- General Subscription Questions

- Skift Research

- Airline Weekly

- Daily Lodging Report

- Skift Events

- Skift Awards

- Complimentary Newsletters

- Contact Us!

- Help Center

What is the Skift Travel Health Index?

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. Covid-19 has routed the travel industry, with the impact of the pandemic quantified for 22 countries in the Skift Travel Health Index. The Index provides the travel industry with a powerful tool for strategic planning, of utmost importance as times remain uncertain. Skift Research launched the Index in May 2020 as the Skift Recovery Index, and have rebranded it at the start of 2022 as the Skift Travel Health Index, to reflect some far-ranging changes: the addition of many more indicators, additional data partners, and most importantly, our continued effort to track the industry health beyond the impact of the Covid-19 pandemic.

For more information, please visit: https://research.skift.com/recovery/methodology/

- Skift Meetings

- Airline Weekly

- Daily Lodging Report

- Skift Research

Business News

Travel is Back: Skift Travel Health Index Reaches Record High

Andrea Doyle

May 23rd, 2023 at 11:41 AM EDT

Skift Research reports complete travel recovery as the current Travel Health Index has topped 100, indicating that global tourism is now performing better than it did before the pandemic. Every region in the index has grown, and meeting professionals must take note.

- LinkedIn icon

- facebook icon

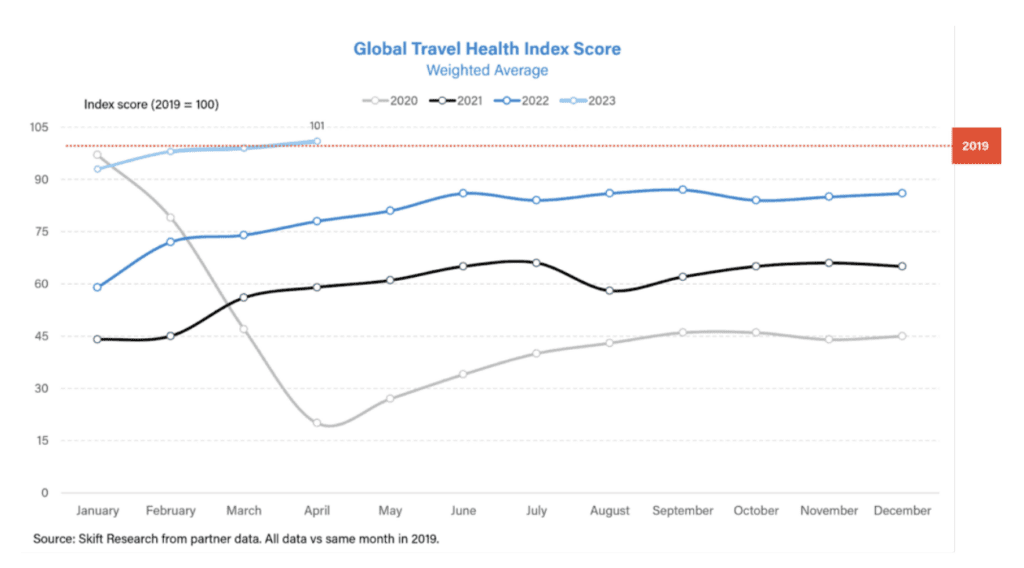

Travel performance has surpassed 2019 levels for the first time since the pandemic, according to the just-released Skift Travel Health Index that increased by 2 percentage points over March 2023 and now stands at 101, indicating complete travel recovery when looking at the global average. This is a record with the index passing the level last reached in 2019.

The Travel Health Index is a proprietary tool produced by Skift Research to track the travel industry’s performance using 84 travel indicators with data from 22 partners.

At its lowest point, the Index hit 20 in April 2020, which indicated that travel performance had dropped to 20 percent of levels in April 2019. The Index covers travel performance since January 2020, up to and including April 2023.

“We started tracking the performance of the travel industry back when it was at its lowest and darkest point. The Index tracks the performance of 22 countries and four main travel sectors within each — aviation, hotels, short-term rentals, and car rental. We compare current performance against the same month in 2019 and use data from 22 data partners to get a very holistic view of recovery,” said Wouter Geerts, Skift’s director of research.

The Index is a powerful tool for the meetings and events industry as it helps with strategic planning. “It’s a great moment for the travel industry to see that our global index score is now back to 100, meaning that performance is back to pre-pandemic levels,” said Geerts.

Hidden behind that number, however, are some nuances. “Not every country has recovered, with some overperformers making up for continued weakness in other countries. And similarly, not every travel sector is fully recovered,” said Geerts. “But we are seeing that demand has returned very strongly since the beginning of 2023, and continued high prices have contributed strongly to full recovery. Seat capacity on airlines is slowly returning to what it was before the pandemic, and a strongly performing short-term rental industry has increased the availability of accommodation supply. All these indicators are extremely important for event planners to stay on top of, to understand the dynamics between demand and supply between different destinations and source markets.”

Skift Research launched the Index in May 2020 as the Skift Recovery Index. At the start of 2022, it was rebranded as the Skift Travel Health Index to reflect some far-ranging changes that include the addition of many more indicators, additional data partners, and, most importantly, a continued effort to track the industry health beyond the impact of the Covid-19 pandemic.

2023 brings two additional data partners into the fold. TravelgateX has started to provide pricing data for hotel stays, and Nium now provides transaction values for flights.

Other data partners include Amadeus , Aviasales , Beyond , CarTrawler , Cendyn , Collinson , Criteo , Duetto , ForwardKeys , Hotelbeds , Key Data Dashboard , OAG , Onyx CenterSource , OTA Insight , RateGain , Shiji Group , Skyscanner , Sojern , Transparent , and TrustYou .

More analysis can be found in Skift’s April 2023 Highlights report and the Skift Travel Health Index data dashboard .

Planned Secures $35 Million in Funding, Hopper’s CEO Joins Board

Planned has secured a significant round of financing and added a travel industry heavyweight onto its board. Up next is expanding AI functionality and travel booking capabilities.

Groupize Acquires The Vendry, Adding Supplier Marketplace to Meetings Management Offering

The combined platform promises to be a new type of all-in-one offering combining meeting and travel management with venue and vendor sourcing.

Convention Data Services President Talks Next Steps After Maritz Acquisition

The intricacies of absorbing a multi-million registration company is the focus of an upcoming internal Maritz tech summit.

Maritz Acquires Convention Data Services from Freeman — Maritz CEO Discusses First Acquisition in 12 Years

Former rivals, Maritz and Convention Data Services, have joined forces. Maritz has acquired the company from Freeman.

Collision Conference in Toronto to Morph Into Web Summit Vancouver

Is Vancouver the new darling of the tech world? The provincial government is betting on it by partnering with a major conference to lure the tech community. The first of three confirmed editions is set for May 2025.

Get the Skift Meetings Standup Newsletter

Our biweekly newsletter delivers fresh, original content – straight to your inbox, every Tuesday and Thursday.

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

The Future of Ultra-Low Cost Carriers in the U.S.

Executive summary, introduction, supply/capacity issues, demand issue, strategic issues, unit costs outweighed unit revenues, analyst cross-fire: where do our experts align , related reports.

- Carbon Offsets: Fact from Fiction June 2024

- The Curious Case of Indigo Airlines, India’s Largest Airline June 2024

- How Technology and AI are Transforming Airline Revenue Management May 2024

- The Opportunity for Long-Haul, Low-Cost Airlines April 2024

Report Overview

Skift Research’s latest report on Ultra Low-Cost Carriers (ULCCs) in the U.S. presents a deep dive into their challenges in the post-pandemic world. We cover all the factors that have impacted the performance and profitability of ULCCs in the U.S., ranging from capacity issues to changes in demand trends. We also cover the issues at the heart of ULCC strategy – diminishing cost advantages and the impact of shrinking network exclusivity as network carriers have scaled their capacities on domestic leisure destinations. Many airline executives believe that the ULCC business model is broken and, thus, will not survive for long.

Our report analyses all the factors to see if this claim holds. Will ULCCs eventually cease to exist, or are some ULCCs impacted more than others?

What You'll Learn From This Report

- Shifts in Passenger Demand

- Growth of Premium Airline Products

- Network Exclusivity of ULCCs

- Relation between Operating Margins (EBIT) and Network Exclusivity for U.S. Airlines

- Rise of Unit Costs of ULCCs

Ultra-low-cost carriers (ULCCs) or budget airlines have succeeded significantly in the U.S. and worldwide. Currently, one-third of the global airline capacity is controlled and operated by budget carriers. Thanks to the availability of newer, more fuel-efficient narrowbody aircraft that offer superior range, budget airlines can operate domestically over long distances and run longer flights to leisure destinations.

In the U.S., ULCCs have shown remarkable growth, increasing their market share from 6% at the end of 2013 to over 13% by the end of 2020. However, the pandemic significantly impacted all U.S. airlines, with ultra low cost carriers recovering faster than legacy carriers due to their focus on domestic routes. The competitive landscape in the domestic U.S. market changed significantly during the pandemic.

The introduction of basic economy products by U.S. network carriers just before the pandemic and the move to flood excess (and grounded) capacity into leisure markets dominated by ULCCs have greatly impacted ULCCs in the U.S. These strategic moves have also significantly affected their profitability. As a result, some executives from legacy airlines, such as Scott Kirby and Ed Bastian, believe that ULCCs will face challenges in the future.

Ultra low cost carriers like Spirit and Frontier have been particularly affected by the changes in the competitive landscape. Furthermore, they have faced additional challenges, such as losing a portion of their fleet to engine issues when conditions are already challenging. In addition to the industry changes, ULCCs are also experiencing a decline in their competitive advantages, such as reduced exclusivity on routes, increasing unit costs, and lower operational efficiencies, all of which have contributed to negative profitability. As a result, the future of ULCCs in the U.S. is uncertain, as suggested by Scott Kirby. It remains to be seen if all U.S. ULCCs are struggling with the same issues.

“ ULCCs are going out of business in the next five years.”

– Said Scott Kirby, CEO of United Airways, in an interview with Brian Summers and Jon Ostrower on The Air Show . The following are some of Kirby’s quotes about ULCC and its business model.

“Fundamentally flawed business model – customers hate it.”

“Uproute their network, won’t charge for ancillary, won’t charge for change fees.”

Is Scott Kirby right about ultra low cost carriers? Will it have a broader impact on low-cost carriers like Southwest and JetBlue, both of which have their own fair share of struggles?

Until the start of the Pandemic, U.S. Ultra Low Cost Carriers (Frontier, Spirit, Allegiant and Sun Country)and Low Cost Carriers (Southwest, JetBlue, Alaska and Hawaiian) were doing well. These airlines were profitable until the start of the pandemic in 2020. The average operating profit margin of all LCCs and ULCCs was higher than that of Legacy Carriers.

So what happened post-pandemic? The leisure market recovered much faster than the corporate business market in 2021 and subsequent years, which ideally should have been better for the LCCs and ULCCs – given their focus on leisure passengers.

Is this a structural problem for ultra low cost carriers, or are just a few airlines performing below expectations? Scott Kirby believes this group of carriers are as good as done, but the reality is somewhere in the middle. Sure, budget carriers in the U.S. have struggled, but Allegiant and Sun Country posted their best-ever annual profits in 2023. Also, some airlines like Spirit and Southwest are struggling for reasons that are unique to their business – whether its multiple failed mergers Spirit has gone through and almost a fifth of its fleet getting grounded because of engine issues or whether it is an outdated scheduling system that has impacted Southwest.

Allegiant and Sun Country performed better than the network carrier’s average in 2023, while JetBlue and Spirit have struggled with profitability. This appears to be more of an airline-specific problem than a category problem. However, some airlines have managed to curb the produce good operating results despite the high operating costs and changing demand patterns, especially among leisure travellers in the post-pandemic world.

What changed during and after the Pandemic?

Introduction of basic economy by legacy airlines.

While Delta started basic economy in 2012, United and American Airlines introduced basic economy fare class in 2017, right before the pandemic. The move didn’t necessarily materialize as the pandemic came knocking, but as travel demand surged post-pandemic, things started to change for the better. The basic economy offered by legacy carriers stood in direct competition with ULCC offerings. Ultra low cost carriers’s rise has been largely attributed to its bare-bones model of operation, where they unbundle everything from the airline ticket price except for the basic seat fare. Everything over and above the basic seat fare, sometimes even a bottle of water, is chargeable.

Price-sensitive leisure travellers loved this offering by ULCC, which gave rise to airlines like Spirit in the last decade. However, this model was no longer unique to ULCCs and LCCs – with the introduction of basic economy by legacy airlines in late 2017 – Delta, United and America all had a basic economy product. Why switch to a ULCC or LCC when you can get the same price on an airline with a much better network and stronger loyalty programs with more redemption and earning options? That was essentially what legacy carriers asked. And it worked.

This increased competition, both with the increased capacity/frequency from the legacy carriers and with a new basic economy product that directly competed with ULCC’s comparative bare-bones offering, has had a significant impact on ULCC profits – particularly Spirit and Frontier, which have a significant presence in Florida in cities like Orlando, Fort Lauderdale, Fort Myers and Tampa.

Legacy carriers went after domestic leisure destinations.

With border restrictions and an international COVID lockdown in place in many countries, U.S. legacy carriers started doubling down on domestic leisure destinations by increasing capacity in cities like Fort Lauderdale, Las Vegas, Orlando, Miami, and Tampa – which are the biggest markets for ultra low cost carriers.

Most carriers still had a sizable number of their aircraft grounded at that time, and since domestic travel was anticipated to recover quickly and with no sign of business travel coming back – U.S. legacy carriers increased capacity on domestic leisure destinations.

After the pandemic, U.S. network carriers focused on domestic leisure destinations and increased their capacities in the traditional ULCC markets. Analysis of the capacity from U.S. network carriers in the three biggest markets—Spirit, Frontier, Allegiant, and Sun Country—revealed that Frontier was the most impacted among the four, as network carriers increased their capacities by 18%. This impact was particularly significant as Frontier’s biggest hub, Denver, saw a 30% increase in capacity from network carriers. Spirit also faced increased competition from network carriers, with a 7% capacity increase in Fort Lauderdale, Orlando, and Las Vegas. Allegiant also experienced increased competition in Las Vegas, as did Spirit and Frontier. On the other hand, Sun Country benefited from reduced network carrier capacity in Los Angeles.

Now, ULCCs have a formidable presence in the domestic leisure market. Hence, legacy carriers’ move to increase capacity impacted their most vital markets and, ultimately, their profitability.

Adding too much capacity too fast

ULCCs have also suffered from their losing airline capacity discipline. The category had the highest average capacity increase in 2023 from 2019, at nearly 23%. Network carriers had an average growth of just 9%, with United Airlines growing the most in capacity, at 19% in 2023 compared to 2019.

Hybrid LCCs like Alaska, JetBlue, and Hawaiian deployed less capacity in 2023 than in 2019. Southwest was the only carrier in this group to grow its capacity by nearly 11% over its 2019 capacity, and the overall group average growth rate was under 1% in 2023.

Legacy airlines have been increasing capacities at ULCCs’ biggest markets. ULCCs themselves have also significantly increased their capacity, saturating their core markets. In 2023, Spirit increased capacity by over 50% in its top three markets, which included Fort Lauderdale, Las Vegas, and Orlando. Frontier increased its capacity by 25% in its top three markets. Sun Country increased its capacity by 20%, while Allegiant decreased its capacity by 4% in its top three markets.

This excess capacity flooding in the market has impacted ULCC profitability as passenger yields dropped due to increased competition and capacity, leading to lower prices.

ULCCs’ revenues depend on increasing capacity, as flight revenues on each segment are largely fixed. So, to increase revenues, ULCCs deploy more capacity. However, this works only when unit revenues are more than unit costs. Until the start of the pandemic, this was the case with ULCCs in the U.S., where their unit revenues far outweighed their unit costs, and with the gradual increase in capacity, ULCCs continued to make money. However, that changed post-pandemic, as we will see later in the report, how the growth unit costs far outweighed the growth of unit revenues for ULCCs.

Demand for Premium Economy outpaced Regular Economy

International demand and demand for premium products grew faster than for economy products.

As the demand for travel returned post-pandemic, there were many different shifts and variations compared to demand patterns in the pre-pandemic era. The demand for premium products – premium economy and the business class grew more than the economy in the U.S. This is further demonstrated by the data from OAG Traffic Analyzer. The compound annual growth rate (CAGR) of premium economy passengers from 2020 to 2023 grew by 29%, slightly over 28%, which is the CAGR for economy passengers. The total traffic for business travellers also grew by 40% annually in the same period, according to data from OAG.

Regarding overall demand recovery in the U.S., business and premium economy passengers recovered quicker in 2023 than economy (Full Y) passengers.

This isn’t all. This seems to be true on the revenue side, as shown in Delta Air Lines’ revenues between 2019 and 2023. Revenues from premium cabins increased by 27% in 2023 compared to 2019, whereas revenues from main cabins increased by 12% in the same period.

Furthermore, in 2019, Delta Air Lines’ premium revenues were .68x of main cabin revenues and roughly 41% of total passenger revenues. Fast-forward to 2023, and premium revenues have grown in importance for the airline. They are now .78x of main cabin revenues (improving by ten basis points) and account for roughly 44% (improving by three basis points) of the airline’s total passenger revenues. The theme is also consistent with other network carriers, which have reported strong revenue growth in premium cabin revenues.

Premium cabins and international networks are both areas where ULCCs have no expertise or presence, given their focus on single economy cabins and domestic/regional leisure markets.

Have Ultra Low-Cost Carriers lost their cost advantage?

United Airlines and Scott Kirby will want you to believe that ULCCs are losing their cost advantage against Hybrid LCCs (Southwest, Alaska, JetBlue and Hawaiian) and Network Carriers (Delta, American and United). United Airlines’ Chief Commercial Officer, Andrew Nocella, said in the Q3 earnings call that ULCCs are struggling because costs between ULCCs and Legacy carriers are converging.

Is that so?

In 2019, ULCCs had a 50% cost advantage over hybrid carriers and about 88% over network carriers. Fast-forward to 2023, and the cost advantage has shrunk, albeit little, but it’s decisive. When compared against hybrid LCCs, ULCCs had an advantage of over 45%, and against network carriers, the cost advantage was over 80%, which is still a lot. High labour costs have impacted ULCC’s cost structure. “The days of paying crew peanuts are over”, said Andrew Nocella on the earnings call, and that is true. For instance, Spirit’s per unit salaries and wages cost increased by 40% in 2023 compared to 2019. Spirit’s salaries and wages comprised 37% of its unit cost (CASM ex-fuel and special items) in 2019 and 41% of its unit costs in 2023.

Compared to 2019, Spirit’s unit cost increased by 27% in 2023, while Frontier’s increased by nearly 20%. Allegiant’s cost has risen by over 30%, but its impact on them has been less than others, and I’ll explain why that’s the case for Allegiant. Sun Country’s unit cost has gone up by nearly 12%, the lowest within the ULCC category of airlines. The higher unit cost restricts ULCCs from offering more competitive prices in a market already flooded with extra capacity by network carriers.

This also means that ULCCs will need to charge more for their tickets – raising overall prices. This, according to Ed Bastian, will eventually benefit Delta and other premium airlines in the U.S. Unlike Scott Kirby, Ed Bastian and the Delta executives, who recently spoke at the Q2 2024 earning calls , do not believe that ULCCs will go out of business but will undergo a significant transformation and transition more towards becoming full-service airlines thereby blurring the lines between the two groups.

Another reason why airlines like Spirit and Frontier have struggled post-pandemic is their decreasing aircraft utilization rate. LCCs, particularly ULCCs, have relied on high aircraft utilization to get a leg up in the past, but that is not possible anymore because of the need for longer ground times and work rules in favour of crew and pilot shortages. Spirit’s aircraft utilization dropped from 12.8 hours per aircraft per day in Q2 2019 to 11.3 hours in Q2 2023.

Spirit is not alone; all ULCCs still had average aircraft utilization rates lower than in 2019. Although Spirit and Frontier have consistently improved their utilization rates since 2020, even in 2023, aircraft are utilized less on average compared to 2019 for both Spirit (-10%) and Frontier (-7%). This reduction has hindered the airlines’ ability to generate more revenue from their fleet.

Reducing Network Exclusivity

One not-so-talked-about strategy by ULCCs is providing connectivity between cities largely left out by big national carriers. This works for the ULCC in many ways. First, they can establish themselves as the primary carrier in that region. Second, they pay significantly lower airport fees, which fits perfectly with their business model of low-cost operations. Third and arguably the most important one – in times of economic downturns, these exclusive city pairs help airlines sustain operations as travellers will have no choice but to travel via these airlines. Since these airlines are the only ones operating these city pairs, they also have the pricing power which helps in profitability.

In 2019, Frontier had 120 exclusive city pairs, roughly 28% of all the routes it operated, whereas Spirit had 55 such routes, accounting for 17% of its total capacity. This also means that on roughly 72% of all Frontier routes and 83% of all Spirit routes, at least one more airline is also operating, putting the travellers in pole position rather than the airline, thereby reducing pricing power.

By comparison, Allegiant Air, another ULCC in the U.S., had 89% of its total flights between city pairs, the only operator—418 exclusive city pairs.

Network exclusivity is vital because our research suggests it is linked to profitability. This is especially true for ULCCs, which have a significant portion of their airline capacity deployed in domestic markets. Our research shows that airlines with exclusivity on at least one-third of their total routes were profitable (positive EBIT margins) in 2023.

In 2023, Allegiant Air increased the number of exclusive routes from 418 to 469, still accounting for 85% of all its routes. However, Frontier’s exclusive network decreased from 120 in 2019 to 42 in 2023. Spirit’s exclusive network also dropped relative to its total network from 17% in 2019 to 15%, highlighting an airline-specific problem at both Spirit and Frontier.

Airline veteran David Neelaman echoes this sentiment. His new airline, Breeze Airways, a low-cost carrier that started operating in 2021, has more than 100 routes on which it flies exclusively. He believes exclusivity helps ULCCs during tumultuous times when cost advantages and the overall competitive landscape start to shrink.

David also pointed out that his team is working on more than 1,000 routes that are potential markets for Breeze. This statement by Neelaman points to a contrarian view that the market for ULCC is still big enough for airlines to continue to grow and be profitable.

Let’s summarize all the factors and see if ULCC’s business model is under real threat or if there’s a way out.

Let’s analyse all the factors we have studied thus far and determine whether they are structural issues impacting all ULCCs in the U.S. or cyclical problems faced by only some ULCCs.

Travel demand surged after the pandemic, peaking in 2023, with airlines flying a record number of passengers. 2023 was arguably a better year for the U.S. airline industry than 2019 in terms of overall revenues, but the industry landscape had changed significantly as costs increased industry-wide. So, the airline won’t be profitable unless the unit revenues exceed the unit costs.

In 2023, despite record revenues, operating costs like employee salaries and aircraft maintenance have increased significantly from 2019. Network carriers, with their vast network of international destinations, premium cabins, and loyalty programs, have been able to offset most of the increase in operating costs, but that’s not the case with other airlines.

Spirit, Frontier, and Allegiant had unit costs growing much faster than unit revenues within the ULCC category, with Sun Country as the only exception. The same is true for Hybrid LCCs like Southwest, JetBlue, and Hawaiian—they combined for an average cost increase of 19%, while their unit revenues only increased by 8% compared to 2019.

Are ULCCs struggling right now? Yes. Will they go out of business in the next five years? Unlikely.

ULCCs improved their market share considerably from just 6% in 2013 to over 11% in 2019 and reached 13% in 2021 in the U.S. domestic market.

Allegiant, Sun Country, and Breeze have shown that ULCCs still have many advantages. The continued growth in demand for discount economy products is another sign that ULCCs won’t go away anytime soon. Sun Country’s EBIT margin for 2023 was 12.2% above the network carrier’s average margin (9.3%), and so was Allegiant’s 10% margin for 2023, which also shows that not only are some ULCCs sustaining operations but also thriving at a time when the viability of their entire business model is in question, and the competitive landscape has shifted drastically.

Despite the intense competition and higher cost of operations, Allegiant and Sun Country have shown a way to be profitable. Sure, they are much smaller than Spirit and Frontier, but the notion that the entire ULCC category will likely get whipped out of the market is certainly not true. Breeze has followed in their footsteps as well.

Brian Summers, The Airline Observer

“ Consumers will always have a yen for low-cost air travel, whether in the United States or elsewhere. But for now, U.S. legacy carriers are doing a much better job than ever of giving that to them, without cannibalizing their revenue. That puts ULCCs under a lot of pressure. So far, basic economy combined with much larger planes (the industry calls that upgauging) has been a rousing success for major U.S. airlines. Yes, United’s costs are far higher than Frontier’s or Spirit’s. But the issue isn’t overall costs. The issue is the marginal costs for, say, that last 15 percent of seats on the plane. On a big airplane, those last incremental seats aren’t all that expensive to fly, and so full-service airlines can offer great deals on them, without losing their shirts. The other important piece is about who is buying basic economy tickets. Airlines have made basic fares just punitive enough that most business travelers and premium leisure customers don’t want to buy them. This protects their most important revenue. I’d be very wary of saying this is a forever phenomenon. It could be, but the industry is cyclical and what happens today isn’t always a great predictor of what we will see in 10 years. If Frontier and Spirit can keep their costs from rising too much, they can always bounce back. Ryanair has proven what an airline can do if it is obsessed with costs for the long term. ”

Jay Shabat, Skift Airline Weekly

On Spirit and Frontier: “Compared to 2019, ULCCs, especially Spirit and Frontier, grew too much. Part of the problem was they were planning on growth – they hired the people to grow, they got the facility to grow, and suddenly, they couldn’t grow because of capacity constraints. …..Spirit and Frontier overdid it in Florida and Vegas.” On Scotty Kirby’s comment: “I think he has a point about ULCCs, but I will be a little careful about saying that the ULCC business model is no longer sustainable. I think there’s plenty of things they can do to overcome this ”

Gordon Smith, Skift Airline Weekly

“The rise of the ‘ultra’ low-cost carrier has been one of the most fascinating trends within the U.S. airline industry in the past decade. Previous LCCs such as Southwest and even JetBlue seem mainline by comparison, with complimentary bags and onboard snacks. What’s been arguably even more fascinating is seeing the old guard respond. American, Delta, and United have all introduced stripped back basic economy fares. There’s little doubt that this has taken some of the wind out of the ULCCs sails.

The future direction of the U.S. industry is, as it always has been, uncertain. Beyond big ticket trends such as consolidation, it’s still unclear if the Spirits and Frontiers can keep their cost base low enough to meaningfully counter the intense competition being offered by the legacy players. As we’ve already seen in the post-pandemic period, flooding popular leisure markets is a lose-lose for almost everyone, bar the consumer. For continued relevance and sustained profitability, ULCCs will need to be smarter and much more disciplined in just about every area of their business.”

Meghna Maharishi, Skift

“Scott Kirby has a point — to an extent. ULCCs like Spirit and Frontier need to make changes to their business models if they are to survive. Legacy carriers have been able to introduce unbundled basic economy fares without it harming their bottom lines. And some of these carriers are even expanding their basic economy capacity because it’s been so successful. ULCCs pre-pandemic also added too many seats in popular leisure markets like Las Vegas and Florida, and now they’re paying the cost. That overcapacity in seating has become an issue for all the more domestic-focused carriers. It’s unclear if ULCCs can keep their costs low enough while remaining competitive against the legacies.

But it is also highly possible that these trends are cyclical. Spirit and Frontier could bounce back in a few years. And there are other examples of ULCCs that have been doing well since the pandemic — Sun Country, Allegiant and Ryanair. I think Spirit and Frontier need to carefully assess how they can make meaningful changes that could make them more profitable without straying too far from their business model.”

Upon evaluating the impact of various factors on Ultra-Low-Cost Carriers (ULCCs), the question arises: Is Scott Kirby’s assessment of ULCCs fair? ULCCs have encountered challenges in maintaining their competitive cost advantages and operational efficiency, with diminishing route exclusivity playing a significant role. This exclusivity, previously instrumental in driving profitability during economic downturns and travel booms, has declined.

The industry’s competitive landscape has undergone considerable changes, particularly with the introduction of comparable basic economy products by U.S. network carriers and heightened competition in domestic leisure markets—traditionally a stronghold of U.S. ULCCs.

However, it’s important to note that these changes have not affected all ULCCs equally. For instance, large-scale budget airlines such as Spirit and Frontier have faced a disproportionately higher impact. Various factors, including increased capacity by network carriers in popular destinations like Florida and Vegas, supply constraints, and dwindling route exclusivity, have notably affected these carriers more than others like Allegiant and Sun Country.

Allegiant and Sun Country have demonstrated resilience, which is evident in their high operating margins, surpassing those of major carriers such as Delta, United, and American. Allegiant has managed to retain exclusivity on over 85% of its routes. At the same time, Sun Country has diversified its revenue streams and maintained capacity discipline in the face of rapid expansion by its peers.

Despite United executives’ perspective that the endgame for ULCCs has arrived, there is evidence to suggest otherwise. Although Spirit and Frontier are struggling, Allegiant and Sun Country show resilience. The enduring demand for discount economy travel suggests that Spirit and Frontier could stage a come back if they address their internal inefficiencies.

- Knowledge Hub

- Product Status

Find a Data Set

- Browse All Data Sets

- Global Airline Schedules Data

- Flight Status Data

- Historical Flight Data

- Flight Seats Data

- Flight Emissions Data

- Minimum Connection Times

- Master Data

- Passenger Booking Data

- Global Flight Connections Data

- Airfare Data

How we deliver data

- Data Delivery

- Latest Product Updates

Data Suppliers

- Share your data

Try our Data

Flight data sets.

The world's most accurate and information-rich flight data

ANALYTICS PLATFORM

- Analyser Analytics Platform

EXPLORE ANALYSER MODULES

- Connections

DEMO ANALYSER PLATFORM

Powerful aviation analysis platform to drive commercial and operational decision making across the industry.

WE POWER THE AIR TRAVEL ECOSYSTEM

- Consultancies

- Governments & Security

- Travel Technology

- Airport Service Providers

TRUSTED BY LEADING ORGANISATIONS

- Air Black Box

- View All Case Studies

Springshot: Minimizing delays with OAG's Status Data

- All Blogs, Webinars & Podcasts

- Future of Travel

- Aviation Market Analysis

- Aviation Sustainability

- Data, Technology & Product

- Where To Meet Us

- Monthly Live Webinars

- Travel Recovery Tracker

- Busiest Flight Routes in the World

- Busiest Airports in the World

- Airline Frequency and Capacity Statistics

- Monthly OTP Analysis

- Middle East Market Analysis

- US Aviation Market Analysis

- South East Asia Market Analysis

- China Aviation Market Analysis

- View All Analysis

The Future of the Airline Passenger Experience

From booking, to in-flight entertainment and loyalty programs. How can airlines innovate?

OUR COMPANY

- Diversity & Inclusion

- OAG & The Environment

- Our Locations

- What's New At OAG

GET IN TOUCH

- Press Office

Explore a career at OAG. See the latest job openings here.

- Covid-19 Recovery

Navigating Generational Shifts in the Airline Industry

The airline industry is undergoing two significant transitions reshaping its future landscape. First, there is an ongoing system transition —a shift from historically entrenched legacy IT systems towards more modern, dynamic, and adaptive frameworks. This transformation promises to overhaul operational efficiencies and data capabilities, which we detailed in our previous System Transition Report .

Simultaneously, a more subtle yet profound shift in consumer demographics and preferences is unfolding.

Traditionally, airline customer centricity has been geared towards Generation X and Baby Boomers, who have been the predominant travel spenders for the last two to three decades. However, as of this year, Millennials (born 1981-1996) have surged to become the demographic contributing to more than half of all air travel spending. Alongside them, Generation Z (born 1997-2012), the youngest group of paying travelers, is beginning to leave its mark. By 2035, these two groups are together projected to account for over 80% of all airline-related travel expenditures.

This generational pivot demands a deep understanding of evolving traveler needs - a prerequisite for airlines to remain competitive.

This article explores three crucial consumer behavior myths that challenge traditional airline offerings. We will delve into the implications of these trends for airlines and showcase pioneering best practices from selected carriers that have swiftly adapted their service offerings to meet these emerging demands.

MYTH #1: YOUNGER TRAVELERS ARE ULTRA COST-FOCUSED

Conventional wisdom in the airline industry has long held that younger travelers, given lower average incomes, gravitate towards low-cost carriers (LCCs), driven primarily by price sensitivity. However, recent data tells a different story; one where experience often trumps cost. Our latest survey of 2,000 North American travelers reveals a surprising trend:

- 27% of Gen Z and Millennials are willing to pay up to $100 USD more to fly with legacy carriers over low-cost options.

- This preference for premium service significantly outstrips that of Gen X and Baby Boomers, who show a respective 17% and 18% willingness to pay more for legacy travel.

This shift towards prioritizing quality and experience among younger travelers is not confined to North America. The latest Klook Travel Pulse survey echoes similar sentiments globally, with one in three Millennial and Gen Z travelers in Asia willing to spend more than double their monthly income on a holiday. Notably, safety and security emerge as the paramount concerns for Gen Z when selecting accommodations, underscoring their demand for a guaranteed positive experience.

These insights compel us to rethink the narrative around younger travelers. While cost remains a factor, it is clear that Millennials and Gen Z are increasingly willing to invest in travel that aligns with their values; seeking unique, secure, and sustainable experiences. The latter emphasis on sustainability is particularly accelerating. A notable percentage of Gen Z and Millennial travelers are willing to pay higher rates for travel services that demonstrate environmental responsibility. Specifically, 54% of Gen Z travelers and 48% of Millennials are willing to pay more for sustainable travel options . This trend represents a critical consideration for airlines as they strategize to meet the evolving preferences of the next generation of travelers.

MYTH #2: AIRLINE LOYALTY PROGRAMS ARE UNSHAKEABLE CASH COWS

The value of airline loyalty programs is well-documented, with top programs from carriers like Delta, American Airlines, and United Airlines each valued at over $20 billion USD—often exceeding the market value of the airlines themselves.

These programs are pivotal for generating stable revenue, especially during periods of fluctuating demand, such as the pandemic, primarily through partnerships with credit card companies that purchase miles in bulk. This revenue model has led many airlines to invest heavily in expanding their loyalty schemes over the past few decades. Yet, a disconnect is growing, particularly among younger travelers who are drifting away from traditional loyalty programs.

Recent surveys indicate a significant decline in the likelihood of customers recommending these programs—see our previous deep dive into the future of the airline experience .

Why is this decline happening? It's primarily due to younger travelers’ growing reluctance to commit to a single brand.

- A McKinsey study highlights that Gen Zers and Millennials engage with almost twice as many brands as Baby Boomers and are less likely to commit to just one.

- Our 2024 North American traveler survey supports this notion, showing that only 65% of Gen Z and 70% of Millennials are enrolled in airline loyalty programs compared to 89% of Baby Boomers and 80% of Gen X.

The challenge for airlines is to rethink and adapt these programs to appeal more to younger demographics, who value unique and enriching experiences over transactional rewards—see Myth #1.

How can airlines address this? Here are two ideas:

OFFER ADVENTURE REWARDS

An airline could partner with adventure travel companies to offer unique experiences like skydiving or scuba diving packages as part of their loyalty rewards. This would cater to the thrill-seeking tendencies of younger generations and position the airline as a provider of exciting life experiences, not just flights.

LAUNCH CULTURAL IMMERSION PROGRAMS

Another unconventional approach could be to offer immersive cultural experiences, such as exclusive access to local festivals or culinary classes with renowned chefs at the destination. These experiences could be tailored to reflect the destinations that travelers are flying to, offering them a deeper connection to the culture and people of the area, with the respective airline acting as the bridge or enabler to these experiences.

These types of experiential rewards could help transform airline loyalty programs from being seen as mere transactional points systems into gateways to memorable, life-enriching experiences that resonate with the values and interests of tomorrow’s main travelers.

MYTH #3: FLIGHT BOOKING INNOVATION HAS BEEN COMPLETED

Given the early emergence of Online Travel Agencies (OTAs) and the rapid digitization of flight booking processes, including airline.com websites since the early 2000s, there's a prevailing belief that the innovation in online flight booking has reached its zenith and cannot be further advanced.

However, the reality suggests significant room for improvement. Even Kayak’s CEO has recently pointed out that " online travel still sucks ," highlighting ongoing issues with user-friendliness in online travel booking.

The current complexities and overwhelming options in online flight booking underscore the process's inefficiency.

- For example, travelers in the U.S., on average, sift through 277 pages of travel content before making a booking decision.

- Consequently, the majority of travel bookings (62.5%) still occur on desktop devices, where comparing various options is more manageable than on smartphones.

However, this booking behavior is rapidly changing, particularly driven by younger generations, including Millennials and Gen Z, who are reshaping expectations around flight bookings. Case in point:

- Approximately 75% of Gen Z and Millennials use social media on their smartphones for travel planning.

- This is in stark contrast to the lesser engagement seen in more senior generations, where 50% of Gen X and 32% of Baby Boomers use social media for travel planning, according to JustFly .

And it's more than just social media and smartphone usage. The time of booking is changing. Younger travelers are not just browsing; they are actively engaging in “on-the-go” booking. Our latest Traveler Survey highlights that while only 5-7% of all travelers buy ancillary services directly from their smartphones at the gate or during flight, this share more than doubles for Gen Z. This indicates a shift from purchasing ancillary services at the time of booking to the time of consumption.

As we discussed in our June Innovation Radar , airline pioneers like United Airlines and Singapore Airlines are responding to these trends by integrating personalized advertising and retail opportunities into their in-flight entertainment systems. United's strategy of displaying tailored ads on seat-back screens and Singapore Airlines’ dynamic KrisWorld IFE system are examples of how traditional flight booking and ancillary sales are evolving into a continuous, integrated experience that meets travelers at their point of need.

All these advancements underscore a broader industry trend where travel booking is no longer confined to pre-trip interactions but extends throughout the journey, enhancing engagement and revenue opportunities for airlines. The challenge for the industry will be to harness these insights and technologies to deliver seamless, intuitive, and highly personalized booking experiences that align with the mobile-centric lifestyles of modern travelers.

LEVERAGING DATA TO ENHANCE TRAVELER ENGAGEMENT

For airlines to effectively serve travelers throughout their journey, they need to utilize constantly updated Flight Status Data . This ensures that travelers receive timely and accurate information. Moreover, leveraging Aviation Data Insights to understand popular destinations among Millennials and Gen Z can help tailor specific in-flight offers. By integrating such personalized promotions directly on travelers' smartphones and in-flight entertainment systems, airlines can enhance passenger satisfaction and maximize ancillary revenue opportunities.

REcommended:

Related Insights

Top airline-tech innovations from smart boarding to inclusive in-flight entertainment.

02 July 2024

Skift Travel Health Index: May 2024

20 June 2024

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market

- Home equity loan

- Personal loans

- Student loans

- Options pit

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Orbán's Moscow visit was 'an appeasement mission,' says von der Leyen

- Oops! Something went wrong. Please try again later. More content below

Hungarian Prime Minister Viktor Orbán's visit to Moscow was "nothing more than an appeasement mission," European Commission President Ursula von der Leyen said in a speech on Thursday.

"Two weeks ago, a European Union prime minister went to Moscow. This so-called peace mission was nothing but an appeasement mission," von der Leyen told the European Parliament in Strasbourg, France.

Orbán met Russian President Vladimir Putin in Moscow earlier this month as part of what Orbán called a "peace mission" to find a way to end the war in Ukraine.

"Only two days later, Putin's jets aimed their missiles at a children's hospital and maternity ward in Kiev," von der Leyen said. "That strike was not a mistake. It was a message, a chilling message from the Kremlin to all of us."

"Our answer has to be just as clear: No one wants peace more than the people of Ukraine, a just and lasting peace for a free and independent country."

Orbán's Moscow trip coincided with Hungary taking over the rotating presidency of the Council of the European Union, wherein EU member states take turns to chair discussions among themselves for six months at a time.

Recommended Stories

The eu just re-elected its president for another five years — here's what that means for tech.

The European Union's president, Ursula von der Leyen, was confirmed in the role for another five years Thursday after parliamentarians voted overwhelmingly to re-elect her. The scale of her support (401 votes for vs 284 against with 15 abstentions) -- a far firmer endorsement than last time around -- may say more about lawmakers' concerns over rising geopolitical uncertainties, with war still raging in Ukraine and the U.S. headed for an election in November that could return Donald Trump to the White House by 2025, than reflecting ardent passion for her leadership. Von der Leyen has already pressed ahead with major reforms in digital policy.

President Biden, 81, tests positive for COVID. For older people, the disease is still serious.

President Biden has tested positive for COVID.

The final trailer for Alien: Romulus looks tense, bloody and awesome

The final trailer for Alien: Romulus looks scary and bloody as hell.

Boxer Ryan Garcia officially charged with vandalism for damage at a Beverly Hills hotel

Garcia was arrested in June for vandalism at the Waldorf Astoria in Beverly Hills, one of a slew of recent antics that have affected his boxing career.

2025 MLB schedule: Shohei Ohtani, Dodgers begin season in Japan; A's face Cubs in Sacramento home opener

MLB will begin its season in Japan for the sixth time in league history with Dodgers vs. Cubs.

Biden administration discharges another $1.2 billion in student debt for 35,000 public service workers

The latest round of cancellations brings the total to more than $69.2 billion for nearly 946,000 public service workers since President Joe Biden took office.

Tardy pass! Prime Day school supply deals ring on — Sharpie, Fiskars and more, from $2

You're not too late. From No. 1 bestselling lunchboxes to No. 2 pencils, we're here to school you on A+ savings of up to 70% off.

Report: Clippers trading Russell Westbrook to Jazz for Kris Dunn, setting up buyout to join Nuggets

Russell Westbrook is expected to sign with the Denver Nuggets after reaching a contract buyout with the Jazz.

NASA cancels $450M Viper moon mission, dashing ice prospecting dreams

NASA has canceled a $450 million program to map water ice deposits on the moon after cost overruns and scheduling delays. The mobile robot was due to conduct a 100-day mission to map lunar ice and use a 1-meter drill to detect and analyze these ice deposits. It would’ve been NASA’s first resource-mapping mission off planet Earth.

Affordable life hacks: These 10 problem-solvers from Amazon are $5 or less

A few bucks can get you a fan-favorite makeup remover, a mega-popular detangling brush or other tried-and-true buys.

Netflix earnings preview: Investor expectations high as stock flirts with records

Netflix will report second quarter earnings after the bell on Thursday. Here's what to expect.

ChatGPT: Everything you need to know about the AI-powered chatbot

ChatGPT, OpenAI’s text-generating AI chatbot, has taken the world by storm since its launch in November 2022. What started as a tool to hyper-charge productivity through writing essays and code with short text prompts has evolved into a behemoth used by more than 92% of Fortune 500 companies. The company announced it’s building a tool, Media Manager, that will allow creators to better control how their content is being used to train generative AI models — and give them an option to opt out.

Ubisoft delays its Rainbow Six and Division mobile games until at least April 2025

Ubisoft has delayed two mobile games, Rainbow Six Mobile and The Division Resurgence, until at least April 2025. The company also revealed that Call of Duty titles will start appearing on Ubisoft+ later this year.

Wayfair's anti-Prime Day deals are still going strong with prices starting at just $9

Score deep discounts on brands like Kelly Clarkson Home, Sealy, Cuisinart and KitchenAid during the last day of this sale.

'Golden path' at risk if Fed doesn’t cut rates: Goolsbee

Chicago Fed president Austan Goolsbee signaled in an interview with Yahoo Finance that the central bank is closer to cutting interest rates and warned that it risks a recession if officials wait too long to ease monetary policy.

The 40+ best Amazon Prime Day deals are still available — Shop top picks from Apple, Shark, Yeti and more before the discounts end

Extended Prime Day deals: Save up to 60% on knives, vacuums, luggage and more.

Down to $7, these double-sided hooks make swapping your shower liner a cinch

'Goodbye, sore arms': Replace the curtain with less strain, thanks to this set with 70,000+ five-star fans.

A COVID diagnosis, a major defection: Biden's reelection bid runs into new challenges

The political ground shifted once again below Biden's feet this week in the form of a high-profile defection from his cause and a COVID-19 diagnosis. Here's what happened and how it affects the president's reelection campaign

Does insurance cover online therapy?

When you find an online therapist covered by your insurance plan, your therapy session expenses may cost nothing more than a copay (and they may even be free).

The best post-Prime Day travel deals to swoop up before the gates close — starting at $6

Jet-setting bargains include a flight crew-tested neck pillow for $13 and a set of bestselling suitcases for $50.

Advertisement

Supported by

Modi’s Moscow Visit Showcases a Less Isolated Putin, Angering Ukraine

Prime Minister Narendra Modi of India made his first visit to Russia in five years, even as Ukraine reeled from an attack on a children’s hospital.

- Share full article

By Paul Sonne and Anupreeta Das

They hugged and strolled under the trees. They sipped tea and exchanged thoughts for hours. They petted horses together at the stables.

The jovial scenes between President Vladimir V. Putin of Russia and Prime Minister Narendra Modi of India, captured during the Indian leader’s first visit to Russia in five years, illustrated a sobering reality.

Despite the West’s campaign to isolate Russia over its 2022 invasion of Ukraine, other nations have pursued their own interests with regard to Moscow, helping Mr. Putin shore up the Russian economy and continue to wage his war. India, which has close ties to the United States, has emerged as the second-biggest importer of Russian oil after China in the years since the invasion.

Mr. Modi’s state visit, which began late Monday with a trip to Mr. Putin’s residence outside Moscow, underscored the point. At the Kremlin on Tuesday, Mr. Putin awarded Mr. Modi the Order of St. Andrew, the Russian government’s highest civilian honor, expressing “sincere gratitude” for his contribution to relations between their states.

“We have had two and a half years now of endless Russian atrocities, and most of the world is not daunted or uncomfortable maintaining some kind of business as usual with Moscow,” said Andrew S. Weiss, the vice president for studies at the Washington-based Carnegie Endowment for International Peace. “That’s a really sad commentary on Russia’s continued geopolitical weight.”

While Mr. Modi was hugging the Russian leader late Monday, rescue workers and volunteers in Kyiv were clearing away rubble from a Russian strike on Ukraine’s biggest pediatric hospital . Images of children outside the destroyed medical facility with their IVs still attached, or in some cases covered in blood, wrenched a nation that has been exhausted by more than two years of Russian bombardment.

“It is a huge disappointment and a devastating blow to peace efforts to see the leader of the world’s largest democracy hug the world’s most bloody criminal in Moscow on such a day,” Ukraine’s president, Volodymyr Zelensky, wrote on X .

The state visit was also juxtaposed against the gathering of NATO countries on Tuesday in Washington, where they discussed continued support for Ukraine.

Western governments have failed to persuade India and many other governments around the world to take a public position against Mr. Putin’s war. Mr. Modi has avoided condemning Russia’s invasion and instead issued general calls for peace, maintaining the warm relations with Moscow that India has cultivated since the days of the Cold War.

The Indian leader said he had discussed Ukraine with Mr. Putin at his residence, agreeing on the need for peace as soon as possible.

“Any person who believes in humanity feels pain when people die, and especially when innocent children die,” Mr. Modi said Tuesday, a possible implicit reference to the hospital attack. “When we feel such pain, the heart simply explodes, and I had the opportunity to talk about these issues with you yesterday.”

The state visit offered still more evidence that Mr. Putin has managed to avoid the pariah status Western leaders tried to force on him after the invasion. Mr. Putin has maintained a robust diplomatic schedule holding two meetings with China’s leader , Xi Jinping, in two months, along with meeting the leaders of Vietnam , Hungary , Belarus and the nations of Central Asia,

On Tuesday, Indian officials said that the two countries had struck various agreements to strengthen economic ties, with the goal of reaching $100 billion in bilateral trade by 2030.

Russia and India also said they would strengthen their military cooperation, including manufacturing more weapon spare parts and units in India. They pledged to continue developing national payment systems, which allow Russia to conduct trade outside U.S. dollars and away from platforms impacted by Western sanctions.

Mr. Modi, who said he had met Mr. Putin 17 times over the course of the past decade, invited Mr. Putin to visit India next year.

“Russia is India’s true friend,” Mr. Modi said at a meeting with members of the Indian community in Moscow, according to the Russian state news agency Tass.

While India imported little Russian crude before the invasion of Ukraine, the nation has since risen to become the No. 2 importer of Russian oil after China, helping fill the Kremlin’s coffers despite a Western ban on most Russian oil imports. In many cases, India has been refining Russian crude and re-exporting it to European nations that are subject to the ban, giving it a lucrative middleman role .

Matthew Miller, the State Department spokesman, told reporters on Tuesday that the U.S. has “been quite clear about our concerns” about India’s relationship with Russia, and has related them “privately, directly to the Indian government” — including within the past 24 hours. “We continue to urge India to support efforts to realize an enduring and just peace in Ukraine,” he said.

Mr. Modi said Tuesday that as a friend, he had always told Mr. Putin that peace was a prerequisite for future generations to have a bright future.

“That is why we believe that war is not a solution,” he said. “There can be no solution through war. Bombs, missiles and rifles cannot ensure peace. That is why we emphasize dialogue.”

India has a long history of friendly relations with Moscow. The Soviet Union and later Russia for decades supplied much of India’s arms and military equipment, though that reliance has decreased in recent years, in part because of pressure from the United States.

“This has been a time-tested relationship, and there is a consensus in India, regardless of political orientation, that the relationship with Russia is one to be preserved and not squandered,” said Rajan Menon, professor emeritus of political science at City College.

Mr. Putin has cast his invasion of Ukraine as an anti-imperial struggle against an encroaching West, and that message has resonated in parts of the developing world that once lived under Western colonialism. According to a Pew Research Center poll conducted this year, just 16 percent of respondents in India expressed unfavorable views of Russia, compared with 46 percent who voiced positive associations.

During his talks with Mr. Putin, Mr. Modi sought the early discharge of all I ndian nationals who were recruited by the Russian army under “false pretenses,” according to government officials. The contentious issue had introduced a sour note in the countries’ friendly relations. Mr. Putin agreed to the discharge of those citizens, who India has said number between 35 and 50.

Mr. Menon predicted that India would continue to cultivate deeper ties with the United States over the long term, but not at a cost of having to choose sides.

“Anyone who expects you can peel India off and put it in the U.S. column — that is not going to happen,” he said. “Would you rather be completely dependent on the United States or Russia, or have a position of maneuverability between the two?”

Michael Crowley contributed reporting.

Paul Sonne is an international correspondent, focusing on Russia and the varied impacts of President Vladimir V. Putin’s domestic and foreign policies, with a focus on the war against Ukraine. More about Paul Sonne

Anupreeta Das is the finance editor of The New York Times, overseeing broad coverage of Wall Street, including banking, investing, markets and consumer finance. She was previously the deputy business editor of The Wall Street Journal. More about Anupreeta Das

Our Coverage of the War in Ukraine

News and Analysis

For months, Ukraine’s electricity grid has faced repeated Russian missile and drone attacks that have knocked out power plants and gutted substations. Now, it is contending with another, more unexpected threat: a sizzling heat wave.

After meeting with Donald Trump, Prime Minister Viktor Orban of Hungary wrote to a top E.U. official to say that Trump had told him he was planning a swift push for a peace deal between Russia and Ukraine.

Ukraine’s Parliament is in a state of disarray , denting the government’s credibility as it struggles to reset its war effort after months of Russian advances.

The Rise of Slaughterbots: Driven by the war, many Ukrainian companies are working on a major leap forward in the weaponization of consumer technology .

Motorcycles and Mayhem: In the latest tactic for storming trenches, Russians use motorcycles and dune buggies to speed across open space, often into a hail of gunfire.

Escaping the Russian Army: Facing grim job prospects, a young Nepali signed up to join Russia’s military, which sent him to fight in Ukraine. His ordeal turned into a tale worthy of Hollywood .

How We Verify Our Reporting

Our team of visual journalists analyzes satellite images, photographs , videos and radio transmissions to independently confirm troop movements and other details.

We monitor and authenticate reports on social media, corroborating these with eyewitness accounts and interviews. Read more about our reporting efforts .

IMAGES

VIDEO

COMMENTS

The New View of the Travel Health Index. January 2024 Highlights marks the debut of our reformed index. The index stands at 114 for January 2024, 14% growth over January 2023.

The Skift Travel Health Index paints a positive picture for the travel industry this month, gaining 3 percentage points (pp) over March 2024 to reach 108. This represents an 8% surge over last ...

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. The Index provides the travel industry with a powerful tool for strategic planning and tracking global travel performance. Skift Research launched the Index in May 2020 as the Skift Recovery Index.

The index covers travel's performance since January 2020, up to and including January 2023. The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. The Index provides the travel industry with a powerful tool for strategic planning, which is of utmost importance ...

The Skift Travel Health Index for May 2023 continues to indicate the full return of global travel. Despite a 1 percentage point drop over the prior month, the index stands at 100, as highlighted ...

The Skift Travel Health Index now stands at 86 points, meaning it falls 14% short of 2019 performance levels. Although there has been little movement into year end, performance in 2022 has improved over 2021. All regions improved their performance during 2022, with Europe seeing the strongest growth at nearly 50%. Latin and North America ...

The Travel Health Index is a proprietary tool produced by Skift Research to track the travel industry's performance using 84 travel indicators with data from 22 partners. The global index ...

Global Travel Performance Has Stagnated. In September 2022 the global average score of the Skift Travel Health Index remained at 86% of 2019 levels, which is virtually the same score we have seen since June 2022. Achieving the final 14% to get completely back to pre-pandemic performance levels continues to depend mostly on Asia Pacific getting ...

The Skift Travel Health Index has now been sitting around the 85% mark since June, and has not been able to break through that metaphorical ceiling. In October 2022, the global average score of the Skift Travel Health Index dropped three percentage points to 84% compared to October 2019. Although this is a month-over-month decline, it is still ...

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. The Index provides the travel industry with a powerful tool for strategic planning, which is of utmost importance as times remain uncertain.

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. Covid-19 has routed the travel industry, with the impact of the pandemic quantified for 22 countries in the Skift Travel Health Index. The Index provides the travel industry with a powerful tool for ...

The Skift Travel Health Index reached 103 in May 2024, reflecting a 3% year-over-year increase. Hotels lead the accommodation sector at a 7% growth, while vacation rentals lag 4% behind 2023 ...

The Skift Travel Health Index in March 2024 witnessed 9 countries exhibiting growth over 2023 levels. China remains at the forefront, growing 21% year-on-year. Japan's double-digit growth during ...

The overall travel performance hasn't grown this fast month-over-month since March 2021, with the latest Skift Travel Health Index data registering a 9 percentage point increase between January ...

Skift Research launched the Index in May 2020 as the Skift Recovery Index. At the start of 2022 we rebranded the Index as the Skift Travel Health Index, to reflect some far-ranging changes: the addition of many more indicators, additional data partners, and most importantly, our continued effort to track the industry health beyond the impact of ...

The average global Index score took another jump up, now standing at an average of 58 points in April 2021, compared to a baseline of 100 in April 2019. The index score is a holistic and real-time ...

The Travel Health Index is a proprietary tool produced by Skift Research to track the travel industry's performance using 84 travel indicators with data from 22 partners. At its lowest point, the Index hit 20 in April 2020, which indicated that travel performance had dropped to 20 percent of levels in April 2019.

Skift Research launched the Index in May 2020 as the Skift Recovery Index. At the start of 2022 we rebranded the Index as the Skift Travel Health Index, to reflect some far-ranging changes: the addition of many more indicators, additional data partners, and most importantly, our continued effort to track the industry health beyond the impact of ...

Skift Travel Health Index: June 2022 Highlights SKIFT REPORT 2022 2 FIRST DECLINE IN INDEX SINCE START OF 2022 During June 2022, the Skift Travel Health Index dropped one point compared to the previous month. It is the first time since January 2022 that the Index registered a decline, and although small, it is significant in what it implies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance .

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance .

The global Skift Travel Health Index is 102 points for July 2023. Keep reading for insights from the Skift team in the Skift Travel Health Index: July 2023 Highlights.. As one of Skift's data partners, we provide flight data (powered by OAG Metis) to enable the reporting of travel performance along with other key data points - together this creates the Skift Travel Health Index, a vital ...

Skift Travel Health Index: May 2024 Highlights ; Research By Sector. Tourism; Technology; Hospitality; Consumer Habits; See All Sectors; Featured Tools. State of Travel 2023; Skift Travel 200;

The Vozdushny Express "Capsule" hotel has one-person rooms with no windows that start at $58 for four hours and goes up to $232 for a 24-hour period. According to news reports, Snowden is ...

Travel Health Index; Skift Travel 200; Subscribe. search. person Login lock. Purchase or Subscribe to view this report Report Overview ... Skift Research's latest report on Ultra Low-Cost Carriers (ULCCs) in the U.S. presents a deep dive into their challenges in the post-pandemic world. We cover all the factors that have impacted the ...

The airline industry is undergoing two significant transitions reshaping its future landscape. First, there is an ongoing system transition —a shift from historically entrenched legacy IT systems towards more modern, dynamic, and adaptive frameworks. This transformation promises to overhaul operational efficiencies and data capabilities, which we detailed in our previous System Transition ...

Hungarian Prime Minister Viktor Orbán's visit to Moscow was "nothing more than an appeasement mission," European Commission President Ursula von der Leyen said in a speech on Thursday. "Two weeks ...

Prime Minister Narendra Modi of India made his first visit to Russia in five years, even as Ukraine reeled from an attack on a children's hospital. By Paul Sonne and Anupreeta Das They hugged ...

People clear rubble from a building of one of the largest children's hospitals of Ukraine, 'Okhmatdyt', partially destroyed by a Russian missile strike on July 8, 2024 in Kyiv, Ukraine.

American citizen Travis Leake has been sentenced to 13 years in a penal colony in Russia, state media RIA Novosti reported Thursday, after he was detained on drug charges last year.