- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Best travel insurance companies of April 2024

Amy Fontinelle

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 8:41 a.m. UTC April 12, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

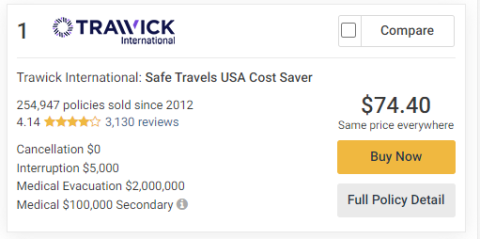

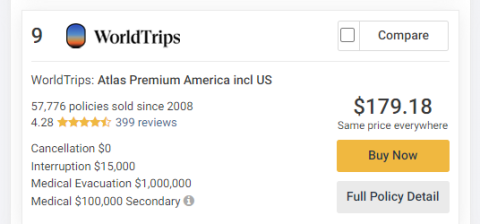

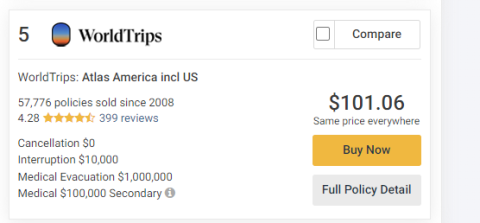

WorldTrips is the best travel insurance company of 2024 , based on our in-depth analysis of travel insurance policies. Its Atlas Journey Preferred and Atlas Journey Premier plans get 5 stars in our rating because of the extensive coverage they provide for the price. Both plans come with high limits for important benefits such as emergency medical and evacuation, travel delay and missed connections. WorldTrips travel insurance also offers a pre-existing medical condition exclusion waiver if you buy a plan within 21 days of making your first trip deposit.

Best travel insurance of 2024

Why trust our travel insurance experts

Our travel insurance experts evaluate hundreds of insurance products and analyze thousands of data points to help you find the best trip insurance for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Travel insurance quotes comparison

Best travel insurance companies, best travel insurance.

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel, WorldTrips has two top-rated travel insurance plans in our rating:

- Atlas Journey Preferred provides $100,000 per person in emergency medical benefits as secondary coverage, with the option to upgrade to primary coverage. Primary coverage means you don’t have to first file a medical claim with your health insurance company. Atlas Journey Preferred is also the best travel insurance for cruises with $1 million in coverage for emergency evacuation.

- Atlas Journey Premier costs more but gives you $150,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier has $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan includes travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 411 reviews of policies purchased through the travel insurance comparison site since 2008.

Best travel insurance for emergency evacuation

Travel insured international.

Top travel insurance plan

If you’re traveling to a remote area, consider Travel Insured International’s Worldwide Trip Protector. It has the best travel insurance for emergency evacuation of travel insurance policies in our rating. This top travel insurance plan provides up to $1 million in emergency evacuation coverage per person and $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits.

- Only plan in our rating that offers $150,000 in non-medical evacuation coverage.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person is only available for cruises and tours.

Travel Insured International has a rating of 4.39 stars out of 5 on Squaremouth, based on 3,402 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for missed connections

If you’re looking for good travel insurance for missed connections , it’s worth considering TravelSafe. Its Classic plan includes $2,500 in missed connection coverage for each person on the plan. Some travel insurance companies only provide missed connection coverage for cruises and tours, but TravelSafe doesn’t impose that restriction.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of our best-rated travel insurance plans.

- No “interruption for any reason” coverage option.

- Weak baggage delay coverage of $250 per person after 12 hours.

TravelSafe has a rating of 4.3 stars out of 5 on Squaremouth, based on 1,506 reviews of policies purchased on the travel insurance comparison site since 2004.

Best trip insurance for traveling with a pet

Go Ready Choice by Aegis has the most affordable travel insurance of the best-rated travel insurance companies in our rating. It’s also the best trip insurance for pet parents , with an optional Pet Bundle add-on that includes pet medical, pet kennel and pet return benefits.

- Cheapest of our best trip insurance plans.

- Optional pet bundle adds pet medical expense and pet return benefits.

- Low emergency medical and evacuation limits.

- Low missed connection benefit of $500 per person for cruises and tours only.

- Low baggage and personal items loss benefit of $500 per person.

Aegis has a rating of 4.06 stars out of 5 on Squaremouth, based on 1,111 reviews of policies purchased on the travel insurance comparison site since 2013.

Best travel insurance for families

Top-scoring plan

Travelex Insurance Services has the best travel insurance for families because you can add kids aged 17 and younger to your Travel Select plan at no additional charge.

- Free coverage for children 17 and under on the same policy.

- Robust travel delay coverage of $2,000 per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Low emergency medical coverage of $50,000 per person.

- Non-medical evacuation is not included.

- Low baggage delay coverage of $200 requires a 12-hour delay.

Travelex has a rating of 4.43 stars out of 5 on Squaremouth, based on 2,048 reviews of policies purchased on the travel insurance comparison site since 2004.

Best travel insurance for add-on coverage options

Travel Guard Preferred from AIG allows you to customize your policy with a host of available upgrades, making it the best traveler insurance for add-on options . These include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings.

There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million. This is a good option if you’re looking for foreign travel health insurance.

See our full AIG travel insurance review

- Bundle upgrades allow you to customize your travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best travel insurance for cruise itinerary changes

Nationwide’s Cruise Choice plan is good travel insurance for cruises . It has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion.

Cruise Choice also has a missed connections benefit of $1,500 per person after only a 3-hour delay when you’re taking a cruise or tour. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Benefits for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Missed connection coverage of $1,500 per person for tours and cruises, after a 3-hour delay.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” upgrade available.

Nationwide has a rating of 4.02 stars out of 5 on Squaremouth, based on 570 reviews of policies purchased on the travel insurance comparison site since 2018.

What is the best travel insurance?

The best travel insurance for international travel is sold by WorldTrips, according to our in-depth trip insurance comparison.

The best travel insurance plan for you will depend on the trip you are planning and the coverage areas that are most important to you.

- Best cruise travel insurance

- Best COVID travel insurance

- Best “Cancel for any reason” travel insurance

- Best senior travel insurance

Best travel insurance for cruises

The best cruise travel insurance is Atlas Journey Preferred sold by WorldTrips . This plan offers solid travel insurance for cruises for a low rate.

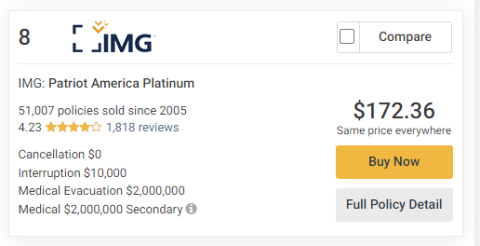

Via TravelInsurance.com’s website

Best travel insurance for COVID-19

The best COVID travel insurance is the Trip Protection Basic plan sold by Seven Corners . It is a relatively low cost travel insurance plan with optional “cancel for any reason” coverage that reimburses up to 75% of your prepaid, nonrefundable trip expenses.

Best travel insurance for “cancel for any reason”

The best “cancel for any reason” (CFAR) travel insurance is Seven Corners’ Trip Protection Basic. Adding CFAR coverage to a RoundTrip Basic plan only increases the cost by about 40%, which is lower than other plans we analyzed. For the extra cost, you get coverage of 75% of your prepaid, nonrefundable trip expenses, as long as you cancel at least 48 hours before your scheduled departure.

Best travel insurance for seniors

The best senior travel insurance is the Gold plan sold by Tin Leg . It is an affordable plan with travel medical primary coverage of $500,000 and a pre-existing conditions waiver if you insure the full amount of your trip within 14 days of your first trip deposit.

How much is travel insurance?

The average cost of travel insurance is 5% to 6% of your prepaid, nonrefundable trip costs .

How much you pay for travel insurance will depend on:

- The cost of your trip.

- Your destination.

- The length of your trip.

- The ages of travelers being insured.

- Your state of residence.

- The travel insurance policy you choose.

- The total coverage amounts in your policy.

- Any travel insurance add-ons you select.

Here are average travel insurance rates for a 30-year-old female who is insuring a 14-day trip to Mexico.

How much travel insurance should I buy?

Travel insurance companies typically offer several plans with varying maximum limits. The higher the coverage limits, the more you’ll pay for travel insurance.

Squaremouth, a travel insurance comparison site, recommends the following coverage limits for international travel:

- Emergency medical coverage: At least $50,000.

- Medical evacuation coverage: At least $100,000.

If you’re going on a cruise, or to a remote location, Squaremouth recommends:

- Emergency medical coverage: At least $100,000.

- Medical evacuation coverage: At least $250,000.

When evaluating travel insurance plans, our team of insurance analysts considered the best medical travel insurance policies to have at least $250,000 in emergency medical coverage and at least $500,000 in medical evacuation coverage.

When should I buy travel insurance?

The best time to buy travel insurance is within two weeks of making your first nonrefundable travel payment, whether it’s for a plane ticket, hotel stay, cruise or excursion.

Travel insurance costs the same whether you buy it early or last minute, and buying it early has added benefits:

- You may be able to add on “ cancel for any reason” (CFAR) coverage , an upgrade that is typically only available for a limited time after you’ve started paying for your trip.

- You may qualify for a pre-existing medical conditions exclusion waiver, meaning your pre-existing conditions will be covered by travel insurance. This waiver is generally added to your policy automatically, provided you buy the travel insurance within a certain window after your first trip deposit.

- You will be covered over a longer period of time for unforeseen events that could cause you to cancel your trip, such as medical emergencies, inclement weather and natural disasters.

Expert tip: You can buy travel insurance up to the day before you leave on your trip, but waiting may cost you the opportunity to qualify for a pre-existing conditions exclusion waiver or to buy a “cancel for any reason” upgrade.

Where can I buy travel insurance?

You can buy a travel insurance plan:

- Online. Visit a travel insurance company’s website to buy a policy directly or use a comparison website like Squaremouth or Travelinsurance.com to see your options and compare plans. You may also be able to purchase travel insurance online through an airline, cruise, hotel, rental car company or other provider you book a ticket with.

- In person. A travel agent or insurance agent may be able to assist you in buying travel insurance.

Travel insurance trends in 2024

Americans are changing the way they travel and this includes buying travel insurance when they might have skipped it in the past. As spending on trips continues to rise , travelers have more to lose if their plans are disrupted.

Based on travel insurance searches from Jan. 1 to April 1, 2024, here are the main benefits travelers are looking for.

Source: Squaremouth.com

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- $3,000, 8-day trip to Mexico for two travelers age 30.

- $3,000, 8-day trip to Mexico for two travelers age 70.

- $6,000, 17-day trip to Italy for two travelers age 40.

- $6,000, 17-day trip to Italy for two travelers age 65.

- $15,000, 17-day trip to Italy for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to France for four travelers ages 40, 40, 10 and 7.

- $15,000, 17-day trip to the U.K. for four travelers ages 40, 40, 10 and 7.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

Best travel insurance FAQs

According to our analysis, WorldTrips has the best trip insurance. Two of its plans — Atlas Journey Preferred and Atlas Journey Premier — get 5 stars in our rating.

The best travel insurance policy for you will depend on what type of coverage you need. With so many different policies and carriers, the policy that was best for your friend’s trip to California might not be ideal for your trip to Japan. If you’re looking for the best travel insurance for international travel, you may be willing to pay more for higher coverage levels.

A comprehensive travel insurance plan bundles several types of travel insurance coverage, each with its own limits. To ensure you have adequate financial protection for your trip, your travel insurance policy should include the following travel insurance coverages:

- Trip cancellation . With trip cancellation insurance , you’re covered if you need to call off your trip because of a reason listed in your policy, such as unexpected illness, injury or death of you, a family member or a travel companion, severe weather, jury duty and your travel supplier going out of business.

- Travel delay. Once your trip has started, travel delay insurance reimburses you for unexpected expenses you incur after a minimum delay, such as five hours. It can cover needs like airport meals, transportation and even overnight accommodation.

- Trip interruption. If you need to cut your trip early for a reason listed in your policy, trip interruption insurance can reimburse you for any prepaid, nonrefundable payments you’ll lose by leaving early. It can also pay for a last-minute one-way ticket home.

- Travel medical . Emergency medical benefits are especially important if you need international health insurance for travel outside of the country. Your domestic health insurance may provide limited coverage once you leave the U.S. The best travel medical insurance pays for ambulance service, doctor visits, hospital stays, X-rays, lab work and prescription medication you may require while traveling.

- Emergency medical evacuation. If you’re traveling to a remote area, or planning excursions such as boating to an island, emergency medical evacuation coverage is a good idea. This coverage pays to transport you to the nearest adequate medical facility if you are injured or sick while traveling.

- Baggage delay. After a certain waiting period, such as six or 12 hours, this coverage will reimburse you for necessities you need to buy to tide you over while you wait for your bag to arrive. Be sure to save your receipts and look at your coverage limit, as some caps are low, like $200.

- Baggage loss. Baggage insurance can reimburse you if your bag never arrives, or if your personal belongings are stolen during your travels. Coverage limits apply here, as well as exclusions for certain items such as electronics.

“Typically, travelers are expected to pay their expenses out of pocket, and then file a claim for reimbursement,” said James Clark, spokesperson for Squaremouth. “However, there are medical situations in which a provider may be required to pre-authorize payment to make sure the policyholder receives the treatment they need.”

According to Clark, “Providers can pre-authorize payment for medical care and emergency evacuations. With that said, every circumstance is unique, and providers will handle each situation on a case-by-case basis.”

Travel insurance covers your prepaid, nonrefundable trip costs — as well as extra money you may need to spend due to unforeseen circumstances and emergencies — both before and during your trip.

Travel insurance coverage varies by plan, but in general travel insurance covers costs associated with these problems:

- Bankruptcy of a travel insurance company, such as your airline or tour operator.

- Dangerous weather conditions.

- Delayed and lost luggage.

- Illness or death in your family that requires you to stay home or cut your trip short.

- Illness that needs medical attention.

- Injury requiring medical evacuation.

- Jury duty.

- Travel delays and missed connections.

- Theft of your personal belongings while traveling.

- Unexpected job loss.

Travel insurance policies often exclude or limit “foreseeable” losses. Typical travel insurance exclusions include:

- Accidents or injuries caused by drinking or drug use.

- Canceling your trip because you changed your mind.

- Ending your trip early because you changed your mind.

- Losses caused by intentional self harm, including suicide.

- Losses due to war, civil disorder or riots.

- Medical tourism.

- Medical treatment for pre-existing conditions.

- Mental health care.

- Natural disasters that begin before you buy travel insurance.

- Non-medical evacuation.

- Normal pregnancy.

- Medical treatment related to high-risk activities.

- Routine medical care, such as physicals or dental care.

- Search and rescue.

Your U.S. health insurance may provide little or no coverage in foreign countries. Check with your health insurance company to see if you have any global benefits and ask how they work. If your health care does extend across the border, the benefits it provides abroad may not be the same benefits it provides domestically.

Medicare usually won’t pay for health care outside of the United States and its territories, so older travelers planning an international trip should look into the best senior travel insurance with robust medical benefits.

The best time to buy travel insurance is immediately after booking your trip and making a nonrefundable payment — in other words, as soon as you’re at risk of losing money. This way, you’ll know the total cost that you need to insure and you’ll have the longest window to take advantage of your policy’s benefits if something goes wrong.

You can’t wait until something goes wrong and then buy travel insurance to get reimbursed for your loss. Travel insurance only covers unexpected losses.

Travel insurance companies can decline to cover travel to certain countries. For example, you may find that some trip insurance companies don’t offer coverage to countries with a Level 4: Do Not Travel advisory from the U.S. State Department.

Travel insurance policies also frequently exclude certain risks that you’re more likely to encounter in Level 4 or Level 3 countries. For example, your policy may not cover losses related to declared or undeclared wars or acts of war or losses related to known or foreseeable conditions or events.

Some credit cards , such as the Chase Sapphire Preferred® Card , offer benefits such as trip cancellation and interruption insurance, baggage delay insurance and trip delay reimbursement when you use your card to pay for your trip.

Ask your credit card issuer for your card’s benefits guide to see what coverage you may have. Keep in mind that it may not cover all the risks you want to protect against, such as the cost of international health care or emergency medical evacuation .

Business travel insurance makes sense if you are self-employed and paying for your own travel expenses, or if you are traveling internationally and want medical coverage abroad.

You might also consider buying travel insurance for a business trip if your company won’t cover extra expenses if your flight is delayed or you need to head home early.

Cruise travel insurance can help protect you financially if you need emergency medical care in a remote location, or if a delayed flight causes you to miss embarkation and you need to pay extra to catch up to your cruise.

Experts caution that travel insurance you buy through a cruise line may not be as comprehensive as plans you can buy directly from travel insurance companies.

Some travel insurance plans cover rental cars as an optional upgrade, for an additional cost. The 5-star rated travel insurance companies in our rating offer these optional rental car benefits:

- Travel Insured International — Rental car damage and theft coverage of $50,000.

- WorldTrips — Rental car damage and theft coverage of $50,000 with a $250 deductible.

Travel insurance typically only covers a single trip, although your insured trip can have multiple destinations.

If you’re looking to insure several trips in the same year, annual travel insurance may be a good option for you.

Travel insurance may be required, depending on the country you plan to visit. But it’s smart to consider buying a travel insurance policy for international travel, even when it is not required. A good travel insurance policy can protect you financially if you need emergency medical assistance when traveling, or if you need to cut your trip short and buy a last-minute plane ticket home because an immediate family member is ill.

Wondering if travel insurance is worth it? What travel insurance covers

Editor’s Note: This article contains updated information from previously published stories:

- Spirit Airlines scrubs 60% of its Wednesday flights, says cancellations will drop ‘in the days to come.’

- ‘Just a parade of incompetency’: Spirit Airlines passengers with ‘nightmare’ stories want more than apology, $50 vouchers

- ‘This is not our proudest moment’: Spirit Airlines CEO says more flight cancellations expected this weekend

- Hurricane Irma: Flight cancellations top 12,500; even more expected

- Is an annual travel insurance policy right for you?

- How 2020 and COVID-19 changed travel forever – and what that means for you

- COVID-19 or delta variant have you ready to scrap your trip? Here’s how to cancel like a pro

- Sunday: Snow is over, but flight cancellations top 12,000

- After nearly 13,000 Harvey cancellations, Irma is new threat to airline flights

- What’s the difference between travel insurance and trip ‘protection’?

- How to choose the right travel insurance for your next vacation

- Travel insurance can save the day

- Angry passengers brawl after Spirit cancels flights

- What to do when travel insurance doesn’t work

- How lockdowns, quarantines and COVID-19 testing will change summer travel in 2021

- Travelers will pay and worry more on summer vacation this year. But they won’t cancel

- How to find a hotel with COVID testing and quarantine facilities wherever you travel

- Yearning to travel in 2022? First, figure out your budget – then pick a destination

- Pro tips for surviving a long flight during a pandemic: Get the right mask, bring a pillow

- Want to steer clear of contracting COVID-19 on your next vacation? Follow these guidelines

- Post-pandemic travel: Is it OK to ask another passenger’s vaccine status or request they mask up?

- These days, forgetting these important travel items could cost you thousands of dollars

- International travel hacks: When to book flights and hotels, how to deal with COVID-19 rules

- Traveling post-coronavirus: How do you book your next trip when so much remains uncertain?

- The COVID-19 guide to holiday travel – and the case for why you shouldn’t go this year

- Should you travel during the holidays? Americans struggle with their decision

- ‘There’s still pent-up demand’: What you should know about fall travel

- Planning for life after coronavirus: When will we know it’s safe to travel again?

- ‘Busiest camping season’: Travelers choose outdoor recreation close to home amid COVID-19 pandemic

- Considering a camping trip this summer? Tips to make sure your gear is good to go

- RVing for the first time? 8 tips for newbies I wish I’d known during my first trip

- Five myths about travel agents

- Should I buy travel insurance?

- Is travel insurance stacked against you?

- Five myths about travel insurance and terrorism

- These eight things could get your travel insurance claims rejected

- There’s a good chance that your credit card already gives you some kind of travel insurance coverage

- How to avoid a hotel cancellation penalty

- Change fees and travel insurance continue to rise

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Amy Fontinelle has more than 15 years of experience helping people make informed decisions about their money, whether they’re refinancing a mortgage, buying insurance or choosing a credit card. As a freelance writer trained in journalism and specializing in personal finance, Amy digs into the details to explain the products and strategies that can help (or hurt) people seeking greater financial security and wealth. Her work has been published by Forbes Advisor, Capital One, MassMutual, Investopedia and many other outlets.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

AXA Assistance USA travel insurance review 2024

Travel Insurance Jennifer Simonson

10 worst US airports for flight cancellations this week

Travel Insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Cheapest travel insurance of April 2024

Travel Insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel Insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Outlook for travel insurance in 2024

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

The best travel insurance companies to make sure your next trip is covered

Travel insurance can protect you against a range of unforeseen events, from lost bags to medical emergencies..

Whether you're taking a family vacation to Disney World or a romantic cruise through the Mediterranean, travel insurance could help protect your trip from the unexpected. From trip cancellations and flight delays to medical emergencies, travel insurance could protect you financially and give you peace of mind.

There are several different types of travel insurance plans to choose from when shopping for a policy. Here are a few of the common coverage types:

- Trip cancellation coverage : Helps you recoup travel expenses if you can't travel, though generally limited to specific reasons.

- Travel delay coverage: Helps you cover expenses if your travel is delayed due to a covered reason.

- Trip interruption coverage: Helps if you need to cut your trip short. Covered reasons may include an injury or illness on the trip, or a family emergency at home.

- Medical expenses and emergency evacuation coverage: This covers unforeseen medical expenses when traveling outside of the U.S. where your health insurance may not work. Emergency evacuation could help get you home if medically needed while overseas.

- Baggage loss: Covers baggage that is lost, damaged or stolen during your trip.

You'll also want to consider the prospective insurer's epidemic-related coverage. Each insurance company covers epidemic-related issues, such as Covid-19, differently, so it's worth checking the fine print on a policy you're considering.

CNBC Select analyzed dozens of different U.S. travel insurance products and narrowed down the top six for all sorts of travelers. (Read more about our methodology below.)

Best travel insurance companies

- Best for lost baggage and personal belongings: AXA Assistance USA travel insurance

- Best for customization: Travel Guard travel insurance

- Best for cancellation coverage: Allianz travel insurance

- Best for travel medical plans: USI Affinity travel insurance

- Best for cruise insurance: Nationwide travel insurance

- Best for luxury travel: Berkshire Hathaway Travel Protection

Best for lost baggage and personal belongings

Axa assistance usa travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

24/7 assistance available

- Three tiers of plans available

- Highly rated for financial strength

- Cancel for any reason only available on highest-tier coverage

AXA Assistance USA ’s travel insurance offers three different plans for travelers to choose from, with the most basic plans including trip interruption and cancellation and baggage and personal effects coverage. The platinum plan offers coverage for lost ski days and golf rounds, ideal for trips centering around those activities.

Best for customization

Travel guard® travel insurance.

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

For those wanting to cover an upcoming trip, Travel Guard is a strong option because of its variety of coverage types. With three base packages available online and more options available through a representative, there are a variety of ways to customize your policy. The deluxe, preferred and essential plans include coverage for one related child age 17 or younger.

Best for trip cancellation coverage

Allianz travel insurance.

10 travel insurance plans make it possible to customize your coverage. For families, Allianz's OneTrip Prime package covers children age 17 and younger when traveling with a parent or grandparent.

- Trip cancellation benefits can reimburse your prepaid, nonrefundable trip payments if you have to cancel your trip for one of the covered reasons stated in your plan documents.

- Limited coverage for risky sports

Travelers who want the ability to cancel their trips will find 10 different travel insurance policies through Allianz . You can either purchase coverage for a specific trip or purchase an annual plan that covers an entire year's worth of trips. Instead of basic cancel for any reason coverage, Allianz offers a Cancel Anytime policy that can reimburse up to 80% of prepaid, non-refundable trip costs, while many other companies we reviewed cap "cancel for any reason" (CFAR) coverage at 75%.

Best for travel medical plans

Usi affinity travel insurance.

USI Affinity has travel medical policies in addition to trip cancellation policies. Travel medical plans include an option for frequent travelers to cover multiple trips. Trip cancellation options include coverage for road trips and group travel.

- Wide variety of plans for both trip cancellation coverage and travel medical insurance

- CFAR only covers up to 70% of non-refundable trip costs

People who are traveling out of the country can find medical plans from USI Affinity to cover them during their travels. Frequent travelers can get an annual medical plan that covers them on multiple trips of 30 days or less. This company also has trip cancellation insurance policies in addition to global travel medical plans.

Best for cruise insurance

Nationwide travel insurance.

Nationwide's wide coverage for travel insurance allows many different types of travelers to find coverage that fits their needs. Three levels of cruise insurance coverage gives extra options to cruise passengers.

- 10-day review period on cruise insurance policies to make sure the plan meets your needs (not available in NY or WA)

- Most basic cruise plan doesn't offer CFAR coverage

Those planning a cruise in the future might find cruise-specific travel insurance helpful. Nationwide offers cruise-specific insurance that can cover things like emergency accidents, sicknesses, itinerary changes and trip interruption to start. Nationwide offers three tiers of cruise insurance (universal, choice and luxury) to get the right level of coverage for every type of trip. Nationwide offers a 10-day review period on its cruise policies (though unavailable in NY or WA), giving you extra time to look over the policy and ensure it’s a good fit.

Best for luxury travel

Berkshire hathaway travel protection.

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

- Wide variety of policies available

- Strong financial strength rating by AM Best

- Cancel for any reason only provides reimbursement for up to 50% of non-refundable trip payments

Since a luxury vacation is a large investment, insuring it could make sure that cost is covered if you have to cancel or have your trip interrupted. Berkshire Hathaway ’s LuxuryCare travel insurance has high limits of coverage for trip interruption coverage, medical expenses, and coverage for things like sporting equipment. Berkshire Hathaway also covers cruises and adventure travel with other separate plans.

Travel insurance FAQs

How do i choose the best travel insurance .

The best travel insurance is one that will meet your needs, cover the type of travel you’re doing (and the experiences you’re planning) and will give you the peace of mind you need.

Shopping around for travel insurance can help you make sure that you get the best deal possible. Since policies and coverage can vary by company, it could be helpful to get several quotes and compare the coverage limits and types available from several companies to find the best deal for your specific needs and trip.

To simplify the shopping process, a travel insurance comparison site like InsureMyTrip or Squaremouth could help you get an idea of how much you’ll spend and what types of insurance coverage are available for your trip.

Is travel insurance worth it?

Whether or not travel insurance is worth it could depend on the types of coverage you already have, including whether or not an existing travel credit card you hold could provide similar coverage, and whether that would cover your concerns.

Some travel credit cards offer car rental insurance , baggage insurance, trip delay insurance, and trip cancellation and interruption insurance. In addition, others offer more coverage like travel accident insurance.

The Chase Sapphire Reserve® card, for example, offers travel accident insurance, emergency evacuation insurance, and coverage for baggage delays and lost luggage reimbursement. Several of CNBC Select’s top travel credit cards also offer some credit card travel insurance that could cover potential travel issues.

How much does travel insurance cost?

The average travel insurance costs between 4% and 10% of your prepaid, non-refundable trip costs, according to travel insurance marketplace InsureMyTrip .

However, travel insurance costs vary based on the cost of the travel you’re insuring, as well as the age of the travelers and any extra coverage that’s added to the policy.

Bottom line

Travel insurance can cover a variety of unexpected events on your trip, from lost baggage to emergency medical expenses. While costs vary based on age, type of coverage and trip costs, it can be useful if you need to cancel or cut your trip short.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every travel insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of travel insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best travel insurance.

Our methodology

To determine the best travel insurance companies, CNBC Select analyzed dozens of U.S. travel insurance companies that come with a wide variety of policies and offer coverage for a number of situations.

When narrowing down the best travel insurance companies, we focused on the coverage available, including the number of plans available, 24/7 assistance availability and cancel for any reason (CFAR) coverage availability. We also considered financial strength ratings from AM Best and Better Business Bureau ratings for customer satisfaction.

From there, we sorted our recommendations by the best overall and runner-up, best for cancellation coverage, best for travel medical plans, best for cruise insurance and best for luxury travel.

Note that the premiums and policy structures advertised for travel insurance companies are subject to fluctuate in accordance with the company’s policies.

Catch up on CNBC Select’s in-depth coverage of credit cards , banking and money . And follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- What to do if you can't make your mortgage payments Kelsey Neubauer

- Aura review: Protect your identity, finances and family Elizabeth Gravier

- 5 hidden insurance fees to avoid Liz Knueven

- Search Search Please fill out this field.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more .

- Personal Finance

Best Travel Insurance Companies for April 2024

:max_bytes(150000):strip_icc():format(webp)/EricRosenberg-2023-Square-0224d594cbdc4555900b9c356d7b60b9.jpg)

According to our research, Travelex is the best travel insurance company because its comprehensive coverage comes at a relatively low cost. We chose the best travel insurers in our list based on an analysis of 31 travel insurance companies across several areas that are most important to travelers, including options available for your coverage, claim and policy limits, what the policy does and doesn't cover, and typical policy costs. We took time to research insurance coverage limits and what the policies covered and rank companies accordingly.

Travel insurance is an important product to consider when booking a trip, especially if it's a pricy one or you believe there's a chance it could be canceled. If you're like the 40% of people who told Nationwide Travel Insurance they plan to travel more in 2024 than in 2023, then travel insurance could be key to making those plans a reality.

Our list of top travel insurance companies can help you choose the right provider, but you should also do your research to make sure the policy covers your particular trip. And if general travel insurance isn't enough, you may be able to add cancel for any reason (CFAR) travel insurance to your policy to ensure an unexpected situation comes up, like a last-minute work or family obligation, or safety concern.

- Best Overall: Travelex

- Runner-Up, Best Overall: Allianz Travel Insurance

- Best Value: InsureMyTrip

- Most Comprehensive Coverage: World Nomads

- Best for Older Adults: HTH Travel Insurance

- Best for Cruises: Nationwide

- Best for Medical Coverage: GeoBlue

- Our Top Picks

Allianz Travel Insurance

InsureMyTrip

World Nomads

HTH Travel Insurance

- See More (4)

The Bottom Line

- Compare Providers

- What Is Travel Insurance?

How to Get Travel Insurance

What does travel insurance cover.

- How Much Does Travel Insurance Cost?

- What Happens When You Cancel a Trip?

Best Overall : Travelex

- Number of Policy Types: 3

- Coverage Limit: Up to 100% up to $50,000 for cancellations

- Starting Price: $24

Travelex offers coverage (up to 150% for interruptions) for you or your family members at a competitive price—and kids are included at no extra charge. A relatively low price for the high levels of coverage made it our top choice. Look for the Travel Select plan for the best coverage.

Competitive pricing for comprehensive coverage

Multiple plan options with customizable features

Children younger than 21 covered at no extra cost

Mixed pre-existing medical condition coverage depending on the policy purchase date

No annual plan available

Basic coverage plan features minimal coverage

Travelex Insurance Services is a well-known travel insurance provider based in Omaha, Nebraska. Founded in 1996, Travelex offers several insurance packages depending on the coverage you need for your trip. Policies are underwritten by Berkshire Hathaway Specialty Insurance, which earns an A++ rating from AM Best and AA+ from Standard & Poor’s. Coverage is available to customers worldwide.

The Travel Select plan starts at about $36 and includes trip cancellation insurance, trip interruption, and emergency medical and evacuation, but there also are several ways to customize and upgrade coverage.

Travel is covered up to 100% up to $50,000 for cancellations. You can receive up to 150% of the trip cost, up to $75,000, for trip interruptions. Emergency medical limits are $50,000, and emergency evacuation coverage is good for up to $500,000.

In addition, Travel Select has a 15-day pre-existing medical condition exclusion waiver. If you purchase your policy within 15 days of paying for your trip and insure the full cost of the trip, your pre-existing injury or illness is likely covered.

Runner-Up , Best Overall : Allianz Travel Insurance

- Number of Policy Types: 10

- Coverage Limit: Up to $10,000 per insured, per year for trip cancellation

- Starting Price: $138

Allianz gets the runner-up spot because it offers coverage for frequent travelers with a low cost per trip. Get the best coverage from the AllTrips Executive Plan. Individual trip coverage is also available.

Annual- or single-trip plans are available

Many policy types fit varying needs

Cover yourself and your household all year even if you’re not traveling together

Does not cover extended travel periods

Some annual plans have per-trip limits while others have annual limits

Limit for emergency medical transportation coverage is only $250,000

Allianz Travel is a subsidiary of Allianz, which traces its history back to 1890 in Germany. Travel policies are underwritten by insurers with AM Best ratings of A to A+ and are available only to legal U.S. residents.

Travelers who want to hit the road many times per year should consider annual travel insurance rather than individual per-trip policies. Allianz Travel offers four different annual plans with varying benefit levels. We particularly like its AllTrips Executive Plan, which has the highest limits and coverage.

The AllTrips Executive Plan provides tiered limits starting at $5,000 for trip cancellation insurance or interruption coverage. It also offers $50,000 for emergency medical and $250,000 for emergency transportation per insured per trip. There is a lengthy list of exclusions, including extreme sports, so make sure to read the fine print before jumping into adventure activities.

Quotes for a single traveler, a couple, and a family of four had a price point of $500 per traveler per year. If you pay for comprehensive coverage at $120 per person per trip and are going to travel at least five times per year, you will break even with this plan. If you’re looking for lower costs, the AllTrips Basic, Premier, and Prime options are also available from Allianz.

Best Value : InsureMyTrip

- Number of Policy Types: Multiple options from over 20 providers

- Coverage Limit: Varies

- Starting Price: $25 to $100

Compare policies from more than 20 different travel insurance providers with one form so you know you’re getting a good deal for the coverage you need. You can find low-cost trip coverage or customize a plan to meet your needs so you don’t overpay for coverage you won’t use.

Search for quotes from multiple reputable insurers

Shop around with one application for multiple trip types

View multiple plans from eligible insurers for your planned trip

Many popular insurers are not included in listings

Initial listing pages don’t show policy limits

Includes some policies with low coverage limits

Founded in 2000, InsureMyTrip is a travel insurance comparison website that searches from more than 20 insurers using one intake form. It offers an easy-to-use sign-up tool to quickly compare multiple policies based on your specific needs. Filters are available to pick policies that cover adventure sports, higher limits, increased medical coverage, and more.

A quote for a family of four taking a 14-day trip that costs $4,000 and includes plane and hotel expenses resulted in three suggested plans with costs of around $100 to around $400 for varying levels of travel protection. Basic features included luggage coverage, travel delay, and medical care. Note that rates will differ based on where customers are originating from and where they are vacationing, as well as other variables.

The insurers you'll find while using InsureMyTrip have earned a variety of industry ratings and are generally considered reputable and financially stable. Still, as with policies bought directly from insurers, it’s a good idea to read the policy details before clicking the buy button. Each underlying insurer has different claims processes, exclusions, and limits. InsureMyTrip makes it easier, however, to be an informed travel insurance buyer.

Most Comprehensive Coverage : World Nomads

- Number of Policy Types: 2

- Coverage Limit: Up to $10,000 for trip cancellation

- Starting Price: $100 to $200

Adventure travelers and digital nomads receive good trip protection from this plan, which offers coverage of up to $100,000 for accidents for some of the most extreme adventures.

Extensive coverage with high limits for medical and emergency evacuation

Protects your bags, computers, and sports equipment when traveling

Explorer plan covers adventure sports

Only single-trip plans are available

Most pre-existing medical conditions are not covered

Not all policies cover adventure sports

World Nomads is a good insurer for those looking for adventure. The Australia-based provider was founded in 2000 and is a solid choice for worldwide travel with few excluded activities. Policies are underwritten by various insurers including the financially strong and well-known Nationwide Mutual Insurance Company, Generali Global, AIG, and Lloyd’s.

Coverage includes terrorist attacks, assault, medical repatriation, equipment and baggage, and overseas medical and dental. The high-end Explorer Plan covers activities including snow sports, water sports, aviation, motorsports, athletics, and high-adventure experiences. It names more than 200 activities, many of which other insurers specifically exclude.

For the Explorer Plan, a solo 35-year-old would pay around $200, depending on inputs like state of origin, for a month in Thailand, which is reasonable for such extensive coverage. The Standard Plan costs around $100 for the same trip, but it makes sense to choose higher coverage levels if you’re worried about something going wrong.

This U.S.-based policy is underwritten by Nationwide (rated A by AM Best) with a $100,000 limit for emergency accidents and illnesses, $500,000 for emergency evacuation, $10,000 for trip cancellation insurance (or interruption), and much more.

Though it doesn’t have the same insurance reputation as some other providers, it works with reputable companies to underwrite policies.

Best for Older Adults : HTH Travel Insurance

- Number of Policy Types: 5

- Coverage Limit: Up to $50,000 for trip cancellation

- Starting Price: Varies

Medical coverage may be important to older adults who need excellent travel protection with flexible options while on a budget. This is where HTH Worldwide stands out. Older adults can get high levels of medical coverage.

High levels of medical coverage for adults up to 95 years old

Up to a $1,500 allowance for someone to visit you in the hospital

May be expensive depending on your needs

Best plan for older adults requires existing health insurance

Lowest policy has a $50,000 maximum benefit per person

Headquartered in Pennsylvania, HTH Worldwide was founded in 1997, and HTH Travel Insurance offers plans with high levels of medical coverage. That’s a big concern for older adults leaving the country , as they could end up in a doctor’s office or hospital with an expensive bill to follow. HTH Travel Insurance offers up to $1 million in total coverage for medical.

Policies for travelers with existing primary insurance enjoy 100% coverage for typical hospital charges, including surgery, tests, office visits, inpatient hospital stays, and prescription drugs outside of the U.S., among other coverage.

Medical evacuation is available up to $500,000, but trip interruption and baggage coverage are pretty light. Most people will choose this plan for medical rather than travel benefits. This policy is available to applicants who are 95 years old or younger.

Travel insurance is also available for people without existing health coverage. Most older adults in the U.S. are covered by some existing coverage, such as Medicare, but Medicare doesn’t work outside of the United States, leaving people uninsured when abroad. HTH Travel Insurance provides policies for those without existing medical coverage. The age limit is 95, but there is a 180-day pre-existing medical condition exclusion.

Best for Cruises : Nationwide

- Number of Policy Types: 8

- Coverage Limit: Up to $30,000 for trip cancellation

- Starting Price: $100

Multiple options protect your cruise vacation with tailored coverage for common cruise trip issues. This makes Nationwide a good pick for those who take to the high seas for their vacations. Make sure to review the benefit levels so you pick the right coverage for your needs.

Large insurer with a strong reputation

Three different cruise insurance plans to choose from

Coverage for common cruise issues like missed connections and itinerary changes

Some plans have low coverage levels for some incidents

Benefit limits are low for trip interruption for any reason

Pre-existing medical conditions may not be covered

Nationwide has been around since 1925. The Columbus, Ohio-based insurance company offers the most popular types of insurance including auto, home, and life. It also offers a few types of travel insurance coverage for individual trips, multi-trips, and cruises.

For single trip protection, Nationwide offers trip cancellation insurance of up to $10,000 with its Essentials plan and $30,000 with its Prime plan. Travelers may also get an annual travel insurance package for just $59 a year to cover delays, medical expenses, medical evacuation, lost luggage, and travel assistance.

Its custom-tailored plans for cruises, however, are what landed it in this category. The Universal Cruise plan, Choice Cruise plan, and Luxury Cruise plan make it easy to pick the right coverage for your individual needs. The cost for a couple on a 10-day cruise to Mexico, for example, was quoted at around $200 for both the Universal and Choice plans.

Cruise insurance from Nationwide covers what you worry about most with a cruise. Things like broken-down ships and itinerary changes can lead to missed excursions and flights or other costs. For the Universal Cruise plan, emergency medical expenses are covered up to $75,000 with medical evacuation benefits up to $250,000.

Additionally, all plans include coverage for the weather, an extension of school sessions, work emergencies, and terrorism. The luxury plan also covers the Centers for Disease Control and Prevention warnings in effect at your destination.

Travelers in 2024 have concerns over trip cancelations due to unprecedented events. Nationwide's survey showed that 51% are still worried about a resurgence of COVID-19, while 54% worry about weather-related delays or cancellations. Other worries include technology issues (38%), unruly fellow travelers (37%), and employee strikes (25%). Travel insurance can help alleviate some stress about a trip being canceled.

Best for Medical Coverage : GeoBlue

GeoBlue offers multiple options to buy travel medical insurance coverage for a lower price than a full travel insurance package. It offers medical coverage on its own if you don’t want or need additional travel coverage.

Up to $1 million in medical coverage

Gives a la carte medical coverage when other trip costs are already covered

Different policies allow you to cover various needs and pre-existing medical conditions

Primarily covers medical costs

Additional primary medical coverage required

GeoBlue, headquartered in Pennsylvania, is part of Worldwide Insurance Services, and policies come with a license from Blue Cross Blue Shield Association. Policies are issued by 4 Ever Life International Limited, a company with a history of more than 60 years and an A rating (Excellent) from AM Best.

If you just need coverage for medical needs, GeoBlue is a good choice. This insurer offers only travel medical coverage. Paying for medical coverage means you aren't paying for the rest of your travel insurance, which you already may have covered. If you already have a credit card with travel insurance included, your card's terms likely protect things like lost luggage and missed flights, for example. Instead, you get covered just for medical, and the costs for that are as low as a few dollars per day.

Because you’re mostly getting travel medical coverage, you will pay a lot less than most other insurers on this list. Just make sure you completely understand what it does and doesn't cover. You will receive only minimal luggage protection and travel interruption coverage with GeoBlue's plans.

GeoBlue has two general plans for single trips, multiple trips, and long-term travel. Additionally, there are five specialty policies for niche travel medical insurance needs, like study abroad. It doesn’t cover everything related to your trip, but it makes medical coverage much more affordable.

Travelex is the best travel insurance company because it offers competitive pricing for comprehensive travel insurance. Policies from Travelex cover everything from canceled or interrupted trips to medical emergencies and evacuations. It also features a 15-day pre-existing medical conditions waiver, which means that as long as you book your trip several weeks in advance, you and your family members will likely still be covered.

There are many options to choose from when it comes to travel insurance. It can provide you with peace of mind and save you thousands of dollars if your travel plans are canceled or interrupted at the last minute. With world events like pandemics, natural disasters, and wars that could easily throw an unexpected wrench in your travel plans, travel insurance helps you to stay prepared. Overall, our top choice for travel insurance is Travelex.

Why You Can Trust Our Expert Recommendations for the Best Travel Insurance

Investopedia collected several key data points from over 30 travel insurance companies to identify the most important factors for readers choosing a travel insurance company for their trips. We used this data to review each company for cost, coverage limits, exclusions, customer service, and other features to provide unbiased, comprehensive reviews to ensure our readers make the right decision for their needs. Investopedia launched in 1999, and has been helping readers find the best travel insurance companies since 2020.

Compare the Best Travel Insurance Companies

Travel insurance covers common problems when traveling. From trip interruptions to full cancellations, it can help protect the money you put down for your travel experience.

Common coverage includes more than just an unexpected trip stoppage. It can also cover lost or damaged luggage and changes to your itinerary for covered reasons, among other benefits.

Medical coverage is an important factor to consider because your current health insurance may not work away from home. The best travel insurance includes coverage for medical treatment, dental emergencies, and medical transportation. If you have any pre-existing medical conditions or are at risk, it’s important to make sure your policy covers these, too.

Tips for Picking the Best Travel Insurance for You

When picking the best travel insurance policy, there are a few things you should consider. Here are some tips and factors to think about:

- Look for low pricing and good coverage : Pricing is one of the most significant factors when comparing travel insurance policies. Look for a provider that offers low rates and doesn’t skimp on coverage.

- Don't settle for the first policy type : Depending on where you’re traveling and how long you’re staying there, different types of travel insurance policies may work best for your situation. For instance, you may need a different policy for a weeklong trip than you would if you plan to travel abroad for several months.

- Match your coverage limits to your travel costs : Travel insurance plans have coverage limits for trip cancellation, interruption, and medical expenses. Look for a plan whose coverage limit matches the amount you’ve spent on your travel plans.

- Don't forget to look at the exclusions : Some travel insurance plans come with exclusions. If you’re worried about a particular event or accident, make sure it’s covered before you pay for a plan.

- Look for high customer satisfaction ratings : Customer satisfaction is also an important factor when purchasing a travel insurance plan. Look for a provider with high customer satisfaction ratings and a history of good customer service.

"As someone who is always purchasing travel insurance, and has been for years, the thing that matters to me the most is mainly coverage and customer service. I want to know what my policy will cover, especially if I am taking a trip that involves a lot of activities, as well as how easy it will be to contact the company should I need to do so.I have found in the past that the price is always very reasonable and you can shop around, so it has never been the biggest concern for me." -Alice Morgan, Senior Digital Art Director, Dotdash Meredith

- Select a travel insurance company.

- Apply for the travel insurance plan of choice on the company's website or over the phone.

- Provide basic info about who is traveling and travel plans, like name, age, location of trip, and travel expenses and costs like hotels or airfare.

- Wait to be approved.

- Create an online account for easy access while you travel. Some companies may have an app, too.

- Enjoy your trip, and file a claim online or over the phone if needed.

When you’ve selected a travel insurance plan that meets your needs, the next step is to apply for travel insurance. You’ll need to provide the insurance company with some basic information about yourself and your travel plans, including your age, where you live, the date and location of your trip, and your total travel expenses, including things like flights and hotel stays.

Many insurance companies let you apply for a policy entirely online. When your application has been approved, you can typically manage your account online and add details about your trip. If you do need to file a claim, you can typically complete the process online.

Travel insurance may include many different benefits. Here’s a look at some common situations covered by many travel insurance plans:

- Trip cancellation

- Trip interruption

- Missed connection

- Baggage and possession loss, damage, and theft

- Delayed luggage

- Emergency medical treatment

- Emergency medical evacuation

- Accidental death and dismemberment (AD&D)

Emergency medical treatment may include things like ambulance services, x-rays, doctor bills, dental work, lab work, and more. It'll depend on the travel insurance company, so be sure to ask before paying for the insurance and/or additional benefits.

There are additional specialty coverages as well, such as customized policies for cruises. It’s a good idea to shop around and compare before making a final decision.

What Does Travel Insurance Not Cover?

Just as homeowners insurance often excludes damage from things like earthquakes and floods, travel insurance has common exclusions you need to know about. Here are some types of coverage you may not get with travel insurance:

- Weather-related cancellations and delays

- Trip cancellations or changes due to acts of terrorism

- Trip cancellations or changes due to a pandemic

- Injuries from extreme sports and high-adventure activities

Though most policies have limits and exclusions around these circumstances, not all do. Some insurers on this list have special coverage for these exact causes or include them in standard plan terms. Again, this is why it’s so important to read your policy documents before paying for and locking in your policy.

Travel insurance costs vary widely by coverage and insurer. You can expect to pay anywhere from a few dollars a day to more than $10 a day for short-term and single-trip coverage. The cost of your trip is another major factor in the insurance rate.

That means insurance for a single trip could cost anywhere from around $20 to hundreds of dollars. Annual policies cost around $500 per year for high levels of coverage.

There are many inexpensive travel insurance plans available, but most travelers are best protected with comprehensive coverage. It costs a bit more, but if you need to file a claim, you’ll be glad you have it.

Is Travel Insurance Worth the Cost?