Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

87 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3051 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

What Are Traveler’s Checks?

Where to buy traveler’s checks, how to use traveler’s checks, what to do if traveler’s checks are stolen, 1. no access to credit or debit card, 2. limited access to atms, 3. access good exchange rates , 4. avoid common credit or debit fees, 5. as an added safety measure, 1. limited availability for use, 2. not all banks offer them, 3. potential for additional fees, 4. bulky paperwork, credit card, prepaid card, do your research, tell your bank you are traveling, don’t keep all of your money in 1 place, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

How To Buy and Use Traveler’s Checks

You can still buy and use traveler’s checks in the U.S. and other countries.

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.

If you don’t comply, you could experience delays or even have your claim denied. After you’ve reported your missing check, your provider will void it and issue you a new check.

Some issuers even pledge to get replacement checks out to you within 24 hours !

Best Ways To Use Traveler’s Checks

The following are situations when you might consider using traveler’s checks:

If you don’t have a credit card or a debit card tied to your bank account, a traveler’s check could be a safe alternative to simply carrying lots of cash abroad.

This tip also applies if your particular credit or debit card isn’t accepted abroad. This is more likely to happen if your card is something other than a Visa or Mastercard , as those credit cards claim the widest global network.

In many places, you can easily get cash in the local currency at an ATM once you arrive. This wouldn’t be a problem in Europe, for example, but ATMs are rare in some parts of the world. In addition, ATMs can malfunction, networks can be down, and machines might even run out of cash.

Traveler’s checks allow you to get local currency at participating banks, hotels, and other foreign locations without regard for these potential problems.

Buying traveler’s checks can help you avoid bad exchange rates. If you decide to exchange currency once you arrive, you might not get the best conversion rates by doing this at the airport.

By purchasing traveler’s checks before you leave, you can lock in a set amount at the current exchange rate.

Read our guide for the best places to exchange currency .

If your credit or debit card charges a foreign transaction fee , you can be charged a fee every time you make a purchase with your card in a foreign country. If your card also charges ATM fees, these fees can add up quickly.

To avoid these fees, it might make sense to use traveler’s checks. Although there may be a fee involved when you purchase or cash a traveler’s check, it might still be less than other fees your credit or debit card may charge.

Hot Tip: If your card charges a foreign transaction fee, it will typically be 3% of each purchase you make.

If you’re traveling to a potentially unsafe region, traveler’s checks keep your money secure. Even if you’re in a relatively safe place, anyone who enters your room or has access to your bags could search for your money.

The main benefit of traveler’s checks is that they reduce your risk of theft or loss. Since they can’t be cashed without your signature and often require a photo ID, they are less appealing to thieves or pickpockets. They can also be easily replaced if you provide the issuer with the proper information.

Cons of Using Traveler’s Checks

Here are some reasons that might discourage you from using traveler’s checks:

In much of Europe and Asia, traveler’s checks are no longer widely accepted and cannot be easily cashed — even at the banks that issued them.

This means that cashing in traveler’s checks might require hunting down a bank branch or hotel that accepts them during business hours.

Bottom Line: Those relying solely on traveler’s checks may find that they are unable to cash them in many remote or rural locations.

Certain major banks, such as Bank of America, no longer offer traveler’s checks at all. This might mean ordering traveler’s checks online well in advance of your travel plans or having to find a new bank that offers them.

If a company does offer traveler’s checks, it typically charges fees for both buying and cashing in a traveler’s check. While some banks offer them for free if you are a customer, others charge between 1% to 3% of the total purchase amount.

Check the math for your own situation, but using traveler’s checks could actually cost more than using an ATM or credit card abroad.

Not only are traveler’s checks a hassle to carry, but most companies also require that you keep proof of purchase for the checks to verify the check numbers if they are lost or stolen.

Both of these just add up to keeping track of additional paperwork.

Other Alternatives

Obviously, traveler’s checks aren’t your only option when it comes to obtaining foreign currency. Here are some other options you should consider.

Cash is convenient and relatively easy to exchange. You can bring money from home into a foreign bank or currency exchange location almost anywhere in the world. It can be easily exchanged without the worry of multiple bank fees or ATM fees adding up.

Hot Tip: Be aware: if you exchange your money in tourist areas, you might be hit with a bad exchange rate.

On the downside, carrying paper money is a risk since it can’t be replaced if stolen.

A debit card can be used at an ATM to collect cash. While not all ATM machines (especially in more rural places) accept foreign debit cards, you will find that most do.

Depending on your bank, you might even have to pay both an out-of-network ATM and an international ATM fee for this convenience.

Hot Tip: An out-of-network ATM fee is typically between $2 to $3.50 per transaction in 2021 and a typical international ATM fee can range from $2 to $7 per transaction (plus a 3% conversion fee), depending on your bank and card.

Most restaurants and stores accept foreign debit cards, but carrying a form of backup currency is always wise . Additionally, foreign transaction fees can add up quickly if you are using your debit card frequently.

Like debit cards, credit cards are small and easy to carry. Mastercard, Visa, and more recently, American Express , are widely accepted in other countries, so you can rest easy knowing you will be able to complete your purchases. You can also limit fees by getting a credit card with no foreign transaction fees .

A credit card also comes with fraud protection. You can dispute fraudulent charges and get them removed from your account if reported timely.

Hot Tip: While you can use a credit card for ATM transactions, you will be hit with a cash advance fee . It’s best to avoid doing this, if possible.

If you have difficulty getting approved for a credit card , a prepaid card could be a good alternative. You simply load the card with money from your bank account and use it as a debit card at an ATM or as a credit card at merchants and hotels.

While prepaid cards are locked with a PIN number, they can sometimes be difficult to use at ATM machines. Additionally, fees for foreign currency transactions can be as high as 7% , depending on the card.

Hot Tip: Booking hotels, airfare, or activities online will require either a credit card, debit card, or prepaid card.

Money Tips for Traveling Abroad

Know which types of currency are accepted at your destination and how much of each type (if any) you should bring. Especially be aware of any cash you might need on arrival (to obtain a visa , exchange upon arrival, etc.) in case you can’t immediately locate an ATM or a currency exchange office.

Carry a mix of cash, cards, and maybe even traveler’s checks. Ideally, the cards you bring with you shouldn’t have foreign transaction fees or ATM fees . Having some variety also helps if one of your cards isn’t accepted or your cash is lost or stolen.

Always be sure to let your bank and credit card issuers know where you’re going and when so that your card isn’t declined when you try to make a purchase due to unusual activity.

If you exchange money at your bank, you will likely also get a better exchange rate.

Keep some of your currency or an extra card locked in your hotel room’s safe or in a money belt . In the terrible instance that you lose your purse or wallet, you would still have immediate access to additional money.

We’ve shown that traveler’s checks aren’t necessarily the most convenient way to take currency abroad, but depending on if you have limited access to debit or credit cards or they aren’t accepted where you are traveling, it might be worth it to bring some along.

Overall, if you’ve decided that traveler’s checks can be of use to you, taking some, along with some cash and a debit, credit, or prepaid card, may just be the smartest way to travel.

Frequently Asked Questions

Can you still buy traveler's checks.

While many larger banks are no longer offering traveler’s checks, they are still available at American Express and other smaller banks and credit unions. It is worth asking if your bank offers them and at what cost.

How much does it cost to buy traveler's checks?

While some banks offer them for free if you are a customer, others charge between 1% and 3% of the purchase amount.

What is the purpose of a traveler's check?

A traveler’s check offers a safer option than carrying around money. There are multiple safeguards in place to prevent fraud and if the checks are lost or stolen, they can be easily replaced.

Can you cash old traveler's checks?

Traveler’s checks do not expire. You can cash them in at any time — typically even at banks that don’t offer them for sale. This means you can go to your own bank and redeem your traveler’s checks.

To do this, date them, fill out the “Pay To” field (to your bank), and countersign in the presence of the cashier . Any unused value will be returned to you in cash.

Can I buy traveler's checks online?

American Express is the only large bank that offers traveler’s checks online. Its website offers a step-by-step process to order them.

You should check with your local bank or credit union to see if they might also offer this benefit.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![chase traveller biz size chec IHG One Rewards Traveler Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2023/06/IHGOneTravelerCard.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Search Search Please fill out this field.

What Is a Traveler’s Check?

- How It Works

- Where to Get Traveler's Checks

- Where to Cash Traveler's Checks

- Pros and Cons

- Alternatives to Traveler's Checks

The Bottom Line

- Personal Finance

Traveler's Check: What It Is, How It's Used, Where to Buy

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Eliana Rodgers

A traveler’s check (sometimes spelled "cheque") is a once-popular but now largely outmoded medium of exchange utilized as an alternative to hard currency and intended to aid tourists. The product is typically used by people on vacation in foreign countries. It offers a safe way to travel overseas without the risks associated with losing cash. The issuing party, usually a bank, provides security against lost or stolen checks.

Beginning in the late 1980s, traveler’s checks have increasingly been supplanted by credit cards and prepaid debit cards.

Key Takeaways

- Traveler’s checks are a form of payment issued by financial institutions such as American Express.

- These paper cheques are generally used by people when traveling to foreign countries.

- They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash.

- If your traveler's check is lost or stolen it can readily be replaced.

- Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards.

How Traveler’s Checks Work

A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash. Major financial service institutions issue traveler’s checks, and banks and credit unions sell them, though their ranks have significantly dwindled today.

A traveler’s check is similar to a regular check because it has a unique check number or serial number. When a customer reports a check stolen or lost, the issuing company cancels that check and provides a new one.

They come in several fixed denominations in a variety of currencies, making them a safeguard in countries with fluctuating exchange rates , and they do not have an expiration date. They are not linked to a customer’s bank account or line of credit and do not contain personally identifiable information, therefore eliminating the risk of identity theft. They operate via a dual signature system. You sign them when you purchase them, and then you sign them again when you cash them, which is designed to prevent anyone other than the purchaser from using them.

Many banks, hotels, and retailers used to accept them as cash, although some banks charged fees to cash them. However, with the rising worldwide use of credit cards and prepaid debit cards—such as the Visa TravelMoney card, which offers zero liability for its unauthorized use—it is getting much harder to find institutions that will cash traveler’s checks.

History of Traveler’s Checks

James C. Fargo, the president of the American Express Company, was a wealthy, well-known American who was unable to get checks cashed during a trip to Europe in 1890. A company employee, Marcellus F. Berry, believed that the solution for taking money overseas required a check with the signature of the bearer and devised a product for it. American Express and Visa still use the British spelling on their products.

Where to Get Traveler's Checks

Companies that still issue traveler's checks today include American Express , Visa , and AAA . They often come with a 1% to 2% purchase fee. AAA now offers members pre-paid international Visa cards instead of paper checks.

In the U.S., they are available primarily from American Express locations. You can also buy traveler's checks online from the American Express website, but you need to be registered with an account. Visa offers traveler's checks at Citibank locations nationwide, as well as at several other banks.

American Express, Visa, and AAA are among the companies that still issue traveler’s checks.

Where to Cash Traveler's Checks

If you want to convert your traveler's checks into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account. The redemption application online should take less than 15 minutes to complete.

Advantages and Disadvantages of Traveler's Checks

Traveler's checks are handy for tourists who do not want to risk losing their cash or having it stolen while abroad. Because traveler's checks can be reported lost or stolen and the funds replaced, they provide peace of mind. This was particularly a concern before credit cards and ATMs were widespread and affordable worldwide for most travelers. At the same time, these paper checks are now a bit outdated and come with a fee to purchase, making them potentially more expensive and cumbersome than using plastic or electronic payments.

Replaced if lost or stolen

Widely accepted around the world

Convenient to use

They don't expire

Must have the physical check to use it

Incurs a fee to purchase

Limited number of issuers today

Alternatives to Traveler's Checks

The most obvious alternative is to use a credit or debit card issued by a bank that works worldwide and charges low or no foreign exchange fees on purchases or ATM withdrawals. If your bank doesn't allow for this or charges high fees, then prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account, which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection, but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home. Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive, so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

For U.S. citizens living abroad for extended periods, maintaining checking and other bank accounts in the United States provides several advantages, and many checking accounts are friendly for foreign transactions .

Where Do You Buy Traveler's Checks?

You can buy still buy traveler's checks from American Express, Visa, and a handful of other financial institutions. To buy them, visit a location or check the website of an issuing institution. You may need a photo ID in order to set up an account.

How Do You Cash Traveler's Checks?

Many hotels, resorts, and currency traders will cash traveler's checks in exchange for local currency. However, with the rising prevalence of credit and debit cards fewer locations cash traveler's checks.

What Do You Do With Traveler's Checks?

Traveler's checks are a secure way of carrying money while abroad. Many businesses in the tourism industry will cash traveler's checks, and they can also be deposited into a bank account. Because the checks can be easily replaced, they have a lower risk of theft or loss. However, traveler's checks have fallen out of favor due to the increased convenience of credit cards and prepaid debit cards.

Traveler's checks were once a popular way to carry money while vacationing abroad. They are sold in fixed denominations, and can be used for purchases or cashed like an ordinary check. Traveler's checks can be easily replaced, making them less risky than carrying large amounts of cash. However, they have fallen out of favor due to the convenience of using credit or debit cards.

Sparks, Evan. “ Nine Young Bankers Who Changed America: Marcellus Flemming Berry .” ABA Banking Journal, June 26, 2017.

Time Magazine. " Travel (April, 1956): The Host with the Most ."

American Express. " Travelers Cheques ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1322286458-04476bcc51ed474490a6de4473b43dc1.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

PRICE QUOTE REQUEST

1-800-492-1218.

Sales & Service Team:

8AM - 8PM ET

Frequently Ordered Products

- Custom Towing Invoice Form

- Restaurant Guest Checks

- Appliance Service Order Form

- Landlord Rent Receipt Books

- Custom Road Service Towing Invoice

- Road Service Register Form

- Towing Service Form

- Business Receipt Book - Special Wording

- Towing Company Invoice

- Mileage Fuel Trip Report

- Business Checks & Banking Products

- Business Forms

- Carbonless Forms

- Custom Envelope Printing

- Design Services

- Forms By Service

- Labels & Tags

- Marketing Products

- Office Supplies

- Packaging - Bags, Boxes & Bows

- Pressure Seal Documents

- Promotional Products

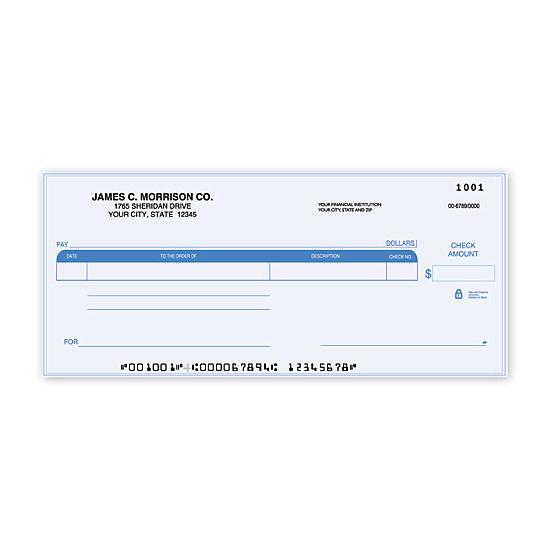

Home :: Business Checks & Banking Products :: Manual Business Checks With Logo :: The Traveller, Business Size Portable Checks

The traveller, business size portable checks.

Item # 59000N

- Size: 8" x 3"

- Parts: 2-Part Carbonless

- Min/QTY: 40

- Price: $79.80

ENTER INFORMATION TO CUSTOMIZE PRODUCT

Enter your business information below then select print options on the right, bank information, transaction information, optional information, select print options.

100% satisfaction guaranteed

- Benefits And Features

A great compliment to computer checks when you are on the go. An ideal full-size business check for organizations that only need small quantities. Our Traveller business checks are full-sized, yet easily carried in your purse, briefcase, or pocket! Conveniently fits in a purse, briefcase, or coat pocket for easy portability. Includes: 40 full-sized checks with 15 1-part deposit tickets, or 160 checks with 60 deposit tickets, and register(s).

- Choose 40 checks with 15 deposit slips, or 160 checks with 60 deposit slips.

- All orders go through proprietary screening to prevent unauthorized orders.

- Compatible with Premier Leather Cover (59001) and Leather Zippered Portfolio (59002), sold separately.

- Additional customization options include imprinting your custom logo.

- Free personalization includes your business imprint plus a choice of standard typeface & business logo.

- Built-in check security trusted by 7,000 financial institutions nationwide, with features such as chemically sensitive paper, microprint border, invisible fluorescent fibers, erasure protection, security screen & warning box.

- Checks are available in 1-part or 2-part duplicate format.

- Blue vinyl cover & check register included.

Similar Products...

Personal Chk - Blue Marble

Compact Size One Write Check

Voucher Check - 3 Per Page

1820 Highway 20 SE

Suite 114, PMB 1094

Conyers, GA 30013

Join our Email List for Exclusive Offers and Updates.

Be the first to know about special offers, new product launches, features, events and more.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to Chase Travel Cards

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What are Chase travel credit cards?

Earning chase points, the value of flexible point currencies, maximizing your benefits, chase travel cards, recapped.

Chase travel credit cards are some of the most popular and beginner-friendly cards. Perhaps you’ve heard a friend or family member totaling up all the great rewards they’re redeeming and you want in. Even if you’ve already got a co-branded card, such as those offered by Hyatt and United, Chase’s own travel credit cards are well-worth investing in.

Let’s take a look at the different types of Chase travel cards, why they’re valuable and the different benefits they provide.

» Learn more: The best travel credit cards right now

Chase has two very distinct categories of travel credit cards. The first is Chase’s own branded cards, like the Chase Sapphire cards or the Chase Freedom cards. These can earn either cash back or points, depending on which card you hold. Chase’s travel cards earn Ultimate Rewards® . These points can be used in many different ways, including:

Gift cards.

Reward travel.

Transfers to other partners.

The second type of travel credit card that Chase offers is the co-branded credit card, which is a partnership between Chase and an airline or hotel. This includes options such as the IHG One Rewards Premier Credit Card and the United Quest℠ Card .

These cards will earn points in the currency of its respective program. For IHG, you’ll earn IHG points . For United, you’ll earn United MileagePlus miles .

» Learn more: Is the Chase Sapphire Reserve® worth its annual fee?

When you sign-up for a new credit card, you’ll usually be able to earn a welcome bonus. This bonus is a lump-sum deposit of points into your account once you’ve met a certain spend threshold.

Two of Chase’s most popular travel cards, the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® , both come with a welcome bonus in points:

Chase Sapphire Preferred® Card : Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

Chase Sapphire Reserve® : Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

You’ll also keep earning Chase points after you receive your sign-up bonus, though the number of Chase points you’ll earn will depend on which card you hold.

The Chase Sapphire Reserve® , for example, will earn 10x points on dining and 5x points on airfare purchased through Chase Ultimate Rewards®. You’ll also earn 3x points on all other travel purchases, including dining purchases, though you’ll be on the hook for a hefty $550 annual fee.

The Chase Sapphire Preferred® Card , meanwhile, will charge you a $95 annual fee and earns 5x points on travel purchased through Chase Ultimate Rewards® and 2x points on all other travel.

The more expensive Chase Sapphire Reserve® card allows you to redeem your points for 1.5 cents in value via Chase's travel portal, while the Chase Sapphire Preferred® Card will give you a value of 1.25 cents per point.

» Learn more: How to build your ideal Chase Ultimate Rewards® wallet

So why would you pick a Chase card rather than a co-branded credit card, especially if you’re pretty loyal to one chain? Say you really like to stay at Hyatt, so you’re trying to decide between the World of Hyatt Credit Card ( $95 annual fee) and the Chase Sapphire Preferred® Card ( $95 annual fee).

The World of Hyatt Credit Card earns up to 9x Hyatt points at Hyatt and 2x points on dining, transit, flights and gym memberships. It earns 1x points everywhere else.

The Chase Sapphire Preferred® Card , meanwhile, earns 5x points on travel booked via Chase's travel portal and 3x points on dining. It also earns 3x points on all other travel — after spending your first $300 on travel purchases annually — and 1x points for all other purchases.

On its face, you can see that World of Hyatt Credit Card will earn you more points than a Chase card, at least when spending at Hyatt. But if you’re into dining out and making normal travel purchases, you’ll outearn the Hyatt card with the Chase card every time.

And using the Chase card won't stop you from getting Hyatt points, either. This is thanks to the status of Chase Ultimate Rewards® as a transferable point currency .

Chase Ultimate Rewards® transfer to 14 different hotel and airline partners, Hyatt included. These points transfer over at a 1:1 ratio so one Chase point becomes 1 Hyatt point.

Even more important than earning Hyatt points is the ability to transfer to other partners. Chase Ultimate Rewards® can be turned into United miles, which you can use to book flights. You can transfer them over to Marriott for a luxurious stay in Europe or even send them to Southwest for cheap flights to Hawaii.

With a whole host of different partners, your Chase Ultimate Rewards® have far more versatility than any single airline or hotel credit card can provide.

» Learn more: A beginner’s guide to traveling on points and miles

Chase’s travel cards do more than just earn and transfer points. Both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® , for example, come with additional benefits simply for being a cardholder.

The Chase Sapphire Preferred® Card features an annual $50 hotel credit, good for hotels booked through Chase's travel portal .

The Chase Sapphire Reserve® provides even more benefits to support its $550 annual fee:

$300 annual travel credit .

Airport lounge access via a Priority Pass Select membership.

Access to the Luxury Hotels & Resorts program.

$100 TSA PreCheck/Global Entry credit.

Although other travel cards also come with handy benefits, the $300 credit the Chase Sapphire Reserve® provides effectively knocks a major chunk off the annual fee.

» Learn more: The Chase Sapphire Preferred® Card vs. Chase Sapphire Reserve®

Is there a best Chase travel credit card? The answer depends on you. If you’re looking for a moderately priced card that’ll provide solid benefits, the Chase Sapphire Preferred® Card may be a good option for you. If you’re wanting some perks at the airport and don’t mind shelling out more for an annual fee, the Chase Sapphire Reserve® may be a better fit.

Whether you’re looking for your first travel card or already have half a dozen under your belt, Chase’s travel credit cards offer excellent earnings and solid perks for any potential traveler.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

1.5%-6.5% Enjoy 6.5% cash back on travel purchased through Chase Travel; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

$300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

All about traveler’s checks, plus modern alternatives

January 18, 2024 | 1 min video

Getting ready to travel? One thing to think about is how you’ll make purchases while you’re away. Traveler’s checks aren’t as common as they used to be. So you might want to consider modern alternatives that may offer the advantages of traveler’s checks and more.

Read on to learn more about the ins and outs of traveler’s checks. And find out about other options—for example, credit cards, prepaid cards and mobile wallets—that could help make the most of your trip.

Key takeaways

- Traveler’s checks are paper documents that can be exchanged for local currency or used to buy goods and services abroad.

- Traveler’s checks feature unique serial numbers, making them replaceable if they’re lost or stolen.

- Fees may apply when purchasing and exchanging traveler’s checks.

- There are modern alternatives to traveler’s checks that you may find more convenient.

Earn 75,000 bonus miles with Venture

Redeem your miles for flights, vacation rentals and more.

What is a traveler’s check?

A traveler’s check is a paper document you can use for making purchases when you’re traveling, typically in other countries. It can be used as cash or a regular check.

Traveler’s checks—you may also see them referred to as “cheques”—are generally printed with a unique serial number. This means you may be able to get a refund if your checks are lost or stolen. The checks are usually available in set denominations—$20 and $50, for example.

How do traveler’s checks work?

Traveler’s checks may be accepted at participating merchants like hotels, restaurants and stores. Just keep in mind that there could be fewer participating merchants than there used to be.

When you purchase your checks, you may notice that they have a space for two signatures:

- First signature: You might be asked to sign each of your traveler’s checks when you buy them. If not, you may want to sign them as soon as possible.

- Second signature: You’ll usually sign your traveler’s checks again when you’re making purchases.

This dual signature method is meant to provide extra security and ensure that only the purchaser is able to use them. The merchant can verify that the second signature matches the first.

How to cash in traveler’s checks

You can use traveler’s checks like cash to pay for goods and services at participating merchants. You’ll typically sign the check in front of the merchant at the time of the purchase.

While traveling, you may also be able to redeem your traveler’s checks for local currency at financial institutions or your hotel.

Potential fees associated with traveler’s checks

It’s possible that certain fees may apply to traveler’s checks. For example, you may need to pay a fee when you purchase them or when you exchange them for currency once you get to your destination. There might also be a fee for depositing unused checks into your bank account.

Where to get traveler’s checks

While traveler’s checks might be harder to find than they used to be, they’re still available. You may be able to purchase them at some banks, credit unions and travel-related service organizations.

Pros and cons of traveler’s checks

Take a look at some of the potential pros and cons of traveler’s checks:

When to use a traveler’s check

You might consider using traveler’s checks in certain situations, including:

- When you don’t have a credit or debit card. Some people may prefer to travel using modern payment options like credit and debit cards. But if you don’t have either, you may find traveler’s checks to be an acceptable alternative.

- When you can’t access an ATM. If you find yourself in a place that doesn’t have an ATM on every corner, you can instead use your checks at merchants that accept them.

- When you want to exchange them for local currency. When you get to where you’re going, you might want to have some local currency on hand. You may be able to exchange your traveler’s checks for currency at certain banks or other financial institutions.

Modern alternatives to traveler’s checks

There are a number of alternatives to traveler’s checks—options you may find faster, easier and more convenient. Here are a few to consider when you’re comparing your choices:

Credit cards

Carrying a credit card may be easier than carrying traveler’s checks. Plus, credit cards can be helpful for making large and online travel purchases like plane tickets and hotel reservations. That’s especially true with travel credit cards , which you could use to earn rewards on travel-related purchases.

Some credit cards may also come with benefits that could be useful while traveling. They might include things like protection from unauthorized charges and the ability to use a mobile app to track your purchases .

Keep in mind that foreign transaction fees may come into play when you use your credit card overseas. While this fee might vary between credit card companies, it could generally be in the range of 1%-3% of your purchase. You may also be charged a currency conversion fee. This fee is often part of a foreign transaction fee.

Some companies don’t charge foreign transaction fees. For example, none of Capital One’s U.S.-issued credit cards charge this fee. View important rates and disclosures .

If you’re traveling with your credit card, your credit card issuer may want to be alerted before you go. That’s because it might flag your purchases as fraudulent if it notices purchases made in an unfamiliar location. Thanks to the added security of its chip cards, Capital One doesn’t require this notification.

See if you’re pre-approved

Check for pre-approval offers with no risk to your credit score.

Debit cards

When you’re traveling, a debit card can be just as easy to carry around as a credit card. And like a credit card, it can help protect against fraud.

The big difference: A credit card lets you “borrow” money for purchases, while a debit card uses the money in your checking account to make purchases.

It may be helpful to carry a debit card when you’re visiting a country that generally favors cash transactions. In that case, you could use your debit card at an ATM to get cash once you’ve reached your destination. And that may be safer than bringing cash with you and exchanging it for local currency once you’ve arrived.

Keep in mind that you could be charged ATM fees when you use a debit card abroad. According to the Consumer Financial Protection Bureau (CFPB), some banks and credit unions don’t charge customers a fee for using their ATMs. But they might charge you if you’re not a customer—and that could be in addition to a fee charged by the operator of the ATM.

Also, be mindful that some banks may charge a foreign transaction fee when you make purchases abroad with a debit card. You may also be charged a currency conversion fee—often, this fee is folded into the foreign transaction fee.

Some banks, though, don’t charge foreign transaction fees. For example, Capital One doesn’t charge this fee for its 360 Checking account .

If you take a debit card on your travels, your bank may ask you to notify it beforehand. That’s because it could notice transactions made in an unfamiliar location and potentially freeze your account. Capital One doesn’t require this notification , thanks to the added security of your chip card.

Prepaid cards

Like credit cards and debit cards, prepaid cards may be easier to carry around than cash. They may also offer some protection against loss, theft or fraud once you register them.

But with a prepaid card, you don’t “borrow” money like you do with a credit card—or use money from your checking account, like with a debit card. Instead, you typically add money to a prepaid card before using it.

According to the CFPB, there are a few ways you can add funds to a prepaid card. For example, you can transfer money from your checking account or load funds at some retailers or financial institutions.

You might be charged one or more fees for using a prepaid card. The CFPB notes that if you get your prepaid card from a retailer, you should find a summary of fees on the card’s packaging. If you get your card from a different provider—online or over the phone, for example—the provider needs to share this information on paper or electronically.

Mobile wallet

You’ll probably have your phone with you when you’re traveling, right? Using a mobile wallet to make purchases is another modern alternative to traveler’s checks.

A mobile wallet is essentially a digital version of your real wallet. Depending on the wallet, you may be able to store things like credit cards, debit cards, prepaid cards, boarding passes, hotel reservations, event tickets and other types of personal data.

Mobile wallets can be convenient, allowing you to make quick and easy payments using your phone or other mobile device when you’re on the go. And they typically use advanced technology that prevents your actual account numbers from being stored in the wallet.

There are lots of mobile wallets to choose from. Researching your options could help you see which will work best while you’re traveling. Keep in mind, some merchants might not take mobile wallet payments.

Traveler’s checks in a nutshell

Traveler’s checks can be a helpful way to pay for things abroad, but there are also more modern options available today, like credit cards, debit cards, prepaid cards and mobile wallets. And with a travel credit card, you could earn rewards on your travel-related purchases.

Ready to upgrade the way you pay before your next trip? Compare Capital One travel credit cards today to find the best option for you, no matter where you’re headed.

Related Content

How do travel credit cards work.

article | February 8, 2024 | 7 min read

Should you notify your credit card company when traveling?

article | February 8, 2022 | 2 min read

Foreign transaction fees: What you need to know

article | August 10, 2023 | 8 min read

Chase for Business

Unlimited 2% cash back *

Unlimited 1.5% Cash Back **

5% cash back in select business categories ***

3X on shipping and select advertising ****

No need to swipe! No need to worry!

Quickly tap, securely pay and be on your way anywhere you see the contactless symbol.

Visit https://www.chase.com/personal/credit-cards/contactless Opens in a new window for more information.

Compare Cards

New cardmember offer, earn rewards, redemption options, employee cards at no additional cost * , ** , *** , ****, travel & purchase protections, auto rental collision damage waiver ^, trip cancellation/trip interruption insurance ^, travel and emergency assistance services ^, roadside dispatch ^, purchase protection ^, cell phone protection ^, extended warranty protection ^.

returns to benefits disclaimer reference ^ These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.

Auto Rental Collision Damage Waiver

Trip cancellation/trip interruption insurance, travel and emergency assistance services, roadside dispatch, purchase protection, cell phone protection, extended warranty protection, built-in fraud protection.

We help safeguard your credit card purchases using sophisticated fraud monitoring. We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card.

* Offer Details For Ink Business Premier

Offers may vary depending on where you apply, for example online or in a branch, and can change over time. To take advantage of this particular offer now, apply through the method provided in this advertisement. Review offer details before you apply.

$1,000 Cash Back After You Spend $10,000 On Purchases In The First 3 Months From Account Opening: You will receive 100,000 bonus points with this bonus offer, which can be redeemed for $1,000 cash back. To qualify and receive your bonus, you must make Purchases totaling $10,000 or more during the first 3 months from account opening. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) After qualifying, please allow 6 to 8 weeks for bonus points to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

Cash Back And Points: Rewards Program Agreement: For more information about the Ink Business Premier rewards program, view the latest Rewards Program Agreement (PDF) . We will mail your Rewards Program Agreement once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will also be available after logging in to chase.com/ultimaterewards . Cash Back and Points: “Cash Back rewards” are the rewards you earn under the program. Cash Back rewards are tracked as points and each $1 in Cash Back rewards earned is equal to 100 points. You may simply see “Cash Back” in marketing materials when referring to the rewards you earn. You may also see, “points” or “Ultimate Rewards points” when referring to the points you can use. How you can earn points: You’ll earn points on purchases of products and services, minus returns or refunds, made with an Ink Business Premier credit card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count and won’t earn points: balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 2% Cash Back: You’ll earn 2% Cash Back rewards for each $1 spent. 2.5% Cash Back: You’ll earn 2.5% Cash Back rewards total for each $1 spent on every purchase totaling $5,000 or more (0.5% additional Cash Back rewards on top of the 2% Cash Back rewards earned on each purchase). Each purchase must bill and post to your account in an amount that is equal to or greater than $5,000 in order to earn a total of 2.5% Cash Back rewards; for example, purchases with items that ship at different times and bill in amounts less than $5,000 will only qualify for earning 2% Cash Back rewards. 5% Cash Back: You’ll earn 5% Cash Back rewards total for each $1 spent on purchases made using your card through Chase Travel (3% additional Cash Back rewards on top of the 2% Cash Back rewards earned on each purchase). 5% total Cash Back on qualifying Lyft rides through 03/2025: You’ll earn an additional 3% Cash Back for each $1 spent when your card is used for qualifying Lyft products and services purchased through the Lyft mobile application through 03/31/2025. Qualifying Lyft products and services include rides taken in Classic, Shared, Lux, or XL modes; bike and scooter rides; and subscription and membership products. Purchase of gift cards, car rentals, vehicle service centers, miscellaneous fees and other Lyft products and services are excluded from this promotion. Future Lyft products or services may not be eligible for additional Cash Back. You may see “5% Cash Back rewards” in marketing materials to refer to the 3% Cash Back rewards earned in addition to the 2% Cash Back rewards earned on all purchases (see above). The additional 3% Cash Back rewards will appear on your billing statement in a separate line from the 2% Cash Back rewards. Lyft is not responsible for the provision of, or the failure to provide, Chase benefits or services. How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and pay with points for products or services made available through the program or directly from third parties. Redemption values for reward options vary. Points expiration/losing points: Your points don’t expire as long as your account remains open, however, you will immediately lose all your points if your account status changes, or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/Mastercard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/Mastercard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won’t qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs .

Flex for Business: We may assign a portion of your Credit Access Line for use with Flex for Business. Flex for Business allows a portion of your Credit Access Line to be used for qualifying purchases over time, with interest. You can avoid interest on new Flex for Business purchases if you pay your entire statement New Balance by the due date and time. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count: balance transfers, cash advances and other cash-like transactions, travelers checks, foreign currency, money orders, or wire transfers, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. A “qualifying purchase” is a purchase of a set dollar amount or higher that we will communicate to you when you are approved for the card. When you use your card for qualifying purchases, they will automatically be included in your Flex for Business balance, provided there is enough available credit in your Flex for Business limit for the entire qualifying purchase amount. We will post your Flex for Business limit and qualifying purchases amount on chase.com . We may cancel, change or restrict your Flex for Business limit and qualifying purchase amount at any time.

Adding An Employee Card: If any employees are allowed to use the account, they will be authorized users and will have equal charging privileges unless individual spending limits are established for them. You, as the Authorizing Officer, together with the business are responsible for any use of the account by you, an authorized user or anyone else permitted to use the account. You, together with the business, are responsible for repaying all balances on the account. All correspondence, including statements and notifications, will be sent to you as the Authorizing Officer. By requesting to add an employee cardholder to the account, you represent all information provided is accurate and is for persons with which the business has a relationship. You also represent that the business has permission to provide the employee information to Chase and to add the employee as a cardholder. If Chase determines any information provided is fraudulent, Chase has the right to close the account.

Account Alerts: Delivery of alerts may be delayed for various reasons including technology failures and capacity limitations. There is no charge from Chase, but message and data rates may apply.

Zero Liability: Zero Liability Protection does not apply to use of an account by an authorized user without the approval of the primary cardmember. If you think someone used your account without permission, tell us immediately by calling the Cardmember Services number on your card or billing statement.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.

Chase Ink Business Premier credit cards are issued by JPMorgan Chase Bank, N.A. Member FDIC. Accounts subject to credit approval. Restrictions and limitations apply. Offer subject to change.

** Offer Details for Ink Business Unlimited

$750 Cash Back After You Spend $6,000 On Purchases In The First 3 Months From Account Opening: You will receive 75,000 bonus points with this bonus offer, which can be redeemed for $750 cash back. To qualify and receive your bonus, you must make Purchases totaling $6,000 or more during the first 3 months from account opening. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) After qualifying, please allow 6 to 8 weeks for bonus points to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

Cash Back And Points: Rewards Program Agreement: For more information about the Ink Business Unlimited rewards program, view the latest Rewards Program Agreement (PDF) . We will mail your Rewards Program Agreement once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will also be available after logging in to chase.com/ultimaterewards . Cash Back and Points: “Cash Back rewards” are the rewards you earn under the program. Cash Back rewards are tracked as points and each $1 in Cash Back rewards earned is equal to 100 points. You may simply see “Cash Back” in marketing materials when referring to the rewards you earn. You may also see, “points” or “Ultimate Rewards points” when referring to the points you can use. How you can earn points: You’ll earn points on purchases of products and services, minus returns or refunds, made with an Ink Business Unlimited credit card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count and won’t earn points: balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 1.5% Cash Back: You’ll earn 1.5% Cash Back rewards for each $1 spent. 5% total Cash Back on qualifying Lyft rides through 03/2025: You’ll earn an additional 3.5% Cash Back for each $1 spent when your card is used for qualifying Lyft products and services purchased through the Lyft mobile application through 03/31/2025. Qualifying Lyft products and services include rides taken in Classic, Shared, Lux, or XL modes; bike and scooter rides; and subscription and membership products. Purchase of gift cards, car rentals, vehicle service centers, miscellaneous fees and other Lyft products and services are excluded from this promotion. Future Lyft products or services may not be eligible for additional Cash Back. You may see “5% Cash Back rewards” in marketing materials to refer to the 3.5% Cash Back rewards earned in addition to the 1.5% Cash Back rewards earned on all purchases. The additional 3.5% Cash Back rewards will appear on your billing statement in a separate line from the 1.5% Cash Back rewards. Lyft is not responsible for the provision of, or the failure to provide, Chase benefits or services. How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and pay with points for products or services made available through the program or directly from third parties. Redemption values for reward options may vary. Points expiration/losing points: Your points don’t expire as long as your account remains open, however, you will immediately lose all your points if your account status changes, or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement.

Chase Ink Business Unlimited credit cards are issued by JPMorgan Chase Bank, N.A. Member FDIC. Accounts subject to credit approval. Restrictions and limitations apply. Offer subject to change.

*** Offer Details For Ink Business Cash

Offers may vary depending on where you apply, for example online or in a branch, and can change over time. To take advantage of this particular offer now, apply through the method provided in this advertisement. Review offer details before you apply.

$350 Cash Back After You Spend $3,000 On Purchases In The First 3 Months From Account Opening and $400 Cash Back After You Spend A Total Of $6,000 On Purchases In The First 6 Months From Account Opening: You will qualify for 35,000 bonus points if you make $3,000 in Purchases within 3 months of account opening. You will qualify for 40,000 bonus points if you make a total of $6,000 in Purchases within 6 months of account opening (for a possible total of 75,000 bonus points, which can be redeemed for $750 cash back). After qualifying, please allow 6 to 8 weeks for bonus points to post to your Chase Ink Business Cash account. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.

Cash Back And Points: Rewards Program Agreement: For more information about the Ink Business Cash rewards program, view the latest Rewards Program Agreement (PDF) . We will mail your Rewards Program Agreement once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will also be available after logging in to chase.com/ultimaterewards . Cash Back and Points: “Cash Back rewards” are the rewards you earn under the program. Cash Back rewards are tracked as points and each $1 in Cash Back rewards earned is equal to 100 points. You may simply see “Cash Back” in marketing materials when referring to the rewards you earn. You may also see, “points” or “Ultimate Rewards points” when referring to the points you can use. How you can earn points: You’ll earn points on purchases of products and services, minus returns or refunds, made with an Ink Business Cash credit card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count and won’t earn points: balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 1% Cash Back: You’ll earn 1% Cash Back rewards for each $1 spent. 2% Cash Back: You’ll earn 2% Cash Back rewards total for each $1 of the first $25,000 spent each account anniversary year on combined purchases in the following rewards categories: gas stations and restaurants (1% additional Cash Back rewards on top of the 1% Cash Back rewards earned on each purchase). After $25,000 is spent on combined purchases in these categories each account anniversary year, you go back to earning 1% Cash Back rewards for each $1 spent, with no maximum. 5% Cash Back: You’ll earn 5% Cash Back rewards total for each $1 of the first $25,000 spent each account anniversary year on combined purchases in the following rewards categories: office supply stores; internet, cable, and phone services (4% additional Cash Back rewards on top of the 1% Cash Back rewards earned on each purchase). After $25,000 is spent on combined purchases in these categories each account anniversary year, you go back to earning 1% Cash Back rewards for each $1 spent, with no maximum. 5% total Cash Back on qualifying Lyft rides through 03/2025: You’ll earn an additional 4% Cash Back for each $1 spent when your card is used for qualifying Lyft products and services purchased through the Lyft mobile application through 03/31/2025. Qualifying Lyft products and services include rides taken in Classic, Shared, Lux, or XL modes; bike and scooter rides; and subscription and membership products. Purchase of gift cards, car rentals, vehicle service centers, miscellaneous fees and other Lyft products and services are excluded from this promotion. Future Lyft products or services may not be eligible for additional Cash Back. You may see “5% Cash Back rewards” in marketing materials to refer to the 4% Cash Back rewards earned in addition to the 1% Cash Back rewards earned on all purchases. The additional 4% Cash Back rewards will appear on your billing statement in a separate line from the 1% Cash Back rewards. Lyft is not responsible for the provision of, or the failure to provide, Chase benefits or services. How you can use your points: You can use your points to redeem for any available reward options, including cash, gift cards, travel, and pay with points for products or services made available through the program or directly from third-party merchants. Redemption values for reward options may vary. Points expiration/losing points: Your points don’t expire as long as your account remains open, however, you will immediately lose all your points if your account status changes, or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/Mastercard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/Mastercard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won’t qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see chase.com/RewardsCategoryFAQs .

Chase Ink Business Cash Card 10% Relationship Bonus: As the authorizing officer of a Chase Ink Business Cash card and account owner of an eligible Chase Business Banking Checking account, you will receive a one-time bonus equal to 10% of Cash Back rewards earned with your Ink Business Cash card during your first 12 monthly billing cycles from account opening. For example, if you earn a total of $2,500 in Cash Back rewards you would earn a bonus of $250 in Cash Back rewards, which can be redeemed for $250 cash back. To qualify, you must open a Chase Ink Business Cash card account between 03/17/2024 and 11/17/2024, your Ink Business Cash card account must be open and not in default and your Business Banking Checking account must be open, as defined in your Business Card and Deposit Account Agreements, at the end of your 12th monthly Chase Ink Business Cash card billing cycle. Cash Back rewards eligible for the 10% Relationship Bonus are: The 5% Cash Back rewards earned on the first $25,000 spent each account anniversary year on office supply stores and internet, cable, and phone services; the 2% Cash Back rewards earned on the first $25,000 spent each anniversary year on gas stations and restaurants; and the 1% Cash Back rewards earned on all other purchases. Cash Back rewards earned through a new cardmember bonus or any other bonus offer, and points moved into your account through the Ultimate Rewards Combine Points feature or any other transfer method, are ineligible. Cash Back rewards must be earned by the end of your 12th monthly billing cycle to be included in the bonus. Please note that in some cases Cash Back rewards are not earned until a billing cycle that occurs after the one in which a purchase is made, in particular when made near the end of a billing cycle. As a result, Cash Back rewards earned on some purchases made during your first 12 monthly billing cycles may not be eligible to be included in the bonus. Please allow 2 to 3 billing cycles from the end of your 12th monthly billing cycle for bonus Cash Back rewards to post to your account. All Chase Business Banking checking accounts are eligible. Having an eligible Chase Business Banking checking account is not a requirement of approval for the Chase Ink Business Cash Card. This offer is subject to change and may be cancelled at any time without notice.

Chase Ink Business Cash credit cards are issued by JPMorgan Chase Bank, N.A. Member FDIC. Accounts subject to credit approval. Restrictions and limitations apply. Offer subject to change.

**** Offer Details for Ink Business Preferred

100,000 Bonus Points After You Spend $8,000 On Purchases In The First 3 Months From Account Opening: To qualify and receive your bonus, you must make Purchases totaling $8,000 or more during the first 3 months from account opening. (“Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) After qualifying, please allow 6 to 8 weeks for bonus points to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.