- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

World Nomads Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does World Nomads travel insurance cover?

World nomads single trip plans, which world nomads insurance plan is best for me, can you buy world nomads travel insurance online, what isn’t covered, is world nomads insurance worth it.

World Nomads

- Travelers can extend coverage mid-trip.

- The standard plan covers up to $300,000 in emergency evacuation costs.

- Plans automatically cover 200+ adventurous activities.

- No Cancel For Any Reason upgrades are available.

- No pre-existing medical condition waivers are available.

World Nomads offers the Standard and Explorer travel insurance plans and excels in sports/activity related travel insurance coverage while offering solid trip delay, baggage delay and lost luggage protections.

The provider offers insurance plans for travel to nearly any country and is available to residents of most countries. In the U.S., World Nomads policies are administered by Nationwide Mutual Insurance Company, a Fortune 100 company offering various types of insurance and financial products.

Here’s what you need to know about World Nomads travel insurance to help you decide which plan makes sense for your trip.

Before you buy a plan, check to see if you already have coverage through a premium travel credit card , and if so, verify whether those limits are sufficient. If they are, standalone emergency medical coverage may be adequate as the travel insurance provided by credit card often excludes healthcare expenses or offers a low limit (the Chase Sapphire Reserve® is one of the few cards to offer emergency medical and dental, however coverage is capped at $2,500 ).

Chase Sapphire Reserve®

World Nomads offers different coverage levels for its travel insurance options, but both qualify as single trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

World Nomads is unique amongst other providers as it is a good fit for adventurous travelers. Its plans automatically include coverage for over 200+ activities, including skiing , rafting, backpacking and bouldering. Note that extreme sports are not covered.

All plans include trip protection, emergency medical insurance , emergency evacuation and coverage to protect your gear.

World Nomads offers two plans, with the latter offering higher limits and additional adventure sports coverage.

The plans can be purchased for trip duration up to a maximum 180 days, and you can extend your coverage mid-trip. The price of the policy will depend on the duration of the trip and the countries that you're visiting.

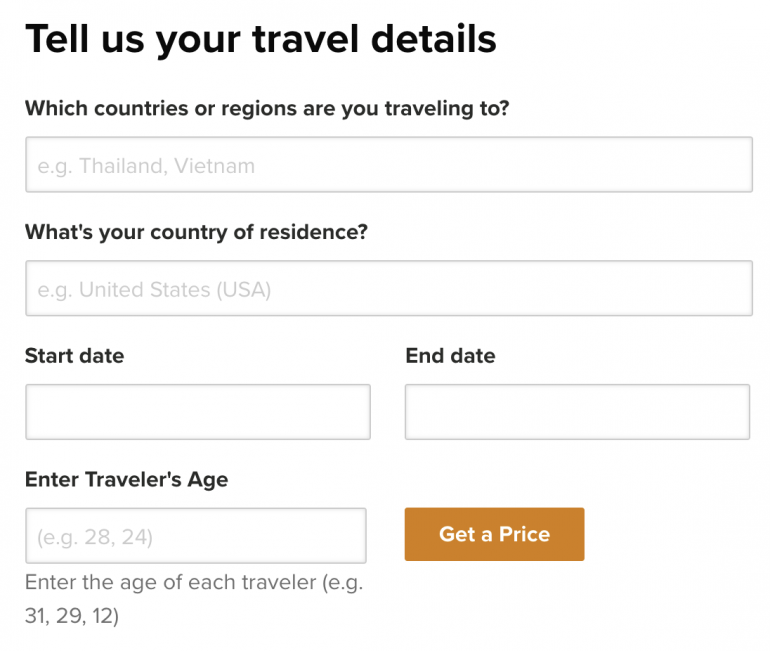

To see the cost of the insurance plan, you will need to input your trip details, your age and state of residence. Unlike many other insurers, you do not need to include the cost of your trip when searching for a World Nomads policy because trip cancellation and interruption benefits are capped at a specific dollar amount rather than a percentage of money spent.

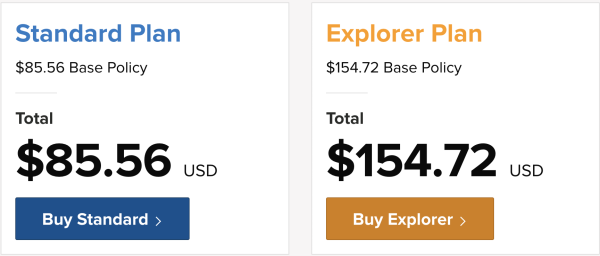

We input a sample trip of a two-week vacation in December 2023 to Italy by a 30-year-old from Illinois.

World Nomads single trip plan cost

Here are some example World Nomads insurance costs based on our example trip.

Standard Plan

The Standard Plan ($86) is a good choice for those who are satisfied with trip cancellation and interruption coverage of $2,500 or less, do not need rental car damage protection, find the limits to be sufficient and do not need coverage for certain adventure sports.

However, this plan still shines in sports coverage, covering activities like wind surfing and bungee jumping, which are seldom covered by travel insurance companies. A full list of covered sports by plan type is available on the World Nomads site.

Explorer Plan

The Explorer Plan ($155) includes all the benefits of the Standard Plan along with higher limits, rental car damage insurance (in the states where it is available) and adventure sports (e.g., skydiving, heli skiing) coverage.

This choice is also good for those whose trips costs less than $10,000 as this is the maximum trip cancellation and interruption protection.

A Cancel For Any Reason (CFAR) upgrade is not offered by World Nomads. If this option is a must, look for a travel insurance company that offers CFAR.

Selecting the appropriate plan for your travels involves understanding which coverage you’d like on the trip.

If you have a premium travel card : If you have a premium travel card that offers an adequate amount of trip cancellation / interruption benefits, you may only need to get a standalone emergency health care policy. For example, The Business Platinum Card® from American Express offers $10,000 per trip and $20,000 per year in trip cancellation benefits . Terms apply. Only the Explorer Plan ($10,000) has a comparable level of trip cancellation protection. Terms apply.

If the coverage provided by your card isn’t adequate or applicable: If you don’t have a premium travel credit card , the coverage provided by your card isn’t sufficient or you didn’t use the card to pay for your trip, then a comprehensive insurance plan like the Standard or Explorer plan might be the best choice.

More chill travelers: If you don’t need adventure sports coverage and your trip costs less than $2,500 (or you already have trip cancellation / interruption benefits from your credit card), the Standard Plan would be sufficient.

» Learn More: How to find the best travel insurance

Go to worldnomads.com and input your trip details.

If your country of residence is the U.S., an additional row will appear asking you to input your state.

» Learn more: Is travel insurance worth it?

Trip insurance plans are filled with exclusions, so you’ll want to pay attention to what is and isn’t covered so there aren’t any surprises. Here are some exclusions you can expect from World Nomads:

Pre-existing conditions: If you’ve sought treatment for any illness or condition in the 90-day period preceding the start of the policy and then seek medical care for the same illness/condition, you may be on the hook for the bill since World Nomads does not cover pre-existing conditions.

Intentional acts: Losses sustained from self-harm, intoxication, drug use or criminal activity are not covered.

Travelers with pre-existing conditions might consider policies from providers like Travel Guard by AIG or Allianz .

» Learn more: The best travel insurance companies right now (World Nomads is on the list!)

World Nomads has been offering insurance since 2002. The company is well established and offers two single trip travel insurance policies to fit many different needs.

Both plans offered by World Nomads include trip cancellation, interruption and delays; emergency accident and sickness medical expenses; emergency evacuation; repatriation of remains; non-medical emergency transportation; baggage and personal effects; baggage delay for outward journeys; rental car damage in certain locations; accidental death and dismemberment; Generali Global Assistance; and adventure sports and activities.

World Nomads does not include Cancel For Any Reason coverage, even as an add on.

You will need to file a claim with the insurer after you’ve incurred costs related to a covered expense. If the claim is approved, you will receive a reimbursement. In some instances, such as baggage delay, World Nomads pays you a fixed amount per day rather than 100% coverage for costs incurred.

World Nomads offers some good travel insurance plans for adventurous, single-trip travelers. This is also a good fit for anyone who is uncertain about their trip length (since you can add coverage during your vacation).

Insurance can be extended mid-trip.

You can insure trips up to 180 days in length — which makes it an attractive option for digital nomads .

Adventure sports coverage is more robust than many other plans.

Simple choice of two plans.

Extreme sports are not covered.

There is no annual plan option. A policy ends once you return within 100 miles of home, even if you’re only home briefly as part of a long trip.

Regardless of your trip cost, trip cancellation and interruption coverage is capped at a dollar amount rather than as a percentage of trip cost. The Standard Plan and Explorer Plan cover trips up to $2,500 and $10,000, respectively. If you’re going on a more expensive trip, you won’t be able to protect the entire trip.

You must be 70 years old or younger to qualify for coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

A previous version of this article misstated World Nomads' insurance offerings. This article has been corrected.

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

World Nomads Travel Insurance Review | Money

E ven the best travel insurance companies don’t generally cover sport injuries, and if they do, it’s for an additional cost. World Nomads, on the other hand, is ideal for thrill-seeking travelers that plan to do more than just head to the beach or visit tourist attractions. The company offers travel insurance options that include coverage for extreme sports, such as snowboarding, skydiving and scuba diving.

Read on for a detailed review on World Nomads’ insurance options, accessibility, customer experience and more.

Best for Adventure Sports

World Nomads offers ideal coverage options for adventure seekers. For example, the Explorer plan — the company’s most comprehensive — insures against accidents that can happen in adventurous activities and sports, including triathlons.

Most of World Nomads’ competitors don’t offer similar insurance packages for travelers involved in high-risk activities. However, purchasing a World Nomads plan may be expensive if your trip doesn’t include sport and adventure activities .

World Nomads Travel Insurance Pros and Cons

- Insurance coverage for 200+ sports and adventure activities

24/7 emergency assistance

- Additional coverage can be purchased during your trip

No pre-existing medical condition coverage

- No coverage options for travelers aged 70+

- No "Cancel for Any Reason" add-on available

Pros explained

World Nomads plans can include coverage for more than 200 types of sports and activities, 24/7 emergency assistance and the option to purchase additional coverage during a trip.

Insurance coverage for 200+ sports activities

World Nomads Travel Insurance is an excellent option for thrill-seeking travelers. The company has two plans that cover a wide range of sport activities.

The Standard package covers activities such as horseback riding, zip lining and river tubing. The Explorer package offers coverage for more intense activities like shark cage diving, skydiving and ice climbing.

However, World Nomads has specific restrictions on some of the activities. For example, the Standard package covers tree climbing but only up to 33 feet. With this in mind, read your insurance agreement carefully to make sure you know the extent of your coverage.

World Nomads Travel Insurance has a hotline with representatives ready to provide emergency assistance 24 hours a day, seven days a week for both the Standard and Explorer plans.

Agents can help you schedule a dentist appointment for an emergency tooth extraction or advise you on how to get a prescription filled while traveling internationally, for example. You can also get assistance for replacing lost or stolen items, arranging medical transportation and arranging an emergency cash advance.

Additional coverage can be purchased during a trip

Another advantage of choosing World Nomads is that if you decide to extend your vacation mid-trip, you can buy additional coverage.

World Nomads policies can cover getaways of up to 180 days. However, if your coverage expires during your trip, you can log onto the World Nomads site and purchase a new policy.

Verify all policy documents the company sends by email as they contain important information regarding waiting periods, conditions and restrictions that may apply.

Cons explained

Just as World Nomads trip insurance has positive features, there are some drawbacks.

World Nomads considers any illness, disease or other condition you’ve had within the past 90 days a pre-existing medical condition. These are not eligible for medical expenses, trip interruption, trip cancellation and accidental death and dismemberment coverage.

World Nomads defines a pre-existing condition as one you’ve:

- Shown symptoms of

- Been tested or treated for

- Been recommended to get a test for

- Received a prescription for

Note that many travel insurers do not underwrite pre-existing conditions. However, some offer a pre-existing condition exclusion waiver if you purchase a policy within a set number of days of making the first payment towards your trip.

Travelers aged 70+ can’t purchase coverage through World Nomads

World Nomads does not insure U.S. travelers that are age 70 or older. But residents of some countries will find other age limits. For example, Canadian travelers must be under age 66 to purchase coverage, and residents from the United Kingdom must be under 65.

No ‘Cancel for Any Reason’ upgrade

Worlds Nomads Travel Insurance doesn’t offer a “Cancel for Any Reason” (CFAR) coverage. This optional add-on is offered by some insurers and it allows you to cancel your trip for any reason, even if it’s not covered in the main policy. CFAR coverage usually provides a refund of up to 75% of your non-refundable trip costs.

World Nomads Travel Insurance Plans

World Nomads Travel Insurance offers two plans, Standard and Explorer. Both plans are similar, but the Explorer plan offers higher coverage limits.

Plans are available for international or domestic travel. If you are purchasing coverage for a domestic trip, you will not be covered unless your destination is over 100 miles away from your home.

Standard Plan

The Standard plan is quite comprehensive, covering trip interruptions and delays, medical expenses, accidental death and dismemberment and more. Some of the plan’s benefit limits include:

- $2,500 for Trip Cancellations

- $100,000 for Medical Expenses

- $300,000 for Emergency Evacuations

This plan also insures baggage, gear and personal effects up to $1,000. Keep in mind that it covers activities and sports that most other insurance companies don’t, such as backpacking, sailing, golfing and more.

Explorer Plan

The Explorer plan covers everything the Standard plan does, but also offers more benefits and higher coverage caps.

Although the Standard plan covers numerous sports and adventures, the Explorer plan is the best option for travelers participating in higher-risk activities, such as hot air ballooning and skydiving. The plan also includes rental car coverage except for residents of Texas or New York.

Here are some of the plan’s benefit limit:

- $10,000 for Trip Cancellations

- $100,00 for Medical Expenses

- $3,000 for Baggage Delays and Personal Effects

- $500,000 for Emergency Evacuations

World Nomads Travel Insurance Pricing

To get a cost estimate for your policy, visit the World Nomads website and request a free quote. Policy prices vary depending on the state of residence and age of the travelers, the dates and destination of your trip and other factors.

World Nomads Travel Insurance Financial Stability

Policies offered by World Nomads Travel Insurance are underwritten by Nationwide Mutual Insurance Company. This means that Nationwide assumes the financial responsibility of paying out the claims. Nationwide Mutual Insurance and World Nomads have an A+ and A- AM Best Financial Strength Rating, respectively.

World Nomads Travel Insurance Accessibility

Availability.

World Nomads Travel Insurance policies are available to residents of all 50 states and over 140 countries.

Contact information

There are several ways you can contact the company’s support team.

For general inquiries about policies, visit the website and fill out a form on the Contact Us page .

For toll-free emergency assistance in the U.S. or Canada, the World Nomads Travel Insurance phone number is (877) 289-0968. For emergency assistance outside of the U.S. and Canada, World Nomads offers a collect number at (954) 334-8143.

You can also email the company at [email protected].

User experience

The company website is easy to navigate overall, including easy-to-follow information regarding benefits and limits. You can also find a detailed list of the numerous sport activities the company covers with each of its plans.

World Nomads Travel Insurance Customer Satisfaction

World Nomads has a poor customer rating of 1.08 out of 5 stars on the Better Business Bureau (BBB). However, the company has received only nine complaints in the past year and the company has answered most of them.

On third-party review sites, some users have complained about the claims process and not being covered for certain activities. To prevent these situations, read your policy carefully or talk to a customer service representative to avoid denied claims.

World Nomads Travel Insurance FAQ

Is world nomads a good travel insurance company, what doesn't world nomads travel insurance cover.

World Nomads policies don't cover pre-existing conditions, routine physicals, non-urgent medical treatments and pregnancy-related expenses.

How do I sign up for World Nomads Travel Insurance?

How do i make a travel insurance claim with world nomads, how we evaluated world nomads travel insurance.

To evaluate World Nomads Travel Insurance, we considered its website accessibility, policies, support options, financial stability and customer reviews. We also compared it to other companies in the travel insurance industry.

Summary of Money’s World Nomads Travel Insurance Review

World Nomads Travel Insurance offers comprehensive policies specifically designed for adventure seekers.

The company has two insurance plans, each one covering trip delays and cancellations, emergency medical expenses, baggage and more. What makes these policies stand out is its coverage for over 150 sports and activities, like hiking, snowboarding, scuba diving and skiing. Other travel insurance providers typically shy away from providing sports coverage, and if they do, it’s at an additional cost.

Before purchasing a policy from World Nomads or any other insurer, check that the activities you’re planning for your trip are covered and be aware of any restrictions.

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

This article may contain affiliate links that Microsoft and/or the publisher may receive a commission from if you buy a product or service through those links.

- Travel Insurance

- World Nomads Travel Insurance Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

World Nomads Travel Insurance Review 2024

Updated: Jan 8, 2024, 12:05pm

Vacationers with a thirst for adventurous activities like mountain biking, skydiving and heli-skiing should take a look at World Nomads’ Standard and Explorer plans. While most travel insurance companies won’t insure these types of activities, World Nomads covers more than 250. With that in mind, we’ve created a breakdown of what they can offer those who have a thirst for adventure.

- Covers activities many insurers will not, such as scuba diving, rock climbing and skydiving.

- $500,000 in coverage for emergency medical evacuation available with both plans.

- 24/7 travel assistance hotline.

- Coverage for sporting equipment theft or loss with both plans.

- No option to purchase “cancel for any reason” coverage.

- No coverage starting at age 66.

- Lower trip cancellation/interruption maximums compared to other plans.

- Some riskier activities, such as high altitude expeditions, not covered.

Table of Contents

About world nomads travel insurance, world nomads travel insurance plans, summary: world nomads’ standard plan vs. explorer plan, world nomads travel insurance cost, does world nomads travel insurance have 24/7 travel assistance, does world nomads cover pre-existing conditions, does world nomads offer “cancel for any reason” coverage, what type of activities does world nomads cover, what’s not covered, how to file a claim with world nomads travel insurance.

When searching for good travel insurance plans, you want to find a policy that covers the types of activities you plan on doing during your trip. World Nomads has been selling travel insurance since 2002 and is underwritten by AIG Insurance Company in Canada. Their plans provide comprehensive travel insurance coverage with the explorer and thrill-seeker in mind.

Here are the key types of travel insurance coverage offered in World Nomad plans:

- Trip cancellation insurance: If you cancel a trip for a reason listed in your policy, trip cancellation insurance can reimburse you 100% for prepaid, non-refundable costs.

- Travel medical insurance: If you get ill or are injured on your trip, travel medical insurance can pay for emergency medical expenses, up to the limits in your plan. These expenses can include doctor and hospital bills, medication and lab work.

- Emergency medical evacuation: If you are injured or ill during your trip and need to be transported, emergency medical evacuation insurance pays for your medical evacuation (medevac) to the closest medical facility that can treat your condition. World Nomad’s emergency assistance team can also arrange for the transportation.

- Travel delay insurance: If your trip is delayed due to a reason covered in your plan, travel delay insurance reimburses for extra costs, such as a hotel room for an overnight delay, up to the amount specified in your policy.

- Travel interruption insurance: Trip interruption insurance can pay for a last-minute flight home in an emergency and money that you lose by cutting a trip short, such as non-refundable activities and hotel stays.

- Baggage and personal effects: Baggage travel insurance can compensate you up to your policy limits if your luggage is lost or stolen. It will reimburse the depreciated value of your suitcases and what you packed. If your bags are delayed, it can reimburse you for the cost of necessities you buy to tide you over. It also extends to your personal belongings, if lost, damaged or stolen. Some exclusions apply, so check your policy to see what’s covered.

World Nomads offers travelers two types of plans: The Standard and Explorer.

Standard Plan

This is a budget-friendly plan that offers pre-and post-departure coverages such as trip cancellation, trip delay, trip interruption, emergency evacuation, emergency medical insurance and baggage and personal effects coverage. It also provides emergency medical assistance and evacuation if you’re injured while participating in high-risk activities such as parasailing, mountain biking or bungee jumping.

Explorer Plan

This travel insurance plan includes all the coverages found in the Standard plan, but it comes with higher coverage limits. For example, emergency medical expenses increases from $5 million to $10 million, trip cancellation from $2,500 to $5,000 and sporting equipment theft or loss from $1,000 to $2,500.

Here’s a comparison of the Standard plan and the Explorer plan and how much coverage you’ll receive with each.

The amount you’ll pay for World Nomads travel insurance will vary depending on your destination, age of travellers, where you reside, cost of trip and other factors.

However, to give you an idea of how much you could pay for a policy, here are a few examples of quotes comparing the Standard plan to the Explorer plan for three different scenarios of travellers from Ontario.

Keep in mind that you must be less than 66 years old when you purchase your policy.

World Nomads travel insurance plans include 24/7 travel assistance. This hotline offers assistance such as:

- Emergency and after-hours travel services.

- Rebooking flights.

- Hotel reservations.

- Ground transportation.

- Luggage tracking.

- Lost/stolen credit card replacement.

There’s also a 24/7 security assistance hotline offering assistance during minor security incidents and life-threatening events, including:

- Secure evacuation assistance.

- Security and safety advisories, global risk analysis and specialist consultations.

- Urgent message alerts.

- 24/7/365 incident response services to assist customers and their families.

You’ll need your policy number, a contact number for where you are at the time of the call, the nature of the problem, our location and prescribed medication, if any.

The assistance team at Travel Guard can be reached by phone collect from anywhere outside Canada and the continental U.S. at +1-416-646.3723 or email at [email protected].

World Nomads also provides support for the fun parts of travel, too. Say you need help planning your next day’s excursion. You can contact its 24/7 Adventure Traveller’s Hotline for:

- Weather reports and travel advisories

- Assistance locating the nearest crag, white-water or trail

- Information on access issues

- Construction and detour information

- Locations of nearby gear shops, guides and outfitters

World Nomads has strict stipulations around coverage for pre-existing medical or dental conditions. The company defines pre-existing conditions as those you have shown symptoms of, had sought or received medical treatment for, or have received a prescription for (or changed your type, usage or dosage) for a specified number of days prior to your policy’s effective date.

However, in some cases a stable pre-existing condition treated by prescription medicine may be covered. If you are taking a prescription for a pre-existing condition that is treated or controlled solely by prescription drugs and there has been no adjustment to the prescription for a specified number of days prior to your policy’s effective date, World Nomads’ definition of pre-existing condition will not apply.

The time period for pre-existing conditions depends on your age. For example, for age 0 to 49, World Nomads will not cover any loss or expense related to your medical condition if it was not stable or controlled in the 90-day period prior to your policy’s effective date. For ages 50 to 59, that time period is 180 days and for ages 60 to 65, that time period is 270 days.

Also, World Nomads will not extend coverage if you’ve been prescribed to take nitroglycerin for a heart condition more than once in seven days, or if you’ve had to take oral steroids, such as prednisone, for a lung condition.

World Nomads does not offer cancel for any reason insurance (also known as CFAR).

Most travel insurance companies tend to exclude coverage for dangerous activities like skydiving and kickboxing. But World Nomads covers more than 250 types of adventurous activities, depending on your plan.

There’s a distinction between activities included for all plans (meaning both the Standard and Explorer plans) and optional extras for snow, water, air, land, sports and experience activities. For example:

Activities for all include:

- Glacier walking

- Indoor ice skating

- Horse-drawn sleigh rides

- Kite surfing

- Sailing/Yachting

- Snorkelling

- Speed boating

- Water skiing/wakeboarding

- Aerial safari

- Bungee jumping

- Canyon swing

- Fly by wire

- Hot air ballooning

- Camel ride or trekking overnight.

- Camping up to 4,500 metres.

- Caving/spelunking

- Cycling/mountain biking up to 6,000 metres.

- Rock climbing/bouldering

- Stilt walking

Optional extras include:

- Skiing/snowboarding (resort)

- Cross country skiing

- Heli or cat skiing/snowboarding

- Snowmobiling

- Black water rafting

- Fishing/angling

- Free diving up to 50 metres

- Kite boarding

- Parasailing

- Scuba diving to 50 metres

- Shark cage diving to 50 metres.

- White water rafting

- Abseiling/rapelling

- Parachuting/parasailing

- Backpacking up to 6,000 metres.

- Cycling/biking on independent cycle tour.

- Trekking up to 6,000 metres.

Each adventure sport, activity and experience is assigned either a Level 1, Level 2 or Level 3. Level 1 is automatically included while Level 2 and Level 3 require an extra premium due to the perceived higher risk. For example, abseiling or repelling is a Level 3 sport.

Even with the plethora of activities that World Nomads covers, there’s a lengthy list of general exclusions that apply to your coverage. For example, the following activities are not covered by your policy:

- Any injury or sickness that occurs in the 48 hours after your departure date.

- Pre-existing conditions that don’t mean the stability criteria.

- Non-emergency medical treatment or surgery.

- Travelling for the purpose of medical treatment.

- Pregnancy or childbirth.

- Any alcohol-related sickness, injury or death.

- Competing at international events as a national representative.

- Participation in extreme sports.

- Participation as a professional athlete.

- Martial arts competitions or bouts.

- Flying as a pilot or crew of any aircraft.

- Any search and rescue operations or costs.

- Intentionally harming yourself, suicide or attempted suicide.

- Cancellations due to war, civil war, acts of foreign enemies, or civil unrest.

- Travel in, to or through Iran, Syria, North Korea or the Crimea region.

Under the adventure sports coverage, there are also some exclusions for certain sports or activities that are not covered. For example, the following activities are not covered:

- Backpacking over 6,000 metres.

- BASE jumping

- Big game hunting

- Bull riding

- Cavern diving to 40 metres.

- Cliff diving

- Crewing of a vessel less than 60 miles from a safe haven.

- Crewing of a vessel more than 60 miles from a safe haven.

- Crewing on a cruise ship.

- Cycling over 6,000 metres in elevation.

- Deep water soloing

- Expeditions, including any activity over 6,000 metres, any activity that is unsupported, exploratory or establishes new routes, any activity in remote or inaccessible regions, or activities in the Arctic Circle, Antarctic or Greenland without a licensed tour operator and guide.

- Extreme pursuits

- Flying as a passenger while stunt flying.

- Free diving

- Free soloing

- High altitude climbing, mountaineering or expeditions over 6,000 metres.

- Hiking over 6,000 metres.

- Horse riding (bare back, polo or rodeo only).

- Martial arts (cage fighting, mixed martial arts, kick boxing and Muay Thai).

- Mongol Rally

- Motor racing (driver or passenger in a motor sport show, race, competition or rally).

- Mountain biking over 6,000 metres.

- Mountain guide (mountaineering, rock climbing instructor or guide using ropes or specialist equipment.)

- Parachuting more than once. (One jump is included.)

- Power lifting

- Rickshaw Run

- Rock climbing, outdoor, over 6,000 metres.

- Rock fishing

- Running (ultramarathon)

- Running of the bulls.

- Scrambling over 6,000 metres

- Scuba diving over 40 metres

- Skydiving more than once. (One jump is included.)

- Snowmobiling on frozen lakes and rivers.

- Speed flying

- Speed trials

- Stunt flying

- Tandem skydiving more than one. (One jump is included.)

- Tramping over 6,000 metres.

- Trekking over 6,000 metres.

- Triathlon, ultra-distance or more.

- Wingsuit flying

- Yungus Road (Death Road).

There are additional special conditions, such as:

- You must be with a professional, qualified and licensed guide, instructor or operator.

- You must have the appropriate certification or licence to do this sport at home.

It’s a good idea to talk with your travel insurance agent before you participate in certain activities so you’re aware of what isn’t covered.

Like most travel insurers, World Nomads has a list of conditions that make you ineligible for any coverage, including:

- A licensed physician has diagnosed you with a terminal condition.

- You have undergone a bone marrow transplant or an organ transplant that requires anti-rejection or immune suppression drugs. (An exception to this rule is corneal transplantation.)

- You require dialysis for any type of kidney disease.

- In the last 12 months, you have been prescribed or utilized home oxygen therapy at any time.

You can file a claim online 24/7 by logging into your account on the World Nomads website. Once you answer a few questions about your claim, you’ll need to provide your supporting documentation. After the claim is submitted, you will receive an email confirmation. Claims can take up to 10 business days to do an initial review and may take longer if required documents are needed to process your claim.

World Nomads Travel Insurance FAQs

Does world nomads pay for medical costs upfront.

In the case of an emergency, say you’re hospitalized and require surgery, World Nomads will pay your medical expenses upfront as long as you (or someone acting on your behalf) contact the 24/7 Emergency Assistance team for approval and the issue is covered by your policy.

If you don’t contact World Nomads before seeking medical attention, emergency evacuation or repatriation, you may be responsible for 30% of medical expenses incurred.

Does World Nomads cover COVID-19?

World Nomads may provide reimbursement for claims arising from COVID-19. For example, if you contract COVID-19 while travelling, you may be eligible for benefits under the trip cancellation, trip interruption and trip delay sections of the policy. You may also be eligible for benefits under the emergency medical coverage section of your policy.

However, as pandemic regulations continue to evolve, if you’re concerned about coverage for COVID-19, it’s best to check your coverage limits with your insurance agent when you’re buying your policy.

Does World Nomads offer coverage extensions?

If you’re travelling and you’d like to stay a little longer, you can extend your travel insurance coverage as long as your policy has not yet expired and you have not yet made a claim. You need to log on to your account and change the end date of your policy up until 24 hours before expiry.

If you’re hospitalized on your scheduled return date, your coverage will automatically be extended at no additional cost for the period of hospitalization and up to seven days after discharge. If you’re unable to travel due to a medical condition, but you’re not hospitalized, your coverage will automatically be extended for seven days after your scheduled return date. Coverage is also automatically extended for up to 72 hours if there is a flight delay.

Ashley is a personal finance writer and content creator. In addition to being a contributing writer at Forbes, she writes for solo entrepreneurs as well as for Fortune 500 companies. Through her financial expertise, she provides millennials and young professionals the tools and resources they need to better manage their finances.

Fiona Campbell is a Staff Writer for Forbes Advisor Canada. She started her career on Bay Street, but followed her love for research, writing and a good story into journalism. She is the former editor of Bankrate Canada, and has over 20 years of experience writing for various publications, including the Globe and Mail, Financial Post Business, Advisor’s Edge, Mydoh.ca and more.

- Goose Travel Insurance Review

- CAA Travel Insurance Review 2023

- TuGo Travel Insurance Review

- Blue Cross Travel Insurance

- Manulife Financial CoverMe Travel Insurance

- Medipac Travel Insurance Review

- RBC Insurance Travel Insurance

- TD Insurance Travel Insurance Review

- Johnson MEDOC Travel Insurance

- Allianz Global Assistance Travel Insurance

- TD Bank Travel Insurance

- CUMIS Travel Insurance Review

- AMA Travel Insurance

- GMS Travel Insurance Review

- CIBC Travel Insurance Review

- BMO Travel Insurance Review

- Desjardins Travel Insurance Review

- Travelance Travel Insurance

- Scotia Travel Insurance Review

- How To Get Pre-Existing Conditions Covered By Travel Insurance

- Should You Buy Travel Insurance And Is It Worth It?

- Why Travel Medical Insurance Is Essential

Do I Need Travel Insurance When Travelling Within Canada?

- Trip Cancellation Travel Insurance

- How To Get Reimbursement For A Travel Insurance Claim

- Do Canadian Travellers Need Schengen Visa Insurance?

- How Travel Insurance Works For Baggage

- How To Travel To The U.S. From Canada

- Do You Need Annual Multi-Trip Travel Insurance?

- Travel Insurance For Trips To Europe

- What Travel Insurance Does Not Cover

- Top 10 Travel Insurance Tips For 2023

- Travel Insurance For A Mexico Vacation

- How To Read The Fine Print Of Your Travel Insurance Policy

- 5 Top Tips For Handling Flight Cancellations Like A Pro

- What Does Travel Delay Insurance Cover?

- Advantages Of Buying Travel Insurance Early

- Travel Insurance For U.K. Trips

- Travel Insurance For Trips To Italy

More from

$10 etias travel pass for europe visits pushed to 2025, what’s the purpose of an etias travel authorization, bcaa travel insurance review 2024, pacific blue cross travel insurance review 2024, cumis travel insurance review 2024.

Enter your ZIP Code!

Get a quote today..

- World Nomads Travel Insurance Review

World Nomads travel insurance is administered by Trip Mate and underwritten by Nationwide Mutual Insurance Company. Together, these companies have come together to provide Americans with comprehensive travel insurance that appeals to travelers with a sense of adventure.

The company is endorsed by several of the country’s leading travel authorities, including Lonely Planet and STA Travel.

World Nomads is a socially conscious company that promotes responsible and respectful travel and supports several charities in third-world countries through member donations and sponsorships.

In addition to travel insurance, World Nomads has created a complete information database for travelers that includes destination guides, travel films, podcasts, and travel stories.

The company also provides scholarships to further the education of young people who are embarking on a career in travel photography, film, or writing.

The “Ask a Nomad” section on World Nomads’ website works as a social media channel, so travelers connect with like-minded individuals who are interested in similar destinations and experiences.

How Does World Nomads Travel Insurance Work?

World Nomads was founded in 2002 and has since become a leader in the travel insurance industry. Its extensive list of coverage inclusions makes it a popular choice among young overseas travelers and backpackers.

Unlike many of its competitors, the company includes coverage for accidents that are the result of adventure and sports activities, and non-medical emergency evacuation coverage that takes care of the cost of transportation when travelers are required to evacuate after events such a natural disaster or terrorism.

World Nomads also provides all members with unlimited access to its One Call 24-Hour Customer Assistance line, which customers can access for medical, legal, and travel advice and assistance

Get Rates With World Nomads Now!

World Nomads Travel Insurance Coverage & Plans

World Nomads offers two travel insurance plans to its members. Both options include comprehensive coverage that is ideal for travelers embarking on vacations both domestically and overseas.

The company tends to appeal to young, single travelers and backpackers by including adventure and sports activities coverage in both of its plans.

World Nomads trip insurance plans include the following coverage:

- Comprehensive

- Trip cancellation/interruption

- Lost/stolen baggage

- Accidental death and dismemberment

While coverage offered by World Nomads on both of its plan options is quite comprehensive, the number of options it offers to its members is limited.

Some of World Nomads’ biggest competitors offer far more plan options to consumers in order to allow travelers to choose the insurance plan that suits their needs best.

World Nomads tends to cater to a more specific type of traveler, and the company has done a good job of targeting its niche by offering extensive coverage inclusions that overseas travelers can appreciate, such as non-medical evacuation and adventure and sports medical coverage.

World Nomads Standard Plan

Ideal for travelers looking for an economical yet extensive insurance option, the Standard Plan provides members with a full range of coverage including:

- Emergency medical

- Emergency and non-emergency evacuation and medical transportation

- Lost baggage

- Trip interruption and cancellation

Members under this plan also receive access to the company’s One Call 24-Hour Assistance Service, which provides a wide range of services including medical assistance, legal assistance, travel services, prescription assistance, messaging services, and emergency cash transfer.

World Nomads Explorer Plan

The World Nomads Explorer Plan provides members with everything the Standard Plan includes along with the added benefit of rental car damage insurance.

Additionally, limits under this plan are higher and, in some cases, twice as high as what’s offered under the Standard Plan.

This is the best plan for those who are planning long overseas trips.

World Nomads Plan Limits

While the travel insurance World Nomads offers to its members is fairly inclusive, it’s important to keep in mind that in most cases, pre-existing medical conditions aren’t covered under either plan.

How Much Does World Nomads Travel Insurance Cost?

When budgeting for travel insurance, it’s best to plan on spending between 4 to 8 percent of the total trip cost. Of course, it’s important to keep in mind that travel insurance premiums are calculated by taking many factors into account including the traveler’s age, family members on the policy, the destination, and dates traveling.

Each company has its own unique calculation that’s used to determine premiums, and therefore, quotes may vary when looking at several travel insurance providers .

In order to receive an exact quote on the rates offered by World Nomads travel insurance, it’s best to contact the company directly or use its online quote calculator using the specific details of your trip.

When compared against its competitors, World Nomads trip insurance appears to offer competitive rates for its plans . Of course, it’s important to consider more than just the cost.

Coverage and customer service are important elements to focus on as well. A well-rounded insurance company offers comprehensive coverage, efficient customer service, and affordable rates to provide its customers with the best possible value.

World Nomads Travel Insurance Reviews & Reputation

World Nomads travel insurance reviews across the web indicate that overall, current and former policyholders are satisfied with the coverage and service they’ve received from the company.

Positive reviews found on Trustpilot describe customer service provided by World Nomads agents as friendly and personable, and the claims process as simple with quick turnaround times.

Although World Nomads doesn’t hold BBB accreditation, the company closely monitors ratings and reviews it receives on Trustpilot, where it has a TrustScore of 5.1 out of 10, which is below many of its competitors’ scores.

Recent issues mentioned by customers include long wait times when calling into the company’s 24-hour service line and technical difficulties with the company’s mobile app and website portal.

World Nomads appears to respond to every review posted by its customers, whether positive or negative.

Customer Assistance Services

World Nomads is a leader when it comes to the digital experience it offers to its consumers.

The company has a secure online portal that allows members to file claims, manage policies, and access 24/7 customer support. Similar functionality is provided by the World Nomads mobile app, which is available for iOS and Android devices.

In addition to a fantastic digital experience, World Nomads members have access to the One Call Worldwide Travel Services network, which is a 24-hour customer service and emergency assistance hotline.

In the travel insurance industry, providing 24/7 access to customer support and emergency assistance is crucial, and it’s features like this that make World Nomads an industry leader.

When travelers require claims assistance and support, it’s often urgent and in a different time zone as the call center. That’s why it’s crucial that insurance providers offer 24-hour customer service to their policyholders.

World Nomads Travel Insurance Financial Stability

Looking for the right travel insurance provider means conducting thorough research about a company’s coverage, costs, customer service, and perhaps most importantly, financial stability. A company’s finances can provide consumers with insight into a company’s ability to follow through with its promises.

Customers who purchase insurance from a company without a strong financial profile run the risk of filing claims that aren’t paid out on time or even at all.

Independent rating agencies such as Standard and Poor’s, Moody’s, and A.M. Best provide consumers with detailed credit ratings for insurance providers and other businesses.

Nationwide Mutual Insurance Company, which provides underwriting services for World Nomads, has an A+ financial strength rating from both Moody’s and A.M. Best.

A rating of A+ indicates that the company’s financial performance is strong with a generally positive outlook. It also suggests to consumers that the company can pay out claims and refund cancellations whenever appropriate.

When compared with many other insurance providers, Worlds Nomads’ financial profile is stable.

World Nomads Travel Insurance Phone Number & Contact Information

- Homepage URL: http://www.worldnomads.com

- Provider Phone: 1-844-207-1930

- Headquarters Address: 520 3rd Street, Suite 201, Oakland, CA 94607

- Year Founded: 2002

Additional Providers

There are several other travel insurance providers that deserve consideration as well which you can see in our Best Travel Insurance Companies article.

These companies didn’t make our list of top providers but we have created some more detailed reviews that you can view below:

- Allianz Travel Insurance Review

- Aon Travel Insurance Review

- Carnival Travel Insurance Review

- Chubb Travel Insurance Review

- CSA Travel Insurance Review

- Expedia Travel Insurance Review

- Hotwire Travel Insurance Review

- IMG Travel Insurance Review

- InsureMyTrip Travel Insurance Review

- JetBlue Travel Insurance Review

- John Hancock Travel Insurance Review

- Medjet Medical Transport Insurance Review

- Orbitz Travel Insurance Review

- Patriot Travel Insurance Review

- Priceline Travel Insurance Review

- Progressive Travel Insurance Review

- Red Sky Travel Insurance Review

- Ripcord Travel Insurance Review

- Travel Insured International

- Travelex Travel Insurance Review

- USAA Travel Insurance Review

- USI Affinity Travel Insurance Review

Free Insurance Comparison

Enter your ZIP code below to view companies that have cheap insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Home Equity Loan Rates

- Best Home Equity Loans

- What Is a HELOC?

- HELOC vs. Home Equity Loan

- Best Free Checking Accounts

- Best High-Yield Savings Accounts

- Bank Account Bonuses

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Best CD Rates

- Citibank CD Rates

- Synchrony Bank CD Rates

- Chase CD Rates

- Capital One CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

World Nomads Travel Insurance Review | 2024

Looking to protect your next vacation? See if World Nomads is a good choice by getting a quote below.

Charlotte Armitage is a copywriter and content manager writing for brands primarily in the travel and recruitment industries. Writing is a major hobby as well as an occupation, but she also spends her time reading, dancing and bouldering.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

World Nomads travel insurance offers financial protection in case of unexpected trip cancellation or medical accident abroad. It offers competitive coverage limits and some plans designed for travelers participating in extreme sports or other adventurous activities.

In this article, we at the MarketWatch Guides team will review coverage options, costs, customer reviews and more for World Nomads. We’ll also compare the provider to our picks for the best travel insurance companies to help you decide on a policy that fits your needs.

- Average Cost: $161

- BBB Rating: F

- AM Best Score: A-

- Medical Expense Max: $100,000

- Emergency Evacuation Max: $500,000

Our Take on World Nomads

We awarded World Nomads 3.9 out of 5 stars overall based on our provider review methodology, naming it our pick for adventure travelers. It has the lowest average cost of the 21 providers we gathered quotes from while providing high coverage limits for baggage and travel delays.

However, World Nomads does not offer cancel for any reason (CFAR) coverage like most other companies we’ve reviewed, which allows you to cancel your trip for reasons other than those listed in your policy. It also holds an F rating from the Better Business Bureau (BBB), which resulted in a lower score in the customer service and reviews section of our methodology. We reached out to the company for a comment on its rating but did not receive a response.

Pros and Cons

How world nomads scored in our methodology.

Based on our travel insurance methodology, World Nomads scored 3.9 out of 5 stars in our review. It earned maximum points for coverage details and delay coverage amount in our review, but lost points in every other ratings category.

World Nomads Travel Insurance Overview

World Nomads is a modern travel insurance provider that has been operating since 2002 and specializes in offering travel insurance policies for a range of vacations and excursions. It also offers travel safety advice and destination guides, and it promotes responsible travel practices.

We rate World Nomads as a good travel insurance company for adventurous travelers in particular. The company’s delay, cancellation and interruption coverage limits are highly competitive, and its travel insurance plans are designed for the vacationer who enjoys an adventurous trip that involves any kind of extreme sport.

Compare World Nomads to the Competition

See the table below for a direct comparison of average plan costs, BBB ratings, CFAR coverage limits and COVID-19 coverage between World Nomads and its competitors.

World Nomads vs Allianz

World Nomads and Allianz Global Assistance both do not offer CFAR coverage, which may be a dealbreaker for travelers foreseeing a change of travel plans.

We found the main differences between World Nomads and Allianz based on our review of customer service and cost. At $265, the average cost of a travel insurance policy with Allianz is over 64% more than the average cost of a World Nomads policy.

Even so, some travelers may feel Allianz’s A+ rating and accreditation with the BBB offsets the high costs associated with its plans. Allianz also offers a mobile app and more than three ways to file a claim, which World Nomads lacks.

See the table below for a direct comparison between popular plans offered by World Nomads and Allianz.

Learn more about Allianz by reading our Allianz travel insurance review .

World Nomads vs Seven Corners

World Nomads and Seven Corners share few similarities. According to quotes gathered by our team, Seven Corners is, on average, 34% more expensive than the average World Nomads plan. World Nomads also offers more coverage for lost luggage, trip and baggage delays.

However, Seven Corners’ most comprehensive plan provides markedly better medical coverage than the World Nomads equivalent. It also offers double the amount World Nomads provides for emergency evacuation and repatriation of remains and five times the amount for medical expenses. Both insurance companies also offer two ways to file a claim.

The table below highlights key differences between popular plans offered by World Nomads and Seven Corners.

Take a closer look at Seven Corners in our review .

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Does World Nomads Travel Insurance Cover?

World Nomads offers two insurance plans: Standard and Explorer. You can customize either plan to cover specific activities for your vacation, and each policy includes coverage for medical expenses , emergency assistance and personal effects.

The Standard Plan from World Nomads includes:

- $2,500 for trip cancellation or interruption

- $500 a day for trip or travel delays

- $750 for baggage delay

- $1,000 in baggage and personal effects coverage

- $100,000 for medical accidents and sickness

- $300,000 for emergency medical evacuation

- $25,000 non-medical emergency transportation, such as a natural disaster

- $5,000 for death and dismemberment on a trip

What sets World Nomads travel insurance apart from other insurers is the large number of adventure sports and activities that its basic coverage includes. In the Standard Plan, activities and extreme sports like bungee jumping, indoor skydiving, biking trips, resort skiing and windsurfing are all covered. More dangerous activities like scuba diving, hot-air ballooning and alpine ski touring are covered in the Explorer Plan.

Optional Riders

A rider is the official insurance term for “add-on.” You can buy one or more riders to attach to the travel insurance policy that you like, creating a personalized plan for your trip.

But World Nomads offers almost no add-ons. That’s because either of the two plans it sells already provides coverage for things that other insurers don’t as part of their base policies. The only extra coverage option you have is a rental car damage rider, and it is only offered with the more comprehensive Explorer plan.

However, you can extend your coverage during a trip, a benefit most travel insurance companies don’t have.

Policies Offered

Here’s a breakdown of the basic coverage options for the World Nomads Explorer Plan and Standard Plan.

Cost of World Nomads Travel Insurance

According to our research, the average travel insurance plan with World Nomads costs $161. However, a solo traveler policy is much lower at $74 for the Standard plan and $116 for the Explorer plan.

When you buy travel insurance, the cost of the plan depends on a variety of factors, including whether you want coverage for dangerous locations or activities. Things like the age and health conditions of the people on the trip affect the price, especially if someone has pre-existing medical conditions.

World Nomads is known for having cost-effective travel insurance coverage , especially given the number of sports and activities covered in its two plans.

Quotes accurate as of December 2023.

Read More: Travel Insurance For Parents Visiting The United States

Does World Nomads Offer 24/7 Travel Assistance?

World Nomads offers clients 24/7 travel assistance when they purchase any insurance plan. Provided by Generali Global Assistance 365 days a year, it gives customers access to professional help and advice for any emergency while they’re on vacation.

The toll-free number for this service is +1-877-289-0968, which can be accessed from the U.S. and Canada. The collect worldwide number is +1-954-334-8143.

You can also contact the service by emailing [email protected].

World Nomads Customer Reviews

Customer reviews and ratings can help indicate the level of service a travel insurance company offers its policyholders. At the time of this writing, World Nomads held a 1 out of 5 star rating with the BBB and a 3.3 out of 5 stars rating on Trustpilot.

To learn what customers like and dislike about World Nomads, we read dozens of customer reviews on the BBB and Trustpilot from recent months. Here are some common themes we found in our search:

What Customers Like

- Reasonably priced: Recent policyholders comment on receiving comprehensive coverage at a competitive price.

- Easy-to-navigate website: Users, including this reviewer , compliment how easy it is to navigate the World Nomads’ webpage and get a quote.

- Clear policy details: Reviewers note that World Nomads explained their purchased policies in great detail, making coverage easy to understand.

What Customers Don’t Like

- Slow claims process: This reviewer , amongst others, stated that they’ve spent months trying to resolve a claim with World Nomads.

- Excessive documentation requests: Many customers, such as this one , complain about the documentation World Nomad asks for during the claims process, stating that it’s more of an ask than with other travel insurers.

- Legitimate claims denied: Policyholders like this one felt their claims were denied when World Nomads should have provided coverage according to their contract.

We reached out to World Nomads for comment on its negative customer reviews but did not receive a response.

How To File a Claim with World Nomads

You can file a claim with World Nomads online on the World Nomads website . To complete the claim process, you need your policy number and copies of any relevant documents for things like a police report, medical insurance, credit card bills and emergency medical or dental records. The company promises to send you regular email updates about the progress of your trip insurance claim.

Is World Nomads Worth It?

Coverage from World Nomads may be worth it if you’re an adventurer looking for travel insurance on a budget. Policies cover a wide range of extreme sports and outdoor activities that other providers exclude. It also offers high coverage limits for baggage and travel delays.

However, World Nomads does not offer CFAR coverage, which is typically available through most other insurance providers. It also has lower-than-average customer review ratings and an F rating with the BBB. While our analysis of customer reviews suggests issues with claims processing and the company’s overall customer service, your individual experience may vary. We encourage you to consider what’s important to you in a travel insurance company before settling on a provider.

Frequently Asked Questions

Does world nomads cover canceled flights.

World Nomads Standard and Explorer plans both cover some instances where flights are delayed, missed or canceled. However, exclusions will apply depending on the situation, and the amount of compensation you receive will depend on whether an alternative flight was offered, the impact on the rest of your trip and the reason for the cancellation.

Can I extend my World Nomads travel insurance?

Yes, you can extend a World Nomads travel insurance policy while in the middle of your vacation. This comes in handy if you want to stay somewhere for longer than planned. All you have to do is buy a new policy from the date your old one ends.

Is World Nomads refundable?

Yes, you can get a full refund on your World Nomads travel insurance policy if you cancel it within 14 days of purchase. This is only valid if you haven’t already started your insured trip and you’re not making a claim.

What are the levels of World Nomads?

World Nomads offers two travel insurance plans: Standard and Explorer. The Standard Plan has lower coverage limits for things like medical treatment, baggage delay and trip interruption, but it covers many sports and activities. The Explorer Plan has higher limits and covers an extensive range of extreme or dangerous vacation activities.

Other Insurance Resources From MarketWatch Guides

Read our comprehensive guides on the following insurance categories to find top providers and peace of mind that you have all aspects of life covered.

- Leading Pet Insurance Companies

- Top Travel Insurance Companies

- Best Homeowners Insurance Providers

- Leading Renters Insurance Companies

- Affordable Renters Insurance Providers

- Top Term Life Insurance Providers

- Budget-friendly Homeowners Insurance Companies

Methodology: Our System for Rating Travel Insurance Companies

- A 30-year-old couple taking a $5,000 vacation to Mexico.

- A family of four taking an $8,000 vacation to Mexico.

- A 65-year-old couple taking a $7,000 vacation to the United Kingdom.

- A 30-year-old couple taking a $7,000 trip to the United Kingdom.

- A 19-year-old taking a $2,000 trip to France.

- A 27-year-old couple taking a $1,200 trip to Greece.

- A 51-year-old couple taking a $2,000 trip to Spain.

- Plan availability (10%): We look for insurers with a variety of travel insurance plans and the ability to customize a policy with coverage upgrades.

- Coverage details (29%): We review the baseline coverage each company offers in its cheapest comprehensive plan. A provider with robust coverage earns full points, including baggage delay and loss, COVID-19 coverage, emergency evacuation and medical coverage, trip delay and cancellation coverage, and more. Companies also receive points for offering a variety of policy add-ons like accidental death and dismemberment, extreme sports, valuable items, cancel for any reason coverage and more.

- Coverage times and amounts (34%): We compare each company’s waiting periods and maximum reimbursement amounts for baggage, travel and weather delays. Companies that offer customers reimbursement after fewer than 12 hours of delays earn full points in this category. We also reward travel insurance providers that cover more than 100% of trip costs in the event of cancellations or interruptions.

- Company service and reviews (17%): We look for indicators that a company is well-prepared to respond to customer needs. Companies with an established global resource network, 24/7 emergency hotline, mobile app, multiple ways to file a claim and concierge services score higher in this category. We assess reputation by evaluating consumer reviews, third-party financial strength and customer experience ratings, specifically from AM Best and the Better Business Bureau (BBB).

For more information, read our full travel insurance methodology.

A.M. Best Disclaimer

More Travel Insurance Reviews:

- Types of Policies Offered

World Nomads Travel Insurance Cost

Compare world nomads travel insurance, how we review travel insurance, world nomads travel insurance review 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're looking for travel insurance that allows you to confidently participate in a wide range of sports and adventure activities around the world, then World Nomads might be right for you. The company's policies cover travel to almost anywhere on the globe and are available to residents of nearly every country.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance Review: Types of Policies Offered

World Nomads has two basic policies: Standard and Explorer. Each covers essentially the same things, but Explorer has higher amounts that World Nomads is willing to pay out for claims. The company's policies cover more than 150 specific activities. These range from bungee jumping and rock climbing to hang gliding and hot-air ballooning. You can see the full list on the company's website.

Additional Coverage Options (Riders)

One of the most common upgraded features of a travel insurance policy is cancel for any reason (CFAR) , where you really can cancel for reason beyond what's in a standard policy. This is not available on every policy, but it is often a feature that travelers are looking for while shopping for travel insurance before their trip. At this time, World Nomads doesn't offer CFAR coverage.

At the time of this review, World Nomads also offers sports equipment coverage. In February of 2022, it expanded coverage to include more than 150 sports and activities including Pickleball and FootGolf. So, as you can imagine, plans with sports coverage will cover virtually any sport you might play.

World Nomads' standard plan is $79. It's a great option for travelers who don't care about some of the extra benefits that the Explorer package covers, like rental car coverage and extreme adventure sports.

If you're looking to have a more comprehensive travel insurance policy, look into World Nomads' Explorer plan for $120. It includes all of the standard package perks as well as extra sports like skydiving, scuba diving, and heli-skiing.

This is a perfect package for someone who's a little more dare-devilish and wants to be taken care of during their risky activities.

How to File A Claim with World Nomad Travel Insurance

You can start an insurance claim by filing it on the company's website.

You can call toll-free in the US and Canada if you need to reach the company in an emergency at: (877) 289-0968.

Callers from outside the US and Canada can reach the company at: (954)-334-8143.

The email address is: [email protected]

You'll need to have the following ready to file a claim:

- Your policy number

- A contact number

- The nature of your problem

- Your location

- Prescribed medication (if any)

See how World Nomads stacks up against the competition.

World Nomads Travel Insurance vs. Allianz Travel Insurance

Allianz is a strong competitor against World Nomads, especially for travelers looking for a more business-oriented option. The co many has been in business for more than 120 years and offers a wide range of insurance, not just travel-related, around the world. A key difference between World Nomads and Allianz is that Allianz offers travel insurance that can cover multiple trips in the same year. You can take an unlimited number of trips within the same calendar year, but you do have to double-check that all of your destinations are covered by the policy you select.

Another difference is that Allianz offers coverage for pre-existing medical conditions. World Nomads doesn't have the same coverage, requiring that the pre-existing condition is fully stable in order for limited coverage with respect to trip cancellations or having to end a trip early.

Allianz Travel Insurance Review

World Nomads Travel Insurance vs. AIG Travel Guard

Travel Guard , a product backed by AIG Travel, is another potential alternative to World Nomads. AIG is a prominent player in the insurance industry, and the Travel Guard product represents true global coverage.

Like World Nomads, Travel Guard does have coverage for pre-existing medical conditions, but there are conditions. This coverage is in the form of an exclusion waiver, and this add-on must be purchased within 15 days of the initial trip payment.

Both travel insurance companies use a tiered approach, but Travel Guard has higher dollar amounts across the board. For example, trip cancellation for Travel Guard covers 100% of the trip cost, while with World Nomads the amount will depends on the tier of the coverage you purchase. Trip Interruption is also a fully covered event with Travel Guards. Depending on the plan selected, it will either cover 100% or 150% of the trip cost.

If you're concerned about COVID-19 coverage with trip insurance, there's more coverage with World Nomads than Travel Guard. With Travel Guard, coverage for having to stay in a country past your original booking dates is an add-on, not a standard part of the policy.

AIG Travel Insurance Review

Compare World Nomad vs. Credit Card Travel Insurance

If you already have a major credit card in your wallet, you most likely have some travel insurance benefits that come with it. These benefits do vary from card to card. Be sure to check your card's specific policies.

Not all credit cards will feature travel insurance protection. The ones that do may have specific limitations. For example, many credit cards with travel protection require that your airfare is paid for with the card in question for protections to take effect.