- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

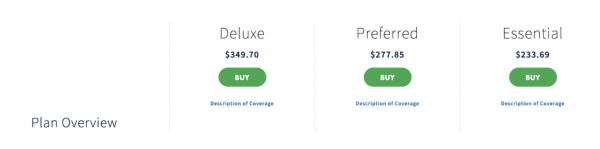

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

TATA TRAVEL

INSURANCE AGENCY

A dvisor Code: AIG2311020000

Call us today for a quote

INDIA 91- 9810794545

Fill out this form

Get a quote.

Even though many people may think that buying traveller insurance is a waste of money, the fact is, it’s an essential part of international trips. If you wish to save your time as well as money when travelling abroad, it’s prudent to buy travel insurance from a reputed insurer.

Every traveller’s needs and circumstances are different. If you need to travel out of the country for work more than once a year, you will have a few set expectations from a travel insurance policy. So, you need to choose a plan that would offer extensive coverage against medical as well as personal liabilities. Let’s find out what exactly is an annual multi-trip insurance plan.

Annual Travel Insurance Policy

If you are fond of travelling or if you need to travel outside the country more than once yearly, then you need to opt for a travel insurance policy without fail. An annual travel insurance policy will not only safeguard your finances during the trip but will also ensure that you are away from unnecessary expenses related to health and safety.

An annual international travel insurance plan, also known as annual multi-trip travel insurance, is specifically designed for frequent flyers. These insurance policies cover several trip-related exigencies. So, if you plan to travel out of the country more than once a year, instead of buying separate traveller insurance, it’s better to opt for a multi-trip policy.

So, if you are a business owner or work in a multinational company that needs you to travel outside the country pretty often, or if you are simply fond of travelling out of the country often, Tata AIG’s annual travel insurance policy can secure your trips and provide unmatched financial coverage against different kinds of trip-related emergencies.

Features of Annual Multi Trip Travel Insurance

If you are thinking about buying an annual travel insurance policy, you need to be aware of its features. Let’s learn about a few of them below-

Unlimited Trips in a Year: With annual multi-trip travel insurance, you can get coverage for an unlimited number of trips in a single year, with each trip having a duration of 30-45 days. This way, it will be cost-saving on your part to just pay the premium for one single policy rather than paying for multiple policies yearly.

Trip Assistance: Suppose you need to cancel or postpone or prepone your trip abroad due to some reason, the policy will compensate for the loss. Also, your flight may get delayed or cancelled and hence, you will be reimbursed for the unused and non-refundable amount of all your bookings like hotels, trips, flights, etc.

Flight delay or cancellation: You might miss a flight because of delays or because your first flight got canceled. With a multi-trip travel insurance plan, you will be compensated if your flight is canceled or delayed.

Unmatched Medical Support: When travelling abroad, you may fall ill and therefore, you might have to visit a doctor or get admitted to a hospital. You may even meet with an accident that may require you to get treated in a local hospital. And as we all know, medical costs abroad are expensive and hence, you may end up blowing off your entire budget on paying for your medical bills. But with an annual travel policy, your medical treatment costs will be taken care of by the insurer.

Loss of Baggage and Passport Coverage: If you end up losing the passport of your luggage during the trip, you can make a travel insurance claim and the insurer will cover all the costs of a replacement for your lost belonging. For your lost checked-in luggage, your total cost would be compensated by the travel plan.

Repatriation and Death Coverage: In case of the traveller’s (policyholder’s) sudden death or permanent disability during the trip, the repatriation of the body or the treatment expenses would be covered under the annual travel insurance policy.

Hijack Cover: If in case your plane gets hijacked, according to the policy terms and conditions, you’d be compensated for the distress caused to you during such an unfortunate incident.

Advantages of Annual Travel Insurance

There has been a rise in people travelling abroad for work and leisure. Most of the countries, keeping in mind the current post-pandemic scenario, expects their travellers to have a valid traveller insurance plan in hand. So, if you need to travel outside India more than once a year, it’s advisable for you to buy an annual travel insurance policy. If you are still not sure whether you’d need one or not, here is a simple list of great advantages that you will get with an annual multi-trip travel insurance policy in hand –

One single policy will provide you extensive coverage against several exigencies that may occur to you during multiple trips abroad in a single year.

Such policies come with an automatic cancellation cover that will allow you to claim reimbursement for a missed flight or cancelled hotel bookings.

You will not have to worry about buying a travel insurance plan every time you book your ticket for a trip abroad during a single year.

Such policies offer easy renewability options and you can also choose different cover plans along with the main insurance policy to make the policy more robust.

From medical emergencies to any other personal liability, an annual travel insurance policy will cover it all.

At Tata AIG, we have some of the best-suited annual multi-trip insurance policies for you.

Eligibility Criteria

The eligibility criteria to opt for multi-trip travel insurance varies from one insurer to another. However, the basic requirement of being able to buy one such policy is that you need to be between the age of 3 months to 70 years.

Travel Insurance

Thanks for submitting!

HOURS & LOCATION

World Trade Center .

Connaught Place, New Delhi-110001 [email protected]

T : 91.11.41090545

M : 9810794545

Monday - Friday

10:00 am to 5:00 pm

Saturday

10:00 am to 1:00 pm

Evenings by Appointment

TATA AIG launches new travel insurance product

Indian travel insurer tata aig general insurance company has unveiled its new travel guard plus “comprehensive travel solution”.

The product offers a range of travel medical coverage, including for injury, illness, disablement, and accidental death while overseas.

Additionally, it has protection for “non-medical contingencies” such as the delay or loss of checked-in and personal baggage, passports, as well as flight delay and cancellation.

Travel Guard Plus also offers both single-trip and annual cover, as well as optional add-on extras, such as the Cruise, Travel Plus, and Accident bundles.

“At TATA AIG we are excited to announce the launch of Travel Guard Plus, which demonstrates the company’s unwavering commitment to its customers’ needs by providing all-encompassing insurance solutions,” said Saurav Jaiswal, President and Chief Operating Officer at TATA AIG. “With our Travel Guard Plus policy, travellers can embark on their adventures with a sense of assurance, as they have a safeguard against unexpected circumstances.”

TATA AIG previously announced in November that it would offer optional travel coverage to customers of Air India via the booking process.

TATA AIG Travel Insurance : Your Companion for Safe and Secure Journeys

Traveling is an exhilarating experience that exposes us to new cultures, breathtaking landscapes, and unforgettable memories. However, along with the excitement, it’s crucial to consider the unexpected challenges that can arise during a trip. This is where travel insurance comes into play, and Tata AIG Travel Insurance stands out as a reliable and comprehensive option for ensuring your journeys are not only memorable but also safe and secure.

Understanding Tata AIG Travel Insurance

Tata AIG General Insurance Company Limited, a joint venture between the Tata Group and American International Group (AIG), is renowned for its wide array of insurance products that cater to various needs. When it comes to travel insurance, Tata AIG offers a range of plans that encompass both domestic and international travel, assuring travelers peace of mind throughout their voyages.

Key Features and Benefits

- Medical Emergencies Coverage: Health-related issues can crop up unexpectedly, leaving you stranded in an unfamiliar place. Tata AIG Travel Insurance covers medical expenses arising from accidents and illnesses, ensuring you receive adequate medical care without worrying about exorbitant bills.

- Trip Cancellation/Interruption: Sometimes, unforeseen circumstances force us to cancel or cut short our trips. With Tata AIG, you can recover non-refundable trip costs due to covered reasons such as medical emergencies, natural disasters, or even job-related issues.

- Baggage and Personal Belongings: Losing luggage or personal belongings can be distressing. Tata AIG’s insurance plans offer coverage for baggage loss, delay, or theft, ensuring you’re compensated for your essential items.

- Emergency Evacuation: In the event of a serious injury or illness that requires evacuation to a medical facility or back home, Tata AIG Travel Insurance can arrange and cover the costs of such emergencies.

- Travel Delay: Travel delays can wreak havoc on your plans and budget. Tata AIG provides compensation for additional expenses incurred due to delayed departures, helping you manage unexpected costs.

- 24/7 Assistance: Travel mishaps don’t follow a schedule, and that’s why Tata AIG offers round-the-clock assistance services. Whether you need medical help, travel advice, or any other form of support, they’re just a call away.

- Coverage Customization: Different travelers have different needs. Tata AIG offers a range of plans that can be customized to match your travel requirements, ensuring you’re not paying for coverage you don’t need.

Why Tata AIG Travel Insurance?

- Reputation and Trust: Tata AIG is a renowned name in the insurance industry, backed by the credibility of the Tata Group and AIG. This legacy speaks to their commitment to delivering reliable services.

- Comprehensive Coverage: From medical emergencies to trip cancellations, Tata AIG’s travel insurance plans are designed to cover a wide spectrum of potential issues, giving you holistic protection.

- Global Reach: Whether you’re exploring a remote village or a bustling metropolis, Tata AIG’s network ensures you have access to assistance and coverage, no matter where you are.

- Ease of Purchase: Tata AIG offers a user-friendly online platform for purchasing and managing your travel insurance. This convenience saves you time and effort, allowing you to focus on planning your journey.

Exploring Additional Advantages of Tata AIG Travel Insurance

In addition to the key features mentioned earlier, Tata AIG Travel Insurance offers a range of additional advantages that further solidify its position as a top choice for travelers seeking comprehensive coverage and exceptional service.

- Adventure Sports Coverage: For the adrenaline junkies and adventure enthusiasts, Tata AIG provides options to include coverage for various adventure sports and activities. Whether you’re planning to go bungee jumping, scuba diving, or skiing, you can tailor your insurance to match your daring spirit.

- Coverage for Pre-existing Medical Conditions: Travelers with pre-existing medical conditions often worry about being stranded without proper medical support. Tata AIG understands this concern and offers plans that cover pre-existing medical conditions, ensuring you receive the care you need even while on the go.

- Cashless Claims: Dealing with paperwork and reimbursement claims can be a hassle, especially when you’re in an unfamiliar location. Tata AIG offers a cashless claims process for medical expenses, making it convenient and stress-free to access medical services without worrying about immediate payment.

- Family Plans: If you’re traveling with your family, Tata AIG provides family-friendly plans that offer coverage for all family members in a single policy. This streamlines the process and ensures everyone is protected under one umbrella.

- Extension of Coverage: Sometimes, trips don’t go as planned, and you might need to extend your stay. Tata AIG allows you to extend your travel insurance coverage, providing you with continued protection in case unexpected situations arise.

- Home Burglary Insurance: Tata AIG’s travel insurance doesn’t just cover you during your trip; it also offers protection for your home while you’re away. This includes coverage against burglary and theft, giving you peace of mind knowing your home is secured.

- Hijack Distress Allowance: While rare, instances of hijacking can cause significant distress. Tata AIG offers coverage for hijack situations, providing a distress allowance to help you navigate through such unfortunate events.

- Legal Assistance: In case you encounter legal troubles during your travels, Tata AIG’s travel insurance plans offer legal assistance and advice, ensuring you have the necessary support to address legal issues in an unfamiliar jurisdiction.

- Student Travel Insurance: Students pursuing education abroad can benefit from Tata AIG’s student travel insurance plans. These plans are tailored to the unique needs of students, offering coverage for tuition fees, medical expenses, and more.

Making an Informed Choice

When selecting travel insurance, it’s crucial to make an informed choice that aligns with your travel plans and preferences. Tata AIG Travel Insurance provides not only a range of plans but also a transparent explanation of coverage options. Their customer service representatives are equipped to guide you through the selection process, helping you understand the nuances of each plan so you can choose the one that best suits your needs.

Embracing a World of Opportunities with Tata AIG Travel Insurance

In today’s interconnected world, travel has become more accessible than ever before. From solo backpackers to family vacationers and business globetrotters, people from all walks of life are traversing the globe. However, regardless of the purpose or destination, one common thread binds all travelers: the need for security and peace of mind. Tata AIG Travel Insurance transcends geographical boundaries to provide a safety net that allows you to explore with confidence, unlocking a world of opportunities.

Tailoring to Diverse Journeys

Tata AIG understands that each journey is unique, and its travel insurance offerings reflect this understanding. Whether you’re planning a leisurely vacation, a business conference, a backpacking escapade, or a spiritual retreat, Tata AIG has a plan designed to cater to your specific needs. This tailored approach ensures that you’re not paying for unnecessary coverage while still enjoying comprehensive protection against the unforeseen.

Building Lasting Memories

Travel is more than just movement; it’s about creating lasting memories that shape our lives. Whether you’re strolling through ancient ruins, immersing yourself in vibrant local cultures, or simply gazing at breathtaking landscapes, these moments become part of your personal narrative. Tata AIG Travel Insurance takes the worry out of these experiences, allowing you to fully engage with your surroundings, build connections, and make memories that will stay with you forever.

A Commitment to Excellence

Tata AIG’s commitment to excellence extends beyond the insurance coverage itself. The company’s dedication to customer service, transparent communication, and quick claims processing showcases its devotion to ensuring a seamless experience for travelers. This commitment is a reflection of Tata AIG’s values, where your safety and satisfaction take center stage.

A Global Safety Net

One of the standout features of Tata AIG Travel Insurance is its global reach. Whether you’re wandering through the bustling streets of Tokyo, exploring the serene beauty of the Swiss Alps, or navigating the chaotic markets of Marrakech, Tata AIG’s support is only a call away. This global safety net empowers you to embrace the spirit of adventure without feeling isolated in unfamiliar territories.

Empowering Responsible Travel

In an era where responsible and sustainable travel is gaining prominence, Tata AIG Travel Insurance aligns itself with these principles. By providing comprehensive coverage, including medical emergencies and unexpected trip disruptions, Tata AIG encourages travelers to venture off the beaten path with the assurance that they can explore responsibly and make ethical choices while minimizing the impact of unforeseen events.

Final Thoughts

Tata AIG Travel Insurance goes beyond being a mere safety net; it’s a reliable partner that ensures your journeys remain unforgettable for all the right reasons. In the world of travel, where surprises can be both delightful and challenging, having comprehensive coverage from a trusted name like Tata AIG allows you to embrace the excitement of exploration while staying prepared for whatever comes your way. Remember, with Tata AIG, your travel adventure is not just insured – it’s empowered.

Q.1 how to extend tata aig travel insurance?

Ans : Extending your Tata AIG travel insurance is a straightforward process that offers you continued coverage and peace of mind during your travels. To extend your policy, begin by contacting the Tata AIG customer service or visiting their official website. Make sure to initiate the extension before your existing policy expires to ensure uninterrupted coverage. You’ll need to provide essential details such as your policy number, travel dates, and any changes in your travel plans. The customer service representatives will guide you through the available extension options, coverage enhancements, and associated costs. It’s advisable to review your current policy terms and conditions before opting for an extension, as certain conditions might have changed. Once you’ve chosen the desired extension, complete the necessary paperwork and payment formalities. Extending your Tata AIG travel insurance is an effective way to adapt to unforeseen circumstances and ensure you’re safeguarded throughout your journey.

Q.2 can someone extend the cover of tata aig travel insurance?

Ans : Extending the coverage of Tata AIG travel insurance is a common query among policyholders seeking to enhance their protection during their journeys. Individuals often find themselves in situations where their original coverage might fall short of their evolving travel needs. In such cases, many wonder if it’s possible to extend the existing policy. Tata AIG, like many insurance providers, typically offers options for policy extension or renewal. However, the feasibility of extending coverage depends on factors such as the policy type, the terms and conditions of the original policy, the duration of the extension required, and the specific circumstances of the traveler. It’s advisable for those interested in extending their Tata AIG travel insurance coverage to directly contact the insurance provider, discuss their requirements, and explore the available options to ensure they have comprehensive protection throughout their travels.

Q.3 how can i get tata aig travel insurance policy detail?

Ans : If you’re looking to obtain details about Tata AIG travel insurance policies, there are several steps you can take to gather the necessary information. Firstly, you can visit the official Tata AIG website and navigate to the “Travel Insurance” section. There, you’ll likely find a comprehensive overview of the various travel insurance plans they offer, including coverage details, benefits, and terms. Additionally, the website might provide you with the option to request a quote or even purchase a policy online. If you prefer a more personalized approach, you can reach out to Tata AIG’s customer service through their provided contact details. Their representatives should be able to assist you in understanding the specifics of each policy, helping you choose the one that aligns best with your travel needs. It’s advisable to thoroughly review the policy documents, including coverage limits, exclusions, and claim procedures, before making a decision. This way, you can ensure that you’re well-informed about the travel insurance policy you’re considering.

Q.4 how is service of tata aig overseas travel insurance claim?

Ans : Tata AIG’s overseas travel insurance claim service is recognized for its efficiency and customer-centric approach. When policyholders encounter unexpected situations such as medical emergencies, trip cancellations, lost baggage, or other covered incidents during their travels abroad, Tata AIG ensures a streamlined and hassle-free claims process. Policyholders can initiate their claims through the company’s online portal or by reaching out to their dedicated customer service representatives. The process usually involves submitting the required documents, such as medical reports, receipts, and incident details, to support the claim. What sets Tata AIG apart is its commitment to quick turnaround times, aiming to process and settle valid claims promptly. The company’s emphasis on clear communication and guidance throughout the claims process helps customers navigate the often complex documentation requirements. Tata AIG’s reputation for transparency and professionalism in handling overseas travel insurance claims has made it a preferred choice for travelers seeking reliable coverage and support during unexpected events abroad.

Q.5 how is tata aig travel insurance for uae?

Ans : Tata AIG Travel Insurance for UAE offers comprehensive coverage and peace of mind for travelers visiting the United Arab Emirates. With its extensive range of benefits, the insurance plan caters to various travel needs, whether it’s for leisure, business, or any other purpose. The policy typically covers medical expenses, including emergency medical treatment and evacuation, ensuring that travelers are financially protected in case of unexpected health issues. Additionally, the insurance provides coverage for trip cancellations, interruptions, and delays, safeguarding against potential financial losses due to unforeseen circumstances. Travelers can also benefit from coverage for lost baggage, travel documents, and personal belongings, minimizing the stress and inconvenience of such situations. Tata AIG’s travel insurance for UAE is designed to offer round-the-clock assistance, allowing travelers to seek help and guidance in emergencies. Whether it’s a sudden illness, travel mishap, or any other travel-related issue, the insurance plan is designed to provide comprehensive support. With Tata AIG Travel Insurance, travelers to the UAE can explore the country with confidence, knowing that they have reliable coverage to handle unexpected situations that may arise during their trip.

Related Posts

The Art of Investment in the Share Market : Strategies for Success

Understanding HDFC Term Insurance : A Comprehensive Guide

The Comprehensive Guide to Tata AIG Car Insurance : Safeguarding Your Drive

United India Insurance : Safeguarding Lives and Assets Across the Nation

Exploring the Legacy and Services of Oriental Insurance

Navigating the Terrain of Health Insurance : Your Comprehensive Guide

National Insurance : Safeguarding Citizens’ Futures

ICICI Prudential Life Insurance: Safeguarding Lives and Dreams

SBI Life Insurance : Safeguarding Futures with Trust and Excellence

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- Main Menu ×

- Search Flights

- Corporate Travel Programme

- Group Booking

- Special Offers

- Travel Insurance

- Flight Schedule

- Check In Online

- Manage Booking

- Seat Selection & Upgrades

- Self-Service Re-accommodation

- Request Refund

- Flight Status

- Nonstop International Flights

- Popular Flights

- Partner Airlines

- Baggage Guidelines

- Airport Information

- Visas, Documents and Travel Tips

- First-time Travellers, Children and Pets

- Health and Medical Assistance

- At the Airport

- The Air India Fleet

- About Flying Returns

- Sign In/Sign Up

- Our Partners

- Family Pool

- Earn Points

- Spend Points

- Upgrade Cabin Class

- Points Calculator

- Customer Support

What are you looking for?

Policy details and changes

Understand your policy, hide view where can i get the full policy wording of the travel insurance policy where can i get the full policy wording of the travel insurance policy -->.

It seems like you're in landscape mode. For the best view, switch to portrait mode where the magic happens!

AIG Travel Guard Insurance Review 2024

Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. Datalign's free tool matches you with financial advisors in your area in as little as 3 minutes. All firms have been vetted by Datalign and all advisors are registered with the SEC. Get started with achieving your financial goals!

The offers and details on this page may have updated or changed since the time of publication. See our article on Business Insider for current information.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

AIG Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits. If you're looking for travel insurance, consider Travel Guard.

AIG Travel Guard Travel Insurance Review

AIG Travel Guard is among the best travel insurance companies with impressive coverage limits, even with its basic plan, Travel Guard Essential. It's emergency medical evacuation coverage is particularly high, making Travel Guard a good choice for insuring cruises, as sea to land evacuations are often expensive.

Additionally, Travel Guard's Premium and Deluxe plans offer coverage that many of its competitors don't, such as its travel inconvenience coverage and ancillary evacuation coverage.

That said, Travel Guard is on the pricey side, compared with its competitors. While age is often a factor in your insurance premiums, Travel Guard tends to quote older travelers higher rates than its competitors. However, you often get what you pay for. In Travel Guard's case, you'll find that its coverage justifies its higher rates.

While great coverage is important, it's also crucial that an insurance company has a smooth claims process, which Travel Guard lacks, according to its customer reviews. Across 135 reviews on its Trustpilot page, AIG Travel Guard received an average of 1.2 stars, with 95% of reviewers giving the company one star. Surprisingly, AIG Travel Guard fares even worse with the Better Business Bureau, receiving an average of 1.08 stars out of five across 301 reviews.

Coverage Options Offered by AIG Travel Guard

AIG Travel Guard offers three primary plans: Travel Guard Essential, Travel Guard Preferred, and Travel Guard Deluxe. Each plan has different coverage limits and various types of protection.

Here's a look at what you'll get with each plan:

Depending on the policy you select, there are also additional coverages that my be included at no extra charge, like pre-existing conditions waiver, single occupancy fee coverage, worldwide travel and medical assistance services, and more. Be sure to check each policy closely to see what is and isn't covered.

Each of these plans also include coverage for one child under 17 as long as their travel costs are equal to or under the adult's cost. Additional coverages do not apply to the child.

AIG Travel Guard Pack N' Go Plan

In addition to these three primary plans, Travel Guard offers the Pack N' Go policy along with an Annual plan. This policy is for last-minute travelers who don't need trip cancellation coverage.

This plan includes:

- Trip interruption and trip delay ($200 per day maximum) up to $1,000

- Missed connection up to $500

- Baggage delay up to $200 and baggage coverage up to $1,000

- Medical expenses up to $25,000 and dental expenses up to $500

- Emergency evacuation and repatriation of remains up to $500,000.

AIG Travel Guard Annual Plan

Taking multiple trips throughout the year? Consider the Travel Guard Annual plan instead of purchasing a new policy for each adventure. This plan comes with coverage for:

- Trip interruption coverage up to $2,500

- Trip delay coverag e up to $1,500 ($150 per day maximum)

- Missed connection coverag e up to $500

- Baggage delay coverage up to $1,000 and lost/damaged baggage coverage up to $2,500

- Medical expenses coverage up to $50,000 and dental expenses up to $500

- Emergency evacuation coverage and repatriation of remains up to $500,000

- Accidental death and dismemberment coverage up to $50,000 and security evacuation up to $100,000

Note: The Annual plan is not available in Washington and New York

Additional Coverage Options from AIG Travel Guard

Like many other travel insurance providers, Travel Guard offers add-ons for an additional cost. These can be selected while you're purchasing your policy.

The availability of these add-ons depends on the policy you're buying. Note also that some are already included in the Preferred and Deluxe plans.

- Medical bundle — Increases coverage amounts for medical expenses and evacuation and adds hospital of choice and additional evacuation benefits.

- Security bundle — Provides various coverages for trip interruption or cancellation due to riot or civil disorder.

- Rental vehicle damage coverage — Reimburses a predetermined amount for physical damage to a rental car in the policy holder's name.

- Cancel for Any Reason Insurance (CFAR) — This is just what it sounds like. Cancel for any reason coverage will reimburse 75% of nonrefundable expenses when you cancel your trip for any reason, up to 48 hours before your scheduled departure. CFAR coverage is only available for Travel Guard's Deluxe and Preferred plans.

- Inconvenience bundle — Offers reimbursement for inconveniences like closed attractions, credit/debit card cancellation, hotel construction, and more.

- Pet bundle coverage — Daily travel benefit for boarding and medical expense coverage for illness or injury of dog or cat. Includes trip cancellation or interruption coverage if the pet is in critical condition or dies within seven days before the departure date.

- Adventure sports bundle — Removes the exclusions for adventure and extreme activities.

- Baggage bundle — Your baggage coverage with AIG becomes primary with increased coverage and baggage delay benefits.

- Wedding bundle — Provides trip cancellation coverage due to wedding cancellation (brides and grooms not covered).

- Name a family member bundle — One person can be named as a Family Member for the purpose of family member-related unforeseen event coverage.

How to Purchase and Manage Your AIG Policy

Aig travel guard cost.

Getting a quote from AIG Travel Guard is quick and easy. Head to AIG website and enter basic information about the trip you're looking to cover. You'll get an instant quote for the insurance plans available for your trip, so it's easy to compare each option. Be prepared to provide information including:

- Your state of residence

- Date of birth

- The cost of your trip

- Travel dates

- Destination

- Method of travel

We ran a few simulations to offer examples of how much a Travel Guard policy might cost. You'll see that costs usually fall within 5-7% of the total trip cost, depending on the policy tier you choose.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Travel Guard travel insurance quotes:

- Travel Guard Essential: $86.96

- Travel Guard Preferred: $152.01

- Travel Guard Deluxe: $188.59

Premiums for Travel Guard's various single trip plans are between 2.8% and 6.3%, well within, and even below, the average cost of travel insurance .

A 30-year-old traveler from California is heading to Japan for two weeks, costing $4,000. The Travel Guard travel insurance quotes are:

- Travel Guard Essential: $198.77

- Travel Guard Preferred: $240.39

- Travel Guard Deluxe: $305.04

Premiums for Travel Guard's various single trip plans are between 5% and 7.6%, within the average cost for travel insurance.

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following Travel Guard quotes:

- Travel Guard Essential: $471.10

- Travel Guard Preferred: $618.22

- Travel Guard Deluxe: $834.78

Premiums for Travel Guard's various single trip plans are between 7.9% and 13.9%, which is significantly higher than the average cost. That said, travel insurance is often more expensive as you get older.

AIG Travel Guard Annual Plan Cost

Getting a quote for the annual plan requires much less information, only asking for the intended policy start date, your state of residence, and how many people you plan to insure. Quotes from AIG remained at $259 per traveler, regardless of state of residence and number of travelers.

How to File A Claim with AIG Travel Guard

Filing a claim with Travel Guard is a straightforward process. You'll need your policy number and can either go to travelguard.com or call Travel Guard at 866-478-8222 to start the claim. Once submitted, you can check the status of your claim at claims.travelguard.com/status.

Compare AIG Travel Guard

See how AIG Travel Guard stacks up against the competition and find the right travel insurance policy for you.

AIG Travel Guard vs. Nationwide Travel Insurance

Nationwide is a household name when it comes to insurance providers and one of the largest and most-recognized insurance providers in the US. Similarly to Travel Guard, Nationwide makes it easy to find coverage by offering just two single-trip plans: the Essential and Prime plan.

In addition, offers plans specifically designed for cruises along with annual trip insurance for those who travel a lot throughout the year.

The Essential Plan comes with trip cancellation coverage of up to $10,000, up to $250,000 in emergency medical evacuation, up to $150 per day reimbursement for travel delays of 6+ hours, and coverage for delayed or lost baggage.

In comparison, the Travel Guard Essential plan covers trip cancellations with up to $100,0000 in coverage, up to $150,000 in emergency medical evacuation expenses, up to $100 per day ($500 total) for trip delays of 12+ hours, along with lost or delayed baggage coverage.

The high-tier Prime Plan from offers even more coverage, including trip cancellation up to $30,000, trip interruption coverage up to 200% of the trip cost (maximum of $60,000), missed connection and itinerary change coverage of $500 each, $250 per day for trip delays of 6+ hours, and up to $1 million in coverage for emergency medical evacuation

AIG's highest-tier Deluxe plan comes with trip cancellation coverage of up to $150,000, up to $1,000,000 in emergency medical evacuation, up to $200 per day ($1,000 maximum) reimbursement for travel delays of 12+ hours, and coverage for delayed or lost baggage.

As you can see, it's hard to compare apples to apples when comparing the two different insurance providers. But it helps to know the specifics of the coverages that matter most to you.

Read our Nationwide travel insurance review here.

AIG Travel Guard vs. Allianz Travel Insurance

With Allianz Travel Insurance , you can choose from 10 different insurance plans to find one that suits your needs. Like Travel Guard, it offers one-off policies for specific trips and an annual travel insurance plan for those who take multiple trips a year. Similar to AIG, too, the different plans offer varying levels of coverage.

's most popular single-trip option is the OneTrip Prime plan. This plan offers trip cancellation coverage up to $100,000, trip interruption coverage up to $150,000, emergency medical coverage for $50,000, coverage for baggage loss, theft, or damage up to $1,000, and up to $800 in travel delay coverage.

The most similar plan from Travel Guard is the mid-tier Travel Guard Preferred plan, which which you'll get up to $150,000 in trip cancellation coverage, trip interruption coverage up to $225,000, $50,000 in emergency medical coverage, coverage for baggage loss, theft, or damage up to $1,000, and travel delay coverage of up to $800.

A variety of factors will determine the final cost of any of these travel insurance policies. However, when comparing quotes with the same factors, Allianz tends to be cheaper. Additionally, Travel Guard seems to be more sensitive to the traveler's age. However, it's best to compare quotes using your specific personal and trip details to determine which policy is the best for you.

Read our Allianz travel insurance review here.

AIG Travel Guard vs. Credit Card Travel Insurance

Before purchasing a travel insurance plan, take a look at the coverage offered through your travel rewards credit cards. Some of the basic coverages you're looking for, like rental car insurance, may already be available through credit card travel protection .

The coverage you have on your credit card couple be sufficient if, for example, you're taking a road trip by car and you don't have any non-refundable trip expenses. It could also be enough if your health insurance covers you while you travel and you aren't overly worried about incurring additional medical expenses during your trip.

It's also worth remembering that credit card coverage is usually secondary versus the primary coverage you'd get with a travel insurance policy. Meaning you'll have to file a claim with the other applicable insurance (like through the airline travel provider) before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

AIG Travel Guard Frequently Asked Questions

What is the coverage limit for medical expenses with aig travel guard.

Depending on the single trip plan you choose, AIG Travel Guard offers $15,000-$100,000 in emergency medical expense coverage.

How does AIG Travel Guard handle pre-existing medical conditions?

All three of Travel Guard's single trip policies offer pre-existing condition waivers as long as you purchase your policy within 15 days of your initial trip payment.

Are AIG and Travel Guard the Same?

Travel Guard is the name used for AIG's travel insurance products, but AIG also offers other insurance products, like AIG Life Insurance .

What Is Covered under AIG Travel Insurance?

Your coverage depends on the policy you buy, but all policies will cover (up to a specified limit) trip cancellation, interruption, delay, emergency medical expenses, lost and delayed baggage, and emergency evacuation.

Does AIG Cover Trip Cancellation?

Yes, Travel Guard plans cover trip cancellation and interruption due to illness, injury, or death of a family member. If your trip is delayed or canceled due to inclement weather, that's covered too. AIG Travel Guard's is also among the best CFAR travel insurance companies.

Why You Should Trust Us: How We Reviewed AIG Travel Guard

The policy that's best for you will be the one that offers the right amount and type of coverage, fits your budget, and is easy to use if you ever need it.

In reviewing Travel Guard, we looked at the company's travel insurance offerings and compared them to plans offered by the top travel insurance companies in the space. Factors considered included things like coverage options, claim limits, what's covered, available add-ons, and typical insurance policy costs. We also considered buyer preferences.

Read more about how Business Insider rates insurance providers .

If you enjoyed this story, be sure to follow Business Insider on Microsoft Start.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel Insurance

Cheapest travel insurance of April 2024

Mandy Sleight

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:52 a.m. UTC April 11, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

WorldTrips is the best cheap travel insurance company of 2024 based on our in-depth analysis of the cheapest travel insurance plans. Its Atlas Journey Preferred and Atlas Journey Premier plans offer affordable travel insurance with high limits for emergency medical and evacuation benefits bundled with good coverage for trip delays, travel inconvenience and missed connections.

Cheapest travel insurance of 2024

Why trust our travel insurance experts

Our team of travel insurance experts analyzes hundreds of insurance products and thousands of data points to help you find the best travel insurance for your next trip. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content . You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Best cheap travel insurance

Top-scoring plans

Average cost, medical limit per person, medical evacuation limit per person, why it’s the best.

WorldTrips tops our rating of the cheapest travel insurance with two plans:

- Atlas Journey Preferred is the cheaper travel insurance plan of the two, with $100,000 per person in emergency medical benefits as secondary coverage and an optional upgrade to primary coverage. It’s also our pick for the best travel insurance for cruises .

- Atlas Journey Premier costs a little more but gives you $150,000 in travel medical insurance with primary coverage . This is a good option if health insurance for international travel is a priority.

Pros and cons

- Atlas Journey Preferred is the cheapest of our 5-star travel insurance plans.

- Atlas Journey Premier offers $150,000 in primary medical coverage.

- Both plans have top-notch $1 million per person in medical evacuation coverage.

- Each plan offers travel inconvenience coverage of $750 per person.

- 12 optional upgrades, including destination wedding and rental car damage and theft.

- No non-medical evacuation coverage.

Cheap travel insurance for cruises

Travel insured.

Top-scoring plan

Travel Insured offers cheap travel insurance for cruises and its Worldwide Trip Protector plan gets 4 stars in our rating of the best cruise travel insurance .

- Worldwide Trip Protector offers $1 million in emergency evacuation coverage per person and a rare $150,000 in non-medical evacuation per person. It also has primary coverage for travel medical insurance benefits, which means you won’t have to file medical claims with your health insurance first.

- Cheap trip insurance for cruises.

- Offers a rare $150,000 for non-medical evacuation.

- $500 per person baggage delay benefit only requires a 3-hour delay.

- Optional rental car damage benefit up to $50,000.

- Missed connection benefit of $500 per person only available for cruises and tours.

Best cheap travel insurance for families

Travelex has the best cheap travel insurance for families because kids age 17 are covered by your policy for free when they’re traveling with you.

- Free coverage for children 17 and under on the same policy.

- $2,000 travel delay coverage per person ($250 per day) after 5 hours.

- Hurricane and weather coverage after a common carrier delay of any amount of time.

- Only $50,000 per person emergency medical coverage.

- Baggage delay coverage is only $200 and requires a 12-hour delay.

Best cheap travel insurance for seniors

Evacuation limit per person

Nationwide has the best cheap travel insurance for seniors — its Prime plan gets 4 stars in our best senior travel insurance rating. However, Nationwide’s Cruise Choice plan ranks higher in our best cheap travel insurance rating.

- Cruise Choice has a $500 per person benefit if a cruise itinerary change causes you to miss a prepaid excursion. It also has a missed connections benefit of $1,500 per person after only a 3-hour delay, for cruises or tours. But note that this coverage is secondary coverage to any compensation provided by a common carrier.

- Coverage for cruise itinerary changes, ship-based mechanical breakdowns and covered shipboard service disruptions.

- Non-medical evacuation benefit of $25,000 per person.

- Baggage loss benefits of $2,500 per person.

- Travel medical coverage is secondary.

- Trip cancellation benefit for losing your job requires three years of continuous employment.

- No “cancel for any reason” (CFAR) upgrade available.

- Missed connection coverage of $1,500 per person is only for tours and cruises, after a 3-hour delay.

Best cheap travel insurance for add-on options

AIG offers the best cheap travel insurance for add-on options because the Travel Guard Preferred plan allows you to customize your policy with a host of optional upgrades.

- Travel Guard Preferred upgrades include “cancel for any reason” (CFAR) coverage , rental vehicle damage coverage and bundles that offer additional benefits for adventure sports, travel inconvenience, quarantine, pets, security and weddings. There’s also a medical bundle that increases the travel medical benefit to $100,000 and emergency evacuation to $1 million.

- Bundle upgrades allow you to customize your affordable travel insurance policy.

- Emergency medical and evacuation limits can be doubled with optional upgrade.

- Base travel insurance policy has relatively low medical limits.

- $300 baggage delay benefit requires a 12-hour delay.

- Optional CFAR upgrade only reimburses up to 50% of trip cost.

Best cheap travel insurance for missed connections

TravelSafe has the best cheap travel insurance for missed connections because coverage is not limited to cruises and tours, as it is with many policies.

- Best-in-class $2,500 per person in missed connection coverage.

- $1 million per person in medical evacuation and $25,000 in non-medical evacuation coverage.

- Generous $2,500 per person baggage and personal items loss benefit.

- Most expensive of the best cheap travel insurance plans.

- No “interruption for any reason” coverage available.

- Weak baggage delay coverage of $250 per person after 12 hours.

Cheapest travel insurance comparison

How much does the cheapest travel insurance cost?

The cheapest travel insurance in our rating is $334. This is for a WorldTrips Atlas Journey Preferred travel insurance plan, based on the average of seven quotes for travelers of various ages to international destinations with a range of trip values.

Factors that determine travel insurance cost

There are several factors that determine the cost of travel insurance, including:

- Age and number of travelers being insured.

- Trip length.

- Total trip cost.

- The travel insurance plan you choose.

- The travel insurance company.

- Any add-ons, features or upgraded benefits you include in the travel insurance plan.

Expert tip: “In general, travelers can expect to pay anywhere from 4% to 10% of their total prepaid, non-refundable trip costs,” said Suzanne Morrow, CEO of InsureMyTrip.

Is buying the cheapest travel insurance a good idea?

Choosing cheaper travel insurance without paying attention to what a plan covers and excludes could leave you underinsured for your trip. Comparing travel insurance plans side-by-side can help ensure you get enough coverage to protect yourself financially in an emergency for the best price.

For example, compare these two Travelex travel insurance plans:

- Travel Basic is cheaper but it only provides up to $15,000 for emergency medical expense coverage. You’ll also have to pay extra for coverage for children.

- Travel Select will cost you a bit more but it covers up to $50,000 in medical expenses and includes coverage for kids aged 17 and younger traveling with you. It also offers upgrades such additional medical coverage, “cancel for any reason” (CFAR) coverage and an adventure sports rider that may be a good fit for your trip.

Reasons to consider paying more for travel insurance

Make sure you understand what you’re giving up if you buy the cheapest travel insurance. Here are a few reasons you may consider paying a little extra for better coverage.

- Emergency medical. The best travel medical insurance offers primary coverage for emergency medical benefits. Travel insurance with primary coverage can cost more than secondary coverage but will save you from having to file a claim with your health insurance company before filing a travel insurance claim.

- Emergency evacuation. If you’re traveling to a remote location or planning a boat excursion on your trip, look at travel insurance with a high medical evacuation insurance limit. If you are injured while traveling, transportation to the nearest adequate medical facility could cost in the tens to hundreds of thousands. It may make sense to pay more for travel insurance with robust emergency evacuation coverage.

- Flexibility. To maximize your trip flexibility, you might consider upgrading your travel insurance to “ cancel for any reason” (CFAR) coverage . This will increase the cost of your travel insurance but allow you to cancel your trip for any reason — not just those listed in your policy. The catch is that you’ll need to cancel at least 48 hours before your trip and will only be reimbursed 50% or 75% of your trip expenses, depending on the plan.

- Upgrades. Many travel insurance plans have optional extras like car rental collision and adventure sports (which may otherwise be excluded from coverage). These will cost you extra but may give you the coverage you need.

How to find the cheapest travel insurance

The best way to find the cheapest travel insurance is to determine what you’re looking for in a travel insurance policy and compare plans that meet your needs.

“Travel insurance isn’t one-size-fits-all. Every trip is different, and every traveler has different needs, wants and concerns. This is why comparison is key,” said Morrow.

Consider the following factors when comparing cheap travel insurance plans.

- How often you’re traveling. A single-trip policy may be the most cost-effective if you’re only going on a single trip this year. But a multi-trip travel insurance plan may be cheaper if you’re going on multiple international trips throughout the year. Annual travel insurance policies cover you for a whole year as long as each trip doesn’t exceed a certain number of days, usually 30 to 90 days.

- Credit card has travel insurance benefits. The best credit cards offer perks and benefits, and many offer travel insurance-specific benefits. The coverage types and benefit limits can vary, and you must put the entire trip cost on the credit card to use the coverage. If your trip costs more than the coverage limit on your card, you can supplement the rest with a cheaper travel insurance plan.

- The coverage you need. When looking for the best travel insurance option at the most affordable price, only buy extras and upgrades you really need. A basic plan may only provide up to $500 in baggage insurance, but if you only plan to take $300 worth of clothes and accessories, you don’t need to pay more for higher coverage limits.

Is cheap travel insurance worth it?

Cheap travel insurance can be worth it, as long as you understand the plan limitations and exclusions. Taking the time to read your policy, especially the fine print, well before your trip can ensure there won’t be any surprises about what’s covered once your journey begins.

“If a traveler is looking for coverage for travel delays, cancellations, interruptions, medical and baggage — a comprehensive travel insurance policy will provide the most bang for their buck,” said Morrow. But if you’re on a tight budget and are only worried about emergency medical care and evacuation coverage while traveling abroad, stand-alone options are cheaper.

Before buying travel insurance, you should also consider what your health insurance will cover.