Bill Burr Verified

Comedy shows, concerts and tour dates, bandsintown merch.

Live Photos of Bill Burr on Tour

Fan reviews.

Fans Also Follow

About bill burr.

- Moscow concerts Moscow concerts Moscow concerts See all Moscow concerts ( Change location ) Today · Next 7 days · Next 30 days

- Most popular artists worldwide

- Trending artists worldwide

- Tourbox for artists

Search for events or artists

- Sign up Log in

- Get the app

- Moscow concerts

- Change location

- Popular Artists

- Live streams

- Deutsch Português

- Popular artists

- On tour: yes

- Bill Burr is not playing near you. View all concerts

- Moscow, Russian Federation Change location

38,682 fans get concert alerts for this artist.

Join Songkick to track Bill Burr and get concert alerts when they play near you.

Nearest concert to you

Schottenstein Center

Touring outside your city

Be the first to know when they tour near Moscow, Russian Federation

Join 38,682 fans getting concert alerts for this artist

Upcoming concerts (17) See all

Arizona Financial Theatre

Hollywood Bowl

Bridgestone Arena

Lawrence Joel Veterans Memorial Coliseum

Bellco Theatre

Greek Theatre

San Jose Civic

View all upcoming concerts 17

Similar artists with upcoming concerts

Tours most with, live reviews.

I saw Ol' Freckles live for the first time in Budapest and it was incredible. In the first 15-20 minutes I thought maybe my expectations were too high, because it started a bit slow, with the same topics he talks about in the podcast. But then he switched gears and he murdered. He has at least two very funny, multiple-layers, perfectly acted bits that made me cry of laughter. He was in his best form, I think funnier than Walk Your Way Out.

Report as inappropriate

Billy boy was fantastic as expected. It was overwhelmingly new material and he had me laughing the whole hour and a half.

It was also pretty funny when he was (justifiably) making fun of the venue for basically being a warehouse (Tonhalle Munich).

Posters (2)

Past concerts

Ys Firehouse

View all past concerts

Bill Burr tour dates and tickets 2024-2025 near you

Want to see Bill Burr in concert? Find information on all of Bill Burr’s upcoming concerts, tour dates and ticket information for 2024-2025.

Bill Burr is not due to play near your location currently - but they are scheduled to play 17 concerts across 1 country in 2024-2025. View all concerts.

Next 3 concerts:

- Phoenix, AZ, US

Next concert:

Popularity ranking:

- Julie Bergan (8921)

- Bill Burr (8922)

- Hodgy (8923)

Concerts played in 2024:

Touring history

Most played:

- Los Angeles (LA) (10)

- Yellow Springs (6)

- Las Vegas (5)

- Philadelphia (4)

- Washington (4)

Appears most with:

- Jay Mohr (2)

- Brody Stevens (2)

- Chris D’Elia (2)

- Joe DeRosa (2)

Distance travelled:

Similar artists

- Most popular charts

- API information

- Brand guidelines

- Community guidelines

- Terms of use

- Privacy policy

- Cookies settings

- Cookies policy

Get your tour dates seen everywhere.

- But we really hope you love us.

All Upcoming Events

Arizona Financial Theatre | Phoenix, AZ

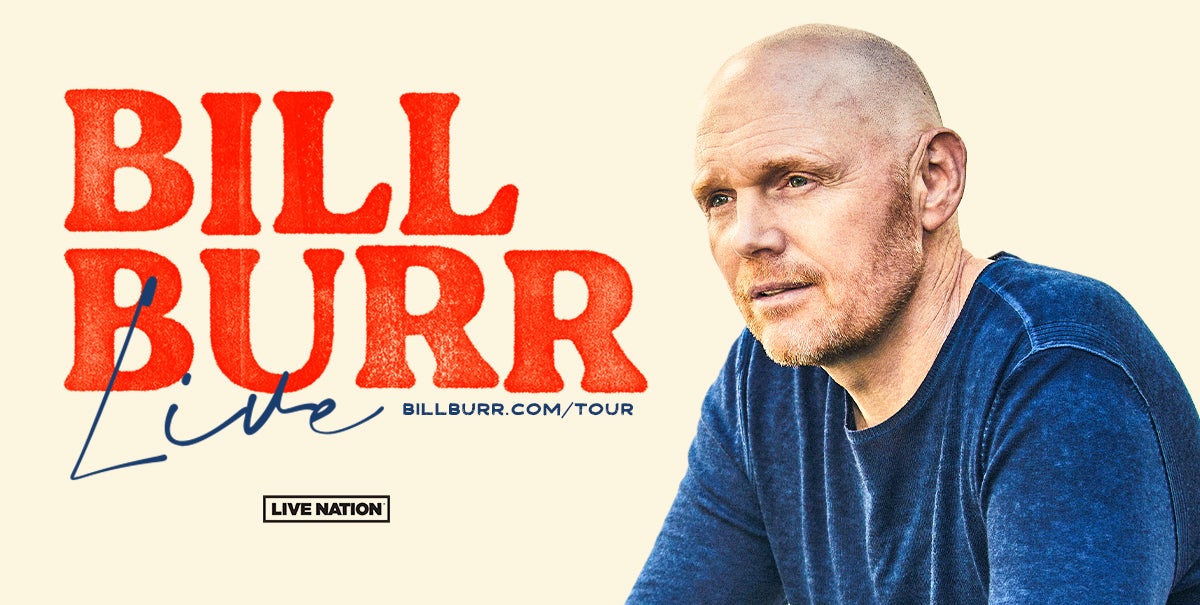

Bill burr live.

- Premier Parking - Bill Burr - Not a Concert Ticket

Hollywood Bowl | Hollywood, CA

Netflix is a joke presents: bill burr live.

- HOLLYWOOD BOWL SHUTTLE / BURBANK SHUTTLE LOT - Bill Burr

- HOLLYWOOD BOWL PARK AND RIDE: CHATSWORTH LINE - Bill Burr

- HOLLYWOOD BOWL PARK AND RIDE: PASADENA LINE - Bill Burr

- HOLLYWOOD BOWL SHUTTLE: VENTURA LOT - Bill Burr

- HOLLYWOOD BOWL PARK AND RIDE: TORRANCE LINE - Bill Burr

- HOLLYWOOD BOWL PARK AND RIDE: CULVER CITY - Bill Burr

- HOLLYWOOD BOWL PARK AND RIDE: LAKEWOOD LINE - Bill Burr

- HOLLYWOOD BOWL SHUTTLE: LOS ANGELES ZOO LOT - Bill Burr

Schottenstein Center | Columbus, OH

Bridgestone arena | nashville, tn, lawrence joel veterans memorial coliseum | winston salem, nc.

- Parking-Bill Burr Live

Bellco Theatre | Denver, CO

Greek theatre-u.c. berkeley | berkeley, ca, san jose civic | san jose, ca, moore theatre | seattle, wa.

Bill Burr Announces 2021 U.S. Tour

Tickets On Sale Starting Friday, April 9th at 10AM Local at BillBurr.com/Tour

WHO : Bill Burr

WHAT : Bill Burr U.S. Tour

Produced by Live Nation, the 21-date tour will kick off on July 2nd in Las Vegas at the Cosmopolitan with stops in Atlanta, Detroit, Indianapolis, St. Louis and more, before wrapping December 30th in Phoenix at Arizona Federal Theater.

TICKETS:

NEW DATES: Tickets go on sale beginning Friday, April 9th at 10AM local time at BillBurr.com/Tour .

RESCHEDULED DATES: Tickets are on sale now for the rescheduled dates below. All previously purchased tickets will be valid for the corresponding rescheduled dates listed below.

BILL BURR TOUR 2021 DATES:

Jul 2 – Las Vegas, NV – The Chelsea at the Cosmopolitan of Las Vegas

Jul 3 – Las Vegas, NV – The Chelsea at the Cosmopolitan of Las Vegas

Aug 28 – Hollywood, FL – Hard Rock Live at Seminole Hard Rock Hotel & Casino Hollywood*

Sept 3 – Atlantic City, NJ – Hard Rock Live at Etess Arena*

Sept 4 – Atlantic City, NJ – Hard Rock Live at Etess Arena*

Sept 5 – Bethlehem, PA – Wind Creek Event Center*

Sept 15 – Kansas City, MO – Starlight Amphitheater*

Sept 16 – Morrison, CO – Red Rocks Amphitheatre*

Sept 30 – St. Louis, MO – Fox Theatre*

Oct. 2 – Minneapolis, MN – Mystic Lake Casino*

Oct 14 – Atlanta, GA – Cobb Energy Performing Arts Centre

Oct 15 – Atlanta, GA – Fox Theatre*

Oct 16 – Atlanta, GA – Coca-Cola Roxy

Oct 21 – Long Beach, CA – Long Beach Terrace Theater*

Nov 5 – Reno, NV – Grand Theater @ The Grand Sierra Resort

Nov 6 – San Jose, CA – Center for the Performing Arts*

Nov 11 – Detroit, MI – Fox Theatre*

Dec 10 – Valley Center, CA – Harrah’s Resort Southern California – The Events Center

Dec 16 – Indianapolis, IN – Murat Theatre at Old National Centre

Dec 17 – Indianapolis, IN – Murat Theatre at Old National Centre

Dec 18 – Indianapolis, IN – Clowes Memorial Hall*

Dec 30 – Phoenix, AZ – Arizona Federal Theater*

A Grammy-nominated comedian, Bill Burr is one of the top comedic voices of his generation achieving success in TV and film as well as on stage. Bill sells out theaters internationally and his Monday Morning Podcast is one of the most downloaded comedy podcasts. Bill made his debut as host of Saturday Night Live on October 10, 2020, he stars opposite Pete Davidson and Marisa Tomei in the Judd Apatow film, The King of Staten Island, and he stars as Mayfeld in The Mandalorian on Disney Plus. His animated Netflix series, F Is For Family, stars Burr, Laura Dern, Justin Long and Sam Rockwell in the cast and will premiere its fifth and final season in 2021. In September 2019, he released his sixth hour-long comedy special, Bill Burr: Paper Tiger, which was nominated for a Grammy Award, was recorded at London’s Royal Albert Hall and is streaming on Netflix. Bill was seen in the Hugh Jackman film, The Front Runner; the Mark Wahlberg and Will Ferrell film, Daddy’s Home; he co-stars opposite Kevin Costner in the indie film, Black or White; was seen in the Paul Feig film, The Heat, alongside Sandra Bullock and Melissa McCarthy and in the Al Pacino and Christopher Walken film Stand Up Guys. Bill received raves for his recurring role as “Kuby” on the hit AMC-TV show, Breaking Bad.

For more, go to Bill’s website and follow Bill on Twitter , Instagram and Facebook .

About Live Nation Entertainment

Live Nation Entertainment (NYSE: LYV) is the world’s leading live entertainment company comprised of global market leaders: Ticketmaster, Live Nation Concerts, and Live Nation Sponsorship. For additional information, visit www.livenationentertainment.com .

MEDIA CONTACTS:

Michael O’Brien | [email protected]

Live Nation Concerts

Monique Sowinski | [email protected]

Read more about

Splice Magazine Music,Motorsports and More!

Licensed Publication of Splice Media Group

Bill Burr Announces 2021 U.S. Tour

Tickets On Sale Starting Friday, April 9th at 10AM Local at BillBurr.com/Tour

WHO : Bill Burr

WHAT : Bill Burr U.S. Tour

Produced by Live Nation, the 21-date tour will kick off on July 2nd in Las Vegas at the Cosmopolitan with stops in Atlanta, Detroit, Indianapolis, St. Louis and more, before wrapping December 30th in Phoenix at Arizona Federal Theater.

NEW DATES: Tickets go on sale beginning Friday, April 9th at 10AM local time at BillBurr.com/Tour .

RESCHEDULED DATES: Tickets are on sale now for the rescheduled dates below. All previously purchased tickets will be valid for the corresponding rescheduled dates listed below.

BILL BURR TOUR 2021 DATES:

Jul 2 – Las Vegas, NV – The Chelsea at the Cosmopolitan of Las Vegas

Jul 3 – Las Vegas, NV – The Chelsea at the Cosmopolitan of Las Vegas

Aug 28 – Hollywood, FL – Hard Rock Live at Seminole Hard Rock Hotel & Casino Hollywood*

Sept 3 – Atlantic City, NJ – Hard Rock Live at Etess Arena*

Sept 4 – Atlantic City, NJ – Hard Rock Live at Etess Arena*

Sept 5 – Bethlehem, PA – Wind Creek Event Center*

Sept 15 – Kansas City, MO – Starlight Amphitheater*

Sept 16 – Morrison, CO – Red Rocks Amphitheatre*

Sept 30 – St. Louis, MO – Fox Theatre*

Oct. 2 – Minneapolis, MN – Mystic Lake Casino*

Oct 14 – Atlanta, GA – Cobb Energy Performing Arts Centre

Oct 15 – Atlanta, GA – Fox Theatre*

Oct 16 – Atlanta, GA – Coca-Cola Roxy

Oct 21 – Long Beach, CA – Long Beach Terrace Theater*

Nov 5 – Reno, NV – Grand Theater @ The Grand Sierra Resort

Nov 6 – San Jose, CA – Center for the Performing Arts*

Nov 11 – Detroit, MI – Fox Theatre*

Dec 10 – Valley Center, CA – Harrah’s Resort Southern California – The Events Center

Dec 16 – Indianapolis, IN – Murat Theatre at Old National Centre

Dec 17 – Indianapolis, IN – Murat Theatre at Old National Centre

Dec 18 – Indianapolis, IN – Clowes Memorial Hall*

Dec 30 – Phoenix, AZ – Arizona Federal Theater*

A Grammy-nominated comedian, Bill Burr is one of the top comedic voices of his generation achieving success in TV and film as well as on stage. Bill sells out theaters internationally and his Monday Morning Podcast is one of the most downloaded comedy podcasts. Bill made his debut as host of Saturday Night Live on October 10, 2020, he stars opposite Pete Davidson and Marisa Tomei in the Judd Apatow film, The King of Staten Island, and he stars as Mayfeld in The Mandalorian on Disney Plus. His animated Netflix series, F Is For Family, stars Burr, Laura Dern, Justin Long and Sam Rockwell in the cast and will premiere its fifth and final season in 2021. In September 2019, he released his sixth hour-long comedy special, Bill Burr: Paper Tiger, which was nominated for a Grammy Award, was recorded at London’s Royal Albert Hall and is streaming on Netflix. Bill was seen in the Hugh Jackman film, The Front Runner; the Mark Wahlberg and Will Ferrell film, Daddy’s Home; he co-stars opposite Kevin Costner in the indie film, Black or White; was seen in the Paul Feig film, The Heat, alongside Sandra Bullock and Melissa McCarthy and in the Al Pacino and Christopher Walken film Stand Up Guys. Bill received raves for his recurring role as “Kuby” on the hit AMC-TV show, Breaking Bad.

Share this:

Discover more from splice magazine music,motorsports and more.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

The Source For All Things Pop Culture

Comedian Bill Burr Announces Dates For 2021 U.S. Tour

Legendary comedian Bill Burr will be hitting the road in 2021 on a U.S. tour! Produced by Live Nation, the 21-date tour will kick off on July 2nd in Las Vegas at the Cosmopolitan with stops in Atlanta, Detroit, Indianapolis, St. Louis and more, before wrapping December 30th in Phoenix at Arizona Federal Theater.

NEW DATES: Tickets go on sale beginning Friday, April 9th at 10AM local time at BillBurr.com/Tour .

RESCHEDULED DATES: Tickets are on sale now for the rescheduled dates below. All previously purchased tickets will be valid for the corresponding rescheduled dates listed below.

BILL BURR TOUR 2021 DATES:

Jul 2 – Las Vegas, NV – The Chelsea at the Cosmopolitan of Las Vegas

Jul 3 – Las Vegas, NV – The Chelsea at the Cosmopolitan of Las Vegas

Aug 28 – Hollywood, FL – Hard Rock Live Arena Casino*

Sept 3 – Atlantic City, NJ – Hard Rock Live at Etess Arena*

Sept 4 – Atlantic City, NJ – Hard Rock Live at Etess Arena*

Sept 5 – Bethlehem, PA – Wind Creek Event Center*

Sept 15 – Kansas City, MO – Starlight Amphitheater*

Sept 16 – Morrison, CO – Red Rocks Amphitheatre*

Sept 30 – St. Louis, MO – Fox Theatre*

Oct. 2 – Minneapolis, MN – Mystic Lake Casino*

Oct 14 – Atlanta, GA – Cobb Energy Performing Arts Centre

Oct 15 – Atlanta, GA – Fox Theatre*

Oct 16 – Atlanta, GA – Coca-Cola Roxy

Oct 21 – Long Beach, CA – Long Beach Terrace Theater*

Nov 5 – Reno, NV – Grand Theater @ The Grand Sierra Resort

Nov 6 – San Jose, CA – Center for the Performing Arts*

Nov 11 – Detroit, MI – Fox Theatre*

Dec 10 – Valley Center, CA – Harrah’s Resort Southern California – The Events Center

Dec 16 – Indianapolis, IN – Murat Theatre at Old National Centre

Dec 17 – Indianapolis, IN – Murat Theatre at Old National Centre

Dec 18 – Indianapolis, IN – Clowes Memorial Hall*

Dec 30 – Phoenix, AZ – Arizona Federal Theater*

ABOUT BILL BURR: A Grammy-nominated comedian, Bill Burr is one of the top comedic voices of his generation achieving success in TV and film as well as on stage. Bill sells out theaters internationally and his Monday Morning Podcast is one of the most downloaded comedy podcasts. Bill made his debut as host of Saturday Night Live on October 10, 2020, he stars opposite Pete Davidson and Marisa Tomei in the Judd Apatow film, The King of Staten Island, and he stars as Mayfeld in The Mandalorian on Disney Plus. His animated Netflix series, F Is For Family , stars Burr, Laura Dern, Justin Long and Sam Rockwell in the cast and will premiere its fifth and final season in 2021. In September 2019, he released his sixth hour-long comedy special, Bill Burr: Paper Tiger , which was nominated for a Grammy Award, was recorded at London’s Royal Albert Hall and is streaming on Netflix. Bill was seen in the Hugh Jackman film, The Front Runner ; the Mark Wahlberg and Will Ferrell film, Daddy’s Home ; he co-stars opposite Kevin Costner in the indie film, Black or White; was seen in the Paul Feig film, The Heat , alongside Sandra Bullock and Melissa McCarthy and in the Al Pacino and Christopher Walken film Stand Up Guys . Bill received raves for his recurring role as “Kuby” on the hit AMC-TV show, Breaking Bad .

For more, go to Bill’s website and follow Bill on Twitter , Instagram and Facebook .

Jason Price founded the mighty Icon Vs. Icon more than a decade ago. Along the way, he’s assembled an amazing group of like-minded individuals to spread the word on some of the most unique people and projects on the pop culture landscape.

PICK OF THE WEEK

‘Farscape: The Complete Series (25th Anniversary Edition)’ — Dive Deep Into Otherworldly Adventure With Shout! Factory’s Definitive Box Set!

- Skip to content

- Accessibility

- Buy Tickets

BILL BURR ANNOUNCES FALL NORTH AMERICAN DATES FOR HIS 2022 ARENA AND AMPHITHEATER TOUR BILL BURR (SLIGHT RETURN)

site categories

Judge schedules new donald trump gag order contempt hearing in latest subplot of hush money trial, breaking news.

Bill Burr Unveils North American Tour Dates For 2024

By Matt Grobar

Matt Grobar

Senior Film Reporter

More Stories By Matt

- Lola Kirke Joins Ryan Coogler’s Supernatural Thriller

- Keke Palmer And SZA To Star In Issa Rae-Produced Buddy Comedy From TriStar Pictures

- Francis Galluppi Tapped To Write & Direct New ‘Evil Dead’ Movie

EXCLUSIVE : Comedian Bill Burr has unveiled the North American dates for his 2024 tour, Bill Burr Live , which will see him visit theaters and arenas in 16 cities from February through July.

Presale tickets will be available starting December 6th at 10 am local time, with general on-sale beginning December 8 at the same time. Check out Burr’s list of dates at his website, where you can also buy tickets, and below.

Related Stories

Russell Peters’ Comedy Special ‘Act Your Age’ Acquired For Worldwide Distribution

Comedian Ralph Barbosa Unveils Dates For First Leg Of His ‘Super Cool Ass Tour’ As He Graduates To Theater Circuit

Also known for his hit Monday Morning Podcast , and his comedic media empire All Things Comedy co-founded with Al Madrigql, Burr last summer made history as the first comedian to perform at Fenway Park. Other notable acting credits for the multi-hyphenate include the Roku Channel’s Immoral Compass , which earned him an Emmy nomination for Short Form Actor, Judd Apatow’s The King of Staten Island , Disney+’s The Mandalorian , Breaking Bad , and the animated series F Is for Family , which he co-created and starred in for Netflix, to name just a few.

Burr is repped by WME, 3 Arts Entertainment, and Schreck Rose Dapello.

Friday, February 16, 2024 Rancho Mirage, CA The Show – Agua Caliente Rancho Mirage

Thursday, February 22, 2024 Portland, OR MODA Center

Saturday, February 24, 2024 Salt Lake City, UT Delta Center

Friday, March 8, 2024 Gary, IN Hard Rock Live

Saturday, March 9, 2024 Indianapolis, IN Gainbridge Fieldhouse

Sunday, March 10, 2024 Detroit, MI Little Caesars Arena

Thursday, March 21, 2024 St Louis, MO Fox Theatre

Thursday, April 25, 2024 Phoenix, AZ Arizona Financial Theatre

Thursday, May 16, 2024 Columbus, OH Schottenstein Center

Friday, May 17, 2024 Nashville, TN Bridgestone Arena

Saturday, May 18, 2024 Winston-Salem, NC Lawrence Joel Veterans Memorial Coliseum

Wednesday, June 5, 2024 Denver, CO Bellco Theatre

Wednesday, June 19, 2024 San Jose, CA San Jose Civic

Saturday, July 20, 2024 Winnipeg, MB Assiniboine Park – Great Outdoors Comedy Festival

*Already on sale

Must Read Stories

Iatse’s michael miller on what it will take for new 3-year labor deal, zendaya’s ‘challengers’ opens to $1.9m in previews; ‘unsung hero’ $1.67m, ‘umbrella academy’ star david castañeda circling lead in chalino sanchez biopic, keke palmer and sza to star in issa rae-produced buddy comedy.

Subscribe to Deadline Breaking News Alerts and keep your inbox happy.

Read More About:

Deadline is a part of Penske Media Corporation. © 2024 Deadline Hollywood, LLC. All Rights Reserved.

- Date May 16 , 2024

- Availability On Sale Now

- May 16 , 2024 | Thursday 7:30PM Buy Tickets

An Emmy and Grammy Award nominee, Bill Burr is a singular voice of his generation, defining his own path as a world-renown comedian, director/writer/producer/star of a #1 film on Netflix, critically-acclaimed dramatic and comedic actor, writer, producer, and a genre-defining podcaster for over 15 years. In October, Bill’s film, Old Dads, which he directed, co-wrote and stars in, premiered as the most-watched film on Netflix in its first and second week of release. Host of the groundbreaking Monday Morning Podcast, Bill is touring arenas and theaters with his Bill Burr Live tour, in 2023 he was the first comedian to perform at the 5,000-seat ancient Roman amphitheater, The Odeon of Herodes Atticus in Athens, Greece, and in 2022 he made history as the first comedian to perform at Fenway Park. His 2022 Netflix special, Bill Burr: Live At Red Rocks, shot at the legendary venue, further stakes his role as one of the most versatile talents of his time.

THIS IS A PHONE-FREE SHOW

No cellphones, cameras or recording devices may be used at the show. After scanning of your mobile tickets , ALL phones and smart watches will be secured in Yondr pouches and unlocked at the end of the show. Guests maintain possession of their phones and if needed, may access their phones at unlocking stations. Anyone observed using a cellphone, smart watch or accessory is subject to removal from the venue.

Information

The Schottenstein Center Ticket Office (Northeast corner of venue) is open weekdays from 9AM-4PM with extended hours on event days . Email [email protected] or call 1-800-GO-BUCKS (1-800-462-8257).

CLICK HERE to rent a suite. CLICK HERE to pre-purchase parking. CLICK HERE for general Traffic & Parking info.

- Skip to content

- Accessibility

- Buy Tickets

Event Information

An Emmy and Grammy nominated comedian, Bill Burr is one of the top comedic voices of his generation achieving success in TV and film as well as on stage. Bill’s Monday Morning Podcast is one of the most downloaded comedy podcasts, his 2023 arena and amphitheater tour, Bill Burr Live , is touring across Europe and North America and on August 21, 2022, Bill made history as the first comedian to perform at Fenway Park.

On October 20, Bill’s film, Old Dads , will premiere on Netflix. Bill directed, co-wrote and stars in the film alongside Bobby Cannavale and Bokeem Woodbine. And on November 21, Bill will voice a lead role in Adam Sandler’s animated Netflix film, Leo .

In 2022, Bill premiered the Netflix special, Bill Burr: Live At Red Rocks , which was shot in October 2021 at the legendary venue, and he hosted the Netflix special, Bill Burr Presents: Friends Who Kill .

Bill was nominated for a 2020 Grammy Award for his album, Bill Burr: Paper Tiger , and he was nominated for a 2022 Emmy Award for Outstanding Actor In A Short Form Comedy Or Drama Series for his Roku Channel series, Bill Burr Presents: Immoral Compass , which is free to stream online. His animated Netflix series, F Is For Family , stars Bill, Laura Dern, Justin Long and Sam Rockwell in the cast and premiered its fifth and final season on Thanksgiving Day, 2021.

Bill made his debut as host of Saturday Night Live on October 10, 2020; made a guest appearance as Coach Bobson in episode 7 of the hit FX on Hulu series, Reservation Dogs ; stars opposite Pete Davidson and Marisa Tomei in the Judd Apatow film, The King of Staten Island; and he stars as Mayfeld in The Mandalorian on Disney Plus.

Bill was seen in the Hugh Jackman film, The Front Runner; the Mark Wahlberg and Will Ferrell film, Daddy’s Home; he co-stars opposite Kevin Costner in the indie film, Black or White; was seen in the Paul Feig film, The Heat , alongside Sandra Bullock and Melissa McCarthy and in the Al Pacino and Christopher Walken film Stand Up Guys . Bill received raves for his recurring role as “Kuby” on the hit AMC-TV show, Breaking Bad .

For more go to Bill’s website and follow Bill on Twitter , Instagram and Facebook .

Note: This event will be a phone-free experience. Use of phones, smart watches and accessories, will not be permitted in the performance space.

Upon arrival at the venue, all phones, smart watches and accessories will be secured in individual Yondr pouches that will be opened at the end of the event. Guests maintain possession of their devices at all times, and can access them throughout the event only in designated Phone Use Areas within the venue. All devices will be re-secured in Yondr pouches before returning to the performance space.

Anyone seen using a device (phone, smart watch or accessories) during the performance will be escorted out of the venue.

We can't wait to see you at Fiserv Forum! Doors open at 6:30pm with the show beginning at 8pm. The box office opens at noon. Guests are encouraged to arrive early. Entry will include security screening and Yondr process.

Floor Tickets

Floor Ticketholders (those with tickets for Reserved Floor Seating Sections F1-F9) are encouraged to use the exclusive Floor Entrance (located on Juneau Avenue, see map ) to access the Floor.

Yondr Phone-Free Event

This event is a phone-free experience by Yondr. Use of phones, smart watches, and accessories will not be permitted in the performance space. No cameras or recording devices will be permitted in the venue.

Upon arrival at the venue, phones, smart watches and airpods will be secured in individual Yondr pouches that will be opened at the end of the event. Guests maintain possession of their devices at all times and can access them throughout the event only in designated Phone Use Areas within the venue in the BMO Club on the Event Level, Main Concourse near Section 121, on the Suite Level near Suite 18, and Upper Concourse near Sections 223/224 . All devices will be re-secured in Yondr pouches before returning to the performance space

All pouches and equipment are routinely sanitized. The Yondr staff is trained and required to follow safety guidelines and hygiene protocols.

Anyone seen using a device during the performance will be escorted out of the venue by security. We appreciate your cooperation in creating a phone-free experience.

At the conclusion of the performance, Yondr staff will be stationed at all exits to unlock your phone.

Specialty Drink

Is there Anything Better than a specialty drink of the night? Enjoy Anything Better, featuring Absolut Vodka, grenadine, lemonade & sprite, topped with cherries! You can find this drink at the bars by sections 104, 108, 115, 119 & 228.

ScriptsWidget

- Skip to content

- Accessibility

- Buy Tickets

Slight Return Tour

- Date November 19 , 2022

- Event Starts 7:00 PM

- On Sale On Sale Now

- Parking Find Parking

- Directions Get Directions

Event Details

GRAMMY®-nominated comedian Bill Burr announced his fall North American dates of his Bill Burr (Slight Return) Tour . Produced by Live Nation, the tour visits 25 cities starting September 8 through December 17, including Orlando’s Kia Center on Saturday, November 19.

Burr is one of the top comedic voices of his generation achieving success in television, film and on stage. His “Monday Morning Podcast,” in which Burr speaks without reservation and off-the-cuff about his past and recent experiences, current events, going on tour, sports and offers advice to questions submitted by listeners, is one of the most-downloaded comedy podcasts.

Burr hosted the Netflix special, “Bill Burr Presents: Friends Who Kill,” in his iconic stage style featuring a showcase of stand-up comics curated by Burr . He recently wrapped filming the feature, “Old Dads , ” which he co-wrote, directed and will star in alongside Bobby Cannavale and Bokeem Woodbine.

Phone-Free Experience

This event will be a phone-free experience. Use of phones will not be permitted in the performance space.

Upon arrival at the venue, phones will be secured in individual Yondr pouches that will be opened at the end of the event. Guests maintain possession of their devices at all times, and can access them throughout the event only in designated Phone Use Areas within the venue. All devices will be re-secured in Yondr pouches before returning to the performance space.

All pouches and equipment are routinely sanitized. The Yondr staff is trained and required to follow safety guidelines and hygiene protocols to practice social distancing, minimal contact and wear required personal protective equipment.

Anyone seen using a device during the performance will be escorted out of the venue by security. We appreciate your cooperation in creating a phone-free experience.

- Skip to content

- Accessibility

- Buy Tickets

{{ data.venue }}

Event starts {{ data.showing_start_time }}.

Bill Burr Brings 2024 North American Tour Bill Burr Live To Little Caesars Arena March 10, 2024

(DETROIT – December 4, 2023) – Bill Burr announces his 2024 North American tour, Bill Burr Live, will visit Little Caesars Arena on Sunday, March 10 at 7 p.m.

Tickets go on sale Friday, December 8 at 10 a.m. at 313Presents.com , LiveNation.com , and Ticketmaster.com . Presale tickets will be available starting Wednesday, December 6 at 10 a.m. For a full list of tour dates and links to tickets, visit BillBurr.com .

Bill Burr Live will visit arenas and theaters in 16 cities from February through July.

An Emmy and Grammy® nominated comedian, Bill Burr is one of the top comedic voices of his generation achieving success in TV and film as well as on stage. Burr’s Monday Morning Podcast is one of the most downloaded comedy podcasts, his 2023 tour visited arenas and amphitheaters across Europe and North America, and on August 21, 2022, Burr made history as the first comedian to perform at Fenway Park.

Burr’s film, Old Dads , premiered on Netflix on October 20 as the most-watched film worldwide on Netflix in its first and second week. Burr directed, co-wrote and stars in the film alongside Bobby Cannavale and Bokeem Woodbine.

Burr voices a lead role in Adam Sandler’s animated Netflix film, LEO , which premiered on November 21 as the #1 movie on Netflix, setting a record as the biggest debut of an animated Netflix film with 34.6 million views in the first six days.

In 2022, Burr premiered the Netflix special, Bill Burr: Live At Red Rocks , which was shot in October 2021 at the legendary venue, and he hosted the Netflix special, Bill Burr Presents: Friends Who Kill .

Burr was nominated for a 2020 Grammy® Award for his album, Bill Burr: Paper Tiger , and he was nominated for a 2022 Emmy Award for Outstanding Actor In A Short Form Comedy Or Drama Series for his Roku Channel series, Bill Burr Presents: Immoral Compass , which is free to stream online. His animated Netflix series, F Is For Family , stars Burr, Laura Dern, Justin Long and Sam Rockwell in the cast and premiered its fifth and final season on Thanksgiving Day, 2021.

Burr made his debut as host of Saturday Night Live on October 10, 2020; made a guest appearance as Coach Bobson in episode seven of the hit FX on Hulu series, Reservation Dogs ; stars opposite Pete Davidson and Marisa Tomei in the Judd Apatow film, The King of Staten Island; and he stars as Mayfeld in The Mandalorian on Disney Plus.

Burr was seen in the Hugh Jackman film, The Front Runner; the Mark Wahlberg and Will Ferrell film, Daddy’s Home; he co-stars opposite Kevin Costner in the indie film, Black or White; was seen in the Paul Feig film, The Heat , alongside Sandra Bullock and Melissa McCarthy and in the Al Pacino and Christopher Walken film Stand Up Guys . Burr received raves for his recurring role as “Kuby” on the hit AMC-TV show, Breaking Bad .

For more go to Burr’s website and follow him on Twitter , Instagram and Facebook . Download a photo here .

Bill Burr Live – 2024 Tour Dates:

- Friday, February 16, 2024 - Rancho Mirage, CA Agua Caliente Rancho Mirage – The Show

- Thursday, February 22, 2024 Portland, OR MODA Center

- Friday, February 23, 2024 Vancouver, BC Rogers Arena – JFL Vancouver*

- Saturday, February 24, 2024 Salt Lake City, UT Delta Center

- Friday, March 8, 2024 Gary, IN Hard Rock Live

- Saturday, March 9, 2024 Indianapolis, IN Gainbridge Fieldhouse

- Sunday, March 10, 2024 Detroit, MI Little Caesars Arena

- Thursday, March 21, 2024 St Louis, MO Fox Theatre

- Thursday, April 25, 2024 Phoenix, AZ Arizona Financial Theatre

- Thursday, May 16, 2024 Columbus, OH Jerome Schottenstein Center

- Friday, May 17, 2024 Nashville, TN Bridgestone Arena

- Saturday, May 18, 2024 Winston-Salem, NC Lawrence Joel Veterans Memorial Coliseum

- Wednesday, June 5, 2024 Denver, CO Bellco Theatre

- Wednesday, June 19, 2024 San Jose, CA San Jose Civic Theater

- Saturday, July 20, 2024 Winnipeg, MB Assiniboine Park - Great Outdoors Comedy Festival

- Sunday, July 21, 2024 London, ON Harris Park – Great Outdoors Comedy Festival

*Already on sale

Little Caesars Arena

Event starts 7:00 pm.

- NEWS/REVIEWS

- COMEDIAN OF THE DAY

- UPCOMING SHOWS

- Previous News

Bill Burr Announces 2024 Tour Dates

Comedian Bill Burr has unveiled the North American dates for his 2024 tour, Bill Burr Live , which will see him visit theaters and arenas in 16 cities from February through July.

Presale tickets will be available starting December 6th at 10 am local time, with general on-sale beginning December 8th at the same time.

An Emmy and Grammy nominee who has established himself as one of the preeminent comedic voices of his generation, Burr has spent this year touring arenas and amphitheaters across Europe and North America. Recently, he saw his first feature, Old Dads , premiere as the most-watched film worldwide on Netflix in its first and second week. In addition to writing and directing, Burr stars in the pic alongside Bobby Cannavale and Bokeem Woodbine. Also of note for Burr lately is Leo , the Netflix pic he voiced alongside Adam Sandler, which premiered at #1 in its first week, setting the record for the streamer’s biggest debut of an animated feature with 34.6 million views in its first six days.

Also known for his hit Monday Morning Podcast , and his comedic media empire All Things Comedy co-founded with Al Madrigql, Burr last summer made history as the first comedian to perform at Fenway Park. Other notable acting credits for the multi-hyphenate include the Roku Channel’s Immoral Compass , which earned him an Emmy nomination for Short Form Actor, Judd Apatow’s The King of Staten Island , Disney+’s The Mandalorian , Breaking Bad , and the animated series F Is for Family , which he co-created and starred in for Netflix, to name just a few.

Bill Burr 2024 Tour Dates: 02/16 – Rancho Mirage, CA @ The Show – Agua Caliente Rancho Mirage 02/22 – Portland, OR @ Moda Center 02/23 – Vancouver, BC @ Rogers Arena – JFL Vancouver 02/24 – Salt Lake City, UT @ Delta Center 03/08 – Gary, IN @ Hard Rock Live 03/09 – Indianapolis, IN @ Gainbridge Fieldhouse 03/10 – Detroit, MI @ Little Caesars Arena 03/21 – St. Louis, MO @ Fox Theatre 04/25 – Phoenix, AZ @ Arizona Financial Theatre 05/16 – Columbus, OH @ Schottenstein Center 05/17 – Nashville, TN @ Bridgestone Arena 05/18 – Winston-Salem, NC @ Lawrence Joel Veterans Memorial Coliseum 06/05 – Denver, CO @ Bellco Theatre 06/19 – San Jose, CA @ San Jose Civic 07/20 – Winnipeg, MB @ Assiniboine Park – Great Outdoors Comedy Festival 07/21 – London, ON @ Harris Park – Great Outdoors Comedy Festival

RELATED ARTICLES MORE FROM AUTHOR

ABC Renews “The Conners” & “Not Dead Yet”

Matt Rife Signs w/ UTA

Kevin Hart Announces “Acting My Age” Comedy Tour Dates

- Consequence

Bill Burr Unveils 2024 North American Tour Dates

"Bill Burr Live" launches in February

Bill Burr has announced his 2024 North American tour, “Bill Burr Live,” spanning 16 cities from February through July.

Burr’s upcoming tour will kick off on February 16th in Rancho Mirage, California. He’ll make stops in Vancouver, Nashville, Denver, and more before concluding the trek in London, Ontario on July 21st.

Fans can look for tickets and deals to sold-out gigs via StubHub , where orders are 100% guaranteed through StubHub’s FanProtect program. StubHub is a secondary market ticketing platform, and prices may be higher or lower than face value, depending on demand.

In November, Burr starred alongside Adam Sandler in his animated Netflix film, Leo.

Get Bill Burr Tickets Here

Bill Burr 2024 Tour Dates: 02/16 – Rancho Mirage, CA @ The Show – Agua Caliente Rancho Mirage 02/22 – Portland, OR @ Moda Center 02/23 – Vancouver, BC @ Rogers Arena – JFL Vancouver 02/24 – Salt Lake City, UT @ Delta Center 03/08 – Gary, IN @ Hard Rock Live 03/09 – Indianapolis, IN @ Gainbridge Fieldhouse 03/10 – Detroit, MI @ Little Caesars Arena 03/21 – St. Louis, MO @ Fox Theatre 04/25 – Phoenix, AZ @ Arizona Financial Theatre 05/16 – Columbus, OH @ Schottenstein Center 05/17 – Nashville, TN @ Bridgestone Arena 05/18 – Winston-Salem, NC @ Lawrence Joel Veterans Memorial Coliseum 06/05 – Denver, CO @ Bellco Theatre 06/19 – San Jose, CA @ San Jose Civic 07/20 – Winnipeg, MB @ Assiniboine Park – Great Outdoors Comedy Festival 07/21 – London, ON @ Harris Park – Great Outdoors Comedy Festival

Personalized Stories

Around the web, latest stories.

How to Get Tickets to Charli XCX’s "Sweat" Tour with Troye Sivan

April 26, 2024

Carin León Announces 2024 "Boca Chueca Tour": How to Get Tickets

April 25, 2024

How to Get Tickets to Pearl Jam’s 2024 Tour

Porter Robinson Announces 2024-2025 Tour

The Get Up Kids to Play Something to Write Home About in Full on Anniversary Tour

The Rolling Stones Reveal Opening Acts for 2024 "Hackney Diamonds" Tour

Kittie Announce Summer 2024 North American Headlining Tour

How to Get Tickets to Dave Matthews Band's 2024 Tour

- Album Streams

- Upcoming Releases

- Film Trailers

- TV Trailers

- Pop Culture

- Album Reviews

- Concert Reviews

- Festival Coverage

- Film Reviews

- Cover Stories

- Hometowns of Consequence

- Song of the Week

- Album of the Month

- Behind the Boards

- Dustin ‘Em Off

- Track by Track

- Top 100 Songs Ever

- Crate Digging

- Best Albums of 2023

- Best Songs of 2023

- Best Films of 2023

- Best TV Shows of 2023

- Top Albums of All Time

- Festival News

- Festival Outlook

- How to Get Tickets

- Photo Galleries

- Consequence Daily

- The Story Behind the Song

- Kyle Meredith

- Stanning BTS

- In Defense of Ska

- Long Time No See

- Good for a Weekend

- Consequence UNCUT

- The Spark Parade

- Beyond the Boys Club

- Going There with Dr. Mike

- The What Podcast

- Consequence Uncut

- Behind the Boys Club

- Two for the Road

- 90 Seconds or Less

- Battle of the Badmate

- Video Essays

- News Roundup

- First Time I Heard

- Mining Metal

Theme Weeks

- Industrial Week

- Marvel Week

- Disney Week

- Foo Fighters Week

- TV Theme Song Week

- Sex in Cinema Week

Follow Consequence

IMAGES

VIDEO

COMMENTS

Bill Burr Concert History. 542 Concerts. William Frederick Burr (born June 10, 1968) is a short tempered, pasty, alabaster-skinned, freckled, orange-haired stand up comedian and actor from (the safe suburbs of) Boston. ... The songs that Bill Burr performs live vary, but here's the latest setlist that we have from the September 07, 2023 concert ...

Bill Burr rants about relationship advice, sports and the Illuminati. Is there anything better? tour dates. 25 Apr 2024. Arizona Financial Theatre. Phoenix, AZ. Sold Out. 26 Apr 2024. Arizona Financial Theatre. Phoenix, AZ. Sold Out. 27 Apr 2024. Arizona Financial Theatre. Phoenix, AZ. Sold Out. 28 Apr 2024.

All Dates Choose date range. United States. 4/25/24. Apr. 25. ... I've been a fan of Bill Burr for a long time. Over the past few years, I only been able to catch him in larger venues. ... In 2024, Bill is touring arenas and theaters with his Bill Burr Live tour, he will be seen in Jerry Seinfeld's Netflix film, Unfrosted: The Pop-Tart Story ...

Follow Bill Burr and be the first to get notified about new concerts in your area, buy official tickets, and more. Find tickets for Bill Burr concerts near you. Browse 2024 tour dates, venue details, concert reviews, photos, and more at Bandsintown.

Past concerts. Nov 17 Las Vegas, NV, US. Dolby Live. Nov 10 New York (NYC), NY, US. NY Comedy Festival Presents Bill Burr Live ... Find information on all of Bill Burr's upcoming concerts, tour dates and ticket information for 2023-2024. Bill Burr is not due to play near your location currently - but they are scheduled to play 1 concert ...

Find concert tickets for Bill Burr upcoming 2024 shows. Explore Bill Burr tour schedules, latest setlist, videos, and more on livenation.com.

BILL BURR (SLIGHT RETURN) FALL 2022 TOUR DATES: 9-8-22 - Tulsa, OK - BOK Center. 9-9-22 - Houston, TX - Toyota Center. 9-10-22 - Dallas, TX - American Airlines Center. ... On August 21, Bill will make history as the first comedian to perform at Fenway Park.

All previously purchased tickets will be valid for the corresponding rescheduled dates listed below. BILL BURR TOUR 2021 DATES: *New Show. Jul 2 - Las Vegas, NV - The Chelsea at the Cosmopolitan of Las Vegas. Jul 3 - Las Vegas, NV - The Chelsea at the Cosmopolitan of Las Vegas. Aug 28 - Hollywood, FL - Hard Rock Live at Seminole ...

Bill Burr rants about relationship advice, sports and the Illuminati. Is there anything better? tour dates. 5 Apr 2024. Live From Yellow Springs Firehouse. Yellow Springs, OH. Sold Out. 5 Apr 2024. Live From Yellow Springs Firehouse - LATE SHOW. Yellow Springs, OH. Sold Out. 6

BILL BURR TOUR 2021 DATES: *New Show. Jul 2 - Las Vegas, NV - The Chelsea at the Cosmopolitan of Las Vegas. Jul 3 - Las Vegas, NV - The Chelsea at the Cosmopolitan of Las Vegas. Aug 28 - Hollywood, FL - Hard Rock Live at Seminole Hard Rock Hotel & Casino Hollywood*

Written by Jason Price on October 12, 2021. Comedy legend Bill Burr has announced spring and summer North American dates for his Live Nation produced 2022 arena and amphitheater tour, Bill Burr ...

Legendary comedian Bill Burr will be hitting the road in 2021 on a U.S. tour! Produced by Live Nation, the 21-date tour will kick off on July 2nd in Las Vegas at the Cosmopolitan with

Tickets go on sale this Friday, April 9th at 10:00 a.m. local time via Burr's website. Check out the complete list of dates below. Bill Burr 2021 Tour Dates: 07/02 — Las Vegas, NV @ The Chelsea at the Cosmopolitan of Las Vegas. 07/03 — Las Vegas, NV @ The Chelsea at the Cosmopolitan of Las Vegas. 08/28 — Hollywood, FL @ Hard Rock Live ...

The leisurely pace of his 2022 tour may be designed to accommodate an increasingly busy schedule. Burr's animated Netflix series, F Is for Family, returns for its fifth season later this year. He recently guested on Reservation Dogs, and appeared in Seasons 1 and 2 of The Mandalorian. Bill Burr 2021-2022 Tour Dates:

Check out his full list of tour dates below. Bill Burr 2022 Tour Dates: 05/20 - Tampa, FL @ MIDFLORIDA Credit Union Amphitheatre. 05/21 - West Palm Beach, FL @ iThink Financial Amphitheatre. 05/27 - Las Vegas, NV @ The Chelsea at the Cosmopolitan of Las Vegas. 05/28 - Las Vegas, NV @ The Chelsea at the Cosmopolitan of Las Vegas.

Louisville, KY (May 16, 2022) - Today, Bill Burr announced the second leg of his Bill Burr (Slight Return) tour, produced by Live Nation, which will visit 25 cities starting in September and includes a stop in downtown Louisville on Thursday, September 29, 2022 at the KFC Yum!Center. Tickets go on sale this Friday, May 20 at 10:00 AM local time at the KFC Yum!

December 4, 2023 7:00am. Bill Burr Koury Angelo. EXCLUSIVE: Comedian Bill Burr has unveiled the North American dates for his 2024 tour, Bill Burr Live, which will see him visit theaters and arenas ...

Host of the groundbreaking Monday Morning Podcast, Bill is touring arenas and theaters with his Bill Burr Live tour, in 2023 he was the first comedian to perform at the 5,000-seat ancient Roman amphitheater, The Odeon of Herodes Atticus in Athens, Greece, and in 2022 he made history as the first comedian to perform at Fenway Park.

Bill's Monday Morning Podcast is one of the most downloaded comedy podcasts, his 2023 arena and amphitheater tour, Bill Burr Live, is touring across Europe and North America and on August 21, 2022, Bill made history as the first comedian to perform at Fenway Park. On October 20, Bill's film, Old Dads, will premiere on Netflix.

Buy Bill Burr Live tickets at the Moore Theatre in Seattle, WA for Jun 29, 2024 at Ticketmaster. Bill Burr Live More Info. Sat • Jun 29 • 7:30 PM Moore Theatre, Seattle, WA. Important Event Info: This event will be a phone-free experience. ... By continuing past this page, ...

GRAMMY®-nominated comedian Bill Burr announced his fall North American dates of his Bill Burr (Slight Return) Tour. Produced by Live Nation, the tour visits 25 cities starting September 8 through December 17, including Orlando's Kia Center on Saturday, November 19. Burr is one of the top comedic voices of his generation achieving success in ...

(DETROIT - December 4, 2023) - Bill Burr announces his 2024 North American tour, Bill Burr Live, will visit Little Caesars Arena on Sunday, March 10 at 7 p.m. Tickets go on sale Friday, December 8 at 10 a.m. at 313Presents.com, LiveNation.com, and Ticketmaster.com.Presale tickets will be available starting Wednesday, December 6 at 10 a.m.

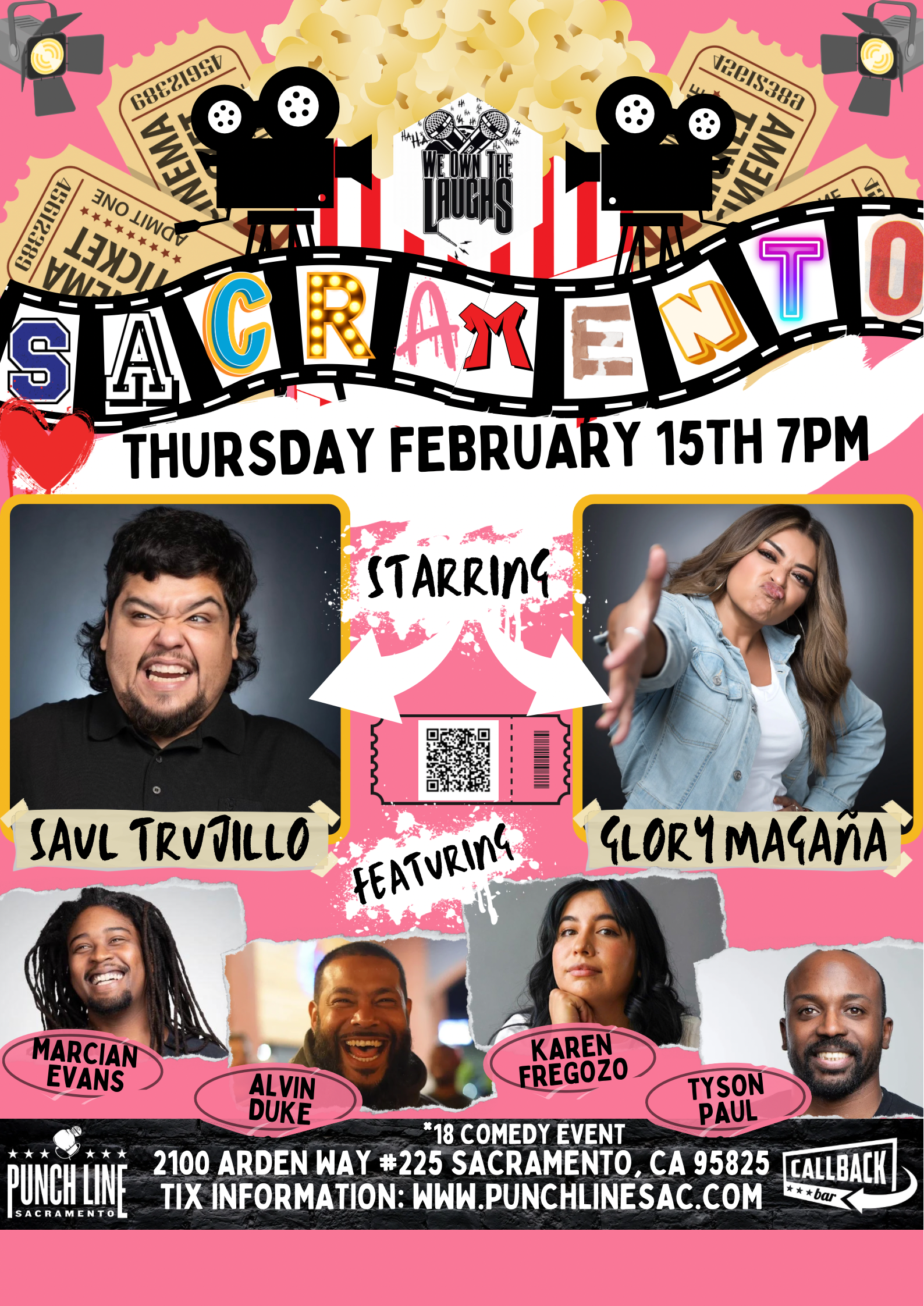

Comedian Bill Burr has unveiled the North American dates for his 2024 tour, Bill Burr Live, which will see him visit theaters and arenas in 16 cities from February through July. ... For the past 7 years, WOTL has expanded throughout the west coast to various legendary comedy clubs/venues as it has grown into one of the best comedy brands in the ...

Bill Burr has announced his 2024 North American tour, "Bill Burr Live," spanning 16 cities from February through July. See the dates and purchase tickets here. ... Get Bill Burr Tickets Here. Bill Burr 2024 Tour Dates: 02/16 - Rancho Mirage, CA @ The Show - Agua Caliente Rancho Mirage 02/22 - Portland, OR @ Moda Center