Time and Materials (T&M) Contracts: How They Work and Free Template

Accurately estimating any construction job is a challenge. If the estimate is too large, the contractor loses the project to a lower bidder. Too small, and the project ends up in the red. Adding to the difficulty, the contractor’s costs can change between the estimate and the completion of work. Materials costs could rise, laborers could drop out of the workforce, new regulations could be imposed. That’s why some contractors propose a time and materials contract.

What Is a Time and Materials (T&M) Contract?

With a time and materials contract, instead of quoting a fixed price for the entire project, a contract will describe the rough scope of the job along with a quote for a fixed hourly wage plus the cost of materials. The contractor might also include a maximum price for the project — commonly called a “not-to-exceed” clause — as a guarantee to protect the client against runaway costs.

Fixed price vs. time and materials:

There are some important differences between fixed price and time and materials contracts. Fixed price contracts , in which the final price is determined before work begins, are more common than time and materials contracts. Fixed price contracts are best suited to projects that are well understood by both the client and the contractor and, therefore, the time needed and costs required are predictable.

In fixed price contracts, if job specifications change after the work begins, client and contractor must negotiate an amendment to their agreement. But a time and materials contract usually specifies only the purpose of the job along with hourly labor rates and materials costs. They’re suited to situations with less predictability because if the job specifications change no renegotiation is required; it just costs more in time and materials.

How Do Time and Materials Contracts Work?

The contractor and client agree on the goal of the project and specify the finished product. It might not be feasible to define all the steps along the way. Within that framework, they agree on hourly wages for the contractor’s employees, as well as for subcontractors. The contractor also specifies the materials to be used, along with a markup rate for material prices.

When to Use Time and Materials Contracts?

Time and materials contracts are best when the scope of the job or its duration cannot be determined before work begins, as is sometimes the case in construction projects. When renovating an old building, for example, removing walls may uncover rot or other damage not visible before the job started. Another situation ripe for a time and materials contract is when the materials prices are likely to change. Perhaps lumber costs or gas prices are predicted to rise significantly over the duration of the job.

What Should Be Included in a Time and Materials Contract?

Besides specifying the goals of the project, a time and materials contract should include a fixed price for labor that includes wages, overhead, general and administrative costs and a markup for profit. Materials cost should include freight, taxes and a standard markup — usually between 15% and 35%. Where appropriate, the contract should also specify a maximum price by way of a not-to-exceed clause.

Parts of a Time and Materials Contract

The goal of any contract is to meet the project requirements, cover the contractor’s costs and overhead and deliver a profit to the contractor. To that end, these items are usually included in a time and materials contract.

- Labor rates: This should include the hourly wages for not only the laborers and subcontractors, but also administrators who manage the project and billing.

- Maximum labor hours: To guard against runaway costs and protect the client, a maximum number of labor hours can be specified. Any excess hours must be absorbed by the contractor.

- Materials markup: The client will be billed for the actual cost of materials (including freight), plus a specified markup, usually between 15% and 35%.

- Time and materials not-to-exceed clause (T&M NTE): A not-to-exceed quote for the entire project can be included so the client knows the maximum cost of the project before work begins.

- Payment milestones: To protect the contractor’s workflow, in some cases you may include agreed-upon milestones for progress payments.

Additional Items to Consider for a Time and Materials Contract

A time and materials contract should stipulate when the contractor will be paid. As an incentive to work efficiently, payment may be tied to reaching milestones in the project. Other options are periodic billing — perhaps weekly or monthly — or a lump sum at completion of the project.

The customer may also specify the quality or type of materials to be used — for example, the grade of lumber on a construction project.

Advantages and Disadvantages of Time and Materials Contracts

Opting for a time and materials contract rather than a fixed price contract has its advantages and disadvantages.

- Advantages: With assurances that all costs will be covered, time and materials contracts are simple to implement and a low risk for the contractor. Profit is predictable. Adjustments are easy when specifications or resource needs change.

- Disadvantages: Clients often prefer a fixed price contract because their risk is lower and budgeting is easier. When bidding against a fixed price contract, the contractor with a time and materials contract may lose the bid. Tracking materials costs and labor hours is extra work for the contractor. With open-ended labor hours, the contractor’s laborers may not be motivated to work efficiently. Including a not-to-exceed clause can help offset this problem.

Government Time and Materials Contracts

Time and materials contracts can be used for government projects only when the contractor can document that the extent or duration of the job cannot be determined or that costs cannot be estimated accurately. The contractor specifies separate fixed hourly rates for each class of laborer. Materials include the necessary supplies, along with the costs of transporting them to the job site, as well as incidental services, such as cleanup work.

Contracts should include a (maximum) ceiling price. The contractor must cover any excess labor costs. To ensure that the contractors work efficiently, the public entity responsible provides oversight on the project.

Billing With Time and Materials Contracts

With a time and materials contract, it is essential for an administrator to track costs and maintain documentation. Receipts for materials should be retained and labor should be documented. Unused materials that are returned should be subtracted from the total.

If the contract has a not-to-exceed clause, the contractor should notify the client when the limit is nearing.

Free Time and Materials Contract Template

Every construction project is unique and requires a contract carefully drafted to match its requirements. But all contracts have certain aspects in common, and there are certain additional elements that every time and materials contract should contain.

Time and Materials Contract Template

This time and materials contract template provides the main structure and core components contractors can customize to the requirements of their project.

Get the free template

Managing Time and Materials Contracts With NetSuite

Companies using time and materials contracts must track how many hours are spent on a project, the billable rate for assigned resources and/or the tasks to be completed and the quantity and cost of materials required to complete the project. They also must follow specific project accounting rules when recognizing revenue from contracts — ASC 606, if operating under U.S. Generally Accepted Accounting Principles (GAAP), or IFRS 15 in countries where International Financial Reporting Standard (IFRS) is required. Without the right software, these would be labor-intensive and time-consuming processes for any contractor.

With NetSuite’s accounting software , accounts receivable departments can invoice clients when time and materials contracts are used. It also automates revenue recognition and helps companies comply with appropriate standards. And NetSuite’s professional services solution provides comprehensive project accounting functionality that makes it easy to track hours spent, materials acquired and the other accounting details required for time and materials contracts.

Time and materials contracts work best when the scope and duration of a project is unpredictable before work begins. The simplicity of a time and materials contract ensures the contractor a profit but adds an administrative burden in terms of tracking time and costs. However, good accounting software can automate much or all of that added burden.

#1 Cloud Accounting Software

Time and Materials FAQs

How do time and materials contracts work?

Time and materials contracts specify the scope of a project but are open-ended. They set out prices for materials and hourly rates for labor, and the client is billed at those rates for as many hours and as much material as is required to complete the project. To protect project owners, time and materials contracts usually include a maximum price in the form of a “not-to-exceed” clause.

When should a time and materials contract be used?

A time and materials contract should be used when the scope or duration of the project cannot be accurately estimated. U.S. Federal Acquisition Rules, in fact, state that is the only case when time and materials contracts are allowed.

What does a time and materials contract mean?

Instead of a fixed price covering the entire project, a time and materials contract quotes hourly labor rates and materials costs. The client pays for this labor and the cost of materials used to complete the project.

Is time and materials a cost type contract?

Yes. The client pays for the costs of the work, rather than a predetermined fixed price.

What is the difference between T&M and fixed price?

In fixed price contracts, the contractor quotes a fixed price for the entire project and assumes the risk of overruns. In a time and materials contract, the contractor charges the client for the cost of materials, plus a fixed hourly rate for labor. In a T&M contract, the client assumes more risk.

What Is a Unit Price Contract & When to Use It?

Not all construction jobs can be perfectly priced at the outset. Often, the scope of work is hard to pin down until a project gets underway. This is where a unit price contract may be appropriate. A unit price contract breaks…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Time & Materials Contracts

Frequently asked questions, q. could you tell me exactly what are time and materials and fixed price contracts.

A. Time-and-materials (T&M) contracts may be used for acquiring supplies or services. These contracts provide for the payment of labor costs on the basis of fixed hourly billing rates which are specified in the contract. These hourly billing rates would include wages, indirect costs, general and administrative expense, and profit. There is a fixed-price element to the T&M contract - the fixed hourly billing rates. But these contracts also operate as cost-type contracts in the sense that labor hours to be worked, and paid for, are flexible. Materials are billed at cost, unless the contractor usually sells materials of the type needed on the contract in the normal course of his business. In that case the payment provision can provide for the payment of materials on the basis of established catalog or list prices in effect when the material is furnished. These contracts also may provide for the reimbursement of material handling costs, which are indirect costs, such as procurement, inspection, storage, payment, etc. These indirect costs are billed as a percentage of material costs incurred (similar to the billing of overhead costs as a percentage of direct labor). Such material handling costs must be segregated in a separate indirect cost pool by the contractor's accounting system and must not be included in the indirect costs included as part of the fixed hourly billing rate for direct labor. It would always be prudent to obtain a pre-award audit of the contractor's accounting system to determine the adequacy of the system to properly segregate material handling costs from other overhead costs being billed with the fixed hourly rates for labor. There is a full discussion of time and materials contracts in Section 2.4.3.3 of the FTA Best Practices Procurement Manual. (Revised: June 2010)

Back to top

Q. The Government has issued a solicitation for a firm fixed-price contract, but the offeror has proposed the contract type be changed to time and materials. If, during negotiations, the Government agrees to this change, what is the likely result? Will there be less risk for the contractor? Will there be greater incentive on the contractor to control costs? Will the contract type have to be changed again after contract award?

A. The Common Grant Rule for governmental recipients permits the use of time and material contracts only after determining that no other contract type is suitable; and if the contract specifies a ceiling price that the contractor may not exceed except at its own risk. This is because the T&M contract has no incentive for the contractor to control costs – the more time and money spent, the more profitable it is for the contractor. Even a cost-plus-fixed-fee contract is preferable in this respect since it fixes the amount of fee dollars for performance of the contract and cost overruns do not result in more profit for the contactor.

If this was a competitive procurement and was advertised as a fixed price contract, you cannot then negotiate a T&M contract without amending the solicitation and allowing other companies to offer proposals on that basis. This represents a material change in the procurement and there could well be other firms that would have proposed on a T&M basis that did not offer proposals on a fixed price basis.

If you award a fixed price contract you will not be able to change the contract type later to a T&M contract and expect FTA to reimburse you for the added costs. FTA has a financial interest in the fixed price contract and the agency cannot give away FTA’s interest without prior FTA approval. In other words, the agency cannot later pay more for something that it had a contract for at a specified price (unless of course the agency changes the contract requirements/specification). (Revised: June 2010)

Q. We are trying to determine a "reasonable" material handling cost. The contractor is trying to charge their General and Administrative (G&A) expenses - but as the fixed rate is three times the amount paid the employee - it appears G&A is a part of their labor rate. What is the basis for material handling costs, i.e., what types of charges are allowed? Aren't rates usually 5-10% of the materials?

A. The Federal Acquisition Regulations (FAR) in its discussion of Time and Materials contracts at subpart 16.601 (b) (2) says that material handling costs are to include only those costs that are clearly excluded from the "labor hour rate." The labor hour rate would include direct labor cost (salary) and overhead charges (and/or G&A charges). In other words, the material handling costs must be segregated in a separate indirect cost pool from the other overhead and G&A costs. Material handling costs would typically include such functions as receiving, inspection, storage and distribution of materials. You are correct in saying that material handling rates are usually less than 10% of the material costs themselves. If the contractor does not have a separate material handling pool, you can negotiate an advance agreement in the contract requiring such a pool, as well as advance agreement on the components of the pool, and place a cap or ceiling on the rate, adjustable downward only at the time of final cost audit. You should not use a predetermined (fixed) material handling rate as this could be interpreted an impermissible cost-plus-percent-of-cost contract. If the contactor will not agree with you and continues to insist on a G&A charge that produces inequitable cost results to your agency, you could also buy the materials and furnish them to the contractor as "owner/agency furnished materials." This would void any markup though it would of course be an administrative burden for your agency. (Revised: June 2010)

Q. Please explain the 'make-up' of Time and Material rates. It is my understanding that no fee is to be applied to any cost other than labor. It states that material burden can be applied to material, provided that the cost is not already included in the labor rate. What about travel, can a Contractor apply any burdens to travel? Please elaborate on what can and cannot be applied to the various elements of cost.

A. You are correct in your statement that no fee or profit is allowed except as part of the fixed billing rate for direct labor hours. To fix a fee rate in the contract and allow the contractor to bill for actual costs (e.g., materials or travel) plus that rate of fee would constitute a prohibited cost-plus-percent-of-cost contract. A contractor is allowed to recover overhead costs on its direct costs, such as materials or travel, if the contractor's accounting system clearly separated the overhead costs associated with those direct costs (e.g., in a material handling overhead pool), and those overhead costs are not included in the overhead pool that is applied to direct labor costs. In other words, there must be no duplicate billing for material handling overhead costs in the rates applied to labor dollars and material dollars. The Contractor must consistently charge all contracts using the same methodology.

As far as overhead costs applied to travel, it would be highly unusual for a Contractor's accounting system to separate the overhead costs associated with direct-charge travel and apply a separate burden rate to those costs. We would think it would be virtually impossible to segregate the overhead costs for direct-charge-to-contracts travel from other types of travel such as corporate managers traveling on general business purpose trips. But if the contractor had a travel-related overhead pool that consistently billed all contracts and this overhead pool has been audited by an independent auditor and found to be proper in accordance with the FAR Part 31cost principles, then we would see it as acceptable.

Q. Isn't a Time and Material procurement no more than a Cost-Plus-Percent-Cost with the mark-ups reshuffled? I don't see the difference...in both scenarios, a contractor will increase profit by incurring more hours worked. Regardless if the markups are hidden in the hourly wage rates...or applied separately after the total direct labor costs are determined...the total cost is the same, and more importantly, the disincentive for the Contractor is the same: More hours will provide more profit.

A. It is correct that for both the Time and Material (T&M) and Cost-Plus-Percent-Cost (CPPC) types of contracts the contractor has a disincentive to control costs; i.e., the more effort he spends the more profitable the job becomes. The CPPC type of contract is prohibited and cannot be used when Federal funds are involved. The T&M contract is permissible but may be used only when the grantee determines that no other type of contract is suitable and the contract specifies a ceiling price that the contractor shall not exceed except at its own risk.

If you have a contractual arrangement where the contractor is being reimbursed for its actual dollar costs (whether those costs are labor, materials, travel, etc. does not matter), and there is a promise to apply a predetermined add on to those costs for overhead and/or profit, then you have an illegal CPPC situation. For example, you cannot agree with a contractor on a cost plus fixed fee contract to pay his actual labor costs plus a predetermined (fixed) overhead rate. You must provide for the ability to audit the overhead rate after the fact and adjust the billings to the actual rate incurred. Likewise, you cannot agree to pay all of the contractor's costs plus a fixed rate of profit on the actual costs incurred. Both of these examples are unlawful CPPC agreements.

You can lawfully negotiate a fixed, fully loaded (labor, overhead, profit) hourly billing rate for a given type of labor and leave the hours to be billed as a flexible amount if the uncertainties of performing the job warrant. The procurement regulations would tell you to monitor and manage this type of contract closely to be sure the contractor was performing well. In your examples, if the agreement is negotiated up front and the hourly billing rate for labor, overhead, profit is fixed, then you have a T&M contract. If, however, only a portion of the billing rate is fixed and there are predetermined (fixed) add-ons like an overhead or profit rate that are applied to the fixed portion of the billings (e.g., the labor costs) then you have a CPPC contract. (Reviewed: June 2010)

Q. Our agency has a Time and Materials contract that has to be extended because the work has not been completed as originally anticipated. The contract is essentially in an "overrun" situation. Can we replace this contract with a Cost-No-Fee contract in order to complete the unfinished work?

A. If you have a Time and Materials (T&M) contract that you consider to be in an "overrun" condition (i.e., where the contractor has not completed the work because of problems over which he has control), we would advise trying to renegotiate the billing rates for the unfinished work so as to delete the estimated profit in the billing rates, rather than awarding a new cost-no-fee contract for the unfinished work. One of the potential problems in changing the type of contract for work originally under the T&M contract is the question of extricating the contractor from a potential loss position under the T&M contract. Someone reviewing the file in the future might well raise this question, and it could be a legitimate issue if the contractor was operating with costs above those projected when the original contract billing rates were negotiated. (Reviewed: June 2010)

Q. When a company proposes Labor Categories and number of hours on a Time & Material Contract, is there a requirement to only use those categories and hours exactly as shown in the contract unless there is a contract modification?

A. In a T&M contract, the contract prices are stated for the hours and labor categories specified in the contract. If the work assigned differs from that originally defined, and thus requires different categories and hours, then the parties must change the contract to add the new categories and hours, and the agreed upon prices for those particular hours. The contractor is not free to use other categories and charge for them as the contractor sees fit. The contractor would then be delivering items (different labor categories/hours) not called for in the contract. If the work is the same as that originally contracted for, the contractor may not charge for different categories at different rates unless there is a contract modification that reflects the agreement of both parties to the changes. (Posted: January, 2010)

Q. Is it allowable to have a Time and Materials subcontract under a Firm Fixed Price Prime Contract? Is there any prohibition against this?

A. There is no prohibition against a T&M subcontract if the prime contract is firm fixed price. In this case it is the prime contractor that is assuming the risk that the subcontractor may not perform. If the prime contract were cost - reimbursement, then it would be prudent for the agency to become involved, to the point of requiring consent to the subcontract, since the agency would bear the risk of non-performance (and thus cost overruns) by the subcontractor. In the latter case the agency would want to ensure that no other type of subcontract was feasible, and also that stringent controls were in place for the prime to manage and monitor the subcontractor's work to ensure satisfactory progress. (Posted: November, 2010)

Q. Our agency awarded a contract for paratransit services. The payment terms call for the contractor to be paid a fixed unit price for every trip – hour provided. The contract has no ceiling price or limit of grantee obligation in total dollar terms. Is this acceptable?

A. A ceiling price/limit of grantee obligation is required by 4220.1F, Chapter VI, 2. c. (2) (c) for T&M type contracts. This contract must be modified to incorporate a ceiling price that cannot be exceeded without the grantee’s written authorization. (Posted: October, 2015)

The Defense Acquisition Encyclopedia

Contracts & Legal

A Time and Materials (T&M) contract is normally used in construction and product development when a company or employee agrees to be paid for their “ Time ” and the “ Material ” used for the development of a product. T&M contracts are used when you can not estimate the size of the project or any of the changes that can occur while in development. They provide flexibility for both the government and the contractor to adjust the scope of work as needed throughout the contract. A T&M contract is the opposite of a Fixed-Price Contract .

Definition: A Time and Materials (T&M) contract is an agreement between two or more parties describing the rough scope of a task based on an hourly fixed wage plus the cost of materials to complete the task.

Purpose of Time & Materials (T&M) Contract

The purpose of a T&M contract is to provide flexibility and transparency in government procurement by allowing for the payment of labor and material costs based on actual usage.

Time & Materials (T&M) Contract Regulations

Website: far subpart 16.6 “time and material contract “, website: dfars 216.6 “time and material contract”.

Application: Time accurately the extent or duration of the work or to anticipate costs with any reasonable degree of confidence. See FAR 12.207 (b) for the use of time-and-material contracts for certain commercial services.

When to Use a Time & Materials (T&M) Contract

A T&M contract should be used when there are too many uncertainties in contract performance that will not allow the use of a fixed-price contract . When the scope of the job or its duration cannot be established before work begins, as is occasionally the case with building projects, time and materials contracts are the best option.

How to Use a Time & Material (T&M) Contract

The client and contractor concur on the project’s objective and the desired outcome. It might not be possible to outline every stage of the process. They settle on hourly pay for both the contractor’s employees and subcontractors within that framework. Along with markup for material pricing, the contractor also defines the materials that will be used.

Time & Materials (T&M) Contract Basis

A Time & Materials ( FAR Subpart 16.6 ) contract provides for acquiring supplies or services on the basis of [1]

- Direct labor hours at specified fixed hourly rates that include wages, overhead, general and administrative expenses, profit; and

- Actual cost for materials (except as provided for in 31.205-26(e) and (f)).

What Should Be Included in a Time & Material (T&M) Contract

A time and materials contract should outline the project’s objectives and contain a fixed price for labor that accounts for wages, overhead, general and administrative expenses, as well as a profit margin. Freight, taxes, and markup should be included in the materials cost. The contract should include a not-to-exceed clause specifying a maximum price where necessary.

- Wages: Hourly wages for laborers, subcontractors, and any other project employees should be included in the labor rates. Additionally, if relevant, hourly administrative rates should be included.

- General and Administrative Expenses: The reoccurring expenses are typically anticipated on a project and agreed to beforehand.

- Maximum labor hours: A maximum cost or portion of the expected price may be stated in the contract. This ensures that the project doesn’t go significantly over budget.

- Cost Increases: Typically, the client is charged for the real cost of the materials plus a markup of 15% to 35%.

- Limitation of time and materials: This restriction covers the costs of the entire project, not just labor. This enables the client to estimate their maximum spending.

- Contractual Breach Clause outlines what will happen if either party violates the agreement. It might have provisions for liquidated damages, choice of law, venue selection, etc.

- Disclaimers: A lot of contractors include disclaimers for warranties, particularly about the caliber of the client’s chosen product. The contractor might not want to be held responsible for the caliber of the materials the client selects if they are specific.

- Terms of Modifications: In the majority of projects, modifications are necessary. The time and materials agreement should specify how changes may happen and when they become legally binding, regardless of whether the project requires the change or is the client’s decision.

- Milestones for payment: The contract should specify when payments are due. This could happen at the project’s conclusion or at specific times. Periodic milestones, such as weekly or monthly ones, are another option

AcqNotes Tutorial

Benefits of a Time & Materials (T&M) Contract

- Easy to adjust to requirements changes

- More flexibility over schedule changes

- Easier contract setup

- Ensures contractor will earn a profit

Downside of a Time & Materials (T&M) Contract

- The customer takes a lot of financial risks

- Tracking expenditures take more effort

- No incentive for being efficient

- Rising labor prices could eat into profit

Limitations of a Time & Materials (T&M) Contract

A Time-and-Materials contract may be used only if:

- Signed by the contracting officer prior to the execution of the base period or any option periods of the contracts; and

- Approved by the head of the contracting activity prior to the execution of the base period when the base period plus any option periods exceeds three years; and

- The contract includes a ceiling price that the contractor exceeds at its own risk. The contracting officer shall document the contract file to justify the reasons for and amount of any subsequent change in the ceiling price. Also, see 12.207(b) for further limitations on using Time-and-Materials or Labor Hour contracts to acquire commercial items.

Definitions: [1]

“ Direct materials ” means those materials that enter directly into the end product, or that are used or consumed directly in connection with the furnishing of the end product or service.

“ Hourly rate ” means the rate(s) prescribed in the contract for payment for labor that meets the labor category qualifications of a labor category specified in the contract that is:

- Performed by the contractor;

- Performed by the subcontractors; or

- Transferred between divisions, subsidiaries, or affiliates of the contractor under common control.

Difference Between a Time and Materials (T&M) Contract and a Firm-Fixed Price (FFP) Contract

The difference is fixed-price contract provides for a price that is not subject to any adjustment on the basis of the contractor’s cost experience in performing the contract, where a time and Materials contract provides for a cost adjustment.

Consideration When Choosing to Use a Time and Materials (T&M) Contract

As a federal program manager and contracting officer, there are numerous crucial considerations to make when deciding whether to use a Time and Material (T&M) contract type for a possible project. Here are some crucial things to remember:

- Project Scope: Evaluate the project’s nature to see if a T&M contract is appropriate. When the scope of the task is ambiguous or prone to change and a firm-fixed price cannot be established, T&M contracts are frequently employed.

- Manpower and Materials: Assess the project’s manpower and material needs. T&M agreements pay the contractor for direct labor hours at set hourly rates as well as for acceptable material expenditures. Make sure the labor categories and rates are clearly defined and meet the requirements of the project.

- Cost Estimation: Collaborate closely with the contractor to create a reasonable estimate of labor hours and material costs based on the anticipated needs of the project. As the project develops, periodically evaluate and revise the estimate to ensure proper billing and cost management.

- Established Guidelines: Establish explicit guidelines for the contractor’s billing and invoicing, including with submission dates and necessary paperwork. Implement controls to verify invoice correctness and make sure costs are justifiable, allowed, and correctly justified.

- Cost Monitoring and Control: Create procedures for keeping an eye on and regulating costs all during the project. Keeping track of actual work hours, material usage, and associated expenses in comparison to estimates may be necessary for this. Review and evaluate expense data often to spot any trends or variations that might need to be addressed.

- Contractual Limitations: Choose the right restrictions and controls to achieve cost management and avoid unnecessary costs. This could entail putting a cap on the contractor’s labor and material expenses, defining a maximum contract value, or including clauses that allow for cost escalation.

- Change Management: Plan for future modifications to the project’s requirements or scope, and create processes for handling changes under the T&M contract. Clearly spell out the steps involved in submitting change orders, recording adjustments to labor or material costs, and receiving the necessary approvals.

- Choosing a Contractor: When choosing a contractor, consider their credentials, track record, and capacity to supply the necessary labor and materials efficiently. Think about their experience managing T&M contracts, their availability, and their track record. To ensure fair competition, do in-depth market research and take multiple bidders into consideration.

- Risk Allocation: Be aware that the government bears a large percentage of the risk associated with T&M contracts because the final cost will be determined by the actual labor and material costs incurred. To minimize risks and guarantee value for money, put in place efficient contract control and performance monitoring.

- Documentation and Reporting: Throughout the contract’s lifecycle, maintain thorough records of the labor hours worked, as well as material receipts, invoices, modification orders, and correspondence. Keep in constant contact with the contractor to guarantee efficient collaboration and timely resolution of any concerns.

Remember to adhere to all laws, rules, and regulations that may apply to T&M contracts, including the Federal Acquisition Regulation (FAR) provisions and any agency-specific recommendations. To maintain compliance and make wise judgments, speak with your company’s legal, financial, and technical professionals. There must be effective communication and collaboration with the contractor to properly control expenses, monitor progress, and complete the project’s goals.

Other Types of Contracts

– See Firm-Fixed Price Contract – See Cost-Reimbursement Contract – See Indefinite Delivery Contract – See Incentive Contract

AcqLinks and References:

- [1] Website: Subpart 16.6 – Time-and-Materials, Labor-Hour, and Letter Contracts

- OSD Time-and-Materials and Labor-Hour Contracts The New Policies

- Guidance: Audit on Time-and-Materials (T&M) and Labor Hour (LH) Contracts

- Template: Boeing Time and Material Contract Template

- Guidelines: Preparation of a General Services Time and Materials Contract

- Website: FAR Subpart 16.2 – Contract Types

Updated: 3/4/2024

Make it easier to manage construction.

Time and materials (t&m) contracts in construction: guide for contractors & project owners.

Last Updated Nov 7, 2023

A time and materials (T&M) contract is a construction agreement where the project owner pays the contractor for all material and labor costs on a project as well as contractor markup. Unlike lump sum contracts , a T&M contract is based on the actual time spent and materials used on a project rather than a fixed fee. This type of construction agreement is often used in cases where the scope of work or project duration is uncertain — or where changes are likely to occur during the project. With projects that have unknowns, T&M contracts provide greater flexibility and transparency for both the owner and the contractor.

Read on to learn more about how T&M contracts work as well as the advantages and disadvantages of these contracts for contractors and project owners.

Table of contents

How time and materials contracts work

A time and materials contract is an agreement where contractors are reimbursed for materials used and hours billed on a project including a negotiated markup . Essentially, the basis of the contractor’s bid includes the unit costs of materials, an hourly or daily rate, and contractor markup.

However, T&M contracts do not provide an unlimited budget for a project. While T&M contracts are based on the actual time and materials used for a project, the client and contractor usually establish an estimate for the project based on the known scope of work when the project commences. Sometimes, the contract will include a maximum limit (a “not-to-exceed” clause) on the amount that the client is willing to pay for the project. This clause limits the client’s financial liability, provides clarity on the overall project cost, and serves as a guideline for the contractor to manage costs, ensuring that the project is completed within the client's specific budget.

T&M contracts are commonly established between a project owner and general contractor when a project’s scope of work is not well defined or when the project duration is unknown. This contract type can also be used between general contractors and specialty contractors depending on the project parameters and goals.

Using the known scope of work, the contractor will do the following:

- Determine loaded labor rates, which include wages, overhead and administrative costs, and profit markup.

- Identify and price the materials that will be required for the project, including freight as well as the contractor’s markup.

- Provide an estimate of labor hours and materials needed to complete the work.

T&M contracts are often easier to negotiate as the financial risks are minimized for the contractor. Under a T&M contract, contractors know that their costs will be reimbursed throughout the duration of the entire project. As project conditions change or the scope of work adjusts throughout the course of construction, contractors can provide project owners with updated estimates of the total cost of the project.

Learn more: 5 Main Types of Construction Contracts

Advantages of T&M contracts

T&M contracts offer advantages to both project owners and contractors.

For project owners who are tackling projects with an unpredictable scope of work, a T&M contract generally provides them with the flexibility to handle any unforeseen conditions that arise. For contractors, profitability is much more likely as they are compensated for all the time and materials used regardless of unknowns.

Win More Work

Quickly build accurate estimates to improve your bid-to-hit ratio in less time.

Disadvantages of T&M contracts

Although a T&M contract offers many advantages, there are also drawbacks for both parties involved. These can be minimized by establishing a well-structured contract, building on a solid relationship, and prioritizing communication and transparency.

T&M contracts are often established between parties that have an existing relationship. The owner is more comfortable selecting a contractor they know won’t drag the project out unnecessarily to try to earn additional revenue.

Potential solutions to mitigating the pitfalls of a T&M contract include the following:

- Adding in a “not-to-exceed” (NTE) clause: Incorporating an NTE clause into the contract decreases the owner’s risk and provides them with greater financial certainty. For the contractor, this removes the burden of managing the client’s expectations around budget because the cost is capped, like a GMP or lump sum contract.

- Establishing clear communication: Maintaining open and clear communication throughout the project can help prevent any potential issues from escalating into larger problems.

T&M contract example

A large retail company approaches Finley Construction, a general contractor, to ask them to renovate a store that was recently damaged by a storm. The project owner is looking to quickly get a contractor onsite, and assess what work needs to be done for the store to be operational again.

Due to the uncertainty of the scope and project duration, the owner decides to use a T&M contract in order to make negotiations easier and get construction started. The two parties have worked together previously and have an established solid relationship.

Finley Construction calculates its loaded labor rates including wages, overhead, and markup as well as unit prices for required materials. They submit this pricing information to the project owner. Eventually, Finley Construction and the owner negotiate and sign the contract, which includes standard terms around payments, change orders, dispute resolution, and more. While a T&M contract can put the owner at greater financial risk, the trust between the two parties mitigates the owner’s concerns.

Finley Construction quickly mobilizes onsite, brings trusted subcontractors on board, and begins work on the project. Based on their contractual payment schedule, Finley Construction submits invoices to the owner monthly, detailing the hours worked and the materials used. The project owner reviews the invoices and pays Finley Construction according to the agreed-upon schedule, and Finley Construction pays its specialty contractors in turn. These invoices serve as a cost update for the owner, enabling them to cross-check the progress with the budget.

During construction, Finley Construction realizes that the storm caused extensive water intrusion and damage to the store which will need significant remediation. With the flexibility of the T&M contract, they can inform the owner, clarify the additional scope, and quickly adapt to resolve the issue.

Once construction is complete, Finley Construction compiles all documentation related to the project, including invoices, receipts, and timesheets. The contractor passes this documentation on to the owner along with a final invoice that outlines the total cost of the project. The owner conducts a final inspection and approves payment to Finley Construction.

In this instance, a T&M contract was the perfect solution that balanced both parties' priorities. The owner was looking to quickly tackle a project with an undefined scope and unclear duration. Due to the nature of their relationship, they were able to quickly bring Finley Construction onboard. Under a T&M contract, the general contractor is likely to turn a profit as long as they’ve correctly calculated their loaded labor rate and material costs.

With a T&M contract, Finley Construction was able to quickly mobilize onsite, handling a tricky construction project with an unclear scope. The partnership between the owner and the contractor yielded a prompt and seamless delivery of a high-quality project.

Contract formation determines success

Understanding the ins and outs of each contract type can significantly impact the success of a project for both owners and contractors. Contract formation presents an opportunity for both parties to mitigate risks and ensure their top priorities are realized.

A well-defined T&M contract can promote clear and effective communication between the owner and contractor, afford the team the ability to adapt to any unforeseen issues that may arise, and ultimately deliver a high-quality construction project amidst the chaos of unknown or undefined conditions.

Categories:

Construction Contract

Noah is an Account Executive at Procore with a focus on General Contractors. He previously worked as a Project Manager for Williams Company, FORE Construction, and Ashton Woods Homes. His areas of specialty include contract administration, budget forecasting, subcontractor management, and schedule. He lives in Tampa, Florida.

Taylor Riso

38 articles

Taylor Riso is a marketing professional with more than 10 years of experience in the construction industry. Skilled in content development and marketing strategies, she leverages her diverse experience to help professionals in the built environment. She currently resides in Portland, Oregon.

Get discovered for relevant work on the Procore Construction Network.

Explore more helpful resources

.css-c249p1::before{width:100%;height:100%;display:block;position:absolute;top:0px;left:0px;z-index:0;content:'';cursor:inherit;} Construction Contract Documents: 9 Key Components

Every construction project — whether a small-scale residential renovation or an extensive municipal development — requires a contract. Construction contracts are multifaceted, often comprising numerous documents that cumulatively define the...

Job Order Contracting (JOC) Explained

Contracts for commercial construction projects usually cover a complete scope of work, but large institutions often have ongoing needs for smaller projects. This is where job order contracting (JOC) comes...

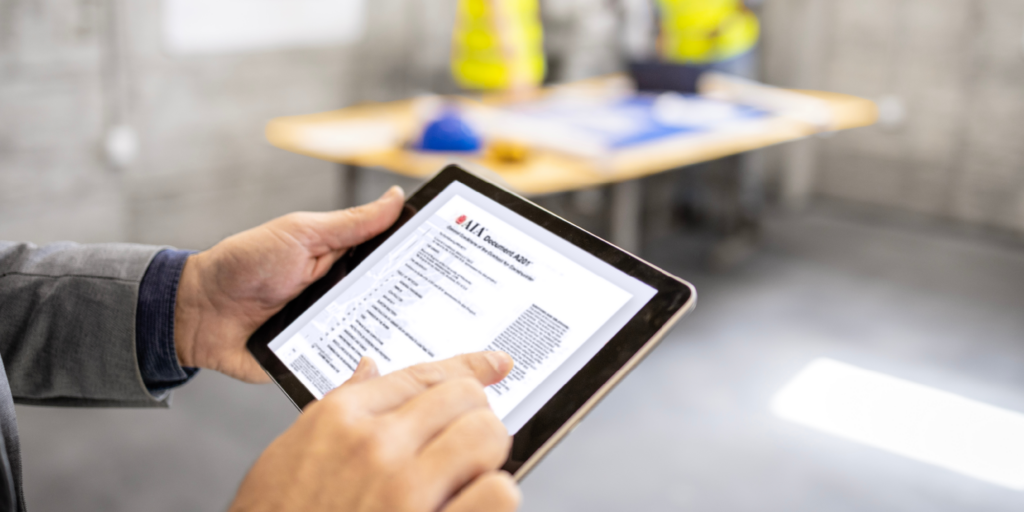

The AIA A201 Explained for Contractors & Owners

Before beginning a project, owners, architects and contractors need to define and agree upon their relationship to each other, so that everyone’s expectations can be met. The AIA document A201...

AIA A305 Contractor’s Qualification Statement Explained

In construction, project owners use Requests for Qualifications (RFQs) to narrow down a list of contractors to find candidates who meet the criteria to bid on a specific project. The...

What’s Included in a T&M rate?

Seems like a pretty straight forward question, right? Unfortunately, with so many mechanical contractors out there, there are many different ways to price that T&M (Time and Materials) rate which could mean you are not comparing apples to apples.

Let’s start out by stating the obvious, not all contractors and created equal. That age-old cliché still holds true … “you get what you pay for.” So be careful when shopping by price alone. You might be expecting a hard working 4×4 F150 and end up with a two-wheel drive Ford Ranger.

That being said, let’s take a closer look at what to look out for when someone says, “our rate is $60/hour.” The first thing to consider is what’s included in the rate. Some firms operate on an a la carte pricing model where everything is priced separately. For example:

- Engineer: $120/hr.

- Designer: $100/hr.

- Project Manager: $80/hr.

- Foreman: $75/hr.

- Millwright: $70/hr.

- Welder: $65/hr.

- Laborer: $55/hr.

- Truck with welder: $150/day

- Oxygen and Acetylene gasses: per tank

- Consumables (like welding rods/wire, blades, grinding wheels): counted and charged at cost plus 15%

Then there are the questions and variables that come up with this pricing model, like:

- Travel time . Does the clock start when the workers show up or when they leave home? Sometimes travel is charged based on a “zone charge” which means there might be a flat fee for travel based on your location. This could add an additional $20-40 dollars per day per person. Some firms charge travel time at an hourly, but reduced rate. When the price is stated as port-to-port, it typically means you will be charged for the time it takes to travel from the mechanic’s shop to yours at the regular rate, so it helps to know how close they are to you.

- Per Diem . It is typical to pay a daily food and living reimbursement for each worker if they are traveling from out of town to your location. This could be another $35-55 per day, per person.

The second most common mechanical T&M rate model is all inclusive . Typically, the hourly rate in this pricing model will be higher than just the rate for the person per hour outlined in the a la carte scenario above. However, all of the “extras” are included in the stated rate. So, while you don’t know if you are getting a foreman or a laborer, the rate is the same regardless of title. For many projects, this model makes sense because the worker could be leading the crew, welding, and digging a hole all in the same day. Just the record keeping alone can be a challenge. Another benefit to this pricing model is that you don’t have to worry about being nickel and dimed for every grinding wheel and welding rod used or wasted since the materials are included in the rate.

For both of the options discussed so far, it’s also helpful to know if the markup for profit and overhead is included. Sometimes the $65/hour rate is marked up another 15%, just like any materials or rental equipment. By the way, don’t be afraid to ask for copies of invoices if you think the materials or rental equipment prices seem out of line.

Finally, if all of this pricing and tracking is more than you want to deal with, you can always ask for a firm fixed price bid to complete your project. With this model, you are simply comparing prices from different contractors and hoping they can all complete the work to your satisfaction. The fixed price bid puts the risk on the contractor’s plate, as you are going to pay the bid price regardless of whether the project takes longer or shorter than expected. When you have a substantial project, lasting more than a couple of weeks and includes fabrications from the shop, this may make sense. It’s important to recognize, however, that you will need a clear scope of work and detailed drawings in order to get an accurate price. The more information that is missing, the more the estimator is going to add to the price to cover any unforeseen circumstances or changes.

Estimates or bids can also vary depending on how much the contractor needs the work. When they are super busy, they may price it a little higher knowing there are other projects in the pipeline. If they are slow, they may lower the price just to keep the team busy and avoid layoffs.

At the end of the day, there are as many different prices as there are projects, so the best thing you can do is work with a trusted, reputable company and talk to them about how their pricing options best fit with your project and understand what’s included.

By the way, if you do a lot of projects on a firm bid basis, be sure to read our next article on how to get the best bid for your fabrication project.

Never miss metal fabrication news!

Subscribe to our newsletter to stay informed on the latest technologies, and advancements.

Recent Posts

Join the gsm team, committed to excellence.

Since 1974, our millwright service and fabrication shop has stood out among machine shops in the metal fabrication and millwrighting fields. This family-owned and -operated industrial metal fabrication company delivers on time and aims to meet or exceed your expectations at every turn. We accomplish that through our long-term, loyal relationships with our team members , clients, and non-profit organizations. For us, it's all about the people.

Watch: The Exceptional People at GSM Industrial

- Contact sales

Start free trial

Time and Materials Contract (T&M): When to Use One & Best Practices

Construction contracts define how owners pay for work done by contractors on a construction project. One of the most popular contracts is called a fixed-price contract or lump sum contract, where a contract defines what will be done and sets a specific and final price for that work. However, this popular method doesn’t work when the construction project timeline and material requirements are unknown. That’s when a time and materials contract is used.

What Is a Time and Materials Contract?

A time and materials contract is a legally binding agreement that outlines how an employer will pay a contractor for the time and materials they spent on a project. A time and materials contract is commonly used in construction project management , though it’s also used in product development and other types of projects.

This means the contractor tracks the time and materials its crew or subcontractors use. Then they use this data to bill the employer appropriately over the course of the project.

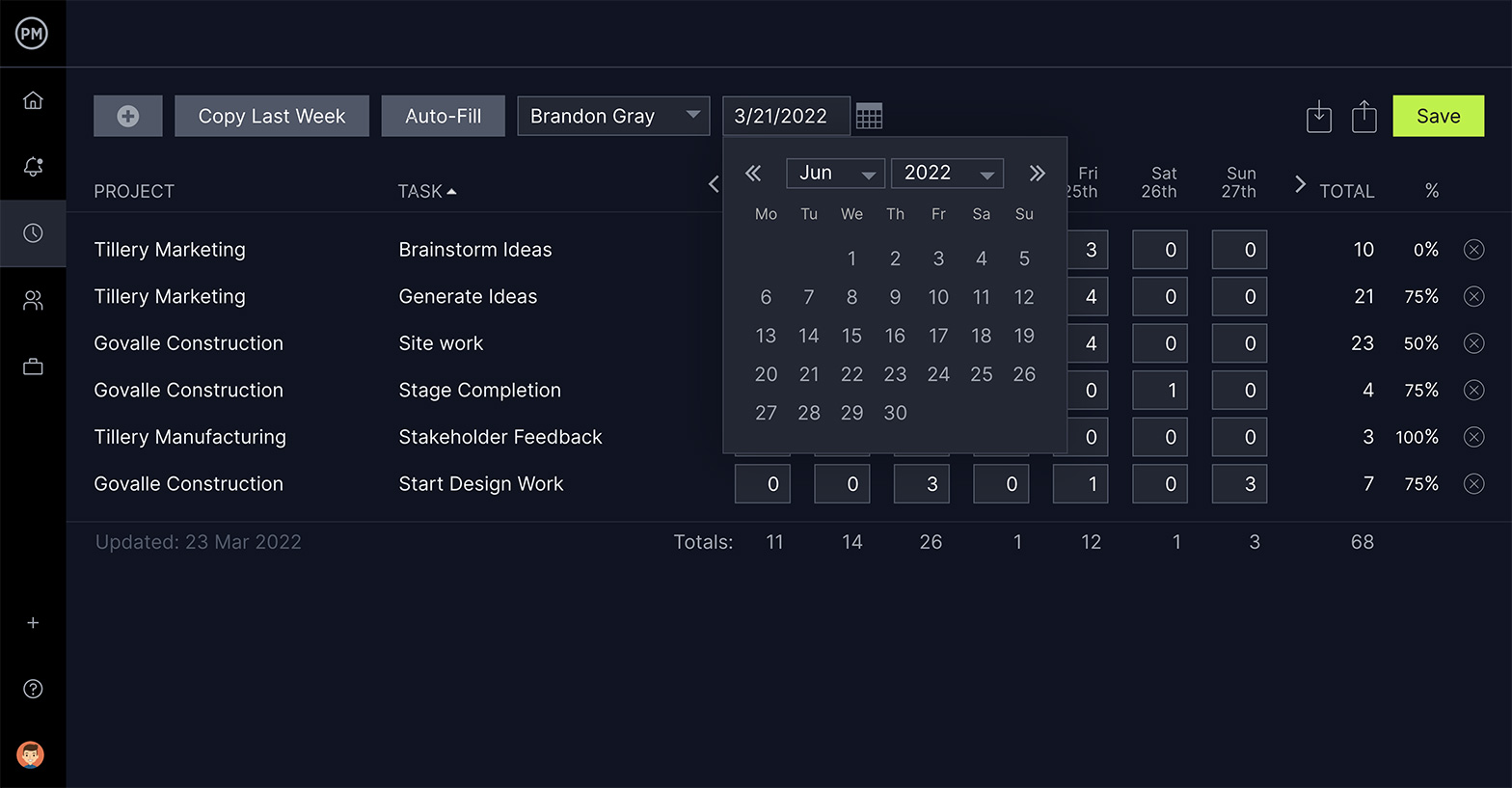

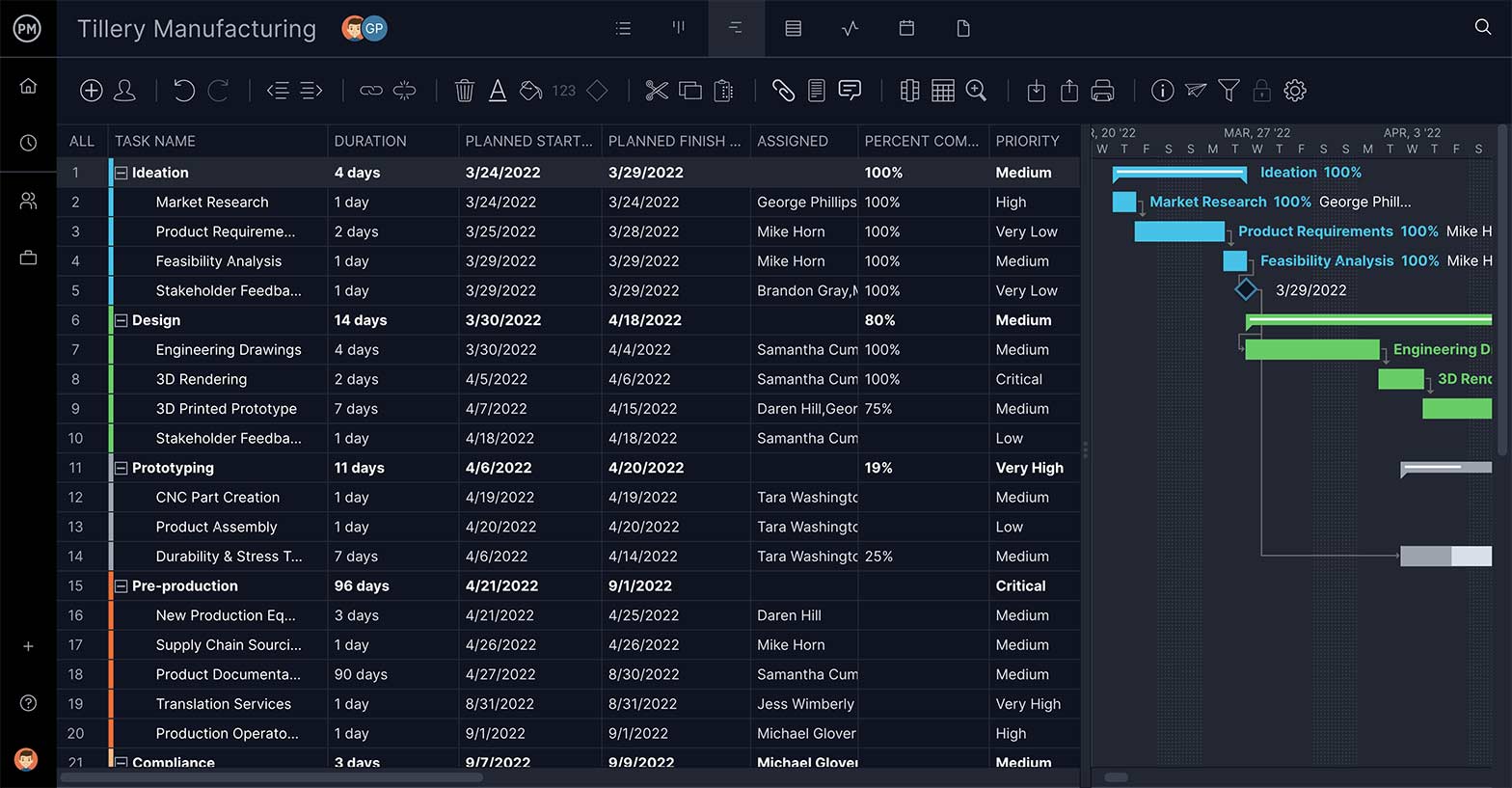

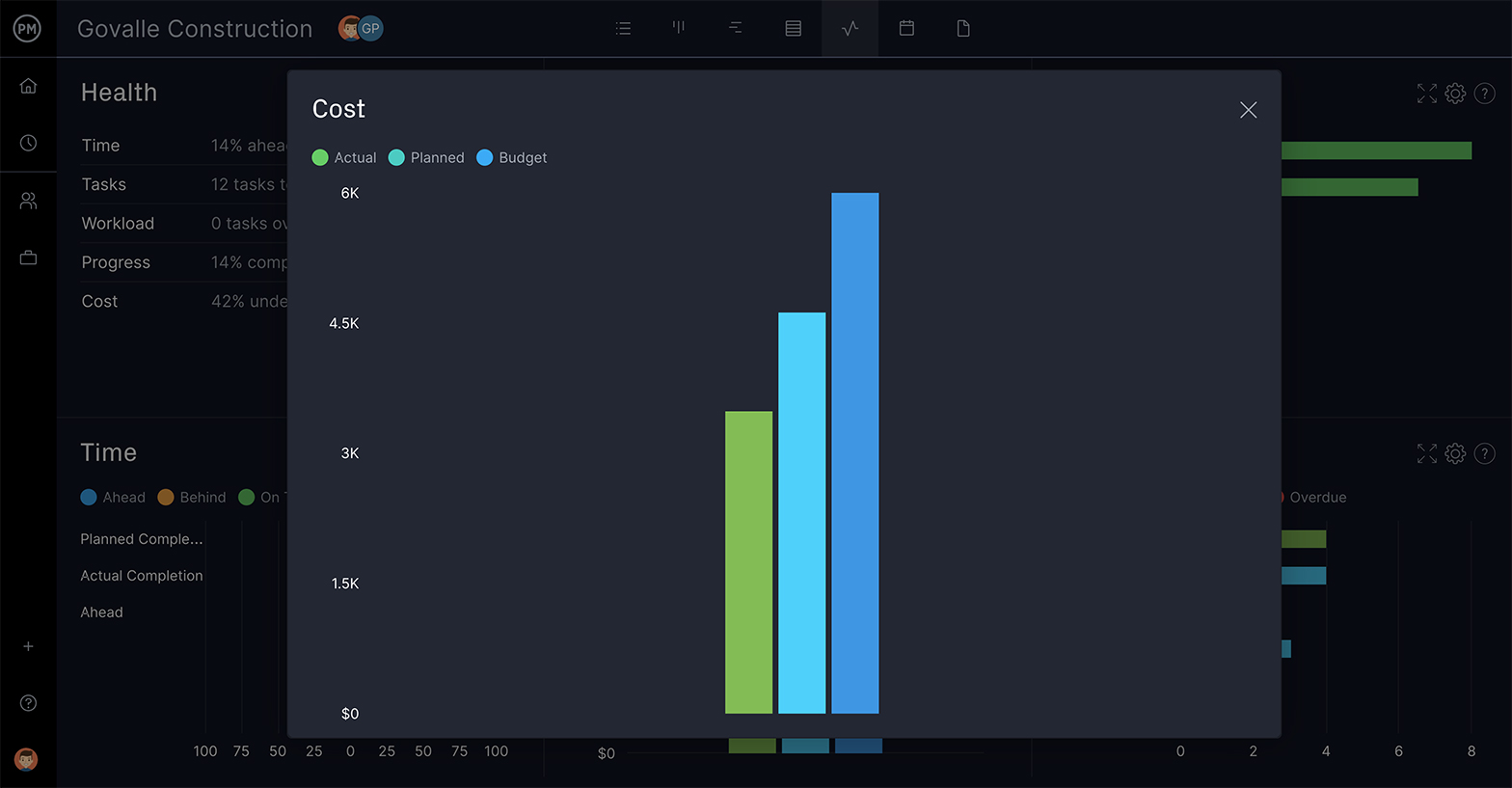

To track time and costs, project owners and contractors should use project management software like ProjectManager . With ProjectManager, you can use Gantt charts, project calendars, timesheets and real-time project dashboards to keep track of time and costs for an effective application of a time and materials contract. Get started with ProjectManager today for free.

What Should Be Included in a Time and Materials Contract?

Now that we’ve learned what a time and materials contract is, let’s go over the key elements that should be part of any time and materials contract.

Labor Costs

One of the most important steps when creating a time and materials contract is to identify the different tasks that need to be executed so that your project is a success. Then, based on that, you’ll need to estimate the time that will take to execute the work so you can understand what your project timeline looks like.

Once you have a clear picture of your project scope, you can begin to estimate costs. In your time and materials contract, you’ll need to define labor categories for each type of tasks, such as plumbing, masonry or electrical work. Then determine an hourly rate for all types of work and include them in the contract.

Material Costs

It’s important to understand that there are different types of costs associated with the material requirements of your project. Here are some examples:

- Direct materials: The term direct materials refers to those raw materials that are directly used in the project. In the case of construction project management, it refers to the concrete, paint, wood and other materials that result in the finished building.

- Direct and indirect costs: You can also specify other direct and indirect costs related to incidental services, material handling costs and other material-related labor costs that aren’t listed under the labor categories you’ve defined in your time and materials contract.

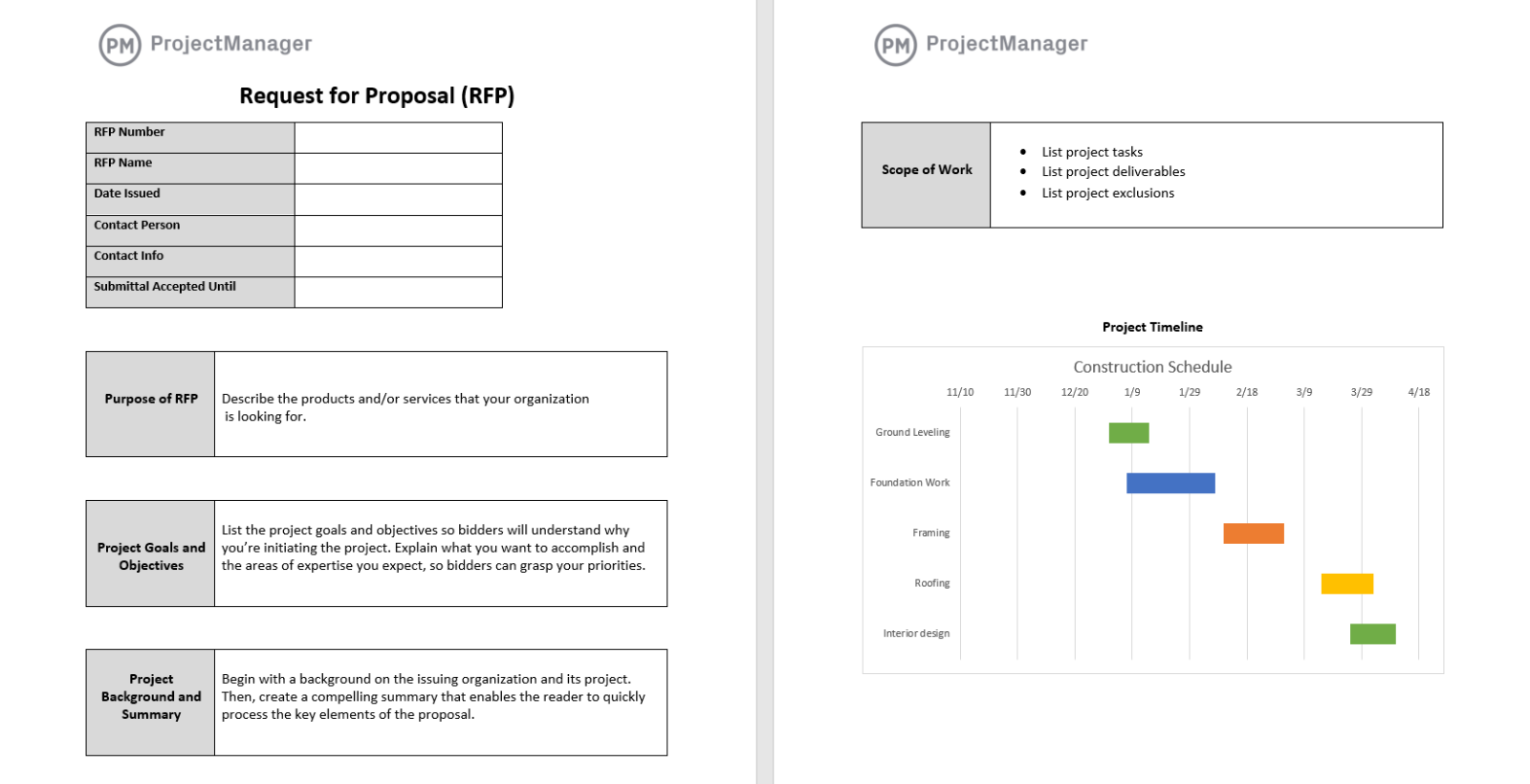

Get your free

RFP Template

Use this free RFP Template for Word to manage your projects better.

When Should You Use a Time and Materials Contract?

Again, a T&M contract is ideal for a project without a clear or accurate estimate of the time and costs involved. There’s no point in using a fixed-price contract unless there is a way to determine the cost. And a cost-reimbursable contract would be impossible to determine without knowing the exact time and materials required to execute the work.

However, a time and materials contract is advisable when the duration of the project is unknown, but there’s a fixed hourly rate for the labor involved. When using a T&M contract, contractors usually add a markup of between 15 and 35 percent.

Therefore, a time and materials contract would be an option for the construction bidding process when dealing with unpredictable scenarios. It is only possible to enter into such an agreement when both parties agree on the conditions, though this is true of all contracts. More importantly, a T&M contract is ideal when there’s a need for flexibility, or you’re new to the industry and can’t make accurate estimates of costs and duration.

Time and Materials Contract vs. Other Construction Contracts

Construction contracts set terms and conditions whenever a project owner hires a contractor to execute construction work. However, construction projects vary in terms of size and complexity, so there are different types of construction contracts to better accommodate the needs of both parties. Let’s see what are the main differences between a time and materials contract and other common construction contracts.

Time and Materials Contract vs. Fixed Price Contract

As mentioned above, there are two main types of payment plans in contract administration . T&M contracts are used when plans are not precise enough to use a fixed-price contract (because there is no definite price for the work.) Instead, contractors are reimbursed for any materials purchased and given a day or hourly rate for their labor.

Time and Materials Contract vs. Cost-Reimbursable Contract

Beyond T&M and fixed-price contracts , there’s a third type of construction contract called a cost-reimbursable contract. This is when the owner pays the contractor for the actual cost of the work. That includes direct and indirect costs, such as materials, equipment and anything else, including salary, that must be paid to get the job done. Contractors will add a clause, such as a fixed fee or some incentive, to make a profit.

Time and Materials Contract vs. Guaranteed Maximum Price (GMP) Contract

A guaranteed maximum price contract sets a maximum price to be paid by the employer to the contractor for a project, regardless of the time and costs. Therefore, the contractor assumes responsibility for delays and all extra costs. However, this shouldn’t be the case, as contractors can use construction project management software to make accurate project estimates and have a good understanding of project timelines and budgets.

Pros & Cons of Time and Material Contracts

Let’s take a moment to look into the benefits and problems with time and material contracts. Depending on the situation, they could be just the kind of contract that works within a construction project. They can just as easily be a detriment and the cons might outweigh the pros, leading an organization to seek one of the other contract options.

The Advantages of T&M Contracts

- It’s easy to respond to changes in the project

- Delays and roadblocks can be dealt with easily

- Negotiations are set at the beginning of the job

The Disadvantages of T&M Contracts

- Tracking time and materials can be difficult

- Contractors have little incentive to work efficiently

- Contractors have to front their own costs

Best Practices When Writing a Time and Materials Contract

When entering into any contract, it’s important the agreement is in writing. Both sides need to agree on the terms and sign off on them. This is especially true of the time and materials contract, as it can end up with the employer bleeding money without construction daily reports . As mentioned earlier, having a maximum price is a recommended safeguard.

When working with any contractor, ensure that they’re licensed by the Contractors State License Board and that the work they’re doing is within the scope of that license. Working with unlicensed contractors opens up liabilities that can impact the project and even the whole organization. This is also true for business licenses or business tax registration if required in the jurisdiction of the project.

One problem with T&M contracts is they can result in more lawsuits than a fixed-price contract. It’s important to know the risks and consequences involved with contracting with third-party workers. There can be issues with back taxes and other IRS penalties, back pay and damage to the organization’s reputation.

Request for Proposal (RFP) Template

This free RFP template helps you specify all the information that construction contractors will need to include in their construction bids including the scope of work, timeline, budget and other details that will later be used in the time and materials contract.

Free Construction Project Management Templates

Project management and construction management are complex disciplines. That’s why we’ve created dozens of project management templates to assist project managers while they plan, schedule and track projects. Here are some construction project management templates to help you save time.

Construction Estimate Template

A very important part of construction project management is time and cost estimates. That’s true for project owners, contractors and subcontractors, whose profitability depends on accurate project estimates. This free construction estimate template is a great tool to start documenting your construction costs.

Construction Schedule Template

Creating a realistic project schedule is key for success in construction as materials, equipment and labor need to be available at the right time to avoid extra costs or delays. This construction schedule template is a simple tool to get started with construction scheduling.

Construction Proposal Template

Project owners decide which is the best contractor for their project by analyzing their project proposal. Use this free construction proposal template to create a proposal that will stand out in the construction bidding process.

How ProjectManager Helps Keep Track of Time & Materials Contracts

Time and material contracts may be right for you. But if you’re going to use one, it’s crucial you closely track the time and materials used by your contractor. This way you’re only paying for work that has actually been done. ProjectManager is award-winning construction project management software that can monitor the time your contractors work on the job and track the materials they use, all in real time.

Easy Time Management

It’s easy to onboard contractors to our tool, and security settings make sure they’re only able to access those parts of the software you give them permission to use. One feature that helps you track their work is our timesheets . When contractors submit their timesheets, they’re sent to the authorized approver and locked to keep the data secure.

Plan with Gantt Charts

Use our Gantt chart view to plan and schedule your project. You can assign and keep track of contractors’ work, as well as track expenses. Once you have a schedule and budget, set the baseline to compare the actual progress and costs to your plan. If you notice contractors spending too much time or money, you can address the issue before it becomes a problem.

Track Data with Live Dashboards

There’s also a live dashboard that tracks a high-level view of the project’s progress and performance. It automatically collects real-time data and calculates it into project costs, time, variance and more. Whatever type of contract you use, our tool makes sure your contractors are working efficiently.

Related Content

- Types of Construction Contracts: Pros, Cons & Best Practices

- Construction Documents: Types of Construction Drawings

- How to Make a Construction Plan

- How to Make a Construction Schedule

- Best Construction Scheduling Software

ProjectManager is online software that helps you organize tasks, teams and projects. Plan, monitor and report on your project through every phase of its life cycle while giving your teams the tools they need to collaborate and work more productively. Join the tens of thousands of teams already using our tool and take this free 30-day trial today.

Deliver your projects on time and under budget

Start planning your projects.

Call us: 202-775-7240

FAR 52.232-7: Payments Under Time-and-Materials and Labor-Hour Contracts

Applicability: This FAR clause specifies the payment terms for Time-and-Materials (T&M) and Labor-Hour (LH) contracts that were not acquired using FAR Part 12 (commercial items). The clause is included in solicitations and contracts when a time-and-materials or labor-hour contract is contemplated (other than a FAR Part 12 acquisition).

Key Requirements: A T&M contract is comprised of two key elements: (1) Time, and (2) Materials (note that a labor hour contract is a T&M contract without the materials). The T&M/LH payments clause specifies how payments will be made for both the Time and the Materials elements of the contract.The clause at FAR 52.215-7 also includes key elements related to other areas, including assignment and release of claims; ceiling price; and the timing of interim payments. While all of these are important requirements, issues most frequently arise related to the Time and/or Materials paragraphs of the clause:

Time: The clause provides for payment at a fixed hourly rate for labor that meets the labor category qualifications of a labor category specified in the contract. The fixed hourly rate includes wages, indirect costs (fringe benefits, overhead, etc.), general and administrative expense, and profit. The labor can be performed by the prime contractor (including any divisions, subsidiaries, or affiliates under common control), as well as by any subcontractor. The Contractor is required to substantiate the hours billed (including any subcontractor hours reimbursed at the hourly rate in the schedule) by evidence of actual payment to employees, maintaining individual daily job timekeeping records, and maintaining records that verify the employees meet the qualifications for the labor categories specified in the contract (the contracting officer can also request additional documentation as he/she deems appropriate). The fixed hourly rates are not varied for overtime work unless there is a specific schedule in the contract for overtime rates.

Materials: The clause defines materials to include direct materials; subcontracts for supplies and; other direct costs(e.g., travel, computer usage charges, incidental services for which there is not a labor category specified in the contract); and applicable indirect costs. Direct materials, subcontracts for supplies and other direct costs are generally billed based on actual cost incurred, provided the payments are made in accordance with the terms and conditions of the agreement or invoice and those payments are ordinarily made within 30 days after the submission of the voucher to the Government. However, if the Contractor furnishes its own materials that meet the FAR definition of a commercial item, the contractor can bill at established catalog or market prices, adjusted to reflect the quantities being acquired and any modifications necessary because of contract requirements.

Other key requirements include the following:

– Payment for materials is subject to the Allowable Cost and Payment clause at FAR 52.216-7.

– Other direct costs and indirect costs cannot include any costs that are already part of the fixed hourly rate, and must be allocated in accordance with the contractors written/established accounting practices.

– Indirect costs are only applied to materials, i.e., they are not applied to the fixed hourly rates (as noted in the Time section of the contract, the fixed hourly rates already include all applicable indirect costs).

– The contractor must obtain materials at the most advantageous prices available with due regard to securing prompt delivery of satisfactory materials; and take all cash and trade discounts, rebates, allowances, credits, salvage, commissions, and other benefits (when unable to take advantage of the benefits, the Contractor shall promptly notify the Contracting Officer and give the reasons).

– No profit is allowed on materials, except when the contractor furnishes its own materials that meet the definition of a commercial item.

Compliance Verification: This function is generally shared among the Contracting Officer Technical Representative (COTR) and the cognizant auditor. The clause contains a specific paragraph (f) entitled “Audit”. Under this paragraph, at any time before final payment under this contract, the Contracting Officer may request audit of the vouchers and supporting documentation. The COTR generally reviews supporting documentation for each voucher, while the cognizant auditor will generally perform reviews on a sample basis or when specifically requested by the contracting officer.

Remedies: This FAR clause includes several specific remedies, including the following:

1. Labor Category Qualifications. The Government will not pay for work performed by employees that do not meet the qualifications specified in the contract, unless specifically authorized by the Contracting Officer. Thus it is imperative that employees meet the qualifications specified in the contract for the labor category to which they are billed.

2. Consent to Subcontract. The time portion of the clause also specifically addresses the issue of Consent to Subcontract. The clause state that if the Contractor fails to obtain consent for any subcontract that requires consent under the clause at FAR 52.244-2, Subcontracts, the Government is not required to reimburse the Contractor for any costs incurred under the subcontract prior to the date the Contractor obtains the required consent. Any reimbursement of subcontract costs incurred prior to the date the consent was obtained shall be at the sole discretion of the Government.

3. Contract Closeout. The Contracting Officer may require a withhold of 5 percent of the amounts due but the total amount withheld for the contract shall not exceed $50,000. The amounts withheld shall be retained until the Contractor executes and delivers the release required by the clause. The withhold is at the discretion of the contracting officer – if the contractor has a history of executing and delivering the release in accordance with the timing requirements of the clause, it is much more likely that the contracting officer will not require the withhold (or may require an amount less than the maximum provided for in the clause).

4. Materials. For the materials portion of the clause, the only remedy is a cost disallowance/non-reimbursement of the cost claimed if the cost does not meet the requirements of the clause.

Background: This contract clause was substantially revised in February, 2007. The revised clause provided a clear distinction between the Time (Fixed hourly rates) and Materials (everything that is not part of the fixed hourly rate) elements of the contract. Prior to these revisions, there were disputes regarding whether work performed by a subcontractor could be billed using the fixed hourly rates or was limited to the actual cost billed by the subcontractor. Some contracts included addendums that allowed subcontractor work to be billed at fixed hourly rates, while others were silent. In addition, there was no specific remedy to address instances where a prime contractor billed for subcontract costs but had failed to obtain the required consent to subcontract. Furthermore, it was also unclear what the remedy was if an employee did not meet the labor qualifications for the category to which he/she was billed. The revised clause was the result of two proposed rules and two public meetings, which were instrumental in forging the current language.

Other Key Information: The Time portion of the contract clause works in conjunction with the solicitation provisions at FAR 52.216-29 (Time-and-Materials/Labor-Hour Proposal Requirements — Non-Commercial Item Acquisition with Adequate Price Competition) and FAR 52.216-30 (Time-and-Materials/Labor-Hour Proposal Requirements — Non-Commercial Item Acquisition without Adequate Price Competition). These provisions address whether or not a contractor will be permitted to bill subcontractor costs using a blended fixed hourly rate or if separate rates are required. Under the blended rate, there is only one rate for each category. For example, a Senior Engineer is billed at the fixed hourly rate of $150 specified in the contract for all work done by a Senior Engineer, regardless of whether that work is performed by the prime contractor or a subcontractor. Conversely, separate rates would require a prime contractor rate for the Senior Engineer (e.g., $160), and a separate rate for each subcontractor (e.g., $140 for a Senior Engineer at Subcontractor A, $150 for a Senior Engineer at Subcontractor B, etc.).

Related Post

Far 52.217-3, 52.217-4 & far 52.217-5 evaluation of options.

Applicability: As stated at FAR 17.208(a) thru (c), the provisions at FAR 52.217-3, 52.217-4, and 52.217-5 are included in solicitations as follows: (a) Insert FAR 52.217-3 when the solicitation includes an option clause and does not include one of the provisions...

FAR 52.216-31 Time-and-Materials/Labor-Hour Proposal Requirements (Part 3)

Commercial Item Acquisition NOTE: This is the third in a three-part series on Time-and-Materials/Labor-Hour Proposal Requirements. Part 1 addressed non-commercial item acquisition with adequate price competition (FAR 52.215-29). Part 2 addressed non-commercial item...

FAR 52.216-30 Time-and-Materials/Labor-Hour Proposal Requirements (Part 2)

Non-Commercial Item Acquisition with Adequate Price Competition NOTE: This is the second in a three-part series on Time-and-Materials/Labor-Hour Proposal Requirements. Part 1 addressed non-commercial item acquisition with adequate price competition. This Part 2...

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

- Clause Library

5252.231-9200 / Basic

Navy 5252.231-9200 reimbursement of travel costs basic (jan 2006) (current).

This clause has not been authorized for official release. We recommend deferring to the text of the clause in your RFP or contract.

(a) Contractor Request and Government Approval of Travel Any travel under this contract must be specifically requested in writing, by the contractor prior to incurring any travel costs. If this contract is a definite or indefinite delivery contract, then the written Government authorization will be by task/delivery orders issued by the Ordering Officer or by a modification to an issued task/delivery order. If this contract is not a definite or indefinite delivery contract, then the written Government authorization will be by written notice of approval from the Contracting Officer’s Representative (COR). The request shall include as a minimum, the following:

(1) Contract number (2) Date, time, and place of proposed travel (3) Purpose of travel and how it relates to the contract (4) Contractor’s estimated cost of travel (5) Name(s) of individual(s) traveling and; (6) A breakdown of estimated travel and per diem charges.

(b) General