupt digital gift cards, checkout.com and mastercard partner to bring virtual cards to online travel agents, network international rolls out mastercard instalments across the uae, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

Thematic Take (monthly)

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

You are using an outdated browser. Please upgrade your browser to improve your experience.

- PRODUCTS & TECHNOLOGIES

- SERVICES & PROMOTIONS

AUG 11, 2020

- JCB and Agribank to issue JCB Ultimate Credit and Debit Cards

August 11, 2020

August 11 2020, Hanoi and Tokyo - Vietnam Bank for Agriculture and Rural Development (Agribank), one of the leading commercial banks in Vietnam and JCB International Co, Ltd. (JCBI) - the international operations subsidiary of JCB Co., Ltd., announced the launch of Agribank JCB Ultimate Credit and Debit Cards today.

Ultimate Credit Card is the highest line of JCB for individual customers in Vietnam with special promotion and premium privileges. Agribank JCB Ultimate Card holders will enjoy global travel insurance, one special and complimentary dish at selected high-end Japanese restaurants in Vietnam, up to 100% off green fee at 10 luxury golf courses and one free stay at FLC Golf Resorts group and free access to over 70 international airport lounges in Vietnam, Thailand, Singapore, Malaysia, Korea, Japan, Hong Kong, China, United Kingdom and Hawaii.

Agribank JCB Debit Card is also launched at the same time with very attractive card design - the lucky cat symbol from Japan. The cardholders also enjoy various benefits such as withdrawal insurance at ATM, special discounts at more than 100 high-end restaurants, free access to JCB Plaza - oversea customer service centers.

Furthermore, the holders of Agribank JCB Card can access JCB acceptance network globally with about 34 million merchants and over a million ATMs in the world, enjoy special privileges at selected merchants and customer service at JCB Plaza around the world.

Agribank JCB Ultimate Credit Card

Agribank JCB Debit Card

About Agribank

Vietnam Bank for Agriculture and Rural Development (Agribank) is the only 100% state-owned commercial bank in Vietnam. Throughout its development, Agribank has always been the largest bank in Vietnam in terms of total assets, operating network and customer base.

Throughout 32 years of development, Agribank has always affirmed its position and role as one of the leading commercial banks in Vietnam. For many consecutive years, Agribank has been in the Top 10 largest enterprises in Vietnam and won many awards from international organizations.

Agribank is currently focusing on effectively implementing the Business Strategy for the 2016-2020 period, with a vision to 2030, successfully implementing the phase two restructuring associated with the task of speeding up the implementation of the Agribank equitization plan under the Prime Minister's Decision, maintaining its leading position in the agricultural and rural financial market, making positive contributions to promoting socio-economic development of the country.

Money in Vietnam: A Tourist Guide to ATMs, Cards and Exchange

This is for all travelers to Vietnam who want to know how to handle money and payments in the country of the Dong.

I will tell you all about withdrawing from an ATM, exchanging currency, and paying by card.

Do you want to know which ATMs don’t charge an access fee? TPbank and VPbank!

Do you wonder if you can use Revolut and Wise in Vietnam? Yes, no problems at all!

This is the full guide to money in Vietnam for tourists!

Currency in Vietnam

The currency in Vietnam is the Vietnamese đồng with code VND.

First things first – don’t laugh at the name! It’s the name for the copper material of the coins in Vietnam’s ancient past . In modern times it just means money, plain and simple, really nothing phallic about it.

It’s one of those currencies with a lot of zeroes. Rampant inflation after 1985 resulted in one of the weakest currencies (unit for unit) in the world to this day. And the proliferation of the joke that everybody is a millionaire in Vietnam.

There are no coins in Vietnam anymore.

The banknote denominations are 500, 1000, 2000, 5000, 10.000, 20.000, 50.000, 100.000, 200.000, and 500.000.

All banknotes 10.000 and over are now made of polymer making them very durable ( unlike money in Laos where you also have to carry lots around and they get ruined pretty quickly being of cotton ).

The biggest banknote of 500.000 VND (~21$) means you don’t have to carry a thick lump of money like with the Indonesian Rupiah .

Can you use your card in Vietnam?

Yes, you can use your foreign card to pay for some things in Vietnam.

Foreign card payments are not that common though. It’s only true in cities and popular tourist hotspots. Bigger hotels, bigger supermarkets, and most tour operators will accept payment by card.

However, most will charge a 2% to 4% commission.

Smaller supermarkets, traditional open-air markets, family-run guesthouses, etc. of course, only accept cash. Imagine going to a floating market on the Mekong Delta and trying to pay by card, ain’t happening mate!

All kinds of cards are accepted: Visa, Mastercard, Maestro, and American Express.

ATMs in Vietnam

ATMs are everywhere in the cities of Vietnam. You won’t have to walk more than a few meters to find an ATM.

In more remote locations like Ha Giang region in the far north or rural villages around Sapa finding an ATM may prove to be an impossible task.

Visas and Mastercards will always be accepted by ATMs. For Maestro and AMEX you may have to try a few ATMs before you find one that accepts your card.

The maximum withdrawal amount on ATMs is between 2 and 5 million VND. The maximum is at TPbank at 5 million.

Withdrawal Fees

Here comes the tricky part – avoiding those pesky ATM withdrawal fees. I’m not talking about the fees you get charged by your bank – those you can avoid by using a FinTech solution like Revolut, Curve, or Monese .

Most ATMs in Vietnam charge a withdrawal fee between 20.000 and 50.000 VND (0.8-2$).

ATMs without withdrawal fees

Only TPbank and VPbank ATMs offer free withdrawals in Vietnam.

Although most ATMs will tell you if there’s an access fee, some in Vietnam don’t. You will only realize you paid a 50.000 VND fee when you check your bank statement. Urghh!

The best ATMs in Vietnam for foreigners are TPbank and VPbank because you can withdraw money without a fee. Guaranteed, tried and tested! Feel free to send me an angry message if they charge you a withdrawal fee!

And yes, I did try most of the other different banks, including Agribank, Vietinbank, Vietcombank, BIDV, Shinhan Bank, HSBC, and more that I don’t remember the names of. They all charge an access fee.

Some travelers report that Saigon Commercial Bank (SCB) also doesn’t charge a fee. I haven’t tried it myself. If you have, let me know in the comments below.

You can find TPbank ATMs on Google Maps. They’re not the most common but there are at least 1-2 in every city ( and more in Hanoi and Ho Chi Minh City ).

TPbank is easily recognizable by its vivid purple colors.

VPbank on the other hand has its branding in green and red.

Exchanging Money in Vietnam

You don’t have to exchange money in Vietnam if you have a card with low fees like Revolut. It will probably turn out to be more expensive to exchange cash than to withdraw from an ATM due to the exchange rate margins.

But I understand if you carry cash when traveling and exchange it for the local currency. It’s normal and safe. So here’s how to be prepared about exchanging money in Vietnam.

What currency to bring

As with almost anywhere in the world, the US dollar is the best foreign currency to carry to Vietnam.

You will have no issues exchanging these currencies too:

- British Pound;

- Japanese Yen;

- Chinese Yuan;

- Swiss Franc;

- Australian Dollar;

- New Zealand Dollar;

- Canadian Dollar;

- Singaporean Dollar;

- Malaysian Ringgit;

If your currency is not on the list it’s better to change your money to something more widely accepted.

I once tried to exchange 20 euros in Vietinbank where they told me they only change US dollars. But the bank next door, Agribank gladly accepted the euros and exchanged them in a few minutes.

The Gold Shops in popular tourist hotspots accept all sorts of currency and are unlikely to turn you around.

Where to Exchange Money

Vietnam is a popular travel destination and exchanging money is common, widespread, and standard.

You can exchange at:

- Banks ( Takes a few minutes. Bring your passport! )

- Exchange bureaus in a city ( Best rates )

- Gold and Jewelry stores ( Most double down as exchange bureaus, thus their rates are good )

- Airports ( worst rates )

- Hotels ( just okay )

- Tour Agencies ( bad rates considering there’s usually a bureau or a gold shop nearby )

- Dodgy guy at the market ( you’re setting yourself up to be scammed )

Tips for Changing Money in Vietnam

Most of these are common sense and not any different from other countries. Here are my top tips:

- Higher denominations = higher rates. For USD, 50 and 100 yield a slightly better rate.

- Damaged banknotes = lower rates + fee ( if accepted at all );

- Don’t accept foreign banknotes with ANY damage ( if changing Dong back to USD for example );

Pro Tips and Common Scams

Scams are one of the reasons I don’t like Vietnam . I don’t get scammed easily but even so, it takes energy and mental fortitude to avoid all the ways in which you can overpay unfairly.

I’ve compiled some smart tips from my travels to Vietnam and fellow travelers’ confessions to give you a heads-up.

- Polymer STICKS when even a little wet. Count your banknotes slowly and twice!

- Never take any banknotes with tears or holes.

- Check banknotes against light ( use your smartphone flashlight in the dark ) to confirm they are not forgeries. Fake banknotes are rare in Vietnam but they do exist.

- Be careful with the so-called “Spirit Money”. These are fake banknotes made of poor-quality paper, for burning and Buddhist ceremonies. They vaguely resemble real USD or VND banknotes but fail to close up scrutiny easily. Nonetheless, in the dark, some not-so-kind individuals may try their luck with you.

- Mentally ignore the last 3 zeroes to make calculations easier. 50.000 is just 50k, 20.000 is 20k.

- Know the multiple of your currency. Say you use US dollars and 10.000 VND is 0.4$. Your multiple is 4. If something costs 40.000 VND, ignore the zeroes, multiply by 4 and you have 16, i.e. 1.6$; Quick maths: 230k VND? -> 2.3*4 =9.2 USD.

- 10k, 50k, and 200k are in a similar shade. Be careful!

- 20k and 500k are also in a similar shade. Be very careful with these two!

- The most common scam is when you pay with 500k, the payee then secretly switches it to 20k and pretends he only received 20k. Taxi drivers are known to do this. They start being aggressive, it can get ugly quickly. Change 500k notes to smaller ones at reputable establishments!

How much cash to bring to Vietnam?

This depends on your way of traveling and your budget. Using your card in Vietnam is pretty easy so there’s no need to go overboard with physical cash.

My advice is to have at least 200$ just in case something goes wrong with your bank cards and you need emergency cash until you sort it out.

When I went to Vietnam I had exactly that much stashed away but since I exclusively used my Revolut and Curve cards , I’ve only ever changed 20 euros once.

On the other hand, if you’re wondering how much money you need to travel to Vietnam, you can check out my backpacker’s budget report for Vietnam .

Example prices

These are actual price ranges from 2024. Inflation isn’t very high right now, so they should remain stable. ( Note: 10.000 = 10k, all prices in VND )

- Coffee with milk: 10 – 25k;

- Pho soup: 35 – 50k;

- Banh Mi sandwich: 6 – 25k;

- Passionfruit cooler: 15 – 25k;

- Can of beer (supermarket): 8 – 20k;

- Can of beer (street bar): 15 – 40k;

- Museums: 20 – 50k;

- Public bus ticket in HCMC or Hanoi: 6 – 10k;

- 1-hour full-body massage: 200-400k;

- Budget hostel : 30 – 220k ( usually breakfast included );

- Mid-range hotels – 300 – 800k;

- Half-day group tour – 500k – 1 million;

- Overland bus travel – ~50k per hour of travel

See my budget report for Vietnam for more details.

Bargaining is an inseparable part of shopping in Vietnam.

In the eyes of locals, any foreigner is rich. Thus, the first price you will hear will be at least x3 what the locals pay.

It’s not uncommon to get a price 10 times higher than the actual!

As a foreigner, you will never get the locals’ price. But if you bargain playfully and politely, you can easily get at least a 50% discount most of the time.

Always assume you are getting the “tourist price” and ask for discounts. When I say always, I mean it – you can bargain for bus tickets, food, clothes, a coconut on the street, etc. You will be overcharged if you don’t bargain.

Tipping is not mandatory in Vietnam.

It’s not expected and it’s not common. Vietnamese people rarely tip.

And considering that you’re paying the tourist price already, one could assume that the tip is automatically included.

If you encounter genuinely friendly staff, exceptional service, and are overall happy with the way you were treated/pampered, do tip. It will bring smiles and good fortunes your way!

Frequently Asked Questions

Let’s answer some of your most burning questions about money in Vietnam.

What is the ATM withdrawal limit in Vietnam?

The maximum withdrawal limit is 5 million VND (~195$) at TPbank ATMs.

TPbank doesn’t charge a withdrawal fee, so you can withdraw twice, thrice, or more in a row. There is no daily limit but you may have one set by your bank.

Can you use US dollars in Vietnam?

You can use US dollars to pay for SOME things in Vietnam.

For example, tours are usually advertised in dollars and payable in dollars too.

For most daily transactions though, only Vietnamese Dong is accepted.

Can you use Revolut in Vietnam?

Yes, Revolut cards work in Vietnam. Both VISA and Mastercard work. You can withdraw from ATMs and pay on POS terminals with your Revolut card.

Similar fintech apps like Wise, Monese, Curve, N26, and Starling also work there.

If you are going to other Southeast Asian countries, you may want to read my money guides for them too:

- Tourist Guide to Money in Laos

- Tourist Guide to Money in Cambodia

- Tourist Guide to Money in Thailand

- Tourist Guide to Money in Timor Leste

- Tourist Guide to Money in Indonesia

Thanks for this recap! What kind of shopping apply to bargaining? Can this be applied to transportation or even fooding?

Transportation – only for unmetered taxis, private transfers and when they’re trying to make you pay for luggage. Otherwise the prices are set and there’s no haggling. Food – mostly no, but sometimes yes. Just use your judgement – if the price is too high, especially if you aren’t in an overly touristy place, ask for a discount 🙂 In Vietnam, almost everything is subject to bargaining. But then again, don’t push it too far.

Currently in Tam Coc. Plenty of businesses have hand held atm machines or there is BIDV booth. All charge 4%! There is another outside Hidden Charm hotel that is not working. My advice, bring plenty of dong or try Ninh Binh.

Good advice, Anne! There is a TPbank ATM in Ninh Binh for sure, it charges 0 for withdrawals.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Unlocking a Locked Agribank Credit Card

The Agribank credit card is an essential item in the lives of those who use Agribank's services. With the Agribank credit card, you can quickly perform various transactions, shop online, manage finances, and more. However, when your Agribank credit card is suddenly locked, preventing any transactions, it can cause a lot of inconvenience. So, how to unlock a locked Agribank credit card ?

Simple and quick steps to unlock your Agribank credit card

I. Reasons for Agribank Credit Card Lock?

Inability to withdraw cash, transfer money, pay bills, or make purchases are signs of Agribank credit card lock. When you encounter these situations, you may have fallen victim to one of the following reasons:

- Entering the wrong pin more than 3 times - Not using the credit card for about a year - Having overdue bad debts - Unusual transactions related to the credit card - Agribank system errors

II. How to Unlock a Locked Agribank Credit Card

1. How to Open an Agribank Credit Card

If you need to open an Agribank credit card for convenient financial management and transaction payments, you should visit Agribank branches/offices to proceed with the transaction. Agribank branches/offices are present across all districts, provinces, cities, including remote areas and mountainous regions, making it easy for you to reach the bank for transactions.

2. Procedure for Unlocking Agribank Credit Card

Agribank only accepts transactions such as card lock or card opening at the service counter. Therefore, the fastest way to unlock the card is to visit the bank's branch/office, where the staff can assist you in reopening your card.

Similarly to when opening an Agribank credit card , you need to bring documents for the staff to verify that you are the cardholder:

- Identification card/resident registration card... that you used for the previous credit card application - Your Agribank credit card

3. Agribank Phone Number

Agribank has a 24/7 customer care center to address and assist customers facing issues with their services. Therefore, in the case of a credit card lock, you can call the Agribank phone number 1900.558.818 for staff advice on procedures and effective solutions.

4. Considerations when unlocking Agribank credit card

Follow these tips to make unlocking your Agribank credit card faster and more convenient:

- Have all relevant documents such as ID card, credit card... - Visit the bank during working hours for smooth transactions. - Pay off debts when you've made cash advances previously

Therefore, you should go to the nearest Agribank branch/office to unlock your locked Agribank credit card, ensuring ease in payments and expenditures.

Currently, many banks such as Vietcombank, BIDV, Techombank ... offer credit card services to meet customer needs and ensure card management. To safeguard cardholder rights, when issues arise that affect the cardholder's benefits, the bank will automatically lock the credit card. If you are using a BIDV credit card and encounter this situation, similar to Agribank, you should visit BIDV to quickly unlock a locked BIDV credit card .

USAA Rewards™ Visa Signature See note ® Credit Card

Earn points on purchases - and even more on gas and dining.

SPECIAL OFFER

- Get a 0% Intro APR for 15 months on balance transfers and convenience checks that post to your account within 90 days of account opening. After this time, the variable regular APR of 15.15% to 31.15% will apply to these introductory balances. There is a fee of 5% of the amount of each balance transfer and convenience check from account opening. See note 1 See note , See note 2 View rates and fees for more details.*

Penalty APRs

Many banks make you pay more in interest charges when you've had a late payment or if your account goes over the credit limit. These charges can be more than double the interest you pay — and they can be charged indefinitely.

Our credit cards do not have penalty APRs.

Balance Transfer and Cash Advance Fee

There is a transaction fee of 5% of the amount of each Balance Transfer and each Cash Advance (including Convenience Checks). Cash Advance Fee is waived when you transfer funds electronically from your USAA credit card to your USAA Bank deposit account.

Redeem your rewards.

Your total points increase with every Qualifying Purchase. Redeem them your way, on your schedule.

Step 1: Earn

Enjoy rewards points that never expire, with extra earnings in select spending categories.

Step 2: Track

Keep tabs on your rewards. Points for posted transactions are usually added within 48 hours. Check your total on usaa.com or the mobile app.

Step 3: Redeem

Choose from a range of exciting redemption options. Redeem some or all of your points.

Benefits and Features

Carry a credit card that's easy to use and manage, with peace of mind built in.

- Agribank Card

- ATM/Branches

Agribank Visa Standard

Features & Benefits

- Transact at millions of card acceptance places (ATM / POS) with Agribank / Visa / MasterCard / JCB logo worldwide, simple consumption, no need to carry cash.

- Pay for goods and services online with 3D-Secured global security standards in any currency.

- Integrating chip card technology according to EMV standard for optimal security and convenient, convenient contactless card technology.

- Connect with Agribank E-Mobile Banking application to perform card management functions right on the phone: Transfer, Non-physical card issuance, Register for 3D-Secured service, Information / history information delivery card transactions, Card lock, Change card transaction limit, Register Internet transactions, Pay with QR-Code, Credit card statement, etc.

- Manage spending efficiently and safely through text messages when having transactions.

Fees & Limits

Initial issuance fee: VND 100,000

Transaction limit:

Register the card

- Agribank Deposit Service

- Agribank loans

- Agribank cards

- Payment and Remittances

- Digital banking

- Mobile transaction unit

- Customer Priority

- Correspondent banking

- Cash management and payment

- Currency Market and Money Market

- Forex Dealing

- Agribank publications

- Agribank Library

Agribank E-mobile Banking

- Terms of use

- Privacy & Security

- ${title} ${badge}

- Corporate Profile

- Board Of Directors

- Agribank Officers

- Regular Savings Account

- Micro Savings Account

- Smart Savings Account

- Starflex Deposit Account

- Starflex Bigla Todo Account

- Starflex Plus Deposit Account

- Bagong Bayani Savings Deposit

- Bagong Bayani Smart Time Deposit

- Bagong Bayani Starflex Time Deposit

- Agri-Machinery Loan (AML)

- Negosyo Loan

- Motorcycle Loan

- Foreclosed Properties

- NEWS & FEATURES

You can now pay you monthly amortization at the comfort of your home by using the Paymaya and Gcash application. With this, we can assure you fast, reliable, and convenient payment method, as we slowly move to digitalize our processes, that will result to an even heightened level of service. Directions:

FAQ’s 1. How can I download the Gcash and Paymaya App? – You can download the Gcash and Paymaya App through Google Playstore or Apple App Store. 2. How do I “Cash in or Add Money” to my Paymaya or Gcash account? – You can ‘add money’ to your PayMaya account via bank transfers or via debit/credit cards, Robinsons Department Store Business Centers, The SM Store Business Services, Smart Padala branches nationwide and select 7-Eleven branches. For the complete list of PayMaya’s ‘add money’ channels, please visit: https://www.paymaya.com/quick-guide/add-money-channels – You can “Cash In” to your Gcash Account via Online Banks, Over the counter transactions or through Global Partners and Remittance. For more details please visit: https://www.gcash.com/getting-started/cash-in/ 3. Can I use the Gcash and Paymaya App to pay my Loan anywhere? – Yes, as long as you have internet connection and sufficient account balance. 4. Can I pay the Loan Amortization of my family or friend using the Gcash and Paymaya App? – Yes, as long as you provide their correct Loan ID/Borrower’s Name/Amount/Email address 5. Are there any fees? – Yes, please prepare a P20.00 convenience fee when paying your Loan Amortization. 6. How do I make sure that the payment was successful? – You will receive a text message as a confirmation of payment within 24hrs. 7. Will the App show the amount due? – No, you may directly go the branch or message our facebook page for the information about your amount due. 8. Can I pay my Loan after my due date? – Yes, you can still pay even after your due date but please take note that failure to pay on time will incur penalty and possible foreclosure of your unit. 9. If I pay my Loan today, when will my payment be posted? – Posting of your loan amortization payment thru Gcash or Paymaya is after 1-2 days 10. What do I do if I erroneously input a wrong Loan ID or Borrower information details? – You can report the erroneous payment to Gcash by clicking this link: https://help.gcash.com/hc/en-us/requests/new?ticket_form_id=360000706713 – You can report and see other details regarding erroneous payment in Paymaya by clicking this link: https://cares.paymaya.com/s/topic/0TO7F000000q8OTWAY/paymaya-consumer

Iloilo Warehouse Sale

Narito na ang pagkakataon niyong magkaroon ng isang sulit na investment para sa kinabukasan ng inyong agri-business. Lumahok sa...

Agribank named one of the Philippines’ best employers of 2023

Oradian partner Agribusiness Rural Bank, Inc. (Agribank), one of the most established and trusted rural banks in the Philippines,...

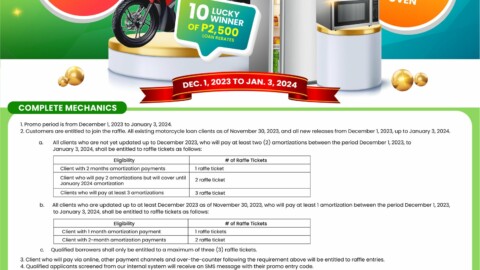

Agribank – Bayad Now Premyo Later Promo

Magiging Merry ang pasko ninyo ka-tROPA sa hinanda naming AGRInaldo! Nagbayad ka na, may chance ka pang manalo ng...

Tarlac City Branch Opening

AGRIBANK TARLAC CITY BRANCH IS NOW OPEN! Good news para sa ating mga ka-AGRI Tarlacquenos. We are now here...

Agribank recognized as one of the Philippine’s Best Employers 2024

Agribusiness Rural Bank, Inc. or AGRIBANK for the second time has been recognized as one of the Philippine’s Best...

FOLLOW OUR YOUTUBE CHANNEL

Follow the official YouTube account account of Agribusiness Rural Bank Inc.

LESS HASSLE NA ANG PAGBABAYAD NG LOAN AMORTIZATION

Gawing mas magaan ang pagbabayad sa AGRIBANK gamit ang ating mga Payment Centers! Pumunta lamang sa pinakamalapit na payment...

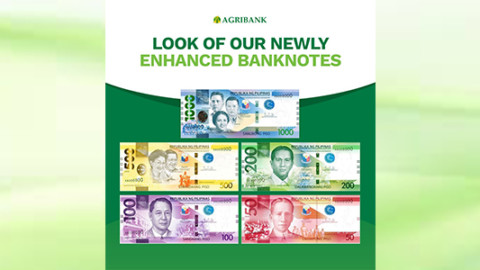

New Bank Notes

Ipinapaalala namin ang pagdo-doble ingat sa mga posibleng pagkalat ng fake banknotes. Ugaliing salatin, tingnan at itagilid ang hawak...

GET IN TOUCH

Head office Address: ROPALI Plaza, Josemaria Escriva Drive, Ortigas Center, Pasig City

Phone: (02) 8942 2474

Email: [email protected]

@AgribankPH

@AgribankROPA

QUICK LINKS

ROPA Products

Terms & Conditions

Privacy Policy

A PROUD MEMBER OF

Agribusiness Rural Bank, Inc. (AGRIBANK), is regulated by the Bangko Sentral ng Pilipinas. Deposits are insured by PDIC up to P500,000.00 per depositor. AGRIBANK is a proud member of RBAP & BAIPHIL

+632 8708-7701 | [email protected]

©2024 AGRIBUSINESS RURAL BANK, INC. | ALL RIGHTS RESERVED

Qualifications:

Candidate must possess at least Bachelor’s/College Degree in Business Studies/Administration/Management, Marketing or equivalent.

At least 2-3 Year(s) of working experience in the related field is required for this position.

Preferably Assistant Manager/Manager specialized in Marketing/Business Development or equivalent.

Must have banking experience and knowledge in the products/services, operation and processes of a bank

Job Description:

Can easily recognize potential markets for finance business and development due to his extensive experience in Motorcycle Loans

Lead the team in achieving long and short term targets

Identify, develop, and evaluate marketing strategy in line with the bank’s operational loan objective

Ensure business plan execution according to strategy

Creating credit scoring models for loan risk assessments

Approving and rejecting loans based on available data

Forecast market trends, analyze competition, new products, and pricing to recommend changes of strategy to marketing and business development strategy

Work closely with credit department on credit policies

Ability to train and motivate staff to perform as expectation.

Job Qualifications:

Candidate must possess at least Bachelor’s/College Degree in Business Studies/Administration/Management, Economics or equivalent.

At least 2 Year(s) of working experience in the related field is required for this position.

Required Skill(s): Data Analysis

Preferably Supervisor/2 Yrs & Up Experienced Employee specialized in Banking/Financial Services or equivalent.

Preferably with background using system online credit loan scoring

Receiving credit and loan applications along with supplementary paperwork.

Reviewing documents to ensure their completion and precision.

Conducting routine inspections to better understand clients’ financial track records.

Performing risk analyses and using the findings to inform the amount of credit extended, if applicable.

Credit Specialists assist in the recovery of unpaid dues.

Compiling a database of regular defaulters and reporting them to the relevant bodies, as appropriate.

- Responsible for transforming digital experience across the entire organization and its sub-business units.

- Drive cross-organizational synergies and integration focusing on digital business opportunities.

- Directs the planning and implementation of enterprise IT and digital systems in support of business operations to improve cost effectiveness, service quality and business development.

- Contribute to the development and delivery of overall strategy, innovation and cultural development.

- Develops and executes the digital and technology strategic and operating plan to support and enhance company’s strategic ambition and business requirement.

- Foster innovation, prioritizing IT initiatives, and coordinating the evaluation, deployment and management of current and future IT systems.

Candidate must possess at least Bachelor’s/College Degree in Engineering (Industrial), Computer Science/Information Technology or equivalent.

At least 5 Year(s) of working experience in the related field is required for this position.

Preferably Assistant Manager/Manager specialized in Digital Marketing or equivalent.

May not be expected to be IT experts but much more focused on driving change, its aim is integrate digital transformation.

The job is not technical or required computer/programming languages or systems, specifically, however, the job requires the person to configure the processes to be operationally efficient and responsive to a market that is now accessed (and delivered) digitally.

Must have banking experience and knowledge in the products/services, operation and processes of a bank.

Preferably Assistant Manager/Manager specialized in Corporate Strategy/Top Management or equivalent.

Develop technical aspects of the company’s strategy to ensure alignment with its business goals

Discover and implement new technologies that yield competitive advantage

Help departments use technology profitably

Supervise system infrastructure to ensure functionality and efficiency

Build quality assurance and data protection processes

Monitor KPIs and IT budgets to assess technological performance

Communicate technology strategy to partners and investors

Candidate must possess at least Bachelor’s/College Degree in Business Studies/Administration/Management or equivalent.

No work experience required.

Required Skill(s): Driving

Preferably with 1 year experience specialized in Collection or equivalent.

With professional Driver License

In charge of managing loan accounts, ensuring prompt payments and minimizing past dues.

Perform remedial actions such as partial payments, extension of terms, assumption of mortgage, or repossession on past due and foreclosable accounts

Regularly visits the borrower, he is in the best position to report on any usual change in the condition of the borrower that may affect his credit standing.

Candidate must possess at least Bachelor’s/College Degree in Business Studies/Administration/Management, Finance/Accountancy/Banking or equivalent.

Required Skill(s): Tech Savvy

Preferably Assistant Manager/Manager specialized in Banking/Financial Services or equivalent.

Identify current market technology trends relevant to the development of new digital platforms and gain knowledge on selected technologies, in order to develop, communicate, and implement business solutions

Responsible in coverting Manual processes into Digital process

Translate local needs into business and technical requirements for digital solutions and capabilities. The role requires a broad range of skills – familiarity with digital banking system.

Provide project status reports. Oversee scope to ensure achieved commitments within agreed on time, cost, and quality parameters.

Represent the project in various project update meetings and be part of the clients meeting to guide them during the process. Responsible for early identification of issues, determining potential resolutions, communicating status, tracking and resolving them in a timely manner.

The position will include providing digital enablement and implementation support.

The IT Manager attends to the management and administrative concerns of the department, including but not limited to budget formulation and monitoring human resources management and day-to-day operations of major IT responsibilities, Data Center Operations, Infrastructure Management, Help Desk/Technical Services, Security Administration, Production Support and Development.

Candidate must possess at least Bachelor’s/College Degree in Engineering (Computer/Telecommunication), Computer Science/Information Technology or equivalent.

Preferably Assistant Manager/Manager specialized in IT/Computer – Network/System/Database Admin or equivalent.

Optional product or system certification

With strong background in System Development

At least 1 Year(s) of working experience in the related field is required for this position.

Required Skill(s): Good communication skill

Preferably 1-4 Yrs Experienced Employee specialized in Banking/Financial Services or equivalent.

Must have experience working in a bank or any financial institutions.

Retention Loan Officer will advise existing customers on the right mortgage product to help improve their current financial needs.

He/she will contact previous customers to sell the Bank’s products.

After determining the best product for the client, our Retention Lending Officers will lock the loan at point of sale, request any documents required and submit a preliminary paperless loan package to a dedicated processing team

The Retention officer will maintain the relationship throughout the process.

With Professional Driver’s License

Conducts Person by Person, Day by Day, Bit by Bit activity with FRs using the ARMS/CVM CARD/EPAMS.

Reviews, discusses and evaluates the PDB/Goal setting calendar of FRs, must set at least 5 accounts to be remedied by each FR daily.

Gives daily itineraries of his FRs. Checks, monitors and reviews the result of itinerary of his Field Representatives.

Validate the new accounts/loan releases to ensure good loan accounts.

Coaches/mentors/suggests/ discusses to the FRs proper corrective measures or handling of clients requests, queries and concerns.

Conducts surprise visit/validation of accounts especially problematic accounts or accounts with irregular payment behavior.

Accompanies the FRs in the Field to assist and persuade clients to pay.

Required Skill(s): Sales and Marketing

Preferably Supervisor/2 Yrs & Up Experienced Employee specialized in Digital Marketing or equivalent

Preferably with experience as a dealer coordinator and knowledgeable with bank loans

The Digital Sales Officer will be responsible for proposing a wide range of digital marketing solutions in all branches

Ensure timely/accurate recording, tracking and reporting of sales activities and customer/competitive information through our System.

Provide an accurate forecast of sales results and continuously management of sales activity – new, renewals and up sells

Perform a current merchant analysis of clients’ needs and provide a winning solution.

Must be a graduate of any four-year business related course; preferably an accountancy/management accounting graduate.

Preferably 1-2 years meaningful experience in internal/external audit

Must be willing to travel anytime anywhere

Can work in low/minimal supervision

Sound knowledge of business organization, operation, polices, internal controls applicable to rural banks (banks)

Thorough knowledge of finance

Knowledge of MS Office Programs, particularly Excel and PowerPoint

Regular Audit of Branch and Head Office Units

Conducts Audit Planning

Conducts actual onsite validations and conducts the whole audit process basing on the C A R M

Enlists all exceptions and prepare an exception sheet.

Conducts Exit Conference to discuss to the auditee all noted exceptions. Ensures that the Exception Sheet is duly approved by the CAE before conducting any exit conference. Provide reports on the results of examination on an exception basis with suggestions for corrective actions

Provide recommendations on the concerning systems that need to be developed or improved

Provide assertions on the proper safeguarding of bank assets

Provide comment/recommendation on the review of the effectiveness of the existing internal control of the banks if necessary

Candidate must possess at least Bachelor’s/College Degree in Finance/Accountancy/Banking or equivalent.

1 Year(s) of working experience in the related field is an advantage for this position.

Fresh Graduates are also welcome to apply.

Thorough knowledge of finance, business organization, operation, polices, internal controls applicable to rural banks (banks)

With at least average oral and written communication skills

Must be keen to details and can work under minimal supervision

Willing to travel anytime and anywhere (Branches)

The Regional Lending Head is responsible for the generation (product sales), administration and efficient operation of all branches, OBO’s within his or her assigned region, including operations in collection, remedial management, customer service, and security and safety of bank’s assets within his assigned region.

Ensuring that bank’s program and policy are properly disseminates and implemented all through-out within the assigned region.

Develops new loan business; provides a satisfactory level of customer service and ensuring continues good business relationship and retention of the existing good client of the bank.

Responsible in attaining the established region wide KRA & KPI through active participation in loan generation (entry), administration / collection and remedial management activity of the bank.

The RLH must ensure that the branch within the assigned region is maintaining a high level of quality loan portfolio that can deliver profitability and stability of the branch within the region.

Ensuring that all loans personnel under his region adheres to the policies and procedures of the bank.

With strong business acumen & good analytical application and strong personality

Willing to travel or assign in any area in VisMin branches (Mandaue, Tagbilaran and Gensan)

The Regional Head is the over-all in charge and must oversee the various activities of all the branches in his region. The Regional Head must ensure the success of the administration and day to day operation of branches. He/she is the forerunner in the area and supervises the activities of the Branch Heads in terms of product sales, consumer loans, retail credit facilities, other paid services, security and customer servicing.

The Regional Head must ensure that set targets for deposits, loans, income, number of accounts and other products and services of his area are met and delivered.

The Regional Head shall assist to ensure the entire organization’s effectiveness in delivering solutions to customer’s needs, and providing clients satisfaction and delight in every transaction.

Preferably Assistant Manager/Manager specialized in Banking/Financial Services or equivalent\

Substantial work experience in a Bank or Financial Institution

Extensive knowledge in the areas of Branch Operations, Marketing and Customer Service

At least five (5) years experience as Branch Head or Loan Officer in other financial institutions

Must be willing and able to travel to market, supervise, and direct the branches located in various cities or municipalities in his/her assigned region.

Must be from the service area where he/she will be assigned.

Must be committed and willing to take on business targets

Candidate must possess at least a Bachelor’s Degree in Business Studies/Administration/Management, Finance/Accountancy/Banking or equivalent.

At least 5 Year(s) of working experience in banking of similar position

Preferably Supervisor/5 Yrs & Up Experienced Employee specialized in Banking/Financial Services or equivalent.

Extensive experience of working in a marketing function in a retail/banking financial services environment.

Strong work exposure in broad range of bank product disciplines – channel development, customer value management, communications and PR, brand development, advertising, sales strategy development

Established credibility and experience interfacing with senior leadership

Ability to work under tight deadlines and to prioritize under pressure

Highly articulate and confident presenter and communicator

Influencing and negotiating

Extensive market knowledge

This position is responsible in generating new accounts for the bank. The same officer is also in charge of generating fresh funds to achieve the target account level and the desired income of the institution. The subject officer shall design and execute marketing plans and programs to assist other members of his team and ensure the delivery and achievement of their respective KRA/KPI.

Basic Responsibilities:

Generate new accounts and grow existing accounts.

Generate fresh funds to ensure continued growth of accounts

Ensure attainment of target set by management

Recognize and identify leads that will help generate loans

Cross-sell other products of the bank and other member companies of Ropali Group of Companies

Log in with your credentials

Forgot your details.

Mobile Menu Overlay

The White House 1600 Pennsylvania Ave NW Washington, DC 20500

A Proclamation on Public Service Recognition Week, 2024

Our Nation’s over 20 million public servants work hard to deliver for our families, communities, and country. Their work matters to people’s everyday lives: They keep neighborhoods safe and the buses running, and build futures for people in their hometowns. They are the lifeblood of our democracy, acting as brave first responders, election workers, and service members defending our country. This week, we recognize our Nation’s public servants, who do the humble yet critical work of keeping our country running.

When I came into office, our country was facing an unprecedented crisis — a pandemic was raging and the economy was reeling. But we turned things around — in no small part because of our public servants. I signed the American Rescue Plan, providing $350 billion to ensure public servants could stay on the job. That money put more police officers in our communities and more teachers and education support professionals in our schools. It went directly to every community in America so public servants could decide how to best help their communities. Because of public servants’ work, child care centers stayed open, families stayed in their homes, and small businesses stayed afloat. At the same time, this legislation also made one of the biggest investments ever in public safety. Our public servants have done an incredible job of putting these resources to work by hiring more officers for accountable, effective community policing and supporting violence intervention programs that help prevent crime in the first place. Together, we created new jobs, new businesses, and new hope for folks across the country.

Our Nation relies on our public servants every day, and they deserve to be treated with dignity and respect. That is why I issued an Executive Order to increase the minimum wage for Federal employees to $15 per hour, ensuring our public servants are paid fairly while also attracting more competitive applicants to these critical roles. I established a White House Task Force on Worker Organizing and Empowerment, led by Vice President Harris, to strengthen the right to organize and bargain collectively, including for Federal Government workers. Further, I launched a Government-wide initiative to promote diversity, equity, and inclusion in the Federal workforce so that it reflects all the communities we serve. My Administration finalized a rule prohibiting Federal agencies from considering an applicant’s current or past pay when determining their future salaries –- eliminating gender and racial pay inequities that can otherwise follow those seeking a job in public service. To ensure all Federal employees feel safe and supported in the workplace, I took executive action to protect Federal employees from discrimination on the basis of their gender identity or sexual orientation — pushing the Federal Government to become the model employer it can and should be.

My Administration has also taken significant action to provide student debt relief — giving our public servants some well-deserved breathing room. I fixed the Public Service Loan Forgiveness Program, which was designed to make sure public servants could get their student loans forgiven once they made payments for 10 years. When I took office, only 7,000 public servants had had their debts forgiven — it was past time to fix it. Thanks to my Administration’s reforms, nearly 876,000 public servants have had their student debts forgiven.

We must do more to protect our Nation’s public servants, who provide the expertise necessary for our democracy to function. To guarantee that career civil servants can continue to share their expertise and keep our democracy working, my Administration finalized a rule to protect the jobs of 2.2 million career civil servants — no matter who is in office.

Meanwhile, my Administration is working to empower and strengthen the career Federal workforce more than ever before. My Budget includes a focus on hiring more public servants into mission critical jobs, helping provide better services to the American people.

This week, I hope all the public servants feel proud. Across the country, we are seeing new shovels in the ground, people going to work, and families thriving. People are feeling pride in their hometowns and their country again and in knowing that we can get big things done when we work together. We are witnessing the greatest comeback our country has ever known — in no small part because of the hard work and dedication of our Nation’s public servants.

NOW, THEREFORE, I, JOSEPH R. BIDEN JR., President of the United States of America, by virtue of the authority vested in me by the Constitution and the laws of the United States, do hereby proclaim May 5 through May 11, 2024, as Public Service Recognition Week. I call upon all Americans to celebrate public servants and their contributions this week and throughout the year.

IN WITNESS WHEREOF, I have hereunto set my hand this third day of May, in the year of our Lord two thousand twenty-four, and of the Independence of the United States of America the two hundred and forty-eighth. JOSEPH R. BIDEN JR.

Stay Connected

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden.

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550

Premiums for AXA plans are between 6.5% and 9.2%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to Purchase and Manage Your AXA Policy

The process of purchasing an AXA policy is simple. After obtaining your quote, you'll need to decide which of AXA's three plans you want to buy. When you pay for your plan, be prepared to provide additional personal information, like your birthday, phone number, and address.

Once you finalize your purchase, you'll have a 10-day free look period, in which you can cancel your policy and get your money back.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can email them to [email protected] or send them by mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

If you need assistance when filing claims, AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the U.S.). Office hours are 9:30 a.m.-5 p.m. ET on Thursdays and 8:30 a.m.-5 p.m. ET on all other weekdays.

AXA's U.S. branch has few reviews on Trustpilot and the Better Business Bureau — just over 20 between the two sites. Its UK branch has over 1,100 reviews, most of which are overwhelmingly negative. However, the quality of AXA Travel Insurance UK isn't necessarily indicative of its U.S. coverage.

In fact, on SquareMouth, where the majority of AXA U.S.'s reviews, reviews are generally positive. It received an average of 4.22 stars out of five across over 900 reviews. Customers reported that adjusting an AXA policy was easy and the customer service team was responsive. However, reviews on the claims process was more mixed, with spotty communication and long wait times.

See how AXA travel insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA to Travel Guard , we'll look at the coverage levels from their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

Read our AIG Travel Insurance review here.

AXA Assistance USA vs. Allianz Travel Insurance

Allianz Travel Insurance provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz Travel Insurance. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Read our Allianz Travel Insurance review here.

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research the terms of your credit card's travel protection before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policy holders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

Read more about how Business Insider rates insurance products here.

AXA Assistance USA FAQs

If you're diagnosed with COVID-19 before a trip and need to cancel, AXA may cover your expenses. Additionally, a COVID-19 diagnosis during a trip may be covered under AXA's medical expense, trip interruption, and trip delay benefits. Be sure to review your policy to ensure coverage details.

While you may extend your coverage in certain circumstances, such as extended hospitalization, and update your travel dates prior to your departure, you can't extend AXA travel insurance plans while you're traveling.

AXA's Gold and Platinum plan cover pre-existing medical conditions as long as you purchase your policy within 14 days of your initial trip deposit. AXA's Silver plan does not cover pre-existing conditions and has a 60-day look-back period.

You can download AXA claims forms on its website and email them to [email protected].

AXA isn't the most flexible travel insurance company and isn't great at specializing, but it offers comprehensive general coverage. Its prices aren't significantly more expensive or cheaper than its competitors.

- Main content

IMAGES

VIDEO

COMMENTS

Features & Benefits. Transact at millions of card acceptance places (ATM / POS) with Agribank / Visa / MasterCard / JCB logo worldwide, simple consumption, no need to carry cash. Pay for goods and services online with 3D-Secured global security standards in any currency. Integrating chip card technology according to EMV standard for optimal ...

Được cấp hạn mức thấu chi tài khoản thẻ ghi nợ lên tới 100.000.000 VND. Quản lý chi tiêu hiệu quả, an toàn thông qua tin nhắn khi có giao dịch. Được hưởng lãi trên số dư tài khoản thanh toán phát hành thẻ. Điều kiện sử dụng: Cá nhân là người Việt Nam và người nước ...

Ứng tiền mặt tại ATM tối đa là: 15.000.000 VND. Ứng tiền mặt tại POS quầy giao dịch tối đa: Bằng 50% hạn mức tín dụng. Thanh toán hàng hóa, dịch vụ tối đa là: 30.000.000 VND. Giao dịch Internet/MOTO: Mặc định là 5.000.000 VND/ngày. Có thể thay đổi hạn mức giao dịch ngày: tối ...

Each year, our customer/owners elect several AgriBank board members, who help ensure we fulfill our mission. Learn More Apply to Be a Director. 2023 Annual Report. Latest News. AgriBank Announces 2024-2025 Board of Directors. ST. PAUL, Minn., March 7, 2024—AgriBank today announced election results for four positions on its board of directors ...

Tiện ích khi sử dụng Thẻ tín dụng quốc tế Agribank Visa/MasterCard: - Quý khách có thể rút/ ứng tiền tại quầy giao dịch, máy ATM, các điểm ứng tiền mặt. - Nộp tiền vào tài khoản, In sao kê với thẻ Visa Agribank. - Mua thẻ trả trước, thanh toán hóa đơn. - Giao dịch thanh toán ...

About this app. Introducing Agribank Online - a user-friendly mobile app designed to make your banking experience convenient, fast, and reliable. With Agribank Online, you can now securely access and manage your existing Agribank Account/s online anytime, anywhere! Get the latest updates on our exciting promos, new products, and better ...

The benefits offered by the debit card includes withdrawal insurance at ATM, special discounts at over 100 restaurants, and free access to JCB Plaza - oversea customer service centers. Moreover, the cardholders of Agribank JCB Card can transact at about 34 million merchant locations worldwide as well as gain access to over a million ATMs.

Agribank giới thiệu đến khách hàng sản phẩm thẻ Phi vật lý - Agribank Vcard cùng trải nghiệm thanh toán trực tuyến. Agribank Vcard là thẻ phi vật lý ghi nợ quốc tế, có đầy đủ các tính năng và độ bảo mật cao thông qua dịch vụ 3D-Secure được cung cấp miễn phí cho chủ thẻ ...

Agribank JCB Ultimate Card holders will enjoy global travel insurance, one special and complimentary dish at selected high-end Japanese restaurants in Vietnam, up to 100% off green fee at 10 luxury golf courses and one free stay at FLC Golf Resorts group and free access to over 70 international airport lounges in Vietnam, Thailand, Singapore ...

At AgriBank, employees are our most valuable asset. You are the key differentiator in the marketplace and ultimately the most important factor in helping us fulfill our mission to support those who feed the world.We are committed to providing you with a competitive compensation and benefits package — your total rewards for making significant contributions to our business and making a ...

In order to qualify for the AgriBuy Rewards business card, you must have a revolving line of credit with Farm Credit Services of America and be in good credit standing. The AgriBuy Rewards business card is offered through AgriBank and cannot be used for cash advance or ATM transactions. Purchases are limited to U.S. and Canada retailers only.

Withdrawal Fees. Here comes the tricky part - avoiding those pesky ATM withdrawal fees. I'm not talking about the fees you get charged by your bank - those you can avoid by using a FinTech solution like Revolut, Curve, or Monese. Most ATMs in Vietnam charge a withdrawal fee between 20.000 and 50.000 VND (0.8-2$).

For more information, visit www.AgriBank.com. Farm Credit supports rural communities and agriculture with reliable, consistent credit and financial services, today and tomorrow. It has been fulfilling its mission of helping rural America grow and thrive for more than a century with the capital

Thẻ ghi nợ quốc tế thương hiệu Master Card hạng chuẩn. Giao dịch tại hàng triệu điểm chấp nhận thẻ ATM/POS có logo MasterCard trên toàn cầu. Thanh toán hàng hóa, dịch vụ trực tuyến với tiêu chuẩn bảo mật toàn cầu D-Secured bằng bất kỳ loại tiền tệ nào. Tích hợp giữa ...

2019 Bản quyền thuộc về Ngân hàng Nông nghiệp và Phát triển Nông thôn Việt Nam Hội sở: Số 2 Láng Hạ, phường Thành Công, quận Ba Đình, Hà Nội ĐT: 1900558818/(+84-24)32053205. Email: [email protected]. Swift Code: VBAAVNVX

- Unusual transactions related to the credit card - Agribank system errors. II. How to Unlock a Locked Agribank Credit Card. 1. How to Open an Agribank Credit Card. If you need to open an Agribank credit card for convenient financial management and transaction payments, you should visit Agribank branches/offices to proceed with the transaction.

Get a 0% Intro APR for 15 months on balance transfers and convenience checks that post to your account within 90 days of account opening. After this time, the variable regular APR of 15.15% to 31.15% will apply to these introductory balances. There is a fee of 5% of the amount of each balance transfer and convenience check from account opening. See note 1 See note, See note 2 View rates and ...

explore #card_visit_agribank at Facebook

AGRIBANK Kawit, Cavite Branch opens today with the presence of Konsehal Jerry Jarin, Mayor Dino Chua of Noveleta, the AGRIBANK management, Mr. Dennis Llabres, Executive Vice President, Ms. Lea Yamballa and our President, Mr. Danny Boy Antonio. We are happy to serve you Caviteños! You may visit our branch at Mana Town Center, Along Centennial Road, Barangay Tabon I, Kawit, […]

Features & Benefits. Transact at millions of card acceptance places (ATM / POS) with Agribank / Visa / MasterCard / JCB logo worldwide, simple consumption, no need to carry cash. Pay for goods and services online with 3D-Secured global security standards in any currency. Integrating chip card technology according to EMV standard for optimal ...

BISMARCK, N.D. - The North Dakota Department of Transportation (NDDOT) will visit four Tribal Nations next week to provide Non-Driver Photo Identification (ID) Cards that can be used for voting purposes. The photo ID cards will be issued for North Dakota residents who do not have a driver license. The Non-Driver Photo ID Card provided at these locations will be free to the public if they are ...

Eligibility. In order to qualify for the AgriBuy Rewards business card, you must have a revolving line of credit with Frontier Farm Credit and be in good credit standing. The AgriBuy Rewards business card is offered through AgriBank and cannot be used for cash advance or ATM transactions. Purchases are limited to U.S. and Canada retailers only.

A travel credit card can be a great tool for travelers. But make sure you choose one that meets your needs. Here's what to look for in a travel credit card.

With this, we can assure you fast, reliable, and convenient payment method, as we slowly move to digitalize our processes, that will result to an even heightened level of service. 1. Open your Gcash Application. 2. Go to "Pay Bills" option3. Click "Loans". 4. Search and select "AGRIBANK". 5.

1. Chase Ultimate Rewards. I'll be honest, I went back and forth on who gets first and second place. I'm a bit of an Amex enthusiast, so my bias leans me that way.

Our Nation's over 20 million public servants work hard to deliver for our families, communities, and country. Their work matters to people's everyday lives: They keep neighborhoods safe and ...

Meghan Hunter is a personal finance and travel expert who has been writing about travel, credit cards, and miles and points since 2015. Previously, she worked as a writer and editor at Million ...