An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Travel resources

Per diem look-up, 1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

City Pair airfares

Visit City Pair Program to learn about its competitive, federally-negotiated airline rates for 7,500+ domestic and international cities, equating to over 13,000 city pairs.

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

GSA lodging programs

Shop for lodging at competitive, often below-market hotel rates negotiated by the federal government.

FedRooms provides federal travelers on official business with FTR compliant hotel rooms for transient and extended stays (up to 29 days). The program uses FEMA and ADA-compliant rooms with flexible booking terms at or below per diem rates. Federal employees should make reservations, including FedRooms reservations, via their travel management service.

Visit GSALodging for more details on FedRooms and for additional programs offering meeting space, long term lodging, and emergency lodging.

Privately owned vehicle (POV) mileage reimbursement rates

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024.

* Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs).

For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

Plan a trip

Research and prepare for government travel.

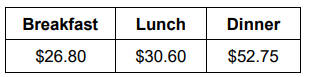

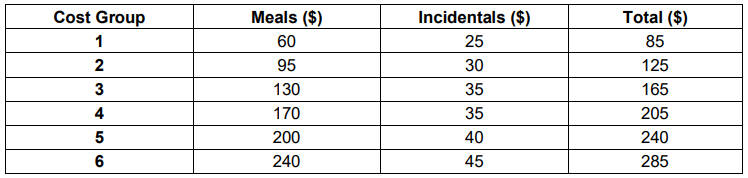

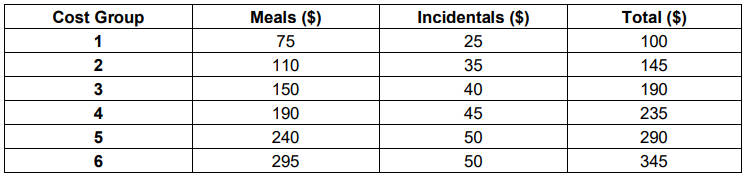

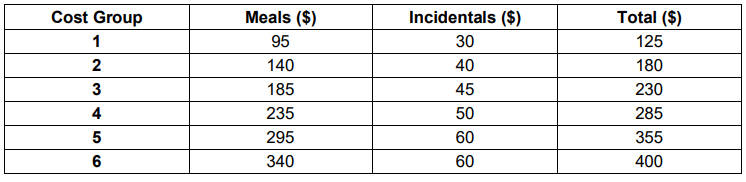

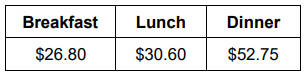

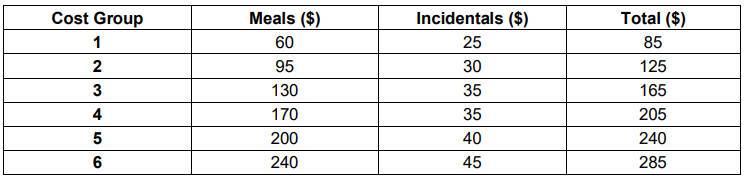

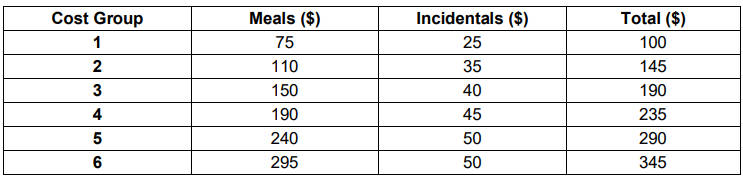

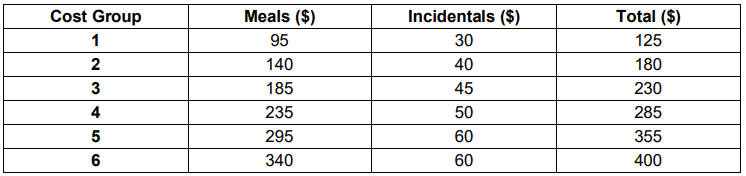

Per diem, meals & incidental expenses (M&IE) Passenger transportation (airfare rates, POV rates, etc.) Lodging Conferences/meetings Travel charge card State tax exemption

Services for government agencies

Programs providing commercial travel services.

Travel Category Schedule (Schedule L) E-Gov Travel Service (ETS) Emergency Lodging Services (ELS) Employee relocation

Travel reporting

Federal Travel Regulation Table of contents Chapter 300—General Chapter 301—Temporary Duty (TDY) Travel allowances Chapter 302 - Relocation allowances

A Bunch of IRS Tax Deductions and Credits You Need to Know

Lowering your taxable income is the key to paying less to the IRS. Several federal tax deductions and credits can help.

- Newsletter sign up Newsletter

Tax season can be stressful and complicated. Thankfully, tax credits and tax deductions can reduce your tax bill and ease the frustration of owing too much money to the IRS.

Here are some common IRS tax deductions and credits. Whether you are a homeowner, parent, charitable giver, older adult, or self-employed person, there are various ways to optimize your tax savings.

Common federal tax credits and tax deductions

If you haven’t filed your taxes yet ( Tax Day is April 15), you can use these and other tax breaks (if you are eligible for them) to reduce tax liability. If you have already filed, this information can help you plan to maximize your tax savings for the 2024 tax year (returns you file in early 2025).

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Consult with a qualified tax professional to ensure you take full advantage of the credits and deductions available to you in compliance with tax laws. Doing so can help you to keep more of your hard-earned money and achieve greater financial stability.

Note: This is a list of common tax deductions and credits that may be available to you. Please note that it is not exhaustive and does not include any particular order or ranking.

The standard deduction

If you are like most taxpayers, you take the standard deduction instead of itemizing deductions.

- The standard deduction reduces your taxable income by a predetermined, fixed dollar amount.

- Itemized deductions can also reduce your taxable income, but the amount varies and is not predetermined.

However, to decide whether to itemize, you must know the standard deduction amount for each tax year. See What’s the Standard Deduction for 2023 and 2024 ?

Family-focused tax credits

Child Tax Credit: The child tax credit (CTC) allows eligible parents and caregivers to reduce their tax liability, possibly resulting in a tax refund. However, not everyone can claim the CTC, and credit amounts can differ for those who can. The child tax credit is based on income, filing status, the number of children, and whether the IRS considers your dependent a qualifying child. For more information on the 2023 CTC (for tax returns filed now, see Child Tax Credit 2023: What You Need to Know .

Earned Income Tax Credit (EITC): Aimed at individuals and families with low to moderate income, the EITC is a refundable tax credit based on earned income and family size. It can financially boost working individuals, especially those with children, but is also available to some taxpayers without children. Unfortunately, many eligible individuals are unaware of the credit or don’t know how to claim it, resulting in it being overlooked.

Child and Dependent Care Credit: The Child and Dependent Care Tax Credit can help you pay for childcare or dependent care services to enable you to work or search for a job.

- You can claim up to $3,000 of eligible childcare expenses for one qualifying individual or up to $6,000 for two or more qualifying individuals.

This is a non-refundable tax credit, meaning it can reduce your federal income tax bill, but you cannot receive the credit as a tax refund. Learn more at Summer Camp Tax Breaks for 2023 .

Adoption Credit: The adoption credit is available for taxpayers who adopt or start the adoption process in a given tax year. The credit can be applied to international, domestic, private, and public foster care adoptions. However, it does not apply to those who adopt their spouse's child. The federal adoption tax credit for the 2023 tax year is worth up to $15,950 (inflation-adjusted yearly), but income limits apply.

Homeowner tax deductions

Mortgage Interest Deduction: Homeowners can deduct the interest paid on mortgage loans, reducing taxable income. This deduction can be particularly beneficial during the early years of a mortgage when interest payments are higher. How much you can deduct might depend on when you bought your home and your filing status. For more information, see Deducting Mortgage Interest on Your Tax Return .

Mortgage Points : Points paid at the time of mortgage origination can often be deducted in the year they were paid, potentially lowering taxable income.

Gains on Home Sale: Individuals who sell their primary residence may qualify to exclude a portion of the capital gains from their taxable income, provided they meet certain ownership and use requirements. This is known as the capital gains tax exclusion for home sales .

Energy-Efficient Home Improvements: Taxpayers who invest in energy-efficient home improvements may be eligible for tax credits. For example, homeowners can lower their federal income tax bills by installing new energy-efficient windows, doors, water heaters, furnaces, air conditioners, and solar panels.

Medical deductions

Medical Expenses: Taxpayers who itemize deductions can deduct qualifying medical expenses that exceed a certain percentage of their adjusted gross income (AGI), which can provide some relief for substantial healthcare costs.

Health Savings Account (HSA) Contributions: Contributions to an HSA are tax-deductible and can be used to pay for qualified medical expenses, offering a tax-efficient way to save for healthcare costs.

Long-term Care Insurance Premiums: Long-term care insurance provides benefits to policyholders dealing with long-term care expenses. If your insurance premiums are substantial, you may be eligible to claim a deduction for some or all of the amount you pay to keep your policy. This can help decrease your tax liability. However, it is important to remember that this tax benefit has certain IRS limitations.

Education credits and deductions

Student Loan Interest Deduction: If you paid interest on your student loan last year, you might be eligible for a tax deduction worth up to $2,500. By using this deduction, you can lower your taxable income.

- However, the IRS has specific rules for who can claim the student loan interest deduction; only some are eligible for the maximum amount.

For more information, see How to Claim the Student Loan Interest Deduction .

AOTC: The American Opportunity Tax Credit (AOTC) is a partially refundable tax credit available to those currently enrolled in college. Eligible taxpayers can claim 100% of the first $2,000 spent on qualified education expenses and 25% of the next $2,000. The maximum credit is $2,500 per qualifying student. If the credit exceeds the tax owed, you can receive a refund for 40% of the remaining amount, up to $1,000 per qualifying student.

Lifetime Learning Credit: The Lifetime Learning Credit (LLC) is worth up to $2,000 per tax return and can be claimed for an unlimited number of years. However, the credit is not refundable. Unlike the American Opportunity tax credit, graduate students are eligible to claim the LLC, and students do not need to attend college at least half-time to qualify.

For more information, see 11 Education Tax Credits and Deductions .

Work-related tax deductions

Home Office Tax Deduction: Self-employed individuals are typically eligible to deduct expenses related to their home office. Here's more about the home office tax deduction .

Educator Expense Deduction: The educator expense tax deduction (also called the teacher deduction) allows some teachers, counselors, principals, or other instructors to write off classroom expenses and supplies on federal income tax returns. For the current tax season (i.e., the 2023 tax year), the maximum educator expense deduction is $300.

Military Moving Expenses: Active-duty U.S. military personnel who relocate due to a military order and permanent change of station may be able to deduct certain moving expenses not reimbursed by the military.

Special deductions for older ddults

Qualified Charitable Distributions: If you are 70½ or older, you can make qualified charitable distributions (QCDs) directly from your IRA to eligible charitable organizations.

- These distributions can be helpful for retirees who want to support charitable causes while minimizing their tax liability.

- QCDs fulfill required minimum distributions (RMDs) without being included in adjusted gross income (AGI).

Extra Standard Deduction: Once you turn 65, you become eligible for an extra standard deduction in addition to the regular standard deduction. This extra deduction reduces taxable income, potentially allowing retirees to keep more of their hard-earned money.

Energy tax credits

EV Tax Credit: To encourage people to purchase electric vehicles (EVs), the federal government offers a tax credit of up to $7,500 for certain "clean vehicles." The EV tax credit amount depends on factors like the vehicle's sourcing, assembly, and when it was put into service. Used EVs may also qualify for a tax credit of up to $4,000. Beginning January 1, 2024, you may be able to take the EV tax credit as a discount when purchasing the vehicle. (Income limits apply to the EV credit.)

EV Charger Tax Credit: If you install an electric vehicle charging station at home, you can receive a federal EV charger tax credit equal to 30% of the cost of hardware and installation expenses. The maximum credit amount is $1,000. Additionally, starting last year, the EV charger tax credit for home and business installations applies to other EV charger equipment like bidirectional (two-way) chargers.

Miscellaneous tax deductions and credits

Charitable Contributions : Donations made to qualifying charitable organizations are tax-deductible for those who itemize, which can incentivize philanthropic giving. Be sure to contribute to legitimate charities and get and keep receipts for your donations. The IRS says that in most cases, the amount of charitable cash contributions taxpayers can deduct as an itemized deduction is usually limited to 60 percent of the taxpayer’s adjusted gross income (AGI).

Jury Duty Pay Returned to Employer: If an employer continues to pay an employee's salary while serving jury duty and requires the employee to turn over the jury duty pay, the employee can deduct the amount turned over to the employer. Keep in mind that jury pay is taxable income.

Gambling Losses: While gambling winnings are taxable, taxpayers can deduct gambling losses up to the amount of their winnings if they itemize deductions. For more information, see Taxes on Gambling Winnings and Losses .

Bad Debt (Uncollected): If you have previously included an amount in your income and cannot collect it, you may be able to deduct it as a bad debt. Check out IRS Topic 453 for more information.

Saver’s Credit : People with low to moderate incomes who contribute to retirement savings accounts may qualify for a tax credit designed to encourage retirement savings.

- If your income falls within the credit limits, you can claim up to $1,000 for single filers or $2,000 for joint filers.

As Kiplinger has reported, for those who qualify for the Saver's Credit , the lower your income, the higher the percentage of retirement plan contributions you get back on your tax return.

- Types of Income the IRS Doesn’t Tax

- Seven IRS Tax Changes to Know Before You File

- Most-Overlooked Tax Credits and Deductions

- Federal Tax Brackets and Income Tax Rates

As the senior tax editor at Kiplinger.com, Kelley R. Taylor simplifies federal and state tax information, news, and developments to help empower readers. Kelley has over two decades of experience advising on and covering education, law, finance, and tax as a corporate attorney and business journalist.

Lottery The Powerball jackpot has soared to $1.3 billion, and everyone is looking for the winning numbers.

By Kelley R. Taylor Last updated 7 April 24

Tax Deadlines Do you know about all the various tax deadlines that fall on Tax Day?

By Katelyn Washington Published 6 April 24

Tax Deductions Do you qualify for the student loan interest deduction this year?

By Katelyn Washington Last updated 29 March 24

Tax Breaks Depending on your age, several tax credits, deductions, and amounts change — sometimes for the better.

By Kelley R. Taylor Last updated 19 March 24

Tax Credits President Biden is calling for new middle-class tax breaks including a mortgage tax credit.

By Kelley R. Taylor Last updated 9 March 24

Property Taxes A new proposal is raising questions about revenue generation in the Sunshine State.

By Kelley R. Taylor Published 22 February 24

State Tax Most states impose additional fees on electric vehicles, but these states don’t penalize EV owners, and some also offer other tax incentives.

By Kelley R. Taylor Last updated 5 February 24

Tax Filing Tax deductions, tax credit amounts, and some tax laws have changed for the 2024 tax filing season.

By Kelley R. Taylor Last updated 26 February 24

State Tax Thousands of Arizona families will need to report income from special child tax relief payments.

By Kelley R. Taylor Last updated 15 March 24

Tax Changes A new bipartisan tax deal could change the child tax credit, R&D expensing, and the employee retention tax credit.

By Kelley R. Taylor Last updated 22 January 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

How To Calculate Leave Travel Allowance For Tax Exemption

Home » B2B » How To Calculate Leave Travel Allowance For Tax Exemption

An employee receives several types of allowances over and above their regular salary. Medical allowance, House Rent Allowance, and Leave Travel Allowance (LTA) are a few examples of such allowances. The allowances are part of the employee’s CTC. The employee can claim tax exemption for the income through these allowances. Leave Travel Allowance is a helpful tax-saving option for employees.

Corporate travel comprises essential and non-essential travel. Traveling to a holiday destination is a non-essential business trip. Many companies provide Leave Travel Allowance to help employees visit tourist destinations or hometowns. An employee may travel alone or with family to enjoy the benefits of LTA. Corporate travel managers can integrate the company’s LTA rules into the travel policy for effective implementation. Keep reading to know how to calculate travel allowance for tax exemption.

Understanding Leave Travel Allowance

The Leave Travel Allowance or Leave Travel Concession is the facility by the employer to enable employees on leave to travel from their place of work to any destination within the country. The name Leave Travel Allowance implies the employee should be on leave during the period of traveling to claim the allowance.

Employers use the quantum of LTA while structuring the annual package or the CTC. It enables the employee to avail of the tax benefits under relevant sections of the Income Tax Act. The corporate travel manager needs awareness of the mandatory requirements to help employees claim tax exemption.

The deductions for tax exemptions cover travel expenses for the round trip. These do not apply to other expenses like boarding, sightseeing, or shopping. One should ensure the traveling expenses do not exceed the Leave Travel Allowance. If the expenditure for traveling is less than the LTA amount, then the remaining amount becomes part of the employee’s taxable income.

Conditions for claiming LTA

Leave Travel Allowance has two obvious requirements: leave and travel. The employee must be on leave during the travel as the aim is to facilitate a break from the official work. Benefits of the Leave Travel Allowance may not be available to all employees in the organization.

The employer has the prerogative to provide the facility to employees by considering employee grades and pay scales. Confirming the pay structure is advisable to know whether the employee is eligible for the Leave Travel Concession. Travel managers should inform the date to claim LTA TO all eligible employees to help them plan travel and submit relevant documents to the finance department.

One can claim the economy fare of an LCC (Low-cost carrier) if traveling by air. LTA also applies to rail journeys. First class AC fare for the shortest route of train travel is permissible to avail tax exemption through LTA.

One may also claim tax exemption for travel by other modes like road transport. The expenses should be equivalent to or lesser than the first class AC fare of the train. Though travel expenses by all modes of travel are acceptable for tax benefits, the employee must produce valid journey tickets or receipts. A spouse, children, siblings, and dependent parents can accompany the employee for LTA travel. The tax exemption is only available for two children.

Factors to consider for LTA calculation

One must find out when to claim Leave Travel Assistance before knowing how to calculate Leave Travel Allowance in salary. Tax breaks for LTA travel expenses are available twice in the four years’ block to eligible employees. The system of block years began in 1986. The current block is 2022 -2025. The employee may claim the tax exemption in the next block if they cannot undertake travel with leave during the current block as the tax break carries forward to the next block. The employee who did not avail of tax exemption during the block of 2018-2021 is eligible to claim the same by availing of LTA in the current block. They are also eligible for claiming tax breaks for the current block of 2022-2025.

Let us understand how to calculate travel allowance to avail tax benefits. An employee can only claim tax-benefits for actual travel expenses by the shortest route. The employee qualifies to claim the entire LTA amount for tax benefit if the actual travel expenses are the same as the LTA amount.

One can claim the amount of Rs 5000/- by submitting documents to prove travel expenses if the LTA amount as per CTC is Rs 5000/-. Travel expenses of Rs 4000/- will add Rs 1000/- to the total taxable income as the employee can only claim tax benefits for Rs 4000/-. Employees opting for the new tax regime are not eligible to claim a tax break.

Suggested Read: Are Travel Expenses Tax Deductible Or Not?

Automated travel management solution

Corporate travel managers should use an automated platform for travel management to help employees get the best deals on travel and hotel bookings if they are going on vacation. It will help them get to travel and hotel bookings without hassles. The automated travel booking systems backed by advanced hybrid engine technology enable complex activities like travel booking and reporting.

Paxes blends super-efficient travel management with HRMS integration options to improve the corporate travel program. Travel managers can configure travel policies by incorporating LTA details of employees to help them avail of tax benefits.

Leave Travel Allowance is a crucial part of income that helps reduce employee tax liability. One should ensure to know the company policy about how to calculate travel allowance before making full use of the benefits and claim travel allowances for tax exemption.

How To Calculate Travel Allowance FAQs

What is the percentage of travel allowance.

Travel allowance depends on company to company and different types of services used during travel. Generally it is 10%.

How much travel allowance is allowed in income tax?

Maximum conveyance allowance is equal to 19200. While LTA depends on the actual spent on the travel.

What is travel allowance in salary?

Fixed percentage of salary that is dedicated to work related travel of the employee.

What is the limit of Traveling allowance exemption?

The traveling allowance exemption limit is the actual amount spent on the journey.

How do I claim travel allowance on my taxes?

Keep accurate records, determine the nature of your travel allowance, calculate the allowable deduction/exemption, claim deduction/exemption in tax return, and keep supporting documents ready.

Can I carry forward the unclaimed LTA of a block year to the next block year?

No, you cannot carry it forward.

What expenses can be included under LTA?

Transportation expenses, accommodation expenses, sightseeing expenses, and food and beverage expenses.

What factors should be considered when calculating travel allowance?

When calculating travel allowances, consider factors like destination, duration, accommodation costs, meals, transportation, and incidental expenses. Also, account for your organization policies, tax regulations, and the purpose of the trip. Accurate record-keeping and expense receipts are crucial.

Is there a standard formula for calculating travel allowance?

There is not a universal standard formula for travel allowance, as it varies widely among organizations and regions. Some may use per diem rates, while others calculate expenses individually. Compliance with local tax laws and company policies typically guides the calculation method used.

Pratyush is a traveling enthusiast who always looks for innovations in business travel management. He has 5 years of experience writing content on corporate travel management and working closely with expert business travel facilitators.

Leave a Reply

Related posts.

Benefits Of Cloud-Based Corporate Travel Management Platform

Long gone are the days of bulky server setups and standalone offline computer applications. The world has moved on to the advanced technology of execution and storage also known as cloud-based systems. Almost no industry Read more…

What Are The Benefits Of Hotel Dynamic Pricing?

The hospitality industry is recuperating steadily from the pandemic hit in 2019-2022. The industry has shown an upward trend and several adaptations in the way of conducting business. Hotel suppliers are evolving with numerous pricing Read more…

Guide On How To Start A Corporate Travel Agency In UAE?

Starting your corporate travel agency can be ecstatic in imagination; but tedious in reality. While the profits may seem enticing, the work needed to earn them can be daunting. However, the labor is worth every Read more…

Let's get started!

Thanks for submitting your details.

We'll get back to you shortly.

How to prepare for the new tax year 2024/25 - from tax codes to child benefit

Here are some ways you can brace for the new tax year and maximise your savings.

- Newsletter sign up Newsletter

The beginning of a new tax year is often a time of major shake-ups. The start to the 2024/25 year has been no different.

As well as tax changes , investors have been hit by a cut to the CGT tax-free allowance , as well as double taxation on second homes and the axing of stamp duty relief for multiple property ownership.

It comes hot on the heels of several other major changes, such as inflation-busting hikes to household bills , the energy price cap dropping by 12.3% and a rise in the state pension .

- Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

With the new tax year now upon us, we’ve highlighted everything you need to know about filing self-assessment tax returns for the new tax year - while being in the good books of the taxman.

New tax year 2024/25 checklist

Here are some pointers to keep in mind when approaching the new tax year:

1. Tax filing for beginners

For those who are filing their tax returns for the first time, they will have to register with HMRC . After registering, you will receive a Unique Taxpayer Reference which will then be used for all future tax returns.

2. Know your tax code

It’s important to know your tax code to work out how much income tax will be taken by the HMRC . These are the numbers and letters on your payslip or pension statement.

They can be a hassle to fix if you get the wrong one, as you could either be owed in large amounts or be left with a hefty bill to pay back. The personal allowance and emergency tax code remain the same for the new tax year - at £12,570 and 1257L respectively. So luckily, you won’t have to update any employee tax codes unless you have been specifically told to by HMRC.

3. Check your tax allowances

Many will have taken advantage of capital tax gains allowance and ISA limits before 5 April 2024 - when the 2023/24 tax year came to an end. But what are the allowances for 2024/25?

With capital gains tax allowance, you can now get £3,000 on your returns (down from £6,000 last year). Luckily, ISAs have been refreshed , so it’s worth considering using them to shield your cash from the taxman. Keep in mind that you have an ISA allowance of £20,000 which applies to cash ISAs , stocks and shares ISAs , lifetime ISAs and innovative finance ISAs.

A 2p National Insurance cut announced during the Spring Budget means that the average worker on £35,400 a year will now be better off by more than £900 (when the January 2p cut is also taken into account). However, you may still be paying more tax overall due to fiscal drag .

You may also consider paying into your children's or spouse’s pension, which would be separate from your annual pension allowance of £60,000.

4. Self-assessment tax returns

Self-assessment tax returns are not just for those who are self-employed. Anybody who rents out property, or gets additional income from savings or investments, is also required to pay tax.

And with more people being brought into higher tax bands due to fiscal drag , it’s worth having a look to avoid being penalised in the future. If you’re unsure about whether you’re eligible, you can check on the UK Government website .

5. Tax relief for couples

For some married couples, tax bill reliefs are available under the Marriage Allowance , where one partner can transfer some of their personal tax allowance to the other to reduce the total tax paid by the couple .

You can transfer £1,260 of your personal allowance to your husband, wife or civil partner, which in turn will reduce their tax by up to £252 in the tax year. But only those who earn between £12,570 and £50,270 can claim this benefit.

6. Claim child benefit

Changes to child benefit made in the Spring Budget last month mean that you may be eligible for child benefit now if you weren’t before.

Under the new guidelines, the income threshold for parents would be raised from £50,000 to £60,000, which means that anyone who earns under this limit will be able to keep all of their child benefit. According to the government’s estimates, this would boost nearly half a million families with a surplus of £1,260 on average.

7. Avoiding scams

Self-assessment tax scams are rife, especially with the onset of a new tax year. Last year, HMRC received over 130,000 reports about tax scams, and almost half of them were offering fake tax rebates.

This means that you should take extra steps to avoid getting caught in one of these scams, especially with the rise of AI and the promise of saving money.

If you do get targeted by a self-assessment scam, you can forward it to HMRC on 60599 or [email protected] . To report any tax scam phone calls to HMRC, you can do it using the GOV.UK website.

It’s also worth reporting this to Action Fraud and contacting your bank immediately if you have fallen for a tax scam. They may be able to help freeze any payments being made from your account to scammers.

Oojal has a background in consumer journalism and is interested in helping people make the most of their money. Before joining MoneyWeek, she worked for Look After My Bills, a personal finance website where she covered guides on household bills and money-saving deals. Her bylines can be found on Newsquest, Voice Wales, DIVA and Sony Music and she has explored subjects ranging from luxury real estate to the cost of living, politics and LGBTQIA+ issues. Outside of work, Oojal enjoys travelling, going to the movies and learning Spanish with a little green owl.

MoneyWeek Travel The new Hôtel des Grands Voyageurs exudes timeless elegance from the golden age of travel, says Matthew Partridge

By Dr Matthew Partridge Published 5 April 24

House prices have fallen on a monthly basis for the first time in six months, according to Halifax. Are property values set to drop again?

By Henry Sandercock Published 5 April 24

Useful links

- Get the MoneyWeek newsletter

- Latest Issue

- Financial glossary

- MoneyWeek Wealth Summit

- Money Masterclass

Most Popular

- Best savings accounts

- Where will house prices go?

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Moneyweek is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.

- Business Today

- India Today

- India Today Gaming

- Cosmopolitan

- Harper's Bazaar

- Brides Today

- Aajtak Campus

- Magazine Cover Story Editor's Note Deep Dive Interview The Buzz

- BT TV Market Today Easynomics Drive Today BT Explainer

- Market Today Trending Stocks Indices Stocks List Stocks News Share Market News IPO Corner

- Tech Today Unbox Today Authen Tech Tech Deck Tech Shorts

- Money Today Tax Investment Insurance Tools & Calculator

- Mutual Funds

- Industry Banking IT Auto Energy Commodities Pharma Real Estate Telecom

- Visual Stories

INDICES ANALYSIS

Mutual funds.

- Cover Story

- Editor's Note

- Market Today

- Drive Today

- BT Explainer

- Trending Stocks

- Stocks List

- Stocks News

- Share Market News

- Unbox Today

- Authen Tech

- Tech Shorts

- Tools & Calculator

- Commodities

- Real Estate

- Economic Indicators

- BT-TR GCC Listing

Choosing New Tax Regime in FY25? Here are the deductions that are allowed under new structure

It should be noted that the adoption of new tax regime comes with certain restrictions. like, exemption claims associated with specific deductions, including house rent allowance(hra), leave travel allowance (lta), sections 80c, 80d, etc, will remain inaccessible..

- Updated Mar 30, 2024, 12:56 PM IST

The Government introduced a New Tax Regime, under Section 115BAC, as an optional alternative to the pre-existing Old Tax Regime. Enforced from April 1, 2020 (FY 2020-21), it was initially aimed at individuals and Hindu Undivided Families (HUF). After operating for three years in this manner, Union Finance Minister Nirmala Sitharaman announced during the Union Budget 2023 that going forward, this New Tax Regime would become the default tax system for those taxpayers who do not express any preference at the commencement of the new fiscal year (FY2025).

Constructed with revised tax slabs and concessional tax rates, it applies uniformly to all categories of taxpayers inclusive of individuals, HUFs and Association Of Persons (AOPs).

Furthermore, during her budget speech for the financial year 2023-24, Sitharaman stated that policy proposals falling under the new income taxation regime have been structured such that they leave more disposable capital with the taxpayers.

The decision on how best to utilise their money is no longer influenced by governmental incentives or disincentives but remains solely the discretion of each taxpayer, the FM had said.

However, it should be noted that the adoption of this new taxing system comes with certain restrictions. Like, exemption claims associated with specific deductions including House Rent Allowance(HRA), Leave Travel Allowance(LTA), Sections 80C ,80D etc, will still remain inaccessible. These benefits were specifically designed for use within the context of the Old Tax Regime.

In Union Budget 2023, FM Sitharaman introduced 5 key changes to encourage taxpayers to adopt the New Tax Regime. It is to be noted that salaried individuals can claim two deductions under the new tax regime -- Standard Deduction and deduction under section 80CCD (2) for employer's contribution to NPS.

Here are the latest changes in the New Tax Regime:

1. Standard Deduction and Family Pension Deduction

In the case of salary income, the Standard Deduction of Rs 50,000, which was previously only available under the Old Tax Regime, was extended to the new tax regime. Under the New Tax Regime, you can enjoy a tax-free income of Rs 7.5 lakhs, which is after you apply the standard deduction and tax rebate.

Family pensioners can also benefit from this deduction. They can claim either Rs 15,000 or 1/3rd (33.33 per cent) of their pension, whichever is lower.

It is to be noted that the benefit of the Standard Deduction will be allowed to pensioners only if the pension is taxable as salary income. If someone chooses the pension as income from the other source, then the benefit of the Standard Deduction will not be applicable.

Documents required for standard deduction

No supporting documents are required to claim the Standard Deduction. But to file the IT return of a salaried individual, the following documents are required.

> Bank statements of the previous fiscal year.

> Income statements from interest or fixed deposits.

> TDS (Tax Deducted at Source) certificates.

> Investment documents.

> Form 26AS and Form 1040.

2. Deduction under Section 80CCD(2)

Section 80CCD(2) applies to only salaried individuals and not to self-employed individuals. The deductions under this section can be availed over and above those of Section 80CCD(1).

Section 80CCD(2) allows a salaried individual to claim the following deduction:

Central Government or State Government Employer: Up to 14 per cent of their salary (basic + DA)

Any other employer: Maximum deduction of 10 per cent of salary (basic + DA)

Under the updated tax regulations, individuals can avail the advantage of employer contributions to their National Pension System (NPS) account as per Section 80CCD(2) of the Income Tax Act. This deduction is limited to the employer's NPS contributions made on behalf of the employee, up to 10 per cent of the employee's salary (Basic + DA).

The new tax regime also offers exemptions for voluntary retirement, gratuity, and leave encashment.

3. New Tax Regime Exemption List (not exclusive)

> Transport Allowances w.r.t. Person with Disabilities (PwD)

> Conveyance Allowance

> Travel/ Tour/ Transfer Compensation

> Exemptions for Voluntary Retirement Scheme u/ Section 10(10C)

> Gratuity Amount u/ Section 10(10)

> Leave Encashment u/ Section 10(10AA)

> Deductions on Deposits in Agniveer Corpus Fund u/ Section 80CCH(2)

Tax slabs of New Tax Regime applicable for FY2024-25

Tax Slab Rates

Up to Rs. 3L NIL

Rs 3L to Rs 6L 5% on income which exceeds Rs 3,00,000

Rs 6L to Rs 9L Rs 15,000 + 10% on income more than Rs 6,00,000

Rs 9L to Rs 12L Rs 45,000 + 15% on income more than Rs 9,00,000

Rs 12L to Rs 15L Rs 90,000 + 20% on income more than Rs 12,00,000

Above Rs 15L Rs 150,000 + 30% on income more than Rs 15,00,000

TOP STORIES

- Advertise with us

- Privacy Policy

- Terms and Conditions

- Press Releases

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today

Add Business Today to Home Screen

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- For International Visitors

- Know Before You Visit

Customs Duty Information

What is a customs duty.

Customs Duty is a tariff or tax imposed on goods when transported across international borders. The purpose of Customs Duty is to protect each country's economy, residents, jobs, environment, etc., by controlling the flow of goods, especially restrictive and prohibited goods, into and out of the country.

Dutiable refers to articles on which Customs Duty may have to be paid. Each article has a specific duty rate, which is determined by a number of factors, including where you acquired the article, where it was made, and what it is made of. Also, anything you bring back that you did not have when you left the United States must be "declared." For example, you would declare alterations made in a foreign country to a suit you already owned, and any gifts you acquired outside the United States. American Goods Returned (AGR) do not have to be declared, but you must be prepared to prove to U.S. Customs and Border Protection the articles are AGR or pay Customs duty.

The Customs Duty Rate is a percentage. This percentage is determined by the total purchased value of the article(s) paid at a foreign country and not based on factors such as quality, size, or weight. The Harmonized Tariff System (HTS) provides duty rates for virtually every existing item. CBP uses the Harmonized Tariff Schedule of the United States Annotated (HTSUS), which is a reference manual that the provides the applicable tariff rates and statistical categories for all merchandise imported into the U.S.

Duty-Free Shop articles sold in a Customs duty-free shop are free only for the country in which that shop is located. Therefore, if your acquired articles exceed your personal exemption/allowance, the articles you purchased in Customs duty-free shop, whether in the United States or abroad, will be subject to Customs duty upon entering your destination country. Articles purchased in a American Customs duty-free shop are also subject to U.S. Customs duty if you bring them into the United States. For example, if you buy alcoholic beverages in a Customs duty-free shop in New York before entering Canada and then bring them back into the United States, they will be subject to Customs duty and Internal Revenue Service tax (IRT).

Determining Customs Duty

The flat duty rate will apply to articles that are dutiable but that cannot be included in your personal exemption, even if you have not exceeded the exemption. For example, alcoholic beverages. If you return from Europe with $200 worth of purchases, including two liters of liquor, one liter will be duty-free under your returning resident personal allowance/exemption. The other will be dutiable at 3 percent, plus any Internal Revenue Tax (IRT) that is due.

A joint declaration is a Customs declaration that can be made by family members who live in the same household and return to the United States together. These travelers can combine their purchases to take advantage of a combined flat duty rate, no matter which family member owns a given item. The combined value of merchandise subject to a flat duty rate for a family of four traveling together would be $4,000. Purchase totals must be rounded to the nearest dollar amount.

Tobacco Products

Returning resident travelers may import tobacco products only in quantities not exceeding the amounts specified in the personal exemptions for which the traveler qualifies (not more than 200 cigarettes and 100 cigars if arriving from other than a beneficiary country and insular possession). Any quantities of tobacco products not permitted by a personal exemption are subject to detention, seizure, penalties, abandonment, and destruction. Tobacco products are typically purchased in duty-free stores, on sea carriers operating internationally or in foreign stores. These products are usually marked "Tax Exempt. For Use Outside the United States," or "U.S. Tax Exempt For Use Outside the United States."

For example, a returning resident is eligible for the $800 duty-free personal exemption every 31 days, having remained for no less than 48 hours beyond the territorial limits of the United States except U.S. Virgin Islands, in a contiguous country which maintains free zone or free port, has remained beyond the territorial limits of the United States not to exceed 24 hours. This exemption includes not more than 200 cigarettes and 100 cigars:

- If the resident declares 400 previously exported cigarettes and proves American Goods Returning (AGR) , the resident would be permitted or allowed to bring back his AGR exempt from Customs duty.

- If the resident declares 400 cigarettes, of which 200 are proven AGR or previously exported and 200 not AGR or not previously exported, the resident would be permitted to bring back his 200 previously exported cigarettes tax and Internal Revenue Tax (IRT) free under his exemption.

- The tobacco exemption is available to each adult 21 years of age or over.

In December 2014, President Obama announced his intention to re-establish diplomatic relations with Cuba. The President did not lift the embargo against Cuba. Absent a democratic or transitional government in Cuba, lifting the embargo requires a legislative statutory change. Since the announcement, however, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) has amended the Cuba Assets Control Regulations (CACR), effective January 16, 2015, to authorize travel within certain categories to and from Cuba and to allow certain imports from and exports to Cuba.

All travelers, including those from Cuba, must comply with all applicable laws and regulations. This includes the Harmonized Tariff Schedule of the United States (“HTSUS”) (2016) limitations on personal exemptions and rules of duty extended to non-residents and returning U.S. residents.

Persons subject to U.S. jurisdiction are authorized to engage in all transactions, including payments necessary to import certain goods and services produced by independent Cuban entrepreneurs as determined by the State Department and set forth in the State Department’s Section 515.582 list located at FACT SHEET: U.S. Department of State Section 515.582 List . On October 17, 2016, the Office of Foreign Asset Control relaxed restrictions so authorized travelers, arriving direct from Cuba, are now able to bring Cuban merchandise for personal use back to the United States and qualify for the U.S. Resident exemption (HTSUS 9804.00.65, which allows up to $800 total in goods, and adults 21 and older may include 1 liter of alcohol, 200 cigarettes, and 100 cigars). This exemption also applies to travelers, arriving from any country in the world, with declared Cuban merchandise.

Declared amounts in excess of the exemption are subject to a flat 4% rate of duty, and any applicable IRS taxes, pursuant to HTSUS 9816.00.20 and 19 CFR 148.101, which impose a duty rate of 4% of the fair retail value on goods from a Column 2 country.

Regarding goods: The Department of State will, in accordance with the State Department’s Section 515.582, issue a list of prohibited goods. Placement on the list means that any listed good falls within certain Sections and Chapters of the HTSUS which do not qualify for this exception.

Regarding entrepreneurs : The Cuban entity must be a private business, such as a self-employed entrepreneur or other private entity, not owned or controlled by the Government of Cuba. Travelers engaging in these transactions are required to obtain evidence that demonstrates the goods purchased were obtained from a Cuban entrepreneur, as described above, and should be prepared to furnish evidence of such to U.S. Government authorities upon request. Evidence may include a copy of the entrepreneur’s license and/or an invoice and/or purchase order demonstrating the goods were purchased from a specific Cuban entrepreneur. Whether a traveler presents adequate evidence that a good qualifies from importation and that it was bought from a licensed independent Cuban entrepreneur shall be determined on a case-by-case basis by the inspecting CBP officer.

Imports under Section 515.582 (i.e., imports from licensed independent entrepreneurs not on the Department of State’s prohibited list) must comply with all current U.S. Customs and Border Protection (CBP) formal and informal entry requirements, as applicable. This means that, while there is no value cap on the amount of goods that may be imported under this provision, the applicable duties in the HTSUS must be considered.

In particular, HTSUS 9804.00.65 allows for the duty-free importation of personal-use articles from a Column 2 country when the fair retail value of such goods is under $800. Also see 19 C.F.R. 148.33. HTSUS 9816.00.20 establishes a duty rate of 4% of the fair retail value for personal-use articles under $1,000 imported from a Column 2 country. Thus, any articles imported under this section for personal use with a value of under $800 can be imported duty free, and any articles imported for personal use with a value between $800 and $1800, will be subject to a flat 4% duty rate. Any articles valued over $1800, regardless of whether for personal use, will be subject to entry and should be classified, appraised, and assessed duty appropriately under the specific HTSUS Column 2 rates. Also see 19 C.F.R. 148.101 and 148.102. Any commercial importation, i.e., not for personal use, is subject to entry requirements and payment of applicable duties, fees, and taxes.

While these revised regulations may facilitate certain travel and trade with Cuba, all other laws and regulations applicable to international travel and the importation/exportation of goods remain in full effect. This means that all United States agency requirements applicable to a particular importation must be met and fully complied with, such as the regulations of the Food and Drug Administration, the Consumer Product Safety Commission, and the Animal and Plant Health Inspection Service.

Alcoholic Beverages

One American liter (33.8 fl. oz.) of alcoholic beverages may be included in your returning resident personal exemption if:

- You are at least 21 years old.

- It is intended exclusively for your personal use and not for sale.

- It does not violate the laws of the state in which you arrive.

Federal and state regulations allow you to bring back one liter of an alcoholic beverage for personal use duty-free. However, states may allow you to bring back more than one liter, but you will have to pay any applicable Customs duty and IRT.

While federal regulations do not specify a limit on the amount of alcohol you may bring back beyond the personal exemption amount, unusual quantities may raise suspicions that you are importing the alcohol for other purposes, such as for resale. CBP officers enforce the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) laws, rules, and regulations and are authorized to make on-the-spot determinations that an importation is for commercial purposes. If such determination is made, it may require you to obtain a permit and file a formal entry to import the alcohol before the alcohol is released. If you intend to bring back a substantial quantity of alcohol for your personal use, you should contact the U.S. Port of Entry (POE) through which you will be re-entering and make prior arrangements for the importation.

Also, state laws might limit the amount of alcohol you can bring in without a license. If you arrive in a state that has limitations on the amount of alcohol you may bring in without a license, that state's law will be enforced by CBP, even though it may be more restrictive than federal regulations. We recommend that you check with the state government about their limitations on quantities allowed for personal importation and additional state taxes that may apply. Ideally, this information should be obtained before traveling.

In brief, for both alcohol and cigarettes, the quantities eligible for duty-free treatment may be included in your $800 or $1,600 returning resident personal exemption, just as any other purchase should be. But unlike other kinds of merchandise, amounts beyond those discussed here as being duty-free are taxed, even if you have not exceeded, or even met, your personal exemption. For example, your exemption is $800 and you bring back three liters of wine and nothing else, two of those liters will be dutiable and IR taxed. Federal law prohibits business-to-private consumer shipping of alcoholic beverages by mail within the United States.

How to Pay Customs Duty

If you owe Customs duty, you must pay it before the conclusion of your CBP processing. You may pay it in any of the following ways:

- U.S. currency only.

- Personal check in the exact amount, drawn on a U.S. bank, made payable to U.S. Customs and Border Protection. You must present identification, such as a passport or U.S. driver's license. CBP does not accept checks bearing second-party endorsement.

- Government check, money order or traveler's check if the amount does not exceed the duty owed by more than $50.

In some locations/POEs, you may pay duty with either MasterCard or VISA credit cards.

Increased Duty Rates

Items from certain countries.

Under what is known as its "301" authority, the United States may impose a much higher than normal duty rate on products from certain countries. Currently, the United States has imposed a 100 percent rate of duty on certain products of Austria, Belgium, Denmark, Finland, France, The Federal Republic of Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden and the Ukraine. If you should bring more of any of these products back with you than fall within your exemption or flat rate of duty, (see below) you will pay as much in duty as you paid for the product or products.

While most of the products listed are not the type of goods that travelers would purchase in sufficient quantities to exceed their exemption, diamonds from the Ukraine are subject to the 100 percent duty and might easily exceed the exemption amount.

For information on countries that may become subject to a higher than normal duty rate, check the Department of Commerce Web site.

Countries With Free or Reduced Customs Duty Rates

The United States gives Customs duty preferences-that is, conditionally free or subject to reduced rates-to certain designated beneficiary developing countries under a trade program called the Generalized System of Preferences (GSP). Some products that would otherwise be dutiable are not when they are wholly the growth, product, or manufacture of a beneficiary GSP country. Visit the Office of United States Trade Representative website for additional GSP information.

- Many products from Caribbean and Andean countries are exempt from duty under the Caribbean Basin Initiative (CBI), Caribbean Basin Trade Partnership Act, Andean Trade Preference Act and the Andean Trade Promotion and Drug Eradication Act.

- Many products from certain sub-Saharan African countries are exempt from duty under the African Growth and Opportunity Act.

- Most products from Israel, Jordan, Chile and Singapore may also enter the United States either free of duty or at a reduced rate under the U.S. free trade agreements with those countries.

- The North American Free Trade Agreement (NAFTA) went into effect in 1994. If you are returning from Canada or Mexico , your goods are eligible for free or reduced duty rates if they were grown, manufactured, or produced in Canada or Mexico, as defined by the Act.

Additional information on these special trade programs can be found on the CBP Web site.

Household Effects & Personal Effects - Customs Duty Guidance

Household effects conditionally included are duty-free. These include such items as furniture, carpets, paintings, tableware, stereos, linens, and similar household furnishings; tools of the trade, professional books, implements, and instruments.

You may import household effects you acquired abroad duty-free if:

- You used them abroad for no less than one year.

- They are not intended for any other person or for sale.

For Customs purposes, clothing, jewelry, photography equipment, portable radios, and vehicles are considered personal effects and cannot be brought in duty-free as household effects. However, duty is usually waived on personal effects more than one year of age. All vehicles are dutiable.

Mailing and Shipping Goods - Customs Duty Guidance

Unaccompanied purchases are goods you bought on a trip that are being mailed or shipped to you in the United States. In other words, you are not carrying the goods with you when you return. If your unaccompanied purchases are from an insular possession (IP) or a Caribbean Basin Initiative (CBI) country and are being imported within 30 days and sent directly from those locations to the United States, you may enter them as follows:

- Up to $1,600 in goods will be duty-free under your personal exemption if the merchandise is from an IP.

- Up to $800 in goods will be duty-free if it is from a CBI or Andean country.

- Any additional amount, up to $1,000, in goods will be dutiable at a flat rate (3%).

To take advantage of the Customs duty-free exemption for unaccompanied tourist purchases (mailing/shipping) from an IP or CBI country:

Step 1. At place and time of purchase, ask your merchant to hold your item until you send him or her a copy of CBP Form 255 (Declaration of Unaccompanied Articles), which must be affixed to the package when it is shipped.

Step 2. (a) On your declaration form (CBP Form 6059B), list everything you acquired on your trip that is accompanying you. You must also complete a separate Declaration of Unaccompanied Articles form (CBP Form 255) for each package or container that will be sent to you after you arrive in the United States. This form may be available where you make your purchase. If not, you may find the form on the CBP website.

Step 3. When you return to the United States, the CBP officer will: (a) collect Customs duty and any tax due on the dutiable goods you have brought with you; (b) verify your list of unaccompanied articles with your sales receipts; (c) validate your CBP Form 255 to determine if your purchases are duty-free under your personal exemption ($1,600 or $800) or if the purchases are subject to a flat rate of duty.

Step 4. Two copies of the three-part CBP Form 255 will be returned to you. Send the yellow copy of the CBP Form 255 to the foreign shopkeeper or vendor holding your purchase, and keep the other copy for your records.

Step 5. When the merchant gets your CBP Form 255, he or she must place it in an envelope and attach the envelope securely to the outside wrapping of the package or container. The merchant must also mark each package "Unaccompanied Purchase." Please remember that each package or container must have its own CBP Form 255 attached , the most important step to follow in order to gain the benefits allowed under this procedure.

Step 6. If your package has been mailed, the U.S. Postal Service will deliver it after it clears Customs. If you owe duty, the Postal Service will collect the duty along with a postal handling fee. If a freight service transports your package, they will notify you of its arrival and you must go to their office holding the shipment and complete the CBP entry procedure. If you owe duty or tax, you will need to pay it at that time in order to secure the release of the goods. You could also hire a customs customhouse broker to do this for you. However, be aware that customhouse brokers are private businesses and are not CBP employees, and they charge fees for their services.

If freight or express packages from your trip landed in the U.S. before you return and you have not made arrangements to pick them up, CBP will authorize their placement into general order bonded warehouse or public storage after 15 days (days for perishable, flammable, explosives). This storage and all other related charges (transportation, demurrage, handling) will be at your risk and expense. If the goods are not claimed within six months, they will be sold at auction.

Per U.S. Postal Service regulations, packages sent by mail and not claimed within 30 days from the date of U.S. arrival will be returned to the sender unless the amount of duty is being protested.

- Skip to navigation

- Skip to main content

Tax-free travel allowance increases

On this page, what has changed.

Are you an employer or self-employed professional without staff ( zzp'er )? The tax-free travel allowance ( reiskostenvergoeding ) has increased from €0.21 per kilometre to €0.23 per kilometre from 1 January 2024.

Are you self-employed ( zzp'er) ? If you are an entrepreneur for income tax purposes , you can deduct the amount per kilometre from your profit.

Employers can refund their employees’ travel costs free of tax. This also applies to public transport costs. And for taxi, boat, or airplane costs, within reason.

Employers may also choose to refund more than the tax-free kilometre allowance of €0.23. The surplus counts as wages and you have to pay wage tax over this. You can also make use of the discretionary scope in the work-related cost scheme (WKR) for the surplus. This way, the extra travel allowance remains untaxed.

The tax-free travel allowance does not apply to employers who offer their employees a company car or bicycle.

- employers who refund their employees’ travel costs

- self-employed professionals without staff ( zzp’ers ) who deduct travel expenses from their profit

The change in law has entered into effect on 1 January 2024.

This article is related to:

Related articles.

- Work-related costs scheme: staff allowances

- Deductions and tax schemes

- Company use of a private car

External links

- 2024 Tax Plan: essential steps for society and for the tax system (Dutch government)

Questions relating to this article?

Please contact the Netherlands Enterprise Agency, RVO

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Understanding business travel deductions

More in news.

- Topics in the News

- News Releases

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IRS Tax Tip 2023-15, February 7, 2023

Whether someone travels for work once a year or once a month, figuring out travel expense tax write-offs might seem confusing. The IRS has information to help all business travelers properly claim these valuable deductions.

Here are some tax details all business travelers should know

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. A taxpayer is traveling away from home if they are away for longer than an ordinary day's work and they need to sleep to meet the demands of their work while away.

Travel expenses must be ordinary and necessary. They can't be lavish, extravagant or for personal purposes.

Employers can deduct travel expenses paid or incurred during a temporary work assignment if the assignment length does not exceed one year.

Travel expenses for conventions are deductible if attendance benefits the business. There are special rules for conventions held outside North America .

Deductible travel expenses include:

- Travel by airplane, train, bus or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

- Shipping of baggage and sample or display material between regular and temporary work locations.

- Using a personally owned car for business.

- Lodging and meals .

- Dry cleaning and laundry.

- Business calls and communication.

- Tips paid for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to the business travel.

Self-employed individuals or farmers with travel deductions

- Those who are self-employed can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) .

- Farmers can use Schedule F (Form 1040), Profit or Loss From Farming .

Travel deductions for the National Guard or military reserves

National Guard or military reserve servicemembers can claim a deduction for unreimbursed travel expenses paid during the performance of their duty .

Recordkeeping

Well-organized records make it easier to prepare a tax return. Keep records such as receipts, canceled checks and other documents that support a deduction.

Subscribe to IRS Tax Tips

Thank you for signing up!

AI Summary to Minimize your effort

Transport Allowance for Salaried Employees - Meaning, Exemption, Calculation, Rules

Updated on : Mar 19th, 2024

11 min read

Transport Allowance is an allowance a company or employer provides to employees to compensate for their travel from their residence to the workplace. It is a type of special allowance. Like other allowances, transport allowance is a part of CTC and has fixed pay.

As the employee’s income tax computation is done by their employers for tax deduction purposes, salaried taxpayers may or may not be very concerned about their salary structuring and details of various kinds of allowances and exemptions available to them even before arriving at gross total income. However, understanding allowances and exemptions provided on such allowances is also significant for tax planning. This helps them choose the right CTC structure and lawfully claim the tax benefit to which they are entitled. Additionally the availability of the exemption depends on the tax regime chosen by the taxpayer.

This article will discuss one such allowance, i.e., transport allowance and its tax provisions.

What is Transport Allowance?

Transport allowance could mean allowance provided for the purpose of transport from residence to the place of work . However, transport allowance under Section 10(14) of Income-tax Act,1961 read with rule 2BB of Income-tax rules can be either of the following:

- Allowance granted to an employee to meet his expenditure for the purpose of commuting between his place of residence and office/place of duty

- Allowance granted to an employee working in the transport business to meet his personal expenditure during his duty performed in the course of running such transport from one place to another place provided the employee is not in receipt of daily allowance

Transport allowance is taxable in the hands of the employee since it is added to their gross salaries. However, employees can claim tax exemption for transport allowance as per the exemption limit.

Quantum of Exemption

Section 10(14) read with Rule 2BB provides for transport allowance exemption. The amount of exemption is as follows:

Changes by Finance Act, 2018

From the financial year 2018-2019, the tax exemption for medical and transport allowances has been merged. The Income Tax Department introduced a standard deduction in place of transport and medical allowance. From the financial year 2019-2020, the standard deduction is Rs 50,000, which covers the transport and medical allowance.

Thus, employees can claim the deduction of Rs 50,000 while filing their ITR without producing any bills or documents. Employers will consider the standard deduction to compute the net taxable salary while calculating the TDS. This change shall take effect from the financial year 2018-19. Accordingly, no separate transport allowance of Rs 1,600 per month is available to employees other than physically challenged employees and employees of a transport business. The limit of Rs 40,000 has been increased to Rs 50,000 in the Interim Budget 2019. Know the highlights of the Interim Budget 2019 here.

Difference Between Transport Allowance and Conveyance Allowance

A transport allowance is an allowance given to meet commuting expenses between the place of residence and office or to meet the personal expenditure of an employee of a transport business.

A conveyance allowance is an allowance granted to meet the expenditure on conveyance in the performance of office duty.

Transport allowance is fully taxable for all employees in both regimes. However it is exempt under both tax regimes to the extent of 3,200 per month for the employees who are physically challenged such as blind/deaf/dumb or orthopedically handicapped with disability of lower extremities. C onveyance allowance is exempt from tax only to the extent of actual expenditure incurred.

Illustration

Let us derive the taxable income of an employee for the FY 2017-18, FY 2018-19, FY 2019-20 and onwards.

Let us look the same illustration for an employee who is specially abled.

Transport Allowance Under the New Tax Regime

From the FY 2020-21, the government introduced the new tax regime for individual and HUF taxpayers under section 115BAC. In the new tax regime, there are flat tax rates and no deductions or exemptions. For example, an individual opting for the new tax regime cannot claim exemptions for HRA and others. Also, the individual cannot claim deductions for any tax-saving investments. However, the new tax regime allows an individual to claim the following tax-exempt allowances:

- Allowance by the employer to meet the cost of travel on tour or transfer. It includes an allowance towards the cost of travel, such as airfare, rail fare and other transportation costs.

- Any allowance by the employer to meet the ordinary daily charges incurred by an employee on account of absence from the usual place of duty. The allowance should be in respect of the tour or for the period of the journey in connection with a transfer. The allowance includes expenses an employee incurs for food and other daily costs while travelling.

- Allowance to meet conveyance expense incurred while performing duties of an office or employment of profit. However, in this case, the employer should not provide a free conveyance to the employee. The allowance includes travelling expenses an employee incurs while performing official duties.