CIBC Aventura Visa Infinite Card Review

The CIBC Aventura Visa Infinite Card is easily one of Canada’s most underrated travel rewards credit cards. You get a decent earning rate and great travel benefits. The rewards are flexible, and the annual fee for the first year is typically waived.

Even though CIBC is one of the big six banks in Canada, their credit cards don’t seem to get as much attention as American Express and co-branded travel credit cards. That’s a mistake, as this card offers a lot of value. Read my CIBC Aventura Visa Infinite Card review now for the full details.

CIBC Aventura Visa Infinite Card

- $139 annual fee – First year free

- 15,000 Aventura points when you make your first purchase

- 20,000 Aventura points when you spend $3,000 in the first 4 months

- 25,000 Aventura points when you spend $6,000 in the first 4 months

- Earn 2 points per $1 spent on CIBC travel

- Earn 1.5 points per $1 spent on gas, grocery, and drug store purchases

- Earn 1 points per $1 spent on all other purchases

- Visa Airport Companion Program membership and 4 free annual passes

Welcome Bonus and Earn Rate

The CIBC Aventura Visa Infinite Card typically has a welcome bonus of 35,000 – 50,000 Aventura points. This offer is usually broken down into two parts. You get the first bonus when you make your first purchase, and the second bonus is given when you spend $3,000 in the first four months. Right now, you get another 25,000 Aventura points when you spend $6,000 in the first four months . This is the best offer the card has ever had.

It’s worth noting that CIBC gives you four months to meet the minimum spending requirement to get your full welcome offer. This is relevant since most other credit card providers only give you three months. The card does have an annual fee of $139, but it’s usually waived for the first year.

The earning rate is a respectable 2 Aventura points per dollar spent on CIBC travel bookings, 1.5 points on gas, grocery, and drug store purchases, and 1 point on all other purchases. This isn’t the highest earning rate available out there, but it’s similar to other comparable travel rewards credit cards .

Benefits and Perks

The CIBC Aventura Visa Infinite Card is an excellent travel credit card because it provides a fair amount of benefits for people who are on the move. It’s a bit shocking more people don’t consider this card, especially since the annual fee for the first year is usually waived.

Airport Lounge Access

Cardholders get a free Visa Airport Companion Program membership, plus four free annual passes. This gives you access to 1,200+ global airport lounges in more than 100 countries. To give you some context, the value of these passes is about $190, so this perk alone is worth more than the annual fee.

NEXUS Application Rebate

Another travel benefit of the CIBC Aventura Visa Infinite is the NEXUS application rebate of $50. It’s good every four years, but NEXUS memberships last five years, so you’re essentially getting your NEXUS for free. Keep in mind that you must charge your NEXUS application to your CIBC Aventura Visa Infinite card to be entitled to the rebate.

Travel Insurance

- Travel medical – $5,000,000 for 15 days / 3 days if you’re 65 or older

- Trip cancellation – up to $1,500 per person / $5,000 total

- Trip interruption – up to $2,000 per person

- Flight/trip delay – up to $500 / 4 hours

- Delayed and lost baggage – up to $500 / 6 hours

- Auto rental collision/loss damage – 48 consecutive days / $65,000

- Hotel/motel burglary – $2,500

- Common carrier travel accident – $500,000

Your out-of-province emergency travel medical insurance covers you for up to 15 days if you’re under the age of 65 or for three days if you’re 65 or older. Although 15 days may seem short, you can purchase extended coverage.

Mobile Device Insurance

The CIBC Aventura Visa Infinite Card is one of the few travel cards that also come with mobile device insurance . Your eligible devices (cell phones and tablets) are covered up to $1,000 from theft, loss, and accidental damage. To be eligible, you must charge the full cost of your device to your card. If your phone is being subsidized, then you must charge the full amount of your bill to your card.

Purchase Insurance

- Purchase security – 90 days

- Extended protection insurance – Up to one additional year

Cardholders that charge the full cost of their purchases to their CIBC Aventura Visa Infinite Card are covered for loss, theft, and damage for 90 days, thanks to the included purchase security. In addition, the manufacturer’s warranty is doubled, up to one additional year.

Visa Infinite Benefits

- Concierge service – Have someone plan your trip, make reservations, deliver presents and more.

- Luxury Hotel Collection – When booking hotels through the Visa Infinite Hotel Collection, cardholders can access the best available rates, free Wi-Fi and room upgrades (when available).

- Dining and Wine Country programs – Enjoy food and wine discounts and invites to private events.

How to Redeem Your Points

CIBC Rewards points are pretty easy to earn and understand. You can redeem 1,000 Aventura Points for $10 in travel, so your CIBC Aventura Visa Infinite card earns you 1% – 2% in rewards.

What’s nice about Aventura Points is that you have a few options. You can book online through your CIBC rewards account or via the Aventura Travel Assistant. What many people don’t realize is that the Aventura Travel Assistant is a full-service travel agency, and they can book a few things that you might not find through the online portal, such as attraction tickets and rooms at certain hotels. Basically, just about anything you find on Expedia can be booked through the Aventura Travel Assistant .

Since all travel being booked is done in real-time, there are no blackout dates to worry about. Plus, you can pay any taxes and/or surcharges from your flights if you book via your CIBC rewards account.

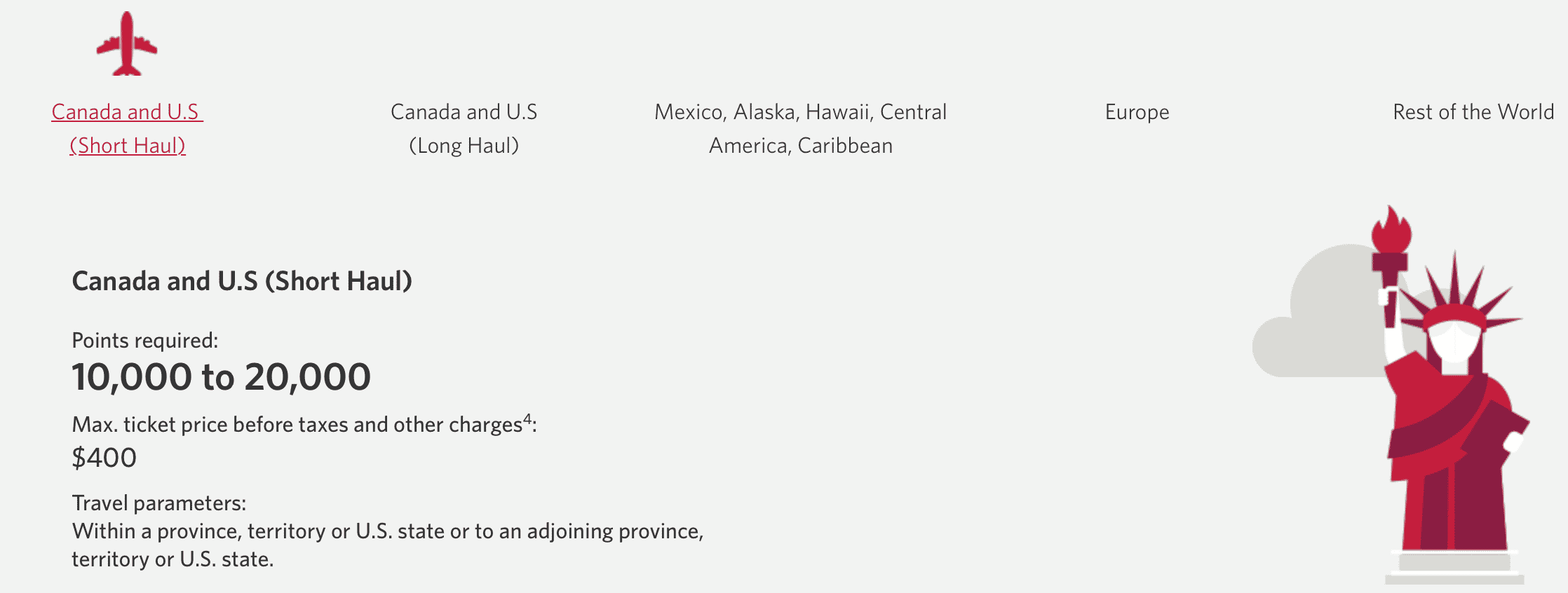

There’s also a fixed points option to redeem your points for flights based on five different zones. For example, Canada and the U.S. (long haul) require 25,000 – 35,000 points and have a maximum ticket price of $800. If that flight costs you more than $800, you’ll need to pay the remaining balance in points at $1 = 100 Aventura points ratio. On occasion, CIBC runs promotions where fewer points are required to redeem a flight, so the fixed points option can be quite lucrative.

CIBC Aventura Visa Infinite Card Eligibility

- Canadian citizen or permanent resident

- At least the age of majority in your province or territory

- You have a minimum annual personal gross income of $60,000 or a household income of $100,000

Although no formal credit score is required, I recommend one of at least 700 before applying. That puts your credit score in good standing, which is ideal for a mid-tier credit card.

How the CIBC Aventura Visa Infinite Compares

Since the CIBC Aventura Visa Infinite Card is a mid-tier travel credit card, it has a lot of competition. That said, the card is very strong so to determine what’s best for you, you need to see what else is out there.

CIBC Aventura Visa Infinite Card vs. BMO World Elite Mastercard

I personally think the closest competition the CIBC Aventura Visa Infinite Card has is the BMO World Elite Mastercard . The BMO card also typically has no annual fee for the first year, 4 free annual airport lounge passes, and slightly better travel insurance.

Some people will also point out that the BMO World Elite Mastercard has a better earning rate, but it takes 150 BMO Rewards points to earn $1 in travel. That means overall, you’re probably coming out ahead with the CIBC Aventura Visa Infinite Card.

CIBC Aventura Visa Infinite Card vs. Scotiabank Passport Visa Infinite Card

Another card worth considering is the Scotiabank Passport Visa Infinite card since it comes with six free annual lounge passes. I consider Scotia Rewards to be slightly more valuable than CIBC Rewards, but the Scotiabank Passport Visa Infinite does not waive the annual fee of $139 for the first year. The card does come with no foreign transaction fees , which will appeal to many travellers.

CIBC Aventura Visa Infinite Card vs. American Express Gold Rewards Card

There’s also the American Express Gold Rewards Card . this card gives you four free annual Plaza Premium lounge passes, similar to the lounge passes you get with the CIBC Aventura Visa Infinite Card. This card is also appealing because of the higher earning rate of 2 American Express Membership Rewards points per dollar spent on grocery, gas, pharmacy, and travel purchases. You can also transfer your points to Aeroplan at a 1:1 value, which could increase the value of your points.

Final Thoughts

My CIBC Aventura Visa Infinite Card review is positive. The card is ideal for the people in the following situations:

- You want flexible rewards: Use your points on travel booked through CIBC travel or the fixed points travel option.

- You want travel benefits: Get airport lounge access, a NEXUS rebate, and travel insurance.

- You don’t want to pay a high annual fee: The yearly fee is waived for the first year, so you can test out the card.

Although the card doesn’t make my list of the best travel credit cards in Canada , it’s still a great travel credit card. You get great travel benefits, flexible rewards, and a decent earning rate. Admittedly, there are other cards out there that may offer higher earn rates, or better perks, but not many are as well-rounded as the CIBC Aventura Visa Infinite Card.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

35 Comments

Hey Barry, hope you’re doing well!

– $100 travel credit when you book travel with an Aventura Travel Assistant until … October 31, 2019 .vs November 1, 2018 – 1.5 (vs 5 … wish it was 5 lol) points per $1 spent at gas stations, grocery stores and drugstores

Thanks for the awesome summary + review!

Thanks for catching the typo with the multiplier. As for the travel credit, read between the lines. . .

Did you get a chance to compare the fixed points travel booked via Amex MR vs Aventura Travel?

It depends. Amex and CIBC are similar as both offer flights on just about every major airline without blackout dates but it’s the number of points required that could make a difference. Amex’s fixed pricing starts at 15K points on short popular routes whereas CIBC is a little more variable.

There’s no clear winner since it depends on the timing and situation. CIBC often runs promotions and deals so that’s worth a look but Amex points are easier to accumulate since there are more cards you can earn points with.

Technically speaking, CIBC will probably cost you fewer points within North America, but you should always compare.

Thanks! They sure don’t make it easy for consumers to compare.

For the Priority Pass membership and four complimentary lounge entries per year. If I will be traveling in one month time, do I have enough time to get this benefit? Thanks

I think so. I would call CIBC right after you apply to see if they can rush you the card. Once you have that, just register for Priority Pass ASAP and download the app so you don’t have to wait for the physical card.

If I am the cardholer and my wife is not. Can my wife also use the lounge if she is travelling with me? Thanks

Yes as she would be your guest and you would be using one of your passes.

WARNING: Aventura Travel INSURANCE: I thought I would share my bad experience encountered with the travel insurance included with the Aventura card. They use a company called Global Excel to handle the insurance. My wife and I had a trip booked with Aventura that had to be cancelled a week before because of an accident. We filled out the appropriate paperwork with Global Excel, including the doctors sign off etc. A month later I received a letter in the mail indicating my claim was DECLINED. After many emails back and forth, it turns out since the Airlines (Air Canada / WestJet in Canada) offer a one year flight credit for the ticket, they won’t pay the insurance until that credit is gone – Thus you need to wait a year before you can receive the payment. So if you want to try an book a new trip that uses a different airline, then you are OUT OF LUCK. I tried to work with the travel agent and WestJet to cancel the credit, but Global Excel want to see very specific evidence of cancellation before they would pay out. WestJet was not able to cancel the credit for reasons I don’t understand. BUYER BEWARE – Nova Scotia..

Can I buy my parents the tickets from our personal travel agent and get the points

Can my parents use the complimentary lounge entries if I purchase them the tickets on my cc

Not unless they have a Priority Pass Membership.

In regards to booking travel and being insured under the card for baggage and delayed flights. Can this travel be booked directly through a travel agent or the airlines website (independent of Aventura travel agent)?

As long as you pay for your travel with the CIBC Aventura card, the travel insurance would apply.

WARNING: I am moving away from my CIBC Aventura Visa Infinite card and from travel cards in general because I’m finding it increasingly difficult to get good value when I try to redeem the Aventura points I earn.

Certainly, those penguin ads are correct – you can redeem your points for flights on any airline at any time with no blackout periods. The catch comes when you calculate what your points would earn you by subtracting the taxes/fees the CIBC Rewards system wants to charge from the full price of the ticket(s) you would pay if you booked the tickets on any third party website, then dividing that difference by the number of points you have to redeem. In some cases, your points are earning you less than 0.5%.

Round trips to Europe are now particularly bad value based on my searches to date. Specific example: Calgary to London non-stop on Air Canada – 50,000 points + $670 in “Taxes and Fees” gets you a ticket that would cost you $862 on aircanada.com. Do the math: (862-670)/50000 = 0.00384 or 0.384%. It’s even more annoying when you notice that the taxes quoted on aircanada.com are only $270. Why the $400 difference?…..look at the price breakdown on aircanada.com and you’ll see the Air Transportation Charges are made up of a Base Fare of $192 and a “Carrier Surcharge” of $400.

Certainly, there are better values elsewhere, particularly select flights within North America, to Latin America and Asia where I can still find redemption values of up to 1.5% or higher. However, you need to check each case to see if you’re getting good value. More and more airlines are inserting these “surcharges” or “fees” into their base ticket price to deflate the value of the points in their own reward systems. Air Canada and many European carriers have been doing this for a long time. But now I’m finding US carriers like United and Delta, who weren’t doing it up to a year or so ago, are climbing on this bandwagon. My fear is that it is only a matter of time until all carriers adopt this trick.

CIBC offers other avenues for redeeming your points such as merchandise, payment with points and financial products with points. These options get you anywhere from 0.6 to 0.8% in value. Another option – buying all-in vacation packages – seems to be the best choice as you essentially redeem 100 points for every $1 (1%) you would pay if you bought the package from Sunwing, Westjet, etc. That’s great if you’re a vacation package family – we’re not.

Where am I taking my business? The Scotiabank Passport Visa Infinite which doesn’t charge foreign exchange fees (worth ~$1000 per year to me), awards 1-2 points per $ in purchases, gives decent spending bonuses and allows you to cash your points for a predictable 1 point = $0.01 (1%). Overall, I estimate my purchases will earn me $0.024 per dollar I spend or a 2.4% value versus the 0.5 to 1.5% I’d get (depending on the travelling/redeeming I’m doing) if I stayed with CIBC Aventura.

I also have a PC Financial World Elite Mastercard which we use for the vast majority of our grocery and gasoline purchases in Canada. With all of the weekly grocery bonuses and the 7 cents/litre in gas bonuses, I estimate I’m earning over 3% on this card because I focus its use in these areas. The Scotiabank Visa will replace the CIBC Visa for all of my other spending.

In summary, do the math to calculate the real value you’re getting from your card. You might be surprised.

These are ALL very good points and 100% valid. It’s basically whey I hate Air Miles. Aeroplan/Air Canada can offer good value but usually on specific routes or when you books business class flights. A lot of people have switched to cash back cards these days since it’s an easier system to understand.

The Scotiabank card as you stated is predictable and gives you good additional travel benefits. The PC Financial World Elite Mastercard is one of my favourites as I also do a lot shopping at their stores. I just signed up for PC Insiders as I did the math and realized that I would get good value for the $99 annual fee.

Agreed. My only apprehension in making the switch to the Scotiabank Passport is that there is some hidden restriction in Scotia’s points system that renders it less valuable than the “glossy brochure” language on their website would suggest. I would love to hear from someone who’s had actual hands-on experience redeeming Scotia points. Not being able to peek inside the underlying points system before you sign up and commit yourself is the single biggest unknown in calculating the value of a given reward card. I’d much rather go with a straight cash back card if I could find one that gives a decent % on purchases and doesn’t charge foreign exchange fees.

With Scotiabank, I believe you can use your points at a 1% ratio. You can do this through their portal or on your own and then claiming the points towards your travel purchases after.

I’d love to use my hard earned Aventura points but I’ve tried for several days now at over an hour on hold each time to reach the rewards centre and a travel assistant to book a couple of hotels. Points are not worth much to me if I can’t talk to someone about redeeming them. I’ll keep trying I guess. Apparently, though, my call is very important and they’ll be with me shortly. Not impressed!

For the ” 7 cents/litre in gas bonuses” with PC Financial World Elite Mastercard. Is that available for people living in Toronto? If yes, how do I go about in getting that? Thanks so much

Hi Tom. I live in Calgary. Across Western Canada, Loblaws had a number of service stations co-located with their grocery stores. They have since sold the stations to Mobil but the 7 cents per litre is still offered to those who use their PC Financial card to make the purchase. You don’t get a direct reduction at the pump but instead earn 70 Optimum Points for every full litre you buy. You can then redeem those points for purchases in their grocery stores. Because I don’t live in Toronto and am not familiar with what is offered in that part of the country, I don’t know if the same offer is available to you.

Are Aventura points still able to be transferred to Aeroplan points?

No, that partnership ended.

Your commercial on tv with penguins needs to be reworked. Penguins dont travel , have credit cards or talk on phone. Use real people and tell it like it is not a load of crap. Maybe to somepeople this ad is funny but to my wife and me it is a stupid ad and whoever thought it up should give their heads a good shake. More people should email you guys and give you feedback. Ask people what they think of ads and it might help your business.

From the CIBC website:

The $750 value is based on the following, as at July 1, 2019: i. $120 travel credit as disclosed in the offer Terms and Conditions as provided below; ii. $400 value is based on the maximum redemption value for 20,000 Aventura Points on a short haul airfare purchase, based on the Aventura Airline Rewards Chart at http://www.cibcrewards.com , before taxes and other charges;

What concerns me is the “on a short haul airfare purchase” so that means you can only use these points for flights that are 180 mins or less? That seems to significantly lower the value of these points…

CIBC is just trying to justify how you get $750 in value. the $400 maximum value refers to their fixed travel program. You can use your points on any flight. You can check out their redemption chart here.

https://rewards.cibcrewards.com/travel/

This is a helpful review, Barry. Thanks. We find good value with Scotia Momentum Visa, a cash back card. We appreciate the 4% rebate on groceries and recurring bill payments, i.e.; Netflix, Telus, Spotify…

The Scotia Momentum Visa is an excellent card.

Barry, excellent read

How can I transfer points from my USD Visa to my CAD Visa accounts?

I really have no idea, you’d have to contact CIBC to find out.

I have waited up to 21/2 hours for a reply when trying to book a flight oh, that music! I finally gave up and drove to the airport and booked directly, using my card. Absolutely dreadful service. Thinking of dumping the card, why should you gave to go through the hassle to do something so simple?

I just received my CIBC Aventura Infinite Card. I am thinking of applying for Nexus card for myself and my spouse. Will the Nexus Fee be waived for both of us or just the card holder? Thanks

It applies to a one-time use. You could use it for you or your wife, not both.

“Receive one (1) statement credit up to a maximum value of $100 CAD when NEXUS application fee is charged to an eligible card, regardless of NEXUS application approval.”

Just a heads up that Aventura (and others) have teamed up with Dragon pass to give cardholders with Plaza Premium lounge access. More info here!

https://ppg.dragonpass.ca/Landing

All the best! FT

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

- [email protected]

- 888.482.5887

- Who are we?

Why Aventura World?

- Our Parent Company

South Pacific

Latin america.

- Endorsements

- Helpful Articles

- Tour Requirements

Request Information

Taste of tyrol - innsbruck, austria, from the alps to the adriatic, south pacific highlights, switzerland & austria, tuscany, italy, national parks of the west.

Aventura World Experience

It’s all about traveling to spectacular places at a relaxed pace, discovery, education, and inspiring interactions.

Travel for all

We go the extra mile to deliver meticulously planned travel programs at prices to suit all budgets

Cultural Discovery

Meet locals, enjoy people-to-people interactions to understand their life, culture, social aspects, and the region’s economy.

From our Programs

United states.

The Splendor Of The Southwest and Its National Parks

7 Days/6 Nights

Ancient Capitals, Colonial Cities & The Caribbean

8 Days/7 Nights

15 Days/12 Nights

Imperial Russian Waterways

12 Days/10 Nights

Southern Charm

Magic Of Colombia

Best Of Argentina & Brazil

10 Days/8 Nights

Budapest, Vienna & Prague

9 Days/7 Nights

Our Destinations

View Europe Vacation Packages

View South Pacific Vacation Packages

View Asia Vacation Packages

View Africa Vacation Packages

View Latin America Vacation Packages

View USA Vacation Packages

At Aventura World we understand that a great travel offer needs to be communicated. Our marketing department is pleased to provide multi-channeled support that can be easily integrated into your program to create a comprehensive advertising campaign at no additional cost.

Experience the world with our YouTube of the day

We invite you to become part of Aventura World…a living, breathing entity made up of a team of destination experts and travel planning partners that collaborate to share unforgettable travel experiences, and work in fruitful ways to enhance economies and promote overall wellbeing of our entire global community.

Let our professional, experienced staff handle the details of your next group travel program with Aventura World, a valued leader in the U.S group travel marketplace since 1972.

Ahh, Italy. The Amalfi Coast with its food, wine, historic sites and spectacular coastline is one of the most amazing destinations anywhere in the world. The ancient ruins of Pompeii, the streets of Sorrento, and the extension to Rome provide an itinerary sure to please your Chamber travelers. More importantly, when challenges arose – a healthcare issue and an emergency flight home – Aventura World was there with exceptional customer service and care to take care of our travelers.

The sights, sounds and tastes of the Amalfi Coast were spectacular. From the ruins of Pompeii, to the sidewalk cafes of Sorrento, to breathtaking cliffs plunging into blue bays of the Mediterranean, this was a trip I'll remember forever. The itinerary and personal care provided by Aventura World made this one of the best journeys Barbara and I have had together. The guide was exceptionally good, earning a standing ovation from our fellow travelers. In the end though, it was the destinations themselves that made the trip so memorable. It's no wonder this coastline has been an envied vacation spot since the days of Caesar.

We greatly appreciate you and Aventura World for introducing us to Egypt and its 5000 year history of contributions to civilization. From the Great Pyramids of Giza, to the temples of the ancient gods of the pharaohs, to the Valley of the Kings and the beauty and mystique of the life-giving Nile, we were entranced, educated and entertained. It was a marvelous trip for Janice and me and for our members. Thank you .

Visiting the Tyrol region of Austria was breathtaking. This was truly a trip of a lifetime. Prost!

Our trip to Austria and Germany went off without a hitch. The weather in early November was perfect for us Floridians and our tour guide was fantastic! We were amazed at the 16th, 17th and 18th century towns that we visited, especially when the oldest buildings in our city date back only 100 years. Munich, Salzburg, Mittenwald, Garmish/Partenkirchen and Innsbruck and we added an optional Romantic Road/Nuremberg extension to our trip. The hills were truly alive with the sound of music as we watched the Julie Andrews movie while on the bus before touring the sites used in the movie. I recommend this trip to everyone.

CIBC Aventura ® Visa* Card review

Get up to 10,000 Aventura Points (up to $100 in travel value†); Earn up to 2,500 Aventura Points† for completing bonus activities within 60 days from your account approval† 7,500 Aventura Points after you make your first purchase within first 4 months.†

- Rates & Fees

1 point for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1 point for every $1 spent on travel purchased through the CIBC Rewards Centre†

1 point for every $2 spent on all other purchases†

$0 Annual Fee

20.99% Purchase APR non-Quebec residents†

22.99% Cash Advance APR for non-Quebec residents†

22.99% Balance Transfer Rate for non-Quebec residents†

Good Recommended Credit Score

$15,000 Required Annual Household Income

By Hannah Logan

Play article

( mins)

( )

Compare other CIBC credit cards

- Best CIBC credit cards in Canada

- CIBC Aventura® Gold Visa* card

- CIBC Aventura® Visa Infinite* Card

- CIBC Dividend Platinum® Visa* Card

Compare other Visa credit cards

- Best Visa credit cards in Canada

- CIBC Dividend® Visa Card

- BMO eclipse Visa Infinite Privilege* Card

- RBC Visa Platinum Card

Compare other travel credit cards

- Best travel credit cards in Canada

- TD® Aeroplan® Visa Infinite* Card

- BMO Ascend™ World Elite®* Mastercard®*

- Rogers™ World Elite® Mastercard®

Are you looking for a travel credit card with no annual fee with some handy perks and easy to earn rewards? The CIBC Aventura ® Visa offers new cardholders the opportunity to earn up to 2,500 Aventura Points † within the first 60 days of your account approval†. Add in a no annual fee, some travel benefits, and the ability to earn rewards on all purchases, and you have yourself a pretty decent travel credit card.

About the CIBC Aventura ® Visa* card

The CIBC Aventura ® Visa* Card is a travel card that allows you to earn rewards for every purchase and later redeem those rewards for travel and more. Cardholders can also easily earn points through everyday spending. Once you have enough points, you can redeem them for a variety of products including travel.

Travel points aren’t the only thing you earn, you’ll also enjoy no annual fee for the primary cardholder, as well as up to three additional cards.

CIBC Aventura Visa Card for Students

Being a student doesn't mean you have to pick a credit card that doesn't offer any rewards or benefits. In fact, student cards can help you develop responsible credit habits, and the CIBC Aventura Visa Card for Students is a perfect example. With this card, you'll enjoy rewards, concierge service, complimentary insurance coverage and a generous welcome bonus.

The CIBC Aventura Visa for Students Card comes with no minimum annual income requirement and a $1,000 minimum credit limit. And get ready for perks galore - you can take advantage of even more student benefits with a free SPC+ membership.

Pros and cons of the CIBC Aventura ® Visa* card

Easy to earn welcome bonus

Points can be earned on all purchases

Use Aventura Points to cover full airfare including taxes and fees

Can book with any airline with no blackout periods and points don’t expire†

Lower earn rate than some other travel cards on the market

Main benefits and features

The CIBC Aventura ® Visa* Card allows cardholders to quickly earn Aventura Points so they can travel faster and farther, with no limitations on airlines you can use your points to book with or blackout periods.

Welcome offer

Join and earn up to 2,500 Aventura Points† for no annual fee. Earn by completing all of the 5 following activities, worth 500 points each when completed within 60 days of of your CIBC Aventura® Visa* account approval. †

- Share your email address with CIBC

- Sign up for eStatements for your new Aventura Visa Card

- Add an authorized user on your new Aventura Visa Card

- Hold an eligible CIBC chequing account

- Add your Aventura Visa card with Apple Pay®, Samsung Pay or Google Pay™

How to earn rewards on regular purchases

The welcome bonus is a great perk, but CIBC Aventura ® Visa* Card cardholders can easily earn points on a daily basis based on the following structure:

- 1 point for every $1 spent on eligible travel purchases made through the CIBC Rewards Centre †

- 1 point for at $1 spent on eligible gas stations, EV charging, grocery stores, and drug store †

- 1 point for every $2 spent on all other eligible purchases †

All you have to do is shop with your card and, for those who are wondering, no your points won’t expire † as long as you are a cardholder. Each point is worth about $0.0116, however the value changes based on how you choose to redeem each point.

How to redeem rewards

When it comes time to redeem your rewards, you can do so easily online . Rewards can be redeemed in a number of different ways:

- Travel : flights, hotels, car rentals and more †

- Shopping: redeem for merchandise or gift cards through the CIBC Rewards online catalog †

- Points that pay the bills : your points can be used to pay down your credit card balance or credit card purchases moments after you make them. †

As a general rule of thumb, your points go the furthest when redeemed for travel, especially since with this card you can fly on any airline with no consideration for blackout periods.

To redeem for travel or merchandise, you’ll have to log into your CIBC Rewards account or call the CIBC Rewards Centre. If you want to use your points towards a flight through the Aventura ® Airline Rewards Chart, you will need to have at least 80% of the required points. You can use your points to fly with any airline with no blackout periods. Also, it’s worth mentioning that your points can be used to cover taxes and fees on flight tickets which is not common with most travel credit cards

These are some examples of how far your points can get you:

If you would prefer to redeem your points towards your statement balance you can do this through your CIBC online banking account. Just click ‘ payment with points ’.

Additional perks and features

On top of the main benefits listed above, this card also comes with a few additional perks, including the following:

- 90-day purchase security protection in case your new purchase gets stolen or breaks †

- Auto Rental Collision and Loss Damage Insurance †

- $100,000 Common Carrier Accident Insurance †

- Extended Protection Insurance †

- Aventura Travel Assistant, which tailors travel bookings to your needs, with no booking fees †

Rates and fees

The CIBC Aventura ® Visa* Card does not have an annual fee. You can also get up to three additional cards at no charge. Cardholders will pay a relatively standard 20.99% † purchase annual interest rate, 22.99% † (for non-Quebec residents only) cash advance annual interest rate, and a 22.99% † (for non-Quebec residents only) balance transfer annual interest rate.

What are the eligibility requirements?

In order to apply for this credit card, you need to meet the following eligibility requirements:

- Be a Canadian resident

- Have reached the age of majority in your province

- Have a fair credit score (>640)

- Have a minimum household annual income of $15,000

How to get the CIBC Aventura ® Visa* card

Applying for the CIBC Aventura ® Visa* Card is easy and can be done online, takes about five minutes and you’ll get a response in as little as 60 seconds.

You will be asked to confirm that you meet the eligibility qualifications, which is smart because you’d hate to fill it all out and then realize you’re not eligible.

Next is a page with all the important credit card info regarding terms and current rates, etc. Read through this information and click ‘agree’ at the bottom to proceed.

After this, you will be asked to fill out your personal information. This includes your Canadian address, phone number, birthdate, etc. You will be asked for your Social Insurance Number, so make sure you have that ready.

If you are already a CIBC customer and use CIBC Online Banking, you can log in and it will connect this information for you. Once you have completed your application you can expect to receive the credit card, assuming you are approved, within 2-3 weeks by mail.

What we like

The CIBC Aventura ® Visa* Card is a decent travel card, especially considering that it is free. You can earn points on all purchases, the welcome bonus is easy to obtain, and there are a couple of handy perks and benefits. We also appreciate that this credit card allows travellers to use their rewards towards paying for taxes and fees as well, not just the actual flight itself.

What we like less

The point earn rates are a little low in comparison to a couple of other travel credit cards on the market and the fact that the amount of points required to redeem for flights through the Aventura Flight Rewards Chart is not a fixed amount can make things a bit confusing when trying to figure out how to get the most for your points.

Although the welcome offer might not be as high as other cards on the market, there is no spending minimum making it extremely accessible for cardholders. This card’s flexible points redemption means you can decide how you want the CIBC Aventura ® Visa* Card to work for you. Whether you’re a frequent flyer or an avid online shopper, this card is a great companion for your wallet.

† Terms and Conditions apply

This is a digital-exclusive offer. †

To be eligible for this offer:

1) This offer must have been directly communicated to you from CIBC or from a partner/affiliate; and

2) You must apply for the eligible card through the link provided in the CIBC or partner/affiliate communication to you. †

This offer is reserved for you. Please do not forward it to anyone else. CIBC may approve your application, but you are not eligible to receive this Offer if you have opened, transferred or cancelled another eligible card within the last 12 months. †

This offer is not available for the residents of Quebec. For Quebec Residents offer - visit CIBC.com product page here

Résidents du Québec : Pour en savoir plus sur ce produit CIBC, suivez ce lien

About our author

Hannah Logan is a freelance writer, blogger, and content creator from Ottawa. She spends half the year in Canada and half the year travelling around the world. A self-described wannabe Indiana Jones, Hannah first developed an interest in personal finance in an effort to prolong her travel lifestyle. Today, she shares her stories from her travels as well as finance tips, tricks, and knowledge to help others fulfil their savings and travel goals as well. You can keep up with Hannah’s adventures on her personal travel blog, EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

Latest Articles

Defunct Lynx Air blames contractor for delayed passenger refunds

WestJet Encore pilots announce tentative deal in labour dispute with regional carrier

New gildan ceo vince tyra updates investors on priorities amid leadership battle.

B.C. port terminal among sites blocked in co-ordinated pro-Palestinian protests

B.C. celebrates 10 billion seedlings planted since 1930

Most actively traded companies on the toronto stock exchange.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

- Book Travel

- Credit Cards

CIBC Aventura

Best ways to earn:

Best ways to redeem:.

CIBC Aventura is the flagship travel rewards program by the Canadian Imperial Bank of Commerce, which can only be earned on CIBC’s Aventura-branded credit cards.

CIBC Aventura is a fixed-value points currency, meaning that points can be redeemed only at a fixed value, through multiple ways.

These aren’t necessarily the points to use for luxury hotels and First Class flights; however, they’re great to offset the cost of other travel expenses, including boutique hotels, train tickets, economy flights, and other incidentals.

Earning Points via Signup Bonuses

The only way to earn CIBC Aventura is from the bank itself, via its suite of Aventura-earning credit cards.

- The CIBC Aventura Visa Card is a no-fee card, which typically comes with a small signup bonus.

- The CIBC Aventura Gold Visa Card is an entry-level product among the CIBC Aventura cards. The card frequently puts on promotions for first-year annual fee rebates, along with a sizeable welcome bonus, which typically ranges between 20,000–50,000 CIBC Aventura Points.

- The CIBC Aventura® Visa Infinite* Card is a mid-range offering by CIBC. The card frequently puts on promotions for a first-year annual fee rebate, along with a sizeable welcome bonus of 20,000–50,000 CIBC Aventura Points.

- The CIBC Aventura Visa Infinite Privilege Card is the premium offering by CIBC. For a substantial annual fee, cardholders will have comprehensive travel insurance coverage, and elevated earnings on CIBC Travel Rewards purchases.

- The CIBC Aventura Visa Card for Business is the CIBC Aventura-earning card aimed at business owners. The card sometimes puts on promotions for a first-year annual fee rebate, along with a welcome bonus of 20,000–60,000 CIBC Aventura Points, though typically paired with a high minimum spending requirement.

Earning Points via Daily Spending

Beyond signup offers, you can earn CIBC Aventura Points through daily spending on the above credit cards. The earning rates are as follows:

- 1 Aventura Point per dollar spent at gas stations, grocery stores, drugstores, and on travel purchases via the CIBC Travel Rewards Centre

- 1 Aventura Point per $2 spent on all other purchases

- 2 Aventura Points per dollar spent on travel purchases via the CIBC Travel Rewards Centre

- 1.5 Aventura Points per dollar spent at gas stations, grocery stores, and drugstores

- 1 Aventura Point per dollar spent on all other purchases

- 1.5 Aventura Points per dollar spent at gas, grocery stores, and drugstores

- 3 Aventura Points per dollar spent on travel purchases via the CIBC Travel Rewards Centre

- 2 Aventura Points per dollar spent on dining, entertainment, transportation, gas, and groceries

- 1.25 Aventura Points per dollar spent on all other purchases

- 1.5 Aventura Points per dollar spent on gas and other travel purchases

From an everyday spending perspective, the CIBC Aventura® Visa Infinite* Card is a clear winner.

Earning 1.5 Aventura Points per dollar spent on gas and groceries is quite good, and unless you spend quite a bit in those categories, it’s not necessarily worth paying a $499 annual fee to earn 2 points per dollar on the CIBC Aventura® Visa Infinite Privilege* Card.

If you’re looking to offset cash expenses for travel, such as tours, cruises, short-term rentals, or independent hotels, then redeeming Aventura Points directly against other travel purchases is an excellent use.

Redeeming CIBC Aventura Points

CIBC Aventura offers various redemptions, from a the CIBC Aventura Airline Rewards Chart to redeeming for financial products.

Redeeming for Travel Booked Directly with Vendors

On an ongoing basis, you can apply your Aventura Points directly to travel purchases at an elevated rate of 1.25 cents per point.

Usually, you can offset the cost of incidental travel purchases at a rate of 8,000 Aventura Points to $50, or at a value of 0.625 cents per point.

With this promotion, the value of your CIBC Aventura Points is doubled, so the same 8,000 Aventura Points results in $100, or at a value of 1.25 cents per point.

To do this, you’ll want to log in to your CIBC Online account and use the “pay using points” option.

In order to redeem at 1.25 cents per point, you must “pay using points” while the transaction is still pending, as you won’t be able to do so after the transaction has already posted.

Aventura Airline Rewards Chart

Using the Aventura Airline Rewards Chart , you can earn up to 2.29 cents per point in value. The chart works by applying a fixed number of points to any cash ticket to a certain region.

You can apply the number of points indicated on the chart to any cash ticket at or below the maximum ticket price that CIBC dictates.

For example, for short-haul flights in Canada and the U.S., you’ll need 10,000 – 20,000 Aventura Points to book a one-way flight with a maximum cash ticket price of $400.

Note that the maximum ticket price only includes the base fare, and does not apply to any additional taxes and fees . If you wish to apply points towards the additional taxes and fees, you can at the fixed travel rate of 1 cent per point.

Redeeming points this way results in a value of up to 2.29 cents per point.

CIBC Rewards Travel Centre

You can redeem Aventura Points at a set value of 1 cent per point for any bookings made through the CIBC Rewards Travel Centre, including flights, hotels, car rentals, and cruises.

You might be wondering why flights are included if there’s already a flight reward chart above. Well, CIBC’s online travel portal can be limited in airlines it displays, so if you wish to redeem on low-cost-carriers or for flights with smaller airlines like Harbour Air, you’ll have to do so via calling in to the CIBC Rewards Travel Centre.

If you’re using Aventura Points to redeem for hotels or car rentals, the usual warnings of using an online travel agency apply.

You won’t earn any hotel status benefits or accrue elite qualifying nights at hotels. For car rentals, you won’t earn things like Hertz points or free rentals through National Free Days.

This doesn’t apply to airfare, though, as you’ll still accrue the same amount of elite qualifying miles, segments, and dollars. As long as you have your frequent flyer number attached to your booking, or add it in at the check-in counter, your travel should count towards elite status qualification.

One major thing to note about using CIBC to book airfare is that any and all changes and cancellations must be done through the third-party booking agency, and can’t be done through the airline.

Considering all of the above, it’s still worthwhile to book car rentals or hotels, especially if it’s a one-off rental agency you’re not concerned about accruing status for.

Similarly, if you’re planning to stay at a boutique hotel where there’s no such thing as status, then booking through CIBC Travel won’t make a difference.

Redeeming for Financial Products

You can also redeem CIBC Aventura Points towards a statement credit on the following CIBC-branded financial products :

- Investor’s Edge Portfolio

- Line of credit

These come at a fixed rate of 0.83 cents per point, and you must have at least 12,000 points in order to begin redeeming.

Redeeming for these financial instruments is done using the “pay with points” feature in CIBC’s online banking interface.

Gift Cards & Merchandise

Redeeming CIBC Aventura Points for merchandise isn’t always a bad idea , especially if there’s a holiday or promotional sale. Outside of those circumstances, though, you’ll be looking at between 0.4–0.8 cents per point, depending on the item.

This doesn’t take into account any additional points or savings you could accrue through the Aeroplan eStore and cash back portals, among others.

With gift cards, it’s almost always going to come out to 0.71 cents per point in value. The only exception to this is redeeming for CIBC prepaid Visa cards, which have the lowest redemption value at just 0.63 cents per point.

Statement Credits

Speaking of 0.63 cents per point, this is also the rate you’ll redeem at if redeeming Aventura Points against all other non-travel, non-financial products.

Simply apply your using points in the CIBC online banking interface using the “pay with points” feature.

Needless to say, redeeming points at 0.63 cents each is a bad idea, and you’d be much better served with a cash back card .

CIBC Experiences

CIBC also runs auctions for special experiences , such as a Bermuda island retreat or tandem skydiving in British Columbia.

Due to the nature of such redemptions, it’s difficult to assign a cent per point value, but some of the bids can end up being quite reasonable. So, it’s always worth a look to see if nobody is bidding for what’s sure to be a good time.

CIBC Aventura Points are optimally used via the Aventura Airline Rewards Chart , but that might be restrictive for folks who want to apply their points to a greater set of all travel purchases.

Luckily, you can redeem your Aventura Points towards all travel at 1.25 cents per point through the “pay with points” feature.

Otherwise, you can think of CIBC Aventura Points as a stop-gap for miscellaneous travel purchases on your travels around the world, between traipsing from hotel to hotel and flight to flight.

Use them for train tickets, entrance fees, and all the other incidentals you may rack up on your journey.

IMAGES

COMMENTS

With Aventura ®, get exclusive access to the Aventura Travel Assistant 4. Call 1 888 232-5656. More adventure, less planning, no booking fees. With the Aventura Travel Assistant 1, personalized expertise isn't a luxury—it's the standard. We remove the hassle by taking care of everything you need to travel.

Multiplying your Aventura Points is as easy as buying groceries, pumping gas or booking a trip. 1 point. for every $1 spent at eligible gas stations, electric vehicle charging stations, grocery stores and drug stores 3. Accelerate your savings with up to 10 cents off per litre on gas.

Welcome to your CIBC Aventura® Visa* Card. Enjoy travel flexibility and travel protection with the CIBC Aventura Visa Card at no annual fee. Earn 1 Aventura Point for every $2 you spend on your card.1 Earn rewards even faster with the Points Multiplier® feature and redeem for a selection of rewards including: truly flexible travel—fly any ...

For your convenience, you can access cibcrewards.com 24 hours a day to check your account balance and redeem for Travel and Rewards.. To contact us by phone: CIBC Aventura ® and CIBC Gold Visa * Customers . General Inquiries and Rewards Redemptions. Phone: 1-888-232-5656 (In Canada & U.S.) or 905-696-4907 (elsewhere)

The CIBC Aventura Visa Infinite Card is easily one of Canada's most underrated travel rewards credit cards. You get a decent earning rate and great travel benefits. The rewards are flexible, and the annual fee for the first year is typically waived. Even though CIBC is one of the big six banks in Canada, their credit cards don't seem to get ...

At Aventura World we understand that a great travel offer needs to be communicated. Our marketing department is pleased to provide multi-channeled support that can be easily integrated into your program to create a comprehensive advertising campaign at no additional cost. Experience the world with our YouTube of the day.

The baseline use-case for CIBC Aventura points would be to redeem them at a value of 1 cent per point (cpp) against travel that's booked through the CIBC Rewards Travel Centre. For example, the current signup bonus of 35,000 Aventura points on the CIBC Aventura Visa Infinite would be redeemed against $350 worth of travel booked via CIBC.

The CIBC Aventura ® Visa Infinite * Card is a flagship travel credit card from CIBC, and therefore comes with all the key insurance policies that a frequent traveller would expect. This includes out-of-province emergency medical insurance of up to $5,000,000, plus coverage for flight and baggage delays, trip cancellation and interruption ...

Top 10 Best Travel Agency in Aventura, FL - April 2024 - Yelp - Jerry Allen Travel, House of Travel, AC Journeys, Pro Cruise Planner, Itravel Agency, Areas Travel, Safari Tours, Soul Travel Agency, Payless Travel, Amber Cruises and Travel

Purchase any scheduled flight with your CIBC Aventura Visa Infinite Card and you can receive up to $500 (CAD) coverage for reasonable and necessary accommodation and restaurant expenses, up to $100 (CAD) for ground transportation and up to $100 (CAD) for entertainment expenses when your flight is delayed for more than 4 hours.

For the CIBC Aventura Infinite Visa card, CIBC Aventura World MasterCard or CIBC Aventura World Elite MasterCard, Out-of-Province Emergency Travel Medical Insurance (TMI) covers the primary cardholder, their spouse and dependent children for the first 15 days of a trip if the insured person is age 64 or under, or for the first 3 days of a trip ...

The CIBC Aventura Visa Card is a competitive travel rewards card that offers a decent rewards earn rate, flexibility to book flights with any airline via the CIBC Rewards Center, and up to 10 cents off per liter of fuel - all for no annual fee.. You'll earn 1 Aventura point for every $1 spent on gas, groceries, and drugstore purchases, 1 Aventura point for every $1 spent using the CIBC ...

The CIBC Aventura ® Gold Visa * Card is currently offering an elevated bonus of up to 45,000 Aventura Points,† structured as follows: 15,000 Aventura Points when you make your first purchase†. 30,000 Aventura Points when you spend $3,000 (CAD) or more in the first 4 monthly statement periods†. The $139 annual fee is currently rebated in ...

Get up to 10,000 Aventura Points (up to $100 in travel value†); Earn up to 2,500 Aventura Points† for completing bonus activities within 60 days from your account approval† 7,500 Aventura ...

CIBC Aventura® Visa Infinite* Card. Experience more of the world with our most flexible travel rewards program 1. Digital exclusive offer. Join and get up to $1,400 in value †! $60,000 individual, or $100,000 household minimum annual income.

How many points do you want to redeem? Results are based on economy class round-trip fare for one passenger. Personal. Credit Cards. Aventura Flight Finder. Apply online, book a meeting, or call 1-866-525-8622.

Your best option is the CIBC Aventura Visa Infinite. You can redeem your CIBC points in 7 ways, including travel, charity, financial products, merch, gift cards, and statement credits. The best way to redeem your points is maximizing the CIBC Aventura Airline Redemption Chart, which can get you up to 2.29 cents per point.

If your credit card is lost or stolen, report it and request a replacement card through CIBC Online Banking ® or the CIBC Mobile Banking App ®. For credit cards, call: 1-800-663-4575. (Canada and the U.S.) 1-514-861-9898.

Best Travel Agents in Aventura, FL - Jerry Allen Travel, Itravel Agency, Pilot Travel, Mirabel Travel, Amber Cruises and Travel, Meet The Jarquins, Soul Travel Agency, M.A.D.E. PROPERTIES, Areas Travel, Brandy's Paradise

From an everyday spending perspective, the CIBC Aventura® Visa Infinite* Card is a clear winner. Earning 1.5 Aventura Points per dollar spent on gas and groceries is quite good, and unless you spend quite a bit in those categories, it's not necessarily worth paying a $499 annual fee to earn 2 points per dollar on the CIBC Aventura® Visa Infinite Privilege* Card.

I have the Aventura Visa Infinte Privilage & my wife has the Infinte, and we both find it worth it. The benefits are great, we have accumulated a good amount of points, and I have used my nexus rebates for me and her. We both like our cards, and find them better than many other competitors. I just realized that my wife also has nexus rebates.

An annual $200 travel credit to use at the CIBC Rewards Centre1. Elevate your airport experience with 6 complimentary visits at 1,200+ lounges globally through the Visa Airport Companion Program2. Access to redeem your Aventura® Points for Business Class seats on any airline3,4.