BIR Income Tax Calculator Philippines

Travel Tax Philippines [Latest Rates: 2024]

As the saying goes, ‘The only certainties in life are death and taxes,’ and if you’re planning to travel out of the Philippines, you’ll have to deal with the latter before you can enjoy your trip.

You’re probably aware that the Philippine government imposes a travel tax on citizens, residents, and foreigners who have stayed in the country for over a year, but you might not know the intricacies of who needs to pay, how much it costs, or how it could affect your travel plans.

Whether you’re booking a leisurely vacation, gearing up for a business trip, or sending off your loved ones, it’s crucial that you’re familiar with the requirements and process of this tax.

As you consider the impact on your budget and prepare for your journey, you’ll find that understanding the nuances of the Travel Tax can help you avoid common pitfalls, and there are some tips and tricks that could save you time, money, and hassle.

Key Takeaways

- Travel tax is a levy imposed on individuals departing from the Philippines to support tourism infrastructure and cultural heritage preservation.

- Certain individuals, such as overseas contract workers, returning residents, and former Filipino citizens, may be exempt from paying the travel tax.

- The Travel Tax Exemption Certificate (TEC) can be applied for online through the TIEZA website, and the original passport must be presented.

- Travel tax rates vary depending on destination, ticket class, and traveler category, and the TIEZA website provides detailed information on current rates and applicable passenger categories.

Understanding Travel Tax

To grasp the concept of travel tax in the Philippines, it’s essential to know that certain individuals may be exempt, but you’ll need to visit the TIEZA website to understand the specific requirements.

Instituted by Presidential Decree (PD), the travel tax is a levy imposed on individuals departing from the Philippines. It’s designed to bolster tourism infrastructure and cultural heritage preservation.

However, you might qualify for a Travel Tax Exemption. To determine your eligibility, you’ll have to present your original passport for any application related to the exemption.

This is an indispensable step, ensuring that your identity and travel records are accurately assessed.

Should you find that you’re eligible, TIEZA’s online portal simplifies the process by allowing you to apply for a Travel Tax Exemption Certificate (TEC) from the comfort of your home.

This digital convenience saves you time, making your travel preparations more efficient.

Lastly, don’t forget to check the Consulate General’s website for any holidays that might affect consular service availability.

Knowing these dates in advance can prevent any unwelcome surprises during your travel tax exemption application process.

Who Needs to Pay Travel Tax in the Philippines?

You might wonder if you’re on the hook for travel tax when heading out of the Philippines.

It’s key to know if you fall under the category of travelers who must pay, or if you meet the exemption criteria.

Let’s take a look at who’s obligated to pay and what conditions might let you off the hook.

Eligible Travelers

Understanding who must pay the travel tax when departing from the Philippines is crucial, as it generally includes all travelers except for certain exempted groups like returning residents and overseas contract workers.

If you’re planning to leave the country, you’ll likely need to settle this tax unless you belong to an eligible group.

Here’s what you need to remember:

- Always have your Philippine Passport ready to verify your identity and travel tax eligibility.

- Returning residents can avail of the exemption, keeping more cash in their pockets.

- Overseas Contract Workers (OCW) are spared from the tax, a small relief for their global contributions.

- Former Filipinos also enjoy exemption privileges, easing their visits back to their roots.

- Visit the TIEZA website for a full rundown on exemptions and apply online for a Travel Tax Exemption Certificate (TEC).

Exemption Criteria

While most travelers must budget for the travel tax, certain groups may find themselves exempt, sparing them this additional cost before departure.

The exemption criteria for the travel tax in the Philippines benefit returning residents, overseas contract workers (OCW), and former Filipino citizens.

To enjoy these exemptions, it’s essential to present your original passport in all cases. You can apply for the Travel Tax Exemption Certificate (TEC) online through the TIEZA platform.

Rates and Categories

You’ll find that travel tax rates in the Philippines vary, with specific categories of passengers eligible for different rates or exemptions.

It’s essential to understand which category you fall into, as this determines how much you’ll need to pay, or if you’re exempt altogether.

The TIEZA website offers detailed information on the current tax rates and applicable passenger categories, ensuring you’re well-informed before your trip.

Current Tax Rates

To determine your travel tax, it’s essential to know that rates vary depending on your destination, ticket class, and traveler category. The Travel Tax in the Philippines, collected by TIEZA, applies to international travelers.

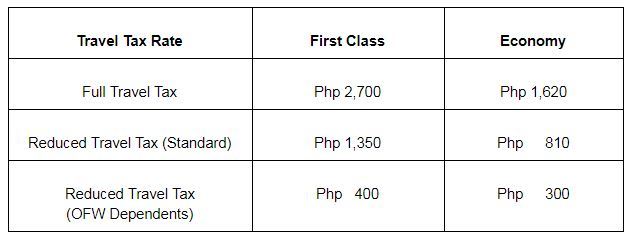

Here are the current tax rates you should be aware of:

Applicable Passenger Categories

Understanding the current tax rates is crucial. Now let’s focus on which passenger categories these rates apply to and what exemptions may be available for you.

If you’re a returning resident, an overseas contract worker (OCW), or a former Filipino, you might be exempt from travel tax when your air ticket is issued.

Remember, this tax is a levy on individuals departing the Philippines, but exemptions are there to alleviate the financial burden for specific groups.

To claim your exemption, check out the TIEZA website for the necessary requirements. You’ll need to present your original passport without exception.

TIEZA’s online platform allows you to apply for the Travel Tax Exemption Certificate (TEC). Conditions and limitations do apply, so make sure to review them thoroughly on TIEZA’s website.

Exemptions and Privileges

Often, travelers departing from the Philippines aren’t required to pay the travel tax if they meet certain conditions listed on the TIEZA website.

This levy imposed on travelers can be fully or partially exempted, granting you some financial relief as you embark on your journey.

To vividly paint the picture for you, here are some key points about the exemptions and privileges that could apply to your travel plans:

- Filipino Overseas Workers are fully exempt from the travel tax, lightening their financial burden.

- Filipino students studying abroad can apply for a fifty percent (50%) exemption, making their educational journey more affordable.

- Diplomats and officials of international organizations enjoy a full waiver, acknowledging their global service.

- Infants aged two years and below don’t have to pay the tax, easing travel for young families.

- Athletes and delegates attending international competitions sanctioned by the Philippine Sports Commission may be granted full exemption as a form of support.

Remember to check the TIEZA website for the complete list of exemptions and privileges and to apply for your Travel Tax Exemption Certificate (TEC) online.

Don’t miss out on these opportunities to save on your travel expenses!

Payment Process

While you may qualify for an exemption from the Philippine travel tax, it’s essential to know the steps for paying it if required.

Should you not be eligible for an exemption, or you’re simply preparing for your travel requirements, understanding the payment process is crucial.

To begin with, you’ll need to visit the official website of the Tourism Infrastructure and Enterprise Zone Authority (TIEZA).

TIEZA is responsible for managing travel tax collections in the Philippines. On their website, you’ll find clear instructions and the necessary forms for the payment process.

You’re required to present your original passport when making the payment, which serves as your primary identification. This ensures that the travel tax is correctly attributed to you as the traveler.

For your convenience, TIEZA also offers an online platform for processing payments. This means you can settle your travel tax from the comfort of your home or office.

After completing the online transaction, ensure to print out the confirmation or receipt provided.

Lastly, keep in mind the place of payment when planning your travel tax settlement. While the online option is often the most convenient, TIEZA has authorized physical locations where payments can be made in person if needed.

Impact on Travel Budget

Securing a travel tax exemption can significantly reduce your expenses, allowing for a more cost-effective trip from the Philippines.

As you’re planning your journey, knowing that you mightn’t have to shoulder the additional cost of travel tax can be a relief.

This is especially true for eligible individuals who are leaving the country, as the Philippine government has provisions to ease the financial burden of travel.

Here’s how the exemption can impact your travel budget:

- Extra funds for travel essentials : With the savings from the tax exemption, you can allocate more money for other travel necessities.

- Increased travel opportunities : The money saved could enable you to visit additional destinations or extend your trip.

- Budget-friendly fares : Use the exemption to offset the cost of airfare, possibly allowing you to opt for more convenient or direct flights.

- Accommodation upgrades : Redirect the funds to enhance your stay with better accommodation options.

- Cultural experiences : Spare cash means more opportunities to immerse yourself in cultural events or local cuisine.

Avoiding Common Issues

To steer clear of complications when claiming your travel tax exemption in the Philippines , ensure you’re familiar with the necessary requirements and have your original passport on hand.

It’s crucial to be aware that the Philippine government mandates this document for all exemptions without exception. So, don’t forget it!

Also, stay informed about the operational hours and official holidays to plan your visit to the Consulate General, avoiding unnecessary setbacks.

This preparation helps you tackle any issues head-on and ensures you’re not caught off-guard.

Moreover, before setting off on your journey, whether within the country or outbound, understand the fuel surcharge and its associated refund policies.

Such knowledge will ease your travel experience, letting you manage your finances more effectively.

Additionally, delve into the fare conditions and services offered by your carrier, paying close attention to those concerning oxygen service and unaccompanied minors.

This step is particularly important if you’re traveling from or within an Enterprise Zone. Being well-informed prevents misunderstandings and guarantees that you receive the services you expect from your chosen airline.

In conclusion, don’t let the Travel Tax in the Philippines gobble up your wallet like a ravenous beast! Secure your exemption like a savvy traveler and guard your precious funds.

Remember, every peso saved is a victory against the monstrous jaws of travel expenses. So, be proactive, leap onto TIEZA’s website, and snatch that Travel Tax Exemption Certificate with the agility of a ninja.

Make your travel budget bulletproof and your adventures absolutely epic!

Philippine Airports – Terminal Fee, Travel Tax & Flights Guide

Are you traveling in the Philippines or abroad? There are some important things to know before you fly.

This detailed guide answers frequently asked questions about Philippine airports and flights.

Philippine terminal fee + travel tax

Here’s a lowdown on fees that you might have to pay at airports in the Philippines. Followed by helpful tips about individual airports.

What is the terminal fee? Do I need to pay at the airport?

You need not worry about the terminal fee if you are arriving at any airport in the Philippines. The terminal fee should already be included in the flight ticket price upon booking for both domestic and international flights.

The airport terminal fee or “Philippine passenger service charge” (DPSC) is an airport tax/exit fee for passengers departing from airports in the Philippines. Overseas Filipino workers (OFWs) are exempted from paying the terminal fee. The terminal fee ranges from P50 to P220 per person for domestic flights or P600 to P1,135 per person for international flights.

What is PH Travel Tax?

The Philippine travel tax is a fee for Filipinos traveling abroad. The full travel tax is P1,620 for passengers on economy class plane tickets and P2,700 when flying first class. You need not worry about the travel tax if you’re a foreigner traveling in the Philippines on a short visit or simply transiting as this fee only applies to citizens of the Philippines, permanent resident aliens, and non-immigrant aliens who have stayed in the Philippines for a period of not less than one year. You can check TIEZA’s website for the full details on PH travel tax exemptions and reduced fees.

PH Travel Tax Online Payment

Selected airlines including Cebu Pacific offer the option of paying the Philippine Travel Tax online on their website. This is highly recommended if you want to skip lining up at the airport. You can also pay the travel tax online on the TIEZA Online Travel Tax Payment System (OTTPS) website.

Manila-NAIA International Airport (MNL)

The Manila Airport is the busiest airport and the main international gateway to the Philippines. Commonly referred to as “NAIA” or Ninoy Aquino International Airport, it is located in the cities of Pasay and Parañaque, within the Metro Manila area in Luzon Island (Northern Philippines).

Manila Airport Transfers & Car Charter

Manila Airport-NAIA Shuttle Bus

Manila-NAIA Airport – Private Transfer

Manila Private Car Charter

View all discounts

Where to stay near Manila Airport — For a comfortable and convenient stay, book a room in Newport World Resorts (formerly Resorts World Manila) located right across the street from Terminal 3. The Manila Bay Entertainment City area is also a great option since it is conveniently connected to Terminal 3 via the newly opened skyway. Click below to check room rates and promos.

Check Rates See more

Manila Airport-NAIA terminal fee — The terminal fee is not collected at Manila Airport for domestic and international flights. The terminal fee should already be paid for/included in the plane ticket price, at the time of booking.

See more about Manila

Mactan–Cebu International Airport (CEB)

Cebu Airport, is around 15 kilometers away from the center of Cebu City. It is located in Lapu Lapu City, Mactan Island. Travel time may take 1 hour or more, depending on traffic jams, especially crossing Mandaue. Without traffic, the drive should take around 45 minutes.

Cebu Airport transfers

Cebu Airport Private Transfers – for Cebu City, Mactan & more

Cebu Car Charter – Cebu City/Mactan Private DIY Transport

Where to stay near Cebu Airport

Cebu Airport terminal fee — The terminal fee is not collected at Cebu Airport for domestic and international flights. The terminal fee should already be paid for/included in the plane ticket price, at the time of booking.

See more about Cebu

Boracay-Caticlan Airport (MPH)

Caticlan Airport, located in Malay, Aklan, is less than one kilometer away from Caticlan Jetty Port. You can take a shuttle, tricycle, or even walk if you are not bringing heavy luggage. Go on a short ferry ride to Cagban Jetty Port in Boracay Island. Then, ride a shuttle or multicab to your resort/destination in Boracay Island.

Boracay Airport transfers & tours

See all discounts

Caticlan Airport-Boracay Hotel Shared Transfers – Shuttle+Ferry Ticket

Caticlan Airport–Boracay Hotel Private Transfers

Hotels near Boracay Airport — There some options to stay near the airport, but most of them are not good. Head straight to Boracay if you can. If you get stuck in town, click below to check rates on places to stay nearby.

Boracay Airport terminal fee — Boracay Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the terminal fee at the airport.

See more about Boracay

Kalibo International Airport (KLO)

Kalibo airport is located near the town center, just 4 kilometers away or under 10-minutes by car. Travel time to Boracay takes around 1 hour. If you are headed to Boracay, you can either take a 1-hour shuttle or bus to Caticlan Jetty Port, where you can find ferries that go to Boracay Island. You can find them outside the arrivals area or book the trip online easily.

Kalibo Airport transfers

Kalibo Airport-Boracay Hotel Shared Transfers – Shuttle+Ferry Ticket

Kalibo Airport–Boracay Hotel Private Transfers

Kalibo Airport terminal fee — The terminal fee is not collected at Kalibo Airport for domestic and international flights. The terminal fee should already be paid for/included in the plane ticket price, at the time of booking.

Hotels near Kalibo Airport

Check rates See more

See more about Kalibo

Puerto Princesa International Airport (PPS)

Puerto Princesa Airport, located in Palawan, is located right within city proper. Puerto Princesa has a small city center, so getting around usually takes 15-minutes or less. There are shuttle vans stationed near the arrivals area that can take you directly to El Nido and other towns on the island. Or, go on a tricycle from the arrival area or airport exit gate to get to your destination in the city.

Puerto Princesa Airport transfers

Puerto Princesa Airport to PP City Hotel Transfers

Puerto Princesa – El Nido Shuttle Transfers

Where to stay near Puerto Princesa Airport

Puerto Princesa Airport terminal fee — The Puerto Princesa Airport passenger terminal fee is P700 per person for international flights. If you are on a domestic flight, the terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Palawan

Bohol-Panglao International Airport (TAG)

Bohol Airport transfers

Bohol Airport – Panglao/Tagbilaran Transfers (Private Shuttle/Car)

Bohol Private Car Charter

Where to stay near Bohol Airport

Bohol Airport terminal fee — Bohol–Panglao Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the domestic terminal fee at the airport.

See more about Bohol

Clark International Airport (CRK)

Clark Airport is around 15 kilometers away from Angeles City proper or 95 kilometers from Manila. Travel time is approximately 2 hours.

Clark Airport transfers

Clark Airport Private Transfers – to/from Manila & more

Where to stay near Clark Airport

Clark Airport terminal fee — The terminal fee is not collected at Clark Airport for domestic and international flights. The terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Clark & Pampanga

Davao International Airport (DVO)

Davao Airport is around 10 kilometers away from Davao City Center. You can ride a metered taxi, which takes around 30 to 45 minutes.

Where to stay near Davao Airport

Davao Airport terminal fee — The terminal fee is not collected at Davao Airport for domestic and international flights. The terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Davao

Iloilo International Airport (ILO)

Iloilo Airport, located in Cabatuan-Santa Barbara is around 20 kilometers away from Iloilo City proper. Travel time is around 25 to 40 minutes. From the airport, you can ride a shuttle or taxi to get to Iloilo City.

Iloilo Airport transfers

Iloilo Airport-Iloilo City Hotel Shuttle – ILO Private and Shared Transfers

Where to stay near Iloilo Airport

Iloilo Airport terminal fee — The terminal fee is not collected at Iloilo Airport for domestic and international flights. The terminal fee should already be paid for / included in the plane ticket price, at the time of booking.

See more about Iloilo

Cagayan de Oro-Laguindingan Airport (CGY)

Cagayan de Oro Airport, located in the Laguindingan town, Misamis Oriental, is around 35 kilometers away from Cagayan de Oro City proper. Travel time to Cagayan de Oro or Iligan cities takes up to 1 hour.

Where to stay near Cagayan de Oro Airport

Cagayan de Oro Airport terminal fee — Cagayan de Oro Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the domestic terminal fee at the airport.

See more about CDO & Northern Mindanao

Bacolod-Silay International Airport (BCD)

Bacolod Airport, located in Silay City, Negros Occidental, is around 18 kilometers away from Bacolod City proper. Travel time takes approximately 30 to 45 minutes.

Where to stay near Bacolod-Silay Airport

Bacolod Airport terminal fee — Bacolod Airport terminal fee should already be paid for / included in the plane ticket price, at the time of booking. You do not have to pay the domestic terminal fee at the airport.

See more about Bacolod & Negros Occidental

More Philippine Airports

Basco airport (bso), batanes.

Distance to Basco Town Proper — 750 m; 3 mins

Hotels near Basco Airport

Check rates

Busuanga-Coron Airport (USU)

Distance to Coron Town Proper — 22 km; 20 mins

Hotels near Coron Airport

Butuan Airport (BXU)

Distance to Guingona Park — 12.3 km; 17 mins

Hotels near Butuan Airport

Calbayog Airport (CYP)

Distance to Calbayog City Proper — 6 km; 11 mins

Hotels near Calbayog Airport

Camiguin Airport (CGM)

Distance to Mambajao Municipal Hall — 1.3 km; 13 mins

Hotels near Camiguin Airport

Catarman Airport (CRM)

Distance to Catarman Town Proper — 2 km; 6 mins

Hotels near Catarman Airport

Cauayan Airport (CYZ)

Distance to Cauayan City Proper — 3.5 km; 10 mins

Hotels near Cauayan Airport

Cotabato Airport (CBO)

Distance to Cotabato City Plaza — 9.1 km; 13 mins

Dumaguete Airport (DGT)

Distance to Dumaguete Boulevard — 3.5 km; 10 mins

Hotels near Dumaguete Airport

Dipolog Airport (DPL)

Distance to Dipolog Cathedral — 1.8 km; 4 mins

Hotels near Dipolog Airport

Laoag Airport (LAO)

Distance to Laoag City Proper — 7.5 km; 15 mins

Hotels near Laoag Airport

General Santos International Airport (GES)

Distance to General Santos City Hall — 14.5km; 23 mins

Hotels near General Santos Airport

Jolo Airport (JOL)

Distance to Jolo Municipal Hall — 1.5km; 4 mins

Hotels near Jolo Airport

Legazpi Airport (LGP)

Distance to Legazpi City Proper — 3.5 km; 10 mins

Hotels near Legazpi Airport

Masbate Airport (MBT)

Distance to Masbate City Center — 850 m; 2 mins

Hotels near Masbate Airport

Naga Airport (WNP)

Distance to Naga City Proper — 11 km; 24 mins

Hotels near Naga Airport

Ozamiz Airport (OSZ)

Distance to Immaculate Concepcion Cathedral — 4.8 km; 10 mins

Hotels near Ozamiz Airport

Pagadian Airport (PAG)

Distance to Pagadian City Hall — 6.5 km; 10 mins

Hotels near Pagadian Airport

Romblon-Tablas Airport (TBH)

Distance to San Agustin Pier — 34 km; 34 mins. To Odiongan Town Proper — 25 km.

Hotels near Romblon Airport

San Jose Airport (SJI)

Distance to San Jose Town Proper — 2.5 km; 5 mins

Hotels near San Jose Airport

Siargao Airport (IAO)

Distance to Dapa Ferry Terminal — 15 km; 20 mins. To Cloud 9 Boardwalk, General Luna — 32 km; 43 mins

Hotels near Siargao Airport

Surigao Airport (SUG)

Distance to Surigao City Hall — 4.5 km; 8 mins

Hotels near Surigao Airport

Tacloban Airport (TAC)

Distance to Leyte Provincial Capitol — 10.5 km; 23 mins

Hotels near Tacloban Airport

Tandag Airport (TDG)

Distance to Tandag City Proper — 4 km; 8 mins

Hotels near Tandag Airport

Tawi-Tawi Airport (SGS)

Distance to Bongao Municipal Hall — 6 km; 8 mins

Hotels near Tawi-Tawi Airport

Tuguegarao Airport (TUG)

Distance to Tuguegarao City Proper — 4 km; 10 mins

Hotels near Tuguegarao Airport

Virac Airport (VRC)

Distance to Virac Town Proper — 3 km; 6 mins

Hotels near Virac Airport

Zamboanga International Airport (ZAM)

Distance to Zamboanga City Hall — 3.5 km; 9 mins

Hotels near Zamboanga Airport

Before you go

How do I know if the terminal fee is included in the airline booking?

Check the breakdown of taxes and fees on your booking receipt or when booking the flight ticket. The terminal fee is usually labeled as PH Passenger Service Charge, Domestic Passenger Service Charge or International Passenger Service Charge. There’s usually also a corresponding Aviation Security Fee (ASF) and separate Value Added Tax for the terminal fee.

Do I still need to pay the terminal fee, even after paying the travel tax?

Yes, the terminal fee and travel tax are separate fees. If you’re not exempted, then you need to pay both.

Do I need to pay the terminal fee and travel tax when I arrive in the Philippines?

The airport terminal fee and Philippine Travel Tax does not apply to arriving passengers.

Don’t leave yet. There’s more!

Discover more blogs and travel tips in:

- Philippines

- Puerto Princesa

- General Santos

- Cagayan de Oro

- Southeast Asia

Find more posts about:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

March 10, 2016 at 10:50 am

I like the parking area in SM CITY CEBU CITY PHIL I PINES because they have red and green lights on each parking space. The red lights means occupied and the green lights means vacant.

May 4, 2016 at 9:19 pm

Do you know the current terminal fee for departure from Tagbilaran airport?

May 4, 2016 at 9:56 pm

Terminal fee at Tagbilaran Airport is P100

May 15, 2016 at 5:40 pm

Hi. I am budy from Indonesia. I would like to ask you related airport tax terminal fee and philippines travel tax. I booked the ticket from Jakarta to Manila (transit). And then Manila to Seoul. I am foreign passport holder. Should I pay airport tax terminal fee and phillipines travel tax? Thanks ☺

May 15, 2016 at 5:53 pm

If you have a single journey ticket, I’m not sure if you have to pay, but if you are changing airlines or if you’re required to check-in for your next flight then you may have to pay the international terminal fee. The Philippine travel tax is mostly for Philippine residents.

May 15, 2016 at 11:38 pm

taxinternational travel is 1,620 in pesos thats the full payment is it require to pay even after 6months you arrived in manila and you are going out again another 1,620

May 16, 2016 at 3:37 am

Hello Gloria,

If you are required to pay the PH travel tax, you may have to pay this fee for every departure regardless of the time between your flights. It is charged specifically for every plane ticket. You can read more info about it at http://tieza.gov.ph/travel-tax/ .

June 4, 2016 at 3:21 pm

was their another charges aside from travel tax, terminal fee. going to hongkong.. the so called TIEZA??

June 4, 2016 at 4:38 pm

Those are the only charges you need to pay at the airport if you are departing on an international flight from the Philippines

August 7, 2016 at 7:25 pm

I am an OFW in Dubai and i will take my vacation to Philippines this August, I already have my OEC and as part of my vacation itenerary, I am planning also to take a short visit/tour to Singapore from Philippines, Ijust want to ask , should I pay travel tax and terminal fee upon exiting Philippines going to Singapore for this tour? Awaiting your reply… Thank you so much :)

October 18, 2016 at 6:00 pm

Hello,im planning to tour in mumbai,india…how much is my travel tax? will be departuring at naia international airport…thank you

December 14, 2016 at 6:53 pm

im already travel to india last 2015 of august,do i need to pay another travel tax f i go there again this dec?

December 14, 2016 at 7:18 pm

As far as I know, Philippine citizens pay PH travel tax for every international departure, kahit same day pa yung pag uwi mo and travel international ulit.

February 1, 2017 at 4:48 pm

hi, im an OFW , me and my mom and bb will travel to HK for holiday via CEbupacific airways in the tkts it says passenger service charge and TAXES AND FEES PH Passenger Service Charge – PHP 491.07 – is this the terminal fee? Hong Kong Airport Construction Fee – PHP 577.94 Air Passenger Departure Tax – PHP 770.59 – is this the travel tax? Security Surcharge – PHP 288.97 and i want to ask also , since im OFW am i exempted with this taxes (terminal and travel tax going to HK for holiday?)

February 1, 2017 at 9:52 pm

I’ll breakdown the list so it’s easier to go through them.

PH Passenger Service Charge – PHP 491.07 – is this the terminal fee?

This I believe is the PH airport terminal fee. There should be another item called the “PH PSC Value Added Tax: 58.93,” which usually amounts to P58.93. So, the total is the P550 terminal fee.

This terminal fee should be refundable for OFWs with OEC.

Air Passenger Departure Tax – PHP 770.59 – is this the travel tax?

This is a HK$120 fee charged in Hong Kong, not in the Philippines.

February 19, 2017 at 5:12 am

Hi i am traveling to singapore next week. First time ko.. Magkanu babayaran kong travel tax, and do i need to pay terminal fees?. Mejo nervous kc aq as a first timer eh,, sana matulungan m ko.. Saka do i need to fill up embarkation card and where to get it ba… Your reply is going to be a good help.,

February 23, 2017 at 5:27 pm

P1,620 po yung travel tax per person for economy class tickets. Sa airport po yan binabayaran. Kung galing ka Manila Airport, hindi na kelangan mag bayad ng terminal fee sa airport kase nabayaran na po yan sa ticket.

Yung embarkation card before arriving in Singapore, usually dini-distribute po yan during the flight. Sakali wala sa flight mo, naka lagay lang yan sa immigration checkpoint sa Singapore.

Safe trip Lovelie!

March 5, 2017 at 5:43 am

Hi, Next week is my departure going to Saudi and I visit my hubby. How much to pay the terminal fee? Thanks

March 9, 2017 at 5:00 am

If you are departing from Manila. There is no terminal fee charged at the airport. The fee is already paid for when you bought the ticket.

March 17, 2017 at 5:15 am

Hello Marcos. My wife (Philippine citizen & Philippine passport holder) is flying out of NAIA terminal 2 for UK settlement. Does she have to pay travel tax?

March 17, 2017 at 3:31 pm

I’m not sure Jason. Better check the TIEZA website or contact them to confirm.

April 23, 2017 at 12:15 am

Hello. I am a singaporean I will be going to davao for a 1 week holiday. I just want to check do I need to pay for the airport tax for my arrival and departure when I go back to singapore

April 23, 2017 at 8:56 am

You don’t need to pay the terminal fee when you arrive in the Philippines. If you’re flying out of Davao, you need to pay the terminal fee at the airport. If you’re flying from Manila, no need to pay. The fee is already included in the ticket price. See the list of terminal fee prices above.

May 12, 2017 at 2:03 pm

I’m travelling to Vietnam with my Swedish husband flying from Manila to Hanoi.

Does he need to pay travel tax fee, P1,620? He has 9a/Tourist Visa, non-immigrant but stays here in Philippines since 2015 and only do tourist visa extension every 2 mos to stay legally here.

Riza from GenSan

May 12, 2017 at 2:09 pm

Hello Riza,

I’m not sure if he is required to pay. Best to contact TIEZA to be sure.

Enjoy your trip!

May 14, 2017 at 12:12 pm

There seems to be a bit of a confusion (mix up) here … Under “Airport terminal fee” you wrote: “You do not have to pay the terminal fee if you are on a flight from Manila, Caticlan (Boracay), or a domestic flight from Cebu.” and again under “Popular Philippine Airports” you wrote: Cebu-Mactan (CEB) Domestic – Included in flight ticket. International – P750. But … under “Mactan–Cebu International Airport (CEB)” you wrote: “The Cebu Airport passenger terminal fee is P750 per person for domestic flights. If you are on an international flight, you do not have to pay the terminal fee since it should already be paid for / included in the plane ticket price, at the time of booking.” This is the total opposite of the first two. So which is correct? Also if you go international but is required to change plane, like Cebu to Manila, then Manila to Bangkok, do you have to first pay Domestic then International terminal fees or do you pay the International terminal fee twice? Once in Cebu (750) and again (as included in ticket) in Manila?

May 14, 2017 at 5:17 pm

The first one is correct. Thanks for pointing out the error Luigi.

Just did a mock online booking for a Cebu-Manila-Bangkok flight, only the P750 PH international terminal fee shows up on the receipt. So, you might have to pay the terminal fee (for international flights) ONLY ONCE & it’s already included in the total price, upon purchase. This assumes that the whole journey is on a single plane ticket, and not two separate tickets.

If you booked a Cebu – Manila flight ticket, and another Manila – Bangkok flight ticket … You might have to pay the domestic terminal fee in Cebu, and international terminal fee in Manila. Both should already be included in the total price, upon purchase. So, you don’t need to pay at the airport. If both flights are on the same airline, on the same day, best to ask the airport/airline staff if you can get a refund for your Cebu-Manila terminal fee… If they are on different airlines & on different dates, you will need to pay both.

You only pay the international terminal fee once.

May 18, 2017 at 12:02 pm

Hello po, magandang araw pupunta po ako ng dubai by july… Aside from plane ticket, terminal fee and travel tax may babayaran pa po ba ako. Thank you po.

May 18, 2017 at 9:37 pm

Yun lang po mga babayaran sa Manila Airport.

May 30, 2017 at 5:58 pm

Kasali na ba sa na book na ticket ang travel and tax na babayaran pag sa cebu airport going singapore? Ang babayaran ko nalangba ay ang terminal fee na 750 pesos?

May 30, 2017 at 7:12 pm

Sa airport binabayad yung travel tax & terminal fee for international flights, at Cebu Airport.

May 31, 2017 at 8:46 am

Good am sir. I am a tourist here staying almost two years going bk to Singapore this month flying by Jetstar airline at naia terminal 1. Can u tell me how much is the total travel taxs I must pay? Me 1adult. And my Wife 1adult Filipino passport.1 children age 3 years plus Filipino passport and lastly 1infant 1years plus Filipino passport too. And the terminal fees do I still needs to pay in the airport terminal 1. Or no more already. Pls kindly reply n help thanks so much sir. Have a nice day.

May 31, 2017 at 11:17 am

The terminal fee is already included in the ticket if you are departing from any terminal in Manila Airport. With regards to the travel tax, you might want to review the information posted at the TIEZA website: http://www.tieza.gov.ph/index.php/travel-tax .

June 8, 2017 at 8:26 am

We want to go on holidays to Philippines from Denpasar and we would like to enter for example to Palawan and visit Boracay and Malapascua as well, please could you advice us which would be the best airport to leave Philippines or who to plan this trip? thanks a lot

June 8, 2017 at 7:10 pm

You can try this route: Bali-Denpasar – Manila – Coron — El Nido (ferry) — Puerto Princesa (land trip) — Cebu — Boracay-Caticlan — Manila. Enjoy!

July 10, 2017 at 5:09 pm

Hi im going to barhain i will visit my family nextweek do i have to pay or how much i need to pay ?

August 6, 2017 at 5:37 pm

Hi. Tumatanggap ba ng credit card ang Mactan Airport for the payment of travel tax na P1620?

August 19, 2017 at 10:26 pm

It’s paid in cash at the airport, AFAIK. You may want to check the travel tax online payment.

August 9, 2017 at 9:44 am

Hi Good morning..my husband sponsored me and my son For visa going to dubai..do i still need to pay the travel tax and terminal fee?

August 19, 2017 at 10:13 pm

Travel tax, yes. Terminal fee, no if flying from Manila.

August 17, 2017 at 6:47 am

I am going to Singapore next week and I am wondering If how much is the current terminal fee from DVO-SIN?

August 19, 2017 at 10:09 pm

Kindly see the post above for the international terminal fee at Davao Airport.

August 30, 2017 at 12:28 pm

I wish you had posted or been able to see the dates of when these posts were put up. I am so confused on this terminal fee b/s. No other country will take Philippines money so I am trying to figure out all this. A lot of your prices are wrong and not up to date.

August 30, 2017 at 5:52 pm

Hey Duane, can you share what prices you had found to be not updated?

September 4, 2017 at 6:36 pm

Hi! Filipino (ofw) with transit in the Philippines to Japan then back to bkk. Do I need to pay taxes and oec. Thank you!

September 4, 2017 at 11:23 pm

As far as I know, OFWs are exempt from PH travel tax/terminal fees.

September 6, 2017 at 1:58 pm

Hello, I’m travelling to Cebu from Australia. Are there any fees to pay for arrival?

September 6, 2017 at 4:58 pm

No fees on arrival, Jakester.

September 13, 2017 at 6:17 am

Hi how r u Pls my wife she is Filipina she is not working she is family visa at kuwait and my son have Filipino passbort wat she will pay if she go kuwait by Philippines airline Tnx Mohamed sabry

September 20, 2017 at 12:06 pm

Hello! I’m in Hong Kong for a quick vacation. Do I need to pay any travel tax in Hong Kong Intl Airport when I go back to Manila? Thank you!

September 20, 2017 at 10:24 pm

There are no travel tax or airport fees for the Hong Kong to Manila flight.

September 22, 2017 at 8:19 am

Do I need to pay all these fees when booking Philippine Airlines? Passenger service charge usd 11, airport construction fee usd 12, airport passenger security chare usd 6, Air passenger departure tax usd 16, is this what they called travel tax and do we need to pay coz we’re on European passports? Many thanks if someone can answer our queries.

September 22, 2017 at 9:00 am

The “travel tax” commonly mentioned on this page is the Philippine Travel Tax . It mostly applies to Philippine citizens traveling abroad and foreigners on long-term PH visa.

If you are visiting the PH for a short time, you shouldn’t need to worry about it. It is paid at the airport not when you book your flight online anyways.

Those fees you mentioned are probably mandatory airport/gov’t fees. So yes, you may need to pay all of them.

October 3, 2017 at 10:59 pm

Hi tanong ko Lang poh if I need to pay terminal fee or travel tax ? I’m British citizen with British passport I stayed here just for 30 days. Tnx

October 4, 2017 at 9:36 am

You only need to pay the terminal fee is it’s not already included in the ticket fare (on purchase). All airlines have started to include terminal fee in the price of the ticket recently.

October 15, 2017 at 9:29 pm

May tax and departure fee pa po bang babayaran sa Hong Kong Airport pag uwi namin sa Manila or kasama na sya ticket?

Ito po yung nakalagay sa ticket namin. Air Asia po yung airline.

Flight 2x Guests 11340.00 PHP International Passenger Service Charge – 1100.00 PHP (departure fee of ph or hk?) Airport Construction Fee – 1140.00 PHP (this is hk right?) Airport Tax – 1980.00 PHP (ito po ba yung included airport tax sa hong kong? so mag babayad pa kami ng tax & departure fee dito sa ph pag alis?)

Sorry, I’m just confused and needed answers. Thank you in advance!

October 28, 2017 at 10:51 pm

Walang Tax/Airport/Departure fee on flights from HK Airport.

July 30, 2019 at 2:52 pm

Ask ko lang about sa following fees. Bakit magkaiba sila?

Departure ( Kota Kinabalu) Fare, taxes and fees 2x International Passenger Service Charge1,100.00 PHP

Arrival (Manila) Fare, taxes and fees 2x Passenger Service Charge790.00 PHP 2x Regulatory Service Charge26.00 PHP

Thank you…

August 4, 2019 at 3:51 pm

Yung fees sa “Arrival (Manila)” na flight, fees yan ng departure airport (for example, yung exit fee/taxes for Kota Kinabalu Airport departures)

November 6, 2017 at 6:21 pm

hi pano pumunta ng clark airport galing manila? saka magkano kaya? meron bang direct?

November 17, 2017 at 10:13 pm

There is a new point-to-point/direct bus from Manila Airport – Terminal 3 to Clark Airport operated by Genesis Bus Company.

I haven’t taken it yet but news sites report that they are initially charging promo rates. Regular rates are:

Clark to North Edsa: P380 Clark to Ninoy Aquino International Airport Terminal 3: P450 Clark to Ortigas : P400

November 13, 2017 at 5:34 pm

Hi po I’m going in vacation dis November In PH for 2 months im from Italy..di ako makakakuha ng oec kasi wala na ako babalikan work dito pede ako magbayad ng travel tax para makabalik sa Italy

January 3, 2018 at 9:03 am

This is so informative and helpful! Thank you!☺

March 11, 2018 at 12:25 am

wooahhh I just know that NAIA do not need to pay terminal fees for domestic but I went to davao last november and bohol just this year January and both airports charged me for terminal fee. so doble pala binayad ko. badtrip

March 16, 2018 at 8:14 am

Hi! We’re going on a cruise to asia and we will embark the ship in manila seaport. Do we have to pay terminal fee before checking on board the ship? The cruise will end in shanghai and we already bought ticket to fly home. Same question, do we have to pay terminal fee upon arrival in manila? Thanks!

March 16, 2018 at 1:07 pm

Hello Jon M., the terminal fees discussed on this page is for airports in the Philippines. I recommend that you inquire with the cruise operator about fee included/not included in your package.

March 21, 2018 at 4:20 pm

Hi sir Marcos, have a bless day po. We’re planing for a vacation in taiwan with my children, and my husband is an Ofw . So we are entitled for travel tax exemption? As a dependents of my husband ofw? Thank you..

March 27, 2018 at 7:36 pm

i want to book ticket from Kuala Lumpur to Japan – however it will be transit at Manila Airport for 22 hours that required me to go out from the airport and check in hotel. Do I need to pay any tax in airport when arriving/departure from/to manila?Im malaysian

March 28, 2018 at 10:48 am

There are no taxes at the airport that you need to pay. Enjoy your trip!

May 5, 2018 at 8:39 pm

Would you please let me know the following fees from MIA:

– Fee for permanent resident in Philippines – Travel tax per person including permanent resident – Terminal fee per person including permanent resident

May 14, 2018 at 2:43 am

hey there…

on my airasia itinerary, the terminal fee is already included in the price. Theres also an airport tax involved in the price of the ticket which costs Php1060. Do I have to pay a separate airline tax of Php 1620? and are they different?

June 24, 2018 at 6:26 pm

I am on OFW working in Malaysia but is planning a vacation trip with my family to Taipei. As on OFW I have previleged not to pay the Terminal fee and travel tax however my family is not exempted, However as far as I know they are allowed to pay only 50% of the terminal fee, is this still applicable for them?

July 15, 2018 at 6:16 pm

Hi Eugenio. I’m not sure. You can try asking the airlines on FB.

June 29, 2018 at 6:46 am

Good day! Next week na po flight ko to migrate to new york. My ticket was booked in the US, ask ko lng po kng may bbayaran pa ako airport tax, terminal fee sa NAIA 1?thank you!

July 3, 2018 at 2:17 pm

Very expensive travel tax and terminal fee but you cannot see any progress here in Philippines. Everywhere you go, there is fee! Unlike in other countries they are not collecting any terminal fee fee from customer.

July 15, 2018 at 6:02 pm

Hi Trisha, all airports around the world charge terminal fees and taxes, you just don’t notice it because it’s already included in the airfare. As for the travel tax for international Pinoy travelers, PH Gov’t should really make an exception for ASEAN flights, which will encourage more intra-regional tourism activities/spending.

July 5, 2018 at 11:09 pm

Do I need to pay travel tax for domestic flight. Manila to Palawan?

July 15, 2018 at 5:56 pm

The P1,620 PH Travel Tax is for Pinoys traveling abroad only.

July 20, 2018 at 3:22 pm

I and my husband and my son 6 years old will travel to HK next year, may 2019. from clark airport. can i know how much is the travel tax each? I’m confused po kasi may nakita ko na blog saying that it’s only 600 pero un iba 1620 .THANKYOU!

July 29, 2018 at 1:56 am

There are two fees you will be asked to pay at the airport.

1. Clark Airport Terminal Fee = P600 per person 2. Philippine Travel Tax (for PH citizens traveling abroad = P1,620 per person

Total = P2,220

July 31, 2018 at 1:50 pm

Hi! Can i pay travel tax using credit card at the airport?

August 11, 2018 at 6:07 am

Not sure but do check out the online payment for the travel tax.

August 28, 2018 at 3:06 pm

Im not informed. Been going to Phil 2x already. Can I get the refund of my TF from those past flight I had?

September 19, 2018 at 6:48 pm

Terminal fee at Mactan International Airport is ₽850

September 21, 2018 at 12:29 am

Thanks for the update Melanie

October 3, 2018 at 3:23 am

Thanks …

November 17, 2018 at 11:34 pm

I am a filipino. My husband is indonesian.. My baby born in Brunei. We reached cebu last June 2018. And our scheduled flight Will be on november 28,2018. My baby is 9months old now. Is she need to pay for travel tax and terminal fee ? Even she is holding 1passport (Indonesia). If needed to pay, Any discount for her?

November 18, 2018 at 3:45 pm

Hi Celeste,

You can check the link to TIEZA’s website that I provided on the article. Here the link in case you missed it: http://tieza.gov.ph/travel-tax/

Details are posted there on exemptions. Here is what i found:

—– Who may be exempted from paying the Travel Tax? The following Filipino citizens are exempted from the payment of travel tax pursuant to Sec. 2 of PD 1183, as amended:

Overseas Filipino workers Filipino permanent residents abroad whose stay in the Philippines is less than one year Infants (2 years and below) —–

February 5, 2019 at 1:35 pm

Hi we are travellling to hk from davao. I have with me my wife and my kids (1 & 3). Do my children need to pay the terminal pay? Thanks

February 6, 2019 at 5:05 am

Infants (under 2 years old) are not charged the terminal fee. Children over 2 years old are applicable to pay the terminal fee.

February 27, 2019 at 8:22 am

Hi. Just want to ask if my family still needs to pay Travel Tax and Terminal Fee? They are departing from Manila International Airport. I booked their tickets at PAL and they have an Immigrant Passport . Thank you

March 1, 2019 at 2:33 pm

Hi Cecille, the terminal fee applies to all passengers & the travel tax applies to Philippine citizens. Might be worth asking the airline about the policy/exemptions, in your case.

March 26, 2019 at 12:44 pm

Hi sir good afternoon, Where’s the Kalibo international airport to pay the travel tax and terminal fee? How much? Lining up?

March 26, 2019 at 9:55 pm

Hi Willium, no need to pay the terminal fee at the airport. It’s already included when you book the flight.

May 16, 2019 at 12:20 pm

Gud pm,where will i pay for the travel tax and how much will it costs each for the minors ages 14 and 17, and age of 19?from philippines to us.thank you

July 2, 2019 at 9:07 pm

Is the airport tax a one time fee? Should I pay it every time I travel out of the country?

Thanks in advance ?

July 12, 2019 at 11:37 pm

YES. You have to pay for every departure, regardless of the time difference between trips.

August 16, 2019 at 1:43 pm

Hi po, ask lang if the terminal fee is also exempted for OFW for domestic flights in all domestic airports?

August 24, 2019 at 6:12 pm

manila to osaka

October 8, 2019 at 11:50 pm

This is extortion. How can the government impose a tax on international travellers? Also most airlines do not make it clear that there is terminal fee in Cebu. Philippines needs to stop this corruption.

November 9, 2019 at 7:21 pm

All airports charge a terminal fee. Most airports in the world charge way more than any airport in the Philippines. They just include the terminal fee in your ticket price so you don’t see it. In any case, for international flights from Mactan Cebu, purchased since 1st September this year, they have the terminal fee included in the ticket price now.

October 24, 2019 at 11:04 am

hi, sa binayaran ko sa airline may nakalagay na 1,680 na travel tax.. dalawa kase kame.. tapos pagdating sa airport siningil pa ko na Passenger service charge 600 per person.. bukod pa dun sa 1,620 na airport tax..

November 22, 2019 at 10:05 am

Saang airport po?

November 18, 2019 at 2:53 pm

I would like to give an update regarding the Airport Terminal Fee or what it is now called as INTERNATIONAL PASSENGER SERVICE CHARGE, I just booked a ticket and I saw in the payment invoice, it is already included in the ticket price. So no need to pay at the airport for the Terminal fee. For all you travelling passengers, please confirm it first in the invoice before paying for the terminal fee at the airport. To avoid paying twice . . .

December 24, 2019 at 9:06 am

Need to know, l stayed here in the Philippines for 2 years. Do l need topay my stay? Im a dual citizen.

February 19, 2020 at 9:48 am

Hi! Do you have any details regarding students being exempted from the airport terminal fee?

June 2, 2020 at 3:26 pm

I just wanna ask.

If I buy one way ticket to abroad then pay travel tax, and buy another ticket going back to origin country (separate transactions) will i need to pay the travel tax again?

June 5, 2020 at 10:28 am

you pay the travel tax only once per exit from the Philippines (not on entry/return).

November 27, 2020 at 9:08 am

i am OFW bound to Papua New Guinea, I didn’t get travel tax refund before I left the Phils. IS there any way to refund my travel tax if I arrive in the Philippines?

and, I red in the statement, Travel tax refund will due after 2 years…

please teach me about this…

thank you…

September 6, 2021 at 5:50 pm

Does a family treasure coming from other country to Philippines have airport fee and insurance fee? How much? Thanks

February 2, 2022 at 3:19 am

Thank you for providing the detailed information on the additional travel taxes imposed at the airport. Especially for people of the Philippines taking international flights! My daughter-in-law was concerned about what someone had told her, and I am thankful to find your information!

- Airport Transfer

Things to Do

Traveloka PH

14 Apr 2022 - 5 min read

Travel Tax in the Philippines: Everything a Traveler Needs to Know

Paying the travel tax is one of the steps a traveler must do before flying out for an international trip. Here's a guide on what you need to know about this tax.

What is Travel Tax?

The Philippine travel tax is an additional fee you need to pay every time you go abroad.

You can read up on it in greater detail under Presidential Decree 1183 , but all you need to know about it is that you are required to pay this fee no matter which country you are headed to.

Who is required to pay the travel tax?

If you fall under any of the following demographic, you are required to pay the travel tax:

Who is exempted from paying the travel tax?

Manila to singapore flight.

Cebu Pacific

Start from ₱ 3,082.00

Manila (MNL) to Singapore (SIN)

Thu, 18 Apr 2024

Jetstar Asia Airways

Start from ₱ 3,172.73

Tue, 16 Apr 2024

Start from ₱ 4,352.95

There are also other individuals who are exempted from paying the travel tax:

I fall under the travel tax exemption. What do I need to avail of it?

Depending on your case, you will need:

1. Original documents required by your embassy or agency , which can include but are not limited to:

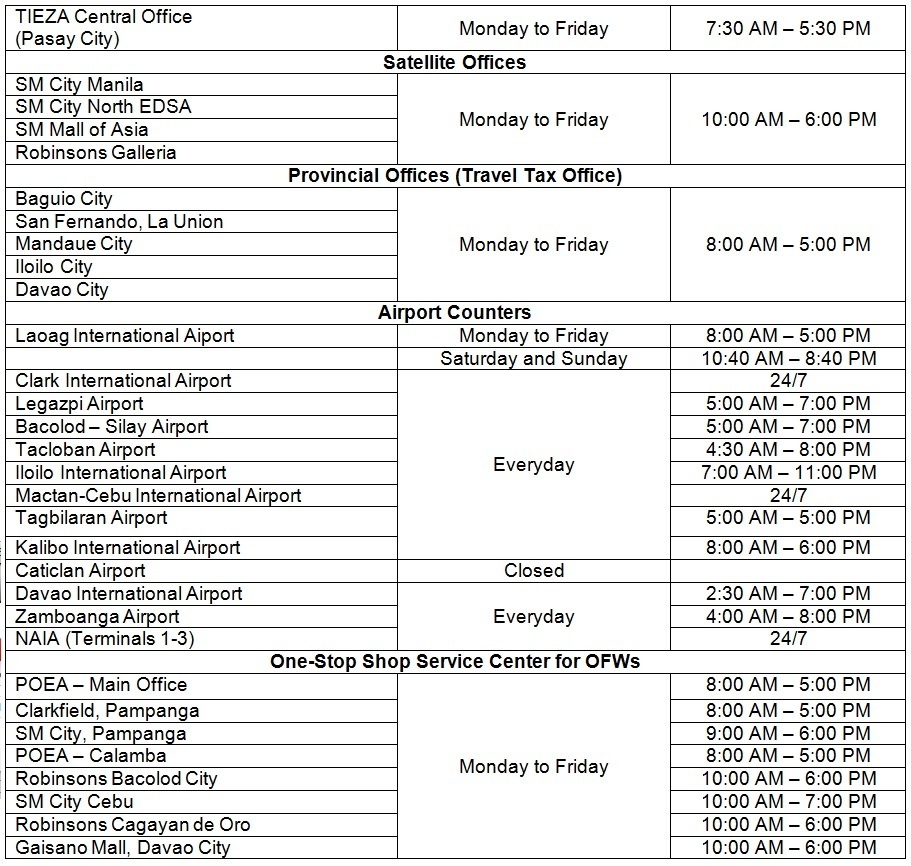

2. Travel to the nearest TIEZA Travel Tax Field Office in the Philippines , either in the airports or in the provincial field offices.

Show your original documents, as well as photocopies.

3. Pay a PHP 200 processing fee.

Wait for your Travel Tax Exemption Certificate to be released, and present this to the authorities at the airport.

How much do I have to pay?

Depending on your ticket, your travel tax will vary. See the table below:

Where do I pay the Philippine travel tax?

You can pay your travel tax in advance in several malls. Check out these mall counters that accept travel tax payments:

You can also pay your travel tax on the day of your flight in the airport counters. You need to show your ticket and passport.

Meanwhile, there are also provincial offices and other government offices where you can pay the travel tax:

You can also pay online. Here's how:

Where does that money go.

As per Section 73 of the Republic Act No. 9593 , the money earned from the travel tax is divided accordingly:

How do I get a refund?

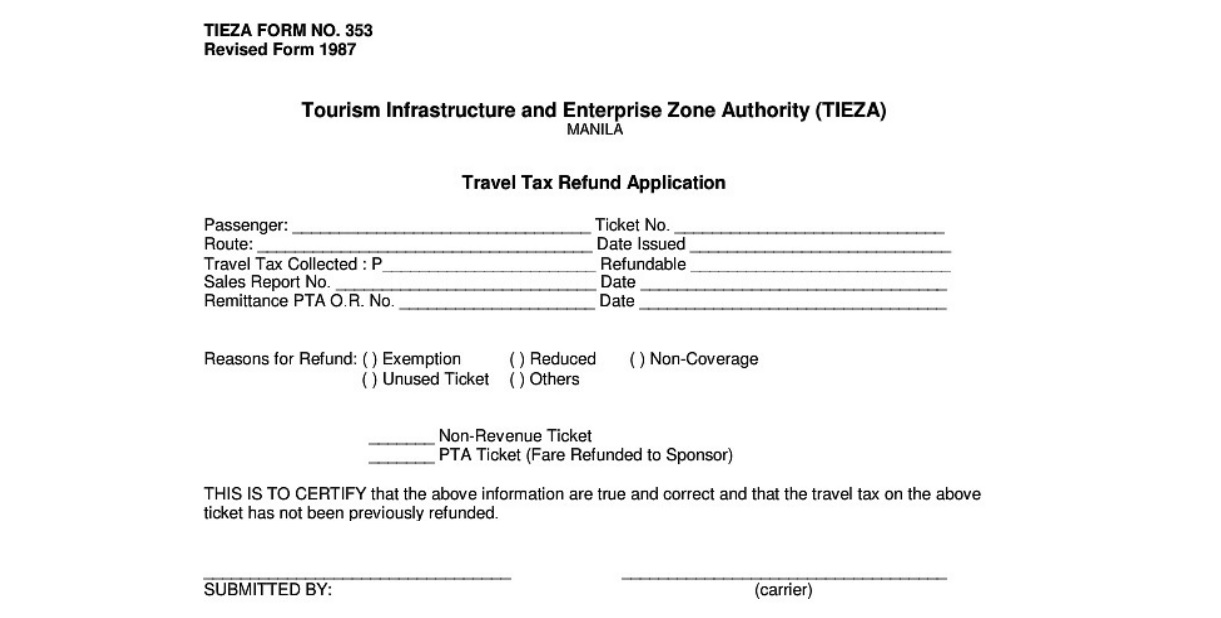

You qualify for a refund if you fall under one of the following conditions:

What do you need to present to get a refund?

Depending on your case, prepare the following:

Now you know your travel tax basics. Make sure you keep them in mind when you plan and book your trips with Traveloka!

Payment Partners

About Traveloka

- How to Book

- Help Center

Follow us on

- Flight + Hotel

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

Download Traveloka App

- Disclaimer and Affiliate Disclosure

- Privacy Policy

Travel Tax Philippines: All You Need to Know to Fly Without Hassle

Published by Ms. D on January 29, 2024 January 29, 2024

Ever wondered how much the travel tax Philippines is? Traveling outside the Philippines can be an exciting adventure, but it often comes with various considerations, including the travel tax. If you’re planning a trip abroad, it’s essential to understand what this tax is about, who needs to pay it, and how much it costs.

Table of Contents

What is travel tax philippines.

The Philippine travel tax is a levy imposed on individuals departing from Philippine airports for international destinations. This tax is collected to generate revenue for the country’s tourism infrastructure and related projects.

The requirement to pay travel tax is applicable to:

1. Filipino citizens. 2. Taxable foreign passport holders. 3. Non-immigrant foreign passport holders who have resided in the Philippines for over a year.

How Much is the Philippine Travel Tax?

The amount of travel tax in the Philippines varies depending on the passenger’s class of travel and destination. As of the latest information available, the rates are as follows:

- First class passengers: PHP 2,700

- Economy class passengers: PHP 1,620

If you are qualified, you may apply for Reduced Travel Tax (RTT), which is a tax reduction program designed to lower the cost of travel for eligible individuals. There are two types of RTT, namely standard and privileged.

Standard Reduced Travel Tax

As per the Tourism Infrastructure and Enterprise Zon Authority (TIEZA) , the following individuals may apply for standard reduced travel tax.

- Minors (from 2 years and one (1) day to 12th birthday on date of travel)

- Accredited Filipino journalist whose travel is in pursuit of journalistic assignment

- Those authorized by the President of the Republic of the Philippines for reasons of national interest

The standard reduced travel tax for first-class passengers is PHP 1,350, and for economy passengers, it is PHP 810 .

Privileged Reduced Travel Tax

The privileged reduced travel tax is exclusively available to dependents of Overseas Filipino Workers (OFW), namely:

- Legitimate spouse of an Overseas Filipino Worker (OFW)

- Unmarried children of an OFW, whether legitimate or illegitimate, who are below 21 years of age

- Children of OFWs with disabilities even above 21 years of age.

The privileged reduced travel tax for first-class and economy-class passengers is PHP 400 and PHP 300 , respectively.

How to Avail of the Reduced Philippine Travel Tax

To help you get started applying for RTT, here’s a general step-by-step guide.

Step 1: Understand the criteria for eligibility for RTT and determine whether you pass for the standard or privileged reduced travel tax.

Step 2: Gather all necessary supporting documents to prove your eligibility. Depending on your eligibility, the requirements can vary. Check the complete details here – Reduced Travel Tax | Tourism Infrastructure and Enterprise Zone Authority (tieza.gov.ph)

Step 3: If you have not yet purchased your airline ticket or made any travel arrangements, you can apply for the RTT in advance online as long as you have all the requirements already. Do note that filing for RTT online is limited to those who have not yet purchased their airline ticket and have not yet paid the full travel tax rate. Online RTT applications submitted after 5 P.M. or on weekends are processed on the next working day.

If you have already purchased an airline ticket and prefer to pay your RTT at the airport, proceed to step 4.

Step 4: Arrive at the airport or designated government office where travel tax payments are processed. Look for the travel tax counter or designated personnel.

Step 5: Present your supporting documents to the personnel at the travel tax counter. This will verify your eligibility for the reduced travel tax rate.

Step 6: Pay the reduced travel tax amount applicable to your category. The personnel will inform you of the exact amount to be paid based on your eligibility.

In case you have paid for the full travel tax amount despite being eligible for RTT, TIEZA advises you to apply for a refund of the excess travel tax paid ON-SITE at any TIEZA Travel Tax Office or airport counter.

Step 7: Once the reduced travel tax is paid, you will receive a receipt or clearance indicating that the tax has been settled. Keep this document safe, as you may need it during your travel.

Step 8: With the reduced travel tax paid and clearance obtained, proceed with your travel plans as usual.

Philippine Travel Tax Discounts for Senior Citizens and PWDs

Under current laws, senior citizens and PWDs are entitled to a 20% discount on the travel tax and terminal fee.

Who Is Exempted From Travel Taxes in the Philippines?

There are certain categories of individuals who are exempt from paying travel tax in the Philippines. They are the following:

- Foreign Diplomatic and Consular Officials and Members of their Staff

- Officials, Consultants, Experts, and Employees of the United Nations (UN) Organization and its agencies

- United States (US) Military Personnel including dependents and other US nationals with fares paid for by the US government or on US Government-owned or chartered transport facilities

- Overseas Filipino Workers (OFW)

- Filipino permanent residents abroad whose stay in the Philippines is less than one (1) year

- Philippine Foreign Service Personnel officially assigned abroad and their dependents

- Officials and Employees of the Philippine Government traveling on official business (excluding Government-Owned and Controlled Corporations)

- Grantees of foreign government funded trips

- Bona-fide Students with approved scholarships by appropriate government agency

- Infants (Up to second birthday on date of travel)

- Personnel (and their dependents) of multinational companies with regional headquarters, but not engaged in business, in the Philippines

- Balikbayans whose stay in the Philippines is less than one (1) year

- Family members of former Filipinos accompanying the latter

Where to Pay Philippine Travel Tax

Passengers can settle their travel tax at designated counters in Philippine airports before departure. These counters are typically located in the international departure area of the airport.

How to Pay Philippine Travel Tax Online?

If you plan to pay the Philippine travel tax, here is a guide that provides step-by-step instructions on how you can do it.

Step 1: Go to the official website of the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) – Tourism Infrastructure and Enterprise Zone Authority (tieza.gov.ph)

Step 2: Look for the Travel Tax section on the top of the page beside the About Us tab.

Step 3: Within the Travel Tax section, select Pay Travel Tax Online .

Step 4: Click on the MYEG icon on the laptop photo. The link should direct you here – Online Travel Tax Services System (tieza.online)

Step 5: Fill out the form with the required details.

Step 6: Proceed and select your preferred payment method. This could be through e-wallets, online bank transfers, or credit/debit cards.

Step 7: Follow the prompts to complete the payment process.

Step 8: After successful payment, make sure to keep a copy of the payment confirmation for your records.

How Much is the Terminal Fee in NAIA?

The terminal fee at Ninoy Aquino International Airport (NAIA) varies depending on the terminal and the type of flight. As of 2023, the NAIA charges PHP 300 for domestic flights and PHP 750 for international flights.

How Much is the Travel Tax from the Philippines to Canada?

Filipino passengers traveling from the Philippines to Canada are subject to a travel tax. The amount varies depending on the passenger’s class of travel. First class passengers are charged PHP 2,700 while economy class passengers are charged PHP 1,620.

Is Travel Tax Included in PAL Ticket?

For Philippine Airlines (PAL) tickets, the travel tax is typically not included in the ticket price. Passengers are required to settle the travel tax separately before departure.

Can I Pay Travel Tax at the Airport?

Yes, passengers can pay their travel tax at the airport before their flight. There are designated counters in Philippine airports where travelers can settle this fee conveniently.

Want to Travel Locally in the Philippines?

If you are planning to explore the local destinations in the Philippines, make sure to check out our 15 Top Destinations in the Philippines – Our Recommendations 2024

The author of Budget and Life is a Filipina who holds a Bachelor of Arts degree in Mass Communications and is a licensed professional teacher in the Philippines. She is currently pursuing a career in content writing.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Related Posts

Fully Booked Bookstore Experience

For all book enthusiasts heading to the Philippines, Fully Booked is an absolute must-visit destination. This bookstore in the Philippines is a go-to destination for all your book needs! If you are curious to learn Read more…

How Much Should You Spend in Accommodation in the Philippines?

Planning a vacation in the Philippines can be a thrilling experience, but it can also be stressful if you’re on a tight budget. One of the biggest expenses to consider when planning your trip is Read more…

10 Exciting Things to Do in the Philippines in Summer

If you’re dreaming of a vacation in the Philippines in summer, then you’re in for a treat. As a proud local of this tropical paradise, I’m here to spill all the beans on what to Read more…

How Much Travel Tax In The Philippines

The Philippines imposes a travel tax on citizens and resident aliens of the Philippines who are leaving the country for any reason other than for official, business, or employment purposes. The travel tax is collected by the Philippine Department of Tourism (DOT) and is used to fund the development of the tourism industry in the country.

The amount of travel tax you are required to pay depends on your destination and the class of travel you choose. The travel tax rates are as follows:

- First class: PHP 1,620 (about $33)

- Business class: PHP 1,110 (about $22)

- Economy class: PHP 820 (about $17)

- Tourist class: PHP 820 (about $17)

The travel tax is waived for children below two years of age and for Filipinos who are traveling to countries that have a reciprocal tax-exemption agreement with the Philippines.

The travel tax must be paid at the International Tourist Bureau of the DOT or at any authorized travel agency before departure. You can also pay the travel tax online through the DOT’s website or through the Philippine Travel Tax Payment System (PTTPS), a web-based system that allows you to pay the travel tax using a credit card or through a bank transfer.

In conclusion, the travel tax in the Philippines is a mandatory fee that is imposed on citizens and resident aliens of the Philippines who are leaving the country for any reason other than for official, business, or employment purposes. The amount of travel tax you are required to pay depends on your destination and the class of travel you choose. The travel tax must be paid before departure at the DOT or at an authorized travel agency, or online through the DOT’s website or the PTTPS.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Articles airasia Flights: All You Need to Know about Travel Tax in the Philippines

Explore other articles and discussions on this topic.

14/12/2023 • FAQs

Information.

What is the Philippine Travel Tax? The Philippine Travel Tax is a fee you need to pay before leaving the country for international flights. The amount of the travel tax may vary depending on the type of flight ticket you have. Travelers are typically required to pay the travel tax before they check in for their international flight. Please note that policies and fees are subject to change, and it's advisable to check with relevant authorities or official sources for the most latest information on Philippine Travel Tax.

How much is the Philippine Travel Tax? Your travel tax varies according to the type of ticket you have. Check the table below for more information.

Who is required to pay the Philippine travel tax?

The obligation to pay travel tax applies to:

Who is exempted from paying the travel tax? The payment of travel tax is exempted for the following categories of Filipino citizens:

Where to pay the Philippine travel tax? To process your travel tax payment online, you may refer to this link: https://tieza.gov.ph/online-travel-tax-payment-system/ . Please be informed that Philippine Travel Tax will not be offered online if the transaction is for a child or with a child/infant. You also can pay your travel tax at the airport counters on the day of your flight by presenting your ticket and passport.

How do I get a refund ? You may visit https://tieza.gov.ph/travel-tax-refund/ for more information on Travel Tax Refund Policies and Requirements.

404 Not found

all the colours of the Philippines, designed your way

Tropical Experience Travel Services - Tours of the Philippines

HOME - About the Philippines - Design your trip - Tour Samples - About us - Sustainability - Contact and Booking - Terms and Conditions - Guests Reviews

Travel Taxes and Airport Fees in the Philippines

Other questions & answers.

You may probably have read somewhere online that there is, there was or there may be a terminal fee to pay to exit the Philippines . It is quite important to be aware of it precisely and in advance, because it’s usually required to pay this kind of fees in cash and you will want to arrive at the airport with the right amount of money. Indeed, at the end of the trip you are actually likely to have spent all your local currency.

Fees for international flights (exiting the Philippines)

Manila Airport used to require foreign tourists to pay fees to leave the country. Now, terminal fees are NOT required anymore in Manila Airport. To be precise, you are still paying your terminal fees, yet they are already included in your flight ticket and you can proceed straight to departures without paying anything else.

Mactan Cebu Airport on the contrary, currently requires to pay a “Passenger Service Charge” to foreign tourists leaving the country. The fee is 850 Philippine Pesos. It is equivalent to around 15 € or 16 USD. Note this information was lastly updated on June 2020.

Clark Airport asks for a Passenger terminal fee of 600 Philippine Pesos (around 11 € or 12 USD). Note this information was lastly updated on June 2020.

Other International Airports : the 3 above are the main international gates of the Philippines. For other Airports, you may check with your travel agent or research about the specific airport.

For Filipino Citizens or Residents of the Philippines : other rules apply, you may check with local authorities about the fees you need to pay to exit the country and how.

Fees for Domestic Flights (within the Philippines)

For domestic flights, as of writing (June 2020) it is not possible to give a comprehensive answer or make a precise list, since situations often change.

If you depart from Manila Airport , you won’t need to pay any additional fees, since they are already included in your ticket.

For other local airports , it depends by the local rules: most still ask to pay a terminal fee upon departure to both local and foreign travellers, usually not exceeding 200 pesos/person (less than 4 € or 4 USD).

The Philippines Today

The Philippines Today, Yesterday, and Tomorrow

Philippine Travel Tax (11 Commonly Asked Questions)

The Philippine Travel tax has become one of the most reliable sources of funding for the government.

In fact, 50 percent of the total travel tax collected is retained by TIEZA. TIEZA or Tourism Infrastructure and Enterprise Zone Authority replaced the PTA or Philippine Tourism Authority.

The CHED (Commission on Higher Education) gets 40 percent of the collected tax and the National Commission For Culture and the Arts get the remaining 10 percent of travel tax collected.

Enumerated hereunder are the common questions asked by Filipinos and Tourists alike about the Philippines travel tax.

1. What is the Philippine Travel Tax ?

Philippine travel tax is a levy imposed by the Philippine government on individuals who are leaving the Philippines irrespective of the place where the air ticket is issued and form or place of payment.

2. Who Must Pay The Travel Tax?

- Citizens of the Philippines

- Taxable Foreign Passport Holders

- Non-immigrant foreign passport holders who have stayed in the Philippines for more than one (1) year

3. Which Philippine government agency has the power to collect Travel Tax?

The TIEZA or Tourism Infrastructure and Enterprise Zone Authority is the government agency mandated by law to collect the travel tax.

4. What is the Travel Tax For?

The Philippine Travel Tax was originally imposed to curtail unnecessary foreign travel and to conserve foreign exchange. Later, the tax was used to generate much-needed funds for tourism-related programs and projects. It is recognized that tourism promotion alone is not enough to attract tourists to the Philippines. Adequate tourism facilities and infrastructures need to be provided for the growth of the tourism industry. The Travel Tax plays an important role in funding the development and maintenance of these tourism facilities and infrastructures to enhance the countries competitiveness as a major tourism destination.

5. Are those exempted from paying travel tax also exempted from paying terminal fee?

Under the law, only the following are exempted from paying terminal fee

- OFW (Overseas Filipino Worker)

- Pilgrims endorsed by the National Commission of Muslim Affairs

- Athletes endorsed by the Philippine Sports Commission

- Others authorized by the Office of the President

6. How Much Is The Travel Tax?

Under the law, the rate for a 1st class passenger is 2,700 pesos and the rate for economy class is 1,620 pesos. This rate is the full travel tax.

7. Where to pay Travel Tax in the Philippines?

The Following Companies operating in the Philippines are delegated to collect the tax upon issuance of tickets: 1. Airline Companies 2. Shipping companies 3. Travel agencies

For tickets issued outside the Philippines or for internet-booked tickets, pay the travel tax directly at 1. TIEZA Travel Tax Offices 2. Travel Tax Counter at major international airports like NAIA or Mactan-Cebu international airport or Clark International Airport.

Philippine Travel Tax Online Payment now available.

8. What are the documents required when paying travel tax?

Bring your original passport and airline ticket

9. Who are exempted from paying the Philippine Travel Tax?

- Overseas Filipino workers

- Filipino permanent residents abroad whose stay in the Philippines is less than one year Family members accompanying such are also exempted

- Infants (2 years and below

- Foreign Diplomatic and Consular Officials and Members of their Staff

- Officials, Consultants, Experts, and Employees of the United Nations (UN) Organization and its agencies

- United States (US) Military Personnel including dependents and other US nationals with fares paid for by the US government or on US Government-owned or chartered transport facilities

- Crew members of airplanes plying international routes

- Filipino permanent residents abroad whose stay in the Philippines is less than one (1) year

- Philippine Foreign Service Personnel officially assigned abroad and their dependents

- Officials and Employees of the Philippine Government traveling on official business (excluding Government-Owned and Controlled Corporations)

- Grantees of foreign government-funded trips

- Bona-fide Students with approved scholarships by the appropriate government agency

- Personnel (and their dependents) of multinational companies with regional headquarters, but not engaged in business, in the Philippines

- Those authorized by the President of the Republic of the Philippines for reasons of national interest

10. May a travel tax be refunded? Yes, travel tax can be refunded like

- When there is undue tax – you are exempt but you paid

- Tax inadvertently paid twice for the same ticket

- Entitled to exemption or reduced tax

- Offloaded passengers /canceled flights

- Downgraded ticket

- Reduced Travel Tax

- Travel Tax Exemption

- Unused ticket

11. Where are the locations of TIEZA travel tax offices?

Provincial Offices

Laoag Travel Tax Unit Departure Lobby Laoag International Airport Laoag City, Ilocos Norte Telefax: (077) 772-1162 Monday to Friday, 8 am – 5 pm Saturday and Sunday, 8 am – 9 pm

Baguio Travel Tax Unit Department of Tourism Building Governor Pack Road Baguio City Tel. No.: (074) 442-6226 Monday to Friday, 8 am – 5 pm

San Fernando, La Union Travel Tax Unit Mabanag Hall, San Fernando, La Union Telefax: (072) 607-1963 Monday to Friday, 8 am – 5 pm

Clark/DMIA Travel Tax Unit Departure Lobby Diosdado Macapagal International Airport Clarkfield Pampanga Monday to Sunday, 4 am – 1 am

SM City San Fernando, Pampanga Travel Tax Unit 3/F Government Service Center, SM City Pampanga San Fernando, Pampanga Monday to Friday, 10 am – 6 pm

Kalibo Travel Tax Unit Departure Area Kalibo International Airport Kalibo, Aklan Monday to Sunday, 8 am – 12midnight

New Bacolod-Silay Airport Travel Tax Unit Departure Area New Bacolod-Silay Airport Brgy. Bagtic, Silay City Monday to Sunday, 5 am – 7 pm

Iloilo Travel Tax Unit DOT Region VI Bldg., Capitol Grounds, Bonifacio Drive, Iloilo City Tel. No.: (033) 366-0480 Telefax: (033) 335-0245 Monday to Friday, 8 am – 5 pm

Iloilo International Airport Travel Tax Unit Departure Area IIA Cabatuan, Iloilo M-T-TH-F-Sunday, 8 am – 11 pm Wednesday and Saturday 8 am – 5 pm

MCIA Travel Tax Unit International Departure Area Mactan Cebu International Airport Lapu-Lapu City, Cebu Tel. No.: (032) 236-3481 24/7 Operation