- General Subscription Questions

- Skift Research

- Airline Weekly

- Daily Lodging Report

- Skift Events

- Skift Awards

- Complimentary Newsletters

- Contact Us!

- Help Center

What is the Skift Travel Health Index?

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. Covid-19 has routed the travel industry, with the impact of the pandemic quantified for 22 countries in the Skift Travel Health Index. The Index provides the travel industry with a powerful tool for strategic planning, of utmost importance as times remain uncertain. Skift Research launched the Index in May 2020 as the Skift Recovery Index, and have rebranded it at the start of 2022 as the Skift Travel Health Index, to reflect some far-ranging changes: the addition of many more indicators, additional data partners, and most importantly, our continued effort to track the industry health beyond the impact of the Covid-19 pandemic.

For more information, please visit: https://research.skift.com/recovery/methodology/

- Knowledge Hub

- Product Status

Find a Data Set

- Browse All Data Sets

- Global Airline Schedules Data

- Flight Status Data

- Historical Flight Data

- Flight Seats Data

- Flight Emissions Data

- Minimum Connection Times

- Master Data

- Passenger Booking Data

- Global Flight Connections Data

- Airfare Data

How we deliver data

- Data Delivery

- Latest Product Updates

Data Suppliers

- Share your data

Try our Data

Flight data sets.

The world's most accurate and information-rich flight data

ANALYTICS PLATFORM

- Analyser Analytics Platform

EXPLORE ANALYSER MODULES

- Connections

DEMO ANALYSER PLATFORM

Powerful aviation analysis platform to drive commercial and operational decision making across the industry.

WE POWER THE AIR TRAVEL ECOSYSTEM

- Consultancies

- Governments & Security

- Travel Technology

- Airport Service Providers

TRUSTED BY LEADING ORGANISATIONS

- Air Black Box

- View All Case Studies

Springshot: Minimizing delays with OAG's Status Data

- All Blogs, Webinars & Podcasts

- Covid-19 Recovery

- Future of Travel

- Aviation Market Analysis

- Aviation Sustainability

- Data, Technology & Product

- Where To Meet Us

- Monthly Live Webinars

- Travel Recovery Tracker

- Busiest Flight Routes in the World

- Busiest Airports in the World

- Airline Frequency and Capacity Statistics

- Monthly OTP Analysis

- US Aviation Market Analysis

- South East Asia Market Analysis

- China Aviation Market Analysis

- View All Analysis

AVIATION NETWORK CHAMPIONS ASPAC

Awards for Asia-Pacific airlines and airports to recognize their dedication as they move towards full recovery.

OUR COMPANY

- Diversity & Inclusion

- OAG & The Environment

- Our Locations

- What's New At OAG

GET IN TOUCH

- Press Office

Explore a career at OAG. See the latest job openings here.

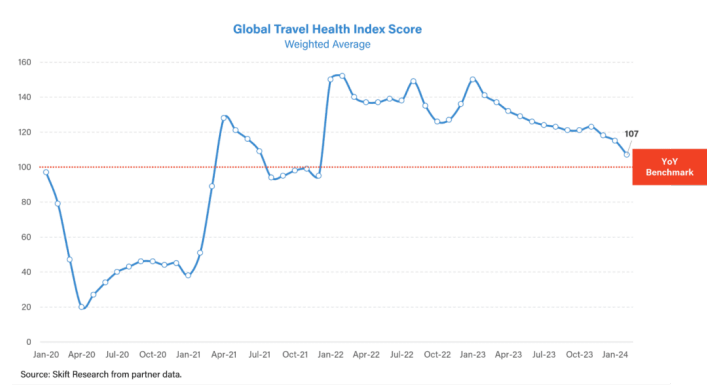

Skift Travel Health Index: February 2024

The global Skift Travel Health Index now benchmarks year-on-year, since 2023 was a year of recovery for the industry. In February 2024, the Travel Health Index is up 7% year-on-year. Keep reading for insights from the Skift team in the Skift Travel Health Index: February 2024 Highlights .

OAG helps enable Skift's Travel Health Index by providing flight data (powered by OAG Metis ). The Index records travel performance along with other key data points and is a vital source to track the travel industry’s recovery from the COVID-19 pandemic.

The Skift Travel Health Index is 107 in February 2024.

Highlights from this month's Skift Travel Health Index include:

- Growth numbers in the Asia Pacific region appear to be stabilizing, reducing slightly compared to previous months.

- Having suffered a decline following earthquakes in Turkiye last year, travel performance in the country shows a 16% YoY growth.

- International inbound tourists to Japan are projected to reach 33 million this year, reflecting a 31% surge compared to 2023, and a 4% increase over 2019.

- Melbourne & Sydney Hotels have taken their turn to experience the "Swiftie bump" with Sydney seeing a 93% occupancy level three days before the eras tour, a high level which persisted across the four day concert period.

" The travel industry continues to demonstrate a positive momentum in February 2024, gaining 7% year-on-year. Asia Pacific continues to be the frontrunner but slightly reducing growth levels indicate a trend towards normalization.. " - Saniya Zanpure

Download the latest Skift Travel Health Index Highlights here

Related OAG Content:

We’re always adding new content, keep up to date by registering your interest here.

View our Privacy Notice

Related Insights

Three tech innovations set to transform the passenger experience and operational efficiency.

03 April 2024

Unlocking Full Potential: Elevating the Flight Booking Experience

13 March 2024

Methodology

Why does travel need a stock index.

The travel sector has seen a dramatic expansion of public companies over the last few years. It started when Airbnb came public in late 2020. What followed were so many public offerings, we called 2021 the year of the travel IPO . Frontier and Sun Country IPO’ed, while the SPAC boom brought Sonder, Inspirato, and Vacasa into the public market, among many others.

This is great news for our industry. The wide range of public companies speaks to Travel’s growing maturity and prominence within the broader business community. It creates a valuable level of standardization and transparency into the financial health of the travel industry. And it provides us with a critical read on investor sentiment vis-à-vis travel.

But even as the number of public travel companies has grown, there was still no major stock index that tracked the performance of the travel industry.

The major hurdle is that travel is not often viewed as a proper industry itself. The global industry classification standard (GICS), which slices and dices major stock indexes into 11 different buckets does not consider travel to be a standalone industry. Instead, the Airlines are shunted as a sub-sector under the broader category of “Industrials.” Hotel brands fall under “Consumer Discretionary,” but hotel owners likely end up as “Real Estate.” Meanwhile online travel agencies fall into the “Information Technology” industry.

None of these are wrong per se, Expedia is a tech company and a Marriott stay is a discretionary consumer purchase. But by scattering travel companies across half a dozen different industries it is hard to take a holistic pulse of the industry or to aggregate financial data in a meaningful way.

The goal of Skift Research’s Skift Travel 200 is to rectify this problem and to build a stock index designed for the travel industry from the ground up. You can think of the Skift Travel 200 as the S&P 500 for the travel industry. The index currently tracks 196 public companies in the travel sector from 34 countries divided into five travel sectors and 14 sub-sectors. The cumulative market capitalization of our travel index is over one trillion dollars.

Market Weighting of the ST200

The Skift Travel 200 is built as a market capitalization weighted index. This is the industry standard methodology for stock indices. Each company in the index has a market value, also called a market capitalization, determined by stock market investors. A market cap is the equity value of each business calculated by taking the share price of each stock multiplied by total shares outstanding for each company.

In this kind of stock cap index each individual company is given a weight based on the relative size of its market value. The change in the price of the Skift Travel 200 is determined by adding up the change in each underlying constituent stock and then weighting those changes based on the relative size of each company.

Change in Index = ∑ Change in Stock * Weight of Stock

As a market capitalization weighted index, the larger a company is, the more of a ‘vote’ it has over what happens to the ST200. This means that Booking Holdings, with a market capitalization of $100+ Billion has more impact on the performance of the overall ST200 than Travelzoo with a market value of ~$90 million.

While this system is less ‘fair’ than an equal weighted average where every company has the same impact, we believe that this is a useful methodology. The reality is that larger companies tend to have more revenue and employees. And they also tend to be less volatile than smaller-cap peers. By using a market-weighted approach, the index is not skewed by a few smaller companies that may see large percentage changes in their value but which don’t have a large overall industry impact.

ST200 Sector Breakdown

Source: Skift Research. Data as of 9/18/2023.

We subdivide the travel industry into five sectors: Accommodation, Airlines, Travel Tech, Cruise and Tours, and Ground Transportation. Each is further subdivided into sub-sectors of which there are 14 in total.

Accommodation is the largest sector within travel. We break it down into six subsectors: global hotel brands, regional hotel brands, hotel management and operations, hotel REITS, alternative accommodations, and time shares.

Airlines are nearly as big. We primarily divide this into two groups: network carriers, the largest single subsector, and low cost carriers. We also have a very minor group of other airline related companies.

Travel tech largely consists of online travel businesses like Expedia Group and Booking Holdings. Online travel is the third largest subsector behind network carriers and global hotel brands. We classify Airbnb under alternative accommodations rather than online travel, though it could arguably fit in either location. The secondary travel tech subsector is B2B tech which includes global distribution systems, property management systems, corporate travel agencies, channel managers, and the like.

Cruise lines and tour operators are combined into one sector. Both share similarities in that they offer multi-day pre-packaged itineraries that combine multiple suppliers and destinations into one offering. Both are also commonly sold through third party distribution channels. The Cruise and Tours sector has relatively fewer public companies.

Ground transportation is our smallest sector. It is primarily made up of car rental companies and intercity bus lines. There were not enough public companies to divide this category into meaningful subsectors but if more companies in the space IPO or otherwise come to light we would look to revisit this classification.

Introducing the Index Divisor

The Skift Travel 200 is maintained via an index divisor. The divisor functions like the shares outstanding for a company. The market value of a company is determined by its share price multiplied by its shares outstanding. For a stock index, which doesn’t have any legal shares issued, market value is determined by index price multiplied by its divisors.

Index Market Value = Index Price * Index Divisor

Stock Indices also face the issue of how to handle additions or removals of the underlying stocks that make up the index. Making a change to the stocks inside the index will change the market value of the index in a dramatic way but we don’t want those changes to affect the index price.

Take the example of Airbnb. The Skift Travel 200 starts in December 2018 but Airbnb only goes public in December 2020. Airbnb IPO’ed with a market value of ~$80B. At the time the total market cap of all other travel stocks was ~$810 billion. If we just added Airbnb without any adjustment then the market value of the travel index would increase to $890 billion. Even though travel stocks were flat that day, if we did nothing to control for adding ABNB, then the index would rise ~10% due to the extra market cap.

We want the index to always reflect the fundamental performance of underlying stocks and to hide the impact of back-end administrative changes. We solve this issue by adjusting the index divisor. The market cap formula can be rewritten as:

Index Price = Market Value / Divisor

And because we know that we want the index price to stay the same when we add or remove any companies, we adjust the divisor to match the change in market value.

(1) Old Index Price = New Index Price

(2) Old Market Value / Old Divisor = Index Price = New Market Value / New Divisor

(3) New Divisor = Old Divisor * New Market Value / Old Market Value

(4) New Divisor = Old Divisor * Change in Market Value

In our example, when we add Airbnb the divisor goes up by 10% to match the 10% raise in market value. This works in reverse too, if a company gets taken private and removed from the index, we would adjust the divisor lower.

Quarterly Rebalancing

We update the Skift Travel 200 four times a year. Each quarter Skift Research decides if there are any new public travel companies that should be added to the index and any that should be removed. Every quarter we will recalculate a new divisor. This divisor captures changes in market value due to company changes as well as changes in market value due to the issuance of new shares or buybacks of shares from existing companies within the index.

We will always rebalance the index at the end of the quarter. But from time to time, we may also add extra divisor adjustments within a quarter to rebalance the index for a major merger, bankruptcy, or stock split.

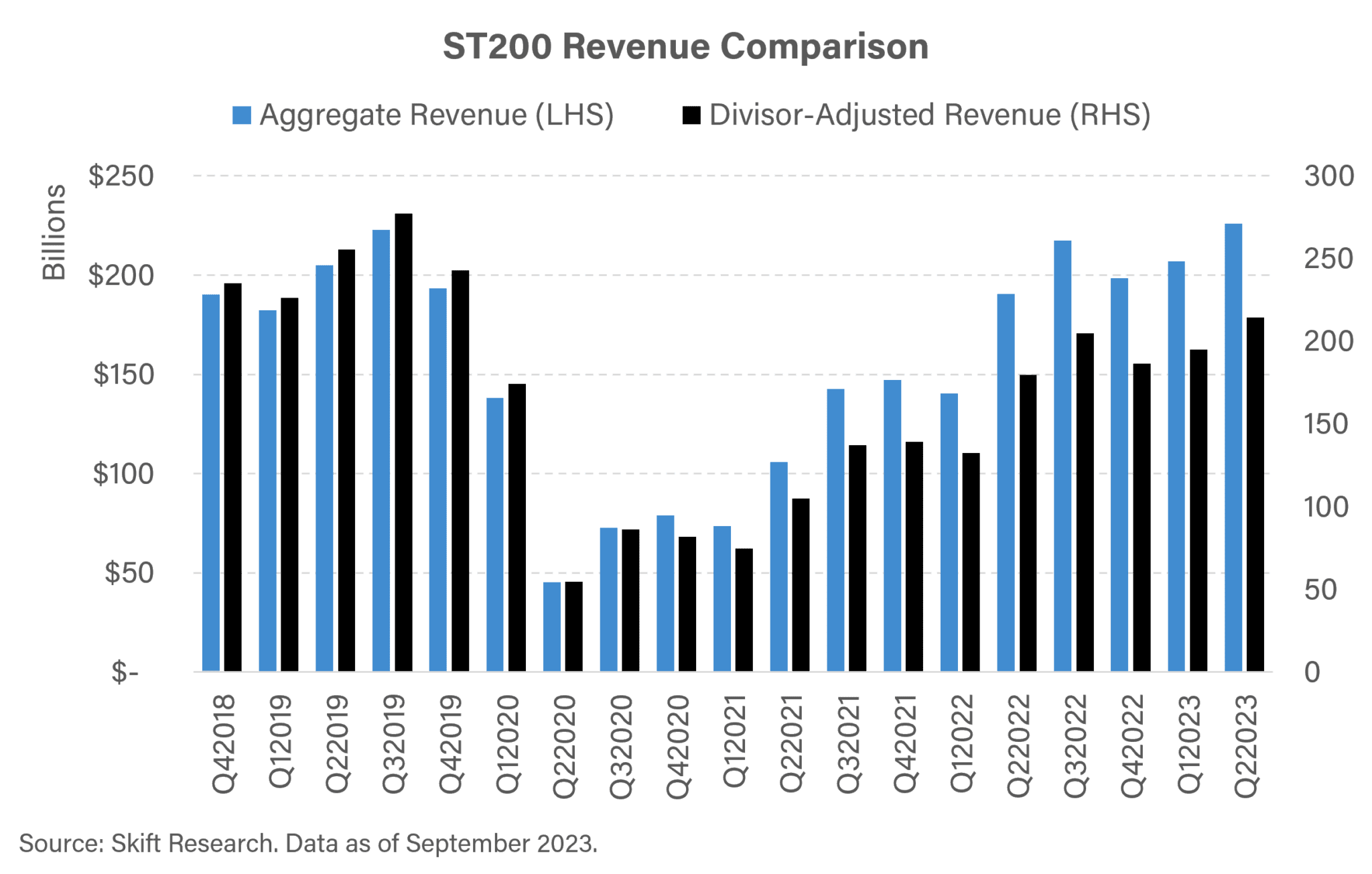

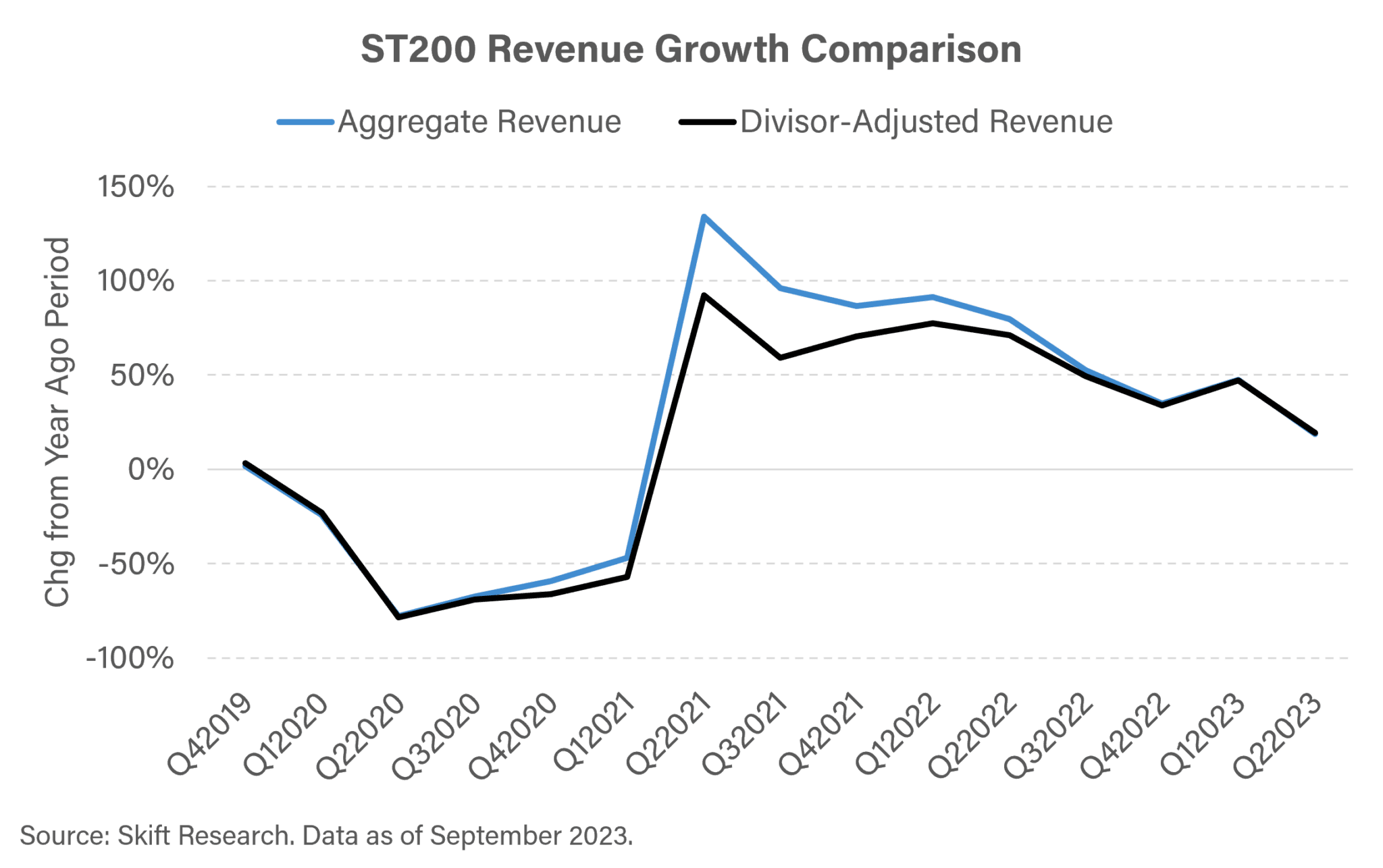

Divisor-Adjusted Fundamental Data

One of the benefits of a travel-specific stock index is that we can aggregate fundamental company data, such as sales and profits, to understand how the industry is performing over time. However, changes to the index composition means we will run into the same issue with time series revenue data as we face with market values.

Just as aggregate market value will be subject to big swings by adding a new company, so too will aggregate revenues. Back to our Airbnb example, if we add that company in December 2020, it will throw off growth rates for revenue in the following quarter. That is because Q1 2021 sales will include Airbnb revenue, but Q1 2020 sales will not. That gives an unfair boost to revenue growth rates when we add a new company to the index in the prior quarter. This would work in reverse if we removed a company.

To adjust for this, just like we do for market value, we use the index divisor as a scalar. We divide aggregate revenue by the index divisor to get divisor-adjusted revenue. This is the equivalent of revenue per share for an individual company.

The drawback of this approach is that divisor-adjusted revenue is not in dollar units which can be confusing especially when we are used to thinking of revenue as a dollar figure. But the benefit is that divisor-adjusted revenue makes for more accurate growth rate comparisons over time.

We can see the difference between these two revenue measurements most clearly by looking at year-on-year growth rates. Airbnb is added in December 2020 so Q1 2021 sees a large divisor adjustment. This is also around the time of travel SPACs and IPOs — all adding aggregate market value and revenue which is causing the divisor to be adjusted upwards. Aggregate revenue grew by 134% in Q2 ’21 vs. Q2 ’20. But keep in mind that many of the companies included in that 2021 aggregate revenue figure were not part of the index in 2020, so they are artificially inflating this growth rate. The divisor-adjusted growth rate is 40 points lower at 92%. This is probably a more accurate read on the actual pace of top-line growth for the industry at that time. Still an impressive gain, but more realistic than what the aggregate figures would lead you to believe.

Throughout our reporting on the ST200 we will switch back and forth between these two measurements. For any static comparisons within a single quarter, for instance breaking down revenue by sector or comparing the travel industry with other industries, we will use aggregate revenue in dollars. But when making time series comparisons across quarters, we will use divisor-adjusted revenue.

ST200 Company Constituents

Below is a table with all the current constituents that make up the Skift Travel 200 and the corresponding sector and sub-sector we have assigned to that business.

- Neighborhoods

- Assessments

- Restaurants

- Sex Offenders

- Building Permits Filed

- City Guides

- Tourist Attractions Articles

- Work and Jobs

- Houses, Apartments

- U.S. Cemeteries

Jump to a detailed profile, search site with google or try advanced search

- Idaho , ID smaller cities , ID small cities

- Latah County

- Moscow, ID housing info

- Moscow, Idaho

Moscow: Frozen walkway on U of I campus

Moscow: early fall

Moscow: Autumn 2007 - Vibrant colors at the University of Idaho Arboretum, Moscow, Idaho

Moscow: View from the Top of Moscow Mountain looking Southeast.

Moscow: The McConnell House - on the National Register and the Headquarters and Museum for the Latah County Historical Society

Moscow: Looking over Moscow from the Southeast - Church steeples peeking thru the fall colors and the hills behind.

Moscow: Storm over Moscow Mountain

Moscow: Hills of the Palouse

Moscow: terrain

Moscow: St Mary's Catholic Church

Moscow: local farm

- see 20 more

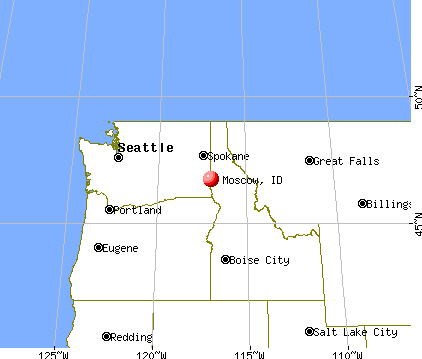

- General Map

Please wait while loading the map...

Current weather forecast for Moscow, ID

Zip codes: 83843 , 83844 .

Median gross rent in 2022: $930.

Moscow, ID residents, houses, and apartments details

Detailed information about poverty and poor residents in Moscow, ID

Compare current foreclosures near Moscow, ID:

- 22,245 83.0% White alone

- 1,511 5.6% Two or more races

- 1,394 5.2% Hispanic

- 761 2.8% Asian alone

- 463 1.7% Black alone

- 212 0.8% American Indian alone

- 105 0.4% Native Hawaiian and Other Pacific Islander alone

- 61 0.2% Other race alone

Races in Moscow detailed stats: ancestries, foreign born residents, place of birth

According to our research of Idaho and other state lists, there were 39 registered sex offenders living in Moscow, Idaho as of April 16, 2024 . The ratio of all residents to sex offenders in Moscow is 656 to 1. The ratio of registered sex offenders to all residents in this city is lower than the state average.

The City-Data.com crime index weighs serious crimes and violent crimes more heavily. Higher means more crime, U.S. average is 246.1. It adjusts for the number of visitors and daily workers commuting into cities.

Recent articles from our blog. Our writers, many of them Ph.D. graduates or candidates, create easy-to-read articles on a wide variety of topics.

- Popular New Year’s resolutions Dec 31

- Christmas is America’s favorite holiday season Dec 24

- Fish in the American dish: recreational fishing Dec 10

- American hunting and wildlife Nov 19

- The National Football League is an American treasure Nov 12

Latest news from Moscow, ID collected exclusively by city-data.com from local newspapers, TV, and radio stations

Ancestries: German (16.4%), English (8.7%), American (7.0%), Irish (6.1%), European (4.8%), Norwegian (3.2%).

Current Local Time: PST time zone

Incorporated in 1887

Elevation: 2583 feet

Land area: 6.15 square miles.

Population density: 4,266 people per square mile (average).

1,619 residents are foreign born (3.8% Asia , 1.0% Europe ).

Median real estate property taxes paid for housing units with mortgages in 2022: $2,682 (0.6%) Median real estate property taxes paid for housing units with no mortgage in 2022: $2,402 (0.6%)

Latitude: 46.73 N , Longitude: 117.00 W

Daytime population change due to commuting: +437 (+1.6%) Workers who live and work in this city: 10,301 (76.2%)

Area code: 208

Moscow, Idaho accommodation & food services, waste management - Economy and Business Data

Single-family new house construction building permits:

- 2022: 41 buildings , average cost: $334,900

- 2021: 43 buildings , average cost: $283,800

- 2020: 43 buildings , average cost: $274,500

- 2019: 38 buildings , average cost: $252,300

- 2018: 40 buildings , average cost: $236,000

- 2017: 31 buildings , average cost: $254,400

- 2016: 28 buildings , average cost: $210,000

- 2015: 31 buildings , average cost: $228,900

- 2014: 22 buildings , average cost: $246,900

- 2013: 31 buildings , average cost: $199,400

- 2012: 22 buildings , average cost: $213,200

- 2011: 22 buildings , average cost: $208,400

- 2010: 28 buildings , average cost: $222,300

- 2009: 20 buildings , average cost: $192,700

- 2008: 31 buildings , average cost: $244,800

- 2007: 48 buildings , average cost: $241,200

- 2006: 85 buildings , average cost: $198,700

- 2005: 64 buildings , average cost: $213,300

- 2004: 67 buildings , average cost: $173,400

- 2003: 46 buildings , average cost: $154,200

- 2002: 54 buildings , average cost: $165,500

- 2001: 45 buildings , average cost: $158,500

- 2000: 46 buildings , average cost: $136,800

- 1999: 32 buildings , average cost: $122,400

- 1998: 37 buildings , average cost: $122,300

- 1997: 33 buildings , average cost: $122,200

- Educational services (36.2%)

- Accommodation & food services (9.2%)

- Professional, scientific, technical services (6.1%)

- Health care (5.7%)

- Public administration (3.3%)

- Food & beverage stores (2.8%)

- Religious, grantmaking, civic, professional, similar organizations (2.5%)

- Educational services (38.3%)

- Accommodation & food services (8.5%)

- Professional, scientific, technical services (5.7%)

- Construction (3.9%)

- Public administration (3.4%)

- Food & beverage stores (3.3%)

- Agriculture, forestry, fishing & hunting (2.8%)

- Educational services (33.9%)

- Health care (10.4%)

- Accommodation & food services (10.1%)

- Professional, scientific, technical services (6.5%)

- Social assistance (3.6%)

- Religious, grantmaking, civic, professional, similar organizations (3.4%)

- Public administration (3.2%)

- Postsecondary teachers (9.8%)

- Other management occupations, except farmers and farm managers (4.4%)

- Other office and administrative support workers, including supervisors (4.0%)

- Life and physical scientists (3.5%)

- Other sales and related occupations, including supervisors (3.5%)

- Retail sales workers, except cashiers (3.4%)

- Computer specialists (3.2%)

- Postsecondary teachers (13.0%)

- Other management occupations, except farmers and farm managers (5.3%)

- Computer specialists (5.0%)

- Life and physical scientists (4.2%)

- Building and grounds cleaning and maintenance occupations (3.6%)

- Other sales and related occupations, including supervisors (3.6%)

- Retail sales workers, except cashiers (3.0%)

- Other office and administrative support workers, including supervisors (6.5%)

- Secretaries and administrative assistants (6.5%)

- Postsecondary teachers (6.1%)

- Information and record clerks, except customer service representatives (4.8%)

- Waiters and waitresses (4.0%)

- Cashiers (3.9%)

- Retail sales workers, except cashiers (3.8%)

Average climate in Moscow, Idaho

Based on data reported by over 4,000 weather stations

Air Quality Index (AQI) level in 2022 was 80.6 . This is about average.

Particulate Matter (PM 2.5 ) [µg/m 3 ] level in 2022 was 4.83 . This is significantly better than average. Closest monitor was 1.9 miles away from the city center.

Earthquake activity:

Natural disasters:, hospitals and medical centers in moscow:.

- GRITMAN MEDICAL CENTER (Voluntary non-profit - Private, provides emergency services, 700 SOUTH MAIN STREET)

- LATAH HEALTH HOME CARE AND HOSPICE (510 W PALOUSE RIVER DRIVE)

- MILESTONE DECISIONS INC #3 (LEXINGTON) (2087 LEXINGTON AVENUE)

- GOOD SAMARITAN SOCIETY - MOSCOW VILLAGE (640 NORTH EISENHOWER STREET)

- KINDRED NURSING AND REHAB - ASPEN PARK (420 ROWE STREET)

- LATAH HEALTH SERVICES, INC (510 W PALOUSE RIVER DR)

- FMC PALOUSE (723 MAIN ST)

- MOSCOW DIALYSIS CENTER (212 RODEO DR STE 110)

- GRITMAN HOME HEALTH (700 SOUTH MAIN STREET)

Airports and heliports located in Moscow:

- Fountains Airport (ID60) ( Runways: 2)

- Taylor Ranch Landing Area Airport (09ID) ( Runways: 1)

- Gritman Medical Center Heliport (7ID7)

Amtrak station:

Colleges/universities in moscow:.

- University of Idaho ( Full-time enrollment: 10,416; Location: 875 Perimeter Drive; Public; Website: www.uidaho.edu; Offers Doctor's degree )

- New Saint Andrews College ( Full-time enrollment: 152; Location: 405 S. Main Street; Private, not-for-profit; Website: nsa.edu; Offers Master's degree )

- Mr Leon's School of Hair Design-Moscow ( Full-time enrollment: 32; Location: 618 S Main St; Private, for-profit; Website: mrleons.com)

Other colleges/universities with over 2000 students near Moscow:

- Washington State University ( about 8 miles; Pullman, WA ; Full-time enrollment: 25,055)

- Lewis-Clark State College ( about 23 miles; Lewiston, ID ; FT enrollment: 3,199)

- Eastern Washington University ( about 60 miles; Cheney, WA ; FT enrollment: 11,643)

- North Idaho College ( about 67 miles; Coeur d'Alene, ID ; FT enrollment: 4,684)

- Spokane Community College ( about 68 miles; Spokane, WA ; FT enrollment: 6,482)

- Gonzaga University ( about 68 miles; Spokane, WA ; FT enrollment: 6,780)

- Spokane Falls Community College ( about 69 miles; Spokane, WA ; FT enrollment: 6,052)

Public high schools in Moscow:

- PARADISE CREEK REGIONAL ALT ( Students: 20, Location: 1314 S MAIN, Grades: 10-12)

- MOSCOW HIGH SCHOOL ( Location: 402 E 5TH ST, Grades: 9-12)

Private high school in Moscow:

- LOGOS SCHOOL ( Students: 341, Location: 110 BAKER ST, Grades: PK-12)

Public elementary/middle schools in Moscow:

- MOSCOW CHARTER SCHOOL ( Students: 590, Location: 1723 EAST F ST, Grades: PK-8, Charter school )

- A.B. MC DONALD ELEMENTARY SCH ( Students: 491, Location: 2323 E D ST, Grades: PK-5)

- LENA WHITMORE ELEMENTARY SCHOOL ( Students: 302, Location: 110 S BLAINE ST, Grades: KG-5)

- WEST PARK ELEMENTARY SCHOOL ( Students: 293, Location: 510 HOME ST, Grades: KG-2)

- J. RUSSELL ELEMENTARY SCHOOL ( Students: 165, Location: 119 NORTH ADAMS STREET, Grades: 3-5)

- PALOUSE PRAIRIE CHARTER SCHOOL ( Location: 1500 LEVICK ST, Grades: PK-8, Charter school )

- MOSCOW MIDDLE SCHOOL ( Location: 1410 E D ST, Grades: 6-8)

Private elementary/middle school in Moscow:

- ST MARY S SCHOOL ( Students: 121, Location: 412 N MONROE ST, Grades: KG-6)

Library in Moscow:

- LATAH COUNTY DISTRICT ( Operating income: $1,008,340; Location: 110 S JEFFERSON ST; 104,312 books ; 7,928 audio materials ; 5,282 video materials ; 6 local licensed databases ; 51 state licensed databases ; 200 print serial subscriptions )

User-submitted facts and corrections:

- Washington State University is not 46 miles from Moscow. It is in Pullman, WA, about 8 miles away.

Points of interest:

Click to draw/clear city borders

Notable locations in Moscow: Moscow Volunteer Fire Department Station 3 (A) , Central Fire Station (B) , Moscow-Latah County Library (C) , Latah County Courthouse (D) , Moscow City Hall (E) , Latah County Jail (F) , McConnell Hall (G) , Chrisman Hall (H) , Willis Sweet Hall (I) , Morrill Hall (J) , Canterbury Hall (K) , Lindley Hall (L) , Ridenbaugh Hall (M) , French Hall (N) , Hotel Moscow (O) , Kenworthy Theatre (P) , Moscow Volunteer Fire Department Station 2 (Q) , Moscow Volunteer Fire Department Station 1 (R) , Moscow Rural Fire Department (S) . Display/hide their locations on the map

Shopping Centers: Palouse Empire Mall (1) , Moscow Mall (2) , Korns Shopping Center (3) . Display/hide their locations on the map

Churches in Moscow include: Our Saviors Lutheran Church (A) , First Church of Christ Scientist (B) , Church of the Nazarene (C) , Saint Marks Episcopal Church (D) , Emmanuel Lutheran Church (E) , First United Methodist Church (F) , Saint Marys Roman Catholic Church (G) , Grace Baptist Church (H) , First Presbyterian Church (I) . Display/hide their locations on the map

Cemeteries: Sunset Memorial Gardens Cemetery (1) , Memorial Gardens Cemetery (2) . Display/hide their locations on the map

Tourist attractions: Appaloosa Horse Club (Museums; 2720 West Pullman Road), Prichard University of Idaho Art Gallery (Museums; 414 South Main Street), Latah County Historical Society (Museums; 327 East 2nd Street), C & B Music & Vending (Amusement & Theme Parks; 1424 South Main Street), Bumpers III (Amusement & Theme Parks; 1884 West Pullman Road).

Hotels: Royal Motor Inn (120 West 6th Street), Super 8 Motel (175 Peterson Drive), Hillcrest Motel (706 North Main Street), Palouse Inn (101 Baker Street), University Inn-Best Western (1516 West Pullman Road), Pantry (1516 West Pullman Road), Mark IV Motor Inn Restaurant & Lounge (414 N Main), Broiler (1516 West Pullman Road).

Courts: United States Government - U S Court- Clerk Of District Court- District J (220 East 5th Street), United States Government - U S Court- Clerk Of District Court- Probation Of (220 East 5th Street), Latah County - Latah County Courthouse (522 South Adams Street), Latah County - District Court- District Court Clerk & Judges Moscow (Courthouse).

Birthplace of: Josh Ritter - Musician , Brent Pease - Football player and coach , Hec Edmundson - Sprinter , Dean Mortimer - Politician , C. Scott Grow - Accountant , Matt Penoncello - College basketball player (Eastern Wash. Eagles).

Drinking water stations with addresses in Moscow and their reported violations in the past:

Past monitoring violations: Monitoring and Reporting (DBP) - Between APR-2005 and JUN-2005 , Contaminant: Total Haloacetic Acids (HAA5) . Follow-up actions: St Compliance achieved (AUG-11-2005) Monitoring and Reporting (DBP) - Between APR-2005 and JUN-2005 , Contaminant: TTHM . Follow-up actions: St Compliance achieved (AUG-11-2005)

Past health violations: MCL, Monthly (TCR) - In OCT-2008 , Contaminant: Coliform MCL, Monthly (TCR) - In AUG-2008 , Contaminant: Coliform Past monitoring violations: 16 regular monitoring violations

Past monitoring violations: Monitoring and Reporting (DBP) - Between JUL-2012 and SEP-2012 , Contaminant: Chlorine One routine major monitoring violation One regular monitoring violation

Past monitoring violations: Monitoring and Reporting (DBP) - Between JUL-2012 and SEP-2012 , Contaminant: Chlorine One routine major monitoring violation

Past monitoring violations: Failure To Address Deficiency - In APR-17-2013 , Contaminant: GROUNDWATER RULE . Follow-up actions: St Public Notif requested (MAR-28-2013), St Formal NOV issued (JAN-13-2014) Failure To Address Deficiency - In APR-17-2013 , Contaminant: GROUNDWATER RULE . Follow-up actions: St Public Notif requested (MAR-28-2013) Failure To Address Deficiency - In APR-17-2013 , Contaminant: GROUNDWATER RULE . Follow-up actions: St Public Notif requested (MAR-28-2013), St Formal NOV issued (JAN-13-2014) Failure To Address Deficiency - In APR-17-2013 , Contaminant: GROUNDWATER RULE . Follow-up actions: St Public Notif requested (MAR-28-2013), St Formal NOV issued (JAN-13-2014) Failure To Address Deficiency - In APR-17-2013 , Contaminant: GROUNDWATER RULE . Follow-up actions: St Public Notif requested (MAR-28-2013), St Formal NOV issued (JAN-13-2014) 9 routine major monitoring violations 186 regular monitoring violations 5 other older monitoring violations

Past health violations: MCL, Monthly (TCR) - In JUL-2011 , Contaminant: Coliform . Follow-up actions: St Violation/Reminder Notice (SEP-01-2011) , St Public Notif requested (SEP-04-2011) MCL, Monthly (TCR) - Between APR-2011 and JUN-2011 , Contaminant: Coliform . Follow-up actions: St Violation/Reminder Notice (AUG-01-2011) , St Public Notif requested (AUG-04-2011) , St Public Notif received (SEP-09-2011) MCL, Monthly (TCR) - In JUN-2009 , Contaminant: Coliform MCL, Acute (TCR) - In JUN-2009 , Contaminant: Coliform Past monitoring violations: Follow-up Or Routine LCR Tap M/R - In JAN-01-2006 , Contaminant: Lead and Copper Rule . Follow-up actions: State No Longer Subject to Rule (NOV-08-2011) 18 routine major monitoring violations 54 regular monitoring violations

Drinking water stations with addresses in Moscow that have no violations reported:

- COUNTRY HOMES MOBILE PARK ( Population served: 90 , Primary Water Source Type: Groundwater)

- Lesbian couples: 0.3% of all households

- Gay men: 0.1% of all households

People in group quarters in Moscow in 2010:

- 2,793 people in college/university student housing

- 108 people in nursing facilities/skilled-nursing facilities

- 51 people in local jails and other municipal confinement facilities

- 33 people in correctional residential facilities

- 32 people in group homes intended for adults

- 28 people in emergency and transitional shelters (with sleeping facilities) for people experiencing homelessness

- 22 people in workers' group living quarters and job corps centers

- 19 people in other noninstitutional facilities

People in group quarters in Moscow in 2000:

- 3,492 people in college dormitories (includes college quarters off campus)

- 302 people in nursing homes

- 42 people in local jails and other confinement facilities (including police lockups)

- 27 people in other noninstitutional group quarters

- 16 people in homes for the mentally retarded

- 15 people in other nonhousehold living situations

- 9 people in religious group quarters

- 8 people in homes for the physically handicapped

- 3 people in homes for the mentally ill

- Kibbie Dome. University of Idaho.

Banks with branches in Moscow (2011 data):

- Wells Fargo Bank, National Association: Moscow Branch at 221 South Main Street , branch established on 1953/04/01; Moscow Eastside Branch at 1313 South Blaine St , branch established on 1976/11/16 . Info updated 2011/04/05: Bank assets: $1,161,490.0 mil , Deposits: $905,653.0 mil , headquarters in Sioux Falls, SD , positive income , 6395 total offices , Holding Company: Wells Fargo & Company

- Sterling Savings Bank: Moscow Branch at 609 South Washington , branch established on 1998/06/15; Moscow Branch at 201 South Jackson Street , branch established on 1920/01/01 . Info updated 2012/03/21: Bank assets: $9,207.8 mil , Deposits: $6,454.1 mil , headquarters in Spokane, WA , positive income , Commercial Lending Specialization , 192 total offices , Holding Company: Sterling Financial Corporation

- U.S. Bank National Association: Blaine Street Branch at 1314 South Blaine Street , branch established on 1994/10/14; Moscow Branch at 301 South Main , branch established on 1936/07/20 . Info updated 2012/01/30: Bank assets: $330,470.8 mil , Deposits: $236,091.5 mil , headquarters in Cincinnati, OH , positive income , 3121 total offices , Holding Company: U.S. Bancorp

- Zions First National Bank: Moscow Branch at 105 South Main Street , branch established on 1963/09/20 . Info updated 2006/11/03: Bank assets: $17,531.3 mil , Deposits: $14,905.3 mil , headquarters in Salt Lake City, UT , positive income , Commercial Lending Specialization , 151 total offices , Holding Company: Zions Bancorporation

- JPMorgan Chase Bank, National Association: Moscow Branch at 1790 West Pullman Road , branch established on 1995/02/27 . Info updated 2011/11/10: Bank assets: $1,811,678.0 mil , Deposits: $1,190,738.0 mil , headquarters in Columbus, OH , positive income , International Specialization , 5577 total offices , Holding Company: Jpmorgan Chase & Co.

- AmericanWest Bank: Moscow Financial Center at 600 South Jackson , branch established on 1970/12/21 . Info updated 2011/12/12: Bank assets: $2,274.6 mil , Deposits: $1,889.1 mil , headquarters in Spokane, WA , positive income , Commercial Lending Specialization , 76 total offices , Holding Company: Skbhc Holdings Llc

For population 15 years and over in Moscow:

- Never married: 55.6%

- Now married: 33.9%

- Separated: 0.7%

- Widowed: 2.5%

- Divorced: 7.3%

For population 25 years and over in Moscow:

- High school or higher: 97.8%

- Bachelor's degree or higher: 53.5%

- Graduate or professional degree: 21.2%

- Unemployed: 9.0%

- Mean travel time to work (commute): 13.0 minutes

Graphs represent county-level data. Detailed 2008 Election Results

Political contributions by individuals in Moscow, ID

Religion statistics for Moscow, ID (based on Latah County data)

Food Environment Statistics:

Health and nutrition:, moscow government finances - expenditure in 2021 (per resident):.

Regular Highways: $1,541,000 ($58.71)

Parks and Recreation: $283,000 ($10.78)

General Public Buildings: $5,000 ($0.19)

Solid Waste Management: $4,591,000 ($174.90)

General - Other: $3,103,000 ($118.21)

Sewerage: $2,989,000 ($113.87)

Parks and Recreation: $2,690,000 ($102.48)

Water Utilities: $2,633,000 ($100.31)

Regular Highways: $1,703,000 ($64.88)

Local Fire Protection: $1,148,000 ($43.73)

Central Staff Services: $1,081,000 ($41.18)

Protective Inspection and Regulation - Other: $913,000 ($34.78)

Financial Administration: $868,000 ($33.07)

General Public Buildings: $420,000 ($16.00)

Judicial and Legal Services: $386,000 ($14.71)

Transit Utilities: $151,000 ($5.75)

Air Transportation: $96,000 ($3.66)

Housing and Community Development: $67,000 ($2.55)

Health - Other: $7,000 ($0.27)

- General - Interest on Debt: $505,000 ($19.24)

- Intergovernmental to Local - Other - Air Transportation: $57,000 ($2.17)

Local Fire Protection: $22,000 ($0.84)

Financial Administration: $20,000 ($0.76)

Water Utilities: $16,000 ($0.61)

Sewerage: $11,000 ($0.42)

Parks and Recreation: $10,000 ($0.38)

Regular Highways: $4,000 ($0.15)

- Total Salaries and Wages: $10,780,000 ($410.68)

- Water Utilities - Interest on Debt: $275,000 ($10.48)

Moscow government finances - Revenue in 2021 (per resident):

Solid Waste Management: $6,248,000 ($238.03)

Regular Highways: $294,000 ($11.20)

Miscellaneous Commercial Activities: $167,000 ($6.36)

Parks and Recreation: $138,000 ($5.26)

Other: $24,000 ($0.91)

Highways: $822,000 ($31.32)

General Revenue - Other: $307,000 ($11.70)

Fines and Forfeits: $128,000 ($4.88)

Donations From Private Sources: $29,000 ($1.10)

Rents: $11,000 ($0.42)

Special Assessments: $6,000 ($0.23)

- Revenue - Water Utilities: $6,005,000 ($228.77)

Highways: $1,203,000 ($45.83)

Public Utilities Sales: $1,267,000 ($48.27)

Other License: $593,000 ($22.59)

Occupation and Business License - Other: $120,000 ($4.57)

Alcoholic Beverage License: $32,000 ($1.22)

Moscow government finances - Debt in 2021 (per resident):

Outstanding Unspecified Public Purpose: $9,319,000 ($355.02)

Retired Unspecified Public Purpose: $980,000 ($37.33)

Beginning Outstanding - Public Debt for Private Purpose: $354,000 ($13.49)

Outstanding Nonguaranteed - Industrial Revenue: $317,000 ($12.08)

Retired Nonguaranteed - Public Debt for Private Purpose: $37,000 ($1.41)

Moscow government finances - Cash and Securities in 2021 (per resident):

- Other Funds - Cash and Securities: $66,768,000 ($2543.64)

- Sinking Funds - Cash and Securities: $1,488,000 ($56.69)

Strongest AM radio stations in Moscow:

- KRPL (1400 AM; 1 kW; MOSCOW, ID; Owner: KRPL, INCORPORATED)

- KQQQ (1150 AM; 25 kW; PULLMAN, WA; Owner: RADIO PALOUSE, INC.)

- KMAX (840 AM; 10 kW; COLFAX, WA; Owner: PALOUSE COUNTRY, INC.)

- KWSU (1250 AM; 5 kW; PULLMAN, WA; Owner: WASHINGTON STATE UNIVERSITY)

- KGA (1510 AM; 50 kW; SPOKANE, WA; Owner: CITADEL BROADCASTING COMPANY)

- KOZE (950 AM; 5 kW; LEWISTON, ID; Owner: 4-K RADIO, INC.)

- KRLC (1350 AM; 5 kW; CLARKSTON LEWISTON,, WA; Owner: IDA-VEND COMPANY, INC.)

- KXLY (920 AM; 20 kW; SPOKANE, WA; Owner: SPOKANE RADIO, INC.)

- KCLK (1430 AM; 5 kW; ASOTIN, WA; Owner: CLARKSTON BROADCASTERS, INC.)

- KTBI (810 AM; daytime; 50 kW; EPHRATA, WA; Owner: TACOMA BROADCASTERS, INCORPORATED)

- KMJY (700 AM; 10 kW; NEWPORT, WA; Owner: JAMES E. AND HELEN G. STARGEL)

- KERR (750 AM; 50 kW; POLSON, MT; Owner: ANDERSON RADIO BROADCASTING, INC.)

- KLER (1300 AM; 5 kW; OROFINO, ID; Owner: CENTRAL IDAHO BROADCASTING)

Strongest FM radio stations in Moscow:

- KZZL-FM (99.5 FM; PULLMAN, WA; Owner: PALOUSE COUNTRY, INC.)

- KZFN (106.1 FM; MOSCOW, ID; Owner: KRPL, INC.)

- KRFA-FM (91.7 FM; MOSCOW, ID; Owner: WASHINGTON STATE UNIVERSITY)

- KHTR (104.3 FM; PULLMAN, WA; Owner: RADIO PALOUSE, INC.)

- KUOI-FM (89.3 FM; MOSCOW, ID; Owner: UNIVERSITY OF IDAHO)

- KRLF (88.5 FM; PULLMAN, WA; Owner: LIVING FAITH F/SHIP EDUC. MINISTRIES)

- KRAO-FM (102.5 FM; COLFAX, WA; Owner: PALOUSE COUNTRY, INC.)

- KMOK (106.9 FM; LEWISTON, ID; Owner: IDA-VEND COMPANY, INC.)

- KCLK-FM (94.1 FM; CLARKSTON, WA; Owner: CLARKSTON BROADCASTERS, INC.)

- KVAB (102.9 FM; CLARKSTON, WA; Owner: CLARKSTON BROADCASTERS, INC.)

- KVTY (105.1 FM; LEWISTON, ID; Owner: IDAVEND CO. INC.)

- KNWV (90.5 FM; CLARKSTON, WA; Owner: WASHINGTON STATE UNIVERSITY)

- KOZE-FM (96.5 FM; LEWISTON, ID; Owner: 4-K RADIO, INC.)

- KATW (101.5 FM; LEWISTON, ID; Owner: PACIFIC EMPIRE COMMUNICATIONS CORP.)

- KDRK-FM (93.7 FM; SPOKANE, WA; Owner: CITADEL BROADCASTING COMPANY)

- KIXZ-FM (96.1 FM; OPPORTUNITY, WA; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

- KPBX-FM (91.1 FM; SPOKANE, WA; Owner: SPOKANE PUBLIC RADIO, INC.)

- KMBI-FM (107.9 FM; SPOKANE, WA; Owner: THE MOODY BIBLE INSTITUTE OF CHICAGO)

- KNWO (90.1 FM; COTTONWOOD, ID; Owner: WASHINGTON STATE UNIVERSITY)

- KCDA (103.1 FM; POST FALLS, ID; Owner: CAPSTAR TX LIMITED PARTNERSHIP)

TV broadcast stations around Moscow:

- KUID-TV ( Channel 12; MOSCOW, ID; Owner: STATE BOARD OF EDUCATION, STATE OF IDAHO)

- KWSU-TV ( Channel 10; PULLMAN, WA; Owner: WASHINGTON STATE UNIVERSITY)

- KLEW-TV ( Channel 3; LEWISTON, ID; Owner: FISHER BROADCASTING - WASHINGTON TV, L.L.C.)

- K40EE ( Channel 40; PULLMAN, WA; Owner: SPOKANE TELEVISION, INC.)

- National Bridge Inventory (NBI) Statistics

- 31 Number of bridges

- 210ft / 63.7m Total length

- $18,737,000 Total costs

- 112,000 Total average daily traffic

- 4,083 Total average daily truck traffic

- 168,000 Total future (year 2039) average daily traffic

- New bridges - historical statistics

- 2 1910-1919

- 2 1930-1939

- 5 1950-1959

- 1 1960-1969

- 6 1970-1979

- 2 1980-1989

- 4 1990-1999

- 5 2000-2009

- 4 2010-2019

2002 - 2018 National Fire Incident Reporting System (NFIRS) incidents

- Fire incident types reported to NFIRS in Moscow, ID

- 645 44.9% Structure Fires

- 547 38.1% Outside Fires

- 147 10.2% Mobile Property/Vehicle Fires

- 96 6.7% Other

Fire-safe hotels and motels in Moscow, Idaho:

- Hillcrest Motel, 706 N Main, Moscow, Idaho 83843 , Phone: (208) 882-7579

- Value Inn By Cavanaughs, 645 W Pullman Rd, Moscow, Idaho 83843 , Phone: (208) 882-1611

- La Quinta Inn, 185 Warbonnet Dr, Moscow, Idaho 83843 , Phone: (208) 882-5365, Fax: (208) 882-5374

- Fairfield Inn & Suites Moscow, 1000 W Pullman Rd, Moscow, Idaho 83843 , Phone: (208) 882-4600, Fax: (208) 882-4601

- 62.0% Utility gas

- 31.2% Electricity

- 2.3% Fuel oil, kerosene, etc.

- 0.7% Bottled, tank, or LP gas

- 0.3% Other fuel

- 75.2% Electricity

- 22.5% Utility gas

- 0.9% No fuel used

- 0.6% Bottled, tank, or LP gas

Moscow compared to Idaho state average:

- Black race population percentage significantly above state average.

- Hispanic race population percentage below state average.

- Median age significantly below state average.

- Renting percentage above state average.

- Length of stay since moving in above state average.

- Number of rooms per house below state average.

- Number of college students significantly above state average.

- Percentage of population with a bachelor's degree or higher significantly above state average.

Moscow on our top lists :

- #52 on the list of "Top 101 cities with largest percentage of females in industries: educational services (population 5,000+)"

- #56 on the list of "Top 101 cities with largest percentage of males in industries: educational services (population 5,000+)"

- #56 on the list of "Top 101 cities with the most people walking to work (population 5,000+)"

- #81 on the list of "Top 101 cities with the most people taking a bicycle to work (population 5,000+)"

- #90 on the list of "Top 101 cities with largest percentage of males in occupations: life, physical, and social science occupations (population 5,000+)"

- #91 on the list of "Top 101 cities with the least people living the same house as 1 year ago (population 5,000+))"

- #11 on the list of "Top 101 counties with highest percentage of residents voting for 3rd party candidates in the 2012 Presidential Election"

- #61 on the list of "Top 101 counties with the lowest surface withdrawal of fresh water for public supply"

Total of 199 patent applications in 2008-2024.

City-data.com does not guarantee the accuracy or timeliness of any information on this site. Use at your own risk. Website © 2024 Advameg, Inc.

IMAGES

VIDEO

COMMENTS

Skift Take. As we enter 2024, the travel industry is poised for strong growth, building on the recovery momentum of 2023. The Skift Travel Health Index now benchmarks performance year-on-year ...

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. Covid-19 has routed the travel industry, with the impact of the pandemic quantified for 22 countries in the Skift Travel Health Index. The Index provides the travel industry with a powerful tool for ...

Travel Health Index as of January 2023. ... There has been an increase over December 2022, with the Skift Travel Health Index now sitting at 89, which is a noteworthy 30 percentage points (pp ...

The Travel Health Index is a proprietary tool produced by Skift Research to track the travel industry's performance using 84 travel indicators with data from 22 partners. The global index ...

The Skift Travel Health Index dropped for the first time in 2022, as the mess at airports and airlines is catching up with the industry. Javascript is required for this site to display correctly ...

The global Skift Travel Health Index now benchmarks year-on-year, since 2023 was a year of recovery for the industry. In February 2024, the Travel Health Index is up 7% year-on-year. Keep reading for insights from the Skift team in the Skift Travel Health Index: February 2024 Highlights. OAG helps enable Skift's Travel Health Index by providing ...

Findings from a new Skift Research report on The Opportunity for Long-Haul, Low-Cost reveal that JetBlue's operating profit margins (flight operations) over the Atlantic were above 50% in the ...

Skift Research's survey reveals that this trend has created a thriving market, estimated at $1.9 billion (₹159.6 billion) in outbound travel spending. Most newlyweds who had an international ...

It also had been a few weeks since a travel startup has raised over $100 million. But last week, it happened twice: Once by a startup that rents hydrogen-powered cars to taxi companies, and once ...

Skift Travel 200; Short-Term Rental Top 250; Travel Health Index; Hotel Tech Benchmark; Skift Research. Access exclusive travel research, data insights, and surveys. Subscribe Now. Advertise;

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more hotels and short-term rental ...

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance .

The Skift Travel 200 is built as a market capitalization weighted index. This is the industry standard methodology for stock indices. Each company in the index has a market value, also called a market capitalization, determined by stock market investors. A market cap is the equity value of each business calculated by taking the share price of ...

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance .

Moscow - Capital, Kremlin, Red Square: Inner Moscow functions like a typical central business district. In this area are concentrated most of the government offices and administrative headquarters of state bodies, most of the hotels and larger shops, and the principal theatres, museums, and art galleries. The inner city's function as a residential area has not been completely lost, however ...

Moscow will impose a 10-day lockdown from next week in an effort to curb soaring Covid-19 cases, the city's mayor has said, as Russia endures its worst-ever phase of the pandemic.

1 of 15. CNN —. Moscow officials have approved the construction of a new "supertall" building that will become the city's tallest skyscraper. Measuring 404 meters (1,325 feet) in height ...

Moscow, Idaho detailed profile. Mean prices in 2022: all housing units: $430,569; detached houses: $486,364; townhouses or other attached units: $378,630; in 2-unit structures: $421,355; in 3-to-4-unit structures: $372,321; in 5-or-more-unit structures: $328,083; mobile homes: $33,994 Median gross rent in 2022: $930. March 2022 cost of living index in Moscow: 91.7 (less than average, U.S ...