Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Squaremouth Travel Insurance Review — Is It Worth It?

Content Contributor

61 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

81 Published Articles 460 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Compliance Editor & Content Contributor

78 Published Articles 639 Edited Articles

Countries Visited: 40 U.S. States Visited: 27

Squaremouth Travel Insurance: Positives

Covid-19 coverage, optional add-ons, squaremouth travel insurance policy elements, coverage exclusions, how to shop for travel insurance with squaremouth, squaremouth travel medical insurance options, squaremouth annual travel insurance options, squaremouth frequent flyer/mileage award ticket insurance options, squaremouth cruise insurance options, squaremouth adventure sport insurance options, squaremouth group travel insurance options, squaremouth one-way trip insurance options, squaremouth vs. buying directly from insurance providers, squaremouth vs. insuremytrip, squaremouth travel insurance options vs. credit card insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Part of planning for your next vacation should include asking yourself, “What if something goes wrong?” Your answer to that question likely includes shopping for travel insurance.

Choosing the right policy can reduce your out-of-pocket expenses if you have delays, cancellations, or injuries. But how do you choose from the overwhelming number of travel insurance policies available? Enter Squaremouth : a website that provides travel insurance reviews and comparisons to help you shop for your next policy.

Squaremouth doesn’t provide insurance. Instead, it helps you shop for insurance. That can be a great starting point, but there are other elements you should understand before selecting and paying for a policy. Choosing the right policy, even on a comparison page like Squaremouth, can take considerable time and effort.

Here’s a look at the positives and negatives of Squaremouth and how shopping for a policy works at Squaremouth.

- Provides comparisons of coverage and prices across dozens of insurance providers

- Makes it easy to add favorites or choose items to compare in detail

- Has a zero-complaint guarantee

Rather than comparison shopping on individual travel insurance websites, you can do it all on Squaremouth’s website . You’ll see prices across numerous providers and multiple plans from these providers. It’s the best free tool to start looking for insurance across the many possible plans you could buy.

When shopping for plans, you can select your favorite providers, which Squaremouth remembers for the future to help you efficiently compare plans the next time you shop on Squaremouth’s site.

Squaremouth has a “ zero-complaint guarantee ,” promising fair adjudication of your travel insurance claim if you buy a policy through its marketplace. While Squaremouth doesn’t provide insurance, it will take a second look at your claim and ensure it’s resolved correctly. The website describes this policy as follows:

“If your claim has been denied and you believe the determination was made unfairly, our team of licensed claims adjusters will investigate your case and mediate with the provider on your behalf. If the complaint is not resolved to Squaremouth’s satisfaction, we will remove the provider from our website and stop selling their policies.”

Contrary to the name of the policy, the company can’t guarantee there are no complaints. Still, it can advocate for you if you have problems with your insurance provider after buying a policy through Squaremouth’s platform.

Squaremouth Travel Insurance: Negatives

- It’s not an insurance provider and doesn’t sell travel insurance policies

- There are mixed reviews from customers, mostly related to customer service

- It doesn’t provide coverage details or exclusions in the comparison charts

Squaremouth isn’t an insurance provider and doesn’t directly sell or underwrite travel insurance. Having “Squaremouth travel insurance” is impossible since Squaremouth is a comparison website — not a policy provider. As a comparison marketplace, Squaremouth lets you compare policies and costs from multiple providers. In this regard, you aren’t buying travel insurance from Squaremouth but are using Squaremouth to find travel insurance.

It may help to think of Squaremouth the way you think of Expedia: You shop for flights on Expedia, but Expedia isn’t the airline you’re flying with.

Squaremouth functions as an intermediary, and many of the negative reviews of Squaremouth involve this aspect. Squaremouth can’t process your claim or explain your coverage since it’s not your provider. To be fair, some complaints also appear to misunderstand that Squaremouth isn’t the insurance provider. You’ll need to contact your policy provider for policy questions.

Additionally, some reviews complain that Squaremouth’s customer service lacks quality and availability. It has limited online chat hours and requires an email outside those times. Some customers say responses to emails are slow and aren’t helpful. However, reviews of the Squaremouth insurance marketplace don’t necessarily indicate how good or bad the providers and plans it sells are.

When comparing travel insurance providers on Squaremouth, the exact details of a policy aren’t elaborated .

You may see that Company A offers $100,000 of emergency medical benefits while Company B offers $75,000. It sounds like Company A would be better, but that can’t be confirmed without a full analysis of the policy terms. Those elements aren’t made clear when comparing policies on Squaremouth, so you’ll have to use this only as a starting point before making a final selection and paying for a policy.

You should visit the provider’s website after finding a plan that sounds good on Squaremouth’s site and price out your trip. Look for inclusions/exclusions, and ensure this is the right policy for your trip.

Squaremouth has a dedicated page discussing COVID-19-related coverage on the policies available through its marketplace. Most policies cover trip cancellations, costs from quarantines, and other pandemic-related expenses , but how they do that and what expenses (or how much) can be reimbursed will vary by policy.

When reading a policy’s coverage details before buying, you can find detailed explanations. You also can use the Squaremouth page to reference current entry restrictions in various countries you might want to visit.

Some policies have unique inclusions that others don’t — such as money you lose when a destination wedding is canceled (offered by WorldTrips ) — and most policies provide add-on services for extra costs. These will cover things like extreme sports, turning your medical coverage into primary coverage, or “cancel for any reason” (CFAR) coverage . It’s important to know what’s included, what’s not, and how much it will cost to add these extras. You may fare better paying for a more robust policy than buying a bargain policy and adding numerous extras .

“You get what you pay for” tends to be true when comparing insurance plans from the same provider. More expensive plans will include more coverage types and higher maximum payouts in coverage categories. However, that saying isn’t necessarily true when comparing costs between travel insurance providers .

That’s where Squaremouth comes in, allowing you to compare travel insurance across providers , filter for what you want or don’t want, and see how similar policies stack up against each other for coverage and pricing.

To better understand the comparisons Squaremouth provides, it helps to understand the most common travel insurance categories. This way, you’ll know what these insurance benefits are and which ones are important for you.

- Cancel for Any Reason (CFAR) Coverage: Usually an add-on for most travel insurance companies , it covers cancellations outside other coverage types. However, it doesn’t cover everything and every reason you might cancel a trip, so be sure to understand the specifics.

- COVID-19 Coverage: If you or a traveling companion test positive for COVID-19 and need to quarantine, cancel a trip, or miss a flight, your expenses or losses can be covered. Ensure you understand how your policy treats COVID-19 because some require separate coverage while others include it as part of the medical coverage.

- Pre-existing Medical Conditions: Your current medical conditions may be covered if you buy a plan within certain timelines. Otherwise, look-back periods tend to apply.

- Trip Cancellation Insurance: You’ll receive reimbursement for prepaid, non-refundable costs if you cancel a trip for one of the covered reasons in your policy.

- Trip Interruption: Once your trip starts, this coverage goes into effect, and can reimburse non-refundable costs from lost parts of your trip. It also can cover expenses to catch up with your trip, such as a tour that has already departed, if there are delays for covered reasons.

- Trip Delay: You can be reimbursed for transportation, meals, and other expenses you incur due to delays. Timelines for when this coverage begins will vary by plan.

- Baggage Loss or Damage: Your lost, damaged, or stolen baggage — including the items inside, with some exceptions — will be covered. Some policies are primary, while others are secondary.

- Baggage Delay: You can be reimbursed for reasonable costs you incur when your luggage is delayed. The waiting period for when your coverage kicks in will vary by plan.

- Emergency Medical and Dental: Illnesses and injuries are covered during your trip, plus the resulting expenses. It also can cover deductibles or unpaid expenses from your health insurance provider since this coverage is usually secondary.

- Emergency Assistance and Transportation: If adequate healthcare isn’t available nearby, you can be evacuated to an appropriate facility. If you die during your trip, this policy covers bringing your remains to the U.S. or paying for local burial costs.

- Accidental Death and Dismemberment: This coverage provides payments if you lose your life, a limb, or eyesight during a trip. If you die, the benefit payment goes to your designated beneficiary.

- Rental Car Damage: You’ll be covered for collision damage, theft, vandalism, natural disasters, or damages for reasons beyond your control. Some vehicle types, such as luxury cars, are excluded from most policies, but coverage should apply to all drivers listed on your rental agreement. Coverage is up to the cash value of the car or the cost of repairs and related expenses — whichever is less. Certain countries may be excluded from the policy, so check the details.

Sometimes, understanding what’s not included may be more important than a list of benefits or choosing the lowest offer when looking at Squaremouth travel insurance reviews and prices.

Why? Exclusions are built into every insurance benefit , so you should review the details. Insurance terminology isn’t fun, but it’s essential to understand whether your trip — destination, dates, activities, and health conditions — will be covered. The only thing worse than not having travel insurance for your trip is paying for travel insurance that doesn’t cover your trip.

Common exclusions include injuries sustained while intoxicated and medical emergencies related to pregnancy . You also aren’t covered when flying a plane, hang-gliding, bungee jumping, or participating in extreme sports unless you get a particular policy with add-ons for those activities.

Most policies also exclude war zones and areas with ongoing hostilities . This could include places like Ukraine and Sudan and areas with travel safety warnings like Syria or Iran. Ensure you read your policy details to confirm it covers your intended destination.

How Much Does Squaremouth Travel Insurance Cost?

Buying travel insurance from Squaremouth costs the same as buying it directly from the insurance provider. There are no markups or fees for buying on Squaremouth’s website instead of buying directly from an insurance provider, such as Seven Corners or Generali Global Assistance .

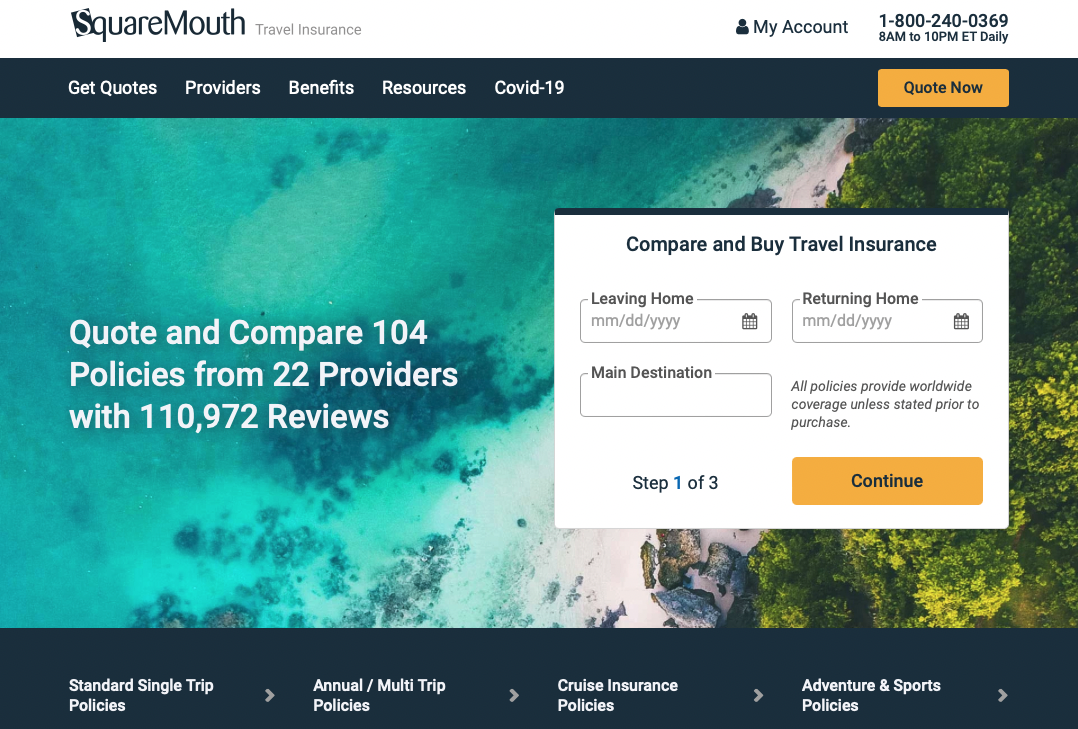

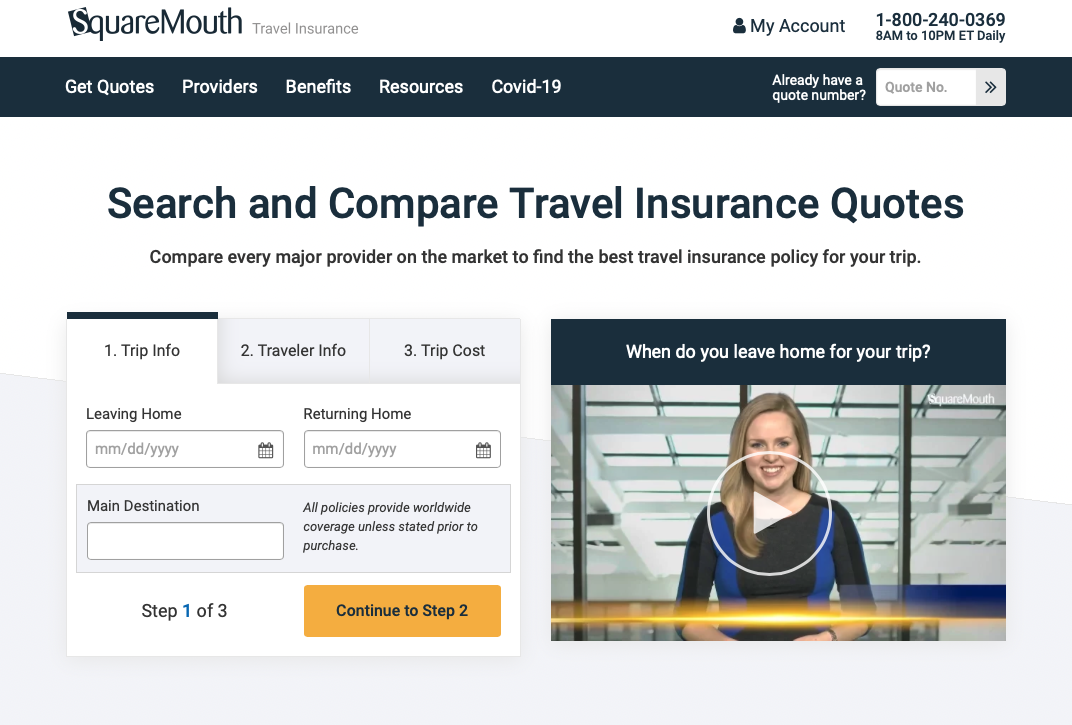

You can search for several types of insurance from the Squaremouth home page. You can start in 1 of 2 ways: Click on the different types of policies or enter your trip information . The policy types (as seen above) can be found under the policy search widget on the home page:

You’ll see options for single-trip policies (most common), multi-trip or annual policies, cruise-specific policies, and policies geared toward adventure or extreme sports.

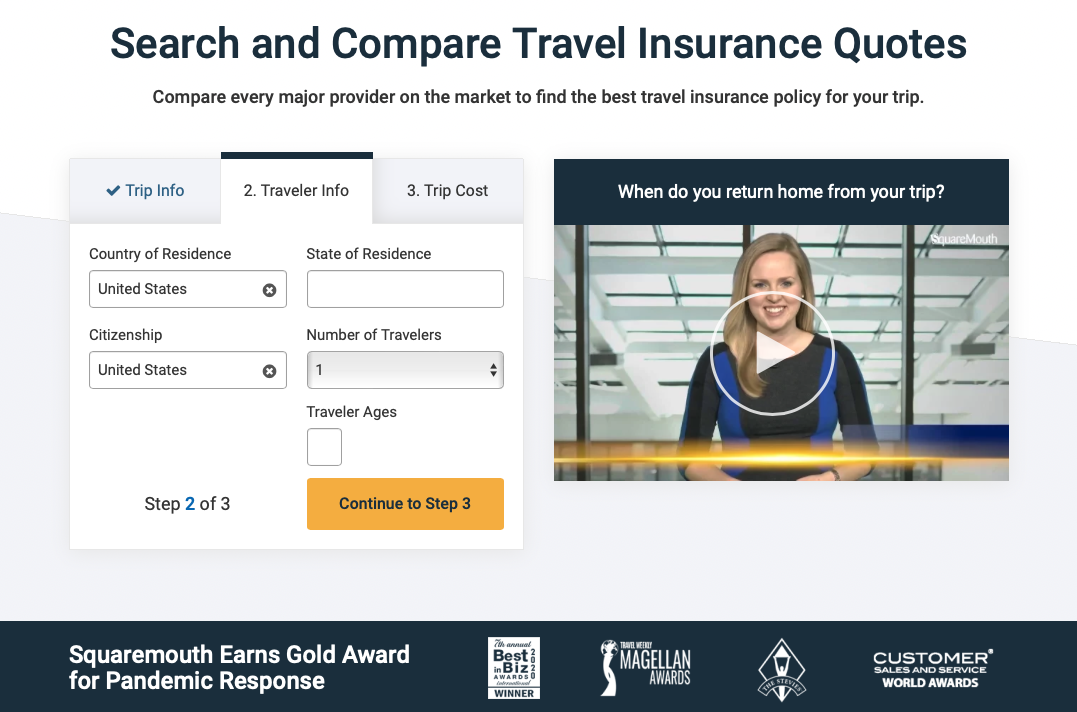

If you fill out the information on the home page, providing dates and destinations , the second page will ask for information about the traveler(s) to be covered:

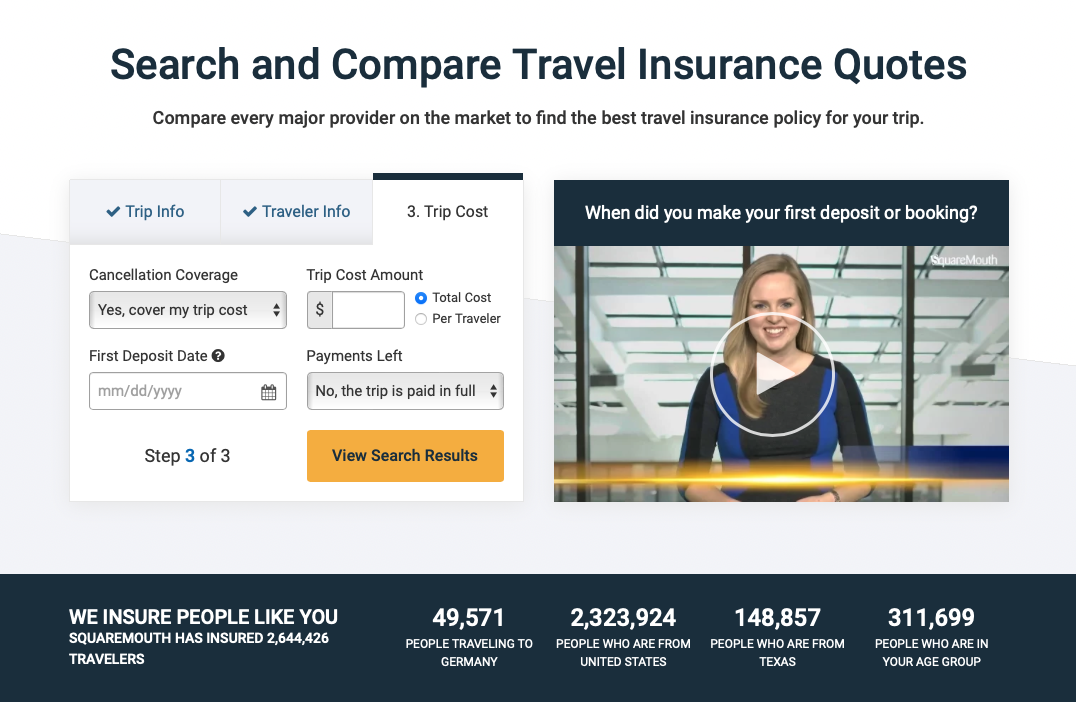

Page 3 asks about trip costs , when you made your first deposit, and whether you have remaining payments. There’s also a yes/no option for cancellation coverage related to your trip costs:

From here, you’ll see a list of results. My search returned 88 policies, sorted by the providers with the best review scores. You can filter your results in several ways:

- Popular Filters: The most popular filters are listed here for easy access. These include COVID-19 coverage, CFAR, trip interruption, trip delay, medical evacuation, and pre-existing medical conditions.

- Preset Filters: Limit your searches to policies covering cruises, COVID-19, and policies that meet the requirements to apply for a Schengen Visa.

- Reviews: Filter by insurance provider ratings, ranging from 1 star or more to 5 stars .

- Cancellation: Here, you can select trip cancellation reasons that you want to cover with your policy, such as hurricanes, terrorism, financial default of your travel company, losing your job, or other work-related issues.

- Medical: You can filter for policies providing primary medical coverage, coverage for pre-existing conditions, emergency medical benefits, and even the deductible amount you want your policy to include.

- Evacuation: You can filter for policies that include medical and non-medical evacuation.

- Loss or Delay: Find coverage that includes reimbursement for bagage loss, baggage delay, trip delay, quarantine extension, or missed connections during your trip.

- Accidental Death: You can filter by 24-hour policies, flight-only policies, and common carrier policies.

- Sports: You can choose the type of sport you’re doing on a trip and indicate whether it’s part of a competition.

- Other Benefits: Find coverage that includes rental car protections, a money-back guarantee, 24-hour assistance services, identity theft protection, or renewable policies.

After applying any desired filters, you’ll see only the policies that match your settings. In this example, I filtered for CFAR policies with emergency evacuation coverage of $1,000,000.

You will see the insurance provider’s name and the name of the plan at the top, plus key highlights of the policy listed in the middle. The review ratings are visible on the left side, and the right side holds several important elements: the price, an option to view the full policy details, an option to buy the policy, and a Compare checkbox:

You can add as many or as few policies as you want to compare , but only 5 policies can fit on the screen at once:

You can use the Next Policy button at the top if you’ve selected more than 5 policies for comparison. If you set any filters for your search, your filters will be displayed at the top since those are likely your primary concerns. Scrolling down, you can see coverage similarities and differences in other areas, like trip cancellation benefits or lost luggage reimbursement.

Most policies also offer add-ons for an additional cost. You can view these by clicking on +More near the Buy Now button.

Once you find a travel insurance policy you like, you can buy it directly from Squaremouth. There’s no cost savings for going to the provider’s page and buying the policy there. Squaremouth affirms this on its website :

Due to strict regulations in the insurance industry, it is not legal to discount or upcharge a premium. For this reason, the price of an individual travel insurance policy will be the same wherever you purchase it.

Even still, it makes sense to go to the provider’s website to view the full policy details, exclusions, and inclusions. It’s critical that you understand the specific terms of a policy before buying so that you can ensure it’s the right policy for your trip.

There’s no price difference on Squaremouth’s or the provider’s sites, but you should go to the provider’s site anyway. There, you can read the full terms of a policy before buying the wrong one.

If you click on the Buy Now button, you may see a pop-up message about important exclusions before moving forward. For instance, this policy doesn’t cover 1 airline and 4 countries:

While many people think of travel insurance as a broad-based plan covering everything from delays to cancellations and even medical bills, it is possible to buy medical-focused and even medical-only plans . These medical insurance plans won’t necessarily help you with out-of-pocket costs from delayed flights but can help if you get sick or injured.

These policies are mixed in with the other results you see when searching for plans on Squaremouth. You can focus on medical insurance plans using filters in the Medical menu. Options include the coverage amount you want and primary policies.

An annual policy may be cheaper than buying multiple policies throughout the year for each trip.

Along with standard information like the number of travelers and where you live, you’ll also choose a start date, the expected number of trips this year , and an estimate of your longest trip :

For this example, we priced a trip starting July 1, 2023, for 2 travelers (ages 35 and 33), both U.S. citizens living in California. We estimated 5 trips this year, with the longest lasting 20 days.

You’ll notice that you don’t need to enter specifics about any particular trip , such as where you’re going or trip cost. You’ll see the same filters on the results page as you would on the standard travel insurance search results.

Compared to the 88 policies available with single-trip insurance shopping, this search provided just 6 results:

Price ranges are incredible here: more than $1,000 difference from the cheapest to the most expensive policy. Notice that the cheapest plans don’t cover COVID-19, trip cancellation, trip interruption, terrorism, financial default of a travel provider, travel delays, baggage delays, or CFAR . That’s quite a list of exclusions when paying $300+ for an annual travel insurance policy.

Many of us book flights with miles and hotels with points. Can these be insured? Unfortunately, it’s rare. To complicate matters, Squaremouth doesn’t have filters for policies that cover redeposit fees for your points and miles .

Some policies (a minority) may cover the fees for canceling an award redemption and putting the points or miles back in your account. To find these, you’ll need to read the full policy details . You won’t find this information in Squaremouth’s comparison charts.

You can search for policies tailored to cruisers , but it’s also possible to click on Cruise in the filters after conducting a standard search.

You’ll enter your travel dates and main destination from the cruise search page. Interestingly, you can only put 1 location, despite the fact most cruises visit more than 1 country. On the next page, you’ll enter trip costs, deposit date, whether you have remaining payments, and information about the travelers .

For a sample search, we estimated a 1-week cruise to the Bahamas in November 2023. The trip covers 2 passengers (ages 60 and 58) who made a deposit in the past 24 hours but have remaining payments on their $2,000 trip. Policy costs ranged from $111 to $297 :

A comparison of the cheapest and most expensive policies shows many similarities . The differences include maximum payouts for emergency evacuation, trip delay, and accidental death and dismemberment.

While it’s possible to filter for adventure sports in the standard search results, you also can go to the Adventure & Sports Travel Insurance page and begin your search with the types of activities you want to cover:

For example, there are multiple options for scuba diving, including mixed gas and multiple depth points. It’s important to choose exactly the sport you’ll be undertaking and the conditions in which you’ll participate. For example, will you be with a guide or coach? This can change your coverage requirements.

After choosing the sport(s) you want to cover, you’ll provide trip details as usual to see available policies.

If you’re traveling in a group (departing and returning home within 2 days of each other), a group travel insurance policy could help cost-effectively cover everyone. Some important rules must apply for a group policy:

- Organized groups of 8 or more traveling together.

- Travelers must be visiting the same destination.

- All travelers must be U.S. residents.

- Departure dates must be more than 21 days from the policy purchase date.

You can enter trip costs per traveler or overall , plus you’ll enter each traveler’s birth date. You’ll enter the home state of the majority of travelers , the earliest date anyone starts the trip, and the last date anyone will return home .

Unfortunately, filtering for so-called “one-way trip insurance” on Squaremouth is impossible. One-way insurance would cover a traveler who leaves home from Texas, spends a week vacationing in Mexico, and then flies to England for a new job. These are situations where you are not returning to the trip’s starting point.

You can’t filter for these policies on Squaremouth because most policies have a start and end date based on when you return “home.” They’re also based on your state of residence for cost and legalities. Unfortunately, Squaremouth won’t show you these policies.

Companies like Expatriate Group can provide one-way insurance policies that cover you en route to your destination and provide limited coverage once you arrive until you find other coverage. Think of it as coverage just between 1 country and the next.

How Reliable Is Squaremouth Travel Insurance?

Squaremouth says there’s no extra cost when you buy insurance from its website rather than buying directly. However, it’s always good to double-check.

I priced a 1-week policy for myself to visit Italy in November 2023. Squaremouth told me the cheapest policy was the battleface Discovery Plan at $45.86 . However, battleface returned a price of $36.99 . Even more confusing was that the included benefits didn’t match .

On the same itinerary, Squaremouth provided a price of $103 for WorldTrips Atlas Journey Preferred. WorldTrips returned the same price on its own site, and the benefits/maximum payment amounts matched .

Squaremouth isn’t the only site that provides comparisons as a one-stop-shop for travel insurance. InsureMyTrip has some of the same features. How do their prices match up?

We searched for a 1-week trip to Italy for 2 travelers (ages 35 and 33) who made their first trip deposit earlier today. The results across the 2 sites weren’t the same; Squaremouth showed providers unavailable on InsureMyTrip and vice versa . However, the policies available on both sites matched.

Here are Squaremouth’s search results:

And here are InsureMyTrip’s search results:

The $105 policy from John Hancock and $109 policy from WorldTrips matched when appearing on both sites, however.

While it’s nice that Squaremouth provides a simple shopping platform, buying travel insurance isn’t the only way to get coverage on your next trip. Some of the best credit cards for travelers also provide robust coverage. Cards like The Platinum Card ® from American Express , Capital One Venture X Rewards Credit Card , Chase Sapphire Preferred ® Card , and the Chase Sapphire Reserve ® can protect your next holiday. Consider these benefits to see if they’re sufficient before buying extra travel insurance:

Always compare your travel insurance options, whether shopping from multiple travel insurance companies or using travel insurance provided by a credit card .

Rather than selling insurance, Squaremouth provides a simple-to-use shopping platform for travel insurance of various types. You can filter results in numerous ways to help you find the right policy for your next trip — or even your next year of trips. Some details will be lacking in the comparisons, and you should always consult the full policy from the insurance provider before buying travel insurance. However, seeing numerous plans, comparing them, and understanding their relative costs with just a few clicks is fantastic.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

How do i contact squaremouth travel insurance.

You can call 800-240-0369 in the U.S. or 727-564-9203 from outside the U.S. Squaremouth also offers chat with the same hours as phone service: 8 a.m. to 10 p.m. ET daily. Outside these hours, email [email protected] .

Who owns Squaremouth?

Specialty Program Group (SPG) LLC bought Squaremouth in early 2023. SPG is a New Jersey-based specialty insurance brokerage firm that also bought Insureon and CM&F in recent years.

Where is Squaremouth's headquarters?

Squaremouth is headquartered in St. Petersburg, Florida, and also has offices in Fort Wayne, Indiana. It was acquired by Specialty Program Group (SPG) LLC in 2023; this company is based in Summit, New Jersey.

Who is the founder of Squaremouth?

Squaremouth was founded by Chris Harvey and Matt Outten and launched in 2003.

Should you buy travel insurance through Squaremouth?

You won’t pay extra to buy a policy from Squaremouth instead of directly from the insurance provider. Due to legal requirements, Squaremouth can’t charge extra for travel insurance policies. The advantage is the ease of use; the disadvantage is that you may not see the full policy details or exclusions on Squaremouth’s website, but you can find these on the provider’s site.

Is it best to buy travel insurance direct or from Squaremouth?

Buying either way has no cost advantage — from Squaremouth or a provider directly. The advantage to buying from Squaremouth is the ease of use for comparing multiple policies. The disadvantage is that you may not see the full policy details or exclusions on Squaremouth’s website, but you can find these on the provider’s site.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

May We Suggest?

Is this it, how about this, search results.

Our reviewers evaluate products and services based on unbiased research. Top Consumer Reviews may earn money when you click on a link. Learn more about our process.

Squaremouth Review

Sunday, April 7th

2024 Travel Insurance Plan Reviews

- Squaremouth

- One-stop shopping for policies from more than 30 providers

- All insurers quoted through SquareMouth have to comply with "Zero Complaint Guarantee" and have a high A.M. Best rating

- Four policy types available: standard single trip, annual/multi-trip, cruise, adventure/sports

SquareMouth has helped more than two million customers to find the right travel insurance. This service brings you quotes from more than 30 top names in the industry and makes it easy to compare their coverage and benefits. Over the last year alone, SquareMouth sold nearly $100 million in travel insurance policies.

Best selection of insurers and policies here

To make a fair comparison across travel insurance websites, we used the profile of two 35-year old travelers taking a $3,000 trip to Mexico in six months, paid in full on the date we requested the quote. Naturally, because SquareMouth is a referral service, we got many more options than with platforms that only offer policies from a single insurer: 56 that best matched our search criteria, out of a total of 102. The top five policies ranged in price from $106 to $208 and included plans from Trawick International, Seven Corners, Tin Leg, Generali Global Assistance, and IMG.

Information at a glance

What we really like about using SquareMouth is how easy it is to see at a glance what each policy has to offer. On our list, we noticed right away that one insurer was a Forbes 5-Star Travel Insurance Provider in the previous calendar year, another was featured by Forbes for offering superior coverage during the pandemic, and a third got kudos from Forbes for its travel delay benefits. All policies had a preview of the coverage for COVID-related cancellations or medical, trip cancellation and interruption, medical evacuation and general medical benefits. It was also very easy to click the "Compare Policy" checkboxes and see any travel insurance that we wanted to see side-by-side.

Easy to compare

Another thing we liked about SquareMouth is how easy it is to compare all the policies they match you with. You can sort the results by least expensive to most expensive, and use their side-by-side comparison tool to evaluate the details of each policy.

Take advantage of thousands of customer ratings

Another big benefit of using a referral platform like SquareMouth is being able to see hundreds - or thousands - of reviews from other travelers. Every quote tells you how many policies that company has sold via SquareMouth and since what year, plus ratings from clients. You can click on the "Full Policy Detail" and read what clients have said, while getting the complete information about any travel insurance coverage you're considering.

No upselling here

We also appreciate that this travel insurance service aims to "downsell" you: in other words, they'll recommend the lowest-priced policy that still matches the coverage you need. SquareMouth doesn't base its sales on commissions, so there's no reason for them to push policies that are more costly.

Terrific variety of travel insurance types

A final reason to consider getting your travel insurance through SquareMouth is the variety of coverage types available here. Our quote was for a traditional single-trip policy, but what if you're an avid traveler who wants to cover multiple trips in a year? Or you're taking a cruise? Maybe you're an adventurer participating in skydiving, an athlete competing in amateur sports competitions, or bringing expensive gear for skiing or scuba? When you get an insurance quote from a single insurer, the answer may be "no" , but through SquareMouth you can find policies from companies that will say "absolutely!" .

Disappointing drop in the BBB rating

All of these positives are why we were shocked to see that since our last review, SquareMouth's listing with the Better Business Bureau had dropped to a "D-" for failing to respond to 13 customer complaints. That's not a huge number, but we were puzzled to see that most of those were in the most recent one-year period. We wonder what SquareMouth's excuse would be for not addressing such a small number of client concerns.

Digging deeper

However, this disappointment should not be a huge factor in whether you use SquareMouth. Why? If you look at the BBB complaints, you'll see that they're all related to failures on the end of the insurer - not SquareMouth. So, they logged their complaints with SquareMouth, when really their complaints were with an entirely different company. Of course, ultimately your satisfaction with your travel insurance will depend on that insurance company.

Outstanding choice

Overall, SquareMouth is an outstanding place to shop for travel insurance. We love being able to see thousands and thousands of customer ratings - and this site offers more client reviews than any other provider we evaluated. With their large insurance network, you'll get a competitive quote and be able to check out other customer reviews and comments. Once again they earn high marks in our review of travel insurance providers.

More Travel Insurance Plan Reviews

- Insure My Trip

- Travel Insurance

- Travelex Insurance Services

- Insured Nomads

- Allianz Travel

- Quote Wright

- Travel Guard

- Seven Corners

- World Nomads

- Travel Insurance Center

- Axa Travel Insurance

The 13 Best Travel Insurance Plans

Who offers the best travel insurance.

With daily news stories of delayed and canceled flights, lost baggage, and travelers stranded overseas in the middle of a natural disaster, it's easy to see why travel insurance is so important. Like most types of insurance, travel insurance is bought in the hopes that you'll never need it. But, for most travelers, it's worth the price for the protection it provides.

Have you ever thought that this coverage was just an unnecessary, added expense? That's fairly common: most people assume that they've got protection through their credit card company, their regular health insurance, even their homeowners' policy. In some situations, that may be accurate - but unless you know the details of those types of coverage, you're more likely to be left paying out-of-pocket expenses you thought were taken care of... but aren't included.

Travel Insurance Plan FAQ

What is travel insurance, what does travel insurance cover, what does travel insurance not cover, can i get travel insurance if i have a pre-existing medical condition, is travel insurance expensive, my chocolate is going someplace warm. will it melt, where can i buy travel insurance, is it safe to get travel insurance online.

Continued from above...

And, even if you do have that kind of protection, travel insurance policies can amplify your benefits. For example, if you choose a plan that offers $500,000 in primary medical coverage, you might not need to touch your regular health insurance: your bills will be reimbursed up to that amount, no matter what your everyday health plan includes. Car rental insurance can go above and beyond what's paid for by your credit card company or even your own vehicle's coverage - and that can be critical if you're driving in another country and have an accident.

What type of travel insurance do you need? Naturally, that depends on your trip, your travel party, and your budget. A single-trip policy will be more affordable than multi-trip coverage - but if you're traveling internationally more than once in a year, the annual policy becomes much more economical. Do you need to be able to cancel for any reason? Is it important to you to have a waiver of the pre-existing conditions exclusion? Are there any children under 18 in your party that might be included at no extra charge, depending on the insurer you select? These are all factors that will influence your decision when picking a travel insurance plan.

Confused yet? You do have a lot of options. Here are some criteria to help you sort through them and ultimately wind up with the travel insurance coverage you need:

- Quote process. How easy is it to get a quote that matches your insurance needs? Does the site explain the questions it asks, and does it display all of the possible plans in a way you can understand? Can you buy your policy right then and there, or do you have to click through to another site?

- Value. What's included for your premium? From one site to another, you will probably see the same price on any given plan because the states regulate travel insurance prices. However, it's worth your time to compare premium prices and benefits among different insurers, so that you get the most for your money.

- Reputation. It's easy for an insurance company to get high marks from customers if they never had to make a claim on the policy. What do clients who've filed claims say about the way they were treated? Were they reimbursed quickly? Did they get updates about the status of the claim? It's also good to check the Better Business Bureau's rating of any travel insurance service you're going to use.

To help you get the protection you need on your next adventure, TopConsumerReviews.com has evaluated and ranked today's most popular sources of travel insurance. We're confident that this information will make it easy to protect yourself and what you've spent on your trip - and to have backup if something goes off track on your journey. Bon voyage!

Compare Travel Insurance Plans

Select any 2 Travel Insurance Plans to compare them head to head

Travel Insurance Plan Articles

How travel insurance can save your vacation, what does travel insurance cost, what to look for in a travel insurance policy.

Trending Travel Insurance News

Business Insider on ...

I'm a financial planner, and I'd recommend annual travel insurance to ...

If you travel frequently, an annual travel insurance policy can be a lifesaver when the unexpected arises, especially if you need medical care.

Fri, 05 Apr 2024

10 Wallet-Friendly Travel Insurance Companies That Will Keep You ...

Are you tired of overpriced travel insurance that doesn’t even cover what you need? Look no further! In this blog post, we have compiled a list of wallet-friendly travel insurance companies that will ...

Trawick Travel Insurance Review 2024

Trawick offers a wide range of affordable travel insurance plans with varying levels of coverage. Some policies include cancel-for-any reason (CFAR).

Tue, 02 Apr 2024

Travel Medical Insurance: Essential Coverage for Health and Safety ...

Our guide on medical travel insurance answers what medical expenses it covers, when you need medical travel insurance, and how to file a claim.

Wed, 03 Apr 2024

Travel insurance for backpackers: What you need to know

Embarking on a backpacking adventure? Whether you’re taking a much-needed vacation or becoming a digital nomad, backpackers travel insurance can have your back. Medical insurance on its own often ...

Travel Insurance For Indonesia: Everything You Need To Know

A good travel insurance policy will cover emergency medical costs should you fall ill or injure yourself while away. This may also extend to medical rescue, and repatriation costs, for severe cases ...

Thu, 04 Apr 2024

Travel Insurance For Singapore: The Complete Guide

As standard, travel insurance for Singapore can also cover repatriation and emergency rescue, in severe medical cases, the loss or theft of your baggage and belongings and trip cancellation if you can ...

Related Travel Insurance Plan Reviews

Since you're interested in Travel Insurance Plans, here are some other reviews you might find interesting.

Cruise Vacation Sites

What's the best place to book a cruise vacation? You've finally got some time off, and you've decided you want the full-experience: sailing, relaxing, and new and exciting ...

French Lessons

Who offers the best French lessons? When we think of someone speaking French, we think soothing and seductive, as it's simply dreamy to hear.

Low Calorie Meal Delivery

What's the best place to find Low Calorie Meal Delivery today? In recent years, the popularity of low-calorie diets has surged.

Luggage Stores

Which luggage store is the best? Luggage is something that everyone will need at some point in their life, whether it be a backpack for an overnight trip or school, or a full set of luggage ...

Spanish Lessons

Who offers the best Spanish Lessons? Have you always wanted to learn Spanish?

Travel Visa Services

What's the easiest way to get a travel visa? Online travel visa providers have revolutionized the way individuals apply for visas when planning their international trips.

Newest Reviews

Canadian Personal Loans

Who Offers the Best Personal Loans in Canada? In urgent need of some quick cash?

Canadian Will Services

Where is the Best Place for Canadians to Create a Will? Planning for the inevitable isn't exactly a dinner table conversation starter, but creating a will is a critical step in securing your legacy.

Chinese Lessons

Where Can You Get the Best Chinese Lessons Online? The motivations for learning Chinese are as diverse and compelling as the language itself.

Medicare Advantage Plans

Which Medicare Advantage Plan provider is the best? If you or a family member is approaching the age of 65, or if you are soon eligible for Medicare Parts A and B, now is the perfect time to start looking at ...

Mediterranean Meal Delivery

What is the best Mediterranean meal delivery service? In a world where the Mediterranean diet has been lauded for its heart-healthy benefits and flavorful palette, Mediterranean meal delivery services are ...

Personal Loans

Where Can You Find the Best Personal Loans? Personal loans are a type of borrowing where you can get money from a bank, credit union, or online lender and pay it back over time with interest.

Is Squaremouth Travel Insurance Legit? A Comprehensive Review

Squaremouth serves as a travel insurance comparison platform, aiding travelers in discovering the optimal insurance coverage for their journeys .

With a track record of assisting more than 3.2 million travelers in economizing both time and money on their travel insurance, Squaremouth boasts the most user-friendly quoting and comparison engine in the current market.

This platform enables travelers to swiftly acquire a travel insurance policy from all major providers in the United States .

In this piece, we will closely examine Squaremouth, a prominent travel insurance comparison platform, and address the query: Is Squaremouth travel insurance legit? .

Squaremouth Travel Insurance Contact Information

If you need to get in touch with Squaremouth Travel Insurance for any purpose , you have the following contact options available:

Squaremouth Travel Insurance Pros and Cons

Wondering if you need travel insurance before booking your trip?

While not mandatory for every destination, some countries insist on it for visitors.

Travel insurance is highly recommended for international travel, providing crucial emergency medical expense coverage since US health insurance doesn’t apply abroad.

It’s especially useful when you’ve incurred non-refundable expenses.

Despite its cost being a fraction of your trip, the peace of mind it offers is valuable.

Although SquareMouth has benefits, it may not be the ideal choice for everyone when shopping for trip insurance.

- Zero-complaint guarantee for extra support

- Compare dozens of insurance policies

- Quickly review multiple quotes

- Limited customer reviews on the BBB and Trustpilot.com

- Doesn’t offer its own insurance policies

Travel Insurance Benefits and Coverages

Travel insurance plans are crafted to provide a bundled set of advantages safeguarding both travelers and their financial commitment in case unforeseen events affect their journey.

This encompasses coverage for situations leading to trip cancellations or interruptions, as well as financial losses incurred due to issues encountered during the travel.

Typically, travel insurance policies are extensive, encompassing various protections such as reimbursement for cancellations, assistance with medical emergencies, compensation for travel delays, and coverage for lost luggage.

Squaremouth outlines the prevalent types of travel insurance benefits usually incorporated into a policy .

Travel Insurance Benefit Types

Cancellation: Travel insurance cancellation benefits provide reimbursement for unused trip expenses in the event that travelers need to cancel their trip entirely or cut their journey short due to a covered reason.

Medical & Evacuation: Travel medical insurance provides coverage for the expenses associated with treating an illness or injury that occurs while traveling.

Delay: Travel delay benefits aim to safeguard travelers against financial losses arising from trip delays or missed connections.

Luggage: Travel insurance offers advantages for travelers to acquire necessary items in the event of delayed luggage, and it can also reimburse the expenses incurred due to lost or damaged belongings.

Accidental Death: Travel insurance plans may offer a one-time lump sum payout in the unfortunate event of a traveler’s death or the loss of a limb while on their journey.

Sports: Certain travel insurance plans may encompass benefits that apply to adventurous travelers engaging in activities that would typically be excluded from coverage.

Additional Benefits: Many policies are extensive, providing a range of supplementary advantages.

Though numerous policies offer similar benefits, there can be significant variations in coverage amounts and prices.

It is crucial for travelers to identify the benefits that matter most to them, especially if they are visiting countries that mandate travel insurance .

Squaremouth consistently advises travelers to purchase the most affordable policy that aligns with their required benefits and coverage amounts based on their trip details.

What Are The Key Travel Insurance Benefits?

Many travel insurance plans are designed to address the typical worries of travelers.

In the constantly evolving realm of travel, it’s essential for travelers to identify crucial benefits in a policy.

Trip Cancellation

Trip Cancellation coverage offers reimbursement for a traveler’s pre-paid and non-refundable trip expenses in the event of trip cancellation due to unexpected circumstances.

While commonly associated with illness, injury, or death, each policy outlines a specific set of additional covered reasons.

Cancel For Covid-19 Sickness

Cancellation coverage due to Covid-19 illness can provide reimbursement for travelers who need to cancel or cut short their journey due to contracting the virus.

Cancel For Any Reason

The Cancel For Any Reason (CFAR) option is an elective enhancement that offers travelers maximum flexibility.

This feature allows partial reimbursement of prepaid and non-refundable trip expenses in the event of cancellation for reasons not covered by the standard policy.

Emergency Medical

Emergency Medical is able to cover the expenses accrued by a traveler in the case of a medical emergency while on their journey.

This coverage includes ambulance services, hospital fees, physician services, and various other medical expenses.

Medical Evacuation

In the case of a medical emergency during a journey, Medical Evacuation services can swiftly transport a traveler to the closest suitable medical facility.

Medical Coverage For Covid-19

Coverage for Covid-19 medical expenses can provide reimbursement for the healthcare expenses incurred by a traveler if they happen to contract Covid-19 unexpectedly while on their journey and need medical treatment.

Travel Delay

Travel Delay coverage provides compensation for expenses related to meals and lodging in the event of an unforeseen delay during a journey.

Extension Of Coverage

Coverage Extension refers to the duration during which a traveler’s insurance policy can offer benefits beyond their originally planned return date, in the event that they are unable to return home due to circumstances beyond their control.

SquareMouth Travel Insurance Pricing

SquareMouth collaborates with different insurance providers , resulting in variable pricing based on the chosen plan.

It’s important to note that the travel insurance quote from SquareMouth may not be precise, as the insurance provider could impose additional fees.

Prior to purchasing your plan, the provider will furnish you with a more comprehensive estimate.

Notably, SquareMouth does not levy additional charges for its services.

The amount you pay for a plan through the platform remains consistent with what you would pay when purchasing directly from the insurance provider.

SquareMouth Travel Insurance Financial Stability

While exploring options on SquareMouth for insurance plans, you have the ability to review the AM Best scores of each insurance provider.

AM Best, an impartial platform, assesses companies based on their financial strength.

A higher financial strength rating indicates a more stable insurance provider, alleviating concerns about potential issues such as the inability to fulfill claims or loss of coverage due to a sudden business shutdown.

It’s important to note that SquareMouth, being a relatively new company, lacks a financial strength rating.

However, since SquareMouth doesn’t directly sell its own insurance plans, the security of your insurance coverage is not compromised in the event of SquareMouth facing financial challenges.

Customer Reviews About Squaremouth

As of December 2023, Squaremouth has garnered feedback from 49,040 customers on ResellerRatings.com, achieving an impressive average rating of 5 stars .

SquareMouth Travel Insurance Claims

Travel insurance claims center.

Travel insurance serves as a safeguard against unforeseen circumstances, shielding travelers from financial setbacks caused by flight cancellations, delays, misplaced luggage, injuries incurred abroad, and various other disruptive events during their journeys.

If your trip didn’t go as planned and you need to file a travel insurance claim, continue reading for resources and provider contact information .

What Can You Claim?

Travel insurance offers financial safeguards in case unexpected events interfere with or affect your travel arrangements.

Below are the prevalent complications that travel insurance might address:

Today, travelers often worry about travel disruptions and delays, which are prevalent issues.

In the event that your journey is postponed or you fail to catch a connecting flight due to circumstances beyond your control, travel insurance can potentially cover additional expenses like lodging and meals.

Cancellations

This insurance usually provides reimbursement for non-refundable costs in case you have to cancel or curtail your journey for covered reasons, such as illness, injury, or unexpected events.

Medical Emergencies

Travel insurance might provide financial protection for medical costs resulting from sickness or injury during your travels.

This coverage can include expenses such as hospital stays, visits to doctors, and emergency evacuations.

It’s important to note that there could be coverage limits and specific exclusions that apply.

Travel insurance can provide protection in case of lost, stolen, or delayed baggage, offering reimbursement for necessary items and replacement expenses.

Additionally, certain policies may extend coverage to include damage to baggage.

How To Claim Travel Insurance

Every travel insurance claim is distinct and will be addressed accordingly by your travel insurance providers.

To achieve the optimal result, it is crucial to be well-prepared and proactive.

Begin by considering the following suggestions:

Contact Your Provider

Contact your insurance provider’s claims team using the information provided in your policy.

They will help you navigate the process, address your questions, aid in preparing your claim, and inform you of the required documentation.

Gather Required Documentation

Prior to starting your claim process, ensure that you collect all essential documentation pertaining to your incident.

This might involve original receipts, medical reports, police reports, travel itineraries, and any other pertinent evidence to substantiate your claim.

Complete Claim Form and Interview

You may be required to fill out a claim form with your provider.

Accuracy is crucial, so make sure to provide all the necessary details.

Attach supporting documentation to facilitate a prompt assessment of your claim.

Expect a member of your provider’s claims team to reach out to you for further discussion.

Submit The Claim

After filling out the claim form and assembling the necessary documents, you are ready to submit your claim.

Providers generally receive claims through email, regular mail, or a secure online portal.

Remember to keep copies of all documents for your personal records.

Frequently Asked Questions (FAQs)

For further information about Squaremouth Travel Insurance , please refer to the dedicated Frequently Asked Questions (FAQ) section.

What is Squaremouth com?

Squaremouth operates as an internet-based platform that assesses travel insurance plans offered by all significant providers within the United States.

Will travel insurance cover flight cancellation?

A thorough travel insurance plan should provide coverage for your flight in case you have to cancel or modify your plans due to unforeseen circumstances.

A valid travel insurance policy can safeguard you in case any unexpected issues arise during your vacation.

How does SquareMouth work?

SquareMouth serves as a streamlined hub for purchasing travel insurance plans, offering a simplified process.

On the platform, you can easily compare various plans, make payments, and secure coverage from a partnering insurance company .

Notably, SquareMouth does not impose any extra fees for its services.

Does SquareMouth handle travel insurance claims?

No. You need to submit a claim directly to your insurance provider.

However, SquareMouth’s zero-complaint guarantee provides support in case you are dissatisfied with your insurance company’s handling of a claim and require additional assistance.

Is SquareMouth safe to use?

Yes, SquareMouth is safe to use. This travel insurance marketplace is authentic and collaborates directly with prominent providers.

SquareMouth ensures transparency by eliminating hidden fees or additional charges when purchasing an insurance plan.

Squaremouth travel insurance provides a dependable and user-friendly solution for securing travel insurance for your journey.

With a diverse selection of policies from leading providers, an intuitive website, and a committed customer service team, Squaremouth ensures a seamless experience.

Backed by its Zero Complaint Guarantee and price guarantee, Squaremouth demonstrates confidence in its products and providers.

I believe this article offered a mix of pleasure and valuable insights as you explored the intricacies of Squaremouth Travel Insurance.

Discover more articles on our blog that explore a range of insurance-related topics similar to this one.

Insurance Strategy Specialist

Howdy Robert is a seasoned Insurance Strategy Specialist known for his strategic acumen in devising tailored insurance solutions. With a focus on strategic planning, Howdy collaborates with individuals and businesses to develop customized insurance strategies that align seamlessly with their unique risk profiles and financial aspirations.

Howdy earned his degree in Strategic Insurance Planning from Horizon University , providing him with a robust academic foundation in insurance principles, strategic management, and risk analysis. This educational background serves as the bedrock for Howdy’s ability to create dynamic and forward-thinking insurance strategies.

In his role as an Insurance Strategy Specialist, Howdy excels in various insurance sectors, including:

- Property and Casualty Insurance

- Life and Annuities

- Commercial Liability Insurance

- Specialty Lines (e.g., Cyber Insurance)

- Employee Benefits and Group Coverage

Howdy’s expertise spans these diverse sectors, allowing him to design comprehensive insurance strategies that cater to the nuanced needs of each client.

With over a decade of practical experience, Howdy Robert has honed his skills as a trusted advisor in the insurance industry. His professional journey includes collaborating with a wide array of clients, from individuals seeking personal coverage to businesses navigating complex risk landscapes. Howdy’s experience extends beyond traditional coverage, incorporating strategic planning to ensure that clients not only have protection but also a roadmap for achieving their broader financial goals.

As an Insurance Strategy Specialist, Howdy Robert is dedicated to providing clients with strategic insights and customized solutions. His ability to navigate multiple insurance sectors and design tailored strategies sets him apart, offering clients a holistic approach to risk management and financial planning.

Join me on:

Share this:

You are using an outdated browser. Please upgrade your browser to improve your experience.

Squaremouth

Squaremouth is a prominent US-based travel insurance marketplace. Learn pros, cons, pricing, services, and more.

InsuranceRanked values your trust!

InsuranceRanked.com is a free online resource that provides valuable content and comparison features to visitors. To keep our resources 100% free for consumers, InsuranceRanked.com attempts to partner with some of the companies listed on this page, and may receive marketing compensation in exchange for clicks and calls from our site. Such compensation can impact the location and order in which such companies appear on this page. All such location, order and company ratings are subject to change based on editorial decisions.

Our Phone Insurance Partners

5Devices, AIG TravelGuard, Akko, Faye, Generali Global, Hiscox, Insurance321, Next Insurance, Simply Business, Squaremouth, The Hartford, Tivly, Travelex Insurance, TravelInsurance.com, Upsie, VSP

HOME > TRAVEL INSURANCE > SQUAREMOUTH

Squaremouth 2024 Review

Award-Winning Writer, Digital Communications Leader

Squaremouth Review

Arguably the largest travel insurance marketplace operating in the United States, Squaremouth offers 90 unique travel insurance plans from over 30 different insurance companies. No matter where you decide to go and what you decide to see, there’s a good chance Squaremouth offers a policy that will cover your situation.

With so many choices, searching for the right travel insurance plan can quickly become overwhelming. How can you ensure you’re getting the best level of protection for your money? Moreover, if you do end up with a claim, who can you turn to for help?

In this article, we’ll cover everything that Squaremouth offers: What insurance companies they work with, the types of policies you can buy, and where to go if you need to file a claim.

What is Squaremouth?

Squaremouth was founded in 2003, making them one of the oldest travel insurance marketplaces online. As an insurance agency, the company is licensed to sell insurance products in all 50 states and the District of Columbia. Because state regulations vary, the number of insurance policies may be limited based on your primary residence.

One of the advantages of buying through Squaremouth is their “Zero Complaint Guarantee.” If you are not satisfied with a claim, their team of claims adjusters will review the case and mediate on your behalf. Although they cannot guarantee that the claim will be paid out, they will remove any insurance company that does not fulfill claims to their satisfaction. While the guarantee offers an additional layer of assurance, Squaremouth doesn’t publish data on what percentage of claims decisions are overturned through their intervention.

The company offers four different categories of travel insurance, which may include medical care coverage. However, these plans are usually not compliant with the Affordable Care Act regulations, because they are temporary in nature and are designed to cover travelers when they are away from their primary residences. Therefore, you should not expect a travel insurance plan to cover routine care, nor prescription medications while you are home.

Squaremouth Travel Insurance Options

As a travel insurance marketplace, Squaremouth offers policies from 32 different insurance providers. Some of the well-known names they offer plans from include:

- April Travel Protection

- AXA Assistance USA

- Berkshire Hathaway Travel Protection

- Generali Global Assistance

- Seven Corners

- Tin Leg - a Squaremouth Brand

- Travelex Insurance Services

- TripAssure - a Trip Mate Brand

While most marketplaces do not offer their own insurance policies, Squaremouth offers a line of plans under the Tin Leg brand. With six different levels of coverage, the Tin Leg policies are underwritten by either Berkshire Hathaway Specialty Insurance Company with a AM Best Rating of A++ (Superior), or Starr Indemnity & Liability Company with a AM Best Rating of A (Excellent). All other plans are underwritten by their specialty insurance providers.

Which Travel Insurance Plans Does Squaremouth Offer?

Squaremouth plans can be broken down into four categories: Single trip policies, annual or multi-trip policies, adventure and sports policies and group policies for 10 or more travelers. Each one offers a different level of coverage, based on your trip length, destination, and level of coverage you prefer.

- Single Trip Policies: As the name suggests, single trip policies only cover the start and finish of one outing away from home. These travel insurance plans can cover trips that start and end in the United States, or journeys to one or several nations. A single trip policy will often cover benefits for trip cancellation, trip interruption, baggage delay or loss, and limited medical coverage. Single trip coverage is best for individuals or groups who are traveling internationally, and want the peace-of-mind to know that in the event of an emergency, their property and health may be protected.

- Annual/Multi-Trip Policies: For travelers who plan on taking several trips across the United States or around the world every year, Squaremouth also offers annual policies. Also known as multi-trip policies, these plans are best for those who know they will be traveling more than 50 miles from their residence several times each year. Although these plans usually offer the same coverage as single trip policies for up to 364 days, they may come with annual claims limits as well.

- Adventure and Sports Policies: For thrill seekers, most travel insurance plans won’t cover their activities of choice. Squaremouth offers a line of plans specifically designed for travelers who want to hit the slopes, climb mountains, or participate in other “risky” behavior. While adventure and sports policies usually cost more than traditional policies, they provide additional medical insurance in case of injury. Before buying, be sure to read the fine print to ensure your activities are covered.

- Group Policies: For groups of 10 or more, Squaremouth also offers group policies that will cover everyone on an itinerary. While they usually include all the benefits of a single trip plan, groups can often get discounts by booking together under a single policy.

What Additional Insurance Options are Available?

Although most travel insurance plans will cover the most common situations, buying insurance early can unlock additional benefits. When purchasing a plan within 14 to 21 days of placing the first deposit on your trip, many policies allow you to add cancel for any reason coverage or pre-existing condition waivers.

- Cancel for Any Reason Coverage: Trip cancellation coverage allows travelers to recover their costs if a covered situation forces them to cancel their trip, such as an illness, death of a family member, or a storm at their destination. Cancel for any reason coverage allows policy holders to recover between 50% and 70% of their costs if they decide not to take a trip for a situation not covered by trip cancellation.

- Pre-Existing Condition Waivers: Most travel insurance policies may not cover recurrences of conditions individuals already have, such as heart disease or cancers. Buying travel insurance early may grant access to pre-existing condition waivers, which will extend trip cancellation and health benefits to a recurrence of a pre-existing condition diagnosed or required care 120 days or more before your trip.

How to Buy Travel Insurance from Squaremouth

Searching for travel insurance on Squaremouth.com begins with their three-step quote process. To start searching, you will be asked to provide details about your trip, including:

- Your departure date, return date, and primary destination.

- Your age, country of residence and citizenship, and ages of travelers on the trip.

- Your date of first deposit, if you plan on including cancellation insurance, total amount of your trip and if any payments are remaining.

From there, Squaremouth.com will show you a number of policies that may fit your requirements. You can also break down options by their benefits, including:

- Trip interruption

- Emergency medical

- Medical evacuation

- Pre-existing medical condition waivers

- Cancel for any reason insurance

- Primary medical coverage

You can also search by top selling plans, insurance companies, and plan prices. Once you have decided upon a plan, you will be asked additional questions about the travelers on your plan, including:

- Your name, birthdate and gender

- The names, birthdates and gender of everyone on your itinerary

- Home address and e-mail

- Telephone number

Payments are handled online through a major credit card or debit card.

How Do I Get my Travel Insurance Documents?

Once your payment is confirmed by Squaremouth, your receipt and documents will be delivered to you via email. For policies purchased from Tin Leg, your insurance documents will come directly from Squaremouth.

Policies purchased from any other travel insurance provider will arrive via e-mail from the companies themselves. It’s important to retain this information, as it will provide not only proof of insurance, but also give you the addresses and phone numbers of the plan’s customer service and claims teams.

Transactions on Squaremouth are secured by a RSA 2048-bit encryption. Amazon Web Services provides the SSL certificate for the website, and is renewed yearly.

Squaremouth Reviews and Ratings

Of all the travel insurance markets, Squaremouth may offer not only the most reviews of products, but offers a number of reviews of their service as well. Travelers are encouraged to leave both good and bad reviews of their insurance companies, based on their customer service and claims experiences.

Over the years, Squaremouth earned a Stevie Award for having a top-tier customer service department, alongside Travel Weekly Magellan Awards and Best of the Biz awards. Squaremouth is also the preferred travel insurance provider for Forbes.com.

Outside of their awards, the company has mixed reviews. The company is rated D- by the Better Business Bureau, and is not accredited by the independent organization. TrustPilot gives Squaremouth an average review of just under three stars, and Angie’s List gives them a B rating based on one review.

As with any travel insurance market, it’s important to do your research to determine if you feel comfortable with a company before buying. Although there are mixed reviews, Squaremouth is a reputable company offering travel insurance policies from multiple providers.

Pros and Cons of Squaremouth

- One of the biggest travel insurance marketplaces online

- Multiple levels of coverage, ranging from single trip plans to annual, multi-trip, and adventure plans

- Over 30 insurance providers and 90 plans in one place

- Selection of multiple insurance plans may be overwhelming

- Mixed reviews from BBB and others

- Company can only advocate on behalf of customers, but can’t overturn claim decisions

Final Thoughts on Squaremouth

Overall, Squaremouth is possibly the most comprehensive travel insurance marketplace available today. With over 90 policies available from 32 insurance companies (including their own brand), the site is one of the first places people shop for their insurance. But with so many choices, smart shoppers should approach the site with a knowledge of what benefits they want, and which companies have the best reviews in the event a claim is necessary.

Frequently Asked Questions

Is squaremouth trustworthy.

Squaremouth is one of the oldest travel insurance marketplaces on the internet, with a wide selection of insurance companies and plans represented.

Who owns Squaremouth?

Squaremouth is founded and co-owned by company CEO Chris Harvey. Based in Florida, Squaremouth is an independent corporation that has made the Inc. 5000 list every year between 2013 and 2020.

Squaremouth is one of many travel insurance marketplace websites available to travelers based in the U.S. and other parts of the world. The company sells their own brand of travel insurance, Tin Leg, along with plans from 31 other insurance companies.

We’ll Introduce You!

Get a free no-obligation quote from Squaremouth

Other Travel Insurance Companies

Squaremouth Travel Insurance: A Complete Review

- By Chris Tate

- November 9, 2023

Imagine this: you’ve meticulously planned a road trip across the United States, excited to explore stunning landscapes and vibrant cities. But as you set out, you encounter unexpected inclement weather, throwing a wrench in your travel plans.

This is where travel insurance, like Squaremouth, can be a lifesaver. In this article, we’ll delve into why travel insurance is a must, especially in the face of unpredictable weather, and explore the features that make Squaremouth the go-to choice for travel enthusiasts.

Without further ado, let’s jump into the article.

For more information on squaremouth, you can find them here.

Why Choose Squaremouth? Well we have Unpredictable Weather.

Traveling across the United States is a dream come true for many, but the country’s diverse climate can throw unexpected challenges your way. From torrential rains in the Pacific Northwest to snowstorms in the Northeast, weather can be a formidable adversary. Travel insurance steps in as your safety net when your adventures are at the mercy of Mother Nature.

Whether you’re hitting the slopes in Colorado or sunbathing in Florida, Squaremouth Travel Insurance ensures you’re prepared for the unexpected. Here’s a detailed breakdown of what Squaremouth is known for:

The Features of Squaremouth Travel Insurance

- Trip Cancellation: Life can be unpredictable, and you might need to cancel your trip due to unforeseen circumstances. Squaremouth covers you for trip cancellations, allowing you to recoup your non-refundable expenses.

- Weather-Related Delays: When flights get delayed or canceled due to weather conditions, it can throw your travel plans into disarray. Squaremouth provides coverage for such inconveniences, ensuring you stay on track.

- Emergency Medical Coverage: Falling ill during your travels is a situation no one wishes for, but Squaremouth has you covered. They offer comprehensive emergency medical coverage, so you can get the care you need without worrying about the bills.

- Lost or Delayed Baggage: If you’ve ever experienced the frustration of lost or delayed baggage, you’ll appreciate Squaremouth’s coverage. They reimburse you for the essentials you need while your belongings catch up with you.

- 24/7 Assistance: Squaremouth’s round-the-clock support ensures you have someone to turn to, no matter where you are. Whether you need help finding a local doctor or arranging transportation, they’ve got you covered.

Why Choose Squaremouth?

Travel enthusiasts love Squaremouth for several reasons, and it’s not just about the coverage. Here’s why they stand out:

- Transparency: Squaremouth is known for its clear and straightforward policies. They provide you with all the necessary information, so you know exactly what you’re getting.

- Customization: Your travel needs are unique, and Squaremouth understands that. They offer a range of policies that can be customized to suit your specific requirements.

- Extensive Network: With Squaremouth, you’re not just buying insurance; you’re gaining access to a vast network of trusted providers and partners. This means you’ll always have support wherever your travels take you.

- Easy Claims Process: In the unfortunate event that you need to make a claim, Squaremouth ensures the process is as hassle-free as possible, allowing you to get back to your adventures quickly.

Thoughts & Takeaways

As you plan your next adventure across the United States or any other part of the world, remember that travel insurance is your safety net. The unpredictability of weather is just one of many reasons why it’s a must-have for any traveler. Squaremouth Travel Insurance, with its comprehensive coverage, transparency, and exceptional support, is the ideal choice for travel enthusiasts.

So, before you embark on your next journey, take the time to explore the options that Squaremouth offers. From trip cancellations to medical emergencies, they’ve got your back, so you can focus on what you love – exploring new places, experiencing different cultures, and creating unforgettable memories. Don’t let unexpected weather or other travel hiccups dampen your spirits. With Squaremouth, you can travel with confidence, knowing you’re protected every step of the way. Your adventures await; let Squaremouth be your trusted companion.

- Travel Blog

Copyright © 2022 all rights reserved by The405Voyager

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

- Travel Insurance

- Squaremouth Review

Squaremouth Travel Insurance Review

The following companies are our partners in Travel Insurance: Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .