- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Do Travel Credit Cards Work?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

An overview of travel credit cards

What types of travel credit cards are out there, common benefits of travel credit cards, how do travel credit card rewards work, what to look for in a travel credit card, which travel cards are recommended, if you’re considering a travel credit card.

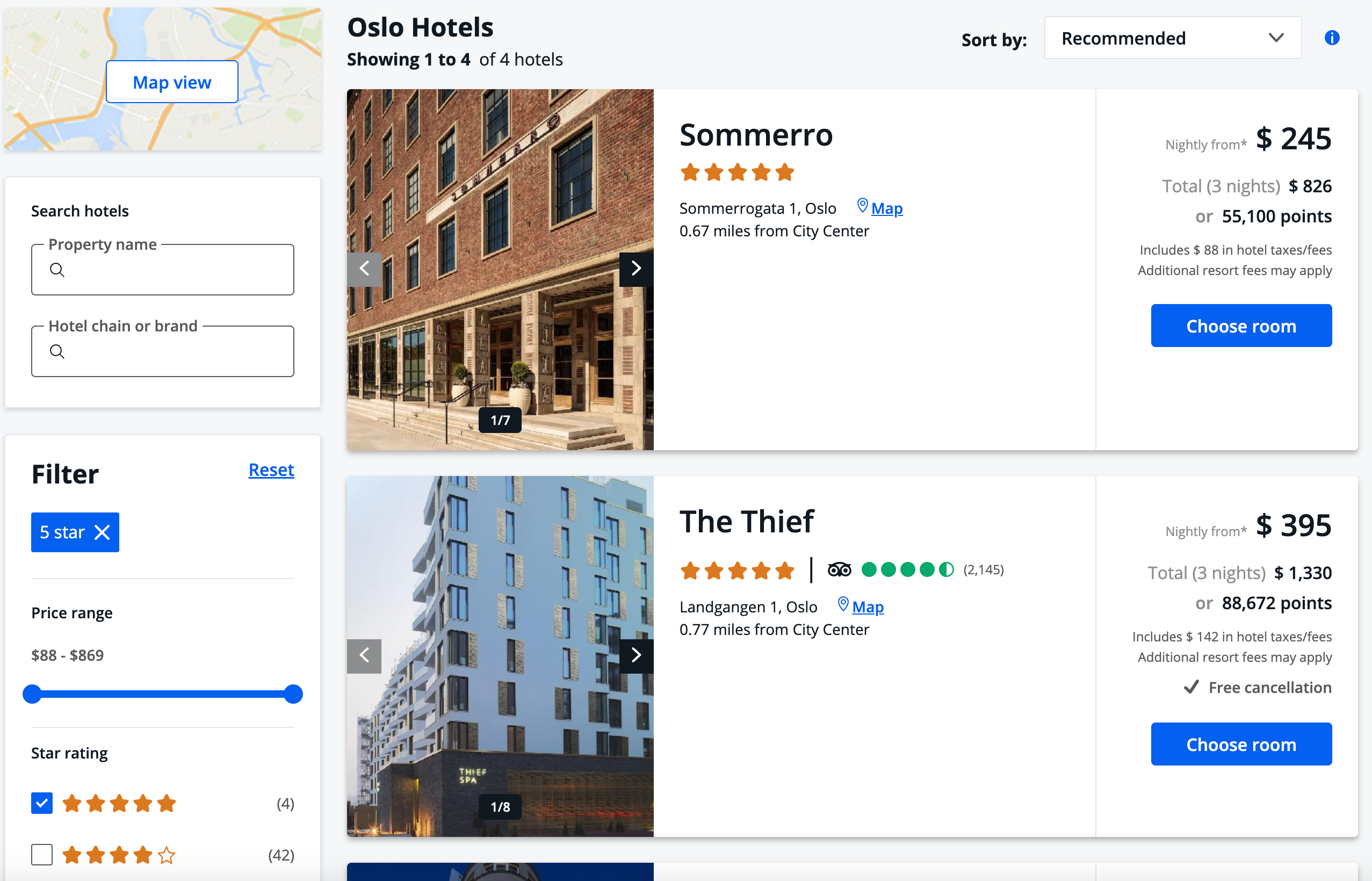

You’ve probably heard of travel credit cards or travel rewards cards, but you may not be clear on how they work. These cards pay you points or miles for making both travel purchases and everyday purchases. Once you accumulate enough points or miles, you can redeem them for rewards like flights and hotel stays.

If you travel often, one of these cards can be a smart financial tool. Thinking of applying for a travel credit card? Here are the basics of travel credit card rewards to get you started.

Travel-specific credit cards work similarly to any other rewards credit card: When you make charges, you earn currency at different rates that can be turned into rewards.

Currencies vary from card to card, but are generally called "points" or "miles." For example, most airline cards pay miles in that airline’s loyalty program. Hotel credit cards and general travel cards usually pay you with points. Both types of currencies are redeemable for travel and other rewards.

Typically, a travel credit card will pay you extra in its currency when you use the card to purchase travel, but rates vary. One card might offer you 2 points or miles per $1 spent on airline purchases, while another might offer you 3 points or miles per $1 spent on airline purchases.

Many travel rewards cards also pay points or miles on everyday non-travel purchases, but usually at a lower rate — for example, only 1 point or mile per $1 spent.

» Learn more: The beginners guide to points and miles

These are some common types of travel points credit cards.

Airline credit cards

Airline credit cards pay miles in the loyalty program of a particular airline, which you can redeem for flights or upgrades. The card may also come with additional perks, like priority boarding and a free checked bag .

Typically speaking, the higher the annual fee, the more built-in travel benefits you can expect from the card.

Example airline credit card : United℠ Explorer Card .

Hotel credit cards

Hotel credit cards focus on a particular hotel group’s loyalty program, and you’ll earn more points when making purchases at participating hotel properties. You can redeem points for free hotel stays or room upgrades.

Your card might also come with perks like a free night each year you carry the card or automatic elite status in the hotel’s rewards program.

Example hotel credit card : Marriott Bonvoy Boundless® Credit Card .

General travel cards

There are several general travel credit cards that offer greater flexibility in how you spend your rewards. With these, you earn points for everyday spending, plus bonus points for spending in specific categories, like dining, travel or groceries. Your points are redeemable for flights, vacation packages, rental cars, hotel stays and more. Some of these cards allow you to transfer your points directly to hotel and airline loyalty programs, too.

Example general travel card : Chase Sapphire Preferred® Card .

Flat-rate credit cards

Flat-rate travel credit cards are simple and easy to use. You’ll earn a certain number of points or miles on every purchase, and there are no spending categories to keep track of, and it’s less confusing to earn rewards.

Example flat-rate travel rewards card: Capital One Venture Rewards Credit Card .

Premium travel cards

Some travel cards offer premium perks . They’re designed for the frequent traveler who wants access to more benefits. These cards often have higher annual fees, but the perks can be worthwhile, and they may earn at a higher rewards rate.

Example premium travel card : The Platinum Card® from American Express .

» Learn more: The best points and miles credit cards for beginners

Some of the most popular travel credit cards offer several added benefits, like:

No foreign transaction fees: Some credit cards charge foreign transaction fees when making purchases in other currencies while abroad, others do not.

Trip cancellation or trip delay insurance: Your trip may not go as planned. A card with built-in travel insurance can reimburse you when your plans change due to qualifying reasons.

Baggage delay or lost baggage insurance: Travel credit cards may include coverage for baggage interruptions. This way, if your bag is lost or delayed for a lengthy time, you can purchase toiletries and/or clothing and get reimbursed.

Travel credits: A travel credit card may come with travel credits, which allow for a specific dollar amount of travel expenses to be offset by a statement credit.

TSA PreCheck/Global Entry application fee credits: Some travel cards offer up to $100 in application fee credits for TSA PreCheck or Global Entry . If you use your card to pay these application fees, you can earn statement credit for reimbursement.

Airport lounge access: Some premium travel credit cards include airport lounge access . This gives cardholders the ability to relax in a participating airport lounge before their flight.

Cardholders collect points or miles until they're ready to redeem them for rewards, and redemption options will depend on the card that you have. You can generally redeem travel credit card rewards for flights, hotel stays, vacation packages and more.

Several credit card issuers deposit miles or points directly into your account with the accompanying airline or hotel loyalty program, whereas other credit card issuers host their own online shopping portal for travel rewards.

» Learn more: 5 steps to get started with rewards travel

A few credit card issuers will let you transfer your points to partners, which can include other airlines, hotels and car rental agencies. In most cases, you start at the card issuer’s online portal to transfer these points. Once your points have transferred to another loyalty account, you can book award travel directly through the hotel or airline loyalty program. In general, these types of points give you more flexibility for redemptions.

Some programs also let you redeem points and miles for gift cards, complementary travel experiences, cash back or a statement credit, but these choices typically don't offer the best value for your points.

Examples of how redemptions and earning rates vary

Here are just a few examples of some of the variances you'll find across travel credit cards:

Chase Sapphire Reserve® . You can use your Chase Ultimate Rewards® points to book travel on Chase's travel portal or you can transfer your points to one of over a dozen partners. The points typically have a higher value when they're redeemed on the website.

Southwest Rapid Rewards® Plus Credit Card . While you can earn Rapid Rewards points with several Southwest partners , you can't use your Rapid Rewards points to fly other domestic airlines.

IHG One Rewards Premier Credit Card . With this IHG card, you can earn 26 points per dollar spent at participating IHG hotels, but will only earn 5 points per dollar spent on gas stations, travel and restaurants. All other purchases earn 3 points per dollar.

» Learn more: 10 worst travel credit card mistakes

There are many travel credit cards available. When choosing any financial product, always consider your personal goals and purchase habits. This can help you narrow down the right product for you.

Here’s what to look for when comparing travel credit card options:

Bonus offer: Many credit cards offer a sign-up bonus to new cardholders — usually a chance to earn a large number of bonus points after spending a certain amount on the card in the first few months after opening the account. Compare these offers and their points value before choosing a card.

Earning potential: Not all travel credit cards offer the same earning potential. Look to see how each card rewards points or miles, and don’t forget to consider purchase categories. Also, check to see if the earning potential is unlimited, as you'll want to maximize your earning potential. For some, choosing to get a flat-rate travel credit card may work best.

No foreign transaction fees: If you travel internationally, check to see if the card charges foreign transaction fees. This way, you don’t get charged extra fees when using your card.

Perks: Extra travel benefits, like priority boarding for your flight or a welcome gift at your hotel can make your travels more enjoyable.

Annual fee: Some travel credit cards charge an annual fee, others don’t . It’s essential to understand the annual fee before applying for a credit card to make sure you can comfortably afford it. Travel cards with more perks may have a higher annual fee.

» Learn more: Are travel credit cards worth it?

You have several excellent options to choose from when deciding which card to get, like:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card .

No annual fee: Bank of America® Travel Rewards credit card .

Flat-rate travel rewards: Capital One Venture Rewards Credit Card .

Bonus travel rewards and high-end perks: Chase Sapphire Reserve® .

Luxury perks: The Platinum Card® from American Express .

Business travelers: Ink Business Preferred® Credit Card .

Airline credit card: Delta SkyMiles® Gold American Express Card .

Hotel credit card: World of Hyatt Credit Card .

For more details, plus other highly recommended cards, see NerdWallet’s 15 best travel credit cards .

Now you know how travel credit cards work. They can be very worthwhile — after all, you may as well earn rewards for travel purchases and other expenses that you’re already charging to your card.

By redeeming earned travel rewards, you can make your future travels more affordable. Do your research and consider your own goals before choosing a travel credit card .

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Drazen_/Getty Images

Advertiser Disclosure

How do travel rewards credit cards work?

This type of card allows you to earn points or miles you can redeem for travel reservations, and it typically offers additional travel benefits

Published: November 23, 2022

Author: Jason Steele

Editor: Brady Porche

How we Choose

If you’re interested in investing in a travel credit card, it’s important to know the ins and outs before you commit to the one that’s right for you.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

For many rewards credit card users, the opportunity to earn a free vacation is much more attractive than earning cash back or merchandise. Using travel rewards credit cards allows you to dream of spending relaxing days in beautiful places, rather than merely reducing the amount on your credit card statement balances by a percent or two.

- What is a travel rewards credit card?

A travel rewards credit card is one that allows you to earn points or miles that you can redeem for travel reservations. In addition to offering rewards, these cards are also more likely to offer other features and benefits that are valuable to frequent travelers.

Credit cards that offer travel rewards have become very popular in recent years — there are now several different types of them.

One of the most familiar kinds are those co-branded by airlines, often called frequent flyer cards. These cards earn miles through a single airline’s loyalty program. Likewise, there are many hotel rewards cards that are co-branded with major hospitality chains.

Most credit card issuers also offer general-purpose travel reward cards that earn points or miles in their own loyalty programs. Some of these issuers allow you to redeem your rewards directly for travel reservations through their in-house travel agencies.

Other travel rewards programs let you redeem their points and miles for statement credits toward travel that you book yourself. And several popular programs let you transfer your rewards to airline miles or hotel points, in addition to letting you book travel directly or offering statement credits toward travel reservations. There are also travel cards designed for the needs of small business owners.

- Types of travel credit cards

Airline credit cards are co-branded with an airline and offer both travel rewards and benefits when flying with that carrier. Standard rewards earned on airline cards are 2 miles (or rewards points) per dollar spent with the airline, and sometimes more in select bonus categories, plus 1 mile per dollar spent elsewhere. Airline cards also offer perks such as priority boarding, discounts on in-flight food and beverages and a free checked bag.

Hotel credit cards are similarly co-branded, with a hotel chain in this case, and designed to reward purchases made at that chain. Some offer enticing perks and bonuses , letting you earn points toward free night stays and benefits like room upgrades and late checkouts. Hotel credit cards differ from airline cards in that there’s no standard rewards structure.

General travel cards

Travel rewards credit cards not co-branded with a travel provider offer points or miles in a program created by the card issuer. Credit card users who earn these rewards can redeem them directly with the card issuer for travel reservations — such as American Express Membership Rewards and Citi’s ThankYou points program — or transfer them to partner airlines and hotels. Flexibility is the key advantage of general travel rewards.

Premium travel cards

Luxury travel cards typically come with a high annual fee. But if you’re a frequent flyer who enjoys luxury perks, you can probably justify an annual fee of $200 or more . Most elite cards are loaded with valuable perks — airport lounge access, travel credits, luxury travel insurance, elite status benefits and luxury hotel perks — that can more than make up for those hefty annual fees, if you use them regularly.

- How do you earn rewards with a travel credit card?

There are many ways to earn points and miles with a travel rewards card, including:

Sign-up bonuses

First, most travel rewards credit cards offer new applicants the chance to earn a sign-up bonus. However, card issuers prefer to call these offers “new account bonuses” or “welcome offers.”

By any name, these offers allow new applicants to earn large numbers of valuable points or miles, usually after completing a minimum spending requirement. For example, a travel rewards credit card that’s co-branded with an airline might offer new applicants 50,000 miles after they spend $4,000 within three months of account opening.

Points and miles

Beyond the new account bonuses, travel rewards cards offer points or miles for spending. Typically, a travel rewards credit card will offer a single point or mile per dollar spent on most purchases. But these cards will almost always offer additional bonus points for other purchases as well.

For example, airline and hotel cards will offer additional rewards for purchases from their brands, and many cards feature bonuses for common purchases such as dining , groceries and gas.

Ongoing bonuses and promotional offers

Many travel rewards credit cards will also feature bonuses and promotional offers for certain activities, such as reaching an annual spending threshold, adding another cardholder or just renewing your card for another year.

- Other benefits of travel credit cards

Beyond offering points and miles toward award travel, travel rewards credit cards can offer valuable cardholder benefits:

- Flight perks: Airline credit cards often come with perks such as priority boarding, discounts on inflight purchases and one or more free checked bags. Premium rewards cards with high annual fees may offer a membership in their airport business lounge programs.

- Elite status: Hotel and airline reward cards can often get you elite status, entitling you to receive room upgrades, late checkouts and even free breakfasts.

- Travel insurance: Many travel rewards cards can offer travel insurance policies that cover rental cars theft and damage, trip delay/cancellation and lost luggage.

- Special deals: Many travel cards also feature special deals. For example, an airline or hotel card can give you additional access to award flights and free night stays beyond what’s offered to non-cardholders.

- How to redeem travel points

Many general travel credit cards have their own proprietary loyalty programs that issue reward points. When you’re ready to redeem your rewards with these programs, you have a range of options, including cash back, gift cards, merchandise, travel reservations and charitable donations. Here are our guides for some of the most popular travel rewards programs:

- Chase Ultimate Rewards

- American Express Travel

- Citi ThankYou rewards

- Capital One Travel

- Bank of America Travel Center

To redeem airline miles, log into your frequent flyer miles account with the airline your card is associated with. The major carriers — American, Delta and United — often use pricing systems that correspond with the cash price of new reservations, making it harder to get good deals on domestic award flights. But they also allow you to redeem your miles on flights operated by foreign carriers, which can offer major value if you’re traveling internationally.

Other carriers, such as JetBlue and Southwest , have frequent flyer programs with more or less fixed values for their rewards. So, you can redeem your rewards for any unsold seat, and the number of points required directly correlates with the price of the ticket. Most airline programs also offer options to redeem miles for other rewards, such as merchandise, gift cards, hotel reservations and rental cars, but non-travel options rarely offer as much value as award flights.

When it comes to redeeming hotel rewards, you’ll often receive the most value when using your points during peak travel season, when rooms are the most expensive. But you may need to book award stays in advance to find available rooms.

Tips for maximizing your travel rewards

- Use your card for as many of your expenses as possible, within your means. But remember to pay off the balance in full each month to avoid accruing interest charges.

- Take advantage of credit card category bonuses in your everyday spending by using the right card for the right purchase. For example, use a card that offers bonus rewards on groceries when you’re shopping, and a card that offers bonus rewards on gas when you’re filling up your car.

- Shop through portals to earn extra miles. Popular travel rewards programs may offer additional point and mileage bonuses when you shop through their rewards portals, so be sure to log in before you shop. You can also use dining portals to earn bonus rewards when dining.

- Redeem your points for off-season travel. Keep an eye on when air fares or accommodation rates are at their lowest. If you’re not tied to a specific time of year, you could save by using your points at a time when airlines and hotels are less busy.

- What to watch out for

It’s also important to understand that award travel isn’t usually free:

Annual fees

First, the most compelling travel rewards cards tend to have an annual fee, although some will waive it for the first year. And if you choose to carry a balance on your credit card , the cost of the interest charges may exceed the value of the travel rewards you earn.

Since non-reward cards will offer lower interest rates than similar cards that offer travel rewards, it’s best to steer clear of travel rewards cards unless you avoid interest charges by paying your statement balance in full . And most travel rewards cards have eliminated foreign transaction fees, so that’s not the issue it once was.

Taxes and surcharges

When it comes time to redeem your rewards, there could also be taxes and fees that you must pay. For example, airlines impose taxes, fees and “carrier imposed surcharges” on many award tickets — including passenger fees mandated by the Transportation Security Administration (TSA). For domestic flights, it’s unlikely you’ll pay more than the $5.60 TSA surcharge, each way.

But for international travel, you could end up paying hundreds of dollars in government taxes and fees. In extreme cases, you may be asked to pay more than $1,000 in surcharges imposed by the airlines when you redeem your miles for an awards ticket.

How to avoid unnecessary fees

When you redeem your points or miles directly for travel reservations or statement credits, you can avoid any cash payments. You can typically avoid surcharges when you redeem hotel points, as taxes on lodging are typically tied to the dollar amount paid — meaning there are no taxes or fees on award stays. However, some hotels will impose so-called resort fees on award stays, while others will waive those fees when you pay with points.

You might also have to pay fees for transferring points or miles from one person to another. But even when programs charge those fees, you can easily avoid them by simply booking travel reservations from one account in the name of another traveler.

Other fees to look out for include airline change and cancellation fees. When you cancel a hotel reservation within the cancellation period — often 48 hours before arrival — there’s typically no cancellation or change fee.

Bottom line

Travel rewards credit cards offer a way for you to earn exciting awards reservations in return for opening a new account and using your card. At the same time, these cards can provide you with valuable perks and benefits just for being a cardholder.

By understanding all the advantages, as well as the potential costs, you can decide if it makes sense for you to apply for a travel rewards credit card and which one is right for you.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Jason Steele is a professional journalist and credit card expert who has been contributing to online publications since 2008. He was one of the original contributors to The Points Guy, and his work has been appearing there since 2011. He has also contributed to over 100 of the leading personal finance and travel outlets. He’s frequently interviewed and quoted by mainstream outlets on the subjects of credit cards and travel. Jason is passionate about travel rewards credit cards, which he uses to earn rewards that he can redeem for him and his family to travel around the world. Jason is also the founder and producer of CardCon, a conference for credit and credit card journalists that’s held annually.

On this page

- Maximize your travel points

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Education

Best credit cards for international travel

The best credit cards for international travel can make traversing the globe a more comfortable and rewarding experience. Compare our top picks to see how they work for your travel style and goals.

Best no-annual-fee travel credit cards of 2023

Looking for the best travel rewards with no annual fee doesn’t have to be hard. There are plenty of great credit cards you can explore to help you earn and redeem rewards for travel.

Best credit cards for trip cancellation

What to know about prepaid travel credit cards

10 credit and money tips for travel abroad

TSA PreCheck vs. Global Entry vs. Clear: Which is best for you?

Explore more categories

- Card advice

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

Shop for Car Insurance

Other Insurance Products

Types of mortgages

Calculators

Find & Compare Credit Cards

Cards with Rewards

Cards for a Purpose

Cards for Building Credit

Credit Card Reviews

Understanding Credit & Score

Student Loans

Paying for College

Personal Finance for College Students

Life Events

How Do Travel Rewards Work?

Travel rewards turn everyday spending into exciting travel opportunities through point accumulation and strategic redemptions.

Quality Verified

Updated: March 21, 2024

- Types of Travel Rewards Cards

- How to Earn Travel Rewards

- How to Redeem Travel Rewards

- How to Maximize Rewards

- Are Travel Credit Cards Worth It?

Advertising & Editorial Disclosure

About Grace Pilling

Grace Pilling was the Senior Content Manager for Credit Cards at MoneyGeek. She previously led personal finance teams at Bankrate, CreditCards.com and MoneyUnder30.

Pilling has a bachelor's degree in English from Western Sydney University and a diploma in book editing, proofreading and publishing. She is focused on empowering readers to make informed financial choices that support their best lives, not a company’s bottom line.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How to use chase ultimate rewards® for travel.

Whether you're a longtime cardholder or just starting your credit card journey with Chase, you may be wondering: What is the best way to use Chase points ? The answer will be different for everyone, but if you like to travel, you may find that using your points on your trips is your favorite way to spend them. Learning how to use Chase Ultimate Rewards to make the most of your points could help you pack in a few extra adventures when planning your next getaway.

How to earn Chase Ultimate Rewards points

Chase Ultimate Rewards points are redeemable points you can earn through welcome bonus offers or when making purchases with your Chase-branded cards, such as:

- Chase Sapphire

- Chase Freedom

- Chase Ink Business

You may also earn Ultimate Rewards at an accelerated rate on certain purchases or bonus categories — the typical rate is one point earned per dollar spent.

Redeeming Chase Ultimate Reward points

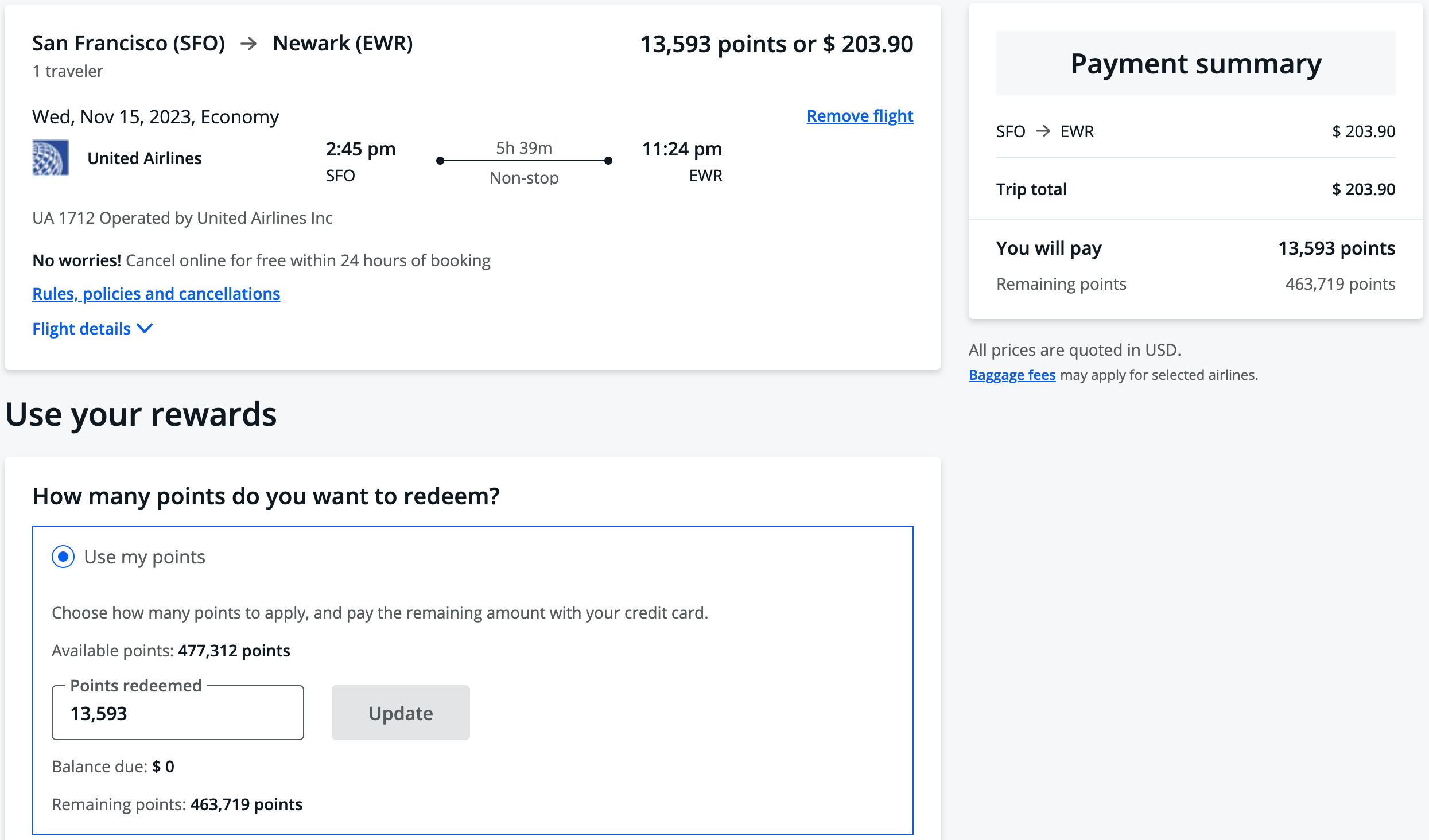

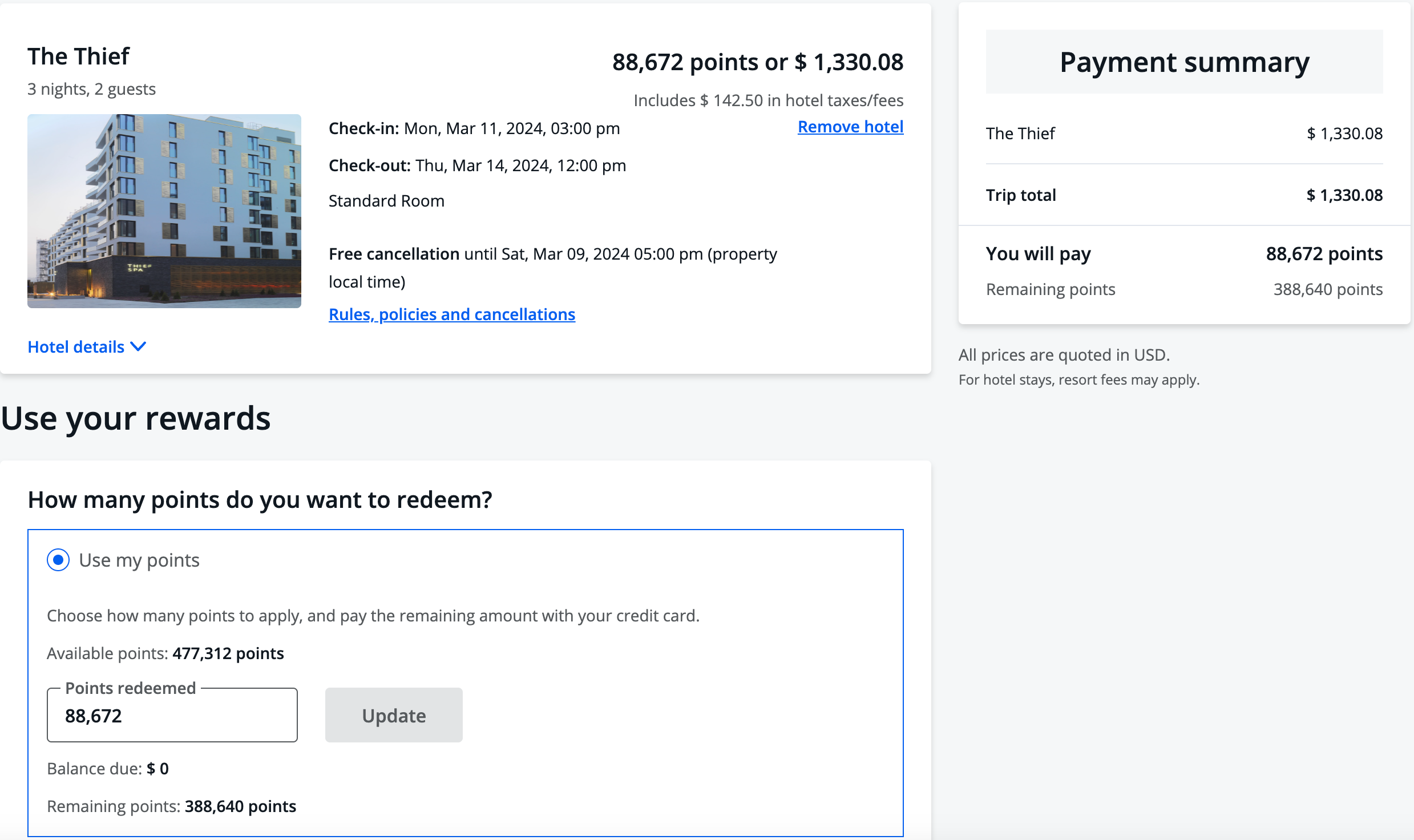

As a general rule of thumb, one point equates to $0.01 in redeemable value. This can fluctuate, however, depending on how you decide to redeem your points. When it comes to travel there are three main ways to redeem Ultimate Rewards points:

- Booking travel directly through the Chase travel portal.

- Transferring your points to Chase travel partners, such as airlines and hotels.

- Redeeming your points for gift cards or statement credits.

Using Ultimate Rewards points for travel

If you decide to redeem your Chase Ultimate Rewards to book travel, you may want to know what your options are. The main way you can redeem your points is through the Chase travel portal. There, you can directly find, book and pay for travel expenses such as flights, hotels, car rentals, cruises, tours and other activities or transfer points to hotel and airline partners.

When transferring your Ultimate Rewards to Chase travel partners, i.e. airlines and hotels, the transfer ratio is typically 1:1. That means that however many Ultimate Rewards points you have, you'll have the same amount in partner points with whichever Chase Ultimate Rewards travel partner you choose.

Why book through Chase Travel portal?

Something to note when using the portal is that the value of your points can change depending on which card you have.

For instance, if you have the Chase Freedom Unlimited ® card, your points are worth one cent each. With the Chase Sapphire Preferred ® or Ink Business Preferred ® cards, your points are each worth 1.25 cents. You'll get the highest value with the Chase Sapphire Reserve ® , as points are worth 1.5 cents each in the travel portal with that card.

If you have multiple eligible cards, you can combine your points to get the most out of them.

One of the benefits of booking through the Chase travel portal is that you can earn points on paid reservations. For instance, with Chase Sapphire Reserve ® you can earn 5x points on airfare and 10x points on hotels and rental cars booked through the portal.

You can book flights, hotels and rental cars directly through the travel portal, but if you want to book a cruise using Ultimate Rewards points, you'll have to call Chase directly.

There's no right or wrong when it comes to how to redeem Chase Ultimate Rewards points. However, if you've been bitten by the travel bug, you may find the best way to use them is by transferring them to Chase partners or booking through the Chase travel portal. Take some time to compare points transfers and the travel portal and see which one helps you make the most out of your points.

- card travel tips

- credit card benefits

What to read next

Rewards and benefits frequent flyer programs: a guide.

Frequent flyer programs offer a variety of perks. Learn more about what frequent flyer programs are and what to consider when choosing one.

rewards and benefits Are frequent flyer credit cards worth it?

Frequent flyer credit cards help frequent flyers earn and redeem points or miles towards the cost of their future travel plans. Learn more about their risks and rewards.

rewards and benefits Chase Sapphire Events at Miami Art Week

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

rewards and benefits How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

How do credit card rewards work?

December 12, 2023 | 5 min read

Credit card rewards allow cardholders to earn cash back, miles or points when they make purchases. How those rewards are earned and redeemed depends on the type of credit card , the card issuer and the cardholder’s spending habits.

Learn more about credit card rewards, how to redeem them and how to maximize their value.

Key takeaways

- Cardholders can earn rewards by using their rewards credit card.

- Rewards typically come in the form of cash back, miles or points.

- Choosing a card that fits your lifestyle and spending habits may make earning rewards more convenient.

- Ways to redeem rewards vary depending on your rewards card and the card issuer.

Explore rewards credit card offers

See if you’re pre-approved for cash back and miles cards—with no harm to your credit.

What are credit card rewards?

Credit card rewards are typically offered in the form of cash back, miles and points. They can be earned by using a rewards credit card to make purchases.

Learning about how different types of rewards programs work could help you use your card to your advantage. That could mean understanding the perks available to you and looking for ways to maximize your rewards with things like early spend bonuses.

How do cash-back rewards work?

A cash-back card allows you to earn a percentage of your purchase back as cash. Generally, there are 3 categories of cash-back cards: flat rate, tiered and rotating:

Flat-rate cash-back card

With a flat-rate cash-back card, you earn the same percentage rate on every eligible purchase you make with your card. That rate applies to gas, groceries and a whole host of other purchases.

Capital One Quicksilver and QuicksilverOne cards are examples of flat-rate cash-back cards. Both offer unlimited 1.5% cash back on every purchase, every day.

Tiered-category cash-back card

A tiered-category card allows you to earn different levels of cash back for different spending categories. Tiered-rewards categories might include dining and entertainment.

For example, SavorOne from Capital One is a tiered-category card. It offers unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores. 1 The Savor Rewards card has similar rewards. But there are differences between Savor and SavorOne that you may want to check out before you apply.

How do credit card companies know which purchases qualify for cash-back rewards? Typically, they attach a merchant category code to credit card transactions to categorize purchases.

Rotating-category cash-back card

Rotating cash-back cards offer rewards for purchases in a variety of spending categories during the year. In some cases, you can pick the categories. In other cases, the credit card issuer does.

Some rotating cash-back cards allow you to earn bonus rewards in certain purchase categories. Bonus categories typically offer a higher rate than other purchases, which may be rewarded with a flat cash back rate. You may want to remember to activate your bonus categories each time they change in order to maximize the rewards you earn. How often bonus categories change is up to the card issuer.

How do miles and travel rewards work?

Credit cards that earn miles or travel points are generally known as travel rewards cards . With a travel rewards card, you typically earn rewards for every dollar you spend. Capital One VentureOne , Venture Rewards and Venture X cards are travel rewards cards.

Miles-earning cards typically offer flexibility on where and how you can redeem your rewards. Cards associated with a particular airline or hotel might be another option, but they may offer more limited rewards options.

Keep in mind that the term miles doesn’t have anything to do with the actual distance you’ve traveled. The value of a mile and what you can do with it depends on the credit card issuer and the specifics of the rewards program it offers.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

How do points rewards work?

Rather than offering cash back or miles, some rewards cards offer points based on every dollar a cardholder spends. The value of those points may differ based on the kind of purchases they make.

How you earn or redeem points varies based on your card. Some may be similar to a miles-earning card, while others may be more like a cash-back card.

Some points-rewards card issuers use what’s known as a fixed-point system. That typically means you’ll consistently earn the same amount of points for making a purchase in a particular spending category. Others may rotate spending categories to reward certain types of purchases more than others. In that case, keeping track of the rotating categories may help you earn the highest rewards for your spending.

How do you redeem credit card rewards?

Ways to redeem credit card rewards may vary depending on your rewards card and the card issuer. Here are some common redemption options:

- Redeem for cash. With cash back, points and even some miles cards, you can redeem your rewards for cash. This may be a preferable option with cash-back cards and some points cards. It may help to know that the value of miles and other points may be lower when you redeem them this way. After you redeem your rewards, your card issuer might mail you a check, or you may be able to apply rewards directly to your account as a statement credit. 2

- Earn a statement credit. You may be able to redeem your rewards as a statement credit. Statement credits typically help lower your monthly credit card balance.

- Cover your purchases. Rewards cards may also let you cover recent purchases. For travel cards, that might mean a recent travel-related expense. But cash back and some points cards might offer other ways to redeem.

- Redeem for travel. When you redeem rewards for travel, you typically use miles or points you’ve earned to make travel-related bookings like flights, hotels and rental cars. This option may be most common with travel cards but may apply to other types of rewards cards as well. Some credit card issuers may give you the option of converting points or cash-back rewards into travel rewards.

- Get gift cards. Some issuers let you redeem your rewards for gift cards to use at your favorite retailers.

- Shop with online retailers. Capital One lets cardholders use rewards to shop at Amazon.com and through PayPal Pay with Rewards . 3

How credit card rewards work in a nutshell

To maximize your credit card rewards, consider choosing a card that matches your lifestyle and spending habits. Whether you’re a globe-trotting adventurer, an avid foodie or someone who wants to be rewarded for everyday purchases, there may be a Capital One rewards card for you.

Compare Capital One rewards credit cards and benefits today.

Related Content

What is the best rewards credit card for you.

article | April 16, 2024 | 7 min read

Capital One rewards credit card benefits

article | April 30, 2024 | 8 min read

Use your Capital One rewards at Amazon.com

article | January 28, 2020 | 4 min read

Travel invented loyalty as we know it. Now it’s time for reinvention.

Travel brands didn’t invent loyalty programs, which have been traced to as far back as the 18th century . 1 James J. Nagle, “Trading stamps: A long history,” New York Times , December 26, 1971. But ever since the first major airline frequent flier programs appeared in the early 1980s—soon to be followed by similar programs from hotel chains—the travel industry has become known for letting customers accumulate redeemable “miles” and “points.” Modern-day voyagers are deeply familiar with loyalty-related concepts such as status tiers, members-only lounges, and point-earning credit cards.

Travel loyalty programs were originally designed to influence travelers’ behavior. By offering rewards such as free flights and hotel rooms to frequent customers, a company might convince power users to consolidate their travel spending with its brand. Why fly airline X when you’re halfway to earning a free perk for remaining faithful to airline Y?

Over time, many travel loyalty programs became wildly successful—not just as a way to boost sales or strengthen customer relationships but as major profit centers in their own right. Travel companies found they could sell loyalty points in bulk to, for instance, banks, which in turn offered the points to their credit card customers as rewards for spending. In 2019, United’s MileagePlus loyalty program sold $3.8 billion worth of miles 2 Brian Sumers, “How is United Airlines’ loyalty program worth $22 billion?,” Skift, June 15, 2020. to third parties, which accounted for 12 percent of the airline’s total revenue for that year. In 2022, American Airlines’ loyalty program brought in $3.1 billion in revenue, and Marriott’s brought in $2.7 billion. 3 Form 10-K, fiscal year ending December 31, 2022, American Airlines Group, Inc.; Form 10-K, fiscal year ending December 31, 2022, Marriott International, Inc. Many loyalty programs have evolved into discrete divisions with their own profit-and-loss ledgers.

Along the way, however, some travel players have shifted their focus away from the original purpose of these programs. As loyalty programs have become powerful bottom-line enhancers, companies have sometimes been tempted to view them first and foremost as revenue generators instead of tools to sway customers’ behavior or to improve customers’ experiences . The postpandemic resurgence of travel demand has also pressured companies to shore up their loyalty programs’ viability by devaluing members’ points and miles and enacting rule changes that have at times caused customer frustration. At the same time, innovative loyalty programs in other industries are raising the bar, opening customers’ eyes to the value that loyalty programs can offer.

As a result of these factors, travel loyalty program members have become increasingly disloyal. For some customers, reaching the top tier of a loyalty program is still almost a facet of their personal identities—“Just a couple of more flights, and I’ll reach elite status!” But many loyalty program members now seem more inclined to play the field. The warm feelings at the heart of loyalty, which lead travelers to show allegiance to a brand and trust that their faithful behavior will be noticed, seem to fade when brands let their focus drift away from rewarding their most valuable and consistent customers.

Loyalty is about more than a program, a department, or a tangible redemption offer.

Loyalty is about more than a program, a department, or a tangible redemption offer. True loyalty is won through a genuine desire to forge bonds with customers and thereby maximize each customer’s lifetime value to the brand. Travel brands, therefore, should consider rethinking and reinventing their loyalty programs in ways that frame loyalty as something more than points and miles. A mindset shift, coupled with three practical actions, could help restore the luster of loyalty programs while bringing straying customers back into the fold.

A mindset shift, coupled with three actions, could restore the luster of loyalty programs while bringing customers back into the fold.

How we got here: Disruption, devaluation, and dissatisfaction

When travel came to a halt as a result of the COVID-19 pandemic, many travel brands—hoping to keep customers happy—“froze” the loyalty program status levels of members who might have otherwise lost perks due to a lack of travel activity. When travel spending was slow to resume, brands changed their program rules to make status tiers significantly easier to reach and maintain. These moves made sense in the face of an unprecedented disruption, with far fewer miles and points being redeemed.

But as travel recovered, loyalty programs became burdened by increased redemptions and overpopulated high-status tiers (evidenced, for example, by the lines outside the doors of airport lounges). Some major travel brands have responded by adjusting loyalty program rules. They’ve ended the status extensions that were granted during the pandemic, and they’ve devalued points and miles—raising the bar to redeem them for free flights and rooms.

All these changes have, understandably, been made with an eye toward programs’ profit-and-loss statements. But collectively, they’ve resulted in widespread customer dissatisfaction. Program members have chafed at having their points devalued and benefits clawed back. Meanwhile, successful loyalty programs in other sectors have opened customers’ eyes to other types of value that these programs can provide, such as better customer experiences, richer communities, more tailored personalization, and exclusive access to events or offers.

Loyalty surveys conducted by McKinsey in 2021 4 The 2021 loyalty survey of roughly 10,000 American consumers covered multiple sectors (including airlines, hotels, cruise lines, banks, retail, grocery, and others). and 2023 5 The 2023 loyalty survey of 3,200 American travelers covered the airline, lodging, and cruise sectors. revealed a steep decline in the likelihood that a customer would recommend airline, hotel, and cruise line loyalty programs to a friend or colleague—even though the likelihood that customers would recommend the airline, hotel, and cruise line brands remained relatively steady (Exhibit 1).

A focus on a loyalty program’s bottom line can distract from its higher purpose

A travel loyalty program might be able—at least temporarily—to disappoint its members while inflicting minimal damage on its company’s earnings. This is because so much of a modern travel loyalty program’s importance comes from B2B sales of batched points or miles. The programs’ most relevant customers in terms of generating revenue are credit card companies, not individual travelers. And these B2B deals generally involve long-term contracts that guarantee sales years in advance. A travel brand can unilaterally issue more loyalty program points to sell to third parties at any time, as well as raise the redemption levels for flights or rooms if margins become undesirable.

Meanwhile, airline travelers have fewer options than they did in the past. Consolidation of major airline brands means it’s harder for frequent fliers to abandon one airline and its loyalty program for another without losing access to convenient flight routes or departure times. And customers who have already banked a large number of miles or points with one airline or hotel program can feel locked in.

For all these reasons, loyalty programs appear to be in a position of strength. But a narrowed emphasis on revenue and costs could lead to brands’ losing focus of the big picture. Travel loyalty programs were originally conceived as a clever way to influence customer behavior—and encourage customer loyalty. But it’s not clear if the programs are currently fulfilling either mandate as successfully as they could.

McKinsey research reveals that airline loyalty programs’ ability to change fliers’ behavior declined between 2017 and 2021, and again between 2021 and 2023 (Exhibit 2). During those time frames, it became less likely that a customer who was a member of a given airline loyalty program would report that they chose the associated airline over other options or increased the frequency of their spending with that airline. If this trend continues, it could eventually create a vicious cycle: airlines would cut loyalty program budgets if they deemed them ineffective at influencing customer behavior, lower budgets would lead to reduced program benefits, and less attractive benefits would result in customers perceiving program participation as having less value.

McKinsey research further shows that loyalty program members these days aren’t especially loyal (Exhibit 3). Hotel, cruise, and airline travelers are typically members of about three or four different loyalty programs within a given sector, our analysis finds. On a yearly basis, they consider traveling with about three different brands within that sector and ultimately transact with more than one of them. Travelers don’t even consolidate their spending with the brand they say they “prefer” within a sector: the median share of the customer’s wallet for preferred brands is only about 50 percent in lodging, 60 percent in cruise lines, and 60 percent in airlines—with the remainder of the customer’s spending spread around to other players within the same sector.

Evidence suggests this trend will persist. According to our 2023 survey on travel loyalty, younger generations are more likely to consider and transact with multiple travel players. Gen Zers and millennials consider about 1.7 times as many brands as do baby boomers and the Silent Generation and transact with about 1.3 times as many brands.

All this comes at a time when the travel loyalty market is becoming more competitive. Consumer banks, which were once content to offer cobranded credit cards featuring travel brands as the marquee partner, are now launching their own self-branded travel awards ecosystems and booking platforms. Travelers might wonder why they should put all their loyalty points in one basket with a single airline or hotel brand when a consumer bank might offer more flexible rewards redemption and possibly a better user experience. (It’s worth noting that our research suggests the likelihood that a customer would recommend some of the major consumer banks with travel loyalty initiatives to a friend or colleague is far higher than the likelihood that a customer would recommend a cruise line, lodging brand, or airline.)

How to reshape loyalty for a new travel landscape

Our research finds that experience —far more than tangible, “earn and burn” benefits—is what wins customers’ loyalty. Experiential factors, including “offering an experience worth paying more for” and “feeling taken care of,” have become more important over time and now account for three of the top five (out of more than 40) drivers of loyalty to cruise lines, hotels, and airlines. For hotels, experience has four times more impact than tangible benefits on purchase frequency, while for airlines, experience is more than twice as likely to influence frequency. Positive past experiences are the biggest factor in customers’ desire to travel more with a company in the future.

The following three steps could help travel brands adjust to this changing landscape and engender loyalty that goes beyond a mere quest for redemptions and perks.

Put experience at the core of loyalty programs

When our 2023 survey asked American respondents which company they’re most loyal to, Amazon received more votes than the top six travel players combined—despite the absence of any traditional, points-based loyalty program. How does Amazon win loyalty? By providing a frictionless experience.

How can travel brands learn from this and win customers’ love even when points and miles are worth less? By offering distinctive, satisfying experiences: making customers feel delighted is the key to their hearts, but McKinsey’s 2023 loyalty survey showed that only 20 percent of travelers were delighted by a recent travel experience.

Companies should strive to design loyalty programs around experiential benefits that make travelers feel special. This can be win–win, such as when Delta offered free in-flight Wi-Fi to loyalty members, which led to a better experience for the members while also boosting enrollment in Delta’s loyalty program. In retail, some programs bring together engaged communities of like-minded brand loyalists. Advance notice or exclusive access to offers can send loyalty members a signal that the brand considers them VIPs.

Brands should seamlessly integrate customer experiences between desktop, mobile, and physical locations—meaning that frontline workers have an important role to play. Proper execution of customer service is vital for getting experiences right, so companies should try to keep frontline workers top of mind. Workers should be given the proper training and tools to satisfy customers, and the effectiveness of this training should be measured.

When it comes to mitigating, or avoiding, a negative customer experience, saying “sorry” can go a very long way. Companies should proactively engage customers after service shortfalls, as a service challenge can actually lead to an increase in customer satisfaction if handled well. The form an apology takes might be made commensurate with a customer’s status level in the brand’s loyalty program, and any recompense can be informed by a predictive analysis of its impact —considering factors such as the magnitude of the lapse and the nature of the customer’s other recent interactions with the brand.

(Finally) use data to offer personalization to members

Travel brands have long had access to reams of customer data. Loyalty program members surf on travel companies’ Wi-Fi, sleep in their hotel rooms, fly on their planes, and cruise on their ships. But many travel brands haven’t yet captured the opportunity to use these unique data to offer their members personalization on par with other industries. Likewise, although airlines and hotels have incredibly sophisticated, lightning fast, AI-enabled pricing algorithms, they aren’t consistently harnessing their technology capabilities to power real-time customer personalization.

Nontransactional engagement opportunities, such as the daily interactions fostered by social communities, offer rich troves of data that can be used to hone personalization. In turn, personalization can drive engagement, as seen in Sephora’s Pocket Contour Class initiative, which lets users upload a selfie to get personalized makeup tips.

Personalization can be employed to tailor both experiences and offers for loyalty members. Our research has shown that 78 percent of consumers are more likely to make a repeat purchase when offered a personalized experience . The goal should be to achieve a hypersegmentation of program members that’s so nuanced, it results in a “ segment of one .”

Rethink partnerships to protect self-interests while delivering customer value

Since the 1980s, travel companies have been partnering with banks to launch cobranded credit cards. But several credit card brands now offer their own, self-branded travel rewards ecosystems. These ecosystems sometimes direct bookings to airlines, hotels, and cruise lines—but they can also serve as a way for credit card brands to steal away travelers’ loyalties. These types of transactional partnerships with consumer banks might eventually cease to be a winning play for travel companies. In time, travel loyalty programs could be driven to seek alternate sources of funding.

The best kinds of partnerships build richer connections with consumers while boosting engagement through thoughtful collaborations. Uber’s partnership with Marriott gives users the option to link the brands’ loyalty programs, tapping into two large customer bases and providing more convenient travel experiences.

One promising recent example of collaboration is a travel media network. A hotel company might, for instance, launch a media network that allows third-party brands to place relevant, nonintrusive, personalized advertisements in the hotelier’s owned spaces—websites, hotel lobbies, guest room TVs, and so forth. This type of partnership can offer travelers an elegant, curated experience while providing the travel brand with an alternate monetization route.

In general, travel companies should cultivate collaborations that protect their interests, generate new revenue streams, add personalization and value for loyal customers, and diversify touchpoints with those customers. Early action could prove vital here, as the travel space will not accommodate infinite partner ecosystems.

As other industries raise the bar and consumers grow increasingly dissatisfied with travel loyalty programs as they are designed today, travel industry leaders may need to ask themselves some hard questions. How can points and miles be paired with experiences and excitement? Which partners are truly adding value? What is causing customers to stray, and how can their loyalties be won back?

Travel brands were loyalty innovators. But travel loyalty programs might soon hit an inflection point. Now is the time to innovate and win back customers’ allegiances.

Lidiya Chapple is an associate partner in McKinsey’s Atlanta office, where Jillian Tellez Holub is a partner; Clay Cowan is a partner in the Dallas office; and Ellen Scully is a consultant in the Seattle office.

The authors wish to thank Bella Alfaro, Alex Cosmas, Marilyne Crépeau, Oren Eizenman, Austin Hack, Ryan Mann, Jacob Miller, Afiya Romeo, Matthew Straus, and Jamie Wilkie for their contributions to this article.

This article was edited by Seth Stevenson, a senior editor in the New York office.

Explore a career with us

Related articles.

Prediction: The future of CX

Rebooting customer experience to bring back the magic of travel

Experience-led growth: A new way to create value

A beginner’s guide to credit card points

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal loans

- • Debt management

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Credit card points are a type of rewards currency that can be earned in exchange for eligible credit card spending.

- To earn boosted points on your credit card, you'll need to maximize bonus category spending, earn any available welcome bonus and take advantage of promotional offers.

- To get the most value from your points, redeem them for high-value options like travel or points transfers to airline and hotel partners.

It can be challenging to learn a new credit card points system, especially considering how different they can all be from each other. After all, there are a lot of details to keep track of, from which types of purchases earn the most points to which redemption options are the most valuable.

In this guide, we make it easy to understand the basics behind all of these points systems. That way, you can stop stressing about your points and start using them effectively. Here’s what to know about credit card points and how they work:

What are credit card points?

Points round out cash back and miles as the three types of credit card rewards you’ll find when comparing credit cards — although points and miles are treated pretty similarly by card issuers. With each type, you earn at a set rate for each dollar you spend.

Cash back systems offer you a percentage of your purchase back in dollars — for example, a 2 percent cash back card would award you 2 cents back per dollar spent. Instead of dollars, credit card points systems reward you in the form of points for your spending. So, you might earn 2X points per dollar on select spending, for example.

However, the rate of points you’ll earn may differ depending on the type of purchase you make. Some credit card issuers extend a fixed rate for all purchases, while others offer higher rates for specific types of purchases within what’s called “bonus categories.”

Among rewards cards, travel credit cards tend to offer more points (or miles) for travel-related spending. A top travel rewards card might offer 5X points per dollar spent on eligible travel-related purchases — such as flights or rideshares — and 1X points per dollar on all other purchases.

How to earn credit card points

In addition to using your credit card for daily purchases — especially in bonus categories — there are a few things you can do to expand your earning potential .

Maximize bonus category spending

With most points rewards cards, you earn points by making specific purchases using your card. Issuers typically offer different points rates for different types of purchases. So, you might be able to earn more points per dollar on travel, dining, groceries or other purchase categories.

For example, if you’re an avid traveler and spend a significant amount on flights and hotel rooms, The Platinum Card® from American Express could be a good choice for you. It offers:

- 5X Membership Rewards points per dollar spent on flights booked directly with airlines or through American Express Travel on up to $500,000 per calendar year

- 5X points on prepaid hotels booked through American Express Travel

- 2X points on prepaid car rentals through American Express Travel

- 1X points on all other purchases

By focusing your purchases with this card on flights and hotels, you’ll earn a lot more points than if you just used this card for everyday spending.

Leverage bonus offers

Many credit card issuers offer a variety of ways to earn additional points on their cards. Those options include:

- Welcome bonuses: Also called sign-up bonuses, these can be earned by meeting certain spending minimums within the first few months of opening the cards. For instance, the Amex Platinum offers new cardholders a welcome bonus of 80,000 points after spending $8,000 within the first six months of account opening.

- Referral bonuses: These bonuses are for current cardholders who get a friend or relative to apply for the card. Generally, you’ll refer a friend through a link and receive a certain amount of points for the referral. The number of points depends on the issuer’s specific referral bonus , but it can be a substantial amount.

- Limited-time-offer programs: These programs — for example, Amex Offers — allow you to earn more points on spending with specific retailers. To earn these offers, you can either go through your issuer’s branded shopping portal or log in to your account and activate any offers that you’re interested in. Then, you just simply have to meet the terms of the offer.

How to redeem credit card points

Every credit card rewards program is different, but most programs offer several common options for redeeming your rewards . Those options typically include:

- Statement credits. With a statement credit , the issuer deposits the cash value of the redeemed points directly into your account balance. Not every issuer offers this option, so if that’s how you plan to redeem your rewards, be sure this perk is available to you before applying.

- Travel purchases. With a travel rewards card, you can usually redeem your points for flights or hotel rooms through the issuer’s travel portal . American Express, Chase and Capital One all offer such travel portals. And most premium travel credit cards let you transfer your rewards to airline or hotel loyalty programs, which can provide you with more value for your points.

- Shopping portals. Most issuers offer their own shopping portals through which you can redeem points for merchandise from partner retailers.

- Online retailers. Some issuers allow you to redeem your points directly with online retailers, like Amazon. This is different from shopping portals, because you generally redeem at checkout with the merchant, rather than through an issuer’s shopping portal. While this can be a convenient way to use your rewards, it’s usually not the most lucrative.

- Gift cards. Issuers may offer various gift card options, including major department stores, restaurants and more. Be aware that redeeming for gift cards generally won’t give you the best value for your points.

- Charitable donations. Select issuers allow you to donate your points to a charity or a nonprofit organization. You can check if your issuer provides this option by logging in to your account and viewing your redemption options.

How much are credit card points worth?

Credit card points can have different values — it all depends on how an issuer’s points system works and how you redeem them. You’ll usually get a 1:1 redemption for many options — which means 1X point is equal to 1 cent — though credit card issuers may adjust that value at any time. Some options, like redeeming for gift cards or shopping with points on Amazon, provide less than 1 cent in value.

However, you may be able to get more than 1 cent in value for specific redemption options. For instance, if you earn the 75,000-point welcome bonus on the Chase Sapphire Preferred® Card (by spending $4,000 in the first three months), those points have a base value of $750. However, you can increase the value of your points with this card by 25 percent if you redeem them for travel through the Chase Travel portal. That means that your 75,000 points could be worth as much as $900.

Read your credit card’s fine print to learn how much your points are worth, and pay attention to whether point values go up or down depending on how you redeem them.

How to calculate points values

Determining your points value with a certain redemption option often takes some quick division: You’ll want to divide the dollar value of a booking by how many points you’d need to redeem for it. For example, if you’re looking at a $300 flight also available for 15,000 points, your point redemption value would be 2 cents per point — or a great deal!

You’ll sometimes get the most value for your credit card points and miles if you transfer and redeem them with airline partners.

Here are Bankrate’s latest points and miles valuations for some of the most popular credit card rewards programs.

The bottom line

Your earning structure, redemption options and points value will vary based on the card you’re using. That’s why you need to be strategic about how you redeem your credit card points. If your points are worth more as cash back than they would be if you redeemed them for gift cards, why not choose cash back?

Likewise, if your points value increases when you redeem them for travel purchases , it makes sense to save up your points for your next big trip. The better you understand how credit card points systems work, the more you’ll get out of your rewards — and be in a position to leverage the top rewards credit cards on the market. With a little practice, you’ll be able to fully maximize your credit card rewards .

Cash back vs. travel points: How to choose credit card rewards

How to redeem credit card rewards

Are my credit card rewards taxable?

Are rewards credit cards worth it?

How to decide which rewards credit card is best for you

Best Rewards Credit Cards of 2024

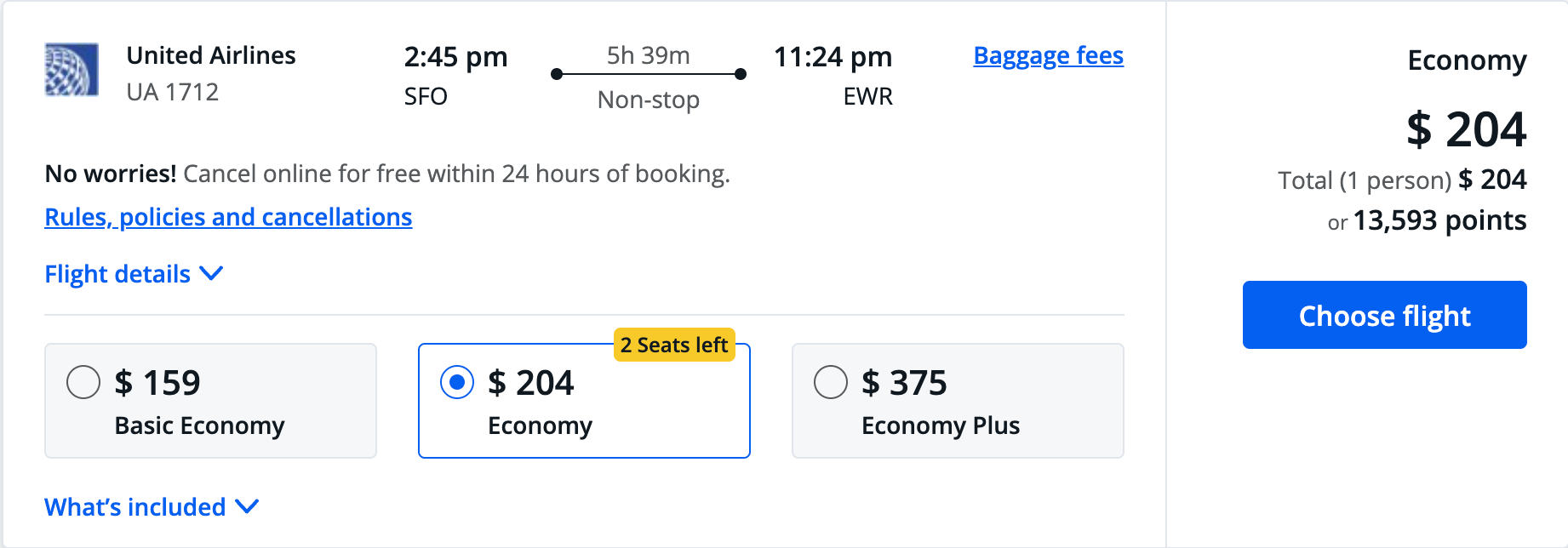

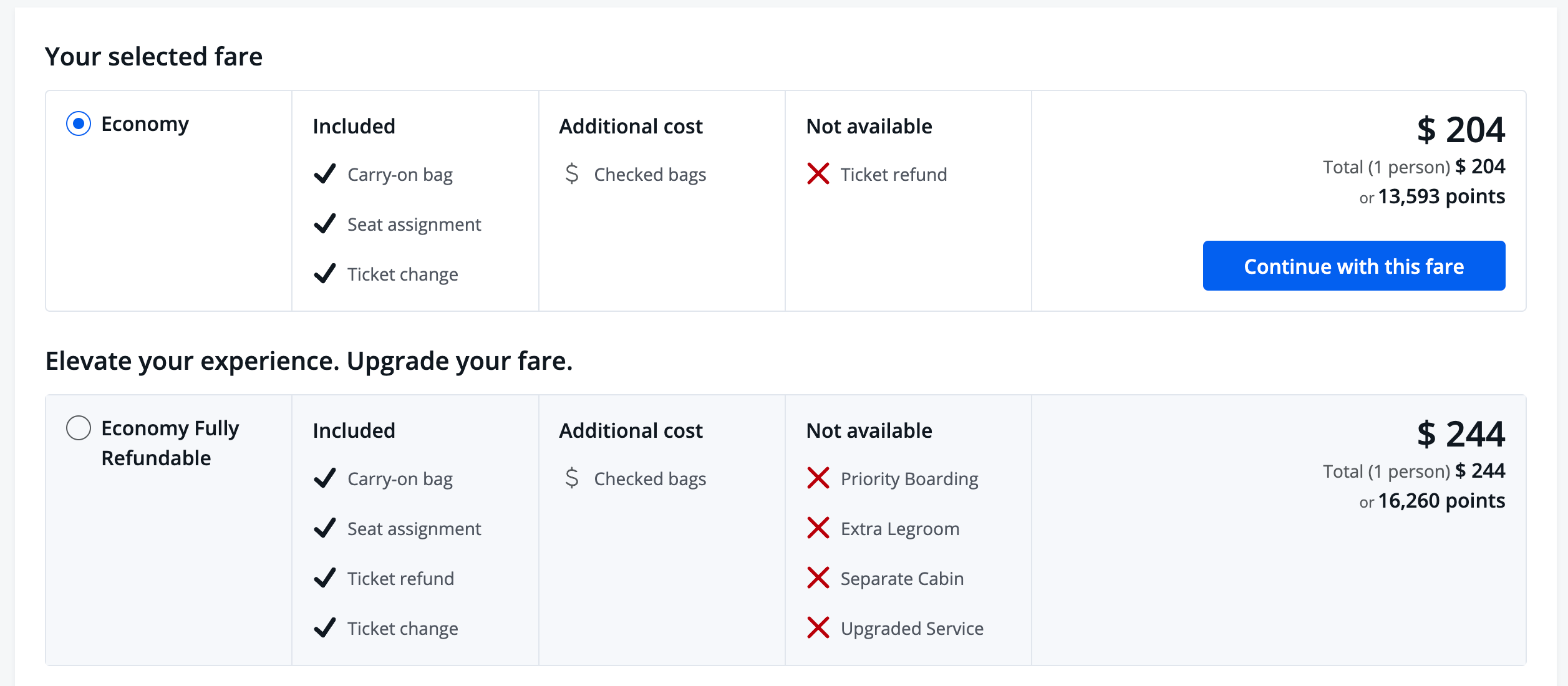

How to book travel (and save points) with Chase Travel

Editor's note : This is a recurring post, regularly updated with the latest information.

Chase Ultimate Rewards is one of the best flexible rewards currencies available, and you can get some incredible value from your Ultimate Rewards points .

Generally, we recommend transferring Chase points to the program's airline and hotel partners for award bookings. However, sometimes redeeming Ultimate Rewards points for paid travel through Chase Travel℠ is more advantageous. This option can save you money, particularly when traditional award space is unavailable, as you can book almost any available flight or hotel through Chase Travel.

Here's what you need to know about Chase Travel.

Related: New Chase Sapphire Preferred offer: Earn 75,000 of the most valuable points

What is Chase Travel?

To maximize your Ultimate Rewards points, it's often best to transfer them to partner programs like United MileagePlus , World of Hyatt or British Airways Executive Club for award reservations. However, it's important to compare the points needed for a direct booking through Chase Travel to those required for an award booking. Sometimes, booking through the portal can be beneficial, as the points price is tied to the cash cost of the flight or hotel stay, potentially resulting in lower point requirements.

However, you need to have some Chase points before using Chase Travel. If you're unfamiliar with Chase's most popular cards and welcome offers, here are a few current ones to be aware of.

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a TPG favorite. It currently comes with one of the highest sign-up bonuses from Chase — 100,000 bonus points after you spend $8,000 on purchases in the first three months of account opening.

Based on our valuations , the bonus points alone are worth $2,050. However, you can redeem these points through Chase Travel for a fixed value of 1.25 cents apiece.

Read more: Ink Business Preferred Credit Card review: A great all-around business card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is another fantastic addition to your wallet. For a limited time, you'll earn an elevated 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The bonus is worth $1,538 based on TPG valuations .

Like the Ink Business Preferred, you'll get a value of 1.25 cents per point when booking directly through Chase Travel with the Sapphire Preferred. You'll also earn 5 points per dollar on paid travel purchased through Chase (excluding the first $50 in hotel purchases that qualify for the card's annual hotel credit ).

Read more: Chase Sapphire Preferred credit card review: 75,000-point bonus for a top travel card

Chase Sapphire Reserve®

For a limited time only, the Chase Sapphire Reserve® offers 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening, which is worth $1,538 based on TPG valuations.