- Tourism Quest news

TATA AIG Introduces ‘Travel Guard Plus’ – A Comprehensive Travel Insurance Solution with Enhanced Features

- Includes Medical Expenses – Injury and /or illness, Accidental Death and Disablement (Overseas), emergency medical evacuation coverage

- Also covers non-medical contingencies like Delay / Loss of Checked-in Baggage, Loss of personal baggage, Loss of Passport, Compassionate Travel/ Stay, Accommodation extension, Up-gradation to Business Class and many more

- It also provides instant gratification in case of flight delay or flight cancellation

- Assistance services like medical assistance, lost luggage or lost passport etc

- Geographical Scope includes Schengen, worldwide including USA/Canada and Worldwide excluding USA/Canada geo-scopes

- Option for Single Trip insurance cover up to 365 days

- Offers add-on bundles like Cruise bundle, Travel Plus bundle, Accident bundle

TATA AIG General Insurance Company Limited, a leading general insurance provider, has launched “Travel Guard Plus”, a comprehensive travel insurance product that redefines complete coverage for travellers with an array of bundle plans. TATA AIG’s Travel Guard Plus has been meticulously designed to meet people’s diverse travel needs with a wide range of plans where 41 different types of covers has been packaged to meet the need of customers.

TATA AIG’s Travel Guard Plus provides coverage for a range of situations including Loss of Personal Baggage, Compassionate Travel / Stay, Accommodation extension, Up-gradation to Business class, Personal Accident in India, and Instant Gratification that allows travellers to get instant money in case of any flight delays or cancellation on real-time basis. These enhancements aim to elevate the overall travel experience and setting new standards in a travel protection, ensuring travellers have access to extensive coverage tailored to their needs with the ease of claims.

Amongst the many product enhancements, one significant transformation is the customization of plans. Customer can choose from 3 add-on bundles – Cruise Bundle, Travel Plus Bundle, Accident Bundle which caters to cruise related contingencies, frequent flyer cover, coma cover, adventure sports cover. The plans have been customised in addition to the base plans. Moreover, the policy also provides optional assistance services which allows travellers to customize their coverage even further.

Speaking about the new TATA AIG Travel Guard Plus, Mr. Saurav Jaiswal, President & Chief Operating Officer, TATA AIG General Insurance Co. Ltd. said, “At TATA AIG we are excited to announce the launch of Travel Guard Plus, which demonstrates the company’s unwavering commitment to its customers’ needs by providing all-encompassing insurance solutions. With our Travel Guard Plus policy, travellers can embark on their adventures with a sense of assurance, as they have a safeguard against unexpected circumstances. Our emphasis is on ensuring a stress-free experience tailored to each traveller’s specific requirements.”

Key Additions in Travel Guard Plus:

· Annual Multi Trip cover with higher single per trip duration of up to 180 days

· Single Trip with an option of single policy up to 365 days.

· Optional Assistance Services such as Care at Home, Baggage tracking, Lost Passport tracking to enhance convenience.

· Non-medical coverage only plan that suits several travellers who requires cover for non-medical covers only – such as for students who travel abroad for study or young travellers travelling for short duration preferring only non-medical travel insurance.

· Separate plan for Schengen geo-scope.

· New age covers such as adventure sports, instant gratification for flight cancellation/flight delay, loss of Personal Baggage, Personal Accident in India and pandemic coverage.

· Senior Plus plan (71 – 80 years) for higher medical sum inured up to $100000.

· Super Senior plan (> 80 years) for higher medical sum insured up to $50000.

NYC Tourism Launches Content Collaboration with Sony Pictures’ Upcoming Film Ghostbusters: Frozen Empire

Staah successfully concludes the chennai chapter of ‘the big connect’ a hospitech conference.

Related posts

Cleartrip onboards a new captain; signs up mahendra singh dhoni as brand ambassador, jamaica tourism drives economic growth with record arrivals and earnings, max life forays into group annuity solutions; launches ‘max life smart guaranteed pension plan’, leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

TATA Travel Guard

Tata AIG General Insurance Company Limited is a joint venture between Tata Group and American International Group (AIG).The company offers a range of general insurance covers for businesses and individuals and has a comprehensive range of general insurance products for Liability, Marine Cargo, Personal Accident, Travel, Rural-Agriculture Insurance, Extended Warranty etc. Each product offering is backed by professional expertise. Tata AIG General Insurance Company Limited has an asset base of approximate 0.6 billion USD.

Toll Free - 1800 266 7780

This policy covers for medical treatment expenses including ancillary expenses like loss of passport, baggage loss etc and personal liability. The policy uses the services of a external service provider in the event of an emergency. This policy also has an inbuilt deductable amount which is applicable in all claims apart from accidental death.

Unique Features of TATA Travel Guard

Automatic extension of the policy upto 7 days

Higher dental cover/ Bounced hotel & airline booking. Available in all variants

Personal Liability cover in all plans

Comprehensive emergency medical evacuation cover

Fraudulent charges (payment card security)

Repatriation of mortal remains upto sum insured

Eligibility Criteria for TATA Travel Guard

Product benefits of tata travel guard, exclusions for tata travel guard.

- Insured Person is traveling against the advice of a Physician; or is travelling for the purpose of obtaining treatment.

- Any Pre-existing Condition or any complication arising from it

- While under the influence of liquor or drugs.

- Through deliberate or intentional, unlawful or criminal act, error, or omission.

- Whilst participating as the driver, co-driver or passenger of a motor vehicle during motor racing or trial runs.

- Any pre-existing injury or condition

- Pregnancy except from ectopic pregnancy

- Racing on wheels or horseback, winter sports, canoeing in white water rapids and bodily contact sports

- Treatment rendered by a doctor who shares the same residence as the insured or who is a member of the insured persons family

- Mental illness, stress, psychiatric or psychological disorders

- 1. Insured Person is traveling against the advice of a Physician; or is travelling for the purpose of obtaining treatment.

- 2. Any Pre-existing Condition or any complication arising from it;

- 3. Suicide, attempted suicide(whether sane or insane) or intentionally self inflicted Injury or Illness, or sexually transmitted conditions, mental or nervous disorder, anxiety, stress or depression, Acquired Immuno Deficiency Syndrome (AIDS), Human Immunodeficiency Virus (HIV) infection

- 4. Serving in any branch of the Military or Armed Forces of any country, whether in peace or War

- 5. Being under the influence of drugs, alcohol, or other intoxicants or hallucinogens,

- 6. Operating or learning to operate any aircraft, or performing duties as a member of the crew on any aircraft or Scheduled Airline;

- 7. Any loss arising out of War, civil war, invasion, insurrection, revolution, act of foreign enemy,

- 8. Performance of manual work for employment or any other potentially dangerous occupation,

- 9. Participation in winter sports, skydiving/ parachuting, hang gliding, bungee jumping, scuba diving, mountain climbing,

- 10. Pregnancy and all related conditions. This however does not include ectopic pregnancy proved by diagnostic means and is certified to be life threatening by the Physician

- 11. Any non medical expenses

Claim Process for TATA Travel Guard

Assistance service provider is to be informed in each & every medical treatment. Non Intimation may invalidate the claim.

Service Provider details

Assistance Details: While in India Contact No: 1800 119966 from BSNL/MTNL Landline or 1800 22 9966 E Mail: [email protected] Assistance Details: While abroad Contact No: +603-2118-0783 or +603-2118-0784 E Mail: [email protected] SMS: 'CLAIM' to 5616181

- Bonus History / Fund Performance

- Latest News

- Submit Comment

- Call Us: 86559 86559

- Select City* Mumbai Delhi Bangalore Hyderabad Pune Chennai Kolkata Nashik Others

TATA TRAVEL

INSURANCE AGENCY

A dvisor Code: AIG2311020000

Call us today for a quote

INDIA 91- 9810794545

Fill out this form

Get a quote.

Even though many people may think that buying traveller insurance is a waste of money, the fact is, it’s an essential part of international trips. If you wish to save your time as well as money when travelling abroad, it’s prudent to buy travel insurance from a reputed insurer.

Every traveller’s needs and circumstances are different. If you need to travel out of the country for work more than once a year, you will have a few set expectations from a travel insurance policy. So, you need to choose a plan that would offer extensive coverage against medical as well as personal liabilities. Let’s find out what exactly is an annual multi-trip insurance plan.

Annual Travel Insurance Policy

If you are fond of travelling or if you need to travel outside the country more than once yearly, then you need to opt for a travel insurance policy without fail. An annual travel insurance policy will not only safeguard your finances during the trip but will also ensure that you are away from unnecessary expenses related to health and safety.

An annual international travel insurance plan, also known as annual multi-trip travel insurance, is specifically designed for frequent flyers. These insurance policies cover several trip-related exigencies. So, if you plan to travel out of the country more than once a year, instead of buying separate traveller insurance, it’s better to opt for a multi-trip policy.

So, if you are a business owner or work in a multinational company that needs you to travel outside the country pretty often, or if you are simply fond of travelling out of the country often, Tata AIG’s annual travel insurance policy can secure your trips and provide unmatched financial coverage against different kinds of trip-related emergencies.

Features of Annual Multi Trip Travel Insurance

If you are thinking about buying an annual travel insurance policy, you need to be aware of its features. Let’s learn about a few of them below-

Unlimited Trips in a Year: With annual multi-trip travel insurance, you can get coverage for an unlimited number of trips in a single year, with each trip having a duration of 30-45 days. This way, it will be cost-saving on your part to just pay the premium for one single policy rather than paying for multiple policies yearly.

Trip Assistance: Suppose you need to cancel or postpone or prepone your trip abroad due to some reason, the policy will compensate for the loss. Also, your flight may get delayed or cancelled and hence, you will be reimbursed for the unused and non-refundable amount of all your bookings like hotels, trips, flights, etc.

Flight delay or cancellation: You might miss a flight because of delays or because your first flight got canceled. With a multi-trip travel insurance plan, you will be compensated if your flight is canceled or delayed.

Unmatched Medical Support: When travelling abroad, you may fall ill and therefore, you might have to visit a doctor or get admitted to a hospital. You may even meet with an accident that may require you to get treated in a local hospital. And as we all know, medical costs abroad are expensive and hence, you may end up blowing off your entire budget on paying for your medical bills. But with an annual travel policy, your medical treatment costs will be taken care of by the insurer.

Loss of Baggage and Passport Coverage: If you end up losing the passport of your luggage during the trip, you can make a travel insurance claim and the insurer will cover all the costs of a replacement for your lost belonging. For your lost checked-in luggage, your total cost would be compensated by the travel plan.

Repatriation and Death Coverage: In case of the traveller’s (policyholder’s) sudden death or permanent disability during the trip, the repatriation of the body or the treatment expenses would be covered under the annual travel insurance policy.

Hijack Cover: If in case your plane gets hijacked, according to the policy terms and conditions, you’d be compensated for the distress caused to you during such an unfortunate incident.

Advantages of Annual Travel Insurance

There has been a rise in people travelling abroad for work and leisure. Most of the countries, keeping in mind the current post-pandemic scenario, expects their travellers to have a valid traveller insurance plan in hand. So, if you need to travel outside India more than once a year, it’s advisable for you to buy an annual travel insurance policy. If you are still not sure whether you’d need one or not, here is a simple list of great advantages that you will get with an annual multi-trip travel insurance policy in hand –

One single policy will provide you extensive coverage against several exigencies that may occur to you during multiple trips abroad in a single year.

Such policies come with an automatic cancellation cover that will allow you to claim reimbursement for a missed flight or cancelled hotel bookings.

You will not have to worry about buying a travel insurance plan every time you book your ticket for a trip abroad during a single year.

Such policies offer easy renewability options and you can also choose different cover plans along with the main insurance policy to make the policy more robust.

From medical emergencies to any other personal liability, an annual travel insurance policy will cover it all.

At Tata AIG, we have some of the best-suited annual multi-trip insurance policies for you.

Eligibility Criteria

The eligibility criteria to opt for multi-trip travel insurance varies from one insurer to another. However, the basic requirement of being able to buy one such policy is that you need to be between the age of 3 months to 70 years.

Travel Insurance

Thanks for submitting!

HOURS & LOCATION

World Trade Center .

Connaught Place, New Delhi-110001 [email protected]

T : 91.11.41090545

M : 9810794545

Monday - Friday

10:00 am to 5:00 pm

Saturday

10:00 am to 1:00 pm

Evenings by Appointment

TATA AIG Introduces ‘Travel Guard Plus’ – A Comprehensive Travel Insurance Solution with Enhanced Features

Redefining full coverage for travellers with an array of bundle plans, “Travel Guard Plus” is a comprehensive travel insurance product from TATA AIG General Insurance Company Limited, a top general insurance provider. With a variety of plans that include 41 different types of coverage tailored to satisfy consumer demands, TATA AIG’s Travel Guard Plus has been meticulously designed to fulfil people’s diverse travel needs.

Travel Guard Plus from TATA AIG offers coverage for a range of situations, such as Loss of Personal Baggage, Compassionate Travel / Stay, Extension of Stay, Upgradation to Business Class, Personal Accident in India, and Instant Gratification, which enables travellers to receive immediate financial assistance in the event of real-time flight delays or cancellations. By ensuring that travellers have access to comprehensive coverage that caters to their needs and that filing claims is simple, these improvements seek to improve the entire travel experience while also setting new benchmarks in travel protection.

The customisation of plans is one of the major changes among the many product advancements. The Cruise Bundle, Travel Plus Bundle, and Accident Bundle are the three add-on bundles available to customers. These bundles cover adventure sports, frequent flyer, coma, and cruise-related contingencies. In addition to the basic plans, the plans have been modified. Moreover, the policy offers further assistance services that can be chosen, giving travellers even more customisation options for their coverage.

Mr. Saurav Jaiswal, President & Chief Operating Officer, TATA AIG General Insurance Co. Ltd., commented on the new TATA AIG Travel Guard Plus, saying, “At TATA AIG, we are excited to announce the launch of Travel Guard Plus, which demonstrates the company’s unwavering commitment to its customers’ needs by providing all-encompassing insurance solutions.” Travellers can embark on their adventures with confidence thanks to our Travel Guard Plus coverage, which protects against unforeseen events. Our focus is on providing a stress-free experience that is customised to meet the individual needs of every traveller.

Key Additions in Travel Guard Plus:

- Annual Multi-Trip cover with a higher single-trip duration of up to 180 days

- Single Trip with an option of a single policy up to 365 days.

- Optional Assistance Services such as Care at Home, Baggage tracking, and Lost Passport tracking

- to enhance convenience.

- Non-medical coverage only plan that suits several travellers who require coverage for non-medical covers only – such as for students who travel abroad for study or young travellers travelling for short durations, preferring only non-medical travel insurance.

- Separate plan for the Schengen geo-scope.

- New age covers such as adventure sports, instant gratification for flight cancellation/flight

- delay, loss of Personal Baggage, Personal Accident in India, and pandemic coverage.

- Senior Plus plan (71–80 years) for a higher medical sum insured up to $100,000.

- Super Senior plan (> 80 years) for higher medical sum insured up to $50000.

Share this:

Leave a reply cancel reply.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Discover more from Voyagers World

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Get the Tata Capital App to apply for Loans & manage your account. Download Now

- Personal Loan

- Business Loan

- Vehicle Loan

- Loan Against Securities

- Loan Against Property

- Education Loan New

- Credit Cards

- Microfinance

- Rural Individual Loan New

Personal loan starting @ 10.99% p.a

- Instant approval

- Overdraft Facility

All you need to know

- Rates & Charges

- Documents Required

Personal loan for all your needs

Overdraft Loan

Personal Loan for Travel

Personal Loan for Medical

Personal Loan for Marriage

Personal Loan for Home Renovation

- Personal Loan EMI Calculator

Pre-payment Calculator

Eligibility Calculator

Check Your Credit Score

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Home Loan with instant approval starting @ 8.75% p.a

- Easy repayment

- Home Loan Online

- Approved Housing Projects

Home Loan for all your needs

- Home Extension Loan

Affordable Housing Loan

Plot & Construction Loan

- Balance Transfer

Home Loan Top Up

- Calculators

- Home Loan EMI Calculator

- PMAY Calculator

Balance Transfer & Top-up Calculator

- Area Conversion Calculator

- Stamp Duty Calculator

Register as a Selling Agent. Join our Loan Mitra Program

Business loan to suit your growth plan

- Collateral-free loans

- Customized EMI options

Business loan for all your needs

- Machinery Loan

Small Business Loan

EMI Calculator

- GST Calculator

- Foreclosure Calculator

Looking for Secured Business Loans?

Get secured business loans with affordable interest rates with Tata Capital. Verify eligibility criteria and apply today

Accelerate your dreams with our Vehicle Loans

- Flexible Tenures

- Competitive interest rates

Explore Used Car Loans

- Used Car Loan

Loan On Used Car

Explore Two Wheeler Loans

- Two Wheeler Loan

Used Car EMI Calculator

Two Wheeler EMI Calculator

Get upto 95% of your car value and book your dream car

A loan upto ₹5,00,000 to own the bike of your choice

Avail Loan Against Securities up to ₹40 crores

- Quick access to finance

- Zero foreclosure charges

Explore Loan Against Securities

Loan against Shares

Loan against mutual funds

- Loan Against Securities Calculator

Avail Loan Against Property up to ₹3 crores

- Loan against property

- Business loan against property

- Mortgage loan against property

- EMI Options

Loans for all your needs

Secured Micro LAP

Empowering Rural India with Microfinance loans

- Quick processing

Want To Know More?

Avail a Rural Individual Loan

- Working Capital Loans

- Cleantech Finance

Structured Products

- Equipment Financing & Leasing

Construction Financing

Commercial Vehicle Loan

- Explore all Business Loans

Digital financial solutions to aid your growth

- Simple standard documentation process

- Quick disbursal

Most Popular products

Channel Financing

Invoice Discounting

Purchase Order Funding

Working Capital Demand Loan

Sub Dealer Loan

Pioneering Climate Finance through innovative solutions

Most popular products

Project & structured design

Debt Syndication

Financial Advisory

Cleantech Advisory

Financing solutions tailored to your business needs

- Quick approvals

- Flexible payment options

Our Bestselling Products

Structured Investment

Letter of Credit

Lease Rental Discounting

Avail Term Loans up to Rs. 1 Crore

- Customise loan tenures as per your needs

- Get your loan processed, sanctioned and funds disbursed digitally

Equipment Finance

Avail Digital Equipment Loans up to Rs. 1 Crore

- Attractive ROIs

- Customizable Loan tenure

Equipment Leasing

Avail Leasing solutions for all asset classes

- Up to 100% financing

- No additional collateral required

Ensure your business’ operational effeciency with ease

- Wide range of equipments covered

- Minimum paperwork

- Construction Finance

- Construction Equipment Finance

Moneyfy by Tata Capital

A personal finance app, your one-stop shop for comprehensive financial needs - SIP, Mutual Funds, Loans, Insurance, Credit Cards and many more

- 100% digital journey

- Start investing in SIP as low as Rs 500

SIP Calculator

Investment Calculator

- Mutual Funds

- Fixed Deposit

Wealth Services by Tata Capital

Personalised Wealth Services for exclusive customers delivered by a team of experts from a suite of product offerings

- Inhouse research & reports

- Exclusive Privileges & Offers

Financial Goal Calculator

Retirement Calculator

- Download forms

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Bestselling insurance solutions

Motor Insurance

Life Insurance

Health Insurance

Home & Travel Insurance

Wellness Insurance

Protection Plan & other solutions

Retirement Solutions & Child Plan

Quick Links for loans

- Used Car Loans

- Loan against Property

Loan Against securities

Quick Links for insurance

- Car Insurance

- Bike Insurance

Saving & Investments

Medical Insurance

Cardiac Insurance

Cancer care Insurance

Other Insurance

- Wellness solutions

- Retirement Solution Plans

- Child Plans

- Home Insurance

- Travel Insurance

- Mutual Fund

Choose from our list of insurance solutions

Retirement Solutions & Child Plans

Quick Links for Loans

Cancer Care Insurance

Offers & Updates

Download the moneyfy app.

Be investment ready in minutes

Take a Tata Capital Home Loan

Lowest interest rates starting at 8.75%*

Apply for a Tata Card

Get benefits worth Rs. 18,000*

Sign in to unlock special offers!

You are signed in to unlock special offers.

- Retail Customer Login

- Corporate Customer Login

- My Wealth Account

- Dropline Overdraft Loan

- Two wheeler Loan

Quick Links for Insurance

- Term insurance

- Savings & investments

- Medical insurance

- Cardiac care

- Cancer care

Personal loan

- Rate & Charges

Loan Against Shares

Loan Against Mutual Funds

Avail a Rural Individual Loan

Compound Interest Calculator

Home Insurance & Travel Insurance

Travel & Home Insurance

Tata aig travel guard, (uin : tattiop23097v032223).

While you are vacationing abroad, any unforeseen contingency should be the last thing on your mind. However, you cannot ignore this aspect, as traveling abroad involves a certain degree of risk, right from falling ill, having a flight delay, to baggage loss or having met with an accident. To remove the stress out of traveling, all you need is Tata AIG Travel Guard.

Disclaimer: Tata Capital Limited (“TCL”) bearing License no. CA0896 valid till 21-Jan-2027, acts as a Composite Corporate Agent for TATA AIA Life Insurance Company Limited, HDFC Life Insurance Company Limited, BAJAJ Allianz Life Insurance Company Limited, Kotak Mahindra Life Insurance Company limited, TATA AIG General Insurance Company Limited, IFFCO Tokio General Insurance Company Limited & Star Health and Allied Insurance Co Ltd. Please note that, TCL does not underwrite the risk or act as an insurer. For more details on the risk factors, terms & conditions please read sales brochure carefully of the Insurance Company before concluding the sale. Participation to buy insurance is purely voluntary.

The Registered office of TCL is Tata Capital Limited, 11th Floor, Tower A, Peninsula Business Park, Ganpatrao Kadam, Marg, Lower Parel, Mumbai-400013

Key Features

Accidental Death and Dismemberment benefit

Accident and Sickness medical expense reimbursement

Baggage delay benefit and checked baggage loss benefit

Home Burglary

Trip Cancellation

Missed Connection/Missed Departure

Bounced Hotel/Airline Booking

Flight Delay

Subscribe to our newsletter

Submitted successfully

- Media Center

- Branch Locator

- Tata Capital Housing Finance Limited

- Tata Securities Limited

Tata Mutual Fund

Tata Pension Fund

Important Information

- Tata Code of Conduct

- Master T&Cs’ Tata Capital Limited

- Master T&Cs' Tata Capital Financial Services Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited

- Vendor Feedback Form

- Rate History

- Ways to Service

- Our Partners

- Partnership APIs

- SARFAESI – Regulatory Display - Tata Capital Limited

- SARFAESI – Regulatory Display - Tata Capital Housing Finance Limited

Investor Information

- Tata Capital Limited

Our Private Equity Funds

- Tata Capital Healthcare Fund

- Tata Opportunities Fund

- Tata Capital Growth Fund

Amalgamated Companies

- Archived Documents of Tata Capital Financial Services Limited

- Archived Documents of Tata Cleantech Capital Limited

Top Branches

Most important terms & conditions - home loans.

Download in your preferred language

Policies, Codes & Other Documents

- Tata Code Of Conduct

- Audit Committee Charter

- Affirmative Action Policy

- Whistleblower Policy

- Code of Conduct for Non-Executive Directors

- Remuneration Policy

- Board Diversity Policy

- Code of Corporate Disclosure Practices and Policy on determination of legitimate purpose for communication of UPSI

- Anti-Bribery and Anti-Corruption Policy

- Vigil Mechanism

- Composition Of Committees

- Notice Of Hours Of Work, Rest-Interval, Weekly Holiday

- Fit & Proper Policy

- Policy For Appointment Of Statutory Auditor

- Policy On Related Party Transactions

- Policy For Determining Material Subsidiaries

- Policy On Archival Of Documents

- Familiarisation Programme

- Compensation Policy for Key Management Personnel and Senior Management

- Fair Practice Code - Micro Finance

- Fair Practice Code

- Internal Guidelines on Corporate Governance

- Grievance Redressal Policy

- Privacy Policy on protecting personal data of Aadhaar Number holders

- Dividend Distribution Policy

- List of Terminated Vendors

- Policy for determining Interest Rates, Processing and Other Charges

- Policy specifying the process to be followed by the Investors for claiming their Unclaimed Amounts

- NHB registration certificate

- KYC pamphlet

- Fair Practices Code

- Most Important Terms & Conditions - Home Equity

- Most Important Terms & Conditions - Offline Quick Cash

- Most Important Terms & Conditions - Digital Quick Cash

- Most Important Terms & Conditions - GECL

- Most Important Terms & Conditions - Dropline Overdraft

- GST Details

- Customer Grievance Redressal Policy

- Recovery Agents List

- Legal Disclaimer

- Privacy Commitment

- Investor Information And Financials

- Guidelines On Corporate Governance

- Anti-Bribery & Anti-Corruption Policy

- Whistle Blower Policy

- Policy Board Diversity Policy and Director Attributes

- TCHFL audit committee Charter

- Code of Conduct For Non-Executive Directors

- Code of Corporate Disclosure Pracrtices and policy On determination of Legitimate purpose

- List of Terminated Channel Partners

- Policy On Resolution Framework 2.0

- RBI Circular On Provisioning

- Policy for Use of Unparliamentary Language by Customers

- Policy for Determining Interest Rates and Other Charges

- Additional Facility

- Compensation Policy For Key Management Personnel And Senior Management

- Guidelines for release of property documents in the event of demise of Property Owners who is a sole or joint borrower

- Prevention Of Money Laundering Policy

- Policy For Accounting Of Tax In Respect Of The Tax Position Under Litigation

- Cyber Security Policy

- Conflict Of Interest Policy

- Policy For Outsourcing Of Activities

- Surveillance Policy

- Anti-Bribery And Anti-Corruption Policy

- Code Of Conduct For Prevention Of Insider Trading

Tata Capital Solutions & Services

- Loans for You

- Loans for Business

- Overdraft Personal Loan

- Wedding Loan

- Medical Loan

- Travel Loan

- Home Renovation Loan

- Personal Loan for Govt employee

- Personal Loan for Salaried

- Personal Loan for Women

- Small Personal Loan

- Required Documents

- Application Process

- Affordable Housing

- Business Loan for Women

- MSME/SME Loan

Vehicle Loans

More Products

- Emergency Credit Line Guarantee Scheme (ECLGS)

- Credit Score

- Education Loan

- Rural Individual Loans

- Structured Loans

- Commercial Vehicle Finance

- Personal Loan Pre Payment Calculator

- Personal Loan Eligibility Calculator

- Balance Transfer & Top-Up Calculator

- Home Loan Eligibility Calculator

- Business Loan EMI Calculator

- Business Loan Pre Payment Calculator

- Loan Against Property EMI Calculator

- Used car Loan EMI Calculator

- Two wheeler Loan EMI Calculator

- APR Calculator

- Personal Loan Rates And Charges

- Home Loan Rates And Charges

- Business Loan Rates And Charges

- Loan Against Property Rates And Charges

- Used Car Loan Rates And Charges

- Two Wheeler Loan Rates and Charges

- Loan Against Securities Rates And Charges

Uh oh, something went wrong

Please try again later.

- Looking for Investments?

- Looking for Loans?

Download our Moneyfy App

Start an SIP in minutes by signing up with the Tata Capital Moneyfy App. We are your one stop shop for all things investment.

Enter your mobile number to receive link to download the app

Download the app for your device.

An SMS has been sent to XXXXXXX051 Click on the link in the message to download the Moneyfy App.

Scan QR to download the App

Download our TATA Capital App

Looking for a seamless loan experience? Get the Tata Capital Loan App and Apply for loans, Download Account Statement/Certificates, Track your requests & much more.

Thank you for subscribing

We will send news and updates to your registered email ID

Stay updated!

We are constantly crafting offers and deals for you. Get them delivered straight to your device through website notifications.

All you have to do is Click on “Allow”

Looking for offers...

Download The Moneyfy App

Be investment ready in minutes by signing up with the Tata Capital Moneyfy App. We are here to make mutual fund investments simpler for you.

Just enter your mobile number and we will share the link with you.

TATA AIG Insurance Online

- TATA AIG Insurance

Travel Insurance

- Premium Chart

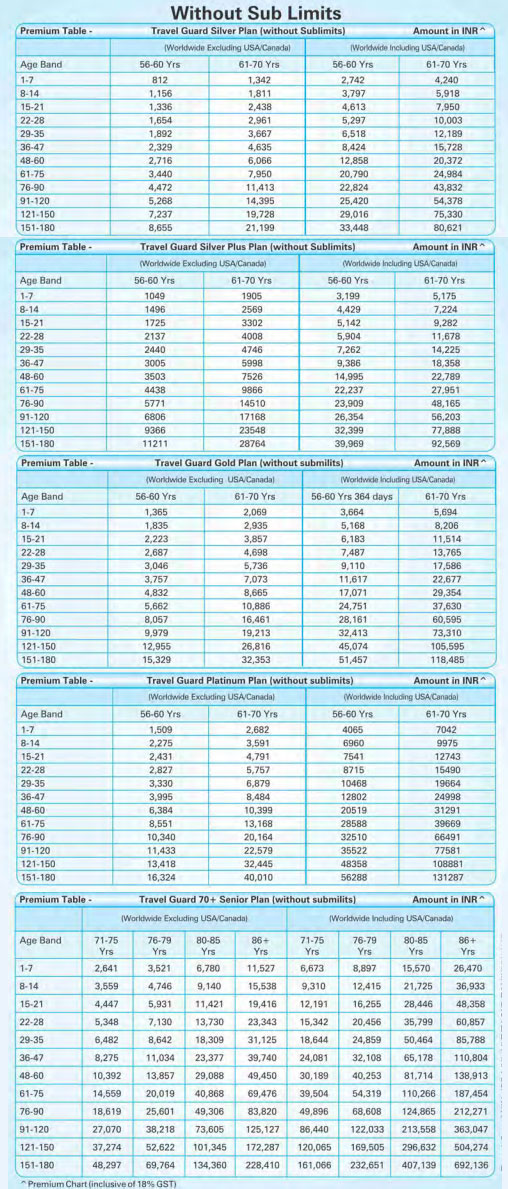

TATA AIG Travel Insurance Premium Chart

Tata aig travel insurance premium calculator, email these results, tell a friend about this plan, calculate tata aig international travel insurance premium.

Indian travelers can use our friendly Tata AIG overseas travel guard premium calculator to calculate the price of travel health insurance both for taking a single trip or for travelling multiple time within a year.

Indian travelers can quickly review the cost of travel insurance by seeing the TATA AIG travel insurance rate chart which is very important in case of a medical emergency while in a foreign country. Travelers up to the age of 99 years can be covered under Tata AIG visitors insurance without sublimits. Tata AIG overseas travel insurance offers cashless hospitalization for inpatient expenses incurred in preferred network hospital.

- * Included under the benefit limit of accident and sickness medical expenses reimbursement.

- # Maximum amount to be reimbursement per bag is 50% and maximum value per article contained in any bag is 10% of sum(s) insured.

- ^ Flight delay - Deductible of 12 hrs, $10 per 12 hours and maxium $100.

- ^^ Hijack - Deductible of 1 day, $100 per day and maximum $500

TATA AIG Multi Trip Travel Insurance - Available from 19 - 70 years of age

Note: Option of buying the policy without medical sublimits for the age above 56 years.

TATA AIG Annual Multi-trip Premium Chart - With Sublimits

Note: Premium in Indian Rupees

Plans are available only upto the age of 70 years. The premiums shown below for above 70 years is only for RENEWALS

TATA AIG Annual Multi-trip Premium Chart - Without Sublimits

Tata aig travel insurance faq's.

Tata AIG travel insurance cost depends on the age of the traveler and the travel destination. If you are traveling to USA and or Canada then you have to pay more when compared to traveling elsewhere. If the traveler is a senior citizen then the premium is higher when compared to younger traveler. The length of travel and the maximum medical coverage are also factors which decides the cost of TATA AIG travel insurance.

Once the traveler has Tata AIG travel insurance and needs to use the policy, the policy holder should contact the claims service provider using the telephone numbers provided in the policy. They will help the policy holder according to the requirements for the specific claim.

Tata AIG travel insurance is one of the best travel insurance in India for people traveling overseas from India.

Tata AIG travel insurance covers pre existing medical conditions for up to $1,500 independent of the age and maximum coverage chosen. Tata AIG travel insurance plans cover pre-existing illness under life threatening situations as per policy terms and conditions.

Tata AIG Travel Insurance can be renewed up to a total of 360 days for travelers up to the age of 70 years. For travelers above 70 years, the renewal can be done for a total of 180 days.

We will refund the full premium but for the cancellation fee for TATA AIG travel insurance trip cancellation if the traveler cancels his trip and does not travel outside India.

TATA AIG travel insurance is the best Indian travel insurance for overseas travel since TATA AIG has the largest market share amongst all Indian insurance companies for international travel insurance from India. TATA AIG travel insurance the popular well known general insurance company which offers health insurance cover for you and your dear ones in overseas for different reasons. TATA AIG travel insurance takes care of your health issues when the travelers are in overseas. If offers cashless hospitalization claims benefit while visit to a doctor and pharmacy bills are reimbursed. TATA AIG has also good claims settlement ratio. It is a well-known brand in the insurance industry worldwide.

Once you fill the online application and complete the purchase successfully. The e-copy of the policy will be sent to your email-id provided in the online application form where you can download TATA AIG travel insurance.

How much does travel insurance cost?

Some important factors that determine the cost of overseas travel insurance are

Coverage for senior citizen travellers is more expensive than for younger travelers as older travelers are more prone to emergency sickness and accidents.

Coverage in countries like US, Canada… where health care while sophisticated is also expensive. Travelers insurance cost in these countries is more when compared to countries in Asia.

The cost of travel insurance increases in price depending on the number of travel days.

The higher the medical maximum coverage required the greater is the premium for the insurance plan.

The cost of travel insurance with sublimits would be less than that of travel insurance without sublimits . Travel insurance without sublimits offer comprehensive coverage without have any specific limits on the medical expenses up to plan maximum. Whereas Travel insurance with sublimits would have defined limits on specific medical expenses.

TATA AIG travel insurance India, TATA AIG international travel insurance

You can buy Travel Guard policy online by using a credit/debit card, direct funds transfer using NEFT or RTGS or by using a cheque

Travelers who have already traveled from India and do not have insurance can buy TATA AIG travel insurance online.

Calculate the international travel insurance premium for Indian travelers and senior citizens travelling overseas

In case of Claim or reimbursement of treatment expenses, notify TATA AIG overseas travel insurance.

Download TATA AIG Travel Guard brochure online!

Travel insurance customers can renew their existing policy online before the exipry date at any time.

Travel insurance from TATA AIG

Student insurance, senior insurance, health insurance, schengen insurance, annual insurance, pre-existing insurance, covid insurance, what does tata aig travel insurance cover.

The plan covers for medical expenses due to accident and sickness while traveling outside India.

Reimbursement for loss of checked in baggage.

Coverage for expenses incurred in obtaining a duplicate or new passport.

The policy pays for immediate dental treatment occurring due to sudden acute pain during an overseas insured journey.

Compensation for damages to be paid to a third party, resulting from death, bodily injury or damage to property; caused involuntarily by the insured.

In the unfortunate event of the common carrier being hijacked, plan will pay a distress allowance.

Reimbursement of additional expenses due to trip delay (only if the trip is delayed for more than 12 hours).

Travel Guard gives worldwide coverage against Accidental Death and Dismemberment while abroad.

Reimbursement for reasonable expenses incurred for purchase of emergency personal goods due to delay in arrival of checked in baggage while overseas.

Find out more about TATA AIG Travel Guard insurance

Travel insurance FAQ's

Answers to FAQ related to TATA AIG Travel Medical Insurance for visitors from India.

Travel insurance reviews

TATA AIG Travel Insurance Reviews - Customer experiences and testimonials.

Popular travel destinations

TATA AIG travel insurance for popular travel destinations.

Travel insurance customer care

TATA AIG Travel insurance customer care information for Indians travelling overseas.

Travel health insurance from TATA AIG

You can find different sections of insurance types here.

- Get best quotes for TATA AIG travel insurance for above 80 years old

- Pre-existing coverage travel insurance

Parents travel insurance

Individual travel insurance.

Seniors above 80 years

TATA AIG Overseas medical insurance for senior citizens above 80 years.

Explore »

Pre-existing coverage

TATA AIG travel insurance for pre-existing conditions.

International travel insurance for Indian parents overseas.

TATA AIG individual overseas travel insurance online

Resourceful TATA travel insurance links

TATA AIG travel insurance for Indians traveling overseas.

Business travelers making multiple trips overseas annually can buy the annual multi trip travel insurance.

TATA AIG Asia Travel Guard insurance for Indians going to other Asian countries.

Senior travelers up to the age of 90 years can opt for TATA AIG travel insurance coverage.

Applying for Schengen visa? Then this TATA AIG Schengen insurance is a good option to go for!

Compare and buy TATA AIG domestic travel insurance.

Search TATA AIG travel insurance

Travel insurance to Australia

Travel insurance to Canada

Travel insurance to USA

Travel insurance to UK

Travel insurance to New-Zealand

Travel insurance to Dubai

Travel insurance to Thailand

Travel insurance to Singapore

Travel insurance to Malaysia

Travel insurance to Africa

Travel insurance to Bali

Travel insurance to Mauritius

Travel insurance to Srilanka

Travel insurance to Vietnam

Travel insurance to Seychelles

Travel insurance to Egypt

Travel insurance to South Africa

Travel insurance to Kenya

Travel insurance to Tanzania

Travel insurance to China

Travel insurance to Japan

Travel insurance to Maldives

Travel insurance to Hong-Kong

Customers Testimonials

I would highly recommend nriol.com and Tata AIG for travel insurance. The purchase process was simple, the people were helpful and the rates were competitive. But, most importantly, my claim was settled promptly without much bureaucracy.

Thanks a lot for the speedy response and sending me the policy pdf. This is very useful and will be helpful for my parent's travel. I really liked the quick customer service and very happy with the response.

Thank you very much for your amazing service and response. I am really satisfied with the service and support of NRIOL. This is the second time I have benefited from the excellent service of NRIOL. I would surely recommend NRIOL to anyone looking to buy insurance for travelling abroad.

Hi NRIOL team Thanks, I have received the policy. Much appreciate your help and time.

Do you need health insurance?

New addition to your family? GET THEN INSURED Find Affordable HEALTH INSURANCE!!

Do you need travel insurance?

Is your family visiting you? GET THEN INSURED Find Affordable TRAVEL INSURANCE!!

Do you need domestic travel insurance?

Get free quotes and buy Indian Domestic travel insurance plans offered by TATA AIG.

TATA AIG CITATION

Mr. Jaideep Deorukhkar, Head Travel Services at Tata AIG says "NRIOL has been one of our key partners in India for the past 16 years and has been pivotal in providing Tata AIG customers an opportunity to purchase their TATA AIG travel insurance online".

- Call : (080)-41101026

- Contact

IMAGES

VIDEO

COMMENTS

Trade logo displayed above belongs to Tata Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders).

and State Department and private service warnings about travel to certain locations. The Assistance Company will also arrange for special medical care en-route (i.e. dialysis, wheelchairs, etc.). Subject to receiving reasonable notice of this request. • Emergency Travel Agency - the Assistance Company agrees to provide You with 24 hour

Write to us at: A&H Claims Department, Tata AIG General Insurance Co. Ltd. Travel Guard Policy UIN: TATTIOP23097V032223 7th and 8th Floor, Romell Tech Park, Cama Industrial Estate, Western Express Highway, ... R13_IPA TRAVEL GUARD BROCHURE_Runig_23-12-22 Created Date: 12/23/2022 3:52:58 PM ...

Buy travel insurance online with instant online travel insurance policy quotes & price from Tata AIG General insurance. Click here for more details! ... please read sales brochure / policy wording carefully before concluding a sale. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id ...

Title: Travel_Guard Created Date: 9/27/2018 5:58:46 PM

TAGIC/B/TG/Jan 15/8 Ver 1/All 389 [email protected] How to lodge a claim: Claims for which prior intimation has not been given to the Assistance Company must be lodged with Tata AIG General Insurance Company within 30 days. However it is advisable to register a claim abroad by informing the assistance company. Call these local

Tata AIG General Insurance Company Limited Registered Office: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai - 400013 24X7 Toll Free No: 1800 266 7780 or 1800 22 9966 (For Senior Citizens) Fax: 022 6693 8170 Email: [email protected] Website: www.tataaiginsurance.in IRDA of India Regn.

TATA AIG General Insurance Company Limited, a leading general insurance provider, has launched "Travel Guard Plus", a comprehensive travel insurance product that redefines complete coverage for travellers with an array of bundle plans. TATA AIG's Travel Guard Plus has been meticulously designed to meet people's diverse travel needs with ...

This insurance is underwritten by AIG Asia Pacific Insurance Pte. Ltd. This Brochure is not a contract of insurance and is intended for general circulation only. The precise terms, conditions and exclusions of this plan are specified in the Policy. AIG Asia Pacific Insurance Pte. Ltd. AIG Building, 78 Shenton Way, #09-16, Singapore 079120

Tata AIG General Insurance Company Limited is a joint venture between Tata Group and American International Group (AIG).The company offers a range of general insurance covers for businesses and individuals and has a comprehensive range of general insurance products for Liability, Marine Cargo, Personal Accident, Travel, Rural-Agriculture Insurance, Extended Warranty etc.

At Tata AIG, we have some of the best-suited annual multi-trip insurance policies for you. Eligibility Criteria. The eligibility criteria to opt for multi-trip travel insurance varies from one insurer to another. However, the basic requirement of being able to buy one such policy is that you need to be between the age of 3 months to 70 years ...

TAGIC/B/TG/Jan 15/8 Ver 2/All 389 [email protected] How to lodge a claim: Claims for which prior intimation has not been given to the Assistance Company must be lodged with Tata AIG General Insurance Company within 30 days. However it is advisable to register a claim abroad by informing the assistance company. Call these local

Redefining full coverage for travellers with an array of bundle plans, "Travel Guard Plus" is a comprehensive travel insurance product from TATA AIG General Insurance Company Limited, a top general insurance provider. With a variety of plans that include 41 different types of coverage tailored to satisfy consumer demands, TATA AIG's ...

One of the best international travel insurance in India is the Tata AIG travel insurance for its claim settlement record and brand awareness. Tata AIG travel insurance plans are designed to cater the needs of the travelers traveling outside India. Tata AIG travel insurance policies have a worldwide recognition and is well accepted in all countries.

With TATA AIG Domestic Travel Guard Policy, travel within India without any worries. This domestic travel insurance plan takes care of emergency expenses incurred in cases of many travel and medical disruptions. Benefits include cover for accidental death, reimbursement of accommodation charges due to delay in the trip, loss of tickets ...

For more details on the risk factors, terms & conditions please read sales brochure carefully of the Insurance Company before concluding the sale. Participation to buy insurance is purely voluntary. The Registered office of TCL is Tata Capital Limited, 11th Floor, Tower A, Peninsula Business Park, Ganpatrao Kadam, Marg, Lower Parel, Mumbai-400013

Premium chart and calculator for TATA AIG Travel guard Insurance, Calculate the international travel insurance premium for Indian travelers and senior citizens travelling overseas. TATA AIG Insurance Online. Chat with us (080) 41101026. ... TATA AIG travel insurance brochure.

Travel Guard Policy UIN: TATTIOP21207V022021 1 Tata AIG General Insurance Company Limited - Registered Office: Peninsula Business Park, Tower A,15th Floor, G.K. Marg Lower Parel,Mumbai - 400013, Maharashtra, India 24X7 Toll Free No: 1800 266 7780 or 1800 22 9966 (Senior Citizen) Fax: 022 6693 8170 Email: [email protected] Website: www.tataaig.com

Stay insured! Travel worry-free with TATA AIG travel insurance in partnership with Air India Express. Learn more about the terms and conditions of the policy.

MSN

A professional course like MBA can cost a minimum INR 25 lakh in India. The average tuition fee in most schools across tier-I and II cities can range between INR 60,000- INR 1.5 lakh per year ...