7 Best Kebab Restaurants in Marmaris

When it comes to kebab cuisine in Marmaris, a delightful coastal town in Turkey, there’s certainly no shortage of incredible spots to indulge in. In this guide, we delve into the 7 best kebab restaurants that have made a name for themselves through exceptional food, authentic preparation methods, and unparalleled customer service. So, let’s embark on a flavorful adventure and explore what these renowned establishments have to offer.

#1 La Kebap Restaurant: Savor the Flavor of Authenticity

La Kebap Restaurant is a food establishment specialized in serving various types of kebabs, a culinary tradition with roots in Middle Eastern cuisine. The restaurant primarily focuses on kebabs, offering a diverse range of preparations from classic shish kebabs to doner kebabs and everything in between. Using fresh, quality ingredients, La Kebap provides an authentic culinary experience, presenting a menu designed to satisfy both traditional kebab lovers and those interested in trying a modern twist on this beloved dish. Besides kebabs, the restaurant also offers an assortment of Mediterranean and Middle Eastern sides such as tabbouleh, hummus, and baba ganoush. Additionally, a selection of refreshing beverages and traditional desserts complement the main course options. La Kebap Restaurant offers both dine-in and take-away services to cater to different customer preferences.

Address: Armutalan, Adnan Menderes Cd. No:110, 48706 Marmaris/Muğla, Türkiye

#2 Marmaris Hatay Döner: Taste the Legacy of Turkish Delicacies

Marmaris Hatay Döner is a restaurant dedicated crafting authentic doner kebabs, a cornerstone of Turkish cuisine, originating from the Hatay region. They prioritise quality and authenticity because they are known for their unique approach to this traditional food. The restaurant sources high-grade meats marinated in a blend of regional spices before being slow-roasted on a vertical rotisserie, following the time-honored Hatay method. Apart from the iconic doner kebab, they also serve an array of sides influenced by Mediterranean flavors, such as fresh salads and pita bread.

Address: Armutalan, Şht. Ahmet Benler Cd. No:26 D:E, 48700 Marmaris/Muğla, Türkiye

#3 Yılmaz Döner: Discover the Art of Turkish Kebabs

Yılmaz Döner is a restaurant with a primary focus on the preparation and serving of authentic Turkish doner kebabs. The establishment prides itself on adhering to traditional Turkish cooking methods, showcasing the rich flavors and textures of the iconic dish. Freshly cut, marinated meat is cooked on a vertical rotisserie and served in a variety of ways, including in sandwiches, on platters, or as part of combo meals. Aside from their signature doner kebabs, Yılmaz Döner also offers a selection of complementary dishes and sides, such as Turkish rice, salads, and a variety of traditional sauces. Patrons can choose to enjoy their meals within the cozy, inviting ambiance of the restaurant or opt for take-out services. In essence, Yılmaz Döner provides an authentic Turkish dining experience that revolves around the beloved doner kebab.

Address: Tepe, 48700 Marmaris/Muğla, Türkiye

#4 Antakya Döner: Embark on a Flavorful Journey through Turkish Tradition

Antakya Döner is a restaurant specializing in serving genuine doner kebabs, a delicacy deeply rooted in the culinary traditions of Turkey’s Antakya region. Renowned for their attention to detail and authenticity, they skillfully roast quality meats on a vertical spit to achieve that characteristic flavor and succulence associated with traditional doner kebabs. Apart from their celebrated kebabs, Antakya Döner extends its menu to include an array of side dishes showcasing the Mediterranean influence on Antakya’s cuisine, such as vibrant salads and a variety of freshly baked breads. Customers have the flexibility to enjoy their meal in the welcoming setting of the restaurant or avail of the takeaway option. By offering an array of traditional dishes, Antakya Döner aims to transport its patrons to the heart of Turkey through an immersive dining experience.

Address: Tepe, 48. Sk., 48700 Marmaris/Muğla, Türkiye

#5 Ege Vera: Where Culinary Dreams Come True

Ege Vera is a dining establishment featuring a menu including a diverse cuisine of the Aegean region of Turkey. The restaurant is known for serving a variety of traditional dishes that reflect the area’s rich culinary heritage, featuring an abundance of fresh vegetables, olive oil, and seafood. Alongside these, Ege Vera offers a unique take on the iconic doner kebab, prepared with their signature marinades and cooked to perfection on a vertical rotisserie. The menu extends beyond the kebab, offering a wide range of Aegean classics such as mezes, seafood dishes, and traditional desserts. The restaurant provides a warm and inviting atmosphere for those wishing to dine in. Alternatively, a takeaway service is available for those seeking to enjoy Ege Vera’s offerings at their own convenience. In essence, Ege Vera encapsulates the vibrant flavors of the Aegean in every dish.

Address: Tepe, Kubilay Alpugan Sk. No:5, 48700 Marmaris/Muğla, Türkiye

#6 Marmaris Kirtil Ev Yemekleri Döner Kebap Salonu: A Taste of Turkish Tradition

Marmaris Kirtil Ev Yemekleri Döner Kebap Salonu is a unique dining venue combining the appeal of home-style cooking with the allure of traditional Turkish kebab culture. The restaurant’s primary highlight is the doner kebab, a beloved Turkish dish made with marinated meats slow-cooked on a vertical spit, prepared true to its origins. However, Marmaris Kirtil sets itself apart by integrating home-style Turkish dishes into its menu, offering a comforting variety of meals prepared using time-honored recipes and locally sourced ingredients. From slow-cooked stews and casseroles to refreshing salads and breads, the menu reflects an authentic domestic culinary experience. The restaurant provides a homely atmosphere for dining in, but also offers take-away service for patrons wishing to enjoy their meals elsewhere.

Address: Tepe, 36. Sk. No:69, 48700 Marmaris/Muğla, Türkiye

#7 Ottoman Kebap Marmaris: Savor the Rich Flavors of History

Ottoman Kebap Marmaris is a restaurant devoted to bringing the grandeur of the Ottoman culinary legacy to the present day, with a special emphasis on kebab preparations. Their menu pays homage to the empire’s rich and varied gastronomy, headlined by the iconic doner kebab. The meat, marinated in a blend of special spices, is slow-cooked on a vertical grill, staying true to the authentic method. In addition to the kebabs, the restaurant offers a range of Ottoman-inspired dishes, featuring mezes, stuffed vegetables, and traditional desserts, each recipe carrying a story from the imperial kitchen. Diners can enjoy their meals in the eatery’s elegant interior that echoes the Ottoman aesthetic or avail themselves of the take-away option for convenience.

Address: Armutalan, 48706 Marmaris/Muğla, Türkiye

Wrapping up, the kebab restaurants in Marmaris truly offer a delectable dive into the robust flavors and traditions of Turkish cuisine. Each of the seven highlighted establishments brings something unique to the table, be it a certain dish, method of preparation, or their distinctive atmosphere. Trying out these top kebab spots isn’t just about the food, but also the cultural immersion and sense of community that come with it. So go ahead, explore these gems of Marmaris, and embark on a memorable gastronomic journey.

- Living In Croatia

- Croatian Recipes

- Balkan Recipes

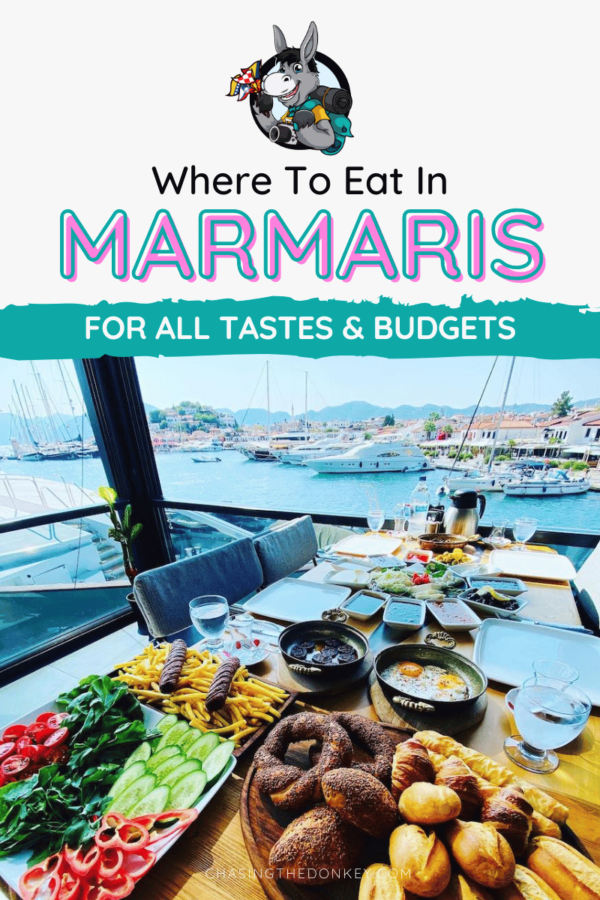

Home > Best Restaurants In Marmaris: 17 Marmaris Restaurants I Love In 2024

Best Restaurants In Marmaris: 17 Marmaris Restaurants I Love In 2024

Written by our local expert Nicky

Nicky, originally from the UK, is now a local in Turkey. She moved to Marmaris, Türkiye for love 12 years ago and is now your Turkey travel planner.

If you’re visiting Marmaris any time soon, the good news is that not only will you have the time of your life in the sun, with plenty to see and do, but there are also some amazing restaurants to try.

Turkish food is simply delicious; in fact, once you’ve tried it, it might become your new favorite. From all manner of different kebabs to baklava, borek, gözleme, and, of course, the famous Turkish breakfast , you won’t struggle to find something you adore. But of course, you’ll find all the regular international food here too, as Marmaris is a major tourist hotspot .

To help you find the best food while you’re enjoying your holiday in the sun , let’s check out some of the best places to eat. I tried to keep it to a list of the 10 best restaurants in Marmaris, but I had to make it 17 as it was so hard to choose.

Skip Ahead To My Advice Here!

Marmaris’ Food Scene

Marmaris isn’t short of restaurants; in fact, you’ll be spoiled for choice. You’ll find a superb blend of traditional and international, and of course, there are plenty of doner kebab joints when you’ve finished your night out and you want a delicious wrap to enjoy before bed.

Marmaris as a whole encompasses not only Marmaris center itself but also Icmeler , which is around ten minutes away on the mountain road. Both resorts offer excellent food, and it’s definitely worthwhile checking out as many eateries as you can during your time. It’s very easy to get stuck with one or two places you like on repeat, but trust me, you’ll be missing out!

It’s for this reason that I really discourage all-inclusive hotels . Sure, they’re awesome for facilities and the fact that your drinks are included in the price, but the food is so repetitive and not the greatest quality. There are so many amazing places to eat and drink around the town that if you don’t head out, you’re going to wish you had.

Marmaris itself doesn’t have any particular traditional food that hails from the town, but Mugla as a whole (the province Marmaris belongs to) does have Mugla kofte and Mugla simit. These are both variations of foods you’ll find all across Turkey , but they’re made slightly differently in Mugla.

Mugla kofte is a little smaller than the regular kofte you might see elsewhere, and it’s traditionally eaten either in a wrap or bread or on a plate with salad and rice. Mugla simit is very similar to regular simit, except in this case, they’re larger and super-soft. You can find both of these things in Marmaris, along with all the other delicious Turkish dishes you might already know and love.

Marmaris Marina, in particular, is famous for its traditional fish restaurants that line the walkway. You’ll see different types of seafood displayed outside in a display fridge, and the friendly staff will be more than happy to talk you through your options. Here, you can try the famous fresh fish and raki combination that locals love!

- Turkish Food You’ve Got To Try

15 Best Marmaris Restaurants And Eateries

When you arrive in Marmaris, you’ll notice very quickly that there are countless restaurants to try. Just like everywhere in the world, some restaurants are better than others, so knowing beforehand where to go is a major help.

Many restaurants tend to serve the same thing, e.g., burgers, chips, pizza, etc, but if you want something different and more authentic, you won’t struggle to find it. From my years of experience in eating in Marmaris, I’ve come up with 15 of the best spots across Marmaris and Icmeler.

Happy eating!

1. Cihan Ocakbaşı – My Pick For The Best Restaurant In Marmaris

Siteler, Barbaros Cd. No:2, 48700 Marmaris/Muğla

Cihan is one of the most famous restaurants in Marmaris, and it’s not by accident – it’s also one of the best. Both locals and tourists flock here all year round, and it’s a very tourist-friendly way to try authentic kebabs and meze .

The menu may be small, but what they do serve is done to perfection, and while you’re sitting and enjoying, you can watch the open kitchen grilling meat and making bread from scratch. This restaurant is also relatively low-cost compared to many others in the area, but they certainly don’t sacrifice quality.

Cihan serves traditional kebabs, such as Adana, Urfa, chicken or lamb şiş, çop şiş, and a variety of casseroles. They also have an extensive list of meze to try, and they also serve alcohol, including raki and local beers. If you have a sweet tooth, try their kunefe, which is one of the best in the area.

2. Ida Restaurant – You Won’t Be Disappointed

İçmeler, Kenan Evren Blv. No:17, 48720 Marmaris/Muğla

Over in Icmeler, you’ll find Ida Restaurant, a firm favorite amongst regular visitors to the area. Ida doesn’t have dancing entertainment or loud music. Instead, it’s a chilled-out ambiance with tasty food and fantastic drinks . In fact, the cocktail menu here is seriously top quality – try their apple mojito; it’s the best I’ve ever had.

The diverse menu at Ida is quite large, but they don’t do anything bad. You’ll find a range of international dishes, including steaks, but they also do traditional food, such as testi kebab, and a large range of fish dishes.

Ida might not be the cheapest restaurant in Marmaris, but it’s certainly not the most expensive either. The quality of food makes it more than worthwhile, and the staff are super helpful and friendly. They also have a new tapas bar which has recently opened next door, so give that a try if you’re into Mediterranean tapas.

3. Town Steakhouse – Good Value For Money

Içmeler, 75. Yıl Cd. 208.Sokak, 48720 Marmaris/Muğla

This restaurant is one of the newest additions to the gastronomical scene is Town Steakhouse, and they certainly had a fantastic first year in business. Located in Icmeler’s Old Town, you’ll definitely need to reserve a table during high season as they’re regularly full up.

The reason they’re so busy is quite obvious – the food is seriously high quality, and the presentation is something else entirely. They also have a sumptuous cocktail menu that is reasonably priced and good quality, and again, the presentation is on another level.

I’d recommend the sharing platter for starters as it gives you a little bit of everything and has a real Mediterranean flare with calamari, different dips, borek, and salads. This restaurant is particularly famous for its steak dishes, and they’re massive. You really do get value for money here.

4. Ege Barbekü – Best Steak Restoran In Town

Hatipirimi, 148. Sk. No:7, 48700 Marmaris/Muğla

Ege is another ocakbaşı-style restaurant that serves kebabs, and many locals head there to watch football, drink raki, and socialize. However, it’s definitely not a sports bar as this restaurant is high quality and offers indoor and outdoor decking area. They’re also open all year round.

The meze menu is extensive and offers something for everyone, while the mains menu provides a range of meat dishes that many other similar restaurants in the area don’t offer. For instance, this is the only place in Marmaris that I know of serving the most delicious steak cooked in butter (tereyağlı lokum). It really will knock your socks off, but even if that’s not for you, there is a huge range of other dishes to sample.

You’ll notice many locals heading to this restaurant for celebrations, such as birthdays, and that should tell you a lot about how good this place is.

5. Bono Good Times Beach – Best Seaside Location

Çıldır, 207. Sk. No: 4/C, 48700 Marmaris/Muğla

If you’re after a beachfront location, it has to be Bono Beach. This is a high-quality, high-end spot that also offers sun loungers and a free beach during the day. At night, a live band or DJ plays chilled-out music, and you can sit and watch the sunset and the moon appear over the sea. It’s a really tranquil place, and it’s no wonder that it’s a favorite amongst locals and tourists.

Bono Beach is a classy option, and that shows in their menu. You’ll find mostly international dishes here, but they’re served wonderfully well, and even the burgers are the gourmet variety. The pasta dishes at Bono are wonderfully flavourful, and if you’re into cocktails, the menu is large and of excellent quality.

Bono has a sister restaurant on the marina, so if you like your meal at the beach restaurant, head down to the marina to compare.

6. Pideci Mehmed – Try This Place For Lahmacun

Photo Credit: Pideci Mehmed

Hatipirimi, İnönü Cd. No.19, 48700 Marmaris/Muğla

Pide and lahmacun are two of my favorite Turkish dishes, and Pideci Mehmed is definitely the best place to try them. Basically, if you’ve never had pide before, it’s a flatbread that comes with many different fillings, and it’s shaped like a boat and then cut up into slices.

You can try all different versions, including meat and peppers (kuşbaşılı pide), minced meat (kiymali), cheese and spinach, cheese and egg, and chicken with peppers. Pideci Mehmed place has a large selection of different sides to try, and it’s a relaxed spot where you can call in, order, wait, and then eat with your hands. It’s totally chilled out, and that’s ideal after a day on the beach.

Lahmacun is often called Turkish pizza, but it’s not like pizza at all. This is a thin and crispy base that is covered in minced meat, peppers, onions, and spices, and you eat it rolled up with a little salad inside, smothered in freshly squeezed lemon juice. Again, Pideci Mehmed does the best lahmacun in my eyes.

7. Taj Mahal – Asian Cuisine

Siteler, Karacan plaza Taj mahal rest, Kemal Seyfettin Elgin Blv., 48700 Marmaris/Muğla

Sometimes in life, you crave a delicious Indian meal, and if you’re in Marmaris, you’ll definitely find one. Taj Mahal serves some of the best Indian food I’ve ever had, and that’s saying something, considering it’s from Turkey! The chef at this restaurant is from Bradford, India, which is known to have a sizeable Indian community. The spices are also imported directly from India itself.

The set menu is excellent value, and you can choose from starters, a main course, rice, naan, and a drink for one complete price. Alternatively, you can pick and choose what you want from a large selection of authentic Indian dishes. The starters are my favorites here; I love the poppadoms and pickle tray, and the onion bhajis are divine.

During the summer months, the Taj Mahal is very busy indeed, and it is probably a good idea to book a table if you want to sit upstairs on the outer deck, where you can look over the busy streets below as you enjoy delicious food. This is definitely the type of food that you’ll need to lay down after!

8. Queen Steakhouse & Fish – Serves A Generous Breakfast Plate

Sarıana, Sarıana Mah. M.Münir Elgin Bulvarı, Netsel Marina No:38-8 D:2, 48700 Marmaris/Muğla

If you’re celebrating a special occasion or you want to enjoy a high-end meal with amazing surroundings, it has to be Queen Steakhouse & Fish. This restaurant is located at the far end of the marina, overlooking the entire bay, right over to Icmeler. On a clear day, you can see for miles.

The restaurant is known for its top-quality food, and while it’s definitely not the cheapest place to go, it’s more than worth it if you want to splurge. Queen offers fantastic steaks and they have a large fish menu on offer. This is one of the best restaurants to enjoy a full Turkish breakfast as you overlook the massive yachts in the harbor.

If you’re visiting with children, they also have a large children’s menu and an outdoor seating area where you can enjoy the chilled-out ambiance.

9. Samdan Restaurant – Great Meals If You Are Homesick

Siteler, Cumhuriyet Blv. No:21, 48700 Marmaris/Muğla

If you’re a steak lover, Samdan is an excellent choice. Located in the Siteler neighborhood, this restaurant is very close to some of the larger hotels in the area, including all-inclusive. The fact that it’s very busy most nights should tell you a lot about the quality of food in those hotels!

Samdan has nightly entertainment with music and dancing, but it’s not too over the top and doesn’t start until around 10 pm. That means you can enjoy your meal without too much fuss going on around you. They also show all sports on TV, which might be an important factor for you.

Food-wise, this restaurant does a huge range of meat dishes, but they also cater to vegetarians. The menu is generally international, but their casseroles are very traditional and extremely delicious. The drinks menu is pretty good, and they offer two-for-one cocktails during the peak summer months.

10. Kerem’s Plate (Previously Karem Restaurant) – Local Food And Service

İçmeler, Osmangazi Cd. No:30, 48720 Marmaris/Muğla

You won’t find a huge amount of authentic Turkish cuisine in Icemler, but Kerem’s Restaurant is a shining light in the middle of many restaurants serving international fare. This is a family-run restaurant that offers traditional dishes, including meat skewers, guvec, casseroles, and amazing desserts.

The restaurant is located on the canal just before the beachfront and offers a cozy place to enjoy a meal. They don’t play loud music, even if the restaurants around do, and the ambiance is chilled out and really enjoyable.

Kerem is a firm favorite among those who visit Icmeler regularly, and it has an excellent reputation for a reason.

11. Sevgiyolu – Quick Service

Kemeraltı, Hasan Işık Cd. NO:14 Z/1, 48700 Marmaris/Muğla

For traditional kebabs, Sevgiyolu is a wonderful choice. They also do fantastic pide and lahmacun and come a very close second to Pideci Mehmed. This is the only place in Marmaris that does a good Manisa kebab, and if you’ve never tried it, I highly recommend you do!

Sevgiyolu is a more laid-back kebab spot compared to the larger ocakbaşı restaurants. They also do a roast beef roast on Sundays during the summer months if you’re missing your roast at home!

Again, this is another place that locals love, and you’ll notice their delivery drivers leaving with orders all the time. The menu is pretty large, so you’re sure to find something you like, but don’t be afraid to try something new, as you’ll find a lot of authentic dishes here.

12. The Love Boat – One Of The Top Fine Dining Restaurants

İçmeler, Cumhuriyet Cd. No:26, 48700 Marmaris/Muğla

If you ask anyone who lives in Icmeler, where the highest quality spot is, they’ll probably tell you about The Love Boat. This is high-end dining, and it’s somewhere that you have to try at least once.

The waiting staff are all dressed in white navy outfits, and the restaurant is themed like a boat. You can sit outside and enjoy watching the world go by, but the food is really high quality. The grilled fish and steak dishes here are sublime, and they’re presented in an exquisite way.

Again, this isn’t a cheap option, but it’s somewhere to go if you want a special night or you’re celebrating something important. During the peak summer months of July and August, it’s a good idea to reserve a table beforehand.

13. Liberty Restaurant – Excellent Service On The Seafront

İçmeler, Kayabal Cd. No:67, 48720 Marmaris/Muğla

One of the best places for a traditional Turkish breakfast overlooking the sea is Liberty Restaurant. This is another spot located in Icmeler, and they’re also a great place if you’re looking for traditional Trabzon pide – they’re huge, juicy, and totally delicious!

This restaurant has a jetty that goes out over the sea, and they also have a free beach to use if you’re buying drinks and food throughout the day. The breakfast here is large and extensive, allowing you to try lots of different breakfast dishes you might not have had before.

The lunch menu offers regular items such as burgers, pizzas, and baguettes, but the evening menu is a lot more extensive and features fish, steaks, and authentic Turkish dishes.

The evening vibe here is really chilled out, and with the lack of loud music and entertainment, it’s a terrific place to wind down.

14. O’Yes Restaurant – Pleasant Atmosphere

Tepe, Barbaros Cd. Yat Limanı No:9, 48700 Marmaris/Muğla

O’Yes has been around in Marmaris for many years, and it’s a firm favorite with plenty of repeat customers. The menu is shown in several different languages, and they offer breakfast, lunch, and dinner choices.

This restaurant is located towards the beginning of the marina and has one of the most beautiful views over the beachfront and beyond. The staff here are very experienced and helpful, and it’s also a renowned place to enjoy sunset drinks, with an extensive cocktail menu.

The lunch menu is great, and they’re famous for their Mexican baguettes – definitely try it! The evening menu is a lot larger and offers international and local dishes, including plenty of choices for vegetarians.

15. Memed Ocakbaşı – Warm And Friendly Team

Sarıana, 20. Sk. No: 2 D:4, 48700 Marmaris/Muğla

Our final choice is another top-quality place to try kebabs and meze. Memed Ocakbaşı is always busy with local people and tourists, and it’s a great place to relax and enjoy a grand meal and a few drinks.

The restaurant’s décor is really impressive, with plenty of greenery, old-fashioned photos on the walls, and several rooms to make the entire restaurant seem much bigger than it really is. You can also go to the kitchen front and choose the meat you want, with the staff more than happy to help you decide.

This is a fantastic place to enjoy raki and kebabs. However, it’s also a very family-friendly place with a large children’s menu and a relaxed vibe inside. This is the sister restaurant of Pideci Mehmed, so it goes without saying that their pide is also of excellent quality.

16. Golden River Steak House – Big Portions

Nestled in the heart of the Marmaris district, Golden River Steak House is a gem for meat lovers and is often cited as one of the best restaurants in Marmaris.

This spot is all about quality and taste, specializing in big portions that don’t skimp on flavor. The menu includes a variety of meats, such as salami, pepperoni, and premium steaks, all cooked to perfection.

The atmosphere is warm and welcoming, with great service that makes you feel right at home. Prices are acceptable, ensuring you get value for your money. It’s the kind of place where you can find something to satisfy everyone, making it a must-visit for those seeking the best of the best in steak dining options in Marmaris.

17. Ricky’s Chippy

For those craving a taste of British cuisine in Marmaris, Ricky’s Chippy is the go-to spot. Specializing in the classic fish and chips, this eatery offers a slice of home with its authentic flavors and big portions.

Located conveniently in Marmaris, Ricky’s Chippy has become a favorite among both locals and tourists for its friendly atmosphere and quality dishes. The menu also includes other British favorites like sausage, making it easy to find something to satisfy your cravings.

Prices are acceptable, and the service is friendly, ensuring a pleasant dining experience for all who step through its doors.

Move This Adventure To Your Inbox & Get An Instant Freebie

No spam. Unsubscribe at any time.

Brands We Use And Trust

Top restaurants in marmaris faqs, what types of cuisine are available in marmaris.

Marmaris offers a wide variety of culinary delights to suit all tastes. You can find traditional Turkish dishes, including kebabs, mezes (appetizers), and fresh seafood. Additionally, there are international cuisines available, such as Italian, Indian, Chinese, and more. You’ll be spoiled for choice!

Are there any vegetarian/vegan-friendly options?

Yes, Marmaris has many restaurants that cater to vegetarian and vegan diets . They offer delicious plant-based dishes made with local ingredients. Do not hesitate to ask the staff for specific vegetarian or vegan options; they will be more than happy to assist you.

Where can I find the best seafood restaurants in Marmaris?

Marmaris is known for its fresh seafood. The marina area is a top place to find excellent seafood restaurants. You can enjoy a variety of fish, shrimp, calamari, and other delicious marine delights while enjoying a scenic view of the harbor.

Can I find budget-friendly restaurants in Marmaris?

Absolutely! Marmaris has a range of eateries to suit different budgets. From small local cafes serving tasty Turkish street food to casual dining restaurants offering affordable meal options, you will find something that fits your budget.

Are there any restaurants with a romantic ambiance?

Yes, Marmaris offers a variety of intimate and romantic dining spots. Many waterfront restaurants provide a stunning setting with sunset views or cozy candlelit tables. These establishments are perfect for a romantic dinner with your loved one.

Do I need to make a reservation at popular restaurants?

While not always necessary, it is advisable to make a reservation, especially during peak tourist seasons. Popular restaurants can get busy, and having a reservation ensures you have a table when you arrive.

Are credit cards accepted at most restaurants?

Yes, most restaurants in Marmaris accept credit cards. However, it is always a good idea to carry some cash, as a few smaller local eateries may only accept cash payments.

Can you recommend any must-try dishes in Marmaris?

When in Marmaris, don’t miss out on trying some local favorites such as Turkish pide (a flatbread topped with various ingredients), doner kebabs, Turkish breakfast (kaval), and baklava (a sweet pastry made with layers of filo, nuts, and honey).

- Beautiful Beaches In Marmaris

- Marmaris Vs. Antalya – How To Choose

- Luxury Resorts On The Turkish Coast

- Best Beach Towns In Turkey

- Why You Should Visit Marmaris

- Top Things To Do In Marmaris

- Marmaris Or Bodrum – How To Choose

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Subscribe To Unlock Your FREE Customizable Travel Packing List & All Our Best Tips!

Unlock Your FREE Customizable Travel Packing List!

Subscribe Now For Instant Access To Stress-Free Packing

- Things to Do

- Attractions

- Excursions in Marmaris

- Excursions in Icmeler

- Excursions in Turunc

- Water Sports

- Restaurants

- Airport Transfer

- Mobility Scooter

Marmaris Turkey

Updated information 2023 - hotels - things to do - airport - attractions - shopping - restaurants - night life - reviews & more ....

Best Travel Agents

Full List of Excursions

Unbeatable Prices

Easy Booking

Marmaris Yuvarlakcay Tour

Marmaris White Tour

Marmaris Turkish Bath

Marmaris Jeep Safari Tour

Swim with Dolphins in Marmaris

Marmaris Ephesus Day Trip

Marmaris Akyaka Tour

Marmaris Fethiye Tour

From a small fishing village, Marmaris has grown into a popular resort destination in Turkey during the recent years. A holiday to Marmaris becomes even more rewarding and a thrilling experience if you can manage to visit some of the interesting places around this beautiful holiday resort. We always recommend excellent tour packages to take you around Marmaris. Here are some interesting local tours which you can enjoy when you visit Marmaris Turkey

Marmaris Attractions

Explore Marmaris Turkey

Popular Attractions in Marmaris

Answers like How & When ?

Hints & Tips

Ataturk Statue Marmaris

Dancing Fountains Marmaris

Heaven Island Marmaris

Grand Bazaar Marmaris

Marmaris Museum

Icmeler Beach

Marmaris Beach

Nimara Cave Marmaris

There’s no doubt that Turkey is a haven for tourists, especially those who are coming from Europe and Middle East. The country is interestingly found between these two continents. Most often people visit here to see how the intermarriage between Oriental and European cultures affects the society and way of living of its people, among others. Here is the list of all attractions that Marmaris has got for you.

Marmaris Turkey – Enjoy A Memorable Holiday Experience

Vibrant nightlife, exciting activities, white-sand beaches and lots of remarkable family-friendly attractions – the list of things to see and do in Marmaris is endless. Holidays to Marmaris are never one-paced. With a spectacular coastline providing stunning views and a mountainside covered with beautiful pines, there is no better Turkish destination to be than Marmaris. Regardless of your reasons for visiting Marmaris, be it for relaxation, cruising, going beneath the waves, or enjoying panoramic views of Marmaris from several hundreds of feet high, the beautiful resort town has what you’re looking for and in abundance.

Generally, Turkey features beach friendly temperature. Wherever you are in the country, expect hotter temperatures around late March. And by July, expect the temperature to be extremely hot. Additionally, summer months usually offers 12 hours of sunlight daily. The same applies to Marmaris.

Marmaris is a perfect destination worth visiting all year round; hence there is actually no best time to visit. However, summer months attracts a much large crowd who come for a fun-packed holiday in the sun. No matter the time you visit, you’ll find what you’re looking for.

As one of Turkey’s busiest resort, Marmaris primary attraction lies in its beaches. Its long stretch of beaches along the coast is filled with locals and tourists alike who come to sunbathe. Not only that, the beaches make for a perfect spot for some great water sports activities such as parasailing, scuba diving, fishing, and swimming. For luxury vacation experience, climb aboard a yacht cruise.

Marmaris is a perfect destination for a wonderful family holiday. The Uzan Yali Beach offers plenty of space for kids to build sandcastles and take a dip in the waters. Other family-friendly beaches in Marmaris include the nearby Olu Deniz or Cleopatra Island. If you’ve had enough of the beaches in Marmaris, get aboard a boat and head for the beaches in Icemeler. Shopping

In between enjoying the many water sports activities, and savoring the thrills of your vacation in Marmaris, take some time to try out some shopping. Marmaris is home to many great shopping facilities, markets and local stores. Shopping is without doubt one of the finest things to do in Marmaris. Remember to sharpen your bargaining skills. Things to find include locally made onyx vases, bowls and ashtrays, Turkish clothes, mosaic lanterns, shoes, jewelry and many more.

Indeed, Marmaris offers a variety of products for visitors. Among the popular shopping centers in Marmaris is the Marmaris Grand Bazaar, also known as Carsi Market. Shopping hours are from 9am to 10pm. And during peak season, most local stores stay open till after 10pm.

- +90 552 665 37 80

Marmaris tours and excursions

Marmaris tours offer a kaleidoscope of experiences for adventurers and leisure seekers alike. Our Marmaris tour organization ensures seamless journeys with a plethora of options. From captivating Marmaris excursions to invigorating day trips, we curate unforgettable experiences tailored to your preferences. Enjoy the enchanting landscapes and vibrant culture with our meticulously crafted tours from Marmaris. See hidden paradises and must-see attractions the myriad of things to do in Marmaris. Whether it's cruising along the azure waters or delving into historical sites, Marmaris beckons with endless possibilities. Trust Tour Maris travel agency to navigate you through the myriad activities in Marmaris, ensuring every moment is filled with wonder and excitement.

Marmaris tours and excursions 2024

Paragliding in Marmaris

Skydiving in Marmaris is a unique opportunity to see all the beauties of the region from a bird's eye view. We offer you an excellent opportunity to v ...

Aqua Dream water park in Marmaris

Aqua Dream water park in Marmaris is perfect for those who like a lot of adrenaline rush. Well, and where, if not in the water, you can freshen up eve ...

Atlantis Water Park in Marmaris

Atlantis Water Park in Marmaris is the best choice for outdoor enthusiasts. We present to your attention the Atlantis Water Park tour in Marmaris. Thi ...

Buggy safari in Marmaris

Buggy Safari in Marmaris is a great way to spend a weekend. Buggy safari is ideal for those who lacked new sensations and a quick off-road trip in the ...

Diving in Marmaris

Scuba diving in Marmaris is for you if you are a lover of new and exciting experiences. This excursion is perfect for lovers of the marine flora and f ...

Dolphin show in Marmaris

The Dolphin show in Marmaris is an adventure that will give absolute delight not only to children but also to adults. We all know about the wonderful ...

Jeep safari in Marmaris

Jeep safari in Marmaris is very popular among tourists. The whole jeep safari trip lasts about seven hours but will be very fun and exciting. This tri ...

Quad bike safari in Marmaris

Quad bike safari in Marmaris are the best way to diversify your fun vacation and get to know the beauties of Turkey's nature while driving a powerful ...

Night foam disco on a yacht in Marmaris

Night foam disco on a yacht in Marmaris is the incendiary chords of modern European music, a light show and a charge of fun that everyone definitely n ...

Ferry to rhodes from Marmaris

Ferry to Rhodes from Marmaris - an excursion that will allow you to feel the culture and customs of Greece. Touch history, ancient myths, and legends ...

Pirate yacht in Marmaris

Pirate yacht in Marmaris is ideal for lovers of sea trips. Our animation team will create an atmosphere of lightness and fun for you. The huge vessel, ...

Swimming with dolphins in Marmaris

Dolphin therapy has an unusually miraculous effect on the human body. Swimming with dolphins in Marmaris is always ready to receive guests who love ne ...

Horse riding in Marmaris

Horse riding in Marmaris is one of the most popular excursions in Marmaris. While riding horses, you will enjoy communicating with these amazing anima ...

Rafting in Marmaris

Rafting in Marmaris will help everyone to challenge themselves and test the strength of their willpower. Memories of the trip will remain in your memo ...

Fishing in Marmaris

Fishing in the Aegean Sea is one of the most popular and interesting activities for outdoor enthusiasts. While spending your holidays in Marmaris, we ...

Merging of the two seas in Marmaris

The union of two seas in Marmaris is a great option for those who have always dreamed of visiting one of the most amazing places in Turkey. Spend your ...

Snorkeling in Marmaris

Marmaris snorkeling is an excursion that will give you a lot of positive emotions and impressions. All you need to snorkel in Marmaris is the desire a ...

Tour to Rhodes from Marmaris

Rhodes from Marmaris is a great trip that will brighten up your holiday. During the excursion to Rhodes from Marmaris, you will be able to choose a re ...

Turkish bath in Marmaris Ottoman

The Turkish bath in Marmaris is a must for every tourist if you want to get to know the cultural traditions of Turkey. We offer you a Turkish bath tou ...

Turkish night in Marmaris

Show Turkish night in Marmaris is a great start to get acquainted with the culture of our country, an opportunity to get closer to the people and get ...

Vip hamam in Marmaris

The VIP-hamam program differs from the usual one in the first place, by a huge number of additional procedures. After the main massages, you are given ...

Hamam in Marmaris

Turkish bath in Marmaris is a must visit for every tourist who wants to relax body and soul. We bring to your attention Hamam Armutalan in Marmaris. T ...

Aegean Islands from Marmaris

The Aegean Islands will be a good option to diversify your holiday in Marmaris. During the whole walk you can enjoy wonderful views of the sea and nat ...

Excursion to Dalyan Köyceğiz from Marmaris and crab fishing

A tour to Dalyan from Marmaris and crabbing has always attracted all tourists with its extraordinary archeological monuments and crystal clear beaches ...

Dalyan tour from Marmaris

Tour Dalyan from Marmaris will be a great opportunity to get acquainted with the nature of Turkey. A pleasant climate, picturesque landscapes and comf ...

Marmaris to Cappadocia

Excursion from Marmaris to Cappadocia is perfect for you if you really want to immerse yourself in the fascinating world of Turkish culture and histor ...

Pamukkale from Marmaris

Pammukale from Marmaris is an excursion that will give you a lot of positive emotions, a boost of strength and vivacity. You will pass to the snow-whi ...

Istanbul from Marmaris

Excursion to Istanbul from Marmaris will begin with a visit to memorable places such as the palace of Sultan Mehmed, which in ancient times of the Ott ...

Fethiye from Marmaris

An excursion to Fethiye from Marmaris and the Valley of the Butterflies from Marmaris will not leave anyone indifferent, because it includes a visit t ...

Ephesus from Marmaris

Ephesus tour from Marmaris is ideal for history buffs. Among the well-preserved sights of Ephesus, we recommend that you pay your attention to the Tem ...

_16052632955fae5fbf93263.jpeg)

Cleopatra Island from Marmaris

Cleopatra Island excursion, which takes place on a huge yacht with outdoor areas, tables and sunbeds. The yacht will take you straight to the island. ...

Ephesus and Pamukkale from Marmaris

Ephesus-Pamukkale from Marmaris is a two-day excursion that is perfect for anyone who is interested in the history and nature of Turkey. The advantage ...

Rent Yacht in Marmaris

A private yacht in Marmaris provides an amazing opportunity to feel truly free and explore the unexplored corners of nature that hides the fabulous Ae ...

Go Karting in Marmaris

Marmaris karting excursion is suitable for any tourist age group. In order for you to find the control of the car, you absolutely do not need a driver ...

THE TOP Marmaris Tours

Marmaris local travel agency Tour Maris has created this website to help any tourist find a suitable excursion in Marmaris and perfect their vacation in our city. We wish you all a pleasant stay in Marmaris Turkey!

Boat trips in Marmaris from the organizer

If you adore the sea, which beckons with its beauty and freshness, then sailing on a yacht or a pirate ship is perfect for you. Don't miss the chance to enjoy excursions in the Mediterranean and the Aegean Sea in one day

Private excursions in Marmaris from Tour Maris

An individual excursion will be a good option for couples or family holidays because it will be selected especially for you. The tour program is made in your opinion. All excursions in Marmaris with affordable prices

Excursions by plane from Marmaris.

Excursions by plane from Marmaris, A tour to Istanbul will be a great way to diversify your stay in sunny Turkey. In just one day, you can see all the beauty of this city and see a huge number of historical sites. In the morning you will be picked up directly from the hotel and taken to the airport, upon arrival our professional Russian-speaking guide will meet you and accompany you throughout the trip. In Istanbul, you can visit Sultan Mosque, Hagia Sophia, Topkapi Palace, and much more. Choosing excursions from Tour Maris you will always be provided with everything you need and the trip will be as comfortable as possible. With prices for an excursion to Istanbul, you can in the goods tab or write to our manager

Overnight excursions from Marmaris

Overnight excursions from Marmaris, An excellent option to get to know the natural beauty of the Turkish region would be a tour of the amazing Cappadocia. Our company will provide everything you need for your comfort and safety. You will be picked up directly from the hotel by comfortable transfers and we will set off on our journey. The tour price will include breakfasts, lunches, dinners, accommodation in beautiful hotels, guide services, and of course your health insurance. Also, for a separate cost, you can give yourself the most unforgettable flight in a bright hot air balloon. We strongly recommend that you visit a colorful excursion to Cappadocia with an overnight stay from Marmaris.

Private yacht tour in Marmaris

private yacht tour in Marmaris will be one of the best memories of your life. A beautiful yacht will take you on a wonderful Mediterranean cruise. You can arrange a pleasant date for your significant other or have a noisy birthday party. We will prepare everything, especially for you, taking into account any preferences. Also, to arrive on the yacht, a VIP class car will pick you up and deliver you directly to the pier. The yacht itself has everything for the most ideal holiday: a huge number of sun loungers, a bar, and any kitchen you like. The route will be designed according to any of your preferences, we will be able to visit a huge number of picturesque bays, where you can dive directly from the yacht.

Payment on the day of the tour. Our excursions from Marmaris will give you a great mood!

- Things to Do Guide

- Top 10 Attractions

- Places to See Guide

- Top 10 Sights

- Charming Places

- Eating Out Guide

- Shopping Guide

- Nightlife Guide

- Things to Do with Kids

- Daily Tours & Excursions

- Daily Boat Trips

- Day Trips from Marmaris

- Outdoor Sports & Nature

- Water Sports

- Old Town, Harbour, Marina

- Marmaris Castle & Museum

- Beaches Day Out

- Water Parks

- 4×4 Off-Road Safari

- Quad & Buggy Safari

- Scuba Diving

- Turkish Bath (Hamam)

- Best Restaurants

- Best Nightclubs

- Day Trips Master Guide

- Dalyan, Turtle beach, Mud Baths

- Dalyan & Koycegiz by Bus

- Cleopatra Island & Beach

- Traditional Village Tour

- Pamukkale Hot Air Balloon Tour

- Pamukkale Day Trip

- Ephesus Day Trip

- Ephesus and Pamukkale 2-Day Trip

- Boat Trips Master Guide

- Daily Private Boat Rentals

- Cleopatra Island Boat Trip

- Dalyan Boat Trip

- All Inc. Boat Trip

- Davy Jones Pirate Boat Trip

- Mega Diana Boat Trip

- Aegean Islands Boat Trip

- Night Cruise & Party Boat

- Turkey Blue Cruise Guide

- Chartering Yachts & Gulets

- Gulet Types & Prices

- Best Luxury Gulets

- Best Standard Gulets

- Yacht & Gulet Charter

- Cabin Charter

- Best Blue Cruise Itineraries

- Yacht Clubs

- Master Guide

- central Marmaris

- Sogut & Taslica

- Top Rated Hotels

- Top Rated Apartments

- Cheap & Budget Hotels

- Camping & Glamping

- About Marmaris

- Festivals & Events

- Public Transportation

- Dalaman Airport Guide

- Airport Transfers

- Rhodes Ferries

- Car Rentals

- Property Guide

- Plans and Maps

- Uselful Numbers

Whether you want to spend your entire holiday dining on steak or chips or fancy something traditionally Turkish, you’ll find this and all manner of other cuisines in this highly developed holiday resort.

Best Areas & Zones

Marmaris bazaar and marmaris castle.

The Marmaris Bazaar and the area around Marmaris Castle are among the regions that make dining enjoyable with their historical atmosphere and lively environment. In this area, you can find restaurants offering some of the finest examples of Turkish cuisine.

In the small restaurants within the Bazaar, you can taste delicious kebabs, döner, and olive oil-based mezes. Additionally, there are many patisseries and dessert shops where you can try traditional Turkish sweets.

The cafes and restaurants around Marmaris Castle offer a historical atmosphere and the opportunity to dine with stunning views. You can enjoy seafood against the backdrop of the castle or try the delicious flavors of Mediterranean cuisine. Many of the restaurants in this area offer romantic dinners with live music in the evenings.

No Regrets Booking Advice

Along marmaris promenade and coastal road.

Marmaris Promenade and Coastal Road are perfect places to take a pleasant break while walking and enjoy a meal with a sea view. The cafes and restaurants lined up here cater to all tastes with their extensive menu options. After a morning walk along the coast, you can have breakfast at the cafes offering freshly squeezed fruit juices and various breakfast options.

For lunch and dinner, you can enjoy fresh fish and seafood at the seaside restaurants. Calamari, shrimp, and sea bass are among the tastiest dishes in Marmaris.

Additionally, there are various restaurants offering flavors from Italian, French, and Asian cuisines along the Promenade. The places along the Coastal Road are ideal for a pleasant dinner while watching the sunset.

Netsel Marina Area

Netsel Marina is the area where Marmaris’s most luxurious and stylish restaurants are located. It is an excellent choice for those who want to dine with a view of the yacht marina. The restaurants here offer a wide range of world cuisines. Especially the restaurants specialized in seafood and gourmet dishes stand out with their quality service and elegant atmosphere.

You can enjoy coffee and light snacks throughout the day at the cafes in the Marina. In the evening, these places, ideal for a romantic dinner, stand out with their sea view and calm atmosphere. Netsel Marina is also a preferred area for special occasions and celebrations.

Uzunyalı Area

The Uzunyalı area, with one of the longest beach strips in Marmaris, offers both sea and dining pleasure. This area hosts many restaurants and cafes where you can enjoy delicious meals with a sea view after a day at the beach. The venues lined up along the coast offer flavors from various cuisines and cater to all tastes.

In Uzunyalı, you can start your day with fresh fruit juices, breakfast platters, and Turkish coffee at the seaside cafes for breakfast. In the afternoon, after a pleasant time at the beach, you can prefer cafes offering sandwiches, salads, and seafood for a light lunch.

Uzunyalı is also ideal for dinner. You can have a romantic dinner at the seaside restaurants while watching the sunset. The restaurants here offer a wide range of Aegean and Mediterranean cuisine as well as international dishes.

There are also restaurants where you can taste the traditional flavors of Turkish cuisine. Many restaurants in Uzunyalı also offer live music and entertainment programs in the evenings, allowing you to have a pleasant time after dinner.

Armutalan and Siteler Area

The Armutalan and Siteler areas have ideal places for those who want to experience more local and authentic food in Marmaris. The restaurants in these areas especially offer some of the best examples of Turkish cuisine. Dishes such as lamb tandir, meat stew, and various mezes are among the must-try foods here.

The Siteler area also stands out with more modern cafes and fast-food options. Here, you can find international chain restaurants as well as local businesses.

Armutalan offers places where you can have a pleasant family meal in a more peaceful and calm environment.

Icmeler Area

Icmeler , located near Marmaris, offers a calmer and more peaceful atmosphere. Dining in Icmeler provides a pleasant experience with a sea view. The restaurants along the coast particularly offer delicious examples of seafood and Mediterranean cuisine.

In the mornings, you can have a light breakfast at the seaside cafes and enjoy freshly squeezed fruit juices. For lunch and dinner, you can try fresh fish, mezes, and olive oil-based dishes at the seaside restaurants.

İçmeler is also an ideal place for romantic dinners and special celebrations. You can take a walk along the coast, listen to live music at various bars, and enjoy the night.

What to Eat? Turkish Cuisine

You can also choose from a wide range of Turkish mezes, kebabs, dishes based on aubergine and meat and world-famous Turkish sweets such as baklava and Turkish delight at the many Turkish restaurants and taverns.

Turkish food is largely based on that of the Ottoman Empire which remained powerful from the 13th to the 19th century. Influences of Persian, Central Asian, Middle Eastern, Mediterranean, Caucasian and Balkan cuisines can be found in the melting pot of different cultures which is Turkish cuisine.

Common ingredients in Turkish food include lamb, chickpeas, aubergines, olive oil, yogurt, cheese, rice, pastry, spinach, potatoes, bread, tomatoes and spices and herbs such as cumin, paprika, mint and thyme.

Popular starters (mezes) include hummus (a chickpea dip), dolma (vine leaves, peppers, pumpkin or aubergines stuffed with rice and/or meat), Börek (thin layers of dough stuffed with meat, cheese and vegetables) and cacik (cucumber with yogurt, dried mint and olive oil).

Popular main dishes include Kuzu Güveç (lamb casserole), olive oil-drizzled lamb kebabs, köfte (meatballs made from minced meat, parsley, bread-egg, onion and spices such as cumin, oregano, mint, garlic and pepper.

Vegetarian dishes include fried aubergine and pepper served with yogurt and garlic, Rice pilaf (rice with white beans, lentils, chickpeas, black-eyed peas and vegetables) and Mücver (grated courgette/squash with egg, onion, dill and cheese, fried or oven cooked).

Famous Turkish sweets include Turkish delight, baklava (pistachios or walnuts sweetened and wrapped in sweet pastry), lokma (fried dough dipped in syrup) and helva (made from sautéed semolina, pine nuts, butter, sugar and milk).

Where to Eat Cheap?

Marmaris offers a variety of dining options that cater to all budgets, including some great places for affordable meals.

If you eat where the locals eat, than it is cheaper. You can keep it cheap and tasty at the many fast food restaurants which serve everything from burgers to kebabs, or have a pie or pasty at one of the British pubs.

Here are a few suggestions on where to eat cheaply in Marmaris:

Local Lokantas and Kebab Shops

Local lokantas (small, casual restaurants) are a great place to find affordable and delicious Turkish food. These family-run establishments offer a range of traditional dishes like soups, stews, and casseroles. Popular options include lentil soup (mercimek çorbası), stuffed vegetables (dolma), and various types of kebabs.

Kebab Shops

Kebab shops are another excellent option for budget-friendly meals. You can enjoy doner kebabs, chicken shish, and lamb kofta at very reasonable prices. Many kebab shops also offer dürüm (wraps) which are both tasty and inexpensive.

Street Food and Markets

Street food.

Marmaris has a variety of street food vendors offering quick and affordable snacks. Simit (a type of Turkish bagel covered in sesame seeds), corn on the cob, and gözleme (Turkish flatbread with various fillings) are popular choices.

Marmaris Market

The local markets are not just for shopping; they also have food stalls where you can enjoy freshly prepared Turkish delicacies. The Marmaris Thursday Market is particularly well-known for its vibrant atmosphere and delicious street food options.

Budget-Friendly Cafes and Bakeries

There are numerous budget-friendly cafes in Marmaris where you can enjoy a light meal or snack. Many cafes offer sandwiches, salads, and pastries at reasonable prices. They are perfect for a quick and affordable meal.

Bakeries are an excellent choice for cheap eats. You can find a variety of fresh bread, pastries, and savory pies. Borek, a pastry filled with cheese, spinach, or meat, is a popular and inexpensive option.

Cheap Eats in Popular Areas

Armutalan and siteler.

These areas are known for their affordable dining options. You can find numerous small restaurants and cafes serving traditional Turkish meals at budget-friendly prices.

Back Streets of Marmaris

Venture away from the main tourist areas and explore the back streets of Marmaris. Here, you’ll find hidden gems offering authentic and inexpensive Turkish cuisine.

- ATTRACTIONS

Best of Marmaris Boat Trips

Best of marmaris day tours, best of marmaris sports, top leisure tickets, popular now, best beaches in and around marmaris (insider guide advice), marmaris castle & the archaeology museum + tickets tips, central marmaris – marmaris city centre (top attractions, sights), cleopatra island & beach (boat tours, tickets with advice), best marmaris daily tours & excursions (prices + insider advice), best daily boat trips in marmaris: top tickets & tours, marmaris to dalyan boat trip (turtle beach & mud baths), dalyan guide – turtle beach, mud baths, kaunos, top things to do & see, 4×4 off-road jeep safari in marmaris (prices with insider advice), quad & buggy safari in marmaris (prices with insider advice), don't miss, more on this topic, top 10 best restaurants in marmaris + advice, marmaris dolphin park (dolphins watch, meet & swim + prices), guide to shopping in marmaris (where & what to buy).

- Main Attractions

- Sightseeing

- Food & Drink

- Yachting & Sailing

- Towns & Villages

- Accommodation

- Best Beaches

- Kizkumu beach

- Marmaris Castle

- Dalyan Turtle Beach

- Knidos ancient City

- Pamukkale Hot Air Balloon

- Privacy & Cookie Policy

© 2010-2024 Travel Guide & Holidays to Marmaris, Turkey + Medical Tourism in Turkey

15 Unmissable Things To Do In Marmaris

Co-Founder of The Turkey Traveler. Globetrotter, Adventurer, and Frequent Traveler to Turkey!

This website uses affiliate links. For more information, click here .

The sun-kissed coastal gem of Marmaris is a popular destination in Turkey, known for its warm turquoise waters, ancient historical landmarks, boat tours, and beautiful landscapes. Needless to say, there are plenty of things to do in Marmaris for any traveler, no matter what your age or who you’re traveling with.

Although Marmaris is well known for its all-inclusive resorts and beaches, we implore you to get out and explore. In this guide, we’ve shared some of our favorite attractions in Marmaris, from incredible day trips you can take to more relaxing experiences.

Whether you’re visiting as a family, a couple, or by yourself, don’t miss out on these things to do in the area for an unforgettable time in Turkey’s southwestern coast.

Planning a trip to Marmaris last-minute?

Make sure you book your tours, places to stay, and airport transfers ahead of time to ensure availability!

Here is our recommended airport transfer in Marmaris:

- Private Airport Shuttle From Dalaman Airport To Marmaris (Best way to get to your hotel!)

Here are our recommended tours in Marmaris:

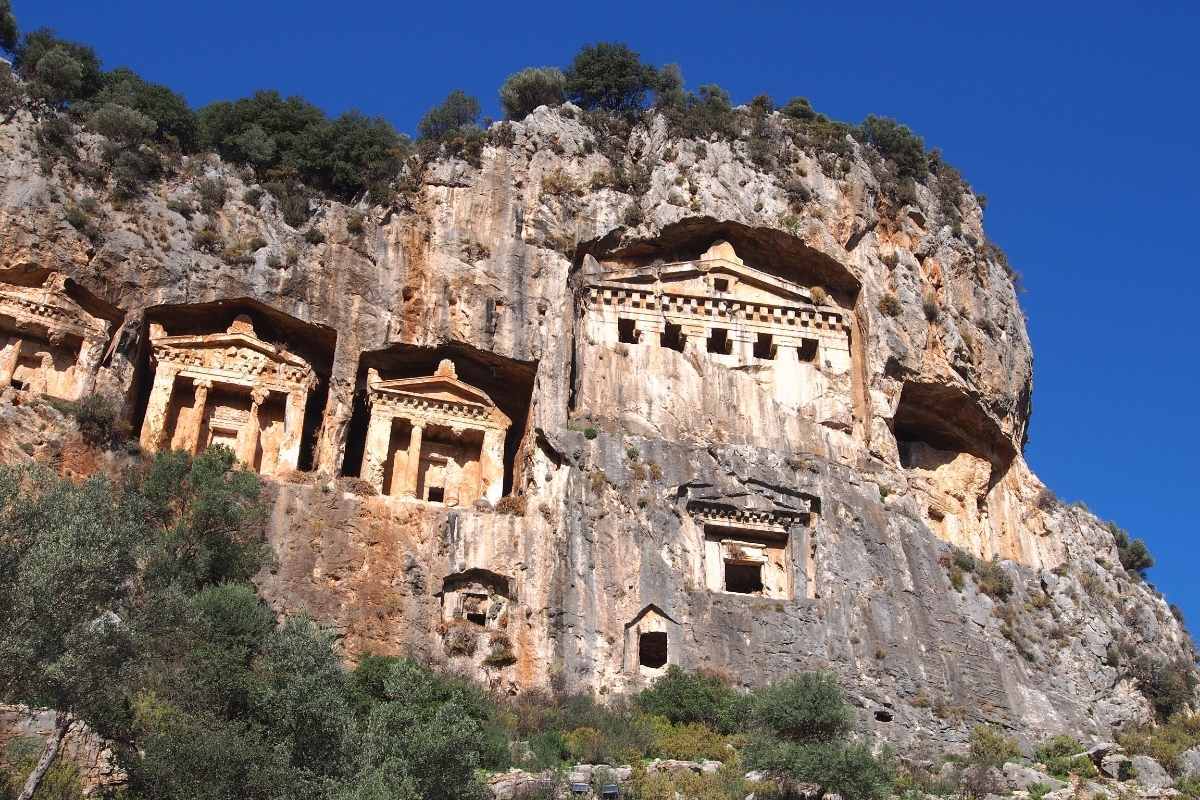

- Dalyan River Boat Cruise + Lycian Rock Tombs (Best historical attraction)

- Full-Day Trip to Ephesus (The best day trip from Marmaris)

- Marmaris Turkish Bath and Spa (Great for relaxing!)

Here are our recommended places to stay in Marmaris:

- Motto Premium Hotel&Spa (Cute beachfront hotel near the town center!)

- Liman Deluxe Hotel (Beautiful boutique hotel in the center! Not too expensive!)

- L’Olive Homes (Nice apartments in Marmaris!)

Things To Do In Marmaris

1. go back in time and visit marmaris castle and museum.

One of the most popular things to do in Marmaris is to visit the small and charming Marmaris Castle. Rumoured to have ancient origins dating back to a mind-blowing 3000BC, various civilizations have utilized this incredible fortress over the years including the Persians, Romans, and most recently, the Ottomans.

One of the most striking features of the castle, and perhaps why it was so vital to various armies, is the fact it is strategically positioned on a hill overlooking Marmaris Bay. Not only would this have been ideal in the event of an invasion, but it provides a commanding view of the surrounding area.

A bonus of visiting Marmaris Castle is that it includes a visit to the Marmaris Museum located within the castle complex. It houses a huge collection of various artifacts and exhibits from the ancient Greek, Roman, and Ottoman eras including gorgeous pottery, sparkling jewelry, ancient coins, and even stoneware and tools.

The Ottoman section of the museum was the most impressive exhibit, in our opinion, with a wide variety of weapons, uniforms, and naval equipment on display.

2. Explore the quaint streets of Marmaris Old Town (Marmaris Carsi)

Marmaris Old Town, known locally as Marmaris Carsi, is a wonderful place to simply wandering around and explore all the nooks and crannies, shop for boutiques, or relax in a cozy cafe.

These narrow, other-worldly cobbled streets are the epitome of the Mediterranean with the majority of buildings reflecting a stunning blend of Greek, Ottoman, and traditional Turkish influences. It makes for wonderfully picturesque backdrop for photos to capture on a summer holiday.

As you explore the Old Town, you’ll notice how the streets are lined with a lovely selection of local shops selling handmade jewelry, clothing, and souvenirs, and even small markets where you can haggle for sweet treats and spices.

In the evening, the once quiet streets become a buzzing center point of the city. This is when the best atmosphere for Marmaris’ Old Town can be found, once people have returned from lazying around on the beach, freshened up, and ready to roam the quaint streets in search of some fresh seafood and sip on some tasty cocktails.

3. Marvel at the Yachts at Marmaris Marina

If you’re looking for things to do in Marmaris at night, then be sure to take an evening stroll around Marmaris Marina and you’d be forgiven for thinking you were in the South of France.

The luscious tree-covered green mountains nestled in front of a deep orange sunset create a picturesque scene, and a super-impressive display of luxury yachts and boats docked up showcase why this beautiful region of Turkey is a popular favorite amongst the wealthy.

Once you’ve finished dreaming about what you will do with your lottery winnings, you can take a break at one of the many waterfront cafes and restaurants that line the Marina.

Sip on a refreshing Turkish Tea during the day, or sink an Efes or two of an evening, all whilst taking in the Marina’s unique atmosphere.

As well as treating yourself to a tasty meal or some drinks, the Marina also serves as one of the main hubs for various boat trips and excursions where you can book yourself onto a day cruise for the following day.

4. Relax on the Beaches of Marmaris

It’s not a holiday to Marmaris without spending a few days relaxing on the golden sands. There are many beaches in Marmaris and its surrounding areas, but if you want to find the most beautiful, you should opt for a day trip to Cleopatra Beach on Sedir Island.

Admittedly, Marmaris’s beaches aren’t the most picturesque beaches in the world, or in Turkey for that matter, but they are still incredibly popular during the summer months and you’d be crazy not to indulge in some sun, sea, and sand when you’re there.

Marmaris Beach is the closest to the town center, and as a result, is heaving pretty much for the entirety of summer. The sand is soft, and the waters are clear, though you will be hard-pressed to find a decent spot any time after 11 am.

If you’d like a beach that is a little more idyllic yet still close to Marmaris, then Icmeler Beach is a great choice. Set within a relatively small bay, Icmeler Beach is a hub for water sports and makes for a great day out from Marmaris itself.

Jump on a jet ski and ride the waves, gather up the troops and head out on a banana boat, or even splash the cash and parasail through the deep blue skies with unbelievable views of the beach down below.

5. Take A Dalyan River Cruise

If you’ve explored pretty much all of what Marmaris town has to offer, then why not jump on a day trip along the Dalyan River? It’s a superb way to see a lesser-visited part of the Dalyan region and you’ll see some incredible sights along the way.

The Dalyan River is a beautiful and quiet reed-lined river that provides a unique opportunity to witness several ancient Lycian rock tombs carved into the cliffs. These tombs date back hundreds of years and are the final resting place of Kings and Queens of the Lycian era, and showcase the incredible workmanship of the ancient civilizations here.

After sailing past the rock tombs, you’ll be taken to Dalyan’s iconic mud baths where you’ll be able to indulge in an incredibly therapeutic experience – covering yourself in mineral-rich mud and then letting it harden on your skin. Once the healing properties of the mud have worked their magic, take a dip into the warm thermal springs to wash away the mud and feel how soft your skin has become.

Following the mud baths, you’ll come across Iztuzu Beach, also known as Turtle Beach, because it’s a significant breeding ground for loggerhead turtles, which sometimes make an appearance by the boats if the captain throws some squid into the waters – this would arguably be the highlight of any trip along the Dalyan River, but it’s not guaranteed. We saw one for all of three seconds and it didn’t come back for another bite.

Most of the Dalyan River cruises also include a lunch on the boat or at one of the riverside restaurants where you’ll be able to enjoy a traditional Turkish meal with your new friends, savouring the delights of fresh seafood.

6. Go On A Day Trip to Rhodes, Greece

If you want to get out of Marmaris for the day, then why not head out of the country altogether and go on a day trip to the Greek island of Rhodes? Marmaris’s proximity to the island makes this entirely possible within a day.

The best way to visit Rhodes for the day is on a day tour, since they can whisk you around the highlights of the island and take you back to your hotel after.

Your adventure begins by being picked up from your hotel and then enjoy the scenic ferry journey across the Aegean, relaxing on the deck and enjoying the sea breeze. Upon arriving in Rhodes, you’ll usually have around six hours of exploration time before it’s time to head back, which is plenty of time to see the main sights.

Rhodes’ medieval old town is a UNESCO World Heritage Site and should be the first thing on your itinerary. The Palace of the Grand Master is up next, serving as the residence of the Grand Master of the Knights of Rhodes. Its medieval architecture is incredibly unique and offers panoramic views from the palace grounds.

For a spot of lunch, indulge in one of the many Greek tavernas that line the cobbled streets and sample the unique dishes of the region like moussaka or souvlaki. Mandraki Harbor is also a unique stopping point on any trip to Rhodes, with its iconic windmills and the Fort of St. Nicholas an imposing building of the island.

Before it’s time to return back to your ferry, shop for souvenirs to surprise those back home with something unique and unexpectedly Greek. On your return journey, you’ll be able to witness the gorgeous sunset dip beyond the Aegean which makes for the cherry on the cake of a busy but memorable day trip from Marmaris.

7. Splash Around Atlantis Water Park

If you’re looking for things to do in Marmaris with the kids, then a visit to Marmaris Atlantis Water Park would make for an excellent, fun-filled day out. It’s the largest water park in the city and features a wide selection of thrilling water slides, a wave pool, soft play areas for the younger ones, and even a mini golf course.

The water park is only open during the summer months from the beginning of May right through to the end of October. If you’re visiting Marmaris and haven’t rented a car, don’t worry, the water park also offers visitors free shuttle service to and from your hotel.

It’s worth noting that the slides close for 30 minutes from 1pm – 1:30pm, but luckily, the water park is virtually located on a beautiful sandy beach which you also get access to while you wait for it to reopen.

It’s not an issue to leave for the beach and then come back into the park for more slides or even a bite to eat at one of the onsite restaurants.

8. Marvel at Amos Ancient City

One of the most impressive historical sights local to the Marmaris region is the ancient city of Amos. Situated along the Bozburun Peninsula just a short 20km drive away from Marmaris center, Amos and its crumbling ruins date back to the Hellenistic period with the city thought to have been founded in the 6 th century BC by ancient Greek settlers.

Being thousands of years old, the archeological site is just ruins, however, some are better preserved than others and provide a valuable insight into the city’s past.

The city walls are the most notable, along with a small amphitheater that would’ve been used for performances and events, a temple, and several towers and tombs. Following examination of several inscriptions found in the ancient city, it is believed that the early inhabitants of Amos had originated from the Greek island of Rhodes just a short boat ride away.

Visitors can reach Amos by car from Turunc town or Marmaris which is a little further afield but still within a short driving distance. It’s free to enter the ruins however it is possible to get a knowledgeable guide who can provide you with expert information on the ancient city.

9. Take A Day Trip to Ephesus

Perhaps one of Turkey’s most iconic landmarks is the Ancient City of Ephesus, a UNESCO World Heritage Site and home to one of the Ancient Wonders of the World.

The city of Ephesus dates back to the 10th Century BC, where it was first settled by the Greeks and used as a port city known for its trading links.

Today, it’s one of the largest and best preserved archaeological sites in the country, and where you can marvel at some grand works of Greco-Roman architecture.

The Temple of Artemis, Library of Celsus, and nearby House of the Virgin Mary are notable landmarks in the complex worth seeing.

Visiting Ephesus from Marmaris is a full day activity, since the ruins are 190km away (2.5 hours drive by car), but fortunately the trip can be made easy by booking onto a day tour.

10. Go Scuba Diving

Diving is another popular thing to do in Marmaris and is one of the main reasons why people flock to this part of the Turkish coast.

With its stunning underwater caves, vibrant reefs, and intriguing shipwrecks, Marmaris has diving sites that have intrigued divers for many years.

One of the most popular diving sites is Baca Cave, also known as Chimney Cave, which is a sea cave that lies between 5-50 meters below the surface.

Another popular site is Kadirga Cove , where you’ll find the shipwreck of a sunken ship from the Hellenistic period.

The crystal-clear waters of Marmaris and the diverse array of marine life and underwater landmarks to explore make it one of the best destinations in Turkey to go diving.

Whether you’ve scuba dived before or it’s your first time, diving in Marmaris promises an immersive journey into the Mediterranean’s treasures.

11. Take A Buggy Safari

Looking for more adventurous things to do? Then perhaps a buggy safari would pump some adrenaline through your veins!

The buggy safari is not only an off-road experience for the adventurous and thrill seeking, but a bonding experience for you and your travel mates.

As you explore the lush landscapes of Marmaris from your 4×4 buggy, passing through pine forests and rivers, you’ll get to battle your mates in a water fight game! That’s right, they give you water pistols so you can turn your experience into a water fight.

What’s more is that you don’t need a driving license for this experience since you’ll be driving around inside a private area, and full instructions are given upon arrival.

If you’re looking for a fun way to kill a couple of hours, this is certainly up there as one of the most fun activities you can do in Marmaris.

12. Relax In A Turkish Bath

If you’re finding Marmaris to be overcrowded and chaotic, then you might want to experience some relaxation instead. A Turkish Bath is the ultimate way to wind down and rejuvenate your body – especially if you’re visiting in the winter.

If you’ve never had a Turkish Bath before, allow me to enlighten you. The Turkish Bath experience is a combination of massage, body scrub, steaming, and washing.

You begin by sitting in a steam room on a marble slab (like the one pictured above), where the steam opens your pours and cleanses your body.

After that, you will be scrubbed down by a natir with a corse mitten, and then massaged with foam on a hot slab. After you have been steamed and washed, you will be taken to a separate area for an oil massage to lock in the moisture.

The result is you feel relaxed, and incredibly clean.

13. Take A Boat Trip From Marmaris

Being a coastal destination, most of the attractions in Marmaris revolve around being on the water. A stroll along the promenade in the evening will show you just how many boat trips and excursions you can take – the choices can be overwhelming.

One of the most popular boat trips you can take is on the huge galleon pirate ships, in which 100+ people all gather on the huge boats and sail around the coves, beaches and islands.

We personally find these ships overwhelming, but some people really enjoy the lively atmosphere. They are known to play really loud music, encourage excessive drinking with an open bar, and are filled with people from all over the world, so you can meet with other travelers and share in the good times.

There are several companies offering boat trips, but they all visit the same destinations, usually secluded beaches and coves where you can go snorkeling and sun bathing on the beach.

The boat trips from Marmaris are a full day activity and include lunch (often a BBQ), and usually have a bar where you can buy soft drinks or alcoholic drinks.

They also include hotel pick up and drop off.

14. Take A Day Trip To Pamukkale

Another day trip you can take, and quite possibly the furthest day trip we would recommend, is to Pamukkale. This natural wonder, also known as Cotton Castle, is a unique phenomenon formed by mineral waters cascading over the white terraces.

The white terraces, complete with several bathing pools, have been a tourist attraction for centuries. Legend has it that people traveling the old Silk Road through the ancient city of Hierapolis (located at the top of the hill), used to bath in these mineral rich waters as they believed them to have healing properties.

Today you can still swim in the pools, as well as check out the ancient ruins of Hierapolis and its grand amphitheatre.

Pamukkale is located 203km away from Marmaris and takes around 2 hours 45 minutes to drive. We highly recommend you visit Pamukkale by day tour or hire a car and drive yourself, as it won’t be possible to visit for a day using public transport.

15. Head Over to Oludeniz & The Blue Lagoon

If you’re thinking the beaches in Marmaris aren’t really living up to your expectations, then I recommend you drive over to Oludeniz to see the world-famous Blue Lagoon .

This lagoon is famous for its bright, turquoise waters and picturesque scenery, backed by the Babadağ mountain which is known as being one of the highest paragliding jump points in the world.

The beach is a protected nature reserve and since it’s protected by a bay, the waters are calm and gentle, perfect for young kids to go swimming in or to explore on a peddle boat.

Though it’s a 139.9 km journey and takes about 2.5 hours to drive, it’s worth the effort. It’s one of the most photographed scenes in Turkey and features on the postcards you find in souvenir stores.

Map Of Marmaris Attractions

To help you plan your visit, here is a map that show the locations of the attractions mentioned on this list.

Final Thoughts

Marmaris is a bustling and vibrant place with so many places to explore, things to do, and experiences to have. It’s not one of the best coastal destinations in Turkey for no reason, and we hope this guide gave you some inspiration for what to do there.

Have you been to Marmaris? What was your favorite thing to do there? Let us know in the comments.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

AFFILIATE DISCLOSURE

This website uses affiliate links, meaning I may earn a commission if you make a purchase through a link at no extra cost to you. TheTurkeyTraveler is a participant in the Amazon Services LLC Associates Program. As an Amazon Associate, I earn from qualifying purchases. For more information, see our full affiliate disclosure .

© 2024 The Turkey Traveler

IMAGES

COMMENTS

Additionally, a selection of refreshing beverages and traditional desserts complement the main course options. La Kebap Restaurant offers both dine-in and take-away services to cater to different customer preferences. Address: Armutalan, Adnan Menderes Cd. No:110, 48706 Marmaris/Muğla, Türkiye.

Turkey is known for its diverse and delicious street food offerings. Here are some of the best Turkish street foods you must try:Döner Kebab: One of Turkey's...

1. Fantasia. 270 reviews Open Now. Pizza, Fast Food $. I will most certainly make a point of visiting Cello and staff at fantasia... Fantastic Fantasia. 1. Showing results 1 - 1 of 1. Best Doner Kebab in Marmaris, Marmaris District: Find 270 Tripadvisor traveller reviews of THE BEST Doner Kebab and search by price, location, and more.

16. Golden River Steak House - Big Portions. Nestled in the heart of the Marmaris district, Golden River Steak House is a gem for meat lovers and is often cited as one of the best restaurants in Marmaris. This spot is all about quality and taste, specializing in big portions that don't skimp on flavor.