I agree to the terms and conditions and agree to receive relevant marketing content according to the privacy policy.

International Car Rental Insurance When You Travel Abroad

Alevin Chan

Planning a driving holiday ? Don’t overlook your overseas car rental insurance , which has a different focus than your regular travel insurance plan. Here’s how these two different but complementary policies work together.

If you’re planning a driving holiday down the Gold Coast, you may be wondering if the policy you bought using a travel insurance discount , or the free one that comes with your credit card also covers you when renting a car overseas.

Generally speaking, no. A standard travel insurance plan does not cover overseas car rental. Instead, you’ll have to get separate car insurance for rentals abroad to cover the use of your rental car.

Let’s take a look at the difference between travel insurance and overseas car rental insurance to better understand why.

Table of contents

What is the difference between travel insurance and car rental insurance for rental abroad, how much is car rental excess cover, what is car rental excess cover, what does rental car excess cover, what is the difference between car rental excess cover and overseas car rental insurance, best travel insurance with rental car excess cover, from your car rental provider, from your travel insurance plan, from third-party providers.

- Collision Damage Waiver (CDW)

- Loss Damage Waiver (LDW)

Supplementary liability insurance (SLI)

- [Bonus] Things to note about driving in West Malaysia

Travel insurance and overseas car insurance do have some overlap in the benefits they offer, but both of these are designed with different areas of focus.

Standard travel insurance does not always cover rental cars since it is aimed at offering broad-based cover against the common risks of overseas travel. On the other hand, overseas car rental insurance is for the specific liabilities that drivers take on whenever they get behind the wheel while travelling abroad. In most cases, you do need some form of insurance to drive a rental car. However, the type of insurance and the extent of coverage can vary depending on your individual circumstances and location.

As the driver, you will be liable for damages or claims should your car cause injury or loss to others, or damage to public or private property.

Furthermore, should the car you rent be stolen, lost or damaged, you will also be responsible for the cost of repairs and/or replacement of the vehicle.

Whether you’re travelling solo or with family, rental car insurance or holiday car insurance is critical for anyone planning to rent a vehicle overseas. If you are unsure of how to tell if your travel insurance covers a rental car, it is best to contact your policy provider to check before embarking on your trip.

And because travel insurance and car rental insurance while abroad ultimately have different goals, it is crucial to think of both of them separately – even if there is some overlap between the two.

Looking for the best credit cards to complement your spending patterns and expenditure in 2024? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

There’s one thing to highlight about international rental car insurance, and it’s that while having this insurance will shield you from the financial impact of a road accident, you may not be fully spared the backlash.

This is because international rental car insurance plans commonly come with excess , which is the amount you have to pay before your policy pays the rest . Insurance excess is nothing new – most motor insurance policies impose a S$100 excess charge for windscreen repairs, for instance.

However, in the case of international car rental insurance, the excess may be set at a high amount – up to several thousands, or more. If your policy comes with a high excess, you will potentially have to pay a large amount out of your own pocket, which negates the whole point of having an overseas car rental insurance plan in the first place!

This is where rental car excess cover comes in. This is an insurance benefit that reduces the amount of excess you have to pay, or waives it off completely.

With rental car excess cover, you can be compensated for the full sum of repairs or damage, or claims from injuries or loss.

Clearly, this is a crucial benefit to have when renting a car, which makes it a shame that it is not included in most international rental car insurance policies.

Instead, you’ll have to obtain your own rental car excess cover, which you can do in the following ways.

Related to this article: How Much Does It Cost To Rent A Car In Singapore?

Rental car excess cover should be part of the list of travel essentials for travellers seeking comprehensive protection for renting and driving overseas.

Depending on the plan, rental car excess can cover the excess amount in case of damage or theft, and additional fees that rental companies may impose to remedy minor accidents, such as flat tyres, lost keys, and towing charges. This cover can also extend to accidental loss or damage of the rented vehicle and coverage for additional drivers listed on the agreement. To enhance your coverage and ensure that you are fully protected, it is advised to add rental excess cover to your international car rental insurance.

Car rental excess cover and overseas car rental insurance differ primarily in their scope of protection. While overseas car rental insurance covers damages and theft of the rental vehicle, car rental excess cover specifically addresses the excess charge that insurance policies often leave to the renter.

For instance, if you're involved in an accident causing S$2,000 in damages with a S$500 excess, your excess cover would handle the S$500, while the rental insurance would take care of the remaining damages. In this scenario, if you only have overseas car rental insurance and no car rental excess cover, you would be responsible for paying the $500 excess out of pocket.

In most cases, the cost of car rental excess cover will be significantly less than the potential expense of the excess charges in case of damage or theft, offering substantial savings. Prices for car rental excess vary depending on your destination and where you purchase the cover; buying directly from the rental company might be more expensive compared to opting for a third-party insurer. Regardless of where you choose to purchase your car rental excess cover from, it will allow you to mitigate potential financial losses by paying just a fraction of what the real cost could be in the absence of excess cover.

Finding the right travel insurance that includes rental car excess cover can significantly enhance your travel experience by providing peace of mind on the road. Here are some of the best travel insurance options with comprehensive rental car excess coverage to ensure that you are well-protected against unexpected expenses, allowing you to focus on enjoying your journey.

*Premiums based on 7-day trip to Australia

How do I get rental car excess cover?

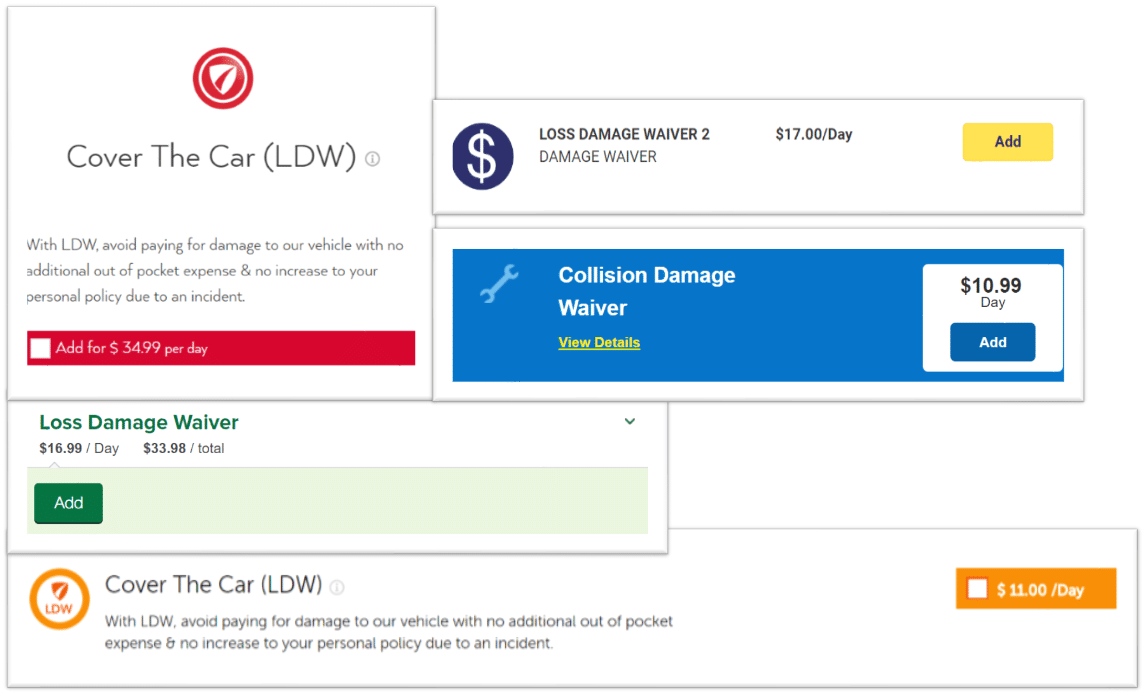

When you’re renting a car, your rental provider will likely attempt to upsell you on rental car excess cover.

You will be offered several different add-ons that are charged separately, and you get a sneaking suspicion that you have to purchase every last one of them in order to be fully covered against any excess or additional charges.

You’d be right, for several reasons.

One, because motor insurance policies don’t actually cover the entire vehicle , leaving out some commonly damaged components like tyres and windows and sunroofs. So if you neglect to purchase the appropriate add-on, you will be liable for charges related to a damaged window or undercarriage.

Two, it also doesn't help that car rental companies attempt to nickel-and-dime you by splitting up important coverage into different add-ons .

For instance, there’s what is commonly known as a Collision Damage Waiver (CDW) that reduces your excess should your rental car get damaged in an accident.

What if your vehicle gets stolen instead?

Well, in that case you’ll need Loss Damage Waiver (LDW), which is essentially CDW + protection against theft. Without LDW, you’ll be liable for the entire amount of replacing the lost vehicle.

The takeaway here is that, yes, while your car rental provider offers excess cover, it is unlikely to be the most cost-effective option, seeing as to how you’d have to basically buy the entire suite of add-ons.

And even then, you may still not be completely off the hook; some rental companies have two “levels” of CDW/LDW, with only the more expensive option offering 100% excess waiver.

Related to this article: Best Travel Insurance Plans for Road Trips, Water Sports and Extreme Sports

Some cheap travel insurance plans offer rental car excess waiver , whether bundled in by default, or as a paid add-on. As its name suggests, this benefit covers you for any excess imposed by your car rental company.

Generally, any and all excess claims are covered, no matter what the originating incident is. So there’s less need for you to worry about what parts of your rental car are covered, or not.

However, this is still not a “blank-check” situation, as some restrictions may still apply. For instance, your travel policy may not cover damage to windows or tyres or some forms of damage or loss.

Also, the amount of excess waiver offered may not be large enough. For instance, FWD Travel Insurance offers S$1,000 in car rental excess waiver. If your excess exceeds this amount, you’ll have to cover the remainder on your own.

Related to this article: Driving to Malaysia? Travel Insurance May Be More Important than You Think

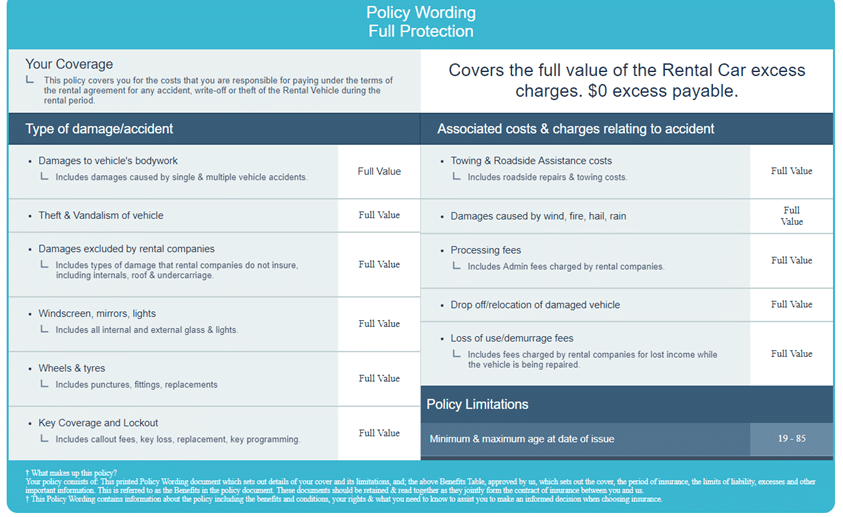

Another option is to purchase a rental car excess cover package from a third-party provider, such as RentalCover or Worldwide Insure .

This works similarly to the rental car excess benefit provided under a travel insurance policy; it covers you for the excess on your rental car policy.

And, depending on the actual package you sign up for, you may also be covered for other charges such as damage to tyres, windows and car underbody, road rage incidents, mis-fueling the vehicle with the wrong type of fuel, etc.

The difference is that a third-party rental car excess plan may offer up to unlimited waiver of all excess and incidental charges, such that you do not have to pay extra should your rental car get damaged or stolen.

You may find that in comparison to your rental car provider, third-party rental car packages may offer better value, providing all-round cover at a lower cost.

Related to this article: Driving to Malaysia in 2023: The Ultimate One-Stop Guide

What are the other rental car protection types I can get?

When renting a car, there are several common policies available to enhance your insurance for car rentals abroad and provide you with added protection and peace of mind during your travels. Even the best travel insurance for road trips may not offer complete coverage so it is recommended to consider these additional protection types.

Collision damage waiver (CDW)

A collision damage waiver (CDW) offers comprehensive coverage for any damage to a rental car in your possession. Whether you encounter an accident while on the road or come to find your car damaged while it was parked, a CDW ensures you're not financially responsible for repairs. This waiver often includes coverage for accident-related towing fees, the rental agency's administrative fees and any lost revenue from the vehicle being unavailable for rent, known as loss of use.

Loss damage waiver (LDW)

A loss damage waiver, or LDW, enhances your car rental insurance by combining the benefits of a CDW with theft protection. This means not only are you covered for damages to the rental car, but you're also protected in the event the car is stolen during your rental period.

It's important to note, however, that neither LDW nor CDW covers damages to other vehicles or injuries resulting from an accident while abroad.

Supplemental liability insurance (SLI) is a crucial addition to any overseas car rental insurance policy. It covers claims made by third parties for physical damage or injuries they sustain due to the rental vehicle. This coverage is vital even if the accident was not your fault, offering protection against potential financial liabilities resulting from third-party claims.

A note on driving in West Malaysia

Oh, one more thing. If all you’re doing is driving up to West Malaysia, know that you may be able to get by with the motor insurance policy you obtained for driving in Singapore.

This is because most (if not all) motor insurance plans in Singapore cover for driving not only in Singapore but within West Malaysia and a little bit into South Thailand (typically, 80 km in).

However, you need to check with your insurer if your policy still covers you when driving a rental car – some insurers may not allow this.

Having said that, it might still be a good idea to get a cheap Malaysian travel insurance and a separate international car insurance for your out-of-Singapore road trip regardless.

Why? Well, because should you inadvertently get into a fender bender on the North-South Expressway, you can use your rental car insurance to settle any claims.

Otherwise, if you only have your primary motor insurance, you’d have to take a hit on your No-Claim Discount as well as risk having your premiums increased.

Related to this article: What to Look for in a Car Insurance When Driving to Malaysia

Read these next: Travel Insurance Guide: Five Things All Travellers Must Know Is Travel Insurance With COVID-19 Coverage Still Necessary? Best Travel Insurance For Travellers With Pre-Existing Conditions Why You Should Buy Travel Insurance (And What Happens If You Don't)

Similar articles What is Public Liability Insurance and What Does it Cover? Car Warranty vs Car Insurance: What’s the Difference? 7 Facts You Need to Know About Car Rental Insurance in Singapore What to Look for in a Car Insurance When Driving to Malaysia AIG Car Insurance Review (2024): Lean-but-Robust Car Insurance Travel Insurance Add-ons: Which Ones are Worth Your Money? What Should You Do If Your Car Gets Stolen Overseas? Etiqa Private Car Insurance (Review): Affordable Base Plan With Option To Pay For Add-ons

Tags Travel Insurance Best Travel Insurance car rental insurance Compare Travel Insurance road trip driving overseas

An ex-Financial Planner with a curiosity about what makes people tick, Alevin’s mission is to help readers understand the psychology of money. He’s also on an ongoing quest to optimise happiness and enjoyment in his life.

Related Articles

Allianz Travel Hero Review: Fuss-Free Plan that is Value-For-Money

American Express Travel Insurance Review: Protect Both Your Trip and Your Miles

OCBC Travel Insurance Review

Financial tip:, use a personal loan to consolidate your outstanding debt at a lower interest rate.

© 2015-2024 SingSaver PTE LTD. All rights reserved. This online platform is operated by SingSaver Pte. Ltd. and by continuing to use www.singsaver.com.sg (the “SingSaver Website”) or by carrying out a transaction on the SingSaver Website, users are deemed to have agreed with the Terms and Conditions and Privacy Policy of the SingSaver Website. All insurance product-related transactions on the SingSaver Website are arranged and administered by SingSaver Insurance Brokers Pte. Ltd., a wholly owned subsidiary of SingSaver Pte. Ltd. SingSaver Insurance Brokers Pte. Ltd. is a licensed and authorised broker regulated by the Monetary Authority of Singapore (“MAS”). SingSaver Pte. Ltd. (which administers all other financial products on the SingSaver Website) is not regulated by MAS. SingSaver is located at Eon Shenton, 70 Shenton Way, 18-08, Singapore, 079118 .

- Travel Insurance

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Travel Insurance For Singapore: The Complete Guide

Updated: Apr 2, 2024, 4:42pm

Table of Contents

Singapore travel insurance, what does travel insurance for singapore cover, can i tailor my travel insurance for singapore, what does travel insurance for singapore exclude, how much does travel insurance for singapore cost, how can i compare travel insurance for singapore, frequently asked questions (faqs).

Singapore has long been a holiday favourite for Australians, either as a stop-over city on the way to Europe or the Middle East or as base for exploring Asia. According to the latest figures from data portal, Statista, 566,000 Australians visited the country in 2022.

If you’re also planning to visit, travel insurance for Singapore can safeguard your trip against a number of potential mishaps, such as falling ill while away, losing your luggage and belongings or even needing to cancel the trip before it’s even begun. Singapore is a safe country, but the cost of medical care is high. Find out more about how travel insurance for Singapore works below.

There are three main types of travel insurance policy for Singapore. These are:

- Single trip: for a one-off trip in the space of 12 months to Singapore

- Annual multi-trip : for more than one trip in the space of 12 months to Singapore or various destinations. This type of cover can work out more cost-effective than buying multiple single trip policies but not always so it’s best to compare both types of cover.

- Long-stay/backpacker : for an extended stay in Singapore, of typically 60 or 90 days, or 12 or 18 months. Cover for 24 months may be available, from certain providers.

When applying for travel insurance online, you’ll first be asked to enter your holiday destination. Depending on the insurer, you’ll need to click on Singapore, Asia or Worldwide travel excluding the US and nearby destinations such as Mexico, the Caribbean, Canada and Greenland. The latter option excludes a part of the world where medical costs are the highest, which in turn, bumps up the cost of cover. If you’re also planning to travel to the US, for example, there are separate worldwide policies that include it as a destination.

Insurers usually offer at least two or more types of travel insurance policy from basic or comprehensive cover and anything in between. Comprehensive policies offer the highest cover levels and widest range of benefits.

A key component of all travel insurance policies is emergency medical cover. You’ll find a comprehensive policy for Singapore will often offer an unlimited amount.

The standard of medical facilities and care in Singapore is similar to, or higher than in Australia, and the cost often much higher, so medical cover can prove a vital resource should you fall ill, or get injured, while away.

Note that in the case of an emergency, you’ll likely need to pay up-front first, and then reclaim the costs from your insurer, or confirm payment from your insurer with a hospital before it will provide treatment.

As standard, travel insurance for Singapore can also cover repatriation and emergency rescue, in severe medical cases, the loss or theft of your baggage and belongings and trip cancellation if you can no longer travel for reasons such as falling ill, suffering a bereavement or losing your job.

They will also likely include an array of other forms of protection, providing the most at comprehensive level. This includes cover for lost or stolen money, passports and documentation, missed departures, online fraud, and travel delay. The types of cover on offer, and cover limits, will vary between providers. You can find exactly what a policy includes in its product disclosure statement (PDS), which is usually found on an insurer’s website.

There are a number of ways you can ensure your policy fits your needs. Many insurers offer optional add-ons that you can purchase if you need specialised cover. These include insurance for gadgets (such as a smartphone or laptop), a cruise and playing golf.

If you’re thinking of participating in more high-octane activities, check your policy’s PDS. Many cover around 100 or so sports automatically. Cover for what an insurer classes as high-risk activities, such as skydiving, bungee jumping, outdoor rock climbing, and activities requiring a set of wheels, such as quad biking, may require purchasing an additional ‘sports pack’ for your policy.

While reading through a policy’s PDS, it’s crucial to also take note of any limitations of cover. These can differ between policies, but generally you can expect most insures to refuse claims relating to a pre-existing condition. This is a medical condition you had before taking out the policy. The insurer may not cover such conditions, or may refuse your claim if you did not declare your condition on applying for the policy.

An insurer is also unlikely to accept claims for an injury caused by taking part in a sport or activity where you did not wear the appropriate safety gear, such as a helmet, knee pads or a harness. Claims resulting from disorderly behaviour or being under the influence of drink or drugs will also likely be rejected.

It’s best to regularly check government advice for your destination, which it publishes on its Smartraveller website. This includes warnings about natural disasters, terrorism threats and pandemics. Visiting Singapore, or a part of the country, if the government puts it on its “do not travel” list, could invalidate your policy.

The amount you’ll need to pay for your travel insurance policy will depend on a range of factors. An insurer will consider your holiday destination, associated costs when travelling there and the length of time you’ll be travelling.

The price of a policy can rise for mature travellers and those with pre-existing conditions, as insurers view these travellers as more likely to claim on their policy.

To provide an idea of how much travel insurance for Singapore can cost, we ran quotes on the sites of the insurers we’ve rated the top five for travel insurance.

We used the profile of a family of four, aged 42, 40, 14 and 12, spending 13 to 26 May in the country, and assumed they have no pre-existing conditions, (although these providers do offer cover for pre-existing conditions should you need it).

We found basic cover ranged from around $106 to $202, while comprehensive cover started at around $241, with the most expensive policy costing just under $304.

Before choosing a policy, it’s important to shop around. An easy way to do this is to run quotes on the websites of various insurers and compare factors such as the type of cover a policy includes and cover levels against price.

To help you with your search, we’ve conducted some research and found our pick of the best comprehensive travel insurance policies .

Is travel insurance for Singapore worth it?

While travel insurance for Singapore isn’t mandatory, it can be considered a travel essential if you have no other means of covering emergency costs while away.

Emergency medical fees can easily stack up to thousands of dollars alone, and without travel insurance in place, you would have to cover them out of pocket. Travel insurance also can cover a number of eventualities that we often fail to consider, such as an airline, transport company, or accommodation provider going bust.

What is ‘excess’ in insurance?

An excess is a set amount you’ll be expected to pay on each approved claim. It’s usually levied per person on the policy, per event, per claim, but you can check the PDS for the specifics concerning your insurer. You usually can pick from a range of excess amounts, from $50 to $250 on average, when taking out a policy.

The more you choose to pay in excess, the lower your policy premium—the cost of your policy—typically will be, while paying less in excess will raise the cost. An excess is usually deducted from a claim amount, so you won’t need to pay for it out of pocket. However, it’s still crucial that you make sure it’s affordable.

Can I buy a policy while I’m in Singapore?

Some providers won’t cover a holiday if it’s already started. Others may cover you, but apply a waiting period of around 72 hours before you can claim.

The best time to take out travel insurance is as soon as you’ve booked your holiday, as you’ll be immediately covered for trip cancellation. Insurers are highly unlikely to consider claims resulting from something that happened before you took out the policy.

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Best Family Travel Insurance

- Travel Insurance Cancellation Cover

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

- Cover-More Travel Insurance Review

- Fast Cover Travel Insurance Review

- Travel Insurance Saver Review

- Allianz Comprehensive Travel Insurance Review

- 1Cover Comprehensive Travel Insurance Review

- Australia Post Comprehensive Travel Insurance Review

More from

The new travel document aussies will need to visit europe, our pick of the best comprehensive travel insurance providers in australia, our pick of the best cruise travel insurance, travel insurance direct review: pros and cons, cover-more comprehensive travel insurance review, insureandgo travel insurance review.

I have been writing for newspapers, magazines and online publications for over 10 years. My passion is providing, in a way that is easily accessible and digestible to all, the knowledge needed for readers to not only manage their finances, but financially flourish.

Popular searches

Your search history

No search history

- Our products

- TravelSmart Premier

TravelSmart Premier | Travel Insurance

Greater assurance with extended coverage for covid-19.

- Get up to 30% off

With no additional premium needed, get up to $150,000 coverage 1 expenses and emergency medical evacuation if you are diagnosed with COVID-19 during your travels. Read more

Embark on your travels with financial protection. Yes now you can – whether it’s a much-deserved holiday, that overdue adventure tour, a quick weekend getaway or essential work travel.

Now you can be fully immersed in your travel experiences, knowing that TravelSmart Premier is providing you the protection against unexpected events –from travel delays to leisure adventurous activities accidents.

For existing customers, we will pre-fill your details to simplify your purchase. Use the Great Eastern App to make a faster purchase today.

Key benefits

Extended coverage for travel inconveniences due to covid-19.

Whether you, your relative or travel companion on the same trip is diagnosed with COVID-19, you can be assured that your coverage is extended to support cancellations and postponements. Get complete peace of mind with an automatic extension of coverage up to 30 days, without extra premium, if you are hospitalised or quarantined overseas due to COVID-19.

Comprehensive worldwide protection with extensive medical coverage

Travel with ease as you are supported with our 24-hour international emergency assistance services including up to $1 million emergency medical evacuation coverage.

Our plan also extends to cover medical expenses that includes Emergency Dental Treatment 2 , Traditional Chinese Medical (TCM) and Chiropractor treatments.

Protect against unexpected travel cancellation and inconveniences

Up to $15,000 coverage against flight cancellations and includes coverage for other travel inconveniences, like loss of baggage, non-recoverable accommodation expenses and trip disruptions due to unforeseen events.

Complimentary benefits at no extra premium 2

Indulge in action-packed adventures like mountaineering, snowboarding and skydiving, knowing you are covered at no additional premium.

Your questions answered

(Applicable for Elite and Classic single trip 2-way plans and annual multi-trip plans, each trip must not exceed 90 days.)

If you are purchasing a new policy, we have extended the TravelSmart Premier policy to cover certain situations pertaining to COVID-19. This means that for some benefits, cover is expanded to include losses occurring after COVID-19 was a known event and could reasonably have been expected to lead to a claim. For a detailed summary of what is covered or not covered for COVID-19, please refer to the policy wording.

Before purchasing the policy, please note that: • Your Trip is under the latest permitted travel arrangement as per Singapore Government travel advisory. • For single-trip policies and annual multi-trip policies, the extension only applies if the trip is no longer than 90 days in a row. • The extension is applicable to Elite and Classic plans only. • You are not serving stay home notice or quarantined due to COVID-19 or traveled to any countries other than the list of countries permitted as per Singapore Government travel advisory within 14 days before your trip started. • If required by authorities, you must take a COVID-19 Polymerase Chain Reaction (PCR) test or any COVID-19 equivalent test approved by Singapore authorities within 72 hours before the start of your trip and you must be tested negative. Otherwise, there is no cover under section 38a - Medical expenses while overseas, section 38b - Emergency medical evacuation, section 38c - Repatriation, section 38g - Automatic extension of cover, section 38h – Overseas quarantine allowance and section 38i - Overseas hospital allowance of this extension. • We will not cover if you, a relative, or a travel companion is diagnosed (or suspected of being infected) with Covid-19 at the point of purchase of this policy or trip.

Q1: What are the benefits provided for COVID-19 cover?

Please refer to the table below for COVID-19 coverage:

Q2: Where can I find details on the latest permitted travel arrangements issued by the Singapore government?

For the latest permitted travel arrangements issued by the Singapore government, please visit ICA Safe Travel website at https://safetravel.ica.gov.sg/ .

Q3: If the destination that I am going to has been suspended from the latest permitted travel arrangement as per the Singapore authorities, will I still be covered for the COVID-19 extension if I proceed with the trip?

No, the COVID-19 extension is only applicable if your trip is under the permitted travel arrangements as per the Singapore Government travel advisory at the point of your trip commencement.

Q4: If I have already departed for my trip before the permitted travel arrangement was suspended by the Singapore authorities, will I still be covered for the COVID-19 extension?

Yes, you will still be covered under the COVID-19 extension in view that the permitted travel arrangement was suspended after you have departed for your trip.

Q5: Will the policy cover my loss if I need to cancel my trip due to being diagnosed with COVID-19?

We will pay for any non-recoverable travel, accommodation expenses and/or cost of entertainment tickets that were paid in advance due to the cancellation of your trip if you are diagnosed with COVID-19 in Singapore within 30 days prior to the scheduled departure date of your trip. Please note that reimbursement of any travel and/or accommodation expenses redeemed using mileage points, holiday points or any reward schemes is excluded. If the policy is purchased less than seven days before your departure date, the Trip Cancellation benefit will only apply upon death due to COVID-19.

Q6: Will the policy cover my loss if I need to postpone my trip due to being diagnosed with COVID-19?

We will pay for any non-recoverable administrative charges arising from your travel and accommodation expenses that were paid in advance due to the postponement of your trip if you are diagnosed with COVID-19 in Singapore within 30 days prior to the scheduled departure date of your trip. Please note that reimbursement of any travel and/or accommodation expenses redeemed using mileage points, holiday points or any reward schemes is excluded.

Q7: I want to cancel my travel plans because I'm afraid to travel due to COVID-19. Am I covered?

Trip cancellation due to concern or fear of travel because of COVID-19, is not covered under the policy.

Q8: Can I claim for compensation if my flight is delayed by airline following instruction or recommendation by the government due to COVID-19 situation?

Flight delay by airline following instruction or recommendation of the government due to COVID-19 situation does not fall under the policy coverage.

Q9: If I contracted COVID-19 while traveling overseas, can I claim for medical expenses incurred?

We will reimburse the overseas medical expenses incurred up to 90 consecutive days from the date you are diagnosed with COVID-19. Please note that the policy will not cover your overseas medical expenses incurred if you are travelling against the advice of the Government or any local authority at the destination.

Q10: Will the policy cover my loss if I am diagnosed with COVID-19 during my trip and as a result, I am unable to continue with the trip?

We will pay up to the sub-limit that applies to your selected plan for the reasonable extra travel expenses or the cost of the unused portion of non-recoverable travel expenses (economy class), accommodation costs and entertainment tickets (for admission to theme parks, musicals, plays, theatre or drama performances, concerts or sports events) that you paid in advance if you are forced to change any part of your trip as a direct result of you, a relative on the same trip, or a travel companion being diagnosed with COVID-19 by a medical practitioner while you are overseas.

Q11: Will my policy be automatically extended in the event that I am hospitalised overseas or quarantined due to COVID-19?

We will automatically extend your period of insurance with no extra premium for up to 30 days if you are hospitalized or quarantined overseas as a direct result of you being diagnosed with COVID-19 by a medical practitioner while you are overseas.

Q12: If I am quarantined overseas, am I entitled to any overseas quarantine allowance under my travel insurance

We will pay you a cash benefit up to the limit that applies to your selected plan for each full 24-hour period of quarantine, if you are placed under mandatory quarantine by the local authorities as a direct result of you being diagnosed with COVID-19 by a medical practitioner while you are overseas. Quarantine benefit is payable for quarantine at designated facility which is legally recognized by respective countries’ legislation.

Q13: If I am hospitalised overseas, am I entitled to any hospital allowance under my travel insurance?

We will pay you a cash benefit that applies to your selected plan for each full 24-hour period that you are in hospital overseas as an inpatient as a direct result of you being diagnosed with COVID-19 by a medical practitioner while you are overseas.

Q14: If I contracted COVID-19 upon my return to Singapore, can I claim for medical reimbursement?

The policy is designed to protect you during your overseas journey. If you are diagnosed with COVID-19 within Singapore, after your journey, your policy will not cover the costs of any medical expenses incurred locally.

Q15: Who can purchase TravelSmart Premier?

In order to qualify for travel insurance from Great Eastern, you must meet the following criteria: • You are a Singaporean or Singapore Permanent Resident; or foreigner with a valid Employment Pass, Work Permit, Dependant’s Pass, Student’s Pass or Long Term Social Visit Pass residing in Singapore. • You are at least 18 years old at the time of purchase (only required if you are the applicant). • You are not travelling contrary to the advice of a qualified medical practitioner or for the purpose of obtaining medical treatment. • You bought the policy before you leave Singapore on your trip.

Q16: What is the difference between TravelSmart Premier Basic, Classic and Elite Plans?

The differences are in the policy features and maximum amounts payable per person per trip in the event of a claim. For the best cover and highest protection, we suggest you choose Elite plan. You can view the travel policy document and compare the amounts payable for each of the policy features, to help you choose a suitable plan.

Q17: Who is considered Family under TravelSmart Premier?

For Single Trip Policies, Family means: • An adult and/or his/her spouse and unlimited number of biological or legally adopted children; or • One (1) or two (2) adults who are not related by marriage and a maximum of four (4) children who must be at least family related (i.e. biological or legally adopted child or ward, sibling, grandchild, niece, nephew or cousin) to any one of the adults; and All insured persons under the Single Trip Family Cover must depart from and return back to Singapore together at the same time as a Family.

For Annual Multi-Trip Policies, Family means: • An adult and/or his/her spouse and unlimited number of biological or legally adopted children; and • The insured persons under the family cover are not required to travel together on a journey. However, child insured person under the age of ten (10) years must be accompanied by a parent or adult guardian for any trip made during the period of insurance.

Q18: What do I indicate as the Period of Insurance?

You will need to indicate the start date and end date of your trip for the Period of Insurance. The start and end date will be based on Singapore time. • Start date: The date you are departing from Singapore (e.g. If you are departing from Singapore on 04 Dec 2020 23:50, you should indicate the Start Date as 04 Dec 2020). • End date: The date you are arriving in Singapore (e.g. If you are arriving in Singapore on 05 Dec 2020 00:30, you should indicate the End Date as 05 Dec 2020).

Q19: Can I purchase TravelSmart Premier for my child who is traveling on a student exchange program or field trip?

Yes, child below 18 years old can apply for any plans under an individual cover, provided the proposal is made in the parent or adult guardian's name. Child below 10 years old must be accompanied by an adult (parent or guardian) for the entire trip. Please note that child benefits apply.

Q20: Can I purchase travel insurance if I am already overseas?

No, you will need to purchase your travel insurance before setting off for your overseas trip from Singapore. We strongly encourage you to purchase early before departure as our travel insurance provides pre-journey coverage as well.

Q21: If I have pre-existing illness, can I still purchase travel insurance?

Yes, you may still buy the policy. However, please note that the policy does not cover any loss, damage or liability directly or indirectly arising as a result of any pre-existing medical condition. For more information, please refer to your policy documents.

Q22: I will be travelling to more than two countries and will be back to Singapore before flying to the next country (e.g. Singapore > Bangkok > Singapore > Seoul> Singapore). Can I purchase one single trip policy for the entire journey in this case?

Sounds like a great trip! In this case, you will need to buy 2 separate single trip policies because the coverage for a single trip policy ends when you return to Singapore. Alternatively if you travel more than 3 times a year, an annual policy would be recommended as your insurance costs will be considerably cheaper compared to buying a single trip travel policy each and every time.

Q23: I’m travelling to more than one country during my trip. Can I still get a policy?

Yes, please select all destinations on your itinerary.

Q24: If I am travelling overseas to seek medical treatment, can I take up travel insurance?

Our policy covers people who are travelling overseas for business or for holiday. It is not intended to cover people who are travelling to seek medical treatment.

Q25: If I am only travelling one-way, will I be able to purchase travel insurance?

Yes, please select one-way trip. Your cover will cease when you arrive at your place of residence or workplace in the destination country within 4 days, or 3 hours after you have cleared immigration in the destination country, whichever is earlier.

Q26: Does the policy cover business travel?

Yes. Your policy will cover you for business travel except for • any loss, damage or liability arising as a result of manual or hazardous work; • travel relating to your job as a licensed tour guide or staff of a travel agency; • you taking part in naval, military, air force, civil defence or police training, duties, services or operations. For more information, please refer to the policy document.

Q27: What is the maximum period of coverage for an overseas trip?

• For Single Trip Policy: 182 consecutive days for Classic/ Elite Plan and up to 30 consecutive days for Basic Plan. • For an Annual Multi-Trip Policy: 90 consecutive days for Classic/ Elite Plan and up to 30 consecutive days for Basic Plan.

Q28: When will the coverage for my travel policy start?

Our pre-journey benefits provide coverage for trip cancellation and postponement 30 days before your departure date or policy issuance date, whichever is later. For all other benefits, the coverage starts after departure from Singapore.

Q29: I am stranded in a country and my policy is expiring. Can it be extended?

The Policy will be automatically extended (all plans except Basic Plan) without any additional premium for: • Up to a maximum of 30 days if you are hospitalised and quarantined overseas as advised by the attending medical practitioner. • Up to a maximum of 7 days if: a) The conveyance in which you are travelling is delayed through no act or omission of you. b) The airport or seaport is closed due to adverse weather conditions, strike, riot or civil commotion with the result that the Trip is not completed when the Period of Insurance ceases.

Q30: What are some of TravelSmart Premier’s general exclusions?

TravelSmart Premier does not cover any loss, injury or damage arising if: • You have a pre-existing medical condition. • You are not fit to travel or are travelling against the advice of a doctor. • Any strike, riot, civil commotion, dangerous health threat, natural disaster or any events in the destination you are traveling to which a government or any relevant authority issued a public warning or statement about before you left Singapore. Please refer to the policy wording for the full list of exclusions.

Q31: Are any countries excluded from coverage?

TravelSmart Premier does not cover any travel in, to, or through UN sanction list of countries such as: • Cuba • Iran • Syria • Crimea Region • North Korea

Q32: Does TravelSmart Premier cover adventurous activities?

If you have purchased the Elite or Classic plan, the Policy covers accidental injury or death when you participate in these activities for leisure purposes and under guidance and supervision of qualified guides or instructors of the local licensed tour operator: • Bungee jumping; • Canoeing or white water rafting with a qualified guide and below Grade 4 (of International Scale of River Difficulty); • Dog Sledding; • Hang gliding; • Helicopter or airplane rides for sightseeing; • Hot air balloon rides for sightseeing; • Jet skiing; • Mountaineering at mountains or trekking below the height of four thousand (4,000) metres above sea level; • Paragliding; • Parasailing; • Skiing or snowboarding all within official approved areas of a ski resort; • Sky diving; • Underwater activities involving artificial breathing apparatus for diving up to a maximum depth of thirty (30) metres and insured holds a PADI certification (or similar recognised diving qualification) and is diving with a buddy who holds a PADI certification (or similar recognised diving qualification) or with a qualified diving instructor; • Zip-lining, Zip-riding.

Q33: Does being pregnant affect my travel insurance cover?

We will pay for your necessary medical treatment outside Singapore within the stipulated policy limits for pregnancy-related sicknesses. However, this is not applicable if treatment is sought in home country or for a one way trip policy.

Q34: Am I covered for emergency medical treatment including air ambulance to get me home?

Yes, if the treating doctor and our medical emergency assistance provider agree that an air ambulance is necessary, you will be covered up to the limits shown in your policy.

Q35: Who decides when emergency evacuation is necessary?

This decision will be made by consultation between the treating doctor and our medical emergency assistance provider. Please call our 24-hour Emergency Assistance Hotline at +65 6708 7453 for assistance.

Q36: If I have misplaced my receipts/ documents, can I still claim for loss of personal items?

It is important that you keep the original documentation and receipts for any items that you intend to make a claim for, as this will provide a more accurate assessment of their value. If not, your claim may be affected.

Q37: What should I do if any of my belongings are lost or stolen? Is a police report required?

You need to report the theft or loss to the police within 24 hours of discovering it, and ask them for a report in writing. If applicable, report the theft or loss to your airline, transport company or hotel and ask them for a report in writing. These documents will be required when you are making a claim.

Q38: What should I do if I fall sick or encounter an accident abroad?

Please contact our 24-hour Emergency Assistance Services Hotline at +65 6708 7453 if you need emergency medical assistance while travelling.

Q39: How do I file for a claim?

To submit a claim, you can download a copy of our claim form here: https://giexchange-sg.greateasterngeneral.com/giexchange/pdf/Travel_Claim_Form.pdf. Claims submission should be filled in with full particulars and full facts of the claim including its occurrence, detailed circumstances and extent of loss, and submit it with any supporting documents as soon as reasonably possible but no later than 30 days after the incident. For general enquiries: Please contact our Customer Service Hotline at 6248 2888, Mondays to Fridays, 9am to 5.30pm (excluding public holidays) or email us [email protected] . Alternatively, you can inform your servicing agent who can also assist you with the claim.

Q40: Will I receive a premium refund if I decide not to proceed with my Trip?

• Cancellation for Single Trip Policy: The policyholder may cancel this Policy at any time prior to the commencement of this Policy coverage and the cancellation will apply from the date we receive the notice of cancellation. We will refund the premium paid less S$25 administrative charge. However, there will be no refund if we receive the notice of cancellation on or after your trip departure date.

• Cancellation for Annual Multi-Trip Policy: If this Policy is issued as an annual multi-trip Policy, it may be terminated by either party by giving 1 month’s written notice. If this Policy is terminated by us, a pro-rata refund of premium will be granted to the Insured for the remaining part of the Policy Period. If the Insured terminates this Policy, the refund of premium will be based on the following scale:

Q41: Can I amend the start date of my travel policy?

Unfortunately, it is not possible to amend the start date. The existing policy would need to be cancelled and replaced with a new policy. Please note that you cannot cancel a short-term travel policy once you have passed the designated start date.

Q42: What type of changes do we need to tell you about?

You will need to inform us of any changes to the information completed when taking out travel insurance from us. This will include, but not be limited to: your name, your travelling companion details, details of your children, trip details including region to be visited and duration of trip, and any other additional information that might impact on your risk either before or while travelling.

Let us match you with a qualified financial representative

Our financial representative will answer any questions you may have about our products and planning.

How can I help you?

Your last Servicing Representative will contact you.

Enter contact details

We'll send you a text before calling.

By continuing, you are agreeing to Great Eastern Privacy Policy .

Your submission has been sent successfully.

Your submission has failed. Please try again.

Understand the details before buying

With effect from 15/10/2021, COVID-19 coverage will be extended under Elite and Classic plans automatically to countries under the latest permitted travel arrangements as per Singapore Government travel advisory. Kindly note that some countries may require COVID-19 insurance coverage as a condition of entry. Please ensure you select a plan that meet the requirement of your intended destination(s). For full details of the COVID-19 coverage, please refer to the brochure and FAQ.

1 COVID-19 extension is applicable up to 90 days each trip for Elite and Classic single trip 2-way plans and annual multi-trip plans.

2 Not applicable for Basic Plan.

- The above is for general information only. It is not a contract of Insurance. Please refer to the policy documents for the precise terms and conditions of the insurance plan.

- This policy is subject to the Premium Before Cover Warranty Clause, which requires the premium to be paid and received on or before the inception date of the Policy.

- This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites ( www.gia.org.sg or www.sdic.org.sg ).

- TravelSmart Premier is underwritten by Great Eastern General Insurance Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group.

Information correct as at 22 June 2022.

Sign up now to enjoy up to 30% off * Classic and Elite plans

Use promo code <TSP30%> for 30% off single trip 2-way plan

Use promo code <TSP10A> for 10% off annual multi-trip plan

Applicable for new sign-up(s) only.

Terms and conditions apply.

*Promotion is valid from 1 April to 30 June 2024.

Use the Great Eastern App to make a faster purchase today!

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

What are your options for rental car insurance?

Comparing dedicated rental car insurance policies available to Singapore residents.

Driving holidays are fun, but whenever I’m behind the wheel of a rental car I always have a certain paranoia that something will happen, resulting in a huge inflated repair charge (online horror stories of people getting 4 figure bills for a small scratch come to mind).

The best solution, as always, is insurance. Most travel insurance policies do cover some degree of rental car excess, but to put your mind at ease you might want to consider dedicated rental car insurance.

Rental car companies offer their own insurance packages, but these tend to be very expensive. If you’re traveling in the USA or Canada, for example, you’re looking at forking out an extra US$10-30 a day, which can really add up. In Europe and Australia, you’ll find that insurance is usually included in your rate, but with a high deductible. In those cases, you can buy a separate insurance package from the rental company to reduce that deductible to 0, again at a significant mark up.

That’s where third party rental car insurance comes in. The options can be bewildering at first, but in this article, I want to lay out some of the the options available to those of us resident in Singapore (typically defined as having stayed in Singapore for the past 6 months).

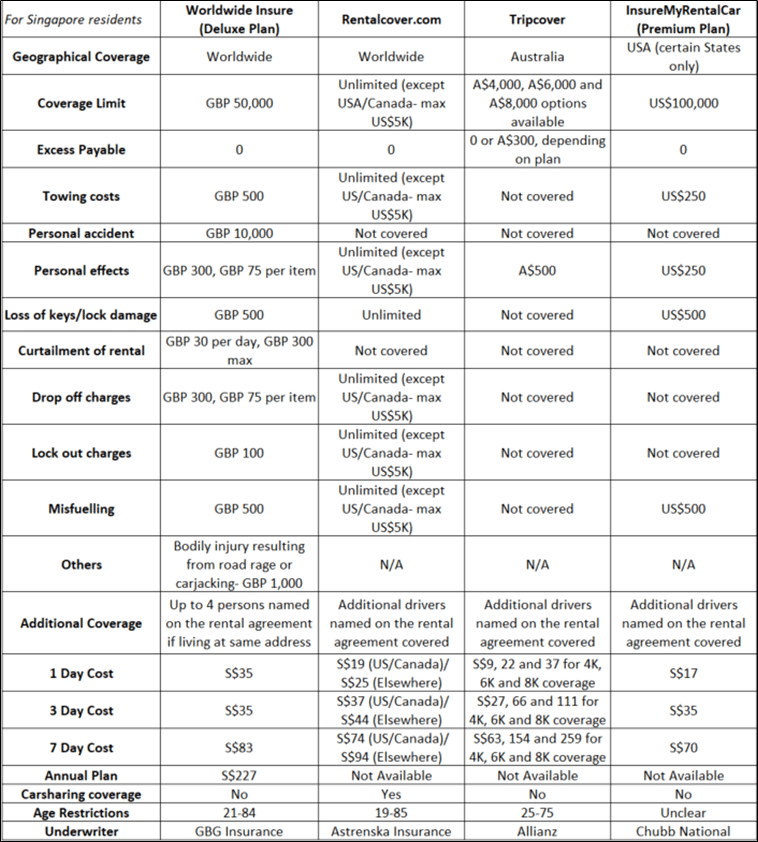

Here’s a summary table to kick us off:

Here are 3 questions to ask when selecting a policy:

- What is my residency?

The first and most important question. Your residency determines the type of plans and coverage available to you. I’ve made the above table with the assumption that you are resident in Singapore (which has nothing to do with citizenship- more about where you’ve stayed the past 6 months). There may be more options if you’re a resident elsewhere.

- How much coverage do I need?

The amount of coverage you require differs depending on the country you’re going to drive in. In Europe and Australia, for example, CDW/LDW is usually already included in your rental cost. This means that what you really need coverage for is the deductible (the amount of the damage you’re liable to pay before the rental company picks up the rest).

In the USA or Canada, however, CDW/LDW is optional. Rejecting it means you’ll need higher coverage because the rental company can go after you for up to and including the total value of the vehicle should the worst happen.

- What kind of provider am I using?

There is a difference between car rental and car sharing. Car rental is what Avis, Budget, Hertz, National, Europcar, Sixt, Thrifty, Dollar, Alamo, Advantage etc offer. Car sharing is what startups like Turo and TravelCar offer, where you rent the vehicle of another individual under a P2P arrangement. With the exception of Rentalcover.com, none of the plans here (or travel insurance plans for that matter) cover car sharing.

Let’s take a closer look at each of the four providers in the table above.

Worldwide Insure (Worldwide)

Worldwide Insure’s policy is underwritten by Bulstrad Life Vienna Insurance Group. You can view the full policy wording here .

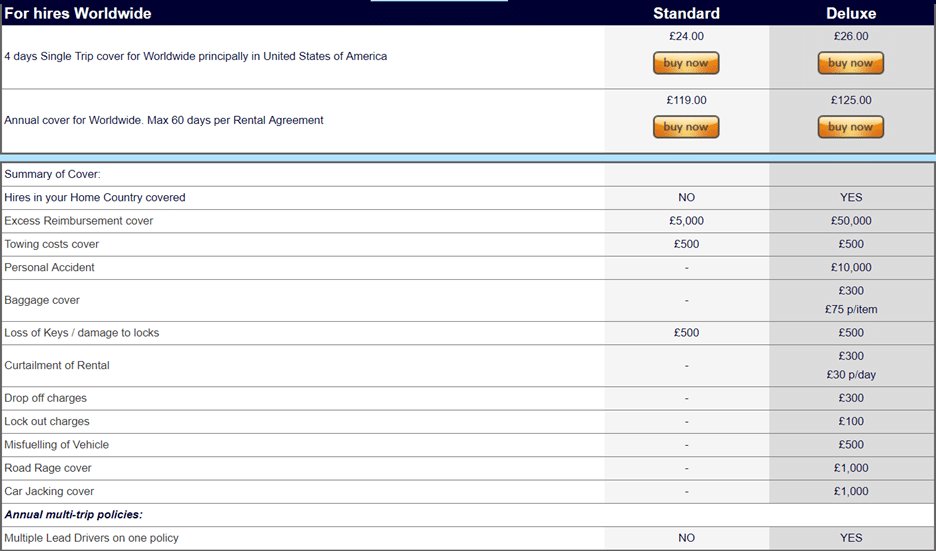

A few years ago, this was one of the best value plans on the market. In recent times, however, the price has gone up. When I first wrote about Worldwide Insure in 2015, coverage cost roughly GBP 3 per day, with an annual Standard package available for GBP 51 and Deluxe for GBP 59.

Here’s a quote I just pulled from their website:

As you can see above, the daily coverage cost is now about GBP 6 per day, with the Standard and Deluxe packages more than doubling in price. Given the small price difference between Standard and Deluxe and the vast difference in coverage (GBP 5,000 vs GBP 50,000), it really doesn’t make sense to go for the former.

Here are a few other things to note:

- The policy covers you plus up to 4 others named on the rental agreement provided you live at the same address

- If you opt for an annual plan, the cap on your rental duration is 60 days.

- The policy explicitly excludes Iceland

- This policy does not cover cars with a retail price in excess of GBP 50,000

- Unlike other dedicated rental car policies, this one includes personal accident/bodily injury coverage

Rentalcover.com (Worldwide)

Rentalcover.com’s policy is underwritten by Astrenska Insurance . You can find the full policy wording here . Do note that the exact wording may differ depending on which geography you’re renting from, so be sure to check when you’re booking.

Rentalcover.com offers high coverage, at a price to match. You’re really paying for peace of mind though, that no matter how expensive a car you rent you’ll be covered by the policy.

One crucial thing to note about RentalCover.com is that the coverage works differently depending on whether you’re renting in the USA/Canada or outside of it . If you’re renting in the USA/Canada, your maximum coverage is US$5K. You therefore need to opt in for CDW/LDW because this policy is not designed to cover the entire value of the car. If you’re renting outside the USA/Canada, policy coverage is unlimited.

Here’s how customer service puts it:

We would like to inform you that for visitors going to the USA we offer an Extra Cover USA, specifically designed for those customers whose car booking includes a “CDW” or “LDW” policy, the basic insurance. Although the CDW/LDW of your rental company does not have any deductible (meaning that, you will not have to pay a deductible in case of an accident because the rental company takes over the total value of the vehicle), the drivers could continue to incur significant expenses, costs not contemplated in the LDW. Therefore, this policy covers these possible costs up to a total of US$2,800.00. Please note that this amount is enough to cover any cost that the driver is obliged to pay in addition to the LDW policy (Partial Collision Damage and Theft Coverage). If you want, you can also increase the policy limit up to US$5,050.00 by logging into your RentalCover account. Our Extra Cover USA in addition to covering any type of damage to the rented vehicle (repair and replacement of windshields, tires, headlights and mirrors etc), includes free assistance on the road and covers damages, costs and other fees that are not included in the LDW policy of your company rental.

- This is the only policy that covers car sharing

- The policy covers any additional drivers named on the rental agreement

- There is no annual plan option, so you will need to buy a new policy every time you rent

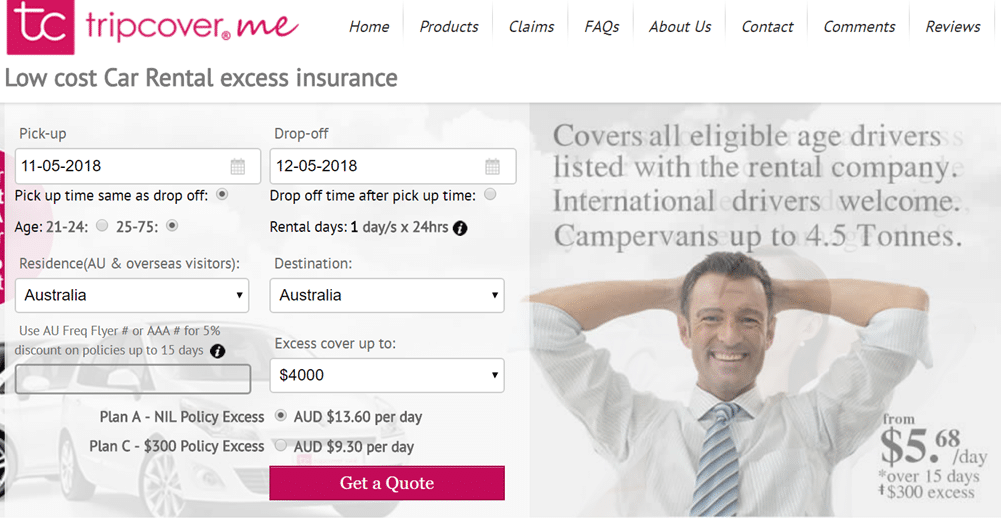

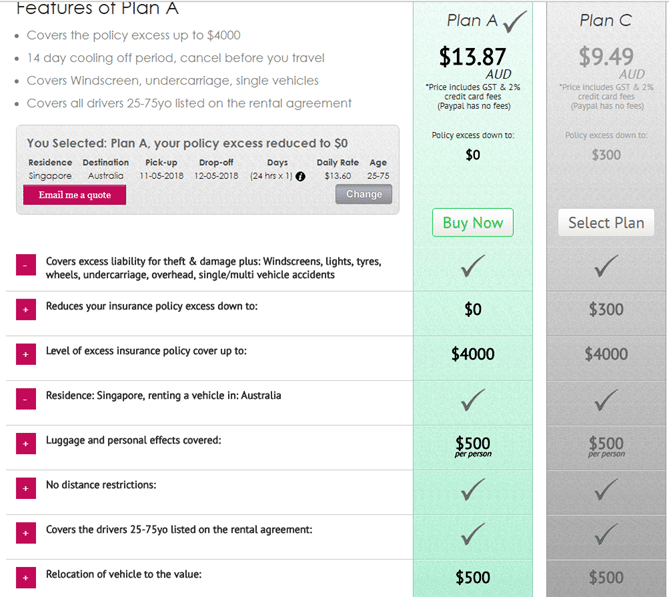

Tripcover (Australia)

Tripcover’s policy is underwritten by Allianz . You can view the full policy wording here .

You may have seen another Australia-only policy out there offered by Hiccup; it’s basically the same things as this. These policies can cover Australian residents when they travel overseas, but will only provide coverage in Australia for those of us resident in Singapore.

- Coverage here comes in 3 flavors, with total coverage of A$4K, $6K or $8K. That may sound lower compared to the coverage limits of the other 3 policies, but remember this is specifically for rental in Australia where insurance comes standard with the car. Ergo, this policy is meant to help you cover some of the excess for which you’d otherwise be liable, rather than the cost of the entire car

- The policy can have two sub-versions depending on what option you pick: either a A$300 deductible or 0 deductible . The price difference is really negligible so I’d just reduce it to 0 if I were you

- This policy will cover any additional drivers named on the rental agreement

- No annual plan is available, so you will need to buy a new policy every time you rent

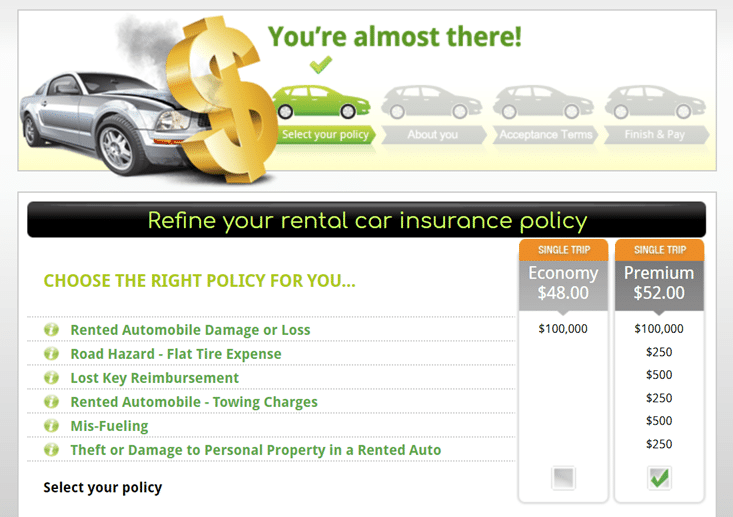

InsureMyRentalCar

InsureMyRentalCar’s policy is underwritten by Chubb National and ACE American Insurance . You can view the full policy wording here .

There is a small price difference between the Economy and Premium plans, and for the difference I’d much rather take Premium.

- This policy does not cover the following states: Iowa, Kansas, Louisiana, Massachusetts, Montana, New York, North Carolina, North Dakota, Oregon, Rhode Island, South Carolina, Texas, Virginia, Washington and West Virginia.

- But who cares, California’s included!

- I was not able to find age limits in the policy wording. If you have your heart set on this policy you’ll need to contact them to ask

It always makes sense to do some research beforehand on the CDW/LDW options offered by the rental company and compare the costs to what you’d pay with a third party rental car insurance policy. In some cases, you might be more than happy to pay the rental company’s rates (although US$35 a day in the States with Avis seems…excessive).

If not, be sure to check if your travel insurance provides you with the necessary coverage. Most policies cover between S$2-4K of damage, which may or may not suit your needs depending on where you’re heading. Such coverage would be insufficient for travel to the US and Canada, especially if you reject CDW/LDW, but might be ok for Australia or Europe.

- general travel

- rental cars

Similar Articles

Hack: skip the immigration lines in kuala lumpur with priority pass, details: changi terminal 2 northern wing reopens, 15 comments.

Tripcover Aus provides a discount for Qantas Frequent Flyer members (free signup)

Do some travel insurance and some credit card cos. include coverage?

only in the US

Mastercard World Elite provides CDW. Made a successful claim last year. https://www1.mastercard.com/content/dam/mastercardoffers/APMEA/world-elite/documents/TermsandConditions/CR_2018-2019_Mastercard_World-Elite_Singapore_TNC_English.pdf

Thanks David, saved me on buying travel insurance for the CDW! Didn’t know MasterCard WE offers this benefit!

i had no idea either. thanks for the tip

I think it’s worth a mention that the coverage provided by the rental car companies themselves do not require any spending upfront if an accident was to occur, however the services you mention above all require upfront payment to the car rental company which is then reimbursed by the insurance provider after payment has been made. (Time to whip out the foreign currency spend credit card)

Nice one Aaron. As an Australian living in Singapore, I’ve found the the most annoying thing about travel insurance policies here is that they never have enough (or any) insurance coverage for rental cars. For anyone renting in Australia (but the guide also generally applies everywhere except North America), I’ve updated my 2018 Ultimate Guide To Rental Car Insurance: https://www.ridehacks.com/ultimate-guide-to-rental-car-insurance

Be warned: it’s epic.

Your article is insanely good.

Thanks for the write-up .

The black hole is the ease or even possibility of claims since I believe the above doesn’t have local office in Singapore.

I can certainly forsee scammers setting up shop and collecting premiums.

Or I can forsee companies just not replying to your emails of claims and then what does one do.

Would be good if people who have claimed successfully volunteer to share their experiences !

My Friend in US says, on top of this we need to get the personal liability insurance. I could not see anyone offering that. Is it included in the CDW itself?

this should be covered by your regular travel insurance

Thank you Aaron

I think it’s worth a mention that the coverage provided by the rental car companies themselves do not require any spending upfront if an accident was to occur, however the services you mention above all require upfront payment to the car rental company which is then reimbursed by the insurance provider after payment has been made. (Time to whip out the foreign currency spend credit card) Car insurance

Hello Aaron, Woud you advice me to subscribe this policy for my new car ? https://www.axa.com.sg/car-insurance Thank you for this review by the way 🙂

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

Must Read Guide: Insurance For Car Rental In Singapore

- December 6, 2022

Share This Post

Table of Contents

You’ve got your rental car and are ready to start your trip. You probably would ask yourself, “what insurance should I get when renting a car?”.

Car insurance is meant to cover the rental car in case it gets into an accident. Most of the time, the car rental company buys car rental insurance before renting out the car. Here’s a guide to help you with your car rental needs.

Car Rental Insurance

Types of rental car insurance:

Collision Damage Waiver : Coverage for theft, vandalism, and collision damage to your rental vehicle.

Theft Protection : Protection against theft includes the cost of replacing a stolen rental vehicle and any repairs necessitated by an attempted theft.

Third-Party Liability : Coverage for bodily injury or property damage to a third party as a result of an accident you cause while driving a rented vehicle is known as third-party liability.

Personal Accident Insurance : Protects you and your passengers from financial hardship in the event of an accident while driving a rented car.

What Other Insurance Should Be Considered?

1. Windshield And Tires

Tire, wheel, and windshield damage are typically not covered by collision damage waivers. Renters are typically expected to cover repairing or replacing damaged parts, such as flat tires or bent rims.

People should choose this coverage so that they will not be financially responsible for the repairs if any damage occurs to those features.

This is probably because flat tires and cracked windshields happen often, so many insurance companies leave them out to keep their overall premiums low. But if you don’t want to risk paying for damage to both of these parts, make sure your policy covers them.

2. Travel Insurance

This type of insurance is highly recommended for renters who want to travel outside Singapore. However, the insurance coverage provided by some rental car companies is only valid within Singapore’s borders and becomes null and void when the rented vehicle leaves the country.

A good travel insurance policy can cover medical expenses, trip cancellation fees, lost luggage, and even car rental excess. Extra insurance coverage is always a wise investment when renting a car. Always choose full coverage, as this will protect you from the financial hardship of losing a sizable amount due to an accident.

3. Rental Car Requirement

Getting behind the wheel of a rental car from some companies requires meeting stringent requirements.

1. The minimum age to obtain a licence (younger drivers may be barred from obtaining one).

2. The minimum number of years of driving experience.

3. The type of licence

Note: An International Driving Permit is useful if you intend to drive while on vacation in another country (IDP). The International Driving Permit is a translation of your domestic licence. The IDP permits drivers to operate motor vehicles in foreign countries. You must always carry both your IDP and your national driver’s licence. Visit AA Singapore to obtain an International Driving Permit in Singapore.

4. Register Your Co-Driver

If a friend or family member will drive the rental car at some point, register them when you obtain car insurance.

While this will increase your insurance premiums – particularly if your co-driver(s) are young males with less than two years of driving experience – it is preferable to still register and pay for your co-driver..

In the event of an accident involving an uninsured driver, your auto insurance is automatically nullified, leaving you with no coverage whatsoever. Depending on the severity of the incident, this could be catastrophic or even financially ruinous.

The amount you must pay out of pocket before filing a claim with the insurance company is referred to as the “excess.” Most Singaporean insurers base their quotes on an excess of $500 or $600.

Both “excess” and premiums are costs you bear, so when comparing auto insurance quotes, you should consider both factors holistically. There is no point in being enticed by a car insurance policy with a low premium but a high deductible (such as $1,000 or more) if you end up in an accident.

Contact us to learn more and to better assist you with your car rental insurance needs.

6. Workshops

In most cases, your auto insurer will require you to take your vehicle to a service centre that they have pre-vetted and approved. In this way, you and your car insurance company can rest easy about the cost and quality of the repairs.

If you want to have your vehicle serviced at a specific repair facility, however, or if you simply want more options, you’ll need to select a plan that allows you to do so. Plans that cover maintenance at any garage will likely cost more than those that don’t.

7. Roadside Assistance

Do you think it would put your mind at ease to know that you could call for help whenever you needed it if you were involved in an accident?

If so, you should verify that your car insurance policy includes 24-hour roadside assistance. This could be especially helpful for inexperienced drivers who aren’t familiar with what to do in the event of an accident.

8. No Claims Discount (NCD)

The NCD guarantee is important because you don’t want to lose your entire NCD because of a single accident and then have to wait for years to get it back up to 50% or more. In the event of a claim, some car insurers offer NCD guarantees or protectors that last a lifetime.

9. Auto-Renewal Of Car Insurance Premium

It’s a bad idea to let your car insurance policy renew automatically every year: Annual car insurance rates fluctuate for various reasons, some of which are outlined above. When renewing your car insurance, it’s best to shop around and get quotes from at least three companies.

Singapore's Rental Car Restrictions and Low-Cost Insurance

Rental car insurance can be useful in preventing the rental company from going after you for costs related to damages and losses, but it is not without its limitations.

A car rental excess is an additional cost the renter pays when they pick up their rented vehicle.

Some rental car companies may charge a higher “excess” on damage claims to compensate for lower insurance premiums.

Renters are still responsible for paying for minor repairs and damages in the event of an accident.

Conclusion About Insurance For Car Rental

To know more about car rental insurance, talk to us and get a better grasp of what we can offer as the best rental car company. At Hong Seh Leasing , we value your time and efficiency in renting a car. We offer different leasing services for brands such as: Mercedes Benz , BMW , Toyota , and Lexus . We also offer electric van & lorry leasing for your travel needs.

Frequently Asked Questions About Insurance For Car Rental

Do i need to purchase a car insurance to rent a car.

All car rental companies must have insurance, whether comprehensive, Third Party Only, or Third Party, Fire and Theft. Car insurance is included in the rental package, so you don’t need it.

I Rented A Car And Damaged It; What Do I Do?

If you got into an accident, damaged a rental car, and don’t have collision coverage, you have to pay for it out of pocket. But if it’s with insurance — depending on what the car insurance covers — the excess/deductible varies.

Is There A Car Rental Insurance If I Go Overseas?

Only in Singapore will your car rental insurance cover you. If you plan on driving a rental car internationally, you should find out from the company whether or not coverage extends to driving in foreign countries.

Though some car rental insurance policies allow their vehicles to be driven abroad, these policies typically have coverage limits that do not extend to damage done while the vehicle is in foreign territory.

What Do I Do To File A Rental Car Insurance Claim?

Gather proof from the scene —Pictures and videos can help. Collect things like medical certificates, bills, and other costs. Your insurance company will want to know about any accidents within 24 hours or by the next business day.

If not, the insurer might not pay for any claims related to the accident, and the hirer might have to pay for all damages caused by the accident. If you need to, take your car to a certified shop.

© 2021 Hong Seh Group. All Rights Reserved.

- Single Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Family Travel Insurance

- Schengen Travel Insurance

- International Health For Individuals

- International Health for SME

- Travel Insurance Promotion

- COVID-19 Alerts

Tips on Getting a Suitable Travel Insurance To Cover Car Rental

When looking for a travel insurance policy to cover your car rental, there are a few things you need to keep in mind. First, make sure that the policy covers the country or countries you will be visiting. Some policies only cover specific countries, therefore it is important to read the fine print before committing to a plan.

Today, we will discuss a few tips on how to get a suitable travel insurance policy to cover your car rental.

1. Name All Co-drivers

If you plan on renting a car, be sure to name all co-drivers on your travel insurance policy. This will ensure that everyone is covered in the event of an accident.

Should an uninsured motorist drive your vehicle and get into an accident, your vehicle will not be covered for damages.

2. Inform Your Insurer If You Are Traveling To Another Border

3. ensure you qualify for driving a car overseas.

Some car rental companies overseas might have certain restrictions for renting a car.

This includes: age restrictions (disqualifying younger drivers), years of driving experience, and even the license type that you possess. In some countries, it is common for rental car companies to reject P-plate drivers.

An International Driving Permit (IDP) can come in handy if you plan on driving during your vacation abroad.

4. Check If The Car Insurance Covers Windshield and Tyres

Your rental car insurance may not cover the whole automobile. The windshield and tires, for example, may not be covered by your policy.

If your automobile's tyres are hacked or the windshield is broken during a robbery, you may be held responsible for the full losses if your insurance does not cover these two items.

Therefore it is important to check with your rental car company or insurance policy to see if they are included in the coverage.

5. Understanding Excess

The excess in car insurance policies is usually a fixed amount that you must pay before any claims are paid out.

For example, if your excess is $500 and you have an accident that causes $5000 worth of damage, you will only need to folk out $500, while your insurer covers the remaining $4500.

It is not worth claiming your insurance when for instance , you only have $100 worth of damage as your excess will usually be higher than the amount you need to pay.

Assuming having the same coverage, the lower the excess you want to pay, the higher your premium.

Buying Travel Insurance

Another alternative is to purchase a good personal travel insurance policy, which will cover you in the event of accident. Aside from obtaining comprehensive automobile rental insurance, visitors may rely on simply purchasing a decent personal travel insurance plan.

In addition, a travel insurance policy can cover you in a variety of situations, including medical emergencies, travel disruptions, flight delays, the loss of items, theft, and even automobile rental excess.