Terms & Conditions | Disclaimer & Internet Privacy Statement © The Hongkong and Shanghai Banking Corporation Limited 2002-2024. All rights reserved.

- Primary navigation

- Main Content

It’s been three long years, and finally the time has come for us to dust off our passports and start packing our bags again. The threat of COVID-19 is still with us, however. So how should we choose our travel insurance to ensure we are well covered?

Protection against COVID-19

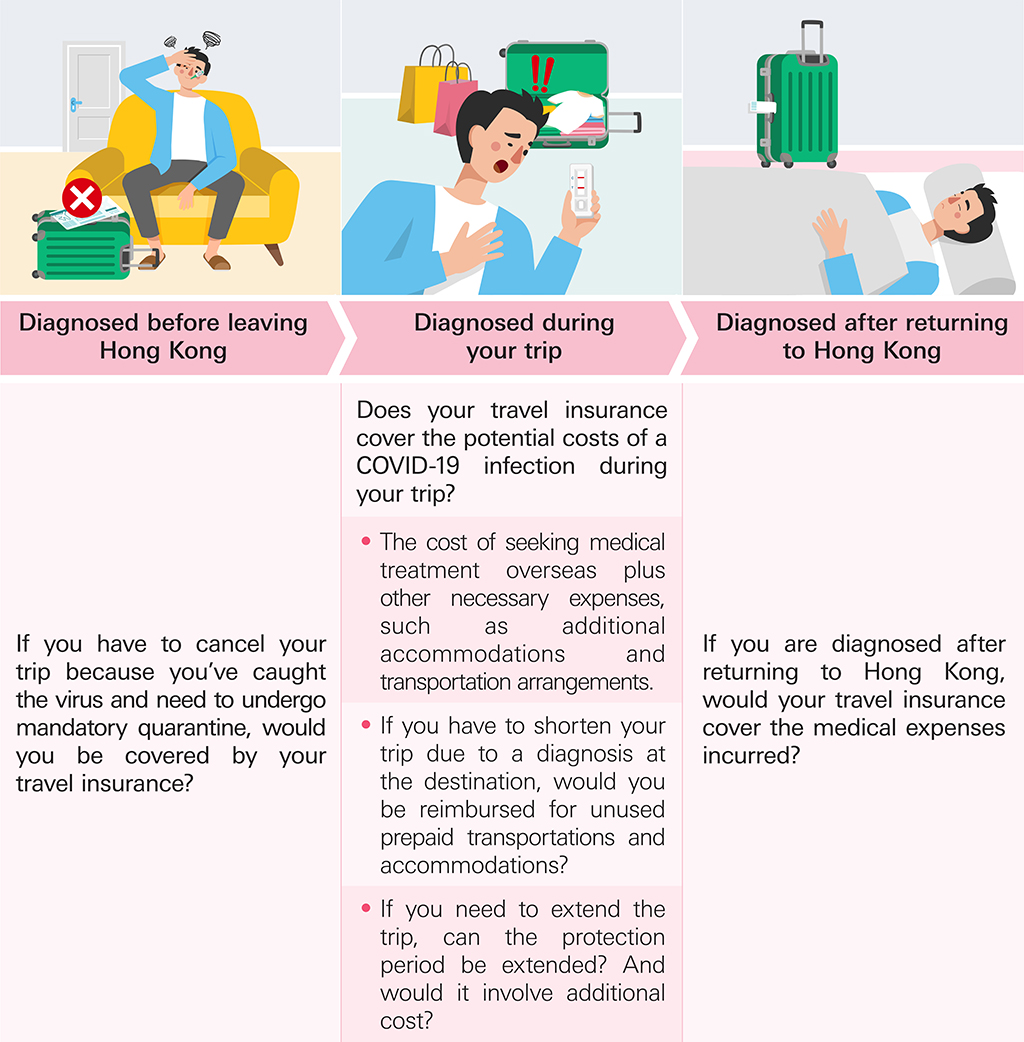

Pay particular attention to whether a travel insurance policy offers COVID-19 coverage. Possible scenarios include:

There are plans on the market that cover all the above scenarios, protecting you all the way from before your departure, to after your return home. You should choose a plan based on your specific needs.

Yet, travel insurance isn’t only about COVID-19 protections. Check to see if the scope of coverage includes the following too:

Enjoy global medical coverage with a VHIS plan

Once the borders completely reopen, you’d probably transit back into frequent traveller mode, whether for business or pleasure. You may even have plans for moving or studying abroad. If you will be staying overseas for extended periods of time, a medical protection plan that covers overseas medical expenses is a must-have in addition to travel insurance. Choosing a Voluntary Health Insurance Scheme (VHIS) that can cater to your needs is crucial. Some of the plans would protect you against medical expenses in the Greater China area, Asia or even other parts of the world. On top of the global medical coverage, there are other reasons for getting a VHIS policy:

The past three years have been a stark reminder that the future can be unpredictable. Only by preparing adequate protection for ourselves and our families can we make sure that no sudden illness or mishap would disrupt our plans.

Travel Insurance Checklist 2022

Post a comment.

- Privacy and Security

- Terms of Use

- Hyperlink Policy

© Copyright.The Hongkong and Shanghai Banking Corporation Limited 2002-2024. All rights reserved

This website is designed for use in Hong Kong. Cross-border disclosure Cross-border disclosure This link will open in a new window

![hsbc travel insurance hk 20240125_[Insurance]_Best_Deal_Guarantee_Campaign_(Jan_2024)_D-PJ24_0028_Campaign_Top_Banner_Mobile_EN_(1440_x_256)_1.jpg](https://images.contentstack.io/v3/assets/bltdf909986be592dae/bltfd378697dabebdad/65b20543ebfd0300043cfd61/20240125_[Insurance]_Best_Deal_Guarantee_Campaign_(Jan_2024)_D-PJ24_0028_Campaign_Top_Banner_Mobile_EN_(1440_x_256)_1.jpg?width=3840&disable=upscale&fit=bounds&auto=webp)

Get the Best Travel Insurance in Hong Kong 2024

Policy search details.

TraveLead Travel Insurance - Supreme

Cancellation coverage.

Medical Coverage

Bags & Belongings Coverage

25% discount

Customers of selected travel insurance products on Apr 10, 6pm - Apr 23, 6pm, 2024 can receive an Uber Taxi HK$100 Voucher for a premium of HK$180 or above , or an Uber Taxi HK$200 Voucher for a premium of HK$350 or above , or an Uber Taxi HK$300 Voucher for a premium of HK$500 or above (after applying discount). Limited quantity. First-come, first-served. Terms and conditions apply.

- "Zurich Life HK$100,000 free term life protection"

Apply via MoneyHero to get the best price, guaranteed. Learn more here .

-D-PJ24_0190-Campaign_Static-Banner_EN_OP.jpg?width=3840&disable=upscale&fit=bounds&auto=webp)

- Includes extension of COVID-19 Overseas Medical Expenses

- Covers the accidental loss or damage of mobile phone, tablets PC and laptop computer; covers rental vehicle excess

Allianz Advanced (Plus) [for ages 0 to 54]

Exclusive price.

50% discount

"HK$100,000 free term life protection"

-D-PJ24_0190-Campaign_Static-Banner_EN_OP.jpg?width=3840&disable=upscale&fit=bounds&auto=webp)

- Child Cover at 50% off with Full Limit same as Adult

- Cancellation benefits enhanced to protect for trips purchased with air mile or loyalty card points in addition to cover against all levels of outbound travel alerts

Generali Bravo Travel Protector (Standard Plan)

38% discount

Free 3-month Deliveroo Plus Silver Membership. Terms and Conditions apply.

New customers who purchase any Generali Insurance products through MoneyHero during the promotion period will eligible $100 Travel Expert discount offer if the flight ticket order is over HKD3,000 ( Applicable for booking on Travel Expert website ). This offer is provided by Generali and valid until 30 Jun 2024 – Please refer to the gift redemption Terms and Condition.

-D-PJ24_0190-Campaign_Static-Banner_EN_OP.jpg?width=3840&disable=upscale&fit=bounds&auto=webp)

- COVID-19 Medical Expenses

- Cover damage or loss of mobile phone and leisure sports

bolttech TravelCare - Superior Plan (Previously known as FWD General Insurance Company Limited)

- 40% discount

Free first-year "SoCare Health Pass" individual plan (valued at HK$390)

This product is available for purchase only via MoneyHero.

-D-PJ24_0190-Campaign_Static-Banner_EN_OP.jpg?width=3840&disable=upscale&fit=bounds&auto=webp)

- Age limit: 6 weeks to 85 years old

- COVID-19 Cover+

Single Trip Travel Insurance - Silver

- Enjoy 35% discount for successful application via MoneyHero

- ChargeSpot power bank rental offer: 2 pieces of free HK$6 rental coupon

Caution: System maintenance on Every Sunday from 00:00-04:00: Insurance policies will not be issued during this period. Please apply at other times.

-D-PJ24_0190-Campaign_Static-Banner_EN_OP.jpg?width=3840&disable=upscale&fit=bounds&auto=webp)

- No age limit applies

- Include COVID-19 protection

TraveLead Travel Insurance - Extra

-D-PJ24_0190-Campaign_Static-Banner_EN_OP.jpg?width=3840&disable=upscale&fit=bounds&auto=webp)

- Covers the accidental loss or damage of mobile phone, tablets PC and laptop computer

Zurich Get "Z" Go+ Travel Insurance Plan - Deluxe Plan

- Aged 76 or above can enjoy 100% sum insured

- Personal property coverage including mobile phone, laptop computer tablet computer or camera drone cover

JourneyGuard - Plan II

- 20% discount

- For Novel Coronavirus coverage, click "See more"

- Comprehensive Travel Delay Coverage

Blue Cross Travel Smart - Select Plan

Avo Travel Protection (Upgraded) Policy – Lite

- Includes ‘Free COVID-19 Extension’

- Covers loss of or damage to tablet computers and laptop computers

SmartTraveller Plus – Premier Plan

- No upper age limit provided the insured person is at least 30 days old

Allianz Basic (Plus)[for ages 0 to 54]

Allianz advanced [for ages 0 to 54], smarttraveller plus – privilege plan, single trip travel insurance - bronze, allianz basic [for ages 0 to 54], travelead travel insurance - essential.

- Medical Expenses including inpatient, outpatient and follow-up treatments; covers amateur hazardous sports, such as hot air ballooning, scuba diving, skiing, etc

Allianz Standard [for ages 0 to 54]

Allianz standard (plus) [for ages 0 to 54], smarttraveller plus – standard plan.

i-Travel Plus (single trip) Plan C

- Loss of baggage cover HK$5,000

JourneyGuard - Plan I

- Comprehensive travel delay coverage

JourneySure Travel Insurance Plan - Gold Cover

- Effective from 23 July 2022, JourneySure Travel Insurance Plan extends its coverage to COVID-19 protection, with no change on member privilege

Universal Voyage Travel Insurance Plan - Silver Plan (Basic Benefit)

- Include Rental Vehicle Excess

Avo Travel Protection (Upgraded) Policy – Plus

- Covers loss of or damage to mobile phones, tablet computers and laptop computers

Generali Bravo Travel Protector (Classic Plan)

Single trip travel insurance - gold, i-travel plus (single trip) plan b.

- Loss of baggage cover HK$15,000

- Loss of Money cover HK$2,000

Universal Voyage Travel Insurance Plan - Gold Plan (Basic Benefit)

Zurich Get "Z" Go+ Travel Insurance Plan - Essential Plan

Journeysure travel insurance plan - diamond cover, blue cross travel smart - premier plan, zurich get "z" go+ travel insurance plan - essential plan [for aged 76 or above], i-travel plus (single trip) plan a.

- Loss of Baggage cover HK$20,000; Loss of Money cover HK$3,000

- Loss of or damage to mobile phone cover up to HK$2,000

Generali Bravo Travel Protector (Premier Plan)

PRUChoice Travel Insurance (Single Trip Cover)

Universal voyage travel insurance plan - diamond plan (basic benefit).

China Ping An Online Insurance - Premier Plan

- Coverage for sport activities including skiing, diving, bungee jumping, hiking, etc; 24-hour worldwide emergency medical

TravelSafe Insurance Plan - Worldwide Gold

- With COVID-19 Benefits

- Pay HK$300 for the first full 5 hours of Travel Delay

Zurich Get "Z" Go+ Travel Insurance Plan - Comprehensive Plan

Travelsafe insurance plan - worldwide platinum, zurich get "z" go+ travel insurance plan - comprehensive plan [for aged 76 or above], zurich get "z" go+ travel insurance plan - deluxe plan [for aged 76 or above], financial insights at your fingertips.

Explore new ways to earn, save, and grow your money for short and long-term goals. Browse the latest analyses, tips and hacks from the MoneyHero team so you can get the most from your dollars!

Corporate Cards: Features, perks and how to get one for your business

A business credit card can help you earn perks and streamline budget management. Read on to learn how to get one!

Tips for buying home insurance in Hong Kong

Home insurances provide coverage on the things and place you love. Let MoneyHero walk you through the basics.

【Shortcut key of bank hotline】How to contact CS directly?

Calling up the bank to sort your troubles? Let us help by giving you the shortcuts to the services you need.

5 Tips for Hiring a Foreign Domestic Helper in Hong Kong

Looking to hire a domestic helper to help lighten the load at home? Read on for tips to a smooth hiring process!

The Best Travel Insurance Hong Kong 2024

Part 1: best travel insurance plan in hong kong .

MoneyHero has compared a few travel insurance products based on their characteristics for you to select the most suitable product according to your own needs.

Part 2 : What does Hong Kong Travel Insurance cover?

Most Hong Kong Travel Insurance plans provide coverage for personal accidents, overseas and follow-up medical expenses, and worldwide emergency assistance services. They also protect the insured from different types of travel disruptions, such as travel delays, baggage loss, and trip cancellation. Losses of personal money and travel documents are also covered if they are caused by accidents covered under the specific insurance policy. Other Hong Kong Travel Insurance protections include compensation on rental vehicle excess, theft of mobile devices, and personal liability.

It is essential to look at the major exclusions in the terms of the policy before purchasing a Hong Kong Travel Insurance plan. If the above situations are caused by events listed under “Major Exclusions”, the insured usually won't be compensated by the Hong Kong travel insurance company. Some common major exclusions are war, civil war, acts of foreign enemies, rebellion, military or usurped power, nuclear hazards, acts of terrorism, and pre-existing, congenital and hereditary conditions.

If the insured will participate in leisure and sports activities during his/her trip, he/she should check in advance whether the activity falls into the scope of “high-risk activities” that are usually listed under “Major Exclusions” in the policy terms, such as trekking at an altitude limit greater than 5,000 meters above sea level or diving to a depth greater than 30 meters below sea level.

Normally, Hong Kong travel insurance plans require any activities in the air, unless an insured person is traveling as a fare-paying passenger in a licensed aircraft operated by a recognised airline, or participating in an activity of which the maneuver or navigation is managed and controlled by another licensed person and the provider of such activity, to be authorized by the relevant local authority.

Part 3 : How to claim travel insurance online?

Step 1: Check the time limit for submitting claim form

Travel insurance companies usually require you to make the claim within a specific time limit, usually within 21 to 30 days of the occurrence.

Step 2: Prepare original documents / proofs / reports

Here are some common documents that are needed for claiming travel insurance online. Each insurance company may have their own list of required documents, please checkout their official website for specific requirements. Click here to find the contact information of the insurance companies.

Documents required for medical claims: Boarding pass (shows the travel period), official medical receipt (with detailed medical expanse), medical report and detailed diagnostic report / referral letter / discharge certificate from a registered doctor.

Documents required for flight delay / baggage delay: Flight tickets and boarding pass with the actual boarding time, delay confirmation report issued by the airline, official receipt of the additional expense due to the delay (e.g. hotel).

Documents required for lost / damage of personal belongings: Clear photo of the lost / damaged item, purchase receipt, repair receipt, boarding pass.

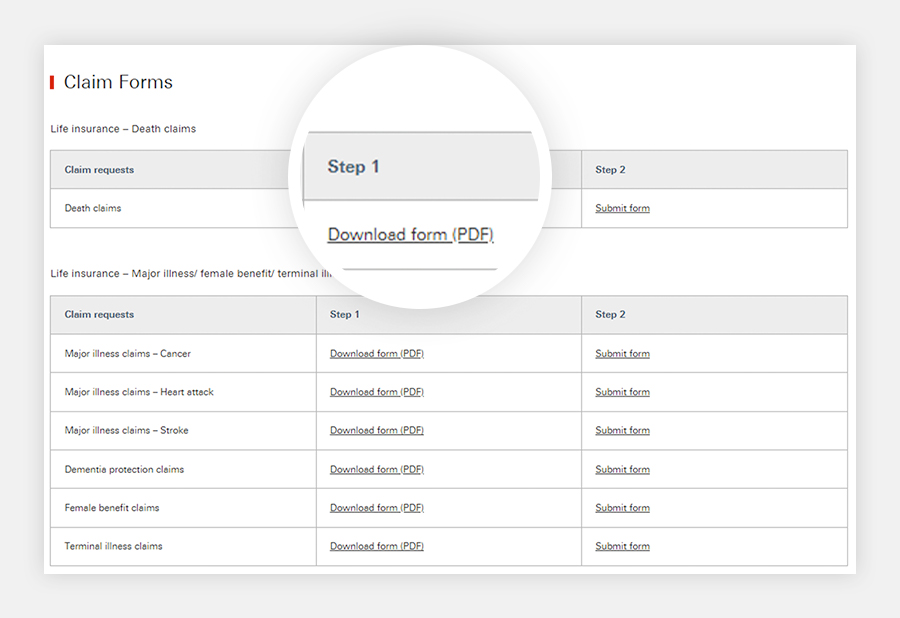

Step 3: Download and fill in the claim form

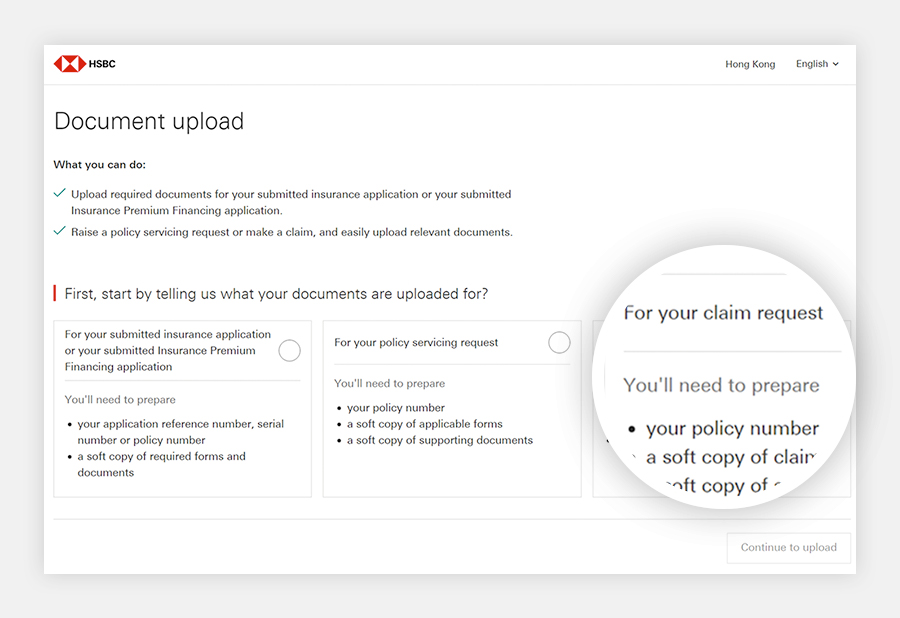

Step 4: Upload the claim form and related documents to the insurance company’s official website

Part 4 : How to compare travel insurance?

An all-rounded travel insurance that is suitable for you can save you from a lot of trouble from handling travel incidents, so you can devote more time to enjoying your vacation or business trip. Employers should also select travel insurance that is catered for employees who travel for business consistently to protect the interests of both parties.

Please keep in mind that insurance companies may have some exclusions in the travel insurance policies. Therefore, price should not be your only concern when selecting a suitable travel insurance. You should also pay attention to items that are not covered in your policies so you can plan ahead and avoid unexpected expenses. For example, you should check if the Hong Kong Government issued any Outbound Travel Alert to certain politically unstable countries and if the travel insurance policy covers any accidents that occur in countries under Outbound Travel Alert.

There are 2 major things you need to consider when comparing travel insurance, your travel destination and your travel activities.

Outbound Travel Alert / Terrorist Attack

The Hong Kong Government introduced The Outbound Travel Alert System to help people better understand the risk or threat to personal safety in traveling to popular travel destinations. It classified countries / territories into 3 alert levels, Amber, Red and Black, based on the severity of the threat in a place that may affect personal safety.

Some travel insurance plans cover countries that are under Outbound Travel Alert, normally there will be compensation for the expenses from trip cancellations due to the issue of Travel Alert before departure, and the accommodation charges and additional expenses from curtailment of trip. However, you should pay attention to the terms and conditions of reimbursement, as some travel insurance only covers Black Outbound Alert. Not all travel insurance policies cover the acts of terrorism, and even if it does, it is not applicable under certain circumstances.

The definition of acts of terrorism

Each travel insurance company may have their own definition of acts of terrorism. Some of them may see whether war, military power, nuclear weapons etc. are involved. War is generally not covered, only Allied World covers war that occurs during the journey, while AXA, Blue Cross, FWD, MSIG, STARR and Zurich do not cover any acts of terrorism related to nuclear fission, nuclear fusion, or radioactive contamination. However, as long as the government in your destination declared the event as acts of terrorism, even though the event only involves common terrorist attacks like guns and bombs, there is still a high possibility of a successful claim.

Self-driving tours

Excluded in third-party liability insurance

Most insurance companies will offer third-party liability insurance but not covering self-driving tours with rental cars as the medical and personal accident benefits are only applicable to the insured person. Overseas car rental companies would usually purchase car insurance for their rental cars, which already covers personal accidents, traffic accidents and third-party assets.

Rental Vehicle Excess

In case of traffic accidents, part of the repair cost may be self-financed, those are usually referred to as “Collision Damage Waiver Excess” or “Rental Vehicle Excess”, which is determined by the car rental company and the rest are compensated by the insurance company. For example, if you purchased an insurance policy with HK$3,000 excess and the car rental company has a HK$5,000 excess, you will be responsible for HK$2,000 and you can claim the remaining HK$3,000 from the insurance company after you return to Hong Kong. STARR’s “Essential” and “Extra” Travel Insurance plans do not cover Rental Vehicle Excess.

If there is any serious injury that leads to hospitalization, you will have to pay attention to the medical expenses coverage, and check the details of medical treatment overseas hospital cash allowance and worldwide emergency assistance service.

Keep the traffic accident record

Travel insurance companies normally require the insured person to provide car rental receipt, car rental insurance proof, traffic accident record and NOC (Non-Operation Charge) receipt etc. Please ensure that the report number, police station information, accident description, car rental company reference number and car rental company corporate seal is included in the traffic accident record.

Part 5 : What should I do if I get injured during the trip?

Call for prior approval

Prior approval from some insurance company may be required before any assistance or hospital admission deposit is guaranteed. The insured person or his/her representative should call the corresponding emergency hotline to provide the insurance certificate number or the policy number, the name and HKID card or passport number of the insured person, and the nature and the location of the emergency for validation.

Keep official documents

All the original copies of the related medical documents must be properly preserved, so it can be used to claim the medical expense after returning to Hong Kong. Those medical documents must be able to show the disease or injury the insured person suffered, like medical certificate, receipts or bills, doctor’s certificate, medical report etc. You should also keep the proof of traveling, like boarding pass and statement of travel records, to submit them along with the claim form.

Some travel insurance plans may not cover all injuries or medical expenses during your trip. For example, most insurance companies cover leisure and amateur sports activities during the journey including winter sports, bungee jumping, hiking, rock climbing, horse riding, scuba diving and other water sports etc., but exclude any dangerous sports with altitude limit not over 5,000 meters above sea level or depth not greater than 30 meters below sea-level. So any injuries that are caused by sports activities excluded from the plan will not be covered.

Part 6 : What should I do if I lost digital gadget during the trip?

If you lost your digital gadget during the trip, you should report it to the police station within 24 hours and keep all the related documents and official receipts for filing the travel insurance claim. Please keep in mind that if there is evidence of the insured person not taking proper care of the said property, travel insurance companies have the right to not cover the loss.

Check if your digital gadget is covered

Most travel insurance companies will list out the digital gadgets that are covered (and not covered) in their policy wordings. For example, FWD covers for loss of mobile phone but excludes the loss of pager, handheld portable telecommunication equipment and computer equipment. Blue Cross stated that only one mobile phone for each insured person will be covered in the same period of insurance.

Also, not all plans under the same travel insurance cover the same amount of items. You may require to purchase a high level plan to get both of your mobile phone and laptop computers covered.

Report to the police and take pictures of the digital gadget

Proof is required to claim for lost digital gadget and police report is one of the important documents that would facilitate your claiming process. You may also want to take a clear picture of your digital gadgets before starting your journey, so it can be a proof for the insurance company. If your digital gadgets are damaged, you would also need to take a picture as a record of its condition.

1. Which travel insurance offers Covid-19 Coverage?

MoneyHero has sorted out a few Covid-19-covered travel insurance products for your easy comparison. Please click here to learn more details on our Covid-19 Travel Insurance Comparison page.

2. When should I buy travel insurance?

You should buy travel insurance BEFORE starting your journey. The insurance plan is activated at the moment you purchase it, so the earlier you buy the better. You are suggested to purchase travel insurance right after you purchased your flight ticket, so even the unexpected changes before your departure may be covered. For example, FWD provides reimbursement of irrecoverable prepaid costs due to cancellation of trip in the event of the Insured Person being diagnosed with COVID-19 30 days before the start of the journey.

If your flight is canceled or delayed due to adverse weather conditions, you may be covered if you have already purchased travel insurance before any weather warnings are issued.

Also, if unfortunately a Black Outbound Alert is issued to your destination, you will be covered if you have already purchased travel insurance that covers trip cancellation due to Black Outbound Alert before it is issued. However, if you purchase the travel insurance after the Black Outbound Alert is issued, you may not be covered.

3. Can I buy travel insurance during my trip?

No. Since travel insurance policies are normally only valid for travel originating from and returning to Hong Kong, any purchase of travel insurance after departure will not be accepted. There will be no compensation even if you have encountered any accidents during the trip. So please do not leave everything until the last minute and buy travel insurance as soon as your departure and return date is confirmed.

4. What is the difference between Single Trip and Annual Travel Insurance? Is annual travel insurance cheaper?

Annual travel insurance is best for frequent travelers and business travelers as annual travel insurance covers unlimited trips per year. Employers should purchase travel insurance for employees who travel business trips frequently to protect mutual interests.

Single-trip travel insurance is best for people who do not travel frequently and prefer short trips or short-distance travel. As the price is generally lower than the annual one, you can purchase single-trip travel insurance at a lower cost while bringing you peace of mind during your trip.

5. Which travel insurance cover flight delay and trip cancellation? What are the claim procedures?

Normally a travel insurance company covers flight delays resulting from adverse weather conditions, natural disasters, closure of airport, hi-jack, technical or other mechanical derangement.

Trip cancellation will be covered if it is due to death, serious sickness or injury of the Insured Person, adverse weather conditions, natural disaster or unexpected outbreak of infectious diseases, riot at the destination that prevents the Insured Person from continuing the journey or Black Outbound Alert for the destination is in effect during the journey.

Most insurance companies have policies that cover flight delay and trip cancellation, including Allianz, STARR, Allied World, FWD, Zurich and AXA. You may refer to this article for more information.

6. Can I specifically require coverages on top of my current travel insurance plans?

Apart from the regular benefits included in the travel insurance plans, some travel insurance companies allow insured person to add extra benefit items. So you can partially customize your insurance plan to fit your needs even better. For example, AVO offers winter sports extra benefits, water sports extra benefits and pre-wedding photoshoot and wedding extra benefits. These optional add-ons let you choose your own travel insurance coverage based on your travel purpose.

MoneyHero has partnered with the most trusted banks and financial institutions in Hong Kong to help you find the right financial products for you. Through our comparison engine, you can compare credit cards , personal loans , mortgages , medical insurance , travel insurance , HK stock accounts , US stock accounts , payroll accounts and other financial products. We provide accurate, up-to-date information and an unbiased overview of financial products in Hong Kong so that you can make the best choice, saving your time and money.

You should buy travel insurance before every trip. However, most people have a question: Which is the best travel insurance plan in Hong Kong? You could consider below points when you choose the plan that suits you:

Buy a suitable travel insurance plan based on your destination.

Example ︰In recent years, there were many terrorist attacks in Europe. If you plan to spend your holiday in Paris, you should pay attention to the terms related to terrorism coverage.

Choose the best plan to fit your journey and transportation means.

Example : The chance of flight delay is high if you plan to go to Japan in April (peak cherry season) by budget flight, you should be focusing on the delay coverage.

Apply for a cheaper plan with basic coverage.

Example : Travel insurance companies in HK often offer discounts, you can even apply for a 5-day basic plan with less than HK$100.

MoneyHero.com.hk provides a one-stop platform for you to:

- Choose the travel insurance plan based on your special needs and journey.

- Compare plans from more than 10 travel insurance companies and complete the purchasing process in one platform.

- Find out the latest offers provided by travel insurance companies in HK.

Travel insurance is insurance that provides coverage for accidents and other losses incurred while travelling. However, the insurance company might add the exclusion clauses, which remove the insurance coverage for the specified events and choose not to insure the events. The relevant reasons include: such coverage is available under another class of insurance, the risks are not suitable to be taken up, or some special conditions are required, etc. There are numbers of categories included in the exclusion clauses of a travel insurance policy, including:

When you apply for any insurance plan, disclose all relevant information to the insurer.

- Read the exclusions and terms of the policy thoroughly

- Bring a copy of your policy when you travel, and leave a copy with someone back home so they know who to call if you get into an accident during your trip.

Most travel insurance companies in Hong Kong provide different type of plans for different travelers. They include:

- Single Trip Plan

- Annual Plan

- Cruise Plan

Annual travel insurance plan is suitable for travel lovers and business travellers.

Unlike single travel insurance plan, annual travel insurance plan covers for an unlimited number of trips within a year (the insurance period). The Insured Person does not need to buy insurance for every single trip if they already purchase annual travel insurance. It can help customers to save time and money. Each Journey, which is under the coverage of annual travel insurance, lasts no longer than 90 days. A trip, which is covered by single travel insurance, can last no longer than 180 days. There is no big difference in benefits between annual and single plan.

To attract customers, many companies provide discount promotion. For example, you can enjoy 30% off exclusive discount if you buy CHUBB / Allied World / STARR / FWD/ Zurich and Falcon single trip plan in Moneyhero.com.hk platform. MSIG is also providing 45% discount now. Let’s take a 5-day Japan trip as an example, the difference between the cheapest and most expensive plan can up to $220:

Travel insurance is a contract between you and the insurer, where you are entitled to compensation for any loss related to an adverse event during travel. You, as the policyholder, are covered when you incur losses during domestic or international travel.

Most travel insurance plans provide the following coverage:

- Personal Accident Benefit

- Medical Expenses Benefit

- 24-hour Worldwide Emergency Aid

- Travel Delay Benefit

- Baggage Delay Benefit

- Trip Cancellation Benefit

- Baggage Benefit

- Personal Money Benefit

- Loss of Travel Documents Benefit

- Rental Vehicle Excess Protection Benefit

- Credit Card Protection Benefit

- Personal Liability Benefit

Some plans provide special coverage:

- Loss of Mobile Phone Benefit

- Trauma Counselling

- Delay Due to Over-selling Tickets

- Delay Due to Airline Collapse

Different insurance plans have their own set of rules and specific coverage terms. Our comparison tool helps you set them apart so you can choose one that fits your requirements.

Remember, you can use our comparison tool for free! Filter your search results according to provider, insurance benefits, price range, and other features. All you have to do is to click the Apply Now button and you're one step closer to full protection on your next trip.

More people choose to buy travel insurance online because of convenience and efficiency these days.

There are four benefits of buying travel insurance online:

Many insurance companies sell their insurance plans online. The Insured Person can compare and buy travel insurance online via desktop and/or mobile devices anywhere. It is no longer necessary to spend extra time to somewhere else for signing up for a travel insurance policy with the insurance agent.

The Insured Person can buy travel insurance online 24/7. Some insurance companies allow their customers to buy the plan a few hours before the start date of the trip.

- Efficient and Effective

You can fill the form and buy the plan within minutes. Then, spend more time planning a travel itinerary.

Since there is no insurance agent involved during the time of purchase, the operating cost is relatively lower. Therefore, the premium of online travel insurances is cheaper than the traditional ones.

Many of us take electronic devices like mobile phones along with our trips. However, most travel insurances do not cover us for mobile phones. Only Allied World, AXA, and CHUBB provide mobile phone coverage:

If you lost your personal items during the trip, you should report to local police after the incidence within 24 hours and keep all supporting documents and original receipts for an insurance claim. You should also pay attention that your insurer may refuse your claim if you have not looked after your properties properly.

The government of Hong Kong launched the Outbound Travel Alert (OTA) System to help Hong Kong people understand the risk to personal safety in traveling overseas, and there are three colors, namely Amber, Red and Black to indicate the alert level. Many travel insurance plans cover countries with OTA and they usually cover trip cancellation and trip curtailment, but applicants should keep in mind that the actual compensation depends on the policy's maximum limit, while some insurance plans only cover countries with a Black Alert. In addition, not all insurance plans cover terrorist attacks, you should check the exclusions even if they have a terrorism cover.

Does travel insurance cover rental cars?As rental cars are not classified as a way of public transportation, a rental car accident is not covered under the personal accident benefits. Rental charges usually include basic protection with third-party liability; if you want more protection, you could choose a comprehensive coverage plan. Now that many travel insurance plans offer a Rental Vehicle Protection which normally compensates for the motor insurance policy excess incurred by you only, excluding other expenses due to the accident. Applicants should read the policy's terms carefully.

Travel delay coverage varies by the insurance policy. You will probably get a compensation of about HK$300 if you experienced a delay of more than 6 hours. Some insurance plans also reimburse the extra costs for accommodations. Applicants should keep all relevant receipts and ask the airlines or transportation agencies to provide a written proof as a clear evidence, or the insurer may refuse the claim.

Basically you should buy travel insurance as early as possible. It is recommended that you buy your travel insurance once you have booked your air tickets and hotels to get better coverage. Travel insurance cover usually starts once you have bought the policy; if you buy the insurance and the government issues a Black OTA for your travel destination while it covers a Black Alert, you may make a claim. But if you buy an insurance after the Black Alert has been issued, you would not be compensated for that.

Let's find out the travel insurance plan that fit you the best now!

- Apply Online

- Shortcuts / Useful Links

- Download forms

People Protection

Group Business Travel Insurance

Why group business travel insurance.

Travelling can be essential to business. But it can become a stressful and expensive affair if things don’t go as planned in an increasingly uncertain world. Chubb’s portfolio of business travel solutions can protect your employees wherever your business takes them. For travel with confidence, this insurance covers them for a wide range of incidents – from lost passports and cash to accidents.

Contact your Relationship Manager

Call 2198 8000

Coverage highlights: .

1. Benefits

Whether it’s a mishap abroad, or lost business documents, passports and personal belongings along the way, travelling on business can be stressful without the right insurance coverage. Accidents or illnesses that happen to key staff members while representing your interests abroad, or even a family crisis back on the home front can also distract them from the objectives of their business trip. Chubb can protect your business from these unanticipated challenges to your overseas business ventures.

2. Get prepared, get covered!

With Chubb’s Business Travel, you can protect your business interests in the event of an emergency. Anything, from flying out a replacement colleague to reimbursement for abortive expenses, can be covered.

Chubb’s Business Travel offers on-the-spot emergency assistance 24 hours a day, 365 days a year, anywhere in the world. Whether it’s a minor glitch or a major emergency, our fuss-free multinational risk management and business trip insurance solutions offer total peace of mind.

3. Vital assistance with just one phone call

With Chubb Assistance, special arrangements can be organised to airlift your personnel out of remote areas where proper medical care is not available.

4. Customise your own business travel programme

One of the best features of Chubb’s Business Travel is that all the benefits can be tailored to meet your needs.

i. The above general insurance plan ("this Plan") is underwritten by Chubb Insurance Hong Kong Limited (“Chubb”) which is authorised and regulated in Hong Kong SAR by the Insurance Authority. Chubb reserves the right of final approval of the policy issuance. Hang Seng Bank Limited ("Hang Seng Bank") is registered as an insurance agency by the Insurance Authority (License No.: FA3168) and authorised by Chubb for distribution of this Plan. This Plan is a product of Chubb and not Hang Seng Bank. Upon application to this Plan, insurance premium will be payable to Chubb, and Chubb will provide Hang Seng Bank with commission and performance bonus as remuneration for distribution of this Plan. The existing staff remuneration policy on sales offered by Hang Seng Bank takes into account various aspects of the staff performance instead of focusing solely on the sales amount.

ii. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Hang Seng Bank and the customer out of the selling process or processing of the related transaction, Hang Seng Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the insurance product, underwriting, claims and policy service should be resolved directly between Chubb and the customer.

iii. The above information is intended to be a general summary for reference only. Please refer to the policy wording for exact terms, conditions and details of the exclusions.

Business Banking

- Your Business Essentials

- Your Business Operation

- Scale Your Business

- Beyond Hong Kong

- Banking Digitally

- Forms Download Centre

- Bogus calls, SMS and phishing emails

- Security Information Centre

- Protecting You from Financial Crime

- Regulatory Disclosures

- CRS Information Centre

- FATCA Information Centre

- e-Banking Security

- Bank's Prevailing Tariff

Important Message to Readers and Internet Privacy Policy Statement 沪ICP备17018950号-2

© Hang Seng Bank Limited

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

Making a claim and getting assistance

Submit a claim for.

Life insurance

General insurance

Submit a claim for your life insurance plan in 3 simple steps, step 1: prepare claim materials.

First, download and complete the relevant forms below and prepare supporting documents (if any)

- Death claims

- Major illness / Female benefit / Terminal illness claims

- VHIS Pre-authorisation and claims

- Disability claims

- Hospital cash / Unemployment claims

- HSBC One cancer coverage claims

- HSBC Premier Elite / HSBC Global Private Banking life coverage claims

Step 2: Submit claim request

You can submit the completed forms and supporting documents in any of the following ways:

- Submit documents online

- Drop them off at one of our branches

- Send all the forms and documents by mail to: 18/F, Tower 1, HSBC Centre, 1 Sham Mong Road, Kowloon, Hong Kong

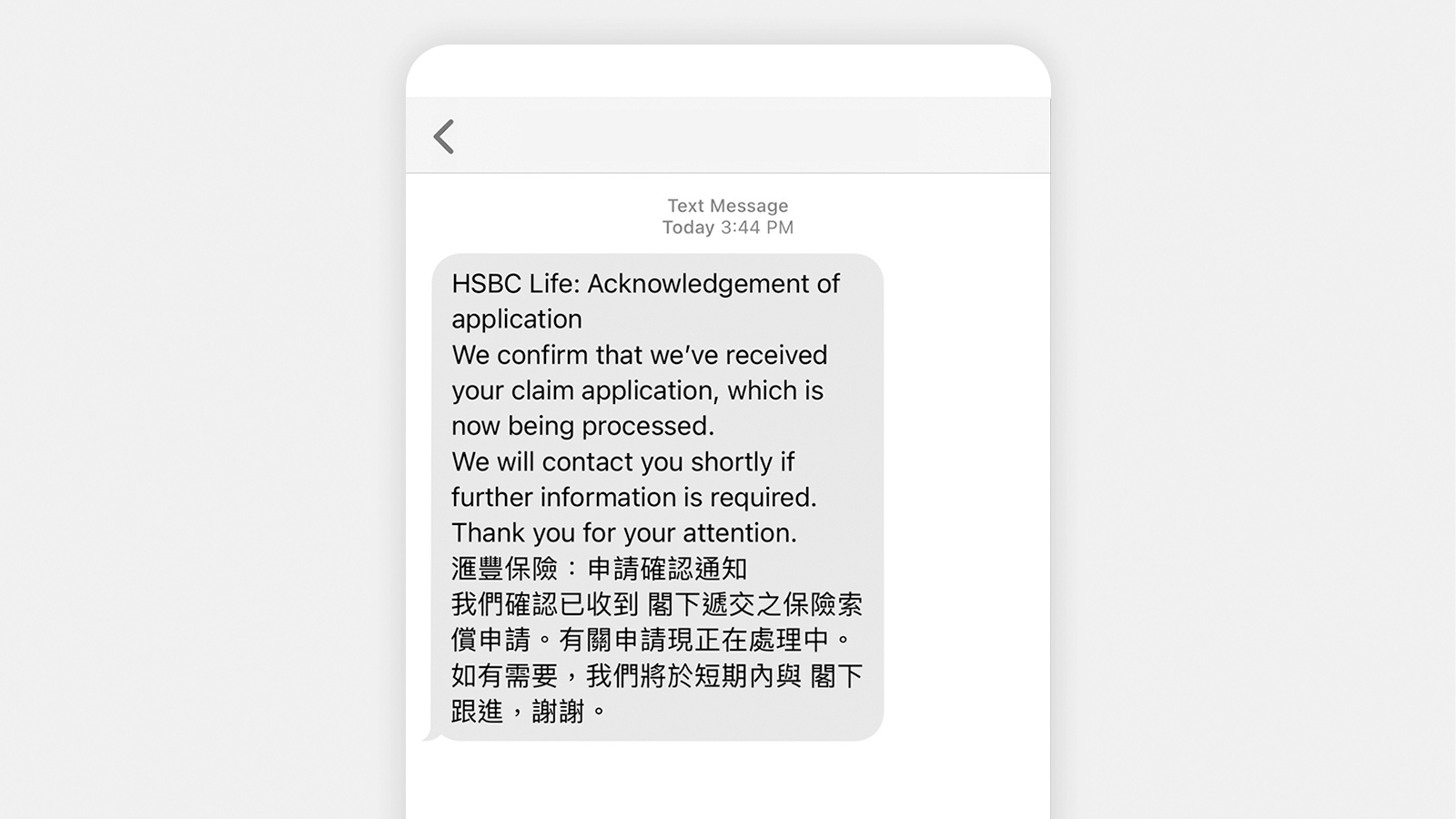

Step 3: Stay updated on claim or payment status

We'll send you an SMS once we've received your claim request. While we assess your claim, our Claims Servicing Specialists will keep you posted on the status.

Once approved, we'll issue the payment via payment method of your choice within an average of 2 business days[@insurance-time-taken-payment].

Need assistance for your life insurance claim?

Call us and get personalised assistance from our Claims Servicing Specialists and VHIS Medical Concierge Consultants for:

- making medical appointments

- help with claim related documentation and progress status update

- following up with doctors on required supporting documents (if applicable)

HSBC Life Claims Hotline:

(852) 3128 0122

Lines are open 9:00am to 6:00pm, Monday to Friday, except Saturday, Sunday and public holidays

Worldwide Emergency Assistance Service for VHIS 24/7 Hotline:

(852) 2193 5863

Find out more

What documents do i need to submit to make a claim , death benefit claims.

- Death Claim Form with Part I fully completed and signed by Beneficiary(ies)/Claimant(s)

- Death Claim Form with Part II fully completed and signed by the Attending Physician with chop, if needed

- Certified True Copy Death Certificate of Insured Person Certified by Bank Staff

- Copy of ID Card/Passport/Birth Certificate of Insured Person

- Copy of ID Card/Passport/Birth Certificate copy of Beneficiary(ies)/Claimant(s)

- Copy of Relationship Proof Between Insured Person and Beneficiary(ies)/Claimant(s)

- Original Policy Document

- Copy of Bank Account Proof of Beneficiary (applicable for sole or joint name bank account)

Major Illness/ Female Benefit/ Terminal Illness Claims

- Major Illness/ Female Benefit/ Terminal Illness Claim Form with Part I fully completed and signed by the Policyholder/Claimant/Insured Person and/or Dementia Protection Benefit Recipient

- Major Illness/ Female Benefit/ Terminal Illness Claim Form with Part II fully completed and signed by the Attending Physician with chop

- Major Illness/ Female Benefit/ Terminal Illness Claim Form with Part III fully completed and signed by the Policyholder/Claimant/Insured Person and/or Dementia Protection Benefit Recipient (if applicable)

- Copy of Histopathology, Laboratory Test Report, Endoscopy, Ultrasonogram, X-Ray, CT Scan, MRI, Diagnostic Written Report(s) and Operating theatre summary (if applicable)

- Copy of Policyholder and Insured Person's Identity Card

- Copy of Bank Account Proof (applicable for Policyholder's sole or joint name bank account other than Policyholder's premium deduction account)

VHIS Medical Claims

- VHIS Medical Claim Form with Part I fully completed and signed by the Policyholder/Insured Person

- VHIS Medical Claim Form with Part II fully completed and signed by the Attending Physician/ Surgeon with chop (to be obtained by Insured Person/ Claimant)

- Original receipt(s) of the medical expenses (including but not limited to deposit receipt)

- Copy of settlement advice from other insurer (if applicable)

- Copy of Bank Account Proof (applicable for Policyholder's sole or joint-name bank account other than Policyholder's premium deduction account)

Disability Claims

- Disability Claim Form with Part I fully completed and signed by the Policyholder/Insured Person

- Disability Claim Form with Part II fully completed and signed by the Attending Physician with chop (this report required to be applied by the claimant at his/her own cost)

- Copy of Sick Leave Certificate with diagnosis and/ or Consultation Proof

- Copy of Physiotherapy/ Occupational Therapy Report(s) (if applicable)

- Copy of Police Report (if applicable)

- Copy of Policyholder & Insured's Identity Card

Hospital Cash Benefit Claims

- Hospital Cash Benefit Claim Form with Part I fully completed and signed by the Policyholder/Insured Person

- Hospital Cash Benefit Claim Form with Part II fully completed and signed by the Attending Physician with chop (this report required to be applied by the claimant at his/her own cost)

- Copy of Discharge Summary/Discharge Slip if admitted into a hospital(s) under the Hospital Authority

- Copy of full set Hospital Receipt

- Copy of Laboratory, Ultrasonogram, X-Ray, CT Scan, MRI and Diagnostic Written Report(s) (if applicable)

- Copy of Policyholder & Insured Person's Identity Card

Unemployment Claims

- Unemployment Claim Form fully completed and signed by the Policyholder

- Copy of the letter of redundancy of employment and last payroll with breakdown on Severance Payment.

HSBC One Cancer Coverage Claims

HSBC One Cancer Claims

- Cancer Claim Form Part 1 completed and signed by Insured Person and Part 2 completed and signed by the Attending Physician with chop

- Copy of Diagnosis Proof (e.g. medical reports)

- Copy of Insured Person's ID

HSBC One Death Claims

- Death Claims Form Part 1 completed and signed by Payee

- Copy of Insured Person's Death Certificate

- Copy of Insured Person's Identity Card

- Copy of Letters of Administration (of Insured Person's Estate)

- Copy of Payee's Identity Card

For easier reference, you can check the "Claims Document Checklist" on the claim form. If you have any questions on claim submission, please call us at (852) 3128 0122 .

How can I follow up on the claim if I am currently unable to collect the above death documents?

Who will receive the payout of a death claim .

- If a designated beneficiary has been appointed, the death benefit will be paid to the beneficiary

- If a designated minor beneficiary has been appointed, the death benefit will be paid to the designated trustee or the legal guardian (if no designated trustee is assigned)

- If a designated beneficiary has been appointed but deceased before the insured person, the death benefit will be paid to the policyowner

- If no beneficiary has been appointed and the policyowner is alive, the death benefit will be paid to the policyowner

- If no beneficiary has been appointed and the policyowner is not alive, the proceeds are payable to the estate of the policyowner

- If the policy has been assigned, the assigned amount of proceeds are first payable to the assignee according to Assignment Deeds and the balance amount of proceeds will be payable according to above rules

How do I check the status of my claims?

Once we've received your claim request, we'll notify you via SMS. While we assess your claim, our professional Claims Servicing Specialist will get in touch with you to update about the status of your claim.

If you want to seek help or an immediate update of your claim, please call us at (852) 3128 0122 .

For VHIS claims, can I request to obtain Certified True Copy(ies) of original invoice(s) and receipt(s) after claim processing?

Yes, you can make your request on the claim form. We'll send you the Certified True Copy(ies) of original invoice(s) and receipt(s) after claim processing.

However, Certified True Copy will not be issued if the claims are fully reimbursed. If you have any special request about the invoice(s) and receipt(s), please call us at (852) 3128 0122 .

General insurance

Submit a claim online.

Use our online claims notification facility[@insurance-axa-online-claim] to notify AXA of your claim immediately, even during busy periods (such as after adverse weather).

You can also download forms and documents and submit to AXA by post.

Need assistance?

Personal General and Medical Insurance (AXA)

(852) 2867 8678

Monday to Friday: 9am to 6pm

Saturday: 9am to 1pm

The hotline is operated by AXA or its authorised representatives.

24/7 General Insurance hotlines

Disclaimer .

Life insurance policies are underwritten by HSBC Life (International) Limited ("HSBC Life") which is authorised and regulated by the Insurance Authority ("IA") to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group's insurance underwriting subsidiaries. Policyholders are subject to the credit risk of HSBC Life and early surrender loss.

General insurance products are underwritten by AXA General Insurance Hong Kong Limited ("AXA"), which is authorised and regulated by the Insurance Authority of the Hong Kong SAR.

The Hongkong and Shanghai Banking Corporation Limited ('HSBC') is registered in accordance with the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) as an agency of HSBC Life for the distribution of life insurance products and AXA for distribution of general insurance products in the Hong Kong Special Administrative Region. These products are products of HSBC Life and AXA but not HSBC and they are intended only for sale in the Hong Kong SAR.

In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between HSBC and you out of the selling process or processing of the related transaction, HSBC is required to enter into a Financial Dispute Resolution Scheme process with you; however, any dispute over the contractual terms of the above insurance product should be resolved between HSBC Life or AXA and you directly.

- Help and support

© Copyright. The Hongkong and Shanghai Banking Corporation Limited 2002-2024. All rights reserved

This website is designed for use in Hong Kong. Cross-border disclosure

Hong Kong Travel Insurance Comparison: A Complete Overview

Are you looking for the top travel insurance products in Hong Kong? With plenty of options out there, it could be a headache when choosing the right one. No matter if you’re flying to Japan, South Korea, Thailand, Taiwan, or even Singapore, y our long-awaited trip deserves the best protection, and we’ve done the hard work to get you covered with the perfect fit.

So, MoneySmart is here to rescue you from the hassle of sifting through travel insurance products. From pricing to coverage, claiming process, and special offers, we’ve dug deep to present you with the cream of the crop. So, let the adventure begin worry-free!

Read on to find out more details about how to choose the right travel insurance that fits your needs!

Table of contents: Hong Kong travel insurance comparison

What does travel insurance cover, how to compare travel insurance policies, hong kong travel insurance price overview, which travel insurance policy offers the highest coverage for medical and accident expenses, which travel insurance policy offers the highest coverage for skiing, scuba diving, or parachuting, which travel insurance policy offers the highest coverage for personal property.

- Frequently asked questions: Travel Insurance

Travel insurance coverage can differ depending on the insurance provider and policy. In general, travel insurance can help cover expenses related to trip cancellations, medical emergencies, lost or stolen baggage, and travel interruptions.

In general, travel insurance covers the 3 main types of coverage for medical and accident expenses:

- Medical coverage includes costs for accidents or illnesses during the trip, like fees for overseas doctors and follow-up visits after returning to Hong Kong.

- Personal accident coverag e provides reimbursement for death, permanent disability, and severe burns resulting from accidents during the trip.

- Emergency support coverage includes emergency medical evacuation or repatriation, visits for relatives, and more.

Comparing insurance policies is complicated. There are so many areas you can be insured in, but not all are equal in importance. So how do you know which aspects to compare?

Review your trip quickly and identify the most likely scenarios to occur

First of all, you definitely want to make sure that you’re covered in the scenarios that are more likely to occur on your trip. Sure, it’s nice to know you’re being covered for kidnapping or terrorist attacks, but statistically speaking you’re more likely to come down with a bout of food poisoning or lose your luggage. So, review your trip quickly and find out the most likely situations to happen during your trip.

Here are key areas to look out for when deciding on the best value for travel insurance:

- Medical coverage : Unless you’re invincible, there’s always the chance you’ll fall ill or get involved in an accident. Medical coverage can pay for your overseas medical expenses, as well as medical expenses incurred upon your return to Hong Kong.

- Travel mishaps : Lost luggage, missed flights, trip delays and cancellations can happen on even the most meticulously-planned of trips.

- Loss or damage to personal belongings : Get compensated if you are pickpocketed, your belongings get damaged in transit and so on.

Find your best fitted travel insurance plan

Review each plan you have come across and find out your best fitted plan. For instance, some plans may have a higher coverage on medical expenses, but not so much on personal perperty protection. After knowing which one you want, look at the premiums.

Taking an adult going on a 7-day trip to Japan as an example, the lowest premium travel plan is offered by Alliance (HK$196), while most others range from around HK$200 to HK$300.

Here you can find most popular travel insurance plans in Hong Kong. In order to compare all Hong Kong travel insurance options, we will use a 7-day insured trip to Japan of an adult as an example:

(The premium is for reference only. For the latest rate, check the travel insurance quote here.)

The premium cost ranges from HK$84.8 to HK$463. It is important to note that when comparing premiums, you should consider if the coverage provided by the travel insurance plan meets your needs and expectations. And if you’re not sure which one to choose from h ere are the 4 basic travel insurance policies in Hong Kong.

So, which travel insurance policy offers the highest coverage for medical and accident expenses? Here is the comparison of travel insurance for a 7-day single trip to Japan :

Allianz Travel – Bronze Plan [for ages 2 to 54]: HK$1,000,000 medical coverage available

The Allianz Travel – Bronze Plan offers a basic plan at a low price, providing HK$1,000,000 in medical coverage. It is important to note that this plan only covers medical expenses and does not include any other coverage.

Allianz Travel - Bronze Plan [for ages 0 to 54]

Key features.

Up to HKD 1,000,000 medical expenses

24/7 Emergency assistance services

Easy, fast, online claims process

Loadings applied: Ages 55 to 59 +100%; ages 60 to 64 +250%; ages 65 or above +500%

STARR Companies TraveLead Extra Plan: HK$1,000,000 medical coverage with trip cancellation and loss/damage of luggage coverage

STARR Companies TraveLead Extra Plan has a slightly higher price, but it offers additional coverage for trip cancellation (up to HK$25,000) and compensation for loss or damage to luggage (HK$10,000).

STARR Companies TraveLead Extra Plan

【MoneySmart Exclusive Offer】 MoneySmart customers who successfully apply for a Starr Travel Insurance product during the promotional period will be entitled to 200 SmartPoints, if the premium reaches **HK$300 or above will be entitled to 600 SmartPoints! (**Equivalent to HK$60 Rewards amount, to redeem e-vouchers such as,

- HK$50 HKTVmall E-voucher;

- HK$50 YATA E-voucher;

- or other e-vouchers/products from over 20+ brands Learn More about how SmartPoints works here . T&C apply.

Coronavirus Disease (COVID-19) Extension (For Single-Trip and Annual Travel Policy)

Staycation Benefit (For Annual Travel Policy Only)

Travel Delay coverage up to HK$1,500

Overseas Medical Expenses coverage up to HK$1,000,000

Accidental Death or Total Permanent Disability coverage up to HK$1,000,000

Dah Sing Insurance JourneySure Travel Insurance – Gold: HK$50 YATA cash coupon available for products over HK$200

Dah Sing Insurance JourneySure Travel Insurance offers excellent medical coverage of HK$500,000, trip cancellation coverage of HK$20,000, and compensation for loss or damage to baggage up to HK$15,000. What sets it apart is the special offer of a HK$50 YATA coupon for products over HK$200.

With the coupon, you can enjoy nearly a 25% discount on a HK$200 travel insurance product.

Dah Sing Insurance JourneySure Travel Insurance - Gold

【MoneySmart Exclusive Offer】 Enjoy 25% discount on Dah Sing Travel Insurance via MoneySmart using promo code "MS202401"! And for a limited time only, with a single purchase of Dah Sing Travel Insurance product of premium HK$400 or above (after discount) through MoneySmart, you will receive a gift of one HK$100 HKTV Mall Department Store e-Coupon!

Cover insurable loss of trip cancellation or curtailment due to the issuance of Amber, Red and Black Outbound Travel Alerts, Travel Agent or the operator of the Public Common Carrier bankrupt or winding up

Comprehensive delay coverage providing trip delay allowance, reimburse the paid and forfeited cost of Transport Ticket, Accommodation, group tour fees, admission fees of overseas sports, musical or other performance events

Cover leisure or amateur activities during the journey, including skiing, water skiing, rafting, parachuting, bungee jump, scuba diving, rock climbing and mountaineering

Loss of Income Protection caused by accidental bodily injury

Cover Golfer “Hold-in-One”

Zero excess for all coverage

Loss due to act of terrorism

Worldwide Emergency Assistance Services, includes unlimited benefit amount for Emergency Medical Evacuation

Personal Belongings , loss of money & camera Cover, enhanced sum insured for Camera

Family Plan covers maximum 2 parents and unlimited number of legal child(ren) aged under 18 for premium of 2 only

Rental Vehicle Excess Cover

Free and Automatic Extension of the Policy for 14 days in case the Insured Journey is forced to be extended beyond the control of the Insured Person

Personal Liability maximum HK$2,000,000

Dah Sing Insurance members can enjoy 20% premium discount

When planning for riskier activities that have a higher chance of accidents, it is important to consider getting insurance coverage specifically for those activities, including skiing, scuba diving, and parachuting.

Note that some travel insurance policies have limitations on coverage, including restrictions on height and depth. For example, if a skiing location exceeds a certain height, the travel insurance may not cover the activity. We strongly recommend thoroughly reviewing the details of insurance policies.

When searching for travel insurance policies that provide the highest coverage for skiing, scuba diving, and parachuting, there are several options to consider.

Here is the comparison of travel insurance for a 7-day single trip to Japan:

STARR Companies TraveLead Essential Plan

The STARR Companies TraveLead Essential Plan covers most high-risk activities such as skiing and scuba diving without any height or depth restrictions, providing medical coverage up to HK$500,000.

This plan is the most affordable option among all the travel insurance plans. However, it only includes medical coverage and does not offer any additional coverage. Perfect for those who want to get medical coverage only.

Coronavirus Disease ( COVID-19 ) Extension (For Single-Trip and Annual Travel Policy )

Overseas Medical Expenses coverage up to HK$500,000

Accidental Death or Total Permanent Disability coverage up to HK$600,000

BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia)

Apart from covering skiing, scuba diving, and parachuting, the BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia) also provides coverage for personal liability (HK$1,500,000), vehicle rental coverage (HK$2,500), and loss of home contents (HK$10,000).

MoneySmart Travel Insurance 101: What is loss of home contents?

Loss of home contents refers to the coverage provided by the insurance policy for the loss or damage of personal belongings and possessions while the insured person is traveling. This coverage typically includes items such as clothing, electronics, jewellery, and other personal items that may be lost, stolen, or damaged during the trip.

This is a comprehensive travel insurance product that covers not only medical expenses but also provides additional coverage for personal liability, vehicle rental, and loss of home contents.

-with no line.png)

BOCG Insurance Universal Voyage Travel Insurance - Silver Plan (Asia)

【MoneySmart Exclusive Offer】 Enjoy 20% discount on BOCG Travel Insurance via MoneySmart! And within the promotional period, who successfully apply for an BOCG Travel Insurance of premium HK$300 or above will be entitled to one complimentary HK$75 UBER e-Coupon.

Double Indemnity of Personal Accident, up to HK$1,200,000 (only applicable to Single Travel Plan).

Maximum limit for medical expenses up to HK$500,000, including the treatment expenses incurred inHong Kong within 3 months after the insured person’s return from abroad and Trauma Counselling Protection are also provided.

Protection for Dangerous Activities1, including bungee jumping, parachuting, rafting, diving, trekking & hot-air ballooning(not applicable to professional sportsmen or people engaged in competition).

If “Black Alert” is issued which results in travel delay, cancellation and curtailment etc., the irrecoverable deposits or charges will be payable. (For details, please refer to the list of Outbound Travel Alert)

If Compulsory Quarantined due to Infectious Disease or issuance of any Outbound Travel Alert2 to the destination, the period of insurance will be automatically extended.

Rental Vehicle Excess Protection, cover limit up to HK$2,500 (per event).

24-hour Worldwide Emergency Assistance , offers you medical emergency assistance service, overseas hospital admission deposit guarantee and medical evacuation to suitable hospital or country of residence.

Dah Sing Insurance JourneySure Travel Insurance – Diamond

Dah Sing Insurance JourneySure Travel Insurance – Diamond has a slightly higher premium due to its comprehensive coverage, which includes higher compensation for medical coverage, trip cancellation, loss or damage of baggage, and coverage for high-risk activities like skiing, scuba diving, and parachuting (excluded: rock climbing or mountaineering above 5,000m or scuba diving below 30 m depth).

Additionally, vehicle rental is also covered.

While it may be slightly more expensive than other travel insurance products, it offers a special promotion of a HK$50 YATA coupon, which can provide up to a 25% discount, making it a better deal.

Dah Sing Insurance JourneySure Travel Insurance - Diamond

Cruise Interruption Cover additional transport ticket and excursions tour cancellation

Losing your phone, wallet, or any other personal property can ruin your trip, but if you get travel insurance beforehand, you can be assured of being compensated for your loss!

When it comes to claims for property loss, there are certain things you need to do to meet the insurance company’s requirements. For instance, if you encounter theft or damage to your property, you should report it to the local police within 24 hours and get a written report.

And when you make a claim, you’ll need to provide receipts for the items that were lost or damaged. Make sure the receipts have the purchase date, price, model, and category of each item. Also, keep in mind that the insurance company might subtract the depreciation value of the property when calculating the coverage amount.

Here is a comparison of the travel insurance offering the highest coverage for property losses:

Zurich Get “Z” Go+ Deluxe Plan: The highest coverage for lost property

The Zurich Get “Z” Go+ Deluxe Plan offers the highest compensation for lost property, up to HK$25,000. If you have valuable property that needs to be covered, this insurance plan is worth considering.

BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia) also provides coverage for lost property with compensation of up to HK$6,000. Additionally, the travel insurance policy covers up to HK$500,000 in overseas medical expenses.

Blue Cross TravelSafe Plus Global Diamond Plan

Now you can have peace of mind knowing that your lost property is covered by the Blue Cross TravelSafe Plus Global Diamond Plan. It offers up to HK$20,000 for baggage loss.

Last tip: Get your insurance as early as possible

Buying your travel insurance in haste robs you of the chance to compare the various options and get a value-for-money policy that offers enough coverage at a reasonable price. You definitely don’t want to spend too much on a policy, or get one that’s so thin it barely covers you for anything. So spend a bit of time to pick the best policy for you, taking a careful consideration of various factors, including your destination, trip duration, and planned activities.

Travel insurance protects you not just the time when you’re on holiday to enjoy life, but also the weeks before you leave Hong Kong. So, the only way you can have a trip with the peace in mind is to buy your travel insurance in advance—not in the cab, on your smartphone as you rush to the airport! Don’t forget to check out the latest offers from MoneySmart travel insurance selection.

Frequently asked questions: Travel insurance

What is travel insurance.

Travel insurance is a type of insurance that provides coverage for unexpected events that may occur while traveling, such as trip cancellation, medical emergencies, lost or stolen baggage, and travel interruption.

Do I really need travel insurance?

A: It is highly recommended to purchase travel insurance before embarking on any trip, especially if you are traveling internationally. Travel insurance can provide financial protection for unexpected events that may occur while traveling.

What does travel insurance typically cover?

Related articles.

If you haven’t made up your mind, you can check out the t ravel insurance guide : things to consider before purchasing.

Autumn is around the corner, check where you can see the best Japan autumn leaves now! (With top spots recommendation and transportation guide!)

Want to stay ahead of the crowd? Visit the MoneySmart blog for more financial tips!

MoneySmart—Your One-Stop Financial Products Platform

Homepage: www.moneysmart.hk/en/

Fraud warning

Please be cautious of any special offers you see on social media or via messages, and avoid opening links or downloading any apps you receive from these sources inviting you to register to benefit from special offers. These links or apps may contain malware that can take over your phone. Please also refrain from inputting your account information, passwords or any other personal information into such apps or websites. Learn more .

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

Travel Care

Go on a totally fuss-free, carefree holiday with travel care.

Not all who wander are lost, but your luggage certainly could go missing. That's just one of the unexpected events that could put a dampener on your travel plans - there might also be flight delays, accidents or lost passports to contend with.

Travel Care provides a comprehensive suite of coverage and Allianz's Authorised Representative's emergency hotline (+603-76283919 or +603-79653919) is available 24 hours a day to support you through any emergency you might face, so you and your loved ones can have a stress-free trip filled with beautiful memories.

Stand to receive a Touch 'n Go eWallet Reload PIN worth up to RM50

Be one of the first 200 customers to purchase travel care with the promo code 'hsbc23' and get a touch ‘n go ewallet reload pin worth up to rm50. promotion period 27 november 2023 - 30 april 2024., ¹allianz travel care ("this plan") is underwritten by allianz general insurance company (malaysia) berhad (company no. 200601015674 (735426-v)) ("allianz general") and hsbc bank malaysia berhad ("hsbc malaysia") is the intermediary in distributing this plan. travel care customer campaign promotion terms & conditions apply..

- Overseas and domestic travel coverage This includes coverage for luggage and travel delays, and for overseas travel, the coverage also includes loss or damage to your travel documents, personal luggage and valuables, and more

- Accidental death and permanent disability coverage

- Emergency medical evacuation and repatriation programme

- Reimbursement of medical expenses We'll reimburse the necessary and reasonable medical, surgical or hospital charges, and emergency dental treatment fees incurred as a result of accidental bodily injuries, illness or death during your trip

- Option to purchase rider plans to extend your coverage when you participate in certain sports or events during your travels

What your coverage includes

What you need to know, are you eligible.

You're eligible for a Travel Care plan if you belong to one of the following categories:

- Malaysian citizen or permanent resident

- valid work permit or student pass holder

- legally employed in Malaysia

You'll also be able to get coverage for your spouse and child if they legally reside in Malaysia.

Good to know

Emergency contact information .

If there's an emergency when you're travelling, you can call the Allianz 24-hour emergency hotline on +60 3 7628 3919. Toll fees may apply.

Cover for COVID-19

Travel Care covers medical expenses for COVID-19 treatment, subject to policy terms and conditions. Your diagnosis must be certified by a medical practitioner, and you'll also need to provide a supporting lab report or medical report that states your diagnosis.

Cover for high-altitude mountaineering

You can get cover for high altitude mountaineering by contacting Allianz via email on [email protected] , or by calling 1300 22 5542.

What options for Travel Care plans are available?

The following plans are available:

- Adult Plan/Adult Annual Plan: if you're aged 18-70 years old

- Child Plan/Child Annual Plan: if you're aged 30 days-17 years old

- Senior Citizen Plan: if you're aged 71-80 years old

- Family Plan: if the policyholder is aged 18-70 years old, the policyholder's 1 selected legal spouse is aged 18-70 years old and the policyholder's child/children is/are aged 30 days-24 years old

- Under family plan, the payment per individual will be based on the limit under an adult plan and/or child plan, as the case may be subject to the maximum limit as stated in the Schedule of Benefits in the brochure and policy document.

- Maximum period of coverage per journey/trip is 200 days for one way or return trip.

- Maximum period of coverage per journey/trip is 90 days for annual policy.

- Maximum period of coverage per journey/trip for High Altitude Mountaineering activities is 30 days.

- Each trip must begin and end in Malaysia except for one way trip.

- Maximum period of coverage per journey/trip is 30 days for one way/return trip or annual policy.

- Premium is subject to Service Tax.

- Customer may opt for Automatic Renewal (for annual policy only). This policy is deemed to be automatically renewed and the applicable premium will be charged upon expiry unless otherwise instructed.

For other key terms and conditions, please refer to the Product Disclosure Sheet in the link below.

Ready to apply for Travel Care?

Get a quote via mobile banking or online banking.

If you have an HSBC debit or credit card, you can apply via our mobile banking app or through online banking. Go to the homepage, select 'Products and services', and choose 'Travel Care'. We'll help you apply by filling in information from your records.

Get a quote without logging on

If you have an HSBC debit or credit card, you can also get a quote without logging on to mobile banking.

Scan the QR code to get the app

Download the HSBC Malaysia Mobile Banking app on your iOS or Android device.

- Learn more about mobile banking

Need help? Check out our step by step mobile guide .

The information provided on this page is not a contract of insurance. The descriptions of cover are a brief summary for quick and easy reference. The precise terms and conditions that apply are in the policy document. Allianz Travel Care ("this Plan") is underwritten by Allianz General Insurance Company (Malaysia) Berhad (Company No. 200601015674 (735426-V)) ("Allianz General") and HSBC Bank Malaysia Berhad ("HSBC Malaysia") is the intermediary in distributing this Plan. This Plan is exclusively for HSBC Malaysia Credit and Debit Cardholders only. Please read and understand the Product Disclosure Sheet (PDS), Brochure and Policy Wording before signing up.

- Product Disclosure Sheet (PDF) Product Disclosure Sheet (PDF) Download

- Brochure (PDF) Brochure (PDF) Download

- Policy Wording (Domestic) (PDF) Policy Wording (Domestic) (PDF) Download

- Policy Wording (Overseas) (PDF) Policy Wording (Overseas) (PDF) Download

- Allianz General Insurance Company - Privacy Notice (PDF) Allianz General Insurance Company - Privacy Notice (PDF) Download

Important Notes

1. The benefits payable from this insurance product are protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to certain limits. Please refer to PIDM's TIPS Brochure, the PIDM website , or contact Allianz General Insurance Company (Malaysia) Berhad to get more information about the Takaful and Insurance Benefits Protection System(TIPS)

2. For after-sales service, you can contact Allianz by [email protected] or on 1300 22 5542 .

3. You may find out more about our coverage by visiting your nearest Allianz branch.

Related products

HSBC UniversalLegacy plan

Leave a lasting legacy for the ones who matter.

HSBC UniversalIncome plan

Continue to pursue your passions even in your golden years.

HSBC HealthPlus plan

Make your health a priority by preparing for the unexpected.

Connect with us

- Easy Banking

- Premium Banking

- Priority Banking

- Priority Private

- Private Banking

- Business Banking

- Commercial Banking

- Corporate Banking

Cross Border

- Greater Bay Area Banking

- International Banking

Digital Banking

- Digital Banking Service Guide

- SC Mobile App download

- Payments and Transfers

- Brunei Darussalam

- Cote d'Ivoire

- Falkland Islands

- Philippines

- Sierra Leone

- South Africa

- South Korea

- United Arab Emirates

- United Kingdom

- United States

You're about to leave our website

This hyperlink will bring to you to another website on the Internet, which is published and operated by a third party which is not owned, controlled or affiliated with or in any way related to Standard Chartered Bank (Hong Kong) Limited or any member of Standard Chartered Group ( the "Bank").

The hyperlink is provided for your convenience and presented for information purposes only. The provision of the hyperlink does not constitute endorsement, recommendation, approval, warranty or representation, express or implied, by the Bank of any third party or the hypertext link, product, service or information contained or available therein.

The Bank does not have any control (editorial or otherwise) over the linked third party website and is not in any way responsible for the contents available therein. You use or follow this link at your own risk. To the extent permissible by law, the Bank shall not be responsible for any damage or losses incurred or suffered by you arising out of or in connection with your use of the link.

Please be mindful that when you click on the link and open a new window in your browser, you will be subject to the terms of use and privacy policies of the third party website that you are going to visit.

Enjoy 40% premium discount upon application (Limited-time offer for Children and below 18 years old: 50% premium discount)

- General Insurance

Allianz Travel Protect

- Apply on online banking Apply on online banking

- MAKE A CLAIM MAKE A CLAIM

- Apply Now Apply Now

Special 40% discount for Standard Chartered customers

- From now until 2 July 2024, enjoy 4 0% discount upon successful application for Allianz Travel Protect single and annual plans.

- Limited-time offer for Children and below 18 years old: 50% premium discount

- Terms and conditions apply.

Exclusive 45% discount offer for Standard Chartered Credit Card Cardholders

- From now until 1 July 2024, enjoy 45% discount upon successful application using the promotion code and payment made by the Eligible Card for Allianz Travel Protect single and annual plans.

- Promotion code: SCBCARDS45

- Offer applicable to policies issued through iBanking and SC Mobile only.

- T&C APPLY

Travel Protect Information

From now until 2 July 2024 (both dates inclusive), you can enjoy 40% premium discount upon successful application and payment made for Allianz Travel Protect plan(s) directly via Standard Chartered Mobile App or Allianz Global Corporate & Specialty SE (incorporated in the Federal Republic of Germany with limited liabilities) Hong Kong Branch (“Allianz”) websites as accessed through Standard Chartered Bank (Hong Kong) Limited (the “Bank”) website.