Growth of the Ocean Cruise Line Industry

Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024.

While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships. Simultaneously, new additions to fleets adopted a more modern and environmentally friendly approach. In 2024, passenger numbers are expected to surpass the pre-COVID levels of 2019.

Between 2023 and 2024, a total of 10 new ships, with a combined passenger capacity of 25,450, are set to be added (refer to the tables below). This influx will bring the worldwide ocean cruise passenger capacity to 673,000, spread across 360 ships. These vessels are projected to carry a total of 30.0 million passengers by the end of 2024, representing a 4.2% increase over 2023 and a 9.2% increase over 2019.

Shipbuilding Summary

Sources: Royal Caribbean Cruises, Ltd., Carnival Corporation and plc, NCL Corporation Ltd., Thomson/First Call, Cruise Lines International Association (CLIA) , The Florida-Caribbean Cruise Association (FCCA) , DVB Bank and proprietary Cruise Market Watch Cruise Pulse data.

Switch language:

Cruise in 2022: the state of the industry

Using the latest thematic insights from GlobalData, Peter Nilson looks at the state of the cruise industry.

- Share on Linkedin

- Share on Facebook

At the beginning of the year, many companies, governments, and travel authorities had predicted a stronger recovery for the cruise market in 2021. Unfortunately, that was not the case.

The pandemic has proven unpredictable, with many cruise destinations going into second and third lockdowns during 2021 after a global surge in Covid-19 cases .

Go deeper with GlobalData

Innovation in Ship: Anti-fouling Ship Hull Coatings

Environmental sustainability in ship: bio-fuel propulsion marine ve..., premium insights.

The gold standard of business intelligence.

Find out more

Related Company Profiles

The walt disney co, carnival corporation & plc, expedia group inc, norwegian cruise line holdings ltd.

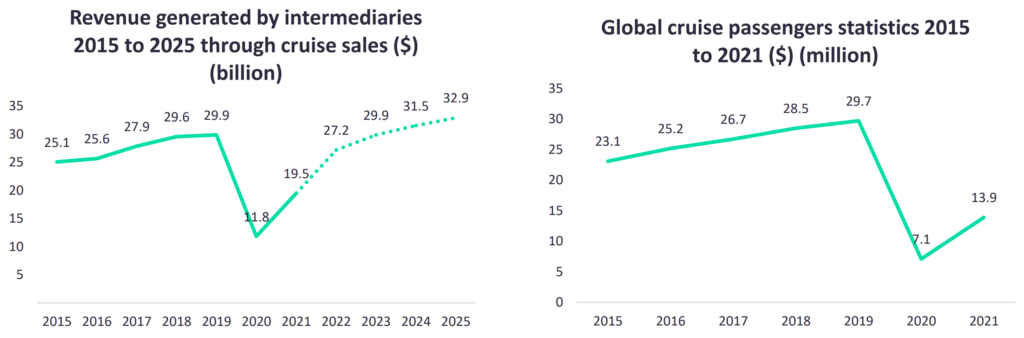

While the cruise industry has experienced a 96% Year-on-Year (YoY) increase of passengers, reaching 13.9 million, it still does not compare to the pre-pandemic levels of 2019, where there were 29.7 million passengers globally. It has been an even worse year for travel intermediaries specializing in cruise holidays.

These companies are the primary selling points for cruise trips and are often responsible for selling upgrades, premium drinks packages and excursions. Global spending across 60 major cruise markets increased by 65% YoY, resulting in total revenues of $19.4bn. Nevertheless, this was still far from pre-pandemic levels in 2019, which were approximately $29.8bn, 35% higher than 2021’s figure.

To reduce costs, many ships were retired between 2019 and 2021. Cruise ships are the most expensive assets, making this practice a necessity for many firms to stay afloat.

However, more optimistic times lie ahead for the sector. During the pandemic, the cruise industry has witnessed new innovative cruise ships and a brand-new competitor in the form of Virgin Voyages . Many cruise liners have come good with orders for new cruise ships built before the pandemic, resulting in an exciting time for loyal cruise holidaymakers to try new ships, services, and onboard experiences.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

Global cruise passengers and revenue

2021 provided a tough lesson for the cruise industry, with businesses aiming to make a swifter recovery from the latest round of lockdowns.

The cruise industry’s recovery rate was modest in 2021. Although a 96% YoY increase sounds positive, it is still nowhere near pre-pandemic levels. In 2021, only 13.9 million passengers went on a cruise, 53% lower than the pre-pandemic levels of 2019.

With the fluctuations of global passengers, revenues will generally follow a similar pattern unless there is a substantial shift in consumer behaviour. Usually, the most significant impacts on a travel company’s revenues, aside from passenger flows, are an economic recession, foreign exchange, or a change in booking trends.

During the pandemic, it has become clear that the latter affected cruise intermediary revenues. In 2021, revenue generated for cruises from intermediaries reached $19.5bn, a 65% YoY increase from $11.8bn. However, cruise passenger flows increased by 95% YoY, which is a significantly higher rate of improvement.

According to the CEO of the Royal Caribbean Group, Richard Fain, this was not unexpected. The world’s fourth-largest cruise company has seen intermediaries such as online travel agencies (OTAs) and high street agencies lose a proportion of their market share, with customers opting to book directly with the cruise operator rather than a third party.

The same sentiment was echoed by Norwegian Cruise Lines CEO Frank Del Rio, who said the company had witnessed a similar booking pattern. The result is not surprising. Many agencies have had to cut back on their workforce due to poor revenue performance in 2020, resulting in fewer sales agents to capture the rising demand in 2021. This has led to more customers booking directly with cruise companies.

Research from GlobalData also supports this, when comparing two consumer surveys from 2019 and 2021. In 2019, 44% of respondents said they typically book via an OTA. However, in a Q4 2021 survey, only 24% of respondents said they booked their last holiday via this booking method. In addition, respondents who said they booked directly increased from 32% to 36%.

New cruise ships and trends for 2022

There are many new cruise ships scheduled to set sail in 2022. Many of these boast a more contemporary feel to their décor and interior, moving away from the traditional looks of the past cruise ships and moving to a more fashionable boutique hotel design.

The motivation for this stems from the fact that cruise operators need to attract a younger market. This evolution is necessary for making cruise businesses more resilient in the future by drawing the next generation of cruise tourists.

According to a 2020 GlobalData survey, 37% of Gen Z and Millennials said that they ‘strongly’ or ‘slightly’ agreed with the notion that they would book an international trip this year. In comparison, only 22% of those older than 35 responded with the same sentiment, highlighting that the younger generation may be more likely to travel in today’s travel climate.

Furthermore, cruising has also become more popular with younger adults. In GlobalData’s Q3 2019 and 2021 global consumer surveys, the percentage of Gen Z and Millennial respondents who typically take a cruise holiday increased from 17% to 21%, indicating changes in consumer tastes.

The importance of Covid-19 safety protocols on cruise ships has never been more critical. According to GlobalData, there is a demand from consumers to receive information about Covid-19 initiatives. This data shows that consumers need substantial levels of communication from cruise providers, and that cruise companies will need to develop robust communication strategies, which need to be scaled over the next few years.

Many travellers are opting to book directly with the operator rather than via an intermediary such as an OTA. According to a Q3 2019 GlobalData survey, 44% of consumers said they typically book via an OTA.

However, this has fallen substantially over the last two years. In a Q4 2021 survey, only 24% of respondents said they booked their previous holiday via an OTA.

In addition, respondents who said they booked directly with a travel supplier increased from 32% to 36%, showing that booking directly with the supplier is becoming more trustworthy and popular.

Nevertheless, this booking behaviour could well be a temporary result, with some cruise operators expecting intermediary trade to pick up again in 2022.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Leading cybersecurity companies for the shipping industry

Marine propulsion systems, transmission and ship engine room equipment for the shipping industry, australian industry group voices concern over strategic fleet proposal, the top 10 biggest cruise ships in the world, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

Ship Technology In Brief

Ship Technology Global : Ship Technology Focus (monthly)

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

Cruise Industry: 100+ Statistics, Facts, and Trends [2023]

Over 32M passengers were expected to go cruising in 2020.

Only a handful of 400 cruise ships ready to hit the water could take passengers onboard due to COVID-19.

The result? Over $60B in losses.

So if you’d like to learn more about the cruise industry, you’ve come to the right place.

In this data-driven roundup, we’ve compiled the most relevant and up-to-date stats and facts on the topic to help you catch the essence.

Let’s dive right in:

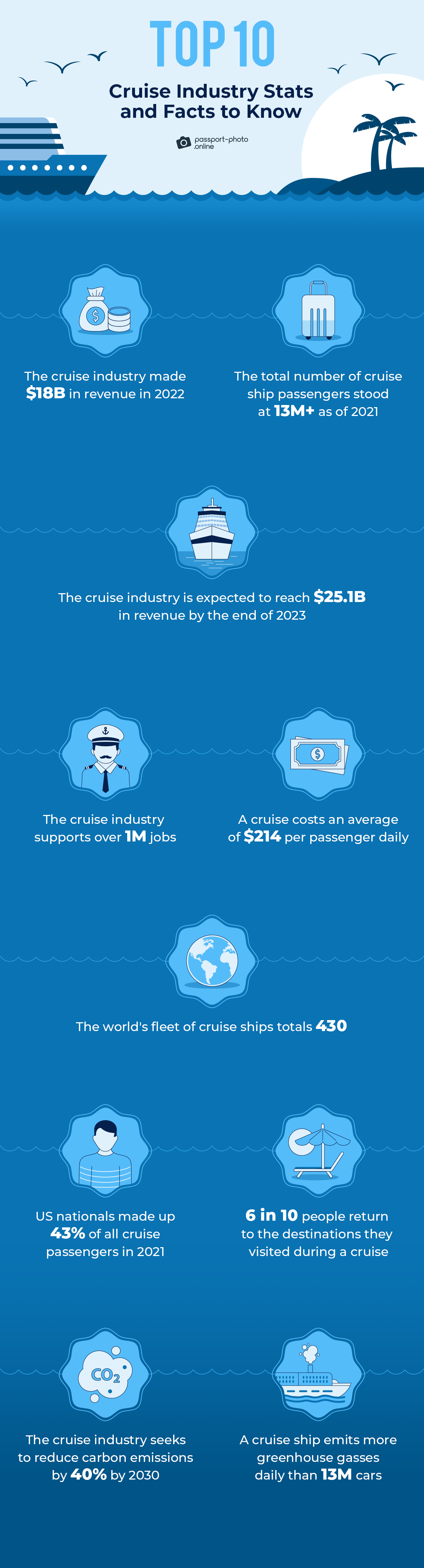

Top 10 Cruise Industry Stats and Facts to Know in 2023

General cruise industry statistics & facts, wonder of the seas, working onboard a cruise ship, cruise ships: a general overview, cruise industry demographics, cruise ships pollute but are good at recycling, covid-19 impact on cruise tourism.

- The cruise industry made $18B in revenue in 2022.

- The total number of cruise ship passengers stood at 13M+ as of 2021.

- The cruise industry is expected to reach $25.1B in revenue by the end of 2023.

- The cruise industry supports over 1M jobs.

- A cruise costs an average of $214 per passenger daily.

- The world’s fleet of cruise ships totals 430.

- US nationals made up the majority (43%) of all cruise passengers in 2021.

- US nationals made up 43% of all cruise passengers in 2021.

- The cruise industry seeks to reduce carbon emissions by 40% by 2030.

- A cruise ship emits more greenhouse gasses daily than 13M cars.

- The global revenue of cruises is set to reach $30B by 2024.

- Only 22% of cruise tickets are purchased online. Instead, 78% of the sales come from offline channels (e.g., ticket offices).

- Wonder of the Seas, owned by Royal Caribbean Group., is the world’s largest cruise ship.

- 1.7M passengers cruised to the Caribbean region in 2021.

- The US, Canada, and Mexico make up half of all cruise passengers.

- Crime rates on cruise ships are 95% lower than on land.

- Wonder of the Seas is the largest cruise ship in the world. It’s 1,188 feet long and 209 feet wide (362 x 64m).

- Wonder of the Seas can take up to 7K passengers and 2.3K crew members onboard.

- The Wonder of the Seas ship was ordered in 2016 and completed in 2022, with a construction cost of $1.3B.

- Wonder of the Seas has a Central Park (the first ever park at sea) with over 20K natural plants.

- The Wonder of the Seas ship has four thrusters with 7.5K horsepower each, which help it reach the cruising speed of 22 knots (25 mph).

- Wonder of the Seas has 24 bars and dining facilities.

- There are eight specially designed neighborhoods on the Wonder of the Seas ship.

Looking for passport photos? Discover more information:

- Take Baby Passport Photo at Home

- Passport Size Photos Maker

- Take Green Card Photo

- The cruise industry provided 1.7M jobs in 2019.

- It takes 24 passengers to support one full-time job on a cruise ship.

- The cruise industry has average employee turnover rates: 25–35%.

- A cruise ship may require over 2K crew members.

- Cruise ships have a strict, military-like chain of command: officers > staff > crew members.

- 70% of cruise ship crew work in the hotel division.

- Most cruise companies (70%) hire employees via foreign agencies.

- A typical cruise ship employment form is a 6-month-long contract.

- Cruise ship crew are on call around the clock.

- An average cruise ship member in the US makes $29K annually.

- 72 new ships were manufactured in 2021.

- The average cost of building a cruise ship is $600M.

- There were 65 ocean cruise lines as of 2022.

- The three leading cruise companies made 85% of the global revenue in 2021.

- Only 11% of cruise ships can accommodate more than 4K passengers.

- Most cruise ships (32%) can take 2–3K tourists onboard.

- 371 out of 430 cruise ships operated in 2022.

- Here’s a look at the highest-rated cruise lines:

- The cruise ship’s passenger capacity is projected to reach over 38M in 2027.

- The average age of a cruise ship is 14.

- The world’s longest cruise ship (~1,188 ft or 362m) is just 6.5 ft (2m) longer than the fifth longest ship (853 ft or 260m).

- Royal Caribbean has all five longest cruise ships in its fleet.

- The most expensive cruise ships are Oasis of the Seas and Allure of the Seas. The former cost 1.5B to build, and the latter’s price tag was 1.4B.

- Here’s a breakdown of the world’s largest cruise ships:

- 57% of cruisers are college graduates.

- 83% of cruise passengers are married.

- Cruisers spend around $385 in the port city before boarding a ship.

- During a typical cruise, passengers spend an average of $750 per person in port cities.

- Cruise passengers are 47 years old, on average.

- 85% of Millennials plan to cruise in the future, compared to 82% of Gen Xers and 79% of Gen Zers.

- Eight in 10 cruisers are likely to book their next vacation on a cruise ship.

- ~70% of cruisers are willing to board a cruise ship next year.

- Almost 60% of people who have never cruised say they are likely to cruise in the next few years.

- 70% of cruisers have an annual household income greater than $80K.

- 17% of Americans have cruised at least once.

- Most cruisers (77%) travel with a spouse.

- 30% of cruise passengers travel mainly with under-aged children.

- A quarter of cruisers generally travel with friends.

- A 3K-person cruise ship generates an average of 150K gallons (567 liters) of sewage per week.

- Cruise ships dump as much as 1B gallons (3.7B liters) of bacteria, heavy metals, and nutrients into the sea yearly.

- Here’s an overview of the waste produced by a 3K-passenger cruise ship during one week voyage:

- The cruise line industry dumps 285K gallons (1M liters) of wastewater into the sea every day.

- 75% of solid waste is incinerated on cruise ships, and the ash is typically discharged at sea.

- 24% of the solid waste generated by all ships comes from cruise ships.

- Cruise ships recycle 60% more waste daily than people on land.

- Cruise lines recycle 80K tons of paper, plastic, aluminum, and glass each year.

- The global revenue from cruises dropped by 88% in 2020.

- The cruise industry made just $3B in 2020 compared to 27B in 2019.

- The revenue growth in the cruise market is expected to plateau at 3% by 2026.

- The number of cruise passengers globally dropped by 84% in 2020.

- The cruise industry expected to carry 32M passengers in 2020.

- The number of ocean cruise passengers stood at 7M in 2020.

- Only 5M people went ocean cruising in 2021.

- The number of cruise passengers from North America dropped from 15M in 2019 to 3M in 2020.

- In 2021, the cruise industry declined by 25% compared to 2020.

- In the Middle East, the number of cruise passengers declined by 92% in 2020, followed by a 160% increase in 2021.

- In North America, the number of cruise passengers dropped by 80% in 2020 and continued to decline by another 25% in 2021.

- Leading cruise companies saw a 90% drop in revenue in 2021 compared to 2019.

- Here’s a look at the net income of the largest cruise companies between 2019 and 2021:

- The cruise industry’s economic contribution in 2019 was $154B.

- In 2020, the economic contribution of the cruise industry dropped by 59% to $63B.

- Due to the COVID-19 outbreak, cruise industry-supported jobs shrank by 50%.

- The number of cruise passengers will surpass the 2019 levels by 2024.

Stacking It All Up

There you have it.

A comprehensive list of cruise industry statistics, facts, and trends to help you better understand the market and its direction.

Was there a statistic you found particularly surprising? Or maybe there are other cruising stats you’d like to see?

Let us know in the comments.

Is the cruise industry growing?

Before 2019, the cruise industry had a 3–5% yearly growth, but in 2020, the market saw a drop of over 80% due to COVID. In 2021, the market got back on track, seeing a 300% increase in revenue and 50% in passenger numbers.

How big is the cruise line industry?

There are over 60 ocean cruise lines, operating a total of 430 ships. In 2019 (before coronavirus), these cruises brought $27B in revenue. By the end of 2023, that number is expected to reach $25B.

Who are the biggest players in the cruise industry?

Three companies made 85% of the total revenue in the cruise industry in 2021. These are Carnival Cruise ( 45%) , Royal Caribbean Group ( 25% ), and Norwegian Cruise Line ( 15% ).

What’s the #1 cruise line in the world?

Carnival Cruise Lines is the #1 cruise line in the world in terms of revenue ( $12.168B ). However, Royal Caribbean has five of the world’s largest cruise ships in its fleet.

How much money does the cruise industry make?

The cruise industry made $18B in revenue in 2022. It’s also set to reach $30B by 2024.

Fair Use Statement

Did you like our infographics? If so, feel free to share them with your audience. Just remember to mention the source and link back to this page.

- Bureau of Transportation Statistics, “Summary of Cruise Ship Waste Streams”

- Comparably, “Cruise Ship Salary”

- Condé Nast Traveler, “Top Cruise Lines: Readers’ Choice Awards 2022”

- Cruise Industry News , “Cruise Ships in Service (Oct 2022)”

- Cruise Industry News, “31.7 Million Cruise Passengers Possible in 2022”

- Cruise Lines International Association, “Environmental Stewardship”

- Cruise Lines International Association, “Security At Sea”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2019”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2020”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2021”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2022”

- Cruise Market Watch, “Financial Breakdown of Typical Cruiser”

- Cruise Market Watch, “Passenger Origins”

- Friends of the Earth, “ 2022 Cruise Ship Report Card”

- Grand View Research, “Cruise Market Size, Share & Trends Analysis Report By Type (Ocean Cruises, River Cruises), By Region, And Segment Forecasts, 2022 – 2028”

- Indeed, “How Much Do Cruise Ship Workers Make?”

- Scherb M., “Improving Employee Retention Rates in Cruise Industry by Assessing Living and Working Conditions”

- Ship Technology, “Wonder of the Seas Cruise Ship”

- Statista, “Cruise Passenger Volume Index Worldwide in 2019 and 2020, with a Forecast until 2026, by Scenario”

- Statista, “Gross Tonnage of Cruise Ships in the Global Order Book In 2021, by Region”

- Statista, “Largest Cruise Ships Worldwide as of February 2022, by Length”

- Statista, “Leading Countries in the Cruise Industry Revenue Worldwide from 2019 to 2022”

- Statista, “Most Expensive Cruise Ships Worldwide in 2022, by Building Cost”

- Statista, “Net Income of Carnival Corporation & Plc Worldwide from 2008 to 2021”

- Statista, “Net Income of Norwegian Cruise Line Holdings Ltd. Worldwide from 2011 to 2021”

- Statista, “Net Income of Royal Caribbean Cruises Ltd. Worldwide from 2007 to 2021”

- Statista, “Number of Ocean Cruise Passengers Worldwide from 2009 to 2021”

- Statista, “Number of Ocean Cruise Passengers Worldwide from 2019 to 2021, by Region”

- Statista, “Percentage Change in Revenue of Leading Cruise Companies Worldwide during the Coronavirus (COVID-19) Pandemic in 2020 and 2021”

- Statista, “Revenue Growth of the Cruise Industry Worldwide from 2018 to 2026”

- Statista, “Revenue of the Cruise Industry Worldwide from 2017 to 2026”

- Statista, “Revenue Share of Sales Channels of the Global Cruise Industry from 2017 to 2026”

- Statista, “Worldwide Market Share of Leading Cruise Companies in 2021”

- Statista, “Year-Over-Year Percentage Change in Cruise Passengers during the Coronavirus (COVID-19) Pandemic Worldwide in 2020 and 2021, by Source Region”

- Wander Eat Write, “What Working on Cruise Ships Is Really Like: Pros & Cons”

- Wikipedia, “Environmental Effects of Shipping”

- Wikipedia, “List of Cruise Lines”

- Wikipedia, “List of Largest Cruise Ships”

- Wikipedia, “Wonder of the Seas”

Adam is an SEO & Digital PR writer with a child’s curiosity about the surrounding world. His superpower to dig out juicy facts got him citations in Forbes, Social Media Today, and 90+ other news outlets. Adam enjoys snapping pictures and won the national Huawei Next Image Award.

43+ Cruise Industry Statistics for 2024

Welcome to our curated and vetted list of 43+ cruise industry statistics for 2024.

Here’s a quick breakdown of what we’ll cover:

Top Cruise Industry Statistics

Passenger volumes and forecasts, revenue and market growth, cruise ship characteristics, cruise destinations and ports, cruise demographics and preferences, environmental and sustainability practices.

- In 2024, approximately 36M passengers globally are anticipated to embark on cruises.

- The global cruise market is expected to expand by 9.29% from 2023 to 2027, reaching $35.87B in 2027.

- In 2024, the worldwide cruise sector will produce $30.11B in revenue.

A total of 323 cruise ships are currently in operation globally.

There are 51 ocean and 27 river cruise lines in the world.

On average, a cruise ship can host around 3,000 passengers.

There were 12,592 cruise guests from North America in 2022.

- A cruise ship earns an estimated net profit of $291 per passenger.

- The typical age of a cruise tourist is 46.5 .

01. In 2024, cruise passenger volume is expected to hit 120% of 2019’s levels, with 36M passengers setting sail.

02. There were 12,592 cruise guests from North America in 2022.

03. In 2022, Celebrity Cruises, a luxury brand under Royal Caribbean Cruises, led selected cruise brands in passenger capacity, boasting a combined vessel capacity of about 32,500.

Sources: CLIA #1 , CLIA #2 , Statista

04. The global cruise market is expected to expand by 9.29% from 2023 to 2027, reaching $35.87B in 2027.

05. In 2024, the worldwide cruise sector will produce $30.11B in revenue.

06. The US is projected to lead the cruise industry in terms of revenue, reaching $18.36B.

07. Offline sales channels are expected to account for 76% of global cruise industry revenue in 2027, surpassing online sales, which are projected to constitute 24%.

08. A cruise ship earns an estimated net profit of $291 per passenger. Consequently, a fully booked 7-day trip on Royal Caribbean’s Symphony of the Seas could generate $9.8M in revenue, with profits of $1.7M.

09. In 2023, Carnival Corporation & plc’s global revenue reached $20.036B, a 108.38% surge from the previous year.

10. In 2023, Royal Caribbean Cruises reported a revenue of $13.173B, an 82.48% increase from the previous year.

11. In 2022, the number of businesses in the US cruise and travel agency franchise sector rose to 38 from 27 the previous year, with 42 expected to operate in 2023.

Sources: LoveTheMaldives , Statista #1 , Statista #2 , Statista #3 , MacroTrends #1 , MacroTrends #2

12. A total of 323 cruise ships are currently in operation globally.

13. There are 51 ocean and 27 river cruise lines in the world.

14. Ocean liners typically have an average passenger capacity of about 3,000 guests, while larger river cruise ships accommodate ~150 guests.

15. The largest cruise ships can accommodate 5,412 passengers in double occupancy, with a maximum capacity of 6,318 if all berths are filled.

16. In 2023, the worldwide cruise industry’s ocean-going vessels had an average passenger capacity of ~701,490, with projections indicating a rise to over 764,000 by 2025.

17. The average age of ships in the fleet of CLIA (Cruise Lines International Association) members is 14.1 years.

18. As of April 2023, Royal Caribbean’s Wonder of the Seas is the world’s largest cruise ship, with a gross tonnage of 236,860.

19. In February 2023, Royal Caribbean was home to the world’s longest cruise ships, with Harmony of the Seas, Wonder of the Seas, and Symphony of the Seas, each exceeding 1,180 feet (360 meters) in length.

20. As of November 2022, Royal Caribbean’s Allure of the Seas was the world’s most expensive cruise ship, with a construction cost of ~$1.43B. It’s the fourth-largest cruise ship globally, with a gross tonnage of 225,000.

Sources: Cruise Market Watch , LM&W, PA , CruiseMapper , Carnival , CLIA , Marine Insight , The Telegraph , Cruise Fever

21. In 2022, the Caribbean, Bahamas, and Bermuda topped the list of global cruise destinations, attracting approximately 9M passengers.

22. Port Canaveral in Florida, US, was the world’s busiest cruise port in 2022, recording approximately 4.1M passenger movements.

23. In August 2023, Tripadvisor’s most expensive luxury cruise was a 125-night global tour with Silversea Cruises’ Silver Wind, costing nearly $132,000 per person.

Sources: CLIA , Statista , Travel Weekly

24. The typical age of a cruise tourist is 46.5.

25. The average age of a Norwegian Cruise Line passenger is 52.5 years.

26. Royal Caribbean cruise passengers have a median age in the low 40s, skewing younger on 3–4 night cruises and older on cruises of 10+ nights.

27. Cruise trips typically last about seven days on average.

28. Of those who have cruised, 85% plan to cruise again.

29. Cruise vacations are gaining popularity among Millennials and Gen Xers, with 73% of those who haven’t cruised yet open to considering it.

30. Most travelers (73%) cruise with family from at least two generations.

31. Solo travelers typically book their cruises 1–12 months before departure.

32. In 2022, Carnival Corporation & plc carried 7.7M passengers worldwide.

33. In 2022, Royal Caribbean Cruises served over 5.5M passengers worldwide.

34. In 2022, Norwegian Cruise Line served roughly 1.66M passengers.

35. Norwegian Cruise Line was the highest-rated mega-ship operator in Condé Nast Traveler’s June 2023 survey, scoring 86.72.

36. Virgin Voyages was the highest-rated large-ship cruise operator in Condé Nast Traveler’s June 2023 survey, scoring 94.07.

37. Viking led June 2023’s midsize-ship cruise line ratings by Condé Nast Traveler with a score of 94.98.

38. Emerald Cruises led the June 2023 Condé Nast Traveler small-ship cruise line ratings with a 95.27 score.

39. Viking led the June 2023 Condé Nast Traveler river cruise line ratings with a 97.32 score.

Sources: Carnival Corp. , CLIA , Condé Nast Traveler , Cruise1st Blog , Norwegian Cruise Line , Royal Caribbean International , Royal Caribbean Press Center

40. Low-friction hull coatings are used on 96% of ships.

41. Cruise ships generate up to 90% of their freshwater onboard. They use advanced systems to conserve and repurpose water, avoiding reliance on resource-scarce areas.

42. A significant 60% of ships set to launch from 2023 to 2028 will use LNG fuel as their main propulsion source.

43. New ship classes are typically 20% more efficient than their predecessors.

Sources: CLIA

Stacking It All Up

That concludes our deep dive into cruise industry statistics.

If you think this information would benefit your audience, you’re welcome to share it. Just remember to link back to this page as a nod to our efforts.

How many people are there on a cruise ship?

How many cruise ships are there, how many cruise lines are there, how many cruises depart from north america, how much does a cruise ship make per trip.

A cruise ship earns an estimated net profit of $291 per passenger. Consequently, a fully booked 7-day trip on Royal Caribbean’s Symphony of the Seas could generate $9.8M in revenue, with profits of $1.7M .

As a Digital PR specialist and a member of the Society of Professional Journalists (SPJ), I have 5+ years of writing experience. Over the course of my career, my work has garnered significant attention, with features in numerous prominent publications such as The New York Times, Forbes, Inc., Business Insider, Fast Company, Entrepreneur, BBC, TechRepublic, Glassdoor, and G2.

- CLIA Cruise Lines

- CLIA Global Executive Committee

- Mercy Ships

- Explore Topics

- Join or Renew

- Professional Development

- Travel Agent Cruise News

- Verify a Member

- Eligibility

- Marketing Partners

- Refund Policy

- Executive Partners

- Fact Sheets

- News and Media Room

- Australasia

- North America

- North West and Canada

- UK & Ireland

- My Certifications

- My Training

- Find a Travel Agent

- Cruising Home

- News and Research

- News Releases and Statements

Cruise Industry 2022 Outlook Report Quantifies Value of Cruise Tourism, Underscores Leadership in Health and Safety, Environmental Sustainability and Destination Stewardship

Press Release | January 27, 2022

Latest report features new 2020 economic impact data, including critical insights concerning the industry’s recovery from the pandemic, the value of cruise tourism and the leadership and advancements in the areas of responsible tourism and maritime practices.

WASHINGTON, DC (27 January 2022) – Cruise Lines International Association, the leading voice of the global cruise community, today released the 2022 State of the Cruise Industry Outlook report. The annual report shows how the industry has continued to resume responsibly with proven protocols that are leading the way, underscores the value of cruise tourism to local communities and national economies around the world, and charts the industry’s continued progress towards achieving carbon neutrality.

“The 2022 State of the Cruise Industry Outlook report provides an opportunity to reflect on how far our industry has come as CLIA ocean-going cruise lines have welcomed more than six million guests onboard since resuming operations in July 2020. While our focus on health and safety remains absolute, our industry is also leading the way in environmental sustainability and destination stewardship” said Kelly Craighead, president and CEO of CLIA.

“Coastal and maritime tourism is an important economic driver, and we continue to work in partnership with cruise destinations so that communities thrive from responsible tourism. Our members are also investing in new technologies and new ships and pursuing the goal of net carbon neutral cruising by 2050.”

The 2022 outlook report also features reflections from cruise industry partners and community members around the world, including from Robert Courts MP, United Kingdom Maritime Minister; Mato Franković Mayor of Dubrovnik; Laura McDonnell, shop owner in Juneau, Alaska; Alex Fraile, tour guide in Palma de Mallorca, Spain; Danny Genung, CEO, Harr Travel; and Mandy Goddard, M.Ed., CLIA Elite Cruise Counselor (ECC).

Highlights from the report include:

· Fleet of the Future. By 2027, the CLIA ocean-going cruise line member fleet will reflect significant advancements in the cruise industry’s pursuit of a cleaner, more efficient future.

- 26 LNG-powered cruise ships

- 81% of global capacity fitted with Advanced Wastewater Treatment Systems

- 174 cruise ships with shoreside power connectivity

· 2020 Global Economic Impact. When compared to 2019, the 2020 economic data illustrates the pandemic’s far-reaching effects on the wider cruise community and underscores the importance of cruise tourism to economies around the world.

- 5.8M passenger embarkations (-81%)

- 576K cruise-supported jobs (-51%)

- $63.4B total economic contribution (-59%)

· Resumption Progress. Industry-leading protocols are facilitating the resumption of cruise tourism around the world, which is putting people back to work and reinvigorating local and national economies.

- More than 75% of ocean-going member capacity has returned to service

- Nearly 100% projected to be in operation by August 2022

· Value of Cruise Tourists. Cruise tourists, and the money they spend, create jobs and opportunities for local communities around the world.

- Every 24 cruisers creates one full-time equivalent job

- Cruisers spend an average of $750 USD per passenger in port cities over the course of a typical seven-day cruise

- 6 in 10 people who have taken a cruise say that they have returned to a destination that they first visited via cruise ship

· Destination Stewardship. Continued collaboration with local communities in the destinations cruise ships visit remains a critical focus for the cruise industry, including in Dubrovnik, Croatia, the Greek destinations of Corfu and Heraklion, and the City of Palma in the Balearic Islands.

· Class of 2022. CLIA ocean-going member cruise lines are projected to debut 16 new cruise ships in 2022, including five LNG-powered vessels and nine expedition ships. The class of 2022 will be 100% equipped with Advanced Wastewater Treatment Systems.

To view the full 2022 State of the Cruise Industry Outlook report, please click here . For more information, please contact [email protected] .

Media Inquiries

Please send media inquiries to - [email protected]

Don’t yet have a login? Create a new account

Forgot Password

If you have forgotten your Password, complete the information requested below and click the submit button.

You will receive an email with a reset token to change your password.

Please allow at least 10 minutes to receive the email before requesting another password reset. Please be sure to check your Spam folder for the password reset email.

Please note: the Email you provide must be the one that is associated with your profile.

If you have difficulty resetting your password please email [email protected] .

Create a New CLIA Account

Set or change password.

Please use the form below to set or change your password. Passwords must be at least 8 characters.

We are sorry. An error has occurred.

Please confirm, select your region to be directed to the correct website.

Baltimore Port: What impact will bridge collapse have on shipping?

PORT FEATURES

Current status of cargo ships inside port, cruise ships, london metal exchange warehouses, bunker fuel.

Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here.

Reporting by Josephine Mason, Nick Carey, Helen Reid, Jonathan Saul, Nigel Hunt, Marwa Rashad, Scott DiSavino, Shariq Khan and Eric Onstad; Compiled by Josephine Mason and Nina Chestney; Editing by Nick Macfie and Nick Zieminski

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Portugal's new conservative government restores state symbols on logo

Portugal's new conservative government, in its first edict, on Wednesday reinstated the heraldic symbols harking back to the Age of Exploration on the official state emblem that its predecessor had ditched for a "more inclusive and secular" logo.

The marine insurance industry is bracing for huge claims from the Baltimore bridge disaster

- Huge insurance claims are expected after the Dali collided with a major bridge on Tuesday.

- The claims could be on par with the $1.5 billion from the Costa Concordia disaster, an expert told Insurance Business.

- Insurance claims could include damage to the ship, business interruption, and worker compensation.

The marine insurance industry is bracing for huge claims from Tuesday's Baltimore bridge disaster.

Insurance claims from the collision of the Dali containership with the Francis Scott Key Bridge could be on par with a 2012 maritime disaster that led to $1.5 billion in payouts, John Miklus, the president of the American Institute of Marine Underwriters, told trade magazine Insurance Business on Tuesday.

Luxury cruise ship Costa Concordia capsized off the coast of Italy in January 2012, killing 32 people in one of Europe's worst modern maritime tragedies. That disaster led to the marine insurance industry's highest payout, according to the trade publication.

"I wouldn't be surprised if this were similar," Miklus told Insurance Business.

It was not immediately clear how long it took to settle all of Costa Concordia's claims, but it appears to have taken at least a few years.

"You've got various components to the loss," Miklus added. "A big one is going to be rebuilding the bridge and all the loss of revenue and loss of tolls while that's taking place."

Related stories

The Baltimore bridge brought in about $53 million in toll revenue for the Maryland Transportation Authority in 2023, Moody's analyst Cintia Nazima told The Wall Street Journal on Tuesday.

Other insurance claims from Dali's Baltimore collision could include damage to the ship and its cargo, as well as business interruption, property, trade credit, and worker compensation, per Business Insurance.

The marine insurance and reinsurance markets are likely to foot most of the bills, S&P Global reported on Tuesday.

The Baltimore bridge itself is insured by insurance giant Chubb, per Insurance Insider.

Dali, the ship, is covered by Britannia P&I Club, a specialist insurer that provides protection and indemnity cover for the maritime industry. Britannia is a member of the London-based International Group of P&I Clubs.

The International Group of P&I Clubs will only cover the first $10 million in claims from any one incident, per the company's website. The remaining bill will be shared by the members, groups from specialist marketplace Lloyd's of London, and reinsurers.

The claims process could take years, mirroring the situation surrounding the Ever Given containership, which ran aground and blocked the Suez Canal for six days in March 2021.

SCOR, a French reinsurer estimated in June 2022 that Ever Given's claims could top $2 billion.

"It will take many years to settle the claims from the Ever Given and the process will include much debate about who is liable," SCOR wrote in the report. "The issue of responsibilities and applicable laws in today's global maritime world is complex."

Watch: The container ship that destroyed the Francis Scott Key Bridge has crashed before

- Main content

- Manage Account

IFPI Global Report 2024: Music Revenues Climb 10% to $28.6 Billion

The total figure is the highest mark since 1999, not counting for inflation, while the number of paid streaming subscriptions passed 500 million for the first time.

By Richard Smirke

Richard Smirke

- Share this article on Facebook

- Share this article on Twitter

- Share this article on Flipboard

- Share this article on Pinit

- + additional share options added

- Share this article on Reddit

- Share this article on Linkedin

- Share this article on Whatsapp

- Share this article on Email

- Print this article

- Share this article on Comment

- Share this article on Tumblr

Global music sales grew for the ninth consecutive year in 2023, with recorded music revenues increasing in every market and region, and across almost all formats, according to the International Federation of the Phonographic Industry’s ( IFPI ) Global Music Report 2024.

Taylor Swift Crowned IFPI’s Global Recording Artist For Record Fourth Time

Total revenues climbed to $28.6 billion, a rise of just over 10% on the previous year , and the second highest growth rate on record after 2021’s 18.5% year-on-year spike.

Trending on Billboard

Driving last year’s growth was an 11.2% rise in paid streaming subscription revenue, which totaled $14 billion, up from $12.7 billion in 2022, and accounted for almost half (48.9%) of global music sales.

The rise in global paid streaming revenue comes after many of the leading streaming services, including Spotify, Apple Music, Amazon Music, YouTube Music and Deezer, all raised their subscription prices in key territories over the past 12-18 months. For the majority of streaming services, the hikes were their first price rises since launching more than a decade ago.

Despite the rising cost for consumers, the number of music streaming subscribers continues to grow globally, with IFPI reporting that the number of paid subscriptions to streaming services surpassed 500 million for the first time in 2023.

When shared usership and family accounts are considered, there are now more than 667 million users of paid subscription accounts globally, says the London-based organization, up 13% from the 589 million recorded in the previous 12 months.

Total streaming revenues, comprising of paid subscription and advertising-supported tiers, rose 10% to $19.3 billion to make up 67% of worldwide recorded music sales, roughly flat with last year’s share of the market.

Sales Up Across (Nearly) All Formats

Although streaming continues to dominate global music revenues, 2023 also saw strong gains in physical record sales and performance rights revenues. Combined CD and vinyl revenues grew for a third consecutive year to $5.1 billion, up 13% on 2022’s total, with Asia generating almost half (49%) of all physical revenues worldwide.

IFPI attributed the region’s continued dominance of the physical market to strong sales of K-pop acts such as boyband Seventeen, who topped IFPI’s 2023 global album charts with FML and also had the year’s eighth best-selling album with follow-up set SEVENTEENTH HEAVEN .

In terms of market share, physical accounted for just under 18% of the overall market last year, marginally up from 17.5% in 2022 but still down on 2021’s share.

Performance rights revenue, meanwhile, climbed 9.5% to $2.7 billion, representing 9.5% of global revenues, while sync income was up 4.7% to $632 Million, representing 2.2%.

The only formats to record a decline in 2023 were digital downloads and what IFPI classifies as other (non-streaming) digital formats, which fell by 2.6% to $900 million, representing just 3.2% of the global market.

“The figures in this year’s report reflect a truly global and diverse industry,” said IFPI chief financial officer and interim joint head John Nolan in a statement accompanying the report.

Nolan said the strong rise in paid streaming subscribers worldwide, as well as services’ price increases, contributed “significantly” to overall revenue growth. He also said the music industry’s recovery from its lows of a decade ago wouldn’t have been possible without “record companies’ sustained investment in artists and their careers.”

No Change in the Global Top 10 Music Markets, With U.S. Still On Top

In terms of world markets, IFPI said that music revenues were up in all of the 58 markets it tracks, with the U.S. retaining its long-held No. 1 position with music sales growing 7.2%, compared to 4.8% growth last year.

Japan holds steady in second place with sales growing 7.6% in 2023. The third and fourth-biggest markets for recorded music remain the United Kingdom (+8.1%) and Germany (+7%), respectively.

The rest of the top 10 is made up of China (+25.9%), representing the fastest rate of increase in any top 10 market, followed by France (+4.4%), South Korea (percentage not provided), Canada (+12.2%), Brazil (+13.4%) and Australia (+11.3%). (IFPI’s free-to-access report does not provide market-by-market revenue breakdowns).

Those cross-market gains are mirrored on a regional basis with revenues from the U.S. and Canada region up 7.4%.

Combined, the U.S. and Canada region accounts for almost 41% of global recorded music revenues, reports IFPI, while Latin America — where streaming makes up 86% of the market — saw growth of 19.4%, far outpacing the global growth rate and representing the 14th consecutive year of revenue growth in the region.

Europe remains the second-biggest region for music sales, accounting for more than a quarter (28%) of global revenues and growing 8.9% year-on-year. In third place is Asia, where revenues rose by almost 15% in 2023, driven by strong gains in physical and digital sales.

Revenues in the Middle East and North Africa, where streaming holds a 98% share of the recorded music market, rose by almost 15%.

(IFPI uses current exchange rates when compiling its Global Music Report, restating all historic local currency values on an annual basis. Market values therefore vary retrospectively as a result of foreign currency movements, says IFPI, which represents more than 8,000 record company members worldwide, including all three major labels, Universal Music Group, Sony Music Entertainment and Warner Music Group.)

Transformation Underway

Present at the Global Music report’s launch in central London were senior executives from all three major labels, as well as Konrad von Löhneysen , founder and director of Germany-based independent Embassy Of Music. Leila Oliveira , president of Warner Music Brazil, also participated in the event via video call from Rio.

Reflecting current industry trends, the potential impact of artificial intelligence (AI) on the record business, and particularly risks around generative AI, was a key topic of conversation among the speakers.

“The reality is that we’re at the beginning stages of another transformational event for the music industry,” said Dennis Kooker , president of global digital business at Sony Music Entertainment.

“While I’m enthusiastic about where the evolution will lead, it is essential that we find new products and new business models around these technologies to ensure the future of human creativity can be invested in, and that creators can be rewarded,” Kooker said.

Adam Granite , executive vp of market development at Universal Music Group, said that while AI used “in the service of artists is wonderful,” AI that uses musicians’ work “without authorization and compensation is not.”

“We believe it’s perfectly possible to develop and adopt AI technology while also ensuring artists rights are protected,” said Granite, citing UMG’s recent partnerships with Roland Corporation and YouTube on AI initiatives as industry-led developments that give “artists a seat at the table and will help safeguard their rights” as more AI products enter the music business.

Get weekly rundowns straight to your inbox

Want to know what everyone in the music business is talking about?

Get in the know on.

Billboard is a part of Penske Media Corporation. © 2024 Billboard Media, LLC. All Rights Reserved.

optional screen reader

Charts expand charts menu.

- Billboard Hot 100™

- Billboard 200™

- Hits Of The World™

- TikTok Billboard Top 50

- Song Breaker

- Year-End Charts

- Decade-End Charts

Music Expand music menu

- R&B/Hip-Hop

Culture Expand culture menu

Media expand media menu, business expand business menu.

- Business News

- Record Labels

- View All Pro

Pro Tools Expand pro-tools menu

- Songwriters & Producers

- Artist Index

- Royalty Calculator

- Market Watch

- Industry Events Calendar

Billboard Español Expand billboard-espanol menu

- Cultura y Entretenimiento

Honda Music Expand honda-music menu

Select your country/region to personalize your site experience

- Argentina (English)

- Argentina (Español)

- Australia (English)

- Austria (English)

- Österreich (Deutsch)

- Bahamas (English)

- Belgium (English)

- Brazil (English)

- Brazil (Portuguese)

- Canada (English)

- Chile (English)

- Chile (Español)

- Colombia (English)

- Colombia (Español)

- Czech Republic (English)

- Denmark (English)

- Ecuador (English)

- Ecuador (Spanish)

- Finland (English)

- France (English)

- France (Français)

- Germany (English)

- Greece (English)

- Guatemala (English)

- Guatemala (Español)

- Deutschland (Deutsch)

- Hong Kong (English)

- Hungary (English)

- India (English)

- Indonesia (English)

- Ireland (English)

- Israel (English)

- Italy (English)

- Japan (English)

- Korea (English)

- Luxemburg (English)

- Mainland China (English)

- 中国内地 (简体中文)

- Malaysia (English)

- Mexico (English)

- Mexico (Español)

- Netherlands (English)

- New Zealand (English)

- Norway (English)

- Peru (English)

- Peru (Español)

- Philippines (English)

- Poland (English)

- Portugal (English)

- Puerto Rico (English)

- Serbia (English)

- Singapore (English)

- Slovenia (English)

- South Africa (English)

- Spain (English)

- Sweden (English)

- Switzerland (English)

- Schweiz (Deutsch)

- Taiwan (English)

- Thailand (English)

- Turkey (English)

- United Arab Emirates (English)

- United Kingdom (English)

- United States (English)

- Venezuela (English)

- Venezuela (Español)

- Vietnam (English)

Search Jobs

What would you like to do?

- Administration

- Animation and Visual Effects

- Architecture and Design

- Asset Management

- Building, Construction and Facilities

- Business Strategy and Development

- Call Center

- Communications

- Data Science and Analytics

- Engineering

- Facilities and Operations Services

- Finance and Accounting

- Food and Beverage

- Gaming and Interactive

- Graphic Design

- Health Services

- Horticulture and Landscaping

- Hotel and Resorts

- Housekeeping

- Human Resources

- Legal and Business Affairs

- Maritime and Cruise Operations

- Marketing and Digital Media

- Merchandising

- Project Management

- Quality Assurance

- Research and Development

- Retail Operations

- Sciences and Animal Programs

- Social Responsibility

- Sports and Recreation

- Stage Productions

- Supply Chain Management

- Theme Park Operations

Brand Select ABC News Adventures by Disney Aulani, A Disney Resort & Spa Consumer Products Games & Publishing Disney Advertising Disney Branded Television Disney Cruise Line Disney Direct to Consumer Disney Entertainment Disney Entertainment & ESPN Technology Disney Entertainment Television Disney Experiences Disney Music Group Disney Platform Distribution Disney Star Disney Store Disney Theatrical Group Disney Vacation Club Disney's Hilton Head Island Resort Disney+ Hotstar Disneyland Paris Disneyland Resort ESPN FX Networks Hong Kong Disneyland Resort Industrial Light & Magic Lucasfilm Marvel Entertainment Marvel Studios National Geographic Partners Federal Credit Union Pixar Animation Studios The Walt Disney Company (APAC) The Walt Disney Company (Corporate) The Walt Disney Company (EMEA) The Walt Disney Company (India) The Walt Disney Company (LATAM) The Walt Disney Studios Walt Disney Animation Studios Walt Disney Imagineering Walt Disney World Resort

Job Level Select Business Support / Administrative Executive Internships / Programs Management Operations / Production Professional Talent

Where would you like to work?

Country/Region Select Argentina Australia Bahamas Brazil Bulgaria Canada Denmark Finland France Germany Hong Kong India Indonesia Italy Japan Mexico Netherlands Norway Philippines Poland Shipboard Singapore South Korea Spain Sweden Switzerland Taiwan Turkey United Kingdom United States

State/Province Select Bavaria British Columbia Buenos Aires F.D. California Canton of Zurich Capital Region Connecticut DC Eastern England Florida Haryana Hawaii Île-de-France Region Illinois Islands District Istanbul Jakarta Special Capital Region Karnataka Lombardy Lower Saxony Madrid Maharashtra Mazovia Mecklenburg-Vorpommern Metro Manila Mexico City Missouri New South Wales New York North Carolina North Holland Ontario Oslo County Pennsylvania São Paulo Seoul Sofia-grad South Carolina Stockholm County Taipei Taiwan Tamil Nadu Telangana Tennessee Texas Tokyo Uusimaa Victoria Washington

City Select Amsterdam Anaheim Austin Bengaluru Branson Bristol Buenos Aires Burbank Celebration Charlotte Chennai Chessy Chicago Copenhagen Coupvray Cypress Destin Durham Emeryville Fresno Glendale Greater Manchester Gurgaon Helsinki Hilton Head Island Houston Hyderabad Istanbul Iver Heath Jakarta Kapolei Kings Mountain Kissimmee Lake Buena Vista Lancaster Lantau Island Livermore London Los Angeles Madrid Makati City Manhattan Beach Marne-la-Vallée Mexico City Milan Minato-ku Montévrain Moore Park Morrisville Mumbai Munich New Taipei City New York Newhall Orlando Oslo Palm Desert Papenburg Paris Quarry Bay Raleigh Rancho Mirage Richmond San Francisco Santa Monica São Paulo Seattle Seoul Serris Sevierville Singapore Sofia Stockholm Sydney Taipei Tampa The Woodlands Tlalpan Toronto Tulalip Vancouver Warsaw Washington Wismar Zurich

Be Part of the Story

Revenue Management Analyst

Job summary:, about the role & team.

Are you passionate about driving consumer-facing strategies with direct impact to the Walt Disney World Parks and Resorts business? Are you a partner-focused teammate with a natural curiosity to understand the “why” behind business performance?

The Disney Cruise Line Revenue Management Analyst will work closely with the Revenue Management team for each ship to manage pricing and promotions as well as implement inventory build throughout the year. We manage business rules, create exception reports, and address reservations with pricing or promotion issues. Through partnerships with Guest Services, Travel Account Operations, and Guest Communications, and Business Systems Management, we also build annual cruises and all the associated rules that support said cruises and launch them in coordination with the digital team.

What You Will Do

Every single day as a Revenue Management Analyst is different! On any one day you might:

- Manage business rules for pricing and promotions within the Disney Cruise Line’s reservation system

- Create/Audit exception reports to ensure prices, promotions, and taxes are being properly implemented on reservations.

- Address reservations with pricing and promotion issues as requested by BSM and SGS.

- Partner with Contracted Group Sales department to provide system pricing for group reservations.

- Complete ad hoc projects and data analysis to assist in achieving short & long term revenue goals

- Evaluate and suggest improvements to department processes and reports

- Manage and build business rules in the Seaware reservation system

- Basic database/SQL reporting for validating data and troubleshooting reservation issues

- Field calls from guest services to troubleshoot reservation issues related to business rules

- Work with the digital team to ensure continuity between the Seaware reservation system and disneycruise.com

- Build inventory for future cruise sales in the Seaware reservation system and associated business rules

- Use Microsoft excel for report validations and analysis of promotions and pricing

- Work with other departments to support test environments for the reservation system

Required Qualifications & Skills

- 1+ years of relevant work experience

- Proven strong analytical and communication skills

- Proven success collaborating with a range of partners

- Strong sense of responsibility, ownership, and pride in delivering quality results

- Ability to quickly learn new systems and processes

- Proficient in Excel

- Proven experience with database reporting tools

Preferred Qualifications

- Cruise Industry experience

- Bachelor’s degree in Business, Finance, Industrial Engineering, or related field

About Disney Experiences:

Disney Experiences includes Disney’s iconic travel and leisure businesses, which include six resort destinations in the United States, Europe and Asia, a top-rated cruise line, a popular vacation ownership program, and an award-winning guided family adventure business. Disney’s global consumer products operations include the world’s leading licensing business across toys, apparel, home goods, digital games and apps; the world’s largest children’s publisher; Disney store locations around the world; and the shopDisney e-commerce platform.

About The Walt Disney Company:

The Walt Disney Company, together with its subsidiaries and affiliates, is a leading diversified international family entertainment and media enterprise with the following business segments: Disney Entertainment, ESPN, Disney Parks, and Experiences and Products. From humble beginnings as a cartoon studio in the 1920s to its preeminent name in the entertainment industry today, Disney proudly continues its legacy of creating world-class stories and experiences for every member of the family. Disney’s stories, characters and experiences reach consumers and guests from every corner of the globe. With operations in more than 40 countries, our employees and cast members work together to create entertainment experiences that are both universally and locally cherished.

This position is with Magical Cruise Company, Limited , which is part of a business we call Disney Experiences .

Magical Cruise Company, Limited is an equal opportunity employer. Applicants will receive consideration for employment without regard to race, color, religion, sex, age, national origin, sexual orientation, gender identity, disability, protected veteran status or any other basis prohibited by federal, state or local law. Disney fosters a business culture where ideas and decisions from all people help us grow, innovate, create the best stories and be relevant in a rapidly changing world.

Watch Our Jobs

Sign up to receive new job alerts and company information based on your preferences.

Job Category Select a Job Category Administration Animation and Visual Effects Architecture and Design Asset Management Banking Building, Construction and Facilities Business Strategy and Development Call Center Communications Creative Culinary Data Science and Analytics Engineering Facilities and Operations Services Finance and Accounting Food and Beverage Gaming and Interactive Graphic Design Health Services Horticulture and Landscaping Hotel and Resorts Housekeeping Human Resources Legal and Business Affairs Licensing Maritime and Cruise Operations Marketing and Digital Media Merchandising Operations Production Project Management Publishing Quality Assurance Research and Development Retail Operations Sales Sciences and Animal Programs Security Social Responsibility Sports and Recreation Stage Productions Supply Chain Management Talent Technology Theme Park Operations

Location Select Location Amsterdam, Netherlands Anaheim, California, United States Austin, Texas, United States Bengaluru, India Branson, Missouri, United States Bristol, Connecticut, United States Buenos Aires, Argentina Burbank, California, United States Celebration, Florida, United States Charlotte, North Carolina, United States Chennai, India Chessy, France Chicago, Illinois, United States Copenhagen, Denmark Coupvray, France Cypress, Texas, United States Destin, Florida, United States Durham, North Carolina, United States Emeryville, California, United States Fresno, California, United States Glendale, California, United States Greater Manchester, United Kingdom Gurgaon, India Helsinki, Finland Hilton Head Island, South Carolina, United States Houston, Texas, United States Hyderabad, India Istanbul, Turkey Iver Heath, United Kingdom Jakarta, Indonesia Kapolei, Hawaii, United States Kings Mountain, North Carolina, United States Kissimmee, Florida, United States Lake Buena Vista, Florida, United States Lancaster, Pennsylvania, United States Lantau Island, Hong Kong Livermore, California, United States London, United Kingdom Los Angeles, California, United States Madrid, Spain Makati City, Philippines Manhattan Beach, California, United States Marne-la-Vallée, France Mexico City, Mexico Milan, Italy Minato-ku, Japan Montévrain, France Moore Park, Australia Morrisville, North Carolina, United States Mumbai, India Munich, Germany New Taipei City, Taiwan New York, New York, United States Newhall, California, United States Orlando, Florida, United States Oslo, Norway Palm Desert, California, United States Papenburg, Germany Paris, France Quarry Bay, Hong Kong Raleigh, North Carolina, United States Rancho Mirage, California, United States Richmond, Australia San Francisco, California, United States Santa Monica, California, United States São Paulo, Brazil Seattle, Washington, United States Seoul, South Korea Serris, France Sevierville, Tennessee, United States Singapore, Singapore Sofia, Bulgaria Stockholm, Sweden Sydney, Australia Taipei, Taiwan Tampa, Florida, United States The Woodlands, Texas, United States Tlalpan, Mexico Toronto, Canada Tulalip, Washington, United States Vancouver, Canada Warsaw, Poland Washington, DC, United States Wismar, Germany Zurich, Switzerland

Job Level Select Professional Operations / Production Management Business Support / Administrative Internships / Programs Executive Talent

Email Address

Country/Region of Residence Select Afghanistan Aland Islands Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia, Plurinational State Of Bonaire, Sint Eustatius and Saba Bosnia and Herzegovina Botswana Bouvet Island Brazil British Indian Ocean Territory Brunei Darussalam Bulgaria Burkina Faso Burundi Cambodia Cameroon Canada Cape Verde Cayman Islands Central African Republic Chad Chile Christmas Island Cocos (Keeling) Islands Colombia Comoros Congo Congo, the Democratic Republic of The Cook Islands Costa Rica Cote D'ivoire Croatia Cuba Curacao Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Falkland Islands (Malvinas) Faroe Islands Fiji Finland France French Guiana French Polynesia French Southern Territories Gabon Gambia Georgia Germany Ghana Gibraltar Great Britain Greece Greenland Grenada Guadeloupe Guam Guatemala Guernsey Guinea Guinea-Bissau Guyana Haiti Heard Island and McDonald Islands Holy See (Vatican City State) Honduras Hong Kong Hungary Iceland India Indonesia Iran, Islamic Republic Of Iraq Ireland Isle of Man Israel Italy Jamaica Japan Jersey Jordan Kazakhstan Kenya Kiribati Korea, Democratic People's Republic Of Korea, Republic Of Kosovo Kuwait Kyrgyzstan Lao People's Democratic Republic Laos Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macau Macedonia, the Former Yugoslav Republic Of Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mayotte Mexico Micronesia, Federated States Of Moldova, Republic Of Monaco Mongolia Montenegro Montserrat Morocco Mozambique Myanmar Namibia Nauru Nepal Netherlands Antilles Netherlands New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norfolk Island Northern Mariana Islands Norway Oman Pakistan Palau Palestinian Territory, Occupied Panama Papua New Guinea Paraguay Peru Philippines Pitcairn Poland Portugal Puerto Rico Qatar Reunion Romania Russian Federation Rwanda Saint Barthelemy Saint Helena, Ascension and Tristan Da Cunha Saint Kitts and Nevis Saint Lucia Saint Martin (French Part) Saint Pierre and Miquelon Saint Vincent and the Grenadines Samoa San Marino Sao Tome and Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Sint Eustatius Sint Maarten (Dutch Part) Slovakia Slovenia Solomon Islands Somalia South Africa South Georgia and the South Sandwich Islands South Sudan Spain Sri Lanka Sudan Suriname Svalbard and Jan Mayen Swaziland Sweden Switzerland Syrian Arab Republic Tahiti Taiwan Tajikistan Tanzania, United Republic Of Thailand Timor-leste Togo Tokelau Tonga Trinidad and Tobago Tunisia Turkey Turkmenistan Turks and Caicos Islands Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States United States Minor Outlying Islands Uruguay Uzbekistan Vanuatu Venezuela, Bolivarian Republic Of Viet Nam Vietnam Virgin Islands, British Virgin Islands, U.S. Wallis and Futuna Western Sahara Yemen Zambia Zimbabwe

Confirm Email

- Travel, Tourism & Hospitality ›

Leisure Travel

- Revenue growth of cruises worldwide 2019-2028

Revenue growth of the cruises market worldwide from 2019 to 2028

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

Definition:

Additional Information:

The main performance indicators of the Cruises market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues. Users represent the aggregated number of guests. Each user is only counted once per year.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

For further information on the data displayed, refer to the info button right next to each box.

Other statistics on the topic Cruise industry worldwide

- Largest cruise ships worldwide 2023, by gross tonnage

- Number of global ocean cruise passengers 2009-2027

Shipbuilding

- Most expensive cruise ships worldwide by building cost 2022

- Number of passengers carried by Royal Caribbean Cruises worldwide 2007-2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

Statistics on " Cruise industry worldwide "

- Travel and tourism revenue worldwide 2019-2028, by segment

- Revenue of the cruises industry worldwide 2019-2028

- Revenue of the cruise industry in leading countries 2025-2028

- Share of sales channels of the global cruise industry revenue 2018-2028

- Longest cruise ships worldwide 2023, by length

- Gross tonnage of new cruise ship orders worldwide 2015-2022

- Gross tonnage of new cruise ship orders worldwide by region 2022

- Gross tonnage of cruise ship deliveries worldwide by region 2022

- Gross tonnage of cruise ships in the global order book by region 2022

- Average passenger capacity of ocean-going cruise vessels worldwide 2018-2026

- Number of global ocean cruise passengers 2019-2022, by source market

- Main global cruise destinations 2019-2022, by number of passengers

- Busiest cruise ports worldwide 2019-2022, by passenger movements

- Number of Carnival Corporation & plc passengers worldwide 2007-2023

- Number of passengers carried by Norwegian Cruise Line worldwide 2011-2023

- TUI cruise passengers worldwide 2013-2023, by brand

- Worldwide cruise company market share 2022

- Revenue of Carnival Corporation & plc worldwide 2008-2023, by segment

- Net income of Carnival Corporation & plc 2008-2023

- Revenue of Royal Caribbean Cruises worldwide 2009-2023, by segment

- Net income of Royal Caribbean Cruises worldwide 2007-2023

- Revenue of Norwegian Cruise Line worldwide 2013-2023, by segment

- Net income of Norwegian Cruise Line worldwide 2011-2023

- TUI cruise brand revenue worldwide 2015-2023, by brand

- Annual growth rate of the global cruise passenger volume 2017-2022

- Global cruise passenger volume index 2019-2026, by scenario

- COVID-19 impact on cruise passenger volume worldwide 2020-2022, by source region

- Percentage change in revenue of leading cruise companies worldwide 2020-2023

Other statistics that may interest you Cruise industry worldwide

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Revenue of the cruises industry worldwide 2019-2028

- Premium Statistic Revenue growth of cruises worldwide 2019-2028

- Premium Statistic Revenue of the cruise industry in leading countries 2025-2028

- Premium Statistic Share of sales channels of the global cruise industry revenue 2018-2028

Cruise ships

- Basic Statistic Largest cruise ships worldwide 2023, by gross tonnage

- Basic Statistic Longest cruise ships worldwide 2023, by length

- Premium Statistic Most expensive cruise ships worldwide by building cost 2022

- Premium Statistic Gross tonnage of new cruise ship orders worldwide 2015-2022

- Premium Statistic Gross tonnage of new cruise ship orders worldwide by region 2022

- Premium Statistic Gross tonnage of cruise ship deliveries worldwide by region 2022

- Premium Statistic Gross tonnage of cruise ships in the global order book by region 2022

- Premium Statistic Average passenger capacity of ocean-going cruise vessels worldwide 2018-2026

Cruise passengers

- Premium Statistic Number of global ocean cruise passengers 2009-2027

- Premium Statistic Number of global ocean cruise passengers 2019-2022, by source market

- Premium Statistic Main global cruise destinations 2019-2022, by number of passengers

- Premium Statistic Busiest cruise ports worldwide 2019-2022, by passenger movements

- Basic Statistic Number of Carnival Corporation & plc passengers worldwide 2007-2023

- Premium Statistic Number of passengers carried by Royal Caribbean Cruises worldwide 2007-2023

- Premium Statistic Number of passengers carried by Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic TUI cruise passengers worldwide 2013-2023, by brand

Cruise companies

- Premium Statistic Worldwide cruise company market share 2022

- Premium Statistic Revenue of Carnival Corporation & plc worldwide 2008-2023, by segment

- Premium Statistic Net income of Carnival Corporation & plc 2008-2023

- Premium Statistic Revenue of Royal Caribbean Cruises worldwide 2009-2023, by segment

- Premium Statistic Net income of Royal Caribbean Cruises worldwide 2007-2023

- Premium Statistic Revenue of Norwegian Cruise Line worldwide 2013-2023, by segment

- Premium Statistic Net income of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic TUI cruise brand revenue worldwide 2015-2023, by brand

Impact of COVID-19

- Premium Statistic Annual growth rate of the global cruise passenger volume 2017-2022

- Premium Statistic Global cruise passenger volume index 2019-2026, by scenario

- Premium Statistic COVID-19 impact on cruise passenger volume worldwide 2020-2022, by source region

- Premium Statistic Percentage change in revenue of leading cruise companies worldwide 2020-2023

Further related statistics

- Basic Statistic Opinions on the coronavirus impact on cruises according to Italians 2020

- Premium Statistic Wishes about the development of the number of tourists in Norway 2019

- Basic Statistic Current importance of marketing tools to UK tourism business 2011

- Premium Statistic Opinions about the tourism industry in Norway in 2019

- Basic Statistic Governmental support of the tourism industry 2011

- Basic Statistic Share of tourist services in the United Kingdom (UK) in 2012, by employment size

- Premium Statistic Nikon's R&D expenditures FY 2014-2023

- Premium Statistic Global polymer dispersions market value 2019-2024

- Premium Statistic Embedded computing market value worldwide 2018-2027

- Premium Statistic Arvato - revenue by region 2016

- Premium Statistic U.S. hydraulic cylinder exports 2008-2014

Further Content: You might find this interesting as well

- Opinions on the coronavirus impact on cruises according to Italians 2020

- Wishes about the development of the number of tourists in Norway 2019

- Current importance of marketing tools to UK tourism business 2011

- Opinions about the tourism industry in Norway in 2019

- Governmental support of the tourism industry 2011

- Share of tourist services in the United Kingdom (UK) in 2012, by employment size

- Nikon's R&D expenditures FY 2014-2023

- Global polymer dispersions market value 2019-2024

- Embedded computing market value worldwide 2018-2027

- Arvato - revenue by region 2016

- U.S. hydraulic cylinder exports 2008-2014

Advertisement

‘A Lot of Chaos’: Bridge Collapse Creates Upheaval at Largest U.S. Port for Car Trade

A bridge collapse closed Baltimore’s port, an important trade hub that ranks first in the nation by the volume of automobiles and light trucks it handles.

- Share full article

Shipping in the Port of Baltimore

Monthly cargo handled by the Port of Baltimore

By Peter Eavis and Jenny Gross

- March 26, 2024

The Baltimore bridge disaster on Tuesday upended operations at one of the nation’s busiest ports, with disruptions likely to be felt for weeks by companies shipping goods in and out of the country — and possibly by consumers as well.

The upheaval will be especially notable for auto makers and coal producers for whom Baltimore has become one of the most vital shipping destinations in the United States.

As officials began to investigate why a nearly 1,000-foot cargo ship ran into the Francis Scott Key Bridge in the middle of the night, companies that transport goods to suppliers and stores scrambled to get trucks to the other East Coast ports receiving goods diverted from Baltimore. Ships sat idle elsewhere, unsure where and when to dock.

“It’s going to cause a lot of chaos,” said Paul Brashier, vice president for drayage and intermodal at ITS Logistics.

The closure of the Port of Baltimore is the latest hit to global supply chains, which have been strained by monthslong crises at the Panama Canal, which has had to slash traffic because of low water levels; and the Suez Canal, which shipping companies are avoiding because of attacks by the Houthis on vessels in the Red Sea.

The auto industry now faces new supply headaches.

Last year, 570,000 vehicles were imported through Baltimore, according to Sina Golara, an assistant professor of supply chain management at Georgia State University. “That’s a huge amount,” he said, equivalent to nearly a quarter of the current inventory of new cars in the United States.

The Baltimore port handled a record amount of foreign cargo last year, and it was the 17th biggest port in the nation overall in 2021, ranked by total tons, according to Bureau of Transportation Statistics.

Baltimore Ranks in the Top 20 U.S. Ports

Total trade in 2021 in millions of tons

Baltimore ranks first in the United States for the volume of automobiles and light trucks it handles, and for vessels that carry wheeled cargo, including farm and construction machinery, according to a statement by Gov. Wes Moore of Maryland last month.

The incident is another stark reminder of the vulnerability of the supply chains that transport consumer products and commodities around the world.

The extent of the disruption depends on how long it takes to reopen shipping channels into the port of Baltimore. Experts estimate it could take several weeks.

Baltimore is not a leading port for container ships, and other ports can likely absorb traffic that was headed to Baltimore, industry officials said.