Don't know which tour is suitable for you?

Let us help you. Please tell us more about your interests. We will send some suggestions based on your needs.

- Trip Finder

- Saved Tours

- Group Tours Calendar

- Our California office it's now

- 17:12 PM(Wed) - We Are Open

- Tel: 1-909-988-8885 Toll free : 1-855-325-2726 (USA & CANADA)

- Whatsapp: Website Line : 1-909-818-5901

- Monday to Friday 8:30AM - 5:30PM (PST) Saturday 8:30AM - 3:00PM (PST)

What Differentiates Us from other Japan Tourist Travel Agencies

All Japan Tours is the only Japan Specialists in the US, with a Japan office and our own coaches, providing fully escorted Japan tour packages, custom Japan vacations, luxury private tours, special-interest tours, business and educational programs to match your requirements.

We started our first travel business in Japan in 2000 with Shinsu Travel Co., Ltd, a licensed reservation service (Tokyo Prefecture Travel Agent License Number 3-5036) for foreign travelers wishing to travel Japan. With the growth and expansion of this in-bound travel business, All Japan Tours was formed to take this cultural experience to the US by organizing fully escorted and in-depth tours of Japan.

In addition to our US staff, we have bilingual Japanese staff at our Tokyo office with the local knowledge to arrange whatever experiences you would like from your trip.

Our Travel Agent Concept for Traveling to Japan

We know experience and expertise matters when you travel. That's why we have professional, knowledgeable staff located in Japan and the US. Our bilingual staff knows the best places in Japan because they themselves are locals.Whether you take one of our fully escorted group tours or custom tours, we offer first class service at a great value. When you book with All Japan Tours, you can rest assured that our experienced staff is with you every step of the way.

Why All Japan Tours?

All Japan Tours offers expertise and experience, but perhaps the best reason to book with us is our genuine passion for Japan and our commitment to sharing that passion others. Through careful planning, we strive to give our clients the best experience possible. We are committed to showing you the many facets of this beautiful and fascinating country.

Peace of mind

When you book with All Japan Tours, you can be sure your money is safe. We are 100% bonded against financial failure through the CST trust account program. This program was created by the State of California to protect consumers who purchase travel related products. Our California Seller of Travel Number (CST #2102781-40) guarantees that we are fully registered and are recognized by the State of California as a seller of travel.

We are also a member of All Nippon Travel Association (ANTA), which congregates all Japanese travel agents. We have been a member since 2001. We are licensed by the Ministry of Land, Infrastructure, and Transport of Japan, in accordance with the provision of the Travel Agency Law. This means you can have peace of mind when you book with us.

How Does Our Japan Travel Agency Process Work?

Contact US Please contact us by phone, fax, or email for tour availability. If you interested in a custom tour, please tell us the destinations, dates and preferred ingredients of your dream trip.

Get your trip planned We will arrange an initial phone consultation or exchange emails with you to better understand your specific interests and vacation preferences.

Book your trip Please click on reservation, read and understand to all important issues described in the Terms & Conditions. Then, submit the Tour Reservation Form on-line or download it to submit by fax.

Making your tour deposit A deposit of US$200 per person must be remitted before the reservation can be processed. Deposit payment applies to land packages only, air travel can be purchased separately. Payment can be made in US Dollars by Visa, Mastercard, American Express or Discover credit cards, paypal, cashier's check, personal check or money order from a US Bank or by bank wire transfer. Contact us for our bank information if paying by wire transfer. Credit card payment If you are paying by credit card, an authorization form is required. Please download credit card authorization form, print out and send it by fax to 909-349-1736 or submit the on-line the credit card authorization form. Check payment If you are paying by check, please make all checks payable to All Japan Tours Paypal If you are paying by paypal, please send paypal payment to [email protected]

Booking confirmation Upon completion of the reservation form, and submission of your deposit, you will receive a booking confirmation, deposit receipt/invoice of the balance. The balance payment is due 2 months before departure. Note : We will send you a reminder email when the balance payment is due.

Final Payment After the final payment is received, we will send you the confirmation of the tour booked including confirmed itinerary & schedules.

Enjoy your unforgetable Japan trip

We do not accept any reservation bookings by telephone. All reservation bookings must be made by completing and submitting either our secure online form or our printable form

Terms & Conditions

Our vehicles.

All Japan Tours philosophy is that it's as much about enjoying the journey, as the destinations. Our commitment to quality and service is apparent in every aspect of our tours, including our fleet of top of the line luxury coaches.

All Japan Tours has the newest coach fleet on the road. This means the latest features, luxurious finishes and high safety standards.

Our on the Road Team

For us, the most important part of making your trip unforgettable is our team on the road. On all our Japan escorted group tours, a team of two travel professionals-a tour guide and a driver-will accompany you. All are committed, passionate and eager to share their local knowledge with you.

They are there to make sure you see and get the best out of what's on offer. They will make sure you're being dropped off right to the door of your accommodation, look after your luggage at the end of each day and be on hand to share tips on where to eat, what to see or anything else you need.

Our Tour Guides

The majority of All Japan Tours guides have more than five years of experience. They are carefully chosen, speak fluent Japanese and English and are among the best in the business.

These well-seasoned experts are on hand to give tailored advice on ideas of things to do with your free time as well as share their in-depth knowledge of Japanese history and culture to give you a unique and insightful trip. They can provide expert local information that you won't find in a guidebook.

Our drivers are second to none and work as a team with the tour guides. Each driver holds a Heavy Passenger Vechicle licence and has been screened for a clear track record and extensive driving experience. They are also regularly trained in defensive driving, updated road rules and destination/itinerary delivery.

Their experience and knowledge of the roads allow them to navigate and handle weather and road conditions well to ensure your journey is as safe and comfortable as possible.

Don't know which tour is best for you? Let us help you.

- share trip finder saved tours inquiry book now

Email Signup

Our Services

News Release

1/26/2024 jtb set to sponsor mlb's world tour, offer exclusive hospitality packages for seoul series, 4/28/2023 useful information for traveling to japan, japan tours.

Popular Destinations

Travel Services

Travel News Letter

Jtb usa official sns.

Tourism Statistics

Provide the latest and most up-to-date tourism statistics / Japanese economic trend

Tourism Statistics Highlight 05 April 2024

- Inbound According to Japan National Tourism Organization (JNTO), the estimated number of international travelers to Japan in February 2024 was 2,788,000 (+7.1% compared to 2019).

- Japanese tourists According to preliminary figures from the Immigration Service Agency of Japan, the number of Japanese overseas travelers in February 2024 accounted for 978,885, +82.0% compared to February 2023, and -36.2% compared to 2019.

February 2024 (Estimated figures)

2,788,000 Visits

YOY +89.0%

View more statistical bulletins

978,885 Visits

YOY +82.0%

Statistics of Visitors to Japan from Overseas

- Overseas Residents’ Visits to Japan by month

- Overseas Residents’ Visits to Japan by year

- Overseas Residents’ Visits to Japan by Country and Region

- Overseas Residents’ Visits to Japan by country

- Overseas Residents’ Visits to Japan by Region

View more time series

Statistics of Japanese Tourists Travelling Abroad

- Japan Residents’/Japanese Visits Abroad by Month

- Japan Residents’/Japanese Visits Abroad by Year

- Japan Residents’/Japanese Visits Abroad by Country and Region

- Japanese Visits Abroad by Airport and Seaport, Monthly

- Japanese Visits Abroad by Airport and Seaport in the Last Decade

Japanese Economic Trend

- GDP Growth Rate

- Unemployment Rate

- Exchange Rate

- Consumption Expenditure per Household

- Consumption expenditures on Travel & Communication

- Sales of Department Stores

- Wholesale Price of Unleaded Gasoline

View more time series related to Japan Economic Trend

- About Our Policies

- Statistics/White Paper

- Information

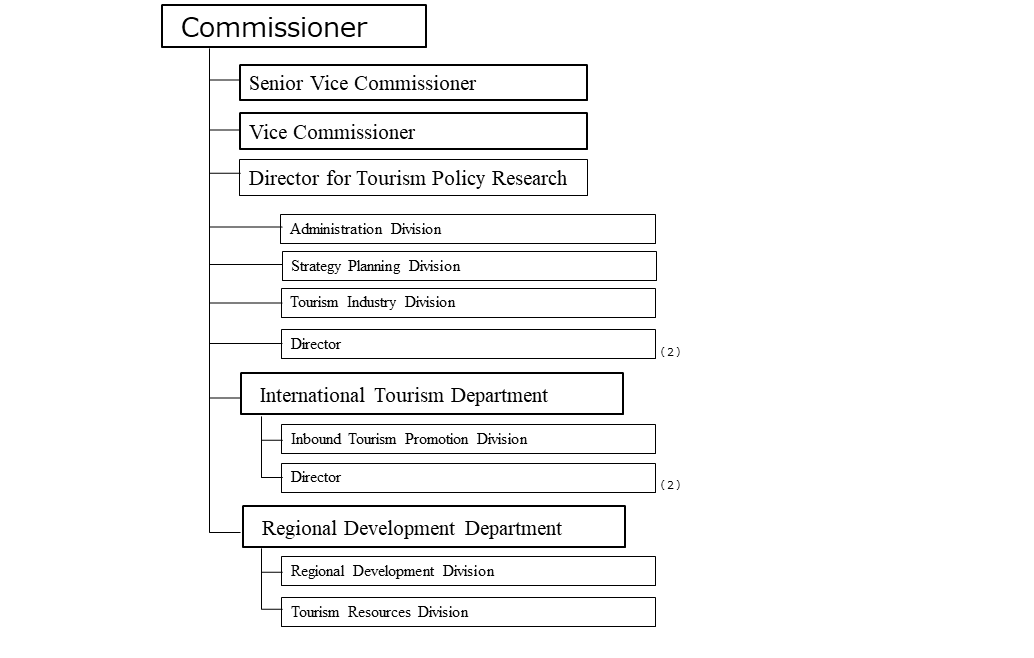

About the JTA

- Organization & Structure

Last Update : 2024/3/22

Japan Tourism Agency Organization

Regional Organization

Tourism divisions of district transport bureaus and okinawa general bureau, japan national tourism organization.

- Vision of the Japan Tourism Agency

- Office of Tourism Nation Promotion

- The Japan Tourism Agency Logo

Inquiries Regarding This Page

For information about the Japan Tourism Agency: Administration Division, JTA Tel: +81-3-5253-8111

For information about district transport bureaus and the Okinawa General Bureau: Please contact each organization directly.

Opening Remarks

Keynote remarks.

.png)

November 2021

Feature Article

Overview of the Japanese Government's Tourism Policy for Foreign Tourists

by hirokazu nishikawa.

1. History of the Japanese Government’s Tourism Policy

The Japanese government's tourism policy began in earnest in 2003. In January of that year, the then prime minister set a goal of doubling the number of foreign visitors to Japan by 2010 from the approximately 5 million at that time, followed by the launch of the “Visit Japan Campaign” by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) in April of the same year to strategically promote the Japanese brand overseas.

The reason behind these moves by the government was that since 1964, when overseas tourism was liberalized, the number of Japanese tourists traveling abroad increased due to the strong yen and rising national income, while at the same time witnessing a significant gap between the number of Japanese tourists traveling abroad and that of foreign tourists visiting Japan. It is conceivable that the current situation is far from reaching the policy goal of the time, which was to "improve the international balance of cashflow and promote economic and cultural exchange with foreign countries.”

The number of foreign visitors to Japan has been steadily increasing since 2003. In 2008 the Japan Tourism Agency was newly established as a bureau under MLIT, and in 2016 the government set a goal of achieving 40 million foreign visitors to Japan annually by 2020, further strengthening the system to achieve the aim of becoming a tourism-oriented country.

In 2019, Japan was ranked 12th (3rd in Asia) in terms of the number of incoming foreign tourists (31.88 million), increasing its popularity as a tourist country and steadily growing its visitor numbers, but due to the coronavirus, was forced to significantly decrease its numbers the following year.

2.Outline of the Japanese Government's Tourism Policy for Foreign Tourists (Introduction of the FY2022 Budget Request)

Since the spread of the COVID-19 virus, domestic and international tourism demand has decreased significantly, and the tourism industry has been severely affected. Against this backdrop, I would like to introduce some of the major policies aimed at improving the environment for and the gradual revival of inbound tourism within the budget outlined for the next fiscal year by the Japan Travel Agency, as follows.

Emergency Project for Improving the Environment for Foreign Visitors Traveling to Japan

In order to create an environment in which foreign visitors traveling to Japan can fully enjoy their trip in a stress-free and comfortable manner at tourist spots, accommodation facilities, and public transportation, and to create a safe and secure travel environment in case of emergencies such as disasters, the following measures will be supported: enhancement of multilingual tourist information provisions, development of free Wi-Fi services, dissemination of cashless transactions, promotion of barrier-free environments for disability accessibility, improvement of countermeasures against the COVID-19 virus, and strengthening of multilingual responses in case of emergencies.

(Some examples of measures)

Utilizing a contactless check-in system using Digital Transformation

Signage in multiple languages

Free Wi-Fi in transportation facilities and vehicles

Sustainable Tourism Promotion Project

As the interest in sustainable tourism* is increasing worldwide, Japan will promote it, as well as addressing overtourism and carbon neutrality, by establishing a management system that can be used as a model across other regions in order to become the tourist destination of choice for travelers around the world.

(*) The World Tourism Organization’s (UNWTO) definition of sustainable tourism: tourism that fully considers current and future economic, social, and environmental impacts while responding to the needs of visitors, industries, the environment, and the communities that host them.

As an example of efforts, by implementing the Japan Sustainable Tourism Standard for Destinations (JSTS-D), a best-practice for sustainable tourism destination management has been developed and is being implemented nationwide.

(Examples of overtourism in each region)

Crowded and congested tourist spots (The two pictures on the left)

Residents picking up trash left by tourists / Traffic obstruction in tourist areas (The two pictures on the right)

(The Role of these Guidelines)

Use as a Self-Assessment Tool: a guideline for tourism policy making and tourism planning

Use as a Communication Tool: an opportunity for the community to work together to create a sustainable region and tourist destination

Use as a Promotional Tool: branding as a tourist destination and improving international competitiveness

Implementation of Strategic Promotion for Foreign Tourists

Focusing on a post-COVID-19 virus future, the Japan National Tourism Organization (JNTO) will work on strategic promotion for inbound tourism to Japan in order for it to easily recovery, increase travel spending, and attract more visitors to regional areas. By doing these, Japan aims to achieve its goals of 60 million foreign visitors and 15 trillion yen in foreign travel spending by 2030. In particular, the following five measures will be taken.

1. Implementing promotions to stimulate the desire to revisit Japan among repeat visitors

A large-scale campaign to stimulate the desire to revisit Japan will be conducted for repeat travelers in the Asian market, who are expected to resume visiting Japan at an early stage. In addition, JNTO will promote an increase in consumption by strengthening the dissemination of experiential tourism in local areas.

2. Strengthening promotions based on changes in demand due to Covid

Promotions of experiences that are expected to have increased demand in the post- COVID-19 virus era, such as sports and adventure tourism, will be fortified to take into consideration local lifestyles and nature.

3. Thoroughly utilizing market-specific strategies based by country

In order to strategically attract visitors from key markets to Japan, JNTO will accurately grasp the trends in each and conduct detailed promotions based on market-specific strategies. Specifically, in the Asian sector, since Japan is already well known as a travel destination, detailed promotions tailored to individual travel demands will be implemented. For the European, U.S. and Australian markets, the promotion will focus on appealing to interests such as attractive activities.

4. Bolstering dissemination of regional tourism offerings

Consultations will be made to improve the quality of local attractions to meet post- COVID-19 demands and to advertise these regional offerings according to the needs of each market in order to interest tourists.

5. Strengthening digital marketing

The foundations of digital marketing will be strengthened through collecting and analyzing the information obtained by foreign tourists from websites, etc. to effectively develop promotions.

The initiatives introduced in the previous section are only a small part of the budgeted projects scheduled for the next fiscal year. The overall basic policy for next year's budget is to do its utmost to maintain employment and continue business operations, and to provide support for thorough measures that prevent the spread of infection.

At the same time, the government will revitalize tourist attractions by renewing accommodation facilities and removing abandoned buildings, refine local tourism resources through cooperation with various stakeholders, and stimulate travel demand by supporting local tourism businesses. In the next fiscal year, it is necessary to realize a full-scale recovery of tourism that supports the local economy with an eye on the time post-COVID-19 virus, while taking all possible measures to ensure the survival of tourism areas and industries that are in danger. In addition, promotion of these efforts will continue, as well as those to increase the number of mid- to long-term visitors and repeat visitors, and content that will become the signature products of profitable regions will be created.

In addition, necessary measures to cope with the COVID-19 virus will be considered in the budgeting process, taking into account the future infection situation and trends in tourism demand. The Go To campaign promoting domestic tourism, which was introduced in this journal last year, is not being considered in the initial budget for the next fiscal year, at least at this point. To read last year's article, please click here: JITTI Journal- November 2020 Feature Article.

Efforts and Challenges toward the Realization of a Tourism-oriented Nation Microsoft Word - 20130701048.docx ( sangiin.go.jp )

A Study on the Changes in Japan's Inbound Tourism Policy

268407547.pdf ( core.ac.uk )

Japan Tourism Agency

訪日外国人旅行者数・出国日本人数 | 統計情報 | 統計情報・白書 | 観光庁 ( mlit.go.jp )

スライド 1 ( nihon-kankou.or.jp )

①.表紙・総括表_2ver2 ( mlit.go.jp )

Image Sources

JAL and ANA have received around 10% more international flight bookings for this coming Golden Week holiday period

Japanese outbound travelers still recovered slowly to 1.2 million in March 2024

International visitors to Japan exceeded 3 million in March 2024 for the first time, boosted by cherry blossom

Guest nights in home-sharing in Japan for the first two months of 2024 were 30% more than a year ago

Interest in overseas travel of Japanese people is much lower than the world’s average

Foreigners’ guest nights in Japan were up 23% in February 2024 compared to pre-pandemic

Japanese outbound travelers still recovered slowly in February 2024

International visitors to Japan were record-high 2.8 million for February

Japanese passport issues were up 2.8 times to 3.4 million in 2023, with half issued to 30 years old or younger

Port calls of foreign-based cruise ships in Japan in 2023 recovered to 63% of the peak in 2017

60% of Japanese people agree to dual-pricing for inbound travelers, while 50% of 60s disagree

ikyu.com is top OTA in Japan for Net Promoter Score, followed by Rakuten Travel and Expedia

Japanese outbound travelers in January 2024 increased by 90% year on year, but still decreased by 40% over 2019

International visitors to Japan from 10 source markets reached record-high for January

Foreigners’ guest nights in Japan were up 32% in December 2023 compared to pre-pandemic

Narita Airport recovered international flight passengers to 70% of the pre-pandemic level in 2023 due to surge in inbound travelers

Spending in Japan by international travelers in 2023 reached record-high 5.3 trillion JPY

Japanese outbound travelers were 9.6 million in 2023, not reaching half of those in 2019

Japanese people who prefer to be alone has significantly increased across all generations, with 54% saying they prefer to be alone

Guest nights in Japan by both Japanese and foreigners finally exceeded the pre-pandemic level for three consecutive months

47% of inbound travelers in japan said that clean public toilets make them have better images of the areas, ana begins serving complimentary in-flight internet access even to international flight business class passengers .

This site uses Cookie to enhance users’ experiences.

- Corporate customers

- Individual customers

- Business partners

- Our Business

- Sustainability

- Corporate information

- The JTB Way

- The Value Creation Process at JTB

- Brand Movie

- 110 years of JTB history

- Tourism business

- Area solution business

- Business solution

- Global Business (incl. Japan Inbound business)

- Top Commitment

- Sustainable Business Management

- Feature Story

- Materiality-Guided Sustainability Priorities

- Data Highlights

- The JTB Brighter Earth Project

- Report / Materials

- Sustainable business management

- Mental and Physical Wellbeing

- Personal Growth and Development

- Helping communities and businesses

- Empowering Our People to Shine

- Human Rights & Diversity

- Creating Regional Allur

- Caring for the Earth

- Stakeholder Connections

- JTB Sustainability Priorities and the SDGs

- Corporate Governance

- Sustainability Report

- Top message

- Company profile

- Company Brochure (ESSENCE BOOK)

- JTB group organization

- Our history

- Overseas Group Companies

Print to PDF

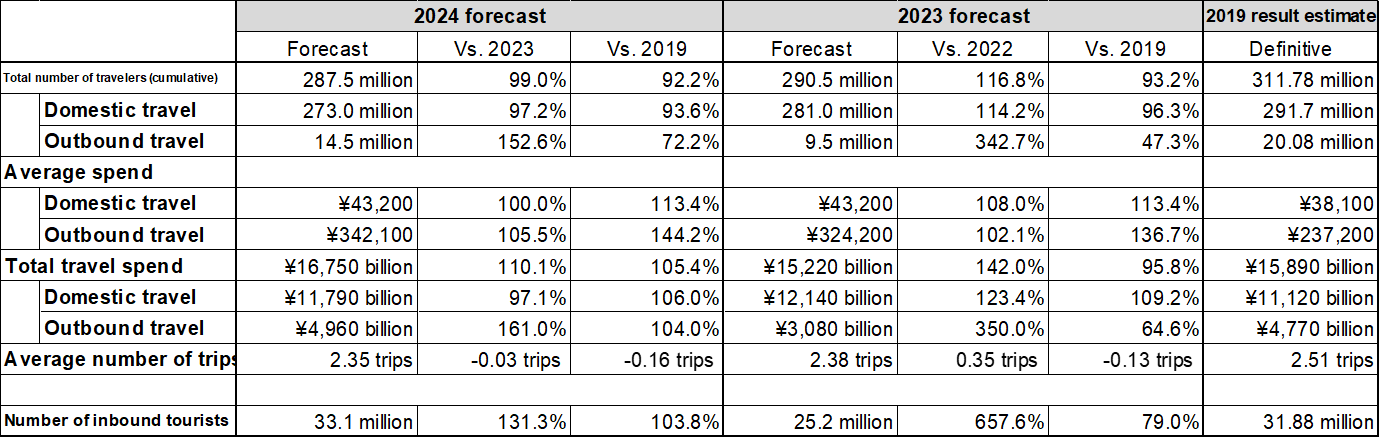

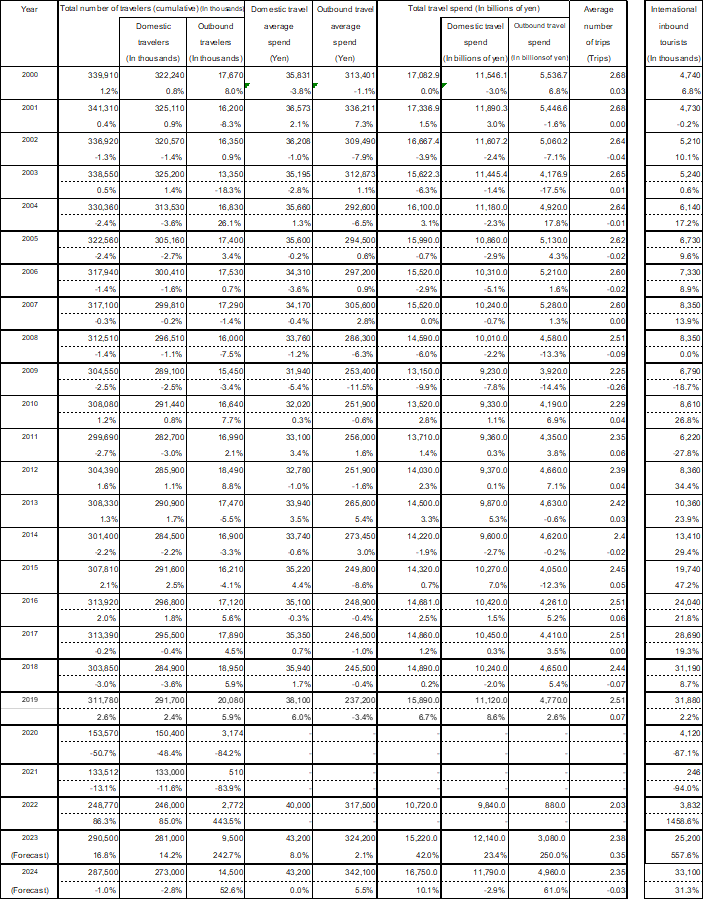

The number of inbound tourists is likely to hit record high at 33.1M. ●The number of Japanese domestic travelers is estimated at 273 million (97.2% of 2023 and 93.6% of 2019). ●The number of outbound travelers is estimated at 14.5 million (152.6% of 2023 and 72.2% of 2019). ●The number of international inbound tourists is estimated at 33.1 million (131.3% of 2023 and 103.8% of 2019).

JTB has compiled a report on a 2024 travel trend outlook. For 2021 and 2022 when COVID-19 had a significant impact, JTB released estimates for domestic trips only. JTB resumed releasing estimates for Japanese resident outbound trips and international inbound trips in 2023. The survey provides estimates on overnight or longer trips of Japanese residents travelling in Japan (including business trips and visits to hometowns) and of international visitors travelling to Japan. The estimates are made based on data such as economic indicators, consumer behavior surveys, transport/tourism related data, and surveys conducted by the JTB Group. The survey has been conducted continuously since 1981. The estimated size of the travel market in 2024 is as follows.

*Domestic travel spend means total expenditures incurred after leaving home and until returning home. It includes spending at travel destinations such as shopping and meals and does not include spending before and after a trip (e.g., the cost of purchasing clothing or other travel goods).

*Outbound travel spend includes travel expenditures (including fuel surcharges) and spending at travel destinations such as shopping and meals. It does not include spending before and after a trip (e.g., the cost of purchasing clothing or other travel goods).

*For inbound trips, only the number of inbound tourists is estimated. Travel spend is not calculated.

*Figures at or below the second decimal point are rounded for comparisons with previous years and with 2019.

*The number of domestic travelers is the number of travelers going on an overnight or longer trip.

*The numbers of domestic travelers and outbound travelers both include those on business trips and visiting their hometown.

*Because the survey results are rounded, there could be discrepancies in the sub-totals or differences with previous years' figures.

<Social and Economic Trends and Environment Surrounding Traveling>

1.Situation of COVID-19 and travel trends before the end of 2023

The World Health Organization (WHO) announced in May 2023 the end of a global health emergency brought about by COVID-19 after more than three years had elapsed since they had declared COVID-19 as a worldwide pandemic in March 2020. While economic activities have mostly returned to their pre-COVID conditions worldwide, ongoing inflations and high interest rates caused by factors such as the rapid recovery in demand are having various impacts on people's lives. With respect to travelling, except for some countries and regions, international arrival and departure restrictions have generally been removed, enabling international travel in the same manner as in the pre-COVID period. According to the World Tourism Barometer released by the United Nations World Tourism Organization (UNWTO) in November 2023, the number of international tourists worldwide during the January-September 2023 period recovered to 87% of its pre-COVID level. Unstable international situations and the resulting rises in energy and other prices, however, are causing concerns. Furthermore, there are regional differences in recovery: the Asia Pacific region including Japan is recovering slower than Europe and the United States.

The Japanese government ended its border control measures in April 2023 and re-classified COVID-19 into Class-5, the same category as seasonal influenza, under the country's infectious disease laws in May 2023. These brought people's lives mostly back to pre-pandemic conditions. Regulatory restrictions on travelling have also been removed, and some regions are implementing a government-funded travel discount program as well as travel support measures of local governments. Partly due to these measures, tourism activities are returning nationwide, combined with a recovery in inbound tourism. Meanwhile, some tourist spots and areas are experiencing a service staff shortage and rising accommodation charges due to changes in the environment caused by the COVID-19 pandemic. In addition, there are concerns about overtourism.

2.Economic environment surrounding traveling and living conditions

The Nikkei Stock Average has remained over ¥30,000 since May 2023, demonstrating robust market activities in Japan. Meanwhile, the country's economic outlook remains uncertain due to the impact of global conditions and monetary policies of European countries and the United States. The World Economic Outlook released by the International Monetary Fund (IMF) in October 2023 forecasted Japan's growth rate in 2023 at 2.0%, which was above the actual growth rate of 1.0% recorded in 2022. The IMF, however, makes a grimmer forecast for 2024, expecting the 2024 growth rate to decline to 1.0%.

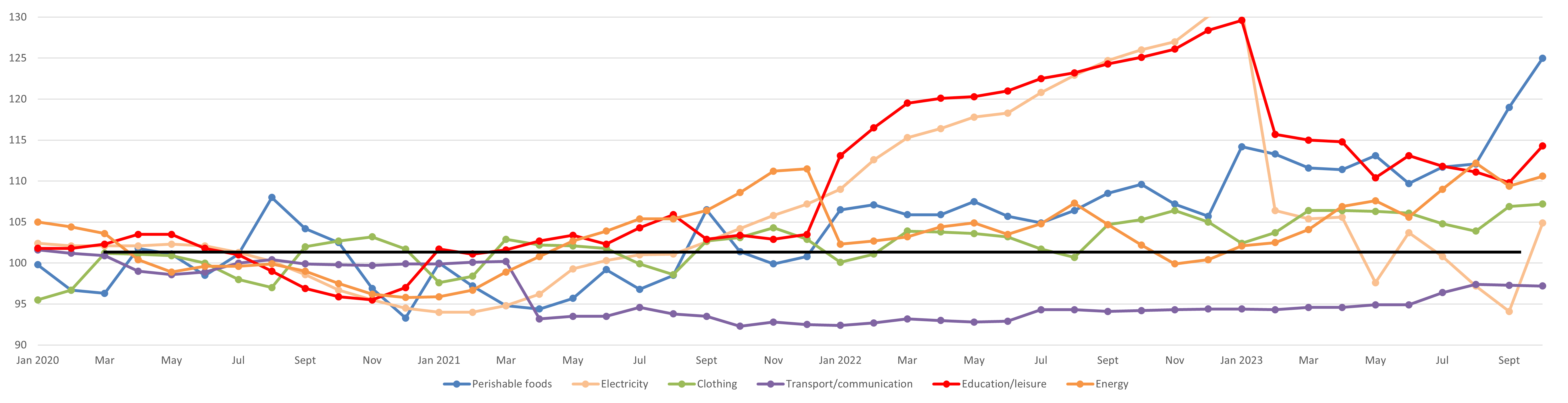

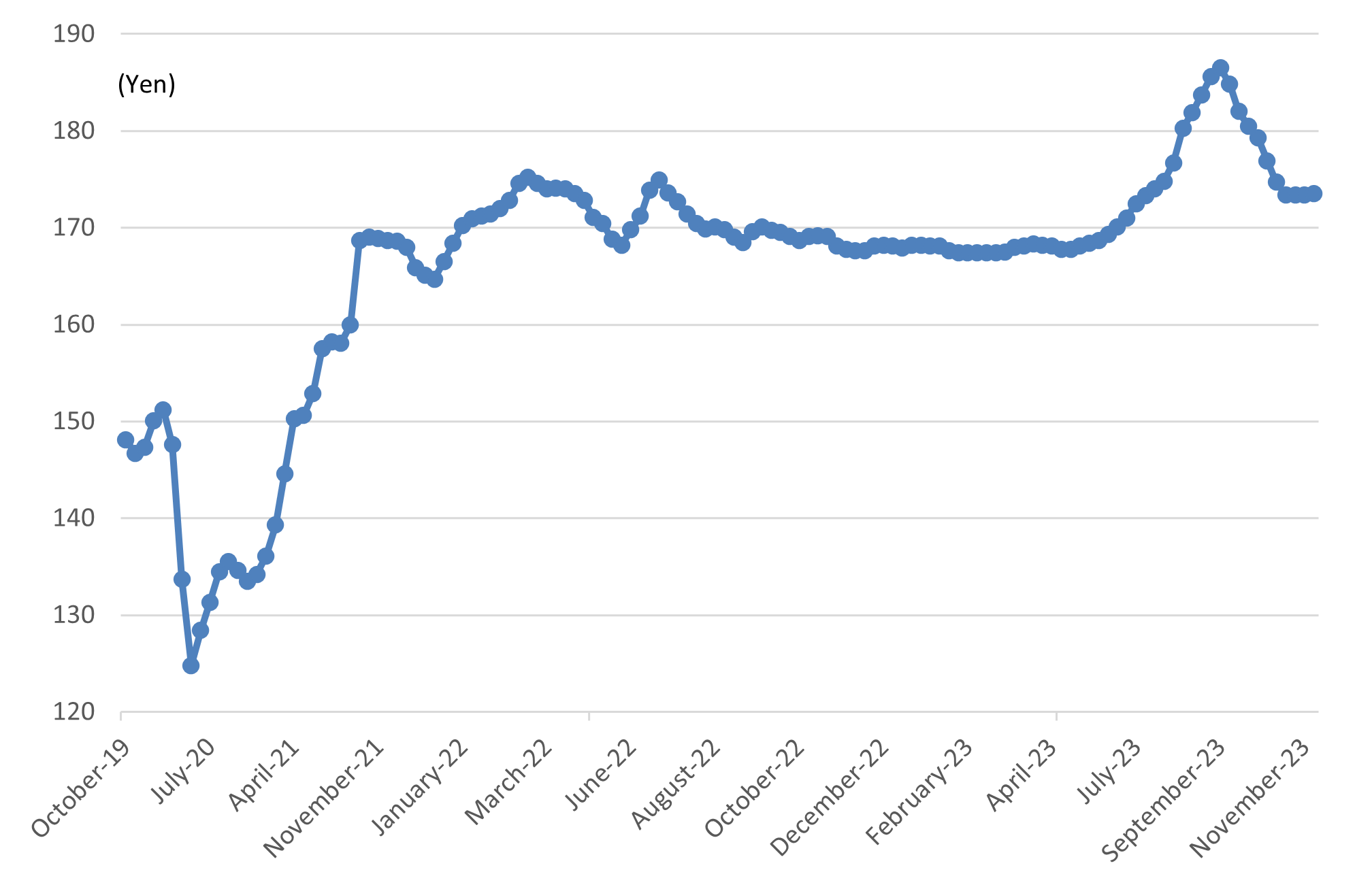

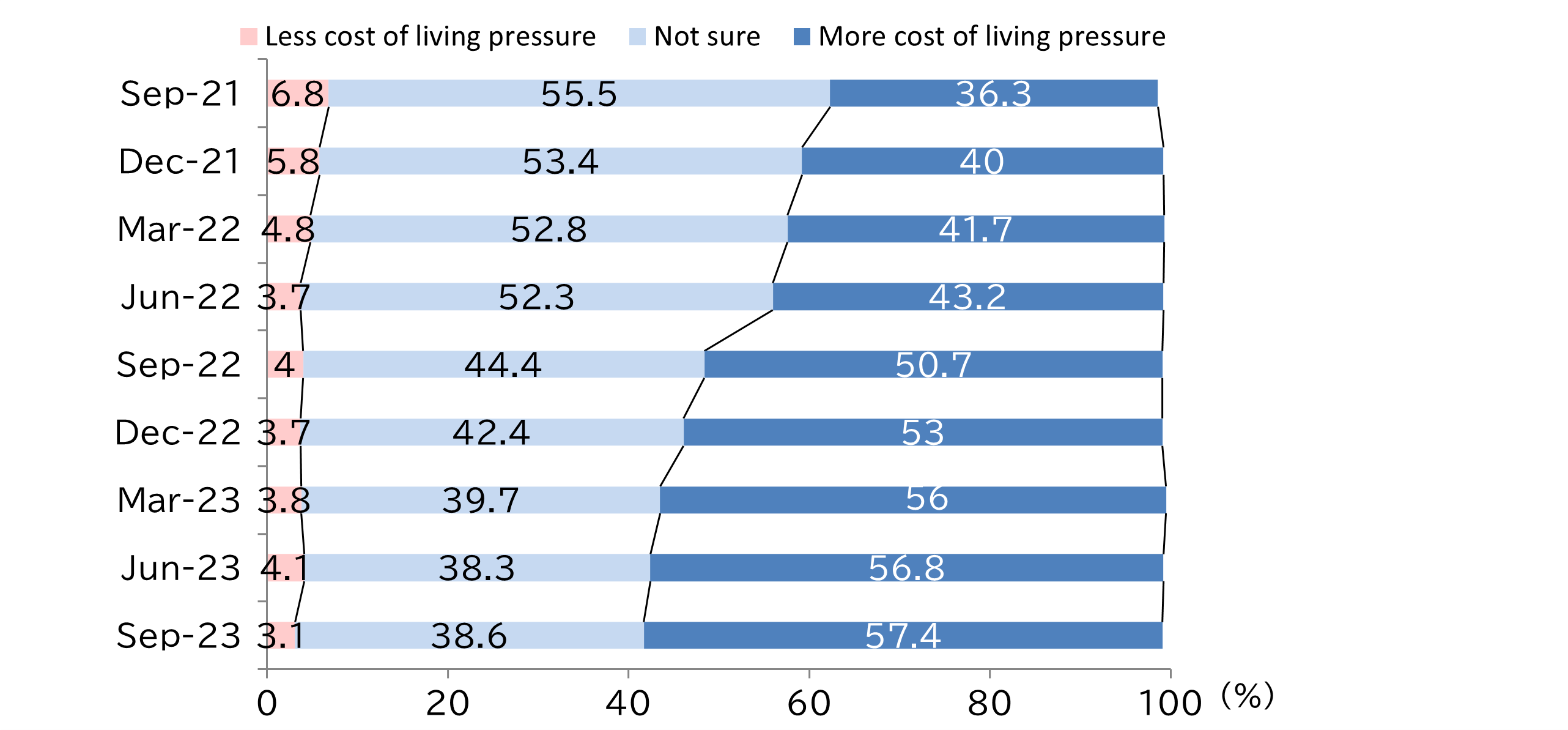

Looking at the current economic conditions, the trend of the rising US dollar against the Japanese yen accelerated in 2023 with a US dollar temporarily nearing the ¥152 mark on the FOREX market in November 2023. This has led to the ongoing rises in import prices, which are having a material impact on households (Figure 2). Looking at the consumer price index of major items, while electricity cost has relatively been stable thanks to the subsidies continuously provided by the Japanese government, prices of perishable foods, clothing, among others are rising and transport and communication costs are also steadily increasing (Figure 3). The prices of gasoline have also been kept down by the government subsidies, but they have constantly remained at around ¥170/liter (Figure 4). In this environment, looking at consumer sentiments, according to the current living conditions illustrated in a Bank of Japan survey on consumer sentiment, the ratio of respondents who are feeling a greater cost of living pressure has been consistently on the rise since September 2021, reaching 57.4% of all the respondents in September 2023, which is 21.1 percentage points (pp) higher compared with September 2021 (Figure 5). This shows that economic conditions remain difficult.

(Figure 2) 2023 FOREX Rates of Major Currencies Against Yen

Source: Telegraphic Transfer Middle Rate (TTM) in the Tokyo FOREX market (FOREX data provided by Mitsubishi UFJ Research & Consulting Co., Ltd.)

(Figure 3) Consumer Price Index of Major Items

Source: Prepared by JTB Tourism Research & Consulting Co. based on consumer price index data (2020=100) provided by the Ministry of Internal Affairs and Communications, Japan

(Figure 4) Regular Gasoline Price

Source: Prepared by JTB Tourism Research & Consulting Co. based on a survey of petroleum product prices by the Agency for Natural Resources and Energy, Japan

(Figure 5) Current Living Conditions

Source: Prepared by JTB Tourism Research & Consulting Co. based on data from the consumer sentiment surveys conducted by the Bank of Japan

3.Status of travelers

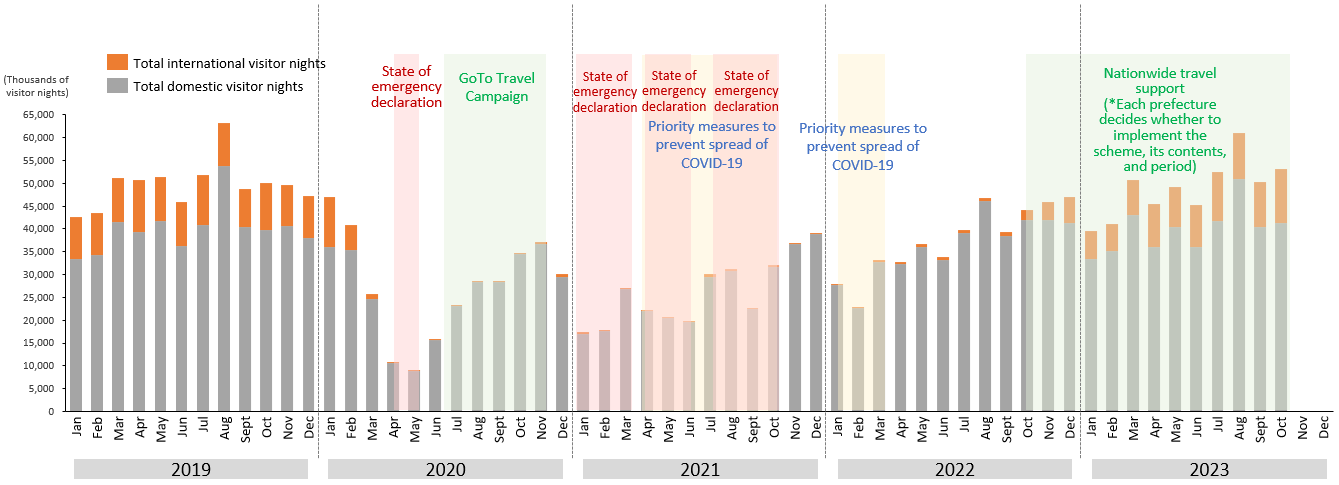

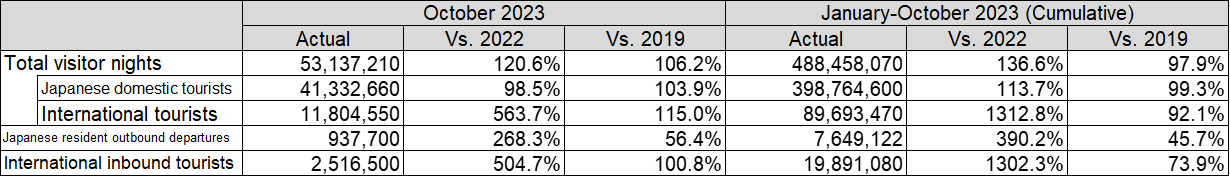

With respect to domestic travel, the number of visitor nights recovered to nearly its pre-COVID level in 2023 mainly because no COVID-related restrictions were placed on people's movements, the classification of COVID-19 was changed to Class-5 on May 8, and the Japanese government offered nationwide travel support subsidies. The total visitor nights in October 2023 were 41,333,000, representing 98.5% of the same figure in October 2022 (41,969,000) and 103.9% of the same month in 2019 (39,791,000). The cumulative total visitor nights from January to October 2023 stood at 398,765,000, representing 113.7% of the same period in 2022 (350,730,000) and 99.3% of the same period in 2019 (401,723,000) *1 (Figure 6).

*1: Source: Visitor nights statistic surveys by the Japan Tourism Agency; the first preliminary figure for October 2023, the second preliminary figure for January-September 2023, and definitive figures for 2019 and 2022.

After the Japanese government ended its border control measures on April 29, 2023, international travel has become easier in terms of national regulations. Recovery in outbound travelers, however, has been slow due to factors including inflations, the cheaper yen, and ongoing uncertainty in situations of certain areas. In October 2023, Japanese resident outbound departures stood at 938,000, representing 268.3% of the same figure in October 2022 (350,000 departures). The October 2023 figure, however, only represents 56.4% of the same figure in October 2019 (1,663,000 departures). The cumulative total for the January-October period was 7,649,000 departures, representing 390.2% of the same figure in the same period in 2022 (1,960,000 departures) and 45.7% of the same period in 2019 (16,726,000 departures) *2 (Figure 7).

*2: Numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO); an estimate for October 2023, a provisional figure for January-September 2023, and definitive figures for October 2019 and October 2022.

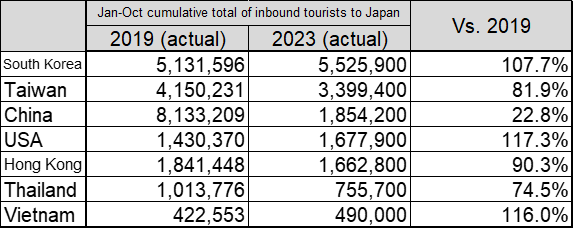

Recovery in inbound tourism accelerated in 2023 due to factors such as the end of Japan's border control measures and the termination or relaxation of measures to combat COVID-19 worldwide. The number of inbound tourists to Japan in October 2023 was 2,517,000, representing 504.7% of the same figure in October 2022 (499,000) and 100.8% of the same figure in October 2019 (2,497,000), exceeding its pre-COVID level for the first time on a single-month basis. The cumulative total for the January-October period was 19,891,000, representing 1,302.3% of the same period in 2022 (1,527,000) and 73.9% of the same period in 2019 (26,914,000) *3 (Figure 7). By country and region, the largest number of inbound tourists to Japan during the January-October 2023 period came from South Korea (5,526,000; 107.7% of the same period in 2019), followed by Taiwan (3,399,000; 81.9% of the same period in 2019), and China (1,854,000; 22.8% of the same period in 2019) (Figure 8).

*3: Numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO); estimates for September and October 2023, a provisional figure for January-August 2023, and definitive figures for 2019 and 2022.

(Figure 6) Cumulative Total Visitor Nights

Source: Prepared by JTB Research & Consulting Co. based on visitor nights statistic surveys conducted by the Japan Tourism Agency; definitive figures for 2019 to 2022, the second preliminary figure for January-September 2023, and the first preliminary figure for October 2023).

(Figure 7) Total Visitor Nights, Japanese Resident Outbound Departures and International Inbound Tourists in October 2023 and January-October 2023 Period (Cumulative)

Source: Prepared by JTB Research & Consulting Co. based on visitor nights statistic surveys conducted by the Japan Tourism Agency and the numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO).

(Figure 8) 2023 International Inbound Tourists by Country and Comparison with 2019 (Top 7 Countries)

Source: Prepared by JTB Research & Consulting Co. based on the numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO).

<2024 Travel Market>

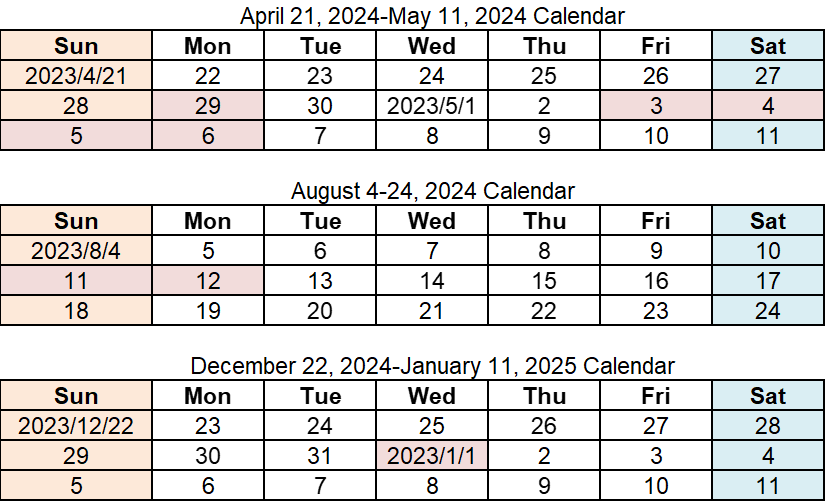

4.2024 calendar and major events

There are 11 long weekends in 2024. It is a significant increase from 2023 which had seven long weekends. While the Golden Week holidays are split into the first long weekend (Saturday, April 27 to Monday, April 29) and the second long weekend (Friday, May 3 to Monday, May 6), it can become 10 consecutive holidays from Saturday, April 27 to Monday, May 6, if one takes time off work from Tuesday, April 30 to Thursday, May 2. In summer, if one takes time off work during the Obon festival period (Tuesday, August 13 to Friday, August 16), there will be nine consecutive holidays from Saturday, August 10 to Sunday, August 18. The 2024/25 year-end/new year period can be turned into nine consecutive holidays from Saturday, December 28 to Sunday, January 5, if one takes time off work on Monday, December 30 and Tuesday, December 31.

*The red letters indicate national holidays.

[1]The 33rd Olympics Games (Paris 2024 Summer Olympics) and Paris 2024 Paralympics Games

One of the notable events in 2024 is the 33rd Olympics Games (Paris 2024 Summer Olympics) and Paris 2024 Paralympics Games that will take place in France. The 33rd Olympics Games (Paris 2024 Summer Olympics) will start on Friday, July 26 and end on Sunday, August 11, while the Paris 2024 Paralympics Games is scheduled to start on Wednesday, August 28 and to end on Sunday, September 8. Both events will take place in multiple cities including Paris, while the surfing Olympics event will be held in Tahiti, a French territory.

[2]Extension of Hokuriku Shinkansen and opening of Kurobe-Unazuki Canyon Route in Japan

In Japan, the Kanazawa-Tsuruga section of Hokuriku Shinkansen is scheduled to start operating on Saturday, March 16. This reduces the travel time between Tokyo Station and Fukui Station to as short as two hours 51 minutes. In addition, in the Kurobe Canyon in Toyama Prefecture, the Kurobe-Unazuki Canyon Route that connects the Kurobe Dam and the Kurobe Gorge Railway Keyakidaira Station will be opened to the public on Sunday, June 30.

In addition, there are art events scheduled in 2024 such as the 8th Yokohama Triennale (Yokohama City, Kanagawa; Friday, March 15 to Sunday, June 9) and Echigo-Tsumari Art Triennale 2024 (Tokamachi City, Niigata; Saturday, July 13 to Sunday, November 10).

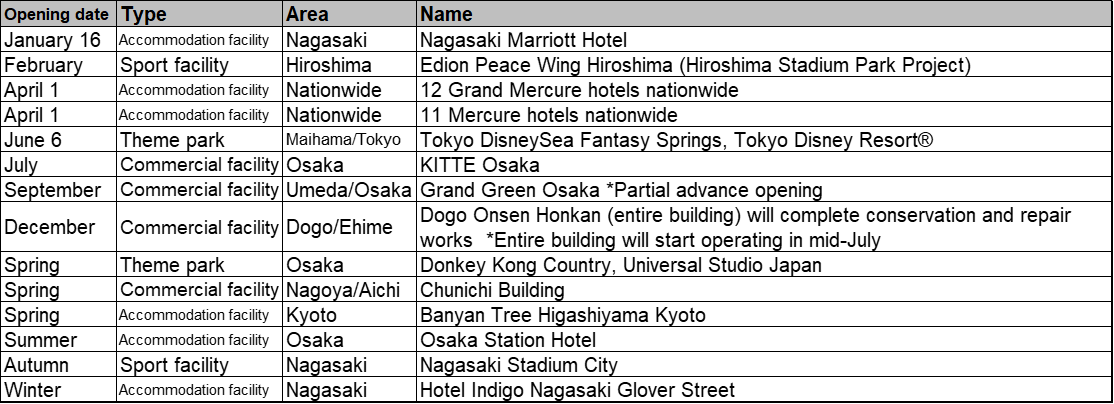

[3]Successive openings of new areas in popular theme parks and large commercial facilities

There are many scheduled openings of commercial facilities and launches of new contents in popular theme parks in 2024.

Universal Studio Japan plans to expand the Super Nintendo World™ area to 1.7 times the current size to open the Donkey Kong Country area featuring globally popular Donkey Kong. Meanwhile, Tokyo Disney Resort® plans to open a new theme port, Fantasy Springs, the eighth theme port in Tokyo DisneySea, on Thursday, June 6. The new port will consist of three areas themed after Frozen, Rapunzel, and Peter Pan and a new Disney Hotel, Tokyo DisneySea Fantasy Springs Hotel.

Regarding commercial facilities, as part of the redevelopment project around Osaka Station in Osaka City (Osaka), the Umekita 2nd Project "Grand Green Osaka," some facilities including a park, hotel, and commercial facilities will start operating in September ahead of others. In Nagoya City (Aichi), the Chunichi Building, which closed in 2019 due to ageing, has been rebuilt and is scheduled to open in spring. In Matsuyama City (Ehime), Dogo Onsen Honkan, which has been operating partially for conservation and repair works since 2019, will begin operating in full in mid-July for the first time in five years (conservation and repair works are scheduled to be fully completed in December).

[4]Lively activities for accommodation facilities; many new openings including openings of all the Mercure Hotels in Japan

New accommodation facilities are also scheduled to open successively. Daiwa Resort Co., Ltd. has rebranded 23 existing Daiwa Royal Hotels into 12 Grand Mercure hotels, the first group of Mercure hotels in Japan, and 11 Mercure hotels. All the hotels will start operating on April 1.

In the Kansai area, Banyan Tree Higashiyama Kyoto, the flagship brand of Banyan Tree Hotels & Resorts headquartered in Singapore, is scheduled to open in Kyoto City (Kyoto) in spring, while the Osaka Station Hotel is scheduled to open in Osaka City (Osaka) inside KITTE Osaka. which is scheduled to open in July (Figure 9).

(Figure 9) Main Facilities Scheduled to Open in 2024

5. Domestic travel trends *Domestic trips of residents of Japan excluding international inbound tourists

The number of domestic travelers in 2024 is projected at 273 million (97.2% of 2023 and 93.6% of 2019).

The average spend is estimated at ¥43,200 (100.0% of 2023 and 113.4% of 2019).

Total domestic travel spend is forecast at ¥11,790 billion (97.1% of 2023 and 106.0%of 2019).

In 2024, the number of domestic travelers is estimated at 273 million (97.2% of the same figure in 2023 and 93.6% of 2019), average spend at ¥43,200 (100.0% of the same figure in 2023 and 113.4% of 2019) due to the expected continuation of high prices, and total domestic travel spend at ¥11,790 billion (97.1% of the same figure in 2023 and 106.0% of 2019). Although the classification of COVID-19 was changed to Class-5 in May 2023 and its impacts were mostly eliminated, the number of travelers is likely to plateau due to factors such as high travel expenditures and the easing of travel appetite (as spending in reaction to the reduced activities during the COVID-19 pandemic will run its course). In 2024, the living environment is anticipated to remain difficult due to the ongoing inflation, while there are expectations for the Japanese government's economic policy.

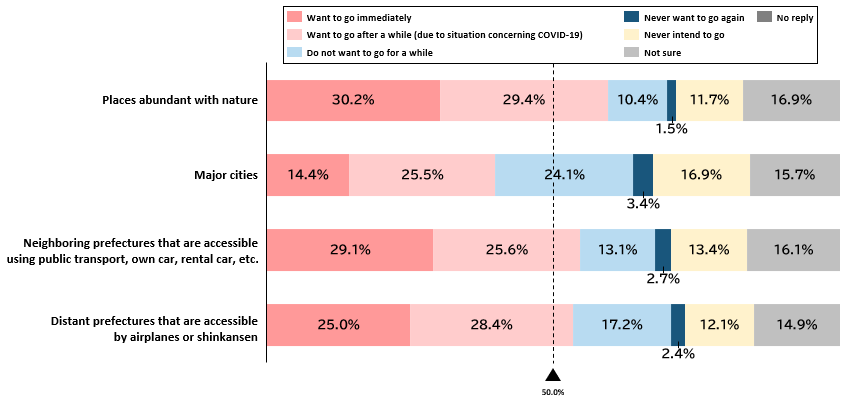

In the 2023/24 year-end/new year travel trend survey (December 23, 2023-January 3, 2024) conducted by JTB, on a question about future domestic travel plans by destination, "Places abundant with nature" ranked first as a place that the respondents "Want to go immediately" with 30.2% of the respondents choosing this option, followed by "Neighboring prefectures that are accessible using public transport, own car, rental car, etc." at 29.1%. This shows a trend of choosing places with nature and nearby places as travel destinations (Figure 10).

Due to COVID-19, climate change, uncertain international situations, and so on, lifestyles and values have changed worldwide, which is affecting Japanese residents' domestic travel preferences and tourist spots in Japan.

Promotion of travel/hospitality operators' and local communities' initiatives with awareness of SDGs

Travel companies are promoting various initiatives aiming to contribute to Sustainable Development Goals (SDGs) and sustainability. For instance, these include tours and events designed to reduce CO 2 emissions, the protection, development, and exchange of traditional local cultures and arts, and the use of natural resources for tourism. Airline carriers are also working on reducing their CO 2 emissions through efforts such as the introduction of sustainable aviation fuel (SAF).

Meanwhile, tourism destinations have begun initiatives to build sustainable tourism spots. For instance, 10 places in Japan were selected in the 2023 Top 100 Stories chosen by Green Destinations, a certification organization for international indices for sustainable tourism developed by the Global Sustainable Tourism Council (GSTC). The Japan Tourism Agency has been promoting the sustainable management of tourism places since the establishment of the Japan Sustainable Tourism Standard for Destinations (JSTS-D) in June 2020.

Nationwide promotion of measures to prevent overtourism

Since the end of the COVID-19 pandemic, some tourist places are facing an issue of overtourism brought about by a recovery in travel demand. In response, the Japanese government prepared a policy package for measures against overtourism and is scheduled to select approximately 20 places for its pilot projects. The government's support may include the dissemination of real-time crowd information of tourist spots to disperse visitors from overcrowded destinations and the introduction of a shared-taxi ride service.

Meanwhile, some tourist places have already started implementing measures to tackle overtourism. For instance, in Kyoto, visiting hours of temples and other tourist attractions have been extended to the early morning and nighttime to spread visitors and efforts are made to reduce congestion by displaying crowd situations on apps or transmitting real-time images of tourist destinations using installed cameras.

(Figure 10) Future Domestic Travel Intensions by Destination Type

Source: Prepared using the unpublished data of JTB's 2023/24 year-end/new year travel trend survey (December 3, 2023-January 3, 2024).

6.International travel trends

The number of outbound travelers in 2024 is estimated at 14.5 million (152.6% of 2023 and 72.2% of 2019).

The average spend is projected at ¥342,100 (105.5%t of 2023 and 144.2% of 2019).

Total outbound travel spend is estimated at ¥4,960 billion (161.0% of 2023 and 104.0% of 2019).

In 2024, the number of outbound travelers is estimated at 14.5 million (152.6% of the same figure in 2023 and 72.2% of 2019), average spend at ¥342,100 (105.5% of the same figure in 2023 and 144.2% of 2019) due to the continuing impact of the cheaper yen and overseas inflations, and total outbound travel spend at ¥4,960 billion (161.0% of the same figure in 2023 and 104.0% of 2019). While international travel has become easier in terms of national regulations after the termination of Japan's border control measures in April 2023, the number of outbound travelers in 2024 is expected to recover slowly due to factors such as uncertain international situations, in addition to economic factors. As a result, the number is not expected to recover to its pre-COVID level at least until 2025. The average spend per person is projected to exceed the previous year and reach the highest since 2000.

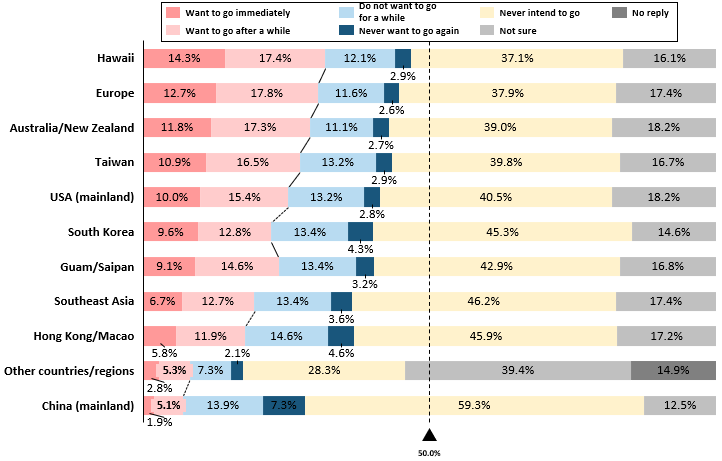

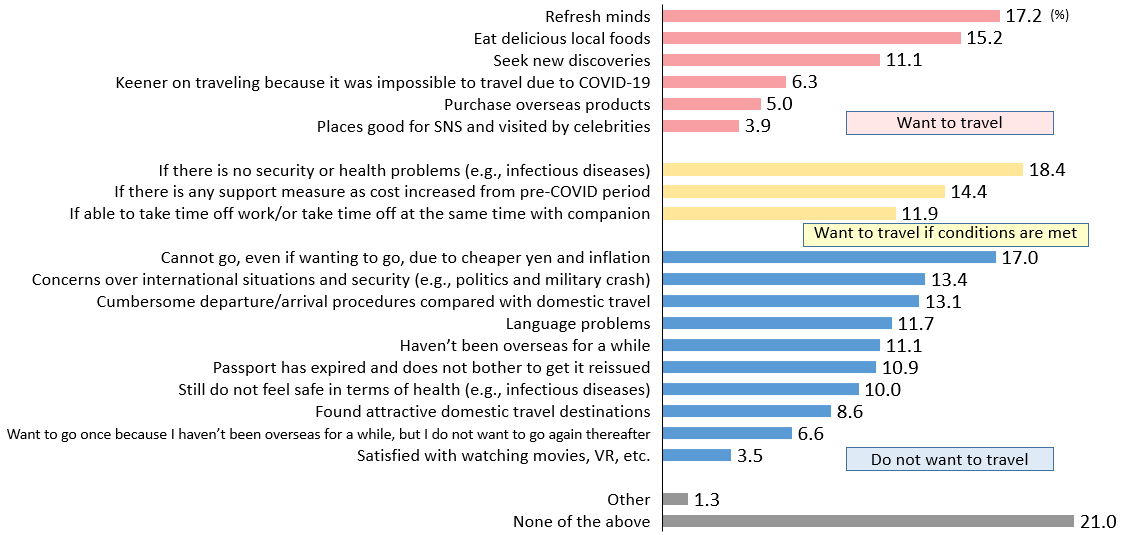

In the 2023/24 year-end/new year travel trend survey (December 23, 2023-January 3, 2024) conducted by JTB, Hawaii ranked highest at 14.3% among the destinations the respondents wanted to go immediately, in response to a question on future outbound travel plans. This was followed by "Europe (12.7%)," "Australia/New Zealand (11.8%)," "Taiwan (10.9%)," "USA (mainland) (10.0%)," "South Korea (9.6%)," and "Guam/Saipan (9.1%)." Relatively distant countries/regions ranked higher, followed by relatively closer countries/regions, showing a clear trend of division between close and distant destinations (Figure 11). With respect to the respondents' current international travel intentions, although they are positive about travelling overseas, economic and other factors are posing obstacles (Figure 12).

(Figure 11) Future International Travel Intensions by Destination

(Figure 12) Current International Travel Intensions

Source: 2023/24 Year-end/new year travel trend survey (December 23, 2023-January 3, 2024) by JTB

7 . Number of inbound travelers to Japan

The estimated number of inbound travelers to Japan in 2024 is 33.1 million (131.3% of 2023 and 103.8% of 2019).

The number of inbound travelers to Japan in 2024 is estimated at 33.1 million (131.3% of the same figure in 2023 and 103.8% of 2019). The number of inbound tourists is rapidly recovering due to the increased ease to travel to Japan from overseas following the end of Japan's border control measures in April 2023 and a sense of better value for money spent due to the cheaper Japanese yen and relatively low prices compared with Europe, the United States, and other areas. By country and region, the numbers of visitors from South Korea, Taiwan, the United States, and Hong Kong have already exceeded or recovered close to their pre-COVID levels. Inbound visitors from these places are expected to further increase in 2024 and to reach a record high exceeding the 2019 level. Although recovery in the number of visitors from China has been significantly slower than other countries/regions, the number is steadily increasing, albeit slowly, and is expected to further recover in 2024, especially those travelling as individuals.

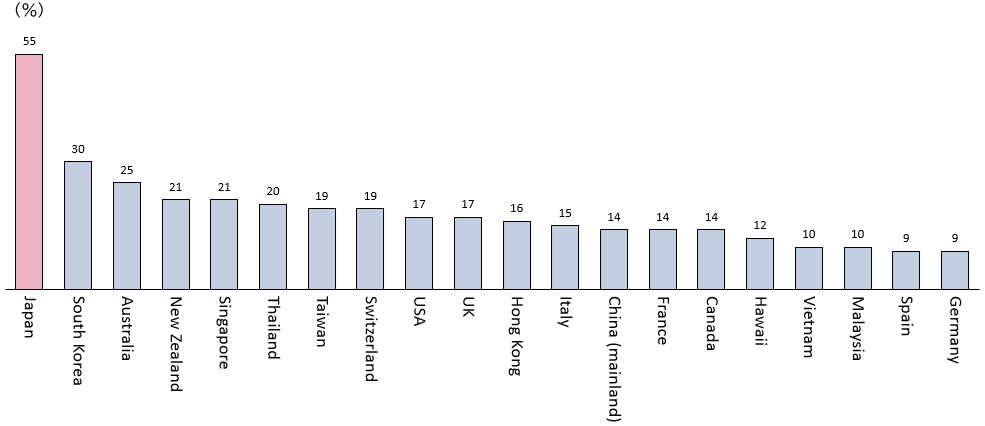

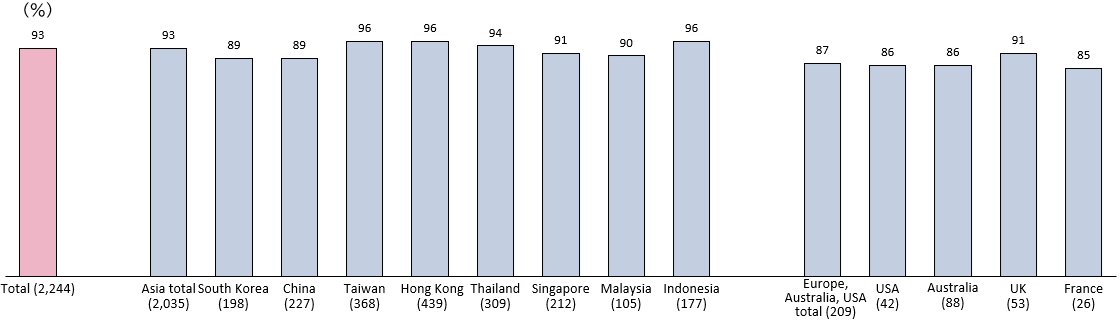

According to the Development Bank of Japan (DBJ) and Japan Travel Bureau Foundation (JTBF) 2023 survey of inbound visitors to Japan from Asia, Europe, the United States, and Australia, released by DBJ and JTBF in October 2023 *4 , Japan ranked first, as in the previous year, as the country/region the respondents wanted to travel next, showing strong popularity of Japan as a travel destination (Figure 13). In addition, there is a strong interest in visiting regional areas in Japan (among those wishing to visit Japan and those who have visited Japan), raising expectations for the spread of inbound visitors to regional communities as promoted by the Japanese government (Figure 14).

*4: A survey of male/female respondents aged 20-79 who have travelled overseas and live in 12 countries/regions including Asia, Europe, USA, and Australia (South Korea, China, Taiwan, Hong Kong, Thailand, Singapore, Malaysia, Indonesia, USA, Australia, UK, France).

(Figure 13) Countries/Regions Respondents Want to Visit Next (n = 7,414; allowed to choose up to 5 destinations; top 20 countries/regions)

Source: Prepared by JTB Research & Consulting Co. based on the DBJ/JTBF 2023 survey of inbound visitors to Japan from Asia, Europe, the United States, and Australia conducted by the Development Bank of Japan (DBJ) and Japan Travel Bureau Foundation (JTBF).

*The countries/regions where the respondents are from and their neighboring countries/regions (China/Hong Kong/Macao, Malaysia/Singapore, Thailand/Malaysia, USA/Canada/Mexico, Hawaii/Guam, Australia/New Zealand, UK/France/other European countries) were removed from the options for the countries/regions to visit next. When calculating percentages, if the "country/region respondents want to visit" and "the respondents' country/region" and "the respondents' neighboring countries/regions" are same, those respondents are removed from the number of samples (denominator).

(Figure 14) Interest in Regional Communities Among People Wishing to Travel to Japan and People Who Have Traveled to Japan (n = 2,244; single answer)

(The percentages of people who have responded that they are "Very keen to travel in the future" or "Keen to travel in the future if there is an opportunity")

(Figure 15) 2000-2022 Estimates and 2023-2024 Forecasts (The figures in the lower row show year-on-year percentage changes)

Back to Index

- Travel, Tourism & Hospitality ›

Leisure Travel

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Number of travel agencies in Japan 2018-2023

Number of travel agencies and similar establishments in japan from 2018 to 2023 (in 1,000s).

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

October 2023

2018 to 2023; as of April 1 of the respective year

Values have been rounded.

Other statistics on the topic Domestic tourism in Japan

Travel, Tourism & Hospitality

Number of visitors to the U.S. from China 2005-2025

Number of outbound visitor departures from China 2010-2024

International tourist arrivals in China 2010-2021

Revenue from tourism in China 2012-2022

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Other statistics that may interest you

- Reservation method distribution of ryokans in Japan FY 2018, by type

- Reservation method distribution of hotels in Japan FY 2022, by type

- Tour operator count in Russia 2010-2020, by market segment

- Travel agencies and tour operators in Spain 2022, by region

- Cost breakdown of TUI AG employees worldwide 2019-2023, by type

- Number of travel agencies in China 2008-2022

- Number of employees in travel agencies and reservation services Japan 2010-2019

- Travel agencies and tour operators: monthly number of workers in Spain 2019-2020

- Leading Chinese tourism enterprises on the Fortune China 500 ranking 2020

- Travel agencies and tour operators: sales and earnings assessment in Spain in 2019

- Number of tourism-related establishments Japan 2011-2020

- Number of hotel and similar lodging rooms Japan 2011-2021

- Number of beds in hotel and similar lodging Japan 2011-2021

- Average share of ryokans with homepages in Japan FY 2018, by language

- Average share of hotels with homepages in Japan FY 2018, by language

- Average share of hotels with homepages in Japan FY 2012-2018

- Average share of ryokans with homepages in Japan FY 2012-2018

- Average share of ryokans with reservations via homepage in Japan FY 2012-2018

- Average share of hotels with reservations via homepage in Japan FY 2012-2018

- Average share of hotels with reservations via homepage in Japan 2018, by language

- Number of hotel and similar lodging rooms Qatar 2008-2021

- Number of domestic and international overnight stays in hotels in Sweden 2018

- Germany: turnover of the accommodation & food service industry 2013-2022

- Share of hotel rooms in France 2024, by region

- Italy: share of holiday accommodations with internet connection 2018, by region

- Number of accommodation and food service employees in the EU 2017, by country

- Number of hotels, motels and inns Myanmar 2010-2019

- Main tourist nationalities in Belgian campgrounds 2020, by number of overnight stays

- Hotel industry turnover in European countries in 2020

- Average share of ryokans with reservations via homepage in Japan 2018, by language

- Average depreciation expense ratio of hotels in Japan FY 2015-2022

- Average gross operating profit ratio of accommodations in Japan FY 2015-2022

- Average staff per room ratio at hotels in Japan FY 2015-2021

- Average operating profit margin of accommodations in Japan FY 2015-2022

- Average operating expense ratio of hotels in Japan FY 2015-2022

- Number of employees tourism sector in Japan 2019, by industry

- Average payout time of hotels in Japan FY 2012-2018

- Average number of guests per worker at ryokan in Japan FY 2012-2018

- Average employee per room ratio at ryokan in Japan FY 2012-2018

Other statistics that may interest you Statistics on

About the industry

- Premium Statistic Reservation method distribution of ryokans in Japan FY 2018, by type

- Premium Statistic Reservation method distribution of hotels in Japan FY 2022, by type

- Premium Statistic Tour operator count in Russia 2010-2020, by market segment

- Premium Statistic Travel agencies and tour operators in Spain 2022, by region

- Basic Statistic Cost breakdown of TUI AG employees worldwide 2019-2023, by type

- Premium Statistic Number of travel agencies in China 2008-2022

- Premium Statistic Number of employees in travel agencies and reservation services Japan 2010-2019

- Premium Statistic Travel agencies and tour operators: monthly number of workers in Spain 2019-2020

- Premium Statistic Leading Chinese tourism enterprises on the Fortune China 500 ranking 2020

- Premium Statistic Travel agencies and tour operators: sales and earnings assessment in Spain in 2019

About the region

- Premium Statistic Number of tourism-related establishments Japan 2011-2020

- Premium Statistic Number of hotel and similar lodging rooms Japan 2011-2021

- Premium Statistic Number of beds in hotel and similar lodging Japan 2011-2021

- Premium Statistic Average share of ryokans with homepages in Japan FY 2018, by language

- Premium Statistic Average share of hotels with homepages in Japan FY 2018, by language

- Premium Statistic Average share of hotels with homepages in Japan FY 2012-2018

- Premium Statistic Average share of ryokans with homepages in Japan FY 2012-2018

- Premium Statistic Average share of ryokans with reservations via homepage in Japan FY 2012-2018

- Premium Statistic Average share of hotels with reservations via homepage in Japan FY 2012-2018

- Premium Statistic Average share of hotels with reservations via homepage in Japan 2018, by language

Other regions

- Premium Statistic Number of hotel and similar lodging rooms Qatar 2008-2021

- Premium Statistic Number of domestic and international overnight stays in hotels in Sweden 2018

- Basic Statistic Germany: turnover of the accommodation & food service industry 2013-2022

- Basic Statistic Share of hotel rooms in France 2024, by region

- Basic Statistic Italy: share of holiday accommodations with internet connection 2018, by region

- Premium Statistic Number of accommodation and food service employees in the EU 2017, by country

- Premium Statistic Number of hotels, motels and inns Myanmar 2010-2019

- Basic Statistic Main tourist nationalities in Belgian campgrounds 2020, by number of overnight stays

- Basic Statistic Hotel industry turnover in European countries in 2020

Related statistics

- Premium Statistic Average share of ryokans with reservations via homepage in Japan 2018, by language

- Premium Statistic Average depreciation expense ratio of hotels in Japan FY 2015-2022

- Premium Statistic Average gross operating profit ratio of accommodations in Japan FY 2015-2022

- Premium Statistic Average staff per room ratio at hotels in Japan FY 2015-2021

- Premium Statistic Average operating profit margin of accommodations in Japan FY 2015-2022

- Premium Statistic Average operating expense ratio of hotels in Japan FY 2015-2022

- Premium Statistic Number of employees tourism sector in Japan 2019, by industry

- Premium Statistic Average payout time of hotels in Japan FY 2012-2018

- Premium Statistic Average number of guests per worker at ryokan in Japan FY 2012-2018

- Premium Statistic Average employee per room ratio at ryokan in Japan FY 2012-2018

Further related statistics

- Basic Statistic Growth of inbound spending in the U.S. using foreign visa credit cards

- Basic Statistic Foreign exchange earnings from tourism in India 2000-2022

- Basic Statistic Contribution of China's travel and tourism industry to GDP 2014-2023

- Premium Statistic Middle Eastern countries with the largest international tourism receipts 2018

- Premium Statistic Change in number of visitors from Mexico to the U.S. 2018-2024

- Premium Statistic Factors affecting accommodation booking worldwide as of July 2016

- Premium Statistic Private short-term rentals booked with Airbnb in New York City in 2010 and 2014

- Premium Statistic International tourist arrivals in Europe 2006-2023

- Premium Statistic Annual revenue of China Tourism Group Duty Free 2013-2023

- Premium Statistic Hotel occupancy rate in Las Vegas 2001-2022

Further Content: You might find this interesting as well

- Growth of inbound spending in the U.S. using foreign visa credit cards

- Foreign exchange earnings from tourism in India 2000-2022

- Contribution of China's travel and tourism industry to GDP 2014-2023

- Middle Eastern countries with the largest international tourism receipts 2018

- Change in number of visitors from Mexico to the U.S. 2018-2024

- Factors affecting accommodation booking worldwide as of July 2016

- Private short-term rentals booked with Airbnb in New York City in 2010 and 2014

- International tourist arrivals in Europe 2006-2023

- Annual revenue of China Tourism Group Duty Free 2013-2023

- Hotel occupancy rate in Las Vegas 2001-2022

- Subscribe Digital Print

- LDP funds scandal

- Latest News

- Deep Dive Podcast

Today's print edition

Home Delivery

- Crime & Legal

- Science & Health

- More sports

- CLIMATE CHANGE

- SUSTAINABILITY

- EARTH SCIENCE

- Food & Drink

- Style & Design

- TV & Streaming

- Entertainment news

Inbound tourism numbers hit record high, with Japan set to achieve 2025 goal

Japan is on course to achieve a government goal of topping the pre-pandemic figure of 32 million annual foreign visitors by 2025, with the January-March quarter seeing a record 8.56 million, data from the Japan National Tourism Organization showed Wednesday.

Foreign travelers also spent ¥1.8 trillion during the January-March period, which translates to about ¥210,000 per person per stay. The total marks the highest figure on record as more people stay longer in Japan thanks to the weaker yen.

Japan also welcomed a record 3.08 million foreign visitors in March, surpassing the previous high of 2.99 million from July 2019, JNTO said.

The spike in numbers can be attributed to the Easter holiday in March, when there were more travelers from Western countries such as Australia and the United States, as well as the attraction of the cherry blossom season.

In 2023, about 25 million visitors came to Japan, spending a record ¥5.3 trillion, with a single tourist on average spending around ¥210,000 per stay.

The figures have already surpassed a target — set at ¥5 trillion total and ¥200,000 on average — that had been fixed for 2025 in the government’s tourism strategy and goals, which were drafted in 2023.

However, other goals in the plan have yet to be reached, and the government held the ministerial meeting on Wednesday evening to discuss their efforts and further plans.

For instance, one of the goals set in the basic plan is to establish sustainable tourist spots, or destinations that can continue to flourish and be self-sustainable in terms of financial, social, cultural and natural resources, with minimum impacts on the environment.

As of November, the latest figure available, there were only 31 areas that have set up such projects, well short of the government goal of 100 by 2025. The tourism agency is offering support to various local governments and destination marketing organizations to encourage more to join.

Another issue that remains is the fact that tourists still tend to congregate in urban areas. In 2023, around 70% of all visitors stayed in the three metropolitan cities of Tokyo, Osaka or Kyoto, or areas surrounding the capital such as Chiba and Kanagawa prefectures. The figure was just over 60% prior to the pandemic.

"I think the potential of rural areas is truly limitless — and we are yet to see this potential fully flourish," said Ichiro Takahashi, the head of Japan Tourism Agency. "While there is a trend of uneven distribution in the three major metropolitan areas, we would like to especially strengthen our efforts to attract visitors to these rural regions."

Meanwhile, outbound tourism remains low compared to inbound arrivals, mostly due to the weak yen and high prices abroad. In March, about 1.22 million people visited foreign countries from Japan, around 60% of the figure during the same period in 2019.

In 2023, the figure was 9.62 million, less than half of the amount recorded in 2019.

However, domestic travel through 2023 almost rebounded to 2019 levels, and individuals spent 17.8% more on average per person. The total consumption amount was ¥21.9 trillion, approaching the goal of ¥22 trillion set by the government for 2025.

Staff writer Gabriele Ninivaggi contributed to this report.

In a time of both misinformation and too much information, quality journalism is more crucial than ever. By subscribing, you can help us get the story right.

We use cookies on this site to enhance your user experience. If you continue to browse you accept the use of cookies on our site. See our Cookie Policy for more information.

- Media & PR

- Meetings & Events

- School Groups

- Travel Trade

- Select Language 简体中文 繁體中文(香港) 繁體中文(臺灣) India (English) Bahasa Indonesia 한국어 ภาษาไทย Tiếng Việt Singapore (English) Philippines (English) Malaysia (English) Australia/New Zealand (English) Français Deutsch Italiano Español United Kingdom (English) Nordic countries(English) Canada (English) Canada (Français) United States (English) Mexico (español) Português العربية Japan(日本語) Global (English)

- India (English)

- Bahasa Indonesia

- Singapore (English)

- Philippines (English)

- Malaysia (English)

- Australia/New Zealand (English)

- United Kingdom (English)

- Nordic countries(English)

- Canada (English)

- Canada (Français)

- United States (English)

- Mexico (español)

- Global (English)

- Fujiyoshida

- Shimonoseki

- Ishigaki Island

- Miyako Island

- Kerama Island

- Tokyo Island

- Koka & Shigaraki

- Hida Takayama

- Ginza, Nihonbashi

- Beppu & Yufuin (Onsen)

- Ginzan Onsen

- Nagasaki Islands

- Kumano Kodo

- Shikoku Karst

- Amami Oshima

- Hachimantai

- Omihachiman

- Aizuwakamatsu

- Diving in Japan

- Skiing in Japan

- Seasonal Flowers in Japan

- Sustainable Outdoors

- Off the Beaten Track in Japan

- Scenic Spots

- World Heritage

- Home Stays & Farm Stays

- Japanese Gardens

- Japanese Crafts

- Temple Stays

- Heritage Stays

- Festivals and Events

- Theater in Japan

- Japanese Tea Ceremony

- Cultural Experiences in Japan

- Culture in Japan

- Local Cuisine Eastern Japan

- Local Cuisine Western Japan

- Local Street Food

- Japan's Local Ekiben

- Japanese Whisky

- Vegetarian and Vegan Guide

- Sushi in Japan Guide

- Japanese Sake Breweries

- Art Museums

- Architecture

- Performing Arts

- Art Festivals

- Japanese Anime and Comics

- Japanese Ceramics

- Local Crafts

- Scenic Night Views

- Natural Wonders

- Theme Parks

- Samurai & Ninja

- Iconic Architecture

- Wellness Travel in Japan

- Japanese Ryokan Guide

- A Guide to Stargazing in Japan

- Relaxation in Japan

- Forest Bathing (Shinrin-yoku)

- Experiences in Japan

- Enjoy my Japan

- National Parks

- Japan's Local Treasures

- Japan Heritage

- Snow Like No Other

- Wonder Around Japan

- Visa Information

- Getting to Japan

- Airport Access

- COVID-19 Practical Information

- Anime Tourism

- Countryside Stays

- Sustainable Travel

- Accommodation

- Sample Itineraries

- Travel Agents

- Deals and Tours

- Traveling by Rail

- How to Travel by Train and Bus

- JR Rail Passes

- Train Passes and Discounted Tickets

- Scenic Railways

- Renting a Car

- Yokohama Cruise Port Access

- Travel Brochures

- Useful Apps

- Accommodation Types

- Online Reservation Sites

- Eco-friendly Accommodation

- Luxury Accommodations

- Traveling With a Disability

- Hands-free Travel

- How to Book a Certified Tour Guide

- Volunteer Guides

- Tourist Information Center

- Japanese Manners

- Sustainable Travel in Japan

- Spring in Japan

- Summer in Japan

- Autumn in Japan

- Winter in Japan

- Seasonal Attractions

- Monthly Events Calendar

- Cherry Blossom Forecast

- Autumn Leaves Forecast

- Japan Visitor Hotline

- Travel Insurance in Japan

- Japan Safe Travel Information

- Accessibility in Japan

- Vegetarian Guide

- Muslim Travelers

- Safety Tips

- All News & Blog

- Travellers Blog

- Guides to Japan

- Stories of Japan

- The Other Side of Japan

- Media Releases

- JAPAN Monthly Web Magazine

My Favorites

${v.desc | trunc(25)}

Planning a Trip to Japan?

Share your travel photos with us by hashtagging your images with #visitjapanjp

Important notice

Our self-service brochure room is now open Monday to Friday from 10am-4pm. Please note we do not accept counter consultations.

For PDF/electronic brochures, please visit this link .

Thank you for your understanding.

All enquiries

By telephone .

Our public enquiry phone line is currently suspended due to COVID-19.

Phone number : 02 9279 2177

If requesting brochures, please specify which areas/cities you wish to visit and include your postal address within Australia or New Zealand.

Information you provide may be used for analysing and enhancing our services after removing all privacy information.

Self-service Brochure Room

Suite 1, Level 4, 56 Clarence Street, Sydney, NSW, 2000, Australia (about a one minute walk from Wynyard station)

Please help yourself to brochures displayed in the room. We do not provide counter consultations.

Opening Hours

Our brochure room is open Monday to Friday, 10:00 – 16:00, excluding the public holidays listed below. We do not take counter consultations.

2023 • 29 December (Fri) – Year End Holiday *

2024 • 1 January (Mon) – New Year’s Day • 2 January (Tue) – New Year Holiday * • 3 January (Wed) – New Year Holiday * • 26 January (Fri) – Australia Day • 12 February (Mon) – National Foundation Day * • 20 March (Wed) – March Equinox * • 29 March (Fri) – Good Friday • 1 April (Mon) – Easter Monday • 25 April (Thu) – Anzac Day • 10 June (Mon) – King's Birthday • 23 September (Mon) – September Equinox * • 7 October (Mon) – Labour Day • 14 October (Mon) – Sports Day * • 4 November (Mon) – Culture Day * • 25 December (Wed) – Christmas Day • 26 December (Thu) – Boxing Day • 30 December (Mon) – Year End Holiday * • 31 December (Tue) – Year End Holiday *

* Japanese public holidays

- JNTO Sydney

Please Choose Your Language

Browse the JNTO site in one of multiple languages

IMAGES

COMMENTS

Fax. +1 (213) 623-6301. e-mail. [email protected]. Business Hours. Monday - Friday: 9:00am - 5:00pm PST (Closed 1 hour for lunch) Closed on major holidays and Dec. 29 - Jan. 3. Visitor Policy. We are not currently accepting walk-in appointments or reservations from the general public. If you have any inquiries, please contact us at infolax ...

Information. Information on illnesses, injuries, and disasters. This is the official website of the Japan Tourism Agency that was inaugurated on October 1, 2008.The website outlines the JTA and introduces various policies and measures to realize a tourism nation.

Contact Us. For inquiries about Japanese tourism information, please contact the Japan National Tourism Organization (JNTO). In addition to 20 offices around the world that provide Japanese tourism information to international travelers, the JNTO has Tourist Information Center it directly operates in Tokyo. If you have comments / impressions ...

The Japan Tourism Agency is an external bureau of the Ministry of Land, Infrastructure, Transport and Tourism. It was established in October 2008 to strongly promote measures to realize a tourism-oriented nation. This is the official website of the Japan Tourism Agency that was inaugurated on October 1, 2008.The website outlines the JTA and ...

Parent agency. Ministry of Land, Infrastructure, Transport and Tourism. Website. www .mlit .go .jp /kankocho /en /. The Japan Tourism Agency (観光庁, Kankō-chō), JTA, is an organization which was set up on October 1, 2008 as an agency of the Ministry of Land, Infrastructure, Transport and Tourism. [4]

Our California Seller of Travel Number (CST #2102781-40) guarantees that we are fully registered and are recognized by the State of California as a seller of travel. ... How Does Our Japan Travel Agency Process Work? 1. Contact USPlease contact us by phone, fax, or email for tour availability. If you interested in a custom tour, please tell us ...

Within six years however, the number of international visitors has more than tripled, reaching a peak of 31.9 million visitors in 2019. ... In October 2011, the Japan Tourism Agency announced a plan to give 10,000 round-trip air tickets to Japan to encourage visitors to come and to boost tourism. However, on December 26, 2011, the Agency ...

JTB is a leading Travel Agency in the USA that provides various Japan and Asian customized tours for individuals and groups Since 1912; Selling Japan Rail Pass, Discount Air Tickets, and Ghibli Museum Tickets.

FEATURED. Inbound According to Japan National Tourism Organization (JNTO), the estimated number of international travelers to Japan in February 2024 was 2,788,000 (+7.1% compared to 2019).; Japanese tourists According to preliminary figures from the Immigration Service Agency of Japan, the number of Japanese overseas travelers in February 2024 accounted for 978,885, +82.0% compared to February ...

Tourism and Regional Development Division Tel: +81-87-802-6737. Planning and Tourism Department. Kyushu District Transport Bureau (Japanese) (Fukuoka, Oita, Saga, Nagasaki, Kumamoto, Miyazaki and Kagoshima). International Tourism Division Tel: +81-92-472-2335. Tourism and Regional Development Division Tel: +81-92-472-2920.

The number of foreign visitors to Japan has been steadily increasing since 2003. In 2008 the Japan Tourism Agency was newly established as a bureau under MLIT, and in 2016 the government set a goal of achieving 40 million foreign visitors to Japan annually by 2020, further strengthening the system to achieve the aim of becoming a tourism-oriented country.

Japan Tourism Agency announced that travel spending by international visitors in Japan totaled 4.8 trillion JPY in 2019, 6.5% more spending than 2018. ... The number of international visitors to ...

The Japan Tourism Agency announced that 31.9 million foreign visitors came to Japan in 2019, hitting a new record for the seventh consecutive year with an increase of 2.2% from 2018.

The Japan Tourism Agency has been promoting the sustainable management of tourism places since the establishment of the Japan Sustainable Tourism Standard for Destinations (JSTS-D) in June 2020. ... 6.International travel trends. The number of outbound travelers in 2024 is estimated at 14.5 million (152.6% of 2023 and 72.2% of 2019).

The number of international visitors to Japan increased 2.4-fold from the previous month in October, exceeding 490,000, as per numbers from the Japan National Tourism Organization.

As of April 2023, there were about 12.1 thousand travel agencies and similar establishments in Japan offering travel-related services. The travel agency industry segment is dominated by a few ...

Source Japan Tourism Agency, Savills Research & Consultancy. 3 Japan ospialiy Hotel room rates have recovered significantly, even leapfrogging ... boom" model of domestic tourism. As such, the number of establishments has fallen from nearly 72,000 in 1995 to under 39,000 in 2017, with the 2008 global financial ...

Apr 17, 2024. Japan is on course to achieve a government goal of topping the pre-pandemic figure of 32 million annual foreign visitors by 2025, with the January-March quarter seeing a record 8.56 ...

Please consult tour operators and travel agencies for travel bookings. -The official website for the Japan Rail Pass is here. -For enquiries about the JR Pass, please check their website and FAQ or contact the agencies directly. -For travel inspiration, tips and other information: ・First-Time Visitor Info ・FAQ

What is JNTO ? Official Name: Japan National Tourism Organization. Established: 1964. Purpose: Committed to the development of international tourism exchanges. Headquarters: 1-6-4, Yotsuya, Shinjuku-ku, Tokyo 160-0004.

Phone number: 02 9279 2177 By email Feel free to contact us for brochure requests and information on travel to Japan using this form. All of our brochures and maps are in English, however we do have a limited selection of Chinese language brochures too.