- Send us feedback

Suggested pages

Popular searches, recent searches, 13.3.1 purpose, 13.3.2 basis, 13.3.4 member eligible to use the travel card, 13.3.5 member not eligible to use the travel card, pay and conditions manual.

- Department of Defence

- Defence Jobs

- Complaints and Resolution

- Defence Housing Australia (DHA)

- Toll Transitions

- Defence Member and Family Support (DMFS)

- Defence Home Ownership Assistance Scheme (DHOAS)

- Commonwealth Superannuation Corporation

- Defence Force Remuneration Tribunal

- Defence Families of Australia

- Defence Reserves Support

- Pay and conditions manual (PACMAN)

- About this website

- Accessibility

- Media and resources

Language English

Per diem rates

You can claim per diems for each night you spend in-country, and you'll be paid at the aid programme rate applicable at the beginning of your trip.

The per diem schedule is based on the United Nations Development Programme's Daily Subsistence Allowance which contains rates for the countries where most of the aid programme work occurs. These rates are reviewed and updated quarterly.

To get details for other countries’ per diems email [email protected] .

Where a married or de facto couple are working on an assignment together, the per diem rate is adjusted. Refer to your contract for more detail, or contact the MFAT officer responsible for managing the open tender.

2024 per diem rates

- Per diem rates effective January 2024 [PDF 568 KB]

2023 per diem rates

- Per diem rates effective October 2023 [PDF 657 KB]

- Per diem rates effective July 2023 [PDF 654 KB]

- Per diem rates effective April 2023 [PDF 649 KB]

- Per diem rates effective January 2023 [PDF 648 KB]

2022 per diem rates

- Per diem rates effective July 2022 [PDF 635 KB]

- Per diem rates effective October 2022 [PDF 637 KB]

2021 per diem rates

- Per diem rates effective January 2021 [PDF 639 KB]

- Per diem rates effective April 2021 [PDF 640 KB]

- Per diem rates effective July 2021 [PDF 638 KB]

- Per diem rates effective October 2021 [PDF 496 KB]

2020 per diem rates

- Per diem rates effective January 2020 [PDF 631 KB]

- Per diem rates effective July 2020 [PDF 4.2 MB]

- Per diem rates effective October 2020 [PDF 498 KB]

- Per diem rates effective January 2020 [PDF 126 KB]

2019 per diem rates

- Per diem rates effective 1 October 2019 [PDF 89 KB]

- Per diem rates effective July 2019 [PDF 432 KB]

- Per diem rates effective April 2019 [PDF 446 KB]

- Per diem rates effective January 2019 [PDF 448 KB]

2018 per diem rates

- Per diem rates effective 1 October 2018 [PDF 452 KB]

- Per diem rates effective July 2018 [PDF 457 KB]

- Per diem rates effective 1 April 2018 [PDF 456 KB]

2017 per diem rates

- Per diem rates effective 1 October 2017 [PDF 453 KB]

- Per diem rates effective 1 July 2017 [PDF 453 KB]

- Per Diem rates effective April 2017 [XLSX 293 KB]

- Per Diem rates effective 1 Jan 2017 [XLSX 265 KB]

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

We use cookies and other tracking technologies to improve your browsing experience on our website, to analyze our website traffic, and to understand where our visitors are coming from. You can find out more information on our Privacy Page .

U.S. Department of State

Diplomacy in action.

You may use the input field below to enter all or part of a post name. The percent sign "%" serves as a wildcard character. Clicking "Go" will display a list of posts matching the name entered with links to the Per Diem data.

ATTENTION: *DEA, FBI and U.S. Marshals Service (USMS) receive danger pay and adjusted post differential at additional locations listed in footnote "u". **To view DOD imminent danger pay see footnote "v".

Daily Rates

ECA's Daily Rates for business travellers help to anticipate the cost of international business trips. Also known as per diems, Daily Rates come as part of a subscription , or can be bought on demand for individual locations or as a global set. Each report itemises daily costs for the following expenses to give flexibility when calculating allowances for short trips abroad:

- Hotel room (3, 4 and 5 star)

- Alcoholic and soft drinks

- Journeys by taxi and other public transport

- Incidental costs

Daily Rates Calculator

ECA's Daily Rates Calculator helps you to calculate and manage daily subsistence allowances for international business travellers.

The calculator makes it easy to adapt ECA's established Daily Rates data to produce per diems in line with your company policy, ensuring fair, accurate and consistent allowances for your global business trips.

More about Daily Rates

articles.

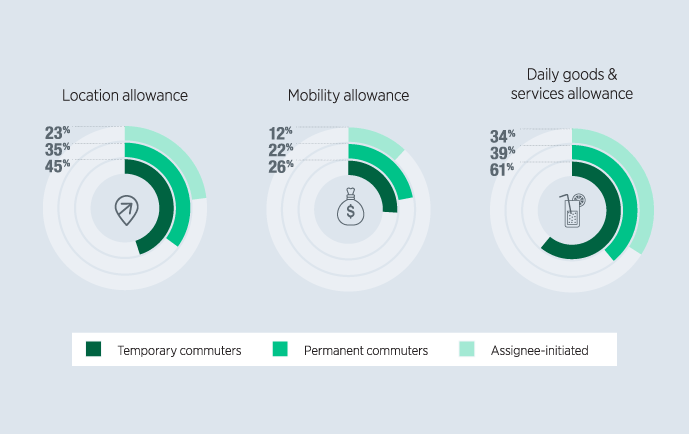

How commuter assignments are changing to support the modern mobile workforce

ECA's recent International Commuters Survey looked at best practice in pay and policy for commuter assignments.

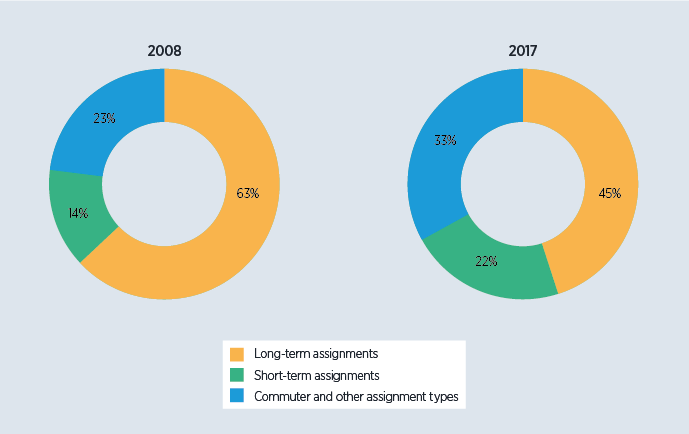

Key considerations when structuring short-term packages

Why are short-term assignments growing in popularity and how are companies structuring packages?

White Papers

ECA Global Perspectives - Cost of Living

This free report explains how ECA's indices are calculated and applied to protect the buying power of people moving between countries as well as lo...

ECA Global Perspectives - National Salary Comparison

Will an individual's spending power be maintained if they move to work in a different country? This free white paper compares local salaries for ma...

Countries, economies and regions

Select a country, economy or region to find embassies, country briefs, economic fact sheets, trade agreements, aid programs, information on sanctions and more.

International relations

Global security.

- Australia and sanctions

- Australian Safeguards and Non-proliferation Office (ASNO)

- Counter-terrorism

- Non-proliferation, disarmament and arms control

- Peacekeeping and peacebuilding

Regional architecture

- Asia Pacific Economic Cooperation (APEC)

- Association of Southeast Asian Nations (ASEAN)

- East Asia Summit (EAS)

- Australia and the Indian Ocean region

- Pacific Islands regional organisations

Global themes

- Child protection

- Climate change

- Cyber affairs and critical technology

- Disability Equity and Rights

- Gender equality

- Human rights

- Indigenous peoples

- People Smuggling, Human Trafficking and Modern Slavery

- Preventing Sexual Exploitation, Abuse and Harassment

- Australia’s treaty-making process

International organisations

- The Commonwealth of Nations

- United Nations (UN)

- World Trade Organization

Foreign Arrangements Scheme

Trade and investment, about free trade agreements (ftas).

- The benefits of FTAs

- How to get free trade agreement tariff cuts

- Look up FTA tariffs and services market access - DFAT FTA Portal

- Discussion paper on potential modernisation – DFAT FTA Portal

About foreign investment

- The benefits of foreign investment

- Investor-state dispute settlement (ISDS)

- Australia's bilateral investment treaties

- Australia's foreign investment policy

For Australian business

- Addressing non-tariff trade barriers

Expo 2025 Osaka, Kansai

Stakeholder engagement.

- Ministerial Council on Trade and Investment

- Trade 2040 Taskforce

- First Nations trade

Australia's free trade agreements (FTAs)

- ASEAN-Australia-New Zealand (AANZFTA)

- Chile (ACLFTA)

- China (ChAFTA)

- Hong Kong ( A-HKFTA & IA)

- India (AI-ECTA)

- Indonesia (IA-CEPA)

- Japan (JAEPA)

- Korea (KAFTA)

- Malaysia (MAFTA)

- New Zealand (ANZCERTA)

- Peru (PAFTA)

- Singapore (SAFTA)

- Thailand (TAFTA)

- United Kingdom (A-UKFTA)

- USA (AUSFTA)

- Trans-Pacific Partnership (TPP)

- European Union (A-EUFTA)

- India (AI-CECA)

- Australia-UAE Comprehensive Economic Partnership Agreement

- Australia-Gulf Cooperation Council (GCC)

Trade and investment data, information and publications

- Fact sheets for countries and regions

- Australia's trade balance

- Trade statistics

- Foreign investment statistics

- Trade and investment publications

- Australia's Trade through Time

WTO, G20, OECD, APEC and IPEF and ITAG

Services and digital trade.

- Service trade policy

- Australia-Singapore Digital Economy Agreement

- Digital trade & the digital economy

Development

Australia’s development program, performance assessment.

- Development evaluation

- Budget and statistical information

Who we work with

- Multilateral organisations

- Non-government organisations (NGOs)

- List of Australian accredited non-government organisations (NGOs)

Development topics

- Development issues

- Development sectors

2030 Agenda for Sustainable Development

- Sustainable Development Goals

Where we deliver our Development Program

Humanitarian action.

Where and how Australia provides emergency assistance.

People-to-people

Australia awards.

- Australia Awards Scholarships

- Australia Awards Fellowships

New Colombo Plan

- Scholarship program

- Mobility program

Public diplomacy

- Australian Cultural Diplomacy Grants Program

- Australia now

- UK/Australia Season 2021-22

Foundations, councils and institutes

- Australia-ASEAN Council

- Australia-India Council

- Australia-Indonesia Institute

- Australia-Japan Foundation

- Australia-Korea Foundation

- Council for Australian-Arab Relations (CAAR)

- Council on Australia Latin America Relations (COALAR)

International Labour Mobility

- Pacific Labour Mobility Scheme

- Agriculture Visa

Australian Volunteers Program

Supporting organisations in developing countries by matching them with skilled Australians.

Sports diplomacy

Australia is a successful global leader and innovator in sport.

A global platform for achievement, innovation, collaboration, and cooperation

About Australia

Australia is a stable, democratic and culturally diverse nation with a highly skilled workforce and one of the strongest performing economies in the world.

Australia in Brief publication

This is the 52nd edition of Australia in Brief, revised and updated in February 2021

Travel advice

To help Australians avoid difficulties overseas, we maintain travel advisories for more than 170 destinations.

- Smartraveller – travel advice

International COVID-19 Vaccination Certificate

Prove your COVID-19 vaccinations when you travel overseas.

- Services Australia

The Australian Passport Office and its agents are committed to providing a secure, efficient and responsive passport service for Australia.

- Australian Passport Office

24-hour consular emergency helpline

- Within Australia: 1300 555 135

- Outside Australia: +61 2 6261 3305

- Getting help overseas

- Visas for Australians travelling overseas

- Visas to visit Australia

24-hour emergency consular support

If you're an Australian citizen and you have serious concerns about your welfare or that of another Australian overseas, contact your local Australian Embassy, High Commission or Consulate, or call our 24-hour Consular Emergency Centre on

- 1300 555 135 within Australia

- +61 2 6261 3305 from anywhere in the world.

Read more about getting help overseas on Smartraveller.

We maintain travel advisories on Smartraveller for over 175 destinations, assigning an overall advice level to each. The advice levels reflect the risks for Australian travellers in each destination. We also provide general advice on a range of travel topics.

Visit Smartraveller to explore our travel advice for all destinations .

We continually review and update our travel advice based on credible information. Stay up to date with any changes by subscribing for updates .

Visit the Australian Passport Office for more about passports.

The Department of Foreign Affairs and Trade does not issue visas for overseas travel or visiting Australia and can’t provide specific information on visas.

Read about visas for Australians travelling overseas .

Find out about visas to visit Australia .

Employee travel allowance rates 2021-22

- Linkedin - external site

- Twitter - external site

- Facebook - external site

Capital city zones

Search capital city boundaries

Excluding Canberra (as at 1 July 2021)

1 High season is 1 April to 30 November. 2 Low season is 1 December to 31 March.

Canberra (as at 25 August 2019)

Regional centres (as at 1 july 2021), related content, parliamentarian travel allowance rates - current, office holder travel allowance rates - current, booking domestic and international travel.

Acknowledgement of Country

The Independent Parliamentary Expenses Authority acknowledges the traditional owners and custodians of country throughout Australia and acknowledges their continuing connection to Land, Waters and Community.

We pay our respects to the people, the cultures and the Elders past, present and emerging.

Home > Company Hub > How much will IR35 cost you? Outside – Inside – Perm

How much will IR35 cost you? Outside – Inside – Perm

- March 9, 2020

This guide talks about the impact IR35 will have on your take-home pay. How much will IR35 cost you? Should you go Inside IR35/Umbrella or Perm?

In Part I of the IR35 mini-series we talked about the current state of contracting and the IR35 mess. We covered some pros and cons of being a contractor and how it compares with being a permie.

It’s now time to talk numbers. The math will hopefully help you decide whether IR35 has made contracting worth continuing. The answer, as usual, is: it depends! Before we dive in, first some definitions. What do we mean by Outside IR35, Inside and Perm:

Outside IR35: The pre-2020 contracting landscape. You operate as a limited company that pays corporation tax and personal income tax. You have the freedom to choose your taxes based on how much you want to withdraw as salary/dividends from your company. Also, business expenses can be claimed.

Inside IR35 / Umbrella : You still operate as a contractor through your limited company or through an umbrella . The take-home pay amounts between inside IR35 and umbrella are very similar. You are taxed more than a permanent employee. That’s because you have to pay both yours and the Employer’s National insurance.

You’re not paid while drinking Pina Coladas on the beach or when sick (except a small amount of Statutory pay).

Your gross pay is usually higher than a perm to compensate for these plus all other minuses that come with contracting, like void periods, short notice period, accounting, DIY pension etc. You don’t get to choose when to withdraw your profits, as everything is taxed at source and you must take all income home now.

Permanent employee (perm) : The majority of the workforce belongs here. The usual employee of a company, who belongs to the company payroll, has a salary that lands in your bank account each month no matter what. Entitled to holidays, sickness pay, and potentially other benefits such as pension, training and mandatory performance reviews.

How much will IR35 cost me Inside IR35 or Umbrella?

This is the most common question. People switching from Outside IR35 to Inside or Umbrella want to know how much income they will lose.

For starters, we assume that the Outside IR35 contractor takes all income home and leaves nothing in the company.

Taking all income out is not the most tax-efficient way to deal with your company money. But it’s a good baseline so let’s start with that. The following graph shows the take-home pay Outside IR35 compared to Inside IR35/Umbrella at the same rate.

The higher the rate the more it will cost you to transition from outside IR35 to inside IR35. But it’s not that bad. (hint: it gets worse).

So in most cases, a contractor will lose anywhere between 15% to 20% of their take-home income. Here’s a graph, showing the percentage difference for the given rates.

Punchline: For tax-inefficient contractors who take all money home, the difference between Outside IR35 -> Inside IR35 (or Umbrella) is between 15-20%.

What if you switch to perm, instead? Let’s see how an Outside IR35 compares to the same gross income taken as a perm employee.

Cost of moving from Outside IR35 (All Out) to Perm

But a few people I know have abandoned contracting altogether and want to switch to perm. What would the impact be if we take the same gross income as a perm?

Here’s the take-home pay when taken as an Outside IR35 contractor vs the equivalent gross pay as a perm employee. I’ve used the salary calculator ( link ) to calculate the take-home pay of all perm salaries.

As you can see, going perm doesn’t make much of a difference. On £600 per day, for which the equivalent annual gross is £132,000, the difference is just £6,000 per year.

However, here’s the catch:

It is really hard to achieve the same gross income as a perm. Here is a table outlining the equivalent gross amount of a daily rate when charged annually (44 working weeks. 5w hols, 8d bank hols, 7d sick/void):

Do you see the problem? In my experience, a contractor on £300/day will find it really hard to find a job at £66,000. Similarly, one who earns £600/day won’t easily find a £132,000 perm salary, even if you account for things like pension and bonus.

And it makes sense from a risk point of view. As we explained in Part I of this IR35 series , as a contractor your client doesn’t provide months of leave notice, job security or any perks. You provide a service at a cost. You are a Capital Expenditure (CapEx budget).

As a perm, the company makes commitments to you which is why the equivalent gross pay is unrealistic. I don’t know exactly what the equivalent “discount” we need to apply here when switching from Outside IR35 to Perm. But I do know there is one. So the percentage difference is higher than the table above suggests – to some extent.

The difference is BIG when the contractor is tax-efficient

The gap between Outside IR35 and all the other options widens further if you’re a tax-efficient contractor.

I’m sure you know a lot of people who don’t take all the money home.

Most contractors I know will at least take advantage of the minimum salary/dividends payout. So they all withdraw a minimum salary and dividends up to the point that doesn’t cross the higher taxpayer threshold (£50,000 as of 2020).

I think we can all agree this is a good tax strategy assuming you have no other (unsheltered) income outside your LTD affairs. Why take more £50,000 a year and pay higher taxes if you can just leave the money in the company and just pay corporation tax? Assuming, of course, you can live on this amount.

To the extreme end of this spectrum, there are people like myself who invest their company money . I consider my LTD money as “take-home” because it can provide income for years to come when invested. Others just leave it in there in cash and at some point, they claim “Entrepreneur’s Relief” (if this is not scrapped soon). This means they will only pay 10% tax to take it out of the company.

This all means the take-home pay for Outside IR35 contractors can be different from person to person despite having the same daily rate.

Putting it all together we have the following groups:

- All Out : Some other people say I want all my capital in my pocket, therefore I’m happy to pay the extra dividend tax to do that. This means I’ll have to apply a 32.5% dividend tax on the money before it becomes “take-home”. All-out approach

- Leave Surplus In strategy: Some, like me, consider the LTD surplus cash as “take-home” pay. Since you can invest the company money, the income/dividends will keep coming and I don’t need to (ever?) withdraw this surplus. So for the purposes of providing me income, the money is effectively take-home although it still belongs to the company. This is mathematically the most tax-efficient way.

- Entrepreneurs Relief approach : Some others take an accumulative approach but with ER in mind. They say, I will only withdraw a minimum salary and dividends as everybody else does and I will leave the rest of the money in the company. When the sum is big enough, I will close the company down and claim Entrepreneur’s Relief by paying only 10% tax to make the money mine . I will call this approach the ER approach.

So for an Outside IR35 contractor who takes a £50,000 take-home and leaves the surplus in the company (on 10% tax, Entrepreneurs Relief) here is the difference in take-home:

That’s a BIG difference. So if you leave some money in the company, moving from Outside IR35 to inside IR35 is going to cost you 30% loss of income on £650 per day. It’s “just” 15% on £200 per day but can go up to 33% loss on £1000 per day.

A bit depressing if you’re an Outside IR35 on a high rate. The data don’t lie!

Putting it all together: Outside IR35 vs Inside IR35 & Umbrella vs Perm

If we put all possible options in one single graph, it looks like this:

And that’s all on the same gross pay!!!

So when people ask me whether converting from contracting to perm has a difference, the answer is: It depends on how well you handle your taxes. If you’re wise with taxes, then it makes a massive difference . As you can see, an Outside IR35 contractor on £500 per day, who L eaves S urplus I n goes from £87,000 down to £70,000 (perm) or £62,400 (Umbrella). That’s a 30% drop in take-home income!

If you want to have a detailed look at the exact numbers, here’s the full table:

Even if you’re not working exactly 44 weeks and make the same assumptions as I do, the above table gives you a good indication. Here is a link to my spreadsheet which I used to calculate all the Outside IR35 take-home options. Use File -> Make a copy to edit the file, please do not request access to edit mine .

You may be wondering:

How can I improve my take-home pay if I cannot continue contracting Outside IR35?

There are a few things you can do to improve your take-home pay.

- Negotiate a rate increase

- Contribute to your pension

Negotiating a rate increase can work sometimes but it’s a bit futile. If everyone is running around like a headless chicken, why would companies offer more? It’s a question of supply and demand really because I’m sure companies still need some flexible workforce to scale up and down quickly.

So we shall wait and see who needs who more 🙂

Contributing to your pension is a sure win from a tax point of view and makes the transition much smoother. That’s because your pension contributions are income-tax-free, NI-free and corporation tax-free. In the next article we are going to answer the following questions:

- How can I increase my take-home pay inside IR35, Umbrella or Perm?

- How much do I need to increase my rate inside IR35 to match my Outside IR35 take-home?

Calculation Notes:

- A contractor works approximately the same weeks as a perm employee. Takes 5 weeks holidays, 8 days bank holidays, 7 days sickness/void periods between contracts. Total: 44 working weeks.

- All calculations were done for the Financial tax year 2019/20

- No pension was added to either perm or contract. It can save both perm and contractors a lot of tax. Pension deserves its own chapter, which is why we’re going to have another article just on how to use pensions to extract more out of your salary.

- Perm calculations include ALL benefits, bonus, overtime etc except pension.

- Used my Outside IR35 Contractor calculator ( Google Sheet ) to calculate all take home styles

- Inside IR35 calculations provided by Contractor Calculator – link

- Salary (perm) calculations by The Salary Calculator – link

Share this article:

Join the newsletter.

Every 2 weeks, I send a handwritten email with honest, valuable content. No spam, ever.

You may also like...

Flexible ISA: Business Owner’s Best Lifehack

Should Limited Companies Invest in a Dividend Fund over a Global Tracker?

Best Places to Hold Cash in the UK in 2024

17 thoughts on “how much will ir35 cost you outside – inside – perm”.

Great article Michael, this really clarifies what I’d always suspected but could never work out the maths for — and thanks for the spreadsheet.

You rock Michael! Great article!! I’m sure it will help lot of people at this time of chaos.

Hi Michael,

Thanks for this. Do you invest your company money through pension (so before corporation tax), or do you do it after you’ve paid corporation tax and invest it privately as profit?

I’m wondering because I’m quite loathe to leave it in government’s control (even private pension age is planned to go up), and that puts me off pensions.

Thank you, Michael. Great article.

I was using the minimum needed salary and dividends approach so it will be a big hit. One of my client has agreed to increase the rate so mitigate the impact and I’ll put the revised rate for future contracts. Increasing pension contribution is another option and I’d also suggest making the full use of ISA allowance while it lasts for any spare income you are forced to withdraw given that tax is already paid. Any dividends invested and re-invested in ISA, hopefully, coupled with some increase in rates, along with pension contribution will hopefully take the edge out of 33% or so hit on income.

@D I do both. As you rightly said, pension contributions suffer from lack of control but are 100% tax-efficient. So some of my investments go into a SIPP (saving corporation tax) and some I invest through my limited company after corporation tax is paid but still pre-income-tax. https://www.foxymonkey.com/how-to-invest-your-company-profits/

@Peterparker sounds like a good plan. I understand not everyone can increase their inside-IR35 rates but should definitely ask to share the pain with the employer.

@Satish, @Peter Jones – Glad you liked it 🙂 Hopefully, the chaos won’t last long!

Great article Michael – thanks for sharing the insightful graphs and calculator. You managed to make a difficult topic enjoyable to read!

Very well thought out and presented Michael. I have already gone permie as I saw the writing on the wall. The tax hike the past 9 months has been painful but at least some respite today in that Entrepreneurs relief has not been canned. I have a reasonable level of co. reserves over 100k; appreciate in your other posts you talk about opening a holding co. and investing via there but I think unless you have 200k plus or a growing warchest (on the expectation of being able to stay contracting outside IR35) the costs of running the two cos. would eat into potential returns too much.

Thanks, Andrew. I was glad to hear ER is not going away too! Starting an investment company for me has a much lower limit. £50k or so. If you can make a say 7-10% on £50,000 that’s between £3,500 to £5,000 versus £0 returns in the bank. But yeah, there’s hassle involved I hear you.

Thanks Michael. That makes sense if you’re planning on adding in fresh capital over time. But if you’re out of the contracting gig like me I think its harder to justify, and the fees for running the co. are going to eat into those returns. That’s why I was so relieved ER was retained as I can pull out the stagnant cash with only a minor hit. If I was staying contracting I would go down your second company route. But what with the world as it is and mine (and presumably most other’s) pensions and investments decimated knowing what to do with anything spare is all up in the air anyway! FIRE is perhaps less achievable but also not likely the top priority right now. Stay safe folks!

Indeed, Andrew, take care!

@Michael. A very in depth article, thanks!

Did you ever do the followup article covering the necessary increase in rate necessary to maintain the same take-home when moving from outside to inside IR35?

With the revised implementation date for IR35 changes now coming into force in a few months time, it’d be great to see your analysis on this.

Glad you found it useful, Martin. I haven’t written the article yet. You can probably estimate that by looking at the last take-home table based on your rate. So for a £500 per day outside IR35 contract (All money out) the equivalent would be ~£650 per day inside IR35.

The more tax-efficient you are with the company money the higher the rate increase to match it. Goes to show why IR35 can be a big showstopper and why it has really killed most of the freelancing job postings!

Hi @Michael, thanks for your response!

Just to check my understanding is correct: following your example, if I translated a £700 a day outside all out (£98k) that would be equivalent to around £900 a day Inside IR35?

Does the same logic apply to cross referencing between the Outside IR35 Entrepreneurs Relief and Inside IR35? ie a £650 a day at Outside ER (£107k) is equivalent to approximately £1,000 a day Inside IR35?

Hi Martin, both your examples are correct. Goes to show how big of an impact moving inside IR35 has. Plus how much room for tax optimisation company directors have!

Very good article. However, I am one of those contractors who are efficient with their tax. I am loosing 30% pay in real terms and its ruining my life. Sold my car (not a really nice one) and had to hand notice in to my sons private school. its heartbreaking. IR35 has ruined my life.

Hello Michael, I’m wondering what would be the best strategy for someone who has stopped contracting and taken on a perm role. Would you close the company, go with ER and take surplus funds out? Or continue down the strategy of investing surplus funds in stocks/shares or property?

I see the benefits if you continue to do contract work outside IR35. Investing surplus funds make total sense especially if you’re being tax efficient. However with Entrepreneurs Relief on the table I seem to think it flips to the other side.

Asking for a friend 😉

Hi Mannuel, short answer is it depends on your goals. If keeping Entrepreneur’s relief is important to you then investing a substantial amount might lose this benefit. You have to be more careful how you want to go about it.

See can I claim entrepreneur’s relief if my company invests?

ER also restricts you from operating in the same space for 24 months. That’s the “phoenixing” rule. So if you want to leave your perm job and go back to contracting, that’s another thing to consider.

Having said that, the Entrepreneur’s Relief rules change all the time so it might not be here for long. Just speculating though, but now we definitely know it’s on the table.

Overall, it depends on many different factors, and you have to run different scenarios. It’s a popular question and part of the tax pillar in the company investing course.

Leave a comment Cancel reply

Notify me via e-mail if anyone answers my comment.

Hi! I’m Michael and I love writing about different ways to earn, save and invest our money. Coffee addict :)

Recent Posts

Are Biotech stocks a good buy now?

- Matched Betting

- Career tips

- Extra Income Ideas

- LTD Companies

- Passive Income

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Travel allowances

Explains the PAYG withholding implications on travel allowances.

Last updated 24 August 2021

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties.

Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies.

You include the amount of the travel allowance in the allowance box on your employee's payment summary.

The exception applies if:

- you expect your employee to spend all of the travel allowance you pay them on accommodation, food, drink or incidental expenses

- you show the amount and nature of the travel allowance separately in your accounting records

- the travel allowance is not for overseas accommodation

- the amount of travel allowance you pay your employee is less than, or equal to the reasonable travel allowance rate.

If the exception applies, you:

- don't withhold tax from the travel allowance you pay your employee

- don't include the amount of the travel allowance in the allowance box on your employee's payment summary

- only include the allowance on their payslip.

If the first two exception conditions are met but you pay your employee a travel allowance over the reasonable travel allowance rate, you're required to withhold tax from the amount that exceeds the reasonable travel allowance rate. You also need to include the total amount of the travel allowance in the allowance box on your employee's payment summary.

You are always required to withhold tax from a travel allowance for overseas accommodation and include the amount of the travel allowance in the allowance box on your employee's payment summary.

Check the relevant Single Touch Payroll (STP) employer reporting guidelines to see how to report these payments through STP:

- STP Phase 1 employer reporting guidelines – allowances

- STP Phase 2 employer reporting guidelines – allowances

Reasonable travel allowance rate

Each year we publish the amounts we consider reasonable for claims for domestic and overseas travel allowance expenses.

- TD 2021/6 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2021–22 income year?

- TD 2020/5 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2020–21 income year?

- TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses

- Keeping travel expense records

- Tax return – allowances

- Tax return – work-related travel expenses

Understanding travel expenses for your Not-for-Profit organisation

Moore australia, travel expenses, non-deductible travel expenses.

- Ordinary home to work travel

- Remoteness of the work location

- Requirement to move continually between work locations

- Requirement to work away from home for an extended period

- Co-existing work location travel (working in more than one location)

- Relocation travel (relocating from a usual place of residence to undertake work duties).

Options for NFPs

1. reimbursements, 2. allowances, 3. honorariums, deductible travel expenditure.

- The travel is at the direction of the employer

- The traveller is paid to conduct the travel (e.g. daily allowance paid includes "travel days" as well as "working days")

- The work required to be completed includes a travel obligation, and

- The travel is not contrived to give the appearance of work-related travel.

Example (continued)

Application of fbt where directors are paid for services.

Moore Australia (VIC)

FOLLOW US ON LINKEDIN

Stay informed.

Subscribe to our database today to receive our latest news.

Expedia Rewards is now One Key™

Cheap flights to chusovoy.

Bundle Your Flight + Hotel & Save!

Add a place to stay

Direct flights only

Featured airlines

- trending down icon Be in the know Get alerts if flight prices drop or rise*

- bex rewards loyalty icon Book smarter Save up to 30% on select hotels after you book a flight*

- one key icon Earn twice Earn your airline miles on top of our OneKeyCash Learn about One Key

Find Your Flights to Chusovoy PEE

Cheap flights to Chusovoy ( PEE)

Get started finding a cheap flight to Chusovoy on Expedia by either choosing a deal on this page or entering into the search bar your travel dates, origin airport, and whether you want roundtrip or one-way airfare. You can filter for flexibility, number of stops, airline, and departure/arrival times to find the best flight for you.

We recommend using the ‘Flexible Dates’ calendar at the top of the page to see the price of plane tickets on the surrounding dates. This allows you to pick the cheapest days to fly if your trip allows flexibility and score cheap flight deals to Chusovoy.

Roundtrip prices range from - , and one-ways to Chusovoy start as low as .

Be aware that choosing a non-stop flight can sometimes be more expensive while saving you time. And routes with connections may be available at a cheaper rate.

Airlines that fly to Chusovoy ( PEE)

You have several options for which airline you choose to travel with to Chusovoy. There are airlines flying into PEE: .

Cheap plane tickets may be available from different airlines at different times and with unique terms. It’s best to understand the details of each airline’s offer before judging its value.

For example, if you plan to check a bag or bring a carry-on, check whether the cheap airfare deal includes a baggage allowance. If not, verify whether the baggage fee is higher than the difference of other airline plane ticket deals offering free checked/carry-on baggage in exchange for a slightly higher airfare.

Additionally, your preferred frequent flyer membership programs may influence your choice of cheap airline. Expedia allows you to enter your membership numbers during checkout to earn points from your airline and Expedia Rewards—all while getting a great deal and planning all your travel in one online platform.

Find the best deals

At Expedia, we source many flight deals from multiple providers, so you can easily find the best deals that are right for you. A great strategy for getting the best deals can be to make sure you book and travel at the optimal times. Airfare to Chusovoy (PEE) varies throughout the year based on seasonal demand. You’ll see the lowest rates for roundtrips to PEE in and in for one-ways.

Cancellation & flexibility

To change or cancel eligible flights, go to ‘My Trips’ and navigate to your itinerary. If you booked within the last 24-hours, you might be able to cancel your flight for free. Learn more about flight changes or cancellations from our customer service portal . Some plane tickets are available with no change fees, which you can filter for during your search.

Frequently asked questions

- What you pack in your cabin baggage can make the difference between a comfortable flight, and one you’d prefer to forget. Start with the most important things, such as your passport (or a valid ID) and your travel documents. Once they’re packed, toss in any medications you might need. Next, think about comfort. A quality neck pillow, earplugs and a juicy novel will help the hours fly by while you’re soaring above the clouds.

- It also pays to check with your airline regarding what you can’t bring on board your flight. Pocket knives, razor blades, swords and batons are among the prohibited items. Anything flammable, explosive or sharp is generally not allowed in your carry-on bag. Don’t forget to pack any sports equipment like baseball bats or ski poles in your checked luggage.

- Whether traveling long or short-haul, layering up is key to staying comfortable. Choose loose, natural fabrics that will keep you cool and pack a pullover for any in-flight cabin temperature changes. Keep your feet happy in a pair of sneakers or closed-toe shoes.

- The condition known as deep vein thrombosis (DVT) is a risk on long-distance flights. It’s the result of blood clotting caused by poor circulation and inactivity. Strolling up and down the aisle and doing leg and foot stretches while seated can help prevent this developing. Wearing compression socks or tights can also help to reduce your risk.

Get up to 100% off your flight to Chusovoy when booking a Flight + Hotel

- Top Flights Destinations

More Popular Airlines

Top flight destinations.

- Flights to Moscow

- Flights to St. Petersburg

- Flights to Yakutsk

- Flights to Vladivostok

- Flights to Sochi

- Flights to Krasnodar

- Flights to Makhachkala

- Flights to Grozny

- Flights to Kaliningrad

- Flights to Yekaterinburg

- Flights to Novosibirsk

- Flights to Volgograd

- Flights to Samara

- Flights to Petropavlovsk-Kamchatskiy

- Flights to Kazan

- Flights to Chelyabinsk

- Flights to Rostov-on-Don

- Flights to Krasnoyarsk

- Flights to Irkutsk

- Flights to Murmansk

Top Flight Destinations In the World

- Flights to United States of America

- Flights to Japan

- Flights to Philippines

- Flights to Costa Rica

- Flights to Italy

- Flights to India

- Flights to Thailand

- Flights to Mexico

- Flights to Greece

- Flights to Dominican Republic

- Flights to Bahamas

- Flights to South Korea

- Flights to Ireland

- Flights to Australia

- Flights to Spain

- Flights to Vietnam

- Flights to New Zealand

- Flights to Germany

- Flights to China

- Flights to Canada

- Darwin Airline SA Lugano

- Evergreen International

- Ghadames Air Transport

- Aircompany Kokshetau

- Royal Airways Limited

- Vietnam Air Service Co.

- West Caribbean Costa Rica

- Olympus Airways

- Bulgarian Air Charter

- Branson Air Express

- Deutsche Bahn

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2024 per diem highlights

We establish the per diem rates for the continental United States (CONUS), which includes the 48 contiguous states and the District of Columbia. Federal agencies use the per diem rates to reimburse their employees for subsistence expenses incurred while on official travel.

Federal per diem rates consist of a maximum lodging allowance component and a meals and incidental expenses (M&IE) component. Most of CONUS (approximately 2,600 counties) is covered by the standard rate of $166 ($107 lodging, $59 M&IE). In fiscal year (FY) 2024, there are 302 non-standard areas (NSAs) that have per diem rates higher than the standard rate.

Since FY 2005, we have based the maximum lodging allowances on average daily rate (ADR) data. ADR is a widely accepted lodging industry measure derived from a property's room rental revenue divided by the number of rooms rented. This calculation provides us with the average rate in an area. For more information about how lodging per diem rates are determined, visit Factors Influencing Lodging Rates .

We remind agencies that the Federal Travel Regulation (FTR) allows for actual expense reimbursement when per diem rates are insufficient to meet necessary expenses. Please see FTR § § 301-11.300 through 11.306 for more information.

FY 2024 results

The standard CONUS lodging rate will increase from $98 to $107. All current NSAs will have lodging rates at or above FY 2023 rates. The M&IE per diem tiers for FY 2024 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59.

There are two new NSA locations this year:

- Huntsville, AL (Madison County)

- Charles Town, WV (Jefferson County)

The following locations that were NSAs (or part of an established NSA) in FY 2023 will move into the standard CONUS rate category:

- Hammond / Munster / Merrillville, IN (Lake County)

- Wichita, KS (Sedgwick County)

- Baton Rouge, LA (East Baton Rouge Parish)

- Baltimore County, MD

- Frederick, MD (Frederick County)

- East Lansing / Lansing, MI (Ingham and Eaton Counties)

- Kalamazoo / Battle Creek, MI (Kalamazoo and Calhoun Counties)

- Eagan/ Burnsville / Mendota Heights, MN (Dakota County)

- Akron, OH (Summit County)

- Wooster, OH (Wayne County)

- Erie, PA (Erie County)

- Corpus Christi, TX (Nueces County)

- Round Rock, TX (Williamson County)

- Appleton, WI (Outagamie County)

- Brookfield / Racine, WI (Waukesha and Racine Counties)

- Morgantown, WV (Monongalia County)

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

Find a Dentist Make your appointment online

Refine Your Search

- General Info

- Full Details

Clinic Images

Procedures & prices.

Kostamed International

Kostamed International Clinic is situated in Ust-Kachka, Perm Region, Russia. It is 2 hours by plane from Moscow. Ust-Kachka is the wonderful small town located between the pine forest in ecologically safe location. It is one of the leading recreation centers in Russia which is widely known for its healing mineral waters and medical-diagnostic base of its resort.

Kostamed International is a network of small clinics providing a full range of dental services such as diagnostics, treatment, prosthetics, implantation, brackets. We have doctors of all dental specializations and all the necessary modern equipment also we use the same materials and technologies as the expensive European clinics do.

We are convinced that dental treatment can be and should be affordable, high-quality, interesting and even enjoyable. We believe that we will repay your trust.

At the foothills of the Ural, on the left bank of the Kama river in the sunny and hospitable resort town called Ust-Kachka, in 2009 one of the leading dentist in the city of Perm Yuri Kostylev decided to open up the unique dental center wherein the team of the leading specialists in dentistry would be assembled.

While starting the clinic we set our minds on raising the provision of dental services in Perm Region to a new modern and innovative level – that was our main goal.

Over the years of work our clinic helped thousands of patients to get a little bit happier so that the fame of the “gifted hands” of our doctors acquired an international level. And it wasn’t surprising. Convenient location - near the airport of Perm, hotel complexes of high standard allowed our patients all over the world not only to receive high level of dental service but also to get rest, recuperate and restore their health and the resort area within walking distance of the clinic contributes greatly to the process of recovering.

The key point of our patients’ confidence is compliance of testing and evaluation of our services with international standards. One of the advantages of applying of our foreign patients is efficiency of rendering services. Indissoluble connection within the working process, daily councils help to make the process of treatment quicker and one of the largest dental laboratories "Eurodent" facilitates the provision of services.

Dental services in the "Kostamed" clinic are a guarantee of security. All medical activities are carried out under sterile conditions in compliance with the required hygiene standards.

For our patients’ comfort all conditions are created. In the comfy walls of our center you will find a high level of service, the atmosphere of the clinic contributes to the relationship of trust between patients and the clinic staff, which improves the quality of diagnosis and painless dental treatment.

As for the medical staff, the management of the clinic in its chief doctor Yuri Kostylev relies on highly qualified doctors which are the experts in different areas such as: dental therapy, implantology, prosthodontics, orthodontics, oral surgery. They work together in one place to create your perfect smile while continuously improving their qualification level by attending seminars, congresses and conferences in Russia and abroad.

The "Kostamed" clinic appreciates that patients entrust us most precious they have - their health. So we are ready to satisfy the demand of the most exacting patient and to live up the invested in us expectations.

For our foreign patients we’d like to offer several options for package tours (from 399 € per 10 days) wherein every option includes visa and language support, free shuttle service from and to the airport. We are ready to offer 1 free night at the hotel (within walking distance of the clinic) regardless of the cost of treatment. We also have cost-effective options for packages that include hotel accommodation during the entire period of stay, food and cultural or recreational activities.

We will be very glad to meet you!

Additional Notes

Public Holidays: open for foreign patients

Accepted Payment Methods

Write a review

Please leave a review if you have received treatments at this clinic. Your feedback is valuable to others seeking the same or similar procedures.

The procedures and prices information has been provided by the clinic and is generally very accurate. Please submit a quote request using the orange button to the right if you are able to describe the procedures needed and your expectations.

The accuracy of detailed quotes is greatly enhanced by pictures or x-rays so please attach those if available.

Clinic Guarantees and Warranties: Please contact the clinic for exact details.

Newsletter sign-up

Stay up-to-date with the latest promotions and destination news.

IMAGES

VIDEO

COMMENTS

Travel advice. To help Australians avoid difficulties overseas, we maintain travel advisories for more than 170 destinations. Smartraveller - travel advice; International COVID-19 Vaccination Certificate. Prove your COVID-19 vaccinations when you travel overseas. Services Australia

Summary. The Aid Adviser Remuneration Framework (the Framework) defines DFAT's policies and procedures for determining the remuneration of commercially contracted international advisers. The Framework requires that advisers are paid in accordance with the market-based remuneration rates and prescribed set of allowances outlined in this document.

The IRGP is the main grants program within the Department of Foreign Affairs and Trade. A combined total of approximately $6.8m in Administered and Departmental funding was allocated to the IRGP in 2013-14. ... Ex officio members will be paid allowances and provided with travel and accommodation in accordance with DFAT's travel policies ...

Long Term Adviser rates are also inclusive of private transport costs and paid annual leave of up to thirty (30) days per annum (20 days recreational, and up to 10 days personal). This is inclusive of annual recreational leave, sick leave, carer's leave and travel time (embarkation/ disembarkation) incurred in accessing leave.

(l) any allowance for risks and contingencies. 2.3. DFAT shall pay the Contractor the Management Fees as follows: (a) a Fixed Management Fee of up to AUD[insert amount] plus GST calculated based on a monthly payment of up to AUD[insert amount]. DFAT shall pay the Contractor the Fixed Management Fee at the end

2.2. 'Agreement' - means the Department of Foreign Affairs and Trade Enterprise Agreement 2019; 2.3. 'APS' - means the Australian Public Service; 2.4. 'APS employee' - means an APS employee within the meaning of the Public Service Act 1999; 2.5. 'casual employee' - means an APS employee engaged on an irregular or ...

This Part includes these Divisions and Annex. Division 1 Rates, limitations and specific situations. Division 2 Equipment costs. Annex 13.3.A Travel costs: Part 1: Brigadier or higher. Part 2: Colonel or lower.

DIBP or post travel service provider with reasonable planning approved summer school A summer school programme determined by DFAT or Austrade and approved by the Secretary. APS Australian Public Service assisted leave fare (ALF) The return economy class airfare to either a designated regional leave centre or a relief centre.

25. An international travel equipment allowance of $430 (as at 1 January 2018) is provided to offset expenses that an employee may incur as a result of preparing to travel overseas, e.g. sturdy luggage and travel accessories including seasonal weather clothing. 26. The equipment allowance is not payable to a person more than once in any 36 month

The new global set of travel rates are effective from 1 July 2010. These costs remain unchanged from 2009. When purchasing rates from ECA, agencies should only purchase Department of Foreign Affairs and Trade (DFAT) approved travel allowance rates. Contact details for the ECA are provided at the end of the Circular.

Per diem rates. The New Zealand Aid Programme provides a per diem allowance to cover the costs of meals, accommodation, and incidentals while overseas. You can claim per diems for each night you spend in-country, and you'll be paid at the aid programme rate applicable at the beginning of your trip. The per diem schedule is based on the United ...

Foreign Per Diem Rates by LocationDSSR 925. You may use the dropdown box below to select a country. Entering the first letter of the country name will jump to that portion of the listing. Clicking "Go" will display Per Diem data for all locations within the country selected. You may use the input field below to enter all or part of a post name.

Booking domestic and international travel; Employee travel allowance rates - Current. 1 July 2023. Current national employee travel allowance rates including commercial and non-commercial rates Open configuration options. Employee travel allowance rates 2022-23. 8 December 2021.

ECA's Daily Rates for business travellers help to anticipate the cost of international business trips. Also known as per diems, Daily Rates come as part of a subscription, or can be bought on demand for individual locations or as a global set. Each report itemises daily costs for the following expenses to give flexibility when calculating allowances for short trips abroad:

Smartraveller - travel advice; International COVID-19 Vaccination Certificate. Prove your COVID-19 vaccinations when you travel overseas. Services Australia; ... Department of Foreign Affairs and Trade. R.G. Casey Building John McEwen Crescent Barton ACT 0221 Australia. Phone: +61 2 6261 1111 Fax: +61 2 6261 3111 ABN: 47 065 634 525.

The Independent Parliamentary Expenses Authority acknowledges the traditional owners and custodians of country throughout Australia and acknowledges their continuing connection to Land, Waters and Community. We pay our respects to the people, the cultures and the Elders past, present and emerging. Employee travel allowance rates - 2021-22.

As you can see, an Outside IR35 contractor on £500 per day, who L eaves S urplus I n goes from £87,000 down to £70,000 (perm) or £62,400 (Umbrella). That's a 30% drop in take-home income! If you want to have a detailed look at the exact numbers, here's the full table: Take-home for given gross.

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies. You ...

The ATO's Draft Taxation Ruling (TR) 2017/D6 provides guidance on when an employee's travel expenses are deductible. The Draft Ruling is intended to supersede and clarify a number of historical positions adopted by the ATO regarding deductible travel. Generally, a tax deduction is available for work-related travel expenses, including air fares ...

Per diem rates look-up Allowances for lodging, meal and incidental costs while on official government travel. Mileage reimbursement rates Reimbursement rates for the use of your own vehicle while on official government travel.

Looking for cheap flights to Chusovoy? Many airlines offer no change fee on selected flights and book now to earn double with airline miles + Expedia Rewards points. Find great 2023 Chusovoy flight deals now!

Most of CONUS (approximately 2,600 counties) is covered by the standard rate of $166 ($107 lodging, $59 M&IE). In fiscal year (FY) 2024, there are 302 non-standard areas (NSAs) that have per diem rates higher than the standard rate. Since FY 2005, we have based the maximum lodging allowances on average daily rate (ADR) data.

Perm is pet friendly! If you need help to decide where to stay, play, or eat with Fido, you've come to the right place. Here's the scoop on our favorite pet friendly hotels, dog friendly activities, and restaurants that allow dogs in Perm.

Kostamed International Clinic is situated in Ust-Kachka, Perm Region, Russia. It is 2 hours by plane from Moscow. Ust-Kachka is the wonderful small town located between the pine forest in ecologically safe location. It is one of the leading recreation centers in Russia which is widely known for its healing mineral waters and medical-diagnostic base of its resort.